OPINION

2021 Feb/23

Need for Restructuring Marginal Firms for Improved Business Dynamics

Feb. 23, 2021

PDF

- Summary

- As reviving corporate sector dynamics is becoming an imminent challenge, there is a stronger tendency where marginal firms remain in the market despite their financial distress and business deterioration. The steep rise in the number of marginal firms not only could directly undermine potential growth of the Korean economy, but also allocate scarce resources excessively to marginal firms. This is highly likely to discourage employment and investment of normal firms. The zombiefication of marginal firms is expected to continue for some time being as Covid-19 quarantine measures lengthen further. Against the backdrop, investors should be conservative in managing investment risk related to marginal firms, while policy authorities need to be fully prepared for any risk that might require measures that are bolder than those attemted to ensure financial stability.

With a continuous decline in business fundamentals, Korea sees a sharp increase in the share of marginal firms who are unable to meet interest expenses with operating profit. According to the financial statements of KOSPI- and KOSDAQ-listed firms for the third quarter of 2020, the share of marginal firms whose interest coverage ratio stood at below 1 surpassed 40% for the first time since the global financial crisis.1) The spread of Covid-19 is pushing almost all firms in the air transport industry and over 60% of shipbuilding, hotel, and leisure firms to the marginal boundary.2) Because the pace of business deterioration surpasses that of falls in interest payment burden amid the super-low interest rate environment, marginal firms are highly likely to face a structural reform in the near future.

Although structural reform on marginal firms deserves attention, it has not been sufficiently discussed due to many inevitable challenges towards that end, such as large-scale layoffs and investor losses that are hard to overcome. Another difficulty is that it is hard to distinguish a zombie or marginal firm from ordinary firms, which is hindering productive discussion in this area.3) This article tries to explore the characteristics marginal firms show, and to assess the adverse impacts of those firms on Korea’s corporate sector. In particular, it presents a new set of criteria for identifying marginal firms, with the focus placed on how to revive business sector dynamics in the low interest rate era. Based on the findings, I propose some policy actions for investors, researchers, policy authorities, and other stakeholders.

Financial characteristics of marginal firms

Although defined slightly differently across researchers, a marginal firm in general means a company who has lost core business capability to survive without any credit support from the government or banks. If the firm’s interest coverage ratio—operating profit divided by interest expenses—falls below 1, the firm is regarded marginal, meaning that it cannot cover its debt financing cost with its business activities. However, the interest coverage ratio criterion may not be always appropriate for Korea’s economy that is largely led by cyclical firms relying heavily on external demand.4) If a cyclical industry with a highly volatile business structure enters into a contraction phase, this could sharply erode operating profit and cause the interest coverage ratio to fall below 1 regardless of a firm’s cash holdings or business capability.5)

Nevertheless, data on firms across different levels of interest coverage ratios show that the ratio appears to reveal some particular aspects of marginality. Firms with a lower interest coverage ratio tend to have a smaller firm size, a lower level of profitability, and a higher debt ratio.6) Their price indicators are also found to be sensitive to market sentiment and highly volatile, suggesting that a high percentage of trading of those firms might have been influenced by asymmetric information. In other words, retail investors who are relatively inferior in terms of information are unlikely to reap high returns on their investment in marginal firms with a low interest coverage ratio. Firms with the ratio of less than 1 tend to frequently increase paid-in capital as part of attempts to secure operating funds, which could worryingly dilute stock value for long-term investors.

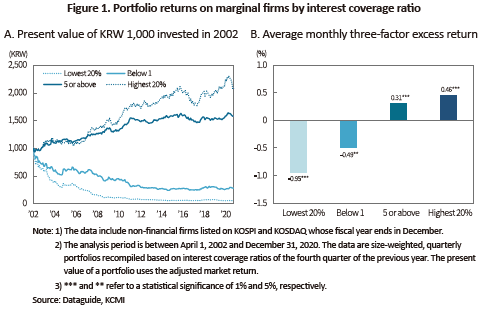

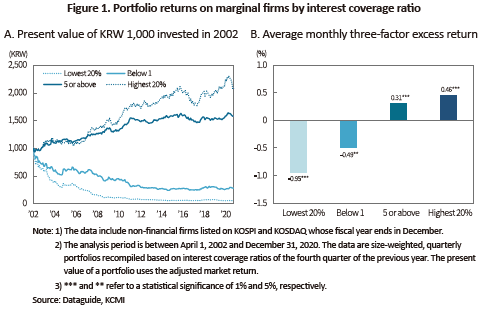

An analysis on portfolio returns on firms with different interest coverage ratios for 225 months between April 2002 and December 2020 reveals that firms with a lower interest coverage ratio is more likely zombiefied, remaining as a chronic marginal firm instead of making immediate improvements to turn around to profit. An investment of KRW 1,000 in a portfolio of firms with their interest coverage ratio below 1 at the beginning of April 2002 would be worth only KRW 275 at the end of December 2020 when considering the market return. However, the same investment in another portfolio of firms with the ratio being 5 or higher would be worth KRW 1,587 during the same period, 5.8 times higher than the previous example (Figure 1A). If other factors such as the size and growth potential are controlled, the portfolio with less than one interest coverage ratio recorded a monthly excess loss of 0.49% (Figure 1B) with the hit ratio being only 41.5%. This implies that those stocks are highly likely to underperform the market average.

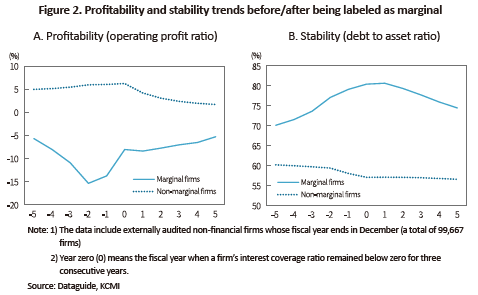

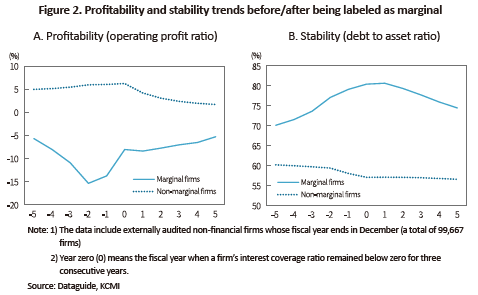

Based on a long-term time series observation on financial characteristics of marginal firms, it is hardly likely for marginal firms to break away from their condition on their own because most of them are financially distressed without a slightest chance of fundamental improvement in business competitiveness. A brief look at externally audited non-financial firms whose interest coverage ratio is below 1 for three consecutive years during the analysis period between 2001 and 2019 reveals that their profitability, stability, and debt-paying ability continued to decline from five years before they were classified as marginal. Around five years before and after being labeled as marginal, those firms failed to escape from the negative margin structure (Figure 2A), with their high-leverage financial structure remaining for a long period of time (Figure 2B). This comes in stark contrasts to non-marginal firms, and such differences have continued to exist.

From investors’ perspective, it is beneficial to outrightly exclude those unproductive marginal firms from their investment portfolio for the sake of higher returns and risk management. On the other hand, this calls for policy authorities in charge of improving market efficiency to pay closer attention to why marginal firms stay instead of leaving the market. The focus of policy responses should be on how to address market inefficiency based on an in-depth analysis on the congestion effect caused by marginal firms.

Need for a new classification criterion under super-low interest rates

The delayed exit of marginal firms observed recently could have stemmed from the post-crisis business environment where lingering low-interest rates have pushed up low-cost borrowing. As the low interest rate trend helps reduce interest-paying burden, marginal firms are more likely than before to exceedingly occupy scarce resource. Trying to assess marginal firms’ congestion effect solely based on whether a firm earned operating profit enough to offset interest expenses or not would provide only a partial picture of the overall economic reality.

Still, most of the domestic research still defines a marginal firm as a company whose interest coverage ratio is below 1 for three consecutive years (“long-term operating loss” marginal firms, hereinafter). Korea’s financial authorities also adopt the same criterion of long-term operating loss for a marginal firm that is subject to financial stability and distress oversight. A proper approach on marginal firms should take into account the increasing need for overseeing marginal firms in the low interest rate environment, which would be possible by a more comprehensive analysis covering the marginal firms that borrow heavily at low rates despite their vulnerable financial soundness, on top of conventional marginal firms.

For example, a recent study on European nations analyzed the congestion effect considering the trend of more marginal firms borrowing at lower costs under the low interest rate environment.7) The approach is also taken by this article for verifying the congestion effect under the low interest rate. To identify financially troubled, unprofitable firms that still stay in the market thanks to an abnormally low cost of financing, this article adopted three criteria: i) a firm whose debt-paying ability is limited with the interest coverage ratio being the lower 50% of those in the same industry; ii) a high-leverage firm whose debt ratio excluding the net current assets is the upper 50% of the industry; and iii) a firm who financed debt at a cost lower than the average borrowing rate of high-rated firms (AA- or above). A firm that meets those three conditions is regarded as a “high-leverage at lower rates” marginal firm. The same analysis was also carried out on conventional marginal firms whose interest coverage ratio is below 1 for three consecutive years, and the results were compared to see if there is any difference in the congestion effect between marginal firms falling under the two criteria—“high-leverage at lower rates” and “long-term operating loss”, of which the latter is widely adopted by Korean researchers and financial authorities.

Marginal firms with high leverage at low rates causing inefficiency in business activities

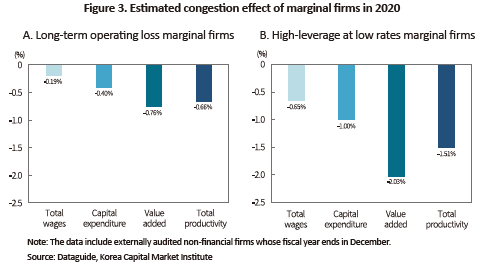

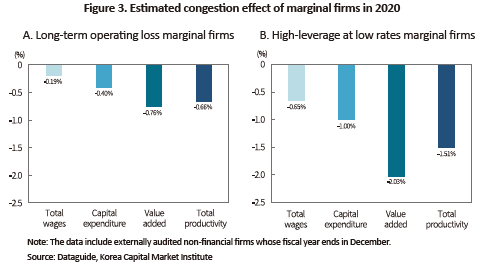

The sample in this analysis includes a total of 99,667 non-financial firms that were externally audited between 2001 and 2019 in Korea. According to the analysis on the congestion effect of marginal firms, an increase in the share of marginal firms is found to have contracted employment and capital expenditure in the overall corporate sector. This is because chronic marginal firms excessively occupying scarce resources could hinder normal firms’ use of human and physical resources. Also confirmed is that the low-margin structure of the marginal firms with high-leverage at lower rates in the super-low interest rate era could distort the market’s price competition structure, imposing adverse impacts on normal firms’ value-added activities and overall productivity.

In particular, the high-leverage at lower rates marginal firms enjoying low-cost borrowings, compared to the other group of long-term operating loss marginal firms, are found to have a worse impact on normal firms’ activities (Figure 3). This implies a possibility that an excessive level of occupation of human and physical resources by marginal firms with high-leverage at lower rates is seriously undermining efficient resource allocation between marginal and normal firms. What this implies is that dealing with the issue of those highly leveraged at low rates could be more effective to ease the spillover effect to sound firms.

Conclusion and implications

This article provides a brief overview of the financial characteristics of marginal firms and assesses the adverse impacts of chronic marginal firms on Korea’s overall corporate sector. What’s necessary for reviving the continuously worsening corporate sector dynamics would be a macro, preemptive approach toward the marginal firm issue that is posing a constraint to productivity improvement. The lengthening Covid-19 pandemic could possibly accelerate the exit of those marginal firms, which requires authorities to be prepared with an effective structural reform on marginal firms.

Because most marginal firms are small-sized with a low liquidation value, it would be impractical to expect a market-oriented restructuring incentive. Hence, it is worth considering establishing a dedicated regulatory body that helps firms restructure bad debt and improve business competitiveness. Moreover, some raised the need for an employment safety net that provides unemployment benefits for a longer period and better job-transfer training to those who lost their job due to restructuring, which would surely prevent unemployment concerns from delaying much-needed corporate restructuring.8)

As mentioned above, marginal firms that are highly leveraged at lower rates have a larger impact on worsening efficient resource allocation. Researchers and financial authorities have long analyzed, managed, and overseen corporate lending based on the conventional marginal firm criterion. Now is the time for them to come up with their own classification criteria that better serve their research objectives and policy goals.

Business sustainability in the post-Covid-19 era has been the subject of intense attention. All of those relevant to this issue should put together their knowledge and insight to restructure marginal firms in a way that minimizes social impacts and improves the sustainability of the business ecosystem.

1) Refer to 2021 Capital Market Outlook and Key Issues (KCMI).

2) The classification in this article is based on the FnGuide Industry Classification Standard.

3) “Corporate Sector Vulnerability: Diagnosis and Challenges Ahead”, KCMI Symposium.

4) Kang, H.S. (2011). An analysis of causality between foreign trade dependency and economic growth: The case of South Korea. Journal of Industrial Economics and Business, 24(4), 2135-2153.

5) The need for a new definition on a marginal firm was raised during the KCMI symposium mentioned above (“Corporate Sector Vulnerability: Diagnosis and Challenges Ahead”).

6) Between Q4 2001 and Q3 2020, firms with the interest coverage ratio for the most recent four quarters being below 1 and above 5 saw their average market capitalization stand at KRW 208.4 billion and KRW 629.6 billion, average returns on equity at –22.9% and 11.4%, and average debt to equity ratios at 138.7% and 61.0%, respectively.

7) Acharya, V. V., Crosignani, M., Eisert, T., Eufinger, C. (2020). Zombie credit and (dis-) inflation: evidence from Europe (No. w27158). National Bureau of Economic Research.

8) Park, C.G., Jung, W.Y., Marginal Firms: Current State and Challenges for More Efficient Resource Allocation, December 7, 2020.

Although structural reform on marginal firms deserves attention, it has not been sufficiently discussed due to many inevitable challenges towards that end, such as large-scale layoffs and investor losses that are hard to overcome. Another difficulty is that it is hard to distinguish a zombie or marginal firm from ordinary firms, which is hindering productive discussion in this area.3) This article tries to explore the characteristics marginal firms show, and to assess the adverse impacts of those firms on Korea’s corporate sector. In particular, it presents a new set of criteria for identifying marginal firms, with the focus placed on how to revive business sector dynamics in the low interest rate era. Based on the findings, I propose some policy actions for investors, researchers, policy authorities, and other stakeholders.

Financial characteristics of marginal firms

Although defined slightly differently across researchers, a marginal firm in general means a company who has lost core business capability to survive without any credit support from the government or banks. If the firm’s interest coverage ratio—operating profit divided by interest expenses—falls below 1, the firm is regarded marginal, meaning that it cannot cover its debt financing cost with its business activities. However, the interest coverage ratio criterion may not be always appropriate for Korea’s economy that is largely led by cyclical firms relying heavily on external demand.4) If a cyclical industry with a highly volatile business structure enters into a contraction phase, this could sharply erode operating profit and cause the interest coverage ratio to fall below 1 regardless of a firm’s cash holdings or business capability.5)

Nevertheless, data on firms across different levels of interest coverage ratios show that the ratio appears to reveal some particular aspects of marginality. Firms with a lower interest coverage ratio tend to have a smaller firm size, a lower level of profitability, and a higher debt ratio.6) Their price indicators are also found to be sensitive to market sentiment and highly volatile, suggesting that a high percentage of trading of those firms might have been influenced by asymmetric information. In other words, retail investors who are relatively inferior in terms of information are unlikely to reap high returns on their investment in marginal firms with a low interest coverage ratio. Firms with the ratio of less than 1 tend to frequently increase paid-in capital as part of attempts to secure operating funds, which could worryingly dilute stock value for long-term investors.

An analysis on portfolio returns on firms with different interest coverage ratios for 225 months between April 2002 and December 2020 reveals that firms with a lower interest coverage ratio is more likely zombiefied, remaining as a chronic marginal firm instead of making immediate improvements to turn around to profit. An investment of KRW 1,000 in a portfolio of firms with their interest coverage ratio below 1 at the beginning of April 2002 would be worth only KRW 275 at the end of December 2020 when considering the market return. However, the same investment in another portfolio of firms with the ratio being 5 or higher would be worth KRW 1,587 during the same period, 5.8 times higher than the previous example (Figure 1A). If other factors such as the size and growth potential are controlled, the portfolio with less than one interest coverage ratio recorded a monthly excess loss of 0.49% (Figure 1B) with the hit ratio being only 41.5%. This implies that those stocks are highly likely to underperform the market average.

From investors’ perspective, it is beneficial to outrightly exclude those unproductive marginal firms from their investment portfolio for the sake of higher returns and risk management. On the other hand, this calls for policy authorities in charge of improving market efficiency to pay closer attention to why marginal firms stay instead of leaving the market. The focus of policy responses should be on how to address market inefficiency based on an in-depth analysis on the congestion effect caused by marginal firms.

The delayed exit of marginal firms observed recently could have stemmed from the post-crisis business environment where lingering low-interest rates have pushed up low-cost borrowing. As the low interest rate trend helps reduce interest-paying burden, marginal firms are more likely than before to exceedingly occupy scarce resource. Trying to assess marginal firms’ congestion effect solely based on whether a firm earned operating profit enough to offset interest expenses or not would provide only a partial picture of the overall economic reality.

Still, most of the domestic research still defines a marginal firm as a company whose interest coverage ratio is below 1 for three consecutive years (“long-term operating loss” marginal firms, hereinafter). Korea’s financial authorities also adopt the same criterion of long-term operating loss for a marginal firm that is subject to financial stability and distress oversight. A proper approach on marginal firms should take into account the increasing need for overseeing marginal firms in the low interest rate environment, which would be possible by a more comprehensive analysis covering the marginal firms that borrow heavily at low rates despite their vulnerable financial soundness, on top of conventional marginal firms.

For example, a recent study on European nations analyzed the congestion effect considering the trend of more marginal firms borrowing at lower costs under the low interest rate environment.7) The approach is also taken by this article for verifying the congestion effect under the low interest rate. To identify financially troubled, unprofitable firms that still stay in the market thanks to an abnormally low cost of financing, this article adopted three criteria: i) a firm whose debt-paying ability is limited with the interest coverage ratio being the lower 50% of those in the same industry; ii) a high-leverage firm whose debt ratio excluding the net current assets is the upper 50% of the industry; and iii) a firm who financed debt at a cost lower than the average borrowing rate of high-rated firms (AA- or above). A firm that meets those three conditions is regarded as a “high-leverage at lower rates” marginal firm. The same analysis was also carried out on conventional marginal firms whose interest coverage ratio is below 1 for three consecutive years, and the results were compared to see if there is any difference in the congestion effect between marginal firms falling under the two criteria—“high-leverage at lower rates” and “long-term operating loss”, of which the latter is widely adopted by Korean researchers and financial authorities.

Marginal firms with high leverage at low rates causing inefficiency in business activities

The sample in this analysis includes a total of 99,667 non-financial firms that were externally audited between 2001 and 2019 in Korea. According to the analysis on the congestion effect of marginal firms, an increase in the share of marginal firms is found to have contracted employment and capital expenditure in the overall corporate sector. This is because chronic marginal firms excessively occupying scarce resources could hinder normal firms’ use of human and physical resources. Also confirmed is that the low-margin structure of the marginal firms with high-leverage at lower rates in the super-low interest rate era could distort the market’s price competition structure, imposing adverse impacts on normal firms’ value-added activities and overall productivity.

In particular, the high-leverage at lower rates marginal firms enjoying low-cost borrowings, compared to the other group of long-term operating loss marginal firms, are found to have a worse impact on normal firms’ activities (Figure 3). This implies a possibility that an excessive level of occupation of human and physical resources by marginal firms with high-leverage at lower rates is seriously undermining efficient resource allocation between marginal and normal firms. What this implies is that dealing with the issue of those highly leveraged at low rates could be more effective to ease the spillover effect to sound firms.

This article provides a brief overview of the financial characteristics of marginal firms and assesses the adverse impacts of chronic marginal firms on Korea’s overall corporate sector. What’s necessary for reviving the continuously worsening corporate sector dynamics would be a macro, preemptive approach toward the marginal firm issue that is posing a constraint to productivity improvement. The lengthening Covid-19 pandemic could possibly accelerate the exit of those marginal firms, which requires authorities to be prepared with an effective structural reform on marginal firms.

Because most marginal firms are small-sized with a low liquidation value, it would be impractical to expect a market-oriented restructuring incentive. Hence, it is worth considering establishing a dedicated regulatory body that helps firms restructure bad debt and improve business competitiveness. Moreover, some raised the need for an employment safety net that provides unemployment benefits for a longer period and better job-transfer training to those who lost their job due to restructuring, which would surely prevent unemployment concerns from delaying much-needed corporate restructuring.8)

As mentioned above, marginal firms that are highly leveraged at lower rates have a larger impact on worsening efficient resource allocation. Researchers and financial authorities have long analyzed, managed, and overseen corporate lending based on the conventional marginal firm criterion. Now is the time for them to come up with their own classification criteria that better serve their research objectives and policy goals.

Business sustainability in the post-Covid-19 era has been the subject of intense attention. All of those relevant to this issue should put together their knowledge and insight to restructure marginal firms in a way that minimizes social impacts and improves the sustainability of the business ecosystem.

1) Refer to 2021 Capital Market Outlook and Key Issues (KCMI).

2) The classification in this article is based on the FnGuide Industry Classification Standard.

3) “Corporate Sector Vulnerability: Diagnosis and Challenges Ahead”, KCMI Symposium.

4) Kang, H.S. (2011). An analysis of causality between foreign trade dependency and economic growth: The case of South Korea. Journal of Industrial Economics and Business, 24(4), 2135-2153.

5) The need for a new definition on a marginal firm was raised during the KCMI symposium mentioned above (“Corporate Sector Vulnerability: Diagnosis and Challenges Ahead”).

6) Between Q4 2001 and Q3 2020, firms with the interest coverage ratio for the most recent four quarters being below 1 and above 5 saw their average market capitalization stand at KRW 208.4 billion and KRW 629.6 billion, average returns on equity at –22.9% and 11.4%, and average debt to equity ratios at 138.7% and 61.0%, respectively.

7) Acharya, V. V., Crosignani, M., Eisert, T., Eufinger, C. (2020). Zombie credit and (dis-) inflation: evidence from Europe (No. w27158). National Bureau of Economic Research.

8) Park, C.G., Jung, W.Y., Marginal Firms: Current State and Challenges for More Efficient Resource Allocation, December 7, 2020.