OPINION

2023 Apr/18

Revitalizing Korea’s ESG Bond Market to Achieve Carbon Neutrality by 2050

Apr. 18, 2023

PDF

- Summary

- The Korean government has recently released the blueprint for “achieving carbon neutrality and green growth by 2050”. The blueprint contains the current Nationally Determined Contribution (NDC) targets including transitioning to a carbon-neutral economy by 2050 and a 40% reduction in greenhouse gas emissions by 2030 (compared to 2018 levels). Attaining the goals of the blueprint requires not only efforts by the government, but also the active participation of the private sector in adopting a lower carbon intensive mode of production and operations. Considering that the low carbon transition requires a large amount of investment, such as for securing mitigation technologies, a more active use of ESG bonds is needed. Despite a slowdown in the global ESG bond market in 2022, a wide range of environment and energy policy measures adopted by major economies have injected new growth momentum into the market. This shift in policy direction demonstrates that environmental issues are directly connected with not only response to climate risk but also with economic growth factors including energy security and technology initiatives. Against this backdrop, Korea also needs to consider various measures to stimulate the ESG bond market, to achieve carbon neutrality and to gain industrial competitiveness.

The Korean government has recently unveiled the blueprint for “achieving carbon neutrality and green growth by 2050”.1) The blueprint contains Korea’s promised targets for implementation of the Paris Climate Agreement, including a transition to a carbon-neutral society by 2050 and a 40% cut in greenhouse gas emissions by 2030 (compared to 2018 levels). To achieve the Nationally Determined Contribution (NDC) and move toward a carbon-neutral economy, Korea needs both measures led by the government, such as energy mix readjustment, as well as private sector driven projects, such as developing a low-carbon manufacturing base. Korea has a large manufacturing share of GDP, at 25%, as well as a carbon-intensive industry structure, such that Korean companies need to make large investments in mitigation technologies for the low carbon transition. Although ESG bonds, especially green bonds should be mobilited to finance the transition, they are significantly underused in Korea, which is well demonstrated by the insufficient issuance of green bonds and inactive participation of private companies.

Current state of the ESG bond market

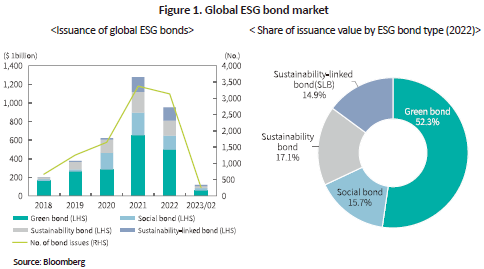

The ESG bond market suffered a setback in 2022. Soaring energy prices, triggered by the Russia-Ukraine war, and steep interest rate hikes for curbing inflationary pressure have had adverse effects on sustainable finance, including the ESG bond market. As illustrated in Figure 1, the issuance of global ESG bonds represented $958 billion in value and 3,151 in number of bond issues in 2022, down by 25.5% and 7.1%, respectively, on a YoY basis. By bond type, social bonds that surged from 2020 to 2021 in response to the Covid-19 pandemic experienced the biggest drop of 37.9% while sustainability bonds, green bonds and sustainability-linked bonds fell by 26.7%, 23.9% and 11.2%, respectively, turning to a downward trend for the first time. In terms of the share of each bond type based on the 2022 issuance value, green bonds account for 52.3% of the global ESG bond market, which shrank from 70.1% in 2019 but still hold the highest share.

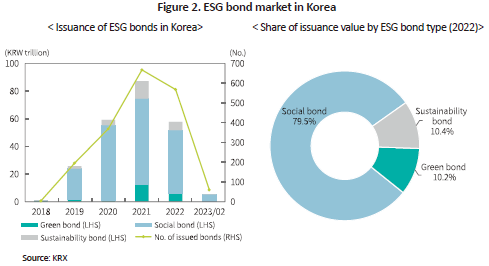

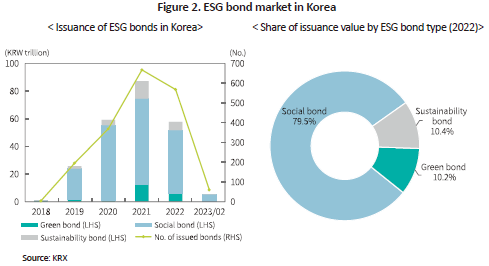

Korea also witnessed the first decrease in ESG bond issuance in 2022. Figure 2 shows that in Korea, the issuance of ESG bonds represented KRW 57.5 trillion in value and 565 in number of bond issues in 2022, down 33.7% and 14.9%, respectively on a YoY basis. By bond type, green bonds and sustainability bonds plunged by 53.0% and 52.2%, respectively in issuance value in 2022, the biggest drop on a YoY basis. On the other hand, social bonds suffered a relatively smaller decline of 26.1%. In the Korean market, ESG bond issuance has yet to stage a recovery coming into 2023. ESG bonds issued in Korea amounted to KRW 5.2 trillion between January and February of 2023, hitting the lowest level since 2019. In terms of the share by bond type, based on the 2022 issuance value, social bonds hold the dominant position with 79.5% while green bonds take up a mere 10.2%, which is in contrast to the global ESG bond market. This demonstrates that Korean companies have not fully tapped into green bonds for the transition to low-carbon manufacturing and business structures.

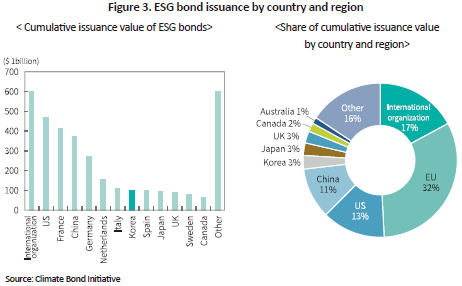

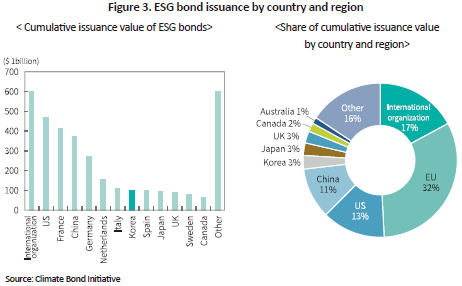

Figure 3 illustrates the ranking and share of each country in terms of the cumulative issuance value of ESG bonds. Among individual countries, excluding international organizations, the US, France and China rank first, second and third, respectively, while Korea takes seventh place in ranking. While the US is the largest ESG bond issuer country, the EU is the largest issuing region. Korea ranks high in overall ESG bond issuance, but its ESG bond market is centered around social bonds, instead of green bonds. Also, in Korea, state-owned companies represent a very high proportion of issuers.

Growth momentum of major ESG bond markets

In key countries and regions, policy measures that are expected to positively impact issuance of ESG bonds, especially green bonds, have recently been adopted. In May 2022, the European Commission announced RePowerEU, a plan to make the EU independent from Russian fossil fuels.2) RePowerEU contains investments of €210 billion by 2027 and €300 billion by 2030 to eliminate Europe’s dependence on Russian gas and raise the production of renewable energy. To fund RePowerEU, green bonds, that adhere to the EU green taxonomy, are expected to be actively issued.

The Inflation Reduction Act (IRA), signed into law in August 2022 in the US, provides $369 billion for fighting climate change, the most aggressive climate investment ever taken by the US Congress. The IRA offers grants and loan guarantees for renewable energy production, electric vehicle purchases and more efficient energy sources featuring $260 billion in clean-energy tax credits. The IRA is expected to help reduce US carbon emissions 40% by 2030, compared to the 2005 level, which corresponds to around 80% of the reduction target set by the US under the Paris Climate Agreement commitment. The financial assistance and benefits for companies and individuals under the IRA are expected to greatly contribute to green bond issuance.

In August 2022, China unveiled the new Green Bond Principles that are more closely aligned with global standards. China’s previous principles diverge from the Green Bond Principles adopted by the International Capital Markets Association (ICMA) that have been established as an international standard. China’s new Green Bond Principles closes many of the previous gaps. Notably, the previous principles allowed issuers to use 30% to 50% of issuance value in a discretionary manner, whereas the new principles require issuers to allocate 100% of the funds raised from green bonds to qualified green projects. China’s new principles are expected to alleviate greenwashing concerns arising from its relatively lax regulations, thereby boosting inbound investments in Chinese green bonds by international investors. The shift in policy direction by major economies reflects the fact that environmental issues are not just related to climate change but are increasingly becoming an important factor of economic growth, as it relates to energy security, technological advantage, industrial competitiveness, and job creation.

Revitalizing Korea’s ESG bond market

In Korea, the ESG bond market has achieved notable quantitative growth in a short period of time, climbing to seventh place as an individual country based on the 2022 cumulative issuance value. But qualitatively, there is much room for improvement and one of the most urgent issues is increasing the use of green bonds by private companies. To this end, policy measures are needed to reduce costs associated with issuing green bonds and to widen the pool of companies eligible for green bond issuance.

Having recognized this issue, Korea’s policy authorities are working on new assistance measures to encourage companies to issue green bonds. In February 2023, the Ministry of Environment announced a pilot program to temporarily cover the interest cost incurred from “K-Green Bond”3) issuance.4) The program, with a total budget of KRW 7.7 billion, will provide up to KRW 300 million per company to cover interest costs. About 70% of the total budget will be primarily allocated to the projects contributing to Korea’s carbon neutrality goal, with the aim of issuance of K-Green Bonds worth around KRW 3 trillion. Applicable interest rate assistance will be 0.4% of issuance value for SMEs, who have a higher green bond issuance burden, and 0.2% for large companies and public institutions. The assistance will be provided for one year following the issuance date and the program will be maintained until the budget is exhausted. The program is expected to serve as growth momentum for the green bond market in Korea. But as this has been launched as a temporary pilot program, what is needed is a more comprehensive long-term support policy. In addition to assistance for issuers, support measures for investors, such as tax credits, need to be considered.

It is also necessary to devise a plan to expand the pool of green bond issuers. Korea’s carbon intensive industrial structure has limited many domestic companies’ access to green bond issuance. In this respect, the case of Japan can be referred, as it shares a similar industrial structure and Paris Climate Agreement targets with Korea. Japan’s Financial Services Agency and Ministry of Economy, Trade and Industry released the Framework for Transition Finance in May 2021. The framework set criteria that allow Japanese companies in implementing decarbonization strategies, to raise funds using transition bonds and transition loans. However, outside of Japan, transition bonds are not yet recognized as a separate ESG bond class and there are many debates surrounding the issue of transition bonds. Despite this fact, Korea should look broadly at measures that can enhance the use of ESG bonds by private companies, including the possible adoption of transition bonds, in light of the urgent need for the country to transition to a carbon neutral society.

1) The Presidential Commission on Carbon Neutrality and Green Growth, March 21, 2023, The Yoon administration’s blueprint for achieving carbon neutrality and green growth by 2050, press release.

2) The European Parliament passed the relevant provisional agreement in October 2022 and EU member states are preparing for the introduction of RePowerEU.

3) “K-Green Bonds” refer to bonds that are issued based on Korea’s green taxonomy in accordance with the revised Korean Green Bond Guidelines released in December 2022.

4) Ministry of Environment, February 23, 2023, Support for K-Green Bond issuance to provide momentum for growth of green finance, press release.

Current state of the ESG bond market

The ESG bond market suffered a setback in 2022. Soaring energy prices, triggered by the Russia-Ukraine war, and steep interest rate hikes for curbing inflationary pressure have had adverse effects on sustainable finance, including the ESG bond market. As illustrated in Figure 1, the issuance of global ESG bonds represented $958 billion in value and 3,151 in number of bond issues in 2022, down by 25.5% and 7.1%, respectively, on a YoY basis. By bond type, social bonds that surged from 2020 to 2021 in response to the Covid-19 pandemic experienced the biggest drop of 37.9% while sustainability bonds, green bonds and sustainability-linked bonds fell by 26.7%, 23.9% and 11.2%, respectively, turning to a downward trend for the first time. In terms of the share of each bond type based on the 2022 issuance value, green bonds account for 52.3% of the global ESG bond market, which shrank from 70.1% in 2019 but still hold the highest share.

Korea also witnessed the first decrease in ESG bond issuance in 2022. Figure 2 shows that in Korea, the issuance of ESG bonds represented KRW 57.5 trillion in value and 565 in number of bond issues in 2022, down 33.7% and 14.9%, respectively on a YoY basis. By bond type, green bonds and sustainability bonds plunged by 53.0% and 52.2%, respectively in issuance value in 2022, the biggest drop on a YoY basis. On the other hand, social bonds suffered a relatively smaller decline of 26.1%. In the Korean market, ESG bond issuance has yet to stage a recovery coming into 2023. ESG bonds issued in Korea amounted to KRW 5.2 trillion between January and February of 2023, hitting the lowest level since 2019. In terms of the share by bond type, based on the 2022 issuance value, social bonds hold the dominant position with 79.5% while green bonds take up a mere 10.2%, which is in contrast to the global ESG bond market. This demonstrates that Korean companies have not fully tapped into green bonds for the transition to low-carbon manufacturing and business structures.

Figure 3 illustrates the ranking and share of each country in terms of the cumulative issuance value of ESG bonds. Among individual countries, excluding international organizations, the US, France and China rank first, second and third, respectively, while Korea takes seventh place in ranking. While the US is the largest ESG bond issuer country, the EU is the largest issuing region. Korea ranks high in overall ESG bond issuance, but its ESG bond market is centered around social bonds, instead of green bonds. Also, in Korea, state-owned companies represent a very high proportion of issuers.

Growth momentum of major ESG bond markets

In key countries and regions, policy measures that are expected to positively impact issuance of ESG bonds, especially green bonds, have recently been adopted. In May 2022, the European Commission announced RePowerEU, a plan to make the EU independent from Russian fossil fuels.2) RePowerEU contains investments of €210 billion by 2027 and €300 billion by 2030 to eliminate Europe’s dependence on Russian gas and raise the production of renewable energy. To fund RePowerEU, green bonds, that adhere to the EU green taxonomy, are expected to be actively issued.

The Inflation Reduction Act (IRA), signed into law in August 2022 in the US, provides $369 billion for fighting climate change, the most aggressive climate investment ever taken by the US Congress. The IRA offers grants and loan guarantees for renewable energy production, electric vehicle purchases and more efficient energy sources featuring $260 billion in clean-energy tax credits. The IRA is expected to help reduce US carbon emissions 40% by 2030, compared to the 2005 level, which corresponds to around 80% of the reduction target set by the US under the Paris Climate Agreement commitment. The financial assistance and benefits for companies and individuals under the IRA are expected to greatly contribute to green bond issuance.

In August 2022, China unveiled the new Green Bond Principles that are more closely aligned with global standards. China’s previous principles diverge from the Green Bond Principles adopted by the International Capital Markets Association (ICMA) that have been established as an international standard. China’s new Green Bond Principles closes many of the previous gaps. Notably, the previous principles allowed issuers to use 30% to 50% of issuance value in a discretionary manner, whereas the new principles require issuers to allocate 100% of the funds raised from green bonds to qualified green projects. China’s new principles are expected to alleviate greenwashing concerns arising from its relatively lax regulations, thereby boosting inbound investments in Chinese green bonds by international investors. The shift in policy direction by major economies reflects the fact that environmental issues are not just related to climate change but are increasingly becoming an important factor of economic growth, as it relates to energy security, technological advantage, industrial competitiveness, and job creation.

Revitalizing Korea’s ESG bond market

In Korea, the ESG bond market has achieved notable quantitative growth in a short period of time, climbing to seventh place as an individual country based on the 2022 cumulative issuance value. But qualitatively, there is much room for improvement and one of the most urgent issues is increasing the use of green bonds by private companies. To this end, policy measures are needed to reduce costs associated with issuing green bonds and to widen the pool of companies eligible for green bond issuance.

Having recognized this issue, Korea’s policy authorities are working on new assistance measures to encourage companies to issue green bonds. In February 2023, the Ministry of Environment announced a pilot program to temporarily cover the interest cost incurred from “K-Green Bond”3) issuance.4) The program, with a total budget of KRW 7.7 billion, will provide up to KRW 300 million per company to cover interest costs. About 70% of the total budget will be primarily allocated to the projects contributing to Korea’s carbon neutrality goal, with the aim of issuance of K-Green Bonds worth around KRW 3 trillion. Applicable interest rate assistance will be 0.4% of issuance value for SMEs, who have a higher green bond issuance burden, and 0.2% for large companies and public institutions. The assistance will be provided for one year following the issuance date and the program will be maintained until the budget is exhausted. The program is expected to serve as growth momentum for the green bond market in Korea. But as this has been launched as a temporary pilot program, what is needed is a more comprehensive long-term support policy. In addition to assistance for issuers, support measures for investors, such as tax credits, need to be considered.

It is also necessary to devise a plan to expand the pool of green bond issuers. Korea’s carbon intensive industrial structure has limited many domestic companies’ access to green bond issuance. In this respect, the case of Japan can be referred, as it shares a similar industrial structure and Paris Climate Agreement targets with Korea. Japan’s Financial Services Agency and Ministry of Economy, Trade and Industry released the Framework for Transition Finance in May 2021. The framework set criteria that allow Japanese companies in implementing decarbonization strategies, to raise funds using transition bonds and transition loans. However, outside of Japan, transition bonds are not yet recognized as a separate ESG bond class and there are many debates surrounding the issue of transition bonds. Despite this fact, Korea should look broadly at measures that can enhance the use of ESG bonds by private companies, including the possible adoption of transition bonds, in light of the urgent need for the country to transition to a carbon neutral society.

1) The Presidential Commission on Carbon Neutrality and Green Growth, March 21, 2023, The Yoon administration’s blueprint for achieving carbon neutrality and green growth by 2050, press release.

2) The European Parliament passed the relevant provisional agreement in October 2022 and EU member states are preparing for the introduction of RePowerEU.

3) “K-Green Bonds” refer to bonds that are issued based on Korea’s green taxonomy in accordance with the revised Korean Green Bond Guidelines released in December 2022.

4) Ministry of Environment, February 23, 2023, Support for K-Green Bond issuance to provide momentum for growth of green finance, press release.