OPINION

2023 Oct/24

Current State and Challenges of Korea’s Sustainability-Liked Bond (SLB) Market

Oct. 24, 2023

PDF

- Summary

- In July 2023, Hyundai Capital successfully issued Sustainability-Linked Bonds (SLBs) for the first time in Korea. This is particularly encouraging in that there have been no issuances for nearly a year since the introduction of SLBs in the Socially Responsible Investment (SRI) segment of the Korea Exchange (KRX) in October 2022. SLBs were designed to offer financing routes to companies struggling to issue conventional ESG bonds, especially green bonds. As they place no restrictions on the use of funds and allow non-environmentally friendly companies to issue ESG bonds, it was initially expected for Korean companies to make extensive use of SLBs. However, the SLB issuance in Korea is still below expectations, which is partly attributable to a lack of awareness of SLBs and the complexity of how SLBs are designed. Against this backdrop, Hyundai Capital’s SLB issuance provides a good opportunity to better understand SLBs and identify challenges for boosting Korea’s SLB market.

In July 2023, Hyundai Capital became the first company in Korea to issue Korean Won-denominated Sustainability-Linked Bonds (SLBs).1) SLBs were introduced to the Socially Responsible Investment (SRI) segment of the Korea Exchange (KRX) in October 2022, but there had been no issuance for nearly a year. In this regard, successful SLB issuance by Hyundai Capital is considered encouraging news. SLBs were designed to induce market participation of companies, particularly those struggling to issue green bonds and other conventional ESG bonds (social bonds, sustainability bonds). Companies that fall under non-environmentally friendly industries or lack eligible projects have had limited access to the green bond market up until now. This can explain why green bonds are not sufficiently issued by private companies in Korea, given its manufacturing-oriented industrial structure. SLBs enable more companies to participate in the sustainable bond market in that it places no restrictions on an issuer’s environmentally friendly nature or the use of funds. Although it was initially expected that private companies would extensively utilize SLBs following their introduction, the actual issuance has fallen short of expectations. This can be partly attributable to the low awareness of SLBs in Korea and the complex design of SLBs. Against this backdrop, it is necessary to understand how SLBs are structured and examine challenges to be addressed to invigorate Korea’s SLB market.

Structure and characteristics of SLBs

One of the features of conventional ESG bonds is that they limit the use of raised funds to eligible projects. This mechanism is designed to prevent ESG-washing, but it also has the drawback of restricting market participation by private companies. Limited utilization of raised funds and the absence of eligible projects discourage companies from issuing ESG bonds. Furthermore, green bond issuance by non-environmentally friendly companies is considered to defeat the original purpose of green bonds, which makes it difficult for those firms to obtain certification.

SLBs were developed with the recognition that greater market participation is needed to tackle material environmental and social issues faced by humanity, such as climate change. SLBs allow companies to use raised funds at their disposal without specifying the scope of fund use, and does not explicitly restrict issuance by non-environmentally friendly companies. In return, SLB issuers commit to achieving specific environmental or social goals, along with specific financial conditions for achieving those commitments.

Fundamentally, an SLB contains ‘what’, ‘how much’ and ‘by when’ the issuing company will achieve, along with specific details about how it will take liability for failure to attain the goal. SBL issuers establish a key performance index (KPI) and commit to achieving an appropriate level of Sustainable Performance Target (SPT) based on the pre-determined KPI. On top of that, they should specify a target date for achieving the SPT and financial incentives regarding the SPT attainment in SLB issuance documents.

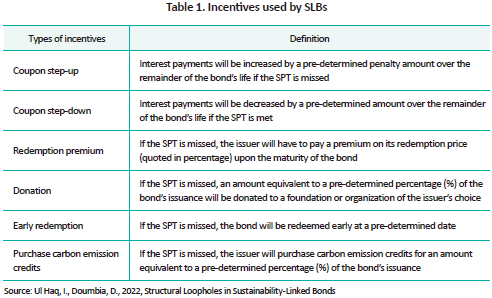

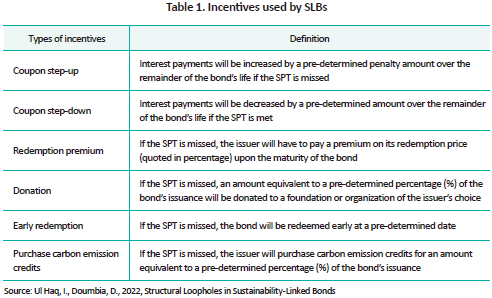

Out of SLBs issued in the global market between 2019 and 2022, more than 95% have the objective of improving the environment. The widely adopted KPI is the amount of carbon emissions, and the common SPT outlines how much the issuing company will reduce carbon emissions compared to a baseline year and before the maturity of the SLB. For example, a company may establish a goal of cutting its carbon emissions by 20% by 2025, compared to the 2020 level. The target date for achieving the SPT is usually set closer to the bond maturity date. SLBs use various types of incentives (Table 1). Among them, the most typical incentive is the coupon step-up, a pre-determined increase in the coupon rate from the target date to the maturity date which comes into effect if the SPT is not achieved.

Hyundai Capital’s SLB issuance

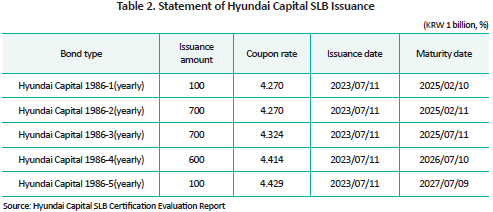

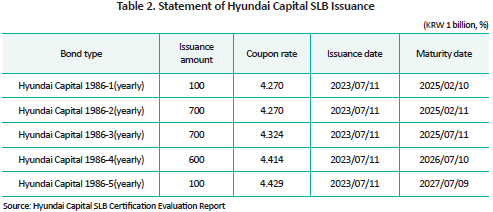

To better understand SLBs, it is worth examining the structure of the SLB issued by Hyundai Capital. As part of its ESG strategy, Hyundai Capital issued a total of five SLBs worth KRW 220 billion in July 2023, with maturities ranging from 1.6 years to 5 years (Table 2). The goal stated in the SLB review document is for Hyundai Capital to expand the proportion of installment financing for electric cars.

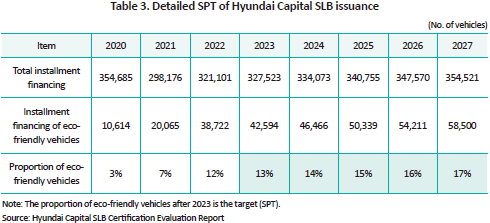

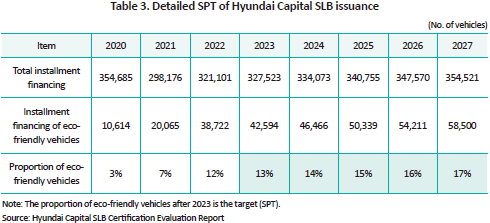

The KPI used by Hyundai Capital is the proportion of eco-friendly vehicles such as electric vehicles (EVs) out of total auto loans, based on the number of cars. The SPT is set at an annual 1% increase in the proportion of eco-friendly vehicle installment financing between 2023 and 2027. The proportion of eco-friendly vehicle installment financing reached as high as 12% as of 2022, and Hyundai Capital aims to raise the proportion to 17% by 2027 (Table 3). The target date for achieving the SPT is specified as December 31 each year.

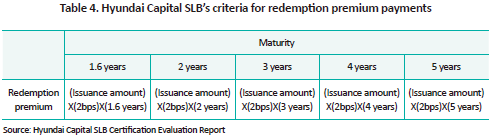

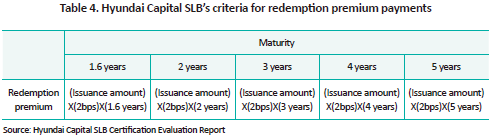

Hyundai Capital uses an incentive in the form of a redemption premium. If the issuer fails to achieve the SPT at the end of the business year immediately before the redemption date of the SLB, it will calculate the premium by multiplying 0.02% of the bond’s issuance amount by the remaining time to maturity. The premium will be paid in cash on the redemption date based on the bond holding ratio of the final bondholders (Table 4).

The case of Hyundai Capital’s SLB issuance highlights the advantages of SLBs. As explained, the company will take a wide range of measures to achieve the SPT, including active cooperation with Hyundai Motor Group, expansion of the sale of eco-friendly car financing products, establishment of an EV business unit, development of leasing products for batteries, development of financial instruments for battery manufacturers and EV charging stations. It may be challenging to incorporate these activities into a single eligible project or evaluate the impact of funds invested in each activity separately, making it difficult to issue green bonds. On the other hand, SLBs only focus on the SPT achievement, regardless of the purpose of fund utilization, allowing companies to pursue a wide range of ESG strategies.

In addition, the complexity of the SLB structure is well demonstrated by the SLB issuance by Hyundai Capital. First, there must be a significant reduction in financing costs for Hyundai Capital to issue SLBs. These cost savings are determined based on the market’s green premium, but the level of the premium is difficult to estimate. In particular, it is widely believed that the green premium is not sufficient in the Korean market. Second, another problem lies in setting and evaluating SPT levels. The International Capital Markets Association (ICMA), which establishes the criteria for SLBs, specifies that issuing companies should establish “ambitious” SPTs that require efforts beyond business-as-usual. Considering this, the 1% annual increase in the share of eco-friendly car financing products, as proposed by Hyundai Capital, should at least exceed the natural growth rate of domestic green vehicle sales. However, it is challenging to gauge what is an ambitious SPT beyond these criteria. Third, it is also difficult to set and evaluate incentives. If Hyundai Capital keeps the redemption premium too low, investment demand for SLBs will decrease, thereby curtailing the green premium. Conversely, if the redemption premium is set too high, the company would bear a higher risk burden and be less motivated to issue SLBs. As such, the levels of the green premium, the SPT and incentives are closely associated, which underscores the difficulty in designing SLBs.

Challenges for invigorating Korea’s SLB market

Since its introduction in 2022, there has been no SLB issuance for a considerable time in Korea, which raises concerns in the market. Against this backdrop, it is welcoming news that the first domestic SLB has been finally issued. However, there are significant challenges to be addressed for the SLB market to be well established in Korea. Despite inconveniences in the use of funds, conventional ESG bonds have better defined criteria for eligible projects, such as the green taxonomy, and a great deal of issuance records that have contributed to the establishment of market benchmarks. On the other hand, SLBs require data, benchmarks and evaluation methodologies for setting and assessing KPIs and SPTs, which currently are lacking in Korea. These issues will be gradually resolved once a growing number of companies participate in the SLB market, leading to the accumulation of relevant data and the formation of benchmarks. It is hoped that such a virtuous cycle of growth of the Korean SLB market will soon come to fruition.

1) In January 2023, SK Hynix became the first Korean company to issue $1 billion worth of SLBs in the international market.

Structure and characteristics of SLBs

One of the features of conventional ESG bonds is that they limit the use of raised funds to eligible projects. This mechanism is designed to prevent ESG-washing, but it also has the drawback of restricting market participation by private companies. Limited utilization of raised funds and the absence of eligible projects discourage companies from issuing ESG bonds. Furthermore, green bond issuance by non-environmentally friendly companies is considered to defeat the original purpose of green bonds, which makes it difficult for those firms to obtain certification.

SLBs were developed with the recognition that greater market participation is needed to tackle material environmental and social issues faced by humanity, such as climate change. SLBs allow companies to use raised funds at their disposal without specifying the scope of fund use, and does not explicitly restrict issuance by non-environmentally friendly companies. In return, SLB issuers commit to achieving specific environmental or social goals, along with specific financial conditions for achieving those commitments.

Fundamentally, an SLB contains ‘what’, ‘how much’ and ‘by when’ the issuing company will achieve, along with specific details about how it will take liability for failure to attain the goal. SBL issuers establish a key performance index (KPI) and commit to achieving an appropriate level of Sustainable Performance Target (SPT) based on the pre-determined KPI. On top of that, they should specify a target date for achieving the SPT and financial incentives regarding the SPT attainment in SLB issuance documents.

Out of SLBs issued in the global market between 2019 and 2022, more than 95% have the objective of improving the environment. The widely adopted KPI is the amount of carbon emissions, and the common SPT outlines how much the issuing company will reduce carbon emissions compared to a baseline year and before the maturity of the SLB. For example, a company may establish a goal of cutting its carbon emissions by 20% by 2025, compared to the 2020 level. The target date for achieving the SPT is usually set closer to the bond maturity date. SLBs use various types of incentives (Table 1). Among them, the most typical incentive is the coupon step-up, a pre-determined increase in the coupon rate from the target date to the maturity date which comes into effect if the SPT is not achieved.

Hyundai Capital’s SLB issuance

To better understand SLBs, it is worth examining the structure of the SLB issued by Hyundai Capital. As part of its ESG strategy, Hyundai Capital issued a total of five SLBs worth KRW 220 billion in July 2023, with maturities ranging from 1.6 years to 5 years (Table 2). The goal stated in the SLB review document is for Hyundai Capital to expand the proportion of installment financing for electric cars.

The KPI used by Hyundai Capital is the proportion of eco-friendly vehicles such as electric vehicles (EVs) out of total auto loans, based on the number of cars. The SPT is set at an annual 1% increase in the proportion of eco-friendly vehicle installment financing between 2023 and 2027. The proportion of eco-friendly vehicle installment financing reached as high as 12% as of 2022, and Hyundai Capital aims to raise the proportion to 17% by 2027 (Table 3). The target date for achieving the SPT is specified as December 31 each year.

Hyundai Capital uses an incentive in the form of a redemption premium. If the issuer fails to achieve the SPT at the end of the business year immediately before the redemption date of the SLB, it will calculate the premium by multiplying 0.02% of the bond’s issuance amount by the remaining time to maturity. The premium will be paid in cash on the redemption date based on the bond holding ratio of the final bondholders (Table 4).

The case of Hyundai Capital’s SLB issuance highlights the advantages of SLBs. As explained, the company will take a wide range of measures to achieve the SPT, including active cooperation with Hyundai Motor Group, expansion of the sale of eco-friendly car financing products, establishment of an EV business unit, development of leasing products for batteries, development of financial instruments for battery manufacturers and EV charging stations. It may be challenging to incorporate these activities into a single eligible project or evaluate the impact of funds invested in each activity separately, making it difficult to issue green bonds. On the other hand, SLBs only focus on the SPT achievement, regardless of the purpose of fund utilization, allowing companies to pursue a wide range of ESG strategies.

In addition, the complexity of the SLB structure is well demonstrated by the SLB issuance by Hyundai Capital. First, there must be a significant reduction in financing costs for Hyundai Capital to issue SLBs. These cost savings are determined based on the market’s green premium, but the level of the premium is difficult to estimate. In particular, it is widely believed that the green premium is not sufficient in the Korean market. Second, another problem lies in setting and evaluating SPT levels. The International Capital Markets Association (ICMA), which establishes the criteria for SLBs, specifies that issuing companies should establish “ambitious” SPTs that require efforts beyond business-as-usual. Considering this, the 1% annual increase in the share of eco-friendly car financing products, as proposed by Hyundai Capital, should at least exceed the natural growth rate of domestic green vehicle sales. However, it is challenging to gauge what is an ambitious SPT beyond these criteria. Third, it is also difficult to set and evaluate incentives. If Hyundai Capital keeps the redemption premium too low, investment demand for SLBs will decrease, thereby curtailing the green premium. Conversely, if the redemption premium is set too high, the company would bear a higher risk burden and be less motivated to issue SLBs. As such, the levels of the green premium, the SPT and incentives are closely associated, which underscores the difficulty in designing SLBs.

Challenges for invigorating Korea’s SLB market

Since its introduction in 2022, there has been no SLB issuance for a considerable time in Korea, which raises concerns in the market. Against this backdrop, it is welcoming news that the first domestic SLB has been finally issued. However, there are significant challenges to be addressed for the SLB market to be well established in Korea. Despite inconveniences in the use of funds, conventional ESG bonds have better defined criteria for eligible projects, such as the green taxonomy, and a great deal of issuance records that have contributed to the establishment of market benchmarks. On the other hand, SLBs require data, benchmarks and evaluation methodologies for setting and assessing KPIs and SPTs, which currently are lacking in Korea. These issues will be gradually resolved once a growing number of companies participate in the SLB market, leading to the accumulation of relevant data and the formation of benchmarks. It is hoped that such a virtuous cycle of growth of the Korean SLB market will soon come to fruition.

1) In January 2023, SK Hynix became the first Korean company to issue $1 billion worth of SLBs in the international market.