OPINION

2023 Jan/03

Implications for the Characteristics of Recent Inflation and the Effect of Diversified Investments in Stocks and Bonds

Jan. 03, 2023

PDF

- Summary

- The prices of major assets that have risen since the Covid-19 pandemic have been subject to significant corrections in 2022. A diversified portfolio of stocks and bonds served as an effective investment strategy until 2021. But the effects of such diversification have dissipated as stock and bond prices move in sync due to counter-cyclical inflation. As uncertainty over inflation mounts, the portfolio comprised of stocks and bonds has become susceptible to upside inflation risks.

These macro-environmental changes are likely to continue depending on future inflation developments, and have significant implications for asset allocation strategies. Despite a recent analysis that inflation shows early signs of fading, there remains considerable uncertainty as to whether the current economy would return to the pre-Covid 19 era of low inflation and low interest rates. At this juncture, it should be noted that the performance of diversified investment in stocks and bonds may also differ from the previous one. What is also needed is a diversification approach as well as an asset allocation strategy aligned with inflation developments.

The prices of major assets that have risen since the Covid-19 pandemic have been subject to significant corrections in 2022. This can be primarily attributable to inflation and tight monetary policy including rate hikes by the US and other advanced economies. In particular, both stocks and bonds, long-established asset classes, have plunged in prices simultaneously, resulting in poor investment performance for major economic players and pension funds.1) In terms of asset allocation, it is noteworthy that a diversified portfolio of stocks and bonds (or hedging effect) remained valid until 2021. However, the effects of such diversification have dissipated in 2022 as stock and bond prices move in sync globally. Amid mounting uncertainty over inflation, the portfolio comprised of stocks and bonds has become susceptible to upside inflation risks. Against this backdrop, this article intends to examine the relationship between inflation and returns on stocks and bonds depending on inflation-related economic developments, and to discuss implications for the effects of a diversified portfolio.

Effects of diversified investments in stocks and bonds

Diversifying a portfolio by investing in stocks and bonds, referred to as main asset classes, has been historically deemed the basic approach to asset allocation. By holding 60% of the portfolio in stocks and 40% in bonds (60/40 portfolio), investors have enjoyed both high expected returns generated from risky stock investments and a steady stream of income from bonds. Bonds have served as a safe asset,2) especially in periods of bearish markets and stock price corrections. As illustrated in Figure 1, both Korea and the US observed a negative (-) correlation between stocks and bonds between 2000 and 2021, suggesting that the 60/40 portfolio has provided effective diversification or an effective hedge.3)

Cumulative investment returns in Figure 2 demonstrate that the 60/40 portfolio-based diversification has proved more effective than stock investments (stock indexes). The 60/40 portfolio has achieved a similar level of returns and lower volatility, compared to the stock index-based portfolio. When the cumulative return as of end-2000 is set at 100, the KOSPI and the 60/40 portfolio return stand at 490 and 473, respectively as of end-November 2022 in Korea, while the S&P500 and the 60/40 portfolio return reach 309 and 316, respectively in the US. In this comparison, cumulative returns are not that far apart. In terms of quarterly returns, the KOSPI and the 60/40 portfolio reveal volatility of 22.5% and 12.9%, respectively in Korea, with the respective volatility of the S&P500 and 60/40 portfolios of the US representing 17.1% and 9.3%. This means the volatility in 60/40 portfolio returns amounts to roughly 55% of the stock index volatility.

Figure 3 shows yearly returns generated from the 60/40 portfolio. This suggests that stock indexes took a nosedive in periods of negative returns including the 2008 global financial crisis, except for 2022 but such losses were offset by returns on fixed-income securities. During the period analyzed, 2022 is the only year when indexes for stocks and bonds post negative (-) returns in both Korea and the US.4) In addition, the correlation between stocks and bonds for 2022 reaches 0.5 or higher (Figure 1). In 2022, the effects of portfolio diversification have dissipated since both stocks and bonds failed to achieve satisfactory returns and the correlation between the two asset classes turned positive (+). This article aims to analyze this phenomenon in line with inflation-related economic aspects.

Economic characteristics of inflation and correlation between stock and bond returns

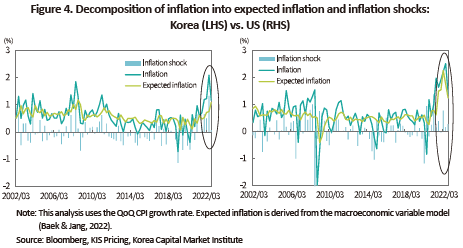

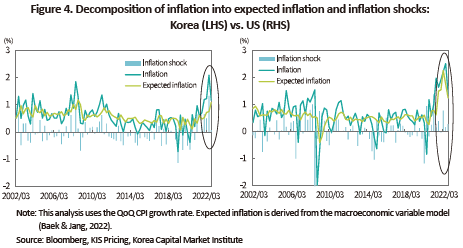

Inflation has been the most important consideration in the asset market in 2022. Realized inflation is typically divided into expected (estimated) inflation and inflation shocks to analyze the correlation between inflation and asset returns (Figure 4). An analysis of recently announced inflation rates has found that the difference between realized inflation and the financial market’s expectation (estimates), or an inflation shock, has a profound impact on asset returns. This result has been derived as asset prices have already taken account of expected inflation levels, and inflation shocks have far more influence on the asset market.5)

The relationship between inflation and returns on assets varies by inflation-related economic features, based on which inflation could be classified into pro-cyclical and counter-cyclical ones (Baek & Jang, 2022). In the US, higher inflation can contribute to reducing the risk of deflation characterized by low inflation and low growth in periods when lower prices pose risks (e.g., between 2000 and 2021). This situation could be defined as pro-cyclical inflation that would have positive effects on economic improvement. A prime example of counter-cyclical inflation is stagflation, an economic cycle characterized by high inflation and slow growth between the 1970s and the early 1980s.6)

Table 1 summarizes expected relations between inflation shocks and returns on stocks and bonds, depending on inflation’s relevance to economic cycles.7) The rise or decline in stock prices can be determined by economic conditions driven by inflation shocks. As for bonds, yields (nominal yields) should be considered the combination of real yields and inflation.8) Under the same conditions, rising inflation pushes up yields on bonds, thereby dragging down bond prices (the inflation effect), while worsening economic conditions help lower real yields on bonds, thereby boosting bond prices (the effect of real yields). In the pro-cyclical inflation period, the effects of inflation and real yields move in tandem with bond prices and at a time of a positive inflation shock, yields on bonds increase while bond prices go down. In counter-cyclical inflation, the effects of inflation and real yields go in the opposite direction to bond prices. Amid greater uncertainty over inflation, inflation would outpace real bond yields when it comes to its impact on an economic slump.9) In 2022, price increases reveal counter-cyclical aspects and a positive inflation shock (Figure 4) seems to have pushed up bond yields and have lowered bond prices (the first scenario in Table 1).

In pro-cyclical inflation, the correlation between returns on stocks and bonds can be negative (-) by way of an inflation shock. Notably, quantitative easing implemented in the wake of the global financial crisis has helped bonds to serve as safe assets amid a decline in stock prices and a sluggish economy. In the counter-cyclical inflation period such as 2022, however, a positive inflation shock would hurt returns on stocks and bonds (the first scenario in Table 1), resulting in a positive correlation between the two asset classes. Even if higher inflation contributes to an economic downturn, bond prices would suffer a decline (while yields are on the rise) and thus, bonds could become risky assets such as stocks, which requires extra caution.

Conclusion

A diversified portfolio of stocks and bonds proved effective after 2000 until recently while bonds played a role as a safe asset. But 2022 has faced a great change in this trend. As counter-cyclical inflation emerges, the correlation between stocks and bonds has been converted to positive from negative, which erodes the benefits of diversification. Furthermore, a positive inflation shock seems to have brought about a simultaneous price drop in both asset classes.

Future inflation developments would determine whether such a macroeconomic transition persists, which would have great implications for asset allocation strategies. If inflation shows early signs of fading as expected by some experts, a diversified mix of stocks and bonds might become a valid investment approach again. However, there remains considerable uncertainty as to whether the current economy would return to the pre-Covid 19 era of low inflation and low interest rates.10) As inflation risks mount, the existing 60/40 portfolio is unlikely to achieve the high returns that were gained during the 2000s and becomes susceptible to the 2022 counter-cyclical inflation. What is needed in the current economic environment is a diversification approach as well as an asset allocation strategy aligned with inflation developments. Additionally, it is noteworthy that in periods of rising inflation and rate hikes, cash equivalents such as short-term (3-month) treasury bonds would act as a safe asset and be a useful tool to hedge against expected inflation (Appendix of Baek & Jang (2022)).

1) In the 2000s, bonds played a role in hedging against the risk from an economic slump or stocks. Bond holdings of insurance firms or pension funds serve as a hedge against debts, in addition to hedging against the risk related to stocks. A rise in interest rates has an adverse effect on bond prices and at the same time, drags down the value of debt.

2) Risky assets can be defined as assets of which prices go down with higher marginal utility for investors (e.g., an economic downturn) while prices go up with lower marginal utility (e.g., an economic boom) (Baek & Jang (2022)).

3) In the case of the US (on the right side of Figure 2), the correlation between stocks and bonds turned negative from positive, starting in 2000, which has been widely verified in multiple studies (Baek & Jang (2022)).

4) The 60/40 portfolio posted a return of -21% in Korea and the US until Q3 of 2022, which, however, has recovered to -14% as both stocks and bonds have experienced a surge in price during Q4.

5) Real inflation at this point

at this point  can be divided into expected inflation

can be divided into expected inflation  determined by previous data

determined by previous data  and the difference between real inflation and expected inflation, or inflation shock

and the difference between real inflation and expected inflation, or inflation shock

. In terms of asset allocation or inflation risk management, expected inflation can be easily hedged through short-term government bonds. Thus, the relationship between inflation shocks and asset returns is of importance (Baek & Jang (2022)).

. In terms of asset allocation or inflation risk management, expected inflation can be easily hedged through short-term government bonds. Thus, the relationship between inflation shocks and asset returns is of importance (Baek & Jang (2022)).

6) The US economy observed counter-cyclical inflation before 2000 and after that year, pro-cyclical inflation took hold. Korea has experienced pro-cyclical inflation since 1982 (see Baek & Jang (2022) and its References).

7) Empirical analysis results for Korea and the US correspond to expectations in Table 1 (Baek & Jang (2022)).

8) The Fisher hypothesis states that the nominal interest rate equals the real interest rate plus inflation.

9) In periods of severe inflation like the 1970s and the early 1980s, inflation effects tend to outdo the impact of the real interest rate (Piazzesi & Schneider, 2007).

10) Amid the prolonged pandemic, intensifying geopolitical conflicts and accelerating responses to climate change, challenges such as raw material prices and supply chains could be entrenched as structural factors fueling price uncertainty (Baek & Jang (2022)).

References

Piazzesi, M., Schneider, M., 2007, Equilibrium yield curves, NBER Chapters, in: NBER Macroeconomics Annual 2006, Volume 21, 389-472.

[Korean]

Baek, I.S. & Jang, G.H., 2022, Relationship between Inflation and Asset Returns: From the Perspective of Hedging against Inflation Risk, KCMI Issue Paper 22-25.

Jang, G.H. & Baek, I.S., 2022, Determinants and Implications of Korea’s Inflation, KCMI Issue Paper 22-19.

Effects of diversified investments in stocks and bonds

Diversifying a portfolio by investing in stocks and bonds, referred to as main asset classes, has been historically deemed the basic approach to asset allocation. By holding 60% of the portfolio in stocks and 40% in bonds (60/40 portfolio), investors have enjoyed both high expected returns generated from risky stock investments and a steady stream of income from bonds. Bonds have served as a safe asset,2) especially in periods of bearish markets and stock price corrections. As illustrated in Figure 1, both Korea and the US observed a negative (-) correlation between stocks and bonds between 2000 and 2021, suggesting that the 60/40 portfolio has provided effective diversification or an effective hedge.3)

Inflation has been the most important consideration in the asset market in 2022. Realized inflation is typically divided into expected (estimated) inflation and inflation shocks to analyze the correlation between inflation and asset returns (Figure 4). An analysis of recently announced inflation rates has found that the difference between realized inflation and the financial market’s expectation (estimates), or an inflation shock, has a profound impact on asset returns. This result has been derived as asset prices have already taken account of expected inflation levels, and inflation shocks have far more influence on the asset market.5)

Table 1 summarizes expected relations between inflation shocks and returns on stocks and bonds, depending on inflation’s relevance to economic cycles.7) The rise or decline in stock prices can be determined by economic conditions driven by inflation shocks. As for bonds, yields (nominal yields) should be considered the combination of real yields and inflation.8) Under the same conditions, rising inflation pushes up yields on bonds, thereby dragging down bond prices (the inflation effect), while worsening economic conditions help lower real yields on bonds, thereby boosting bond prices (the effect of real yields). In the pro-cyclical inflation period, the effects of inflation and real yields move in tandem with bond prices and at a time of a positive inflation shock, yields on bonds increase while bond prices go down. In counter-cyclical inflation, the effects of inflation and real yields go in the opposite direction to bond prices. Amid greater uncertainty over inflation, inflation would outpace real bond yields when it comes to its impact on an economic slump.9) In 2022, price increases reveal counter-cyclical aspects and a positive inflation shock (Figure 4) seems to have pushed up bond yields and have lowered bond prices (the first scenario in Table 1).

Conclusion

A diversified portfolio of stocks and bonds proved effective after 2000 until recently while bonds played a role as a safe asset. But 2022 has faced a great change in this trend. As counter-cyclical inflation emerges, the correlation between stocks and bonds has been converted to positive from negative, which erodes the benefits of diversification. Furthermore, a positive inflation shock seems to have brought about a simultaneous price drop in both asset classes.

Future inflation developments would determine whether such a macroeconomic transition persists, which would have great implications for asset allocation strategies. If inflation shows early signs of fading as expected by some experts, a diversified mix of stocks and bonds might become a valid investment approach again. However, there remains considerable uncertainty as to whether the current economy would return to the pre-Covid 19 era of low inflation and low interest rates.10) As inflation risks mount, the existing 60/40 portfolio is unlikely to achieve the high returns that were gained during the 2000s and becomes susceptible to the 2022 counter-cyclical inflation. What is needed in the current economic environment is a diversification approach as well as an asset allocation strategy aligned with inflation developments. Additionally, it is noteworthy that in periods of rising inflation and rate hikes, cash equivalents such as short-term (3-month) treasury bonds would act as a safe asset and be a useful tool to hedge against expected inflation (Appendix of Baek & Jang (2022)).

1) In the 2000s, bonds played a role in hedging against the risk from an economic slump or stocks. Bond holdings of insurance firms or pension funds serve as a hedge against debts, in addition to hedging against the risk related to stocks. A rise in interest rates has an adverse effect on bond prices and at the same time, drags down the value of debt.

2) Risky assets can be defined as assets of which prices go down with higher marginal utility for investors (e.g., an economic downturn) while prices go up with lower marginal utility (e.g., an economic boom) (Baek & Jang (2022)).

3) In the case of the US (on the right side of Figure 2), the correlation between stocks and bonds turned negative from positive, starting in 2000, which has been widely verified in multiple studies (Baek & Jang (2022)).

4) The 60/40 portfolio posted a return of -21% in Korea and the US until Q3 of 2022, which, however, has recovered to -14% as both stocks and bonds have experienced a surge in price during Q4.

5) Real inflation

6) The US economy observed counter-cyclical inflation before 2000 and after that year, pro-cyclical inflation took hold. Korea has experienced pro-cyclical inflation since 1982 (see Baek & Jang (2022) and its References).

7) Empirical analysis results for Korea and the US correspond to expectations in Table 1 (Baek & Jang (2022)).

8) The Fisher hypothesis states that the nominal interest rate equals the real interest rate plus inflation.

9) In periods of severe inflation like the 1970s and the early 1980s, inflation effects tend to outdo the impact of the real interest rate (Piazzesi & Schneider, 2007).

10) Amid the prolonged pandemic, intensifying geopolitical conflicts and accelerating responses to climate change, challenges such as raw material prices and supply chains could be entrenched as structural factors fueling price uncertainty (Baek & Jang (2022)).

References

Piazzesi, M., Schneider, M., 2007, Equilibrium yield curves, NBER Chapters, in: NBER Macroeconomics Annual 2006, Volume 21, 389-472.

[Korean]

Baek, I.S. & Jang, G.H., 2022, Relationship between Inflation and Asset Returns: From the Perspective of Hedging against Inflation Risk, KCMI Issue Paper 22-25.

Jang, G.H. & Baek, I.S., 2022, Determinants and Implications of Korea’s Inflation, KCMI Issue Paper 22-19.