OPINION

2022 May/03

Risk Factors in Korea’s Bond Market amid Tightening Financial Conditions

May. 03, 2022

PDF

- Summary

- The yields on KTBs are rising steeply as upward pressure on interest rates-the Fed’s earlier-than-expected tightening of monetary policy and rising domestic inflation-mounts. In the KTB market, a plunge in KTB prices and rising volatility have recently dampened investor sentiment. Furthermore, an imbalance between supply and demand resulting from the increase in KTB issuance and weaker demand from major investors have reduced liquidity in the KTB market. In the meantime, a sharp increase in interest rates seems to have a relatively bigger impact on Korea’s corporate bond market, thereby deteriorating liquidity.

In the course of monetary policy normalization, a proper cushion needs to be arranged to prevent a steep decline in liquidity of the bond market. Notably, decreasing liquidity in the KTB market could result in a liquidity crunch across the financial market and a surge in financing costs. Accordingly, Bank of Korea should seek to maintain stability in the financial market by purchasing KTBs if liquidity conditions become tighter. The Korean government needs to take a prudent approach to the increase in KTB issuance, considering growing concerns about the supply and demand imbalance of KTBs. Last but not least, the financial authorities should monitor firms with lower financial soundness to prevent deteriorating liquidity in the corporate bond market from escalating into credit risk.

With a sharp increase in market interest rates, investor sentiment in the bond market is contracting at a rapid pace. Against this backdrop, this article explores developments and risk factors in Korea’s bond market amid tightening financial conditions in Korea and abroad and presents policy implications.

Mounting upward pressure on interest rates in Korea and abroad

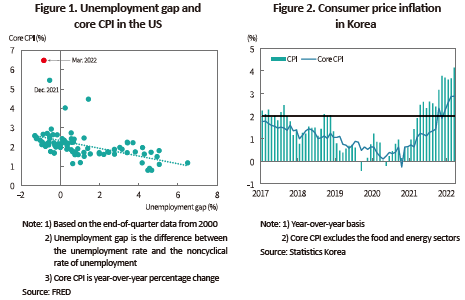

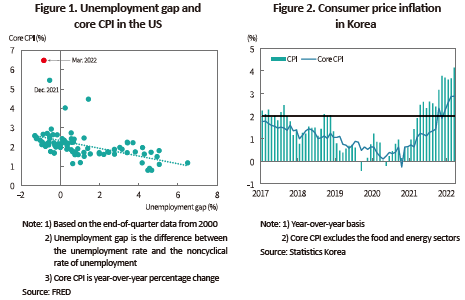

As expectations are rising for the Fed to normalize its monetary policy earlier than expected, interest rates are under upward pressure. While the US has seen its unemployment rate returning to the pre-pandemic level, consumer prices have risen steeply, reaching the highest inflation rate in 40 years (Figure 1). As the need for a policy response to inflation is growing significantly, the Fed is anticipated to raise the federal funds rate at a rapid pace. According to the Fed’s so-called dot plot released in March, the target policy rate as of the end of this year is 1.875% (based on the median value), which could be achieved when the 25 basis point hike is implemented at each of the remaining six FOMC meetings for 2022.1) The market projects that the policy rate would be raised at a faster pace than the dot plot. Given that the policy rate of around 2.5% by the end of 2022 is reflected in the federal funds futures, the market expects the Fed to take two big steps or more by turning to 50 basis point hikes. On top of policy rate hikes, as quantitative tightening is projected to begin as soon as in May, global market interest rates are soaring rapidly.2)

On the domestic front, the high level of inflation also drives up the market interest rate. Consumer price inflation in Korea is hovering significantly over the inflation target (2%), though lower than that of the US (Figure 2). Inflationary pressures stem largely from higher prices of food and raw materials. But given that core inflation which excludes price changes in the food and energy sectors continues an upward trend, the Bank of Korea base rate is highly likely to climb further.3)

The KTB market: a sharp increase in interest rates and an imbalance in KTB supply and demand

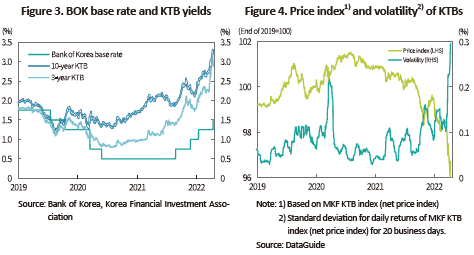

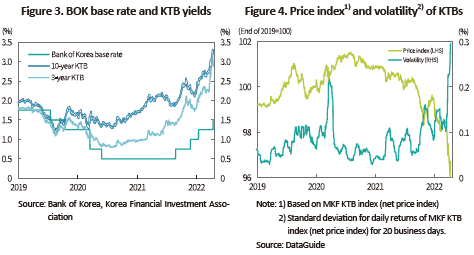

Amid mounting upward pressures on interest rates, the yields on Korea Treasury Bonds (KTBs) are rising steeply (Figure 3). The yields on KTBs at maturities from 3 to 30 years have surpassed the pre-pandemic level considerably, hitting a record high since 2015. The prices of KTBs have continued a downward trend since the second half of 2020 and plunged sharply this year, while volatility has intensified since the end of March to surge to the level of March 2020 when financial market distress reached its height immediately after the Covid-19 outbreak (Figure 4). The current market conditions imply that investor confidence in KTBs has been dampened.

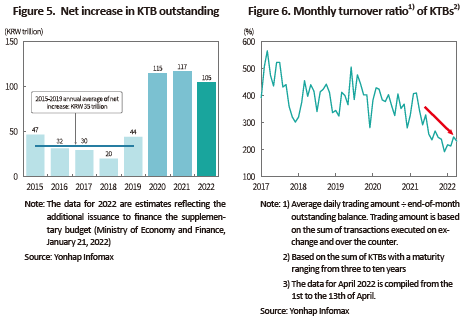

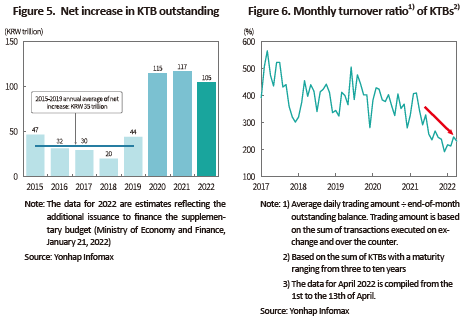

The increase in KTB issuance and contracted demand from major institutional and foreign investors have widened the supply and demand imbalance of KTBs. On the supply side, the KTB issuance has risen immensely due to a continuing need for fiscal expansion to cope with the prolonged Covid-19 pandemic. While the annual increase in KTB outstanding stood at KRW 35 trillion on average during the period from 2015 to 2019, it has jumped up over KRW 100 trillion since 2020 (Figure 5).4) While the KTBs issuance for 2022 has been increased once,5) the uncertainty in the supply of KTBs remains high out of concerns about additional issuance to finance the supplementary budget. In addition to an increase in interest rates, the anxiety over a KTB supply and demand imbalance has contributed to reducing liquidity in the KTB market, as evidenced by a plunge in the turnover ratio.

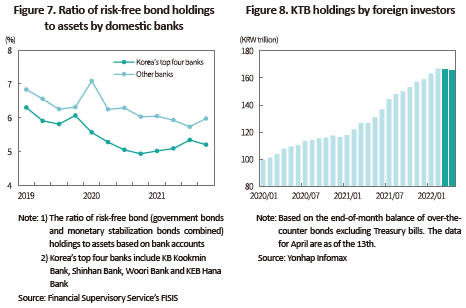

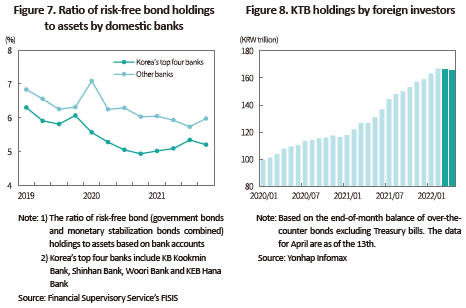

On the demand side, major institutional investors excluding insurance companies show signs of weaker demand for KTBs. In the banking sector, the investment in risk-free bonds by Korea’s top four banks (KB Kookmin Bank, Shinhan Bank, Woori Bank, KEB Hana Bank) has remained low since the spread of Covid-19, driven by regulatory easing on the Liquidity Coverage Ratio (LCR) (Figure 7).6) With measures such as a step-by-step returning to the normal LCR7) and a wider scope of assets recognized as highly liquid assets,8) the banking sector is hardly expected to show a high demand for KTBs for the time being. Pension funds including the National Pension Service are decreasing the weight of domestic fixed income in their portfolios to boost profitability. Securities firms are not actively participating in bond investment for fear of a valuation loss arising from rising interest rates.

As major economies’ monetary policy normalization contributes to reducing global liquidity, foreign investors’ demand for KTBs seems to be weakened. The outstanding balance of KTBs held by foreign investors increased by more than KRW 40 trillion during 2021, but barely increased from March 2022 (Figure 8). Given that foreign investors have purchased a substantial amount of the government bonds since the pandemic, their weakening demand could put a burden on the balance between supply and demand in the KTB market.

Corporate bond market: widening credit spreads and worsening issuance conditions

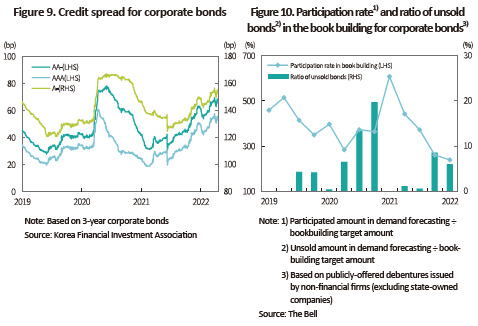

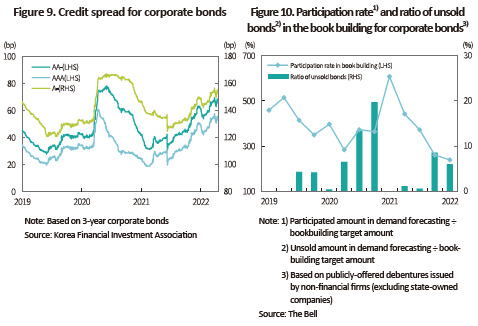

In the meantime, the rapid widening of credit spreads places a greater burden on corporate financing. The credit spread across all credit ratings started to widen steadily from the second half of 2021 and has approached close to the 2020 high in March of 2022 (Figure 9).9) The corporate bond primary market has seen the participation rate in book building falling significantly due to dampening investor sentiment for corporate bonds. At the beginning of the year, demand for corporate bonds usually increases owing to institutional investors’ fund execution. In the first quarter of 2022, however, significant amounts of corporate bonds were unsold due to weak demand (Figure 10).10)

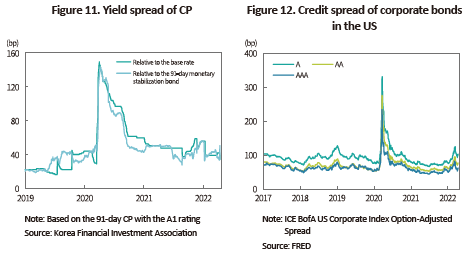

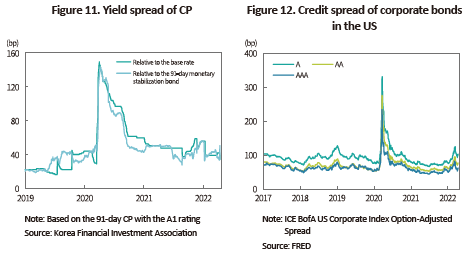

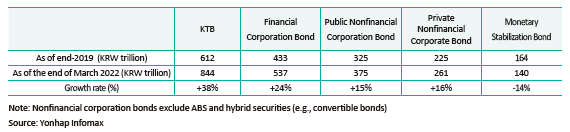

Worsening conditions for corporate bond issuance seem to have stemmed from deteriorating liquidity in the bond market, rather than from escalated credit risk across the financial market. Right after the emergence of the Covid-19 in 2020, credit spreads widened in both the commercial paper (CP) and corporate bond markets. However, the yield spreads of CP remain stable in 2022, indicating that the short-term money market has been relatively stabilized (Figure 11). In the US corporate bond market, the credit spread has widened modestly this year (Figure 12). Taken together, a sharp rise in interest rates seems to have a bigger impact on the domestic corporate bond market.

Policy implications

Central banks of major economies are accelerating monetary policy normalization, which would give rise to higher volatility of the market interest rate. In the course of monetary tightening, a proper cushion needs to be arranged to prevent a steep decline in liquidity of the bond markets.

KTBs, which are classified as risk-free assets, enjoy the highest liquidity in the domestic bond market. Thus, it is worth noting that lower liquidity in the KTB market could lead to a liquidity crunch across the domestic financial market. Furthermore, KTB yields serve as the benchmark rate for financing by both companies and households. If declining liquidity in the KTB market excessively pushes up KTB yields, the yields on corporate bonds and bank debentures would also shoot up, potentially aggravating the financing burden on the corporate and household sectors. Accordingly, Bank of Korea should seek to maintain stability in the financial market by purchasing KTBs if liquidity conditions become tighter.

Considering concerns about the imbalance between KTB supply and demand, the Korean government should take a more prudent approach to the increase in KTB issuance. Unlike other major economies, Korea has no short-term government bonds and the government issues KTBs only in the form of coupon bonds with a maturity of 2 years or longer.11) This means the supply and demand imbalance resulting from the increase in KTB issuance would lead to higher yields on bonds.12) In particular, amid weaker investor sentiment for bonds due to rising interest rates, a larger volume of KTB issuance could further raise interest rate volatility, which requires caution.

Lastly, it is necessary to step up monitoring to prevent decreasing liquidity in the corporate bond market from escalating into credit risk. As mentioned above, the corporate bond market is relatively more vulnerable to contracted investor sentiment resulting from rising interest rates. With tighter financial conditions, credit risk posed by individual companies is likely to intensify rapidly into systemic risk. This necessitates close monitoring of liquidity conditions for firms with low financial soundness.

1) With the rate hike cycle set to continue well into 2023, the policy rate is expected to rise to 2.75% (based on the median value) by the end of 2023.

2) The minutes from the March FOMC meeting indicated that the Fed could begin quantitative tightening (balance sheet rundown) in May at a pace twice as fast as that of quantitative tightening implemented from 2017 to 2019. Quantitative tightening increases the bond supply to the market, contributing to raising interest rates.

3) “The Board will appropriately adjust the degree of monetary policy accommodation as the Korean economy is expected to continue its recovery and inflation to run above the target level for a considerable time, despite underlying uncertainties in domestic and external conditions.” (Monetary Policy Decision, BOK, April 2022)

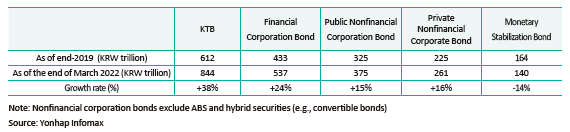

4) The outstanding balance by bond type after the pandemic outbreak is as follows.  5) The first supplementary budget for 2022 has increased the issuance of KTBs by KRW 11.3 trillion.

5) The first supplementary budget for 2022 has increased the issuance of KTBs by KRW 11.3 trillion.

6) In response to Covid-19, the financial authorities reduced the LCR requirement from 100% to 85% in April 2020 and the lowered LCR is applied until the end of June 2022. As a result, the LCR for Korea’s top four banks slid from an average of 105% in 2019 to 90% in 2021, and the LCR for other domestic banks fell to 112% from 127% over the same period.

7) The financial authorities plan to raise the LCR requirement in July this year (from 85% to 90%) and make an upward adjustment of 2.5 percentage points every three months from then on to reach the 100% LCR in July 2023 (Financial Services Commission, March 31, 2022).

8) From February 2022, the unused collateral for guaranteeing net settlements will be recognized as highly liquid assets in the LCR calculation and thus, the LCR for domestic banks are anticipated to rise by 5.8 percentage points (BOK, 2022). This contributes to reducing domestic banks’ demand for risk-free assets.

9) As of April 13, the credit spread for ratings ranging between AAA and A has surpassed the 2020 high by nearly 85%, while the credit spread for the BBB rating has surged to reach 96% to 98% of the 2020 high.

10) This is in part attributable to the unsold corporate bonds in some firms’ book building process due to ESG-related issues.

11) In addition to the KTB issuance, the government can also meet fiscal demand by issuing short-term Treasury bills. But Treasury bills aim to temporarily cover lack of funds and thus, shall be repaid with the revenue from the fiscal year.

12) An increase in short-term government bonds has a relatively small impact on market interest rates as yields on the short-term bonds tend to move with the central bank’s policy rate. In the US, the issuance of T-bills surged in 2020 when there was a higher demand for fiscal spending, while the issuance of coupon bonds increased gradually. With this approach, it has maintained a regular and predictable issuance strategy (US Department of the Treasury, August 5, 2020).

References

Financial Services Commission, March 31, 2022, FSC to Seek Gradual Normalization of Temporary Deregulatory Measures in Financial Sectors, press release.

Ministry of Economy and Finance, January 21, 2022, 2022 Supplementary Budget Proposal press release.

Bank of Korea, 2022, 2021 Annual Report.

US Department of the Treasury, 2020. 8. 5, Report to the Secretary of the Treasury from the Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association

Mounting upward pressure on interest rates in Korea and abroad

As expectations are rising for the Fed to normalize its monetary policy earlier than expected, interest rates are under upward pressure. While the US has seen its unemployment rate returning to the pre-pandemic level, consumer prices have risen steeply, reaching the highest inflation rate in 40 years (Figure 1). As the need for a policy response to inflation is growing significantly, the Fed is anticipated to raise the federal funds rate at a rapid pace. According to the Fed’s so-called dot plot released in March, the target policy rate as of the end of this year is 1.875% (based on the median value), which could be achieved when the 25 basis point hike is implemented at each of the remaining six FOMC meetings for 2022.1) The market projects that the policy rate would be raised at a faster pace than the dot plot. Given that the policy rate of around 2.5% by the end of 2022 is reflected in the federal funds futures, the market expects the Fed to take two big steps or more by turning to 50 basis point hikes. On top of policy rate hikes, as quantitative tightening is projected to begin as soon as in May, global market interest rates are soaring rapidly.2)

On the domestic front, the high level of inflation also drives up the market interest rate. Consumer price inflation in Korea is hovering significantly over the inflation target (2%), though lower than that of the US (Figure 2). Inflationary pressures stem largely from higher prices of food and raw materials. But given that core inflation which excludes price changes in the food and energy sectors continues an upward trend, the Bank of Korea base rate is highly likely to climb further.3)

Amid mounting upward pressures on interest rates, the yields on Korea Treasury Bonds (KTBs) are rising steeply (Figure 3). The yields on KTBs at maturities from 3 to 30 years have surpassed the pre-pandemic level considerably, hitting a record high since 2015. The prices of KTBs have continued a downward trend since the second half of 2020 and plunged sharply this year, while volatility has intensified since the end of March to surge to the level of March 2020 when financial market distress reached its height immediately after the Covid-19 outbreak (Figure 4). The current market conditions imply that investor confidence in KTBs has been dampened.

As major economies’ monetary policy normalization contributes to reducing global liquidity, foreign investors’ demand for KTBs seems to be weakened. The outstanding balance of KTBs held by foreign investors increased by more than KRW 40 trillion during 2021, but barely increased from March 2022 (Figure 8). Given that foreign investors have purchased a substantial amount of the government bonds since the pandemic, their weakening demand could put a burden on the balance between supply and demand in the KTB market.

In the meantime, the rapid widening of credit spreads places a greater burden on corporate financing. The credit spread across all credit ratings started to widen steadily from the second half of 2021 and has approached close to the 2020 high in March of 2022 (Figure 9).9) The corporate bond primary market has seen the participation rate in book building falling significantly due to dampening investor sentiment for corporate bonds. At the beginning of the year, demand for corporate bonds usually increases owing to institutional investors’ fund execution. In the first quarter of 2022, however, significant amounts of corporate bonds were unsold due to weak demand (Figure 10).10)

Central banks of major economies are accelerating monetary policy normalization, which would give rise to higher volatility of the market interest rate. In the course of monetary tightening, a proper cushion needs to be arranged to prevent a steep decline in liquidity of the bond markets.

KTBs, which are classified as risk-free assets, enjoy the highest liquidity in the domestic bond market. Thus, it is worth noting that lower liquidity in the KTB market could lead to a liquidity crunch across the domestic financial market. Furthermore, KTB yields serve as the benchmark rate for financing by both companies and households. If declining liquidity in the KTB market excessively pushes up KTB yields, the yields on corporate bonds and bank debentures would also shoot up, potentially aggravating the financing burden on the corporate and household sectors. Accordingly, Bank of Korea should seek to maintain stability in the financial market by purchasing KTBs if liquidity conditions become tighter.

Considering concerns about the imbalance between KTB supply and demand, the Korean government should take a more prudent approach to the increase in KTB issuance. Unlike other major economies, Korea has no short-term government bonds and the government issues KTBs only in the form of coupon bonds with a maturity of 2 years or longer.11) This means the supply and demand imbalance resulting from the increase in KTB issuance would lead to higher yields on bonds.12) In particular, amid weaker investor sentiment for bonds due to rising interest rates, a larger volume of KTB issuance could further raise interest rate volatility, which requires caution.

Lastly, it is necessary to step up monitoring to prevent decreasing liquidity in the corporate bond market from escalating into credit risk. As mentioned above, the corporate bond market is relatively more vulnerable to contracted investor sentiment resulting from rising interest rates. With tighter financial conditions, credit risk posed by individual companies is likely to intensify rapidly into systemic risk. This necessitates close monitoring of liquidity conditions for firms with low financial soundness.

1) With the rate hike cycle set to continue well into 2023, the policy rate is expected to rise to 2.75% (based on the median value) by the end of 2023.

2) The minutes from the March FOMC meeting indicated that the Fed could begin quantitative tightening (balance sheet rundown) in May at a pace twice as fast as that of quantitative tightening implemented from 2017 to 2019. Quantitative tightening increases the bond supply to the market, contributing to raising interest rates.

3) “The Board will appropriately adjust the degree of monetary policy accommodation as the Korean economy is expected to continue its recovery and inflation to run above the target level for a considerable time, despite underlying uncertainties in domestic and external conditions.” (Monetary Policy Decision, BOK, April 2022)

4) The outstanding balance by bond type after the pandemic outbreak is as follows.

6) In response to Covid-19, the financial authorities reduced the LCR requirement from 100% to 85% in April 2020 and the lowered LCR is applied until the end of June 2022. As a result, the LCR for Korea’s top four banks slid from an average of 105% in 2019 to 90% in 2021, and the LCR for other domestic banks fell to 112% from 127% over the same period.

7) The financial authorities plan to raise the LCR requirement in July this year (from 85% to 90%) and make an upward adjustment of 2.5 percentage points every three months from then on to reach the 100% LCR in July 2023 (Financial Services Commission, March 31, 2022).

8) From February 2022, the unused collateral for guaranteeing net settlements will be recognized as highly liquid assets in the LCR calculation and thus, the LCR for domestic banks are anticipated to rise by 5.8 percentage points (BOK, 2022). This contributes to reducing domestic banks’ demand for risk-free assets.

9) As of April 13, the credit spread for ratings ranging between AAA and A has surpassed the 2020 high by nearly 85%, while the credit spread for the BBB rating has surged to reach 96% to 98% of the 2020 high.

10) This is in part attributable to the unsold corporate bonds in some firms’ book building process due to ESG-related issues.

11) In addition to the KTB issuance, the government can also meet fiscal demand by issuing short-term Treasury bills. But Treasury bills aim to temporarily cover lack of funds and thus, shall be repaid with the revenue from the fiscal year.

12) An increase in short-term government bonds has a relatively small impact on market interest rates as yields on the short-term bonds tend to move with the central bank’s policy rate. In the US, the issuance of T-bills surged in 2020 when there was a higher demand for fiscal spending, while the issuance of coupon bonds increased gradually. With this approach, it has maintained a regular and predictable issuance strategy (US Department of the Treasury, August 5, 2020).

References

Financial Services Commission, March 31, 2022, FSC to Seek Gradual Normalization of Temporary Deregulatory Measures in Financial Sectors, press release.

Ministry of Economy and Finance, January 21, 2022, 2022 Supplementary Budget Proposal press release.

Bank of Korea, 2022, 2021 Annual Report.

US Department of the Treasury, 2020. 8. 5, Report to the Secretary of the Treasury from the Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association