Find out more about our latest publications

Analysis on the Characteristics of Korea’s Strip Bond Market and Plans for Facilitating the Market

Research Papers 21-01 Jan. 08, 2021

- Research Topic Capital Markets

- Page 80

This study aims to analyze the characteristics and economic effects of Korea’s strip bond market in terms of the secondary market and the market’s issuers, investors, and yields, based on which to propose ideas for facilitating the market. A strip bond is a debt obligation which is broken into coupon and principal components and issued as several zero-coupon bonds. Investor can benefit from investing in those bonds as they offer a broader opportunity for long-term, arbitrage investment and eliminate the reinvestment risk a coupon bond usually has. In addition, more information on zero-coupon bonds with diverse maturities in the strip bond market could help complete the yield curve, making the market more comprehensive.

Korea’s strip bond market has been introduced in March 2006 for the purpose of improving the liquidity of benchmark Korea Treasury Bonds, revitalizing the long-term bond market, and effectively responding to market demand for long-term zero-interest bonds. It was 2010 that the issuance of strip bonds began picking up. A more significant increase has been observed around the on-exchange secondary market since 2016.

This paper analyzed the primary and secondary market data to grasp the main characteristics of Korea’s strip bond market. The results confirm the market’s wide-ranging benefits to investors. First, strip bonds have the effect of expanding the supply of long-term duration bonds in response to investors’ demand for long-term assets. With the average maturity of domestic strip bonds continuously on the rise, the proportion of stripped long-term government bonds has been also increasing. The prolonged maturity of those bonds results from two factors. First, the insurance sector increased investment in long-term bonds in response to regulatory changes. Second, institutions holding long-term debt are increasingly using strip bonds for the purpose of duration matching.

The main institutions that invest in strip bonds include insurers, pension funds, asset managers and banks. As a result of analyzing the behavior of major strip bond investors using the trading data of the over-the-counter market, insurers and pension funds tend to invest in long-term strip bonds in order to eliminate maturity mismatches between assets and liabilities. By contrast, asset managers are found to prefer high investment returns, investing in short-term principal strips and coupon strips that have relatively high spreads. Banks act as strip bond providers while investing in various types of strip bonds for higher profitability.

The most notable feature in Korea’s secondary market for strip bonds is the divergence of bond types and market participants between the on-exchange and the over-the exchange markets. The KRX—Korea’s on-exchange market—is a marketplace where principal strips that mature less than one year take up a large proportion of trading, while the OTC market sees a diversity of stripped principal and coupon components changing hands. Recently, liquidity of strip bonds in the KRX has improved significantly, mainly because of the government’s regulatory actions such as introducing a primary dealer system for strip bonds that mandates the dealers to engage in market making for strip bonds with less than one-year maturity. Such a boost in the on-exchange secondary market is certainly viewed positively as it has improved the liquidity of short-term strip bonds, and has helped complete the yield curve of short-term, risk-free bonds. However, its crowding-out effect of contracting trades of longer-term strip bonds is posing a negative aspect.

The introduction of strip bonds provides the effect of improving long-term government bonds and off-the-run bond liquidity. A comparative look at strip bonds with other risk-free bonds, strip bonds’ liquidity is lower than that of short-term KTBs and two-year Monetary Stabilization Bonds, but is higher than long-term KTBs. Stripping long-term KTBs helps boost the liquidity of those otherwise illiquid bonds.

According to the analysis in this paper, Korea’s strip bonds showed higher excess spreads than government bonds do. The average yield on Korea’s strip bonds was found to be consistently higher than the mark-to-market yield on KTBs with the same maturity. Such a result could have been affected by strip bonds’ higher price sensitivity to interest rate changes, compared to coupon bonds with the same maturity. This paper also compared the yields on principal and coupon strips, and found coupon strips’ spread to be higher than principal strips, which is consistent with previous studies on strip bond prices in other countries. Because stripped interest payments are issued as various small-amount bonds, they are illiquid and serve for investors whose investment purpose and strategy are often different from those investing in stripped principal components. Also noteworthy was strip bonds’ spread varying widely across strip types, maturities, interest rate hikes, and trading venues, all of which suggest diverse factors behind how strip bonds are priced.

For steering Korea’s strip bond market towards sustainable development, several improvements are needed in the areas of issuers, investors, secondary market and market infrastructure. Plans are needed to help the issuers to accurately grasp the demand of strip bonds and to elastically supply them. Investors should refine their strategy, fully reflecting the market’s characteristics. Also necessary is a plan to introduce diverse packaged products based on strip bonds. The secondary market needs improvements in price efficiency, which could be achieved by improved liquidity of strip bonds. Last but not least, it is necessary to promote more information on the strip bond market and the underlying bonds to be analyzed and provided.

Korea’s strip bond market has been introduced in March 2006 for the purpose of improving the liquidity of benchmark Korea Treasury Bonds, revitalizing the long-term bond market, and effectively responding to market demand for long-term zero-interest bonds. It was 2010 that the issuance of strip bonds began picking up. A more significant increase has been observed around the on-exchange secondary market since 2016.

This paper analyzed the primary and secondary market data to grasp the main characteristics of Korea’s strip bond market. The results confirm the market’s wide-ranging benefits to investors. First, strip bonds have the effect of expanding the supply of long-term duration bonds in response to investors’ demand for long-term assets. With the average maturity of domestic strip bonds continuously on the rise, the proportion of stripped long-term government bonds has been also increasing. The prolonged maturity of those bonds results from two factors. First, the insurance sector increased investment in long-term bonds in response to regulatory changes. Second, institutions holding long-term debt are increasingly using strip bonds for the purpose of duration matching.

The main institutions that invest in strip bonds include insurers, pension funds, asset managers and banks. As a result of analyzing the behavior of major strip bond investors using the trading data of the over-the-counter market, insurers and pension funds tend to invest in long-term strip bonds in order to eliminate maturity mismatches between assets and liabilities. By contrast, asset managers are found to prefer high investment returns, investing in short-term principal strips and coupon strips that have relatively high spreads. Banks act as strip bond providers while investing in various types of strip bonds for higher profitability.

The most notable feature in Korea’s secondary market for strip bonds is the divergence of bond types and market participants between the on-exchange and the over-the exchange markets. The KRX—Korea’s on-exchange market—is a marketplace where principal strips that mature less than one year take up a large proportion of trading, while the OTC market sees a diversity of stripped principal and coupon components changing hands. Recently, liquidity of strip bonds in the KRX has improved significantly, mainly because of the government’s regulatory actions such as introducing a primary dealer system for strip bonds that mandates the dealers to engage in market making for strip bonds with less than one-year maturity. Such a boost in the on-exchange secondary market is certainly viewed positively as it has improved the liquidity of short-term strip bonds, and has helped complete the yield curve of short-term, risk-free bonds. However, its crowding-out effect of contracting trades of longer-term strip bonds is posing a negative aspect.

The introduction of strip bonds provides the effect of improving long-term government bonds and off-the-run bond liquidity. A comparative look at strip bonds with other risk-free bonds, strip bonds’ liquidity is lower than that of short-term KTBs and two-year Monetary Stabilization Bonds, but is higher than long-term KTBs. Stripping long-term KTBs helps boost the liquidity of those otherwise illiquid bonds.

According to the analysis in this paper, Korea’s strip bonds showed higher excess spreads than government bonds do. The average yield on Korea’s strip bonds was found to be consistently higher than the mark-to-market yield on KTBs with the same maturity. Such a result could have been affected by strip bonds’ higher price sensitivity to interest rate changes, compared to coupon bonds with the same maturity. This paper also compared the yields on principal and coupon strips, and found coupon strips’ spread to be higher than principal strips, which is consistent with previous studies on strip bond prices in other countries. Because stripped interest payments are issued as various small-amount bonds, they are illiquid and serve for investors whose investment purpose and strategy are often different from those investing in stripped principal components. Also noteworthy was strip bonds’ spread varying widely across strip types, maturities, interest rate hikes, and trading venues, all of which suggest diverse factors behind how strip bonds are priced.

For steering Korea’s strip bond market towards sustainable development, several improvements are needed in the areas of issuers, investors, secondary market and market infrastructure. Plans are needed to help the issuers to accurately grasp the demand of strip bonds and to elastically supply them. Investors should refine their strategy, fully reflecting the market’s characteristics. Also necessary is a plan to introduce diverse packaged products based on strip bonds. The secondary market needs improvements in price efficiency, which could be achieved by improved liquidity of strip bonds. Last but not least, it is necessary to promote more information on the strip bond market and the underlying bonds to be analyzed and provided.

Ⅰ. 서론

스트립(Separate Trading of Registered Interest and Principal of Securities: STRIPS)은 채권의 이자와 원금을 분리하여 여러개의 무이표채권으로 발행하여 투자성을 높인 채권을 의미한다. 스트립채권은 이표채권의 재투자위험을 제거하고, 경과물의 유동성 부족을 완화하며, 시장 가격발견 기능을 제고하는 효과를 제공할 수 있는 상품이다.

국내 스트립채권은 2006년에 도입되었고, 2010년부터 발행이 증가하고 있으며, 최근 국채전문유통시장을 중심으로 거래가 활성화되고 있다. 국내 스트립채권은 국고채딜러에 의해 발행되고, 주요 기관투자자들이 다양한 목적으로 투자를 한다. 스트립채권의 투자는 자산의 장기화, 차익거래 및 무위험채권의 투자 등에 활용되고 있다. 특히 최근에는 보험회사에 대한 규제 변화에 따라 규제 목적에 부합하는 장기 무위험자산의 투자 수단으로 스트립채권에 대한 투자가 확대되고 있다. 국내 스트립채권 유통시장은 장내시장과 장외시장으로 구성되어 있다. 장내시장과 장외시장의 스트립채권 거래는 시장참여자, 거래상품 및 거래방식에 있어 확연한 차이가 존재한다. 또한 시장참여자의 특성, 채권시장 상황 및 유동성 등의 다양한 요인은 스트립채권의 가격결정에도 영향을 주고 있다.

국내 스트립채권시장의 규모가 증가하고, 유통시장이 활성화되고 있음에도 불구하고 스트립채권시장에 대한 세부적인 정보제공이나 체계적인 분석은 이루어지지 않고 있다. 특히 거래가 활성화된 2016년 이후의 스트립채권시장을 대상으로 한 분석은 거의 이루어지고 있지 않다. 스트립채권시장이 어떤 특성을 나타내는지, 도입 목적에 부합한 역할과 기능을 하는지에 대한 검증이 적정하게 이루어지고 있지 못한 상황이다. 이에 따라 스트립채권시장의 세부적인 분석을 통해 국내 스트립채권시장의 특성 및 경제적 효과에 대한 검토를 기반으로 투자자의 스트립채권 투자전략의 정교화 및 시장 활성화를 위한 개선방안을 마련할 필요가 있다.

본 연구는 스트립채권 발행시장과 유통시장에 대한 세부적인 분석에 근거하여 스트립채권 특성과 경제적인 효과를 분석하고 스트립채권시장의 활성화 방안을 검토하는 것을 목적으로 한다. 이를 위해 본 연구에서는 스트립채권의 기본 개념과 구조를 살피고, 국내 스트립채권시장의 주요한 특성을 분석한다. 스트립채권의 발행자, 투자자, 유통시장 및 수익률의 특성 분석에 근거하여 스트립채권의 역할과 기능을 평가한다. 이를 바탕으로 국내 스트립채권시장의 활성화를 위한 시사점을 제공한다.

이러한 연구는 국내 스트립채권시장의 활성화와 활용도 제고에 기여할 것으로 기대한다. 스트립채권시장의 세부적인 발행 및 거래 자료를 이용한 스트립채권 특성 분석을 통해 스트립 투자자들이 시장 특성에 부합하는 투자전략 수립에 기여할 수 있을 것으로 보인다. 또한 장기 국고채의 낮은 유동성을 보완하는 스트립채권의 유동성과 수익률에 대한 분석을 통해 채권시장의 완비성을 제고하고 스트립채권시장의 활성화에 시사점을 제공할 수 있을 것이다.

Ⅱ. 스트립채권의 개념과 경제적 효과

1. 스트립채권의 개념과 구조

가. 기본개념

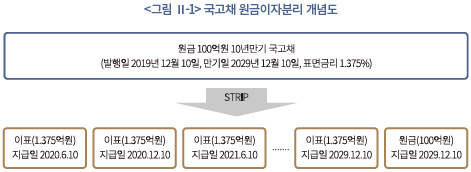

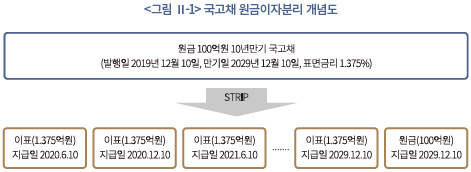

스트립채권은 이표채권(coupon bond)의 현금흐름을 분리하여 이자 및 원금 자체를 개별적인 무이표채권(zero coupon bond)으로 전환시키는 상품이다. 예를 들어 2019년 12월에 발행된 10년 만기 국고채(매년 2회 이자지급)를 발행시점에서 스트립한다고 가정하면, 2029년 12월에 만기가 도래하는 1개의 원금스트립(Principal STRIP)과 6개월마다 만기가 도래하는 20개의 이표스트립(Coupon STRIPs) 등 총 21개의 개별 무이표채권으로 분리하여 발행할 수 있다. 각각의 스트립채권은 할인채 형태로 발행되어 유통시장에서 거래가 가능하다.

스트립의 반대 개념으로 분리된 스트립이자와 스트립원금을 결합하여 원본채권인 이표채권으로 환원할 수도 있는데 이를 재결합(reconstitution)이라고 한다. 즉 분리된 채권들을 다시 조합하여 기존의 이표채권과 동일한 채권을 만들어 낼 수 있다. 또한 스트립채권을 다양하게 조합하여 기존의 기초채권과는 상이한 현금흐름을 갖는 포트폴리오 형태로의 결합도 가능하며 이러한 형태를 패키지(package)라고 한다. 패키지를 허용하는 경우 다양한 만기 및 상환조건을 갖는 새로운 형태의 채권의 발행이 가능하다.

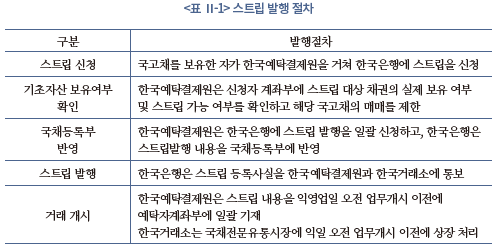

나. 스트립채권 발행 절차

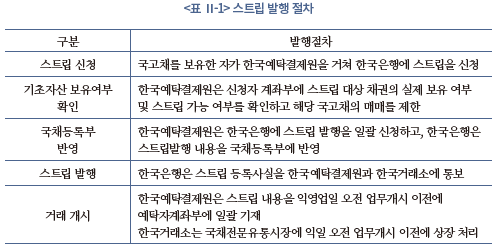

스트립채권은 국채를 기초로 발행하기 때문에 기존 채권과는 다른 발행 절차가 도입된다. 국채를 보유한 기관이 국채관리기관에게 스트립 발행 신청을 하고, 국채관리기관이 이를 승인하고 대체기재 방식으로 등록하는 절차를 통해 발행이 이루어진다.

스트립채권 발행 절차를 자세히 살펴보면 국고채를 보유한 자가 원금이자를 분리하고자 하는 경우에는 한국예탁결제원을 경유하여 한국은행 금융망을 통해 전문송신으로 요청하고, 국고채 예탁자는 한국예탁결제원의 SAFE+ 시스템을 이용하여 소유한 기초채권의 원금이자분리를 신청한다. 채권보유자가 채권스트립을 요구하면 한국예탁결제원은 신청자 계좌부에 스트립 대상 채권이 실제 보유되어 있는지와 원본 채권이 스트립 가능 채권인지 여부를 확인한 후 절차가 종료될 때까지 동 수량에 대해 매매 등의 양도가 제한되도록 조치를 한다. 만일 두조건 중 하나라도 충족하지 못할 경우에는 스트립 및 재구성이 거부된다. 한국예탁결제원이 신청기관의 소유여부 확인 후, BOK Wire+를 통해 한국은행에 일괄 신청하면 한국은행은 신청내용을 확인한 후 국채등록부에 반영한다. 한국은행은 원금이자분리채권의 등록사실을 BOK Wire+를 통한 전문송신 방법으로 한국예탁결제원에 통보하고, 한국거래소 앞으로 상장 및 표준코드 부여를 의뢰한다. 스트립채권의 발행은 기초가 되는 국고채를 차감하는 대신 원금분리채권 및 이자분리채권으로 대체 등록을 통해 완료된다. 원금채권과 이표채권의 재결합의 경우에는 스트립과 반대로 기존 스트립채권을 국고채로 대체하는 절차를 거치게 된다. 한국예탁결제원은 원금이자분리나 재결합의 내용을 익영업일 오전 업무개시 이전에 예탁자계좌부에 일괄 기재하고, 한국거래소도 국채전문유통시장에 익일 오전 업무개시 이전에 상장 처리한다.

스트립이 가능한 금액은 국고채 액면가 1,600만원의 정수배이다. 이는 국채 발행시 이자율이 0.125%단위로 발행되기 때문에 이자스트립 액면가가 최소 1만원 이상 유지되기 위한 것이다.

2. 스트립채권 도입 연혁

가. 주요국의 스트립채권 도입 연혁

스트립채권은 금리 변동에 따른 재투자위험을 관리하기 위해 도입되었다. 1970년대 석유파동으로 높은 인플레이션을 겪게 되었고 이를 통제하기 위해 미국 연준은 고금리 정책을 추진하였다. 고금리 상황은 1982년에 정점을 기록하였고, 이후부터 시장금리가 하락하기 시작하였다. 금리 하향 추세에 따라 연금, 보험회사와 같은 장기 채권 투자자들이 재투자위험에 직면하여 장기 무이표채권에 대한 수요가 증가하였다. 이에 1982년 Merrill Lynch가 미국 국채를 매입하고 원본과 이표를 분리한 TIGRs (Treasury Investment Growth Receipts)를 개발하여 최초로 스트립채권이 도입되었다.1) 이후 다양한 투자은행들이 유사한 상품을 도입하여 연기금이나 개인투자자를 대상으로 무이표채권을 매매하면서 스트립채권시장이 활성화되었다. 그러나 이러한 스트립채권은 발행 증권회사를 통해 만기별로 거래되어 유동성이 부족했고, 신탁에 따른 신용위험 노출이라는 문제점을 가지고 있었다.

국채의 현금 흐름을 분리한 무이표채권 거래가 증가하자 미 재무부는 1985년 2월 연준 대체기재 시스템(Federal Reserve Book Entry System)2)을 통해 분리 가능한 국채를 공표하고 공식적으로 국채 스트립 프로그램을 도입하였다. 제도 도입 초기에는 연준 대체기재 시스템을 통해 스트립할 수 있는 국채를 지정하였다. 1987년에는 미 연준이 스트립채권의 재결합을 허용하여 스트립과 재결합이 가능한 시장이 마련되었다. 연준을 통한 스트립 시스템의 마련은 스트립채권의 표준화를 통한 유동성 제고, 전산화를 통해 스트립 비용 절감의 효과3)를 거두었다. 이후 1997년 1월에는 물가연동국채(Treasury Inflation Protected Securities: TIPS)의 스트립이 허용되었고, 1997년 9월부터는 T-Note, T-Bond 등 모든 국채를 스트립 가능 채권으로 지정하였다. 그럼에도 불구하고 미국의 스트립채권은 장기채인 T-bond를 위주로 발행되고 있다. 단기채나 물가채의 경우 스트립 발행의 유인이 적기 때문이다. 도입 이후 미국의 스트립채권의 발행은 크게 증가하였으나 이후 장기채 발행 감소 등의 요인으로 스트립 발행은 감소하는 추세를 보였다. 2019년말 기준 미국의 스트립채권 잔액은 3,310억달러로 전체 국채의 2.4% 수준을 기록하고 있다.

미국이 스트립 제도를 도입한 이후 캐나다, 프랑스, 벨기에, 네덜란드, 오스트리아, 독일, 스페인, 이탈리아, 일본 등도 스트립채권 제도를 마련하였다. 특히 캐나다는 1987년 캐나다 예탁원을 통한 전자적 대체기재 시스템을 도입한 이래 국채뿐만 아니라 지방정부채, 회사채 및 자산유동화증권 등에 대해서도 스트립 제도를 운영하고 있다. 캐나다 국채는 미국 국채에 비해 유동성이 낮다. 이에 따라 낮은 유동성을 보완하고, 다양한 투자수익을 거둘 목적으로 투자자의 스트립 수요가 지속적으로 증가하였다. 이러한 시장의 수요 증가와 탄력적인 스트립 제도의 도입에 힘입어 캐나다 국채의 스트립 비율은 국채 잔액의 20% 내외를 기록하고 있다. 영국은 1987년에 국채 스트립제도를 도입하였다. 스트립 가능 국채를 지정하고, 국채전문딜러(Gilt-Edged Market Makers: GEMMs)에게 국채 스트립을 허용하였으며 일반 시장참여자들은 국채전문딜러를 통해 스트립에 참여할 수 있도록 하는 제도를 마련하였다. 또한 스트립이 용이하도록 국채의 이자지급 일자를 통일하였다. 프랑스는 1991년 장기 국채인 OATs(Obligation Assimilable du Trésor)에 대한 스트립 제도를 도입하였다. 스트립 및 재결합은 국채전문딜러에게 허용하였고, 일반 투자자들은 국채전문딜러를 통해 스트립을 활용할 수 있도록 하였다. 프랑스의 스트립채권 발행은 10년 이상의 장기채에 집중되어 있으며, 장기채의 스트립 비율은 5% 내외를 기록하고 있다.

주요국은 국채 투자자의 다양한 투자선호에 부응하고 국채시장의 유동성을 제고하기 위해 스트립을 도입하였다. 특히 금리 하락기에 재투자위험을 줄이기 위한 수단으로 스트립이 활용되면서 스트립채권에 대한 투자가 증가하였다. 각국 정부는 재정수요 확대에 따른 장기 국채의 발행 수요가 증가함에 따라 다양한 상품설계가 가능한 스트립채권시장의 활성화를 통해 국채의 수요 확대를 도모하고 있다.

나. 국내 스트립채권 제도

국내 스트립채권 제도는 지표 국고채의 유동성 제고, 장기채시장의 활성화 및 장기 무이표채권에 대한 수요 대응 등을 목적으로 2006년 3월 도입되었다. 제도 도입 당시 대상채권은 2006년 이후부터 신규로 발행되는 5년물 이상의 중장기 국고채를 대상으로 하였고, 스트립원금과 이자의 재결합제도도 허용되었다. 제도 도입 이후 2007년 4월 처음으로 20년 만기 국고채를 대상으로 스트립이 실행되었다.

국고채 스트립관련 제도는 국고채권의 발행 및 국채전문딜러 운영에 관한 규정을 통해 마련되었다. 동 규정에서는 국고채 원금이자분리채권의 대상을 정의4)하고, 국고채 원금이자분리채권의 신청기관을 국고채를 보유한 자5)로 정의하여 국고채전문딜러뿐만 아니라 국고채 투자자들도 스트립이 가능한 제도를 마련하였다.

2014년에는 원금이자분리 대상 국고채를 모든 국고채로 확대하였다. 다만 물가연동국고채는 원금 및 이자가 소비자물가지수에 따라 변동되기 때문에 원금이자분리 대상채권에서 제외하였다.

2016년부터는 스트립전문딜러제도6)를 도입하였고, 스트립전문딜러에게 시장조성의무를 부여하였다. 스트립전문딜러는 거래활성화에 필요한 적정 가격이 형성되도록 스트립채권의 매도‧매수 호가 제시7)를 의무화하는 대신 스트립조건부 비경쟁 인수 물량을 정례 공급하는 방안8)을 도입하였다. 또한 스트립 거래실적을 국채전문딜러 분기평가 항목에 포함시켰다.

3. 스트립채권 도입의 경제적 효과

스트립채권은 기존 이표채를 기초로 다양한 만기의 무이표채권을 공급하여 투자자의 다양한 투자수요에 부합하는 상품을 제공하고, 효과적인 투자전략의 추진을 가능하게 한다. 또한 국채시장 측면에서 국채시장의 효율성을 제고시키고, 국채 수익률의 완성도를 제고하며, 국고채 수요를 증가시키는 효과를 제공한다.

가. 투자자에게 미치는 효과

스트립채권은 장기채 투자자에게 듀레이션이 긴 상품을 공급하는 효과를 제공한다. 2017년에 발행된 이표이자율이 2.125%인 30년 만기 국고채의 발행시점 듀레이션은 22.33년인데 이를 스트립하면 스트립원금의 듀레이션은 30년이 된다. 스트립을 통해 듀레이션을 1.3배 늘릴 수 있다. 이와 같이 스트립채권은 동일한 만기의 이표채에 비해 듀레이션이 길기 때문에 장기채 투자자의 선호에 부합하는 상품을 제공하는 효과를 거둘 수 있다.

스트립채권은 이표채의 재투자위험에 노출된 투자자에게 무이표채권의 공급을 확대하여 재투자위험을 줄이는 효과를 제공한다. 국고채는 일반적으로 매년 2회의 이자를 지급하는 이표채의 형태로 발행된다. 이표채 형태의 무위험채권에 투자하는 투자자의 경우 이자의 재투자 시점의 금리 변동에 따라 재투자위험에 노출된다. 이러한 재투자위험에 노출된 투자자는 무이표채권인 스트립채권을 활용하여 재투자위험을 제거할 수 있다. 외국의 경우에도 재투자위험을 줄이기 위한 목적으로 스트립채권 투자가 이루어지고 있다는 주장이 존재한다. Sundaresan(2002)은 이표채의 가격 및 재투자위험 관리가 스트립채권 투자의 주요 유인이라는 주장을 하고 있다. 그는 국채의 이자율이 높을수록, 국채의 만기가 길수록 스트립의 비율이 높아진다는 결과를 제시하고 있다. Bulter et al.(2014)은 실증분석을 통해 이자율과 스트립채권의 발행의 관련성을 분석하였다. 그들은 높은 이표를 지닌 만기가 긴 국채의 경우 수익률이 하락하는 시기에 스트립 비중이 높아지고 있다는 결과를 제시하고 있다. 이는 스트립채권이 재투자위험을 줄이기 위한 수단으로 사용되고 있음을 지지하는 것이다. 이와 같이 채권수익률이 장기적으로 하락하는 추세를 보이는 경우 이자수익의 재투자위험이 증가하고 이에 따라 스트립채권의 투자 유인이 높아지게 된다. 일반적으로 연기금이나 보험회사와 같이 만기보유 목적의 장기 채권에 투자 비중이 높은 투자자들은 스트립채권을 활용하여 재투자위험을 제거하는 전략을 추진한다.

스트립채권은 차익거래 등을 통해 시장의 가격발견 기능을 향상시키는 효과를 제공한다. 동일한 만기를 지닌 국채와 스트립채권은 시장상황, 채권 특성 및 유동성에 따라 다른 가격이 형성될 가능성이 있고 이러한 가격차이를 활용하여 차익거래를 거둘 수도 있다. Allen & Gale(1988)은 자산의 특성에 따른 가격 차이에 대응한 투자전략이 스트립채권 투자의 주요 요인으로 작용한다고 주장하고 있다. 이론적으로 국고채의 가격이 저평가된 경우 이를 스트립하여 스트립채권을 시장의 매수가격에 매도하여 이득을 취할 수 있다. 또한 스트립채권은 동일한 만기의 이표채에 비해 듀레이션이 길기 때문에 볼록성(convexity)이 크고 이에 따라 금리변동에 따른 가격변화도 크다. 이와 같이 이표채와 할인채의 가격 차이 혹은 스트립채권 간의 가격 차이를 활용하여 차익거래를 할 수 있다. 그러나 스트립채권의 가격 차이에 대한 실증분석은 서로 다른 결과를 보여주고 있다. Halpern & Rumsey(2000)는 동일 만기 스트립채권과 국고채 간의 가격 차이에 대한 실증분석 결과 이표채권의 가격이 스트립채권에 비해 높다는 결과를 제시하고 있다. 반면 Sack(2000)은 미국 국채와 스트립 간의 가격 차이는 크지 않으며, 차익거래 유인은 미미하다는 결과를 제시하고 있다. 실제 시장에서 발생하는 가격의 차이는 딜러간의 거래가격의 차이나 호가의 차이 및 세금 등이 주요 요인으로 작용하고 있다고 주장한다. 반면 스트립이자와 스트립원금 간에서는 일부 가격의 차이가 발생하고 있는데 이는 스트립원금의 경우 기초자산의 영향을 크게 받는데 반해 스트립이자는 규모가 작기 때문에 현금흐름과 유동성 등의 요인이 가격결정에 더욱 크게 작용하기 때문이라고 설명한다.

스트립채권을 통해 상품설계와 투자대상의 다양성을 제고할 수 있다. 스트립채권은 할인채로 현금흐름이 한번만 발생하게 된다. 이러한 스트립채권을 조합하면 투자자의 기간투자 선호에 부합하는 상품을 도입할 수 있다. 이와 같이 스트립채권은 기존의 이표채와 현금흐름의 특성이 다르기 때문에 다양한 채권의 공급을 통해 투자자의 상품 선택의 폭을 넓혀주는 효과가 있다.

또한 스트립채권은 이표채가 할인채로 전환되면서 이자소득세 이연에 의한 절세효과를 거둘 수 있다. 이표 국고채는 표면이자율에 근거하여 과세가 이루어지나 스트립채권은 할인채로 전환되기 때문에 할인액을 이자소득으로 인식하여 과세가 이루어진다. 이에 따라 원금이 상환된 이표부분은 과세가 되지 않기 때문에 세금절감효과가 있다. Grinblantt(2000)는 스트립가격에 대한 결정요인에 대한 실증분석 결과 세금 유인이 스트립에 영향을 미친다는 결과를 제시하고 있다.

나. 채권시장에 미치는 효과

스트립채권의 도입은 국채의 발행시장과 유통시장에 영향을 주고 시장의 효율성을 제고시키는 효과를 제공한다. 스트립채권의 도입을 통해 다양한 만기의 무이표채권 발행이 확대되어 수익률곡선의 완성도가 제고되고 시장의 완비성을 높이는 효과를 거둘 수 있다. 국고채를 스트립하는 경우 다양한 스트립이자와 스트립원금이 발행된다. 이와 같이 무이표채권의 종목수가 증가함에 따라 시장참여자들은 다양한 만기의 무이표채 금리를 관찰할 수 있으며, 이에 따라 금리의 정밀도가 제고될 수 있다. 또한 스트립채권의 유통시장이 발달하는 경우 다양한 만기의 수익률 정보 제공이 확대되어 수익률 곡선의 완성도가 제고되는 효과를 거둘 수 있다.

한편 스트립채권의 도입은 장기 국채와 비지표물의 유동성을 제고하는 효과를 도모할 수 있다. 장기 국고채를 기초로 스트립을 하는 경우 유동성이 낮은 장기채의 활용도가 높아지고 스트립 비중 만큼 유동성을 제고시키는 효과가 존재한다.

이상과 같이 스트립채권의 도입은 투자자에게 다양한 효과를 제공하며, 국채시장의 효율성을 제고하는 효과를 나타낼 수 있다. 이에 본 연구에서는 국내 스트립채권의 발행시장과 유통시장의 특성 분석과 스트립 투자자의 구성에 대한 분석을 통하여 앞에서 논의된 스트립채권의 경제적인 효과가 실제로 이루어지고 있는지를 살펴본다.

Ⅲ. 국내 스트립채권의 특성과 평가

국내 스트립채권시장은 투자자의 수요 증가와 스트립채권시장을 활성화시키려는 정부의 정책에 힘입어 지속적인 성장을 하였다. 스트립채권의 발행이 증가하고 있고, 유통시장도 활성화되고 있다. 그러나 스트립채권시장이 어떤 요인에 의해 활성화되고 있는지, 스트립채권시장이 투자자와 시장에 어떤 영향을 미치는지에 대한 분석은 거의 이루어지지 않고 있다. 이에 본 연구에서는 국내 스트립채권시장의 발행자, 투자자, 유통시장 및 수익률 특성에 대한 분석을 통해 스트립채권시장의 특성을 살펴보고, 스트립채권이 투자자와 국채시장에 어떤 효과를 제공하는지를 평가한다.

1. 국내 스트립채권시장 현황

가. 스트립채권 발행시장 현황

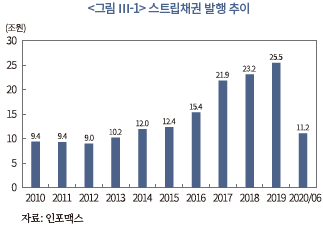

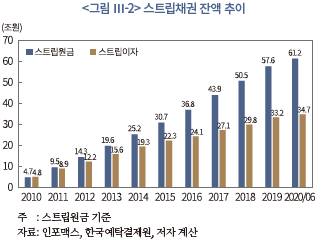

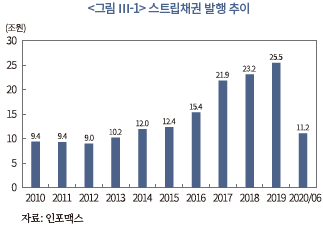

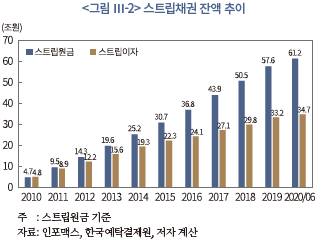

국내 스트립채권시장은 2007년 최초 발행이 이루어진 이후 2009년까지 연간 발행규모가 1조원 미만의 저조한 실적을 기록하였다. 그러나 2010년 이후부터 스트립채권의 발행은 지속적으로 증가하고 있다. <그림 Ⅲ-1>에서 보는 바와 같이 국고채 스트립 발행은 2010년 9.4조원에서 2015년에는 15.4조원으로 늘었고, 2019년에는 25.5조원을 기록했다.

이와 같이 스트립채권의 발행이 증가한 것은 장기 국채에 대한 수요증가가 주요 요인으로 작용하였기 때문이다. 보험회사와 연기금 등은 자산과 부채의 만기 미스매치 해소 및 금리 하향 안정화에 따른 재투자위험 증가에 대응하여 스트립채권의 투자를 지속적으로 늘려왔다. 또한 스트립채권의 투자를 통해 수익을 거두려는 투자자가 확대된 것도 스트립채권시장 확대에 기여한 것으로 보인다. 이와 더불어 스트립채권시장을 활성화하려는 정부 정책도 스트립채권 발행 증가의 한 요인으로 작용하였다.

스트립채권 발행 확대에 따라 스트립채권 잔액은 지속적으로 증가하고 있다. 전체 스트립채권 잔액 규모는 2010년 9.5조원에서 2015년에는 53.0조원으로 증가하였고, 2019년말에는 90.7조원을 기록하였다.

스트립 유형별로 보면 스트립원금 잔액은 2010년 4.7조원에서 2019년말에는 57.6조원으로 늘어났고, 2020년 상반기에는 61.2조원을 기록하였다. 스트립이자 잔액은 2010년 4.8조원에서 2020년 6월말에는 34.7조원으로 늘어났다.

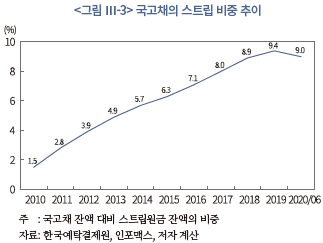

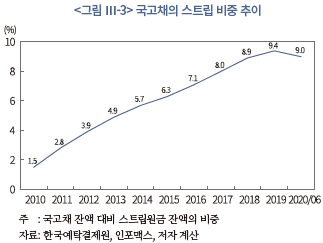

스트립채권의 수요가 증가함에 따라 국고채 스트립 비중은 지속적으로 증가하고 있다. 국고채 대비 스트립원금의 비중은 2010년 1.5%에서 2019년에는 9.4%로 늘어났다. 한편 2020년 상반기 국고채 대비 스트립원금의 비중은 전년말 대비 다소 감소하였다. 이는 스트립 잔액의 증가에도 불구하고 국고채 발행이 더욱 큰 폭으로 증가9)하였기 때문이다.

스트립채권은 국고채를 보유한 발행회사가 스트립을 신청하고 시장의 수요에 따라 추가적인 발행과 상환을 하게 된다. 이에 따라 스트립이 설정되고 일정기간이 지난 이후에도 잔액이 변동하는 모습을 보이고 있다.

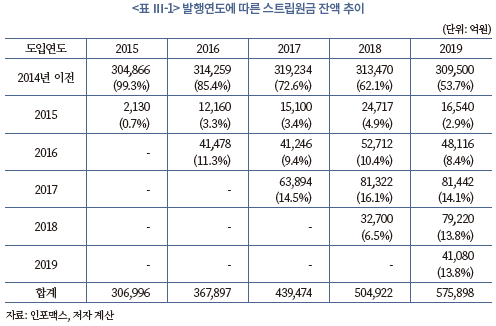

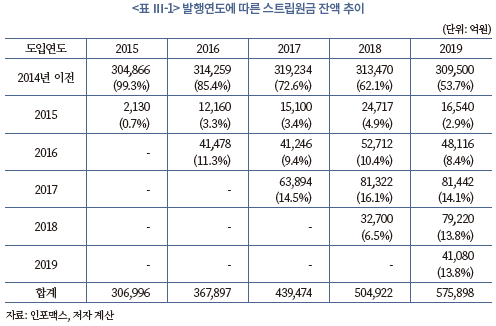

2014년 이전에 설정된 스트립채권의 경우 2017년까지는 잔액이 증가하는 추세를 보이다가 2018년 이후에는 잔액이 소폭 감소하고 있다. 2015년과 2018년에 설정된 스트립채권의 경우에는 설정 당해년도의 잔액에 비해 설정 1년 후의 잔액이 큰 폭으로 증가하였다. 이는 시장의 금리상황과 수급 요인 등에 따라 스트립 물량을 탄력적으로 운영한 데에 따른 결과이다.

설정연도별 스트립채권 잔액의 구성비중을 보면 기존에 발행한 스트립채권의 비중이 높게 나타나고 있다. 2019년말 스트립원금 잔액의 설정연도별 비중을 보면 2014년 이전에 설정된 스트립원금의 비중(53.7%)이 가장 높고, 다음으로 2017년 설정분(14.1%), 2018년 설정분(13.8%)의 순으로 비중이 높게 나타나고 있다. 이는 대부분의 스트립채권이 장기채를 기초로 발행되고 있기 때문이다.

나. 스트립채권 유통시장 현황

스트립채권 유통시장은 장내시장과 장외시장으로 구성되어 있다. 스트립채권 장내거래는 국고채와 마찬가지로 주로 국채전문유통시장에서 경쟁매매 방식으로 거래 되며, 장외거래의 경우 보이스나 메신저를 통해 호가가 교환되고 상대매매방식으로 거래가 이루어진다.

국내 국채 유통시장의 가장 큰 특징 중 하나는 장내시장이 활성화되어 있다는 점이다. 정부는 국채거래 활성화를 위해 다양한 정책을 추진하였으며, 특히 한국거래소에 전자거래플랫폼인 국채전문유통시장을 도입하여 국채의 장내거래 활성화를 도모하였다. 또한 국채전문유통시장을 통한 거래를 촉진하기 위해 국채전문딜러의 장내거래 의무화10)와 같은 제도를 운영하였다. 이러한 정책에 힘입어 국채전문유통시장은 유동성이 매우 높은 시장으로 자리 잡았다.

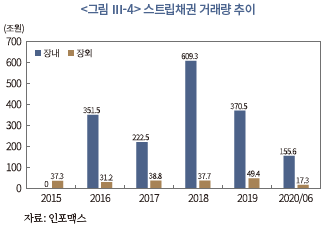

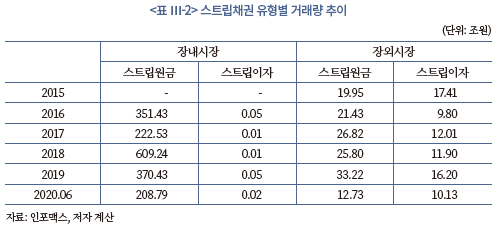

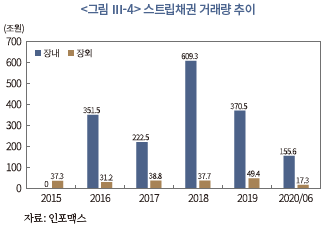

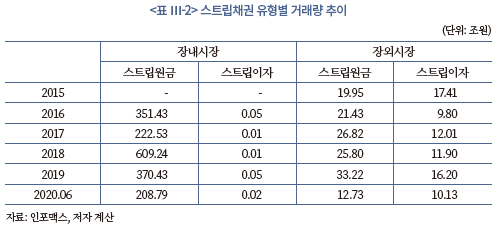

스트립채권 거래량은 2016년 이후 크게 증가하였다. 스트립채권의 전체 거래량은 2015년까지는 40조원 미만이었으나 2016년 장내거래 증가에 힘입어 383조원으로 증가하였고 2018년에는 647조원을 기록하였으며 이후에는 다소 감소하는 추세를 보이고 있다.

거래시장별 스트립채권의 거래량을 살펴보면 2015년 이전까지 스트립채권은 주로 장외에서 거래되었다. 장외시장의 스트립채권 거래는 2015년 37.3조원에서 매년 지속적으로 증가하여 2019년에는 49.4조원을 기록하였다. 장내 스트립채권 거래 추이를 보면 2015년까지 장내 스트립채권 거래는 미미한 수준이었으나 2016년부터 거래량이 크게 증가하여 2018년에는 609.3조원이 거래되었다. 2019년 장내 스트립채권 거래는 전년에 비해 크게 감소한 370.5조원을 기록하였다. 이와 같이 2016년부터 장내 스트립채권 거래가 크게 증가한 것은 스트립채권의 유통시장을 활성화하려는 정부의 정책이 영향을 미쳤기 때문이다. 정부는 장내 스트립채권 유통시장 활성화를 위해 2016년 7월 스트립전문딜러제도를 도입하고 스트립전문딜러에게 스트립채권 호가의무를 부여하였다. 이러한 스트립전문딜러제도의 도입은 장내시장을 중심으로 스트립채권 거래량을 크게 증가시키는 요인으로 작용하였다.

스트립원금과 스트립이자의 거래량을 보면 스트립원금이 스트립이자에 비해 거래가 활발한 것으로 나타났다. 시장별로 스트립채권 유형별 거래 추이를 보면 스트립원금의 경우 2016년부터 장내 거래량이 크게 증가한 반면 스트립이자의 장내거래는 미미한 수준이다. 이와 같이 장내시장에서 스트립이자의 거래가 거의 이루어지지 않는 것은 스트립이자의 종류가 다양하고 발행규모가 작기 때문이다. 20년 만기 국고채(coupon 4%) 2,000억원을 발행 시점에서 스트립한다고 가정하면 만기 20년의 스트립원금 2,000억원과 6개월 단위로 만기가 다른 40억원의 40개 스트립이자가 발행된다. 스트립이자는 다양한 만기의 다수 소액채권으로 쪼개지기 때문에 거래가 원활히 이루어지기 어렵다. 이에 따라 대부분의 스트립이자는 투자자가 만기까지 보유하거나 만기 이전에 재결합 수단으로 활용된다.

장외시장의 경우에는 스트립원금과 스트립이자가 고르게 거래되고 있다. 장외시장의 스트립원금 거래는 2015년 20조원에서 지속적으로 증가하여 2019년 33.2조원을 기록하였다. 장외시장의 스트립이자 거래는 연도별로 변동성을 보이고 있다. 특히 차익거래 유인이 증가하는 시기에는 스트립이자의 거래가 늘어나는 특성을 보이고 있다. 장외시장의 스트립채권은 실수요자를 중심으로 다양한 유형의 스트립채권이 거래되는 특성을 보이고 있다.

2. 국내 스트립채권의 발행 특성 분석

가. 스트립채권의 신청기관

스트립채권은 주로 국채전문딜러가 신청을 하고 발행한다. 국내의 경우에는 국채를 보유한 자가 스트립채권을 발행할 수 있도록 하여 발행기관의 자격을 제한하고 있지는 않지만 대부분 스트립채권은 국채전문딜러가 발행한다.

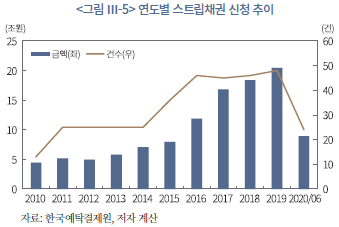

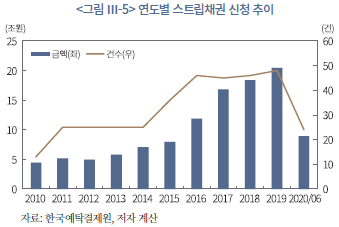

<그림 Ⅲ-5>는 연도별 스트립채권 신청11) 건수와 금액 추이를 나타낸 것이다. 스트립채권 신청 건수는 2014년까지는 연간 25건 내외를 기록하였으나 2015년부터 증가세를 보여 2016년부터는 연간 45건 이상을 유지하고 있다.

스트립채권 신청 금액도 지속적으로 증가하였다. 스트립채권 신청 금액은 2013년 5.8조원에서 2016년에는 11.9조원으로 증가하였고, 이후에도 지속적으로 증가하여 2019년에는 20.5조원을 기록하였다. 이는 국고채딜러가 인수한 물량을 투자자에게 매도하는 과정에서 투자자 수요에 부합하여 스트립을 적극적으로 활용하고 있기 때문이다. 국고채딜러들은 인수한 국고채를 유통시장을 통해 투자자에게 매각하는데, 원활한 소화를 위해 이표채인 국고채를 원금과 이자로 분리하여 기관투자자에게 매각한다. 국채의 주요 투자자들은 다양한 목적으로 국채 스트립채권에 투자를 한다. 보험이나 연기금 등은 규제 환경의 변화 및 자산‧부채의 만기갭 조정을 위해 장기 채권에 대한 높은 수요를 가지고 있다. 이에 따라 국고채딜러는 인수한 장기 국고채를 스트립하여 장기의 스트립채권은 보험이나 연기금에게 매각하고, 다양한 만기의 스트립이자는 다양한 투자수요를 지닌 자산운용사나 은행 등에 소화하는 방식으로 스트립을 활용하고 있다.

나. 스트립채권의 만기특성

스트립채권의 주요 도입 목적 중 하나는 투자자의 장기채 수요 증가에 대응하여 효율적인 장기 투자상품의 공급을 확대하는 것이다. 국내 스트립채권이 이러한 목적에 부합하고 있는지를 살피기 위해 스트립채권의 기초자산 만기 분포와 스트립채권의 만기 구조를 살펴본다.

보험이나 연기금과 같은 투자자들은 장기 부채 증가에 대응하여 자산의 만기를 장기화하려는 수요가 존재한다. 이에 따라 동일한 만기의 이표채에 비해 상대적으로 듀레이션이 긴 스트립채권에 대한 투자를 선호한다. 특히 보험회사에 대한 규제 변화가 장기 스트립채권에 대한 수요를 크게 증가시킨 요인으로 작용하였다. 2011년 도입된 RBC(Risk Based Capital)제도는 자산과 부채의 리스크 특성을 체계적으로 반영하여 예상치 못한 손실 발생시에 이를 충당할 수 있는 자기자본을 보유하도록 하는 제도이다. 장기 부채를 보유한 보험회사들은 제도 변화에 대응하기 위해 자산의 듀레이션을 늘리는 노력을 기울였다. 특히 상대적으로 듀레이션이 긴 스트립채권의 투자를 늘림으로써 자산 듀레이션을 장기화하고 있다. 보험회사의 자기자본제도는 향후 신지급여력제도인 K-ICS(Insurance Core Principles)로 변경될 예정이며, 이 경우 장기채에 대한 수요가 더욱 확대될 가능성이 있다. 이와 더불어 보험업 자본규제의 통일성과 효율성을 제고하기 위해 도입 예정인 보험부채 시가평가 기반의 국제회계기준(IFRS17)도 보험회사의 장기채 수요를 증가시키고 있다. IFRS17은 보험부채를 시가법으로 평가하여 보험회사의 리스크 및 내재가치가 재무제표에 반영되는 제도이다. 이에 따라 보험회사는 자산‧부채 듀레이션갭을 줄이기 위해 장기 스트립채권에 대한 투자를 확대하고 있다.

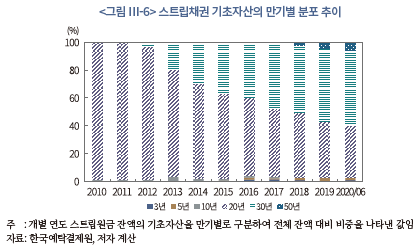

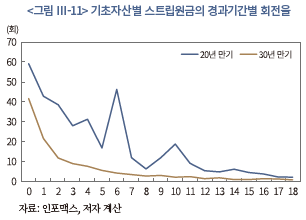

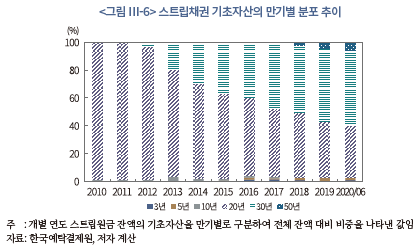

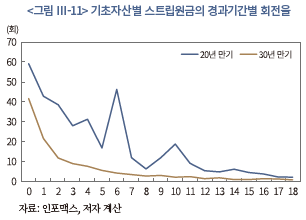

이와 같이 보험과 연기금의 장기채에 대한 투자 수요가 증가하여 장기 국고채를 기초로 하는 스트립채권의 발행이 증가하고 있다. <그림 Ⅲ-6>은 스트립채권 기초자산의 만기 비중을 나타내고 있다. 스트립채권 기초자산의 만기별 비중을 보면 스트립원금 기초자산의 90% 이상이 20년 만기와 30년 만기 국고채에 집중되어 있다. 개별 유형별 비중 추이를 보면 20년 만기 국고채의 비중은 2010년 98.5%에서 2019년에는 40.2%로 줄어들었다. 반면 30년 만기 국고채는 2012년 도입 당시 스트립시장에서 차지하는 비중이 2.6%에 불과하였으나 이후 그 비중이 점차 증가하여 2018년 이후에는 20년 만기 국고채보다 높은 비중을 차지하고 있다. 이와 같이 스트립채권의 기초자산은 20년 만기 국고채에서 30년 만기 국고채로 대체되고 있다. 50년 만기 국고채의 경우에도 2016년 도입 당시 스트립채권시장에서 차지하는 비중은 0.3%에 불과하였으나 최근 그 비중이 점차 증가하여 2019년에는 4.6%를 기록하고 있다. 한편 3년 만기 국고채를 기초로 한 스트립채권의 비중은 1% 미만으로 낮은 상황이다. 단기 지표금리의 역할 강화를 위해 2015년부터 단기 국고채의 스트립을 허용하고 있음에도 불구하고 단기 국고채가 스트립시장에서 차지하는 비중은 높지 않은 것으로 나타났다.

이상에서 보는 바와 같이 스트립채권의 기초자산은 대부분 장기채로 구성되어 있으며, 30년 만기, 50년 만기 초장기채의 비중이 계속 증가하는 추세를 보이고 있다. 이와 같은 결과는 스트립채권이 장기 투자자의 듀레이션을 늘리기 위한 기능을 주로 수행하고 있다는 것을 지지하는 결과이다. 스트립채권은 만기가 길수록 보다 큰 듀레이션과 볼록성을 기대할 수 있다. 만기가 길수록 스트립채권 발행을 통해 얻을 수 있는 스트립이자의 종류가 다양해지는 장점도 있다. 연기금, 보험과 같이 장기채에 주로 투자하는 투자자들은 이표채 형태의 국고채를 보유하기 보다는 상대적으로 듀레이션이 긴 국고채 스트립원금에 투자하는 것을 선호하고 있고 이러한 수요가 스트립 만기구조에 커다란 영향을 미쳤다고 볼 수 있다.

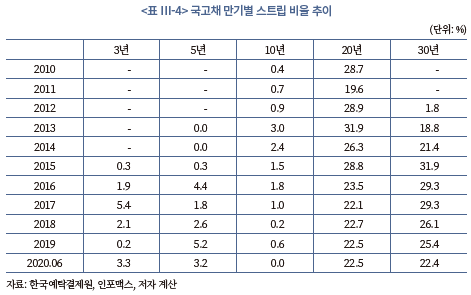

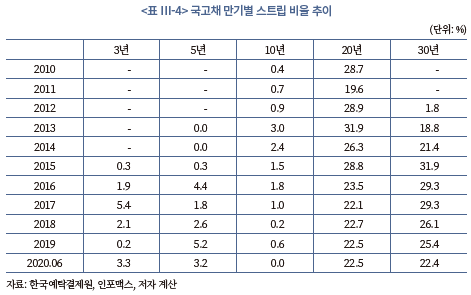

스트립채권 기초자산의 구성이 변화함에 따라 국고채의 만기별 스트립 비율도 크게 변화하고 있다. <표 Ⅲ-4>는 국고채 만기별 스트립 비율의 추이를 나타내고 있다. 20년 만기와 30년 만기 국고채의 스트립 비율은 높은 반면 단기 국고채의 스트립 비율은 낮은 것으로 나타났다.

3년 만기 국고채의 스트립 비율은 2015년 0.3%에서 2017년에는 5.4%까지 증가하였으나 이후 감소세를 보이고 있다. 5년 만기와 10년 만기 국고채의 경우에는 스트립 비율이 낮은 것으로 나타났다. 특히 10년 만기 국고채의 경우 2013년 3.0%를 기록한 이후 스트립 비율이 계속 감소하고 있다. 20년 만기 국고채의 스트립 비율은 2011년 19.6%에서 지속적으로 증가하여 2013년에는 31.9%를 기록하였으나 이후에 감소하는 추세를 보이고 있다. 30년 만기 국고채의 경우에는 2015년까지 스트립 비율이 증가하다가 이후부터 감소하고 있다. 20년 만기 국고채와 30년 만기 국고채를 기초로 한 스트립채권 발행이 증가하고 있음에도 불구하고 최근 들어 동 채권의 스트립 비율이 줄어드는 것은 장기 국고채의 발행이 크게 증가하였기 때문이다. 이와 더불어 최근의 장기 금리 변동도 스트립 비율을 줄이는 요인으로 작용하였다. 일반적으로 스트립은 고금리 이표를 지닌 장기채를 대상으로 금리가 하락하는 시기에 발행 비중이 높아진다. 그런데 2016년 상반기까지 하락 추세를 보이던 장기 금리가 2016년 하반기부터 2018년 상반기까지 상승함에 따라 투자자의 스트립 유인이 줄어들게 되었고 이에 따라 동기간 중 장기채의 스트립 비율은 감소하는 추세를 보였다.

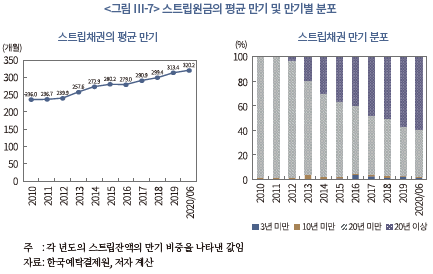

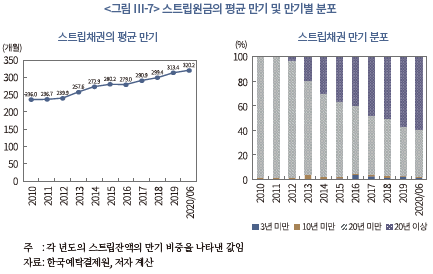

장기 국고채를 기초로 한 스트립채권 발행이 증가함에 따라 스트립채권의 평균 만기는 장기화되고 있다. <그림 Ⅲ-7>은 스트립원금의 평균 만기 및 만기별 비중 추이를 나타내고 있다. 스트립원금의 평균 만기는 2010년 236개월에서 지속적으로 장기화되어 2019년에는 313.4개월을 기록하였다. 스트립채권의 만기 비중을 보면 만기 10년 이상의 비중이 압도적으로 높게 나타나고 있다. 연도별 스트립원금 잔액의 만기 분포를 보면 2010년의 경우 10년 이상 20년 미만의 비중이 대부분을 차지하였으나 2012년부터 20년 이상 만기의 스트립원금이 발행되기 시작하여 2019년에는 20년 이상 만기의 비중이 절반을 넘는 59.5%를 기록하였다.

이상에서 살펴본 바와 같이 국내 스트립채권은 장기 무위험채권의 투자를 선호하는 투자자에게 듀레이션이 긴 상품의 공급을 확대하는 효과를 제공한다. 보험이나 연기금과 같이 장기 부채를 지닌 투자자들은 장기 자산 투자 확대를 통해 자산‧부채의 만기 불일치를 해소하려는 유인을 지니고 있다. 스트립채권은 할인채로 발행되기 때문에 동일한 만기의 이표채에 비해 듀레이션이 더 길다. 이에 따라 투자자산의 만기를 늘리는 효율적인 수단으로 스트립채권이 활용되고 있다.

3. 국내 스트립채권의 투자자 특성 분석

가. 스트립채권 투자자의 매수거래 추이

스트립채권 투자자들은 장기의 투자자산 확대, 재투자위험의 축소 및 채권 특성에 따른 가격 차이를 이용한 차익거래 등 다양한 목적으로 스트립채권에 투자를 한다. 투자자들의 스트립채권 투자는 장내시장과 장외시장을 통해 이루어진다. 장내시장에서는 스트립전문딜러가 단기 스트립채권을 위주로 거래를 한다. 실제 스트립채권 투자자의 다양한 목적의 투자는 장외시장을 통해 이루어진다. 따라서 주요한 스트립채권 투자자의 투자행태는 장외시장의 매수거래를 통해 관찰할 수 있다. 이에 본 절에서는 투자자 유형별 장외시장 매수거래 추이와 특성 분석을 통해 투자자들의 스트립채권 투자 추이와 목적을 살펴본다.

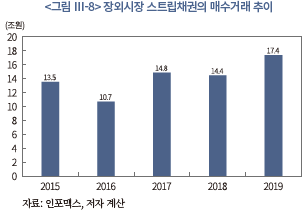

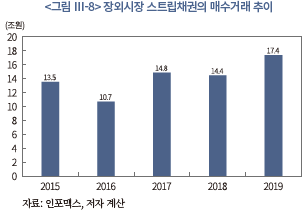

장외 스트립채권 매수거래의 주요 공급자는 국고채딜러와 스트립채권을 보유한 기관투자자이며, 주요한 매수기관은 보험, 연기금, 자산운용 및 은행 등의 다양한 기관투자자들이다. <그림 Ⅲ-8>은 장외시장 스트립채권의 매수거래 추이를 나타내고 있다. 장외시장의 스트립채권 매수거래는 연도별로 변동성을 보이는 가운데 증가 추세를 보이고 있다. 스트립채권 매수거래의 추이를 보면 2015년 13.5조원에서 2016년에는 전년대비 감소한 실적을 기록했으나, 2017년부터 다시 증가세로 돌아서서 2019년에는 17.4조원을 기록했다.

나. 투자주체별 매수거래 특성 분석

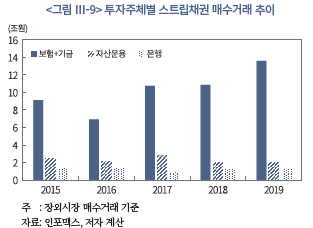

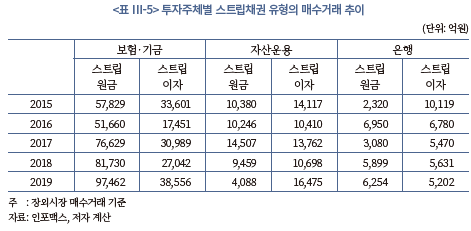

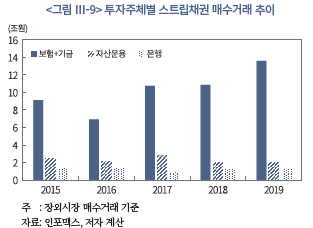

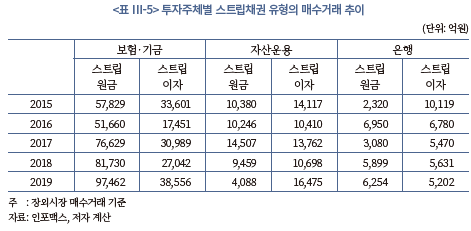

장외시장 스트립채권 매수거래의 투자주체별 규모를 보면 보험‧기금은 증가하는 추세를 보이고 있는데 반해 자산운용과 은행은 2017년 이후 감소하고 있다. 투자주체별 비중을 살펴보면 보험‧기금이 지속적으로 높은 비중을 차지하고 있다. 전체 매수거래에서 보험‧기금이 차지하는 비중은 2015년 67.6%에서 2017년 72.5%, 2019년에는 78.2%로 늘어났다. 한편 자산운용부문의 비중은 2015년부터 2017년까지는 20% 내외를 기록했으나 2018년부터는 감소하는 추세를 나타내고 있다. 은행의 비중은 연도별로 높은 변동성을 보이는 가운데 최근 들어 비중이 감소하고 있다.

스트립채권 유형별 투자비중은 투자주체별로 각기 다른 추이를 나타내고 있다. 보험‧기금의 경우 스트립원금의 투자 비중이 높게 나타난 반면 자산운용은 스트립이자에 대한 비중이 높게 나타나고 있다. 은행의 경우 2015년에는 스트립이자의 비중이 높았으나 이후에는 스트립원금의 비중이 높게 나타나고 있다. 보험‧기금의 스트립 투자에 있어 스트립원금의 비중이 높은 것은 스트립원금이 대규모로 발행되고 있기 때문에 거액의 장기 채권 투자에 보다 적합하기 때문이다. 반면 자산운용사의 경우에는 펀드의 목적 및 설정 규모에 따라 다양한 투자를 하기 때문에 상대적으로 발행규모가 작은 스트립이자에 대한 투자 비중이 높게 나타나고 있다.

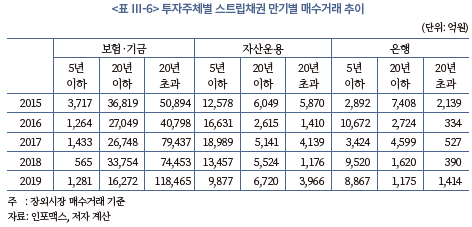

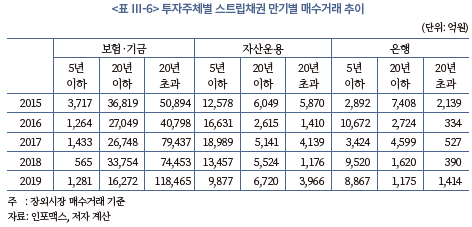

스트립채권 만기별 투자비중도 투자주체별로 각기 다른 모습을 보이고 있다. 보험‧기금은 장기 스트립채권의 비중이 높게 나타나고 있으며, 최근 들어 그 비중이 더욱 증가하는 추세를 보이고 있다. 보험‧기금의 스트립채권 매수거래에서 20년 이상의 장기채의 비중은 2015년 55.7%에서 2019년에는 87.1%로 늘어났다.

자산운용의 경우에는 단기 스트립채권의 비중이 높게 나타나는 가운데 최근 들어 5~20년 만기 스트립채권의 투자 비중이 증가하는 추세를 보이고 있다. 자산운용사의 스트립 매수거래에서 5년 이하의 단기채의 비중은 2015년 51.3%에서 2016년에는 80.5%로 증가하였으나 이후에는 감소세로 돌아서 2019년에는 48.0%를 기록하고 있다. 은행의 스트립채권 만기별 매수거래는 연도별로 높은 변동성을 보이는 가운데 단기 스트립의 비중이 높아지고 있는 추세를 보이고 있다.

이상에서 살펴본 바와 같이 투자자주체별로 스트립채권의 유형별, 만기별 비중은 커다란 차이를 보이는 것으로 나타났다. 보험‧기금의 경우에는 투자자산의 듀레이션을 장기화할 목적으로 스트립채권에 투자를 하기 때문에 장기채의 비중이 높고, 스트립원금의 투자 비중이 높게 나타나고 있다. 특히 보험회사들은 동일한 만기의 이표채에 비해 듀레이션이 긴 스트립채권에 대한 투자를 통해 자산의 듀레이션을 늘리는 투자를 확대하는 것으로 나타났다. 또한 보험‧기금은 금리의 하락 추세에 따른 재투자위험의 증가에 따라 재투자위험을 줄이기 위한 방안으로 이표채 형태의 국고채 투자보다는 스트립채권에 대한 투자를 선호하고 있다.

자산운용의 경우에는 시세차익을 거둘 목적으로 스트립채권에 주로 투자하기 때문에 단기 스트립과 스트립이자의 투자 비중이 높게 나타나고 있다. 스트립이자의 경우는 스트립원금에 비해 유동성이 낮고, 상대적으로 다양한 만기의 증권으로 발행이 되기 때문에 동일한 만기의 국채나 스트립원금에 비해 높은 수익률을 제공한다. 이에 따라 자산운용사들은 스트립채권 투자를 통해 투자수익을 제고할 목적으로 상대적으로 가격이 낮은 스트립채권에 주로 투자하고 있다.

국채전문딜러 자격을 받은 은행의 경우 스트립의 주요 공급자 역할을 하는 한편 스트립 투자자로의 역할을 수행한다. 은행의 경우 유동성 커버리지 지표의 충족과 수익 확대를 목적으로 스트립채권에 주로 투자하고 있다. 은행은 상대적으로 유동성이 높은 단기 국고채 위주로 투자를 하기 때문에 장외 스트립채권 매수거래에서 은행이 차지하는 비중은 낮아지고 있다. 스트립채권에 대한 은행의 투자도 주로 단기 스트립채권을 중심으로 이루어지고 있다.

이와 같이 스트립채권은 투자자의 투자 목적에 따라 다양한 수단으로 활용되고 있으며, 이에 따라 투자자별로 스트립채권의 매수거래 특성에 있어 차이를 보이고 있다. 특히 장외 스트립채권의 매수거래에서 장기 스트립채권의 거래 비중이 높은 것은 스트립채권이 보험‧기금의 자산 듀레이션을 늘리기 위한 수단으로 주로 활용되고 있다는 것을 지지하는 결과이다.

4. 국내 스트립채권의 유통시장 특성 분석

가. 스트립채권의 기간 경과별 거래회전율

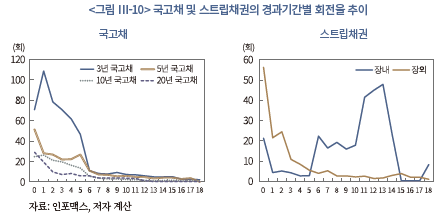

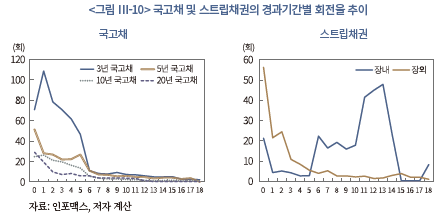

일반적으로 채권은 발행 초기에 거래가 활발히 이루어지다가 일정 기간이 경과하면 거래가 둔화되는 특성을 보인다. 이와 같이 가장 최근에 발행하여 거래가 활발하게 이루어지는 것을 on-the-run 채권이라고 한다. 국내에서는 가장 최근에 발행된 만기별 국고채가 국고채 유통수익률의 지표금리 역할을 하기 때문에 지표물12)이라고 부르고 있다.

대부분의 국고채의 거래는 on-the-run 현상을 보이고 있다. 그러나 스트립원금의 경우에는 국고채와 다른 모습을 보이고 있다. 스트립원금의 거래회전율 특성을 살펴보면 장외시장의 경우에는 발행 이후 6개월까지 비교적 높은 회전율을 보이다가 7개월부터는 거래가 급격히 줄어드는 on-the-run 현상을 보이는 반면 장내 스트립채권 거래의 경우에는 발행 이후 7개월에서 15개월까지 회전율이 다른 기간에 비해 높게 나타나고 있다. 이와 같은 결과는 특정 기간에 3년 만기 및 5년 만기 국고채를 기초로 한 스트립채권의 거래량이 급격히 증가한 특이치가 반영되었기 때문이다. 10년 미만의 만기를 지닌 스트립채권 잔액이 적은 상황에서 정부가 단기채 스트립채권 거래 활성화를 위한 정책을 취함에 따라 특정 기간 경과물의 회전율이 급격히 상승하는 모습을 보이고 있다.

기초자산 만기별로 스트립의 회전율은 커다란 차이를 보이고 있다. 상대적으로 잔액이 크지 않은 스트립채권의 경우 특정 기간 거래량이 증가할 경우 회전율이 크게 상승하여 스트립채권의 거래특성 파악의 왜곡을 초래할 수 있다. 이에 따라 스트립채권의 거래 특성을 보다 명확히 살펴보기 위해서는 스트립채권시장의 대부분을 차지하고 있는 20년 만기와 30년 만기 국고채 스트립원금의 경과기간별 평균 회전율을 살펴볼 필요가 있다.

30년 만기 국고채를 기초로 한 스트립원금의 경과기간별 회전율은 발행 초기에 가장 높은 회전율을 보이고 이후에 감소하고 있다. 특히 발행 1년 이후에는 회전율이 크게 낮아지는 모습을 보이고 있다. 한편 20년 만기 국고채를 기초로 한 스트립원금의 경과기간별 회전율은 발행시점에 가장 높은 회전율을 보이다가 발행 후 5개월까지는 감소하는 추세를 보였으나 발행후 6개월이 경과한 시점에 회전율이 다시 상승하는 모습을 보이고 있다. 이러한 현상은 특정한 기간 스트립 수요가 증가하여 거래가 일시적으로 상승한 영향에 따른 것으로 보인다.

이와 같이 발행 규모가 일정 수준 이상의 스트립채권은 국고채와 동일하게 발행 후 일정기간 거래가 활성화된 이후 거래가 줄어드는 현상을 보이고 있다. 반면 발행 규모가 작은 스트립원금이나 스트립이자의 경우에는 on-the-run 현상을 보이지 않고 특정한 기간의 거래 규모에 따라 회전율이 크게 변동하는 모습을 나타내고 있다.

나. 시장별 거래특성 분석

장내시장과 장외시장의 스트립채권의 거래특성을 살펴보기 위해 2015년부터 2020년 8월말까지의 인포맥스의 스트립원금과 스트립이자의 거래 자료를 이용하여 시장별 스트립채권의 세부적인 유형과 거래규모 및 유동성 등을 분석한다.

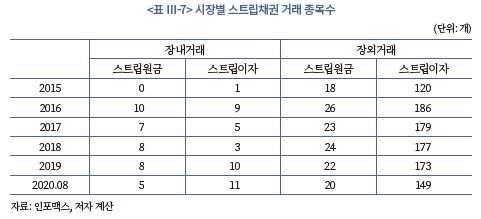

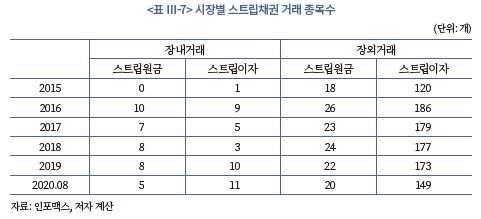

<표 Ⅲ-7>은 장내시장과 장외시장에서 거래되는 스트립채권 종목수를 나타내고 있다. 장내시장은 국고채딜러들이 거래를 한다. 장내시장에서 거래되는 스트립채권 종목은 10개 미만의 스트립원금이 주류를 이루고 있다. 장내에서 거래되는 스트립이자의 종목도 10개 내외로 제한되어 있다. 이와 같이 장내시장은 딜러간의 제한된 종목의 스트립거래가 주로 이루어지고 있다.

기관투자자의 투자수요에 따른 스트립거래는 주로 장외에서 이루어진다. 장외시장에서 거래되는 스트립원금은 20개 이상이며, 스트립이자는 일부 기간을 제외하고 170개 이상을 기록하여 발행된 대부분의 스트립원금과 스트립이자가 거래되는 것을 관찰할 수 있다.

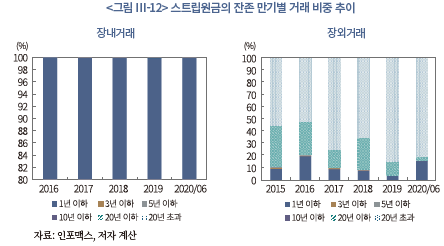

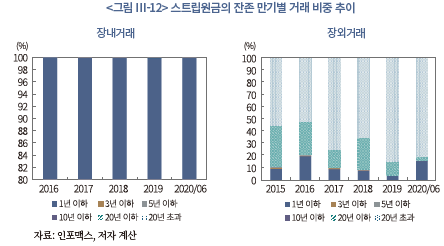

이와 같이 장내시장과 장외시장에서 거래되는 스트립채권의 거래 종목이 다르기 때문에 거래되는 스트립원금과 스트립이자의 만기 구성도 크게 다른 모습을 보이고 있다. <그림 Ⅲ-12>는 장내와 장외시장의 스트립원금의 만기별 거래 비중 추이를 나타낸 것이다. 장내시장의 경우에는 거래되는 대부분의 스트립원금이 잔존 만기 1년 이하로 구성되어 있다. 반면 장외시장의 경우에는 10년 이상의 잔존 만기를 지닌 장기 스트립원금의 거래 비중이 80%를 넘고 있다. 장외시장에서 거래되는 1년 미만의 스트립채권의 거래 비중은 연도별로 높은 변동성을 보이는 가운데 2016년과 2020년을 제외하고는 10% 미만을 보이고 있다. 1년 초과 10년 이하의 스트립원금의 장외거래 비중도 낮은 것으로 나타났다. 이는 국내 스트립채권시장의 경우 장기채를 위주로 스트립이 설정되며, 스트립 도입 초기 발행 규모가 크지 않아서 1년 초과 10년 이하의 스트립 잔액이 상대적으로 적기 때문이다. 한편 스트립이자의 경우에는 대부분 장외에서 거래되고 있으며, 다양한 만기의 스트립이자가 고르게 거래되고 있는 것으로 나타났다.

이와 같이 장내시장과 장외시장의 구조가 극명한 차이를 보이는 것은 장내 스트립전문딜러제도와 같은 시장제도의 차이에 기인한다. 정부는 스트립채권의 단기 지표금리 기능을 강화하기 위해 장내시장에서 스트립전문딜러에게 1년 이내 만기가 도래한 국고채 스트립에 대한 호가의무를 부과하고, 스트립 호가제출 실적과 스트립채권 거래실적을 국채전문딜러 선정의 평가요소에 포함시켰다. 이러한 제도 도입으로 스트립전문딜러들은 단기 스트립채권에 대한 호가를 지속적으로 제시하고 있고 이에 따라 장내시장의 딜러간 단기 스트립채권 거래가 활성화되고 있다. 반면 장내시장에서 장기 스트립채권의 거래는 거의 이루어지지 않고 있다.

이러한 스트립채권 유통시장의 분할은 긍정적인 측면과 부정적인 측면의 양면성을 지니고 있다. 장내시장을 중심으로 단기 스트립의 거래가 활발히 이루어짐에 따라 단기 무위험채권의 수익률곡선 완성도가 제고되고, 시장의 유동성이 활발해지는 긍정적인 측면이 있다. 또한 거래가 활성화됨에 따라 단기 스트립채권은 물론 단기 무위험채권 가격결정의 효율성을 제고시키는 효과를 기대할 수 있다. 반면 장내에서 딜러간 단기 스트립 위주의 거래는 다른 만기의 스트립거래를 구축하는 부정적인 측면도 있다. 단기 스트립에 대한 시장조성을 위하여 딜러의 스트립 재고가 단기 스트립에 집중될 가능성이 있기 때문이다.

다. 스트립채권의 유동성 분석

유동성 지표는 거래기준 유동성 지표와 주문기준 유동성 지표로 구분할 수 있다. 거래기준 유동성 지표는 거래량, 거래빈도, 회전율 및 거래일수 등으로 실제 거래 결과에 기초하여 유동성을 측정하는 방식이다. 주문기준 유동성 측정 지표는 주문서 자료를 기반으로 한 유동성 측정방식으로 거래 가능성과 비용에 대한 정보를 제공한다. 가장 대표적인 거래기준 유동성 측정지표로는 매수‧매도 스프레드를 들 수 있다. 이외에도 Amihud 유동성 지표, 유효스프레드, 주문의 실행시점 등이 거래기준 유동성 지표로 활용된다.

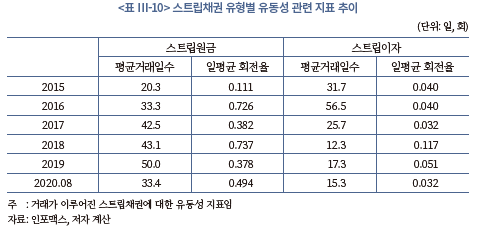

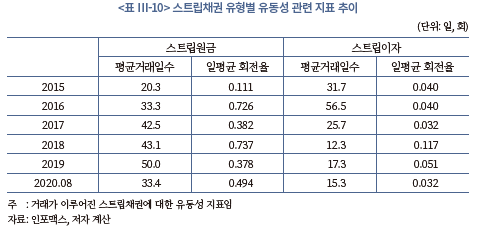

본 절에서는 거래기준 유동성 지표를 이용하여 시장별, 유형별 국고채 스트립채권의 유동성을 비교한다. 개별 스트립채권별로 일일 회전율과 평균 거래일수를 측정하고 스트립 유형별로 유동성 지표를 비교하여 스트립채권의 유통시장 특성을 분석한다.

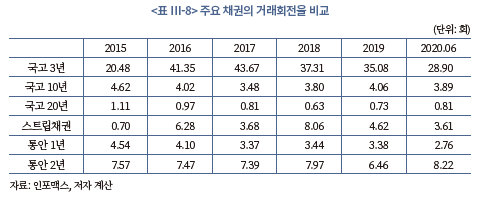

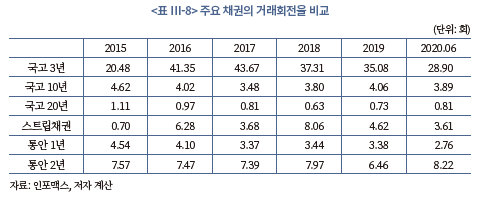

<표 Ⅲ-8>은 스트립채권을 포함한 무위험채권의 연간 거래회전율 추이를 나타낸 것이다. 스트립채권의 거래회전율은 거래가 활발한 3년 만기 국고채에 비해서는 낮은 수준이나 장기 국고채에 비해서는 높은 수준을 보이고 있다. 스트립채권의 거래회전율을 통안채와 비교해보면 2년 만기 통안채에 비해서는 낮은 수준이지만 1년 만기 통안채에 비해서는 높은 유동성을 보이고 있다. 스트립채권의 거래회전율 추이를 보면 2015년 이전에는 매우 낮았으나 2016년 이후에는 높은 값을 보이고 있다. 이는 스트립전문딜러제도 도입이 스트립채권의 유동성 제고에 크게 기여하고 있다는 것을 보여주는 결과이다. 이에 따라 만기 1년 이내의 단기금리에 있어서는 통안채에 비해 높은 유동성을 지니고 있다.

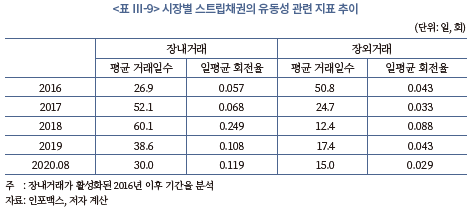

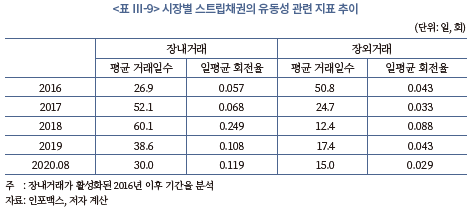

<표 Ⅲ-9>는 스트립채권의 거래시장별 유동성 지표 추이를 나타낸 것이다. 스트립채권의 거래시장별 유동성 지표를 보면 장내시장이 장외시장에 비해 높은 것으로 나타났다. 스트립채권의 평균 거래일수의 시장별 평균값을 보면 2016년에는 장외시장의 평균 거래일수가 50.8일이고 장내시장의 경우 26.9일로 장외시장의 유동성이 장내시장에 비해 높은 것으로 나타났다. 그러나 2017년 이후에는 장내시장의 평균 거래일수가 장외시장에 비해 긴 것으로 나타났다. 이와 같이 2017년 이후 장내시장의 유동성이 높은 것은 스트립전문딜러제도 도입으로 장내 유동성이 크게 증가하였기 때문이다. 스트립전문딜러는 국채전문유통시장에서 최근 만기가 도래하는 스트립채권 3개 종목에 종목당 3개 이상의 호가를 제출해야 한다. 이러한 단기 스트립채권에 대한 지속적인 호가 제공에 따라 장내 스트립채권시장의 유동성이 크게 제고되었다.

일평균 회전율에서도 장내거래가 장외거래에 비해 높은 유동성을 보이고 있다. 평균 거래일수의 결과와 달리 2016년에 장내 일평균 회전율이 장외시장에 비해 높게 나타나고 있는 것은 장내시장에서 주로 거래되는 만기 1년 이내의 스트립채권의 잔액이 상대적으로 작기 때문이다.

스트립채권 유형별 유동성 지표를 살펴보면 전반적으로 스트립원금의 유동성이 스트립이자에 비해 높게 나타나고 있다. 스트립채권의 평균 거래일수를 보면 2015년과 2016년에는 스트립이자의 거래일수가 긴 것으로 나타났으나 2017년 이후에는 스트립원금의 거래일수가 길게 나타나고 있다. 일부 기간 스트립이자의 평균 거래일수가 스트립원금에 비해 길게 나타나고 있는 것은 제한된 종목에서 거래가 꾸준히 이루어졌기 때문이다. 유형별 거래일수 추이를 보면 스트립원금은 2015년 20.3일을 기록한 이후 지속적으로 거래일수가 늘어나는 추세를 보이고 있다. 반면 스트립이자는 2016년 최대 일수를 기록한 이후 연도별로 변동성을 보이는 가운데 거래일수가 줄어드는 추세를 보이고 있다.

거래회전율의 경우에는 전기간에 걸쳐 스트립원금의 회전율이 스트립이자에 비해 높게 나타나고 있다. 스트립원금의 거래회전율의 추이를 보면 연도별로 변동성이 높은 것으로 나타났다. 이와 같은 결과는 스트립 잔액은 증가추세를 보인 반면 스트립의 거래량이 연도별로 높은 변동을 보인 데에 따른 결과이다.

이상의 분석 결과를 정리해보면 장내시장이 장외시장에 비해 높은 유동성을 나타내고 있으며 이는 스트립전문딜러제도의 도입이 주요 요인으로 작용한 것으로 판단된다. 그러나 장내시장에서 주로 거래되는 스트립채권은 만기 도래 1년 이내의 제한된 종목이기 때문에 장내 스트립채권의 유동성 제고가 전체 시장 유동성 제고 효과로 해석하는 데에는 제약이 존재한다.

5. 국내 스트립채권의 수익률 특성 분석

가. 분석방법

스트립채권은 다양한 만기의 채권으로 분리되어 거래가 되기 때문에 다양한 스트립채권의 유통수익률은 금리의 정밀도와 수익률 곡선의 완성도를 제고시키는 기능을 한다. 한편 스트립채권의 유형이나 만기 등에 따라 스트립채권의 가격이 다르다는 주장도 존재한다. Daves et al.(1993)은 스트립원금이 스트립이자에 비해 높은 가격으로 거래되고 있는 시장 이상현상이 나타나고 있다고 주장하고 그 원인으로 스트립원금과 스트립이자 간의 유동성의 차이와 재결합의 특성 등을 들고 있다. Sack(2000)의 연구에서는 동일한 조건의 스트립원금과 스트립이자 간에 수익률 차이가 존재하며, 이는 스트립원금의 경우 기초자산인 국채의 수익률과 관련성이 높은 반면 스트립이자는 채권 자체의 현금흐름에 영향을 받기 때문이라는 결과를 제시하고 있다.

스트립채권의 유형이나 만기별로 가격 차이가 발생하는 경우 이를 활용한 차익거래의 유인이 존재한다. 동일한 조건의 스트립이자와 스트립원금 간 혹은 스트립채권과 동일 만기 국고채 간에 가격 차이가 존재할 경우 투자자들은 재결합이나 다양한 종류의 스트립채권을 결합한 투자를 통해 초과수익을 거둘 수 있다.

이에 본 절에서는 국내 스트립채권의 유형별, 만기별 스프레드13) 추이와 특성을 분석하여 스트립채권의 가격효율성을 평가하고, 국내 스트립채권시장에서 차익거래의 기회가 존재하는지를 살펴본다. 본 분석에 사용된 스트립채권의 일평균 수익률은 인포맥스의 장내외 유통시장 자료를 통해 계산했고, 시가평가수익률은 금융투자협회에서 발표하는 민간 시가평가회사의 만기별 국고채 수익률 평균을 사용14)하였다. 분석기간은 2015년 1월부터 2020년 8월말까지 거래된 모든 스트립채권의 일간 평균 수익률을 대상으로 하되 거래규모가 1억원 미만의 표본은 분석에서 제외하였다.

나. 스트립채권 유형별 스프레드 분석

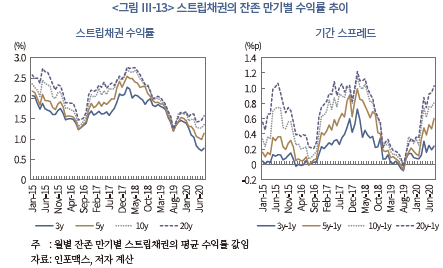

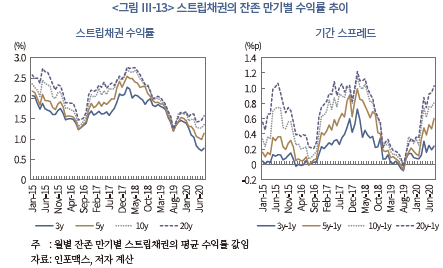

<그림 Ⅲ-13>은 분석 샘플의 잔존 만기별 월평균 수익률과 기간 스프레드의 추이를 나타내고 있다. 스트립채권의 수익률은 시가평가수익률과 유사한 추이를 보이고 있다. 기간별 수익률의 변화 추이를 보면 전반적인 수익률이 하향 추세를 보이는 가운데 2015년 5월~2015년 6월, 2015년 11월~2015년 12월, 2016년 8월~2018년 3월, 2019년 9월~2019년 12월 그리고 2020년 7월~2020년 8월의 기간 중에는 월평균 수익률이 상승하였다. 스트립채권의 만기 스프레드 추이를 보면 금리가 상승하는 시기에는 기간 스프레드가 확대되고 금리가 하락하는 시기에는 기간 스프레드가 축소되는 모습을 보이고 있다.

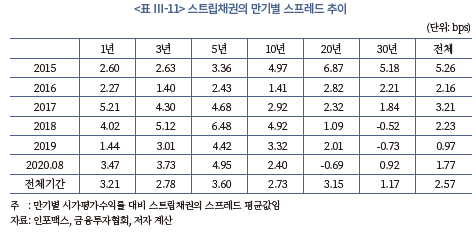

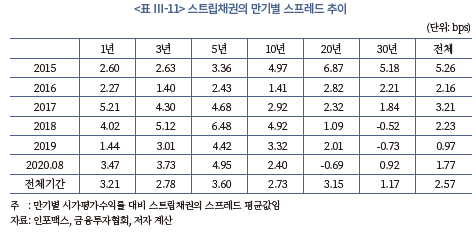

분석기간의 동일 만기 시가평가수익률 대비 스트립채권의 스프레드 평균은 2.57bps를 기록하고 있다. 이는 스트립채권이 동일한 국고채에 비해 낮은 가격으로 거래되고 있다는 것을 의미한다. 이와 같이 스트립채권의 가격이 동일 조건 국고채에 비해 낮은 것은 국고채에 비해 상대적으로 발행 규모가 작고, 다양한 종류로 발행되어 표준화의 정도가 낮은 것이 주요한 요인으로 작용하였기 때문이다.

한편 스트립채권이 동일한 조건의 국고채에 비해 낮은 가격으로 거래되고 있는 결과는 스트립채권을 활용한 차익거래 가능성이 있음을 나타내는 것으로 볼 수 있다. 다양한 스트립채권을 조합하는 경우 국고채에 비해 높은 수익을 거둘 기회가 존재하며 일부 투자자들은 이러한 가격 특성을 반영하여 투자수익을 제고할 목적으로 스트립채권에 투자를 하고 있는 것으로 나타났다.

연도별 스트립채권의 국고채 대비 스프레드 추이를 보면 2015년 5.26bps를 기록한 이후 하락세를 보여 2019년에는 0.97bps를 기록하였다. 이와 같이 스트립채권의 스프레드가 하락한 것은 금리의 하락 추세와 수급요인이 작용하였기 때문이다. 일반적으로 금리가 하락하면 스프레드도 축소하는 경향을 보인다. 저금리 추세는 스트립채권의 가격에도 영향을 미쳐 스프레드가 축소되는 결과를 초래하였을 가능성이 있다. 이와 더불어 스트립채권시장의 참여자가 확대되고, 거래가 증가된 것도 스프레드 축소에 영향을 미쳤을 가능성이 있다. 다양한 목적의 거래가 활성화됨에 따라 스트립채권의 가격 효율성이 제고되어 스프레드 축소에 영향을 미쳤을 가능성이 있다.

만기별 스트립채권의 스프레드를 비교해보면 30년 만기 스트립채권의 스프레드가 가장 낮은 반면 5년 만기 스트립채권의 스프레드가 가장 큰 것으로 나타났다. 30년 만기 스트립채권의 경우 기초자산의 유동성이 낮아 스트립 비율이 높아진 것이 스프레드 축소의 주요 요인으로 작용하였다. 반면 5년 만기 스트립채권의 경우 발행규모가 작아서 유동성이 낮은 것이 높은 스프레드의 주요 요인이 된 것으로 보여진다.

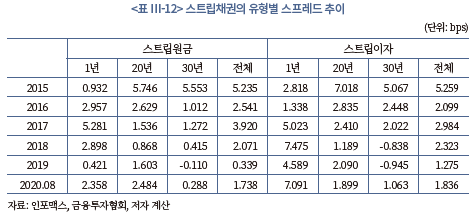

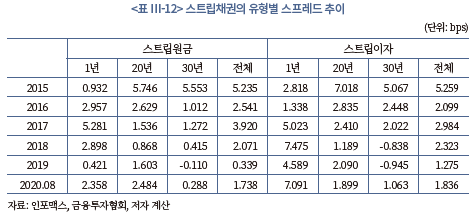

스트립채권 유형별 스프레드를 비교해보면 스트립이자가 스트립원금에 비해 스프레드가 큰 것으로 나타났다. 연도별 추이를 보면 2016년과 2017년의 경우에는 스트립이자의 스프레드가 스트립원금에 비해 낮은 값을 보였으나 이후에는 스트립이자의 스프레드가 지속적으로 높게 나타나고 있다. 이와 같이 국내 스트립채권 유형별 가격 특성은 외국의 스트립채권 가격에 대한 연구와 동일하게 스트립이자의 스프레드 평균이 동일한 조건의 스트립원금에 비해 높은 모습을 보이고 있다.

스트립이자가 동일한 만기의 스트립원금에 비해 낮은 가격을 보이는 것은 스트립이자가 다양한 소액의 종류로 발행됨에 따라 스트립원금에 비해 유동성이 낮아서 만기 보유의 부담이 존재하기 때문이다. 또한 금리의 상승 추세도 일부 영향을 미친 것으로 보인다. 이에 따라 스트립채권 투자를 통해 초과수익을 거둘 목적으로의 투자자들은 스트립이자에 투자하고 만기까지 보유하는 전략을 주로 취한다.

다. 스트립채권 구조에 따른 스프레드 분석

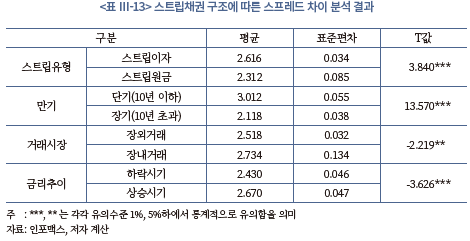

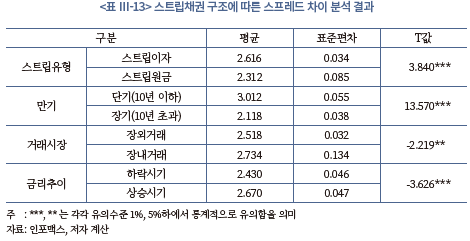

스트립채권의 구조에 따른 가격 차이가 존재하는지를 살펴보기 위해 스트립 유형, 만기 유형, 금리의 상승 여부, 장내 거래 여부 등에 따른 스프레드의 차이에 대한 통계 분석을 실시하였다.

분석 결과 스트립채권의 특성과 시장 상황은 스트립채권의 스프레드에 유의한 영향을 미치는 것으로 나타났다. 스트립 유형별 스프레드 평균값을 보면 스트립이자가 스트립원금에 비해 통계적으로 유의하게 높은 것으로 나타났다. 이는 앞에서 살펴본 바와 같이 스트립이자가 다양한 소액의 채권으로 발행되기 때문에 동일한 만기의 국고채에 비해 낮은 가격으로 거래가 이루어지기 때문이다.

만기별 스프레드 차이를 보면 단기 스트립채권이 장기 스트립채권에 비해 통계적으로 유의하게 높은 스프레드를 나타내고 있다. 이와 같이 장기 스트립채권의 스프레드가 단기 스트립채권에 비해 낮은 것은 장기 스트립채권에 대한 지속적인 수요가 존재하고, 기초자산과 비교하여 유동성의 차이가 크지 않으며, 가격의 차이도 크지 않기 때문에 나타나는 결과라고 볼 수 있다.

거래시장별 스트립채권의 스프레드를 비교해보면 장외시장의 스프레드가 장내시장에 비해 낮은 것으로 나타났다. 이러한 결과는 복합적인 요인에 의한 것으로 해석할 수 있다. 장내시장과 장외시장의 거래참여자와 시장 특성의 차이가 스프레드 차이를 초래한 것으로 볼 수 있다. 이와 더불어 단기 스트립채권이 장기 스트립채권에 비해 높은 스프레드를 나타내는 상황에서 대부분 단기 스트립채권이 장내거래에서 거래되는 것도 스프레드 차이의 한 요인으로 작용한 것으로 해석해 볼 수 있다.

금리 상황에 따른 스트립채권의 스프레드 차이를 보면 금리가 상승하는 시기가 금리가 하락하는 시기에 비해 스프레드가 높게 나타나고 있다. 이와 같은 차이가 발생하는 것은 금리 상황에 따른 수급요인이 작용하기 때문이다. 즉 금리가 하락하는 경우 금리하락에 따른 재투자위험이 증가하고 이에 따라 스트립채권에 대한 수요가 증가하여 상대적으로 스트립채권의 가격이 높게 형성되기 때문에 스프레드가 낮아지는 모습을 보이는 것으로 해석해 볼 수 있다.

이상의 결과를 종합해보면 국내 스트립채권은 동일 만기 국고채 대비 정의 스프레드를 보이고 있으며, 이에 따라 국내 스트립채권시장은 수익률 차이를 이용한 차익거래의 기회가 존재하는 것으로 나타났다. 한편 연도별 스트립채권의 스프레드는 줄어드는 추세를 보여 차익거래의 기회가 줄어드는 모습을 보이고 있다. 이는 금리의 하락 추세와 더불어 스트립채권시장의 가격 효율성이 제고되고 있음을 나타내는 결과라고 해석해 볼 수 있다.

국내 스트립채권의 가격은 다양한 요인에 의해 영향을 받는 것으로 나타났다. 상대적으로 발행규모가 작고 유동성이 낮은 스트립이자가 스트립원금에 비해 높은 스프레드 값을 보이고 있다. 또한 단기 스트립채권이 장기 스트립채권에 비해 통계적으로 유의하게 스프레드가 높은 것으로 나타났다. 이에 따라 스트립채권의 구조에 따른 가격 차이를 이용하여 수익을 제고하는 기회가 존재한다. 자산운용사가 단기 스트립채권과 스트립이자에 투자 비중이 높은 것은 이러한 가격 특성을 반영하여 투자 수익을 높이려는 전략의 한 예라고 볼 수 있다. 한편 시장의 금리 상황도 스트립채권의 스프레드에 영향을 미치고 있다. 이는 금리 하락기에 이표채의 재투자위험이 증가함에 따라 스트립채권에 대한 수요가 증가하기 때문에 발생한 결과로 볼 수 있다.

이와 같이 스트립채권은 다양한 투자 목적으로 활용되며 이러한 투자목적에 따른 수급요인과 시장상황이 스트립채권의 스프레드에 영향을 미치고 있는 것으로 나타났다.

Ⅳ. 결론 및 시사점

국내 스트립채권 투자자는 다양한 목적으로 스트립채권에 투자를 한다. 장기 스트립채권의 투자를 선호하는 투자자들은 장기 국채에 기초한 스트립채권에 주로 투자를 한다. 일부 스트립채권 투자자들은 금리 변화에 따른 재투자위험을 통제하거나 가격 차이를 이용한 차익거래를 거둘 목적으로 스트립채권에 투자하기도 한다.

국내 스트립채권 유통시장은 장내시장과 장외시장이 참여자와 거래되는 스트립채권 특성에 있어 커다란 차이를 보이고 있다. 장내시장은 딜러간에 만기 1년 이내의 단기 스트립원금을 위주로 거래가 이루어지고 있는데 반해 장외시장은 스트립채권에 대한 실제 투자자들 간에 다양한 스트립원금과 스트립이자가 거래되고 있다. 최근 스트립전문딜러제도 도입 이후 장내 스트립채권시장의 유동성이 크게 제고되고 있다. 이러한 장내 유통시장 활성화는 단기 스트립채권의 유동성을 제고하고, 단기 무위험채권의 수익률 곡선의 완성도를 높였다는 측면에서 긍정적으로 평가되지만 장기 스트립채권의 거래를 위축시키는 구축효과가 발생할 가능성이 있다는 점에서 부정적인 측면도 존재한다.

스트립채권의 수익률 특성을 보면 스트립채권의 수익률이 국고채에 비해 높은 것으로 나타났고, 스트립이자의 수익률이 스트립원금에 비해 높은 것으로 나타났다. 스트립채권의 스프레드는 스트립 유형뿐만 아니라 만기, 금리의 상향 여부 및 거래시장별로 차이를 나타내고 있다. 이는 스트립채권의 가격이 다양한 요소에 의해 결정되고 있다는 것을 나타내는 결과이다.

이상과 같은 스트립채권의 특성 분석 결과 국내 스트립채권시장은 투자자, 채권시장에 다양한 효과를 제공하고 있는 것으로 평가된다. 우선 스트립채권은 투자자의 목적에 부합하는 다양한 무위험채권의 공급을 확대하는 효과를 제공한다. 특히 장기 투자를 선호하는 투자자의 수요 증대에 대응하여 듀레이션이 긴 채권의 공급을 확대하는 효과를 지니고 있다. 또한 스트립채권이 가격 차이를 활용하여 투자수익을 제고하려는 투자자에게 투자수익 제고의 기회를 제공하는 역할을 하고 있다. 스트립채권의 수익률 분석 결과를 보면 스트립채권은 동일한 만기의 국고채 대비 정의 스프레드를 나타내고 있고, 스트립원금과 스트립이자 간에도 가격 차이가 존재한다. 이는 스트립채권의 가격 차이를 활용하여 초과수익을 거둘 수 있는 기회를 제공하고 있음을 나타내는 결과이다.

한편 스트립채권의 유통시장 분석 결과를 보면 상대적으로 장내시장을 중심으로 유동성이 제고되어 필요시 스트립채권의 환매 가능성이 높아지고 단기 무위험채권 수익률 곡선의 완성도를 제고시키는 효과를 제공하는 것으로 나타났다. 다만 장내시장에서 거래되는 채권은 대부분 만기 1년 이내의 스트립채권이기 때문에 장내 스트립채권의 유동성 제고가 전체 스트립채권시장의 유동성 제고 효과로 해석하는 데에는 제약이 존재한다.

향후 스트립채권시장이 지속적으로 발전하기 위해서는 다음과 같은 측면에서 시장을 활성화하는 노력이 지속될 필요가 있다.

발행자 측면에서 스트립채권의 수요를 면밀히 파악하고 탄력적인 스트립채권의 공급이 이루어지는 방안을 마련할 필요가 있다. 스트립채권의 주요 투자자는 보험회사와 연기금 등이다. 이에 따라 스트립채권은 주로 보험회사와 연기금의 수요에 따라 발행되었다. 특히 보험회사의 회계기준 변경 등에 따른 장기 스트립채권의 수요로 인하여 스트립채권의 발행이 크게 증가하였고, 스트립채권의 구조와 특성이 결정되었다. 향후 시장의 지속적인 발전을 위해서는 시장구조의 변화와 투자자의 스트립 수요를 정확히 파악하고 대응할 필요가 있다. 이와 더불어 투자자 저변을 확대할 필요가 있다. 다양한 투자목적을 지닌 투자자를 발굴하여 향후 보험회사의 규제 요인에 의한 스트립발행의 수요가 감소하는 상황에 대비할 필요가 있다.

투자자 측면에서 스트립채권의 특성에 따른 투자전략의 정교화가 필요하다. 국내 스트립채권은 투자목적, 금리상황 및 시장여건에 따라 상품 특성과 가격이 다른 모습을 보이고 있다. 이에 따라 스트립채권시장의 특성을 반영한 투자전략의 정교화가 필요하다. 이를 위해서는 투자자들의 스트립채권시장에 대한 분석 능력을 제고할 필요가 있다. 수급요인 및 가격 결정에 영향을 미치는 다양한 요인에 대한 분석에 근거하여 투자전략이 마련되어야 한다. 이와 더불어 스트립채권을 활용한 다양한 패키지 상품을 도입하여 투자자의 선호에 부합하는 상품 설계 능력을 제고해야 한다.

스트립채권 유통시장 측면에서 거래 대상 스트립채권을 확대하는 방안이 마련되어야 한다. 국내 스트립채권의 유통시장은 장내거래를 활성화하려는 정부의 정책에 힘입어 잔존만기 1년 미만의 스트립원금을 중심으로 거래가 활성화되고 있다. 그러나 장기의 스트립채권은 대부분 만기 보유를 목적으로 투자가 이루어지고 있어 유동성이 낮다. 따라서 유동성이 낮은 장기 국채의 유동성을 보완하기 위해 장기채를 기초로 스트립이 활발히 추진되고 스트립채권의 거래가 활성화되는 방안을 마련할 필요가 있다. 특히 단기 스트립채권을 위주로 거래가 이루어지고 있는 장내시장의 거래 대상을 확대하는 노력이 필요하다.

스트립채권의 가격은 스트립 특성, 시장여건, 금리 상황, 유동성 및 정보제공 등 다양한 요소에 의해 결정된다. 특히 스트립채권의 유동성 요소는 가격의 효율성을 제한하는 주요한 요소로 작용하고 있다. 이에 따라 스트립채권의 유동성을 제고하고, 다양한 투자자가 참여하는 방안이 마련되어야 한다.

이와 더불어 스트립채권에 대한 기초 채권 등의 정보제공이 강화되어야 한다. 국내의 경우에는 스트립채권의 발행 및 유통과 관련한 기초정보 제공이 미흡하여 스트립시장에 대한 분석이 이루어지지 못하고 있다. 따라서 스트립채권의 기초자산에 정보를 포함한 발행 관련 정보 제공을 확대할 필요가 있다. 이와 더불어 스트립채권의 유통시장에 대한 정보도 확충될 필요가 있다.

1) 오승현 외(2004)

2) 전자등록부 등록을 통해 증권을 발행하는 시스템을 의미

3) Bulter et al.(2014)

4) 국고채권의 발행 및 국채전문딜러 운영에 관한 규정 제2조 (정의)

5) 국고채권의 발행 및 국채전문딜러 운영에 관한 규정 제17조

6) 기재부장관은 스트립전문딜러를 매 6개월마다 지정할 수 있으며, 스트립전문딜러는 최근 6개월의 스트립 거래실적 및 스트립전담딜러 개수 등을 고려하여 지정한다.

7) 스트립전문딜러는 국채전문유통시장에서 최근 만기가 도래하는 원금분리채권 또는 이자분리채권으로 거래소가 지정하는 3개 종목에 종목당 3개 이상의 호가를 제출해야 한다.

8) 스트립전문딜러는 경쟁입찰 이후 제3영업일까지 경쟁입찰대상 국고채를 대상으로 종목별 20% 이내에서 스트립 발행을 위한 비경쟁인수권한을 행사할 수 있다.

9) 2020년 상반기중 국고채 발행은 과거 연간 발행규모에 버금가는 91.6조원을 기록하였다. 이와 같이 발행규모가 늘어난 것은 재정수요 증가와 더불어 코로나19사태로 4차에 걸쳐 추경이 편성되었기 때문이다. 국채 발행 확대에 따라 국고채 잔액은 전년말 대비 11.0% 증가한 679조원을 기록하였다.

10) 국채전문딜러의 장내거래 의무화는 2001년 도입되었고, 2008년에 폐지되었다.

11) 한국예탁결제원의 스트립채권 신청기관 특성별 신청 금액과 건수를 분석한 결과이며, 신청금액은 실제 발행금액과 차이가 존재할 수 있다.

12) 국고채 지표물의 지정 기간은 3년, 5년, 10년 국고채는 연 2회, 20년물 이상은 통합발행기간(통상 연간 1회)을 기준으로 설정된다.

13) 본 분석에서 스트립채권의 스프레드는 스트립채권의 일평균 유통수익률에서 동일 만기 국고채 시가평가 수익률 간의 차이로 정의한다.

14) 시가평가 수익률과 스트립채권의 잔존 만기별 수익률의 기간을 매칭하기 위해 선형보간법을 사용하여 만기월별 시가평가수익률을 계산하였다.

참고문헌

강승철, 2006, 국채 스트립제도에 관한 소고, 한국예탁결제원 『증권예탁』32.

신현열‧김자혜, 2013, 시장지표를 활용한 자산의 유동성 평가, BOK 『경제리뷰』.

오승현‧유윤주, 2004, 『채권스트립에 관한 연구』, 한국증권연구원 연구보고서.

윤석완‧노상윤, 2005, 국고채 STRIPS를 통한 시장 유동성 증대에 관한 소고,『재정정책논집』 7.

정희준, 2001, 국채간 수익률구조 비교 및 국고채권의 STRIPS 도입에 관한 연구,『증권학회지』.

한국거래소, 2019,『한국의 채권시장』.

Allen, F., Gale, D., 1988, Optimal security design, Review of Financial Studies 3, 229-263.

Amihud, Y., Mendelson, H., 1991, Liquidity, maturity, and the yields on US treasury securities, The Journal of Finance 46(4), 1411-1425.

Bulter, M., Livingston, M., Zhou, L., 2014, A long-term perspective on the determinants of treasury bond stripping levels, Financial Markets, Institutions & Insttruments 23(4).

Daves, P. R., Ehrhardt, M. C., 1993, Liquidity, reconstitution, and the value of U.S. treasury strips, The Journal of Finance 48(1).

Galliani, L., Petrella, G., Trsti, A., 2014, The liquidity of corporate and government bonds: Drivers and sensitivity to different market conditions, JRC Technical Reports.

Grinblatt, M., Longstaff, M. A., 2000, Financial innovation and the role of derivative securities: An empirical analysis of the treasury STRIPS program, The Journal of Finance 60(3).

Halpern, P. and Rumsey, J., 2000, Strip bonds and arbitrage bounds, Canadian Journal of Administrative Sciences, 143-52.

Nobuyuki Jujiki, 2003, The introduction of strips in Japan, Capital Research Journal 6(1).

Sack, B., 2000, Using treasury strips to measure the yield curve, FRB working paper.

Sundaresan, S. M., 2002, Fixed Income Markets and Their Derivatives, South-Western, a division of Thomon Learning.

Volker Vonhoff, 2014, Yield differences between coupon and principal STRIPS, Managerial Finance 40(4), 326-354.

스트립(Separate Trading of Registered Interest and Principal of Securities: STRIPS)은 채권의 이자와 원금을 분리하여 여러개의 무이표채권으로 발행하여 투자성을 높인 채권을 의미한다. 스트립채권은 이표채권의 재투자위험을 제거하고, 경과물의 유동성 부족을 완화하며, 시장 가격발견 기능을 제고하는 효과를 제공할 수 있는 상품이다.

국내 스트립채권은 2006년에 도입되었고, 2010년부터 발행이 증가하고 있으며, 최근 국채전문유통시장을 중심으로 거래가 활성화되고 있다. 국내 스트립채권은 국고채딜러에 의해 발행되고, 주요 기관투자자들이 다양한 목적으로 투자를 한다. 스트립채권의 투자는 자산의 장기화, 차익거래 및 무위험채권의 투자 등에 활용되고 있다. 특히 최근에는 보험회사에 대한 규제 변화에 따라 규제 목적에 부합하는 장기 무위험자산의 투자 수단으로 스트립채권에 대한 투자가 확대되고 있다. 국내 스트립채권 유통시장은 장내시장과 장외시장으로 구성되어 있다. 장내시장과 장외시장의 스트립채권 거래는 시장참여자, 거래상품 및 거래방식에 있어 확연한 차이가 존재한다. 또한 시장참여자의 특성, 채권시장 상황 및 유동성 등의 다양한 요인은 스트립채권의 가격결정에도 영향을 주고 있다.

국내 스트립채권시장의 규모가 증가하고, 유통시장이 활성화되고 있음에도 불구하고 스트립채권시장에 대한 세부적인 정보제공이나 체계적인 분석은 이루어지지 않고 있다. 특히 거래가 활성화된 2016년 이후의 스트립채권시장을 대상으로 한 분석은 거의 이루어지고 있지 않다. 스트립채권시장이 어떤 특성을 나타내는지, 도입 목적에 부합한 역할과 기능을 하는지에 대한 검증이 적정하게 이루어지고 있지 못한 상황이다. 이에 따라 스트립채권시장의 세부적인 분석을 통해 국내 스트립채권시장의 특성 및 경제적 효과에 대한 검토를 기반으로 투자자의 스트립채권 투자전략의 정교화 및 시장 활성화를 위한 개선방안을 마련할 필요가 있다.

본 연구는 스트립채권 발행시장과 유통시장에 대한 세부적인 분석에 근거하여 스트립채권 특성과 경제적인 효과를 분석하고 스트립채권시장의 활성화 방안을 검토하는 것을 목적으로 한다. 이를 위해 본 연구에서는 스트립채권의 기본 개념과 구조를 살피고, 국내 스트립채권시장의 주요한 특성을 분석한다. 스트립채권의 발행자, 투자자, 유통시장 및 수익률의 특성 분석에 근거하여 스트립채권의 역할과 기능을 평가한다. 이를 바탕으로 국내 스트립채권시장의 활성화를 위한 시사점을 제공한다.

이러한 연구는 국내 스트립채권시장의 활성화와 활용도 제고에 기여할 것으로 기대한다. 스트립채권시장의 세부적인 발행 및 거래 자료를 이용한 스트립채권 특성 분석을 통해 스트립 투자자들이 시장 특성에 부합하는 투자전략 수립에 기여할 수 있을 것으로 보인다. 또한 장기 국고채의 낮은 유동성을 보완하는 스트립채권의 유동성과 수익률에 대한 분석을 통해 채권시장의 완비성을 제고하고 스트립채권시장의 활성화에 시사점을 제공할 수 있을 것이다.

Ⅱ. 스트립채권의 개념과 경제적 효과

1. 스트립채권의 개념과 구조

가. 기본개념

스트립채권은 이표채권(coupon bond)의 현금흐름을 분리하여 이자 및 원금 자체를 개별적인 무이표채권(zero coupon bond)으로 전환시키는 상품이다. 예를 들어 2019년 12월에 발행된 10년 만기 국고채(매년 2회 이자지급)를 발행시점에서 스트립한다고 가정하면, 2029년 12월에 만기가 도래하는 1개의 원금스트립(Principal STRIP)과 6개월마다 만기가 도래하는 20개의 이표스트립(Coupon STRIPs) 등 총 21개의 개별 무이표채권으로 분리하여 발행할 수 있다. 각각의 스트립채권은 할인채 형태로 발행되어 유통시장에서 거래가 가능하다.

나. 스트립채권 발행 절차

스트립채권은 국채를 기초로 발행하기 때문에 기존 채권과는 다른 발행 절차가 도입된다. 국채를 보유한 기관이 국채관리기관에게 스트립 발행 신청을 하고, 국채관리기관이 이를 승인하고 대체기재 방식으로 등록하는 절차를 통해 발행이 이루어진다.

스트립채권 발행 절차를 자세히 살펴보면 국고채를 보유한 자가 원금이자를 분리하고자 하는 경우에는 한국예탁결제원을 경유하여 한국은행 금융망을 통해 전문송신으로 요청하고, 국고채 예탁자는 한국예탁결제원의 SAFE+ 시스템을 이용하여 소유한 기초채권의 원금이자분리를 신청한다. 채권보유자가 채권스트립을 요구하면 한국예탁결제원은 신청자 계좌부에 스트립 대상 채권이 실제 보유되어 있는지와 원본 채권이 스트립 가능 채권인지 여부를 확인한 후 절차가 종료될 때까지 동 수량에 대해 매매 등의 양도가 제한되도록 조치를 한다. 만일 두조건 중 하나라도 충족하지 못할 경우에는 스트립 및 재구성이 거부된다. 한국예탁결제원이 신청기관의 소유여부 확인 후, BOK Wire+를 통해 한국은행에 일괄 신청하면 한국은행은 신청내용을 확인한 후 국채등록부에 반영한다. 한국은행은 원금이자분리채권의 등록사실을 BOK Wire+를 통한 전문송신 방법으로 한국예탁결제원에 통보하고, 한국거래소 앞으로 상장 및 표준코드 부여를 의뢰한다. 스트립채권의 발행은 기초가 되는 국고채를 차감하는 대신 원금분리채권 및 이자분리채권으로 대체 등록을 통해 완료된다. 원금채권과 이표채권의 재결합의 경우에는 스트립과 반대로 기존 스트립채권을 국고채로 대체하는 절차를 거치게 된다. 한국예탁결제원은 원금이자분리나 재결합의 내용을 익영업일 오전 업무개시 이전에 예탁자계좌부에 일괄 기재하고, 한국거래소도 국채전문유통시장에 익일 오전 업무개시 이전에 상장 처리한다.

스트립이 가능한 금액은 국고채 액면가 1,600만원의 정수배이다. 이는 국채 발행시 이자율이 0.125%단위로 발행되기 때문에 이자스트립 액면가가 최소 1만원 이상 유지되기 위한 것이다.

가. 주요국의 스트립채권 도입 연혁

스트립채권은 금리 변동에 따른 재투자위험을 관리하기 위해 도입되었다. 1970년대 석유파동으로 높은 인플레이션을 겪게 되었고 이를 통제하기 위해 미국 연준은 고금리 정책을 추진하였다. 고금리 상황은 1982년에 정점을 기록하였고, 이후부터 시장금리가 하락하기 시작하였다. 금리 하향 추세에 따라 연금, 보험회사와 같은 장기 채권 투자자들이 재투자위험에 직면하여 장기 무이표채권에 대한 수요가 증가하였다. 이에 1982년 Merrill Lynch가 미국 국채를 매입하고 원본과 이표를 분리한 TIGRs (Treasury Investment Growth Receipts)를 개발하여 최초로 스트립채권이 도입되었다.1) 이후 다양한 투자은행들이 유사한 상품을 도입하여 연기금이나 개인투자자를 대상으로 무이표채권을 매매하면서 스트립채권시장이 활성화되었다. 그러나 이러한 스트립채권은 발행 증권회사를 통해 만기별로 거래되어 유동성이 부족했고, 신탁에 따른 신용위험 노출이라는 문제점을 가지고 있었다.

국채의 현금 흐름을 분리한 무이표채권 거래가 증가하자 미 재무부는 1985년 2월 연준 대체기재 시스템(Federal Reserve Book Entry System)2)을 통해 분리 가능한 국채를 공표하고 공식적으로 국채 스트립 프로그램을 도입하였다. 제도 도입 초기에는 연준 대체기재 시스템을 통해 스트립할 수 있는 국채를 지정하였다. 1987년에는 미 연준이 스트립채권의 재결합을 허용하여 스트립과 재결합이 가능한 시장이 마련되었다. 연준을 통한 스트립 시스템의 마련은 스트립채권의 표준화를 통한 유동성 제고, 전산화를 통해 스트립 비용 절감의 효과3)를 거두었다. 이후 1997년 1월에는 물가연동국채(Treasury Inflation Protected Securities: TIPS)의 스트립이 허용되었고, 1997년 9월부터는 T-Note, T-Bond 등 모든 국채를 스트립 가능 채권으로 지정하였다. 그럼에도 불구하고 미국의 스트립채권은 장기채인 T-bond를 위주로 발행되고 있다. 단기채나 물가채의 경우 스트립 발행의 유인이 적기 때문이다. 도입 이후 미국의 스트립채권의 발행은 크게 증가하였으나 이후 장기채 발행 감소 등의 요인으로 스트립 발행은 감소하는 추세를 보였다. 2019년말 기준 미국의 스트립채권 잔액은 3,310억달러로 전체 국채의 2.4% 수준을 기록하고 있다.

미국이 스트립 제도를 도입한 이후 캐나다, 프랑스, 벨기에, 네덜란드, 오스트리아, 독일, 스페인, 이탈리아, 일본 등도 스트립채권 제도를 마련하였다. 특히 캐나다는 1987년 캐나다 예탁원을 통한 전자적 대체기재 시스템을 도입한 이래 국채뿐만 아니라 지방정부채, 회사채 및 자산유동화증권 등에 대해서도 스트립 제도를 운영하고 있다. 캐나다 국채는 미국 국채에 비해 유동성이 낮다. 이에 따라 낮은 유동성을 보완하고, 다양한 투자수익을 거둘 목적으로 투자자의 스트립 수요가 지속적으로 증가하였다. 이러한 시장의 수요 증가와 탄력적인 스트립 제도의 도입에 힘입어 캐나다 국채의 스트립 비율은 국채 잔액의 20% 내외를 기록하고 있다. 영국은 1987년에 국채 스트립제도를 도입하였다. 스트립 가능 국채를 지정하고, 국채전문딜러(Gilt-Edged Market Makers: GEMMs)에게 국채 스트립을 허용하였으며 일반 시장참여자들은 국채전문딜러를 통해 스트립에 참여할 수 있도록 하는 제도를 마련하였다. 또한 스트립이 용이하도록 국채의 이자지급 일자를 통일하였다. 프랑스는 1991년 장기 국채인 OATs(Obligation Assimilable du Trésor)에 대한 스트립 제도를 도입하였다. 스트립 및 재결합은 국채전문딜러에게 허용하였고, 일반 투자자들은 국채전문딜러를 통해 스트립을 활용할 수 있도록 하였다. 프랑스의 스트립채권 발행은 10년 이상의 장기채에 집중되어 있으며, 장기채의 스트립 비율은 5% 내외를 기록하고 있다.

주요국은 국채 투자자의 다양한 투자선호에 부응하고 국채시장의 유동성을 제고하기 위해 스트립을 도입하였다. 특히 금리 하락기에 재투자위험을 줄이기 위한 수단으로 스트립이 활용되면서 스트립채권에 대한 투자가 증가하였다. 각국 정부는 재정수요 확대에 따른 장기 국채의 발행 수요가 증가함에 따라 다양한 상품설계가 가능한 스트립채권시장의 활성화를 통해 국채의 수요 확대를 도모하고 있다.

나. 국내 스트립채권 제도

국내 스트립채권 제도는 지표 국고채의 유동성 제고, 장기채시장의 활성화 및 장기 무이표채권에 대한 수요 대응 등을 목적으로 2006년 3월 도입되었다. 제도 도입 당시 대상채권은 2006년 이후부터 신규로 발행되는 5년물 이상의 중장기 국고채를 대상으로 하였고, 스트립원금과 이자의 재결합제도도 허용되었다. 제도 도입 이후 2007년 4월 처음으로 20년 만기 국고채를 대상으로 스트립이 실행되었다.

국고채 스트립관련 제도는 국고채권의 발행 및 국채전문딜러 운영에 관한 규정을 통해 마련되었다. 동 규정에서는 국고채 원금이자분리채권의 대상을 정의4)하고, 국고채 원금이자분리채권의 신청기관을 국고채를 보유한 자5)로 정의하여 국고채전문딜러뿐만 아니라 국고채 투자자들도 스트립이 가능한 제도를 마련하였다.

2014년에는 원금이자분리 대상 국고채를 모든 국고채로 확대하였다. 다만 물가연동국고채는 원금 및 이자가 소비자물가지수에 따라 변동되기 때문에 원금이자분리 대상채권에서 제외하였다.

2016년부터는 스트립전문딜러제도6)를 도입하였고, 스트립전문딜러에게 시장조성의무를 부여하였다. 스트립전문딜러는 거래활성화에 필요한 적정 가격이 형성되도록 스트립채권의 매도‧매수 호가 제시7)를 의무화하는 대신 스트립조건부 비경쟁 인수 물량을 정례 공급하는 방안8)을 도입하였다. 또한 스트립 거래실적을 국채전문딜러 분기평가 항목에 포함시켰다.

3. 스트립채권 도입의 경제적 효과

스트립채권은 기존 이표채를 기초로 다양한 만기의 무이표채권을 공급하여 투자자의 다양한 투자수요에 부합하는 상품을 제공하고, 효과적인 투자전략의 추진을 가능하게 한다. 또한 국채시장 측면에서 국채시장의 효율성을 제고시키고, 국채 수익률의 완성도를 제고하며, 국고채 수요를 증가시키는 효과를 제공한다.

가. 투자자에게 미치는 효과

스트립채권은 장기채 투자자에게 듀레이션이 긴 상품을 공급하는 효과를 제공한다. 2017년에 발행된 이표이자율이 2.125%인 30년 만기 국고채의 발행시점 듀레이션은 22.33년인데 이를 스트립하면 스트립원금의 듀레이션은 30년이 된다. 스트립을 통해 듀레이션을 1.3배 늘릴 수 있다. 이와 같이 스트립채권은 동일한 만기의 이표채에 비해 듀레이션이 길기 때문에 장기채 투자자의 선호에 부합하는 상품을 제공하는 효과를 거둘 수 있다.

스트립채권은 이표채의 재투자위험에 노출된 투자자에게 무이표채권의 공급을 확대하여 재투자위험을 줄이는 효과를 제공한다. 국고채는 일반적으로 매년 2회의 이자를 지급하는 이표채의 형태로 발행된다. 이표채 형태의 무위험채권에 투자하는 투자자의 경우 이자의 재투자 시점의 금리 변동에 따라 재투자위험에 노출된다. 이러한 재투자위험에 노출된 투자자는 무이표채권인 스트립채권을 활용하여 재투자위험을 제거할 수 있다. 외국의 경우에도 재투자위험을 줄이기 위한 목적으로 스트립채권 투자가 이루어지고 있다는 주장이 존재한다. Sundaresan(2002)은 이표채의 가격 및 재투자위험 관리가 스트립채권 투자의 주요 유인이라는 주장을 하고 있다. 그는 국채의 이자율이 높을수록, 국채의 만기가 길수록 스트립의 비율이 높아진다는 결과를 제시하고 있다. Bulter et al.(2014)은 실증분석을 통해 이자율과 스트립채권의 발행의 관련성을 분석하였다. 그들은 높은 이표를 지닌 만기가 긴 국채의 경우 수익률이 하락하는 시기에 스트립 비중이 높아지고 있다는 결과를 제시하고 있다. 이는 스트립채권이 재투자위험을 줄이기 위한 수단으로 사용되고 있음을 지지하는 것이다. 이와 같이 채권수익률이 장기적으로 하락하는 추세를 보이는 경우 이자수익의 재투자위험이 증가하고 이에 따라 스트립채권의 투자 유인이 높아지게 된다. 일반적으로 연기금이나 보험회사와 같이 만기보유 목적의 장기 채권에 투자 비중이 높은 투자자들은 스트립채권을 활용하여 재투자위험을 제거하는 전략을 추진한다.

스트립채권은 차익거래 등을 통해 시장의 가격발견 기능을 향상시키는 효과를 제공한다. 동일한 만기를 지닌 국채와 스트립채권은 시장상황, 채권 특성 및 유동성에 따라 다른 가격이 형성될 가능성이 있고 이러한 가격차이를 활용하여 차익거래를 거둘 수도 있다. Allen & Gale(1988)은 자산의 특성에 따른 가격 차이에 대응한 투자전략이 스트립채권 투자의 주요 요인으로 작용한다고 주장하고 있다. 이론적으로 국고채의 가격이 저평가된 경우 이를 스트립하여 스트립채권을 시장의 매수가격에 매도하여 이득을 취할 수 있다. 또한 스트립채권은 동일한 만기의 이표채에 비해 듀레이션이 길기 때문에 볼록성(convexity)이 크고 이에 따라 금리변동에 따른 가격변화도 크다. 이와 같이 이표채와 할인채의 가격 차이 혹은 스트립채권 간의 가격 차이를 활용하여 차익거래를 할 수 있다. 그러나 스트립채권의 가격 차이에 대한 실증분석은 서로 다른 결과를 보여주고 있다. Halpern & Rumsey(2000)는 동일 만기 스트립채권과 국고채 간의 가격 차이에 대한 실증분석 결과 이표채권의 가격이 스트립채권에 비해 높다는 결과를 제시하고 있다. 반면 Sack(2000)은 미국 국채와 스트립 간의 가격 차이는 크지 않으며, 차익거래 유인은 미미하다는 결과를 제시하고 있다. 실제 시장에서 발생하는 가격의 차이는 딜러간의 거래가격의 차이나 호가의 차이 및 세금 등이 주요 요인으로 작용하고 있다고 주장한다. 반면 스트립이자와 스트립원금 간에서는 일부 가격의 차이가 발생하고 있는데 이는 스트립원금의 경우 기초자산의 영향을 크게 받는데 반해 스트립이자는 규모가 작기 때문에 현금흐름과 유동성 등의 요인이 가격결정에 더욱 크게 작용하기 때문이라고 설명한다.

스트립채권을 통해 상품설계와 투자대상의 다양성을 제고할 수 있다. 스트립채권은 할인채로 현금흐름이 한번만 발생하게 된다. 이러한 스트립채권을 조합하면 투자자의 기간투자 선호에 부합하는 상품을 도입할 수 있다. 이와 같이 스트립채권은 기존의 이표채와 현금흐름의 특성이 다르기 때문에 다양한 채권의 공급을 통해 투자자의 상품 선택의 폭을 넓혀주는 효과가 있다.

또한 스트립채권은 이표채가 할인채로 전환되면서 이자소득세 이연에 의한 절세효과를 거둘 수 있다. 이표 국고채는 표면이자율에 근거하여 과세가 이루어지나 스트립채권은 할인채로 전환되기 때문에 할인액을 이자소득으로 인식하여 과세가 이루어진다. 이에 따라 원금이 상환된 이표부분은 과세가 되지 않기 때문에 세금절감효과가 있다. Grinblantt(2000)는 스트립가격에 대한 결정요인에 대한 실증분석 결과 세금 유인이 스트립에 영향을 미친다는 결과를 제시하고 있다.

나. 채권시장에 미치는 효과

스트립채권의 도입은 국채의 발행시장과 유통시장에 영향을 주고 시장의 효율성을 제고시키는 효과를 제공한다. 스트립채권의 도입을 통해 다양한 만기의 무이표채권 발행이 확대되어 수익률곡선의 완성도가 제고되고 시장의 완비성을 높이는 효과를 거둘 수 있다. 국고채를 스트립하는 경우 다양한 스트립이자와 스트립원금이 발행된다. 이와 같이 무이표채권의 종목수가 증가함에 따라 시장참여자들은 다양한 만기의 무이표채 금리를 관찰할 수 있으며, 이에 따라 금리의 정밀도가 제고될 수 있다. 또한 스트립채권의 유통시장이 발달하는 경우 다양한 만기의 수익률 정보 제공이 확대되어 수익률 곡선의 완성도가 제고되는 효과를 거둘 수 있다.

한편 스트립채권의 도입은 장기 국채와 비지표물의 유동성을 제고하는 효과를 도모할 수 있다. 장기 국고채를 기초로 스트립을 하는 경우 유동성이 낮은 장기채의 활용도가 높아지고 스트립 비중 만큼 유동성을 제고시키는 효과가 존재한다.

이상과 같이 스트립채권의 도입은 투자자에게 다양한 효과를 제공하며, 국채시장의 효율성을 제고하는 효과를 나타낼 수 있다. 이에 본 연구에서는 국내 스트립채권의 발행시장과 유통시장의 특성 분석과 스트립 투자자의 구성에 대한 분석을 통하여 앞에서 논의된 스트립채권의 경제적인 효과가 실제로 이루어지고 있는지를 살펴본다.

Ⅲ. 국내 스트립채권의 특성과 평가

국내 스트립채권시장은 투자자의 수요 증가와 스트립채권시장을 활성화시키려는 정부의 정책에 힘입어 지속적인 성장을 하였다. 스트립채권의 발행이 증가하고 있고, 유통시장도 활성화되고 있다. 그러나 스트립채권시장이 어떤 요인에 의해 활성화되고 있는지, 스트립채권시장이 투자자와 시장에 어떤 영향을 미치는지에 대한 분석은 거의 이루어지지 않고 있다. 이에 본 연구에서는 국내 스트립채권시장의 발행자, 투자자, 유통시장 및 수익률 특성에 대한 분석을 통해 스트립채권시장의 특성을 살펴보고, 스트립채권이 투자자와 국채시장에 어떤 효과를 제공하는지를 평가한다.

1. 국내 스트립채권시장 현황

가. 스트립채권 발행시장 현황

국내 스트립채권시장은 2007년 최초 발행이 이루어진 이후 2009년까지 연간 발행규모가 1조원 미만의 저조한 실적을 기록하였다. 그러나 2010년 이후부터 스트립채권의 발행은 지속적으로 증가하고 있다. <그림 Ⅲ-1>에서 보는 바와 같이 국고채 스트립 발행은 2010년 9.4조원에서 2015년에는 15.4조원으로 늘었고, 2019년에는 25.5조원을 기록했다.

이와 같이 스트립채권의 발행이 증가한 것은 장기 국채에 대한 수요증가가 주요 요인으로 작용하였기 때문이다. 보험회사와 연기금 등은 자산과 부채의 만기 미스매치 해소 및 금리 하향 안정화에 따른 재투자위험 증가에 대응하여 스트립채권의 투자를 지속적으로 늘려왔다. 또한 스트립채권의 투자를 통해 수익을 거두려는 투자자가 확대된 것도 스트립채권시장 확대에 기여한 것으로 보인다. 이와 더불어 스트립채권시장을 활성화하려는 정부 정책도 스트립채권 발행 증가의 한 요인으로 작용하였다.

스트립 유형별로 보면 스트립원금 잔액은 2010년 4.7조원에서 2019년말에는 57.6조원으로 늘어났고, 2020년 상반기에는 61.2조원을 기록하였다. 스트립이자 잔액은 2010년 4.8조원에서 2020년 6월말에는 34.7조원으로 늘어났다.

2014년 이전에 설정된 스트립채권의 경우 2017년까지는 잔액이 증가하는 추세를 보이다가 2018년 이후에는 잔액이 소폭 감소하고 있다. 2015년과 2018년에 설정된 스트립채권의 경우에는 설정 당해년도의 잔액에 비해 설정 1년 후의 잔액이 큰 폭으로 증가하였다. 이는 시장의 금리상황과 수급 요인 등에 따라 스트립 물량을 탄력적으로 운영한 데에 따른 결과이다.

설정연도별 스트립채권 잔액의 구성비중을 보면 기존에 발행한 스트립채권의 비중이 높게 나타나고 있다. 2019년말 스트립원금 잔액의 설정연도별 비중을 보면 2014년 이전에 설정된 스트립원금의 비중(53.7%)이 가장 높고, 다음으로 2017년 설정분(14.1%), 2018년 설정분(13.8%)의 순으로 비중이 높게 나타나고 있다. 이는 대부분의 스트립채권이 장기채를 기초로 발행되고 있기 때문이다.

스트립채권 유통시장은 장내시장과 장외시장으로 구성되어 있다. 스트립채권 장내거래는 국고채와 마찬가지로 주로 국채전문유통시장에서 경쟁매매 방식으로 거래 되며, 장외거래의 경우 보이스나 메신저를 통해 호가가 교환되고 상대매매방식으로 거래가 이루어진다.

국내 국채 유통시장의 가장 큰 특징 중 하나는 장내시장이 활성화되어 있다는 점이다. 정부는 국채거래 활성화를 위해 다양한 정책을 추진하였으며, 특히 한국거래소에 전자거래플랫폼인 국채전문유통시장을 도입하여 국채의 장내거래 활성화를 도모하였다. 또한 국채전문유통시장을 통한 거래를 촉진하기 위해 국채전문딜러의 장내거래 의무화10)와 같은 제도를 운영하였다. 이러한 정책에 힘입어 국채전문유통시장은 유동성이 매우 높은 시장으로 자리 잡았다.

스트립채권 거래량은 2016년 이후 크게 증가하였다. 스트립채권의 전체 거래량은 2015년까지는 40조원 미만이었으나 2016년 장내거래 증가에 힘입어 383조원으로 증가하였고 2018년에는 647조원을 기록하였으며 이후에는 다소 감소하는 추세를 보이고 있다.

거래시장별 스트립채권의 거래량을 살펴보면 2015년 이전까지 스트립채권은 주로 장외에서 거래되었다. 장외시장의 스트립채권 거래는 2015년 37.3조원에서 매년 지속적으로 증가하여 2019년에는 49.4조원을 기록하였다. 장내 스트립채권 거래 추이를 보면 2015년까지 장내 스트립채권 거래는 미미한 수준이었으나 2016년부터 거래량이 크게 증가하여 2018년에는 609.3조원이 거래되었다. 2019년 장내 스트립채권 거래는 전년에 비해 크게 감소한 370.5조원을 기록하였다. 이와 같이 2016년부터 장내 스트립채권 거래가 크게 증가한 것은 스트립채권의 유통시장을 활성화하려는 정부의 정책이 영향을 미쳤기 때문이다. 정부는 장내 스트립채권 유통시장 활성화를 위해 2016년 7월 스트립전문딜러제도를 도입하고 스트립전문딜러에게 스트립채권 호가의무를 부여하였다. 이러한 스트립전문딜러제도의 도입은 장내시장을 중심으로 스트립채권 거래량을 크게 증가시키는 요인으로 작용하였다.

장외시장의 경우에는 스트립원금과 스트립이자가 고르게 거래되고 있다. 장외시장의 스트립원금 거래는 2015년 20조원에서 지속적으로 증가하여 2019년 33.2조원을 기록하였다. 장외시장의 스트립이자 거래는 연도별로 변동성을 보이고 있다. 특히 차익거래 유인이 증가하는 시기에는 스트립이자의 거래가 늘어나는 특성을 보이고 있다. 장외시장의 스트립채권은 실수요자를 중심으로 다양한 유형의 스트립채권이 거래되는 특성을 보이고 있다.

가. 스트립채권의 신청기관

스트립채권은 주로 국채전문딜러가 신청을 하고 발행한다. 국내의 경우에는 국채를 보유한 자가 스트립채권을 발행할 수 있도록 하여 발행기관의 자격을 제한하고 있지는 않지만 대부분 스트립채권은 국채전문딜러가 발행한다.

<그림 Ⅲ-5>는 연도별 스트립채권 신청11) 건수와 금액 추이를 나타낸 것이다. 스트립채권 신청 건수는 2014년까지는 연간 25건 내외를 기록하였으나 2015년부터 증가세를 보여 2016년부터는 연간 45건 이상을 유지하고 있다.

스트립채권 신청 금액도 지속적으로 증가하였다. 스트립채권 신청 금액은 2013년 5.8조원에서 2016년에는 11.9조원으로 증가하였고, 이후에도 지속적으로 증가하여 2019년에는 20.5조원을 기록하였다. 이는 국고채딜러가 인수한 물량을 투자자에게 매도하는 과정에서 투자자 수요에 부합하여 스트립을 적극적으로 활용하고 있기 때문이다. 국고채딜러들은 인수한 국고채를 유통시장을 통해 투자자에게 매각하는데, 원활한 소화를 위해 이표채인 국고채를 원금과 이자로 분리하여 기관투자자에게 매각한다. 국채의 주요 투자자들은 다양한 목적으로 국채 스트립채권에 투자를 한다. 보험이나 연기금 등은 규제 환경의 변화 및 자산‧부채의 만기갭 조정을 위해 장기 채권에 대한 높은 수요를 가지고 있다. 이에 따라 국고채딜러는 인수한 장기 국고채를 스트립하여 장기의 스트립채권은 보험이나 연기금에게 매각하고, 다양한 만기의 스트립이자는 다양한 투자수요를 지닌 자산운용사나 은행 등에 소화하는 방식으로 스트립을 활용하고 있다.

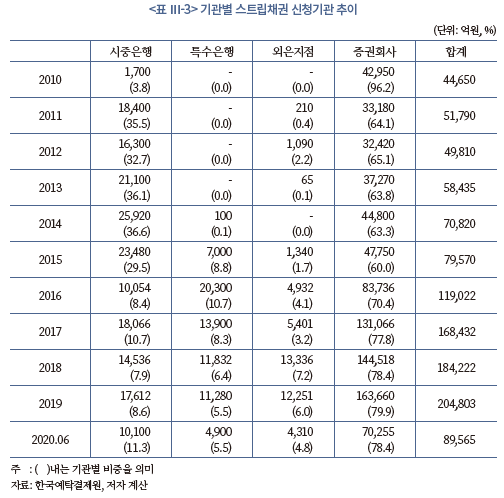

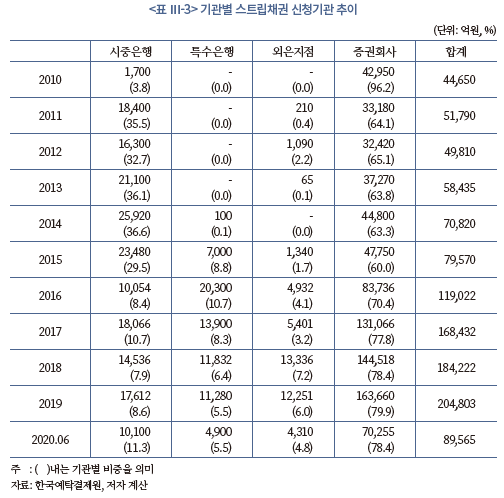

<표 Ⅲ-3>은 기관별 스트립신청 비중의 추이를 나타내고 있다. 기관별 비중을 보면 증권회사의 비중이 가장 높고 다음으로 시중은행의 비중이 높게 나타나고 있다. 증권회사의 비중 추이를 보면 2010년 96.2%에서 2015년에는 60.0%로 감소하였으나 이후부터는 비중이 지속적으로 증가하였다. 스트립채권 신청에 있어 증권회사의 비중이 높은 것은 국고채전문딜러의 기관별 비중에 있어 증권회사의 비중이 높기 때문이다.

시중은행은 2011년부터 2014년까지 30% 넘는 비중을 차지하였으나 이후부터 비중이 줄어들고 있다. 2015년 이후 시중은행의 비중이 감소한 것은 특수은행 및 외은지점이 국채전문딜러에 참여하면서 시중은행 비중을 잠식하였기 때문이다. 2015년부터 외은지점의 스트립채권 신청 비중이 증가하고 있다. 외은지점은 주로 외국인 국채 투자자를 대상으로 스트립을 포함한 국고채의 중개업무를 수행한다. 외국인의 국채 투자 증감에 따라 외은지점의 스트립채권 신청 비중도 변동하고 있다. 특히 최근에는 외국인 투자자의 국채투자가 증가함에 따라 외은지점의 비중이 증가하고 있다.

시중은행은 2011년부터 2014년까지 30% 넘는 비중을 차지하였으나 이후부터 비중이 줄어들고 있다. 2015년 이후 시중은행의 비중이 감소한 것은 특수은행 및 외은지점이 국채전문딜러에 참여하면서 시중은행 비중을 잠식하였기 때문이다. 2015년부터 외은지점의 스트립채권 신청 비중이 증가하고 있다. 외은지점은 주로 외국인 국채 투자자를 대상으로 스트립을 포함한 국고채의 중개업무를 수행한다. 외국인의 국채 투자 증감에 따라 외은지점의 스트립채권 신청 비중도 변동하고 있다. 특히 최근에는 외국인 투자자의 국채투자가 증가함에 따라 외은지점의 비중이 증가하고 있다.

스트립채권의 주요 도입 목적 중 하나는 투자자의 장기채 수요 증가에 대응하여 효율적인 장기 투자상품의 공급을 확대하는 것이다. 국내 스트립채권이 이러한 목적에 부합하고 있는지를 살피기 위해 스트립채권의 기초자산 만기 분포와 스트립채권의 만기 구조를 살펴본다.

보험이나 연기금과 같은 투자자들은 장기 부채 증가에 대응하여 자산의 만기를 장기화하려는 수요가 존재한다. 이에 따라 동일한 만기의 이표채에 비해 상대적으로 듀레이션이 긴 스트립채권에 대한 투자를 선호한다. 특히 보험회사에 대한 규제 변화가 장기 스트립채권에 대한 수요를 크게 증가시킨 요인으로 작용하였다. 2011년 도입된 RBC(Risk Based Capital)제도는 자산과 부채의 리스크 특성을 체계적으로 반영하여 예상치 못한 손실 발생시에 이를 충당할 수 있는 자기자본을 보유하도록 하는 제도이다. 장기 부채를 보유한 보험회사들은 제도 변화에 대응하기 위해 자산의 듀레이션을 늘리는 노력을 기울였다. 특히 상대적으로 듀레이션이 긴 스트립채권의 투자를 늘림으로써 자산 듀레이션을 장기화하고 있다. 보험회사의 자기자본제도는 향후 신지급여력제도인 K-ICS(Insurance Core Principles)로 변경될 예정이며, 이 경우 장기채에 대한 수요가 더욱 확대될 가능성이 있다. 이와 더불어 보험업 자본규제의 통일성과 효율성을 제고하기 위해 도입 예정인 보험부채 시가평가 기반의 국제회계기준(IFRS17)도 보험회사의 장기채 수요를 증가시키고 있다. IFRS17은 보험부채를 시가법으로 평가하여 보험회사의 리스크 및 내재가치가 재무제표에 반영되는 제도이다. 이에 따라 보험회사는 자산‧부채 듀레이션갭을 줄이기 위해 장기 스트립채권에 대한 투자를 확대하고 있다.

이와 같이 보험과 연기금의 장기채에 대한 투자 수요가 증가하여 장기 국고채를 기초로 하는 스트립채권의 발행이 증가하고 있다. <그림 Ⅲ-6>은 스트립채권 기초자산의 만기 비중을 나타내고 있다. 스트립채권 기초자산의 만기별 비중을 보면 스트립원금 기초자산의 90% 이상이 20년 만기와 30년 만기 국고채에 집중되어 있다. 개별 유형별 비중 추이를 보면 20년 만기 국고채의 비중은 2010년 98.5%에서 2019년에는 40.2%로 줄어들었다. 반면 30년 만기 국고채는 2012년 도입 당시 스트립시장에서 차지하는 비중이 2.6%에 불과하였으나 이후 그 비중이 점차 증가하여 2018년 이후에는 20년 만기 국고채보다 높은 비중을 차지하고 있다. 이와 같이 스트립채권의 기초자산은 20년 만기 국고채에서 30년 만기 국고채로 대체되고 있다. 50년 만기 국고채의 경우에도 2016년 도입 당시 스트립채권시장에서 차지하는 비중은 0.3%에 불과하였으나 최근 그 비중이 점차 증가하여 2019년에는 4.6%를 기록하고 있다. 한편 3년 만기 국고채를 기초로 한 스트립채권의 비중은 1% 미만으로 낮은 상황이다. 단기 지표금리의 역할 강화를 위해 2015년부터 단기 국고채의 스트립을 허용하고 있음에도 불구하고 단기 국고채가 스트립시장에서 차지하는 비중은 높지 않은 것으로 나타났다.

이상에서 보는 바와 같이 스트립채권의 기초자산은 대부분 장기채로 구성되어 있으며, 30년 만기, 50년 만기 초장기채의 비중이 계속 증가하는 추세를 보이고 있다. 이와 같은 결과는 스트립채권이 장기 투자자의 듀레이션을 늘리기 위한 기능을 주로 수행하고 있다는 것을 지지하는 결과이다. 스트립채권은 만기가 길수록 보다 큰 듀레이션과 볼록성을 기대할 수 있다. 만기가 길수록 스트립채권 발행을 통해 얻을 수 있는 스트립이자의 종류가 다양해지는 장점도 있다. 연기금, 보험과 같이 장기채에 주로 투자하는 투자자들은 이표채 형태의 국고채를 보유하기 보다는 상대적으로 듀레이션이 긴 국고채 스트립원금에 투자하는 것을 선호하고 있고 이러한 수요가 스트립 만기구조에 커다란 영향을 미쳤다고 볼 수 있다.

3년 만기 국고채의 스트립 비율은 2015년 0.3%에서 2017년에는 5.4%까지 증가하였으나 이후 감소세를 보이고 있다. 5년 만기와 10년 만기 국고채의 경우에는 스트립 비율이 낮은 것으로 나타났다. 특히 10년 만기 국고채의 경우 2013년 3.0%를 기록한 이후 스트립 비율이 계속 감소하고 있다. 20년 만기 국고채의 스트립 비율은 2011년 19.6%에서 지속적으로 증가하여 2013년에는 31.9%를 기록하였으나 이후에 감소하는 추세를 보이고 있다. 30년 만기 국고채의 경우에는 2015년까지 스트립 비율이 증가하다가 이후부터 감소하고 있다. 20년 만기 국고채와 30년 만기 국고채를 기초로 한 스트립채권 발행이 증가하고 있음에도 불구하고 최근 들어 동 채권의 스트립 비율이 줄어드는 것은 장기 국고채의 발행이 크게 증가하였기 때문이다. 이와 더불어 최근의 장기 금리 변동도 스트립 비율을 줄이는 요인으로 작용하였다. 일반적으로 스트립은 고금리 이표를 지닌 장기채를 대상으로 금리가 하락하는 시기에 발행 비중이 높아진다. 그런데 2016년 상반기까지 하락 추세를 보이던 장기 금리가 2016년 하반기부터 2018년 상반기까지 상승함에 따라 투자자의 스트립 유인이 줄어들게 되었고 이에 따라 동기간 중 장기채의 스트립 비율은 감소하는 추세를 보였다.

3. 국내 스트립채권의 투자자 특성 분석

가. 스트립채권 투자자의 매수거래 추이

스트립채권 투자자들은 장기의 투자자산 확대, 재투자위험의 축소 및 채권 특성에 따른 가격 차이를 이용한 차익거래 등 다양한 목적으로 스트립채권에 투자를 한다. 투자자들의 스트립채권 투자는 장내시장과 장외시장을 통해 이루어진다. 장내시장에서는 스트립전문딜러가 단기 스트립채권을 위주로 거래를 한다. 실제 스트립채권 투자자의 다양한 목적의 투자는 장외시장을 통해 이루어진다. 따라서 주요한 스트립채권 투자자의 투자행태는 장외시장의 매수거래를 통해 관찰할 수 있다. 이에 본 절에서는 투자자 유형별 장외시장 매수거래 추이와 특성 분석을 통해 투자자들의 스트립채권 투자 추이와 목적을 살펴본다.

장외 스트립채권 매수거래의 주요 공급자는 국고채딜러와 스트립채권을 보유한 기관투자자이며, 주요한 매수기관은 보험, 연기금, 자산운용 및 은행 등의 다양한 기관투자자들이다. <그림 Ⅲ-8>은 장외시장 스트립채권의 매수거래 추이를 나타내고 있다. 장외시장의 스트립채권 매수거래는 연도별로 변동성을 보이는 가운데 증가 추세를 보이고 있다. 스트립채권 매수거래의 추이를 보면 2015년 13.5조원에서 2016년에는 전년대비 감소한 실적을 기록했으나, 2017년부터 다시 증가세로 돌아서서 2019년에는 17.4조원을 기록했다.

장외시장 스트립채권 매수거래의 투자주체별 규모를 보면 보험‧기금은 증가하는 추세를 보이고 있는데 반해 자산운용과 은행은 2017년 이후 감소하고 있다. 투자주체별 비중을 살펴보면 보험‧기금이 지속적으로 높은 비중을 차지하고 있다. 전체 매수거래에서 보험‧기금이 차지하는 비중은 2015년 67.6%에서 2017년 72.5%, 2019년에는 78.2%로 늘어났다. 한편 자산운용부문의 비중은 2015년부터 2017년까지는 20% 내외를 기록했으나 2018년부터는 감소하는 추세를 나타내고 있다. 은행의 비중은 연도별로 높은 변동성을 보이는 가운데 최근 들어 비중이 감소하고 있다.

자산운용의 경우에는 단기 스트립채권의 비중이 높게 나타나는 가운데 최근 들어 5~20년 만기 스트립채권의 투자 비중이 증가하는 추세를 보이고 있다. 자산운용사의 스트립 매수거래에서 5년 이하의 단기채의 비중은 2015년 51.3%에서 2016년에는 80.5%로 증가하였으나 이후에는 감소세로 돌아서 2019년에는 48.0%를 기록하고 있다. 은행의 스트립채권 만기별 매수거래는 연도별로 높은 변동성을 보이는 가운데 단기 스트립의 비중이 높아지고 있는 추세를 보이고 있다.

자산운용의 경우에는 시세차익을 거둘 목적으로 스트립채권에 주로 투자하기 때문에 단기 스트립과 스트립이자의 투자 비중이 높게 나타나고 있다. 스트립이자의 경우는 스트립원금에 비해 유동성이 낮고, 상대적으로 다양한 만기의 증권으로 발행이 되기 때문에 동일한 만기의 국채나 스트립원금에 비해 높은 수익률을 제공한다. 이에 따라 자산운용사들은 스트립채권 투자를 통해 투자수익을 제고할 목적으로 상대적으로 가격이 낮은 스트립채권에 주로 투자하고 있다.

국채전문딜러 자격을 받은 은행의 경우 스트립의 주요 공급자 역할을 하는 한편 스트립 투자자로의 역할을 수행한다. 은행의 경우 유동성 커버리지 지표의 충족과 수익 확대를 목적으로 스트립채권에 주로 투자하고 있다. 은행은 상대적으로 유동성이 높은 단기 국고채 위주로 투자를 하기 때문에 장외 스트립채권 매수거래에서 은행이 차지하는 비중은 낮아지고 있다. 스트립채권에 대한 은행의 투자도 주로 단기 스트립채권을 중심으로 이루어지고 있다.

이와 같이 스트립채권은 투자자의 투자 목적에 따라 다양한 수단으로 활용되고 있으며, 이에 따라 투자자별로 스트립채권의 매수거래 특성에 있어 차이를 보이고 있다. 특히 장외 스트립채권의 매수거래에서 장기 스트립채권의 거래 비중이 높은 것은 스트립채권이 보험‧기금의 자산 듀레이션을 늘리기 위한 수단으로 주로 활용되고 있다는 것을 지지하는 결과이다.

4. 국내 스트립채권의 유통시장 특성 분석

가. 스트립채권의 기간 경과별 거래회전율

일반적으로 채권은 발행 초기에 거래가 활발히 이루어지다가 일정 기간이 경과하면 거래가 둔화되는 특성을 보인다. 이와 같이 가장 최근에 발행하여 거래가 활발하게 이루어지는 것을 on-the-run 채권이라고 한다. 국내에서는 가장 최근에 발행된 만기별 국고채가 국고채 유통수익률의 지표금리 역할을 하기 때문에 지표물12)이라고 부르고 있다.

대부분의 국고채의 거래는 on-the-run 현상을 보이고 있다. 그러나 스트립원금의 경우에는 국고채와 다른 모습을 보이고 있다. 스트립원금의 거래회전율 특성을 살펴보면 장외시장의 경우에는 발행 이후 6개월까지 비교적 높은 회전율을 보이다가 7개월부터는 거래가 급격히 줄어드는 on-the-run 현상을 보이는 반면 장내 스트립채권 거래의 경우에는 발행 이후 7개월에서 15개월까지 회전율이 다른 기간에 비해 높게 나타나고 있다. 이와 같은 결과는 특정 기간에 3년 만기 및 5년 만기 국고채를 기초로 한 스트립채권의 거래량이 급격히 증가한 특이치가 반영되었기 때문이다. 10년 미만의 만기를 지닌 스트립채권 잔액이 적은 상황에서 정부가 단기채 스트립채권 거래 활성화를 위한 정책을 취함에 따라 특정 기간 경과물의 회전율이 급격히 상승하는 모습을 보이고 있다.

30년 만기 국고채를 기초로 한 스트립원금의 경과기간별 회전율은 발행 초기에 가장 높은 회전율을 보이고 이후에 감소하고 있다. 특히 발행 1년 이후에는 회전율이 크게 낮아지는 모습을 보이고 있다. 한편 20년 만기 국고채를 기초로 한 스트립원금의 경과기간별 회전율은 발행시점에 가장 높은 회전율을 보이다가 발행 후 5개월까지는 감소하는 추세를 보였으나 발행후 6개월이 경과한 시점에 회전율이 다시 상승하는 모습을 보이고 있다. 이러한 현상은 특정한 기간 스트립 수요가 증가하여 거래가 일시적으로 상승한 영향에 따른 것으로 보인다.

이와 같이 발행 규모가 일정 수준 이상의 스트립채권은 국고채와 동일하게 발행 후 일정기간 거래가 활성화된 이후 거래가 줄어드는 현상을 보이고 있다. 반면 발행 규모가 작은 스트립원금이나 스트립이자의 경우에는 on-the-run 현상을 보이지 않고 특정한 기간의 거래 규모에 따라 회전율이 크게 변동하는 모습을 나타내고 있다.

장내시장과 장외시장의 스트립채권의 거래특성을 살펴보기 위해 2015년부터 2020년 8월말까지의 인포맥스의 스트립원금과 스트립이자의 거래 자료를 이용하여 시장별 스트립채권의 세부적인 유형과 거래규모 및 유동성 등을 분석한다.

<표 Ⅲ-7>은 장내시장과 장외시장에서 거래되는 스트립채권 종목수를 나타내고 있다. 장내시장은 국고채딜러들이 거래를 한다. 장내시장에서 거래되는 스트립채권 종목은 10개 미만의 스트립원금이 주류를 이루고 있다. 장내에서 거래되는 스트립이자의 종목도 10개 내외로 제한되어 있다. 이와 같이 장내시장은 딜러간의 제한된 종목의 스트립거래가 주로 이루어지고 있다.

기관투자자의 투자수요에 따른 스트립거래는 주로 장외에서 이루어진다. 장외시장에서 거래되는 스트립원금은 20개 이상이며, 스트립이자는 일부 기간을 제외하고 170개 이상을 기록하여 발행된 대부분의 스트립원금과 스트립이자가 거래되는 것을 관찰할 수 있다.

이러한 스트립채권 유통시장의 분할은 긍정적인 측면과 부정적인 측면의 양면성을 지니고 있다. 장내시장을 중심으로 단기 스트립의 거래가 활발히 이루어짐에 따라 단기 무위험채권의 수익률곡선 완성도가 제고되고, 시장의 유동성이 활발해지는 긍정적인 측면이 있다. 또한 거래가 활성화됨에 따라 단기 스트립채권은 물론 단기 무위험채권 가격결정의 효율성을 제고시키는 효과를 기대할 수 있다. 반면 장내에서 딜러간 단기 스트립 위주의 거래는 다른 만기의 스트립거래를 구축하는 부정적인 측면도 있다. 단기 스트립에 대한 시장조성을 위하여 딜러의 스트립 재고가 단기 스트립에 집중될 가능성이 있기 때문이다.

다. 스트립채권의 유동성 분석

유동성 지표는 거래기준 유동성 지표와 주문기준 유동성 지표로 구분할 수 있다. 거래기준 유동성 지표는 거래량, 거래빈도, 회전율 및 거래일수 등으로 실제 거래 결과에 기초하여 유동성을 측정하는 방식이다. 주문기준 유동성 측정 지표는 주문서 자료를 기반으로 한 유동성 측정방식으로 거래 가능성과 비용에 대한 정보를 제공한다. 가장 대표적인 거래기준 유동성 측정지표로는 매수‧매도 스프레드를 들 수 있다. 이외에도 Amihud 유동성 지표, 유효스프레드, 주문의 실행시점 등이 거래기준 유동성 지표로 활용된다.

본 절에서는 거래기준 유동성 지표를 이용하여 시장별, 유형별 국고채 스트립채권의 유동성을 비교한다. 개별 스트립채권별로 일일 회전율과 평균 거래일수를 측정하고 스트립 유형별로 유동성 지표를 비교하여 스트립채권의 유통시장 특성을 분석한다.

<표 Ⅲ-8>은 스트립채권을 포함한 무위험채권의 연간 거래회전율 추이를 나타낸 것이다. 스트립채권의 거래회전율은 거래가 활발한 3년 만기 국고채에 비해서는 낮은 수준이나 장기 국고채에 비해서는 높은 수준을 보이고 있다. 스트립채권의 거래회전율을 통안채와 비교해보면 2년 만기 통안채에 비해서는 낮은 수준이지만 1년 만기 통안채에 비해서는 높은 유동성을 보이고 있다. 스트립채권의 거래회전율 추이를 보면 2015년 이전에는 매우 낮았으나 2016년 이후에는 높은 값을 보이고 있다. 이는 스트립전문딜러제도 도입이 스트립채권의 유동성 제고에 크게 기여하고 있다는 것을 보여주는 결과이다. 이에 따라 만기 1년 이내의 단기금리에 있어서는 통안채에 비해 높은 유동성을 지니고 있다.

일평균 회전율에서도 장내거래가 장외거래에 비해 높은 유동성을 보이고 있다. 평균 거래일수의 결과와 달리 2016년에 장내 일평균 회전율이 장외시장에 비해 높게 나타나고 있는 것은 장내시장에서 주로 거래되는 만기 1년 이내의 스트립채권의 잔액이 상대적으로 작기 때문이다.

거래회전율의 경우에는 전기간에 걸쳐 스트립원금의 회전율이 스트립이자에 비해 높게 나타나고 있다. 스트립원금의 거래회전율의 추이를 보면 연도별로 변동성이 높은 것으로 나타났다. 이와 같은 결과는 스트립 잔액은 증가추세를 보인 반면 스트립의 거래량이 연도별로 높은 변동을 보인 데에 따른 결과이다.

5. 국내 스트립채권의 수익률 특성 분석

가. 분석방법

스트립채권은 다양한 만기의 채권으로 분리되어 거래가 되기 때문에 다양한 스트립채권의 유통수익률은 금리의 정밀도와 수익률 곡선의 완성도를 제고시키는 기능을 한다. 한편 스트립채권의 유형이나 만기 등에 따라 스트립채권의 가격이 다르다는 주장도 존재한다. Daves et al.(1993)은 스트립원금이 스트립이자에 비해 높은 가격으로 거래되고 있는 시장 이상현상이 나타나고 있다고 주장하고 그 원인으로 스트립원금과 스트립이자 간의 유동성의 차이와 재결합의 특성 등을 들고 있다. Sack(2000)의 연구에서는 동일한 조건의 스트립원금과 스트립이자 간에 수익률 차이가 존재하며, 이는 스트립원금의 경우 기초자산인 국채의 수익률과 관련성이 높은 반면 스트립이자는 채권 자체의 현금흐름에 영향을 받기 때문이라는 결과를 제시하고 있다.

스트립채권의 유형이나 만기별로 가격 차이가 발생하는 경우 이를 활용한 차익거래의 유인이 존재한다. 동일한 조건의 스트립이자와 스트립원금 간 혹은 스트립채권과 동일 만기 국고채 간에 가격 차이가 존재할 경우 투자자들은 재결합이나 다양한 종류의 스트립채권을 결합한 투자를 통해 초과수익을 거둘 수 있다.

이에 본 절에서는 국내 스트립채권의 유형별, 만기별 스프레드13) 추이와 특성을 분석하여 스트립채권의 가격효율성을 평가하고, 국내 스트립채권시장에서 차익거래의 기회가 존재하는지를 살펴본다. 본 분석에 사용된 스트립채권의 일평균 수익률은 인포맥스의 장내외 유통시장 자료를 통해 계산했고, 시가평가수익률은 금융투자협회에서 발표하는 민간 시가평가회사의 만기별 국고채 수익률 평균을 사용14)하였다. 분석기간은 2015년 1월부터 2020년 8월말까지 거래된 모든 스트립채권의 일간 평균 수익률을 대상으로 하되 거래규모가 1억원 미만의 표본은 분석에서 제외하였다.

나. 스트립채권 유형별 스프레드 분석

<그림 Ⅲ-13>은 분석 샘플의 잔존 만기별 월평균 수익률과 기간 스프레드의 추이를 나타내고 있다. 스트립채권의 수익률은 시가평가수익률과 유사한 추이를 보이고 있다. 기간별 수익률의 변화 추이를 보면 전반적인 수익률이 하향 추세를 보이는 가운데 2015년 5월~2015년 6월, 2015년 11월~2015년 12월, 2016년 8월~2018년 3월, 2019년 9월~2019년 12월 그리고 2020년 7월~2020년 8월의 기간 중에는 월평균 수익률이 상승하였다. 스트립채권의 만기 스프레드 추이를 보면 금리가 상승하는 시기에는 기간 스프레드가 확대되고 금리가 하락하는 시기에는 기간 스프레드가 축소되는 모습을 보이고 있다.

한편 스트립채권이 동일한 조건의 국고채에 비해 낮은 가격으로 거래되고 있는 결과는 스트립채권을 활용한 차익거래 가능성이 있음을 나타내는 것으로 볼 수 있다. 다양한 스트립채권을 조합하는 경우 국고채에 비해 높은 수익을 거둘 기회가 존재하며 일부 투자자들은 이러한 가격 특성을 반영하여 투자수익을 제고할 목적으로 스트립채권에 투자를 하고 있는 것으로 나타났다.

연도별 스트립채권의 국고채 대비 스프레드 추이를 보면 2015년 5.26bps를 기록한 이후 하락세를 보여 2019년에는 0.97bps를 기록하였다. 이와 같이 스트립채권의 스프레드가 하락한 것은 금리의 하락 추세와 수급요인이 작용하였기 때문이다. 일반적으로 금리가 하락하면 스프레드도 축소하는 경향을 보인다. 저금리 추세는 스트립채권의 가격에도 영향을 미쳐 스프레드가 축소되는 결과를 초래하였을 가능성이 있다. 이와 더불어 스트립채권시장의 참여자가 확대되고, 거래가 증가된 것도 스프레드 축소에 영향을 미쳤을 가능성이 있다. 다양한 목적의 거래가 활성화됨에 따라 스트립채권의 가격 효율성이 제고되어 스프레드 축소에 영향을 미쳤을 가능성이 있다.

만기별 스트립채권의 스프레드를 비교해보면 30년 만기 스트립채권의 스프레드가 가장 낮은 반면 5년 만기 스트립채권의 스프레드가 가장 큰 것으로 나타났다. 30년 만기 스트립채권의 경우 기초자산의 유동성이 낮아 스트립 비율이 높아진 것이 스프레드 축소의 주요 요인으로 작용하였다. 반면 5년 만기 스트립채권의 경우 발행규모가 작아서 유동성이 낮은 것이 높은 스프레드의 주요 요인이 된 것으로 보여진다.

스트립이자가 동일한 만기의 스트립원금에 비해 낮은 가격을 보이는 것은 스트립이자가 다양한 소액의 종류로 발행됨에 따라 스트립원금에 비해 유동성이 낮아서 만기 보유의 부담이 존재하기 때문이다. 또한 금리의 상승 추세도 일부 영향을 미친 것으로 보인다. 이에 따라 스트립채권 투자를 통해 초과수익을 거둘 목적으로의 투자자들은 스트립이자에 투자하고 만기까지 보유하는 전략을 주로 취한다.

스트립채권의 구조에 따른 가격 차이가 존재하는지를 살펴보기 위해 스트립 유형, 만기 유형, 금리의 상승 여부, 장내 거래 여부 등에 따른 스프레드의 차이에 대한 통계 분석을 실시하였다.

분석 결과 스트립채권의 특성과 시장 상황은 스트립채권의 스프레드에 유의한 영향을 미치는 것으로 나타났다. 스트립 유형별 스프레드 평균값을 보면 스트립이자가 스트립원금에 비해 통계적으로 유의하게 높은 것으로 나타났다. 이는 앞에서 살펴본 바와 같이 스트립이자가 다양한 소액의 채권으로 발행되기 때문에 동일한 만기의 국고채에 비해 낮은 가격으로 거래가 이루어지기 때문이다.

만기별 스프레드 차이를 보면 단기 스트립채권이 장기 스트립채권에 비해 통계적으로 유의하게 높은 스프레드를 나타내고 있다. 이와 같이 장기 스트립채권의 스프레드가 단기 스트립채권에 비해 낮은 것은 장기 스트립채권에 대한 지속적인 수요가 존재하고, 기초자산과 비교하여 유동성의 차이가 크지 않으며, 가격의 차이도 크지 않기 때문에 나타나는 결과라고 볼 수 있다.

거래시장별 스트립채권의 스프레드를 비교해보면 장외시장의 스프레드가 장내시장에 비해 낮은 것으로 나타났다. 이러한 결과는 복합적인 요인에 의한 것으로 해석할 수 있다. 장내시장과 장외시장의 거래참여자와 시장 특성의 차이가 스프레드 차이를 초래한 것으로 볼 수 있다. 이와 더불어 단기 스트립채권이 장기 스트립채권에 비해 높은 스프레드를 나타내는 상황에서 대부분 단기 스트립채권이 장내거래에서 거래되는 것도 스프레드 차이의 한 요인으로 작용한 것으로 해석해 볼 수 있다.

금리 상황에 따른 스트립채권의 스프레드 차이를 보면 금리가 상승하는 시기가 금리가 하락하는 시기에 비해 스프레드가 높게 나타나고 있다. 이와 같은 차이가 발생하는 것은 금리 상황에 따른 수급요인이 작용하기 때문이다. 즉 금리가 하락하는 경우 금리하락에 따른 재투자위험이 증가하고 이에 따라 스트립채권에 대한 수요가 증가하여 상대적으로 스트립채권의 가격이 높게 형성되기 때문에 스프레드가 낮아지는 모습을 보이는 것으로 해석해 볼 수 있다.

국내 스트립채권의 가격은 다양한 요인에 의해 영향을 받는 것으로 나타났다. 상대적으로 발행규모가 작고 유동성이 낮은 스트립이자가 스트립원금에 비해 높은 스프레드 값을 보이고 있다. 또한 단기 스트립채권이 장기 스트립채권에 비해 통계적으로 유의하게 스프레드가 높은 것으로 나타났다. 이에 따라 스트립채권의 구조에 따른 가격 차이를 이용하여 수익을 제고하는 기회가 존재한다. 자산운용사가 단기 스트립채권과 스트립이자에 투자 비중이 높은 것은 이러한 가격 특성을 반영하여 투자 수익을 높이려는 전략의 한 예라고 볼 수 있다. 한편 시장의 금리 상황도 스트립채권의 스프레드에 영향을 미치고 있다. 이는 금리 하락기에 이표채의 재투자위험이 증가함에 따라 스트립채권에 대한 수요가 증가하기 때문에 발생한 결과로 볼 수 있다.

이와 같이 스트립채권은 다양한 투자 목적으로 활용되며 이러한 투자목적에 따른 수급요인과 시장상황이 스트립채권의 스프레드에 영향을 미치고 있는 것으로 나타났다.

Ⅳ. 결론 및 시사점

국내 스트립채권 투자자는 다양한 목적으로 스트립채권에 투자를 한다. 장기 스트립채권의 투자를 선호하는 투자자들은 장기 국채에 기초한 스트립채권에 주로 투자를 한다. 일부 스트립채권 투자자들은 금리 변화에 따른 재투자위험을 통제하거나 가격 차이를 이용한 차익거래를 거둘 목적으로 스트립채권에 투자하기도 한다.

국내 스트립채권 유통시장은 장내시장과 장외시장이 참여자와 거래되는 스트립채권 특성에 있어 커다란 차이를 보이고 있다. 장내시장은 딜러간에 만기 1년 이내의 단기 스트립원금을 위주로 거래가 이루어지고 있는데 반해 장외시장은 스트립채권에 대한 실제 투자자들 간에 다양한 스트립원금과 스트립이자가 거래되고 있다. 최근 스트립전문딜러제도 도입 이후 장내 스트립채권시장의 유동성이 크게 제고되고 있다. 이러한 장내 유통시장 활성화는 단기 스트립채권의 유동성을 제고하고, 단기 무위험채권의 수익률 곡선의 완성도를 높였다는 측면에서 긍정적으로 평가되지만 장기 스트립채권의 거래를 위축시키는 구축효과가 발생할 가능성이 있다는 점에서 부정적인 측면도 존재한다.

스트립채권의 수익률 특성을 보면 스트립채권의 수익률이 국고채에 비해 높은 것으로 나타났고, 스트립이자의 수익률이 스트립원금에 비해 높은 것으로 나타났다. 스트립채권의 스프레드는 스트립 유형뿐만 아니라 만기, 금리의 상향 여부 및 거래시장별로 차이를 나타내고 있다. 이는 스트립채권의 가격이 다양한 요소에 의해 결정되고 있다는 것을 나타내는 결과이다.

이상과 같은 스트립채권의 특성 분석 결과 국내 스트립채권시장은 투자자, 채권시장에 다양한 효과를 제공하고 있는 것으로 평가된다. 우선 스트립채권은 투자자의 목적에 부합하는 다양한 무위험채권의 공급을 확대하는 효과를 제공한다. 특히 장기 투자를 선호하는 투자자의 수요 증대에 대응하여 듀레이션이 긴 채권의 공급을 확대하는 효과를 지니고 있다. 또한 스트립채권이 가격 차이를 활용하여 투자수익을 제고하려는 투자자에게 투자수익 제고의 기회를 제공하는 역할을 하고 있다. 스트립채권의 수익률 분석 결과를 보면 스트립채권은 동일한 만기의 국고채 대비 정의 스프레드를 나타내고 있고, 스트립원금과 스트립이자 간에도 가격 차이가 존재한다. 이는 스트립채권의 가격 차이를 활용하여 초과수익을 거둘 수 있는 기회를 제공하고 있음을 나타내는 결과이다.

한편 스트립채권의 유통시장 분석 결과를 보면 상대적으로 장내시장을 중심으로 유동성이 제고되어 필요시 스트립채권의 환매 가능성이 높아지고 단기 무위험채권 수익률 곡선의 완성도를 제고시키는 효과를 제공하는 것으로 나타났다. 다만 장내시장에서 거래되는 채권은 대부분 만기 1년 이내의 스트립채권이기 때문에 장내 스트립채권의 유동성 제고가 전체 스트립채권시장의 유동성 제고 효과로 해석하는 데에는 제약이 존재한다.

향후 스트립채권시장이 지속적으로 발전하기 위해서는 다음과 같은 측면에서 시장을 활성화하는 노력이 지속될 필요가 있다.

발행자 측면에서 스트립채권의 수요를 면밀히 파악하고 탄력적인 스트립채권의 공급이 이루어지는 방안을 마련할 필요가 있다. 스트립채권의 주요 투자자는 보험회사와 연기금 등이다. 이에 따라 스트립채권은 주로 보험회사와 연기금의 수요에 따라 발행되었다. 특히 보험회사의 회계기준 변경 등에 따른 장기 스트립채권의 수요로 인하여 스트립채권의 발행이 크게 증가하였고, 스트립채권의 구조와 특성이 결정되었다. 향후 시장의 지속적인 발전을 위해서는 시장구조의 변화와 투자자의 스트립 수요를 정확히 파악하고 대응할 필요가 있다. 이와 더불어 투자자 저변을 확대할 필요가 있다. 다양한 투자목적을 지닌 투자자를 발굴하여 향후 보험회사의 규제 요인에 의한 스트립발행의 수요가 감소하는 상황에 대비할 필요가 있다.

투자자 측면에서 스트립채권의 특성에 따른 투자전략의 정교화가 필요하다. 국내 스트립채권은 투자목적, 금리상황 및 시장여건에 따라 상품 특성과 가격이 다른 모습을 보이고 있다. 이에 따라 스트립채권시장의 특성을 반영한 투자전략의 정교화가 필요하다. 이를 위해서는 투자자들의 스트립채권시장에 대한 분석 능력을 제고할 필요가 있다. 수급요인 및 가격 결정에 영향을 미치는 다양한 요인에 대한 분석에 근거하여 투자전략이 마련되어야 한다. 이와 더불어 스트립채권을 활용한 다양한 패키지 상품을 도입하여 투자자의 선호에 부합하는 상품 설계 능력을 제고해야 한다.

스트립채권 유통시장 측면에서 거래 대상 스트립채권을 확대하는 방안이 마련되어야 한다. 국내 스트립채권의 유통시장은 장내거래를 활성화하려는 정부의 정책에 힘입어 잔존만기 1년 미만의 스트립원금을 중심으로 거래가 활성화되고 있다. 그러나 장기의 스트립채권은 대부분 만기 보유를 목적으로 투자가 이루어지고 있어 유동성이 낮다. 따라서 유동성이 낮은 장기 국채의 유동성을 보완하기 위해 장기채를 기초로 스트립이 활발히 추진되고 스트립채권의 거래가 활성화되는 방안을 마련할 필요가 있다. 특히 단기 스트립채권을 위주로 거래가 이루어지고 있는 장내시장의 거래 대상을 확대하는 노력이 필요하다.

스트립채권의 가격은 스트립 특성, 시장여건, 금리 상황, 유동성 및 정보제공 등 다양한 요소에 의해 결정된다. 특히 스트립채권의 유동성 요소는 가격의 효율성을 제한하는 주요한 요소로 작용하고 있다. 이에 따라 스트립채권의 유동성을 제고하고, 다양한 투자자가 참여하는 방안이 마련되어야 한다.

이와 더불어 스트립채권에 대한 기초 채권 등의 정보제공이 강화되어야 한다. 국내의 경우에는 스트립채권의 발행 및 유통과 관련한 기초정보 제공이 미흡하여 스트립시장에 대한 분석이 이루어지지 못하고 있다. 따라서 스트립채권의 기초자산에 정보를 포함한 발행 관련 정보 제공을 확대할 필요가 있다. 이와 더불어 스트립채권의 유통시장에 대한 정보도 확충될 필요가 있다.

1) 오승현 외(2004)

2) 전자등록부 등록을 통해 증권을 발행하는 시스템을 의미

3) Bulter et al.(2014)

4) 국고채권의 발행 및 국채전문딜러 운영에 관한 규정 제2조 (정의)

5) 국고채권의 발행 및 국채전문딜러 운영에 관한 규정 제17조

6) 기재부장관은 스트립전문딜러를 매 6개월마다 지정할 수 있으며, 스트립전문딜러는 최근 6개월의 스트립 거래실적 및 스트립전담딜러 개수 등을 고려하여 지정한다.

7) 스트립전문딜러는 국채전문유통시장에서 최근 만기가 도래하는 원금분리채권 또는 이자분리채권으로 거래소가 지정하는 3개 종목에 종목당 3개 이상의 호가를 제출해야 한다.

8) 스트립전문딜러는 경쟁입찰 이후 제3영업일까지 경쟁입찰대상 국고채를 대상으로 종목별 20% 이내에서 스트립 발행을 위한 비경쟁인수권한을 행사할 수 있다.

9) 2020년 상반기중 국고채 발행은 과거 연간 발행규모에 버금가는 91.6조원을 기록하였다. 이와 같이 발행규모가 늘어난 것은 재정수요 증가와 더불어 코로나19사태로 4차에 걸쳐 추경이 편성되었기 때문이다. 국채 발행 확대에 따라 국고채 잔액은 전년말 대비 11.0% 증가한 679조원을 기록하였다.

10) 국채전문딜러의 장내거래 의무화는 2001년 도입되었고, 2008년에 폐지되었다.

11) 한국예탁결제원의 스트립채권 신청기관 특성별 신청 금액과 건수를 분석한 결과이며, 신청금액은 실제 발행금액과 차이가 존재할 수 있다.

12) 국고채 지표물의 지정 기간은 3년, 5년, 10년 국고채는 연 2회, 20년물 이상은 통합발행기간(통상 연간 1회)을 기준으로 설정된다.

13) 본 분석에서 스트립채권의 스프레드는 스트립채권의 일평균 유통수익률에서 동일 만기 국고채 시가평가 수익률 간의 차이로 정의한다.

14) 시가평가 수익률과 스트립채권의 잔존 만기별 수익률의 기간을 매칭하기 위해 선형보간법을 사용하여 만기월별 시가평가수익률을 계산하였다.

참고문헌

강승철, 2006, 국채 스트립제도에 관한 소고, 한국예탁결제원 『증권예탁』32.

신현열‧김자혜, 2013, 시장지표를 활용한 자산의 유동성 평가, BOK 『경제리뷰』.

오승현‧유윤주, 2004, 『채권스트립에 관한 연구』, 한국증권연구원 연구보고서.

윤석완‧노상윤, 2005, 국고채 STRIPS를 통한 시장 유동성 증대에 관한 소고,『재정정책논집』 7.

정희준, 2001, 국채간 수익률구조 비교 및 국고채권의 STRIPS 도입에 관한 연구,『증권학회지』.

한국거래소, 2019,『한국의 채권시장』.

Allen, F., Gale, D., 1988, Optimal security design, Review of Financial Studies 3, 229-263.

Amihud, Y., Mendelson, H., 1991, Liquidity, maturity, and the yields on US treasury securities, The Journal of Finance 46(4), 1411-1425.

Bulter, M., Livingston, M., Zhou, L., 2014, A long-term perspective on the determinants of treasury bond stripping levels, Financial Markets, Institutions & Insttruments 23(4).

Daves, P. R., Ehrhardt, M. C., 1993, Liquidity, reconstitution, and the value of U.S. treasury strips, The Journal of Finance 48(1).

Galliani, L., Petrella, G., Trsti, A., 2014, The liquidity of corporate and government bonds: Drivers and sensitivity to different market conditions, JRC Technical Reports.

Grinblatt, M., Longstaff, M. A., 2000, Financial innovation and the role of derivative securities: An empirical analysis of the treasury STRIPS program, The Journal of Finance 60(3).

Halpern, P. and Rumsey, J., 2000, Strip bonds and arbitrage bounds, Canadian Journal of Administrative Sciences, 143-52.

Nobuyuki Jujiki, 2003, The introduction of strips in Japan, Capital Research Journal 6(1).

Sack, B., 2000, Using treasury strips to measure the yield curve, FRB working paper.

Sundaresan, S. M., 2002, Fixed Income Markets and Their Derivatives, South-Western, a division of Thomon Learning.

Volker Vonhoff, 2014, Yield differences between coupon and principal STRIPS, Managerial Finance 40(4), 326-354.