Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

How to Respond to Risks in the Financial Services Industry Amid Increased Volatility in the Financial Market

Publication date Sep. 27, 2022

Summary

With the Fed’s base rate hikes and concerns over a global economic recession, volatility is intensifying in Korea’s key financial markets including the FX market, the stock market, the bond market and the short-term money market. A strong US dollar could accelerate the tendency of preferring safe assets across the globe, which could drag down stock indexes and major bond prices in Korea. If volatility in the financial market surges in a short period, financial firms would be exposed to the risk of suffering losses from asset management and capital raising activities. Major risk factors behind increased volatility can be summed up as the need for depositing additional FX margin for derivatives contracts, the possibility of an ELS margin call arising from a drop in stock indexes at home and abroad, the risk of incurring losses in bond holdings due to rising market interest rates, and liquidity risk posed by the rollover of property PF-backed ABCPs. To respond to such risks, the financial authorities should institutionalize the establishment and operation of stabilization funds for the stock, bond and FX markets to alleviate volatility in the financial market. They may also consider putting a restriction on short selling and placing a short position limit on key derivatives in the event of a financial crisis. On top of that, the authorities need to implement liquidity support programs on a regular basis through a revision to the Bank of Korea Act, aiming to prevent any loss sustained by non-banking financial firms from threatening financial stability. Also necessary is to devise a wide range of liquidity support measures that could play a similar role to the financial stabilization fund previously implemented. However, it is noteworthy that financial firms may increase high-risk investments on the expectation that the safety net of the capital market would be bolstered. Accordingly, the desirable approach is to adopt strict principles to ensure that the firms deal with investment losses on their own responsibility and strengthen a proactive risk management system.

Examination of risks in the financial market

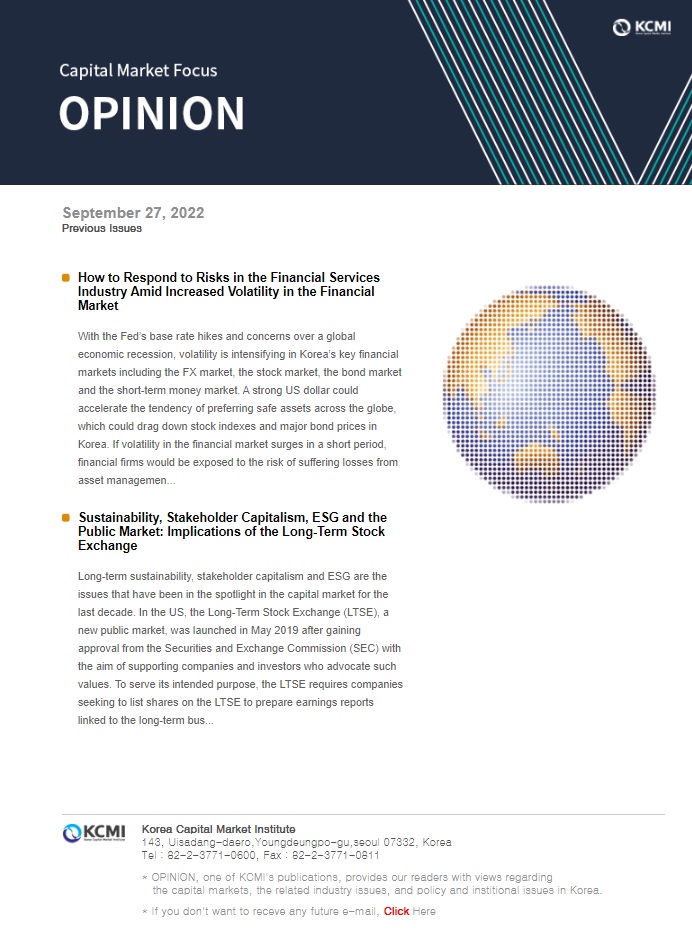

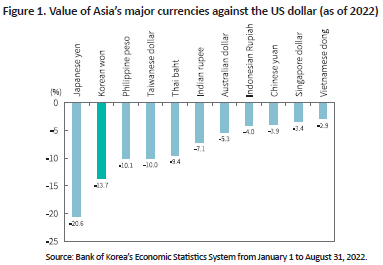

Recently, the won-dollar exchange rate has risen above KRW 1,430, hitting the highest since April 2009. The Korean won has fallen 13.7% against the US dollar since the beginning of 2022, representing the largest decline among major currencies in Asia except for the Japanese yen (Figure 1). With rate hikes by the Fed and concerns about an economic recession, the US dollar remains strong across the globe while the Korean won has kept losing its value due to Korea’s trade deficit and the reversal of the interest rate gap between Korea and the US. The supply and demand in the FX market has become unfavorable to the Korean won. In 2022, foreign investors’ net selling in Korea’s stock market and increasing overseas investments by domestic pension funds and retail investors have put upward pressure on the won-dollar exchange rate. In this situation, if the Korean won soars above a critical point against the US dollar, major financial institutions would be required to pay additional margin in the US dollar when managing financial products, thereby driving up the exchange rate further, which could make investors of the FX market herd towards the US dollar.

Furthermore, a steep rise in the market interest rate could cause financial firms to sustain significant losses from their bond holdings. As of end-2021, the bonds held by insurance firms and securities firms amounted to KRW 720 trillion and KRW 270 trillion, respectively, up 117% and 145% from a decade ago. In 2022, yields on Korea Treasury Bonds (KTBs) and corporate bonds have mostly climbed more or less 180bp until maturity. Accordingly, with the duration of bonds held by financial firms being set as one year, insurance firms and securities firms are expected to lose KRW 12.9 trillion and KRW 4.8 trillion from their bond positions, respectively.1) Insurance firms may partially offset their loss from bond holdings as rising market interest rates could cut back on insurance debts, whereas securities firms could suffer a considerable loss from their bonds unless they actively control risk by using KTB futures. Another risk factor is the increase in the possibility of corporate bankruptcy, driven by a sharp rise in corporate bond yields. According to the latest Financial Stability Report released by Bank of Korea, marginal firms and vulnerable firms, both of which could not generate enough operating profits to cover loan interests, have increasingly taken up a higher proportion in the market despite the decline in market interest rates starting in 2017 and the proportion of high-risk firms in danger of going bankrupt is also on the rise. Once the Covid-19 emergency suspension of debt payments is terminated in late September 2022, it could pose a more significant bankruptcy risk to marginal firms, potentially causing a bigger loss to financial firms with a high share of low-rated corporate loans.

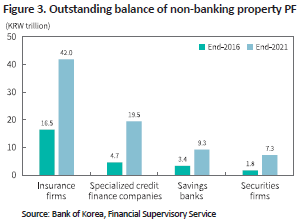

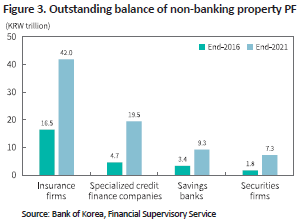

Additionally, the rising financing costs in the short-term money market could serve as a serious risk factor for financial firms. The three-month, A3- CP yield stood at 3.9% as of end-August 2021 but has recently climbed to 6.0% by 210bp. Amid growing demand for rollovers, some specialized credit finance companies face difficulties in CP issuance, which drives up the yield on bonds issued by them. Particularly, it is worth noting that the short-term money market is highly associated with property PF funds. Insurance firms, specialized credit finance companies, savings banks and securities firms have raised their exposure to property PF funds in an effort to boost non-interest income. As for non-banking financial firms, the outstanding balance of property PF loans amounted to KRW 78.1 trillion as of end-2021, posting a threefold rise from KRW 26.4 trillion as of end-2016 (Figure 3). Notably, Special Purpose Companies (SPCs) have increased the issuance of the asset-backed commercial paper (ABCP) with property PF loans as an underlying asset. If financing costs in the short-term money market are rising and the real estate market contracts, it would be hard to issue bonds used to roll over ABCPs and thus, financial firms that have provided a debt guarantee may face great losses. Given that property PF funds are highly associated with default risk and losses arising from default are likely to be passed on to the market, close monitoring is required for the mezzanine and subordinated property PF funds with a high probability of default.

How to manage risks in the financial services industry

To sum up, internal and external factors could increase volatility in the FX market, the stock market, the bond market and the short-term money market. Such higher volatility in the financial market could make some financial firms face a serious risk of suffering losses from asset management and financing activities. Against this backdrop, the financial authorities should officially implement market stabilization programs to prevent unexpected events like geopolitical risks and sovereign default risks of emerging economies from escalating into greater volatility in the financial market. If the stock index drops, the authorities could establish a stock market stabilization fund in the form of a capital call. With a further decline in the stock market, they need to buy more stocks through the stock market stabilization fund and ban short selling. In the worst case, it is worth considering placing a short position limit on stock index futures. The same measures apply to the bond market where a bond market stabilization fund could be established using a capital call if the market interest rate reaches a certain level. With a further rise in the market interest rate, the authorities could purchase more bonds through the bond market stabilization fund and set a short position limit on KTB futures. As for the FX market, an FX market stabilization fund could be formed if the won-dollar exchange rate exceeds a certain level and in the case of an additional increase in the exchange rate, the authorities would make the FX market stabilization fund sell more US dollars and induce key pension funds and institutional investors to engage in currency swaps and forward exchange sale. In this respect, they may consider providing incentives in terms of prudential regulation and tax only for the contributions that financial firms and relevant institutions pay to such stabilization funds for the stock, bond and FX markets. Also necessary is a regulation to support such funds’ profit sharing and relief measures.

What is also needed is to institutionalize the foundation and operation of a non-banking liquidity support agency to prevent prudential and liquidity risks of financial firms from intensifying into systemic risk. In response to the market turmoil triggered by the 2008 global financial crisis and the Covid-19 pandemic, the US Fed established a number of liquidity support programs to purchase CPs, ABCPs and MBS and extend credit to primary dealers. In this respect, Bank of Korea needs to devise regular liquidity support programs to buy CPs, ABCPs and bonds issued by specialized credit finance companies after examining the cases where central banks of key economies provided liquidity support for the non-banking sector in the event of a crisis. To this end, the scope of bonds to be traded in the public market should be expanded to include CPs, ABCPs and corporate bonds through a revision to the Bank of Korea Act. Furthermore, the financial stabilization fund—temporarily implemented to prevent financial firms from going insolvent and to minimize large-scale public funding—needs to become a permanent scheme.

However, if the safety net of the capital market is bolstered through the stock market stabilization fund, the bond market stabilization fund and liquidity support programs, it may lead financial firms to put more focus on high-risk investments than on risk management. In other words, this could result in moral hazards of financial firms because they could pursue excessive profits during normal times and easily earn liquidity support from the government in crises. Therefore, the financial authorities should establish strict principles regarding financial soundness and reserves accumulation to ensure that financial firms deal with incurred losses on their own responsibility before reinforcing the safety net of the capital market. It is also desirable to encourage the firms to proactively strengthen a risk management system.

1) A considerable number of insurance firms and securities firms are known to hedge against the risk from rising bond yields by using KTB futures and interest rate swaps.

Recently, the won-dollar exchange rate has risen above KRW 1,430, hitting the highest since April 2009. The Korean won has fallen 13.7% against the US dollar since the beginning of 2022, representing the largest decline among major currencies in Asia except for the Japanese yen (Figure 1). With rate hikes by the Fed and concerns about an economic recession, the US dollar remains strong across the globe while the Korean won has kept losing its value due to Korea’s trade deficit and the reversal of the interest rate gap between Korea and the US. The supply and demand in the FX market has become unfavorable to the Korean won. In 2022, foreign investors’ net selling in Korea’s stock market and increasing overseas investments by domestic pension funds and retail investors have put upward pressure on the won-dollar exchange rate. In this situation, if the Korean won soars above a critical point against the US dollar, major financial institutions would be required to pay additional margin in the US dollar when managing financial products, thereby driving up the exchange rate further, which could make investors of the FX market herd towards the US dollar.

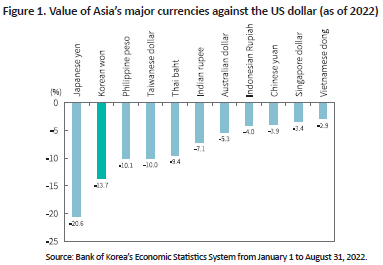

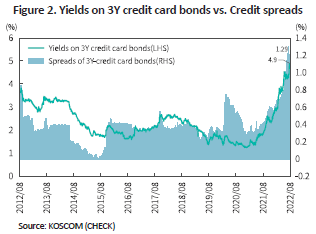

A continuous upward trend in the won-dollar exchange rate would increase volatility both in the stock market and the bond market, which requires caution. If the US dollar, a representative safe asset, continues its gain against other currencies, global institutional investors would sell risk assets such as stocks or bonds and turn to US treasury bonds and other safe assets. In this case, Korea is likely to see a plunge in stock indexes and corporate bond prices. The KOSPI and KOSDAQ have dropped 17% and 22% this year, respectively and the net sale of foreign investors in Korea’s stock market amounted to KRW 14 trillion from January to August 2022. Notably, prolonged depreciation of the Korean won could prompt foreign investors to sell domestic stocks, which in turn, could push up the won-dollar exchange rate further. Meanwhile, corporate bond yields are also rising sharply. The AA- and BBB- corporate bonds with a maturity of three years posted yields of 4.7% and 10.5%, respectively as of end-August 2022, up 220bp compared with the end of 2021. During the same period, the yield on three-year credit card bonds stood at 4.9%, reaching a 10-year high in terms of the absolute yield and credit spread (120bp) (Figure 2). The rapid surge in key corporate bond yields can be attributable to Bank of Korea’s base rate hikes and higher corporate bankruptcy risk driven by a potential recession. The depreciation of the Korean won contributes to a greater risk of default on Korean won bonds, driving up the premium of a credit default swap (CDS). Higher CDS premiums could lower the demand of foreign and institutional investors for bond purchases, thereby lifting the market interest rates.

The short-term money market has suffered increased volatility, as is the case with the FX market, the stock market and the bond market. As of end-August 2022, the yields on the 91-day CD and 91-day CP climbed to 2.92% by 160bp and 3.07% by 150bp, respectively, compared with the end of 2021, indicating that short-term financing costs have almost doubled on a YoY basis. Amid a sharp rise in low-rated CP yields, some companies seem to face difficulties in securing short-term financing. In late June 2022, growing demand for end-of-quarter fund settlement significantly drove up RP yields and led to an outflow of a considerable amount of capital from money market funds (MMFs). If the CP issuance hits a snag with higher demand for rollovers, the risk of default on settlement would increase in the Repo market and assets placed in MMFs would be sold urgently, which could spread relevant risks across the bond market and the stock market. As such, increasing volatility in the financial market means that financial firms could be exposed to considerable risk when managing assets and raising capital. Against this backdrop, this article intends to examine what risks financial firms are exposed to amid growing volatility in the financial market, and to present how to deal with such risks.

Financial firms’ risk of sustaining losses arising from higher volatility

With the won-dollar exchange rate surpassing a certain threshold, financial firms may suffer significant losses in FX-based derivatives contracts. A case in point is a financial firm that sells currency options to hedge against the risk of fluctuating value in foreign currency assets. If a strong US dollar against the Korean won is coupled with intensified volatility in the market, the firm could face a significant loss in asset valuation. Amid an increase in the won-dollar exchange rate, financial firms that have entered into an OTC derivatives contract with foreign banks would be required to provide additional security. If foreign banks receive won-denominated security from Korea’s financial firms and set up upper limits on the security amount, a further increase in the won-dollar exchange rate would reduce the value of security, which requires those financial firms to provide additional security. Likewise, insurance firms could be at risk of suffering losses from fluctuating exchange rates. As they use currency swaps, FX swaps and currency options to hedge against the risk of FX fluctuations in their foreign currency assets, a rapid rise in the won-dollar exchange rate for a short term could cause a loss to existing derivatives contracts.

If stock indexes tumble down in a short period, securities firms should face a considerable valuation loss from ELS hedging and be subject to a margin call, which requires extra caution. Amid the spread of the Covid-19 pandemic around the globe in March 2020, stock indexes in Korea and overseas markets took a nosedive, falling more or less 30% in a short term. At that time, Korea’s securities firms sustained a loss from their short positions in derivatives purchased for ELS hedging and were required to deposit additional FX margin. Some of them made a request for US dollar purchases in large volumes in the FX market and FX swap market to meet the demand for additional margin, which triggered an imbalance in the FX market. This led to a surge in both the won-dollar exchange rate and demand for short-term financing in the Korean won and consequently, the CP yield shot up, which raised concerns about liquidity risk of financial firms. More recently, Hong Kong’s H index slid to 6,550pt, below the levels reported in early 2016 and March 2020 when the H index-related crisis occurred, while Euro STOXX 50 and S&P 500 have been on the decline with increased volatility. This suggests ELS hedging-related risk further intensifies. Such a plunge in stock indexes could expose insurance firms to the risk of suffering losses related to variable insurance products. If stock indexes at home and abroad drop rapidly, life insurance firms with a high proportion of variable insurance should deposit reserves as security. In this case, the size of incurred loss may vary by how much funds a firm can deposit in its account.Financial firms’ risk of sustaining losses arising from higher volatility

With the won-dollar exchange rate surpassing a certain threshold, financial firms may suffer significant losses in FX-based derivatives contracts. A case in point is a financial firm that sells currency options to hedge against the risk of fluctuating value in foreign currency assets. If a strong US dollar against the Korean won is coupled with intensified volatility in the market, the firm could face a significant loss in asset valuation. Amid an increase in the won-dollar exchange rate, financial firms that have entered into an OTC derivatives contract with foreign banks would be required to provide additional security. If foreign banks receive won-denominated security from Korea’s financial firms and set up upper limits on the security amount, a further increase in the won-dollar exchange rate would reduce the value of security, which requires those financial firms to provide additional security. Likewise, insurance firms could be at risk of suffering losses from fluctuating exchange rates. As they use currency swaps, FX swaps and currency options to hedge against the risk of FX fluctuations in their foreign currency assets, a rapid rise in the won-dollar exchange rate for a short term could cause a loss to existing derivatives contracts.

Furthermore, a steep rise in the market interest rate could cause financial firms to sustain significant losses from their bond holdings. As of end-2021, the bonds held by insurance firms and securities firms amounted to KRW 720 trillion and KRW 270 trillion, respectively, up 117% and 145% from a decade ago. In 2022, yields on Korea Treasury Bonds (KTBs) and corporate bonds have mostly climbed more or less 180bp until maturity. Accordingly, with the duration of bonds held by financial firms being set as one year, insurance firms and securities firms are expected to lose KRW 12.9 trillion and KRW 4.8 trillion from their bond positions, respectively.1) Insurance firms may partially offset their loss from bond holdings as rising market interest rates could cut back on insurance debts, whereas securities firms could suffer a considerable loss from their bonds unless they actively control risk by using KTB futures. Another risk factor is the increase in the possibility of corporate bankruptcy, driven by a sharp rise in corporate bond yields. According to the latest Financial Stability Report released by Bank of Korea, marginal firms and vulnerable firms, both of which could not generate enough operating profits to cover loan interests, have increasingly taken up a higher proportion in the market despite the decline in market interest rates starting in 2017 and the proportion of high-risk firms in danger of going bankrupt is also on the rise. Once the Covid-19 emergency suspension of debt payments is terminated in late September 2022, it could pose a more significant bankruptcy risk to marginal firms, potentially causing a bigger loss to financial firms with a high share of low-rated corporate loans.

Additionally, the rising financing costs in the short-term money market could serve as a serious risk factor for financial firms. The three-month, A3- CP yield stood at 3.9% as of end-August 2021 but has recently climbed to 6.0% by 210bp. Amid growing demand for rollovers, some specialized credit finance companies face difficulties in CP issuance, which drives up the yield on bonds issued by them. Particularly, it is worth noting that the short-term money market is highly associated with property PF funds. Insurance firms, specialized credit finance companies, savings banks and securities firms have raised their exposure to property PF funds in an effort to boost non-interest income. As for non-banking financial firms, the outstanding balance of property PF loans amounted to KRW 78.1 trillion as of end-2021, posting a threefold rise from KRW 26.4 trillion as of end-2016 (Figure 3). Notably, Special Purpose Companies (SPCs) have increased the issuance of the asset-backed commercial paper (ABCP) with property PF loans as an underlying asset. If financing costs in the short-term money market are rising and the real estate market contracts, it would be hard to issue bonds used to roll over ABCPs and thus, financial firms that have provided a debt guarantee may face great losses. Given that property PF funds are highly associated with default risk and losses arising from default are likely to be passed on to the market, close monitoring is required for the mezzanine and subordinated property PF funds with a high probability of default.

How to manage risks in the financial services industry

To sum up, internal and external factors could increase volatility in the FX market, the stock market, the bond market and the short-term money market. Such higher volatility in the financial market could make some financial firms face a serious risk of suffering losses from asset management and financing activities. Against this backdrop, the financial authorities should officially implement market stabilization programs to prevent unexpected events like geopolitical risks and sovereign default risks of emerging economies from escalating into greater volatility in the financial market. If the stock index drops, the authorities could establish a stock market stabilization fund in the form of a capital call. With a further decline in the stock market, they need to buy more stocks through the stock market stabilization fund and ban short selling. In the worst case, it is worth considering placing a short position limit on stock index futures. The same measures apply to the bond market where a bond market stabilization fund could be established using a capital call if the market interest rate reaches a certain level. With a further rise in the market interest rate, the authorities could purchase more bonds through the bond market stabilization fund and set a short position limit on KTB futures. As for the FX market, an FX market stabilization fund could be formed if the won-dollar exchange rate exceeds a certain level and in the case of an additional increase in the exchange rate, the authorities would make the FX market stabilization fund sell more US dollars and induce key pension funds and institutional investors to engage in currency swaps and forward exchange sale. In this respect, they may consider providing incentives in terms of prudential regulation and tax only for the contributions that financial firms and relevant institutions pay to such stabilization funds for the stock, bond and FX markets. Also necessary is a regulation to support such funds’ profit sharing and relief measures.

What is also needed is to institutionalize the foundation and operation of a non-banking liquidity support agency to prevent prudential and liquidity risks of financial firms from intensifying into systemic risk. In response to the market turmoil triggered by the 2008 global financial crisis and the Covid-19 pandemic, the US Fed established a number of liquidity support programs to purchase CPs, ABCPs and MBS and extend credit to primary dealers. In this respect, Bank of Korea needs to devise regular liquidity support programs to buy CPs, ABCPs and bonds issued by specialized credit finance companies after examining the cases where central banks of key economies provided liquidity support for the non-banking sector in the event of a crisis. To this end, the scope of bonds to be traded in the public market should be expanded to include CPs, ABCPs and corporate bonds through a revision to the Bank of Korea Act. Furthermore, the financial stabilization fund—temporarily implemented to prevent financial firms from going insolvent and to minimize large-scale public funding—needs to become a permanent scheme.

However, if the safety net of the capital market is bolstered through the stock market stabilization fund, the bond market stabilization fund and liquidity support programs, it may lead financial firms to put more focus on high-risk investments than on risk management. In other words, this could result in moral hazards of financial firms because they could pursue excessive profits during normal times and easily earn liquidity support from the government in crises. Therefore, the financial authorities should establish strict principles regarding financial soundness and reserves accumulation to ensure that financial firms deal with incurred losses on their own responsibility before reinforcing the safety net of the capital market. It is also desirable to encourage the firms to proactively strengthen a risk management system.

1) A considerable number of insurance firms and securities firms are known to hedge against the risk from rising bond yields by using KTB futures and interest rate swaps.