OPINION

2022 Apr/19

The Fourth Industrial Revolution Era: The Financial Services Industry’s Mid- and Long-Term Development Strategy

Apr. 19, 2022

PDF

- Summary

- Korea’s financial sector has previously focused on financing heavy industries and providing face-to-face financial services. To take the lead in the Fourth Industrial Revolution, however, the financial services industry needs to modify its mid- and long-term development strategy. To this end, the 2003 vision for Northeast Asia’s financial hub and the 2009 financial center plan should be overhauled to formulate a new digital financial hub strategy aligned with the Fourth Industrial Revolution era. In addition, it is worth considering the following three strategies for the mid- and long-term development to ensure that Korea’s financial services industry plays a leading role in the Fourth Industrial Revolution. First, greater risk capital should be provided during an innovative startup’s lifecycle consisting of business creation-growth-exit phases by facilitating intellectual property-based finance and capital market-oriented corporate restructuring. Second, the current financial regulatory framework needs to be reshaped into the principle-based, negative list system to boost the growth of fintech, which should be backed by stricter administrative sanctions such as punitive fines. Third, it is necessary to pursue innovation in data infrastructure by building and opening a large Data Dam that serves as the key to the successful Fourth Industrial Revolution.

The role of finance in the Fourth Industrial Revolution

The Korean economy should boost its potential growth rate by accelerating the Fourth Industrial Revolution to break away from the low growth trend. The potential growth rate generally has three components including labor, capital and total factor productivity. As a low birth rate and population aging persist and major industries have become mature, it is hard to expect further increases in labor and capital inputs. Under the circumstances, what is the most urgent is to raise the contribution of total factor productivity to the potential growth rate through technological innovation and institutional efficiency improvement.1) Notably, the Fourth Industrial Revolution spurs the emergence of new industries that could create greater added value. If Korea achieves great success in the Fourth Industrial Revolution, the contribution of total factor productivity would increase, which potentially drives up its potential growth rate.

To better cope with the Fourth Industrial Revolution, nothing is more important than the role of finance. First, if an entrepreneur with superb technology wants to put business ideas into action, risk capital and patient capital should be provided sufficiently across all phases of business creation-growth-exit in the innovative company’s lifecycle. The financial sector plays a role in distributing resources to more productive areas by performing its fund brokerage function while efficiently implementing financial innovation and risk management by offering a wide range of profit models. Second, the financial services industry should pursue digital innovation to enable a larger number of users to take advantage of convenient and affordable financial services. Robo-advisors, alternative credit evaluation for vulnerable social groups, and customized insurance products are a case in point of fintech innovation based on artificial intelligence, blockchain, cloud and big data. Third, another pivotal role of finance is to foster innovation in data infrastructure. In this regard, the future financial services industry needs to provide infrastructure for securing sufficient data and combining and utilizing heterogeneous data by designing an incentive compatible model.

It is necessary to reset the vision and strategy for Korea’s financial services industry to supply risk capital to innovative enterprises and implement innovation for fintech and data infrastructure. Korea’s financial sector has previously focused on financing heavy industries such as electrical and electronics, automotive, steel/chemical, and shipbuilding sectors and primarily offered face-to-face financial services. To take the initiative in the Fourth Industrial Revolution, it needs to revise the mid- and long-term development strategy. Korea came up with the 2003 vision for Northeast Asia’s financial hub to nurture its financial services industry as a new growth engine and the 2009 plan to become the financial center. The two strategies should be overhauled to establish the digital financial hub strategy aligned with the Fourth Industrial Revolution.

Under the context, this article intends to assess previous strategies aiming for Northeast Asia’s financial center and explain why they should be reshaped into the digital financial hub strategy. In addition, as the mid- and long-term development strategy for Korea’s financial services industry, it would present three initiatives including expanding risk capital provision to innovative enterprises, facilitating fintech business through regulatory improvement, and data infrastructure innovation.

Assessment of strategies aiming for Northeast Asia’s financial center

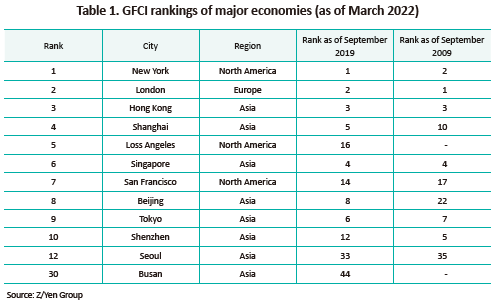

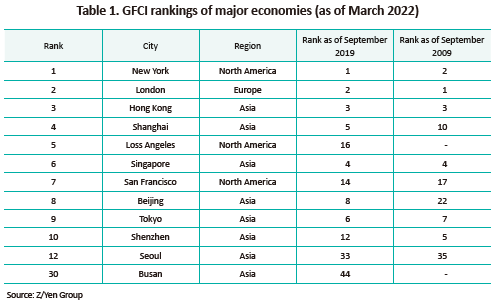

In 2003, the Korean government unveiled a strategy for developing Korea into a Northeast Asian financial hub in a bid to nurture its financial services industry as a new growth engine. Additionally, it enacted the Act on the Creation and Development of Financial Hubs (hereinafter referred to as the “Act”) at the end of 2007, with the aim of strengthening the financial sector’s competitiveness and advancing the financial market to contribute to the growth of the Korean economy. Building on the Act, the government designated Seoul and Busan as financial hubs in early 2009 and has made five revisions to previous plans until 2022 to formulate the basic financial center plan to reinforce the financial services industry’s competitive edge. Major policy initiatives for the financial center plan include financial infrastructure advancement, sophisticated capital markets, improvement in the financial sector’s global competence, and upgrade of international compatibility in the financial system. Since the financial center policy was fully implemented in 2009, Korea’s financial services industry has grown in quantity driven by solid growth of the real economy, as evidenced by a larger pool of foreign investors and greater risk capital provided through the capital markets. Thanks to such efforts, Seoul went up from the 35th place in September 2009 to hold the 12th spot in March 2022 in the Global Financial Centers Index (GFCI). Busan has remained among the top 30 to 50 cities since its 2014 GFCI ranking came out and is ranked 30th as of March 2022.

In Korea, the financial services industry has achieved quantitative growth on the back of the financial center policy implemented for the past decade. Despite the growth, many have pointed out that it falls behind in qualitative indicators such as international competitiveness and financial infrastructure. In the Asian region, Korea’s rivals like Hong Kong, Singapore and Tokyo have remained highly competitive financial hubs, while major cities in China such as Shanghai, Beijing and Shenzhen have obtained a competitive edge in finance due to the Chinese government’s aggressive policy measures to promote its financial sector. A look at the GFCI ranking reveals that rival cities in Asia are ranked higher than the cities in Korea. As shown in Table 1, Hong Kong is placed on the 3rd, Shanghai on the 4th, Beijing on the 8th, Tokyo on the 9th and Shenzhen on the 10th in the GFCI list. This suggests that amid fierce competition among major cities in Asia, Seoul and Busan hardly outperform their Northeast Asian competitors, which has been attributable to the higher tax rate, more rigid labor regulation, and stricter financial regulatory framework compared to those of city-states. Furthermore, Korea’s cities are not equipped with favorable living infrastructure in terms of language, culture and education, the prerequisite for attracting foreign investment institutions. Thus, it seems difficult for Korea to take a leap forward into the Northeast Asian financial hub only with inbound and outbound strategies.

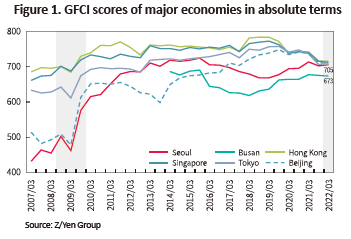

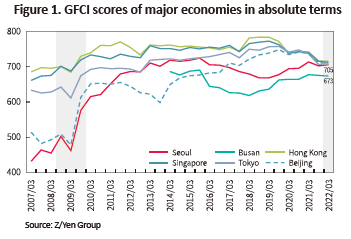

Although Korea’s big cities have barely served as a leading financial center in Asia, its financial services industry holds great promise for the future. As the industry shifts rapidly towards the non-face-to-face digital platform, Korea has strong potential to become a financial hub by tapping into the world’s most advanced ICT solutions and a superior talent pool.ThisiswelldemonstratedbyhigherGFCIrankingsofSanFrancisco,LosAngeles,Beijing and Shenzhen, the cities that have pushed ahead with the digital financial center strategy. Additionally, Hong Kong, Singapore, Beijing and Tokyo—rivals of Seoul and Busan—have witnessed their competitiveness as financial centers weaken slightly, which could serve as an opportunity for Korea. Seoul and Busan have continued an upward trend in the GFCI ranking for the recent three years, earning 705 and 673 scores as of March 2022, respectively whereas GFCI scores of Hong Kong, Singapore, Beijing and Tokyo have dropped to the range between 708 and 715, indicating that the score gap between Seoul and those major cities has narrowed down (see Figure 1). Given that Seoul lagged behind its competitors by a margin of 100 to 200 GFCI scores around 2009, its financial competitiveness has relatively heightened. China is suffering from a slowdown in the growth rate, Hong Kong’s political tensions with China are intensifying,Singaporeisconstrainedbythelimitsofacity-state,andJapan’sagingpopulation serves as an obstacle to digital transition. In contrast, Korea has considerable advantages in that it has diverse innovative growth engines including artificial intelligence, blockchain, big data and biotechnology.

Strategy 1: Expanding risk capital provision to innovative startups

The first challenge for Korea to lead the Fourth Industrial Revolution is to inject more risk capital into innovative startups. Although the low interest rate environment has helped boost liquidity, entrepreneurs are still struggling to raise funds. In particular, there are many companies that have outgrown the initial phase and are still working on innovative technology development. They need large-scale funding but often fail to survive the Death Valley period in the final phase of technology development due to insufficient financing. Innovative startups tend to hold a higher proportion of intangible assets such as patents. Given this, another factor behind their failure in withstanding the Death Valley is the difficulty of raising funds by providing intangible assets as security. According to the 2020 statistics released by the Ministry of SMEs and Startups, the five-year survival rate of startups in Korea stands at 29%, 13%p lower than the OECD average of 42%. With just 18 unicorn companies, Korea is far behind the US (489), China (171), India (53) and the UK (39).2)

For innovators pursuing creative destruction to put their ideas into action, more risk capital should be provided during the overall lifecycle encompassing business creation-growth-exit phases. What is needed in the initial phase is to provide abundant funds to startups by facilitating accelerators and angel investments and effectively enhancing the corporate venture capital (CVC) system. In the intermediate and final phases, IP finance can play a critical role in enabling access to large-scale, long-term funding. Also necessary is to examine the business model of Silicon Valley Bank (SVB) that has successfully established itself in the startup ecosystems of the US and Europe and then to replicate SVB’s portfolio-based financing strategy for venture capital (VC)’s equity investment and venture debt. In the exit phase, more incentives for IPO and M&A should be offered while policy measures are needed to facilitate capital market-oriented corporate restructuring by nurturing the high-yield corporate bond market.

Strategy 2: Invigorating the fintech sector through regulatory improvement

Second, fintech should be facilitated through financial regulation reform for Korea’s financial services industry to successfully implement the Fourth Industrial Revolution. Considering that fintech is designed to allow any person to use affordable, convenient financial services, regardless of their level of wealth or age, it is expected to emerge as an innovative industry representing the Fourth Industrial Revolution era. To cultivate the fintech industry, Korea enacted the Special Act on Support for Financial Innovation in 2018, based on which it introduced the financial regulatory sandbox to contribute to creating various types of innovative financial services. Despite the financial authorities’ push for fintech, however, major cities of Korea have a less competitive fintech ecosystem, compared with other economies. In the 2021 Global Fintech Rankings unveiled by the global research firm, Findexable, Seoul was ranked 31st, slightly below its Asian rivals such as Hong Kong (9th), Singapore (10th), New Delhi (13th), Beijing (17th), and Tokyo (19th). It has been pointed out that Korea’s financial regulatory framework poses a serious challenge to the emergence of innovative financial services in that it centers on rules and the positive list system and specifies tight, rigorous regulatory policies regarding licensing, business conduct and consumer protection. Other barriers include the lack of consistency and transparency resulting from hidden regulations such as best regulatory practices and administrative instructions as well as the regulation for key financial sectors centering on face-to-face services.

To cultivate fintech as a key industry in the Fourth Industrial Revolution era, efforts should be put into reshaping the current rule-based, positive list system into the principle-based, negative list system over the long term. In this respect, it is important to take rigorous disciplinary action against the violation of financial regulations to ensure proper enforcement of the principle-based negative list system. This means that like other advanced countries, Korea should reinforce administrative sanctions such as punitive fines imposed by financial regulators as a response to the violation of regulations on mis-selling and unfair transactions. Additionally, the burden of proof system should be facilitated to enhance regulatory consistency and transparency in financial rules, while the regulation white paper setting out benefits and costs of regulations needs to be disclosed on the official website to promote communication with market participants and private-sector experts. Also necessary is to align the current financial business law centering on face-to-face services with the non-face-to-face digital transition that takes place across the economy and to promote the financial regulatory sandbox to accelerate the adoption of innovative fintech services based on artificial intelligence, blockchain and big data.

Strategy 3: Innovation in data infrastructure

Third, wide access to and easy use of data should be guaranteed for all participants to establish a foundation for the Fourth Industrial Revolution. With the launch of MyData by financial firms in early 2022, consumers have been able to put together and manage their financial data scattered across institutions. However, it is challenging to bring together data scattered across various sectors including healthcare, transportation, telecommunication, distribution, energy, etc. and to combine and tap into such data. For instance, it would be difficult for a small fintech firm to collect personal health and medical data and combine it with financial data to create and sell customized insurance products. As some large financial institutions are reluctant to release pseudonymous data regarding their customers, many fintech firms are restricted from using core data. Although data exchange platforms are recently in operation in the private sector, data exchanged in such platforms are not sufficient and core data are highly priced, which poses difficulties to the use of data by small fintech firms.

It is not an exaggeration to say that the key to the successfully Fourth Industrial Revolution lies in Data Dam. Thus, what is needed is to build and open a large-scale Data Dam that allows innovative startups to have easy access to various data of good quality generated in the private and public sectors. The MyData service adopted by financial authorities should be increasingly applied to a wide range of sectors including healthcare, transportation, telecommunication, distribution and energy to extract more data from different industries and facilitate the combination and use of heterogeneous data. Furthermore, the Open API should be activated to encourage small startups to launch innovative services based on such data, while the incentive system needs to be adopted for the development and use of innovative algorithms including the Open API. Various innovative companies have recently fallen into the so-called Data Death Valley, a phenomenon where companies face a risk of going bankrupt due to lack of data. To support them, a policy is needed for a small startup with quality algorithms and intellectual property to have wide access to core data. Additionally, as a great deal of human and material resources are required to build a large Data Dam, the central and local governments should construct more public data centers and increase the number of business incubation centers to further nurture and support innovative entrepreneurs.

1) Lee, C.Y., January 25, 2016, ‘The capability of creating added value is needed to escape from the low growth trend’, the Korea Economic Daily

2) See CB Insights

The Korean economy should boost its potential growth rate by accelerating the Fourth Industrial Revolution to break away from the low growth trend. The potential growth rate generally has three components including labor, capital and total factor productivity. As a low birth rate and population aging persist and major industries have become mature, it is hard to expect further increases in labor and capital inputs. Under the circumstances, what is the most urgent is to raise the contribution of total factor productivity to the potential growth rate through technological innovation and institutional efficiency improvement.1) Notably, the Fourth Industrial Revolution spurs the emergence of new industries that could create greater added value. If Korea achieves great success in the Fourth Industrial Revolution, the contribution of total factor productivity would increase, which potentially drives up its potential growth rate.

To better cope with the Fourth Industrial Revolution, nothing is more important than the role of finance. First, if an entrepreneur with superb technology wants to put business ideas into action, risk capital and patient capital should be provided sufficiently across all phases of business creation-growth-exit in the innovative company’s lifecycle. The financial sector plays a role in distributing resources to more productive areas by performing its fund brokerage function while efficiently implementing financial innovation and risk management by offering a wide range of profit models. Second, the financial services industry should pursue digital innovation to enable a larger number of users to take advantage of convenient and affordable financial services. Robo-advisors, alternative credit evaluation for vulnerable social groups, and customized insurance products are a case in point of fintech innovation based on artificial intelligence, blockchain, cloud and big data. Third, another pivotal role of finance is to foster innovation in data infrastructure. In this regard, the future financial services industry needs to provide infrastructure for securing sufficient data and combining and utilizing heterogeneous data by designing an incentive compatible model.

It is necessary to reset the vision and strategy for Korea’s financial services industry to supply risk capital to innovative enterprises and implement innovation for fintech and data infrastructure. Korea’s financial sector has previously focused on financing heavy industries such as electrical and electronics, automotive, steel/chemical, and shipbuilding sectors and primarily offered face-to-face financial services. To take the initiative in the Fourth Industrial Revolution, it needs to revise the mid- and long-term development strategy. Korea came up with the 2003 vision for Northeast Asia’s financial hub to nurture its financial services industry as a new growth engine and the 2009 plan to become the financial center. The two strategies should be overhauled to establish the digital financial hub strategy aligned with the Fourth Industrial Revolution.

Under the context, this article intends to assess previous strategies aiming for Northeast Asia’s financial center and explain why they should be reshaped into the digital financial hub strategy. In addition, as the mid- and long-term development strategy for Korea’s financial services industry, it would present three initiatives including expanding risk capital provision to innovative enterprises, facilitating fintech business through regulatory improvement, and data infrastructure innovation.

Assessment of strategies aiming for Northeast Asia’s financial center

In 2003, the Korean government unveiled a strategy for developing Korea into a Northeast Asian financial hub in a bid to nurture its financial services industry as a new growth engine. Additionally, it enacted the Act on the Creation and Development of Financial Hubs (hereinafter referred to as the “Act”) at the end of 2007, with the aim of strengthening the financial sector’s competitiveness and advancing the financial market to contribute to the growth of the Korean economy. Building on the Act, the government designated Seoul and Busan as financial hubs in early 2009 and has made five revisions to previous plans until 2022 to formulate the basic financial center plan to reinforce the financial services industry’s competitive edge. Major policy initiatives for the financial center plan include financial infrastructure advancement, sophisticated capital markets, improvement in the financial sector’s global competence, and upgrade of international compatibility in the financial system. Since the financial center policy was fully implemented in 2009, Korea’s financial services industry has grown in quantity driven by solid growth of the real economy, as evidenced by a larger pool of foreign investors and greater risk capital provided through the capital markets. Thanks to such efforts, Seoul went up from the 35th place in September 2009 to hold the 12th spot in March 2022 in the Global Financial Centers Index (GFCI). Busan has remained among the top 30 to 50 cities since its 2014 GFCI ranking came out and is ranked 30th as of March 2022.

In Korea, the financial services industry has achieved quantitative growth on the back of the financial center policy implemented for the past decade. Despite the growth, many have pointed out that it falls behind in qualitative indicators such as international competitiveness and financial infrastructure. In the Asian region, Korea’s rivals like Hong Kong, Singapore and Tokyo have remained highly competitive financial hubs, while major cities in China such as Shanghai, Beijing and Shenzhen have obtained a competitive edge in finance due to the Chinese government’s aggressive policy measures to promote its financial sector. A look at the GFCI ranking reveals that rival cities in Asia are ranked higher than the cities in Korea. As shown in Table 1, Hong Kong is placed on the 3rd, Shanghai on the 4th, Beijing on the 8th, Tokyo on the 9th and Shenzhen on the 10th in the GFCI list. This suggests that amid fierce competition among major cities in Asia, Seoul and Busan hardly outperform their Northeast Asian competitors, which has been attributable to the higher tax rate, more rigid labor regulation, and stricter financial regulatory framework compared to those of city-states. Furthermore, Korea’s cities are not equipped with favorable living infrastructure in terms of language, culture and education, the prerequisite for attracting foreign investment institutions. Thus, it seems difficult for Korea to take a leap forward into the Northeast Asian financial hub only with inbound and outbound strategies.

The first challenge for Korea to lead the Fourth Industrial Revolution is to inject more risk capital into innovative startups. Although the low interest rate environment has helped boost liquidity, entrepreneurs are still struggling to raise funds. In particular, there are many companies that have outgrown the initial phase and are still working on innovative technology development. They need large-scale funding but often fail to survive the Death Valley period in the final phase of technology development due to insufficient financing. Innovative startups tend to hold a higher proportion of intangible assets such as patents. Given this, another factor behind their failure in withstanding the Death Valley is the difficulty of raising funds by providing intangible assets as security. According to the 2020 statistics released by the Ministry of SMEs and Startups, the five-year survival rate of startups in Korea stands at 29%, 13%p lower than the OECD average of 42%. With just 18 unicorn companies, Korea is far behind the US (489), China (171), India (53) and the UK (39).2)

For innovators pursuing creative destruction to put their ideas into action, more risk capital should be provided during the overall lifecycle encompassing business creation-growth-exit phases. What is needed in the initial phase is to provide abundant funds to startups by facilitating accelerators and angel investments and effectively enhancing the corporate venture capital (CVC) system. In the intermediate and final phases, IP finance can play a critical role in enabling access to large-scale, long-term funding. Also necessary is to examine the business model of Silicon Valley Bank (SVB) that has successfully established itself in the startup ecosystems of the US and Europe and then to replicate SVB’s portfolio-based financing strategy for venture capital (VC)’s equity investment and venture debt. In the exit phase, more incentives for IPO and M&A should be offered while policy measures are needed to facilitate capital market-oriented corporate restructuring by nurturing the high-yield corporate bond market.

Strategy 2: Invigorating the fintech sector through regulatory improvement

Second, fintech should be facilitated through financial regulation reform for Korea’s financial services industry to successfully implement the Fourth Industrial Revolution. Considering that fintech is designed to allow any person to use affordable, convenient financial services, regardless of their level of wealth or age, it is expected to emerge as an innovative industry representing the Fourth Industrial Revolution era. To cultivate the fintech industry, Korea enacted the Special Act on Support for Financial Innovation in 2018, based on which it introduced the financial regulatory sandbox to contribute to creating various types of innovative financial services. Despite the financial authorities’ push for fintech, however, major cities of Korea have a less competitive fintech ecosystem, compared with other economies. In the 2021 Global Fintech Rankings unveiled by the global research firm, Findexable, Seoul was ranked 31st, slightly below its Asian rivals such as Hong Kong (9th), Singapore (10th), New Delhi (13th), Beijing (17th), and Tokyo (19th). It has been pointed out that Korea’s financial regulatory framework poses a serious challenge to the emergence of innovative financial services in that it centers on rules and the positive list system and specifies tight, rigorous regulatory policies regarding licensing, business conduct and consumer protection. Other barriers include the lack of consistency and transparency resulting from hidden regulations such as best regulatory practices and administrative instructions as well as the regulation for key financial sectors centering on face-to-face services.

To cultivate fintech as a key industry in the Fourth Industrial Revolution era, efforts should be put into reshaping the current rule-based, positive list system into the principle-based, negative list system over the long term. In this respect, it is important to take rigorous disciplinary action against the violation of financial regulations to ensure proper enforcement of the principle-based negative list system. This means that like other advanced countries, Korea should reinforce administrative sanctions such as punitive fines imposed by financial regulators as a response to the violation of regulations on mis-selling and unfair transactions. Additionally, the burden of proof system should be facilitated to enhance regulatory consistency and transparency in financial rules, while the regulation white paper setting out benefits and costs of regulations needs to be disclosed on the official website to promote communication with market participants and private-sector experts. Also necessary is to align the current financial business law centering on face-to-face services with the non-face-to-face digital transition that takes place across the economy and to promote the financial regulatory sandbox to accelerate the adoption of innovative fintech services based on artificial intelligence, blockchain and big data.

Strategy 3: Innovation in data infrastructure

Third, wide access to and easy use of data should be guaranteed for all participants to establish a foundation for the Fourth Industrial Revolution. With the launch of MyData by financial firms in early 2022, consumers have been able to put together and manage their financial data scattered across institutions. However, it is challenging to bring together data scattered across various sectors including healthcare, transportation, telecommunication, distribution, energy, etc. and to combine and tap into such data. For instance, it would be difficult for a small fintech firm to collect personal health and medical data and combine it with financial data to create and sell customized insurance products. As some large financial institutions are reluctant to release pseudonymous data regarding their customers, many fintech firms are restricted from using core data. Although data exchange platforms are recently in operation in the private sector, data exchanged in such platforms are not sufficient and core data are highly priced, which poses difficulties to the use of data by small fintech firms.

It is not an exaggeration to say that the key to the successfully Fourth Industrial Revolution lies in Data Dam. Thus, what is needed is to build and open a large-scale Data Dam that allows innovative startups to have easy access to various data of good quality generated in the private and public sectors. The MyData service adopted by financial authorities should be increasingly applied to a wide range of sectors including healthcare, transportation, telecommunication, distribution and energy to extract more data from different industries and facilitate the combination and use of heterogeneous data. Furthermore, the Open API should be activated to encourage small startups to launch innovative services based on such data, while the incentive system needs to be adopted for the development and use of innovative algorithms including the Open API. Various innovative companies have recently fallen into the so-called Data Death Valley, a phenomenon where companies face a risk of going bankrupt due to lack of data. To support them, a policy is needed for a small startup with quality algorithms and intellectual property to have wide access to core data. Additionally, as a great deal of human and material resources are required to build a large Data Dam, the central and local governments should construct more public data centers and increase the number of business incubation centers to further nurture and support innovative entrepreneurs.

1) Lee, C.Y., January 25, 2016, ‘The capability of creating added value is needed to escape from the low growth trend’, the Korea Economic Daily

2) See CB Insights