Find out more about our latest publications

The Current State of the Secondary Market for KTBs and the Analysis of Market Liquidity

Research Papers 23-10 Dec. 21, 2023

- Research Topic Capital Markets

- Page 79

As the role of fiscal policy continues to expand, the issuance of the Korea Treasury Bond (KTB) is increasing rapidly to raise funds for government spending. Consequently, the secondary market for KTBs is becoming more important. Improving the secondary market's price discovery function not only helps the government raise funds efficiently, but also has a positive impact on the primary market.

Liquidity is a key indicator of secondary market conditions. Given the growing importance of the secondary market for KTBs, there is a need to meticulously analyze the factors affecting the KTB market liquidity and the impact of a liquidity shock on the KTB market. This paper examines the structure of the KTB market, focusing on the secondary market, and analyzes the factors affecting KTB liquidity and the impact of a liquidity shock on KTB yields and volatility with the construction of a liquidity index.

The KTB secondary market can be divided into the exchange-traded and over-the-counter (OTC) markets. Almost all KTB trading takes place in the KRX (Korea Exchange) KTB, an inter-dealer exchange market for KTBs, and the OTC markets. These two markets differ significantly in terms of the main purpose of transactions and participant characteristics. The KRX KTB market is characterized by active trading among primary dealers, particularly for benchmarks (on-the-run). On the other hand, the OTC market accommodates diverse institutional investors engaging in the trading of a variety of KTBs, including non-benchmarks (off-the-run). Hence, these significant differences in each secondary market need to be considered for the analysis of the KTB market liquidity.

We estimate a KTB market liquidity index using trading data for benchmarks from the KRX KTB market. Our analysis reveals that market liquidity is highly affected by changes in financial market conditions, exhibiting significant time series variations. In particular, market liquidity deteriorated substantially in March 2020 during heightened market volatility prompted by the shock of the COVID-19 pandemic. In addition, from September 2022 to January 2023, a period marked by escalated uncertainty in global financial markets due to the intensive monetary tightening by central banks in major countries, there was a notable decline in market liquidity. Meanwhile, the liquidity indexes of different maturities are highly correlated, suggesting that changes in financial conditions are the main drivers of liquidity, rather than the idiosyncratic characteristics of a particular maturity.

The regression analysis of the impact of financial conditions on KTB liquidity shows that market liquidity is significantly affected by changes in domestic and global financial market conditions. Not only domestic market conditions such as credit risk and funding liquidity, but also overseas market conditions such as the US dollar index and volatility in the US bond market and stock market exert a significant influence on KTB liquidity. In addition, a decrease in KTB prices contributed to a deterioration in liquidity, while an increase in prices improves liquidity suggesting that investment profits and losses also have an impact on liquidity.

Subsequently, we analyze the dynamic impact of a liquidity shock on the KTB market using a VAR (Vector Autoregression) model. The impact of a liquidity shock persists for a period spanning three to four weeks following the shock. These results indicate that it takes a significant amount of time for the KTB market to recover from liquidity shocks. It also suggests that when liquidity shocks accumulate over a short period of time, the vulnerability of the KTB market rises.

Based on the analysis in this paper, there are several implications for KTB liquidity. First, the growing importance of the secondary market for KTBs calls for the development of comprehensive liquidity indices capable of capturing variations in liquidity across the KTB market, and further research on methodologies is necessary to estimate liquidity indices more accurately. Next, given that KTB liquidity varies significantly in response to changes in domestic and overseas financial conditions, more attention should be paid to the KTB liquidity during periods of deteriorating financial market conditions. The government and the Bank of Korea need to prepare effective policy tools to mitigate excessive deterioration in liquidity when market liquidity worsens due to exogenous factors. In addition, continuous efforts are needed to improve the efficiency and transparency of the government bond market structure. Finally, it is necessary to expand the demand base for KTBs through the diversification of KTB products, as a broader investor base can increase market liquidity and mitigate liquidity shocks.

Liquidity is a key indicator of secondary market conditions. Given the growing importance of the secondary market for KTBs, there is a need to meticulously analyze the factors affecting the KTB market liquidity and the impact of a liquidity shock on the KTB market. This paper examines the structure of the KTB market, focusing on the secondary market, and analyzes the factors affecting KTB liquidity and the impact of a liquidity shock on KTB yields and volatility with the construction of a liquidity index.

The KTB secondary market can be divided into the exchange-traded and over-the-counter (OTC) markets. Almost all KTB trading takes place in the KRX (Korea Exchange) KTB, an inter-dealer exchange market for KTBs, and the OTC markets. These two markets differ significantly in terms of the main purpose of transactions and participant characteristics. The KRX KTB market is characterized by active trading among primary dealers, particularly for benchmarks (on-the-run). On the other hand, the OTC market accommodates diverse institutional investors engaging in the trading of a variety of KTBs, including non-benchmarks (off-the-run). Hence, these significant differences in each secondary market need to be considered for the analysis of the KTB market liquidity.

We estimate a KTB market liquidity index using trading data for benchmarks from the KRX KTB market. Our analysis reveals that market liquidity is highly affected by changes in financial market conditions, exhibiting significant time series variations. In particular, market liquidity deteriorated substantially in March 2020 during heightened market volatility prompted by the shock of the COVID-19 pandemic. In addition, from September 2022 to January 2023, a period marked by escalated uncertainty in global financial markets due to the intensive monetary tightening by central banks in major countries, there was a notable decline in market liquidity. Meanwhile, the liquidity indexes of different maturities are highly correlated, suggesting that changes in financial conditions are the main drivers of liquidity, rather than the idiosyncratic characteristics of a particular maturity.

The regression analysis of the impact of financial conditions on KTB liquidity shows that market liquidity is significantly affected by changes in domestic and global financial market conditions. Not only domestic market conditions such as credit risk and funding liquidity, but also overseas market conditions such as the US dollar index and volatility in the US bond market and stock market exert a significant influence on KTB liquidity. In addition, a decrease in KTB prices contributed to a deterioration in liquidity, while an increase in prices improves liquidity suggesting that investment profits and losses also have an impact on liquidity.

Subsequently, we analyze the dynamic impact of a liquidity shock on the KTB market using a VAR (Vector Autoregression) model. The impact of a liquidity shock persists for a period spanning three to four weeks following the shock. These results indicate that it takes a significant amount of time for the KTB market to recover from liquidity shocks. It also suggests that when liquidity shocks accumulate over a short period of time, the vulnerability of the KTB market rises.

Based on the analysis in this paper, there are several implications for KTB liquidity. First, the growing importance of the secondary market for KTBs calls for the development of comprehensive liquidity indices capable of capturing variations in liquidity across the KTB market, and further research on methodologies is necessary to estimate liquidity indices more accurately. Next, given that KTB liquidity varies significantly in response to changes in domestic and overseas financial conditions, more attention should be paid to the KTB liquidity during periods of deteriorating financial market conditions. The government and the Bank of Korea need to prepare effective policy tools to mitigate excessive deterioration in liquidity when market liquidity worsens due to exogenous factors. In addition, continuous efforts are needed to improve the efficiency and transparency of the government bond market structure. Finally, it is necessary to expand the demand base for KTBs through the diversification of KTB products, as a broader investor base can increase market liquidity and mitigate liquidity shocks.

Ⅰ. 서론

재정정책의 역할이 지속적으로 확대되면서 국채 발행이 빠르게 증가하고 있다. 정부는 재정지출에 있어 기본적으로 조세수입을 활용하되 부족한 부분은 국채 발행을 통해 충당한다. 정부지출 규모가 꾸준히 확대되는 가운데 이를 지원하기 위한 정부의 자금조달 수요가 늘어나면서 GDP 대비 국고채1) 발행잔액 비율이 2000년 6.5%에서 2022년에는 43.4%로 빠르게 높아지고 있다. 우리나라 경제는 저출산, 고령화 등으로 성장동력이 약화되는 가운데 복지지출에 대한 수요는 증가할 것으로 전망된다. 이에 따라 재정의 중요성이 더욱 커지면서 향후에도 국채 발행을 통한 정부의 자금조달 증가세가 이어질 것으로 예상된다.

국채 발행이 빠르게 늘어나면서 국채 유통시장의 중요성이 높아지고 있다. 유통시장에서 형성되는 거래를 통해 국채 수익률이 결정됨에 따라 유통시장의 가격발견 기능 제고는 정부의 효율적인 자금조달로 이어질 뿐 아니라 발행시장 활성화에도 영향을 미친다. 또한 무위험금리(risk-free rate)에 해당하는 국채 수익률은 기업, 가계 등 경제주체의 자금조달에 있어 준거금리 역할을 하며 이에 따라 경제 전반의 자금조달 비용에도 영향을 미친다. 따라서 국채 유통시장의 중요성은 금융시장이 발달할수록 더욱 커지게 된다.

유통시장 여건을 나타내는 대표적인 지표가 유동성이다. 유동성은 시장가격에 크게 영향을 미치지 않으면서 낮은 거래비용으로 신속히 거래를 체결할 수 있는 정도를 나타낸다. 유동성은 거래비용, 가격에 대한 영향력, 거래가 체결되는 데 소요되는 시간 등 유통시장의 다양한 특성을 포괄한다. 유동성이 높은 시장은 수요와 공급의 미세한 변화가 있더라도 급격한 가격 변동이 발생하지 않아 가격 효율성이 높다는 다수의 기존 연구가 존재한다. 이에 따라 다양한 유동성 지표를 통해 시장 유동성의 특성을 이해하려는 노력이 이루어지고 있다.

채권시장 유동성은 채권 자체적인 특성뿐 아니라 채권시장을 둘러싼 다양한 요인에도 영향을 받는다. 먼저 만기, 발행규모, 발행 이후의 경과기간, 발행주체의 신용도 등 채권의 특성이 유동성에 영향을 미친다. 또한 거래시장의 구조, 거래참여자의 행태, 시장조성자 존재 여부, 유통시장 발달 정도 등 유통시장의 특성과 함께 금융시장 여건 변화도 유동성에 영향을 미친다. 국채 유통시장의 중요성이 커지고 있음을 고려할 때, 국채 유동성에 영향을 미치는 요인 및 유동성 변화가 국채시장에 미치는 영향 등을 엄밀하게 분석해 볼 필요가 있다.

채권 유동성의 개념을 도입한 기존의 국내 연구들은 대부분 가격발견 기능 및 시장 효율성의 결정요인으로서 유동성을 분석하는 데 초점을 두고 있다. 그러나 국채 유동성의 변화 양상 및 변동 요인에 대한 심도 깊은 연구가 부족한 가운데 유동성이 국채 가격과 변동성에 미치는 영향을 분석한 연구는 거의 이루어지지 않고 있다. 채권 유형 간 유동성 차이에 관한 연구는 존재하나 유동성 변화의 특성, 유동성에 영향을 미치는 요인, 유동성 변화의 영향 등에 대한 종합적 검토는 부족한 상황이다. 이에 따라 유동성의 다양한 측면을 고려한 국고채 유동성지수를 추정하고 유동성에 영향을 미치는 요인을 분석하는 것은 국채시장 효율성 제고를 위한 정책적 논의에도 중요한 함의를 갖는다.

본 보고서는 유통시장을 중심으로 국고채시장 구조를 살펴보는 한편, 유동성지수 추정을 통해 국고채 유동성의 변동 요인 및 유동성 변화가 국고채 수익률과 변동성에 미치는 영향을 분석하고자 한다. 본 보고서의 구성은 다음과 같다. 제Ⅱ장에서는 우리나라 국고채시장 현황을 살펴본다. 제Ⅲ장에서는 채권 유동성에 관한 개념을 이해하고 이를 바탕으로 우리나라 국고채시장 유동성지수를 추정한다. 제Ⅳ장에서는 유동성 변동 요인 및 유동성 변화가 국고채시장에 미치는 영향을 분석하고, 제Ⅴ장에서는 논의 내용을 바탕으로 시사점을 제시한다.

Ⅱ. 국고채시장 현황

국채는 정부의 세수 부족을 보완하고 경기 활성화를 포함한 다양한 경제 정책을 추진하기 위한 자금조달 수단이다. 또한 국채시장은 투자자에게 안전자산을 공급하고 자산가격 결정에 기본이 되는 무위험금리 및 수익률곡선 정보를 제공하며, 통화정책의 효과가 금리경로를 통해 파급되는 데 있어서도 핵심적인 역할을 한다. 본 장에서는 국고채 발행, 투자자, 유통 등 국고채시장 전반의 현황을 살펴본다.

1. 국고채 발행시장

국채 발행규모가 확대되는 가운데 정부는 원활한 자금조달을 도모하고 조달 비용 절감을 위해 국채시장 제도개선을 꾸준히 추진해 왔다. 다양한 유형으로 발행되었던 국채를 국고채로 단일화2)하였고, 통합발행(fungible issue)3) 및 발행 정례화 제도를 도입하여 국고채의 유형을 표준화하였다. 또한 1999년에는 국고채의 원활한 소화를 위해 국고채전문딜러(Primary Dealer: PD) 제도를 도입하였다. PD는 발행시장에서 우선적으로 입찰에 참여할 수 있는 권리 및 인수‧유통금융 등의 지원을 받는 대신 국채 유통시장에서 시장조성자(market maker)의 의무를 수행해야 한다.

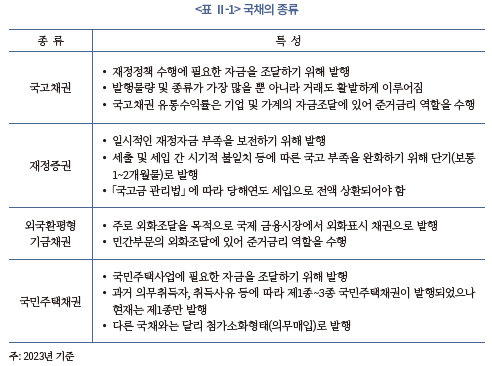

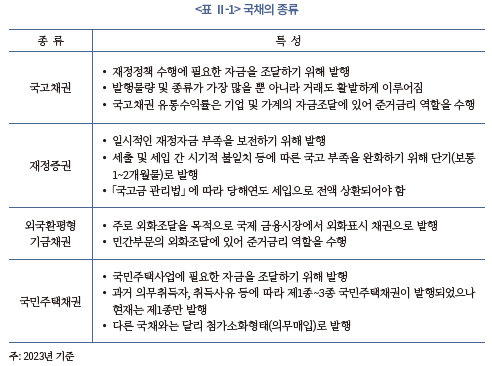

2023년 현재 국채는 국고채권, 재정증권, 외국환평형기금채권, 국민주택채권의 4가지 종류로 발행되고 있다(<표 Ⅱ-1>). 이 중 재정정책 수행에 필요한 자금을 조달하기 위해 발행되는 국고채가 가장 큰 비중을 차지하는데, 2022년말 국채 발행잔액 1,031.5조원 중 국고채가 937.5조원으로 90.9%를 차지한다. 국고채는 다른 종류의 국채에 비해 유통시장 규모가 훨씬 큼에 따라 유동성이 매우 중요하다. 이에 본 연구는 국고채 유동성에 초점을 맞추어 분석을 진행한다.4)

시장 여건의 변화 및 투자자의 다변화된 수요를 반영하여 국고채 상품구성이 다양화되었다. 2000년 이전 국고채 만기 구조는 3년과 5년으로만 구성되어 있었으나 이후 다양한 만기의 국고채가 점진적으로 도입되었다. 2000년 10년 만기 국고채를 발행하였고 2006년과 2012년에는 각각 20년물과 30년물을 도입하였으며, 2016년에는 50년 만기 국고채를 도입하였다. 2021년에는 중장기물에 대한 수급 부담 완화 등을 위해 2년 만기 국고채가 도입되었다. 이에 따라 2023년 현재 고정금리 국고채는 2년, 3년, 5년, 10년, 20년, 30년, 50년의 7개 유형으로 발행되고 있는 가운데 물가연동 국고채가 10년 만기로 발행되고 있다. 한편 개인의 안정적인 자산형성 지원 등을 목적으로 2024년 개인투자용 국채 도입을 추진하고 있으며 초장기물에 대한 금리 헤지수단을 제공하기 위해 30년 국채선물(futures)도 도입 예정이다.5)

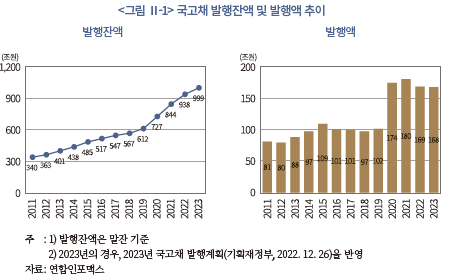

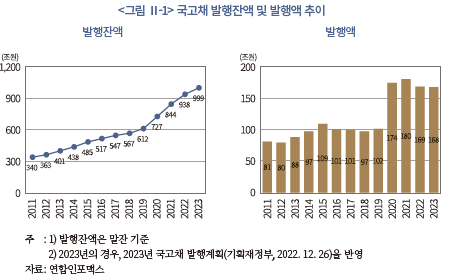

재정정책의 역할이 지속적으로 확대되면서 국고채 발행의 중요성이 커지고 있다. 정부소비지출이 GDP에서 차지하는 비중은 2001~2010년 연평균 13.1%에서 2011~2020년에는 15.6%로 높아졌으며, 코로나19 팬데믹 이후에도 상승세가 이어지며 2021~2022년에는 18.5%를 기록하고 있다. 정부지출 확대를 지원하기 위한 정부의 자금조달 수요가 확대되면서 국고채 발행이 빠른 속도로 늘어나고 있다(<그림 Ⅱ-1>). 국고채 발행잔액은 2011년말 340조원에서 2023년말에는 1,000조원 수준에 이를 것으로 예상된다. 특히, 코로나19 팬데믹 이후 확장적 재정정책 운용으로 인해 국고채 발행이 큰 폭으로 늘어났다. 국고채 발행규모는 팬데믹 이전 5년(2015~2019년) 연평균 102조원 수준이었으나, 이후 4년(2020~2023년) 발행규모는 173조원으로 큰 폭 증가했다.

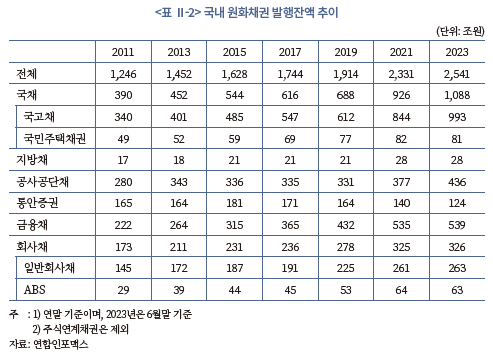

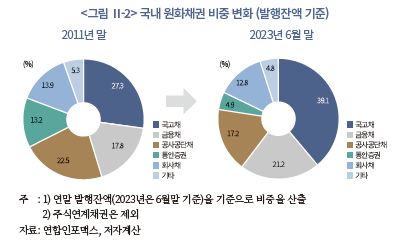

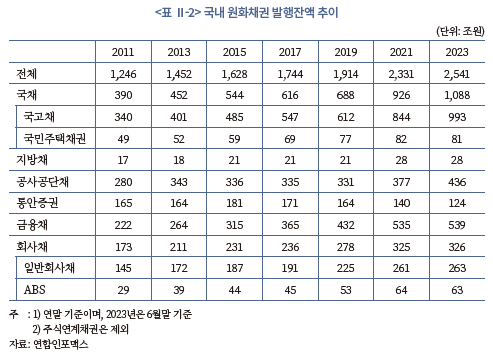

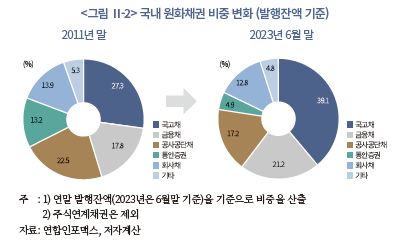

국고채 발행잔액이 빠르게 늘어나면서 국내 채권시장에서 국고채가 차지하는 비중이 크게 확대되고 있다. 국내 원화채권 잔액은 2011년말 1,246조원에서 2023년 6월말 2,541조원으로 103.9% 증가했는데, 동 기간 중 국고채 잔액은 340조원에서 993조원으로 192.1% 늘어나며 채권유형 중 가장 빠른 증가세를 기록하고 있다(<표 Ⅱ-2>). 이에 따라 국내 채권시장에서 국고채가 차지하는 비중은 2011년말 27.3%에서 2023년 6월말에는 39.1%로 빠르게 확대되는 모습이다(<그림 Ⅱ-2>).

국고채시장 확대가 금융시장에 미치는 영향은 양면성을 지니고 있다. 먼저 금융시장으로 공급되는 무위험 자산이 늘어남에 따라 투자자가 선택할 수 있는 투자 대상이 확대되었다는 긍정적인 측면이 존재한다. 또한 다양한 만기의 국채가 유통시장에 공급되면서 수익률 곡선의 완성도가 제고되는 한편, 유통물량 확대를 통해 유통시장 활성화 및 가격발견 기능 제고의 효과를 거둘 수 있다.

반면 국채 발행의 급격한 확대는 국채시장 수급 불안정을 유발함으로써 채권시장 수익률 상승압력으로 작용할 수 있다. 무위험금리에 해당하는 국채 수익률이 상승하는 경우, 신용채권을 포함한 채권시장 전반의 자금조달 비용 상승으로 이어진다. 또한 국채 발행 증가는 채권시장 수급에 영향을 미침으로써 신용채권시장을 위축시킬 가능성이 있다.

가파른 국채 발행 증가세는 장기적으로 재정 여건을 악화시키고 국가의 성장 잠재력을 약화시킬 수 있다. 재정지출 확대, 국세 수입 감소 등으로 인한 재정적자 보전을 위해 적자 국채 발행이 지속되는 경우 국가채무가 빠르게 늘어나 재정지출 여력을 악화시키는 요인으로 작용한다. 일부 선진국에서 국채 발행 확대 및 재정지출 여력 악화의 악순환이 반복되면서 국가채무 비율이 빠르게 상승하는 가운데 성장 잠재력이 하락한 사례가 존재한다. 이에 따라 재정 건전성이 악화되지 않는 수준에서 국채 발행 전략을 마련할 필요가 있다.

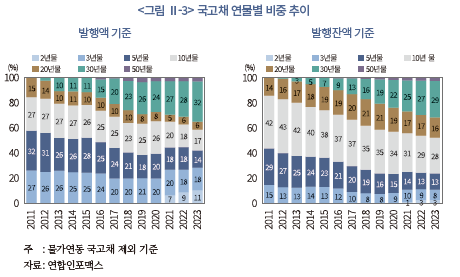

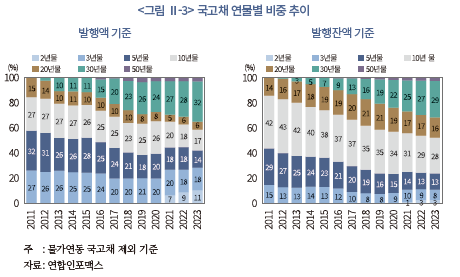

한편 국고채의 만기별 비중 추이를 살펴보면 단기채 비중이 줄어드는 반면 장기채 비중은 확대되는 추세를 나타내고 있다(<그림 Ⅱ-3>). 만기 10년 이상의 장기채 비중(물가연동 국고채를 제외한 발행액 기준)이 2011년 41.9%에서 2019년에는 61.1%까지 확대되었다. 다만 2020년 이후에는 단기채 발행이 증가하고 2021년에는 2년물 국고채가 신규 도입됨에 따라 장기물 비중이 소폭 줄어드는 모습이다.

국고채 장기물 비중이 확대되는 추세를 보이는 것은 주요 국채 투자자인 보험사의 장기 국채에 대한 수요가 증가하였기 때문이다. IFRS17 도입에 따라 보험사는 보험부채를 시가로 평가하게 되는데, 자산‧부채 간 듀레이션 갭이 큰 보험사는 자산 듀레이션 확대를 위해 장기 우량채권에 대한 투자수요가 크게 증가하였다. 보험사의 장기물 수요 확대에 대응하여 정부는 국고채 장기물 발행을 지속적으로 확대하였다. 장기물 발행잔액이 꾸준히 누적되면서 국고채의 평균 만기가 늘어나고 있다. 국고채 평균 잔존만기는 2015년 8.0년에서 매년 지속적으로 증가하여 2018년에는 9.7년, 2022년에는 11.6년까지 늘어났다.

2. 국고채 투자자

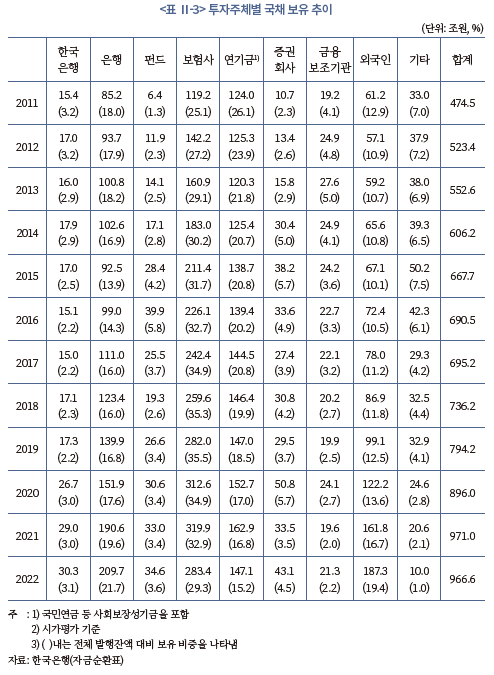

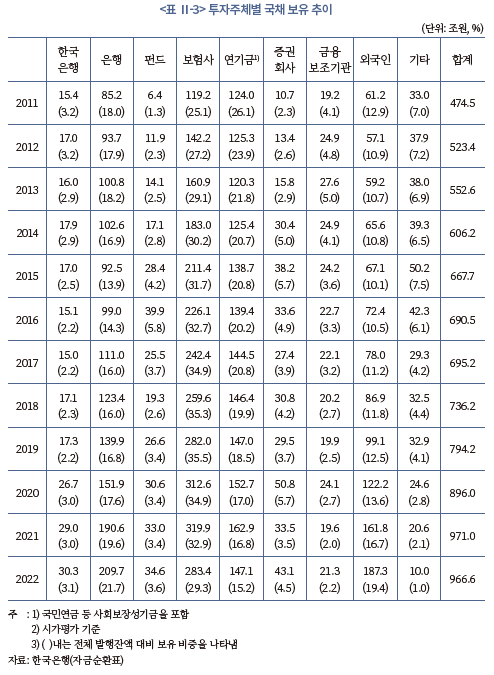

시장 여건 변화에 따라 국고채 투자자 구성도 변화하는 모습이다. 한국은행이 편제하는 자금순환표를 이용하여 주요 기관투자자의 국채 보유 비중을 살펴보면6), 2022년말 기준 보험사, 은행, 연기금의 3개 기관투자자가 국채의 65%를 보유하고 있는 가운데 외국인 비중이 19%를 기록하며 4개 유형의 투자자가 국채의 대부분을 보유하고 있다(<표 Ⅱ-3>). 보험사의 국채 보유 비중이 크게 확대된 것은 IFRS17 시행에 대비하여 만기 30년 이상 초장기물을 중심으로 보험사가 국고채 투자를 꾸준히 확대하였기 때문이다. 다만, 2021년 이후 시장금리의 가파른 상승으로 보험사가 보유한 국채 시가가 상당 규모 감소하면서 최근 보험사의 국채 보유 비중이 다소 줄어드는 모습이다.7)

은행의 국채 비중은 연도별로 다소 변동을 나타내는 가운데 최근 들어 확대되는 추세를 보이고 있다. 글로벌 금융위기 이후 은행에 대한 유동성커버리지비율(Liquidity Coverage Ratio: LCR)8) 규제가 적용됨에 따라 은행은 유동성이 높은 안전자산에 대한 투자수요가 존재하는데, 특히 유동성이 높은 국채 단기물을 중심으로 투자하고 있다.

국민연금을 포함한 연기금의 국채 보유 비중은 지속적으로 축소되고 있다. 이는 수익률 제고 등을 위해 연기금이 해외투자 및 대체투자 비중을 확대하면서 국채에 대한 투자 비중을 축소한 데 주로 기인한다.

외국인의 국채 투자는 2015년까지 정체를 보였으나 2016년 이후 증가세가 이어지고 있으며, 특히 코로나19 팬데믹 이후 국채 보유 비중이 더욱 확대되는 모습이다. 국채시장에서의 외국인 보유 비중은 2015년 10.1%에서 2022년에는 19.4%로 늘어났다. 이처럼 외국인의 국채 투자가 꾸준히 늘어나고 있는 것은 안정적인 거시경제 여건을 바탕으로 우리나라 국채 신용도가 높은 수준을 유지하고 있는 가운데 차익거래유인9)이 존재하기 때문이다. 국채 유통시장의 발달로 현금화가 용이하다는 점도 외국인의 국채 투자 확대 요인으로 작용한다. 외국인이 보유한 국내 채권은 대부분 유동성이 높은 국채와 통안채로 구성되어 있다. 한편 해외 중앙은행, 국부펀드 등 상대적으로 투자시계(investment horizon)가 긴 중장기성향의 외국인 투자자 비중도 확대되는 모습이다.10)

마지막으로 증권사의 국채 보유 비중은 2011년 2.3% 수준에 불과했으나 2014년 이후 3~5% 수준으로 다소 확대되는 모습이다. 증권사는 수익 제고를 위한 투자 목적 이외에도 단기자금 조달을 위해 국채를 보유한다. 특히, 2014년 증권사의 콜시장 참여를 원칙적으로 배제하는 단기자금시장 개편11) 등으로 인해 RP(Repurchase Agreements) 거래를 통한 자금조달 필요성이 높아졌는데 이는 증권사의 국채 투자를 확대하는 요인으로 작용하였다.

3. 국고채 유통시장12)

가. 유통시장 구조

국고채 유통시장은 장내시장과 장외시장으로 구분된다. 장내시장과 장외시장은 시장구조, 거래방식, 거래참여자 및 거래되는 채권의 특성 등 다양한 측면에서 차이를 나타낸다.

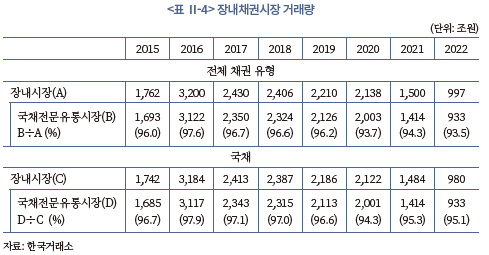

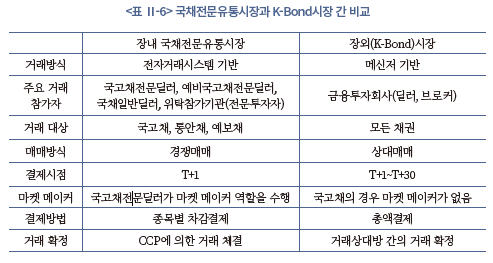

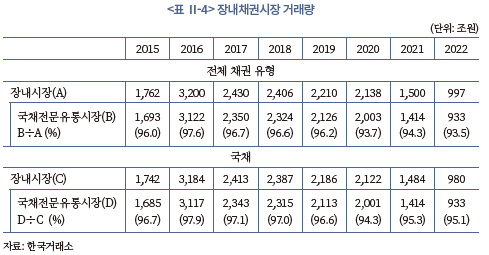

장내채권시장은 거래참여자 및 거래대상 채권에 따라 국채전문유통시장, 일반채권시장, 소액채권시장으로 구분되는데, 국채는 대부분 국채전문유통시장에서 거래된다(<표 Ⅱ-4>).13) 국채전문유통시장은 국고채, 통화안정증권, 예금보험공사채권을 거래대상으로 하며, 전자거래시스템 기반의 경쟁매매 방식14)으로 거래가 이루어진다.15) 직접 참가자격을 갖춘 국채딜러(국고채전문딜러, 예비국고채전문딜러 및 국채일반딜러)가 주요 거래 참가자이며, 일반 기관투자자의 경우 위탁매매를 통해 참가할 수 있다. 위탁참가기관은 기관등록과 거래원 등록을 통해 참가 자격을 얻게 되고 KTS(KRX Trading System for Government Securities) 단말기를 통해 주문을 제출할 수 있으나, 결제는 국채딜러에게 위탁해야 한다. 위탁자의 자금, 증권의 결제에 대한 이행보증책임은 수탁 금융투자회사가 지게 된다. 국채전문유통시장에서는 정부가 지정한 국고채전문딜러(PD)16)가 시장조성자 역할을 한다. 즉 국고채전문딜러는 지표종목별로 매도‧매수의 양방향 조성호가를 지속적으로 제시하는 의무를 지니고 있다. 이러한 시장조성자 제도는 국고채 거래가 원활하게 체결되도록 시장 유동성을 제고하는 기능을 수행한다.

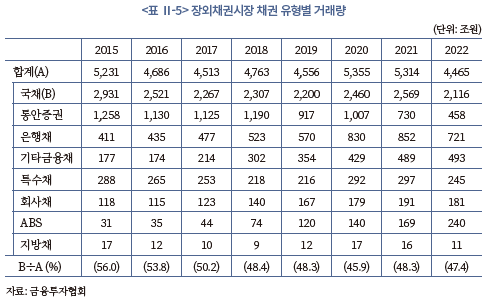

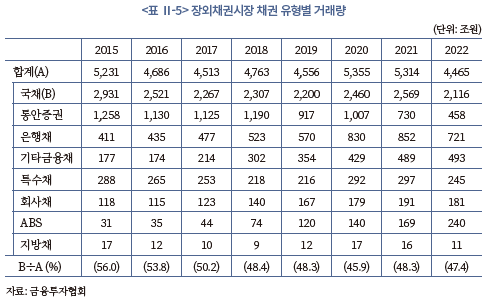

장외시장은 장내시장 이외의 시장을 의미한다. 장내시장의 경우 대부분 거래가 국채 거래인 데 반해, 장외시장에서는 보다 다양한 유형의 채권이 거래된다(<표 Ⅱ-5>). 국내의 대표적인 장외채권시장은 금융투자협회에서 개설한 K-Bond이다. K-Bond에서는 국고채를 포함한 모든 유형의 채권이 거래되며, 거래 참가자는 금융투자회사이다. 금융투자회사는 자체 보유한 자금 및 채권을 이용하여 투자자와 직접 거래하는 딜링거래와 고객의 채권거래 의뢰에 따라 거래상대방을 탐색하여 매매거래를 성립시켜 주는 브로커거래를 수행한다.

장외시장의 채권거래는 상대매매 방식으로 이루어진다. 거래참여자는 메신저를 통해 호가 탐색 및 거래 협의를 하고, 거래에 대한 합의가 이루어지면 채권정보와 결제 내역을 상호 확인하여 거래를 확정한다. 장외거래의 결제일은 매도자와 매수자 간 협의를 통해 T+1일부터 T+30일까지 가능하나 통상적으로 익일(T+1)결제가 이루어진다. 장외채권거래의 결제는 채권과 대금을 동시에 결제(Delivery-versus-Payment: DvP)하는 것을 원칙으로 하고 있다. 채권은 한국예탁결제원의 SAFE+시스템을 통해 예탁자계좌부 상의 계좌 간에 대체되고, 결제대금은 한국은행 금융망이나 은행의 당좌계정을 통해 이체된다.

나. 유통시장 관련 제도

국고채 발행잔액 증가와 함께 유통시장의 효율성 제고를 위한 다양한 제도 변화가 이루어져 왔다. 1999년에는 한국거래소에 경쟁매매 방식의 전자거래 플랫폼인 국채전문유통시장을 도입하였다. 장내 국채시장을 활성화하기 위한 다양한 정책도 추진되었는데, 국채전문유통시장에서 거래의 원활화를 도모하기 위해 PD의 시장조성 기능을 도입하였다. 시장조성자는 고객의 채권 매매를 중개하는 역할과 동시에 자기계좌 거래를 통해 시장에 호가를 제시하는 역할을 한다. 또한 가격 괴리가 발생하는 경우 자기계좌 거래를 통해 가격의 연속성을 유지시키는 역할을 한다. 이와 같은 PD의 시장조성기능은 국채전문유통시장의 가격 효율성을 제고하는 효과를 거두고 있다.

2002년에는 PD가 국고채 지표종목을 거래하는 경우 국채전문유통시장을 통해 거래하는 것을 의무화하는 제도를 도입하였다. 동 제도는 국채전문유통시장에서 PD 간 지표채권 거래를 확대하는 효과를 거두었으나 PD의 거래 부담을 증가시키고 다양한 거래방식을 제약하는 부작용을 초래함에 따라 2008년에 폐지되었다.

2006년에는 국고채의 매매수량단위를 기존 100억원에서 10억원으로 변경하였다. 매매수량단위의 축소는 소액거래 참여자가 장내시장을 활용하여 거래할 수 있는 기반을 제공하여 국채전문유통시장의 거래량을 증가시키는 효과를 거두었다. 2010년에는 PD의 최우선 호가 스프레드를 축소하고 의무호가 수량을 상향 조정하는 등 PD의 시장조성 의무를 대폭 강화하였다.

장외채권시장은 시장참여자에 의해 자발적으로 도입된 시장으로 주로 메신저를 통한 상대매매 방식으로 거래가 이루어진다. 장외채권시장은 거래 편의성이 높지만 투명성이 낮은 문제를 지니고 있다. 이에 따라 거래의 안정성과 투명성을 제고하기 위한 제도개선이 추진되었다. 2010년 금융투자협회는 기존의 메신저거래를 통합한 프리본드시장을 도입하였다. 프리본드시장은 거래의 편의성을 제고한 K-Bond 시장으로 2017년 개편하여 운영되고 있다.

한편 장외채권시장의 정보 효율성을 제고하는 정책도 추진되었다. 2000년에는 장외에서 거래된 채권의 거래 결과를 15분 이내에 공시하는 장외거래 체결내역 공시제도를 도입하였다. 동 제도의 도입을 통해 장외에서 거래되는 채권의 체결 내역이 신속하게 공시되면서 장외채권시장의 사후 투명성이 제고되었다.

2007년에는 장외채권시장에서 거래되는 채권의 호가정보를 금융투자협회가 집계하여 공시하는 장외 호가정보 집중시스템이 도입되었다. 장외 호가정보 집중시스템은 장외시장에서 거래되는 50억원 이상의 모든 채권에 대한 호가정보를 금융투자협회에 실시간으로 보고하고, 금융투자협회는 동 정보를 공시하는 시스템이다. 동 시스템의 도입으로 채권거래참여자의 가격 탐색기능이 강화되는 한편 장외채권시장의 사전 정보 투명성도 크게 높아졌다.

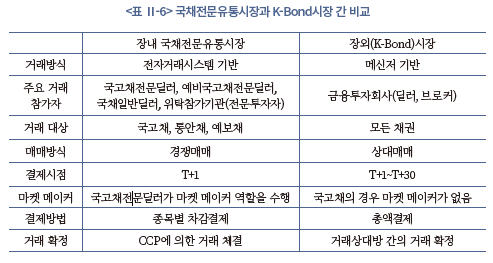

다. 유통시장별 특성

대부분의 국고채 거래는 장내시장인 국채전문유통시장과 장외시장을 통해 이루어지는데, 두 시장은 거래목적 및 참여자의 특성에 있어 큰 차이를 나타낸다. 국채전문유통시장의 경우 국고채 지표물을 위주로 국채딜러 간 거래가 활발히 이루어지고 있는 반면 장외시장에서는 여러 유형의 기관투자자가 비지표물을 포함한 다양한 종목의 국고채를 거래하고 있다. 아래에서는 국고채 거래 자료를 이용하여 유통시장별 특성을 비교해 본다.

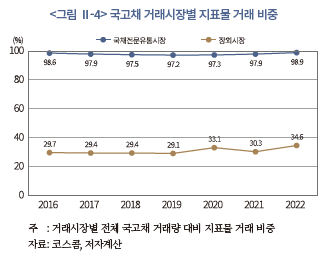

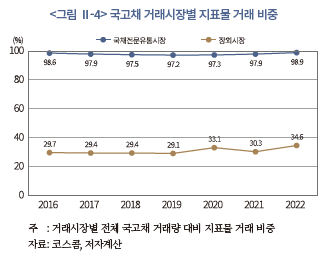

<그림 Ⅱ-4>에서 확인할 수 있는 바와 같이 국채전문유통시장에서의 국고채 거래는 거의 대부분이 지표물이다. 2016년부터 2022년까지 국채전문유통시장에서 이루어진 국고채 거래 중 지표물 비중이 97%를 상회하며 지표물 중심의 거래 특성을 보이고 있다. 반면 장외시장의 경우, 비지표물 거래 비중이 더 높게 나타난다. 2016~2022년 중 장외시장 국고채 거래 중 지표물의 비중은 29~35% 수준으로 국채전문유통시장에 비해 크게 낮은데, 이는 장외시장에서 보다 다양한 종목의 국고채가 거래되고 있음을 나타낸다.

국채전문유통시장에서 지표물 거래 비중이 높은 것은 동 시장이 지표채권의 거래 원활화 및 가격 안정을 위해 도입된 시장이기 때문이다. 국고채전문딜러는 국채전문유통시장에서 지표채권에 대한 시장조성 의무를 갖는다. 국고채전문딜러는 국고채 신규 발행시 입찰에 참여하고, 일정 규모의 국고채를 보유하는 가운데 국채전문유통시장에서 지표채권에 대해 매도 및 매수호가를 제시해야 한다. 국고채전문딜러의 시장조성 기능이 지표채권에 초점을 두고 설정되어 있기 때문에 국채전문유통시장에서 지표물의 거래 비중이 높게 나타나고 있는 것이다. 반면 장외시장에서는 다양한 목적의 비표준화된 국고채 거래가 대량으로 이루어지기 때문에 비지표물의 거래 비중이 더 높은 모습을 보인다.

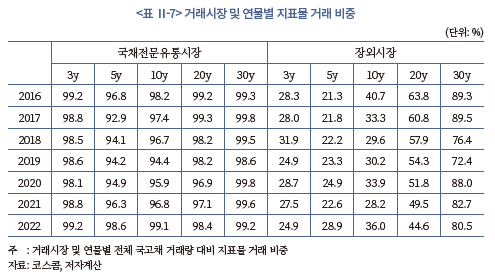

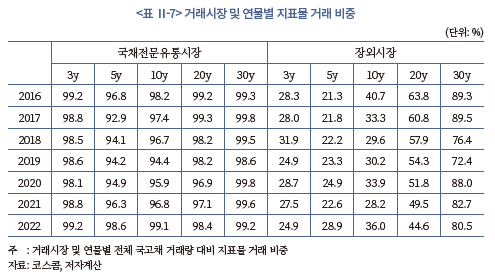

유통시장을 구분하여 연물별 지표물 거래 비중을 살펴보면, 국채전문유통시장에서는 모든 연물에 걸쳐 지표물 비중이 매우 높은 수준을 나타내고 있다(<표 Ⅱ-7>). 이에 반해 장외시장에서는 연물에 따라 지표물 거래 비중이 차이를 보이고 있는데, 단기물에 비해 장기물의 지표채권 거래 비중이 상대적으로 높게 나타난다. 일반적으로 국고채 단기물은 거래가 활발한 상품으로 지표물 기간과 비지표물 기간에 따라 거래시장이 구분되는 특성을 보인다. 지표물 기간에는 국채전문유통시장에서 딜러 간 거래가 활발히 이루어지다가 비지표물로 전환되면 주로 장외시장에서 거래된다. 국고채 장기물의 경우, 단기물에 비해 거래 규모가 적다. 이에 따라 시장조성을 목적으로 하는 거래는 국채전문유통시장에서 이루어지고 기관투자자의 거래는 장외시장에서 이루어지는 특성을 보인다.

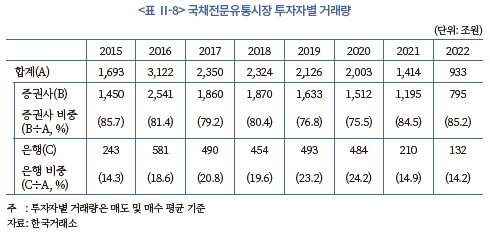

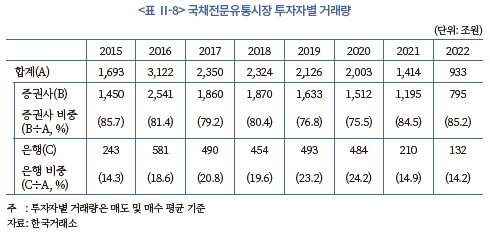

장내시장과 장외시장은 거래참가자 측면에서도 큰 차이를 나타낸다. 국채전문유통시장에서는 국채딜러인 증권사와 은행의 합산 거래 비중이 99%를 상회하며 국채딜러를 중심으로 거래가 이루어지고 있다(<표 Ⅱ-8>). 한편 은행이 증권사에 비해 총자산 및 국고채 보유규모가 더 크지만 거래 비중은 증권사가 은행에 비해 훨씬 높게 나타난다. 이는 국채딜러 업무를 수행하는 증권사의 수가 은행에 비해 많을 뿐 아니라 전문적인 증권 중개업무를 수행하는 증권사가 국채전문유통시장에서 거래를 적극적으로 수행할 유인이 높기 때문이다.

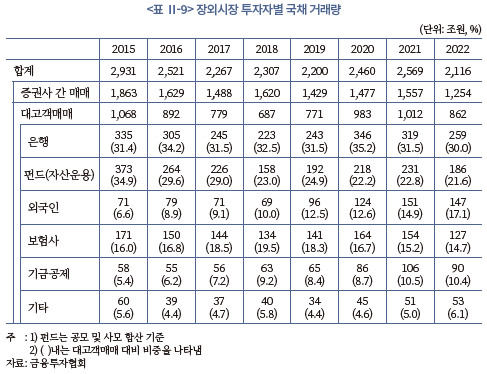

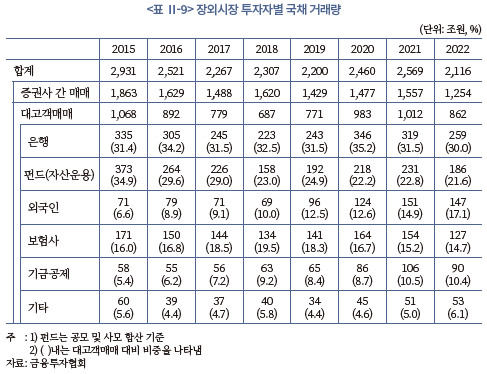

장외시장의 경우 중개기관인 증권사뿐 아니라 은행, 펀드 등 다양한 투자자가 국채 거래에 참가한다. 장외시장 거래는 거래상대방을 기준으로 크게 증권사 간 매매17)와 대고객매매18)로 구분되는데, 증권사 간 매매가 매년 장외 국채거래의 절반 이상으로 거래 규모가 가장 크다(<표 Ⅱ-9>). 대고객매매의 투자자 유형별 거래 비중을 살펴보면 은행과 펀드가 높은 비중을 나타내고 있다. 외국인의 경우 국채 투자 확대세가 이어지면서 대고객매매에서 차지하는 비중이 높아지고 있는 반면, 보험사 및 연기금은 국채 보유규모에 비해 대고객매매에서의 거래 비중이 상대적으로 낮게 나타난다. 유통시장에서 투자자별 참여도가 차이를 나타내는 것은 투자자별 국채 투자 목적 및 전략이 다르기 때문이다. 예를 들어, 보험사 및 연기금과 같이 만기 보유 또는 장기 투자를 목적으로 국채를 거래하는 기관투자자는 국채매매가 활발하지 않아 상대적으로 장외 유통시장에서의 거래 비중이 낮게 나타난다. 반면 펀드와 같이 매매 수익을 추구하는 투자자는 적극적으로 국채를 매매함에 따라 장외 유통시장에서 높은 거래 비중을 보인다.

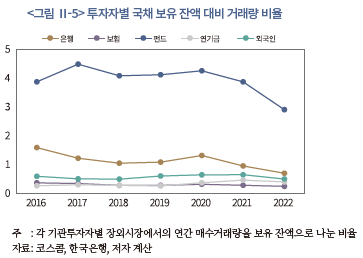

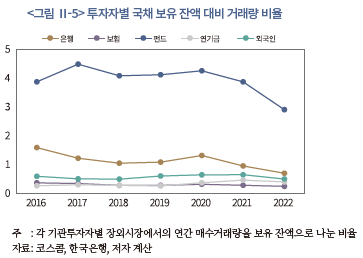

주요 투자자의 국채 투자 전략을 간접적으로 파악하기 위해 투자자별 국채 보유 잔액 대비 장외시장에서의 매수거래 비율 추이를 살펴본다(<그림 Ⅱ-5>). 투자자 유형별로 매수거래 비율을 비교해 보면 펀드가 가장 활발하게 거래를 하고 있는 반면 연기금과 보험은 보유 국채에 비해 거래가 낮은 수준으로 나타났다. 이는 앞서 설명한 것과 같이 펀드의 경우 국채 거래를 통해 수익을 추구하는 투자 전략으로 인해 거래가 활발한 반면, 장기 투자기관인 연기금과 보험사는 상대적으로 국채 거래가 적기 때문이다.

라. 국고채 유통 추이

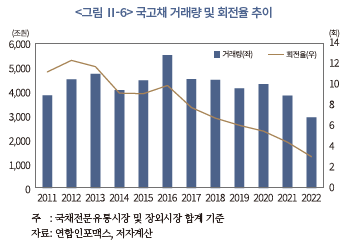

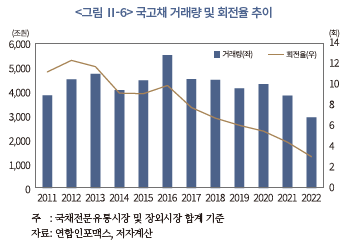

유통시장에서의 국고채 거래 추이를 살펴보면 2017년 이후 거래량과 거래회전율이 하락세를 나타내고 있다(<그림 Ⅱ-6>). 이와 같은 거래 감소세는 국고채 연물 구조 변화에 따른 장기 보유 투자자 비중 확대가 구조적 요인으로 작용하는 가운데 2021년 이후 글로벌 통화긴축 기조가 강화되면서 국고채 투자수요가 크게 위축된 데 기인하는 것으로 판단된다.

먼저, 장기물의 발행 비중 확대가 국고채 거래 감소 요인으로 작용하고 있다. 일반적으로 만기가 10년을 초과하는 국고채 장기물은 단기물에 비해 거래가 저조하다. 특히 국고채 30년물과 50년물과 같은 초장기물의 경우, 단기물에 비해 거래량이 크게 적다. 이는 초장기 채권에 주로 투자하는 보험사, 연기금 등이 매매거래를 통해 수익을 제고하기보다는 장기의 부채 듀레이션을 매칭할 목적으로 국고채를 장기 보유하기 때문이다. 2012년 도입된 30년 만기 국고채는 보험사의 수요 증대에 따라 발행규모가 지속적으로 늘어나고 있으며 2016년 신규 도입된 50년 만기 국고채도 발행이 확대되고 있다. 초장기물의 발행이 늘어남에 따라 상대적으로 국고채 거래가 활발한 펀드 및 증권사의 거래 비중은 감소하고 장기 투자기관인 보험사의 비중이 높아지는 방향으로 투자자 구성이 변화하고 있으며, 이는 국고채 거래를 둔화시키는 요인으로 작용한다.

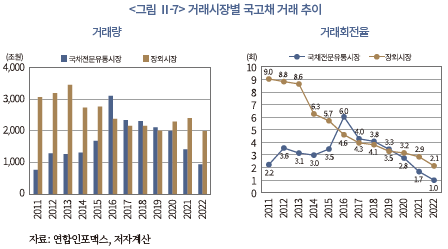

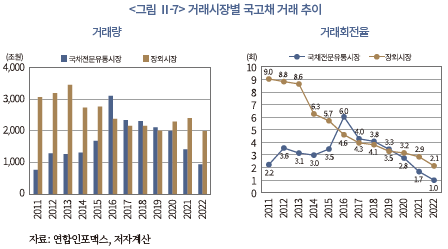

유통시장별로 국고채 거래 추이를 살펴보면 장내시장과 장외시장 간 차이가 발견된다(<그림 Ⅱ-7>). 장내시장의 경우 2016년 거래가 급격히 증가한 이후 감소세로 전환된 반면, 장외시장 거래량은 2014년부터 2019년까지 감소 추세를 보이다가 2020년 이후에는 소폭 증가하는 모습을 보이고 있다.

2016년 장내시장 거래량이 크게 늘어난 것은 스트립채권 활성화를 위해 PD 제도를 개선한 데 크게 기인한다.19) 정부는 스트립채권시장 활성화를 위해 스트립 거래실적을 PD 평가 항목에 포함시켰는데, 이에 따른 PD의 스트립채권 발행 및 거래 증가로 장내 국고채 거래량이 큰 폭으로 늘어났다. 그러나 2017년부터는 장내 거래량 감소세가 이어지고 있으며, 2021년 이후 금리가 가파르게 상승하면서 거래량이 상당폭 감소하였다. 반면 장외시장의 경우 외국인의 국고채 투자 확대 등으로 거래량이 크게 위축되지는 않는 모습이다.

거래회전율 추이를 살펴보면 최근 수년간 장내시장과 장외시장 모두 하락세를 보이는 가운데 특히 장내시장에서 하락폭이 큰 것으로 나타났다. 장내 및 장외시장 전반에 걸쳐 거래회전율이 하락하는 것은 앞서 설명한 바와 같이 단기물에 비해 상대적으로 거래가 적은 국고채 장기물 비중이 늘어난 것에 기인한다. 장내시장에서 거래회전율이 크게 하락한 것은 지표채권 거래 둔화가 주요인으로 작용한 것으로 판단된다. 과거 거래가 활발했던 3년물, 5년물, 10년물 지표채권의 거래량이 급격히 감소함에 따라 장내 국고채 거래회전율도 크게 낮아지는 모습이다.

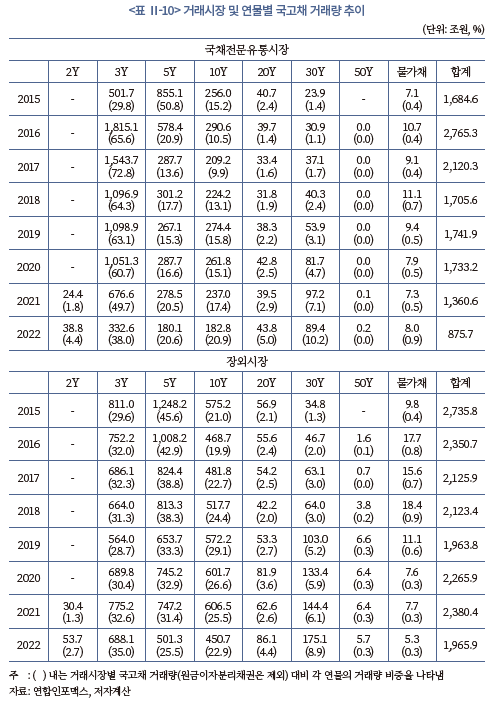

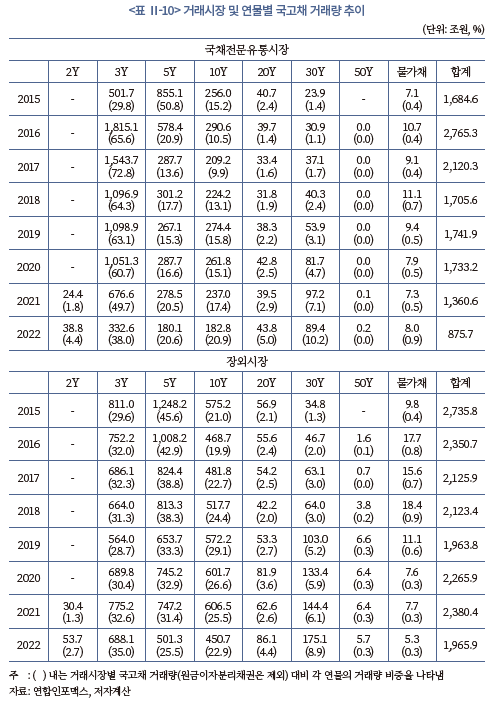

한편 거래시장별 각 연물의 국고채 거래 추이를 살펴보면, 3~10년물 거래가 가장 높은 비중을 나타내는 가운데 최근 들어 장기물 거래가 증가세를 보이고 있다(<표 Ⅱ-10>). 국채전문유통시장의 경우 3년물, 5년물 및 10년물의 합산 거래 비중이 2020년까지 90%를 상회하면서 3개 연물을 중심으로 국고채 거래가 이루어져 왔다. 그러나 2021년 이후 3년물 거래가 급격히 줄어든 반면 장기물 거래는 증가하고 있는데, 이를 통해 국채전문유통시장에서의 거래량 감소가 단기물 거래 위축에 따른 것임을 확인할 수 있다. 장외시장에서도 3~10년물을 중심으로 국고채 거래가 이루어지는 가운데 만기 20년 이상 장기물의 거래 비중이 점진적으로 확대되고 있다. 최근 가파른 금리상승에도 불구하고 장외시장 거래량은 상대적으로 변동성이 작은 모습이다.

이상의 결과를 종합해 보면 국채전문유통시장과 장외시장에서의 국고채 거래는 크게 다른 양상을 나타내고 있다. 이는 앞서 살펴본 것과 같이 두 시장의 거래참여자 구성이 상이한 가운데 이에 따른 거래 특성의 차이가 반영된 결과로 해석될 수 있다.

Ⅲ. 국고채시장 유동성지수 추정

본 장에서는 시장 유동성의 개념을 살펴보고 채권 유동성에 관한 선행연구를 바탕으로 우리나라 국고채시장 유동성지수를 추정한다. 먼저 1절에서는 시장 유동성의 개념과 유동성 측정지표를 살펴보고 2절에서는 채권 유동성에 관한 선행연구에 대해 논의한다. 3절에서는 유통시장별 유동성 지표를 비교해 보고, 4절에서는 국고채 유동성지수 추정을 위한 분석자료 및 추정에 관한 방법론을 설명한다. 마지막 5절에서는 다양한 유동성 지표를 통합하여 유동성지수를 추정하고 유동성지수의 특징을 살펴본다.

1. 유동성의 개념과 측정지표

유통시장 여건을 나타내는 대표적인 지표가 유동성이다. 유동성은 시장가격에 영향을 크게 미치지 않으면서 낮은 거래비용으로 신속히 거래를 체결할 수 있는 정도를 나타낸다. 본 연구에서 사용되는 유동성(liquidity)은 거래의 수월성 및 효율성 등 시장 여건의 질적인 개념으로 통화량(monetary aggregates)과 같은 양적인 개념과는 구분된다.

시장 유동성은 거래비용, 가격에 대한 영향력, 거래가 체결되는 데 소요되는 시간 등 유통시장의 다양한 특성을 포괄하는 개념이다. 이에 따라 단일 지표를 이용하여 유동성의 다양한 차원을 포착하는 데 한계가 존재한다(Amihud et al., 2006). Sarr & Lybek(2002)은 유동성을 밀집성(tightness), 즉시성(immediacy), 심도(depth), 폭(breadth), 회복성(resiliency)의 다섯 가지 측면에서 평가할 수 있다고 하였다.20) 다만 위에서 제시된 유동성의 각 측면 간에 중첩되는 영역이 존재하며, 가용한 데이터를 사용하여 유동성의 각 측면을 정확하게 측정하는 데 어려움이 존재한다.

이처럼 유동성이 시장 전반의 거래 특성을 포괄하는 종합적인 개념임에 따라 단일 지표를 사용하여 유동성을 파악하기보다는, 다양한 지표를 이용하여 유동성의 각 측면을 분석하고 있다. 유동성 측정에 이용되는 주요 지표들을 간략히 살펴보면 다음과 같다.21)

먼저 거래비용(밀집성) 측면에서 유동성을 측정하는 지표로는 최우선 매수호가와 최우선 매도호가의 차이로 정의되는 매수-매도 스프레드가 널리 사용되고 있다. 동 지표는 자산을 매수한 후 즉시 매도할 때 수반되는 비용을 의미한다. 다만, 매수호가 및 매도호가로 거래할 수 있는 수량이 제한적이라는 점에서 유동성의 일부 측면만을 반영한다. 한편 호가 데이터를 이용하여 매수-매도 스프레드를 산출하는 방식22) 외에도 유동성에 관한 이론을 바탕으로 매수-매도 스프레드를 다양한 방식으로 추정하는 지표들이 제안되고 있다(Roll, 1984; Corwin & Schultz, 2012).

가격 영향력(심도 및 폭) 측면에서 유동성을 측정하는 지표로는 Amihud 비유동성 지표(Amihud, 2002)와 Kyle’s lambda(Kyle, 1985)가 대표적으로 사용된다. 거래단위당 가격 변화에 대한 영향을 나타내는 Amihud 비유동성 지표는 일별 거래량 대비 가격 변동률의 절대값 비율을 기간 중 평균한 값으로 정의되며 지표산출이 용이하다는 장점을 갖는다. Kyle’s lambda는 가격 변동률과 거래량을 각각 종속변수와 설명변수로 하는 회귀식의 회귀계수로 정의되는데, 거래의 방향성을 고려한다는 장점이 있으나 고빈도 자료가 사용됨에 따라 데이터 처리가 방대하다는 단점이 있다.23) Pastor & Stambaugh(2003), Florackis et al.(2011) 등도 거래량과 가격 변동률 간의 관계를 바탕으로 거래량이 늘어날 때 가격에 미치는 영향력(price impact)을 측정하기 위한 지표들을 제안하였다.

거래량 및 거래회전율(=거래량÷발행잔액)과 같이 거래활동을 바탕으로 산출되는 지표들도 계산이 간단하다는 장점으로 인해 유동성 지표로 널리 사용된다. 일반적으로 유동성이 높은 시장은 심도가 깊고 폭이 넓어 주문량이 풍부하기 때문에 거래량이 많고 회전율이 높은 특성을 보인다. 다만 해당 지표들은 가격요인을 고려하지 않고 거래의 결과만을 반영한다는 한계가 존재한다.

한편, 대부분의 유동성 지표들은 집단경쟁매매 방식으로 거래가 체결되는 주식시장의 유동성 분석을 위해 제시된 지표들로서 채권시장에 적용하는 데에는 유의할 필요가 있다. 채권시장의 경우 장외유통시장에서의 거래 비중이 높아 유동성 측정 방법론에 대한 합의가 주식시장에 비해 상대적으로 덜 이루어진 편이다.

2. 채권 유동성에 관한 선행연구

채권 유동성에 관한 선행연구를 살펴보면, 먼저 미국 채권시장을 대상으로 다양한 주제에 대한 분석이 진행되어 왔다. 그 중에서도 글로벌 금융시장의 안전자산으로서 핵심적인 역할을 수행하는 미 국채시장에 관한 많은 연구가 수행되었다. Amihud & Mendelson(1991)은 유동성 효과로 인해 동일한 잔존만기를 갖는 단기국채와 장기국채 간 유통수익률에 차이가 발생함을 확인하였다. Jiang et al.(2011)은 거시경제 뉴스 발표가 미 국채가격의 급격한 변동을 일부 설명할 수 있으나 유동성 충격도 가격 변동에 있어 상당한 예측력을 가지고 있음을 보였다. Goyenko et al.(2011)은 경기 위축기에 유동성이 높은 단기국채로 국채 투자수요가 이동하는 유동성 선호현상(flight-to-liquidity)을 확인하는 한편 거시경제 충격을 상대적으로 먼저 반영하는 비지표물(off-the-run)의 유동성 악화가 국채시장 유동성 프리미엄의 주요인임을 분석하였다. Adrian et al.(2023)은 1991년부터 2021년까지 장기간에 걸쳐 미 국채시장 유동성지수를 추정하고 유동성 변동 요인을 분석하였다. Duffie et al. (2023)은 일반적인 거래 여건에서는 변동성이 미 국채시장 유동성 변화의 대부분을 설명할 수 있으나, 유동성 여건이 크게 악화된 금융 스트레스 상황에서는 딜러의 대차대조표 여력(balance-sheet capacity) 제약으로 인해 유동성이 변동성에 의해 설명될 수 있는 것보다 더 크게 악화된다고 분석하였다. 한편, Adrian et al.(2017)과 Fleming et al.(2018)은 각각 금융기관에 대한 규제 변화와 시장구조 변화가 미 국채 유동성에 미치는 영향을 분석하였다.

국채시장뿐 아니라 미국 회사채시장에 대해서도 유동성을 분석한 많은 연구가 진행되었다. Black et al.(2014)은 다양한 유동성 측면 중 거래비용 요인이 유동성 프리미엄에 가장 큰 영향을 미치는 가운데, 시장 전반의 유동성 요인이 채권 고유의 유동성 요인에 비해 채권가격에 미치는 영향이 더 크다는 결과를 제시하였다. Schestag et al.(2016)은 다양한 유동성 지표를 미국 회사채 거래 데이터에 적용하여 그 성과를 비교하였는데, 저빈도(low frequency) 일별 데이터를 이용하여 산출한 유동성 측정 지표들의 성과가 대체로 우수함을 확인하였다.24) 코로나19 팬데믹 기간 회사채 유동성을 연구한 Kargar et al.(2021)과 O'Hara et al.(2021)은 코로나19 발발 이후 회사채 매도 압력의 급격한 증대, 딜러의 유동성 공급 여력 약화로 회사채시장 여건이 급격히 악화되었으나, 이후 연준의 시장개입 발표로 시장 여건이 빠르게 개선되었음을 분석하였다. Boyarchenko et al.(2018)은 하이일드 채권의 유동성 악화가 국채 및 투자적격등급 채권의 유동성 개선을 예측할 수 있음을 보임으로써 신용등급에 따라 채권 유동성 변화 양상이 다르게 나타나는 안전자산 선호현상(flight-to-safety)을 확인하였다.

다음으로 유럽 채권시장을 분석한 연구를 살펴보면, 유로 지역 국채시장을 분석한 Beber et al.(2009)은 국채 수익률 스프레드(sovereign yield spread)가 국가신용에 의해 대부분 설명되나 채권시장 자금이동에 있어서는 유동성이 주 결정요인임을 분석하였다. 이를 통해 시장의 불확실성이 높아지는 시기에는 투자자가 신용도보다는 유동성이 높은 채권에 투자하는 경향을 보인다는 결과를 제시하였다. 2007-2008년 금융위기 전후 유로존 국가의 국채 수익률의 변동 요인을 연구한 Barbosa et al.(2010)은 리만 브라더스 붕괴 이전에는 금융시장의 리스크 프리미엄이 국채 수익률의 주 결정요인이었으나, 이후에는 각국 신용도 및 국채 유동성이 수익률의 주 결정요인으로 작용하였음을 보였다. 한편, 독일과 미국의 회사채시장 거래 분석을 통해 장외시장에서의 투명성이 회사채 유동성에 미치는 영향을 연구한 Gündüz et al.(2021)은 거래 투명성이 낮은 독일 회사채 시장이 미국에 비해 전반적으로 유동성이 낮지만, 거래가 활발한 채권의 경우 오히려 독일 시장에서 높은 유동성을 보인다는 결과를 제시하고 있다.

마지막으로 우리나라 채권 유동성에 관한 연구를 살펴보면 대부분 국고채시장을 대상으로 연구가 이루어져 왔다. 박대근‧신성환‧이창용(2007)은 국채전문유통시장 도입 및 거래집중의무 부과가 거래소시장의 유동성을 크게 개선시켰을 뿐 아니라 장외시장의 유동성과 투명성도 상당히 개선된 것으로 분석하였다. 선정훈‧오승현(2010)은 2002년 1월부터 2006년 5월까지의 장외거래 자료를 이용한 국채 유동성 분석을 통해 가격발견 효율성에 있어 거래량이 중요한 결정요인임을 보였다. 신현열‧김자혜(2013)는 4가지 유동성 지표를 이용하여 채권 유형 간 유동성을 비교하고, 이를 통해 신용도가 높은 채권이 높은 시장 유동성을 나타내나 금융위기 기간 중에는 채권시장 전반에 걸쳐 유동성이 낮아진다는 결과를 제시하였다. 국채전문유통시장 거래자료를 이용하여 PD 제도가 가격발견 기능 및 유동성에 미친 영향을 분석한 김학겸‧안희준‧장운욱(2015)은 PD에 대한 시장조성의무 강화 조치 이후 다양한 유동성 지표가 크게 향상되었다는 결과를 제시하였다. Lee(2018)는 장외 유통시장 자료를 이용하여 기관투자자가 국고채 유동성에 미치는 영향을 분석하였는데, 외국인 보유 비중이 높은 종목일수록 유동성이 낮고 국내 기관투자자 보유 비중이 높은 종목일수록 유동성이 높다는 결과를 제시하고 있다.

3. 유통시장별 유동성 지표 비교

앞서 Ⅱ-3절에서 살펴본 바와 같이 장내시장과 장외시장은 거래참여자, 거래되는 채권의 유형 및 거래방식 등이 달라 유동성 패턴이 다른 모습을 나타낼 가능성이 있다. 이에 본 절에서는 유동성지수 추정에 앞서 국채전문유통시장과 장외시장을 대상으로 Amihud 비유동성 지표, 가격 변동폭, 거래회전율을 비교해 본다. 장내 및 장외시장의 개별 국고채 일별 거래내역 자료를 사용하였으며, 분석 기간은 2015년 1월부터 2023년 6월까지이다. 전체 표본 중 일거래 30억원 미만, 체결건수 5건 미만의 거래는 제외하고 분석을 실시하였다.

거래시장별 Amihud 비유동성 지표를 비교해 보면, 먼저 장내시장에서는 지표물의 유동성이 비지표물에 비해 높다는 결과를 보여주고 있다(<표 Ⅲ-1>). 이와 같은 결과는 국채전문유통시장이 지표물을 위주로 거래가 이루어지고 PD의 시장조성기능이 지표물을 대상으로 도입되고 있기 때문이다. 반면 장외거래의 경우, 대부분 연물에서 지표물이 비지표물에 비해 유동성이 낮은 것으로 나타났다. 이러한 결과는 장외시장에서의 국고래 거래가 비지표물 위주로 이루어지는 특성에 기인한 것으로 해석될 수 있다. 즉, 지표물 기간에는 비교적 가격 효율성이 높은 장내시장을 중심으로 거래가 이루어져 장외사장에서 유동성이 낮게 나타나나, 비지표물 기간이 되면 장외시장에서 거래가 이루어짐에 따라 장외시장에서 유동성이 높게 나타나고 있다. 한편 최근 가파른 금리상승 및 금융시장 불확실성 확대는 장내시장과 장외시장 모두에서 유동성 저하를 초래한 것으로 나타났다. 이와 같은 결과는 시장 변동성이 유동성에 영향을 미친다는 기존 연구들을 지지하는 것이다.

거래시장별 가격 변동폭을 살펴보면 모든 시장에서 비지표물이 지표물에 비해 변동성이 낮은 것으로 나타났다(<표 Ⅲ-2>). 장내시장의 경우 지표물에 대한 시장조성기능이 존재함에도 불구하고 지표물의 최고가격과 최저가격 간 차이가 비지표물에 비해 높게 나타나는데, 이와 같은 결과는 장내시장에서 비지표물 거래가 드물게 이루어지기 때문이다. 즉 비지표물 거래는 대부분 장외시장에서 이루어짐에 따라 장내시장에서 의미있는 비지표물 거래가 발생하지 않고, 이로 인해 가격 변동성이 낮은 것으로 볼 수 있다. 장외시장의 경우에도 비지표물이 지표물에 비해 변동성이 낮은 것으로 나타나는데, 이는 장외시장에서 비지표물이 주로 거래되고 있는 데 기인하는 것으로 판단된다.

거래회전율 측면에서 장내시장과 장외시장을 비교해 보면, 장내시장이 장외시장에 비해 지표채권의 거래회전율이 높은 반면 비지표물의 경우에는 장외시장이 장내시장에 비해 회전율이 높다(<표 Ⅲ-3>). 한편, 장내시장의 경우 지표물의 거래회전율이 비지표물에 비해 월등히 높게 나타나는데 이는 앞서 언급한 바와 같이 장내시장에서는 지표물 위주로 거래가 이루어지고 있기 때문이다.

이상의 결과를 통해 장내시장과 장외시장은 거래방식뿐 아니라 거래 특성도 크게 다른 시장임을 파악할 수 있다. 이에 따라 유동성 분석에 있어 시장별 특성을 반영한 분석 방법과 해석이 도입될 필요가 있다.

4. 국고채 유동성지수 추정 방법론

가. 분석 자료

본 연구는 2015년 1월부터 2023년 6월까지 국채전문유통시장에서의 국고채 지표물 일별 거래자료를 사용하여 유동성을 추정한다. 다만 각 연물 중 3년물, 5년물 및 10년물의 3개 연물에 대해 분석을 수행한다. 위와 같이 분석 대상을 설정한 이유는 다음과 같다.

먼저, 다양한 국고채 유통시장 중 국채전문유통시장 내 거래를 분석 대상으로 하는 것은 전자거래시스템 기반 집단경쟁매매를 통해 거래가 이루어짐에 따라 동 시장의 거래투명성이 높을 뿐 아니라 국채딜러 중심의 기관투자자 시장 구조이므로 다른 국고채 유통시장에 비해 가격발견 기능이 높기 때문이다. 장외시장의 경우 탈중앙화(decentralized)된 시장 구조를 가지고 있다. 유동성 분석을 위해 개발된 지표들은 대부분 집단경쟁매매 방식으로 거래가 이루어지는 주식시장을 분석 대상으로 하고 있는데, 이에 따라 장외 거래자료에 유동성 지표를 적용하는 경우 유동성 측정이 효과적이지 않을 가능성이 크다.25)

다음으로 <그림 Ⅱ-4>에서 살펴본 바와 같이 국채전문유통시장에서는 지표물이 국고채 거래의 대부분을 차지하고 있다. 비지표물 거래 규모가 충분치 않아 거래자료로부터 비지표물 유동성 변화에 관한 의미 있는 정보를 얻는 데 어려움이 크므로 분석 대상에서 비지표물을 제외하였다. 비지표물이 제외됨에 따라 본 연구의 분석이 국고채 전반의 유동성을 살펴보는 데 일부 한계가 존재한다. 그러나 지표물 거래를 통해 결정되는 수익률이 경제 전반의 준거금리로서 역할을 한다는 점에서 지표물 기반의 유동성 추정도 큰 의미가 있다고 할 수 있다.26)

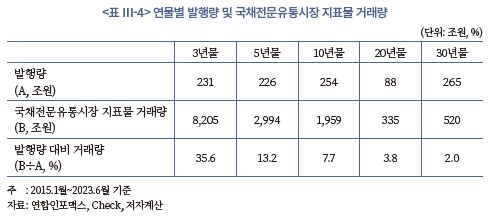

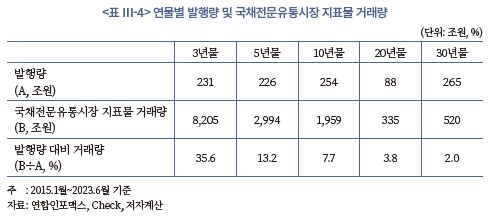

국고채 연물 중 3년물, 5년물 및 10년물을 분석 대상으로 설정한 것은 <표 Ⅲ-4>에서 확인할 수 있는 것처럼 국채전문유통시장 국고채 거래가 위 3개 연물을 중심으로 이루어지고 있어 유동성의 유의미한 동태적 변화를 파악할 수 있기 때문이다. 20년물과 30년물의 경우, 발행량에 비해 유통량이 적은 특성으로 인해 유동성 추정시 변동성이 지나치게 큰 문제점이 발생하여 본 분석에서 제외하였다. 다만, 20년물과 30년물의 거래량이 점차 늘어나고 있음에 따라 향후 유동성 추정을 위한 충분한 거래자료가 확보되면 해당 연물에 대해서도 유동성 분석이 이루어질 필요가 있다. 한편 50년물과 2년물은 각각 2016년 10월과 2022년 2월 발행이 시작되어 전체 분석 대상기간에 대해 거래자료가 확보되지 않는 문제가 발생한다. 따라서 50년물과 2년물도 본 분석에서 제외한다.

마지막으로 일별(daily) 자료를 사용하여 유동성 추정에 소요되는 계산 부담을 줄이고 효율성을 높인다. 일중(intraday) 자료의 경우, 유동성 변화를 세밀하게 살펴볼 수 있다는 장점이 있으나 대량의 호가 데이터가 필요함에 따라 계산 부담이 크게 늘어나고 이로 인해 긴 기간을 분석하는 데 어려움이 크다. 따라서 일별 데이터를 활용하여 국고채 유동성지수의 장기 시계열을 구축하고 유동성의 동태적 변화를 살펴본다.

나. 유동성지수 추정

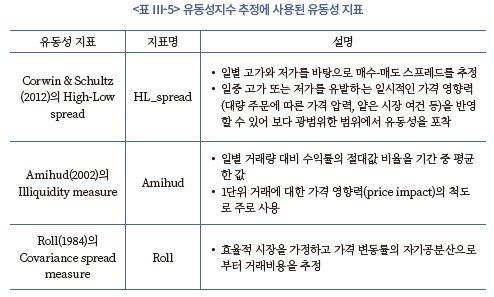

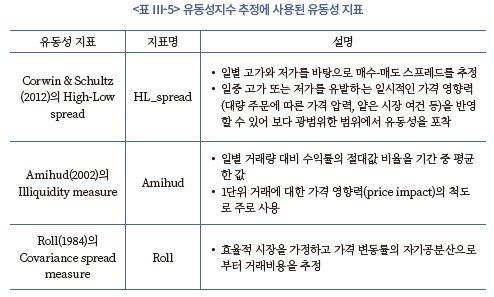

유동성지수는 다음 과정들을 통해 추정한다. 먼저, 각 연물(3년물, 5년물 및 10년물)별로 <표 Ⅲ-5>의 3개 유동성 지표를 일별로 산출한다. 각 지표에 대한 설명은 아래와 같다.

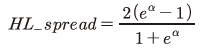

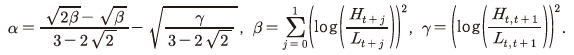

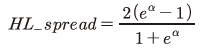

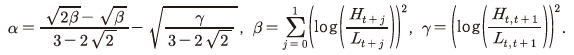

먼저 Corwin & Schultz(2012)는 일별 고가와 저가를 바탕으로 매수-매도 스프레드 추정량(estimator)인 HL_spread를 개발하였는데 동 지표는 다음과 같이 정의된다.27)

Corwin & Schultz(2012)는 HL_spread가 다른 저빈도(low-frequency) 추정량에 비해 성과가 우수할 뿐 아니라 계산이 쉽고 다양한 시장 구조에 적용할 수 있다는 장점을 제시하고 있다. 대량 주문에 따른 가격 압력, 얕은 시장 여건 등으로 일시적으로 가격 영향력이 커지면서 일중 고가 또는 저가로 이어질 수 있는데, HL_spread는 이러한 시장 여건을 반영할 수 있어 일반적인 매수-매도 스프레드에 비해 보다 넓은 범위에서 유동성을 포착할 수 있다.

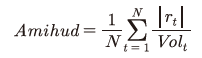

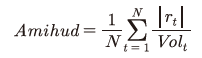

Amihud(2002)가 비유동성 지표로 제시한 Amihud는 다음과 같이 일별 거래량 대비 가격 변동률의 절대값 비율을 기간 중 평균한 값으로 정의된다.28)

Amihud는 1단위 거래에 대한 가격의 반응으로 해석할 수 있어 가격 영향력(price impact)의 척도로 사용된다. 다만, 매수우위 또는 매도우위와 같은 거래의 방향성 및 가격하락 또는 가격상승과 같은 가격 변동의 방향성을 반영하지 못하는 한계가 있다.

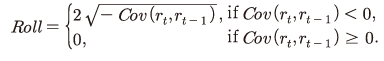

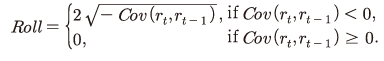

마지막으로 Roll(1984)이 개발한 Roll은 가격 변동률의 자기공분산으로부터 거래비용을 추정하며 다음과 같이 정의된다.

Roll은 효율적 시장을 가정하고 가격 등락이 큰 시장을 유동성이 낮은 시장으로 평가한다. 이에 따라 효율성이 낮은 시장에 대해 Roll을 사용하여 유동성을 측정하는 경우 유동성 지표로서의 유효성이 약화될 수 있다.

각 유동성 지표 산출시 경과이자의 영향을 제외하기 위해 거래가격을 순가격(clean price)으로 전환한 후 지표를 계산하되 지표물이 교체되는 기간은 제외하였다. HL_spread가 음(-)의 값을 갖는 경우에는 Corwin & Schultz(2012)가 제안한 바와 같이 0으로 처리하였다. Amihud의 경우29), 매년 마지막 영업일에 거래량이 매우 적어 지나치게 큰 값을 나타내는 문제가 발생한다. 이로 인한 지표의 왜곡을 방지하기 위해 매년 마지막 영업일에 대해서는 Amihud 산출을 제외하였다. Roll 산출시에는 공분산의 계산기간을 t일을 포함한 직전 10영업일로 하였다.

다음으로 위에서 산출한 3개 유동성 지표로부터 유동성지수를 추정한다. Ⅲ-1절에서 살펴본 바와 같이 유동성은 다양한 측면의 거래 특성을 포괄하며, 이로 인해 단일 유동성 지표가 유동성 상황을 종합적으로 설명하는 데 한계가 존재한다. 이에 유동성 지표로부터 공통요인을 추출하는 방식으로 유동성지수를 추정한다.30)

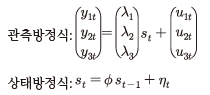

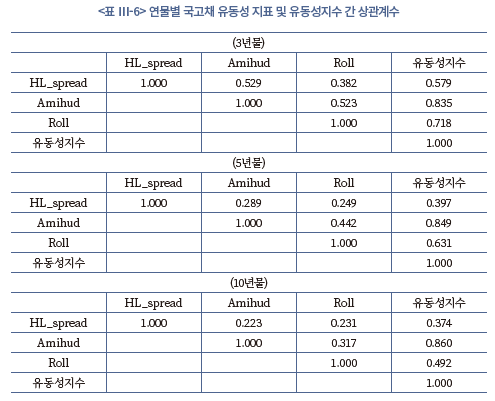

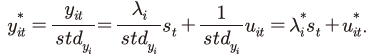

앞에서 산출한 3개 유동성 지표를 각각 로 정의하고 각 유동성 지표에 영향을 미치는 공통요인

로 정의하고 각 유동성 지표에 영향을 미치는 공통요인  를 유동성지수라고 하자.

를 유동성지수라고 하자.  는 관측 가능한 변수이나

는 관측 가능한 변수이나  는 관측되지 않는 비관측(unobserved) 변수이다. 따라서 관측방정식과 상태방정식으로 구성된 아래 상태공간(state-space)모형을 설정하고 상태벡터(state vector)에 해당하는 유동성지수

는 관측되지 않는 비관측(unobserved) 변수이다. 따라서 관측방정식과 상태방정식으로 구성된 아래 상태공간(state-space)모형을 설정하고 상태벡터(state vector)에 해당하는 유동성지수  를 추정한다.31)

를 추정한다.31)

일별자료의 경우 노이즈(noise)가 많아 유동성지수 추정의 안정성이 낮아질 수 있다. 이에 3개 유동성 지표의 주(weekly) 평균값을 계산한 후 Kalman filter를 적용하여 유동성지수를 추정하였으며, 각 연물별로 구분하여 추정을 실시하였다. 추정된 유동성지수는 평균과 표준편차를 각각 0과 1로 표준화한다. 한편 각 연물별 3개 유동성 지표에 대해 주성분분석(PCA)을 시행하면 첫 번째 주성분에 의해 설명되는 변동성의 비율이 3년물, 5년물, 10년물에서 각각 65.3%, 55.4%, 50.4%로 1개 공통요인이 상당한 설명력을 가질 수 있음을 간접적으로 보여준다.

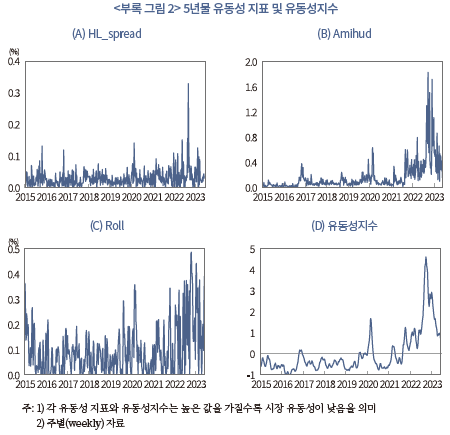

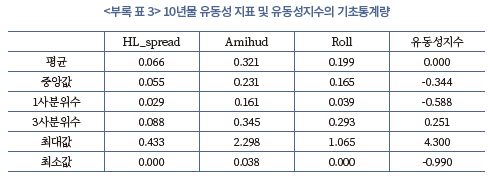

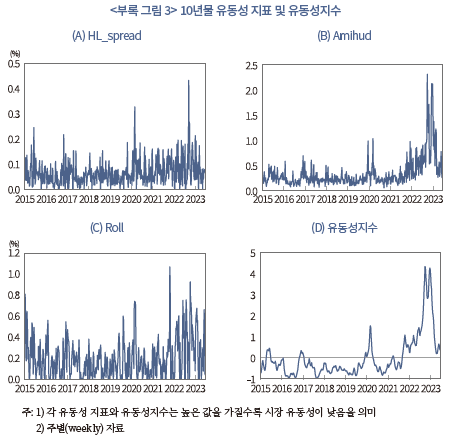

5. 국고채 유동성지수 추정 결과 및 특징

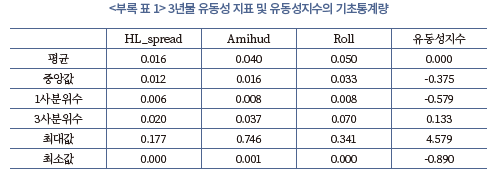

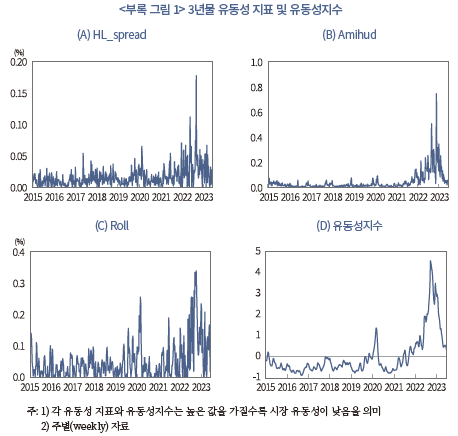

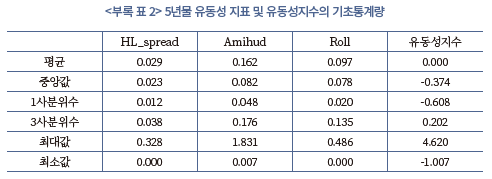

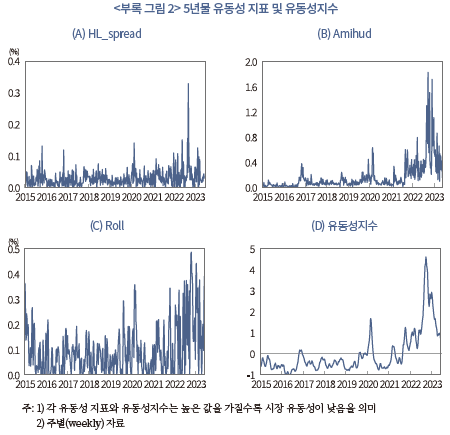

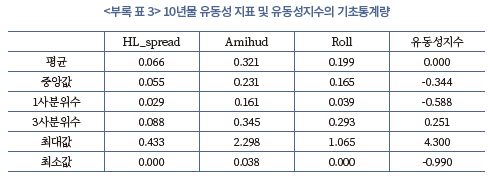

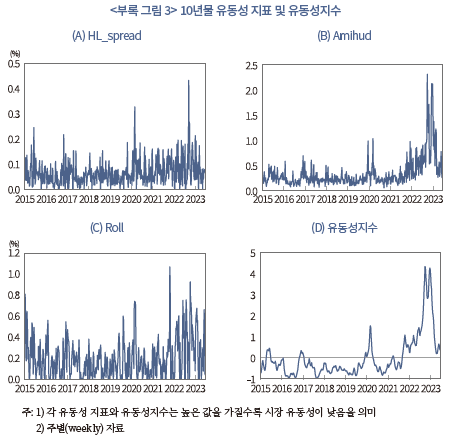

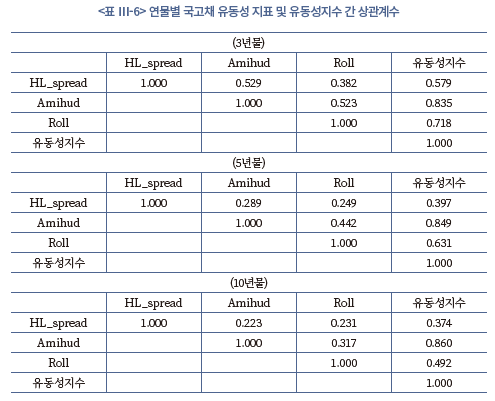

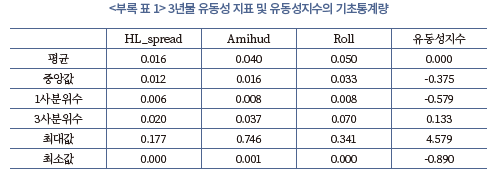

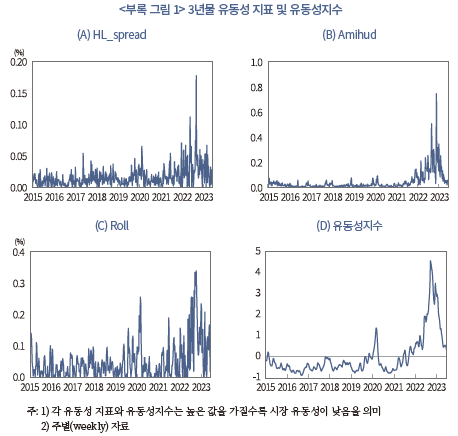

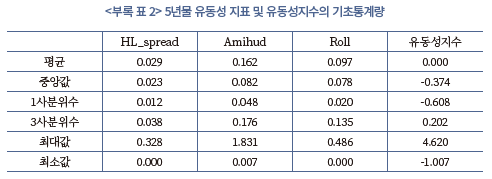

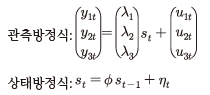

국고채 유동성지수 추정에 사용된 3개 유동성 지표와 유동성지수의 시계열 추이 및 기초통계량은 <부록>에 정리하였다. <부록>의 그림을 통해 유동성지수가 각 유동성 지표에 비해 상대적으로 평활화(smooth)된 변동을 나타내는 것을 확인할 수 있다. <표 Ⅲ-6>은 연물별로 4개 변수(3개 유동성 지표 및 유동성지수) 간 상관계수를 정리하고 있는데, 각 유동성 지표는 유동성지수와 가장 높은 상관계수를 보이고 있다. 이러한 특성들을 감안할 때 국고채 유동성지수는 유동성의 기조적인 변화를 효과적으로 포착하는 것으로 판단된다.

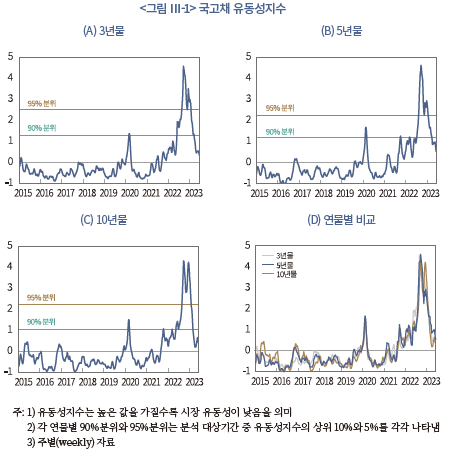

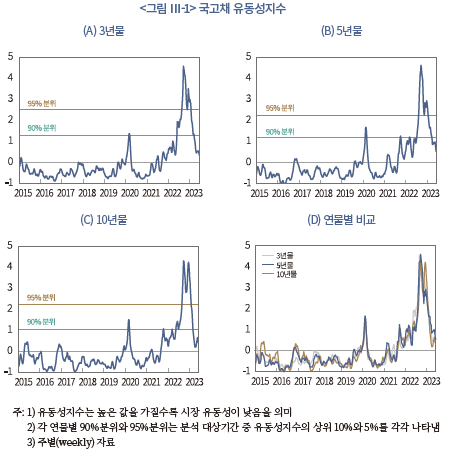

<그림 Ⅲ-1>(A)-(C)는 각 연물별로 추정한 국고채 유동성지수를 나타낸다. 국고채시장 유동성은 금융시장 여건 변화에 크게 영향을 받으며 상당한 시계열 변동을 나타내는 것을 확인할 수 있다. 2015년부터 2019년까지 3개 연물의 유동성지수는 장기평균(0)을 대체로 하회하는 모습을 보이며 국고채 유동성이 대체로 양호했던 것으로 평가된다.

그러나 2020년 들어 유동성 여건이 악화되기 시작하는데, 코로나19 팬데믹 충격으로 금융시장 변동성이 확대되었던 2020년 3월 유동성지수는 분석 대상기간 중 상위 10%(90%분위) 수준을 넘어선다. 이후 주요국 중앙은행의 완화적 통화정책 등으로 글로벌 금융시장이 안정을 되찾으면서 유동성지수가 장기평균 이하로 낮아지며 국고채 유동성이 개선되는 모습을 보인다.

2021년 하반기부터 인플레이션에 대한 우려 증대로 정책금리 인상, 자산매입 종료 등 통화정책 정상화가 빠르게 진행되면서 국고채 유동성이 다시 악화되기 시작한다. 특히, 주요국 중앙은행의 고강도 긴축으로 글로벌 불확실성이 크게 높아진 가운데 한전채 발행 확대, 레고랜드 사태 등으로 국내 금융시장 불안이 확산되었던 2022년 9월 이후 유동성이 크게 악화된다. 2022년 9월부터 2023년 1월까지 모든 연물의 유동성지수가 상위 5%(95%분위) 수준을 상회하며 분석 대상기간 중 유동성 여건이 가장 악화되었던 것으로 나타난다.32) 2023년 2월 이후 유동성지수가 하락세를 나타내고 있으나, 여전히 장기 평균을 상회하며 국고채 유동성 여건이 약화된 모습이다.

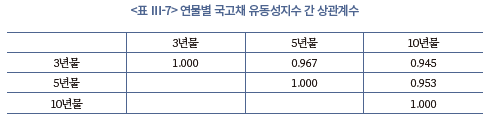

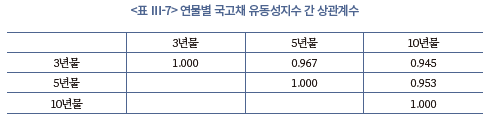

각 연물별 유동성지수의 움직임을 비교해 보면, 대체로 유사한 모습을 보이고 있다(<그림 Ⅲ-1>(D)). <표 Ⅲ-7>은 연물별 유동성지수 간 상관계수를 나타내는데, 각 연물에 걸쳐 상관관계가 매우 강한 것을 확인할 수 있다. 이는 특정 연물의 고유한 특성에 의해 유동성이 변화하기보다는 금융시장 전반의 여건 변화가 유동성의 주 변동 요인으로 작용하고 있음을 의미한다.

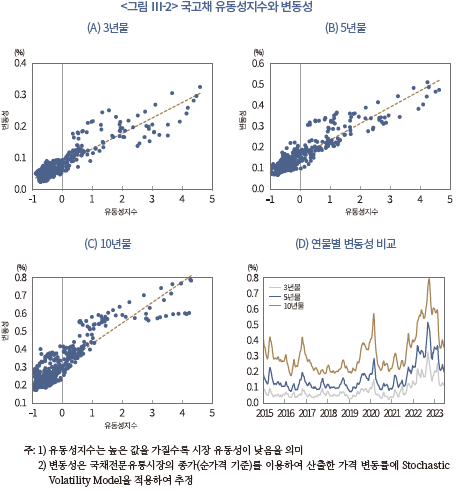

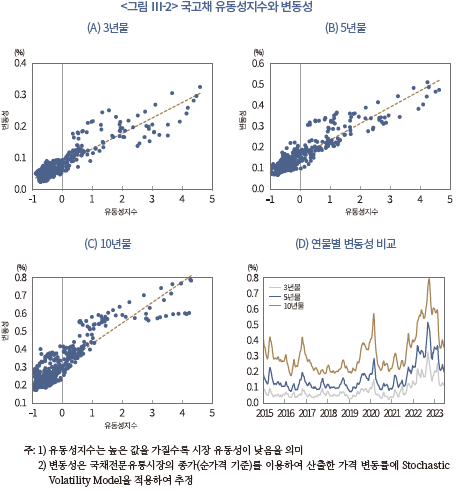

특히, 유동성지수는 채권시장 변동성과 강한 동조성을 보인다. <그림 Ⅲ-2>(A)-(C)는 분석 대상기간 중 각 연물별 유동성지수와 변동성 간 관계를 나타내고 있는데, 국고채 유동성 악화시 가격 변동성도 함께 확대되는 것을 확인할 수 있다. 이와 같은 유동성과 변동성 간 강한 동조성은 미 국채시장에서도 발견되는데, 미 국채 유동성을 분석한 Duffie et al.(2023)은 일반적인 상황에서 변동성이 유동성 변동의 대부분을 설명할 수 있다고 분석하였다.33)

유동성과 변동성 간 인과관계는 양방향에서 존재할 수 있다. 먼저 유동성 악화로 시장의 심도 및 폭이 약화되면 한 단위 거래가 가격에 미치는 영향력(price impact)이 커지게 되고 이는 가격 변동성 확대를 유발한다. 가격 변동성 확대 역시 투자심리 위축, 프리미엄 상승 등을 통해 유동성을 약화시키는 요인으로 작용할 수 있다. Brunnermeier & Pedersen(2009)은 시장 유동성과 변동성 간 밀접한 연관성이 있음을 이론적으로 제시한 바 있다.34) 따라서 불확실성 증대 등으로 금융시장 변동성이 확대되면 유동성과 변동성 간 피드백(feedback) 효과로 인해 유동성 악화가 상당 기간 지속될 수 있다.

Ⅳ. 국고채시장 유동성 분석

본 장에서는 제Ⅲ장에서 추정한 유동성지수를 바탕으로 국고채 유동성의 변동 요인 및 유동성 변화가 국고채 수익률과 변동성에 미치는 영향을 분석한다.

1. 국고채 유동성 변동 요인

본 절에서는 다양한 대내외 변수들을 포함한 회귀분석을 통해 국고채 유동성에 영향을 미치는 요인을 분석한다. 미 국채시장의 유동성 결정요인을 살펴본 Adrian et al.(2023)의 분석모형을 참고하여 금융시장 여건을 나타내는 다양한 변수들을 설명변수로, 추정된 유동성지수를 종속변수로 각각 사용하여 유동성 변동 요인을 분석한다.

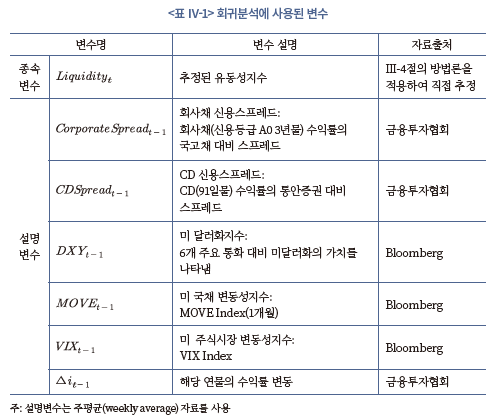

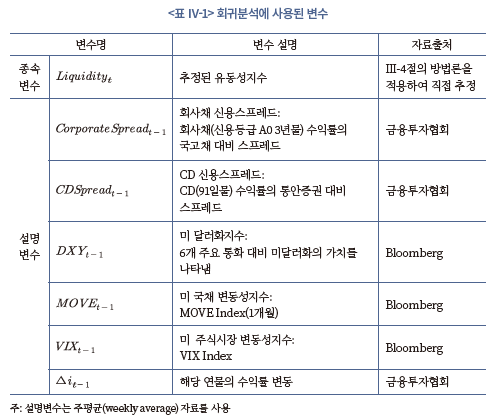

회귀분석의 주요 변수는 <표 Ⅳ-1>과 같다.35) 먼저, 국내시장 여건을 나타내는 설명변수로 신용위험을 나타내는 회사채 신용스프레드와 자금조달 유동성(funding liquidity)을 나타내는 CD 신용스프레드를 설명변수로 사용한다. 글로벌 금융시장 여건을 나타내는 설명변수로 미 달러화지수, 미 국채 변동성지수, 미 주식시장 변동성지수를 추가하였으며, 국고채 수익률 변동 을 설명변수에 포함하여 채권가격 변동의 방향성이 유동성에 미치는 영향도 함께 살펴본다. 시차에 따른 영향을 고려하기 위해 종속변수와 설명변수는 각각 (t)기와 (t-1)기의 값을 사용하였으며, 월별 고정효과를 함께 고려하였다.36)

을 설명변수에 포함하여 채권가격 변동의 방향성이 유동성에 미치는 영향도 함께 살펴본다. 시차에 따른 영향을 고려하기 위해 종속변수와 설명변수는 각각 (t)기와 (t-1)기의 값을 사용하였으며, 월별 고정효과를 함께 고려하였다.36)

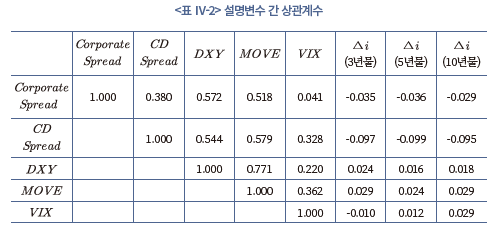

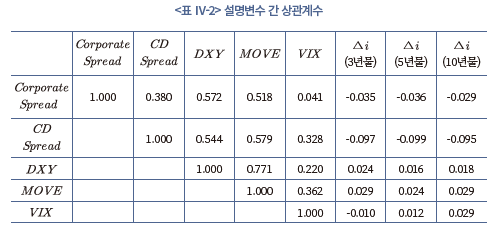

<표 Ⅳ-2>는 설명변수 간 상관계수를 나타내는데, 지나치게 큰 값이 발견되지 않음에 따라 다중공선성(multicollinearity) 문제가 크게 의심되지는 않는다. 다만, 미 달러화지수와 미 국채 변동성지수 간 상관계수가 상대적으로 큰 값을 나타냄에 따라 다소 유의할 필요가 있다고 판단된다.

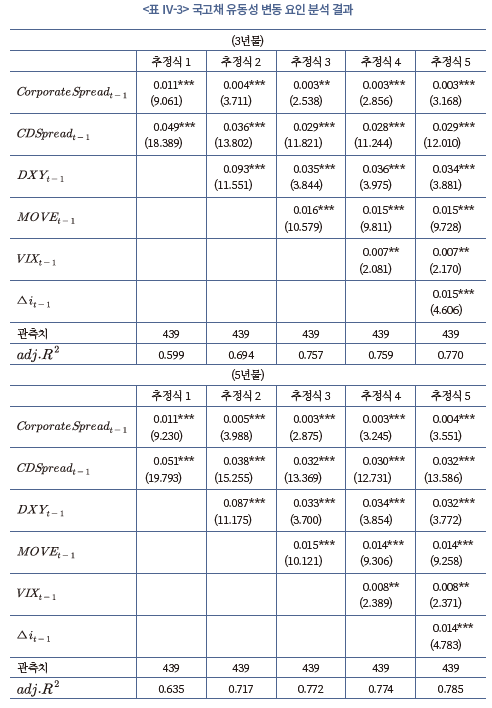

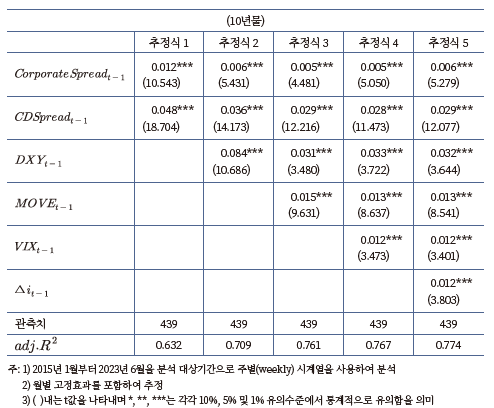

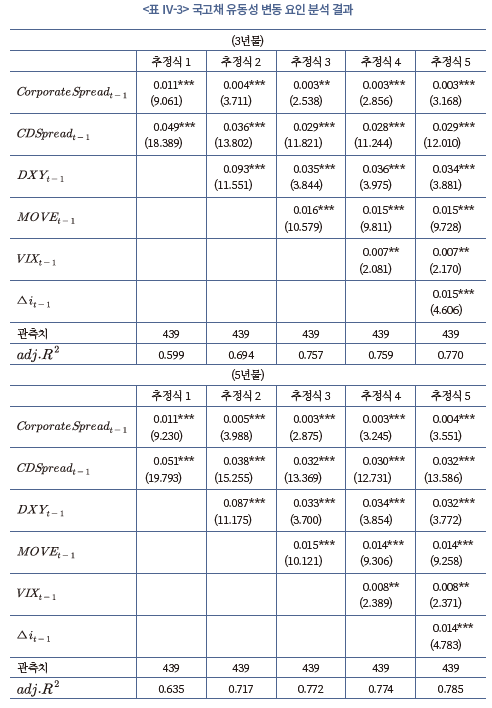

<표 Ⅳ-3>은 각 연물별 유동성지수에 대하여 회귀분석을 실시한 결과를 정리하고 있다. 회귀분석 결과 국고채 유동성은 국내 및 글로벌 금융시장 여건 변화에 크게 영향을 받는 것으로 나타난다. 먼저 추정식 1은 국내 금융시장 여건에 해당하는 회사채와 CD 신용스프레드의 영향력을 살펴보는데, 두 설명변수의 계수가 모두 통계적으로 유의한 양(+)의 값을 나타내며 신용위험 확대 및 자금조달 여건 악화가 유동성을 악화시키는 요인으로 작용함을 보여주고 있다. 회사채 신용스프레드에 비해 CD 신용스프레드의 계수가 훨씬 큰 값으로 추정되는데, 이는 신용위험보다 자금조달 여건이 국고채 유동성에 더 큰 영향력을 미침을 의미한다.

추정식 2~4는 국내시장 여건만을 고려한 추정식 1에 대외시장 여건을 나타내는 설명변수를 추가하였다. 추정계수를 살펴보면 달러화 강세 및 미 채권시장과 주식시장의 변동성 확대 역시 국고채 유동성에 부정적인 영향을 미치는 것으로 나타난다. 다만, 외환시장 및 미국 자본시장과 우리나라 국고채시장 간의 직접적인 연계로 인해 유동성 약화가 나타난다기보다는 국제금융시장 여건 악화로 시장 전반의 투자심리가 위축되면서 국고채 유동성 역시 저하되는 것으로 판단된다.37)

추정식 5는 대내외 시장 여건을 고려한 추정식 4에 국고채 수익률의 변동 을 추가하였다. 해당 변수의 추정치는 유의한 양(+)의 값을 나타내며 국고채 가격 변동의 방향성에 따라 시장 유동성이 변화함을 보여준다. 즉, 국고채 가격 하락(수익률 상승)은 유동성 악화요인으로, 반대로 가격 상승(수익률 하락)은 유동성 개선요인으로 각각 작용한다. 이와 같은 결과는 투자 손익 여부에 따라 국고채에 대한 투자수요가 변화하면서 유동성에 영향을 미치는 것으로 판단된다.

을 추가하였다. 해당 변수의 추정치는 유의한 양(+)의 값을 나타내며 국고채 가격 변동의 방향성에 따라 시장 유동성이 변화함을 보여준다. 즉, 국고채 가격 하락(수익률 상승)은 유동성 악화요인으로, 반대로 가격 상승(수익률 하락)은 유동성 개선요인으로 각각 작용한다. 이와 같은 결과는 투자 손익 여부에 따라 국고채에 대한 투자수요가 변화하면서 유동성에 영향을 미치는 것으로 판단된다.

마지막으로 본 회귀분석에서 고려한 설명변수들은 유동성 변동에 대해 상당한 설명력을 나타낸다. 추정식 5를 기준으로 각 연물별 수정 결정계수(Adjusted R-squared)를 살펴보면 0.770~0.785로 매우 높은 수준을 나타낸다. <그림 Ⅲ-1>에서 국고채 유동성이 금융시장 여건 변화에 따라 크게 변동하는 모습을 보였는데 본 절의 회귀분석 결과를 통해 시장 여건 변화가 유동성의 주 변동 요인임을 확인할 수 있다.

2. 유동성 변화가 국고채시장에 미치는 영향

국고채 유동성 변화는 국고채 수익률과 변동성에 영향을 미침으로써 경제 전반으로 그 영향이 파급된다. 예를 들어 금융시장 여건 악화에 따른 유동성 충격은 국고채 수익률 상승과 변동성 확대로 이어지고, 그 영향은 다시 경제전반의 조달금리 상승, 금리 변동성 확대 등으로 파급된다. 앞서 회귀분석을 통해 유동성은 금융시장 여건 변화와 같은 외생적 요인에 의해 크게 영향을 받는 것을 확인할 수 있었는데, 본 절에서는 예상치 못한 유동성 충격 발생시 국고채 수익률 및 변동성의 동태적 변화를 살펴봄으로써 유동성 변화가 국채시장에 미치는 영향을 분석한다.

국고채 수익률, 변동성, 유동성지수의 3개 변수로 구성된 VAR(Vector Autoregression) 모형을 이용하여 분석을 수행한다. 수익률은 국채전문유통시장의 종가 수익률을 사용하며, 변동성은 국채전문유통시장의 종가(순가격 기준)를 이용하여 산출한 가격 변동률에 Stochastic Volatility Model을 적용하여 추정한 변동성을 사용한다.38) 각 변수의 1차 차분(first difference)한 값을 VAR 모형에 사용하였으며, 앞선 분석과 마찬가지로 연물별로 구분하여 추정한다. VAR 모형의 시차는 각 연물별 BIC(Bayesian Information Criterion)를 기준으로 설정하였다.

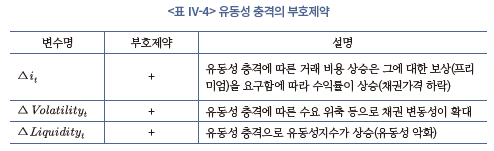

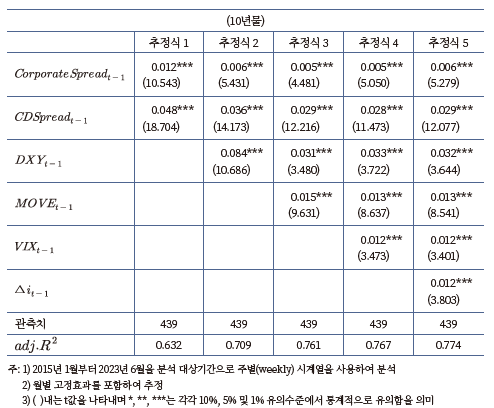

유동성지수에 1 표준편차 충격 발생시 각 변수의 충격반응함수를 살펴본다. 유동성 충격은 부호제약(sign restrictions)을 적용하여 식별하였는데, <표 Ⅳ-4>와 같이 유동성 악화가 수익률 상승 및 변동성 확대를 유발한다는 부호제약을 설정하고 이를 만족하는 충격반응을 베이지언 추정(Bayesian estimation)하였다.

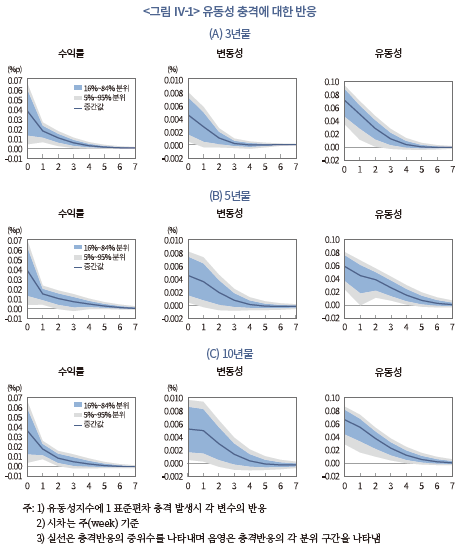

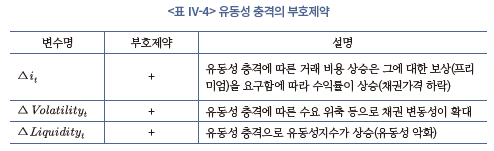

분석 결과, 유동성 충격 발생 이후 3~4주까지 국고채시장에 대한 영향이 이어지는 것으로 나타났으며 각 연물에서 변수별 충격반응은 대체로 유사한 모습을 보였다(<그림 Ⅳ-1>). 먼저 수익률의 반응을 살펴보면, 유동성 충격 발생과 동시에 4bp(중간값 기준) 상승하는 것으로 추정된다. 충격의 영향은 점진적으로 약화되는데, 수익률의 반응은 1주 후에는 +2bp, 2~3주 후에는 +1bp 수준으로 낮아지고 이후에는 크게 유의하지 않은 모습을 보인다.

변동성의 경우 수익률의 반응과 유사한 모습을 나타내는데, 2~3주의 시차까지 변동성이 확대되다가 이후 충격의 영향이 약화된다. 한편 변동성의 반응은 만기가 긴 연물에서 더 크게 나타나는 것을 확인할 수 있다. 앞서 유동성 충격에 따른 수익률의 상승폭은 각 연물에서 대체로 유사하게 나타났는데, 동일한 수익률 변동에 대하여 만기가 길수록 가격 변동률이 더 커지는 채권의 특성을 반영하는 것으로 보인다. 마지막으로 유동성의 충격반응은 다른 변수에 비해 상대적으로 지속성이 높은 모습을 보이며 충격 발생에 따른 유동성 악화는 3~4주까지 이어지는 것으로 나타난다.

이상의 결과는 유동성 충격으로부터 국고채시장이 회복하는 데 상당한 시간이 소요된다는 것을 의미한다. 또한 단기간에 유동성 충격이 누적되는 경우 국고채시장의 취약성이 높아질 수 있음을 시사하는 결과이기도 하다.

Ⅴ. 요약 및 시사점

본 보고서는 유통시장을 중심으로 우리나라 국고채시장 현황을 살펴보는 한편 국고채 유동성지수를 추정하고 이를 바탕으로 유동성 변동 요인과 유동성 변화가 국고채 수익률 및 변동성에 미치는 영향을 분석하였다.

대부분의 국고채 거래는 장내시장인 국채전문유통시장과 장외시장을 통해 이루어지는데 두 시장은 거래 특성이 크게 다른 모습을 나타낸다. 국채전문유통시장의 경우 국고채 지표물을 위주로 국채딜러 간 거래가 활발히 이루어지고 있는 반면 장외시장에서는 여러 유형의 기관투자자가 비지표물을 포함한 다양한 종목의 국고채를 거래하고 있다.

채권 유동성에 관한 기존 국내 연구들이 대부분 가격발견 기능 및 시장 효율성에 초점을 두었던 데 반해 본 보고서는 유동성지수 추정을 통해 시장 여건 변화에 따른 국고채 유동성의 동태적인 특성을 분석하였다. 국고채시장 유동성은 상당한 시계열 변동을 나타내는 가운데 특정 연물의 고유한 특성보다는 금융시장 전반의 여건 변화가 유동성의 주 변동 요인으로 작용하는 모습을 보인다.

유동성 변동 요인을 분석해 보면, 국고채 유동성은 국내 및 글로벌 금융시장 여건 변화에 크게 영향을 받는 것으로 나타난다. 신용위험 및 자금조달 여건과 같은 국내시장 여건뿐 아니라 달러화 지수, 미 채권시장과 주식시장의 변동성과 같은 대외시장 여건도 유동성에 영향을 미치는 요인으로 작용한다. 또한 국고채 가격 하락은 유동성 악화 요인으로, 반대로 가격 상승은 유동성 개선요인으로 각각 작용하며 투자 손익 여부도 유동성에 영향을 미치는 것으로 분석되었다.

VAR 모형을 통해 유동성 충격의 영향을 분석해 보면, 충격 발생 이후 3~4주까지 국고채시장에 대한 영향이 이어지는 것으로 나타났다. 이는 유동성 충격으로부터 국고채시장이 회복하는 데 상당한 시간이 소요된다는 것을 의미한다. 또한 단기간에 유동성 충격이 누적되는 경우 국고채시장의 취약성이 높아질 수 있음을 시사한다.

본 보고서의 분석 결과를 바탕으로 국고채 유동성에 관한 시사점을 도출해 보면 다음과 같다. 먼저, 국고채 유통시장의 중요성이 높아지고 있음에 따라 국고채 유동성지수를 보다 정교한 방법으로 산출하고 관리할 필요가 있다. 본 연구는 국채전문유통시장에서의 지표물 거래자료를 활용하여 유동성지수를 추정하였으나, 장외시장 및 비지표물에 대한 유동성 여건을 반영하지 못하는 한계가 존재한다. 따라서 국고채시장 전반의 유동성 변화를 종합적으로 포착할 수 있는 유동성지수 개발이 요구되며, 유동성지수를 보다 정교하게 추정하기 위한 방법론에 대한 연구가 필요하다.

다음으로 국고채 유동성이 대내외 여건 변화에 따라 큰 폭으로 변동하는 것을 고려할 때 금융시장 여건이 악화되는 시기에 국고채 유동성에 대한 관심을 확대할 필요가 있다. 본 연구의 분석 결과 국고채 유동성은 금융시장 여건이 안정적인 시기에는 변화가 크지 않으나 시장 불확실성이 확대되는 시기에는 빠르게 악화되는 특성을 보였다. 유동성 악화로 인한 국고채 수익률 상승은 정부뿐 아니라 경제주체 전반의 자금조달 비용 상승으로 이어질 수 있다. 국고채 발행이 최근 수년간 빠르게 늘어난 가운데 가계 및 기업 부채도 크게 높은 수준을 기록하고 있다. 이로 인해 유동성 충격은 정부와 민간의 부채 부담을 가중시켜 경제에 부정적 영향을 미치게 된다. 따라서 시장 여건 변화에 따른 국고채 유동성에 대한 모니터링을 강화할 필요가 있다.

마지막으로 국고채시장 유동성 제고를 위한 정책적인 노력도 요구된다. 외생적 요인에 의해 국고채 유동성이 과도하게 악화되는 경우 이를 완화할 수 있는 정부와 한국은행의 효과적인 정책대응 수단을 마련할 필요가 있다. 국고채 시장구조의 효율성 및 투명성 개선은 유동성 제고로 이어질 수 있으므로 이를 위한 지속적인 제도개선 노력도 요구된다. 한편 국고채에 대한 투자자 기반이 확대되는 경우 유동성이 높아지고 시장 여건 변화에 따른 유동성 충격이 완화될 수 있으므로 국고채 상품 다양화 등의 노력을 통해 수요 기반을 확장할 필요가 있다.

1) 2023년 현재 국채는 국고채권, 재정증권, 외국환평형기금채권, 국민주택채권의 4가지 종류로 발행되고 있는데, 본 연구는 국채에서 가장 큰 비중을 차지하는 국고채를 분석 대상으로 한다. 이에 대한 자세한 설명은 Ⅱ-1절을 참조하기 바란다.

2) 외환위기 이전에는 농지채권, 농어촌발전채권, 국민주택기금채권, 철도채권, 양곡증권 등 정책목적에 따라 다양한 국채가 발행되었으나 이를 순차적으로 통합하여 2023년 현재 국채는 <표 Ⅱ-1>과 같이 4종류로 발행되고 있다.

3) 일정 기간 동안 발행하는 국고채의 만기일과 표면금리를 통합하여 국고채의 종류를 표준화하고 발행 물량을 확대하는 제도로서 유동성 제고를 도모할 수 있다.

4) 본 보고서에서는 국채 유동성을 국고채 유동성과 동일한 의미로 사용한다.

5) 한편 우리나라는 2022년 9월 FTSE 세계국채지수(WGBI: World Government Bond Index) 관찰대상국에 등재되었으며 정부는 외국인 국채 투자소득에 대한 비과세 시행, 외국인 투자자 등록제도 폐지, 국제예탁결제기구와 국채통합계좌 개통 추진 등을 통해 세계국채지수 편입을 위해 노력하고 있다(기획재정부, 2023. 9. 29).

6) 자금순환표는 국고채, 국민주택채권, 외국환평형기금채권 등을 포함한 ‘국채’를 기준으로 통계가 편제되고 있으며, 국채의 각 하위항목에 대해서는 통계가 편제되지 않고 있다.

7) 다만, 액면기준 보험사의 국고채 보유(장외채권 거래잔고 기준)는 2021년말 317조원에서 2022년말 334조원, 2023년 6월말 336조원으로 증가세가 이어지고 있다.

8) 글로벌 금융위기 이후 도입된 Basel Ⅲ에서는 향후 한 달간 예상되는 순현금유출액 규모에 상당하는 고유동성 자산을 보유하도록 하는 LCR 규제가 적용된다.

9) 외국인 투자자가 미달러화를 차입한 후 스왑시장에서 이를 원화로 바꿔 원화채권에 투자하는 경우 환율 변동에 대한 리스크 없이 수익을 얻을 수 있는데 이를 차익거래라고 한다. 이때 수익은 ‘원화채권 금리-스왑시장을 통한 원화차입비용(=미달러화 금리+스왑레이트)’이 되는데 이를 차익거래유인이라고 한다.

10) 외국인 채권 보유 잔액 기준 중장기성향 투자자 비중은 2015년 59.2%에서 2020년 71.6%로 상당폭 확대되었다(기획재정부, 2021).

11) 2015년 이후 증권사의 콜시장 참여가 원칙적으로 금지되었다. 다만, 국고채전문딜러 및 한국은행 공개시장운영 대상기관으로 지정된 증권사에 한해 자기자본의 15% 범위 내에서 콜차입이 허용된다.

12) 국고채 유통시장에 대한 보다 자세한 내용은 한국은행(2021)과 기획재정부(2023)를 참고하기 바란다.

13) 한편, 장내채권시장에서 거래되는 채권 유형 중 국채가 거래의 거의 대부분을 차지한다. 2015부터 2022년까지 장내채권시장에서 총 16,643조원의 거래가 이루어졌는데, 이 중 99.1%에 해당하는 16,498조원이 국채 거래이다

(<표 Ⅱ-4>).

14) 경쟁매매시장은 브로커를 통한 거래상대 탐색 및 협상을 거치지 않고 스크린 호가만을 통해 익명으로 가격경쟁에 의해 거래가 체결되는 시장이다.

15) 한편, 경쟁매매 방식 이외에도 신고매매 및 협의매매 방식으로도 거래가 이루어질 수 있으나 대부분의 장내거래는 경쟁매매 방식으로 이루어진다.

16) 국고채전문딜러는 국고채 발행시장에 직접 참여할 권리를 갖는 대신 시장조성 의무를 수행하는 금융회사로 금융투자회사 및 은행을 대상으로 정부가 지정한다.

17) 금융투자협회는 증권사 간 매매의 경우 (매수+매도)÷2를 기준으로 거래현황을 집계하고 있다.

18) 대고객매매는 거래상대방 중 한쪽이 증권사인 경우에 해당한다.

19) 이에 대한 자세한 논의는 김필규(2021)를 참조하기 바란다.

20) 밀집성은 스프레드(bid-ask spread)와 같이 거래비용의 정도를 의미하고 즉시성은 거래가 얼마나 짧은 시간 내에 체결될 수 있는가를 나타낸다. 심도는 거래가격을 중심으로 양방향에 존재하는 주문의 풍부함을 의미하며 폭은 주문량이 충분히 존재하여 거래에 따른 가격 변동이 낮은 정도를 나타낸다. 마지막으로 회복성은 수급 불균형 발생시 이를 빠르게 조정할 수 있는 주문의 신속한 유입 가능성을 의미한다.

21) 시장 유동성 지표에 관한 보다 자세한 내용은 Vayanos & Wang(2013), Holden et al.(2014), Gabrielsen et al.(2011) 등을 참고하기 바란다.

22) 고빈도(high-frequency) 자료를 이용하여 일중(intraday) 매도-매수 스프레드의 변화를 분석하는 경우, 방대한 호가 데이터가 필요하며 이에 수반되는 계산부담도 매우 크다.

23) Kyle’s lambda 추정에 있어 매수에 따른(buyer-initiated) 거래와 매도에 따른(seller-initiated) 거래를 구분한 거래량을 사용한다.

24) 특히 Corwin & Schultz(2012)의 고가-저가 스프레드 추정량(High-low spread estimator), Roll(1984)의 공분산 스프레드 추정량(Covariance spread estimator) 및 Hasbrouck(2009)의 깁스 추정량(Gibbs measure)이 유동성 지표로서 성과가 높은 것으로 나타났다.

25) 상대매매 방식으로 거래되는 장외시장은 국채전문유통시장에 비해 한 시점의 거래정보가 후속 거래의 가격에 미치는 영향력이 약하거나 영향을 미치는 경로가 명확하지 않다는 문제도 존재한다.

26) 분석 대상기간인 2015.1월~2023.6월 중 국고채의 국채전문유통시장 수익률(종가 기준)과 금융투자협회가 발표하는 최종호가수익률 간 차이(절대값 기준)의 평균을 계산해 보면 3년물, 5년물, 10년물이 각각 0.2bp, 0.3bp, 0.3bp로 매우 작은 값을 나타낸다. 이는 국내 채권시장의 지표금리(수익률)가 국채전문유통시장 거래를 통해 결정되고 있음을 의미한다.

27) 영업일 (t+j)에서의 저가와 고가를 과

과  로 정의하는 한편, 영업일 (t)부터 (t+1)까지의 기간 중 저가와 고가를 각각

로 정의하는 한편, 영업일 (t)부터 (t+1)까지의 기간 중 저가와 고가를 각각  과

과  로 정의하자.

로 정의하자.  는 각각 다음과 같이 정의된다.

는 각각 다음과 같이 정의된다.

28)

28)  와

와  는 각각 t일의 가격 변동률과 거래량을 나타내며, N은 유동성 측정 기간 중 영업일 수를 나타낸다.

는 각각 t일의 가격 변동률과 거래량을 나타내며, N은 유동성 측정 기간 중 영업일 수를 나타낸다.

29) 가격 변동률(%)의 절대값을 거래량(조원)으로 나누어 Amihud를 산출하였다.

30) 유동성지수 추정을 위해 사용되는 각 유동성 지표는 0 이상의 값을 가지며, 지표가 높을수록 유동성이 저하됨을 의미한다. 따라서 유동성 지표의 공통요인에 해당하는 유동성지수 역시 높은 값을 가질수록 시장 유동성이 낮음을 의미한다.

31) 유동성 지표가 서로 다른 단위를 가지고 있으나 각 지표의 표준화 여부는 유동성지수 추정에 영향을 미치지 않는다. 예를 들어, 유동성 지표 를 표준편차

를 표준편차 로 나누어 분산이 1이 되도록 표준화

로 나누어 분산이 1이 되도록 표준화 하는 경우, 관측방정식의 각 행(row)을 아래 식과 같이 표현할 수 있으므로 추정계수

하는 경우, 관측방정식의 각 행(row)을 아래 식과 같이 표현할 수 있으므로 추정계수 의 scal e이 변화할 뿐 유동성지수는 표준화 이전과 동일하다.

의 scal e이 변화할 뿐 유동성지수는 표준화 이전과 동일하다.

32) 한국은행(2022)은 국내외 통화긴축 강화로 시장 전반의 유동성이 낮아지는 가운데 한전채 및 은행채 발행 확대에 따른 수급부담, 레고랜드 사태에 따른 신용 경계감 증대 등으로 국내 금융시장 전반으로 불안심리가 확산되었다고 평가하였다. 한편 한국은행(2022)도 2022년 9월 이후 국고채시장 유동성이 코로나19 팬데믹 기간에 해당하는 2020년 3월에 비해 악화되었다는 분석을 제시하고 있다. 자세한 내용은 한국은행(2022)의 <참고Ⅰ-1> 「최근 단기금융‧채권 시장 불안의 파급과정 및 현 상황 평가」를 참조하기 바란다.

33) 다만, 유동성 여건이 크게 악화된 스트레스 상황에서는 딜러의 대차대조표 여력 제약이 유동성을 악화시키는 요인으로 더 크게 작용한다고 분석하였다.

34) Brunnermeier & Pedersen(2009)은 자금조달 유동성(funding liquidity)와 시장 유동성을 연결하여 시장 유동성에 관한 정형화된 사실(stylized facts)을 설명한다.

35) 본 절의 회귀분석은 금융시장 여건을 나타내는 설명변수를 중심으로 모형을 설정하였다. 그러나 국채전문유통시장에서 국고채전문딜러가 시장조성자 역할을 하고 있음에 따라 국고채전문딜러 평가제도 개편 등과 같은 정책 변화도 국고채 유동성에 영향을 미칠 수 있다는 점에 유의할 필요가 있다.

36) 한편, 본 연구의 분석 대상기간(2015년 1월~2023년 6월)은 코로나19 팬데믹 기간을 포함한다. 팬데믹 충격이 국고채 유동성에 직접적으로 영향을 미치기보다는 금융시장 여건의 악화를 통해 유동성에 영향을 미친다. 이에 따라 회귀분석에 사용된 설명변수를 통해 팬데믹의 영향이 반영될 수 있다고 판단하여 팬데믹 기간을 나타내는 더미변수를 고려하지 않았다.

37) 일반적으로 글로벌 금융시장 여건이 악화되면 달러화 강세가 나타나는 가운데 미 채권시장과 주식시장의 변동성이 확대된다.

38) 유동성지수가 주별(weekly) 자료임에 따라 수익률과 변동성은 주 평균값을 사용한다.

참고문헌

기획재정부, 2021, 국채 2020.

기획재정부, 2022. 12. 26, 2023년 국고채 발행계획 발표, 보도자료.

기획재정부, 2023, 국채 2022.

기획재정부, 2023. 9. 29, 한국, 세계국채지수(WGBI) 관찰대상국 지위 유지, 보도참고자료.

김필규, 2021, 『스트립채권시장의 특성 분석 및 활성화 방안』, 자본시장연구원 연구보고서 21-01.

김학겸‧안희준‧장운욱, 2015, 국고채시장의 시장조성활동이 가격발견기능과 유동성에 미치는 영향, 『한국증권학회지』 44(1), 53-91.

박대근‧신성환‧이창용, 2007, 국채 전자거래 시스템 도입의 성과: 미시자료를 이용한 평가, 『금융연구』 12(1), 1-28.

선정훈‧오승현, 2010, 우리나라 국채시장의 가격발견 효율성에 대한 연구, 『경제분석』16(3), 42-77.

신현열‧김자혜, 2013, 시장지표를 활용한 자산의 유동성 평가, BOK 경제리뷰.

한국은행, 2021, 한국의 금융시장.

한국은행, 2022, 『통화신용정책보고서』 (2022년 12월).

Adrian, T., Fleming, M., Shachar, O., Vogt, E., 2017, Market liquidity after the financial crisis, Annual Review of Financial Economics 9, 43-83.

Adrian, T., Fleming, M.J., Vogt, E., 2023, The Evolution of Treasury Market Liquidity: Evidence from 30 Years of Limit Order Book Data, Federal Reserve Bank of New York Staff Reports No. 827.

Amihud, Y., 2002, Illiquidity and stock returns: Cross-section and time-series effects, Journal of financial markets 5(1), 31-56.

Amihud, Y., Mendelson, H., 1991, Liquidity, maturity, and the yields on US Treasury securities, The Journal of Finance 46(4), 1411-1425.

Amihud, Y., Mendelson, H., Pedersen, L.H., 2006, Liquidity and asset prices, Foundations and Trends in Finance 1(4), 269-364.

Barbosa, L., Costa, S., 2010, Determinants of sovereign bond yield spreads in the euro area in the context of the economic and financial crisis,. Banco de Portugal Working Paper.

Beber, A., Brandt, M.W., Kavajecz, K.A., 2009, Flight-to-quality or flight-to-liquidity? Evidence from the euro-area bond market, The Review of Financial Studies 22(3), 925-957.

Black, J.R., Stock, D., Yadav, P.K., 2014, The Pricing of Liquidity Dimensions in Corporate Bonds, Working paper.

Boyarchenko, N., Giannone, D., Shachar, O., 2018, Flighty liquidity, Federal Reserve Bank of New York Staff Reports No. 870.

Brunnermeier, M.K., Pedersen, L.H., 2009, Market liquidity and funding liquidity, The Review of Financial Studies 22(6), 2201-2238.

Corwin, S.A., Schultz, P., 2012, A simple way to estimate bid-ask spreads from daily high and low prices, The Journal of Finance 67(2), 719-760.

Duffie, D., Fleming, M.J., Keane, F.M., Nelson, C., Shachar, O., Van Tassel, P., 2023, Dealer capacity and US Treasury market functionality, Federal Reserve Bank of New York Staff Reports No. 1070.

Fleming, M.J., Mizrach, B., Nguyen, G., 2018, The microstructure of a US Treasury ECN: The BrokerTec platform, Journal of Financial Markets 40, 2-22.

Florackis, C., Gregoriou, A., Kostakis, A., 2011, Trading frequency and asset pricing on the London Stock Exchange: Evidence from a new price impact ratio, Journal of Banking & Finance 35(12), 3335-3350.

Gabrielsen, A., Marzo, M., Zagaglia, P., 2011, Measuring Market Liquidity: An Introductory Survey, SSRN working paper.

Goyenko, R., Subrahmanyam, A., Ukhov, A., 2011, The term structure of bond market liquidity and its implications for expected bond returns, Journal of Financial and Quantitative Analysis 46(1), 111-139.

Gündüz, Y., Pelizzon, L., Schneider, M., Subrahmanyam, M. G., 2021, Lighting up the dark: liquidity in the German corporate bond market, Deutsche Bundesbank Discussion Paper No. 21/2021.

Hasbrouck, J., 2009. Trading costs and returns for US equities: Estimating effective costs from daily data, The Journal of Finance 64(3), 1445-1477.

Holden, C.W., Jacobsen, S., Subrahmanyam, A., 2014, The empirical analysis of liquidity, Foundations and Trends in Finance 8(4), 263-365.

Jiang, G.J., Lo, I., Verdelhan, A., 2011, Information shocks, liquidity shocks, jumps, and price discovery: Evidence from the US Treasury market, Journal of Financial and Quantitative Analysis 46(2), 527-551.

Kargar, M., Lester, B., Lindsay, D., Liu, S., Weill, P.O., Zuniga, D., 2021, Corporate bond liquidity during the COVID-19 crisis, The Review of Financial Studies 34(11), 5352-5401.

Kyle, A.S., 1985, Continuous auctions and insider trading, Econometrica 53(6), 1315-1335.

Lee, J., 2018, Who Improves or Worsens Liquidity in the Korean Treasury Bond Market? Bank of Korea Working Paper No. 2018-3.

O’Hara, M., Zhou, X., 2021, Anatomy of a liquidity crisis: Corporate bonds in the COVID-19 crisis, Journal of Financial Economics 142(1), 46-68.

Pastor, L., Stambaugh, R.F., 2003, Liquidity risk and expected stock returns, Journal of Political economy 111(3), 642-685.

Roll, R., 1984, A simple implicit measure of the effective bid-ask spread in an efficient market, The Journal of Finance 39(4), 1127-1139.

Sarr, A., Lybek, T., 2002, Measuring liquidity in financial markets, IMF working paper WP/02/232.

Schestag, R., Schuster, P., Uhrig-Homburg, M., 2016, Measuring liquidity in bond markets, The Review of Financial Studies 29(5), 1170-1219.

Vayanos, D., Wang, J., 2013, Market liquidity―Theory and empirical evidence, In Constantinides, G.M., Harris, M., Stulz, R.M. (Eds.), Handbook of the Economics of Finance, Volume 2, 1289–1361, North Holland.

<부록> 국고채 유동성 지표 및 유동성지수의 기초통계량과 시계열 추이

재정정책의 역할이 지속적으로 확대되면서 국채 발행이 빠르게 증가하고 있다. 정부는 재정지출에 있어 기본적으로 조세수입을 활용하되 부족한 부분은 국채 발행을 통해 충당한다. 정부지출 규모가 꾸준히 확대되는 가운데 이를 지원하기 위한 정부의 자금조달 수요가 늘어나면서 GDP 대비 국고채1) 발행잔액 비율이 2000년 6.5%에서 2022년에는 43.4%로 빠르게 높아지고 있다. 우리나라 경제는 저출산, 고령화 등으로 성장동력이 약화되는 가운데 복지지출에 대한 수요는 증가할 것으로 전망된다. 이에 따라 재정의 중요성이 더욱 커지면서 향후에도 국채 발행을 통한 정부의 자금조달 증가세가 이어질 것으로 예상된다.

국채 발행이 빠르게 늘어나면서 국채 유통시장의 중요성이 높아지고 있다. 유통시장에서 형성되는 거래를 통해 국채 수익률이 결정됨에 따라 유통시장의 가격발견 기능 제고는 정부의 효율적인 자금조달로 이어질 뿐 아니라 발행시장 활성화에도 영향을 미친다. 또한 무위험금리(risk-free rate)에 해당하는 국채 수익률은 기업, 가계 등 경제주체의 자금조달에 있어 준거금리 역할을 하며 이에 따라 경제 전반의 자금조달 비용에도 영향을 미친다. 따라서 국채 유통시장의 중요성은 금융시장이 발달할수록 더욱 커지게 된다.

유통시장 여건을 나타내는 대표적인 지표가 유동성이다. 유동성은 시장가격에 크게 영향을 미치지 않으면서 낮은 거래비용으로 신속히 거래를 체결할 수 있는 정도를 나타낸다. 유동성은 거래비용, 가격에 대한 영향력, 거래가 체결되는 데 소요되는 시간 등 유통시장의 다양한 특성을 포괄한다. 유동성이 높은 시장은 수요와 공급의 미세한 변화가 있더라도 급격한 가격 변동이 발생하지 않아 가격 효율성이 높다는 다수의 기존 연구가 존재한다. 이에 따라 다양한 유동성 지표를 통해 시장 유동성의 특성을 이해하려는 노력이 이루어지고 있다.

채권시장 유동성은 채권 자체적인 특성뿐 아니라 채권시장을 둘러싼 다양한 요인에도 영향을 받는다. 먼저 만기, 발행규모, 발행 이후의 경과기간, 발행주체의 신용도 등 채권의 특성이 유동성에 영향을 미친다. 또한 거래시장의 구조, 거래참여자의 행태, 시장조성자 존재 여부, 유통시장 발달 정도 등 유통시장의 특성과 함께 금융시장 여건 변화도 유동성에 영향을 미친다. 국채 유통시장의 중요성이 커지고 있음을 고려할 때, 국채 유동성에 영향을 미치는 요인 및 유동성 변화가 국채시장에 미치는 영향 등을 엄밀하게 분석해 볼 필요가 있다.

채권 유동성의 개념을 도입한 기존의 국내 연구들은 대부분 가격발견 기능 및 시장 효율성의 결정요인으로서 유동성을 분석하는 데 초점을 두고 있다. 그러나 국채 유동성의 변화 양상 및 변동 요인에 대한 심도 깊은 연구가 부족한 가운데 유동성이 국채 가격과 변동성에 미치는 영향을 분석한 연구는 거의 이루어지지 않고 있다. 채권 유형 간 유동성 차이에 관한 연구는 존재하나 유동성 변화의 특성, 유동성에 영향을 미치는 요인, 유동성 변화의 영향 등에 대한 종합적 검토는 부족한 상황이다. 이에 따라 유동성의 다양한 측면을 고려한 국고채 유동성지수를 추정하고 유동성에 영향을 미치는 요인을 분석하는 것은 국채시장 효율성 제고를 위한 정책적 논의에도 중요한 함의를 갖는다.

본 보고서는 유통시장을 중심으로 국고채시장 구조를 살펴보는 한편, 유동성지수 추정을 통해 국고채 유동성의 변동 요인 및 유동성 변화가 국고채 수익률과 변동성에 미치는 영향을 분석하고자 한다. 본 보고서의 구성은 다음과 같다. 제Ⅱ장에서는 우리나라 국고채시장 현황을 살펴본다. 제Ⅲ장에서는 채권 유동성에 관한 개념을 이해하고 이를 바탕으로 우리나라 국고채시장 유동성지수를 추정한다. 제Ⅳ장에서는 유동성 변동 요인 및 유동성 변화가 국고채시장에 미치는 영향을 분석하고, 제Ⅴ장에서는 논의 내용을 바탕으로 시사점을 제시한다.

Ⅱ. 국고채시장 현황

국채는 정부의 세수 부족을 보완하고 경기 활성화를 포함한 다양한 경제 정책을 추진하기 위한 자금조달 수단이다. 또한 국채시장은 투자자에게 안전자산을 공급하고 자산가격 결정에 기본이 되는 무위험금리 및 수익률곡선 정보를 제공하며, 통화정책의 효과가 금리경로를 통해 파급되는 데 있어서도 핵심적인 역할을 한다. 본 장에서는 국고채 발행, 투자자, 유통 등 국고채시장 전반의 현황을 살펴본다.

1. 국고채 발행시장

국채 발행규모가 확대되는 가운데 정부는 원활한 자금조달을 도모하고 조달 비용 절감을 위해 국채시장 제도개선을 꾸준히 추진해 왔다. 다양한 유형으로 발행되었던 국채를 국고채로 단일화2)하였고, 통합발행(fungible issue)3) 및 발행 정례화 제도를 도입하여 국고채의 유형을 표준화하였다. 또한 1999년에는 국고채의 원활한 소화를 위해 국고채전문딜러(Primary Dealer: PD) 제도를 도입하였다. PD는 발행시장에서 우선적으로 입찰에 참여할 수 있는 권리 및 인수‧유통금융 등의 지원을 받는 대신 국채 유통시장에서 시장조성자(market maker)의 의무를 수행해야 한다.

2023년 현재 국채는 국고채권, 재정증권, 외국환평형기금채권, 국민주택채권의 4가지 종류로 발행되고 있다(<표 Ⅱ-1>). 이 중 재정정책 수행에 필요한 자금을 조달하기 위해 발행되는 국고채가 가장 큰 비중을 차지하는데, 2022년말 국채 발행잔액 1,031.5조원 중 국고채가 937.5조원으로 90.9%를 차지한다. 국고채는 다른 종류의 국채에 비해 유통시장 규모가 훨씬 큼에 따라 유동성이 매우 중요하다. 이에 본 연구는 국고채 유동성에 초점을 맞추어 분석을 진행한다.4)

재정정책의 역할이 지속적으로 확대되면서 국고채 발행의 중요성이 커지고 있다. 정부소비지출이 GDP에서 차지하는 비중은 2001~2010년 연평균 13.1%에서 2011~2020년에는 15.6%로 높아졌으며, 코로나19 팬데믹 이후에도 상승세가 이어지며 2021~2022년에는 18.5%를 기록하고 있다. 정부지출 확대를 지원하기 위한 정부의 자금조달 수요가 확대되면서 국고채 발행이 빠른 속도로 늘어나고 있다(<그림 Ⅱ-1>). 국고채 발행잔액은 2011년말 340조원에서 2023년말에는 1,000조원 수준에 이를 것으로 예상된다. 특히, 코로나19 팬데믹 이후 확장적 재정정책 운용으로 인해 국고채 발행이 큰 폭으로 늘어났다. 국고채 발행규모는 팬데믹 이전 5년(2015~2019년) 연평균 102조원 수준이었으나, 이후 4년(2020~2023년) 발행규모는 173조원으로 큰 폭 증가했다.

국고채시장 확대가 금융시장에 미치는 영향은 양면성을 지니고 있다. 먼저 금융시장으로 공급되는 무위험 자산이 늘어남에 따라 투자자가 선택할 수 있는 투자 대상이 확대되었다는 긍정적인 측면이 존재한다. 또한 다양한 만기의 국채가 유통시장에 공급되면서 수익률 곡선의 완성도가 제고되는 한편, 유통물량 확대를 통해 유통시장 활성화 및 가격발견 기능 제고의 효과를 거둘 수 있다.

가파른 국채 발행 증가세는 장기적으로 재정 여건을 악화시키고 국가의 성장 잠재력을 약화시킬 수 있다. 재정지출 확대, 국세 수입 감소 등으로 인한 재정적자 보전을 위해 적자 국채 발행이 지속되는 경우 국가채무가 빠르게 늘어나 재정지출 여력을 악화시키는 요인으로 작용한다. 일부 선진국에서 국채 발행 확대 및 재정지출 여력 악화의 악순환이 반복되면서 국가채무 비율이 빠르게 상승하는 가운데 성장 잠재력이 하락한 사례가 존재한다. 이에 따라 재정 건전성이 악화되지 않는 수준에서 국채 발행 전략을 마련할 필요가 있다.

한편 국고채의 만기별 비중 추이를 살펴보면 단기채 비중이 줄어드는 반면 장기채 비중은 확대되는 추세를 나타내고 있다(<그림 Ⅱ-3>). 만기 10년 이상의 장기채 비중(물가연동 국고채를 제외한 발행액 기준)이 2011년 41.9%에서 2019년에는 61.1%까지 확대되었다. 다만 2020년 이후에는 단기채 발행이 증가하고 2021년에는 2년물 국고채가 신규 도입됨에 따라 장기물 비중이 소폭 줄어드는 모습이다.

국고채 장기물 비중이 확대되는 추세를 보이는 것은 주요 국채 투자자인 보험사의 장기 국채에 대한 수요가 증가하였기 때문이다. IFRS17 도입에 따라 보험사는 보험부채를 시가로 평가하게 되는데, 자산‧부채 간 듀레이션 갭이 큰 보험사는 자산 듀레이션 확대를 위해 장기 우량채권에 대한 투자수요가 크게 증가하였다. 보험사의 장기물 수요 확대에 대응하여 정부는 국고채 장기물 발행을 지속적으로 확대하였다. 장기물 발행잔액이 꾸준히 누적되면서 국고채의 평균 만기가 늘어나고 있다. 국고채 평균 잔존만기는 2015년 8.0년에서 매년 지속적으로 증가하여 2018년에는 9.7년, 2022년에는 11.6년까지 늘어났다.

시장 여건 변화에 따라 국고채 투자자 구성도 변화하는 모습이다. 한국은행이 편제하는 자금순환표를 이용하여 주요 기관투자자의 국채 보유 비중을 살펴보면6), 2022년말 기준 보험사, 은행, 연기금의 3개 기관투자자가 국채의 65%를 보유하고 있는 가운데 외국인 비중이 19%를 기록하며 4개 유형의 투자자가 국채의 대부분을 보유하고 있다(<표 Ⅱ-3>). 보험사의 국채 보유 비중이 크게 확대된 것은 IFRS17 시행에 대비하여 만기 30년 이상 초장기물을 중심으로 보험사가 국고채 투자를 꾸준히 확대하였기 때문이다. 다만, 2021년 이후 시장금리의 가파른 상승으로 보험사가 보유한 국채 시가가 상당 규모 감소하면서 최근 보험사의 국채 보유 비중이 다소 줄어드는 모습이다.7)

은행의 국채 비중은 연도별로 다소 변동을 나타내는 가운데 최근 들어 확대되는 추세를 보이고 있다. 글로벌 금융위기 이후 은행에 대한 유동성커버리지비율(Liquidity Coverage Ratio: LCR)8) 규제가 적용됨에 따라 은행은 유동성이 높은 안전자산에 대한 투자수요가 존재하는데, 특히 유동성이 높은 국채 단기물을 중심으로 투자하고 있다.

국민연금을 포함한 연기금의 국채 보유 비중은 지속적으로 축소되고 있다. 이는 수익률 제고 등을 위해 연기금이 해외투자 및 대체투자 비중을 확대하면서 국채에 대한 투자 비중을 축소한 데 주로 기인한다.

외국인의 국채 투자는 2015년까지 정체를 보였으나 2016년 이후 증가세가 이어지고 있으며, 특히 코로나19 팬데믹 이후 국채 보유 비중이 더욱 확대되는 모습이다. 국채시장에서의 외국인 보유 비중은 2015년 10.1%에서 2022년에는 19.4%로 늘어났다. 이처럼 외국인의 국채 투자가 꾸준히 늘어나고 있는 것은 안정적인 거시경제 여건을 바탕으로 우리나라 국채 신용도가 높은 수준을 유지하고 있는 가운데 차익거래유인9)이 존재하기 때문이다. 국채 유통시장의 발달로 현금화가 용이하다는 점도 외국인의 국채 투자 확대 요인으로 작용한다. 외국인이 보유한 국내 채권은 대부분 유동성이 높은 국채와 통안채로 구성되어 있다. 한편 해외 중앙은행, 국부펀드 등 상대적으로 투자시계(investment horizon)가 긴 중장기성향의 외국인 투자자 비중도 확대되는 모습이다.10)

마지막으로 증권사의 국채 보유 비중은 2011년 2.3% 수준에 불과했으나 2014년 이후 3~5% 수준으로 다소 확대되는 모습이다. 증권사는 수익 제고를 위한 투자 목적 이외에도 단기자금 조달을 위해 국채를 보유한다. 특히, 2014년 증권사의 콜시장 참여를 원칙적으로 배제하는 단기자금시장 개편11) 등으로 인해 RP(Repurchase Agreements) 거래를 통한 자금조달 필요성이 높아졌는데 이는 증권사의 국채 투자를 확대하는 요인으로 작용하였다.

가. 유통시장 구조

국고채 유통시장은 장내시장과 장외시장으로 구분된다. 장내시장과 장외시장은 시장구조, 거래방식, 거래참여자 및 거래되는 채권의 특성 등 다양한 측면에서 차이를 나타낸다.

장내채권시장은 거래참여자 및 거래대상 채권에 따라 국채전문유통시장, 일반채권시장, 소액채권시장으로 구분되는데, 국채는 대부분 국채전문유통시장에서 거래된다(<표 Ⅱ-4>).13) 국채전문유통시장은 국고채, 통화안정증권, 예금보험공사채권을 거래대상으로 하며, 전자거래시스템 기반의 경쟁매매 방식14)으로 거래가 이루어진다.15) 직접 참가자격을 갖춘 국채딜러(국고채전문딜러, 예비국고채전문딜러 및 국채일반딜러)가 주요 거래 참가자이며, 일반 기관투자자의 경우 위탁매매를 통해 참가할 수 있다. 위탁참가기관은 기관등록과 거래원 등록을 통해 참가 자격을 얻게 되고 KTS(KRX Trading System for Government Securities) 단말기를 통해 주문을 제출할 수 있으나, 결제는 국채딜러에게 위탁해야 한다. 위탁자의 자금, 증권의 결제에 대한 이행보증책임은 수탁 금융투자회사가 지게 된다. 국채전문유통시장에서는 정부가 지정한 국고채전문딜러(PD)16)가 시장조성자 역할을 한다. 즉 국고채전문딜러는 지표종목별로 매도‧매수의 양방향 조성호가를 지속적으로 제시하는 의무를 지니고 있다. 이러한 시장조성자 제도는 국고채 거래가 원활하게 체결되도록 시장 유동성을 제고하는 기능을 수행한다.

장외시장의 채권거래는 상대매매 방식으로 이루어진다. 거래참여자는 메신저를 통해 호가 탐색 및 거래 협의를 하고, 거래에 대한 합의가 이루어지면 채권정보와 결제 내역을 상호 확인하여 거래를 확정한다. 장외거래의 결제일은 매도자와 매수자 간 협의를 통해 T+1일부터 T+30일까지 가능하나 통상적으로 익일(T+1)결제가 이루어진다. 장외채권거래의 결제는 채권과 대금을 동시에 결제(Delivery-versus-Payment: DvP)하는 것을 원칙으로 하고 있다. 채권은 한국예탁결제원의 SAFE+시스템을 통해 예탁자계좌부 상의 계좌 간에 대체되고, 결제대금은 한국은행 금융망이나 은행의 당좌계정을 통해 이체된다.

국고채 발행잔액 증가와 함께 유통시장의 효율성 제고를 위한 다양한 제도 변화가 이루어져 왔다. 1999년에는 한국거래소에 경쟁매매 방식의 전자거래 플랫폼인 국채전문유통시장을 도입하였다. 장내 국채시장을 활성화하기 위한 다양한 정책도 추진되었는데, 국채전문유통시장에서 거래의 원활화를 도모하기 위해 PD의 시장조성 기능을 도입하였다. 시장조성자는 고객의 채권 매매를 중개하는 역할과 동시에 자기계좌 거래를 통해 시장에 호가를 제시하는 역할을 한다. 또한 가격 괴리가 발생하는 경우 자기계좌 거래를 통해 가격의 연속성을 유지시키는 역할을 한다. 이와 같은 PD의 시장조성기능은 국채전문유통시장의 가격 효율성을 제고하는 효과를 거두고 있다.

2002년에는 PD가 국고채 지표종목을 거래하는 경우 국채전문유통시장을 통해 거래하는 것을 의무화하는 제도를 도입하였다. 동 제도는 국채전문유통시장에서 PD 간 지표채권 거래를 확대하는 효과를 거두었으나 PD의 거래 부담을 증가시키고 다양한 거래방식을 제약하는 부작용을 초래함에 따라 2008년에 폐지되었다.

2006년에는 국고채의 매매수량단위를 기존 100억원에서 10억원으로 변경하였다. 매매수량단위의 축소는 소액거래 참여자가 장내시장을 활용하여 거래할 수 있는 기반을 제공하여 국채전문유통시장의 거래량을 증가시키는 효과를 거두었다. 2010년에는 PD의 최우선 호가 스프레드를 축소하고 의무호가 수량을 상향 조정하는 등 PD의 시장조성 의무를 대폭 강화하였다.

장외채권시장은 시장참여자에 의해 자발적으로 도입된 시장으로 주로 메신저를 통한 상대매매 방식으로 거래가 이루어진다. 장외채권시장은 거래 편의성이 높지만 투명성이 낮은 문제를 지니고 있다. 이에 따라 거래의 안정성과 투명성을 제고하기 위한 제도개선이 추진되었다. 2010년 금융투자협회는 기존의 메신저거래를 통합한 프리본드시장을 도입하였다. 프리본드시장은 거래의 편의성을 제고한 K-Bond 시장으로 2017년 개편하여 운영되고 있다.

한편 장외채권시장의 정보 효율성을 제고하는 정책도 추진되었다. 2000년에는 장외에서 거래된 채권의 거래 결과를 15분 이내에 공시하는 장외거래 체결내역 공시제도를 도입하였다. 동 제도의 도입을 통해 장외에서 거래되는 채권의 체결 내역이 신속하게 공시되면서 장외채권시장의 사후 투명성이 제고되었다.

2007년에는 장외채권시장에서 거래되는 채권의 호가정보를 금융투자협회가 집계하여 공시하는 장외 호가정보 집중시스템이 도입되었다. 장외 호가정보 집중시스템은 장외시장에서 거래되는 50억원 이상의 모든 채권에 대한 호가정보를 금융투자협회에 실시간으로 보고하고, 금융투자협회는 동 정보를 공시하는 시스템이다. 동 시스템의 도입으로 채권거래참여자의 가격 탐색기능이 강화되는 한편 장외채권시장의 사전 정보 투명성도 크게 높아졌다.

다. 유통시장별 특성

대부분의 국고채 거래는 장내시장인 국채전문유통시장과 장외시장을 통해 이루어지는데, 두 시장은 거래목적 및 참여자의 특성에 있어 큰 차이를 나타낸다. 국채전문유통시장의 경우 국고채 지표물을 위주로 국채딜러 간 거래가 활발히 이루어지고 있는 반면 장외시장에서는 여러 유형의 기관투자자가 비지표물을 포함한 다양한 종목의 국고채를 거래하고 있다. 아래에서는 국고채 거래 자료를 이용하여 유통시장별 특성을 비교해 본다.

<그림 Ⅱ-4>에서 확인할 수 있는 바와 같이 국채전문유통시장에서의 국고채 거래는 거의 대부분이 지표물이다. 2016년부터 2022년까지 국채전문유통시장에서 이루어진 국고채 거래 중 지표물 비중이 97%를 상회하며 지표물 중심의 거래 특성을 보이고 있다. 반면 장외시장의 경우, 비지표물 거래 비중이 더 높게 나타난다. 2016~2022년 중 장외시장 국고채 거래 중 지표물의 비중은 29~35% 수준으로 국채전문유통시장에 비해 크게 낮은데, 이는 장외시장에서 보다 다양한 종목의 국고채가 거래되고 있음을 나타낸다.

유통시장을 구분하여 연물별 지표물 거래 비중을 살펴보면, 국채전문유통시장에서는 모든 연물에 걸쳐 지표물 비중이 매우 높은 수준을 나타내고 있다(<표 Ⅱ-7>). 이에 반해 장외시장에서는 연물에 따라 지표물 거래 비중이 차이를 보이고 있는데, 단기물에 비해 장기물의 지표채권 거래 비중이 상대적으로 높게 나타난다. 일반적으로 국고채 단기물은 거래가 활발한 상품으로 지표물 기간과 비지표물 기간에 따라 거래시장이 구분되는 특성을 보인다. 지표물 기간에는 국채전문유통시장에서 딜러 간 거래가 활발히 이루어지다가 비지표물로 전환되면 주로 장외시장에서 거래된다. 국고채 장기물의 경우, 단기물에 비해 거래 규모가 적다. 이에 따라 시장조성을 목적으로 하는 거래는 국채전문유통시장에서 이루어지고 기관투자자의 거래는 장외시장에서 이루어지는 특성을 보인다.

유통시장에서의 국고채 거래 추이를 살펴보면 2017년 이후 거래량과 거래회전율이 하락세를 나타내고 있다(<그림 Ⅱ-6>). 이와 같은 거래 감소세는 국고채 연물 구조 변화에 따른 장기 보유 투자자 비중 확대가 구조적 요인으로 작용하는 가운데 2021년 이후 글로벌 통화긴축 기조가 강화되면서 국고채 투자수요가 크게 위축된 데 기인하는 것으로 판단된다.

먼저, 장기물의 발행 비중 확대가 국고채 거래 감소 요인으로 작용하고 있다. 일반적으로 만기가 10년을 초과하는 국고채 장기물은 단기물에 비해 거래가 저조하다. 특히 국고채 30년물과 50년물과 같은 초장기물의 경우, 단기물에 비해 거래량이 크게 적다. 이는 초장기 채권에 주로 투자하는 보험사, 연기금 등이 매매거래를 통해 수익을 제고하기보다는 장기의 부채 듀레이션을 매칭할 목적으로 국고채를 장기 보유하기 때문이다. 2012년 도입된 30년 만기 국고채는 보험사의 수요 증대에 따라 발행규모가 지속적으로 늘어나고 있으며 2016년 신규 도입된 50년 만기 국고채도 발행이 확대되고 있다. 초장기물의 발행이 늘어남에 따라 상대적으로 국고채 거래가 활발한 펀드 및 증권사의 거래 비중은 감소하고 장기 투자기관인 보험사의 비중이 높아지는 방향으로 투자자 구성이 변화하고 있으며, 이는 국고채 거래를 둔화시키는 요인으로 작용한다.

2016년 장내시장 거래량이 크게 늘어난 것은 스트립채권 활성화를 위해 PD 제도를 개선한 데 크게 기인한다.19) 정부는 스트립채권시장 활성화를 위해 스트립 거래실적을 PD 평가 항목에 포함시켰는데, 이에 따른 PD의 스트립채권 발행 및 거래 증가로 장내 국고채 거래량이 큰 폭으로 늘어났다. 그러나 2017년부터는 장내 거래량 감소세가 이어지고 있으며, 2021년 이후 금리가 가파르게 상승하면서 거래량이 상당폭 감소하였다. 반면 장외시장의 경우 외국인의 국고채 투자 확대 등으로 거래량이 크게 위축되지는 않는 모습이다.

거래회전율 추이를 살펴보면 최근 수년간 장내시장과 장외시장 모두 하락세를 보이는 가운데 특히 장내시장에서 하락폭이 큰 것으로 나타났다. 장내 및 장외시장 전반에 걸쳐 거래회전율이 하락하는 것은 앞서 설명한 바와 같이 단기물에 비해 상대적으로 거래가 적은 국고채 장기물 비중이 늘어난 것에 기인한다. 장내시장에서 거래회전율이 크게 하락한 것은 지표채권 거래 둔화가 주요인으로 작용한 것으로 판단된다. 과거 거래가 활발했던 3년물, 5년물, 10년물 지표채권의 거래량이 급격히 감소함에 따라 장내 국고채 거래회전율도 크게 낮아지는 모습이다.

이상의 결과를 종합해 보면 국채전문유통시장과 장외시장에서의 국고채 거래는 크게 다른 양상을 나타내고 있다. 이는 앞서 살펴본 것과 같이 두 시장의 거래참여자 구성이 상이한 가운데 이에 따른 거래 특성의 차이가 반영된 결과로 해석될 수 있다.

본 장에서는 시장 유동성의 개념을 살펴보고 채권 유동성에 관한 선행연구를 바탕으로 우리나라 국고채시장 유동성지수를 추정한다. 먼저 1절에서는 시장 유동성의 개념과 유동성 측정지표를 살펴보고 2절에서는 채권 유동성에 관한 선행연구에 대해 논의한다. 3절에서는 유통시장별 유동성 지표를 비교해 보고, 4절에서는 국고채 유동성지수 추정을 위한 분석자료 및 추정에 관한 방법론을 설명한다. 마지막 5절에서는 다양한 유동성 지표를 통합하여 유동성지수를 추정하고 유동성지수의 특징을 살펴본다.

1. 유동성의 개념과 측정지표

유통시장 여건을 나타내는 대표적인 지표가 유동성이다. 유동성은 시장가격에 영향을 크게 미치지 않으면서 낮은 거래비용으로 신속히 거래를 체결할 수 있는 정도를 나타낸다. 본 연구에서 사용되는 유동성(liquidity)은 거래의 수월성 및 효율성 등 시장 여건의 질적인 개념으로 통화량(monetary aggregates)과 같은 양적인 개념과는 구분된다.

시장 유동성은 거래비용, 가격에 대한 영향력, 거래가 체결되는 데 소요되는 시간 등 유통시장의 다양한 특성을 포괄하는 개념이다. 이에 따라 단일 지표를 이용하여 유동성의 다양한 차원을 포착하는 데 한계가 존재한다(Amihud et al., 2006). Sarr & Lybek(2002)은 유동성을 밀집성(tightness), 즉시성(immediacy), 심도(depth), 폭(breadth), 회복성(resiliency)의 다섯 가지 측면에서 평가할 수 있다고 하였다.20) 다만 위에서 제시된 유동성의 각 측면 간에 중첩되는 영역이 존재하며, 가용한 데이터를 사용하여 유동성의 각 측면을 정확하게 측정하는 데 어려움이 존재한다.

이처럼 유동성이 시장 전반의 거래 특성을 포괄하는 종합적인 개념임에 따라 단일 지표를 사용하여 유동성을 파악하기보다는, 다양한 지표를 이용하여 유동성의 각 측면을 분석하고 있다. 유동성 측정에 이용되는 주요 지표들을 간략히 살펴보면 다음과 같다.21)

먼저 거래비용(밀집성) 측면에서 유동성을 측정하는 지표로는 최우선 매수호가와 최우선 매도호가의 차이로 정의되는 매수-매도 스프레드가 널리 사용되고 있다. 동 지표는 자산을 매수한 후 즉시 매도할 때 수반되는 비용을 의미한다. 다만, 매수호가 및 매도호가로 거래할 수 있는 수량이 제한적이라는 점에서 유동성의 일부 측면만을 반영한다. 한편 호가 데이터를 이용하여 매수-매도 스프레드를 산출하는 방식22) 외에도 유동성에 관한 이론을 바탕으로 매수-매도 스프레드를 다양한 방식으로 추정하는 지표들이 제안되고 있다(Roll, 1984; Corwin & Schultz, 2012).

가격 영향력(심도 및 폭) 측면에서 유동성을 측정하는 지표로는 Amihud 비유동성 지표(Amihud, 2002)와 Kyle’s lambda(Kyle, 1985)가 대표적으로 사용된다. 거래단위당 가격 변화에 대한 영향을 나타내는 Amihud 비유동성 지표는 일별 거래량 대비 가격 변동률의 절대값 비율을 기간 중 평균한 값으로 정의되며 지표산출이 용이하다는 장점을 갖는다. Kyle’s lambda는 가격 변동률과 거래량을 각각 종속변수와 설명변수로 하는 회귀식의 회귀계수로 정의되는데, 거래의 방향성을 고려한다는 장점이 있으나 고빈도 자료가 사용됨에 따라 데이터 처리가 방대하다는 단점이 있다.23) Pastor & Stambaugh(2003), Florackis et al.(2011) 등도 거래량과 가격 변동률 간의 관계를 바탕으로 거래량이 늘어날 때 가격에 미치는 영향력(price impact)을 측정하기 위한 지표들을 제안하였다.

거래량 및 거래회전율(=거래량÷발행잔액)과 같이 거래활동을 바탕으로 산출되는 지표들도 계산이 간단하다는 장점으로 인해 유동성 지표로 널리 사용된다. 일반적으로 유동성이 높은 시장은 심도가 깊고 폭이 넓어 주문량이 풍부하기 때문에 거래량이 많고 회전율이 높은 특성을 보인다. 다만 해당 지표들은 가격요인을 고려하지 않고 거래의 결과만을 반영한다는 한계가 존재한다.

한편, 대부분의 유동성 지표들은 집단경쟁매매 방식으로 거래가 체결되는 주식시장의 유동성 분석을 위해 제시된 지표들로서 채권시장에 적용하는 데에는 유의할 필요가 있다. 채권시장의 경우 장외유통시장에서의 거래 비중이 높아 유동성 측정 방법론에 대한 합의가 주식시장에 비해 상대적으로 덜 이루어진 편이다.

2. 채권 유동성에 관한 선행연구

채권 유동성에 관한 선행연구를 살펴보면, 먼저 미국 채권시장을 대상으로 다양한 주제에 대한 분석이 진행되어 왔다. 그 중에서도 글로벌 금융시장의 안전자산으로서 핵심적인 역할을 수행하는 미 국채시장에 관한 많은 연구가 수행되었다. Amihud & Mendelson(1991)은 유동성 효과로 인해 동일한 잔존만기를 갖는 단기국채와 장기국채 간 유통수익률에 차이가 발생함을 확인하였다. Jiang et al.(2011)은 거시경제 뉴스 발표가 미 국채가격의 급격한 변동을 일부 설명할 수 있으나 유동성 충격도 가격 변동에 있어 상당한 예측력을 가지고 있음을 보였다. Goyenko et al.(2011)은 경기 위축기에 유동성이 높은 단기국채로 국채 투자수요가 이동하는 유동성 선호현상(flight-to-liquidity)을 확인하는 한편 거시경제 충격을 상대적으로 먼저 반영하는 비지표물(off-the-run)의 유동성 악화가 국채시장 유동성 프리미엄의 주요인임을 분석하였다. Adrian et al.(2023)은 1991년부터 2021년까지 장기간에 걸쳐 미 국채시장 유동성지수를 추정하고 유동성 변동 요인을 분석하였다. Duffie et al. (2023)은 일반적인 거래 여건에서는 변동성이 미 국채시장 유동성 변화의 대부분을 설명할 수 있으나, 유동성 여건이 크게 악화된 금융 스트레스 상황에서는 딜러의 대차대조표 여력(balance-sheet capacity) 제약으로 인해 유동성이 변동성에 의해 설명될 수 있는 것보다 더 크게 악화된다고 분석하였다. 한편, Adrian et al.(2017)과 Fleming et al.(2018)은 각각 금융기관에 대한 규제 변화와 시장구조 변화가 미 국채 유동성에 미치는 영향을 분석하였다.

국채시장뿐 아니라 미국 회사채시장에 대해서도 유동성을 분석한 많은 연구가 진행되었다. Black et al.(2014)은 다양한 유동성 측면 중 거래비용 요인이 유동성 프리미엄에 가장 큰 영향을 미치는 가운데, 시장 전반의 유동성 요인이 채권 고유의 유동성 요인에 비해 채권가격에 미치는 영향이 더 크다는 결과를 제시하였다. Schestag et al.(2016)은 다양한 유동성 지표를 미국 회사채 거래 데이터에 적용하여 그 성과를 비교하였는데, 저빈도(low frequency) 일별 데이터를 이용하여 산출한 유동성 측정 지표들의 성과가 대체로 우수함을 확인하였다.24) 코로나19 팬데믹 기간 회사채 유동성을 연구한 Kargar et al.(2021)과 O'Hara et al.(2021)은 코로나19 발발 이후 회사채 매도 압력의 급격한 증대, 딜러의 유동성 공급 여력 약화로 회사채시장 여건이 급격히 악화되었으나, 이후 연준의 시장개입 발표로 시장 여건이 빠르게 개선되었음을 분석하였다. Boyarchenko et al.(2018)은 하이일드 채권의 유동성 악화가 국채 및 투자적격등급 채권의 유동성 개선을 예측할 수 있음을 보임으로써 신용등급에 따라 채권 유동성 변화 양상이 다르게 나타나는 안전자산 선호현상(flight-to-safety)을 확인하였다.

다음으로 유럽 채권시장을 분석한 연구를 살펴보면, 유로 지역 국채시장을 분석한 Beber et al.(2009)은 국채 수익률 스프레드(sovereign yield spread)가 국가신용에 의해 대부분 설명되나 채권시장 자금이동에 있어서는 유동성이 주 결정요인임을 분석하였다. 이를 통해 시장의 불확실성이 높아지는 시기에는 투자자가 신용도보다는 유동성이 높은 채권에 투자하는 경향을 보인다는 결과를 제시하였다. 2007-2008년 금융위기 전후 유로존 국가의 국채 수익률의 변동 요인을 연구한 Barbosa et al.(2010)은 리만 브라더스 붕괴 이전에는 금융시장의 리스크 프리미엄이 국채 수익률의 주 결정요인이었으나, 이후에는 각국 신용도 및 국채 유동성이 수익률의 주 결정요인으로 작용하였음을 보였다. 한편, 독일과 미국의 회사채시장 거래 분석을 통해 장외시장에서의 투명성이 회사채 유동성에 미치는 영향을 연구한 Gündüz et al.(2021)은 거래 투명성이 낮은 독일 회사채 시장이 미국에 비해 전반적으로 유동성이 낮지만, 거래가 활발한 채권의 경우 오히려 독일 시장에서 높은 유동성을 보인다는 결과를 제시하고 있다.

마지막으로 우리나라 채권 유동성에 관한 연구를 살펴보면 대부분 국고채시장을 대상으로 연구가 이루어져 왔다. 박대근‧신성환‧이창용(2007)은 국채전문유통시장 도입 및 거래집중의무 부과가 거래소시장의 유동성을 크게 개선시켰을 뿐 아니라 장외시장의 유동성과 투명성도 상당히 개선된 것으로 분석하였다. 선정훈‧오승현(2010)은 2002년 1월부터 2006년 5월까지의 장외거래 자료를 이용한 국채 유동성 분석을 통해 가격발견 효율성에 있어 거래량이 중요한 결정요인임을 보였다. 신현열‧김자혜(2013)는 4가지 유동성 지표를 이용하여 채권 유형 간 유동성을 비교하고, 이를 통해 신용도가 높은 채권이 높은 시장 유동성을 나타내나 금융위기 기간 중에는 채권시장 전반에 걸쳐 유동성이 낮아진다는 결과를 제시하였다. 국채전문유통시장 거래자료를 이용하여 PD 제도가 가격발견 기능 및 유동성에 미친 영향을 분석한 김학겸‧안희준‧장운욱(2015)은 PD에 대한 시장조성의무 강화 조치 이후 다양한 유동성 지표가 크게 향상되었다는 결과를 제시하였다. Lee(2018)는 장외 유통시장 자료를 이용하여 기관투자자가 국고채 유동성에 미치는 영향을 분석하였는데, 외국인 보유 비중이 높은 종목일수록 유동성이 낮고 국내 기관투자자 보유 비중이 높은 종목일수록 유동성이 높다는 결과를 제시하고 있다.

3. 유통시장별 유동성 지표 비교

앞서 Ⅱ-3절에서 살펴본 바와 같이 장내시장과 장외시장은 거래참여자, 거래되는 채권의 유형 및 거래방식 등이 달라 유동성 패턴이 다른 모습을 나타낼 가능성이 있다. 이에 본 절에서는 유동성지수 추정에 앞서 국채전문유통시장과 장외시장을 대상으로 Amihud 비유동성 지표, 가격 변동폭, 거래회전율을 비교해 본다. 장내 및 장외시장의 개별 국고채 일별 거래내역 자료를 사용하였으며, 분석 기간은 2015년 1월부터 2023년 6월까지이다. 전체 표본 중 일거래 30억원 미만, 체결건수 5건 미만의 거래는 제외하고 분석을 실시하였다.

거래시장별 Amihud 비유동성 지표를 비교해 보면, 먼저 장내시장에서는 지표물의 유동성이 비지표물에 비해 높다는 결과를 보여주고 있다(<표 Ⅲ-1>). 이와 같은 결과는 국채전문유통시장이 지표물을 위주로 거래가 이루어지고 PD의 시장조성기능이 지표물을 대상으로 도입되고 있기 때문이다. 반면 장외거래의 경우, 대부분 연물에서 지표물이 비지표물에 비해 유동성이 낮은 것으로 나타났다. 이러한 결과는 장외시장에서의 국고래 거래가 비지표물 위주로 이루어지는 특성에 기인한 것으로 해석될 수 있다. 즉, 지표물 기간에는 비교적 가격 효율성이 높은 장내시장을 중심으로 거래가 이루어져 장외사장에서 유동성이 낮게 나타나나, 비지표물 기간이 되면 장외시장에서 거래가 이루어짐에 따라 장외시장에서 유동성이 높게 나타나고 있다. 한편 최근 가파른 금리상승 및 금융시장 불확실성 확대는 장내시장과 장외시장 모두에서 유동성 저하를 초래한 것으로 나타났다. 이와 같은 결과는 시장 변동성이 유동성에 영향을 미친다는 기존 연구들을 지지하는 것이다.

이상의 결과를 통해 장내시장과 장외시장은 거래방식뿐 아니라 거래 특성도 크게 다른 시장임을 파악할 수 있다. 이에 따라 유동성 분석에 있어 시장별 특성을 반영한 분석 방법과 해석이 도입될 필요가 있다.

가. 분석 자료

본 연구는 2015년 1월부터 2023년 6월까지 국채전문유통시장에서의 국고채 지표물 일별 거래자료를 사용하여 유동성을 추정한다. 다만 각 연물 중 3년물, 5년물 및 10년물의 3개 연물에 대해 분석을 수행한다. 위와 같이 분석 대상을 설정한 이유는 다음과 같다.

먼저, 다양한 국고채 유통시장 중 국채전문유통시장 내 거래를 분석 대상으로 하는 것은 전자거래시스템 기반 집단경쟁매매를 통해 거래가 이루어짐에 따라 동 시장의 거래투명성이 높을 뿐 아니라 국채딜러 중심의 기관투자자 시장 구조이므로 다른 국고채 유통시장에 비해 가격발견 기능이 높기 때문이다. 장외시장의 경우 탈중앙화(decentralized)된 시장 구조를 가지고 있다. 유동성 분석을 위해 개발된 지표들은 대부분 집단경쟁매매 방식으로 거래가 이루어지는 주식시장을 분석 대상으로 하고 있는데, 이에 따라 장외 거래자료에 유동성 지표를 적용하는 경우 유동성 측정이 효과적이지 않을 가능성이 크다.25)

다음으로 <그림 Ⅱ-4>에서 살펴본 바와 같이 국채전문유통시장에서는 지표물이 국고채 거래의 대부분을 차지하고 있다. 비지표물 거래 규모가 충분치 않아 거래자료로부터 비지표물 유동성 변화에 관한 의미 있는 정보를 얻는 데 어려움이 크므로 분석 대상에서 비지표물을 제외하였다. 비지표물이 제외됨에 따라 본 연구의 분석이 국고채 전반의 유동성을 살펴보는 데 일부 한계가 존재한다. 그러나 지표물 거래를 통해 결정되는 수익률이 경제 전반의 준거금리로서 역할을 한다는 점에서 지표물 기반의 유동성 추정도 큰 의미가 있다고 할 수 있다.26)

국고채 연물 중 3년물, 5년물 및 10년물을 분석 대상으로 설정한 것은 <표 Ⅲ-4>에서 확인할 수 있는 것처럼 국채전문유통시장 국고채 거래가 위 3개 연물을 중심으로 이루어지고 있어 유동성의 유의미한 동태적 변화를 파악할 수 있기 때문이다. 20년물과 30년물의 경우, 발행량에 비해 유통량이 적은 특성으로 인해 유동성 추정시 변동성이 지나치게 큰 문제점이 발생하여 본 분석에서 제외하였다. 다만, 20년물과 30년물의 거래량이 점차 늘어나고 있음에 따라 향후 유동성 추정을 위한 충분한 거래자료가 확보되면 해당 연물에 대해서도 유동성 분석이 이루어질 필요가 있다. 한편 50년물과 2년물은 각각 2016년 10월과 2022년 2월 발행이 시작되어 전체 분석 대상기간에 대해 거래자료가 확보되지 않는 문제가 발생한다. 따라서 50년물과 2년물도 본 분석에서 제외한다.

나. 유동성지수 추정

유동성지수는 다음 과정들을 통해 추정한다. 먼저, 각 연물(3년물, 5년물 및 10년물)별로 <표 Ⅲ-5>의 3개 유동성 지표를 일별로 산출한다. 각 지표에 대한 설명은 아래와 같다.

먼저 Corwin & Schultz(2012)는 일별 고가와 저가를 바탕으로 매수-매도 스프레드 추정량(estimator)인 HL_spread를 개발하였는데 동 지표는 다음과 같이 정의된다.27)

Amihud(2002)가 비유동성 지표로 제시한 Amihud는 다음과 같이 일별 거래량 대비 가격 변동률의 절대값 비율을 기간 중 평균한 값으로 정의된다.28)

마지막으로 Roll(1984)이 개발한 Roll은 가격 변동률의 자기공분산으로부터 거래비용을 추정하며 다음과 같이 정의된다.

Roll은 효율적 시장을 가정하고 가격 등락이 큰 시장을 유동성이 낮은 시장으로 평가한다. 이에 따라 효율성이 낮은 시장에 대해 Roll을 사용하여 유동성을 측정하는 경우 유동성 지표로서의 유효성이 약화될 수 있다.

다음으로 위에서 산출한 3개 유동성 지표로부터 유동성지수를 추정한다. Ⅲ-1절에서 살펴본 바와 같이 유동성은 다양한 측면의 거래 특성을 포괄하며, 이로 인해 단일 유동성 지표가 유동성 상황을 종합적으로 설명하는 데 한계가 존재한다. 이에 유동성 지표로부터 공통요인을 추출하는 방식으로 유동성지수를 추정한다.30)

앞에서 산출한 3개 유동성 지표를 각각

5. 국고채 유동성지수 추정 결과 및 특징

국고채 유동성지수 추정에 사용된 3개 유동성 지표와 유동성지수의 시계열 추이 및 기초통계량은 <부록>에 정리하였다. <부록>의 그림을 통해 유동성지수가 각 유동성 지표에 비해 상대적으로 평활화(smooth)된 변동을 나타내는 것을 확인할 수 있다. <표 Ⅲ-6>은 연물별로 4개 변수(3개 유동성 지표 및 유동성지수) 간 상관계수를 정리하고 있는데, 각 유동성 지표는 유동성지수와 가장 높은 상관계수를 보이고 있다. 이러한 특성들을 감안할 때 국고채 유동성지수는 유동성의 기조적인 변화를 효과적으로 포착하는 것으로 판단된다.

그러나 2020년 들어 유동성 여건이 악화되기 시작하는데, 코로나19 팬데믹 충격으로 금융시장 변동성이 확대되었던 2020년 3월 유동성지수는 분석 대상기간 중 상위 10%(90%분위) 수준을 넘어선다. 이후 주요국 중앙은행의 완화적 통화정책 등으로 글로벌 금융시장이 안정을 되찾으면서 유동성지수가 장기평균 이하로 낮아지며 국고채 유동성이 개선되는 모습을 보인다.

2021년 하반기부터 인플레이션에 대한 우려 증대로 정책금리 인상, 자산매입 종료 등 통화정책 정상화가 빠르게 진행되면서 국고채 유동성이 다시 악화되기 시작한다. 특히, 주요국 중앙은행의 고강도 긴축으로 글로벌 불확실성이 크게 높아진 가운데 한전채 발행 확대, 레고랜드 사태 등으로 국내 금융시장 불안이 확산되었던 2022년 9월 이후 유동성이 크게 악화된다. 2022년 9월부터 2023년 1월까지 모든 연물의 유동성지수가 상위 5%(95%분위) 수준을 상회하며 분석 대상기간 중 유동성 여건이 가장 악화되었던 것으로 나타난다.32) 2023년 2월 이후 유동성지수가 하락세를 나타내고 있으나, 여전히 장기 평균을 상회하며 국고채 유동성 여건이 약화된 모습이다.

각 연물별 유동성지수의 움직임을 비교해 보면, 대체로 유사한 모습을 보이고 있다(<그림 Ⅲ-1>(D)). <표 Ⅲ-7>은 연물별 유동성지수 간 상관계수를 나타내는데, 각 연물에 걸쳐 상관관계가 매우 강한 것을 확인할 수 있다. 이는 특정 연물의 고유한 특성에 의해 유동성이 변화하기보다는 금융시장 전반의 여건 변화가 유동성의 주 변동 요인으로 작용하고 있음을 의미한다.

유동성과 변동성 간 인과관계는 양방향에서 존재할 수 있다. 먼저 유동성 악화로 시장의 심도 및 폭이 약화되면 한 단위 거래가 가격에 미치는 영향력(price impact)이 커지게 되고 이는 가격 변동성 확대를 유발한다. 가격 변동성 확대 역시 투자심리 위축, 프리미엄 상승 등을 통해 유동성을 약화시키는 요인으로 작용할 수 있다. Brunnermeier & Pedersen(2009)은 시장 유동성과 변동성 간 밀접한 연관성이 있음을 이론적으로 제시한 바 있다.34) 따라서 불확실성 증대 등으로 금융시장 변동성이 확대되면 유동성과 변동성 간 피드백(feedback) 효과로 인해 유동성 악화가 상당 기간 지속될 수 있다.

본 장에서는 제Ⅲ장에서 추정한 유동성지수를 바탕으로 국고채 유동성의 변동 요인 및 유동성 변화가 국고채 수익률과 변동성에 미치는 영향을 분석한다.

1. 국고채 유동성 변동 요인

본 절에서는 다양한 대내외 변수들을 포함한 회귀분석을 통해 국고채 유동성에 영향을 미치는 요인을 분석한다. 미 국채시장의 유동성 결정요인을 살펴본 Adrian et al.(2023)의 분석모형을 참고하여 금융시장 여건을 나타내는 다양한 변수들을 설명변수로, 추정된 유동성지수를 종속변수로 각각 사용하여 유동성 변동 요인을 분석한다.

회귀분석의 주요 변수는 <표 Ⅳ-1>과 같다.35) 먼저, 국내시장 여건을 나타내는 설명변수로 신용위험을 나타내는 회사채 신용스프레드와 자금조달 유동성(funding liquidity)을 나타내는 CD 신용스프레드를 설명변수로 사용한다. 글로벌 금융시장 여건을 나타내는 설명변수로 미 달러화지수, 미 국채 변동성지수, 미 주식시장 변동성지수를 추가하였으며, 국고채 수익률 변동

<표 Ⅳ-2>는 설명변수 간 상관계수를 나타내는데, 지나치게 큰 값이 발견되지 않음에 따라 다중공선성(multicollinearity) 문제가 크게 의심되지는 않는다. 다만, 미 달러화지수와 미 국채 변동성지수 간 상관계수가 상대적으로 큰 값을 나타냄에 따라 다소 유의할 필요가 있다고 판단된다.

추정식 2~4는 국내시장 여건만을 고려한 추정식 1에 대외시장 여건을 나타내는 설명변수를 추가하였다. 추정계수를 살펴보면 달러화 강세 및 미 채권시장과 주식시장의 변동성 확대 역시 국고채 유동성에 부정적인 영향을 미치는 것으로 나타난다. 다만, 외환시장 및 미국 자본시장과 우리나라 국고채시장 간의 직접적인 연계로 인해 유동성 약화가 나타난다기보다는 국제금융시장 여건 악화로 시장 전반의 투자심리가 위축되면서 국고채 유동성 역시 저하되는 것으로 판단된다.37)

추정식 5는 대내외 시장 여건을 고려한 추정식 4에 국고채 수익률의 변동

2. 유동성 변화가 국고채시장에 미치는 영향

국고채 유동성 변화는 국고채 수익률과 변동성에 영향을 미침으로써 경제 전반으로 그 영향이 파급된다. 예를 들어 금융시장 여건 악화에 따른 유동성 충격은 국고채 수익률 상승과 변동성 확대로 이어지고, 그 영향은 다시 경제전반의 조달금리 상승, 금리 변동성 확대 등으로 파급된다. 앞서 회귀분석을 통해 유동성은 금융시장 여건 변화와 같은 외생적 요인에 의해 크게 영향을 받는 것을 확인할 수 있었는데, 본 절에서는 예상치 못한 유동성 충격 발생시 국고채 수익률 및 변동성의 동태적 변화를 살펴봄으로써 유동성 변화가 국채시장에 미치는 영향을 분석한다.

국고채 수익률, 변동성, 유동성지수의 3개 변수로 구성된 VAR(Vector Autoregression) 모형을 이용하여 분석을 수행한다. 수익률은 국채전문유통시장의 종가 수익률을 사용하며, 변동성은 국채전문유통시장의 종가(순가격 기준)를 이용하여 산출한 가격 변동률에 Stochastic Volatility Model을 적용하여 추정한 변동성을 사용한다.38) 각 변수의 1차 차분(first difference)한 값을 VAR 모형에 사용하였으며, 앞선 분석과 마찬가지로 연물별로 구분하여 추정한다. VAR 모형의 시차는 각 연물별 BIC(Bayesian Information Criterion)를 기준으로 설정하였다.

유동성지수에 1 표준편차 충격 발생시 각 변수의 충격반응함수를 살펴본다. 유동성 충격은 부호제약(sign restrictions)을 적용하여 식별하였는데, <표 Ⅳ-4>와 같이 유동성 악화가 수익률 상승 및 변동성 확대를 유발한다는 부호제약을 설정하고 이를 만족하는 충격반응을 베이지언 추정(Bayesian estimation)하였다.

분석 결과, 유동성 충격 발생 이후 3~4주까지 국고채시장에 대한 영향이 이어지는 것으로 나타났으며 각 연물에서 변수별 충격반응은 대체로 유사한 모습을 보였다(<그림 Ⅳ-1>). 먼저 수익률의 반응을 살펴보면, 유동성 충격 발생과 동시에 4bp(중간값 기준) 상승하는 것으로 추정된다. 충격의 영향은 점진적으로 약화되는데, 수익률의 반응은 1주 후에는 +2bp, 2~3주 후에는 +1bp 수준으로 낮아지고 이후에는 크게 유의하지 않은 모습을 보인다.

이상의 결과는 유동성 충격으로부터 국고채시장이 회복하는 데 상당한 시간이 소요된다는 것을 의미한다. 또한 단기간에 유동성 충격이 누적되는 경우 국고채시장의 취약성이 높아질 수 있음을 시사하는 결과이기도 하다.

본 보고서는 유통시장을 중심으로 우리나라 국고채시장 현황을 살펴보는 한편 국고채 유동성지수를 추정하고 이를 바탕으로 유동성 변동 요인과 유동성 변화가 국고채 수익률 및 변동성에 미치는 영향을 분석하였다.

대부분의 국고채 거래는 장내시장인 국채전문유통시장과 장외시장을 통해 이루어지는데 두 시장은 거래 특성이 크게 다른 모습을 나타낸다. 국채전문유통시장의 경우 국고채 지표물을 위주로 국채딜러 간 거래가 활발히 이루어지고 있는 반면 장외시장에서는 여러 유형의 기관투자자가 비지표물을 포함한 다양한 종목의 국고채를 거래하고 있다.

채권 유동성에 관한 기존 국내 연구들이 대부분 가격발견 기능 및 시장 효율성에 초점을 두었던 데 반해 본 보고서는 유동성지수 추정을 통해 시장 여건 변화에 따른 국고채 유동성의 동태적인 특성을 분석하였다. 국고채시장 유동성은 상당한 시계열 변동을 나타내는 가운데 특정 연물의 고유한 특성보다는 금융시장 전반의 여건 변화가 유동성의 주 변동 요인으로 작용하는 모습을 보인다.

유동성 변동 요인을 분석해 보면, 국고채 유동성은 국내 및 글로벌 금융시장 여건 변화에 크게 영향을 받는 것으로 나타난다. 신용위험 및 자금조달 여건과 같은 국내시장 여건뿐 아니라 달러화 지수, 미 채권시장과 주식시장의 변동성과 같은 대외시장 여건도 유동성에 영향을 미치는 요인으로 작용한다. 또한 국고채 가격 하락은 유동성 악화 요인으로, 반대로 가격 상승은 유동성 개선요인으로 각각 작용하며 투자 손익 여부도 유동성에 영향을 미치는 것으로 분석되었다.

VAR 모형을 통해 유동성 충격의 영향을 분석해 보면, 충격 발생 이후 3~4주까지 국고채시장에 대한 영향이 이어지는 것으로 나타났다. 이는 유동성 충격으로부터 국고채시장이 회복하는 데 상당한 시간이 소요된다는 것을 의미한다. 또한 단기간에 유동성 충격이 누적되는 경우 국고채시장의 취약성이 높아질 수 있음을 시사한다.

본 보고서의 분석 결과를 바탕으로 국고채 유동성에 관한 시사점을 도출해 보면 다음과 같다. 먼저, 국고채 유통시장의 중요성이 높아지고 있음에 따라 국고채 유동성지수를 보다 정교한 방법으로 산출하고 관리할 필요가 있다. 본 연구는 국채전문유통시장에서의 지표물 거래자료를 활용하여 유동성지수를 추정하였으나, 장외시장 및 비지표물에 대한 유동성 여건을 반영하지 못하는 한계가 존재한다. 따라서 국고채시장 전반의 유동성 변화를 종합적으로 포착할 수 있는 유동성지수 개발이 요구되며, 유동성지수를 보다 정교하게 추정하기 위한 방법론에 대한 연구가 필요하다.

다음으로 국고채 유동성이 대내외 여건 변화에 따라 큰 폭으로 변동하는 것을 고려할 때 금융시장 여건이 악화되는 시기에 국고채 유동성에 대한 관심을 확대할 필요가 있다. 본 연구의 분석 결과 국고채 유동성은 금융시장 여건이 안정적인 시기에는 변화가 크지 않으나 시장 불확실성이 확대되는 시기에는 빠르게 악화되는 특성을 보였다. 유동성 악화로 인한 국고채 수익률 상승은 정부뿐 아니라 경제주체 전반의 자금조달 비용 상승으로 이어질 수 있다. 국고채 발행이 최근 수년간 빠르게 늘어난 가운데 가계 및 기업 부채도 크게 높은 수준을 기록하고 있다. 이로 인해 유동성 충격은 정부와 민간의 부채 부담을 가중시켜 경제에 부정적 영향을 미치게 된다. 따라서 시장 여건 변화에 따른 국고채 유동성에 대한 모니터링을 강화할 필요가 있다.

마지막으로 국고채시장 유동성 제고를 위한 정책적인 노력도 요구된다. 외생적 요인에 의해 국고채 유동성이 과도하게 악화되는 경우 이를 완화할 수 있는 정부와 한국은행의 효과적인 정책대응 수단을 마련할 필요가 있다. 국고채 시장구조의 효율성 및 투명성 개선은 유동성 제고로 이어질 수 있으므로 이를 위한 지속적인 제도개선 노력도 요구된다. 한편 국고채에 대한 투자자 기반이 확대되는 경우 유동성이 높아지고 시장 여건 변화에 따른 유동성 충격이 완화될 수 있으므로 국고채 상품 다양화 등의 노력을 통해 수요 기반을 확장할 필요가 있다.

1) 2023년 현재 국채는 국고채권, 재정증권, 외국환평형기금채권, 국민주택채권의 4가지 종류로 발행되고 있는데, 본 연구는 국채에서 가장 큰 비중을 차지하는 국고채를 분석 대상으로 한다. 이에 대한 자세한 설명은 Ⅱ-1절을 참조하기 바란다.

2) 외환위기 이전에는 농지채권, 농어촌발전채권, 국민주택기금채권, 철도채권, 양곡증권 등 정책목적에 따라 다양한 국채가 발행되었으나 이를 순차적으로 통합하여 2023년 현재 국채는 <표 Ⅱ-1>과 같이 4종류로 발행되고 있다.

3) 일정 기간 동안 발행하는 국고채의 만기일과 표면금리를 통합하여 국고채의 종류를 표준화하고 발행 물량을 확대하는 제도로서 유동성 제고를 도모할 수 있다.

4) 본 보고서에서는 국채 유동성을 국고채 유동성과 동일한 의미로 사용한다.

5) 한편 우리나라는 2022년 9월 FTSE 세계국채지수(WGBI: World Government Bond Index) 관찰대상국에 등재되었으며 정부는 외국인 국채 투자소득에 대한 비과세 시행, 외국인 투자자 등록제도 폐지, 국제예탁결제기구와 국채통합계좌 개통 추진 등을 통해 세계국채지수 편입을 위해 노력하고 있다(기획재정부, 2023. 9. 29).

6) 자금순환표는 국고채, 국민주택채권, 외국환평형기금채권 등을 포함한 ‘국채’를 기준으로 통계가 편제되고 있으며, 국채의 각 하위항목에 대해서는 통계가 편제되지 않고 있다.

7) 다만, 액면기준 보험사의 국고채 보유(장외채권 거래잔고 기준)는 2021년말 317조원에서 2022년말 334조원, 2023년 6월말 336조원으로 증가세가 이어지고 있다.

8) 글로벌 금융위기 이후 도입된 Basel Ⅲ에서는 향후 한 달간 예상되는 순현금유출액 규모에 상당하는 고유동성 자산을 보유하도록 하는 LCR 규제가 적용된다.

9) 외국인 투자자가 미달러화를 차입한 후 스왑시장에서 이를 원화로 바꿔 원화채권에 투자하는 경우 환율 변동에 대한 리스크 없이 수익을 얻을 수 있는데 이를 차익거래라고 한다. 이때 수익은 ‘원화채권 금리-스왑시장을 통한 원화차입비용(=미달러화 금리+스왑레이트)’이 되는데 이를 차익거래유인이라고 한다.

10) 외국인 채권 보유 잔액 기준 중장기성향 투자자 비중은 2015년 59.2%에서 2020년 71.6%로 상당폭 확대되었다(기획재정부, 2021).

11) 2015년 이후 증권사의 콜시장 참여가 원칙적으로 금지되었다. 다만, 국고채전문딜러 및 한국은행 공개시장운영 대상기관으로 지정된 증권사에 한해 자기자본의 15% 범위 내에서 콜차입이 허용된다.

12) 국고채 유통시장에 대한 보다 자세한 내용은 한국은행(2021)과 기획재정부(2023)를 참고하기 바란다.

13) 한편, 장내채권시장에서 거래되는 채권 유형 중 국채가 거래의 거의 대부분을 차지한다. 2015부터 2022년까지 장내채권시장에서 총 16,643조원의 거래가 이루어졌는데, 이 중 99.1%에 해당하는 16,498조원이 국채 거래이다

(<표 Ⅱ-4>).

14) 경쟁매매시장은 브로커를 통한 거래상대 탐색 및 협상을 거치지 않고 스크린 호가만을 통해 익명으로 가격경쟁에 의해 거래가 체결되는 시장이다.

15) 한편, 경쟁매매 방식 이외에도 신고매매 및 협의매매 방식으로도 거래가 이루어질 수 있으나 대부분의 장내거래는 경쟁매매 방식으로 이루어진다.

16) 국고채전문딜러는 국고채 발행시장에 직접 참여할 권리를 갖는 대신 시장조성 의무를 수행하는 금융회사로 금융투자회사 및 은행을 대상으로 정부가 지정한다.

17) 금융투자협회는 증권사 간 매매의 경우 (매수+매도)÷2를 기준으로 거래현황을 집계하고 있다.

18) 대고객매매는 거래상대방 중 한쪽이 증권사인 경우에 해당한다.

19) 이에 대한 자세한 논의는 김필규(2021)를 참조하기 바란다.

20) 밀집성은 스프레드(bid-ask spread)와 같이 거래비용의 정도를 의미하고 즉시성은 거래가 얼마나 짧은 시간 내에 체결될 수 있는가를 나타낸다. 심도는 거래가격을 중심으로 양방향에 존재하는 주문의 풍부함을 의미하며 폭은 주문량이 충분히 존재하여 거래에 따른 가격 변동이 낮은 정도를 나타낸다. 마지막으로 회복성은 수급 불균형 발생시 이를 빠르게 조정할 수 있는 주문의 신속한 유입 가능성을 의미한다.

21) 시장 유동성 지표에 관한 보다 자세한 내용은 Vayanos & Wang(2013), Holden et al.(2014), Gabrielsen et al.(2011) 등을 참고하기 바란다.

22) 고빈도(high-frequency) 자료를 이용하여 일중(intraday) 매도-매수 스프레드의 변화를 분석하는 경우, 방대한 호가 데이터가 필요하며 이에 수반되는 계산부담도 매우 크다.

23) Kyle’s lambda 추정에 있어 매수에 따른(buyer-initiated) 거래와 매도에 따른(seller-initiated) 거래를 구분한 거래량을 사용한다.

24) 특히 Corwin & Schultz(2012)의 고가-저가 스프레드 추정량(High-low spread estimator), Roll(1984)의 공분산 스프레드 추정량(Covariance spread estimator) 및 Hasbrouck(2009)의 깁스 추정량(Gibbs measure)이 유동성 지표로서 성과가 높은 것으로 나타났다.

25) 상대매매 방식으로 거래되는 장외시장은 국채전문유통시장에 비해 한 시점의 거래정보가 후속 거래의 가격에 미치는 영향력이 약하거나 영향을 미치는 경로가 명확하지 않다는 문제도 존재한다.

26) 분석 대상기간인 2015.1월~2023.6월 중 국고채의 국채전문유통시장 수익률(종가 기준)과 금융투자협회가 발표하는 최종호가수익률 간 차이(절대값 기준)의 평균을 계산해 보면 3년물, 5년물, 10년물이 각각 0.2bp, 0.3bp, 0.3bp로 매우 작은 값을 나타낸다. 이는 국내 채권시장의 지표금리(수익률)가 국채전문유통시장 거래를 통해 결정되고 있음을 의미한다.

27) 영업일 (t+j)에서의 저가와 고가를

29) 가격 변동률(%)의 절대값을 거래량(조원)으로 나누어 Amihud를 산출하였다.

30) 유동성지수 추정을 위해 사용되는 각 유동성 지표는 0 이상의 값을 가지며, 지표가 높을수록 유동성이 저하됨을 의미한다. 따라서 유동성 지표의 공통요인에 해당하는 유동성지수 역시 높은 값을 가질수록 시장 유동성이 낮음을 의미한다.

31) 유동성 지표가 서로 다른 단위를 가지고 있으나 각 지표의 표준화 여부는 유동성지수 추정에 영향을 미치지 않는다. 예를 들어, 유동성 지표