OPINION

2021 Sep/07

A Proposed Improvement for Corporate ESG Disclosures

Sep. 07, 2021

PDF

- Summary

- With climate change measures and socially responsible investment taking hold, the demand for ESG information is growing rapidly. Different reporting standards set forth by international organizations are increasing the burden of producing ESG information on companies while comparability and reliability of ESG information have remained low. This necessitates forward-looking discussions about how to improve ESG corporate disclosures. First of all, listed firms should be mandated to disclose material ESG information in their annual reports. In addition, third-party assurance would be introduced to enhance the credibility of disclosed ESG information. Lastly, the existing separated channels related to ESG information disclosure should be integrated into a single channel to enhance investors’ accessibility.

With a growing interest in political, social and economic aspects of ESG (Environment, Social, Governance, hereinafter referred to as ‘ESG’) activities, demand for EGS-related information is sharply rising. Socially responsible investing by financial institutions has taken hold with the awareness that negative externalities arising from business activities such as climate change risks, widening income inequality should no longer be neglected (Henderson, 2020; OECD, 2020). Against this backdrop, a social consensus appears to have been formed on why corporate ESG disclosure should be bolstered.

In response to increasing demand for ESG information, Korea’s authorities are working on improvement in disclosure schemes. To begin with, they devised a plan to specify the timeline and target firms of mandatory ESG disclosure schemes, and would gradually strengthen ESG disclosure obligations for listed companies in the securities market until 2030.1)

However, how to reinforce ESG disclosure duty should be constructively discussed going forward. Thus far, major international agencies responsible for establishing reporting standards of ESG-related non-financial information have adopted different standards for report preparation, which has aggravated companies’ burden of disclosures. Furthermore, the lack of consistency in ESG evaluation criteria presented by rating agencies has undermined comparability and reliability of information and corporate disclosure.2) Under these circumstances, the Korea Exchange set forth the best ESG management practices that integrate ESG elements into corporate strategy, organizational structure and operation and performance goals and suggested key indicators in terms of organizational, environmental and social aspects, which would guide directions for substantial ESG activities and corporate disclosure.3) Despite such guidelines, a fierce controversy is still underway regarding the timeline, scope and method of the tightening of ESG disclosure.4)

Having adopted the International Financial Reporting Standard (IFRS) as its financial reporting standards, Korea should apply the sustainability reporting standards being prepared by the IFRS Foundation as its ESG-related non-financial reporting rules. The IFRS’ ESG standards are evaluated as the most reasonable rules given international compatibility and close relationship with the existing financial reporting standards.

However, it may take a significant period of time to address sharp conflicts of interest among countries, industries and global agencies in charge of formulating ESG standards before the ESG reporting framework based on a single set of standards takes root in societies. With regulations and policy measures being bolstered by countries, corporate response to climate changes and need for strengthening social responsibilities have posed major financial risks to companies. In view of this trend, it seems undesirable to keep the status quo of Korea’s disclosure system until ESG reporting standards are documented by the IFRS Foundation. In this transition period, it is necessary to formulate policy measures for meeting various stakeholders’ demand for information while minimizing the burden of corporate disclosure.

Directions for mandatory ESG disclosure

Stricter regulations on ESG elements such as a carbon border tax and stronger human rights in the workplace are a global trend and would be established as a new international trade order.5) These regulations are likely to impose substantial risks on Korean companies with higher proportion of export in their business activities. As for firms whose sales are focused on countries and industries where regulations are rapidly beefed up, their investors as well as executives need to manage relevant risks.

Economies including the EU, the US, China, Hong Kong, and Japan that account for a large share of Korean companies’ total export volume have tightened both ESG-related regulations and corporate disclosure obligations.6) Also, the EU’s Proposal for a Corporate Sustainability Reporting Directive (CSRD) puts emphasis on the need for a review on the importance of ESG risk factors at the supply chain level.7) Over the recent five years, Korea’s average annual export to such countries represented 61% of its total export volume.8) In terms of the share of Korea’s aggregate export by item, electrical and electronic goods took up the largest proportion, with chemical products being ranked second followed by transport equipment, machinery and steel products. As for any firms involved in such supply chains, how they deal with ESG elements is expected to have a significant impact on their future contracts with clients.

Some point out that the Korean authorities should move up its timeline for extended application of disclosure obligations and expand the list of target companies to keep pace with other countries’ urgent response regarding ESG management.9) More concretely, they criticize disclosure obligations to be applied only to companies listed on the securities market from 2030 for being too lax, compared with regulations adopted by the EU and other major economies.

In terms of urgency in implementing EGS regulations, however, ESG ‘management practices’ should be distinguished from ESG ‘disclosure’. There is still no theoretical and empirical evidence proving that mandatory ESG disclosure could mitigate negative externalities, social costs or deadweight loss. Furthermore, consistent global reporting standards have yet to be established. Thus, the full-scale imposition of obligations to disclose ESG information could do more harm than good.

Corporate disclosures generate indirect costs such as leakage of proprietary information as well as direct costs from production and distribution of information.10) For instance, if it is mandatory to provide the mid- and long-term goals, targets by year and progress rate with regard to carbon emissions reduction, a company who intends to install carbon reduction equipment has no choice but to sit at the negotiating table with most of its business plan being unveiled to the counterparty. This mandatory regulation is likely to put SMEs with high dependence on externally developed technology and low bargaining power at a disadvantage when it comes to determining a contract price.

Therefore, voluntary disclosure schemes should be facilitated while mandatory disclosure needs to be minimized to ensure that firms’ compliance efforts never exceed benefits of mandatory disclosure system or that the authorities’ regulatory intervention never gives rise to inefficiencies.11) Under the voluntary disclosure framework, firms who are better at handling ESG factors are likely motivated to voluntarily publicize ESG performance at a minimum cost in order to avoid adverse selection where their performance receives an equal recognition to that of less competitive firms.12)

Meanwhile, the argument for urgent introduction of mandatory disclosure rules is based on the awareness that changes in the ESG regulatory environment would have a material impact on business risks and that ESG elements could enormously influence corporate sustainability. Ironically, such an awareness can provide maximized incentives to firms to voluntarily engage in corporate disclosure.

Hence, mandatory ESG disclosure schemes need to focus on addressing the situation where a business entity who underperforms in sustainability and is less capable of dealing with ESG elements fails to properly disclose relevant risks, which thus, requires investor protection. As for the least ESG information required to understand business risks, information asymmetry issues can be tackled by such mandatory disclosures. However, in terms of reporting detailed information, a desirable approach is to encourage companies to identify specific issues for reporting at their need and to voluntarily build market confidence.

Mandatory disclosure of ESG-related material information

A transition towards ESG-centered international economic order is a critical issue directly linked to financial risks, especially for Korean firms heavily focused on export and intermediate goods production. According to the analysis on ESG disclosure of Korean business entities, those who are less prepared for ESG issues and exposed to great risks posed by regulatory changes are unlikely to have their information properly disclosed.13) Since such firms rarely afford to bear social costs incurred by themselves, tightening ESG regulations at a rapid pace could be detrimental to their corporate sustainability. This highlights the need for investor protection by immediately addressing information asymmetries.

For these reasons, it should become mandatory to disclose ESG information critical to making investment decisions as part of ‘business statements’ or ‘matters to be disclosed for investor protection’ contained in annual reports. More concretely, medium-scale businesses or SMEs and firms listed on the KOSDAQ are considered less capable of coping with ESG issues compared to large corporations and listed firms in the securities market. Thus, the mandatory disclosure regulation on minimum ESG information is expected to help protect investors of such companies with low quality ESG reporting.

Introduction of ESG assurance procedures

In addition to mandatory disclosure of financially important ESG information, a review should be carried out to adopt ESG asurance system. If a firm selects key sustainability issues at its discretion to prevent unfavorable information from being made public, it would undermine effectiveness of the mandatory system and deal a blow to credibility of disclosed information.

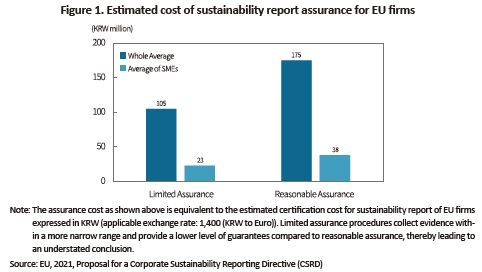

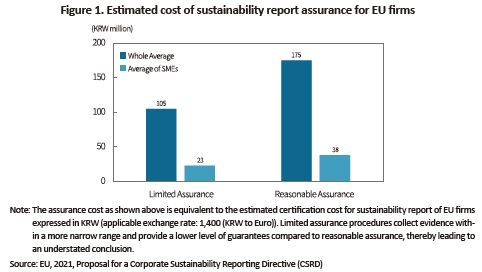

However, it is also necessary to pay keen attention to factors that could aggravate corporate burden to comply with assurance procedures. Although the EU has mandated business entities with employees of 500 or more to disclose non-financial information since 2018, many have questioned effectiveness of such regulatory framework and reliability of reported information. As a way to increase effectiveness, the EU plans to bring in the assurance system. As shown in Figure 1, in terms of average annual assurance costs for non-financial information of EU companies, SMEs and large corporations are expected to spend KRW 23 to 38 million and KRW 105 to 175 million, respectively every year. What is notable is that the assurance cost has been estimated based on the entire report under the EU’s non-financial reporting guidelines. This means that if only the key ESG information is subject to assurance, Korea needs to recalculate the reasonable amount of expenses required for assurance.

Reform of existing ESG disclosure scheme and integrating reporting channels into a single system

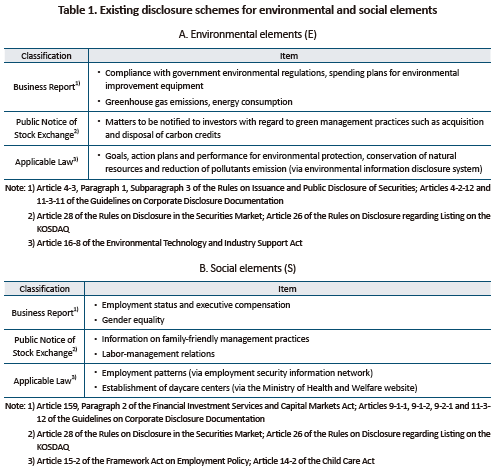

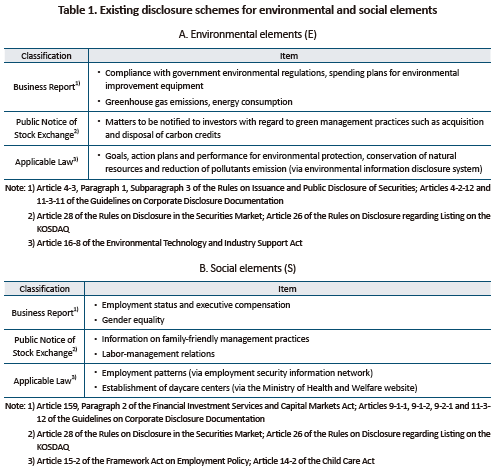

Moreover, there is the need for reshaping existing disclosure schemes of ESG information to integrate reporting channels into a single structure. As illustrated in Table 1, environmental (E) and social (S) information is available via a wide range of channels in accordance with disclosure regulations regarding business reports, stock exchange notices and public announcement required by applicable laws. By item, major environmental and social metrics recommended by the World Economic Forum (2020) have already been covered by existing disclosure schemes in Korea.14) Thus, if reporting channels are integrated into a annual report-based single system to include matters of corporate governance (G) reports that should be mandatorily disclosed from 2026, investors are expected to gain greater access to ESG information.

Conclusion

Sustainability has long been considered an integral part of management practices. After the Corporate Social Responsibility (CSR) concept emerged in the 1950s,15) major global agencies including OECD, UN and ISO emphasized the importance of corporate responsibility for a wide range of sustainability issues such as environment and society. However, the ambiguous concept of CSR has prevented financial institutions from effectively participating in socially responsible investment.16)

The ESG, as an alternative to CSR, has been introduced to classify corporate sustainability into environmental, social and governance factors and to objectively measure and evaluate such non-financial information. In this sense, ESG is likely to have a great ripple effect on the overall corporate management practices by facilitating engagement of diverse stakeholders. In line with this trend, the role of corporate disclosure would come to the fore.

With regard to ESG, however, consistent reporting standards have yet to be established and the level of corporate disclosure varies greatly by company. Unlike institutional investors who have a bargaining power to directly require investee companies to offer necessary information and actively take a part in the relevant process, individual investors not having such power are likely to end up being exposed to information-related risks. Particularly, given that firms with low ESG reporting quality have a tendency to be small-sized or KOSDAQ listed firms, institutional investors have small incentives to engage with such companies. Thus, regulatory efforts should be put into alleviating information asymmetries of those less capable of handling ESG issues.

It would be important to mandatorily disclose ESG information required for making investment decisions as part of ‘business statements’ or ‘matters to be disclosed for investor protection’ contained in annual reports to reduce the ESG information asymmetry. As for detailed information disclosure, companies should be guided to voluntarily build up market confidence in their ESG related information. Also, the certification process needs to be put in place to enhance credibility of reported information.

More importantly, companies should put priority on achieving strong ‘performance’ before figuring out ‘how to publicize ESG-related performance’. Corporate disclosure backed by no substantial outcomes would be subject to harsh assessment in the market.

1) Financial Services Commission, January 14 2021, Comprehensive Measures for Improvement in Corporate Disclosure System, press release

2) Lee, Inhyung, ESG Rating Schemes: Current State and Issues, KCMI Issue Paper, 21-09.

3) Korea Exchange, January 18 2021, Guidance on ESG Information Disclosure, press release

4) The Korea Economic Daily, January 22 2021, Politicians pay attention to ESG schemes to take the initiative in ESG-related agenda

eToday, March 30 2021, Opinions at a debate are sharply divided about moving up the timeline for mandatory ESG disclosure

Law Times, April 5 2021, Companies’ disclosure should be aligned with varying degrees of required ESG information disclosure by business scope

Maeil Business Newspaper, April 28 2021, Need to focus on ESG disclosure: it is of no use if ESG performance is not publicized

5) Larch, M., Wanner, J., 2017, Carbon tariffs: An analysis of the trade, welfare, and emission effects. Journal of International Economics 109, 195-213.

6) Krueger, P., Sautner, Z., Tang, D.Y., Zhong, R., 2021, The effects of mandatory ESG disclosure around the world, Available at SSRN.

7) EU, 2021, Proposal for a Corporate Sustainability Reporting Directive (CSRD).

8) Korea’s export and import information released by Korea Customs Service

9) Impact On, January 15 2021, Controversy over mandatory ESG disclosure: “too late to implement ESG disclosure in 2025” vs. “firms need more time to prepare for ESG schemes”

10) Verrecchia, R.E., 1983, Discretionary disclosure, Journal of Accounting and Economics 5, 179-194.

11) Blacconiere, W.G., Patten, D.M., 1994, Environmental disclosures, regulatory costs, and changes in firm value, Journal of Accounting and Economics 18(3), 357-377.

12) Akerlof, G., 1970, The market for “Lemons”: Quality uncertainty and the market mechanism, The Quarterly Journal of Economics 84(3), 488-500.

13) Lee, Sang Ho, A Proposed Improvement in Corporate Disclosure for Enhancing the Usefulness of ESG Information, KCMI Issue Paper, 21-12.

14) “Measuring Stakeholder Capitalism Towards Common Metrics and Consistent Reporting of Sustainable Value Creation” published by the World Economic Forum in 2020 recommends disclosure on environmental metrics (E) including carbon credit, other greenhouse gas emissions, water pollution, green energy use, response to climate change, violation of environmental rules and regulations; and social metrics (S) including proportion of female workforce, labor welfare issues, workplace safety measures, contribution to communities, and violation of other rules and regulations.

15) Bowen, H.R., 1953, Social Responsibilities of the Businessman, University of Iowa Press.

16) Kang, WonㆍJung Mu Kwon, 2020, Study on Relationship between Non-Financial Indicators and Marketability: Analysis of Market Reaction to Cases for ESG Indicators Development, Yonsei Business Review, 57(2), 1-22.

In response to increasing demand for ESG information, Korea’s authorities are working on improvement in disclosure schemes. To begin with, they devised a plan to specify the timeline and target firms of mandatory ESG disclosure schemes, and would gradually strengthen ESG disclosure obligations for listed companies in the securities market until 2030.1)

However, how to reinforce ESG disclosure duty should be constructively discussed going forward. Thus far, major international agencies responsible for establishing reporting standards of ESG-related non-financial information have adopted different standards for report preparation, which has aggravated companies’ burden of disclosures. Furthermore, the lack of consistency in ESG evaluation criteria presented by rating agencies has undermined comparability and reliability of information and corporate disclosure.2) Under these circumstances, the Korea Exchange set forth the best ESG management practices that integrate ESG elements into corporate strategy, organizational structure and operation and performance goals and suggested key indicators in terms of organizational, environmental and social aspects, which would guide directions for substantial ESG activities and corporate disclosure.3) Despite such guidelines, a fierce controversy is still underway regarding the timeline, scope and method of the tightening of ESG disclosure.4)

Having adopted the International Financial Reporting Standard (IFRS) as its financial reporting standards, Korea should apply the sustainability reporting standards being prepared by the IFRS Foundation as its ESG-related non-financial reporting rules. The IFRS’ ESG standards are evaluated as the most reasonable rules given international compatibility and close relationship with the existing financial reporting standards.

However, it may take a significant period of time to address sharp conflicts of interest among countries, industries and global agencies in charge of formulating ESG standards before the ESG reporting framework based on a single set of standards takes root in societies. With regulations and policy measures being bolstered by countries, corporate response to climate changes and need for strengthening social responsibilities have posed major financial risks to companies. In view of this trend, it seems undesirable to keep the status quo of Korea’s disclosure system until ESG reporting standards are documented by the IFRS Foundation. In this transition period, it is necessary to formulate policy measures for meeting various stakeholders’ demand for information while minimizing the burden of corporate disclosure.

Directions for mandatory ESG disclosure

Stricter regulations on ESG elements such as a carbon border tax and stronger human rights in the workplace are a global trend and would be established as a new international trade order.5) These regulations are likely to impose substantial risks on Korean companies with higher proportion of export in their business activities. As for firms whose sales are focused on countries and industries where regulations are rapidly beefed up, their investors as well as executives need to manage relevant risks.

Economies including the EU, the US, China, Hong Kong, and Japan that account for a large share of Korean companies’ total export volume have tightened both ESG-related regulations and corporate disclosure obligations.6) Also, the EU’s Proposal for a Corporate Sustainability Reporting Directive (CSRD) puts emphasis on the need for a review on the importance of ESG risk factors at the supply chain level.7) Over the recent five years, Korea’s average annual export to such countries represented 61% of its total export volume.8) In terms of the share of Korea’s aggregate export by item, electrical and electronic goods took up the largest proportion, with chemical products being ranked second followed by transport equipment, machinery and steel products. As for any firms involved in such supply chains, how they deal with ESG elements is expected to have a significant impact on their future contracts with clients.

Some point out that the Korean authorities should move up its timeline for extended application of disclosure obligations and expand the list of target companies to keep pace with other countries’ urgent response regarding ESG management.9) More concretely, they criticize disclosure obligations to be applied only to companies listed on the securities market from 2030 for being too lax, compared with regulations adopted by the EU and other major economies.

In terms of urgency in implementing EGS regulations, however, ESG ‘management practices’ should be distinguished from ESG ‘disclosure’. There is still no theoretical and empirical evidence proving that mandatory ESG disclosure could mitigate negative externalities, social costs or deadweight loss. Furthermore, consistent global reporting standards have yet to be established. Thus, the full-scale imposition of obligations to disclose ESG information could do more harm than good.

Corporate disclosures generate indirect costs such as leakage of proprietary information as well as direct costs from production and distribution of information.10) For instance, if it is mandatory to provide the mid- and long-term goals, targets by year and progress rate with regard to carbon emissions reduction, a company who intends to install carbon reduction equipment has no choice but to sit at the negotiating table with most of its business plan being unveiled to the counterparty. This mandatory regulation is likely to put SMEs with high dependence on externally developed technology and low bargaining power at a disadvantage when it comes to determining a contract price.

Therefore, voluntary disclosure schemes should be facilitated while mandatory disclosure needs to be minimized to ensure that firms’ compliance efforts never exceed benefits of mandatory disclosure system or that the authorities’ regulatory intervention never gives rise to inefficiencies.11) Under the voluntary disclosure framework, firms who are better at handling ESG factors are likely motivated to voluntarily publicize ESG performance at a minimum cost in order to avoid adverse selection where their performance receives an equal recognition to that of less competitive firms.12)

Meanwhile, the argument for urgent introduction of mandatory disclosure rules is based on the awareness that changes in the ESG regulatory environment would have a material impact on business risks and that ESG elements could enormously influence corporate sustainability. Ironically, such an awareness can provide maximized incentives to firms to voluntarily engage in corporate disclosure.

Hence, mandatory ESG disclosure schemes need to focus on addressing the situation where a business entity who underperforms in sustainability and is less capable of dealing with ESG elements fails to properly disclose relevant risks, which thus, requires investor protection. As for the least ESG information required to understand business risks, information asymmetry issues can be tackled by such mandatory disclosures. However, in terms of reporting detailed information, a desirable approach is to encourage companies to identify specific issues for reporting at their need and to voluntarily build market confidence.

Mandatory disclosure of ESG-related material information

A transition towards ESG-centered international economic order is a critical issue directly linked to financial risks, especially for Korean firms heavily focused on export and intermediate goods production. According to the analysis on ESG disclosure of Korean business entities, those who are less prepared for ESG issues and exposed to great risks posed by regulatory changes are unlikely to have their information properly disclosed.13) Since such firms rarely afford to bear social costs incurred by themselves, tightening ESG regulations at a rapid pace could be detrimental to their corporate sustainability. This highlights the need for investor protection by immediately addressing information asymmetries.

For these reasons, it should become mandatory to disclose ESG information critical to making investment decisions as part of ‘business statements’ or ‘matters to be disclosed for investor protection’ contained in annual reports. More concretely, medium-scale businesses or SMEs and firms listed on the KOSDAQ are considered less capable of coping with ESG issues compared to large corporations and listed firms in the securities market. Thus, the mandatory disclosure regulation on minimum ESG information is expected to help protect investors of such companies with low quality ESG reporting.

Introduction of ESG assurance procedures

In addition to mandatory disclosure of financially important ESG information, a review should be carried out to adopt ESG asurance system. If a firm selects key sustainability issues at its discretion to prevent unfavorable information from being made public, it would undermine effectiveness of the mandatory system and deal a blow to credibility of disclosed information.

However, it is also necessary to pay keen attention to factors that could aggravate corporate burden to comply with assurance procedures. Although the EU has mandated business entities with employees of 500 or more to disclose non-financial information since 2018, many have questioned effectiveness of such regulatory framework and reliability of reported information. As a way to increase effectiveness, the EU plans to bring in the assurance system. As shown in Figure 1, in terms of average annual assurance costs for non-financial information of EU companies, SMEs and large corporations are expected to spend KRW 23 to 38 million and KRW 105 to 175 million, respectively every year. What is notable is that the assurance cost has been estimated based on the entire report under the EU’s non-financial reporting guidelines. This means that if only the key ESG information is subject to assurance, Korea needs to recalculate the reasonable amount of expenses required for assurance.

Moreover, there is the need for reshaping existing disclosure schemes of ESG information to integrate reporting channels into a single structure. As illustrated in Table 1, environmental (E) and social (S) information is available via a wide range of channels in accordance with disclosure regulations regarding business reports, stock exchange notices and public announcement required by applicable laws. By item, major environmental and social metrics recommended by the World Economic Forum (2020) have already been covered by existing disclosure schemes in Korea.14) Thus, if reporting channels are integrated into a annual report-based single system to include matters of corporate governance (G) reports that should be mandatorily disclosed from 2026, investors are expected to gain greater access to ESG information.

Sustainability has long been considered an integral part of management practices. After the Corporate Social Responsibility (CSR) concept emerged in the 1950s,15) major global agencies including OECD, UN and ISO emphasized the importance of corporate responsibility for a wide range of sustainability issues such as environment and society. However, the ambiguous concept of CSR has prevented financial institutions from effectively participating in socially responsible investment.16)

The ESG, as an alternative to CSR, has been introduced to classify corporate sustainability into environmental, social and governance factors and to objectively measure and evaluate such non-financial information. In this sense, ESG is likely to have a great ripple effect on the overall corporate management practices by facilitating engagement of diverse stakeholders. In line with this trend, the role of corporate disclosure would come to the fore.

With regard to ESG, however, consistent reporting standards have yet to be established and the level of corporate disclosure varies greatly by company. Unlike institutional investors who have a bargaining power to directly require investee companies to offer necessary information and actively take a part in the relevant process, individual investors not having such power are likely to end up being exposed to information-related risks. Particularly, given that firms with low ESG reporting quality have a tendency to be small-sized or KOSDAQ listed firms, institutional investors have small incentives to engage with such companies. Thus, regulatory efforts should be put into alleviating information asymmetries of those less capable of handling ESG issues.

It would be important to mandatorily disclose ESG information required for making investment decisions as part of ‘business statements’ or ‘matters to be disclosed for investor protection’ contained in annual reports to reduce the ESG information asymmetry. As for detailed information disclosure, companies should be guided to voluntarily build up market confidence in their ESG related information. Also, the certification process needs to be put in place to enhance credibility of reported information.

More importantly, companies should put priority on achieving strong ‘performance’ before figuring out ‘how to publicize ESG-related performance’. Corporate disclosure backed by no substantial outcomes would be subject to harsh assessment in the market.

1) Financial Services Commission, January 14 2021, Comprehensive Measures for Improvement in Corporate Disclosure System, press release

2) Lee, Inhyung, ESG Rating Schemes: Current State and Issues, KCMI Issue Paper, 21-09.

3) Korea Exchange, January 18 2021, Guidance on ESG Information Disclosure, press release

4) The Korea Economic Daily, January 22 2021, Politicians pay attention to ESG schemes to take the initiative in ESG-related agenda

eToday, March 30 2021, Opinions at a debate are sharply divided about moving up the timeline for mandatory ESG disclosure

Law Times, April 5 2021, Companies’ disclosure should be aligned with varying degrees of required ESG information disclosure by business scope

Maeil Business Newspaper, April 28 2021, Need to focus on ESG disclosure: it is of no use if ESG performance is not publicized

5) Larch, M., Wanner, J., 2017, Carbon tariffs: An analysis of the trade, welfare, and emission effects. Journal of International Economics 109, 195-213.

6) Krueger, P., Sautner, Z., Tang, D.Y., Zhong, R., 2021, The effects of mandatory ESG disclosure around the world, Available at SSRN.

7) EU, 2021, Proposal for a Corporate Sustainability Reporting Directive (CSRD).

8) Korea’s export and import information released by Korea Customs Service

9) Impact On, January 15 2021, Controversy over mandatory ESG disclosure: “too late to implement ESG disclosure in 2025” vs. “firms need more time to prepare for ESG schemes”

10) Verrecchia, R.E., 1983, Discretionary disclosure, Journal of Accounting and Economics 5, 179-194.

11) Blacconiere, W.G., Patten, D.M., 1994, Environmental disclosures, regulatory costs, and changes in firm value, Journal of Accounting and Economics 18(3), 357-377.

12) Akerlof, G., 1970, The market for “Lemons”: Quality uncertainty and the market mechanism, The Quarterly Journal of Economics 84(3), 488-500.

13) Lee, Sang Ho, A Proposed Improvement in Corporate Disclosure for Enhancing the Usefulness of ESG Information, KCMI Issue Paper, 21-12.

14) “Measuring Stakeholder Capitalism Towards Common Metrics and Consistent Reporting of Sustainable Value Creation” published by the World Economic Forum in 2020 recommends disclosure on environmental metrics (E) including carbon credit, other greenhouse gas emissions, water pollution, green energy use, response to climate change, violation of environmental rules and regulations; and social metrics (S) including proportion of female workforce, labor welfare issues, workplace safety measures, contribution to communities, and violation of other rules and regulations.

15) Bowen, H.R., 1953, Social Responsibilities of the Businessman, University of Iowa Press.

16) Kang, WonㆍJung Mu Kwon, 2020, Study on Relationship between Non-Financial Indicators and Marketability: Analysis of Market Reaction to Cases for ESG Indicators Development, Yonsei Business Review, 57(2), 1-22.