Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Need for Sustainability Disclosure by Funds

Publication date Nov. 08, 2022

Summary

Korea has no administrative sanction applicable to a fund that claims to support ESG value but falls short of conducting investment practices suggested by such value. As a result, some funds may engage in greenwashing intentionally. To avoid this, the EU and US have recently attempted to make it mandatory for financial products to disclose ESG-related information, which sets a good example for Korea to follow. In this respect, it is worth considering the following measures.

Information should be disclosed based on the principle of proportionality, meaning that how much impact sustainability factors have on investment decisions determines the level of information to be disclosed. To this end, funds need to elaborate on what sustainability factors are considered and how to apply such factors in the investment strategy. Fund management firms should report their sustainability analysis capability in terms of retention of professionals and data. If a firm relies on a third-party provider for ESG ratings, data, and analytic tools, a due diligence process for the service provider should be arranged as part of its fiduciary duty. In addition, funds should select a benchmark that aligns with environmental, social and corporate governance features pursued by them and provide a detailed explanation of the principle and methodology of benchmark index calculation within the scope permitted by intellectual property rights. Lastly, if a fund carries out shareholder activities for a particular ESG agenda, it should clarify the agenda and goal of its shareholder activities—whether it is normative or for profit seeking—and inform investors of specific activities and whether the goal is achieved.

Information should be disclosed based on the principle of proportionality, meaning that how much impact sustainability factors have on investment decisions determines the level of information to be disclosed. To this end, funds need to elaborate on what sustainability factors are considered and how to apply such factors in the investment strategy. Fund management firms should report their sustainability analysis capability in terms of retention of professionals and data. If a firm relies on a third-party provider for ESG ratings, data, and analytic tools, a due diligence process for the service provider should be arranged as part of its fiduciary duty. In addition, funds should select a benchmark that aligns with environmental, social and corporate governance features pursued by them and provide a detailed explanation of the principle and methodology of benchmark index calculation within the scope permitted by intellectual property rights. Lastly, if a fund carries out shareholder activities for a particular ESG agenda, it should clarify the agenda and goal of its shareholder activities—whether it is normative or for profit seeking—and inform investors of specific activities and whether the goal is achieved.

Financial authorities of the EU and US recognize greenwashing of ESG-related investment products and investor protection as major agendas. The EU is partially implementing the Sustainable Finance Disclosure Regulation (SFDR) designed for sustainability information disclosure of financial products, whereas the US proposed a regulatory policy to obligate investment advisers and investment companies to disclose ESG-related information this May.

It has been reported that in terms of ESG implementation levels, Korea’s ESG funds are not much different from ordinary funds. As for funds seeking ESG-based active strategic asset allocation, the gap between the lowest and highest ESG scores has more than doubled.1) The problem with Korea’s ESG funds is that it is difficult for investors to identify such information in advance through a prospectus and make informed choices based on their preferences. Against this backdrop, this article tries to explore the current state of disclosure by Korea’s ESG funds and relevant problems, and to present remedial measures.

Current state of sustainability disclosure by ESG funds and resultant problems

In Korea, publicly-offered stock funds have been launched under the name containing terms such as “ESG”, “SRI (social responsibility)”, “Green”, etc. According to a fund rating agency’s arbitrary classification, there are a total of 52 ESG thematic funds being managed in Korea.2) The aggregate amount set aside for such funds reaches KRW 1 trillion 745.8 billion with the net assets under management amounting to KRW 2 trillion 409 billion.3) In terms of both the set amount and the net asset size, ESG funds account for 2.13% of Korea’s entire publicly offered stock funds. This is relatively not small, compared with 1.6% of ESG funds in the US.4)

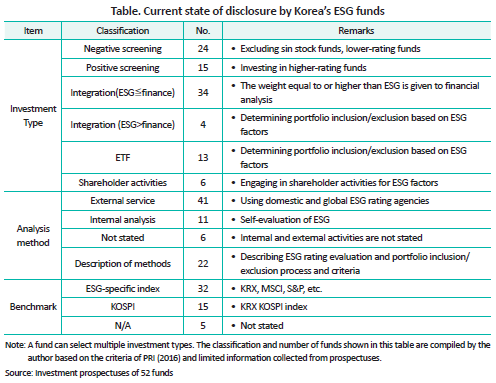

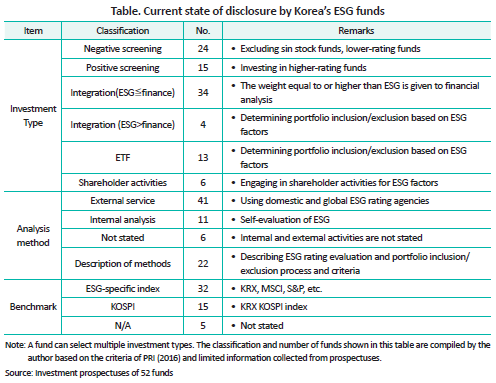

Ordinary investors gain information needed to select the most suitable funds for their investment propensity from an investment prospectus. Korea’s ESG funds describe how ESG factors are reflected in investment decisions in the investment strategy section of the prospectus in compliance with requirements for matters to be contained by collective investment securities.5) To understand how Korea’s ESG funds are conducting disclosure, this article sums up relevant matters in the following table.

Items to be compared are divided into the investment type, analysis method and benchmark. Among ESG investment types,6) integration is the most commonly mentioned strategy, which could be further categorized into financial analysis indicated as a top priority (ESG≦finance) and ESG performance analysis taking priority over financial analysis (ESG>finance). Most ESG funds, except for ETFs fall under the category of integration, among which, however, only four funds give serious consideration to ESG factors when making investment decisions.

Funds falling into the investment type of shareholder activities inform investors that they communicate with investee companies regarding ESG matters or aim to enhance enterprise value by exercising shareholder rights. Such funds are deemed to fulfill a fiduciary duty in that they could boost enterprise value through continuous communication about sustainable factors. But there are only six ESG funds in Korea that specify shareholder activities in the prospectus.

Most of the funds examined in this article are primarily dependent on analysis by domestic and global ESG rating agencies. Notably, they just refer to such agencies but fail to indicate whether they have conducted due diligence on data or methodology employed by the agencies. More than half the funds analyzed provide no description of analysis methodologies. In other words, investors could hardly find any information regarding what ESG factors are selected, how to reflect them in investment decisions, methodologies used for analysis and data sources.

Generally, funds representing a particular topic or theme set benchmarks that track the selected topic. The performance of value investing is assessed by relative returns of a value-based benchmark index. Currently, multiple ESG thematic indexes are produced by the Korea Exchange and Morgan Stanley Capital International (MSCI). But it is notable that as many as 20 ESG funds use other indexes including KOSPI rather than ESG-specific ones or have not set any benchmark at all.

Improvement measures

The Rule 35d-1 Investment Company Act of the US contains the Names Rule, which requires a fund to adopt a policy to invest at least 80% of its assets in the particular type of investments suggested by the fund’s name. The US Securities and Exchange Commission (SEC) recently proposed amendments to tighten the Names Rule, aiming to ban using terms such as “ESG” or “sustainability” in the name of funds if ESG factors are considered in the investment strategy and decision-making process but hardly take priority over financial or economic elements. Under the proposed amendments, a fund could include ESG and relevant terms in its name only if one or more ESG factors including the environment, society and corporate governance are the determinative consideration in the investment selection process. In addition, the fund should specify in fund offering materials the definition of its name and the investment policy and strategy that align with the name.

Korea has the Regulation on Business Conduct and Services of Financial Investment Companies created by the Korea Financial Investment Association, of which §4-2 of Part Ⅳ (Use of Name of Collective Investment Schemes) prevents funds from using any name that might cause investors’ misunderstanding. Considering that this regulation serves as a soft law, there exists no administrative restriction on a fund that claims to support ESG value but falls short of conducting investment practices suggested by its name. As a result, some funds may engage in greenwashing intentionally. To avoid this, the EU and US have recently attempted to make it mandatory for financial products to disclose ESG-related information, which sets a good example for Korea to follow.7) In this respect, it is worth considering the following measures.

Information should be disclosed based on the principle of proportionality, meaning that how much impact sustainability factors have on investment decisions determines the level of information to be disclosed. The scope and requirements of disclosure should be established in proportion to sustainability factors reflected in investment. To this end, a fund needs to elaborate on what sustainability factors are considered and how to apply such factors in its investment strategy.

Fund management firms should disclose their sustainability analysis capability in terms of retention of professionals and data. If a firm depends on a third-party provider for ESG ratings, data, and analytic tools, the due diligence process for the service provider should be arranged as part of its fiduciary duty.

Funds should select a benchmark that aligns with environmental, social and corporate governance characteristics pursued by them and provide a detailed explanation of the principle and methodology of benchmark index calculation within the scope permitted by intellectual property rights. For instance, if a fund seeks to achieve carbon neutrality, it should unveil whether it has adopted an internationally compatible benchmark. Korea requires funds to devise a policy to this effect through the establishment of the Framework Act on Carbon Neutrality and Green Growth for Coping with Climate Crisis.8) Accordingly, funds should figure out the amount of greenhouse gas emissions associated with their investments and monitor the emission reduction process by setting a benchmark.9) On top of that, the concept, process and performance of their ESG investment strategy need to be contained in the asset management report, in addition to essential objective data.

Lastly, if a fund engages in shareholder activities for a particular ESG agenda, it should clarify the agenda and goal of its shareholder activities—whether it is normative or for profit seeking—and inform investors of specific activities and whether the goal is achieved. Currently, asset management firms disclose whether it exerts a voting right and the agenda for which the voting right is exerted in the quarterly business conduct report. However, any ESG fund has not disclosed information regarding the proposal and voting of sustainability-related agenda up to date. Hence, it is necessary to encourage including the concept and outcome of sustainability-specific shareholder activities for greater enterprise value in their asset management report.

1) Park, H.J., 2020, Analysis of Korea’s ESG Funds: Current State and Characteristics, KCMI Issue Paper 20-28.

2) This article uses the FnSpectrum classification standards for ESG-themed stocks provided by FnGuide. A total of 21 asset management firms have launched ESG funds.

3) As of August 18, 2022

4) Based on statistics produced by the Investment Company Institute as of June 30, 2022

5) Paragraph 1, Subparagraph 3 and Item Na of Article 127 (Matters, etc. to be Contained in Registration Statements on Collective Investment Securities) of the Enforcement Decree of the Financial Investment Services and Capital Markets Act

6) Investment types are classified by A Practical Guide to ESG Integration for Equity Investing of PRI (2016).

7) Lee, I.H., 2022, Discussions on Sustainability Disclosure by Collective Investment Vehicles, KCMI Issue Paper 22-18.

8) The Framework Act on Carbon Neutrality and Green Growth for Coping with Climate Crisis specifies that the government shall formulate and implement policy measures regarding 1) disclosure of the greenhouse gas emission amount, the reduced amount of greenhouse gas emissions, and plans of greenhouse gas reduction (Paragraph 1 of Article 55 Facilitation of Green Management of Enterprises) and 2) raising funds, financial support, development of financial instruments, revitalization of private investments, and improvement of the carbon neutrality information disclosure system (Paragraph 1 of Article 58 Financial Support and Revitalization).

9) Information about carbon emissions is not yet complete in terms of accuracy, timeliness and comparability. Accordingly, fund managers should actively discover an investee company’s climate change risk management and its impact through shareholder activities.

It has been reported that in terms of ESG implementation levels, Korea’s ESG funds are not much different from ordinary funds. As for funds seeking ESG-based active strategic asset allocation, the gap between the lowest and highest ESG scores has more than doubled.1) The problem with Korea’s ESG funds is that it is difficult for investors to identify such information in advance through a prospectus and make informed choices based on their preferences. Against this backdrop, this article tries to explore the current state of disclosure by Korea’s ESG funds and relevant problems, and to present remedial measures.

Current state of sustainability disclosure by ESG funds and resultant problems

In Korea, publicly-offered stock funds have been launched under the name containing terms such as “ESG”, “SRI (social responsibility)”, “Green”, etc. According to a fund rating agency’s arbitrary classification, there are a total of 52 ESG thematic funds being managed in Korea.2) The aggregate amount set aside for such funds reaches KRW 1 trillion 745.8 billion with the net assets under management amounting to KRW 2 trillion 409 billion.3) In terms of both the set amount and the net asset size, ESG funds account for 2.13% of Korea’s entire publicly offered stock funds. This is relatively not small, compared with 1.6% of ESG funds in the US.4)

Ordinary investors gain information needed to select the most suitable funds for their investment propensity from an investment prospectus. Korea’s ESG funds describe how ESG factors are reflected in investment decisions in the investment strategy section of the prospectus in compliance with requirements for matters to be contained by collective investment securities.5) To understand how Korea’s ESG funds are conducting disclosure, this article sums up relevant matters in the following table.

Items to be compared are divided into the investment type, analysis method and benchmark. Among ESG investment types,6) integration is the most commonly mentioned strategy, which could be further categorized into financial analysis indicated as a top priority (ESG≦finance) and ESG performance analysis taking priority over financial analysis (ESG>finance). Most ESG funds, except for ETFs fall under the category of integration, among which, however, only four funds give serious consideration to ESG factors when making investment decisions.

Most of the funds examined in this article are primarily dependent on analysis by domestic and global ESG rating agencies. Notably, they just refer to such agencies but fail to indicate whether they have conducted due diligence on data or methodology employed by the agencies. More than half the funds analyzed provide no description of analysis methodologies. In other words, investors could hardly find any information regarding what ESG factors are selected, how to reflect them in investment decisions, methodologies used for analysis and data sources.

Generally, funds representing a particular topic or theme set benchmarks that track the selected topic. The performance of value investing is assessed by relative returns of a value-based benchmark index. Currently, multiple ESG thematic indexes are produced by the Korea Exchange and Morgan Stanley Capital International (MSCI). But it is notable that as many as 20 ESG funds use other indexes including KOSPI rather than ESG-specific ones or have not set any benchmark at all.

Improvement measures

The Rule 35d-1 Investment Company Act of the US contains the Names Rule, which requires a fund to adopt a policy to invest at least 80% of its assets in the particular type of investments suggested by the fund’s name. The US Securities and Exchange Commission (SEC) recently proposed amendments to tighten the Names Rule, aiming to ban using terms such as “ESG” or “sustainability” in the name of funds if ESG factors are considered in the investment strategy and decision-making process but hardly take priority over financial or economic elements. Under the proposed amendments, a fund could include ESG and relevant terms in its name only if one or more ESG factors including the environment, society and corporate governance are the determinative consideration in the investment selection process. In addition, the fund should specify in fund offering materials the definition of its name and the investment policy and strategy that align with the name.

Korea has the Regulation on Business Conduct and Services of Financial Investment Companies created by the Korea Financial Investment Association, of which §4-2 of Part Ⅳ (Use of Name of Collective Investment Schemes) prevents funds from using any name that might cause investors’ misunderstanding. Considering that this regulation serves as a soft law, there exists no administrative restriction on a fund that claims to support ESG value but falls short of conducting investment practices suggested by its name. As a result, some funds may engage in greenwashing intentionally. To avoid this, the EU and US have recently attempted to make it mandatory for financial products to disclose ESG-related information, which sets a good example for Korea to follow.7) In this respect, it is worth considering the following measures.

Information should be disclosed based on the principle of proportionality, meaning that how much impact sustainability factors have on investment decisions determines the level of information to be disclosed. The scope and requirements of disclosure should be established in proportion to sustainability factors reflected in investment. To this end, a fund needs to elaborate on what sustainability factors are considered and how to apply such factors in its investment strategy.

Fund management firms should disclose their sustainability analysis capability in terms of retention of professionals and data. If a firm depends on a third-party provider for ESG ratings, data, and analytic tools, the due diligence process for the service provider should be arranged as part of its fiduciary duty.

Funds should select a benchmark that aligns with environmental, social and corporate governance characteristics pursued by them and provide a detailed explanation of the principle and methodology of benchmark index calculation within the scope permitted by intellectual property rights. For instance, if a fund seeks to achieve carbon neutrality, it should unveil whether it has adopted an internationally compatible benchmark. Korea requires funds to devise a policy to this effect through the establishment of the Framework Act on Carbon Neutrality and Green Growth for Coping with Climate Crisis.8) Accordingly, funds should figure out the amount of greenhouse gas emissions associated with their investments and monitor the emission reduction process by setting a benchmark.9) On top of that, the concept, process and performance of their ESG investment strategy need to be contained in the asset management report, in addition to essential objective data.

Lastly, if a fund engages in shareholder activities for a particular ESG agenda, it should clarify the agenda and goal of its shareholder activities—whether it is normative or for profit seeking—and inform investors of specific activities and whether the goal is achieved. Currently, asset management firms disclose whether it exerts a voting right and the agenda for which the voting right is exerted in the quarterly business conduct report. However, any ESG fund has not disclosed information regarding the proposal and voting of sustainability-related agenda up to date. Hence, it is necessary to encourage including the concept and outcome of sustainability-specific shareholder activities for greater enterprise value in their asset management report.

1) Park, H.J., 2020, Analysis of Korea’s ESG Funds: Current State and Characteristics, KCMI Issue Paper 20-28.

2) This article uses the FnSpectrum classification standards for ESG-themed stocks provided by FnGuide. A total of 21 asset management firms have launched ESG funds.

3) As of August 18, 2022

4) Based on statistics produced by the Investment Company Institute as of June 30, 2022

5) Paragraph 1, Subparagraph 3 and Item Na of Article 127 (Matters, etc. to be Contained in Registration Statements on Collective Investment Securities) of the Enforcement Decree of the Financial Investment Services and Capital Markets Act

6) Investment types are classified by A Practical Guide to ESG Integration for Equity Investing of PRI (2016).

7) Lee, I.H., 2022, Discussions on Sustainability Disclosure by Collective Investment Vehicles, KCMI Issue Paper 22-18.

8) The Framework Act on Carbon Neutrality and Green Growth for Coping with Climate Crisis specifies that the government shall formulate and implement policy measures regarding 1) disclosure of the greenhouse gas emission amount, the reduced amount of greenhouse gas emissions, and plans of greenhouse gas reduction (Paragraph 1 of Article 55 Facilitation of Green Management of Enterprises) and 2) raising funds, financial support, development of financial instruments, revitalization of private investments, and improvement of the carbon neutrality information disclosure system (Paragraph 1 of Article 58 Financial Support and Revitalization).

9) Information about carbon emissions is not yet complete in terms of accuracy, timeliness and comparability. Accordingly, fund managers should actively discover an investee company’s climate change risk management and its impact through shareholder activities.