OPINION

2022 Apr/19

Investment Returns and Expenses in Retirement Plans

Apr. 19, 2022

PDF

- Summary

- The average rate of return in retirement plans for 2021 is estimated at 2.05%, down 0.61%p from 2.67% in 2020. In 2021, the rate of return lower than the payroll increase rate of 4.6% imposed an additional burden on plan sponsors or gave rise to opportunity costs for plan members. The average expense ratio of retirement plans, which indicates the expense to be borne by plan sponsors or plan members, slightly rose to 0.43% in 2021 from 0.42% in 2020. This can be attributable to the increase in fund-related expenses resulting from a higher proportion of investment-linked products. In the meantime, there remains a persistent gap between plan providers’ performance indicators such as the rate of return and expenses and market share measured by the value of plan assets.

Since the retirement pension scheme was introduced, issues have been continuously raised about plan asset management, including the low rate of return, the expense structure irrelevant to plan providers’ products and services and market share deviating from plan providers’ performance. A range of improvements have been proposed to lift the low rate of return, among which “institutional-type” retirement plans, default options and the mandatory plan asset management committee will be implemented this year. Although these policy measures are designed to boost the rate of return on plan assets, they may lay the foundation for promoting competition in the retirement pension market. What is also necessary is the reform of the expense disclosure system and the continued development and improvement of fund products that constitute the mainstay of investment-linked products.

In Korea, retirement plan assets reach KRW 295.7 trillion in value as of the end of 2021 and the rate of return for 2021 is estimated at 2.05%, down 0.61%p from 2.67% in 2020.1) As is the case in 2021, the rate of return lower than the payroll increase rate of 4.6%2) imposes an additional burden on defined benefit (DB) plan sponsors or gives rise to opportunity costs for defined contribution (DC) plan members.

Retirement plan expenses refer to direct costs required for maintaining retirement plans. The average expense ratio of retirement plans—the ratio of expenses to plan assets—slightly rose to 0.43% in 2021 from 0.42% in 2020.

The low return on plan assets has been pointed out as a lingering problem of retirement plans, for which a range of improvements have been proposed. Among such improvement measures, ‘institutional-type’ retirement plans and the default option scheme will be introduced and the establishment of the plan assets investment committee will be mandated this year. Although these measures are designed to boost the retirement plan returns, they are also expected to pave the ground for stimulating competition in the retirement pension market. In the current retirement pension market, the rate of return and the expense ratio—major performance indicators for plan providers—rarely translate to their market share. The flow of funds coupled with the rate of return, recently observed in the markets for DC plans and individual retirement pension (IRP), could offer an opportunity to reignite healthy competition in the retirement pension market over the long run.

Under the context, this article tries to identify changes and characteristics of the return and expenses of retirement plans, and to explore policy measures set to be adopted for addressing relevant problems and alternative solutions.

Rates of return in retirement plans

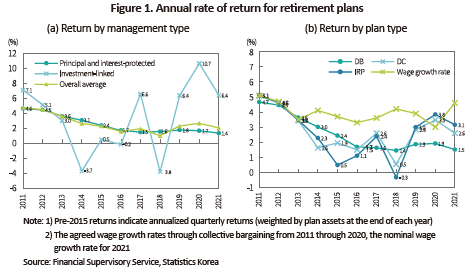

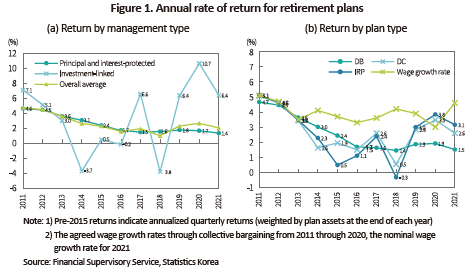

The rate of return on retirement plan assets for 2021 is estimated at 2.05%, posting a 0.61%p decrease from 2.67% in 2020. The drop can be attributable to the fact that the return for principal and interest-protected products has been on the steady decline every year and the return for investment-linked products that surpassed 10% in 2020 has plunged to the mid-6% range in 2021.

Principal and interest-protected products have continued a downward trend in the rate of return (see Figure 1 (a)). The rate of return for investment-linked products started to soar to over 10% in 2020 after hitting the bottom in 2018 and then sank to the range of 6% in 2021.

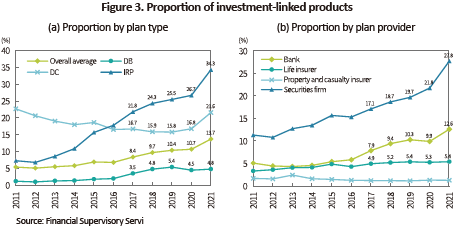

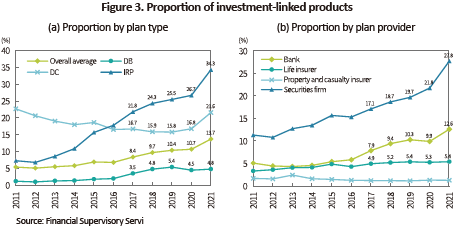

In an analysis of returns by plan type, DC plans and IRPs have outperformed DB plans over the last three years (see Figure 1 (b)). A relatively lower return on DB plans stems from the overwhelmingly high proportion of principal and interest-protected products in DB plans (e.g. 95.2% for 2021; see Figure 3 (a)). Disappointment at poor returns of principal and interest-protected products and stock rallies starting from 2020 have sharply raised the proportion of investment-linked products in DC plans and IPRs, which has brought about higher returns.

Except for the DC plan return for 2020, the rate of return for retirement plans has never outperformed the wage growth rate since 2011 (see Figure 1 (b)). With a DB plan, when the rate of return on plan assets is lower than the rate of payroll increase, a company or plan sponsor must make additional contributions to the plan provider to make up for the difference.3) Even with lower returns from DB plans, DB plan members are not affected directly by the low return on plan assets. However, as continuously low returns would place more burden on plan sponsors, this burden can be passed onto plan members in the long run. For instance, plan sponsors may attempt to lower wage increases due to the contribution burden. Low investment returns require larger contributions from plan sponsors, and the contribution burden would mount as funding shortfalls accumulates. On the other hand, DC plan members bear risks associated with plan investments. In other words, when the rate of return from a DC plan is lower than the wage growth rate, accumulated contributions in the plan would shrink as much as the investment return differs from the pay rise rate, when compared to those in a DB plan or retirement benefits in a severance pay scheme. The funding deficit is borne by DC plan members, not by plan sponsors, meaning that DC plan members incur losses that they would not have done if they were to choose a DB plan or stay in the severance pay system.4)

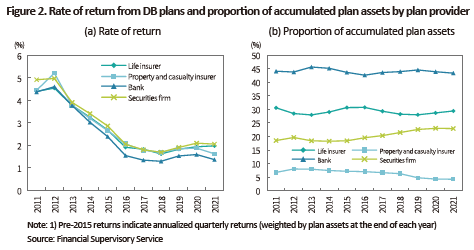

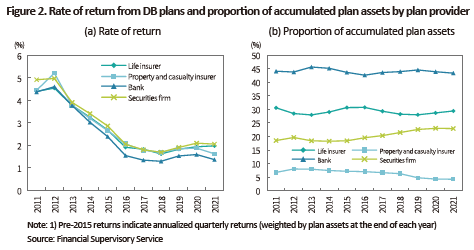

Meanwhile, the rate of return from retirement plans hardly affects plan providers’ market share. With a DB plan, in particular, it is difficult to find any special correlation between the rate of return on plan assets and market share. This is well demonstrated in the banking sector that has reported the lowest return but steadily held the highest market share (see Figure 2).

The rate of return from DC plans has a direct effect on plan members, which requires each member to pay more attention to investment returns and make efforts to boost returns. As part of such efforts, the proportion of investment-linked products in DC plans and IRPs has recently soared (see Figure 3 (a)).5) Securities firms and banks have primarily spurred the growth of investment-linked products (see Figure 3 (b)). Particularly, DC plans and IRPs provided by securities firms took up more than half of the total market share for 2021, 55.5% and 53.6%, respectively.

Expenses for retirement plans

On top of the expenses arising from the difference between plan returns and pay rise rate, a range of expenses are charged for managing retirement plans. Retirement plan expenses generally fall into two categories: Plan administration fees and investment fees. With DB and DC plans, fees for plan administration and investment are borne by plan sponsors while such fees incurred from IRPs are paid by plan members.6) Notably, if assets of DC plans and IRPs are invested in funds, fund management-related costs would be added and borne by plan members. All expenses required for retirement plans are disclosed as the average expense ratio that indicates the ratio of the aggregate annual expenses (equal to the combined amount of plan administration fees, investment fees and aggregate fund management costs) to the end-quarter plan asset amount.

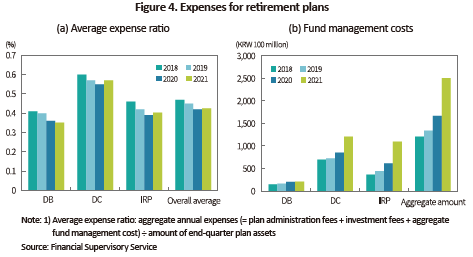

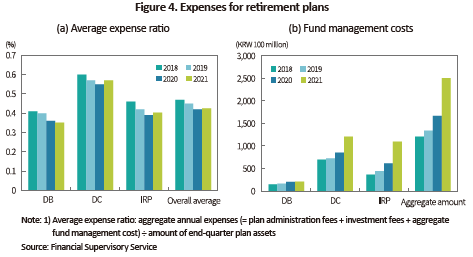

The average expense ratio was on the decline from 2018 and rose slightly to 0.43% in 2021 from 0.42% in the previous year (see Figure 4 (a)).7) Given minor decreases in plan administration and investment fees, a higher average expense ratio can be attributable to the increase in fund management costs resulting from the growth of fund investment amount (see Figure 4 (b)).

It is worth noting that there is no significant relation between the expense ratio and rate of return for retirement plans. With DC plans and IRPs, it is hard to find any significant correlation between the expense ratio and rate of return. Although DB plans exhibit a negative correlation between the two factors, this would hardly be significant if other explanatory variables such as the amount of plan assets and dummies of plan providers are taken into account.8) Nonetheless, there is a tendency that the expense ratio for DB plans is lowered in proportion to the amount of plan assets.

Policy reforms to promote market competition in the retirement pension market

This year, a range of policy improvements will be implemented in an effort to boost retirement plan returns that have fallen short of expectations since the introduction of the retirement pension scheme. Starting from April, the establishment of the DB plan asset management committee will be mandated for business entities with 300 employees or more and the retirement pension fund for SMEs will come into effect. The default option scheme will be adopted in July after a revision to relevant enforcement decrees and a subset of rules.9)

In April, firms with 300 employees or more that have selected DB plans will be mandated to set up the plan asset management committee’. The committee would ensure that plan asset management activities are aligned with the Investment Policy Statement (IPS), the guideline for medium-and long-term asset management. This would have a practical effect of introducing the retirement pension scheme to those entities. What is unique about Korea’s plan asset management is that DB plan assets are concentrated in principal and interest-protected products. In this regard, it is worth noting whether the plan asset mangement committee could help alleviate the concentration on principal and interest-protected plans.

Once introduced, the retirement pension fund for SMEs would allow SMEs with no more than 30 full-time employees to separately make contributions to jointly create a pension fund with Korea Workers’ Compensation & Welfare Service. This can be viewed as a more comprehensive retirement pension scheme than the one previously administered by Korea Workers’ Compensation & Welfare Service. It is expected to facilitate competition in the retirement pension market as the fund would contend with existing plan providers in terms of the rate of return and expense ratio.

Default options are anticipated to have the most influence on how DC plan assets are managed. A default option takes a passive approach in that it is designed to select investment instruments pre-determined by plan sponsors and plan providers in the absence of a clear investment instruction from plan members.10) Considering that the default option can make a favorable impression with existing plan members or create an advertising impact, it is highly likely to have far-reaching effects on DC plan asset management.

These policy measures primarily aim to drive up retirement plan returns. But in the long run, they would play a role in addressing a lack of competition in the retirement pension market where plan assets tend to be heavily invested in certain plan providers regardless of the rate of return and expense ratio. What is needed to foster market competition is to ensure free movement of funds depending on the rate of return and expense ratio. In the meantime, as attention and demand for investment-linked products continue to rise, this requires continuous improvements in fund products that constitute the mainstay of investment-linked products. Furthermore, target date funds (TDFs) should be developed to support the default option scheme while funds based on the low expense structure should be created as a response to increasing fund management costs.

1) The value of retirement plan assets includes the fund accumulated at Korea Workers’ Compensation & Welfare Service (KRW 3.7 trillion), and the analysis of the rate of return and expense ratio did not take into account the fund. Thus, it may vary from the statistical data released by the Financial Supervisory Service (FSS). The retirement plan data analyzed in this article are the one from the FSS’ pension portal (https://100lifeplan.fss.or.kr/main/main.do)

2) This means the nominal wage growth rate of 4.6%, which can be found in the dashboard for major job-related indicators on the Presidential Committee on Jobs website (https://dashboard.jobs.go.kr/index/summary?pg_id=PSCT030300&data2=SCT030300&ct_type=run).

3) Lump-sum severance pay or benefits in a DB plan are calculated based on monthly wage at the end of each year. As a result, retirement benefits computed at the end of the prior year grow proportionally to wage growth. In other words, the relationship of ‘retirement benefits = prior year-end retirement benefits*wage growth rate + the current year’s monthly wage’ is created. When a company accumulates the amount equivalent to retirement benefits at the end of the previous year, if the rate of return on such contributions is the same as the rate of wage increase, the company only has to make contributions to the plan, which are equivalent to monthly wages of its employees for that year without the need for paying additional contributions.

4) This amount is not final but subject to change depending on investment outcomes.

5) Together with the simplified transfer among personal-type IRPs and between personal-type IRPs and retirement savings plans, which took effect from November 2019, the 2021 simplification of the transfer among DB plans, DC plans and business-type IRPs has contributed to the rise in investment-linked products. Another factor behind the increased investment-linked products are a surge in stock prices and greater tax benefits.

6) The asset management expenses imposed on principal and interest-protected products primarily composed of deposit savings products needs to be improved. If an optional cost required to protect the principal and interest amount is imposed, the cost should be charged separately, rather than being included in asset management expenses.

7) Expense-related statistics have been released on an annual basis since 2018.

8) This result can be found in Kim, D.H. & Lee, S.R. (2019) where all forms of retirement plans show a negative correlation between the average expense ratio and rate of return but the negative correlation disappears in the regression analysis that takes into account additional explanatory variables. (Kim, D.H. & Lee, S.R., 2019, Analysis of the correlation between the expense ratio and rate of return of retirement plans and its policy implications, Pension Research 9(1), 17-37.)

9) Sedaily, January 3, 2022, Default options will be applied as early as June, bringing about the “biggest change after the introduction of the retirement pension scheme”

https://www.sedaily.com/NewsVIew/260Q1D39SY

10) As principal and interest-protected products are included in default options, there is a possibility that the existing investment approach heavily relying on principal and interest-protected products would be continuously adopted.

Retirement plan expenses refer to direct costs required for maintaining retirement plans. The average expense ratio of retirement plans—the ratio of expenses to plan assets—slightly rose to 0.43% in 2021 from 0.42% in 2020.

The low return on plan assets has been pointed out as a lingering problem of retirement plans, for which a range of improvements have been proposed. Among such improvement measures, ‘institutional-type’ retirement plans and the default option scheme will be introduced and the establishment of the plan assets investment committee will be mandated this year. Although these measures are designed to boost the retirement plan returns, they are also expected to pave the ground for stimulating competition in the retirement pension market. In the current retirement pension market, the rate of return and the expense ratio—major performance indicators for plan providers—rarely translate to their market share. The flow of funds coupled with the rate of return, recently observed in the markets for DC plans and individual retirement pension (IRP), could offer an opportunity to reignite healthy competition in the retirement pension market over the long run.

Under the context, this article tries to identify changes and characteristics of the return and expenses of retirement plans, and to explore policy measures set to be adopted for addressing relevant problems and alternative solutions.

Rates of return in retirement plans

The rate of return on retirement plan assets for 2021 is estimated at 2.05%, posting a 0.61%p decrease from 2.67% in 2020. The drop can be attributable to the fact that the return for principal and interest-protected products has been on the steady decline every year and the return for investment-linked products that surpassed 10% in 2020 has plunged to the mid-6% range in 2021.

Principal and interest-protected products have continued a downward trend in the rate of return (see Figure 1 (a)). The rate of return for investment-linked products started to soar to over 10% in 2020 after hitting the bottom in 2018 and then sank to the range of 6% in 2021.

In an analysis of returns by plan type, DC plans and IRPs have outperformed DB plans over the last three years (see Figure 1 (b)). A relatively lower return on DB plans stems from the overwhelmingly high proportion of principal and interest-protected products in DB plans (e.g. 95.2% for 2021; see Figure 3 (a)). Disappointment at poor returns of principal and interest-protected products and stock rallies starting from 2020 have sharply raised the proportion of investment-linked products in DC plans and IPRs, which has brought about higher returns.

Meanwhile, the rate of return from retirement plans hardly affects plan providers’ market share. With a DB plan, in particular, it is difficult to find any special correlation between the rate of return on plan assets and market share. This is well demonstrated in the banking sector that has reported the lowest return but steadily held the highest market share (see Figure 2).

On top of the expenses arising from the difference between plan returns and pay rise rate, a range of expenses are charged for managing retirement plans. Retirement plan expenses generally fall into two categories: Plan administration fees and investment fees. With DB and DC plans, fees for plan administration and investment are borne by plan sponsors while such fees incurred from IRPs are paid by plan members.6) Notably, if assets of DC plans and IRPs are invested in funds, fund management-related costs would be added and borne by plan members. All expenses required for retirement plans are disclosed as the average expense ratio that indicates the ratio of the aggregate annual expenses (equal to the combined amount of plan administration fees, investment fees and aggregate fund management costs) to the end-quarter plan asset amount.

The average expense ratio was on the decline from 2018 and rose slightly to 0.43% in 2021 from 0.42% in the previous year (see Figure 4 (a)).7) Given minor decreases in plan administration and investment fees, a higher average expense ratio can be attributable to the increase in fund management costs resulting from the growth of fund investment amount (see Figure 4 (b)).

Policy reforms to promote market competition in the retirement pension market

This year, a range of policy improvements will be implemented in an effort to boost retirement plan returns that have fallen short of expectations since the introduction of the retirement pension scheme. Starting from April, the establishment of the DB plan asset management committee will be mandated for business entities with 300 employees or more and the retirement pension fund for SMEs will come into effect. The default option scheme will be adopted in July after a revision to relevant enforcement decrees and a subset of rules.9)

In April, firms with 300 employees or more that have selected DB plans will be mandated to set up the plan asset management committee’. The committee would ensure that plan asset management activities are aligned with the Investment Policy Statement (IPS), the guideline for medium-and long-term asset management. This would have a practical effect of introducing the retirement pension scheme to those entities. What is unique about Korea’s plan asset management is that DB plan assets are concentrated in principal and interest-protected products. In this regard, it is worth noting whether the plan asset mangement committee could help alleviate the concentration on principal and interest-protected plans.

Once introduced, the retirement pension fund for SMEs would allow SMEs with no more than 30 full-time employees to separately make contributions to jointly create a pension fund with Korea Workers’ Compensation & Welfare Service. This can be viewed as a more comprehensive retirement pension scheme than the one previously administered by Korea Workers’ Compensation & Welfare Service. It is expected to facilitate competition in the retirement pension market as the fund would contend with existing plan providers in terms of the rate of return and expense ratio.

Default options are anticipated to have the most influence on how DC plan assets are managed. A default option takes a passive approach in that it is designed to select investment instruments pre-determined by plan sponsors and plan providers in the absence of a clear investment instruction from plan members.10) Considering that the default option can make a favorable impression with existing plan members or create an advertising impact, it is highly likely to have far-reaching effects on DC plan asset management.

These policy measures primarily aim to drive up retirement plan returns. But in the long run, they would play a role in addressing a lack of competition in the retirement pension market where plan assets tend to be heavily invested in certain plan providers regardless of the rate of return and expense ratio. What is needed to foster market competition is to ensure free movement of funds depending on the rate of return and expense ratio. In the meantime, as attention and demand for investment-linked products continue to rise, this requires continuous improvements in fund products that constitute the mainstay of investment-linked products. Furthermore, target date funds (TDFs) should be developed to support the default option scheme while funds based on the low expense structure should be created as a response to increasing fund management costs.

1) The value of retirement plan assets includes the fund accumulated at Korea Workers’ Compensation & Welfare Service (KRW 3.7 trillion), and the analysis of the rate of return and expense ratio did not take into account the fund. Thus, it may vary from the statistical data released by the Financial Supervisory Service (FSS). The retirement plan data analyzed in this article are the one from the FSS’ pension portal (https://100lifeplan.fss.or.kr/main/main.do)

2) This means the nominal wage growth rate of 4.6%, which can be found in the dashboard for major job-related indicators on the Presidential Committee on Jobs website (https://dashboard.jobs.go.kr/index/summary?pg_id=PSCT030300&data2=SCT030300&ct_type=run).

3) Lump-sum severance pay or benefits in a DB plan are calculated based on monthly wage at the end of each year. As a result, retirement benefits computed at the end of the prior year grow proportionally to wage growth. In other words, the relationship of ‘retirement benefits = prior year-end retirement benefits*wage growth rate + the current year’s monthly wage’ is created. When a company accumulates the amount equivalent to retirement benefits at the end of the previous year, if the rate of return on such contributions is the same as the rate of wage increase, the company only has to make contributions to the plan, which are equivalent to monthly wages of its employees for that year without the need for paying additional contributions.

4) This amount is not final but subject to change depending on investment outcomes.

5) Together with the simplified transfer among personal-type IRPs and between personal-type IRPs and retirement savings plans, which took effect from November 2019, the 2021 simplification of the transfer among DB plans, DC plans and business-type IRPs has contributed to the rise in investment-linked products. Another factor behind the increased investment-linked products are a surge in stock prices and greater tax benefits.

6) The asset management expenses imposed on principal and interest-protected products primarily composed of deposit savings products needs to be improved. If an optional cost required to protect the principal and interest amount is imposed, the cost should be charged separately, rather than being included in asset management expenses.

7) Expense-related statistics have been released on an annual basis since 2018.

8) This result can be found in Kim, D.H. & Lee, S.R. (2019) where all forms of retirement plans show a negative correlation between the average expense ratio and rate of return but the negative correlation disappears in the regression analysis that takes into account additional explanatory variables. (Kim, D.H. & Lee, S.R., 2019, Analysis of the correlation between the expense ratio and rate of return of retirement plans and its policy implications, Pension Research 9(1), 17-37.)

9) Sedaily, January 3, 2022, Default options will be applied as early as June, bringing about the “biggest change after the introduction of the retirement pension scheme”

https://www.sedaily.com/NewsVIew/260Q1D39SY

10) As principal and interest-protected products are included in default options, there is a possibility that the existing investment approach heavily relying on principal and interest-protected products would be continuously adopted.