OPINION

2023 Apr/18

Need for Disclosing Retirement Benefit Liabilities and Funding Ratios

Apr. 18, 2023

PDF

- Summary

- To address the drawback of the severance pay scheme, the retirement pension scheme has been introduced to guarantee employees’ retirement benefits in the event of corporate bankruptcy by implementing the externally funded system. Accordingly, the funding ratio of pension assets to pension liabilities is a key performance indicator for pension plans. Despite its importance, the size of pension liabilities has not been disclosed.

It should also be noted that after 17 years of the introduction of retirement pensions, about 50% of all employees are still covered by a severance pay system, instead of the retirement pension scheme. As a company opting for severance pay is not obligated to keep accumulated contributions outside of the company, it is impossible to figure out the funding position of retirement benefits for more than 5.6 million employees as of the end of 2020.

Considering that funding ratios are critical information, retirement benefit liabilities generated from both retirement pensions and severance pay should be disclosed regularly. As the externally funded system may place a financial burden on companies, it seems difficult to obligate all companies to immediately adopt the retirement pension scheme. A more feasible approach is the implementation of mandatory reporting of the severance pay amount to identify the accurate size of severance pay liabilities.

In Korea, accumulated retirement pension assets are estimated to be worth KRW 331.2 trillion as of the end of 2022, representing a 13.5% increase from KRW 291.9 trillion at the end of 2019.1) The accumulated pension assets of more than KRW 330 trillion are regarded as the most important achievement in the retirement pension scheme. Despite its various benefits including the funding of retirement benefit liabilities, Korea’s retirement pension scheme suffers major challenges such as a low pension plan selection rate, low returns on pension asset management and a low enrollment rate. Lower returns and a higher tendency of choosing the lump sum payment have been recognized as critical issues and various efforts have been put into tackling them. However, relatively less attention has been paid to the low pension enrollment rate that poses a more fundamental problem.

After 17 years of its introduction, the retirement pension scheme has managed to secure a little over 50% of all employees as participants. As employees who have not joined the scheme are covered by a severance pay system, they qualify for retirement benefits as pension participants do. It is notable that employers opting for severance pay are not obligated to reserve retirement benefits. Hence, the receipt of retirement benefits is not guaranteed for employees under a severance pay system if employers go bankrupt.

The retirement pension scheme has been introduced to ensure stable payment of retirement allowances by mandating the externally funded system of retirement benefit liabilities. Accordingly, the pension funding ratio (=pension assets/pension liabilities) is a key performance indicator for pension plans. Considering the importance of the funding ratio, the Korean government has specified a minimum funding ratio for companies in the initial stage of the retirement pension scheme and has managed pension funding ratios.2) As statistical data on the size of pension liabilities have not been released,3) it is hard to obtain accurate funding ratios. But the average funding ratio seems to reach a statutory funding position. If severance liabilities are added, however, the total funding ratio of retirement benefits is expected to fall significantly.

For further improvement in the retirement pension scheme, it is meaningful to develop and adopt a funding index that helps figure out a pension funding position more effectively. To this end, it is necessary to identify the size of severance pay for which the funding ratio is likely to be extremely low to gauge the total funding ratio of retirement benefits. In this respect, this article assesses the amount of severance pay and examines how severance pay affects the funding ratio of retirement benefits.

Assessment of the size of severance pay

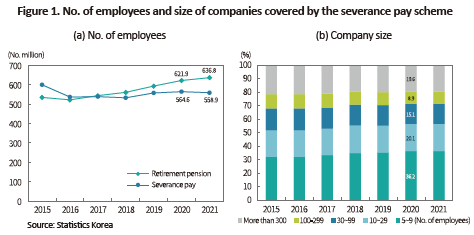

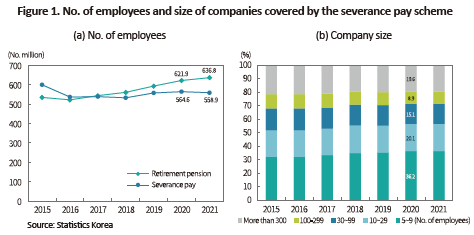

Korea’s Act on the Guarantee of Employees’ Retirement Benefits recognizes severance pay, as well as retirement pensions, as one type of retirement benefit. As of the end of 2020, the number of retirement pension participants has reached 62.19 billion, representing 52.4% of the 118.65 billion employees eligible for retirement pensions. The other 47.6% or 56.46 billion employees are covered by a severance pay system (Figure 1 (a)).

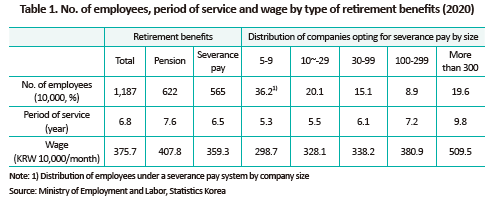

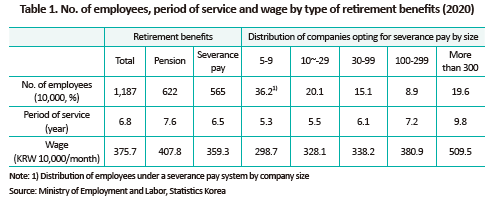

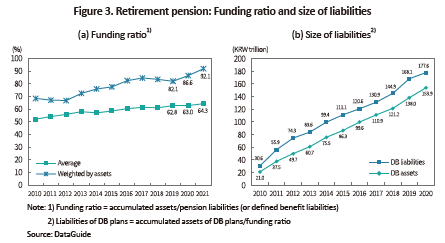

An individual employee’s severance pay is calculated by multiplying the monthly average wage by the length of employment. The resulting amount should be multiplied by the number of employees to calculate the total severance pay amount. This means the severance pay calculation requires the number of employees under a severance pay system, monthly wages and years of service. For this calculation, this article uses the number of nonparticipants among employees eligible for retirement pensions as shown in the Retirement Pension Statistics published annually by Statistics Korea (Figure 1 (a)). Notably, the pension enrollment rate tends to increase as the size of companies grows. For instance, 36.2% of employees under a severance pay system worked for business entities with fewer than five employees as of the end of 2020, while 19.6% were employees of business entities with more than 300 employees (Table 1).

As the average wage and service period varies by company size, this article uses adjusted averages of monthly wage and service period, considering the company size distribution.4) More concretely, small-scale enterprises are characterized by lower average wages and shorter periods of service, compared to the overall average and thus, adjusted average figures are reflected in the calculation of severance pay.5) The period of service of employees under a severance pay system shows a growing trend as the size of companies increases. Accordingly, if the company size distribution for employees covered by a severance pay system is considered, their average period of service would become shorter than the overall average. In 2020, the average service period of employees covered by a severance pay system stood at 6.5 years, compared to all employees’ average of 6.8 years (Table 1).6) Furthermore, the average wage also tends to grow, depending on the increase in company size. If the company size distribution of employees under a severance pay system is reflected, their average wage becomes lower than the overall average. In 2020, the average monthly wage of those covered by severance pay amounted to KRW 3.593 million, 4.4% lower than the overall average monthly wage of KRW 3.757 million.7) Figure 2 (a) illustrates the number of employees who receive severance pay, the adjusted average wage and the adjusted average period of service. If adjusted averages of monthly wage and service period apply to the calculation, the total severance pay for 2020 is estimated to be worth KRW 132.1 trillion (=5.65 million in headcount x KRW 3.593 million x 6.5 years) (Figure 2 (b)). This figure corresponds to around 60% of the KRW 221.1 trillion contributions to DB and DC plans combined.

Assessment of the size of retirement pension liabilities

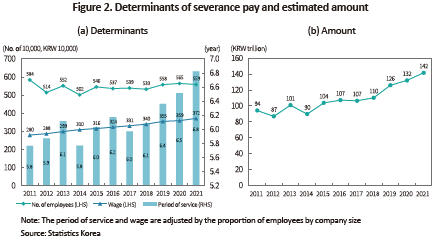

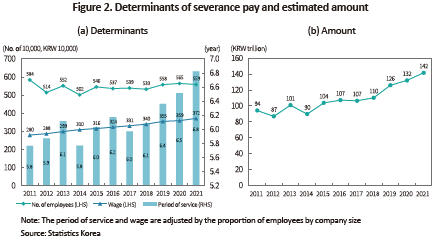

The statistics of accumulated pension assets have been released periodically. On the other hand, the amount of pension liabilities is not made public and thus, it is hard to figure out an accurate funding position of retirement pensions. But as pension liabilities and accumulated contributions kept outside of the company are disclosed in financial statements, individual companies’ funding ratios can be identified by looking at financial statements.8) The arithmetic average of funding ratios has kept rising to around 60% since 2018 (Figure 3 (a)). The average funding ratio weighted by pension assets stood at 92.1% as of the end of 2021. In terms of funding ratios, a wide gap between the arithmetic average and the average weighted by pension assets can be attributable to the fact that companies with larger pension assets exhibit a higher funding position.9) Funding ratios are kept stable as a whole, albeit a considerable divergence between companies.

The size of pension liabilities can be estimated by using the funding ratio obtained from financial statements and the officially released pension assets. As of the end of 2020, the funding ratio of pension assets stood at 86.6% (Figure 3 (a)) and DB plan assets amounted to KRW 153.9 trillion, which could result in the amount of pension liabilities of KRW 177.7 trillion (=KRW 153.9 trillion/0.866).10) This calculation method can also apply to the amount of pension liabilities accruing in other years (Figure 3 (b)).

Funding ratios, disclosure of retirement benefit liabilities, and growth of retirement pensions

This article has estimated the worth of pension liabilities and severance pay liabilities, both of which could not be obtained because the pension liabilities data have hardly been available since the introduction of the retirement pension scheme. In Korea, the funding ratio of DB plans hovered over 90% as of the end of 2021, and if the funding position of DC plans is additionally considered, it would further drive up the pension funding ratio. With the high funding position, Korea is nearing the goal of the retirement pension scheme that aims at improving retirement income security by keeping accumulated contributions outside of the company. However, it should be noted that the funding ratio of retirement benefits would become much lower if severance pay liabilities are included.

Although identifying a pension funding ratio and developing a funding index cannot address the lack of accumulated contributions, it is necessary to understand the scale and severity of the relevant problem. The information regarding the size of pension liabilities should be disclosed to gauge the funding ratio of pension assets to pension liabilities, which can be used to assess how contributions to pension plans can guarantee the receipt of retirement benefits. In addition, it is of great importance to understand the funding position of retirement benefits including the benefits of DB plans and thus, the funding index, tentatively named HanKuk Pension Index (HKP Index) should be developed and disclosed.

In the meantime, it seems difficult to adopt compulsory funding for the severance pay scheme being operated in parallel with the retirement pension scheme. However, what is needed at least is a mandatory submission of basic information including the size of severance pay liabilities to manage severance pay-related data in a systematic way. As the sweeping introduction of the mandatory disclosure system may place a burden on small-sized firms, it is feasible to phase in the disclosure of relevant information.

As of the end of 2020, more than 5.6 million employees are covered by the severance pay scheme. Over the long run, these employees should be integrated into the retirement pension scheme. If the lack of funding hinders the full transfer to the retirement pension scheme, a more reasonable approach is to phase in retirement pensions by the size of companies. It is noteworthy that temporary financial assistance has already been adopted to encourage SMEs to transfer to retirement pensions.11)

Lastly, as a growing number of companies is approaching the 100% funding ratio, contributions to be reserved for retirement benefit liabilities, a major factor in the growth of pension assets, will be reduced. If a company’s pension funding ratio hits 100%, it could maintain the 100% ratio by making additional contributions to cover only retirement benefit liabilities accruing annually. Hence, if a shift to retirement pensions from severance pay is delayed, the growth of pension assets is expected to be lower down the road.

1) See Financial Supervisory Service’s integrated pension portal (https://100lifeplan.fss.or.kr/main/main.do). Contributions to Korea Workers’ Compensation & Welfare Service are not included.

2) The mandated minimum funding ratio of DB plans stood at 60% by 2013, which rose to 70% by 2014-2015, 80% by 2016-2018, 90% by 2019-2021, and 100% after 2022 (Article 5 Paragraph 1 of Enforcement Decree of the Act on the Guarantee of Employees’ Retirement Benefits and Article 4-2 of Enforcement Rules of the said Act).

3) Generally, pension liabilities refer to liabilities of DB plans. Liabilities of DC plans never accrue as they are settled and paid annually.

4) The monthly wage and period of service used in this article have been obtained from the data on the average wage (by gender/company size/age), the period of service and working hours (by gender/company size/education level) released by Korean Women’s Development Institute (https://gsis.kwdi.re.kr/).

5) The figures are adjusted by the proportion of (non) participants by company size as shown in the Retirement Pension Statistics published annually by Statistics Korea. For periods prior to 2015, the 2015 data are used as the relevant data were unavailable.

6) The proportion of employees covered by a severance pay system by company size x the period of service by company size (6.5 years = 36.2% x 5.3 years +… + 19.6% x 9.8 years)

7) The proportion of employees covered by a severance pay system by company size x the average wage by company size (KRW 3.593 million = 36.2% x KRW 2.987 million +… + 19.6% x KRW 5.095 million)

8) Among the companies listed on the KOSPI and KOSDAQ from 2011 through 2021, the data of corporations with account settlements ending in December (excluding financial business entities) are used. Corporate financial statements and the data on defined benefit liabilities and assets accumulated outside of the company have been obtained from DataGuide. Retirement pension liabilities refer to both retirement benefit liabilities incurred by companies opting for a severance pay system and defined benefit liabilities incurred by those adopting a DB pension scheme. As the two liabilities are identical in practical terms, they are not separately treated in corporate accounting.

9) As pension assets are not transferred between companies, the actual funding position can be overestimated by the weighted average funding ratio. Thus, when funding ratios are disclosed, companies with underfunded contributions should be distinguished from those with overfunded contributions.

10) Although not released regularly, the funding ratio of retirement pensions as of the end of 2020 was announced (Ministry of Employment and Labor, January 4, 2022, Analysis of regulatory effects of the Enforcement Decree of the “Act on the Guarantee of Employees’ Retirement Benefits”). According to the statistics, the number of employers and companies who have adopted a DB plan reaches 94,933 and 111,114, respectively. The funding ratio is 89.5%, the contributions are worth KRW 153.3 trillion in total, and pension liabilities amount to KRW 171.1 trillion. Meanwhile, the funding ratio obtained from DataGuide includes the data of companies with severance pay liabilities and a small amount of reserve assets. Although such companies are not obligated to accumulate contributions and thus, have a low funding ratio, it is hard to tell them from other companies under the retirement pension scheme with a low funding ratio through financial statements. This is because both liabilities of DB plans and severance pay liabilities are booked as defined benefit liabilities in financial statements. This suggests the funding ratio obtained from financial statements may be underestimated. If the funding ratio calculated from financial statements is lower than the actual funding ratio, it is possible to overestimate retirement pension liabilities.

11) The Retirement Pension Fund System for SMEs designed to support SMEs with less than 30 full-time employees has provided financial assistance and set a minimum amount of fees, with the aim of alleviating the economic burden of employers who are struggling with the adoption of the retirement pension scheme and facilitating the early introduction and establishment of the scheme (http://www.moel.go.kr/policy/policyinfo/lobar/list25.do).

After 17 years of its introduction, the retirement pension scheme has managed to secure a little over 50% of all employees as participants. As employees who have not joined the scheme are covered by a severance pay system, they qualify for retirement benefits as pension participants do. It is notable that employers opting for severance pay are not obligated to reserve retirement benefits. Hence, the receipt of retirement benefits is not guaranteed for employees under a severance pay system if employers go bankrupt.

The retirement pension scheme has been introduced to ensure stable payment of retirement allowances by mandating the externally funded system of retirement benefit liabilities. Accordingly, the pension funding ratio (=pension assets/pension liabilities) is a key performance indicator for pension plans. Considering the importance of the funding ratio, the Korean government has specified a minimum funding ratio for companies in the initial stage of the retirement pension scheme and has managed pension funding ratios.2) As statistical data on the size of pension liabilities have not been released,3) it is hard to obtain accurate funding ratios. But the average funding ratio seems to reach a statutory funding position. If severance liabilities are added, however, the total funding ratio of retirement benefits is expected to fall significantly.

For further improvement in the retirement pension scheme, it is meaningful to develop and adopt a funding index that helps figure out a pension funding position more effectively. To this end, it is necessary to identify the size of severance pay for which the funding ratio is likely to be extremely low to gauge the total funding ratio of retirement benefits. In this respect, this article assesses the amount of severance pay and examines how severance pay affects the funding ratio of retirement benefits.

Assessment of the size of severance pay

Korea’s Act on the Guarantee of Employees’ Retirement Benefits recognizes severance pay, as well as retirement pensions, as one type of retirement benefit. As of the end of 2020, the number of retirement pension participants has reached 62.19 billion, representing 52.4% of the 118.65 billion employees eligible for retirement pensions. The other 47.6% or 56.46 billion employees are covered by a severance pay system (Figure 1 (a)).

As the average wage and service period varies by company size, this article uses adjusted averages of monthly wage and service period, considering the company size distribution.4) More concretely, small-scale enterprises are characterized by lower average wages and shorter periods of service, compared to the overall average and thus, adjusted average figures are reflected in the calculation of severance pay.5) The period of service of employees under a severance pay system shows a growing trend as the size of companies increases. Accordingly, if the company size distribution for employees covered by a severance pay system is considered, their average period of service would become shorter than the overall average. In 2020, the average service period of employees covered by a severance pay system stood at 6.5 years, compared to all employees’ average of 6.8 years (Table 1).6) Furthermore, the average wage also tends to grow, depending on the increase in company size. If the company size distribution of employees under a severance pay system is reflected, their average wage becomes lower than the overall average. In 2020, the average monthly wage of those covered by severance pay amounted to KRW 3.593 million, 4.4% lower than the overall average monthly wage of KRW 3.757 million.7) Figure 2 (a) illustrates the number of employees who receive severance pay, the adjusted average wage and the adjusted average period of service. If adjusted averages of monthly wage and service period apply to the calculation, the total severance pay for 2020 is estimated to be worth KRW 132.1 trillion (=5.65 million in headcount x KRW 3.593 million x 6.5 years) (Figure 2 (b)). This figure corresponds to around 60% of the KRW 221.1 trillion contributions to DB and DC plans combined.

The statistics of accumulated pension assets have been released periodically. On the other hand, the amount of pension liabilities is not made public and thus, it is hard to figure out an accurate funding position of retirement pensions. But as pension liabilities and accumulated contributions kept outside of the company are disclosed in financial statements, individual companies’ funding ratios can be identified by looking at financial statements.8) The arithmetic average of funding ratios has kept rising to around 60% since 2018 (Figure 3 (a)). The average funding ratio weighted by pension assets stood at 92.1% as of the end of 2021. In terms of funding ratios, a wide gap between the arithmetic average and the average weighted by pension assets can be attributable to the fact that companies with larger pension assets exhibit a higher funding position.9) Funding ratios are kept stable as a whole, albeit a considerable divergence between companies.

Funding ratios, disclosure of retirement benefit liabilities, and growth of retirement pensions

This article has estimated the worth of pension liabilities and severance pay liabilities, both of which could not be obtained because the pension liabilities data have hardly been available since the introduction of the retirement pension scheme. In Korea, the funding ratio of DB plans hovered over 90% as of the end of 2021, and if the funding position of DC plans is additionally considered, it would further drive up the pension funding ratio. With the high funding position, Korea is nearing the goal of the retirement pension scheme that aims at improving retirement income security by keeping accumulated contributions outside of the company. However, it should be noted that the funding ratio of retirement benefits would become much lower if severance pay liabilities are included.

Although identifying a pension funding ratio and developing a funding index cannot address the lack of accumulated contributions, it is necessary to understand the scale and severity of the relevant problem. The information regarding the size of pension liabilities should be disclosed to gauge the funding ratio of pension assets to pension liabilities, which can be used to assess how contributions to pension plans can guarantee the receipt of retirement benefits. In addition, it is of great importance to understand the funding position of retirement benefits including the benefits of DB plans and thus, the funding index, tentatively named HanKuk Pension Index (HKP Index) should be developed and disclosed.

In the meantime, it seems difficult to adopt compulsory funding for the severance pay scheme being operated in parallel with the retirement pension scheme. However, what is needed at least is a mandatory submission of basic information including the size of severance pay liabilities to manage severance pay-related data in a systematic way. As the sweeping introduction of the mandatory disclosure system may place a burden on small-sized firms, it is feasible to phase in the disclosure of relevant information.

As of the end of 2020, more than 5.6 million employees are covered by the severance pay scheme. Over the long run, these employees should be integrated into the retirement pension scheme. If the lack of funding hinders the full transfer to the retirement pension scheme, a more reasonable approach is to phase in retirement pensions by the size of companies. It is noteworthy that temporary financial assistance has already been adopted to encourage SMEs to transfer to retirement pensions.11)

Lastly, as a growing number of companies is approaching the 100% funding ratio, contributions to be reserved for retirement benefit liabilities, a major factor in the growth of pension assets, will be reduced. If a company’s pension funding ratio hits 100%, it could maintain the 100% ratio by making additional contributions to cover only retirement benefit liabilities accruing annually. Hence, if a shift to retirement pensions from severance pay is delayed, the growth of pension assets is expected to be lower down the road.

1) See Financial Supervisory Service’s integrated pension portal (https://100lifeplan.fss.or.kr/main/main.do). Contributions to Korea Workers’ Compensation & Welfare Service are not included.

2) The mandated minimum funding ratio of DB plans stood at 60% by 2013, which rose to 70% by 2014-2015, 80% by 2016-2018, 90% by 2019-2021, and 100% after 2022 (Article 5 Paragraph 1 of Enforcement Decree of the Act on the Guarantee of Employees’ Retirement Benefits and Article 4-2 of Enforcement Rules of the said Act).

3) Generally, pension liabilities refer to liabilities of DB plans. Liabilities of DC plans never accrue as they are settled and paid annually.

4) The monthly wage and period of service used in this article have been obtained from the data on the average wage (by gender/company size/age), the period of service and working hours (by gender/company size/education level) released by Korean Women’s Development Institute (https://gsis.kwdi.re.kr/).

5) The figures are adjusted by the proportion of (non) participants by company size as shown in the Retirement Pension Statistics published annually by Statistics Korea. For periods prior to 2015, the 2015 data are used as the relevant data were unavailable.

6) The proportion of employees covered by a severance pay system by company size x the period of service by company size (6.5 years = 36.2% x 5.3 years +… + 19.6% x 9.8 years)

7) The proportion of employees covered by a severance pay system by company size x the average wage by company size (KRW 3.593 million = 36.2% x KRW 2.987 million +… + 19.6% x KRW 5.095 million)

8) Among the companies listed on the KOSPI and KOSDAQ from 2011 through 2021, the data of corporations with account settlements ending in December (excluding financial business entities) are used. Corporate financial statements and the data on defined benefit liabilities and assets accumulated outside of the company have been obtained from DataGuide. Retirement pension liabilities refer to both retirement benefit liabilities incurred by companies opting for a severance pay system and defined benefit liabilities incurred by those adopting a DB pension scheme. As the two liabilities are identical in practical terms, they are not separately treated in corporate accounting.

9) As pension assets are not transferred between companies, the actual funding position can be overestimated by the weighted average funding ratio. Thus, when funding ratios are disclosed, companies with underfunded contributions should be distinguished from those with overfunded contributions.

10) Although not released regularly, the funding ratio of retirement pensions as of the end of 2020 was announced (Ministry of Employment and Labor, January 4, 2022, Analysis of regulatory effects of the Enforcement Decree of the “Act on the Guarantee of Employees’ Retirement Benefits”). According to the statistics, the number of employers and companies who have adopted a DB plan reaches 94,933 and 111,114, respectively. The funding ratio is 89.5%, the contributions are worth KRW 153.3 trillion in total, and pension liabilities amount to KRW 171.1 trillion. Meanwhile, the funding ratio obtained from DataGuide includes the data of companies with severance pay liabilities and a small amount of reserve assets. Although such companies are not obligated to accumulate contributions and thus, have a low funding ratio, it is hard to tell them from other companies under the retirement pension scheme with a low funding ratio through financial statements. This is because both liabilities of DB plans and severance pay liabilities are booked as defined benefit liabilities in financial statements. This suggests the funding ratio obtained from financial statements may be underestimated. If the funding ratio calculated from financial statements is lower than the actual funding ratio, it is possible to overestimate retirement pension liabilities.

11) The Retirement Pension Fund System for SMEs designed to support SMEs with less than 30 full-time employees has provided financial assistance and set a minimum amount of fees, with the aim of alleviating the economic burden of employers who are struggling with the adoption of the retirement pension scheme and facilitating the early introduction and establishment of the scheme (http://www.moel.go.kr/policy/policyinfo/lobar/list25.do).