OPINION

2023 Jul/25

Tasks to Improve Competitiveness of the Publicly Offered Fund Market

Jul. 25, 2023

PDF

- Summary

- There are two problems at the core of the stagnant market for publicly offered funds. First, the market lacks competitiveness especially in the area of active equity funds. Second, it has no high-quality alternative investment funds. Although retail investors prefer passive management, equity ETFs in particular, active management has clear advantages, such as diversified risk-return profiles, and flexible adaptation to changes in the market environment. Active management is important for enhancing the long-term competitiveness of asset management companies as it improves their capabilities for designing products and management strategies. Hence, it is essential for AMCs to use proactive effort and investment in order to achieve the management target of active, publicly offered funds in a stable manner. For more convenient transactions of publicly offered funds, it is worth considering listing beneficiary certificates. Without the adequate supply of quality AI funds, it is hard to expect stable asset management for retail investors seeking portfolio diversification. Toward that direction, it is advisable to come up with policy incentives that encourage asset managers to design and supply AI funds in the publicly offered fund market. Also recommended is to induce institutional investors to invest more in publicly offered AI funds for growing fund sizes. AMCs should make utmost effort for increasing their principal investment seeking to secure competitiveness in the market.

There has been a slowdown in the publicly offered fund market that provides effective portfolio diversification to small individual investors. Despite persistent institutional improvements such as wider fund distribution channels, better fee schemes, comparative disclosure, and more competition among asset managers, there have been no major shifts in the market trend. Accordingly, the government is currently considering additional institutional reforms to enhance the competitiveness of publicly offered funds. This article first tries to examine the current state of the market and to analyze the characteristics, based on which to offer a glimpse of what lies at the core of the problem. Furthermore, I discuss the overall direction of future tasks necessary for enhancing market competitiveness.

Changes in the asset management market, and slowed growth in publicly offered funds1)

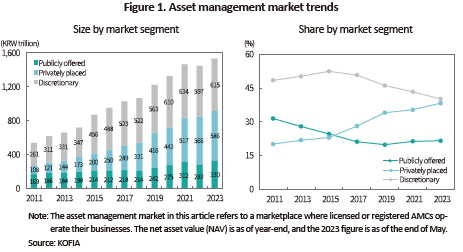

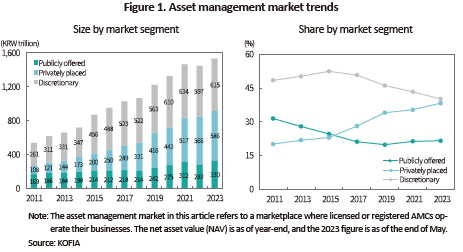

The publicly offered fund market that is mostly invested in by small individual investors is lagging behind the pace of growth in other market segments such as private equity and discretionary investment dominated by professional and institutional investors. Between 2011 and 2023, the publicly offered fund market grew 1.9 times while the markets for private equity and discretionary investments expanded 5.4-fold and 2.4-fold, respectively. The steep growth in both markets were presumably affected by major market trends: Increased assets under management of pension funds including the National Pension Fund; increased AUM of institutional investors such as discretionary management of ultra-long-term insurance assets; and the government’s policy to nurture the private equity market–a move kickstarted in the mid 2010s. As the customer base in the market shifted towards institutional investors, the share of publicly offered funds in the asset management market shrank to 21.6% at the end of May 2023 from 31.4% at the end of 2011.

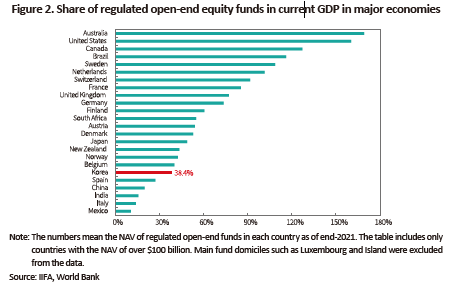

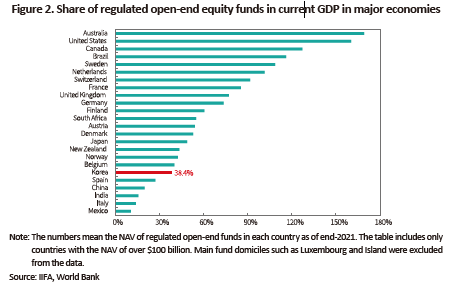

The need for enhancing publicly offered fund competitiveness has been raised persistently because investors do not prefer publicly offered funds anymore despite the favorable market environment shaped by the rapid growth in retirement assets, introduction of ISAs, more tax benefits for pension accounts, and other regulatory improvements. Institutionalization of the asset management market is not a problem unique to Korea, but most developed countries have a publicly offered fund market much larger than that of Korea. According to the International Investment Funds Association, Korea’s open-end fund market amounted to 38.4% of its GDP, ranked 6th from the bottom among 24 nations that have a market of over $100 billion as of end-2021.2) Different market sizes across countries are determined by various factors such as development of equity, debt, and other capital markets, confidence of regulatory and supervisory frameworks, financial systems (centering on banks or capital markets), competitive structures of the financial industry, and the size of pension funds. Hence, there could be complicated reasons why Korea’s publicly offered fund market is relatively small compared to its economic scale. However, investors do not prefer publicly offered funds despite several market improvement efforts as mentioned above, and it is hard to deny that this is because the market itself is less competitive.

Changes in publicly offered fund market, and the core of the problem

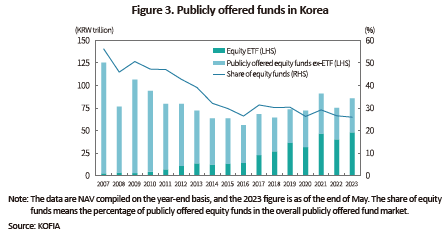

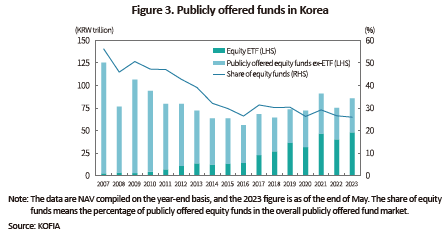

With regard to the recent changes, the most distinctive feature in the mutual fund market is the declining size and product composition. In the past, equity funds used to be the central part of the market. In 2007, right before the global financial crisis, equity funds amounted to KRW 125 trillion in NAV, or 45% of the publicly offered fund market. However, their NAV and share in the market shrank significantly. In particular, ETFs among publicly offered equity funds are growing rapidly while other types of publicly offered equity funds plummeted to around KRW 38 trillion. That accordingly put ETFs at the mainstream of the market.

ETFs have gained popularity as an indirect investment vehicle due to their transaction convenience, low cost, regulatory framework similar to that of publicly offered funds, which is an international phenomenon and thus understandable.3) However, the abrupt decline in non-ETF publicly offered funds is particularly severe in Korea. The reasons behind this could be as follows. First, most publicly offered equity funds are active funds most of which fail to create excessive returns as known as alpha and thus lose investor appetite. Also, the higher investment cost of active funds than passive funds including ETFs is likely to lower active funds’investment performance.4)

Second, transaction convenience of publicly offered equity funds is significantly undermined due to several issues such as sales channels. Because ETFs are listed, investors can easily find and trade them on any stock trading platform. On the other hand, it is impossible to access all equity funds on a single platform because each distribution channel sells a different set of products. Also, fund transactions need a longer time span as compared to ETFs. In this respect, it is highly likely that publicly offered equity funds are shunned by younger investors with higher risk appetite and mobile literacy.

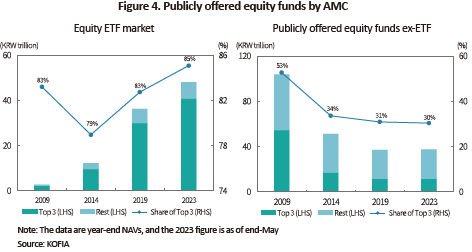

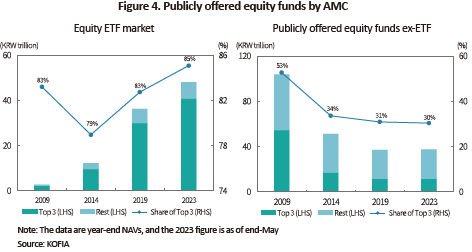

Third, AMCs’ new business strategies could have reshaped the market structure. It is hard to rule out the possibility that the trend changes mentioned above predisposed AMCs to realize the low competitiveness of publicly offered equity funds–especially active funds–and thus to shift their production, marketing, and management capabilities towards ETFs. The data also confirm that the abrupt decline in publicly offered equity funds and the sudden surge in equity ETFs have been primarily driven by large-scale AMCs that once led Korea’s equity fund market. However, given that those large players are losing their share in the market where they once secured dominance, it appears hard to explain the contraction in the market for publicly offered equity funds solely based on slow demand. Some may view that as part of overheated competition, but this seems unlikely when looking at large players are earning more market share in the equity ETF market.

The contraction in publicly offered equity funds, particularly active funds, could impose a negative impact on AMCs and investors. AMCs' long-term competitiveness stems from their capabilities for generating excess returns by combining various resources such as innovative product design, strong analytic capabilities, superb investment management strategies, and skilled professionals. Currently, passive funds account for a large part of equity ETFs in Korea. Although there are some ETFs claiming to be actively managed, they are not actually viewed as active funds due to the current regulation that requires those funds to track indexes to a certain extent. Among equity ETFs whose NAV amounts to KRW 4.8 billion as of end-May 2023, about 27% or KRW 13 trillion invest overseas, and most of them have a similar structure to well-known overseas ETFs. Hence, a contraction in conventional active equity funds could adversely affect AMCs’ long-term capabilities. The contraction in active equity funds could possibly have a negative impact on AMCs' business profitability, which may intensify their marketing competition to win more AUM from ETFs. This poses further challenges for small-scale AMCs.

If passive funds appeal to investors, deteriorated competitiveness of active equity funds may not be a problem. However, this leads to a reduced product selection for investors who prefer active funds. Although more and more investors prefer passive management, there are investors who prefer active funds that have distinct advantages such as diverse risk-return profiles and the ability to adapt to market environment changes. The market's shift towards equity ETFs also raises concerns that those products’ transaction convenience may lead to short-termism in investment and thus dilute the long-term nature of indirect investment.

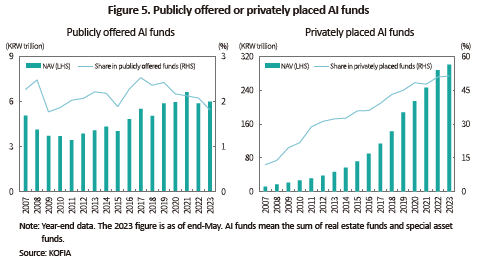

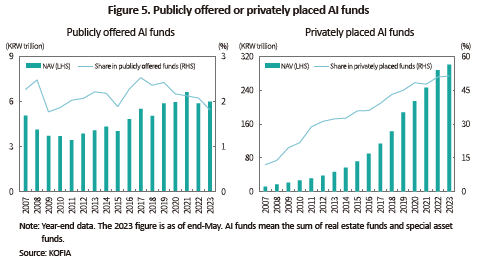

The second characteristics worth considering in the publicly offered fund market is the lack of activity in the AI fund market despite the government’s efforts and aspirations. This means the lack of progress in diversifying underlying assets of publicly offered funds. Before the policy rate hike became a global trend, interest rates had remained low, and as a result, AI assets such as real estate and other special assets had performed well. Accordingly, small individual investors in the publicly offered fund market were expected to increase their exposure to AI for portfolio diversification. However, publicly offered AI funds currently amount to KRW 6 trillion in NAV, garnering less than 2% market share in the overall publicly offered fund market. There is no upward trend over time. By contrast, privately placed AI funds have grown exponentially. As of the end of May 2023, they surged to KRW 301 trillion in NAV, which took up more than a half (51.3%) in the overall private equity market.

Privately placed AI funds are primarily invested by institutional investors and professional investors. However, it is estimated that a significant portion has been ordinary retail investors. But it is hard for individual investors with small assets to invest in privately placed funds that require a minimum investment level.5) Retail investors who want to invest in real estate indirectly may opt for REITs, which differ from publicly offered real estate funds in terms of the content and entities of regulation. They may either subscribe to public offering of listed REITs, or directly buy REITs shares via the secondary market. However, the REITs market is still insignificant, and some argue that REITs are hardly viewed as indirect investment.

In the end, it is the publicly offered fund market that enables retail investors to indirectly invest in AI assets that have large demand. Then, why is this segment of market not growing further? This is due to the innate nature of the asset and the market: AI assets’ low liquidity, and the publicly offered fund market's safety measures for investor protection. Because real estate and special asset funds mostly invest in illiquid assets, even publicly offered funds often take the closed-end form with limited redemption arrangements.6) Hence, it is hard to expect small individual investors in need for cash frequently to invest in publicly offered AI funds that usually come with limited redemption arrangements. It is quite natural that AMCs also prefer establishing and managing privately placed AI funds that come with higher flexibility.7) Moreover, institutional investors including pension funds also prefer privately placed funds that ensure easy and fast establishment along with flexible design and management.

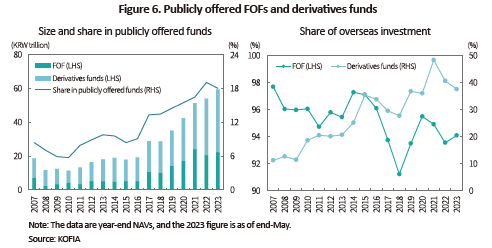

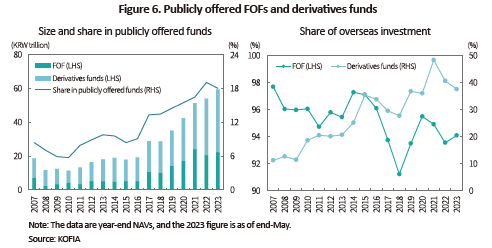

Due to those limitations, publicly placed AI funds were not actively used by small individual investors for portfolio diversification. This triggered an abrupt surge in demand for two types of publicly placed funds–funds of funds, and derivatives funds. As of end-May 2023, those two types of funds amounted to KRW 59 trillion in NAV or 18% of the overall publicly offered fund market. The pace of their growth is also quite rapid. The growth of FOFs has been accelerating since the introduction of publicly offered FOFs whose sub-funds are private equity. Another factor affecting this trend is that AMCs without expertise in overseas investment and unique investment strategies focused more on the sales of FOFs whose sub-funds are products of proven global players.

Given the limitations of publicly placed AI funds, the increased sales of FOFs and derivatives funds in the publicly offered fund market is somewhat unavoidable. However, due to some problems, portfolio diversification for individual investors via FOFs and derivatives funds cannot be a fundamental solution for long-term competitiveness of publicly offered funds. Among others, FOF fees include the fees of their sub-funds and thus are likely to be higher than those of ordinary funds. Also, long-term evaluation is required for AMCs’ ability to select sub-funds. If domestic AMCs merely focus on selecting products of proven global players instead of building expertise in directly investing in overseas assets and devising their own strategies, this could be useless for their long-term competitiveness. Currently, more than 90% of FOF NAV is overseas investment, most of which is from fund products of global AMCs with proven track records. Derivatives funds also have negative effects such as higher exposure to risky investment via leverage and inverse features, despite positive aspects such as hedging.

Tasks to improve competitiveness of the publicly offered fund market

What’s important for enhancing the competitiveness of Korea’s publicly offered fund market is to expand the supply of AI funds investing in diverse assets while making equity funds–especially active ones–more appealing.

Product competitiveness of active equity funds could be determined by actual investment performance after deducting the cost of investment. Towards performance improvement, AMCs must double their effort and investment in bolstering their research including corporate analysis and stock valuation, re-securing talents leaving for private equity, improving their capabilities for designing products and investment strategies. In particular, large-scale AMCs have a leading role to play in leveraging economies of scale for securing competitiveness of active funds.

Another important policy challenge is to enhance transaction convenience of active equity funds. The recently raised idea of listing publicly offered funds on exchanges can be a solution, but this requires a more thorough review in terms of effectiveness because beneficiary certificates already listed exposed some issues such as thin trading volume, deviation between the NAV and the trading price. In addition, it is wise to promote the fund supermarket, a mobile fund distribution platform where most AMCs sell their funds. Making the platform more use-friendly would be of help to attract more investors. Fund supermarkets are an excellent platform that enables investors to compare and select a wide array of fund products at lower distribution fees. In line with that, it is important to make continuous effort to develop more intuitive ways to help investors select quality funds.

Apart from the efforts to improve product competitiveness of active equity funds, it is now time to revisit the adequacy of management regulation over active ETFs. The current regulation requires active ETFs to keep their correlation coefficient with underlying indices of 0.7 or higher, which is regarded as harsh enough to discourage active management. As this market segment is highly favored by individual investors, it is necessary to relax the requirement and thus create a ripe condition for quality active ETFs. This could help improve AMCs’ active management capabilities.

Furthermore, it is critical to supply many quality AI funds in the publicly offered fund market, which requires combined efforts from policymakers and AMCs. With regard to publicly offered AI funds, an incentive scheme is needed for AMCs that are the prime supplier establishing and managing funds. Although all-out deregulation is hard to expect, it is worth considering some minor-level reforms such as making changes on investment management rules for buying and selling real assets, and remuneration schemes. The critical part of AI funds is to select investment assets such as real estate and special assets. It is hard to secure quality investment targets unless the fund size is sufficiently large. Under the current market conditions, it is not easy to increase the size of publicly offered funds solely based on retail investors. Hence, institutional investors need to step into the market. Also worth considering could be tax benefits for publicly offered AI funds. Furthermore, AMCs that establish funds need to scale up their size to for engaging in principal investment. Lastly, it is advisable to facilitate trading of closed-end, publicly-offered AI funds that were listed.

1) For convenience, the asset management market in this article refers limitedly to the marketplace where licensed or registered AMCs operate their businesses.

2) In general, regulated open-end funds are viewed overseas as funds invested by individual investors.

3) According to the Investment Company Institute, equity mutual funds in the US increased 2.3-fold in NAV from 2007 to 2021. During the same period, equity mutual funds grew only 39.3% annually while the NAV of equity ETFs ballooned 10.6 times. The euro area exhibits the similar pattern. Growth is very fast especially among equity ETFs. However, still, non-ETF equity funds known as equity UCITS represent the mainstream (ICI, 2022 Investment Company Fact Book; EFAMA, Fact Book 2022).

4) Changha Kim, Jaeram Lee, and Changjun Lee (2020, Mutual fund performance and stock market anomalies, Journal of Korean Securities Association, 49(1): 41-72); Yeonjeong Ha (2014, Equity fund fees and performance, Journal of Business Research, 29(4), 289-308)

5) The minimum investment required to invest in privately placed funds was KRW 100 million or more before 2021, but has been raised to KRW 3 million or more since 2021.

6) Of course, closed-end, publicly-offered funds are mandated to be listed on an exchange. Still, however, their small trading volume is prone to a large deviation between their NAV and the actual market price.

7) Under the Financial Investment Services and Capital Markets Act, privately placed funds are excluded from quite a few requirements to which publicly placed funds are subject to, such as restrictions on investment management, immediate disclosure, reporting on collective investment assets, supervision on investment management activities, etc.

Changes in the asset management market, and slowed growth in publicly offered funds1)

The publicly offered fund market that is mostly invested in by small individual investors is lagging behind the pace of growth in other market segments such as private equity and discretionary investment dominated by professional and institutional investors. Between 2011 and 2023, the publicly offered fund market grew 1.9 times while the markets for private equity and discretionary investments expanded 5.4-fold and 2.4-fold, respectively. The steep growth in both markets were presumably affected by major market trends: Increased assets under management of pension funds including the National Pension Fund; increased AUM of institutional investors such as discretionary management of ultra-long-term insurance assets; and the government’s policy to nurture the private equity market–a move kickstarted in the mid 2010s. As the customer base in the market shifted towards institutional investors, the share of publicly offered funds in the asset management market shrank to 21.6% at the end of May 2023 from 31.4% at the end of 2011.

With regard to the recent changes, the most distinctive feature in the mutual fund market is the declining size and product composition. In the past, equity funds used to be the central part of the market. In 2007, right before the global financial crisis, equity funds amounted to KRW 125 trillion in NAV, or 45% of the publicly offered fund market. However, their NAV and share in the market shrank significantly. In particular, ETFs among publicly offered equity funds are growing rapidly while other types of publicly offered equity funds plummeted to around KRW 38 trillion. That accordingly put ETFs at the mainstream of the market.

Second, transaction convenience of publicly offered equity funds is significantly undermined due to several issues such as sales channels. Because ETFs are listed, investors can easily find and trade them on any stock trading platform. On the other hand, it is impossible to access all equity funds on a single platform because each distribution channel sells a different set of products. Also, fund transactions need a longer time span as compared to ETFs. In this respect, it is highly likely that publicly offered equity funds are shunned by younger investors with higher risk appetite and mobile literacy.

Third, AMCs’ new business strategies could have reshaped the market structure. It is hard to rule out the possibility that the trend changes mentioned above predisposed AMCs to realize the low competitiveness of publicly offered equity funds–especially active funds–and thus to shift their production, marketing, and management capabilities towards ETFs. The data also confirm that the abrupt decline in publicly offered equity funds and the sudden surge in equity ETFs have been primarily driven by large-scale AMCs that once led Korea’s equity fund market. However, given that those large players are losing their share in the market where they once secured dominance, it appears hard to explain the contraction in the market for publicly offered equity funds solely based on slow demand. Some may view that as part of overheated competition, but this seems unlikely when looking at large players are earning more market share in the equity ETF market.

If passive funds appeal to investors, deteriorated competitiveness of active equity funds may not be a problem. However, this leads to a reduced product selection for investors who prefer active funds. Although more and more investors prefer passive management, there are investors who prefer active funds that have distinct advantages such as diverse risk-return profiles and the ability to adapt to market environment changes. The market's shift towards equity ETFs also raises concerns that those products’ transaction convenience may lead to short-termism in investment and thus dilute the long-term nature of indirect investment.

The second characteristics worth considering in the publicly offered fund market is the lack of activity in the AI fund market despite the government’s efforts and aspirations. This means the lack of progress in diversifying underlying assets of publicly offered funds. Before the policy rate hike became a global trend, interest rates had remained low, and as a result, AI assets such as real estate and other special assets had performed well. Accordingly, small individual investors in the publicly offered fund market were expected to increase their exposure to AI for portfolio diversification. However, publicly offered AI funds currently amount to KRW 6 trillion in NAV, garnering less than 2% market share in the overall publicly offered fund market. There is no upward trend over time. By contrast, privately placed AI funds have grown exponentially. As of the end of May 2023, they surged to KRW 301 trillion in NAV, which took up more than a half (51.3%) in the overall private equity market.

In the end, it is the publicly offered fund market that enables retail investors to indirectly invest in AI assets that have large demand. Then, why is this segment of market not growing further? This is due to the innate nature of the asset and the market: AI assets’ low liquidity, and the publicly offered fund market's safety measures for investor protection. Because real estate and special asset funds mostly invest in illiquid assets, even publicly offered funds often take the closed-end form with limited redemption arrangements.6) Hence, it is hard to expect small individual investors in need for cash frequently to invest in publicly offered AI funds that usually come with limited redemption arrangements. It is quite natural that AMCs also prefer establishing and managing privately placed AI funds that come with higher flexibility.7) Moreover, institutional investors including pension funds also prefer privately placed funds that ensure easy and fast establishment along with flexible design and management.

Due to those limitations, publicly placed AI funds were not actively used by small individual investors for portfolio diversification. This triggered an abrupt surge in demand for two types of publicly placed funds–funds of funds, and derivatives funds. As of end-May 2023, those two types of funds amounted to KRW 59 trillion in NAV or 18% of the overall publicly offered fund market. The pace of their growth is also quite rapid. The growth of FOFs has been accelerating since the introduction of publicly offered FOFs whose sub-funds are private equity. Another factor affecting this trend is that AMCs without expertise in overseas investment and unique investment strategies focused more on the sales of FOFs whose sub-funds are products of proven global players.

Tasks to improve competitiveness of the publicly offered fund market

What’s important for enhancing the competitiveness of Korea’s publicly offered fund market is to expand the supply of AI funds investing in diverse assets while making equity funds–especially active ones–more appealing.

Product competitiveness of active equity funds could be determined by actual investment performance after deducting the cost of investment. Towards performance improvement, AMCs must double their effort and investment in bolstering their research including corporate analysis and stock valuation, re-securing talents leaving for private equity, improving their capabilities for designing products and investment strategies. In particular, large-scale AMCs have a leading role to play in leveraging economies of scale for securing competitiveness of active funds.

Another important policy challenge is to enhance transaction convenience of active equity funds. The recently raised idea of listing publicly offered funds on exchanges can be a solution, but this requires a more thorough review in terms of effectiveness because beneficiary certificates already listed exposed some issues such as thin trading volume, deviation between the NAV and the trading price. In addition, it is wise to promote the fund supermarket, a mobile fund distribution platform where most AMCs sell their funds. Making the platform more use-friendly would be of help to attract more investors. Fund supermarkets are an excellent platform that enables investors to compare and select a wide array of fund products at lower distribution fees. In line with that, it is important to make continuous effort to develop more intuitive ways to help investors select quality funds.

Apart from the efforts to improve product competitiveness of active equity funds, it is now time to revisit the adequacy of management regulation over active ETFs. The current regulation requires active ETFs to keep their correlation coefficient with underlying indices of 0.7 or higher, which is regarded as harsh enough to discourage active management. As this market segment is highly favored by individual investors, it is necessary to relax the requirement and thus create a ripe condition for quality active ETFs. This could help improve AMCs’ active management capabilities.

Furthermore, it is critical to supply many quality AI funds in the publicly offered fund market, which requires combined efforts from policymakers and AMCs. With regard to publicly offered AI funds, an incentive scheme is needed for AMCs that are the prime supplier establishing and managing funds. Although all-out deregulation is hard to expect, it is worth considering some minor-level reforms such as making changes on investment management rules for buying and selling real assets, and remuneration schemes. The critical part of AI funds is to select investment assets such as real estate and special assets. It is hard to secure quality investment targets unless the fund size is sufficiently large. Under the current market conditions, it is not easy to increase the size of publicly offered funds solely based on retail investors. Hence, institutional investors need to step into the market. Also worth considering could be tax benefits for publicly offered AI funds. Furthermore, AMCs that establish funds need to scale up their size to for engaging in principal investment. Lastly, it is advisable to facilitate trading of closed-end, publicly-offered AI funds that were listed.

1) For convenience, the asset management market in this article refers limitedly to the marketplace where licensed or registered AMCs operate their businesses.

2) In general, regulated open-end funds are viewed overseas as funds invested by individual investors.

3) According to the Investment Company Institute, equity mutual funds in the US increased 2.3-fold in NAV from 2007 to 2021. During the same period, equity mutual funds grew only 39.3% annually while the NAV of equity ETFs ballooned 10.6 times. The euro area exhibits the similar pattern. Growth is very fast especially among equity ETFs. However, still, non-ETF equity funds known as equity UCITS represent the mainstream (ICI, 2022 Investment Company Fact Book; EFAMA, Fact Book 2022).

4) Changha Kim, Jaeram Lee, and Changjun Lee (2020, Mutual fund performance and stock market anomalies, Journal of Korean Securities Association, 49(1): 41-72); Yeonjeong Ha (2014, Equity fund fees and performance, Journal of Business Research, 29(4), 289-308)

5) The minimum investment required to invest in privately placed funds was KRW 100 million or more before 2021, but has been raised to KRW 3 million or more since 2021.

6) Of course, closed-end, publicly-offered funds are mandated to be listed on an exchange. Still, however, their small trading volume is prone to a large deviation between their NAV and the actual market price.

7) Under the Financial Investment Services and Capital Markets Act, privately placed funds are excluded from quite a few requirements to which publicly placed funds are subject to, such as restrictions on investment management, immediate disclosure, reporting on collective investment assets, supervision on investment management activities, etc.