OPINION

2022 Oct/11

Default Investment Options and Growth of Target Date Funds

Oct. 11, 2022

PDF

- Summary

- Target Date Funds (TDF) are showing a rapid growth trend. In the US, the size of the TDF market increased sharply in the wake of the adoption of default investment options. Accordingly, the growth of TDFs is expected to pick up speed in tandem with the implementation of the default investment option scheme in Korea.

As Korea has begun to put default investment options in place, companies that have adopted Defined Contribution (DC) plans need to designate TDFs in advance in consultation with employees by taking into account TDFs’ returns and costs. After achieving stable returns, TDFs have recently suffered higher volatility in the return due to a decline in stock prices, which could aggravate difficulties in selecting TDFs. Although lower fees are one of the advantages of TDFs, the costs of TDFs are not necessarily in proportion to their returns. Accordingly, relatively lower-cost TDFs are likely to draw the attention of investors. Given that TDFs are relatively new to the Korean market, the currently available performance indicators of TDFs do not seem to offer reliable information. What is needed in this situation is the selection of suitable TDFs in a transparent manner through a reasonable process.

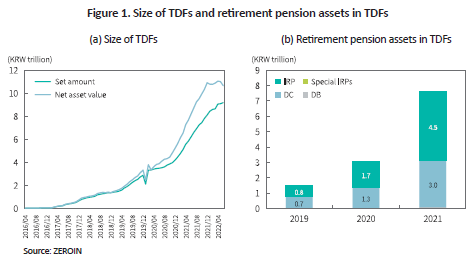

The size of the Target Date Fund (TDF) market is growing rapidly.1) Assets in TDFs stand at KRW 67.2 billion as of end-2016, ballooning to KRW 10.9 trillion by late 2021. Retirement pension assets in TDFs amount to KRW 7.6 trillion as of end-2021, representing 70.2% of the total TDF assets.

Korea has implemented the default investment alternatives scheme under the name of default investment options since July 2022, as part of its efforts to enhance efficiency in managing assets in DC plans.2) Being offered as alternative products, TDFs are likely to gain growing interest and see the size of assets become larger. This is well demonstrated by the US case where TDFs have experienced a surge in assets after auto enrollment and default investment alternatives including TDFs were adopted.3)

Notably, 2022 has seen a plunge in returns on TDFs launched in Korea and overseas markets due to the downturn in the stock market. In particular, TDFs that draw near the designated target date do not have enough time to overcome a decline in returns, which requires a closer look. Out of TDF 2020 products being available in the US in the first quarter of 2020, JP Morgan’s TDF fell 10.1% in the return while the one offered by T. Rowe Price suffered a 14.2% decline.4) Although the drop in returns for the first quarter of 2020 was mostly offset by the increase in stock prices during the second quarter, the 2022 slump in the stock market still has a lingering effect. In Korea, returns on TDFs have also been negatively affected by a drop in stock prices in the first half of 2022. Under the circumstance, concerns have been raised about a wider gap in returns between TDFs.5)

In preparation for the default investment option scheme, an examination of the current state and performance of TDFs would offer significant implications for the establishment of default investment options in Korea.6) In this respect, this article intends to what companies need to consider in selecting TDFs.

The rise of TDFs

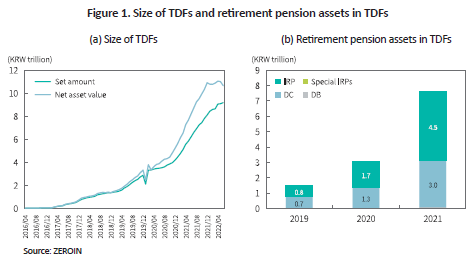

As of end-2021, TDFs reach KRW 8.1 trillion in the set amount and KRW 10.9 trillion in the net asset value. The set amount of TDFs—valued at KRW 4.2 trillion as of end-2020—has almost doubled to KRW 8.1 trillion by the end of 2021.7) A total of 16 fund management firms launched TDFs by the end of 2021. In an analysis of the set fund amount by firm, the top three firms accounted for 76.4%, with the top five taking up a whopping 93.0%. Leading TDF management firms outpaced their rivals in terms of the launch date and the number of TDFs (Figure 1 (a)).8) By target date, TDF 2025 has gained the largest set amount of KRW 1.9 trillion, followed by TDF 2030 of KRW 1.4 trillion and TDF 2045 of KRW 1.3 trillion.

Retirement pension assets worth KRW 7.6 trillion are invested in TDFs as of end-2021, accounting for 70.2% of the net TDF asset value.9) This amount represents 19.0% of the pension assets of KRW 40.2 trillion placed in investment-linked products, indicating that the share of TDFs in investment-linked products has grown significantly over the latest three years (from KRW 1.5 trillion out of KRW 21.8 trillion (7.0%) for 2019 to KRW 3.1 trillion out of KRW 27.3 trillion (11.3%) for 2020). Pension assets in TDFs primarily come from IRPs (58.5%) and DC plans (39.9%) (Figure 1 (b)).

Returns on TDFs

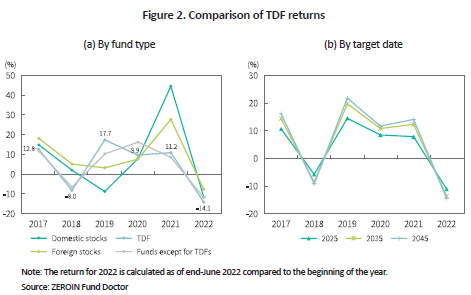

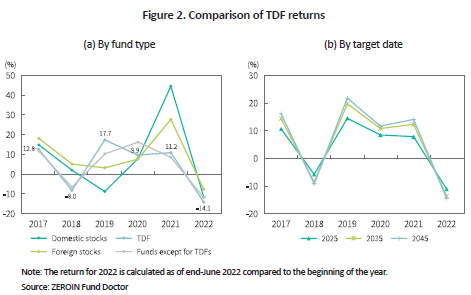

TDFs have achieved an annual return of around 10% since 2018 and have been established as stable investment arrangements for pension plans. In a comparison of returns by fund type, the return on TDFs shows a limited range of fluctuations relative to stock funds launched in Korea and overseas markets, while displaying a similar movement to the return on foreign stock funds (Figure 2 (a)). In terms of TDF returns by target date, the longer time was left until the target date, the higher returns TDFs achieved when the market was bullish, and the opposite trend occurred during a stock market downturn (Figure 2 (b)).

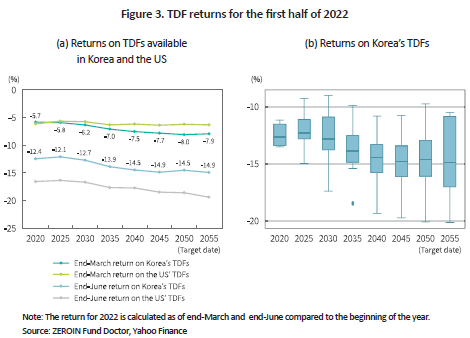

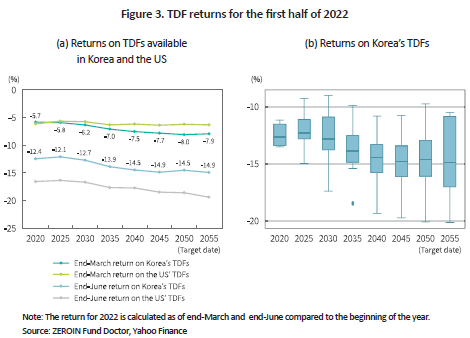

Although TDFs stayed within a range of stable returns until 2021, the returns plummeted during the first half of 2022 on the back of a decline in stock prices. The average return on TDFs that remained at around 11.2% in 2021 fell to -14.0% in late June of 2022 compared to earlier this year (Figure 3 (a)). During the same period, returns on TDFs also went down in the US, showing a bigger decline compared to the fall in Korea’s TDF returns.10) This may be attributable to the fact that Korea’s TDFs have a lower weight of stock holdings across all designated target dates. It is also notable that the further the target date is, the lower return a TDF achieves, which leads to wide variation in returns within the funds having the same target date (Figure 3 (b)). These findings also hold true for the US’ TDFs, because TDFs that have a longer time to reach the target date tend to hold a larger weight of stocks in portfolios.

The total expense ratio of TDFs

In return for asset management services, investors pay costs—calculated as a certain percentage of the assets under management—annually to pension providers. These costs can be calculated based on the total expense ratio. The total expense ratio matters in that the return on funds varies by asset management results but investors have to pay expenses, regardless of the results. This means differences in expense ratios between funds could have a major effect on long-term investment performance.

By asset class, the total expense ratio of Class C and Class S, both of which make up the bulk of retirement pension funds, stands at 0.843% and 0.637%, respectively. The total expense ratio of pension funds is averaged at 0.826%, slightly higher than 0.788% of ordinary funds’ average total expense ratio. The total expense ratio of TDFs—lower than that of other pension funds—is averaged at 0.626%, while the ratio of Class C and Class S represents 0.684% and 0.451%, respectively.11)

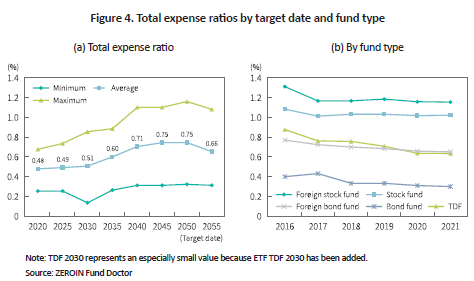

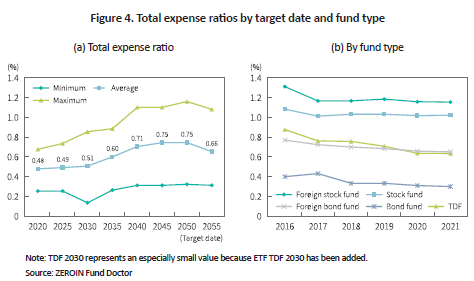

The further the target date, the larger the total expense would be. A TDF with a longer time left before expiration is likely to have more stock holdings in its portfolio, which drives up costs for fund management (Figure 4 (a)).12) The gap in the expense ratio tends to widen by target date. In an analysis of expense ratios by fund type, the expense ratio of TDFs is similar to that of foreign bond funds but much lower than those of stock funds and foreign stock funds (Figure 4 (b)).

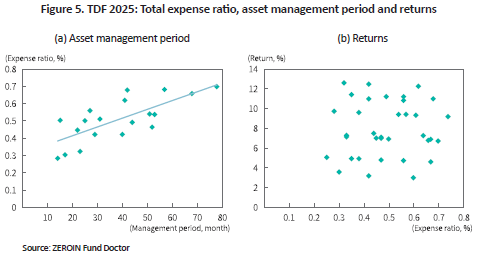

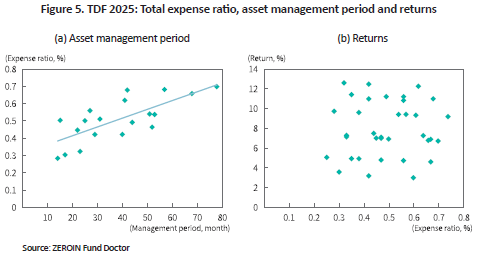

Notably, newly launched TDFs are likely to charge lower fees, indicating that the longer the management period is, the higher the fees would be (Figure 5 (a)). Also notable is no distinct tendency between aggregate expenses and returns (Figure 5 (b)). The difference between the maximum and minimum TDF returns by target date ranges from 0.43% (TDF 2020) to 0.80% (TDF 2040, TDF 2045). Accordingly, if TDFs that come at higher fees are not able to generate sufficiently high returns, plan participants could sustain potential losses, suggesting that the cost is an important factor when selecting TDFs.

Default investment options and TDFs

As Korea is preparing for the introduction and implementation of the default investment option scheme, the authorities, as well as DC plan members and pension plan sponsors, should pay close attention to the new scheme.

In particular, plan participants need to take a closer look at TDFs. Although TDF investors are allowed not to take care of asset management after a TDF is selected, they must have access to material information including TDF costs, previous returns and volatility before they make a choice. Korea’s TDFs also show significant variation in returns and costs, though to a lesser extent than the US’ TDFs, which requires caution of investors. Among all retirement pension plans, TDFs especially seek long-term performance, which makes the initial selection process all the more important.

Pension plan sponsors should be obligated to ensure that their employees have accurate information. The information provided to them and the resultant investment decision could have a serious impact on retirement savings. On top of that, companies implementing the retirement pension scheme need to direct their attention and efforts toward selecting suitable TDFs with the aid of plan providers. The US Department of Labor recommends that companies establish a process for comparing and selecting TDFs and the periodic review of selected TDFs. In addition, companies are also required to devise a mechanism to offer employees relevant information including the fund’s fees and investment expenses.13)

In most cases, plan providers that recommend investment products are highly likely to serve as asset management firms. This is commonly observed in foreign markets such as the US14) and hardly poses any problem itself. But plan sponsors need to discourage plan providers from excessively recommending products developed by themselves. When it comes to selecting TDFs, it is worth considering whether TDFs offered by other plan providers are available or it is possible to select from a range of products provided by a single plan provider.15)

Lastly, the authorities should exert utmost efforts to ensure that information related to TDF management is publicized in a transparent manner. Some researchers who critically view TDFs-related achievements in the US have pointed out a conflict of interest among fund management firms as a major problem.16) Such conflicts of interest may pose more serious issues to TDFs with a long-term horizon than to ordinary fund products, which underscores the importance of disclosure of TDFs-related information.

1) Target Date Funds (TDFs) are structured to weigh toward more conservative choices in asset allocations as they approach target dates. The target date mostly refers to a retirement age when investors need to use pension assets and assets are allocated according to a glide path.

2) Default Investment Alternatives are basic investment arrangements under which retirement pension assets are invested unless an investor makes an explicit investment decision.

3) As Korea’s retirement pension scheme is different from that of the US in terms of the background of auto enrollment and asset portfolios, the impact of adopting default investment options may vary significantly. Given Korea’s decision to include principal-protected products as default investment options, there is a possibility that the existing investment arrangement leaning toward principal-protected products would not disappear.

4) There are great differences in the weight of stock holdings between TDFs that have the same target date or approach the target date (What the Market Selloff Revealed About Target-Date Funds, The Wall Street Journal).

5) Kim, K.M., June 1, 2022, [An analysis of annual returns on TDFs] Annual returns on TDFs vary by as much as 10%, Seoul Economic Daily.

6) This article uses ZEROIN’s fund data in addition to FnSpectrum and data released by the Korea Financial Investment Association. Korea’s short history of the adoption and implementation of TDFs may pose limitations in the stability of performance indicators such as returns and expense ratios.

7) The set amount of TDFs reaches KRW 9.1 trillion as of end-June 2022, up 13% compared to the end of the previous year. But amid a drop in returns, the net asset value of TDFs fell to KRW 10.6 trillion in the first half of 2022, down by KRW 300 billion compared to the beginning of the year.

8) In terms of the US’ TDFs, the top-ranked firm (Vanguard) gained a market share of 36.7% while the top three (including Fidelity, T.Rowe Price) and the top five (including BlackRock, American Funds) account for 61.6% and 78.3%, respectively (Pacholok, M., Zaya, K., 2022, 2022 Target-Date Strategy Landscape, Morningstar Manager Research).

9) Aside from pension assets in TDFs, personal pension TDFs and general TDFs amount to KRW 2.1 trillion (19.0%) and KRW 1.2 trillion (10.9%), respectively, as of end-December, 2021. Pension assets in TDFs account for 25.9% of the total TDF asset value as of end-2016, which increased every year to 39.5% by 2017, 49.6% by 2018, 59.3% by 2019, 59.3% by 2020, and 70.2% by 2021.

10) The MSCI ACWI—the benchmark index of Korea’s TDFs—dropped 20.1% between end-2021 and end-June, 2022 while the Dow Jones Industrial Average fell 15.3% during the same period.

11) Class A shares (17.0% of total funds) typically impose a front-end sales charge. Class C shares (74.0% of total funds) with no front-end fees charge sales fees as a fixed percentage in proportion to the asset management period. Class S shares (9.0% of total funds) are available in Fund Online Korea, a fund supermarket operated by Korea Foss Securities.

12) A substantial proportion of assets in Korea’s TDFs is being invested in the US’ funds. In the US market, the 2021 expense ratios of stock funds and bond funds were averaged at 0.47% and 0.39%, respectively and thus, TDFs with a larger holding of stock funds in portfolios tend to show a higher total expense ratio (ICI, 2022).

13) U.S. Department of Labor, 2013, Target Date Retirement Funds-Tips for ERISA Plan Fiduciaries.

14) In the US, the top three pension fund trustees (fund accounting and administration companies)—equivalent to pension managers in Korea—are Vanguard, Fidelity and T.RowePrice in terms of the trusted asset value, and the top three fund managers that provide fund products to the trustees are Vanguard, Fidelity and T.RowePrice (Duarte, V., Fonseca, J., Goodman, A., Parker, J.A., 2021, Simple Allocation Rules and Optimal Portfolio Choice Over the Lifecycle, working paper. NBER Working Paper 29559).

15) Plan sponsors are not the only subject of litigation. Currently, legal action against BlackRock’s LifePath Index Funds and Fidelity Freedom Funds has been still in progress (Adams, N.E., 2022. 8. 3, TDF Performance Targeted in Several Plan Suits, https://www.napa-net.org/news-info/daily-news/appellate-court-backs-freedom-funds-fee-suit-dismissal).

16) As various issues were raised about TDFs, the US Congress requested the Government Accountability Office (GAO) to initiate an official investigation into the current state and problems of TDFs in May 2021 (U.S. Senate Committee on Health, Education, Labor and Pensions, 2021). In the letter of request, the chairs from each house of Congress called for an investigation into TDF market conditions including achievements, cost structure, asset portfolios, and fund managers’ marketing strategies of TDFs. In addition, they also requested an examination of policy measures taken by the Department of Labor for pension plan participants and policy alternatives that the US Congress could put into action.

Korea has implemented the default investment alternatives scheme under the name of default investment options since July 2022, as part of its efforts to enhance efficiency in managing assets in DC plans.2) Being offered as alternative products, TDFs are likely to gain growing interest and see the size of assets become larger. This is well demonstrated by the US case where TDFs have experienced a surge in assets after auto enrollment and default investment alternatives including TDFs were adopted.3)

Notably, 2022 has seen a plunge in returns on TDFs launched in Korea and overseas markets due to the downturn in the stock market. In particular, TDFs that draw near the designated target date do not have enough time to overcome a decline in returns, which requires a closer look. Out of TDF 2020 products being available in the US in the first quarter of 2020, JP Morgan’s TDF fell 10.1% in the return while the one offered by T. Rowe Price suffered a 14.2% decline.4) Although the drop in returns for the first quarter of 2020 was mostly offset by the increase in stock prices during the second quarter, the 2022 slump in the stock market still has a lingering effect. In Korea, returns on TDFs have also been negatively affected by a drop in stock prices in the first half of 2022. Under the circumstance, concerns have been raised about a wider gap in returns between TDFs.5)

In preparation for the default investment option scheme, an examination of the current state and performance of TDFs would offer significant implications for the establishment of default investment options in Korea.6) In this respect, this article intends to what companies need to consider in selecting TDFs.

The rise of TDFs

As of end-2021, TDFs reach KRW 8.1 trillion in the set amount and KRW 10.9 trillion in the net asset value. The set amount of TDFs—valued at KRW 4.2 trillion as of end-2020—has almost doubled to KRW 8.1 trillion by the end of 2021.7) A total of 16 fund management firms launched TDFs by the end of 2021. In an analysis of the set fund amount by firm, the top three firms accounted for 76.4%, with the top five taking up a whopping 93.0%. Leading TDF management firms outpaced their rivals in terms of the launch date and the number of TDFs (Figure 1 (a)).8) By target date, TDF 2025 has gained the largest set amount of KRW 1.9 trillion, followed by TDF 2030 of KRW 1.4 trillion and TDF 2045 of KRW 1.3 trillion.

Retirement pension assets worth KRW 7.6 trillion are invested in TDFs as of end-2021, accounting for 70.2% of the net TDF asset value.9) This amount represents 19.0% of the pension assets of KRW 40.2 trillion placed in investment-linked products, indicating that the share of TDFs in investment-linked products has grown significantly over the latest three years (from KRW 1.5 trillion out of KRW 21.8 trillion (7.0%) for 2019 to KRW 3.1 trillion out of KRW 27.3 trillion (11.3%) for 2020). Pension assets in TDFs primarily come from IRPs (58.5%) and DC plans (39.9%) (Figure 1 (b)).

Returns on TDFs

TDFs have achieved an annual return of around 10% since 2018 and have been established as stable investment arrangements for pension plans. In a comparison of returns by fund type, the return on TDFs shows a limited range of fluctuations relative to stock funds launched in Korea and overseas markets, while displaying a similar movement to the return on foreign stock funds (Figure 2 (a)). In terms of TDF returns by target date, the longer time was left until the target date, the higher returns TDFs achieved when the market was bullish, and the opposite trend occurred during a stock market downturn (Figure 2 (b)).

Although TDFs stayed within a range of stable returns until 2021, the returns plummeted during the first half of 2022 on the back of a decline in stock prices. The average return on TDFs that remained at around 11.2% in 2021 fell to -14.0% in late June of 2022 compared to earlier this year (Figure 3 (a)). During the same period, returns on TDFs also went down in the US, showing a bigger decline compared to the fall in Korea’s TDF returns.10) This may be attributable to the fact that Korea’s TDFs have a lower weight of stock holdings across all designated target dates. It is also notable that the further the target date is, the lower return a TDF achieves, which leads to wide variation in returns within the funds having the same target date (Figure 3 (b)). These findings also hold true for the US’ TDFs, because TDFs that have a longer time to reach the target date tend to hold a larger weight of stocks in portfolios.

The total expense ratio of TDFs

In return for asset management services, investors pay costs—calculated as a certain percentage of the assets under management—annually to pension providers. These costs can be calculated based on the total expense ratio. The total expense ratio matters in that the return on funds varies by asset management results but investors have to pay expenses, regardless of the results. This means differences in expense ratios between funds could have a major effect on long-term investment performance.

By asset class, the total expense ratio of Class C and Class S, both of which make up the bulk of retirement pension funds, stands at 0.843% and 0.637%, respectively. The total expense ratio of pension funds is averaged at 0.826%, slightly higher than 0.788% of ordinary funds’ average total expense ratio. The total expense ratio of TDFs—lower than that of other pension funds—is averaged at 0.626%, while the ratio of Class C and Class S represents 0.684% and 0.451%, respectively.11)

The further the target date, the larger the total expense would be. A TDF with a longer time left before expiration is likely to have more stock holdings in its portfolio, which drives up costs for fund management (Figure 4 (a)).12) The gap in the expense ratio tends to widen by target date. In an analysis of expense ratios by fund type, the expense ratio of TDFs is similar to that of foreign bond funds but much lower than those of stock funds and foreign stock funds (Figure 4 (b)).

Notably, newly launched TDFs are likely to charge lower fees, indicating that the longer the management period is, the higher the fees would be (Figure 5 (a)). Also notable is no distinct tendency between aggregate expenses and returns (Figure 5 (b)). The difference between the maximum and minimum TDF returns by target date ranges from 0.43% (TDF 2020) to 0.80% (TDF 2040, TDF 2045). Accordingly, if TDFs that come at higher fees are not able to generate sufficiently high returns, plan participants could sustain potential losses, suggesting that the cost is an important factor when selecting TDFs.

Default investment options and TDFs

As Korea is preparing for the introduction and implementation of the default investment option scheme, the authorities, as well as DC plan members and pension plan sponsors, should pay close attention to the new scheme.

In particular, plan participants need to take a closer look at TDFs. Although TDF investors are allowed not to take care of asset management after a TDF is selected, they must have access to material information including TDF costs, previous returns and volatility before they make a choice. Korea’s TDFs also show significant variation in returns and costs, though to a lesser extent than the US’ TDFs, which requires caution of investors. Among all retirement pension plans, TDFs especially seek long-term performance, which makes the initial selection process all the more important.

Pension plan sponsors should be obligated to ensure that their employees have accurate information. The information provided to them and the resultant investment decision could have a serious impact on retirement savings. On top of that, companies implementing the retirement pension scheme need to direct their attention and efforts toward selecting suitable TDFs with the aid of plan providers. The US Department of Labor recommends that companies establish a process for comparing and selecting TDFs and the periodic review of selected TDFs. In addition, companies are also required to devise a mechanism to offer employees relevant information including the fund’s fees and investment expenses.13)

In most cases, plan providers that recommend investment products are highly likely to serve as asset management firms. This is commonly observed in foreign markets such as the US14) and hardly poses any problem itself. But plan sponsors need to discourage plan providers from excessively recommending products developed by themselves. When it comes to selecting TDFs, it is worth considering whether TDFs offered by other plan providers are available or it is possible to select from a range of products provided by a single plan provider.15)

Lastly, the authorities should exert utmost efforts to ensure that information related to TDF management is publicized in a transparent manner. Some researchers who critically view TDFs-related achievements in the US have pointed out a conflict of interest among fund management firms as a major problem.16) Such conflicts of interest may pose more serious issues to TDFs with a long-term horizon than to ordinary fund products, which underscores the importance of disclosure of TDFs-related information.

1) Target Date Funds (TDFs) are structured to weigh toward more conservative choices in asset allocations as they approach target dates. The target date mostly refers to a retirement age when investors need to use pension assets and assets are allocated according to a glide path.

2) Default Investment Alternatives are basic investment arrangements under which retirement pension assets are invested unless an investor makes an explicit investment decision.

3) As Korea’s retirement pension scheme is different from that of the US in terms of the background of auto enrollment and asset portfolios, the impact of adopting default investment options may vary significantly. Given Korea’s decision to include principal-protected products as default investment options, there is a possibility that the existing investment arrangement leaning toward principal-protected products would not disappear.

4) There are great differences in the weight of stock holdings between TDFs that have the same target date or approach the target date (What the Market Selloff Revealed About Target-Date Funds, The Wall Street Journal).

5) Kim, K.M., June 1, 2022, [An analysis of annual returns on TDFs] Annual returns on TDFs vary by as much as 10%, Seoul Economic Daily.

6) This article uses ZEROIN’s fund data in addition to FnSpectrum and data released by the Korea Financial Investment Association. Korea’s short history of the adoption and implementation of TDFs may pose limitations in the stability of performance indicators such as returns and expense ratios.

7) The set amount of TDFs reaches KRW 9.1 trillion as of end-June 2022, up 13% compared to the end of the previous year. But amid a drop in returns, the net asset value of TDFs fell to KRW 10.6 trillion in the first half of 2022, down by KRW 300 billion compared to the beginning of the year.

8) In terms of the US’ TDFs, the top-ranked firm (Vanguard) gained a market share of 36.7% while the top three (including Fidelity, T.Rowe Price) and the top five (including BlackRock, American Funds) account for 61.6% and 78.3%, respectively (Pacholok, M., Zaya, K., 2022, 2022 Target-Date Strategy Landscape, Morningstar Manager Research).

9) Aside from pension assets in TDFs, personal pension TDFs and general TDFs amount to KRW 2.1 trillion (19.0%) and KRW 1.2 trillion (10.9%), respectively, as of end-December, 2021. Pension assets in TDFs account for 25.9% of the total TDF asset value as of end-2016, which increased every year to 39.5% by 2017, 49.6% by 2018, 59.3% by 2019, 59.3% by 2020, and 70.2% by 2021.

10) The MSCI ACWI—the benchmark index of Korea’s TDFs—dropped 20.1% between end-2021 and end-June, 2022 while the Dow Jones Industrial Average fell 15.3% during the same period.

11) Class A shares (17.0% of total funds) typically impose a front-end sales charge. Class C shares (74.0% of total funds) with no front-end fees charge sales fees as a fixed percentage in proportion to the asset management period. Class S shares (9.0% of total funds) are available in Fund Online Korea, a fund supermarket operated by Korea Foss Securities.

12) A substantial proportion of assets in Korea’s TDFs is being invested in the US’ funds. In the US market, the 2021 expense ratios of stock funds and bond funds were averaged at 0.47% and 0.39%, respectively and thus, TDFs with a larger holding of stock funds in portfolios tend to show a higher total expense ratio (ICI, 2022).

13) U.S. Department of Labor, 2013, Target Date Retirement Funds-Tips for ERISA Plan Fiduciaries.

14) In the US, the top three pension fund trustees (fund accounting and administration companies)—equivalent to pension managers in Korea—are Vanguard, Fidelity and T.RowePrice in terms of the trusted asset value, and the top three fund managers that provide fund products to the trustees are Vanguard, Fidelity and T.RowePrice (Duarte, V., Fonseca, J., Goodman, A., Parker, J.A., 2021, Simple Allocation Rules and Optimal Portfolio Choice Over the Lifecycle, working paper. NBER Working Paper 29559).

15) Plan sponsors are not the only subject of litigation. Currently, legal action against BlackRock’s LifePath Index Funds and Fidelity Freedom Funds has been still in progress (Adams, N.E., 2022. 8. 3, TDF Performance Targeted in Several Plan Suits, https://www.napa-net.org/news-info/daily-news/appellate-court-backs-freedom-funds-fee-suit-dismissal).

16) As various issues were raised about TDFs, the US Congress requested the Government Accountability Office (GAO) to initiate an official investigation into the current state and problems of TDFs in May 2021 (U.S. Senate Committee on Health, Education, Labor and Pensions, 2021). In the letter of request, the chairs from each house of Congress called for an investigation into TDF market conditions including achievements, cost structure, asset portfolios, and fund managers’ marketing strategies of TDFs. In addition, they also requested an examination of policy measures taken by the Department of Labor for pension plan participants and policy alternatives that the US Congress could put into action.