Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Importance of Scenario Analysis for Climate Risk Management

Publication date Feb. 07, 2023

Summary

According to the recent IPCC report, abnormal weather events and natural disasters have become more frequent compared to pre-industrial levels and the frequency and severity of climate change will grow exponentially if the current climate trend continues. Extreme climate events, which follow different patterns every year, entail high complexity and non-linearity inherent to climate change. This implies that existing risk assessments based on historical data or trend analysis are hardly sufficient to address climate risks. In response to this challenge, climate finance-related international organizations including the Network for Greening Financial System (NGFS) and the Task Force on Climate Related Financial Disclosures (TCFD) strongly recommend scenario-based climate risk assessment as an alternative solution. Central banks of major economies and global financial services firms have already exerted aggressive efforts to develop scenario-based climate risk assessment models. This shift also requires Korea’s financial services firms to establish a system to proactively respond to climate risks.

The Intergovernmental Panel on Climate Change (IPCC) predicts that if the current global warming trend continues, the average temperature is expected to rise more than 1.5℃ above pre-industrial levels by 2040 and extreme weather events such as massive wildfires, heat waves and cold spells would become more frequent. According to the Sixth Assessment Report (AR6) recently published by the IPCC Working Group 1 (WG1), a rise of 1℃ in the average temperature will cause abnormal climate events, which may appear once in 50 years on average, to likely occur 4.8 times compared to the pre-industrial period (1850-1900). As the temperature increases by 1.5℃, 2℃ and 4℃, the frequency of such events is projected to exponentially grow 8.6 times, 13.9 times and 39.2 times, respectively. In addition, the frequency of heavy precipitation events that may appear once in 10 years on average is expected to increase around 7%, for every 1℃ rise in temperatures. These unusual changes could translate into a significant loss to companies and the real economy. The National Oceanic and Atmospheric Administration (NOAA) has found that the US sustained about 330 weather and climate disasters from 1980 through the first half of 2022, including droughts, floods, cold spells, storms, cyclones, wildfires, and winter storms. The NOAA blames climate change for such extreme events and estimates overall economic damages to reach around $2.2 trillion. Furthermore, according to the 2019 report prepared by the International Labour Organization (ILO), an estimated 1.4% of total working hours were lost globally in 1995 as a result of high heat, which caused the global economy to lose approximately $280 billion in GDP.

Extreme climate events, which follow different patterns every year, entail high complexity and non-linearity inherent to climate change. Accordingly, it seems extremely difficult to predict future developments of climate change and the resultant effects in advance. For this reason, climate finance-related international organizations including the Network for Greening Financial System (NGFS) and the Task Force on Climate Related Financial Disclosures (TCFD) believe that existing risk assessments based on historical data or trend analysis are hardly apt for properly evaluating climate risks. They strongly recommend scenario-based climate risk assessment as an alternative solution. Against this backdrop, this article explores features and cases of the scenario-based climate risk assessment, and discusses relevant implications for Korea’s financial services firms.

Empirical evidence for climate risks and its limitations

The fact that climate change poses financial risks is not just theoretically reasonable but also backed up by several empirical study results. Precedent studies recently conducted overseas find that climate risks have an adverse impact on the price of assets exposed to such risks. Bolton & Kacperczyk (2022) analyze stock returns and company-specific carbon emissions for 14,400 listed companies located in 77 countries to explore a carbon premium. In most countries analyzed, a company’s carbon premium shows a positive (+) correlation with its carbon emission levels and the increase in annual emissions. In addition, Oestreich & Tsiakas (2015), Ilhan et al. (2021) and Monasterolo & de Angelis (2020) suggest that if a company is bound by key carbon emissions reduction commitments such as the Paris Agreement and the emissions trading scheme, it would suffer a fall in its stock value, demonstrating that the risk from a low-carbon transition has already been reflected in the market. On top of that, other studies find that climate risks affect not only stock prices but the prices of a wide range of assets such as loans, bonds and property. Chava (2014) indicates that a company related to adverse environmental issues-hazardous waste and toxic chemicals-pays relatively higher interest on bank loans, while Painter (2020), Goldsmith-Pinkham (2021) and Seltzer et al. (2022) suggest that municipal bonds and corporate bonds that are greatly affected by climate risks have significantly higher spreads. In terms of real estate, Bernstein et al. (2019) analyze seaside houses in the US and find that homes exposed to sea level rise (less elevated above sea level) sell for lower prices than equivalent unexposed properties equidistance from the beach.

The aforementioned empirical studies explore the relationship between climate risks and asset prices and indicate that climate change acts as a variable affecting the value of different asset categories such as stocks, bonds and property. Considering that these studies are primarily based on historical data, however, they have limitations in predicting future developments of climate change and how and to what extent climate risks affect the financial system. In this respect, a more flexible and future-oriented approach is needed to evaluate highly uncertain and complicated climate risks that can hardly be explained by historical data and to devise coping strategies.

Need for climate scenario analysis and related cases

For these reasons, climate finance-related international organizations such as the NGFS and TCFD strongly recommend that financial market participants adopt a climate scenario-based risk assessment strategy. Scenario analysis can be understood as a thinking process that gauges potential effects resulting from each situation, on the assumption that various situations may occur in the future (TCFD, 2017). It differs from other future prediction techniques in that it hardly predicts figures or probability. Assuming that a trend continues under certain conditions, scenario analysis forecasts what the future holds for the trend and seeks coping strategies for each scenario. It could be qualitative analysis in the form of narrative description or quantitative analysis with numeric data and modeling. Regardless of the form it takes, scenario analysis necessitates a compelling scenario that is based on internal consistency, logic and well-defined and reasonable assumptions. The TCFD (2017) finds that scenario analysis offers the following benefits. First of all, it is an effective tool for understanding an issue like climate change that will do severe medium- and long-term damage but is hard to predict the time of occurrence and scale. Additionally, it helps figure out an array of potential situations in advance to bolster the strategic thinking of decision-makers and to review and adjust future strategies and financial and business plans.

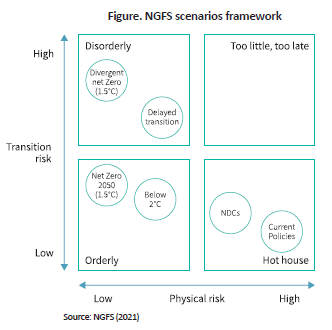

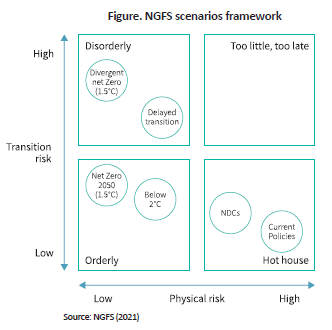

A climate risk assessment process forecasts changes in climate and macroeconomic variables including climate change scenarios, carbon emissions by scenario, carbon prices, energy mix, and growth paths of population and GDP. Building upon such prediction, how variables give a shock to the real economy and financial institutions will be predicted. As it is practically difficult for individual financial institutions to develop climate scenarios on their own, central banks and supervisory authorities of major economies and global financial institutions tend to set up scenarios by taking into account climate change scenarios suggested by the NGFS. As illustrated in the Figure below, NGFS scenarios can be categorized into six types, depending on the rise of average global temperatures, the pace of progress made by countermeasures against climate change, the pace of technical innovation, utilization of decarbonization technology, and regional disparity in responses to climate change. The first category called orderly transition includes Net Zero 2050 and Below 2℃. The Net Zero 2050 scenario aims at limiting global warming to 1.5℃ to achieve net zero emissions by 2050, while the Below 2℃ scenario gives a 67% chance of limiting global warming to below 2℃. The second category is disorderly transition that includes Divergent Net Zero 1.5℃ for differentiated climate change policies introduced across countries and Delayed Transition 2℃ for deferred implementation of the low-carbon transition. Under the third category of hot house world, Nationally Determined Contributions (NDCs) includes non-stringent greenhouse gas reduction targets, while Current Policies assumes that the current growth trend of emissions continues.

NGFS scenarios are used as the fundamental scenario for pilot models of climate stress tests, adopted by central banks of major economies including France and the UK as well as Korea. For instance, the central banks of France and the UK have set up three NGFS-based scenarios: Below 2℃ for orderly transition to the low-carbon framework; Delayed Transition for belated low-carbon transition after 2030; and Business as Usual (BAU) assuming that the global average temperature is expected to rise 4℃ or higher with no low-carbon policy in place. By scenario, they have estimated the reduced added value by industry and the resultant loss to financial institutions. Likewise, Kim & Jeon (2021) of Bank of Korea select two NGFS scenarios of Net Zero 2050 and Below 2℃ and the BAU scenario to estimate the value of losses that financial institutions have suffered from low-carbon transition risks. They suggest that under the Net Zero 2050 scenario, transition risks such as rising carbon prices and stricter regulations of greenhouse gas reduction are expected to sharply cut the added value of high-carbon industries, thereby leading to a 0.7%p fall in the BIS ratio of Korea’s banks by 2050.

More recently, private financial services firms are also increasingly analyzing climate scenarios. According to the 2022 GARP survey on global firms, more than 70% of the entire 78 firms surveyed replied that they analyzed climate scenarios at least once. As many of them carried out their first climate scenario analysis in 2021, it is hard to say that scenario analysis has taken hold. Considering the seven-fold increase in the number of such firms after the first survey in 2019, however, the growth trend is very encouraging. Financial services firms were found to conduct climate scenario analysis for a variety of reasons. The most common answer was figuring out financial shocks from climate risks, followed by risk identification, public disclosure, capacity building for regulatory compliance, and confirmation of portfolio alignment for decarbonization policies including net zero. Although climate scenario analyses are largely in their early stage and need to be improved further, it should be noted that many financial services firms step up efforts to build their own climate risk assessment models and analysis capacity. This suggests that scenario analysis may be established as part of the regular process for climate risk management. It is well known that for several years, global financial players such as HSBC, BlackRock and Goldman Sachs have reflected climate risks, as well as financial risks, as a major risk factor in the entire investment decision making process. It is also noteworthy that they have regularly measured and managed exposure to industries that entail high climate risks.

Implications

In short, climate risks may turn into financial risks that could have a significant impact on asset prices. Scenario-based climate risk assessments could be an effective tool for recognizing climate risks in advance and providing an effective countermeasure. Central banks of major economies and global financial services firms have already recognized climate risks as one type of financial risk and have exerted aggressive efforts to develop scenario-based climate risk assessment models. This shift also requires Korea’s financial services firms to establish a system to proactively respond to climate risks. To this end, they need to adopt climate risk assessment models for investment enterprises and portfolios and develop investment portfolio management techniques that take into account relevant climate risks.

Last but not least, financial services firms should take on an active role in inducing enterprises to make the low-carbon transition, rather than passively managing portfolios’ exposure to climate risks through scenario analysis. As a way of encouraging the low-carbon transition, they can cap credit limits for and impose higher financing costs on those negligent of climate risk management while offering lower interest rates and other financial incentives to others that have made progress in carbon reduction and energy efficiency. In addition, financial services firms help various stakeholders including management, shareholders and investors to accurately identify and assess exposure to climate risks by requiring enterprises to fully disclose climate risk data such as carbon emissions. In this regard, financial services firms should not be complacent with their passive role in managing climate risks for portfolios. They need to make a practical contribution to achieving the climate goal outlined in the Paris Agreement by motivating enterprises to pursue direct greenhouse gas reduction.

References

Bernstein, A., Gustafson, M. T., Lewis, R., 2019, Disaster on the horizon: The price effect of sea level rise, Journal of Financial Economics 134(2), 253-272.

Bolton, P., Kacperczyk, M. T., 2022, Global pricing of carbon-transition risk, Available at SSRN 3550233.

Chava, S., 2014, Environmental externalities and cost of capital, Management Science 60(9), 2223-2247.

Goldsmith-Pinkham, P. S., Gustafson, M., Lewis, R., Schwert, M., 2021, Sea level rise exposure and municipal bond yields, Jacobs Levy Equity Management Center for Quantitative Financial Research Paper.

Ilhan, E., Sautner, Z., Vilkov, G., 2021, Carbon tail risk, The Review of Financial Studies 34(3), 1540-1571.

IPCC WG1, 2021, AR6 Climate Change 2021: The Physical Science Basis.

Monasterolo, I., De Angelis, L., 2020, Blind to carbon risk? An analysis of stock market reaction to the Paris Agreement, Ecological Economics 170, 106571.

NGFS, 2021, NGFS Climate Scenarios for Central Banks and Supervisors.

Oestreich, A. M., Tsiakas, I., 2015, Carbon emissions and stock returns: Evidence from the EU Emissions Trading Scheme, Journal of Banking & Finance 58, 294-308.

Painter, M., 2020, An inconvenient cost: The effects of climate change on municipal bonds, Journal of Financial Economics 135(2), 468-482.

Seltzer, L. H., Starks, L., Zhu, Q., 2022, Climate regulatory risk and corporate bonds, National Bureau of Economic Research, No. w29994.

TCFD, 2017, Recommendations of the Task Force on Climate-related Financial Disclosures.

[Korean]

Kim, J.Y. & Jeon, E.K., 2021, Climate Change Transition Risks and Financial Stability, Bank of Korea Monthly Statistical Bulletin, Vol.75 No.12.

Extreme climate events, which follow different patterns every year, entail high complexity and non-linearity inherent to climate change. Accordingly, it seems extremely difficult to predict future developments of climate change and the resultant effects in advance. For this reason, climate finance-related international organizations including the Network for Greening Financial System (NGFS) and the Task Force on Climate Related Financial Disclosures (TCFD) believe that existing risk assessments based on historical data or trend analysis are hardly apt for properly evaluating climate risks. They strongly recommend scenario-based climate risk assessment as an alternative solution. Against this backdrop, this article explores features and cases of the scenario-based climate risk assessment, and discusses relevant implications for Korea’s financial services firms.

Empirical evidence for climate risks and its limitations

The fact that climate change poses financial risks is not just theoretically reasonable but also backed up by several empirical study results. Precedent studies recently conducted overseas find that climate risks have an adverse impact on the price of assets exposed to such risks. Bolton & Kacperczyk (2022) analyze stock returns and company-specific carbon emissions for 14,400 listed companies located in 77 countries to explore a carbon premium. In most countries analyzed, a company’s carbon premium shows a positive (+) correlation with its carbon emission levels and the increase in annual emissions. In addition, Oestreich & Tsiakas (2015), Ilhan et al. (2021) and Monasterolo & de Angelis (2020) suggest that if a company is bound by key carbon emissions reduction commitments such as the Paris Agreement and the emissions trading scheme, it would suffer a fall in its stock value, demonstrating that the risk from a low-carbon transition has already been reflected in the market. On top of that, other studies find that climate risks affect not only stock prices but the prices of a wide range of assets such as loans, bonds and property. Chava (2014) indicates that a company related to adverse environmental issues-hazardous waste and toxic chemicals-pays relatively higher interest on bank loans, while Painter (2020), Goldsmith-Pinkham (2021) and Seltzer et al. (2022) suggest that municipal bonds and corporate bonds that are greatly affected by climate risks have significantly higher spreads. In terms of real estate, Bernstein et al. (2019) analyze seaside houses in the US and find that homes exposed to sea level rise (less elevated above sea level) sell for lower prices than equivalent unexposed properties equidistance from the beach.

The aforementioned empirical studies explore the relationship between climate risks and asset prices and indicate that climate change acts as a variable affecting the value of different asset categories such as stocks, bonds and property. Considering that these studies are primarily based on historical data, however, they have limitations in predicting future developments of climate change and how and to what extent climate risks affect the financial system. In this respect, a more flexible and future-oriented approach is needed to evaluate highly uncertain and complicated climate risks that can hardly be explained by historical data and to devise coping strategies.

Need for climate scenario analysis and related cases

For these reasons, climate finance-related international organizations such as the NGFS and TCFD strongly recommend that financial market participants adopt a climate scenario-based risk assessment strategy. Scenario analysis can be understood as a thinking process that gauges potential effects resulting from each situation, on the assumption that various situations may occur in the future (TCFD, 2017). It differs from other future prediction techniques in that it hardly predicts figures or probability. Assuming that a trend continues under certain conditions, scenario analysis forecasts what the future holds for the trend and seeks coping strategies for each scenario. It could be qualitative analysis in the form of narrative description or quantitative analysis with numeric data and modeling. Regardless of the form it takes, scenario analysis necessitates a compelling scenario that is based on internal consistency, logic and well-defined and reasonable assumptions. The TCFD (2017) finds that scenario analysis offers the following benefits. First of all, it is an effective tool for understanding an issue like climate change that will do severe medium- and long-term damage but is hard to predict the time of occurrence and scale. Additionally, it helps figure out an array of potential situations in advance to bolster the strategic thinking of decision-makers and to review and adjust future strategies and financial and business plans.

A climate risk assessment process forecasts changes in climate and macroeconomic variables including climate change scenarios, carbon emissions by scenario, carbon prices, energy mix, and growth paths of population and GDP. Building upon such prediction, how variables give a shock to the real economy and financial institutions will be predicted. As it is practically difficult for individual financial institutions to develop climate scenarios on their own, central banks and supervisory authorities of major economies and global financial institutions tend to set up scenarios by taking into account climate change scenarios suggested by the NGFS. As illustrated in the Figure below, NGFS scenarios can be categorized into six types, depending on the rise of average global temperatures, the pace of progress made by countermeasures against climate change, the pace of technical innovation, utilization of decarbonization technology, and regional disparity in responses to climate change. The first category called orderly transition includes Net Zero 2050 and Below 2℃. The Net Zero 2050 scenario aims at limiting global warming to 1.5℃ to achieve net zero emissions by 2050, while the Below 2℃ scenario gives a 67% chance of limiting global warming to below 2℃. The second category is disorderly transition that includes Divergent Net Zero 1.5℃ for differentiated climate change policies introduced across countries and Delayed Transition 2℃ for deferred implementation of the low-carbon transition. Under the third category of hot house world, Nationally Determined Contributions (NDCs) includes non-stringent greenhouse gas reduction targets, while Current Policies assumes that the current growth trend of emissions continues.

NGFS scenarios are used as the fundamental scenario for pilot models of climate stress tests, adopted by central banks of major economies including France and the UK as well as Korea. For instance, the central banks of France and the UK have set up three NGFS-based scenarios: Below 2℃ for orderly transition to the low-carbon framework; Delayed Transition for belated low-carbon transition after 2030; and Business as Usual (BAU) assuming that the global average temperature is expected to rise 4℃ or higher with no low-carbon policy in place. By scenario, they have estimated the reduced added value by industry and the resultant loss to financial institutions. Likewise, Kim & Jeon (2021) of Bank of Korea select two NGFS scenarios of Net Zero 2050 and Below 2℃ and the BAU scenario to estimate the value of losses that financial institutions have suffered from low-carbon transition risks. They suggest that under the Net Zero 2050 scenario, transition risks such as rising carbon prices and stricter regulations of greenhouse gas reduction are expected to sharply cut the added value of high-carbon industries, thereby leading to a 0.7%p fall in the BIS ratio of Korea’s banks by 2050.

More recently, private financial services firms are also increasingly analyzing climate scenarios. According to the 2022 GARP survey on global firms, more than 70% of the entire 78 firms surveyed replied that they analyzed climate scenarios at least once. As many of them carried out their first climate scenario analysis in 2021, it is hard to say that scenario analysis has taken hold. Considering the seven-fold increase in the number of such firms after the first survey in 2019, however, the growth trend is very encouraging. Financial services firms were found to conduct climate scenario analysis for a variety of reasons. The most common answer was figuring out financial shocks from climate risks, followed by risk identification, public disclosure, capacity building for regulatory compliance, and confirmation of portfolio alignment for decarbonization policies including net zero. Although climate scenario analyses are largely in their early stage and need to be improved further, it should be noted that many financial services firms step up efforts to build their own climate risk assessment models and analysis capacity. This suggests that scenario analysis may be established as part of the regular process for climate risk management. It is well known that for several years, global financial players such as HSBC, BlackRock and Goldman Sachs have reflected climate risks, as well as financial risks, as a major risk factor in the entire investment decision making process. It is also noteworthy that they have regularly measured and managed exposure to industries that entail high climate risks.

Implications

In short, climate risks may turn into financial risks that could have a significant impact on asset prices. Scenario-based climate risk assessments could be an effective tool for recognizing climate risks in advance and providing an effective countermeasure. Central banks of major economies and global financial services firms have already recognized climate risks as one type of financial risk and have exerted aggressive efforts to develop scenario-based climate risk assessment models. This shift also requires Korea’s financial services firms to establish a system to proactively respond to climate risks. To this end, they need to adopt climate risk assessment models for investment enterprises and portfolios and develop investment portfolio management techniques that take into account relevant climate risks.

Last but not least, financial services firms should take on an active role in inducing enterprises to make the low-carbon transition, rather than passively managing portfolios’ exposure to climate risks through scenario analysis. As a way of encouraging the low-carbon transition, they can cap credit limits for and impose higher financing costs on those negligent of climate risk management while offering lower interest rates and other financial incentives to others that have made progress in carbon reduction and energy efficiency. In addition, financial services firms help various stakeholders including management, shareholders and investors to accurately identify and assess exposure to climate risks by requiring enterprises to fully disclose climate risk data such as carbon emissions. In this regard, financial services firms should not be complacent with their passive role in managing climate risks for portfolios. They need to make a practical contribution to achieving the climate goal outlined in the Paris Agreement by motivating enterprises to pursue direct greenhouse gas reduction.

References

Bernstein, A., Gustafson, M. T., Lewis, R., 2019, Disaster on the horizon: The price effect of sea level rise, Journal of Financial Economics 134(2), 253-272.

Bolton, P., Kacperczyk, M. T., 2022, Global pricing of carbon-transition risk, Available at SSRN 3550233.

Chava, S., 2014, Environmental externalities and cost of capital, Management Science 60(9), 2223-2247.

Goldsmith-Pinkham, P. S., Gustafson, M., Lewis, R., Schwert, M., 2021, Sea level rise exposure and municipal bond yields, Jacobs Levy Equity Management Center for Quantitative Financial Research Paper.

Ilhan, E., Sautner, Z., Vilkov, G., 2021, Carbon tail risk, The Review of Financial Studies 34(3), 1540-1571.

IPCC WG1, 2021, AR6 Climate Change 2021: The Physical Science Basis.

Monasterolo, I., De Angelis, L., 2020, Blind to carbon risk? An analysis of stock market reaction to the Paris Agreement, Ecological Economics 170, 106571.

NGFS, 2021, NGFS Climate Scenarios for Central Banks and Supervisors.

Oestreich, A. M., Tsiakas, I., 2015, Carbon emissions and stock returns: Evidence from the EU Emissions Trading Scheme, Journal of Banking & Finance 58, 294-308.

Painter, M., 2020, An inconvenient cost: The effects of climate change on municipal bonds, Journal of Financial Economics 135(2), 468-482.

Seltzer, L. H., Starks, L., Zhu, Q., 2022, Climate regulatory risk and corporate bonds, National Bureau of Economic Research, No. w29994.

TCFD, 2017, Recommendations of the Task Force on Climate-related Financial Disclosures.

[Korean]

Kim, J.Y. & Jeon, E.K., 2021, Climate Change Transition Risks and Financial Stability, Bank of Korea Monthly Statistical Bulletin, Vol.75 No.12.