Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

ESG Stock Performance amid Covid-19

Publication date Mar. 09, 2021

Summary

This article explores the impact of corporate environmental and social (ES) activities on stock returns amid the market crisis triggered by the Covid-19 pandemic. A series of analyses carried out here showed that stocks with higher ES scores tend to have a lower price decline. This means that firms with superb ES performance could be less susceptible to an unexpected shock such as Covid-19. Although the academic circle has yet to reach a consensus on the impact of ESG factors on stock performance, the results here show—albeit partially—the importance of non-financial factors such as ESG in investment decisions.

The Covid-19 pandemic not only gave the biggest shock to the global economy after the global financial crisis, but also triggered investors to question about firm sustainability. In a JP Morgan survey targeting 50 global institutional investors, about 55% of the respondents expected ESG investing to gain momentum for the next three years in the aftermath of Covid-19, while 71% said that Covid-19 could give more limelight to climate change, biodiversity, and other sustainability agenda.1) As the stock market plunged with the spread of the Covid-19, the global fund market saw a net outflow of $384.7 billion during the first quarter of 2020 alone, while ESG funds saw a net inflow of $45.6 billion. This evidences investors still paying keen attention on ESG investing.2)

Against that backdrop, the impact of ESG activities on financial performance during the time of crisis such as now has attracted high research interest. Although the academic view on this question appears to slightly lean towards the positive effect, no consensus has yet been reached on this matter with many ongoing discussions. Among others, the proponents for ESG’s positive impact on financial performance argue that firms with excellent ESG performance have a positive corporate image and a high level of confidence at normal times, which could likely lead to less consumer exits and higher resilience when hit by a crisis.3) Others also point out that those firms’ stable relationship with shareholders, investors, management and staff, suppliers, and the local community help them perform stably in a highly volatile market condition. On the other hand, those against the positive impact insist that ESG activities are irrelevant to profit-seeking, only to incur unnecessary costs to bring down firm value.4) Also mentioned is that the nature of ESG information full of unstructured data lowers the reliability of ESG ratings, which makes it almost impossible to figure out how ESG is related to financial performance.5)

Based on those discussions, this article employs domestic data to explore how individual firms’ ES performance impacts their stock returns during the pandemic-triggered stock market plunge between February 24 and March 18, 2021. By revealing the market’s expectations for ESG that is recently gaining ground, this is expected to offer ample implications.

Covid-19 and ESG stock returns

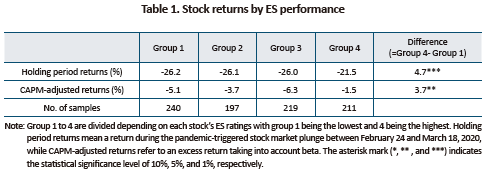

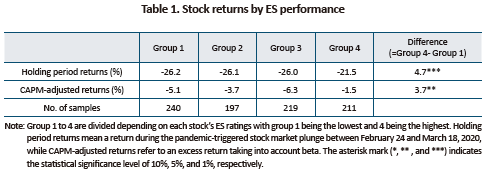

Table 1 illustrates stock returns of 867 KOSPI- and KOSDAQ-listed firms with an ES score during the analysis period. The analyzed firms were divided into four groups according to their ES score. The ES score here uses the average of standardized scores of ES ratings evaluated by Korea Corporate Governance Service as of 2019.

First of all, stock returns during the analysis period confirms that firms with higher ES performance show higher returns. A comparative look at the upper and lower 25% groups shows even more stark difference: The return of group 4 was 4.7 percentage-point higher than that of group 1 during the period. The result remains also consistent for CAPM-adjusted returns as firms with superb social and environmental outcomes saw a smaller decline in returns, except for group 3 whose return was relatively lower. Another exception was found in group 4 whose CAPM-adjusted return was significantly lower by 3.7 percentage-point than that of group 1.6)

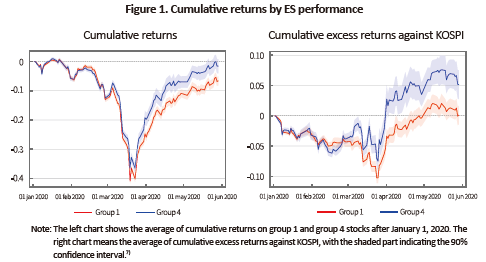

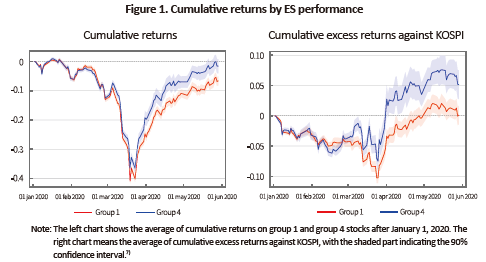

Figure 1 provides a comparative look at cumulative returns of group 1 and 4 for an extended period between January 2 and May 29, 2020. The result confirms a deepened gap between returns across the levels of ES performance in the Covid-19 period. It is found that stocks in group 4 had a milder decline during abrupt stock market plunges (February 24 to March 18, 2020), and a faster rebound during the market recovery from March 19, compared to stocks in group 1. In other words, stocks with superior ES performance show relatively higher resilience.

Conclusion

ESG has long been part of the core global agenda, and the Covid-19 pandemic is serving as a catalyst accelerating this trend. As the idea of a novel virus such as Covid-19 being deeply rooted from global warming and environmental destruction is gaining more ground, there has been a strengthening of global initiatives for addressing environmental issues. This is also leading more and more firms to show keen interest in how to maintain their relationship with their staff and the local community despite contracted business activities and business deterioration.8) ESG—once treated as part of public relations effort or a mere formality for annual report coverage—now means much more than philanthropy, evolving into a major standard for firm evaluation.9) Against that backdrop, this article analyzed the relationship between environmental, social outcomes and stock returns before and after the financial market went through the Covid-19 crisis last year. According to the results, firms with better social and environmental outcomes had a significantly lower decline in their stock prices. In particular, firms with excellent environmental and social outcomes showed high resilience during the first quarter of 2020 when volatility went quite high. Because there is no clear academic consensus on whether ESG actually contributes to financial performance or not, it is hard to conclude that relationship assertively. What’s worth noting, though, is an increase in the number of research results showing that firms with higher ESG performance show stable returns during volatile periods. This is calling for domestic investors to take into account ESG factors for the sake of risk management.10)

1) J.P. Morgan 2020, Why COVID-19 Could Prove to Be a Major Turning Point for ESG Investing

2) Morningstar 2020, Global Sustainable Fund Flows Report

3) Flammer, 2015, Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach; Lin et al. 2017, Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis.

4) Friedman 1970, The Social Responsibility of Business Is to Increase Its Profits

5) Berg et al. 2019, Aggregate confusion: The divergence of ESG ratings; Dimson et al. 2020, Divergent ESG ratings

6) Although not presented in this article, a regression analysis taking into account firm fixed effects and other controllable variables that could affect stock returns reveals a similar result as seen here.

7) For convenience, this article uses simple mean, but portfolio returns (weighted average) are more appropriate for the sake of comparability. The result remains similar when using the weighted average with a narrower confidence interval.

8) Morgan Stanley, 2020, Coronavirus and ESG: Emphasize the Social

9) Of course, there are many other paths via which ESG affects firm value. Although not discussed fully in this article, there are a great number of possibilities, for example, enhancing access to resource via a favorable relationship with the local community and the government, expanding business opportunities based on customer confidence, cutting manufacturing costs by reducing energy consumption, improving labor productivity via staff encouragement, recruiting talents with a positive corporate image and reputation, stabilizing the business environment by minimizing regulatory violations and lawsuits, and generating profits by allocating resources to sustainable projects.

10) MSCI, 2020, MSCI ESG Indexes during the coronavirus crisis; S&P 2020, ESG funds outperform S&P 500 amid COVID-19, helped by tech stock boom; HSBC, 2020 ESG stocks did best in COVID-19 slump

Against that backdrop, the impact of ESG activities on financial performance during the time of crisis such as now has attracted high research interest. Although the academic view on this question appears to slightly lean towards the positive effect, no consensus has yet been reached on this matter with many ongoing discussions. Among others, the proponents for ESG’s positive impact on financial performance argue that firms with excellent ESG performance have a positive corporate image and a high level of confidence at normal times, which could likely lead to less consumer exits and higher resilience when hit by a crisis.3) Others also point out that those firms’ stable relationship with shareholders, investors, management and staff, suppliers, and the local community help them perform stably in a highly volatile market condition. On the other hand, those against the positive impact insist that ESG activities are irrelevant to profit-seeking, only to incur unnecessary costs to bring down firm value.4) Also mentioned is that the nature of ESG information full of unstructured data lowers the reliability of ESG ratings, which makes it almost impossible to figure out how ESG is related to financial performance.5)

Based on those discussions, this article employs domestic data to explore how individual firms’ ES performance impacts their stock returns during the pandemic-triggered stock market plunge between February 24 and March 18, 2021. By revealing the market’s expectations for ESG that is recently gaining ground, this is expected to offer ample implications.

Covid-19 and ESG stock returns

Table 1 illustrates stock returns of 867 KOSPI- and KOSDAQ-listed firms with an ES score during the analysis period. The analyzed firms were divided into four groups according to their ES score. The ES score here uses the average of standardized scores of ES ratings evaluated by Korea Corporate Governance Service as of 2019.

First of all, stock returns during the analysis period confirms that firms with higher ES performance show higher returns. A comparative look at the upper and lower 25% groups shows even more stark difference: The return of group 4 was 4.7 percentage-point higher than that of group 1 during the period. The result remains also consistent for CAPM-adjusted returns as firms with superb social and environmental outcomes saw a smaller decline in returns, except for group 3 whose return was relatively lower. Another exception was found in group 4 whose CAPM-adjusted return was significantly lower by 3.7 percentage-point than that of group 1.6)

ESG has long been part of the core global agenda, and the Covid-19 pandemic is serving as a catalyst accelerating this trend. As the idea of a novel virus such as Covid-19 being deeply rooted from global warming and environmental destruction is gaining more ground, there has been a strengthening of global initiatives for addressing environmental issues. This is also leading more and more firms to show keen interest in how to maintain their relationship with their staff and the local community despite contracted business activities and business deterioration.8) ESG—once treated as part of public relations effort or a mere formality for annual report coverage—now means much more than philanthropy, evolving into a major standard for firm evaluation.9) Against that backdrop, this article analyzed the relationship between environmental, social outcomes and stock returns before and after the financial market went through the Covid-19 crisis last year. According to the results, firms with better social and environmental outcomes had a significantly lower decline in their stock prices. In particular, firms with excellent environmental and social outcomes showed high resilience during the first quarter of 2020 when volatility went quite high. Because there is no clear academic consensus on whether ESG actually contributes to financial performance or not, it is hard to conclude that relationship assertively. What’s worth noting, though, is an increase in the number of research results showing that firms with higher ESG performance show stable returns during volatile periods. This is calling for domestic investors to take into account ESG factors for the sake of risk management.10)

1) J.P. Morgan 2020, Why COVID-19 Could Prove to Be a Major Turning Point for ESG Investing

2) Morningstar 2020, Global Sustainable Fund Flows Report

3) Flammer, 2015, Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach; Lin et al. 2017, Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis.

4) Friedman 1970, The Social Responsibility of Business Is to Increase Its Profits

5) Berg et al. 2019, Aggregate confusion: The divergence of ESG ratings; Dimson et al. 2020, Divergent ESG ratings

6) Although not presented in this article, a regression analysis taking into account firm fixed effects and other controllable variables that could affect stock returns reveals a similar result as seen here.

7) For convenience, this article uses simple mean, but portfolio returns (weighted average) are more appropriate for the sake of comparability. The result remains similar when using the weighted average with a narrower confidence interval.

8) Morgan Stanley, 2020, Coronavirus and ESG: Emphasize the Social

9) Of course, there are many other paths via which ESG affects firm value. Although not discussed fully in this article, there are a great number of possibilities, for example, enhancing access to resource via a favorable relationship with the local community and the government, expanding business opportunities based on customer confidence, cutting manufacturing costs by reducing energy consumption, improving labor productivity via staff encouragement, recruiting talents with a positive corporate image and reputation, stabilizing the business environment by minimizing regulatory violations and lawsuits, and generating profits by allocating resources to sustainable projects.

10) MSCI, 2020, MSCI ESG Indexes during the coronavirus crisis; S&P 2020, ESG funds outperform S&P 500 amid COVID-19, helped by tech stock boom; HSBC, 2020 ESG stocks did best in COVID-19 slump