OPINION

2022 Jul/12

Korea Overnight Financing Repo Rate (KOFR): Significance and Challenges Ahead

Jul. 12, 2022

PDF

- Summary

- As the phase-out of LIBOR has started this year, the benchmark rate reform initiated by major economies from 2012 has entered its final stage. Although progress in the reform varies by nation, the US, the UK and other economies have successfully replaced LIBOR with a risk-free reference rate (RFR). This has increased the possibility that RFRs, instead of quote-based benchmarks, would take hold as a critical reference rate in the global financial market.

Korea has selected an overnight Repo rate as the Korea Overnight Financing Repo rate (KOFR) through the 2019 benchmark reform and has started computing and officially publishing KOFR since November 2021. KOFR publication can be seen as a milestone in paving the way for the benchmark reform in Korea. In this regard, systematic efforts should be made by market participants and the government to ensure that KOFR would be established as a critical benchmark in Korea.

The London Interbank Offered Rate (LIBOR), which has served as a key pillar of the global financial market for the last 30 years, has been phased out starting this year. With the cessation of LIBOR, the benchmark reform initiated by major economies from around 2013 has been in its final stage. In line with the global benchmark reform trend, Korea has been improving how the CD rate is better computed and has developed the Korea Overnight Financing Repo rate (KOFR) as its new risk-free reference rate.

Considering that the risk-free reference rates adopted by the US and the UK have successfully replaced LIBOR and other existing benchmarks, Korea should step up its effort to ensure that KOFR is established as a critical benchmark. Against the backdrop, this article intends to examine the progress in major economies’ benchmark reform and to discuss how to overhaul Korea’s benchmark scheme.

Progress in major economies’ benchmark reform1)

Since the LIBOR scandal, a reform has been underway to enhance confidence and transparency of the benchmark interest rate in major developed economies (the US, the UK, the EU, Switzerland, and Japan). Since around 2013, a benchmark reform has been carried out in the following two directions. First, how the interbank offered rate (IBOR) such as LIBOR, EURIBOR (Euro Interbank Offered Rates) and TIBOR (Tokyo Interbank Offered Rates) is computed has been improved. The underlying issues of IBORs are low liquidity and the resultant possibility of manipulation. With that in mind, IBOR administrators have joined forces with regulatory authorities to reinforce the IBOR control and management system. They also have facilitated the use of transaction data to ensure that IBORs are calculated based on actual transactions.

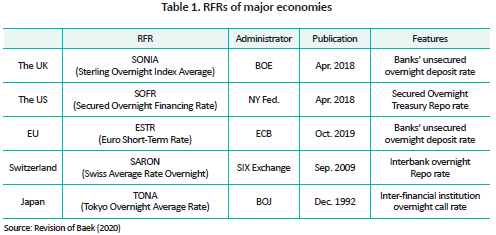

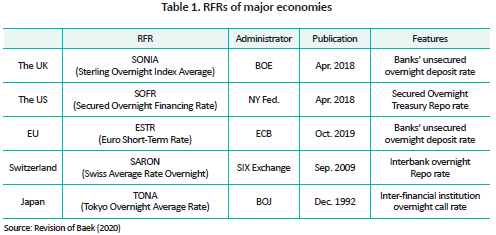

Second, major economies have been developing a near Risk-Free Reference rate (RFR) with higher resilience based on actual transactions, aiming for applying it to derivatives transactions. To this end, they have adopted as the RFR an unsecured overnight rate (Korea’s call rate) or a Repo rate, both of which are highly liquid to guarantee stability for interest rate publication and less susceptible to manipulation. The RFRs selected by major developed economies can be found in Table 1 below.2)

The Financial Stability Board (FSB) that oversees the global benchmark reform has come up with the multi-rate scheme that applies different rates depending on the purpose of use and characteristics of financial contracts. Under the scheme, an improved IBOR applies to spot transactions involving loans and floating rate notes while derivatives are subject to the RFR. However, as improved LIBOR publication failed to boost liquidity in eligible transactions, panel banks that were supposed to submit essential data for LIBOR publication became increasingly reluctant to offer such data. After concluding that credibility of LIBOR remained low in 2017, the UK authorities regulating LIBOR confirmed the permanent cessation of LIBOR starting from 2022.

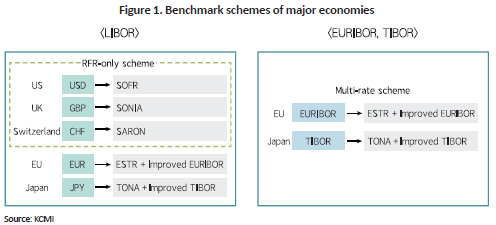

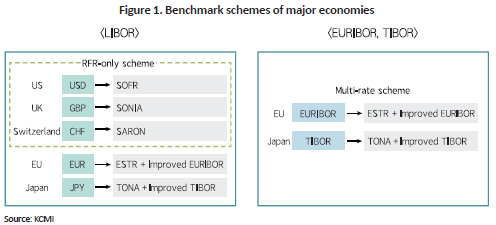

As LIBOR is likely to cease to exist in the near future, nations whose currencies are the basis for LIBOR publication have sought a transition from LIBOR linked to their currencies to a new reference rate (RFR or improved IBOR). As illustrated in Figure 1, they have taken different approaches to selecting a benchmark replacing LIBOR. Such a transition has come in two directions: The multi-rate scheme designed to use both the IBOR and RFR and the single rate scheme aimed to uniformly apply a RFR to all existing IBOR-referencing transactions.

According to the UK authorities’ decision, the LIBOR publication has been suspended sequentially starting this year. As a first step, LIBOR for British pound (GBP), euro (EUR), Swiss franc (CHF) and Japanese yen (JPY) ceased to exist in January 2022.3) As for US dollar (USD) LIBOR, the 1-week and 2-month LIBOR rates expired this year while those with other maturities are scheduled to continue only until June 2023 (FCA, 2022).

With LIBOR expiration becoming a reality, the transition from LIBOR by major economies4) has entered the final stage. First, the UK, the US and Switzerland have replaced the GBP, USD and CHF-linked LIBOR with their own RFRs, SONIA, SOFR and SARON, respectively. As for derivatives and bonds, the shift to RFRs has been carried out smoothly while there were difficulties in applying the RFR to loans, especially in the US. Starting this year, the US and the UK have banned financial institutions from closing new transactions referencing USD LIBOR, with a few exceptions.5) Accordingly, the reference rate for USD loans has been rapidly replaced by SOFR, the RFR adopted by the US (FSB, 2022).6)

Unlike the US, the UK and Switzerland that use the RFR-only scheme, the EU and Japan have introduced the multi-rate scheme combining the RFR and the improved IBOR. The EU and Japan have applied the improved EURIBOR and TIBOR to transactions involving bonds and loans while utilizing RFRs as a reference rate for derivatives transactions.7) This multi-rate approach applies equally to EUR LIBOR and JPY LIBOR that have already expired. The EU has replaced Euro LIBOR with ESTRE (RFR) and improved EURIBOR, whereas TONA (RFR) and improved TIBOR have taken the place of JPY LIBOR

Unlike LIBOR, TIBOR, which serves as a benchmark within Japan, has seen a considerable increase in actual transactions-based publication thanks to the improvement in publication methods. This has resulted in a sharp drop in panel banks’ dependence on expert judgment. According to JBA TIBOR responsible for TIBOR publication, 100% of the quotes submitted by panel banks based on actual transactions or comparable data (Level 1) were reflected in 3-, 6- and 12-month TIBOR rates during 2021 (JBA TIBOR, 2022).8) In contrast, EURIBOR remains highly dependent on expert judgment. EMMI, an institution for EURIBOR publication, has found that panel banks submitted more than 40% of its data for 3-, 6- and 12-month EURIBOR rates based on expert judgment in April (EMMI, 2022).9)

Aside from the five major nations mentioned above, others have completed the process of IBOR improvement and RFR selection. Given nation-specific conditions, they have already opted for the RFR-only scheme or multi-rate approach, or some are still carrying out the evaluation. Canada is expected to end the publication of its IBOR, CDOR (Canadian Dollar Offered Rate) starting from July 2023 and shift to the RFR-only scheme based on CORRA (Canadian Overnight Repo Rate Average) (Canadian Alternative Reference Rate Working Group, 2022). Among Asian nations, Hong Kong has taken a multi-rate approach while Malaysia, Singapore and Thailand plan to move to the RFR-only scheme in preparation for the expiration of IBORs.10)

Benchmark reform in Korea: Progress and future directions

To keep pace with the global trend, Korea has stepped up the effort to enhance the credibility and transparency of its benchmark. It introduced the Act on the Management of Financial Benchmarks (“Act”) in November 2019 to impose stricter regulations on financial benchmarks. Following the enactment, the joint public-private team for the benchmark reform (“Benchmark Reform Team”) was established in June 2019. The Benchmark Reform Team has sought an improvement of how the CD rate— Korea’s existing benchmark—is computed and developed the domestic RFR as developed nations have done.

Concerns have been continuously raised about the credibility and efficiency of the CD rate, a key benchmark in Korea’s financial market. The CD rate has been considered to perform a weak price discovery function due to high rigidity and insufficient volume of eligible transactions. In response to this issue, the Korea Financial Investment Association in charge of CD rate publication is improving the publication method by examining overseas IBOR improvement cases so that the CD rate could be based on actual transactions.11) In addition, the Benchmark Reform Team has selected the overnight Repo rate secured on government bonds and monetary stabilization bonds as Korea’s RFR (February 2021),12) which has been named the Korea Overnight Financing Repo rate (KOFR).

The CD rate and KOFR were designated as the critical benchmark under the Act (March 2021 for the CD rate, September 2021 for KOFR). The Act prescribes that after a critical benchmark is designated, operational rules for publication should be approved and the administrator of the designated benchmark should be nominated. The Korea Securities Depository has been chosen as the administer of KOFR (November 2021) and has been publishing KOFR since November 2021.13) On the other hand, the CD rate administrator has yet to be decided and thus, it has still been calculated and published by the previous method based on quotes submitted by securities firms.14)

KOFR has not been widely used compared to other RFRs adopted by major economies, even considering that it has been less than a year since the first KOFR publication. KOFR has never applied to bonds and loans. In terms of derivatives transactions, 3-month KOFR futures went public on the Korea Exchange in March of this year but have not been actively traded. KOFR futures—equivalent to federal futures of the US—could serve Despite such benefits, KOFR futures have hardly taken hold in the market.15) In this respect, what is interesting is that the ETF using KOFR returns as underlying assets has been listed and is actively traded.16) Given that the RFR-based ETF is a type of financial transaction hardly observed in major economies, such active trading could indicate a huge potential demand and greater applicability of KOFR in the Korean market.

KOFR publication should be regarded as the beginning of Korea’s benchmark reform. As stated above, Korea lags behind major developed nations in benchmark reform. To overhaul the current benchmark system, Korea needs to follow in the footsteps of major economies by adopting a benchmark scheme.17) In other words, it should be determined whether Korea ends the CD rate publication and introduces the RFR-only scheme like the US and the UK, or uses both IBOR (CD rates) and KOFR under the multi-rate scheme adopted by the EU and Japan.18) As indicated in the cases of major economies, the KOFR-only scheme is designed to apply KOFR to all financial transactions referencing CD rates. Under the CD-KOFR scheme, however, it is desirable to apply CD rates to spot transactions involving bonds and loans and use KOFR as a reference rate for derivatives transactions. Once the benchmark scheme suitable for Korea is adopted, the role played by KOFR and the CD rate in the market would become more specific. This would have the effect of facilitating relevant financial transactions, thereby making benchmark transition more efficient.

Conclusion

KOFR has paved the ground for benchmark reform in Korea. A benchmark serves as a reference for a range of financial transactions including derivatives, loans and bonds, having a significant impact on economic activities of financial institutions, companies and households. This suggests that the benchmark reform is likely to influence a wide range of market participants, resulting in competing interests between various stakeholders. The market has its limitations in enhancing a benchmark and implementing a shift to a new benchmark. In this regard, what is noteworthy is that major economies have put a lot of time and effort into the transition to a new benchmark scheme. Therefore, Korea also should exert systematic efforts to encourage market participants to engage in benchmark transition.

1) Major economies have gone through a complex process to reform benchmark interest rates. This article tries to examine key aspects of the reform and take a brief look at each nation’s progress as of 2022. For the background and key aspects of benchmark reform, please refer to Baek (2020).

2) IBOR publication has been improved by nations in which each IBOR administrator is based (the UK for LIBOR, the EU for EURIBOR, Japan for TIBOR). RFRs have been developed by nations of five key currencies (US dollar, British pound, euro, Swiss franc and Japanese yen) tied to LIBOR, EURIBOR and TIBOR.

3) LIBOR expiration means that panel banks have ceased to submit quotes used to compute LIBOR. The 1-, 3- and 6-month LIBOR rates for sterling and Japanese yen would be published on a synthetic basis. Financial institutions are temporarily allowed to use such LIBOR rates only for the valuation of legacy contracts and cannot use them as a reference rate for new contracts (FSB, 2022).

4) LIBOR transition can be divided into new contracts and legacy contracts. A legacy contract means the financial transaction that was closed by using LIBOR as a reference rate before LIBOR cessation. Whether benchmark transition for legacy contracts has been completed varies from nation to nation. This article deals with LIBOR transition for new contracts.

5) The UK has banned financial institutions from engaging in USD LIBOR-referencing financial transactions since January 2022, with a few exceptions, under Article 21A of the UK Benchmarks Regulation Act. In the US, the authorities regulating banks, bank holding companies and savings and loans have jointly released the supervisory guidance to prohibit new financial transactions based on USD LIBOR from January of this year (FRB, 2021).

6) Loans can be divided into syndicated loans and bilateral loans. In the first quarter of 2022, about 98% of new USD syndicated loans used term SOFR rates derived from SOFR futures as a reference rate (Lexology, 2022). As for bilateral loans, it is found that in addition to SOFR, Ameribor and other rates based on banks’ credit risk are applied (Ensing et al., 2022). However, the International Organization of Securities Commissions (IOSCO) has expressed its concerns about the application of benchmarks other than the RFR (IOSCO, 2021). Thus, bilateral loans would be subject to SOFR in the long run.

7) In Japan, TONA (RFR) has increasingly applied to derivatives transactions. According to the ISDA-Clarus survey (ISDA-Clarus, 2022), 97% of derivatives transactions in JPY used TONA as a reference rate in May of this year. On the other hand, the ratio reached just 22% in the EU.

8) Some quotes can be used for Level 1 TIBOR if they meet certain requirements. Accordingly, it may be inappropriate to directly compare TIBOR with EURIBOR or Korea’s CD rate for which the publication method is being improved.

9) In March 2022, the ratio reached as high as 70%. Despite such high dependence on expert judgment, the EU cannot carry out a transition to the RFR-only scheme as the US and the UK have done. This is because EU members have widely used EURIBOR as a reference rate for bank lending to individuals and small- and medium-sized firms. It seems extremely difficult to replace EURIBOR with a RFR due to differences in the legal framework among member states (Tchernookova, 2019).

10) See the website (www.business.hsbc.com/ibor/asp) for the benchmark reform of Asian countries.

11) Financial Services Commission (FSC), August 24, 2020, How to enhance rationality of CD rate publication, press release.

12) FSC, February 26, 2021, RFR selection result and how to facilitate the RFR, press release.

13) For more details on KOFR, see the KOFR website (www.kofr.kr) operated by the Korea Securities Depository.

14) Korea Financial Investment Association, March 5, 2021, Standards for reporting returns for disclosure of the return on final quotes.

15) According to the survey conducted on market participants, there are not many financial institutions in Korea that are well aware of KOFR futures. As a result, they hardly seem to complete internal procedures (system establishment and approval of transactions) for KOFR futures trading. The market participants surveyed also pointed out that market formation for KOFR futures should be improved. Considering that major economies have put a lot of time and effort into facilitating RFR-based transactions, it is necessary to reflect the opinions of market participants.

16) The KOFR ETF was listed in April this year. The Korea Exchange reported that the market cap of the KOFR ETF surpassed KRW 900 billion based on the closing price on June 20, ranking 24th among the total 574 ETFs in Korea.

17) In all major economies, market participants and benchmark administrators have taken the initiative in selecting the benchmark scheme. The authorities of the UK decided to stop offering LIBOR, mainly because panel banks avoided submitting quotes. Financial institutions are the end user of a benchmark. Accordingly, Korea needs to involve market participants with various interests in benchmark scheme selection.

18) CD rates need to be computed by the improved method within the earliest possible time to select the benchmark scheme.

References

Canadian Alternative Reference Rate Working Group, 2022, CDOR Transition Roadmap and Milestones.

Ensing, D.A., Rodriques, S., Gelman, J., Walker, K., 2022. 3. 31, Q1 2022 update on LIBOR transition developments, McQuireWoods.

European Money Markets Institute (EMMI), 2022, EURIBOR Transparency Indicators, March 2022.

Federal Reserve Board (FRB), 2021, Joint Statement on Managing the LIBOR Transition.

Financial Conduct Authority (FCA), 2022, Changes to LIBOR as of End-2021.

Financial Stability Board (FSB), 2022, FSB Statement Welcoming Smooth Transition away from LIBOR.

International Organization of Securities Commissions (IOSCO), 2021, Statement on Credit Sensitive Rates.

International Swap and Derivatives Association (ISDA)-Clarus, 2022, ISDA-Clarus RFR Adoption Indicator: May 2022.

JBA TIBOR, 2022, Result of a Periodic Review of the JBA TIBOR Operational Framework.

Lexology, 2022, Life after LIBOR in the U.S. Loan Market.

Tchernookova, A., 2019, Why EURIBOR is Here to Stay, IFLR.

[Korean]

Baek, I.S., 2020, Benchmark reform in major countries: Progress and implications for Korea, KCMI Issue Paper 20-01.

Considering that the risk-free reference rates adopted by the US and the UK have successfully replaced LIBOR and other existing benchmarks, Korea should step up its effort to ensure that KOFR is established as a critical benchmark. Against the backdrop, this article intends to examine the progress in major economies’ benchmark reform and to discuss how to overhaul Korea’s benchmark scheme.

Progress in major economies’ benchmark reform1)

Since the LIBOR scandal, a reform has been underway to enhance confidence and transparency of the benchmark interest rate in major developed economies (the US, the UK, the EU, Switzerland, and Japan). Since around 2013, a benchmark reform has been carried out in the following two directions. First, how the interbank offered rate (IBOR) such as LIBOR, EURIBOR (Euro Interbank Offered Rates) and TIBOR (Tokyo Interbank Offered Rates) is computed has been improved. The underlying issues of IBORs are low liquidity and the resultant possibility of manipulation. With that in mind, IBOR administrators have joined forces with regulatory authorities to reinforce the IBOR control and management system. They also have facilitated the use of transaction data to ensure that IBORs are calculated based on actual transactions.

Second, major economies have been developing a near Risk-Free Reference rate (RFR) with higher resilience based on actual transactions, aiming for applying it to derivatives transactions. To this end, they have adopted as the RFR an unsecured overnight rate (Korea’s call rate) or a Repo rate, both of which are highly liquid to guarantee stability for interest rate publication and less susceptible to manipulation. The RFRs selected by major developed economies can be found in Table 1 below.2)

The Financial Stability Board (FSB) that oversees the global benchmark reform has come up with the multi-rate scheme that applies different rates depending on the purpose of use and characteristics of financial contracts. Under the scheme, an improved IBOR applies to spot transactions involving loans and floating rate notes while derivatives are subject to the RFR. However, as improved LIBOR publication failed to boost liquidity in eligible transactions, panel banks that were supposed to submit essential data for LIBOR publication became increasingly reluctant to offer such data. After concluding that credibility of LIBOR remained low in 2017, the UK authorities regulating LIBOR confirmed the permanent cessation of LIBOR starting from 2022.

As LIBOR is likely to cease to exist in the near future, nations whose currencies are the basis for LIBOR publication have sought a transition from LIBOR linked to their currencies to a new reference rate (RFR or improved IBOR). As illustrated in Figure 1, they have taken different approaches to selecting a benchmark replacing LIBOR. Such a transition has come in two directions: The multi-rate scheme designed to use both the IBOR and RFR and the single rate scheme aimed to uniformly apply a RFR to all existing IBOR-referencing transactions.

According to the UK authorities’ decision, the LIBOR publication has been suspended sequentially starting this year. As a first step, LIBOR for British pound (GBP), euro (EUR), Swiss franc (CHF) and Japanese yen (JPY) ceased to exist in January 2022.3) As for US dollar (USD) LIBOR, the 1-week and 2-month LIBOR rates expired this year while those with other maturities are scheduled to continue only until June 2023 (FCA, 2022).

With LIBOR expiration becoming a reality, the transition from LIBOR by major economies4) has entered the final stage. First, the UK, the US and Switzerland have replaced the GBP, USD and CHF-linked LIBOR with their own RFRs, SONIA, SOFR and SARON, respectively. As for derivatives and bonds, the shift to RFRs has been carried out smoothly while there were difficulties in applying the RFR to loans, especially in the US. Starting this year, the US and the UK have banned financial institutions from closing new transactions referencing USD LIBOR, with a few exceptions.5) Accordingly, the reference rate for USD loans has been rapidly replaced by SOFR, the RFR adopted by the US (FSB, 2022).6)

Unlike the US, the UK and Switzerland that use the RFR-only scheme, the EU and Japan have introduced the multi-rate scheme combining the RFR and the improved IBOR. The EU and Japan have applied the improved EURIBOR and TIBOR to transactions involving bonds and loans while utilizing RFRs as a reference rate for derivatives transactions.7) This multi-rate approach applies equally to EUR LIBOR and JPY LIBOR that have already expired. The EU has replaced Euro LIBOR with ESTRE (RFR) and improved EURIBOR, whereas TONA (RFR) and improved TIBOR have taken the place of JPY LIBOR

Unlike LIBOR, TIBOR, which serves as a benchmark within Japan, has seen a considerable increase in actual transactions-based publication thanks to the improvement in publication methods. This has resulted in a sharp drop in panel banks’ dependence on expert judgment. According to JBA TIBOR responsible for TIBOR publication, 100% of the quotes submitted by panel banks based on actual transactions or comparable data (Level 1) were reflected in 3-, 6- and 12-month TIBOR rates during 2021 (JBA TIBOR, 2022).8) In contrast, EURIBOR remains highly dependent on expert judgment. EMMI, an institution for EURIBOR publication, has found that panel banks submitted more than 40% of its data for 3-, 6- and 12-month EURIBOR rates based on expert judgment in April (EMMI, 2022).9)

Aside from the five major nations mentioned above, others have completed the process of IBOR improvement and RFR selection. Given nation-specific conditions, they have already opted for the RFR-only scheme or multi-rate approach, or some are still carrying out the evaluation. Canada is expected to end the publication of its IBOR, CDOR (Canadian Dollar Offered Rate) starting from July 2023 and shift to the RFR-only scheme based on CORRA (Canadian Overnight Repo Rate Average) (Canadian Alternative Reference Rate Working Group, 2022). Among Asian nations, Hong Kong has taken a multi-rate approach while Malaysia, Singapore and Thailand plan to move to the RFR-only scheme in preparation for the expiration of IBORs.10)

Benchmark reform in Korea: Progress and future directions

To keep pace with the global trend, Korea has stepped up the effort to enhance the credibility and transparency of its benchmark. It introduced the Act on the Management of Financial Benchmarks (“Act”) in November 2019 to impose stricter regulations on financial benchmarks. Following the enactment, the joint public-private team for the benchmark reform (“Benchmark Reform Team”) was established in June 2019. The Benchmark Reform Team has sought an improvement of how the CD rate— Korea’s existing benchmark—is computed and developed the domestic RFR as developed nations have done.

Concerns have been continuously raised about the credibility and efficiency of the CD rate, a key benchmark in Korea’s financial market. The CD rate has been considered to perform a weak price discovery function due to high rigidity and insufficient volume of eligible transactions. In response to this issue, the Korea Financial Investment Association in charge of CD rate publication is improving the publication method by examining overseas IBOR improvement cases so that the CD rate could be based on actual transactions.11) In addition, the Benchmark Reform Team has selected the overnight Repo rate secured on government bonds and monetary stabilization bonds as Korea’s RFR (February 2021),12) which has been named the Korea Overnight Financing Repo rate (KOFR).

The CD rate and KOFR were designated as the critical benchmark under the Act (March 2021 for the CD rate, September 2021 for KOFR). The Act prescribes that after a critical benchmark is designated, operational rules for publication should be approved and the administrator of the designated benchmark should be nominated. The Korea Securities Depository has been chosen as the administer of KOFR (November 2021) and has been publishing KOFR since November 2021.13) On the other hand, the CD rate administrator has yet to be decided and thus, it has still been calculated and published by the previous method based on quotes submitted by securities firms.14)

KOFR has not been widely used compared to other RFRs adopted by major economies, even considering that it has been less than a year since the first KOFR publication. KOFR has never applied to bonds and loans. In terms of derivatives transactions, 3-month KOFR futures went public on the Korea Exchange in March of this year but have not been actively traded. KOFR futures—equivalent to federal futures of the US—could serve Despite such benefits, KOFR futures have hardly taken hold in the market.15) In this respect, what is interesting is that the ETF using KOFR returns as underlying assets has been listed and is actively traded.16) Given that the RFR-based ETF is a type of financial transaction hardly observed in major economies, such active trading could indicate a huge potential demand and greater applicability of KOFR in the Korean market.

KOFR publication should be regarded as the beginning of Korea’s benchmark reform. As stated above, Korea lags behind major developed nations in benchmark reform. To overhaul the current benchmark system, Korea needs to follow in the footsteps of major economies by adopting a benchmark scheme.17) In other words, it should be determined whether Korea ends the CD rate publication and introduces the RFR-only scheme like the US and the UK, or uses both IBOR (CD rates) and KOFR under the multi-rate scheme adopted by the EU and Japan.18) As indicated in the cases of major economies, the KOFR-only scheme is designed to apply KOFR to all financial transactions referencing CD rates. Under the CD-KOFR scheme, however, it is desirable to apply CD rates to spot transactions involving bonds and loans and use KOFR as a reference rate for derivatives transactions. Once the benchmark scheme suitable for Korea is adopted, the role played by KOFR and the CD rate in the market would become more specific. This would have the effect of facilitating relevant financial transactions, thereby making benchmark transition more efficient.

Conclusion

KOFR has paved the ground for benchmark reform in Korea. A benchmark serves as a reference for a range of financial transactions including derivatives, loans and bonds, having a significant impact on economic activities of financial institutions, companies and households. This suggests that the benchmark reform is likely to influence a wide range of market participants, resulting in competing interests between various stakeholders. The market has its limitations in enhancing a benchmark and implementing a shift to a new benchmark. In this regard, what is noteworthy is that major economies have put a lot of time and effort into the transition to a new benchmark scheme. Therefore, Korea also should exert systematic efforts to encourage market participants to engage in benchmark transition.

1) Major economies have gone through a complex process to reform benchmark interest rates. This article tries to examine key aspects of the reform and take a brief look at each nation’s progress as of 2022. For the background and key aspects of benchmark reform, please refer to Baek (2020).

2) IBOR publication has been improved by nations in which each IBOR administrator is based (the UK for LIBOR, the EU for EURIBOR, Japan for TIBOR). RFRs have been developed by nations of five key currencies (US dollar, British pound, euro, Swiss franc and Japanese yen) tied to LIBOR, EURIBOR and TIBOR.

3) LIBOR expiration means that panel banks have ceased to submit quotes used to compute LIBOR. The 1-, 3- and 6-month LIBOR rates for sterling and Japanese yen would be published on a synthetic basis. Financial institutions are temporarily allowed to use such LIBOR rates only for the valuation of legacy contracts and cannot use them as a reference rate for new contracts (FSB, 2022).

4) LIBOR transition can be divided into new contracts and legacy contracts. A legacy contract means the financial transaction that was closed by using LIBOR as a reference rate before LIBOR cessation. Whether benchmark transition for legacy contracts has been completed varies from nation to nation. This article deals with LIBOR transition for new contracts.

5) The UK has banned financial institutions from engaging in USD LIBOR-referencing financial transactions since January 2022, with a few exceptions, under Article 21A of the UK Benchmarks Regulation Act. In the US, the authorities regulating banks, bank holding companies and savings and loans have jointly released the supervisory guidance to prohibit new financial transactions based on USD LIBOR from January of this year (FRB, 2021).

6) Loans can be divided into syndicated loans and bilateral loans. In the first quarter of 2022, about 98% of new USD syndicated loans used term SOFR rates derived from SOFR futures as a reference rate (Lexology, 2022). As for bilateral loans, it is found that in addition to SOFR, Ameribor and other rates based on banks’ credit risk are applied (Ensing et al., 2022). However, the International Organization of Securities Commissions (IOSCO) has expressed its concerns about the application of benchmarks other than the RFR (IOSCO, 2021). Thus, bilateral loans would be subject to SOFR in the long run.

7) In Japan, TONA (RFR) has increasingly applied to derivatives transactions. According to the ISDA-Clarus survey (ISDA-Clarus, 2022), 97% of derivatives transactions in JPY used TONA as a reference rate in May of this year. On the other hand, the ratio reached just 22% in the EU.

8) Some quotes can be used for Level 1 TIBOR if they meet certain requirements. Accordingly, it may be inappropriate to directly compare TIBOR with EURIBOR or Korea’s CD rate for which the publication method is being improved.

9) In March 2022, the ratio reached as high as 70%. Despite such high dependence on expert judgment, the EU cannot carry out a transition to the RFR-only scheme as the US and the UK have done. This is because EU members have widely used EURIBOR as a reference rate for bank lending to individuals and small- and medium-sized firms. It seems extremely difficult to replace EURIBOR with a RFR due to differences in the legal framework among member states (Tchernookova, 2019).

10) See the website (www.business.hsbc.com/ibor/asp) for the benchmark reform of Asian countries.

11) Financial Services Commission (FSC), August 24, 2020, How to enhance rationality of CD rate publication, press release.

12) FSC, February 26, 2021, RFR selection result and how to facilitate the RFR, press release.

13) For more details on KOFR, see the KOFR website (www.kofr.kr) operated by the Korea Securities Depository.

14) Korea Financial Investment Association, March 5, 2021, Standards for reporting returns for disclosure of the return on final quotes.

15) According to the survey conducted on market participants, there are not many financial institutions in Korea that are well aware of KOFR futures. As a result, they hardly seem to complete internal procedures (system establishment and approval of transactions) for KOFR futures trading. The market participants surveyed also pointed out that market formation for KOFR futures should be improved. Considering that major economies have put a lot of time and effort into facilitating RFR-based transactions, it is necessary to reflect the opinions of market participants.

16) The KOFR ETF was listed in April this year. The Korea Exchange reported that the market cap of the KOFR ETF surpassed KRW 900 billion based on the closing price on June 20, ranking 24th among the total 574 ETFs in Korea.

17) In all major economies, market participants and benchmark administrators have taken the initiative in selecting the benchmark scheme. The authorities of the UK decided to stop offering LIBOR, mainly because panel banks avoided submitting quotes. Financial institutions are the end user of a benchmark. Accordingly, Korea needs to involve market participants with various interests in benchmark scheme selection.

18) CD rates need to be computed by the improved method within the earliest possible time to select the benchmark scheme.

References

Canadian Alternative Reference Rate Working Group, 2022, CDOR Transition Roadmap and Milestones.

Ensing, D.A., Rodriques, S., Gelman, J., Walker, K., 2022. 3. 31, Q1 2022 update on LIBOR transition developments, McQuireWoods.

European Money Markets Institute (EMMI), 2022, EURIBOR Transparency Indicators, March 2022.

Federal Reserve Board (FRB), 2021, Joint Statement on Managing the LIBOR Transition.

Financial Conduct Authority (FCA), 2022, Changes to LIBOR as of End-2021.

Financial Stability Board (FSB), 2022, FSB Statement Welcoming Smooth Transition away from LIBOR.

International Organization of Securities Commissions (IOSCO), 2021, Statement on Credit Sensitive Rates.

International Swap and Derivatives Association (ISDA)-Clarus, 2022, ISDA-Clarus RFR Adoption Indicator: May 2022.

JBA TIBOR, 2022, Result of a Periodic Review of the JBA TIBOR Operational Framework.

Lexology, 2022, Life after LIBOR in the U.S. Loan Market.

Tchernookova, A., 2019, Why EURIBOR is Here to Stay, IFLR.

[Korean]

Baek, I.S., 2020, Benchmark reform in major countries: Progress and implications for Korea, KCMI Issue Paper 20-01.