Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Rising Foreign Exchange Hedging Costs Amid Interest Rate Reversals between Korea and the US and Potential Implications

Publication date Jan. 02, 2024

Summary

The interest rate reversal between Korea and the US, which has persisted since July 2022, stands out in that its size is the largest (2%) and it is likely to last longer than previous episodes. This rate reversal has altered the FX hedging landscape for Korean economic agents who engage in forward exchange selling. In the past, Korean investors or exporters could hedge against the risk of USD/KRW exchange rate fluctuations (USD/KRW decline) and obtain additional gains through hedging. However, as the rate reversal between Korea and the US has recently come to the fore and the interest rate difference is expanding, FX hedging costs are on the rise.

Economic agents in need of FX hedging should be aware of the possibility that hedging costs can be incurred amid the enduring interest rate reversal. And they also need to prepare for the extended period of the rate reversal. Particularly, exporters should brace for the deterioration of profitability potentially arising from the sustained rise in FX hedging costs. In light of these concerns, policy authorities should consider providing FX hedging management support for small and medium-sized exporters. Meanwhile, Korean investors should shift from the habitual routine of pursuing FX hedging in the overseas investment process. It is essential for them to recognize foreign currencies as one of investment portfolios and devise an FX hedging strategy by taking into account FX hedging costs and the financial conditions of individual investors.

Economic agents in need of FX hedging should be aware of the possibility that hedging costs can be incurred amid the enduring interest rate reversal. And they also need to prepare for the extended period of the rate reversal. Particularly, exporters should brace for the deterioration of profitability potentially arising from the sustained rise in FX hedging costs. In light of these concerns, policy authorities should consider providing FX hedging management support for small and medium-sized exporters. Meanwhile, Korean investors should shift from the habitual routine of pursuing FX hedging in the overseas investment process. It is essential for them to recognize foreign currencies as one of investment portfolios and devise an FX hedging strategy by taking into account FX hedging costs and the financial conditions of individual investors.

The US Fed’s aggressive monetary tightening and the subsequent surge in interest rates have persisted since 2022, leading to the ongoing interest rate reversal between Korea and the US1) where US interest rates surpass Korea’s rates. From 2000 onwards, Korea’s interest rates remained higher than US rates and usually returned to their former levels even after occasional instances of rate reversals. Notably, the latest rate reversal between Korea and the US stands out in that its size is the largest (2%) and it is likely to last longer than previous episodes (Lee & Jang, 2023).

The interest rate difference between Korea and the US affects the cost of hedging against USD/KRW exchange rate fluctuations. Economic agents in Korea commonly engage in FX hedging through the forward exchange sale.2) The increasing rate reversal between Korea and the US drives up FX hedging costs for selling forward exchange. Against this backdrop, this article delves into how the rate reversal between Korea and the US affects the rise in FX hedging costs, and highlights potential implications derived from an analysis of overseas investment cases.

Interest rate differences between Korea and the US and FX hedging costs

FX hedging by Korean economic agents is predominantly conducted through the forward exchange sale. Since the 2000s, exporters have engaged in FX hedging for dollar (foreign currency)-denominated export proceeds to be received. Meanwhile, the expansion of overseas investments by Korean investors has led to the continuous growth of FX hedging transactions for overseas assets.

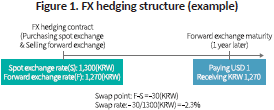

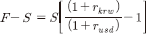

In Korea, the typical process of overseas investments employs the FX hedging structure shown in Figure 1. If an investor converts currencies at the spot exchange rate (S) to purchase overseas assets and enters into an FX hedging (forward selling) contract at the forward exchange rate (F),3) he or she can fix the future USD/KRW exchange rate as the forward exchange rate (F) to hedge against exchange rate volatility. In the case of FX hedging for export proceeds to be received, a forward exchange sale contract is executed without an initial currency conversion. Additional profits or losses—equivalent to the difference between F and S, referred to as the swap point (= F-S)—are generated from the contract execution, which can be considered the hedging cost. The swap rate (= (F-S)/S) represents the percentage rate (%) of profits or losses converted into an annualized value by dividing the swap point by S. The swap point (or FX hedging costs) or the swap rate is determined by the interest rate difference between Korea and the US.4) Historically, if FX hedging is implemented during periods of positive (+) swap points when Korea’s interest rates are higher than US rates, additional gains equivalent to the swap point or swap rate, as well as FX hedging effects, could be generated. Given the current rate reversal between Korea and the US, the situation is reversed. For example, if an exporter executes a one-year FX hedging contract as illustrated in Figure 1, the hedging cost incurred by the exporter amounts to KRW 30 per dollar or 2.3% of the principal as the forward rate (F) is KRW 30 lower than the spot rate (S).

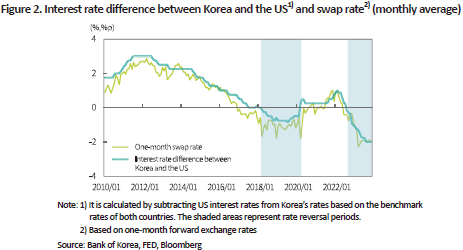

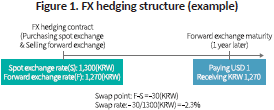

Figure 2 shows how the interest rate difference between Korea and the US and the swap rate have changed since the global financial crisis. With the recent rate reversal, the swap points and swap rate have turned negative according to theoretical values, albeit with a certain time lag.5) If the Figure 2 graph is categorized by the presence of the interest rate reversal, the average rate difference between Korea and the US and the swap rate during the period from January 2010 to February 2018 exhibit positive (+) figures, standing at 1.8% and 1.4%, respectively. It means that FX hedging not only mitigated foreign exchange volatility but also generated an additional annualized profit of 1.4% on average. On the other hand, the average swap rate reached -1.0% during the rate reversal period from Mach 2018 to February 2020 (the shaded area), indicating that an average hedging cost of 1.0% (annualized) was incurred.6) As the rate reversal disappeared following this period, the swap rate turned positive (+). With the recent transition to the rate reversal between the two countries, however, the swap rate has posted around -2% since March 2023, the lowest level observed post the global financial crisis.

Overseas securities investment and analysis of FX hedging costs

This article conducts a comparative analysis of FX hedging costs incurred by overseas securities investment funds, depending on different swap rates. In the establishment process, overseas investment funds determine their FX hedging policy to accommodate the demands of investors, and they are classified into unhedged funds and hedged funds, depending on the use of FX hedging. This categorization also applies to Exchange Traded Funds (ETFs) tracking the S&P 500, which can be divided into unhedged and hedged ETFs. Typically, unhedged funds tend to perform better during the period of rising exchange rates, whereas hedged funds show better performance when exchange rates fall. In the case where substantial hedging costs are incurred, it is worth considering not only the impact of exchange rate fluctuations but also FX hedging costs.

Generally, hedged funds or ETFs hedge against USD/KRW exchange rate fluctuations by rolling over FX swaps (spot purchase + forward sale) with a maturity of one month to one year. Accordingly, hedged funds may incur additional hedging costs (or gains) linked to swap points or swap rates, in addition to the hedging effect for FX fluctuations. In other words, the difference between the FX-adjusted return,’ which excludes the FX change effect from the return of unhedged funds, and the return of hedged funds can be considered hedging costs (or gains).7)

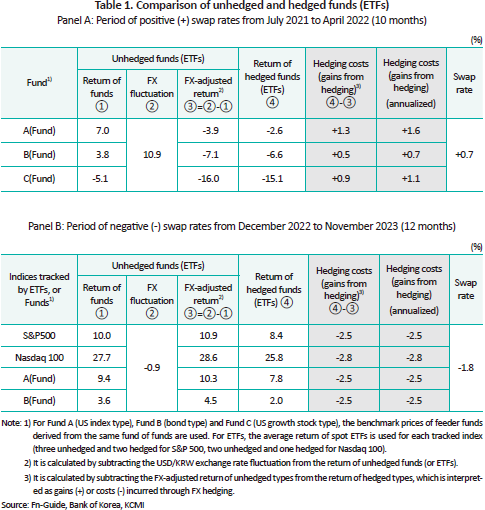

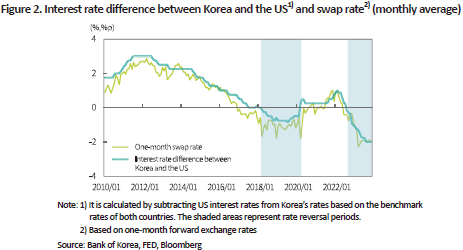

Table 1 distinguishes between periods when swap rates are positive (Panel A) and negative (Panel B), and categorizes overseas securities investment funds8) and ETFs tracking overseas indices (S&P500, Nasdaq 100) into hedged and unhedged types for each period by taking into account the return and FX hedging costs. This article first examines the period from July 2021 to April 20229) when swap rates were positive (Panel A in Table 1). As for Fund A, the return of the unhedged type (①) is 7%, while the FX-adjusted return (③), which excludes the FX increase effect (②) of 10.9%, is -3.9%. During the same period, the return of the hedged type (④) stands at -2.6%, 1.3% higher than the FX-adjusted return (-3.9%). It means that through FX hedging, additional gains of 1.3% (or 1.6% on an annualized basis) are obtained, excluding the FX hedging effect. The increase in FX rates of 10.9% leads to a higher return for the unhedged type, but the hedged type posts a higher return if foreign exchange rate fluctuations are excluded. Fund B and Fund C acquire gains of 0.5% (annualized 0.7%) and 0.9% (annualized 1.1%) from FX hedging, respectively. These gains can be attributed to the effect of positive swap rates (an average of 0.7%) during that period.

Opposite results are observed during the period from December 2022 to November 2023,10) marked by negative swap rates (Panel B in Table 1). Taking an S&P 500-tracking ETF as an example, the return of the unhedged type (①) stands at 10%, and the FX-adjusted return (③) allowing for the -0.9% USD/KRW exchange rate fluctuation (②) reaches 10.9%. During the same period, the return of the hedged type (④) stands at 8.4%. This is 2.5% lower than the FX-adjusted return (10.9%), indicating the FX hedging cost of 2.5%. The Nasdaq 100-tracking ETF, Fund A and Fund B incur FX hedging costs of 2.8%, 2.5% and 2.5%, respectively, which can be attributed to the effect of negative swap rates (an average of -1.8%). When the exchange rate decreases, the hedged type tends to post a higher return than the unhedged type. In this period, however, the hedging cost exceeded the effect of the exchange rate decline, despite a 0.9% fall in the exchange rate, resulting in the return of the unhedged type (①) surpassing that of the hedged type (④). Accordingly, when devising an FX hedging strategy amid rising hedging costs, it is critical to consider not only the hedging effect for mitigating exchange rate fluctuations but also additional hedging costs that may arise if the rate reversal between Korea and the US persists.

Summary and implications

The interest rate reversal between Korea and the US has altered hedging conditions for economic agents in Korea who engage in forward exchange selling. In the past, Korean investors or exporters could gain additional profits by hedging against fluctuations (decline) in the USD/KRW exchange rate. However, the situation has changed due to the recent rate reversal and the widening of the reversal gap, thereby requiring them to bear rising hedging costs.

Economic agents in need of FX hedging should be aware of the possibility that hedging costs can be incurred amid the enduring interest rate reversal. And they also need to prepare for the extended period of the rate reversal. Particularly, exporters should brace for the deterioration of profitability potentially arising from the sustained rise in FX hedging costs. In light of these concerns, policy authorities should consider providing FX hedging management support for small and medium-sized exporters. Meanwhile, Korean investors need to shift from the habitual routine of pursuing FX hedging in the overseas investment process. It is essential for them to recognize foreign currencies as one of investment portfolios and devise an FX hedging strategy by taking into account FX hedging costs and the financial conditions of individual investors.

1) The interest rate difference between Korea and the US is calculated by subtracting the US interest rate from the Korean rate, and the rate reversal indicates that the US interest rate is higher than the Korean rate. This article primarily uses the benchmark interest rate as a reference and as of December 19, 2023, Korea’s benchmark rate stands at 3.5% while the US rate reaches the upper benchmark of 5.5%.

2) A forward exchange sale refers to a transaction of selling dollars in the future. If an investor holds dollar-denominated assets (financial assets, receivables, etc.), this transaction can be used to hedge against the risk of depreciation in the USD/KRW exchange rate and the subsequent evaluation loss in KRW. In this article, FX hedging primarily refers to this type of hedging strategy. In the case of longer maturities (more than one year), transactions may involve currency swaps that include interest rate exchanges during the contract period.

3) A transaction where spot buying and forward selling are simultaneously executed is referred to as a foreign exchange swap (FX swap).

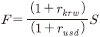

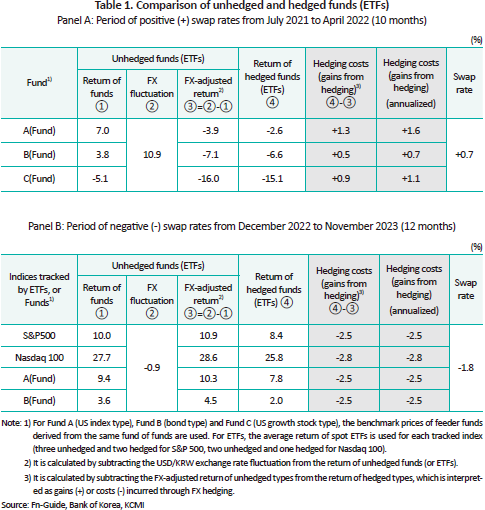

4) If the spot exchange rate is referred to as S, Korea’s interest rate as and the US interest rate as

and the US interest rate as  ,

,  is calculated with the covered interest rate parity (CIRP). Accordingly, the swap point, representing the difference between the forward exchange rate and the spot exchange rate, is derived from

is calculated with the covered interest rate parity (CIRP). Accordingly, the swap point, representing the difference between the forward exchange rate and the spot exchange rate, is derived from

, while the swap rate is calculated as

, while the swap rate is calculated as  based on the interest rate difference between Korea and the US. In this equation, the KRW interest rate of

based on the interest rate difference between Korea and the US. In this equation, the KRW interest rate of  includes the negative (-) basis (b), resulting in a rate lower than the market rate

includes the negative (-) basis (b), resulting in a rate lower than the market rate  . In Figure 2, the swap rate does not precisely match the theoretical rate difference, which can be attributed to various factors affecting the basis (b), including supply and demand factors in the FX swap market, credit risk of KRW and external uncertainties.

. In Figure 2, the swap rate does not precisely match the theoretical rate difference, which can be attributed to various factors affecting the basis (b), including supply and demand factors in the FX swap market, credit risk of KRW and external uncertainties.

5) The basis in footnote 4 can explain the discrepancy between the swap rate and the interest rate difference.

6) Extra FX hedging gains or costs are generated from the actual FX hedging, depending on transaction costs and market conditions, in addition to the swap rate.

7) Transaction costs or market conditions may result in some discrepancies between swap rate data and actual hedging costs. If the return of hedged funds is lower than the FX-adjusted return of unhedged funds, it gives rise to FX hedging costs.

8) This article analyzes cases where unhedged (UH) and hedged (H) funds coexist, such as Fund A (US index type), Fund B (bond type) and Fund C (US growth stock type).

9) Within the timeframe starting from 2020 with comparable funds for analysis, this article selects the period when the one-month maturity swap rate (monthly average) remained at 0.4% or higher.

10) This indicates the period during which the one-month swap rate (monthly average) remains below -0.4%.

References

Lee & Jang, 2023, The Impact of domestic and foreign interest rate reversals on capital flows and foreign capital borrowing costs and its implications, KCMI Issue Paper 23-24.

The interest rate difference between Korea and the US affects the cost of hedging against USD/KRW exchange rate fluctuations. Economic agents in Korea commonly engage in FX hedging through the forward exchange sale.2) The increasing rate reversal between Korea and the US drives up FX hedging costs for selling forward exchange. Against this backdrop, this article delves into how the rate reversal between Korea and the US affects the rise in FX hedging costs, and highlights potential implications derived from an analysis of overseas investment cases.

Interest rate differences between Korea and the US and FX hedging costs

FX hedging by Korean economic agents is predominantly conducted through the forward exchange sale. Since the 2000s, exporters have engaged in FX hedging for dollar (foreign currency)-denominated export proceeds to be received. Meanwhile, the expansion of overseas investments by Korean investors has led to the continuous growth of FX hedging transactions for overseas assets.

In Korea, the typical process of overseas investments employs the FX hedging structure shown in Figure 1. If an investor converts currencies at the spot exchange rate (S) to purchase overseas assets and enters into an FX hedging (forward selling) contract at the forward exchange rate (F),3) he or she can fix the future USD/KRW exchange rate as the forward exchange rate (F) to hedge against exchange rate volatility. In the case of FX hedging for export proceeds to be received, a forward exchange sale contract is executed without an initial currency conversion. Additional profits or losses—equivalent to the difference between F and S, referred to as the swap point (= F-S)—are generated from the contract execution, which can be considered the hedging cost. The swap rate (= (F-S)/S) represents the percentage rate (%) of profits or losses converted into an annualized value by dividing the swap point by S. The swap point (or FX hedging costs) or the swap rate is determined by the interest rate difference between Korea and the US.4) Historically, if FX hedging is implemented during periods of positive (+) swap points when Korea’s interest rates are higher than US rates, additional gains equivalent to the swap point or swap rate, as well as FX hedging effects, could be generated. Given the current rate reversal between Korea and the US, the situation is reversed. For example, if an exporter executes a one-year FX hedging contract as illustrated in Figure 1, the hedging cost incurred by the exporter amounts to KRW 30 per dollar or 2.3% of the principal as the forward rate (F) is KRW 30 lower than the spot rate (S).

Figure 2 shows how the interest rate difference between Korea and the US and the swap rate have changed since the global financial crisis. With the recent rate reversal, the swap points and swap rate have turned negative according to theoretical values, albeit with a certain time lag.5) If the Figure 2 graph is categorized by the presence of the interest rate reversal, the average rate difference between Korea and the US and the swap rate during the period from January 2010 to February 2018 exhibit positive (+) figures, standing at 1.8% and 1.4%, respectively. It means that FX hedging not only mitigated foreign exchange volatility but also generated an additional annualized profit of 1.4% on average. On the other hand, the average swap rate reached -1.0% during the rate reversal period from Mach 2018 to February 2020 (the shaded area), indicating that an average hedging cost of 1.0% (annualized) was incurred.6) As the rate reversal disappeared following this period, the swap rate turned positive (+). With the recent transition to the rate reversal between the two countries, however, the swap rate has posted around -2% since March 2023, the lowest level observed post the global financial crisis.

Overseas securities investment and analysis of FX hedging costs

This article conducts a comparative analysis of FX hedging costs incurred by overseas securities investment funds, depending on different swap rates. In the establishment process, overseas investment funds determine their FX hedging policy to accommodate the demands of investors, and they are classified into unhedged funds and hedged funds, depending on the use of FX hedging. This categorization also applies to Exchange Traded Funds (ETFs) tracking the S&P 500, which can be divided into unhedged and hedged ETFs. Typically, unhedged funds tend to perform better during the period of rising exchange rates, whereas hedged funds show better performance when exchange rates fall. In the case where substantial hedging costs are incurred, it is worth considering not only the impact of exchange rate fluctuations but also FX hedging costs.

Generally, hedged funds or ETFs hedge against USD/KRW exchange rate fluctuations by rolling over FX swaps (spot purchase + forward sale) with a maturity of one month to one year. Accordingly, hedged funds may incur additional hedging costs (or gains) linked to swap points or swap rates, in addition to the hedging effect for FX fluctuations. In other words, the difference between the FX-adjusted return,’ which excludes the FX change effect from the return of unhedged funds, and the return of hedged funds can be considered hedging costs (or gains).7)

Table 1 distinguishes between periods when swap rates are positive (Panel A) and negative (Panel B), and categorizes overseas securities investment funds8) and ETFs tracking overseas indices (S&P500, Nasdaq 100) into hedged and unhedged types for each period by taking into account the return and FX hedging costs. This article first examines the period from July 2021 to April 20229) when swap rates were positive (Panel A in Table 1). As for Fund A, the return of the unhedged type (①) is 7%, while the FX-adjusted return (③), which excludes the FX increase effect (②) of 10.9%, is -3.9%. During the same period, the return of the hedged type (④) stands at -2.6%, 1.3% higher than the FX-adjusted return (-3.9%). It means that through FX hedging, additional gains of 1.3% (or 1.6% on an annualized basis) are obtained, excluding the FX hedging effect. The increase in FX rates of 10.9% leads to a higher return for the unhedged type, but the hedged type posts a higher return if foreign exchange rate fluctuations are excluded. Fund B and Fund C acquire gains of 0.5% (annualized 0.7%) and 0.9% (annualized 1.1%) from FX hedging, respectively. These gains can be attributed to the effect of positive swap rates (an average of 0.7%) during that period.

Opposite results are observed during the period from December 2022 to November 2023,10) marked by negative swap rates (Panel B in Table 1). Taking an S&P 500-tracking ETF as an example, the return of the unhedged type (①) stands at 10%, and the FX-adjusted return (③) allowing for the -0.9% USD/KRW exchange rate fluctuation (②) reaches 10.9%. During the same period, the return of the hedged type (④) stands at 8.4%. This is 2.5% lower than the FX-adjusted return (10.9%), indicating the FX hedging cost of 2.5%. The Nasdaq 100-tracking ETF, Fund A and Fund B incur FX hedging costs of 2.8%, 2.5% and 2.5%, respectively, which can be attributed to the effect of negative swap rates (an average of -1.8%). When the exchange rate decreases, the hedged type tends to post a higher return than the unhedged type. In this period, however, the hedging cost exceeded the effect of the exchange rate decline, despite a 0.9% fall in the exchange rate, resulting in the return of the unhedged type (①) surpassing that of the hedged type (④). Accordingly, when devising an FX hedging strategy amid rising hedging costs, it is critical to consider not only the hedging effect for mitigating exchange rate fluctuations but also additional hedging costs that may arise if the rate reversal between Korea and the US persists.

Summary and implications

The interest rate reversal between Korea and the US has altered hedging conditions for economic agents in Korea who engage in forward exchange selling. In the past, Korean investors or exporters could gain additional profits by hedging against fluctuations (decline) in the USD/KRW exchange rate. However, the situation has changed due to the recent rate reversal and the widening of the reversal gap, thereby requiring them to bear rising hedging costs.

Economic agents in need of FX hedging should be aware of the possibility that hedging costs can be incurred amid the enduring interest rate reversal. And they also need to prepare for the extended period of the rate reversal. Particularly, exporters should brace for the deterioration of profitability potentially arising from the sustained rise in FX hedging costs. In light of these concerns, policy authorities should consider providing FX hedging management support for small and medium-sized exporters. Meanwhile, Korean investors need to shift from the habitual routine of pursuing FX hedging in the overseas investment process. It is essential for them to recognize foreign currencies as one of investment portfolios and devise an FX hedging strategy by taking into account FX hedging costs and the financial conditions of individual investors.

1) The interest rate difference between Korea and the US is calculated by subtracting the US interest rate from the Korean rate, and the rate reversal indicates that the US interest rate is higher than the Korean rate. This article primarily uses the benchmark interest rate as a reference and as of December 19, 2023, Korea’s benchmark rate stands at 3.5% while the US rate reaches the upper benchmark of 5.5%.

2) A forward exchange sale refers to a transaction of selling dollars in the future. If an investor holds dollar-denominated assets (financial assets, receivables, etc.), this transaction can be used to hedge against the risk of depreciation in the USD/KRW exchange rate and the subsequent evaluation loss in KRW. In this article, FX hedging primarily refers to this type of hedging strategy. In the case of longer maturities (more than one year), transactions may involve currency swaps that include interest rate exchanges during the contract period.

3) A transaction where spot buying and forward selling are simultaneously executed is referred to as a foreign exchange swap (FX swap).

4) If the spot exchange rate is referred to as S, Korea’s interest rate as

5) The basis in footnote 4 can explain the discrepancy between the swap rate and the interest rate difference.

6) Extra FX hedging gains or costs are generated from the actual FX hedging, depending on transaction costs and market conditions, in addition to the swap rate.

7) Transaction costs or market conditions may result in some discrepancies between swap rate data and actual hedging costs. If the return of hedged funds is lower than the FX-adjusted return of unhedged funds, it gives rise to FX hedging costs.

8) This article analyzes cases where unhedged (UH) and hedged (H) funds coexist, such as Fund A (US index type), Fund B (bond type) and Fund C (US growth stock type).

9) Within the timeframe starting from 2020 with comparable funds for analysis, this article selects the period when the one-month maturity swap rate (monthly average) remained at 0.4% or higher.

10) This indicates the period during which the one-month swap rate (monthly average) remains below -0.4%.

References

Lee & Jang, 2023, The Impact of domestic and foreign interest rate reversals on capital flows and foreign capital borrowing costs and its implications, KCMI Issue Paper 23-24.