Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Behavioral Biases of Retail Investors in the Stock Market

Publication date Sep. 07, 2021

Summary

In Korea’s stock market, retail investors show a tendency to purchase a stock of which price or trading volume has steeply risen. When stock prices climb, these investors are likely to dispose of their holdings in a hurry while they tend to put off selling and hold stocks with a downward trend in prices. Such trading patterns appear to be associated with behavioral biases including overconfidence, disposition effect, limited attention and representativeness, all of which would undermine direct investment performance. Since retail investors have limited access to information and are likely exposed to a wide range of behavioral biases that impede them from making rational financial decisions, they can hardly achieve trading performance that is commensurate with investment risks. A desirable approach for retail investors is to conduct a sober assessment of their understanding on stock trading and direct investment capability and to tap into indirect investment vehicles if they lack appropriate investment capability in their own judgment.

How do retail investors buy and sell stocks? Few would say that they collect and analyze all available information on the entire investment targets and then build a portfolio to earn a maximum return against risks. In reality, they typically analyze and evaluate investment information obtained from financial institutions, media reports or acquaintances to select a few stocks worth buying and frequently make a purchase or dispose of their holdings. These investment choices are influenced by psychological factors including anxiety over having to buy a stock before its price goes up further, confidence in their capability and knowledge, a feeling of regret for not having sold a positon earlier, and expectations for stock prices to rebound sooner or later. Such realistic factors that overrule rationality of retail traders are referred to as behavioral biases, which would primarily have an adverse impact on their direct investment performance.

Behavioral biases of retail investors

An array of behavioral biases of retail investors observed in the stock market can be largely classified into four categories. The first bias is overconfidence, which leads retail investors to believe that their prediction or evaluation is accurate or their investment capability is above the average. This bias is pointed to as a culprit behind excessive and speculative retail trading. Overconfidence is explicitly shown in cases where male investors are typically more active at stock trading but tend to achieve lower investment performance compared to their female counterparts, or an investor with better performance in offline trading usually engage in more trades and see his or her returns decline after shifting towards online trading platforms.

The second bias is disposition effect, a tendency that investors are likely to hold a losing position for a long time while hurrying to sell a winning position. This effect appears to be attributable to a propensity that retail investors want to avoid mental discomfort of admitting mistakes regarding financial decisions by delaying realization of loss while trying to feel satisfied and relieved from realization of gains. Being swayed by this bias, investors are likely to give away a chance to earn additional profits and to accumulate loss to their holdings, which impairs their overall trading performance. The disposition effect has been widely observed not only in the stock market but also in markets for derivatives and real estate.

The third bias is limited attention, an inclination that with various stocks and abundant information to choose from, retail traders typically select information handy and available or stocks that come to their attention. This behavioral bias stems from humans’ limitations in information processing and cognitive costs deriving from such processing. For example, it is easy to overlook even material information that hardly stands out or is presented in an incomprehensible format. Furthermore, retail investors are apt to put priority on stocks that frequently receive media attention or show a sharp upward movement in price or trading volume.

The fourth bias, representativeness refers to a tendency that individuals make a judgment on a given matter based on similarities or stereotypes. Cases in point are that retail traders predict recent trends in stock prices or financial performance to continue for the time being, or that they perceive companies whose names include ‘.com’ and ‘bio’ as an IT sector firm and a medical company regardless of their substantial business activities. Being affected by the representativeness bias, these investors tend to rely on a few observed values and superficial aspects without any comprehensive analysis on diverse factors, which likely leads to prejudiced judgment and irrational decisions.

Retail investors’ buying and selling decisions: an analysis

From the perspective of behavioral biases, this article tries to take a brief look at characteristics of retail investors’ decisions to buy and sell in Korea’s stock market. In this regard, an analysis was carried out on details of listed stock trading by around 200,000 investors during the period from March to October 2020.

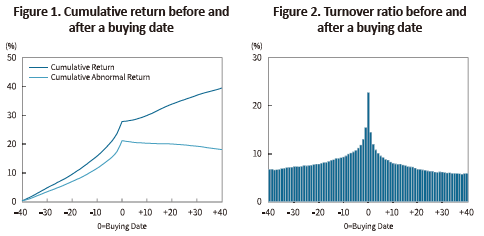

In terms of stock buying of retail investors, Figure 1 shows both cumulative returns and cumulative abnormal returns from 40 days before to 40 days after the purchase date of a given stock. The cumulative abnormal return is an accumulated amount of daily abnormal returns calculated by deducting the expected daily return based on the market model from each stock’s daily return, which represents excess trading performance derived by taking into account each stock’s investment risks. As illustrated in Figure 1, the cumulative return for 40 days prior to the purchase reached as high as 25.8%. The 16.8% cumulative return for 20 days, 10.6% for 10 days and 6.6% for 5 days before the purchase reveal that the stock price displayed a steep upward trend as it approached the purchase date. The cumulative abnormal returns show a similar pattern. The cumulative abnormal returns for 40 days prior to the purchase stood at 19.2%, with the cumulative abnormal returns for 20 days, 10 days and 5 days reaching 12.6%, 8.2% and 5.1%, respectively. This implies that retail investors were highly likely to buy stocks of which prices spiked during the period analyzed.

In terms of trading performance achieved following the purchase date, the cumulative return calculated for 40 days after the purchase stood at 11.6%, exhibiting a significant slowdown in its upward pace. And the cumulative abnormal return is negative, posting -3.1% over the same period. This analysis leads to a conclusion that stock buying of retail investors hardly resulted in efficient investment.

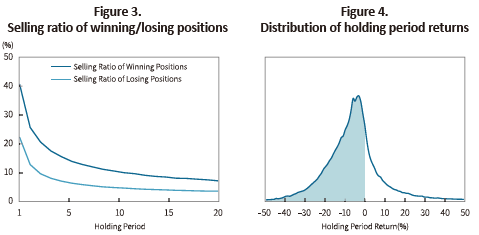

Figure 2 illustrates the daily turnover ratio derived before and after a given purchase date. The turnover ratio of 40 days before the stock buying stood at 6.7%, which kept increasing to 15.4% one day before the purchase date and reached as high as 22.7% on the trading date. This clearly indicates that retail traders bought stocks of which trading volume steeply surged. On the contrary, the ratio plummeted following the stock trade.

This analysis reveals that retail investors’ decisions to buy stocks are constrained by overconfidence, limited attention and representativeness biases. Without expectation or belief that stocks whose prices or trading volume sharply soared recently would continue the upward movement, they would not have engaged in the above-mentioned buying pattern. On the assumption that a retail investor randomly selected a stock on each buying date, the cumulative abnormal return calculated for 40 days after the purchase date is estimated at 2.2%. The difference between the random selection outcome and the investment performance actually observed can be partly regarded as costs of behavioral biases.

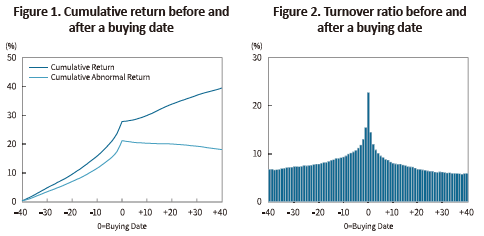

Also noteworthy are patterns of stock selling decisions. For the analysis, the purchase and sale of stocks by retail investors was matched with each other through the First-In-First-Out method.1) Then, if a daily stock price (closing price) is higher than the purchase price, the stock is categorized as a winning position while a stock of which daily price is lower than the purchase price is categorized as a losing position. On the selling date, a stock is classified into a winning position or a losing position through a comparison between its selling price and purchase price.

Figure 3 shows selling ratios of a winning position and a losing position over the holding period, indicating that the selling ratio of the winning position is about two times higher than that of the losing position regardless of the holding period. On the following day of the purchase (for the 1-day holding period), retail investors sold 41% of their winning stocks while selling just 22% of the losing position. This means that they decided to wait and see for some time with 78% of the losing position. In the case where they kept holdings for 10 days after the purchase (for the 10-day holding period), retail traders disposed of 11% of their winning position while they sold off just 5% of the losing position. This tendency of rushing to realize returns and postponing loss realization can be accurately explained by the disposition effect stated above.

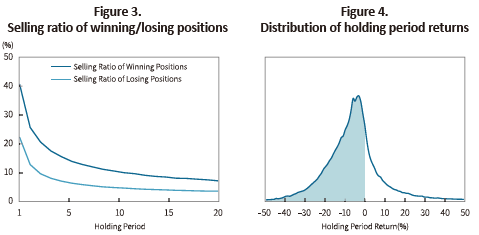

Figure 4 illustrates distribution of holding period returns for stocks being held by retail investors at the end of the period analyzed. Of the total positions, 71.4% represents a negative return, or losses. The remaining positions are likely to post a loss since winning positions were already disposed of. The steep decline in stock positions around a 0% return mark is attributable to winning positions largely being sold off within the range of small returns. This analysis reveals a tendency that retail traders sell stocks even though there is a slight increase in stock prices.

If a retail investor is unlikely to make trading decisions based on private information, such trading activities that limit gains in the bullish market while leading to accumulation of losses in the bearish market can be viewed as inefficient investing behaviors.

Conclusion

According to several previous studies, retail investors engaging in direct investment can hardly gain a return that surpasses the market return. The active or aggressive trading leads to a lower investment performance. This is because retail traders suffer from information asymmetry and are constrained by various behavioral biases that hinder them from making rational trading decisions. As demonstrated earlier, Korea’s retail investors are prone to buy stocks that report a steep rise in price and trading volume and to sell off their holdings when prices go up. On the contrary, they exhibit a propensity to hold off trading and keep a losing position. It seems largely inevitable to be affected by behavioral biases that originate from biased beliefs, emotions and limitations of human cognitive capacity. What is notable is that such biases act as a detriment to direct investment performance.

Although the pace of the upward movement in the stock market has slowed down, the net buying trend of retail investors that has started in 2020 shows no signs of abating. Their net-buying reached KRW 130 trillion in cumulative terms during the period from February 2020 to July 2021, of which the half was invested in the stock market after the KOSPI surpassed the 3,000 mark. With retail trading being still active, retain investors’ monthly trading value has reached KRW 450 trillion in 2021 (the average of buy and sell), representing 70% to 75% of the total stock trading value that is similar to the level in the second half of 2020. Given their behavioral biases and stagnation in the stock market, however, the increase in retail direct investment can be hardly regarded as a positive phenomenon.

Stock prices are influenced by a wide range of factors and stock trading is an act of risk taking. Thus, retail traders should conduct a sober assessment on their understanding of stock trades and direct trading capability. A desirable approach is to tap into indirect investment vehicles if they lack relevant trading capability in their own opinion. In this regard, concerted efforts should be made to facilitate indirect investment and at the same time, it is necessary to create the direct investment environment that would rarely give rise to, and mitigate, behavioral biases of retail traders.

1) It is assumed that stocks that were first bought would be sold off first. The sample for which the disposition date coincides with the purchase date has been excluded.

Behavioral biases of retail investors

An array of behavioral biases of retail investors observed in the stock market can be largely classified into four categories. The first bias is overconfidence, which leads retail investors to believe that their prediction or evaluation is accurate or their investment capability is above the average. This bias is pointed to as a culprit behind excessive and speculative retail trading. Overconfidence is explicitly shown in cases where male investors are typically more active at stock trading but tend to achieve lower investment performance compared to their female counterparts, or an investor with better performance in offline trading usually engage in more trades and see his or her returns decline after shifting towards online trading platforms.

The second bias is disposition effect, a tendency that investors are likely to hold a losing position for a long time while hurrying to sell a winning position. This effect appears to be attributable to a propensity that retail investors want to avoid mental discomfort of admitting mistakes regarding financial decisions by delaying realization of loss while trying to feel satisfied and relieved from realization of gains. Being swayed by this bias, investors are likely to give away a chance to earn additional profits and to accumulate loss to their holdings, which impairs their overall trading performance. The disposition effect has been widely observed not only in the stock market but also in markets for derivatives and real estate.

The third bias is limited attention, an inclination that with various stocks and abundant information to choose from, retail traders typically select information handy and available or stocks that come to their attention. This behavioral bias stems from humans’ limitations in information processing and cognitive costs deriving from such processing. For example, it is easy to overlook even material information that hardly stands out or is presented in an incomprehensible format. Furthermore, retail investors are apt to put priority on stocks that frequently receive media attention or show a sharp upward movement in price or trading volume.

The fourth bias, representativeness refers to a tendency that individuals make a judgment on a given matter based on similarities or stereotypes. Cases in point are that retail traders predict recent trends in stock prices or financial performance to continue for the time being, or that they perceive companies whose names include ‘.com’ and ‘bio’ as an IT sector firm and a medical company regardless of their substantial business activities. Being affected by the representativeness bias, these investors tend to rely on a few observed values and superficial aspects without any comprehensive analysis on diverse factors, which likely leads to prejudiced judgment and irrational decisions.

Retail investors’ buying and selling decisions: an analysis

From the perspective of behavioral biases, this article tries to take a brief look at characteristics of retail investors’ decisions to buy and sell in Korea’s stock market. In this regard, an analysis was carried out on details of listed stock trading by around 200,000 investors during the period from March to October 2020.

In terms of stock buying of retail investors, Figure 1 shows both cumulative returns and cumulative abnormal returns from 40 days before to 40 days after the purchase date of a given stock. The cumulative abnormal return is an accumulated amount of daily abnormal returns calculated by deducting the expected daily return based on the market model from each stock’s daily return, which represents excess trading performance derived by taking into account each stock’s investment risks. As illustrated in Figure 1, the cumulative return for 40 days prior to the purchase reached as high as 25.8%. The 16.8% cumulative return for 20 days, 10.6% for 10 days and 6.6% for 5 days before the purchase reveal that the stock price displayed a steep upward trend as it approached the purchase date. The cumulative abnormal returns show a similar pattern. The cumulative abnormal returns for 40 days prior to the purchase stood at 19.2%, with the cumulative abnormal returns for 20 days, 10 days and 5 days reaching 12.6%, 8.2% and 5.1%, respectively. This implies that retail investors were highly likely to buy stocks of which prices spiked during the period analyzed.

In terms of trading performance achieved following the purchase date, the cumulative return calculated for 40 days after the purchase stood at 11.6%, exhibiting a significant slowdown in its upward pace. And the cumulative abnormal return is negative, posting -3.1% over the same period. This analysis leads to a conclusion that stock buying of retail investors hardly resulted in efficient investment.

Figure 2 illustrates the daily turnover ratio derived before and after a given purchase date. The turnover ratio of 40 days before the stock buying stood at 6.7%, which kept increasing to 15.4% one day before the purchase date and reached as high as 22.7% on the trading date. This clearly indicates that retail traders bought stocks of which trading volume steeply surged. On the contrary, the ratio plummeted following the stock trade.

This analysis reveals that retail investors’ decisions to buy stocks are constrained by overconfidence, limited attention and representativeness biases. Without expectation or belief that stocks whose prices or trading volume sharply soared recently would continue the upward movement, they would not have engaged in the above-mentioned buying pattern. On the assumption that a retail investor randomly selected a stock on each buying date, the cumulative abnormal return calculated for 40 days after the purchase date is estimated at 2.2%. The difference between the random selection outcome and the investment performance actually observed can be partly regarded as costs of behavioral biases.

Figure 3 shows selling ratios of a winning position and a losing position over the holding period, indicating that the selling ratio of the winning position is about two times higher than that of the losing position regardless of the holding period. On the following day of the purchase (for the 1-day holding period), retail investors sold 41% of their winning stocks while selling just 22% of the losing position. This means that they decided to wait and see for some time with 78% of the losing position. In the case where they kept holdings for 10 days after the purchase (for the 10-day holding period), retail traders disposed of 11% of their winning position while they sold off just 5% of the losing position. This tendency of rushing to realize returns and postponing loss realization can be accurately explained by the disposition effect stated above.

Figure 4 illustrates distribution of holding period returns for stocks being held by retail investors at the end of the period analyzed. Of the total positions, 71.4% represents a negative return, or losses. The remaining positions are likely to post a loss since winning positions were already disposed of. The steep decline in stock positions around a 0% return mark is attributable to winning positions largely being sold off within the range of small returns. This analysis reveals a tendency that retail traders sell stocks even though there is a slight increase in stock prices.

If a retail investor is unlikely to make trading decisions based on private information, such trading activities that limit gains in the bullish market while leading to accumulation of losses in the bearish market can be viewed as inefficient investing behaviors.

According to several previous studies, retail investors engaging in direct investment can hardly gain a return that surpasses the market return. The active or aggressive trading leads to a lower investment performance. This is because retail traders suffer from information asymmetry and are constrained by various behavioral biases that hinder them from making rational trading decisions. As demonstrated earlier, Korea’s retail investors are prone to buy stocks that report a steep rise in price and trading volume and to sell off their holdings when prices go up. On the contrary, they exhibit a propensity to hold off trading and keep a losing position. It seems largely inevitable to be affected by behavioral biases that originate from biased beliefs, emotions and limitations of human cognitive capacity. What is notable is that such biases act as a detriment to direct investment performance.

Although the pace of the upward movement in the stock market has slowed down, the net buying trend of retail investors that has started in 2020 shows no signs of abating. Their net-buying reached KRW 130 trillion in cumulative terms during the period from February 2020 to July 2021, of which the half was invested in the stock market after the KOSPI surpassed the 3,000 mark. With retail trading being still active, retain investors’ monthly trading value has reached KRW 450 trillion in 2021 (the average of buy and sell), representing 70% to 75% of the total stock trading value that is similar to the level in the second half of 2020. Given their behavioral biases and stagnation in the stock market, however, the increase in retail direct investment can be hardly regarded as a positive phenomenon.

Stock prices are influenced by a wide range of factors and stock trading is an act of risk taking. Thus, retail traders should conduct a sober assessment on their understanding of stock trades and direct trading capability. A desirable approach is to tap into indirect investment vehicles if they lack relevant trading capability in their own opinion. In this regard, concerted efforts should be made to facilitate indirect investment and at the same time, it is necessary to create the direct investment environment that would rarely give rise to, and mitigate, behavioral biases of retail traders.

1) It is assumed that stocks that were first bought would be sold off first. The sample for which the disposition date coincides with the purchase date has been excluded.