OPINION

2024 Jan/30

Challenges for Increasing the Enrollment Rate of Tax-Advantaged Accounts

Jan. 30, 2024

PDF

- Summary

- Many countries operate voluntary tax-advantaged accounts because limitations in public pension schemes make it indispensable for individuals to willingly accumulate retirement assets. Starting with pension savings accounts that have undergone several changes since their introduction in 1994, tax-advantaged accounts, including more recently adopted ones such as individual retirement pensions (IRPs) and individual savings accounts (ISAs), have been operating in Korea. Despite the growing importance of tax-advantaged accounts, as evidenced by a surge in contributions over the past decade, their enrollment rate remains moderate. Considering the significance of tax-advantaged accounts, active measures are necessary to boost the enrollment rate. One strategy to facilitate the enrollment of tax-advantaged accounts involves raising the currently insufficient level of tax benefits. Since 2014, tax benefits for pension accounts, including pension savings accounts and IRPs, have transitioned to a tax credit system that has been criticized for lowering enrollment rates across all income levels, contrary to expectations. Therefore, it may be worth considering reverting to tax deductions for pension accounts. To improve the enrollment rate among low-income groups, it seems more effective for the government to provide a direct matching contribution for individual contributions to pension accounts. The enrollment rate among individuals in their 20s lags behind that of ISAs. To encourage account enrollment of younger generations, it is necessary to broaden the scope of eligible financial assets and partially ease restrictions on early withdrawal. On top of that, financial institutions should offer personalized asset management services that align with the long-term savings nature of tax-advantaged accounts.

A tax-advantaged account refers to a savings account that incorporates various financial products and provides tax benefits under specific conditions. Representative tax-advantaged accounts currently in operation in Korea include pension savings accounts, individual retirement pensions (IRPs), and individual savings accounts (ISAs). This article delves into the features of the enrollment rate of tax-advantaged accounts in Korea and explores the challenges for raising the account enrollment rate.

Overview of tax-advantaged accounts and contribution status

Most OECD countries operate savings accounts that provide direct or indirect incentives.1) These incentives are categorized into indirect support through tax benefits and direct support involving matching contributions from the government. The widespread adoption of government-operated tax-advantaged accounts can be attributed to population aging that presents a challenge for individuals to accumulate sufficient retirement assets relying solely on public pension plans. Accordingly, there is a pressing need to boost voluntary savings by offering incentives.

Among the tax-advantaged accounts currently available in Korea, pension savings accounts and IRPs fall under the category of pension accounts, where tax benefits and savings limits are managed through the integrated system.2) Key tax benefits include partial tax credits on the savings amount and taxation deferral on investment returns from accounts. Upon withdrawal in the form of an annuity, the savings amount is subject to low-rate taxation, while regular tax rates are applied to early withdrawals from the tax-advantaged amount, indicating inflexibility in premature withdrawals. The nature of pension accounts imposes constraints on the inclusion of certain high-risk assets. Unlike pension accounts, ISAs offer relatively modest tax benefits but are eligible for a wide range of products and provide better liquidity with shorter maturities. In addition, if transferred to a pension account upon maturity, the deposits in ISAs are subject to tax deductions, giving account holders more flexibility in managing accounts.

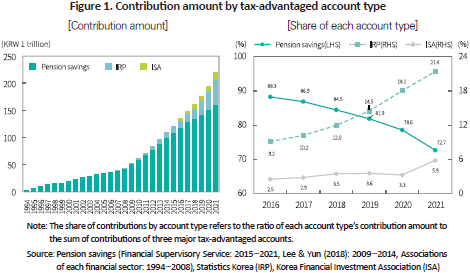

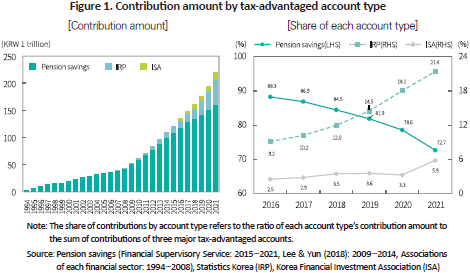

The aggregate contributions to the major three tax-advantaged accounts in Korea have shot up, surpassing KRW 220 trillion by the end of 2021. This contribution amount has already approached KRW 249 trillion, equivalent to the combined contributions of mandatory retirement pensions including both DB (defined benefit) and DC (defined contribution) plans as of the end of 2021. Notably, the rapid growth in pension contributions over the last decade has been influenced by the surge in the number of individuals eligible for the IRP and the introduction of the ISA. Although the contribution amount in pension savings accounts, introduced in 1994, remains the largest, its share of the overall contribution amount has been on the decline while the shares of IRPs and ISAs have risen sharply.

Enrollment rates and characteristics of tax-advantaged accounts

While the contribution amount in tax-advantaged accounts is soaring, the enrollment rate of these accounts remains relatively low. Pension savings accounts with a history of 30 years or so represent a notable voluntary tax-advantaged account type in Korea, with an enrollment rate of only 13.3% as of 2021.3) This rate is quite lower than those of comparable voluntary tax-advantaged savings accounts being operated in advanced countries, such as IRAs of the US.4) As various factors, including income levels, contribute to account enrollment, it is hard to pinpoint why Korea falls behind advanced countries in terms of enrollment rates. However, there is a possibility that insufficient tax benefits have come into play. According to the estimates of OECD (2018), for instance, the level of tax benefits offered by Korea’s pension savings accounts ranks among the lowest compared to other countries analyzed.5)

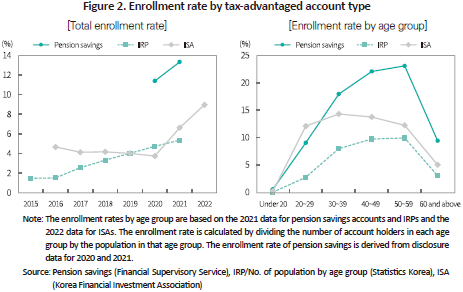

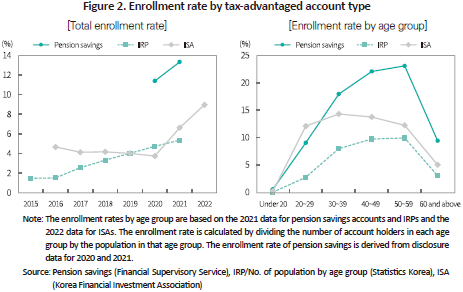

Furthermore, the lack of flexibility in account administration and management may act as a barrier to the enrollment of pension savings accounts. It is fundamentally presumed that pension savings accounts should be utilized as retirement assets. Accordingly, direct investment in high-volatility stocks is not possible and early withdrawal of contributions is highly restricted. In particular, the (former) individual pension savings, which served as the precursor to pension savings accounts until 2000, has a very limited list of eligible assets. The enrollment rate of the ISA, which was most recently introduced in 2016, has rapidly climbed, already outpacing that of the IRP, especially among the younger generation. As illustrated in Figure 2, the enrollment rate of ISAs is highest in the age group of 20 to 29 among the three major tax-advantaged accounts. The rates of pension savings accounts and IRPs reach their highs among those in their 50s, while the ISA enrollment rate peaks among those in thier 30s. For the lack of tax credits for contributions and partial taxation of investment returns, ISAs are evaluated to offer smaller tax benefits compared to pension savings accounts and IRPs.6) Nevertheless, the sharp growth in the ISA enrollment rate among the younger generation can be attributed to the broad range of eligible assets and relatively low liquidity constraints.

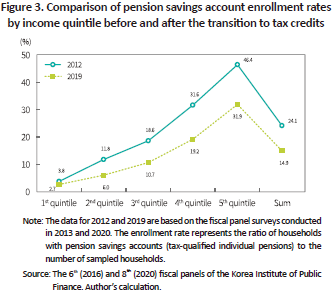

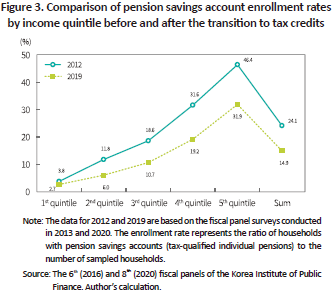

Moreover, tax deductions, which were provided for pension accounts (pension savings accounts and IRPs) until 2013, have been replaced with tax credits since 2014, which seems to be another factor behind low enrollment rates. This article measures the enrollment rate of pension savings accounts for 2012 and 2019 by income percentile, using household microdata. The findings reveal a plunge in enrollment rates across all income quintiles (see Figure 3).7) The overall household-based enrollment rate of pension savings accounts declined from 24.1% in 2012 to 14.9% in 2019. Compared to 2012, the ratio of the 2019 enrollment rate showed a trend of decreasing more substantially for lower-income individuals, indicating a prominent decline in enrollment rates even in lower-income groups.8) This observation hardly aligns with what the government expected from the transition to tax credits, the relative increase in tax benefits and improved enrollment rates among low-income groups. It suggests that the switch to tax credits has had an adverse impact on the enrollment of pension savings accounts.9)

Challenges for improving the enrollment rate of tax-advantaged accounts

Countries have a compelling reason to operate voluntary tax-advantaged accounts. Mandatory enrollment-based pension plans, such as public pensions and retirement pensions, are not enough for individuals to accumulate sufficient retirement assets. This requires more effort to enhance the effectiveness of existing systems. Additionally, various endeavors should be made to boost the enrollment rate of tax-advantaged accounts previously adopted by Korea.

First, the level of tax benefits needs to be elevated to incentivize account enrollment. As for pension savings accounts and IRPs, it is worth considering the retransition from tax credits to tax deductions. However, a different approach is required for low-income groups. The government’s switch to tax credits aimed at providing relatively greater tax benefits to low-income groups. Given that a considerable portion of low-income individuals is not subject to taxation, tax benefits in the form of tax credits or tax deductions may not help improve account enrollment.10) Hence, direct support is indispensable to encourage low-income individuals to enroll in tax-advantaged accounts. In this respect, the government could consider making a matching contribution for individual contributions, which has proven effective in OECD (2018).

What is also needed is greater flexibility in the operation and management of pension accounts. To maximize tax benefits, it is crucial to enroll in tax-advantaged accounts from the time earned income is initially generated. However, as shown in Figure 2, the enrollment rate of tax-advantaged accounts is notably low among those under 30. Asset management regulations should be minimized to encourage younger generations to sign up for tax-advantaged accounts. Pension savings accounts and IRPs are not eligible for direct investment in stocks. In addition, IRPs require more than 30% of contributions to be invested in safe assets such as deposit products. Such regulations could hinder younger generations who prefer direct investment in stocks from enrolling in pension accounts. It should be noted that out of the three major tax-advantaged accounts, the ISA allowing direct investment in domestically listed stocks exhibits the highest enrollment rate among those in their 20s. In this context, it is necessary to consider allowing a certain level of contributions to pension accounts to be directly invested in stocks. As for IRPs, removing the mandatory regulation of safe asset holdings should also be examined. In addition, withdrawal regulations should be alleviated to some extent. A desirable approach is to encourage account holders to avoid early withdrawals until retirement given the nature of pension accounts. However, if such policy regulations deter individuals from enrolling in pension accounts, the policy fails to fulfill its goal of discouraging premature withdrawals. Regarding the relaxation of liquidity constraints, it may be worthwhile to consider incorporating housing purchases and deposits for jeonse (lump-sum housing lease) for non-homeowners as legitimate cases eligible for a low-rate pension income tax (3.3 to 5.5%) applied to premature withdrawals of voluntary contributions and investment returns, both of which have received tax credits.11) This could address concerns about liquidity related to housing costs, one of the primary reasons for younger generations refraining from enrolling in tax-advantaged accounts.

Lastly, financial institutions, including asset management firms, should play a proper role in asset management and operation. In particular, it is crucial to enhance asset management practices given the characteristics of tax-advantaged accounts. Pension accounts including pension savings accounts and IRPs are designed to make contributions to generate a future pension income stream. This requires a long-term perspective in asset allocation and operation compared to conventional financial products. Although the allocation of assets among different asset classes and product types may need adjustment depending on market conditions, investments should adhere to consistent principles. To this end, financial institutions involved in the opening and management of tax-advantaged accounts should play a pivotal role, especially in delivering personalized asset management services including asset allocation, product selection, and rebalancing. If costs are reduced, AI-based personalized asset management services could be provided for small investors. Korean financial institutions need to make bold investments in the initial stage of such services. Asset management firms should also be prepared to design funds suitable for long-term investment, such as asset allocation funds and TDFs (Target date Funds), while offering personalized asset management services.

1) See ‘OECD, 2023, Annual Survey on Financial Incentives for Retirement Savings: OECD Country Profiles 2023’

2) The introduction background of tax-advantaged accounts in Korea and corresponding tax benefits can be found in the report “Kim & Hwang (2023), Widespread use of tax-advantaged accounts and challenges for asset management firms, KCMI Issue Report 23-29”.

3) The enrollment rate of tax-advantaged accounts is calculated by dividing the publicly disclosed number of account holders for each account by the population number. Therefore, this is an individual-based figure, and it may differ from the household-based enrollment rate based on household microdata, which will be explained below.

4) According to Kim & Hwang (2023), the enrollment rates for IRAs in the US (2022) and ISAs in the US (2021) stand at 41.9% and 40.5%, respectively.

5) OECD (2018) estimates the tax benefits that average income earners in OECD countries would receive if they make continuous contributions to a tax-advantaged voluntary individual pension plan during their working years. When comparing the present value of total tax cuts to that of total contributions, the ratio of Korea’s pension savings accounts stands at around 18%, placing the country in the 28th position among the 36 comparable OECD countries (OECD, 2018, Financial Incentives and Retirement Savings: Highlights).

6) KRW 2 million is deducted from the investment returns of an ISA after profits and losses are offset, and the remaining returns are separately taxed at a lower rate (9.9%). When withdrawing from an ISA at maturity, no additional taxation is applied. For more detailed information, please see Kim & Hwang (2023).

7) For the years 2020 to 2021, government support for individuals surged due to the Covid-19 pandemic, which may distort savings patterns. For this reason, this article uses the 2019 data as a comparison against the 2012 data.

8) Given the increase in the household total savings rate during this period, it seems difficult to attribute the decline in the enrollment rate of tax-advantaged accounts to a decrease in income or savings rate (see the Bank of Korea’s National Income Statistics).

9) The decline in incentives for pension contributions after the transition to tax credits is well demonstrated in Lee & Yun (2020), Analysis of behavioral changes arising from the transition to the tax deduction scheme for pension savings, Journal of Tax Studies 20(2), 187-210 and Jung (2018), Analysis of behavioral changes in pension contributions arising from the transition to tad deductions for pension savings, Journal of Insurance and Finance 29(3), 77-102.

10) See Jung (2018).

11) For non-homeowners, early withdrawals for the purpose of house purchases and jeonse deposits are subject to taxation on other income (16.5%).

Overview of tax-advantaged accounts and contribution status

Most OECD countries operate savings accounts that provide direct or indirect incentives.1) These incentives are categorized into indirect support through tax benefits and direct support involving matching contributions from the government. The widespread adoption of government-operated tax-advantaged accounts can be attributed to population aging that presents a challenge for individuals to accumulate sufficient retirement assets relying solely on public pension plans. Accordingly, there is a pressing need to boost voluntary savings by offering incentives.

Among the tax-advantaged accounts currently available in Korea, pension savings accounts and IRPs fall under the category of pension accounts, where tax benefits and savings limits are managed through the integrated system.2) Key tax benefits include partial tax credits on the savings amount and taxation deferral on investment returns from accounts. Upon withdrawal in the form of an annuity, the savings amount is subject to low-rate taxation, while regular tax rates are applied to early withdrawals from the tax-advantaged amount, indicating inflexibility in premature withdrawals. The nature of pension accounts imposes constraints on the inclusion of certain high-risk assets. Unlike pension accounts, ISAs offer relatively modest tax benefits but are eligible for a wide range of products and provide better liquidity with shorter maturities. In addition, if transferred to a pension account upon maturity, the deposits in ISAs are subject to tax deductions, giving account holders more flexibility in managing accounts.

The aggregate contributions to the major three tax-advantaged accounts in Korea have shot up, surpassing KRW 220 trillion by the end of 2021. This contribution amount has already approached KRW 249 trillion, equivalent to the combined contributions of mandatory retirement pensions including both DB (defined benefit) and DC (defined contribution) plans as of the end of 2021. Notably, the rapid growth in pension contributions over the last decade has been influenced by the surge in the number of individuals eligible for the IRP and the introduction of the ISA. Although the contribution amount in pension savings accounts, introduced in 1994, remains the largest, its share of the overall contribution amount has been on the decline while the shares of IRPs and ISAs have risen sharply.

Enrollment rates and characteristics of tax-advantaged accounts

While the contribution amount in tax-advantaged accounts is soaring, the enrollment rate of these accounts remains relatively low. Pension savings accounts with a history of 30 years or so represent a notable voluntary tax-advantaged account type in Korea, with an enrollment rate of only 13.3% as of 2021.3) This rate is quite lower than those of comparable voluntary tax-advantaged savings accounts being operated in advanced countries, such as IRAs of the US.4) As various factors, including income levels, contribute to account enrollment, it is hard to pinpoint why Korea falls behind advanced countries in terms of enrollment rates. However, there is a possibility that insufficient tax benefits have come into play. According to the estimates of OECD (2018), for instance, the level of tax benefits offered by Korea’s pension savings accounts ranks among the lowest compared to other countries analyzed.5)

Furthermore, the lack of flexibility in account administration and management may act as a barrier to the enrollment of pension savings accounts. It is fundamentally presumed that pension savings accounts should be utilized as retirement assets. Accordingly, direct investment in high-volatility stocks is not possible and early withdrawal of contributions is highly restricted. In particular, the (former) individual pension savings, which served as the precursor to pension savings accounts until 2000, has a very limited list of eligible assets. The enrollment rate of the ISA, which was most recently introduced in 2016, has rapidly climbed, already outpacing that of the IRP, especially among the younger generation. As illustrated in Figure 2, the enrollment rate of ISAs is highest in the age group of 20 to 29 among the three major tax-advantaged accounts. The rates of pension savings accounts and IRPs reach their highs among those in their 50s, while the ISA enrollment rate peaks among those in thier 30s. For the lack of tax credits for contributions and partial taxation of investment returns, ISAs are evaluated to offer smaller tax benefits compared to pension savings accounts and IRPs.6) Nevertheless, the sharp growth in the ISA enrollment rate among the younger generation can be attributed to the broad range of eligible assets and relatively low liquidity constraints.

Moreover, tax deductions, which were provided for pension accounts (pension savings accounts and IRPs) until 2013, have been replaced with tax credits since 2014, which seems to be another factor behind low enrollment rates. This article measures the enrollment rate of pension savings accounts for 2012 and 2019 by income percentile, using household microdata. The findings reveal a plunge in enrollment rates across all income quintiles (see Figure 3).7) The overall household-based enrollment rate of pension savings accounts declined from 24.1% in 2012 to 14.9% in 2019. Compared to 2012, the ratio of the 2019 enrollment rate showed a trend of decreasing more substantially for lower-income individuals, indicating a prominent decline in enrollment rates even in lower-income groups.8) This observation hardly aligns with what the government expected from the transition to tax credits, the relative increase in tax benefits and improved enrollment rates among low-income groups. It suggests that the switch to tax credits has had an adverse impact on the enrollment of pension savings accounts.9)

Challenges for improving the enrollment rate of tax-advantaged accounts

Countries have a compelling reason to operate voluntary tax-advantaged accounts. Mandatory enrollment-based pension plans, such as public pensions and retirement pensions, are not enough for individuals to accumulate sufficient retirement assets. This requires more effort to enhance the effectiveness of existing systems. Additionally, various endeavors should be made to boost the enrollment rate of tax-advantaged accounts previously adopted by Korea.

First, the level of tax benefits needs to be elevated to incentivize account enrollment. As for pension savings accounts and IRPs, it is worth considering the retransition from tax credits to tax deductions. However, a different approach is required for low-income groups. The government’s switch to tax credits aimed at providing relatively greater tax benefits to low-income groups. Given that a considerable portion of low-income individuals is not subject to taxation, tax benefits in the form of tax credits or tax deductions may not help improve account enrollment.10) Hence, direct support is indispensable to encourage low-income individuals to enroll in tax-advantaged accounts. In this respect, the government could consider making a matching contribution for individual contributions, which has proven effective in OECD (2018).

What is also needed is greater flexibility in the operation and management of pension accounts. To maximize tax benefits, it is crucial to enroll in tax-advantaged accounts from the time earned income is initially generated. However, as shown in Figure 2, the enrollment rate of tax-advantaged accounts is notably low among those under 30. Asset management regulations should be minimized to encourage younger generations to sign up for tax-advantaged accounts. Pension savings accounts and IRPs are not eligible for direct investment in stocks. In addition, IRPs require more than 30% of contributions to be invested in safe assets such as deposit products. Such regulations could hinder younger generations who prefer direct investment in stocks from enrolling in pension accounts. It should be noted that out of the three major tax-advantaged accounts, the ISA allowing direct investment in domestically listed stocks exhibits the highest enrollment rate among those in their 20s. In this context, it is necessary to consider allowing a certain level of contributions to pension accounts to be directly invested in stocks. As for IRPs, removing the mandatory regulation of safe asset holdings should also be examined. In addition, withdrawal regulations should be alleviated to some extent. A desirable approach is to encourage account holders to avoid early withdrawals until retirement given the nature of pension accounts. However, if such policy regulations deter individuals from enrolling in pension accounts, the policy fails to fulfill its goal of discouraging premature withdrawals. Regarding the relaxation of liquidity constraints, it may be worthwhile to consider incorporating housing purchases and deposits for jeonse (lump-sum housing lease) for non-homeowners as legitimate cases eligible for a low-rate pension income tax (3.3 to 5.5%) applied to premature withdrawals of voluntary contributions and investment returns, both of which have received tax credits.11) This could address concerns about liquidity related to housing costs, one of the primary reasons for younger generations refraining from enrolling in tax-advantaged accounts.

Lastly, financial institutions, including asset management firms, should play a proper role in asset management and operation. In particular, it is crucial to enhance asset management practices given the characteristics of tax-advantaged accounts. Pension accounts including pension savings accounts and IRPs are designed to make contributions to generate a future pension income stream. This requires a long-term perspective in asset allocation and operation compared to conventional financial products. Although the allocation of assets among different asset classes and product types may need adjustment depending on market conditions, investments should adhere to consistent principles. To this end, financial institutions involved in the opening and management of tax-advantaged accounts should play a pivotal role, especially in delivering personalized asset management services including asset allocation, product selection, and rebalancing. If costs are reduced, AI-based personalized asset management services could be provided for small investors. Korean financial institutions need to make bold investments in the initial stage of such services. Asset management firms should also be prepared to design funds suitable for long-term investment, such as asset allocation funds and TDFs (Target date Funds), while offering personalized asset management services.

1) See ‘OECD, 2023, Annual Survey on Financial Incentives for Retirement Savings: OECD Country Profiles 2023’

2) The introduction background of tax-advantaged accounts in Korea and corresponding tax benefits can be found in the report “Kim & Hwang (2023), Widespread use of tax-advantaged accounts and challenges for asset management firms, KCMI Issue Report 23-29”.

3) The enrollment rate of tax-advantaged accounts is calculated by dividing the publicly disclosed number of account holders for each account by the population number. Therefore, this is an individual-based figure, and it may differ from the household-based enrollment rate based on household microdata, which will be explained below.

4) According to Kim & Hwang (2023), the enrollment rates for IRAs in the US (2022) and ISAs in the US (2021) stand at 41.9% and 40.5%, respectively.

5) OECD (2018) estimates the tax benefits that average income earners in OECD countries would receive if they make continuous contributions to a tax-advantaged voluntary individual pension plan during their working years. When comparing the present value of total tax cuts to that of total contributions, the ratio of Korea’s pension savings accounts stands at around 18%, placing the country in the 28th position among the 36 comparable OECD countries (OECD, 2018, Financial Incentives and Retirement Savings: Highlights).

6) KRW 2 million is deducted from the investment returns of an ISA after profits and losses are offset, and the remaining returns are separately taxed at a lower rate (9.9%). When withdrawing from an ISA at maturity, no additional taxation is applied. For more detailed information, please see Kim & Hwang (2023).

7) For the years 2020 to 2021, government support for individuals surged due to the Covid-19 pandemic, which may distort savings patterns. For this reason, this article uses the 2019 data as a comparison against the 2012 data.

8) Given the increase in the household total savings rate during this period, it seems difficult to attribute the decline in the enrollment rate of tax-advantaged accounts to a decrease in income or savings rate (see the Bank of Korea’s National Income Statistics).

9) The decline in incentives for pension contributions after the transition to tax credits is well demonstrated in Lee & Yun (2020), Analysis of behavioral changes arising from the transition to the tax deduction scheme for pension savings, Journal of Tax Studies 20(2), 187-210 and Jung (2018), Analysis of behavioral changes in pension contributions arising from the transition to tad deductions for pension savings, Journal of Insurance and Finance 29(3), 77-102.

10) See Jung (2018).

11) For non-homeowners, early withdrawals for the purpose of house purchases and jeonse deposits are subject to taxation on other income (16.5%).