OPINION

2023 Jan/03

Rising Government Bond Yields: Assessment and Implications

Jan. 03, 2023

PDF

- Summary

- Government bond yields are showing a sharp upward movement. Higher yields pose an obstacle to household and corporate financing activities and lead to a plunge in prices of risky assets such as stocks and real estate property, aggravating a burden for the economy and financial market. In this regard, concerns have been raised over whether the recent rise is a transitory phenomenon or a combined result of structural factors.

This article has decomposed the root cause of government bond yield changes into trend and temporary (cyclical) factors and examined how each factor makes a contribution to the latest run-up. According to the analysis, this round of yield increases has been far more influenced by the trend interest rate that is determined by the potential growth rate and trend inflation, rather than the temporary cyclical factor related to monetary policy. This implies that the latest surge is hardly short-lived.

In the meantime, trend-related escalating inflation has been considered the driving force behind the rise in the trend interest rate. Accordingly, a downward inflation trend must gain momentum promptly to ensure that the trend interest rate-which has primarily pushed up interest rates-is on the decline. Amid various opinions about future inflation developments, there is a possibility that structural factors-de-globalization, shrinking working-age population and accelerating responses to climate change-would prevent the economy from regaining the low-price stance, which requires caution.

Since the global financial crisis, the low interest rate environment has had lasting effects on the economy and financial market through a wide range of channels. Currently, it remains unclear whether the economy could go back to the low interest rate stance. What is needed in this respect is preparation for potential challenges posed by the prolonged high interest rate period.

Government bond yields have shown a sharp upward movement since the second half of 2020. They play a critical role in not only economic players’ financing activities but the pricing of risky assets such as stocks and real estate property. Amid the steep rise, credit spreads for corporate bonds and household lending rates have skyrocketed and stock and real estate property prices have taken a nosedive, exacerbating a burden for the real economy and financial market.

Against this backdrop, this article intends to examine whether the recent increase in government bond yields is a transitory phenomenon or signals a shift in the low interest rate stance that has persisted since the 2008 global financial crisis. Considering that the post-crisis low interest environment has affected considerably the economy and financial market, an analysis of the latest rise is expected to offer great implications for a wide range of economic activities.

The current trend of government bond yields

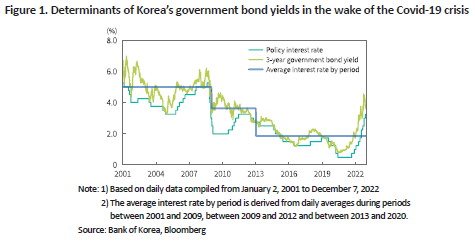

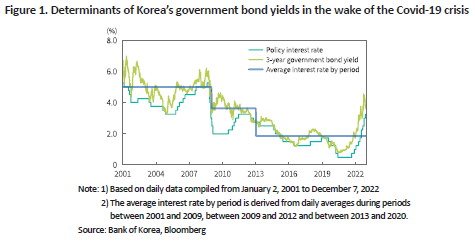

This year has seen a surge in government bond yields, driven by high inflation and Bank of Korea’s policy rate hikes. As illustrated in Figure 1, government bond yields (3-year) fell below 1% in the first half of 2020 in the wake of the pandemic but turned upward starting from the second half of that year. Consequently, the yields soared to mid-4% in October 2022, reaching the highest level since the 2008 global financial crisis. They are currently fluctuating within the mid-3% range after suffering a slight decline this November.

It is worth considering the recent upswing on two fronts. First, it has continued for more than two years, showing the longest upward trend since 2000. This indicates the strong persistence of this round of government bond yield increases. Second, interest rates have recently far outstripped the average of the post-crisis low interest rate environment. Interest rates in Korea have hovered around lower levels after the 2008 financial crisis led to a downward trend. Notably, the average interest rate between 2013 and 2020 stayed around 1.9%.

Analysis of the upward trend in government bond yields

In this section, the root cause of government bond yields is decomposed into trend and cyclical (temporary) factors to see whether the recent hike stems from the rising trend interest rate or cyclical conditions. This article specifies the trend interest rate and cyclical factor as follows. First of all, the Fisher hypothesis states that interest rates are comprised of real factors and inflation-adjusted nominal factors. This means that the trend interest rate is set by the real interest rate trend and inflation trend. Another consideration is economic theories stating that the real interest rate trend and nominal trend are key determinants of the potential growth rate (trend growth) and trend inflation, respectively.1) Trend inflation can be defined from various perspectives but is primarily regarded as average inflation expected to continue over the medium-term horizon or longer.2) Taken together, the trend factor of interest rates (nominal interest rates) could be determined by the potential growth rate and trend inflation. On the other hand, the cyclical factor can be described as the difference between the actual market interest rate and the trend interest rate. The cyclical factor could be affected by a range of conditions, especially fluctuations in the policy rate (monetary policy cycles).

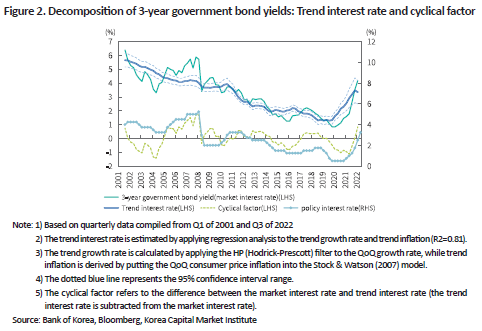

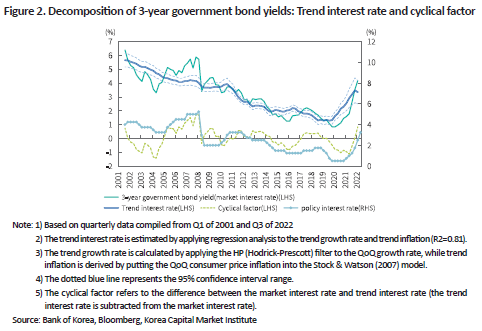

Figure 2 illustrates trend and cyclical factors for 3-year government bond yields, derived based on the analysis above. The trend interest rate is estimated by applying regression analysis to the trend growth rate and trend inflation, while the cyclical factor is produced from government bond yields minus the trend interest rate. In Figure 2, government bond yields move in tandem with the trend interest rate that reveals positive (+) sensitivity to the potential growth rate and trend inflation. When interest rates hit the lowest level in the second quarter of 2020 and the third quarter of 2022, government bond yields stood at 0.85% and 4.19%, respectively, with a difference of 3.34%p. During the same periods, the trend interest rate was estimated at 1.27% and 3.35%, respectively, representing a rise of 2.08%p. This suggests that the increase in the trend interest rate is responsible for 2.08%p out of the total 3.34%p increase in government bond yields, while the cyclical factor accounts for 1.26%p. Accordingly, the trend interest rate seems to have a bigger impact on the recent surge, although the cyclical factor including policy rate hikes have made a partial contribution.3) In the meantime, the rise in the trend interest rate has been more influenced by trend inflation than by the potential growth rate. Thus, 1.94%p out of the 2.08%p increase in the trend interest rate probably comes from the growth of trend inflation.4)

Implications

In summary, the following implications can be presented. First, as this round of policy rate hikes is expected to come to an end in the first half of 2023, the predominant outlook is that economic growth would become sluggish since the rise in interest rates likely has a strong influence starting from 2023. This article predicts that despite a halt to rate hikes, the cyclical factor is unlikely to show signs of abating without a policy rate cut. As shown in Figure 2, the cyclical factor tends to be curtailed in periods of falling policy rates.

Second, a downward inflation trend must gain momentum promptly to ensure that the trend interest rate, the driving force of recent interest rate increases, is on the decline. The cumulative effects of policy rate hikes could alleviate inflation but there remains substantial uncertainty over the return to the low-price stance. Amid various opinions about future inflation developments, there is a possibility that structural factors-de-globalization, shrinking working-age population and accelerating responses to climate change-would prevent the economy from regaining the low-price stance, which requires caution.5)

Since the global financial crisis, the low interest rate environment has had lasting effects on the economy and financial market through a wide range of channels. As stated above, it remains unclear whether the economy could go back to the low interest rate stance. Given that Korea’s economic players have adapted well to low interest rates, it is necessary to prepare for potential challenges posed by the prolonged high interest rate period.

1) See Laubach & Williams (2003) and Cieslak & Povala (2015).

2) For instance, the low-price stance was maintained between 2013 and 2020, with the domestic consumer price inflation (YoY CPI) averaging at 1.1%.

3) During the period analyzed, the correlations between policy rate changes and the trend factor and between policy rate changes and the cyclical factor represent 0.24 and 0.53, respectively. This implies that a shift in policy rates plays a more important role in the cyclical factor than in the trend factor.

4) The potential growth rate for Q2 of 2020 and Q3 of 2022 stands at 2.1% and 2.2%, respectively, while the trend interest rate during the same periods is estimated at around 0.9% and 4.5%.

5) See Goodhart & Pradhan (2020) and Schnabel (2022).

References

Cieslak, A., Povala, P., 2015, Expected returns in treasury bonds, Review of Financial Studies 28(10).

Goodhart, C., Pradhan, M., 2020, The great demographic reversal: Ageing societies, waning inequality, and an inflation revival, Palgrave MacMillian.

Laubach, T., Williams, J.C., 2003, Measuring the natural rate of interest, Review of Economics and Statistics 85(4).

Schnabel, I., 2022b, A new age of energy inflation: Climateflation, fossilfaltion and greenflation, ECB.

Stock, J.H., Waston, M.W., 2007, Why has U.S. inflation become harder to forecast? Journal of Money, Credit, and Banking 39(1).

Against this backdrop, this article intends to examine whether the recent increase in government bond yields is a transitory phenomenon or signals a shift in the low interest rate stance that has persisted since the 2008 global financial crisis. Considering that the post-crisis low interest environment has affected considerably the economy and financial market, an analysis of the latest rise is expected to offer great implications for a wide range of economic activities.

The current trend of government bond yields

This year has seen a surge in government bond yields, driven by high inflation and Bank of Korea’s policy rate hikes. As illustrated in Figure 1, government bond yields (3-year) fell below 1% in the first half of 2020 in the wake of the pandemic but turned upward starting from the second half of that year. Consequently, the yields soared to mid-4% in October 2022, reaching the highest level since the 2008 global financial crisis. They are currently fluctuating within the mid-3% range after suffering a slight decline this November.

It is worth considering the recent upswing on two fronts. First, it has continued for more than two years, showing the longest upward trend since 2000. This indicates the strong persistence of this round of government bond yield increases. Second, interest rates have recently far outstripped the average of the post-crisis low interest rate environment. Interest rates in Korea have hovered around lower levels after the 2008 financial crisis led to a downward trend. Notably, the average interest rate between 2013 and 2020 stayed around 1.9%.

Analysis of the upward trend in government bond yields

In this section, the root cause of government bond yields is decomposed into trend and cyclical (temporary) factors to see whether the recent hike stems from the rising trend interest rate or cyclical conditions. This article specifies the trend interest rate and cyclical factor as follows. First of all, the Fisher hypothesis states that interest rates are comprised of real factors and inflation-adjusted nominal factors. This means that the trend interest rate is set by the real interest rate trend and inflation trend. Another consideration is economic theories stating that the real interest rate trend and nominal trend are key determinants of the potential growth rate (trend growth) and trend inflation, respectively.1) Trend inflation can be defined from various perspectives but is primarily regarded as average inflation expected to continue over the medium-term horizon or longer.2) Taken together, the trend factor of interest rates (nominal interest rates) could be determined by the potential growth rate and trend inflation. On the other hand, the cyclical factor can be described as the difference between the actual market interest rate and the trend interest rate. The cyclical factor could be affected by a range of conditions, especially fluctuations in the policy rate (monetary policy cycles).

Figure 2 illustrates trend and cyclical factors for 3-year government bond yields, derived based on the analysis above. The trend interest rate is estimated by applying regression analysis to the trend growth rate and trend inflation, while the cyclical factor is produced from government bond yields minus the trend interest rate. In Figure 2, government bond yields move in tandem with the trend interest rate that reveals positive (+) sensitivity to the potential growth rate and trend inflation. When interest rates hit the lowest level in the second quarter of 2020 and the third quarter of 2022, government bond yields stood at 0.85% and 4.19%, respectively, with a difference of 3.34%p. During the same periods, the trend interest rate was estimated at 1.27% and 3.35%, respectively, representing a rise of 2.08%p. This suggests that the increase in the trend interest rate is responsible for 2.08%p out of the total 3.34%p increase in government bond yields, while the cyclical factor accounts for 1.26%p. Accordingly, the trend interest rate seems to have a bigger impact on the recent surge, although the cyclical factor including policy rate hikes have made a partial contribution.3) In the meantime, the rise in the trend interest rate has been more influenced by trend inflation than by the potential growth rate. Thus, 1.94%p out of the 2.08%p increase in the trend interest rate probably comes from the growth of trend inflation.4)

In summary, the following implications can be presented. First, as this round of policy rate hikes is expected to come to an end in the first half of 2023, the predominant outlook is that economic growth would become sluggish since the rise in interest rates likely has a strong influence starting from 2023. This article predicts that despite a halt to rate hikes, the cyclical factor is unlikely to show signs of abating without a policy rate cut. As shown in Figure 2, the cyclical factor tends to be curtailed in periods of falling policy rates.

Second, a downward inflation trend must gain momentum promptly to ensure that the trend interest rate, the driving force of recent interest rate increases, is on the decline. The cumulative effects of policy rate hikes could alleviate inflation but there remains substantial uncertainty over the return to the low-price stance. Amid various opinions about future inflation developments, there is a possibility that structural factors-de-globalization, shrinking working-age population and accelerating responses to climate change-would prevent the economy from regaining the low-price stance, which requires caution.5)

Since the global financial crisis, the low interest rate environment has had lasting effects on the economy and financial market through a wide range of channels. As stated above, it remains unclear whether the economy could go back to the low interest rate stance. Given that Korea’s economic players have adapted well to low interest rates, it is necessary to prepare for potential challenges posed by the prolonged high interest rate period.

1) See Laubach & Williams (2003) and Cieslak & Povala (2015).

2) For instance, the low-price stance was maintained between 2013 and 2020, with the domestic consumer price inflation (YoY CPI) averaging at 1.1%.

3) During the period analyzed, the correlations between policy rate changes and the trend factor and between policy rate changes and the cyclical factor represent 0.24 and 0.53, respectively. This implies that a shift in policy rates plays a more important role in the cyclical factor than in the trend factor.

4) The potential growth rate for Q2 of 2020 and Q3 of 2022 stands at 2.1% and 2.2%, respectively, while the trend interest rate during the same periods is estimated at around 0.9% and 4.5%.

5) See Goodhart & Pradhan (2020) and Schnabel (2022).

References

Cieslak, A., Povala, P., 2015, Expected returns in treasury bonds, Review of Financial Studies 28(10).

Goodhart, C., Pradhan, M., 2020, The great demographic reversal: Ageing societies, waning inequality, and an inflation revival, Palgrave MacMillian.

Laubach, T., Williams, J.C., 2003, Measuring the natural rate of interest, Review of Economics and Statistics 85(4).

Schnabel, I., 2022b, A new age of energy inflation: Climateflation, fossilfaltion and greenflation, ECB.

Stock, J.H., Waston, M.W., 2007, Why has U.S. inflation become harder to forecast? Journal of Money, Credit, and Banking 39(1).