Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Global Status of Transition Bond Issuance and its Implications for Korea

Publication date Sep. 05, 2023

Summary

As of 2020, carbon-intensive industries such as power generation, transportation, and manufacturing account for more than 75% of global greenhouse gas emissions. This also holds true for Korea where more than 80% of its total emissions are generated from high-emitting industries such as energy, steel, chemicals, and transportation industries. This suggests carbon footprint reduction by these sectors is critical to achieving the climate goals of the Paris Agreement. In response, the OECD has proposed the active utilization of “transition finance” as a way of supporting carbon-intensive industries’ low-carbon transition and relieving the relevant financial burden. Transition bonds, one of the major transition finance instruments, are designed to allow firms to use the funds raised through bond issuance for transitional activities for carbon neutrality rather than green activities. This would provide a new financing channel for high-emitting firms that struggle to raise funds through existing green bonds. Japan, in which carbon-intensive industries take up a high proportion, recognizes the advantages of transition bonds and secures funds necessary for the transition towards a low-carbon economy. For Korea with a similar industrial structure to Japan’s, transition bonds are expected to be an effective instrument for carbon neutrality. To facilitate the introduction of transition bonds, it is necessary to set clear criteria, establish a policy to avoid transition-washing, and enhance the value of transition bonds as a financial instrument separate from existing green bonds and sustainability-linked bonds.

As of 2020, carbon-intensive industries such as power generation, transportation and manufacturing reportedly account for more than 75% of global greenhouse gas (GHG) emissions.1) This also holds true for Korea where more than 80% of its total emissions are generated from energy industries such as electricity and heat production and oil refining, and high-emitting industries such as steel, chemicals and transportation.2) This suggests carbon footprint reduction by these sectors is critical to achieving the national carbon neutrality target aligned with the goals of the Paris Agreement.

In line with this recognition, the OECD (2022) has recently proposed the active utilization of transition finance to support the low-carbon transition of carbon-intensive industries and mitigate the corporate financial burden involved in the transition process. Under the existing green finance scheme, concerns over greenwashing make it practically difficult for high-emitting firms to secure necessary funds for low-carbon transition activities. Under these circumstances, the introduction of transition finance aims to enable firms engaging in carbon-intensive industries to obtain financing for carbon emissions reduction. Transition bonds, one of the main transition finance instruments, have the advantage of allowing firms to use funds raised through bond issuance for transitional activities for carbon neutrality, rather than green activities. This would provide a new financing channel for firms in high-emitting industries that currently struggle to raise funds through green bonds. Japan and other major economies, where carbon-intensive industries account for a high proportion, have swiftly recognized the benefits of transition finance and secured the funds necessary for a shift towards a low-carbon economy by actively supporting transition bond issuance by firms in high-emitting industries. For Korea with its carbon-intensive industrial structure, transition bonds can serve as an effective means of achieving carbon neutrality. Against this backdrop, this article takes a look at the major features of transition bonds, one of the key transition finance instruments, and the global status of transition bond issuance, and discusses the implications and potential of introducing transition bonds to Korea.

Concept of transition bonds

Transition bonds have been designed to finance carbon emissions reduction and energy efficiency improvement projects by high-emitting industries (steel, transportation, aviation, cement, power generation, etc.) which are extremely difficult to switch to a low-carbon structure due to intrinsic features. It is reported that the concept of transition bonds was first adopted by AXA Investment Managers in 2019. Since transition bonds do not limit the use of funds raised through bond issuance to green activities, they have a relatively wide range of use of funds compared to existing green bonds (Choi, 2022). In other words, green bonds limit their use-of-proceeds (UoPs) to eco-friendly green products, whereas transition bonds allow the raised funds to be put into any project that helps a bond issuer achieve its decarbonization goals by relaxing the requirements for UoPs. For instance, if a power company replaces existing coal power generation facilities with high-efficiency natural gas facilities or a shipping company changes ship fuel from heavy oil to LNG, these are not strictly green activities and thus, it is impossible to obtain financing from green bonds. However, they may raise funds through transition bonds as such projects can be recognized as transitional activities for carbon neutrality (Kim & Lee, 2021).

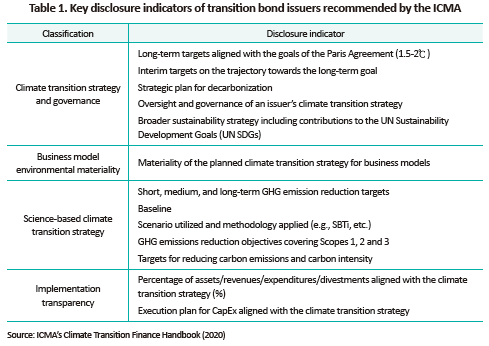

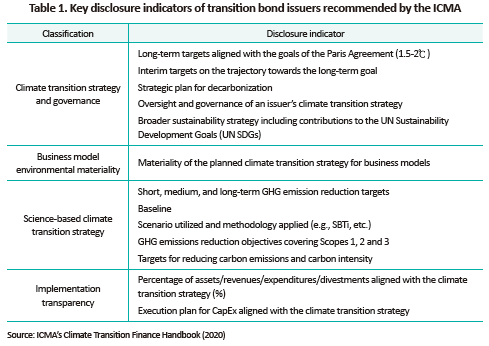

In addition, transition bonds can be distinguished from green bonds in that they focus on an issuer’s low-carbon transition, rather than each transition project. With a focus on eligibility for green activities (whether a project meets green taxonomy), green bonds pay relatively less attention to a project’s environmental improvement effects or an issuer’s performance in terms of low-carbon transition. On the other hand, transition bonds place more emphasis on whether an issuer becomes less brown or greener and is in the process of moving toward an eco-friendly green firm by following a low-carbon trajectory, rather than whether a project itself is green. As for transition bonds, it is important to demonstrate the low-carbon transition. Under this context, the “Climate Transition Finance Handbook” published by the International Capital Market Association (ICMA) in 2020 recommends an issuer to disclose the following four items to ensure the reliability of transition bonds.3) (1) The issuer’s climate transition strategy and governance: the issuer should specifically disclose its climate transition strategy and governance structure that align with the goals of the Paris Agreement. (2) Business model environmental materiality: the issuer should demonstrate that its low-carbon transition trajectory is closely related to core business activities, potentially resulting in environmentally and socially positive impacts. (3) Science-based low-carbon transition strategy: the transition trajectory should be established based on scientific research, be measured quantitatively and consistently, and include emissions reduction targets by phase. It is worth considering setting a carbon emissions reduction path that meets the 1.5℃ target of the Paris Agreement by referring to the Science Based Targets Initiative (SBTi).4) (4) Implementation transparency: the issuer should fully disclose how the raised funds are used and report the result and impact of such use of funds in a transparent manner. If the funds are not spent as planned, the relevant reason should be clearly stated.

Global status of transition bond issuance

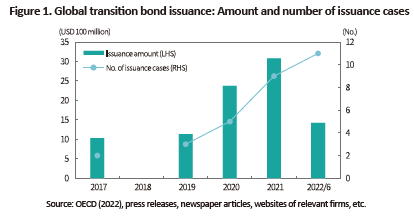

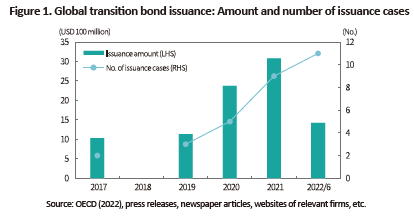

Contrary to high expectations for transition bonds as a new financial instrument to support the transition of carbon-intensive industries, the global transition bond market is not yet large in size. Since transition bonds worth 500 million euros (approximately KRW 700 billion) were issued by Spanish oil and gas supplier Repsol in May 2017, about 30 issuance cases have been reported worldwide until June 2022. The cumulative issuance of transition bonds for the period from May 2017 to June 2022 reached $9.05 billion (approximately KRW 12 trillion), whereas green bonds worth $218.1 billion (approximately KRW 299 trillion) were issued only during the first half of 2022. This indicates the size of the transition bond market is quite small.5) As shown in Figure 1, however, the issuance of transition bonds has been on a steady rise over the past few years. The amount of issued transition bonds jumped from $1.14 billion in 2019 to $3.08 billion in 2021, and the issuance amounted to $1.42 billion in the first half of 2022. The number of transition bond issuance has also shown an upward trend from 2 in 2017 to 11 in 2022, and it is estimated that there were 11 issuance cases in the first half of 2022. Most of the transition bonds for the first half of 2022 seemed to have been issued by Japanese firms, such as NYK Line, Mitsubishi Heavy Industries, Japan Airlines and Kyushu Electric Power. This may result from the Japanese government’s policy direction of designating transition finance for carbon footprint reduction in high-emitting industries as a major national agenda and of actively supporting transition bond issuance by relevant firms.

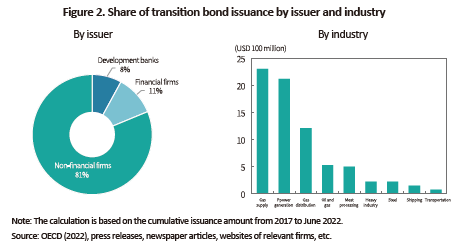

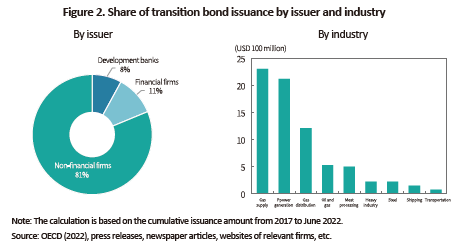

In terms of cumulative issuance amount by issuer, non-financial firms account for a majority of 81%, with financial firms and development banks taking up 11% and 8%, respectively. As mentioned above, it is found that transition bond issuers primarily engage in carbon-intensive industries such as gas supply, power generation, gas distribution, oil and gas development, steel, shipping, and transportation. By industry, the gas supply industry has the largest issuance amount of $2.3 billion, all of which has come from Italy’s SNAM, the biggest European energy infrastructure company. The gas supply industry is followed by power generation of $2.1 billion, gas distribution of $1.2 billion, oil and gas supply of $500 million, and other sectors of $1.3 billion including meat processing, heavy industry, steel, shipping and transportation. Overall, energy and power generation sectors seem to account for a higher proportion in the utilization of transition bonds.

Japan’s support policy for transition bond issuance

At the Leaders Summit on Climate held in April 2021, Japan announced that it would cut GHG emissions by 46% compared to the 2013 level by 2030 and achieve carbon neutrality by 2050. It is noteworthy that Japan is one of the countries with a very high dependence on fossil fuels since coal and natural gas are responsible for more than 60% of its total power generation. After having recognized that carbon emissions reduction by high-emitting industries is an integral part of achieving its GHG reduction targets, the Japanese government has implemented the transition finance policy to help such industries reduce their carbon footprint.

As part of Japan’s transition finance policy, the Ministry of Economy, Trade and Industry (METI), the Financial Services Agency (FSA) and the Ministry of the Environment jointly published the Basic Guidelines on Climate Transition Finance in 2021. The guidelines designate nine high-emitting industries struggling to cut carbon emissions including aviation, cement, chemicals, electricity generation, gas, steel, oil, pulp and paper and maritime transportation, and present a low-carbon roadmap aligned with each industry’s carbon neutrality goal. Japan’s transition finance guidelines have been developed based on the ICMA’s Climate Transition Finance Handbook and recognize bond or loan instruments that meet the following three requirements as transition finance instruments: (1) Instruments based on UoPs supporting activities that are not recognized as green but contribute to the low-carbon transition; (2) General-purpose financial instruments that set carbon footprint reduction targets (SPTs) that align with an issuer’s transition plan and have an incentive adjustment mechanism linked to the attainment of such targets (e.g. sustainability-linked bonds and loan products, linked to carbon reduction target KPIs); and (3) Existing green finance instruments contributing to the low-carbon transition.

The issuance of transition bonds by Japanese firms has recently soared thanks to government policy support. As mentioned earlier, most of the global transition bonds for the first half of 2022 were reportedly issued by Japanese firms. As for Japan’s power generation company JERA, LNG, coal and oil account for 71%, 15% and 14% of its power generation, respectively as of 2020. As it achieved stability in electricity supply and demand, JERA issued transition bonds worth 12 billion yen in May 2022 to convert existing power generation facilities into clean facilities. The raised funds will be put into replacing the existing coal-fired power plants with more efficient thermal plants and developing power generation technology using hydrogen and ammonia co-firing.6) Shipping company NYK Line also issued transition bonds worth 20 billion yen in July 2021 to raise investment funds for newly adopting low-carbon fuel vessels and enhancing the energy efficiency of existing operations. Steelmaker JFE Steel issued 30-billion-yen transition bonds in June 2022, with the aim of cutting emissions by more than 30% by 2030. The raised funds will be used for projects such as converting into an electric arc furnace designed to melt iron scrap with electricity to produce steel, improving energy efficiency, and adopting carbon capture, use and storage (CCUS).

Implications

Transition bonds are beneficial in that they can serve as a new financing channel for projects that could not attract investment under the existing green bond scheme. Still, the size of global transition bond issuance remains extremely small. The following aspects are pointed out as obstacles to further growth of the transition bond market. First, there are no internationally agreed criteria for transition bonds. Second, transition bonds have yet to be differentiated from ESG bonds such as green bonds and sustainability-linked bonds.

The biggest deterrent to the vitalization of the transition bond market is the absence of internationally agreed criteria for transition bonds. Since unified global criteria for transition bonds have yet to be established until now, each issuer or country has developed and used its own framework. Various guidelines for transition bonds have been presented, including the ICMA’s 2020 Climate Transition Finance Handbook, the 2019 Guidelines for Transition Bonds of AXA Investment Managers, the 2019 Green Transition Bonds Framework published by the European Bank for Reconstruction and Development (EBRD), and the Climate Bond Initiative (CBI)’s 2020 Financing Credible Transitions. On top of that, it is reported that Canada, Japan, Australia, Singapore, China and other countries are trying to establish the concept of transition finance. The EU Taxonomy separates green activities as eligible activities contributing to climate change mitigation goals from transition activities in carbon-intensive industries, but does not present separate criteria for transition bonds.

Furthermore, the absence of global criteria for transition bonds may increase the risk of transition-washing. The transition bonds issued by the Bank of China (BoC) in 2021 were invested in a gas project. The project met the Chinese government’s transition finance standards but failed to align with the 1.5℃ trajectory of the Paris Agreement, which sparked a controversy about their eligibility for transition bonds. According to the EU Taxonomy, gas-fired power plants should not exceed the emissions threshold of 100g CO2e/kWh but BoC put the funds raised through transition bonds into the construction of a gas-fired power plant. As is the case with BoC, some argued that the transition bonds issued by Hong Kong-based power company CLP should not be recognized as transition bonds since they were used for natural gas infrastructure construction and thus, are likely to aggravate fossil fuel lock-in.

Another factor behind underused transition bonds is the lack of clear distinction between transition bonds and existing green bonds or sustainability-linked bonds. In theory, it is possible to raise funds for transition activities by issuing sustainability-linked bonds that have set up KPIs for carbon emissions reduction, instead of transition bonds. If the economic substance of transition bonds is similar to that of sustainability-linked bonds that set carbon emissions reduction targets, issuers may prefer green bonds or sustainability-linked bonds with well-established frameworks over transition bonds without specific criteria.

Despite these issues, however, transition bonds can be an effective tool for cutting carbon emissions. Although there are a range of options such as green bonds and sustainability-linked bonds, concerns about greenwashing make it extremely difficult for firms in high-emitting industries to issue green bonds. If such firms cannot find an eligible green project and struggle to issue green bonds, they could issue transition bonds to secure funds for technology and facility investment to achieve carbon neutrality. In particular, transition bonds can be a very useful means to achieve carbon neutrality in countries, such as Korea, heavily dependent on carbon-intensive industries. To facilitate the introduction of transition bonds to Korea, it is necessary to establish criteria for transition bonds, improve the disclosure system to avoid transition-washing, and enhance the value of transition bonds as a financial instrument separate from existing green bonds and sustainability-linked bonds.

1) Climate Watch Historical GHG Emissions (1990-2020). 2023. Washington, DC: World Resources Institute. Available online at: https://www.climatewatchdata.org/ghg-emissions

2) Ministry of Environment, October 25, 2022, South Korea’s greenhouse gas emissions decreased by 6.4% year-on-year to 656.22 million tons in 2020, press release.

3) The ICMA has presented criteria for the use and management of raised funds, reporting and verification for a wide range of ESG bonds including green bonds, sustainability bonds, social bonds and sustainability-linked bonds.

4) SBTi is a global body that provides companies with a methodology of scientifically setting GHG reduction targets that align with the Paris Agreement and conducts relevant verification. In 2015, it was jointly founded by the Carbon Disclosure Project (CDP), the United Nations Global Compact (UNGC), the World Resources Institute (WRI), and the World Wildlife Fund (WWF) and as of April 2023, more than 2,400 global institutions including 38 Korean companies and financial institutions reportedly join SBTi.

5) Yeo, M.L. (2022)

6) Japan’s Ministry of Economy, Trade and Industry predicts that once the hydrogen and ammonia co-firing technology is successfully developed, the technology could help reduce Japan’s total GHG emissions by 20% by 2030.

References

OECD, 2022, OECD Guidance on Transition Finance: Ensuring Credibility of Corporate Climate Transition Plans, Green Finance and Investment.

ICMA, 2020, Climate Transition Finance Handbook.

[Korean]

Kim, C.H. & Lee, S.M., 2021, Study on Establishing the Sustainable Finance Classification Scheme for Promoting Energy Transition, Korea Energy Economics Institute Research Paper 2021-04.

Yeo, M.L., 2022, Current State of Green Bond Issuance and Shrinking Greenium, KCMI Capital Market Focus 2022-21.

Choi, S.Y., 2022, Introduction of Sustainability-Linked Bonds into Korea: Expectations and Challenges, KCMI Issue Paper 23-03.

In line with this recognition, the OECD (2022) has recently proposed the active utilization of transition finance to support the low-carbon transition of carbon-intensive industries and mitigate the corporate financial burden involved in the transition process. Under the existing green finance scheme, concerns over greenwashing make it practically difficult for high-emitting firms to secure necessary funds for low-carbon transition activities. Under these circumstances, the introduction of transition finance aims to enable firms engaging in carbon-intensive industries to obtain financing for carbon emissions reduction. Transition bonds, one of the main transition finance instruments, have the advantage of allowing firms to use funds raised through bond issuance for transitional activities for carbon neutrality, rather than green activities. This would provide a new financing channel for firms in high-emitting industries that currently struggle to raise funds through green bonds. Japan and other major economies, where carbon-intensive industries account for a high proportion, have swiftly recognized the benefits of transition finance and secured the funds necessary for a shift towards a low-carbon economy by actively supporting transition bond issuance by firms in high-emitting industries. For Korea with its carbon-intensive industrial structure, transition bonds can serve as an effective means of achieving carbon neutrality. Against this backdrop, this article takes a look at the major features of transition bonds, one of the key transition finance instruments, and the global status of transition bond issuance, and discusses the implications and potential of introducing transition bonds to Korea.

Concept of transition bonds

Transition bonds have been designed to finance carbon emissions reduction and energy efficiency improvement projects by high-emitting industries (steel, transportation, aviation, cement, power generation, etc.) which are extremely difficult to switch to a low-carbon structure due to intrinsic features. It is reported that the concept of transition bonds was first adopted by AXA Investment Managers in 2019. Since transition bonds do not limit the use of funds raised through bond issuance to green activities, they have a relatively wide range of use of funds compared to existing green bonds (Choi, 2022). In other words, green bonds limit their use-of-proceeds (UoPs) to eco-friendly green products, whereas transition bonds allow the raised funds to be put into any project that helps a bond issuer achieve its decarbonization goals by relaxing the requirements for UoPs. For instance, if a power company replaces existing coal power generation facilities with high-efficiency natural gas facilities or a shipping company changes ship fuel from heavy oil to LNG, these are not strictly green activities and thus, it is impossible to obtain financing from green bonds. However, they may raise funds through transition bonds as such projects can be recognized as transitional activities for carbon neutrality (Kim & Lee, 2021).

In addition, transition bonds can be distinguished from green bonds in that they focus on an issuer’s low-carbon transition, rather than each transition project. With a focus on eligibility for green activities (whether a project meets green taxonomy), green bonds pay relatively less attention to a project’s environmental improvement effects or an issuer’s performance in terms of low-carbon transition. On the other hand, transition bonds place more emphasis on whether an issuer becomes less brown or greener and is in the process of moving toward an eco-friendly green firm by following a low-carbon trajectory, rather than whether a project itself is green. As for transition bonds, it is important to demonstrate the low-carbon transition. Under this context, the “Climate Transition Finance Handbook” published by the International Capital Market Association (ICMA) in 2020 recommends an issuer to disclose the following four items to ensure the reliability of transition bonds.3) (1) The issuer’s climate transition strategy and governance: the issuer should specifically disclose its climate transition strategy and governance structure that align with the goals of the Paris Agreement. (2) Business model environmental materiality: the issuer should demonstrate that its low-carbon transition trajectory is closely related to core business activities, potentially resulting in environmentally and socially positive impacts. (3) Science-based low-carbon transition strategy: the transition trajectory should be established based on scientific research, be measured quantitatively and consistently, and include emissions reduction targets by phase. It is worth considering setting a carbon emissions reduction path that meets the 1.5℃ target of the Paris Agreement by referring to the Science Based Targets Initiative (SBTi).4) (4) Implementation transparency: the issuer should fully disclose how the raised funds are used and report the result and impact of such use of funds in a transparent manner. If the funds are not spent as planned, the relevant reason should be clearly stated.

Contrary to high expectations for transition bonds as a new financial instrument to support the transition of carbon-intensive industries, the global transition bond market is not yet large in size. Since transition bonds worth 500 million euros (approximately KRW 700 billion) were issued by Spanish oil and gas supplier Repsol in May 2017, about 30 issuance cases have been reported worldwide until June 2022. The cumulative issuance of transition bonds for the period from May 2017 to June 2022 reached $9.05 billion (approximately KRW 12 trillion), whereas green bonds worth $218.1 billion (approximately KRW 299 trillion) were issued only during the first half of 2022. This indicates the size of the transition bond market is quite small.5) As shown in Figure 1, however, the issuance of transition bonds has been on a steady rise over the past few years. The amount of issued transition bonds jumped from $1.14 billion in 2019 to $3.08 billion in 2021, and the issuance amounted to $1.42 billion in the first half of 2022. The number of transition bond issuance has also shown an upward trend from 2 in 2017 to 11 in 2022, and it is estimated that there were 11 issuance cases in the first half of 2022. Most of the transition bonds for the first half of 2022 seemed to have been issued by Japanese firms, such as NYK Line, Mitsubishi Heavy Industries, Japan Airlines and Kyushu Electric Power. This may result from the Japanese government’s policy direction of designating transition finance for carbon footprint reduction in high-emitting industries as a major national agenda and of actively supporting transition bond issuance by relevant firms.

At the Leaders Summit on Climate held in April 2021, Japan announced that it would cut GHG emissions by 46% compared to the 2013 level by 2030 and achieve carbon neutrality by 2050. It is noteworthy that Japan is one of the countries with a very high dependence on fossil fuels since coal and natural gas are responsible for more than 60% of its total power generation. After having recognized that carbon emissions reduction by high-emitting industries is an integral part of achieving its GHG reduction targets, the Japanese government has implemented the transition finance policy to help such industries reduce their carbon footprint.

As part of Japan’s transition finance policy, the Ministry of Economy, Trade and Industry (METI), the Financial Services Agency (FSA) and the Ministry of the Environment jointly published the Basic Guidelines on Climate Transition Finance in 2021. The guidelines designate nine high-emitting industries struggling to cut carbon emissions including aviation, cement, chemicals, electricity generation, gas, steel, oil, pulp and paper and maritime transportation, and present a low-carbon roadmap aligned with each industry’s carbon neutrality goal. Japan’s transition finance guidelines have been developed based on the ICMA’s Climate Transition Finance Handbook and recognize bond or loan instruments that meet the following three requirements as transition finance instruments: (1) Instruments based on UoPs supporting activities that are not recognized as green but contribute to the low-carbon transition; (2) General-purpose financial instruments that set carbon footprint reduction targets (SPTs) that align with an issuer’s transition plan and have an incentive adjustment mechanism linked to the attainment of such targets (e.g. sustainability-linked bonds and loan products, linked to carbon reduction target KPIs); and (3) Existing green finance instruments contributing to the low-carbon transition.

The issuance of transition bonds by Japanese firms has recently soared thanks to government policy support. As mentioned earlier, most of the global transition bonds for the first half of 2022 were reportedly issued by Japanese firms. As for Japan’s power generation company JERA, LNG, coal and oil account for 71%, 15% and 14% of its power generation, respectively as of 2020. As it achieved stability in electricity supply and demand, JERA issued transition bonds worth 12 billion yen in May 2022 to convert existing power generation facilities into clean facilities. The raised funds will be put into replacing the existing coal-fired power plants with more efficient thermal plants and developing power generation technology using hydrogen and ammonia co-firing.6) Shipping company NYK Line also issued transition bonds worth 20 billion yen in July 2021 to raise investment funds for newly adopting low-carbon fuel vessels and enhancing the energy efficiency of existing operations. Steelmaker JFE Steel issued 30-billion-yen transition bonds in June 2022, with the aim of cutting emissions by more than 30% by 2030. The raised funds will be used for projects such as converting into an electric arc furnace designed to melt iron scrap with electricity to produce steel, improving energy efficiency, and adopting carbon capture, use and storage (CCUS).

Implications

Transition bonds are beneficial in that they can serve as a new financing channel for projects that could not attract investment under the existing green bond scheme. Still, the size of global transition bond issuance remains extremely small. The following aspects are pointed out as obstacles to further growth of the transition bond market. First, there are no internationally agreed criteria for transition bonds. Second, transition bonds have yet to be differentiated from ESG bonds such as green bonds and sustainability-linked bonds.

The biggest deterrent to the vitalization of the transition bond market is the absence of internationally agreed criteria for transition bonds. Since unified global criteria for transition bonds have yet to be established until now, each issuer or country has developed and used its own framework. Various guidelines for transition bonds have been presented, including the ICMA’s 2020 Climate Transition Finance Handbook, the 2019 Guidelines for Transition Bonds of AXA Investment Managers, the 2019 Green Transition Bonds Framework published by the European Bank for Reconstruction and Development (EBRD), and the Climate Bond Initiative (CBI)’s 2020 Financing Credible Transitions. On top of that, it is reported that Canada, Japan, Australia, Singapore, China and other countries are trying to establish the concept of transition finance. The EU Taxonomy separates green activities as eligible activities contributing to climate change mitigation goals from transition activities in carbon-intensive industries, but does not present separate criteria for transition bonds.

Furthermore, the absence of global criteria for transition bonds may increase the risk of transition-washing. The transition bonds issued by the Bank of China (BoC) in 2021 were invested in a gas project. The project met the Chinese government’s transition finance standards but failed to align with the 1.5℃ trajectory of the Paris Agreement, which sparked a controversy about their eligibility for transition bonds. According to the EU Taxonomy, gas-fired power plants should not exceed the emissions threshold of 100g CO2e/kWh but BoC put the funds raised through transition bonds into the construction of a gas-fired power plant. As is the case with BoC, some argued that the transition bonds issued by Hong Kong-based power company CLP should not be recognized as transition bonds since they were used for natural gas infrastructure construction and thus, are likely to aggravate fossil fuel lock-in.

Another factor behind underused transition bonds is the lack of clear distinction between transition bonds and existing green bonds or sustainability-linked bonds. In theory, it is possible to raise funds for transition activities by issuing sustainability-linked bonds that have set up KPIs for carbon emissions reduction, instead of transition bonds. If the economic substance of transition bonds is similar to that of sustainability-linked bonds that set carbon emissions reduction targets, issuers may prefer green bonds or sustainability-linked bonds with well-established frameworks over transition bonds without specific criteria.

Despite these issues, however, transition bonds can be an effective tool for cutting carbon emissions. Although there are a range of options such as green bonds and sustainability-linked bonds, concerns about greenwashing make it extremely difficult for firms in high-emitting industries to issue green bonds. If such firms cannot find an eligible green project and struggle to issue green bonds, they could issue transition bonds to secure funds for technology and facility investment to achieve carbon neutrality. In particular, transition bonds can be a very useful means to achieve carbon neutrality in countries, such as Korea, heavily dependent on carbon-intensive industries. To facilitate the introduction of transition bonds to Korea, it is necessary to establish criteria for transition bonds, improve the disclosure system to avoid transition-washing, and enhance the value of transition bonds as a financial instrument separate from existing green bonds and sustainability-linked bonds.

1) Climate Watch Historical GHG Emissions (1990-2020). 2023. Washington, DC: World Resources Institute. Available online at: https://www.climatewatchdata.org/ghg-emissions

2) Ministry of Environment, October 25, 2022, South Korea’s greenhouse gas emissions decreased by 6.4% year-on-year to 656.22 million tons in 2020, press release.

3) The ICMA has presented criteria for the use and management of raised funds, reporting and verification for a wide range of ESG bonds including green bonds, sustainability bonds, social bonds and sustainability-linked bonds.

4) SBTi is a global body that provides companies with a methodology of scientifically setting GHG reduction targets that align with the Paris Agreement and conducts relevant verification. In 2015, it was jointly founded by the Carbon Disclosure Project (CDP), the United Nations Global Compact (UNGC), the World Resources Institute (WRI), and the World Wildlife Fund (WWF) and as of April 2023, more than 2,400 global institutions including 38 Korean companies and financial institutions reportedly join SBTi.

5) Yeo, M.L. (2022)

6) Japan’s Ministry of Economy, Trade and Industry predicts that once the hydrogen and ammonia co-firing technology is successfully developed, the technology could help reduce Japan’s total GHG emissions by 20% by 2030.

References

OECD, 2022, OECD Guidance on Transition Finance: Ensuring Credibility of Corporate Climate Transition Plans, Green Finance and Investment.

ICMA, 2020, Climate Transition Finance Handbook.

[Korean]

Kim, C.H. & Lee, S.M., 2021, Study on Establishing the Sustainable Finance Classification Scheme for Promoting Energy Transition, Korea Energy Economics Institute Research Paper 2021-04.

Yeo, M.L., 2022, Current State of Green Bond Issuance and Shrinking Greenium, KCMI Capital Market Focus 2022-21.

Choi, S.Y., 2022, Introduction of Sustainability-Linked Bonds into Korea: Expectations and Challenges, KCMI Issue Paper 23-03.