Find out more about our latest publications

Korea’s Short-Term Financing Securities Market: its Characteristics and Implications

Issue Papers 22-12 Jul. 25, 2022

- Research Topic Capital Markets

- Page 20

Short-term financing securities (commercial paper and short-term bonds) are issued with maturities of less than one year to meet the demand for short-term capital. Although such securities can serve as a flexible and effective financing tool, they are susceptible to market volatility. Furthermore, if the short-term financing securities market becomes tighter, it would influence the entire financial market.

In Korea, the outstanding balance of short-term financing securities has shown a continuous growth trend to amount to KRW 313.8 trillion as of end-May of 2022. Amid a shift in regulations and market environment, the short-term financing securities market has also seen its structure changing. Accordingly, floating securities and instruments with top credit ratings have gradually made up a larger portion of the market. On the other hand, short-term bonds (STBs) have been adopted to address regulatory issues of commercial paper (CP) but they take up a small proportion due to a disparity in the regulatory scheme.

In the short-term financing securities market, one of the most prominent features is a recent surge in the weight of long-term CP. This demonstrates that short-term financing securities are replacing long-term financing instruments while acting as an effective short-term financing tool. It is notable that an excessive increase in the weight of long-term financing instruments would give rise to distortion of credit ratings, a less sophisticated trading price structure and difficulties in redemption during a rate hike cycle, thereby leading to low liquidity of financing instruments. On top of that, if volatility intensifies in the financial market, the spread of short-term financing securities would widen further, which may aggravate the interest payment burden borne by issuers of long-term CP.

This necessitates regulatory measures to ensure that the short-term financing securities market serves its intended purpose. To this end, the regulatory gap between CP and STBs should be narrowed in the short run. In credit evaluation, the limit and duration of STBs should be equally applied to CP and credit ratings should be given based on such conditions. Additionally, varied information including the issue price and returns should be provided to investors to ensure that various aspects of short-term financing securities are reflected in the pricing process. As a long-term approach, it is worth considering replacing CP with STBs.

In Korea, the outstanding balance of short-term financing securities has shown a continuous growth trend to amount to KRW 313.8 trillion as of end-May of 2022. Amid a shift in regulations and market environment, the short-term financing securities market has also seen its structure changing. Accordingly, floating securities and instruments with top credit ratings have gradually made up a larger portion of the market. On the other hand, short-term bonds (STBs) have been adopted to address regulatory issues of commercial paper (CP) but they take up a small proportion due to a disparity in the regulatory scheme.

In the short-term financing securities market, one of the most prominent features is a recent surge in the weight of long-term CP. This demonstrates that short-term financing securities are replacing long-term financing instruments while acting as an effective short-term financing tool. It is notable that an excessive increase in the weight of long-term financing instruments would give rise to distortion of credit ratings, a less sophisticated trading price structure and difficulties in redemption during a rate hike cycle, thereby leading to low liquidity of financing instruments. On top of that, if volatility intensifies in the financial market, the spread of short-term financing securities would widen further, which may aggravate the interest payment burden borne by issuers of long-term CP.

This necessitates regulatory measures to ensure that the short-term financing securities market serves its intended purpose. To this end, the regulatory gap between CP and STBs should be narrowed in the short run. In credit evaluation, the limit and duration of STBs should be equally applied to CP and credit ratings should be given based on such conditions. Additionally, varied information including the issue price and returns should be provided to investors to ensure that various aspects of short-term financing securities are reflected in the pricing process. As a long-term approach, it is worth considering replacing CP with STBs.

Ⅰ. 서론

한국은행은 경제주체 간에 단기자금 과부족을 조절하기 위하여 보통 만기 1년 이내의 단기금융상품이 거래되는 시장을 단기금융시장으로 정의하고 있다. 단기금융시장의 가장 대표적인 상품은 단기조달증권(기업어음, 전자단기채권)이다. 단기조달증권은 기업과 금융기관의 단기적인 자금 수요에 따라 발행하는 증권으로 발행과 관련한 규제가 적어 신속한 자금조달이 가능하고, 장기 채권에 비해 비용 측면의 이점이 있기 때문에 신용도 높은 기업이나 금융기관의 단기 자금조달 수단으로 널리 활용되고 있다. 그러나 단기조달증권은 금융시장 불안정성에 대한 민감도가 높고, 시장의 경색이 금융시장 전반에 영향을 미칠 수 있는 위험을 지닌 투자상품이기도 하다.

국내의 경우 1970년대 단기금융업법 제정을 통해 기업어음이 도입된 이래 다양한 제도 개선이 이루어졌다. 자본시장법 제정시 기업어음에 대한 규제를 대폭 완화하여 다양한 구조의 기업어음 발행이 가능한 제도를 마련하였다. 2012년에는 기업어음의 정보 투명성 제고를 위해 공시제도를 강화하였다. 이러한 제도 개선에도 불구하고 기업어음이 지닌 근본적인 문제가 해결되지 않음에 따라 2013년에는 기업어음을 대체할 전자단기사채 제도가 도입되었다.

제도와 시장환경 변화로 단기조달증권시장의 구조도 변화하였다. 기업어음은 단기 자금조달 수단 이외에 유동화나 회사채를 대체하는 조달 수단으로 활용 범위가 확대되었다. 전자단기사채 제도 도입 이후 전자단기사채가 차지하는 비중이 점진적으로 늘어났지만 기업어음과 전자단기사채의 규제와 활용도의 차이로 전자단기사채 비중은 여전히 낮은 상황이다. 최근에는 금리 상승과 금융시장 불확실성 증대에 따른 장기 채권에 대한 투자자 수요 위축으로 채권 발행 대신 장기 기업어음을 발행하는 기관이 늘어나고 있다. 이와 같은 기업어음의 장기화는 단기조달증권의 신용 스프레드 및 장단기 스프레드에 영향을 미치고 있다.

이에 본고에서는 단기조달증권시장의 제도 및 환경의 변화가 시장구조에 어떤 영향을 미쳤는지를 살펴본다. 또한 장기 기업어음의 발행 확대의 원인과 특성을 살피고 시장에 미친 영향을 검토한다. 이러한 분석에 근거하여 단기조달증권시장의 본원적인 기능 제고를 위한 시사점을 제시한다.

Ⅱ. 시장제도에 따른 단기조달증권의 특성 변화

1. 단기조달증권제도의 변화 추이

기업어음(Commercial Paper: CP)은 기업 및 금융기관의 탄력적인 자금조달을 지원하는 금융혁신 상품으로 도입되었다. 도입 초기 미국의 기업어음은 발행자의 자체 신용도로 자본시장에서 단기자금1)을 조달하고, 유동성 보강기관이 차환의 위험을 보완하여 탄력적인 자금조달 수단으로 각광을 받았다. 투자자들은 신용리스크가 낮고, 만기가 짧아 가격변동 리스크도 적은 기업어음을 주요한 단기 여유자금의 운용 대상으로 활용하였다. 그러나 글로벌 금융위기의 과정에서 유동화 기업어음의 부실화로 다양한 투자자가 손실을 입었고, 기업어음이 신용위험을 이전시킨 주범으로 지목되었다. 이에 따라 기업어음에 대한 규제가 강화되고 위험관리도 강화되었다. 최근에는 코로나19 사태로 기업의 신용위험이 높아지고 기업어음에 투자한 펀드 수탁고가 감소함에 따라, 기업어음 경색현상이 발생하였다. 이에 따라 미국 정부는 각종 지원 방안을 마련하여 단기 조달시장의 정상화를 도모하기도 하였다.

국내 기업어음은 1970년대 단기금융업법 제정을 통해 도입되었다. 제도 도입 이후 기업어음은 상장법인만이 발행 가능하고, 1년 이내 만기를 지니며, 최저액면 1억원 이상, 단기신용등급 B 이상의 기업만이 발행 가능한 제도로 운영되었다. 그러나 2009년 자본시장법 제정으로 기업어음에 대한 규제가 대폭 완화되었다. 기존의 발행주체, 만기, 최저액면, 신용등급의 요건을 모두 삭제하고 기업의 위탁으로 지급을 대행하는 은행이 교부한 어음용지(조폐공사용지)를 활용한 기업어음은 모두 금융투자상품(채무증권)에 포함시켜 다양한 구조의 기업어음 발행이 가능해지는 제도를 도입하였다. 이러한 제도 개선에 힘입어 다양한 구조의 기업어음이 도입되었으나, 다양한 유형의 상품 도입이 단기금융시장의 불안정성을 확대시키기도 하였다. 기업어음은 어음과 채권의 이중적인 성격을 지니고, 실물 발행으로 인해 분실과 위변조의 가능성이 있으며, 발행과 유통에 관한 정보가 부족하다는 문제가 존재하여 금융불안기에 다양한 문제2)를 발생시키기도 하였다.

기업어음의 낮은 정보투명성을 해결하기 위해 2012년에는 기업어음의 공시를 강화하는 정책이 추진되었다. 기업어음은 사모 방식으로 발행되어 신용도나 발행 조건 등에 대한 공시가 적절히 이루어지지 않았고 특히 발행자의 요청에 따라 신용평가기관이 신용등급을 공시하지 않는 소위 미공시 기업어음도 상당한 비중을 차지하였다. 이에 따라 2012년부터 신용등급을 받은 모든 기업어음은 공시를 의무화하였고, 만기 1년 이상의 기업어음에 대하여 증권신고서 제출 의무를 부과하는 규제가 도입되었다.

이러한 제도 개선에도 불구하고 기업어음이 지닌 근본적인 문제는 해결되지 않음에 따라 2013년에는 기업어음을 대체할 새로운 증권제도인 전자단기사채 제도가 도입3)되었다. 전자단기사채는 만기 1년 이내에 할인채 방식의 전자등록채권으로 정의되고 있다. 전자단기사채는 기업어음과 경제적 실질은 동일하지만 전자등록을 통해 발행ㆍ유통과 관련한 정보 투명성을 제고하고, 1년 이내 다양한 만기의 증권4) 발행이 가능하여 기업 및 금융기관의 효율적 자금조달을 지원할 목적으로 도입되었다. 그러나 전자단기사채 도입에도 불구하고 기존의 기업어음 제도는 그대로 유지되어 단기조달증권시장은 기업어음과 전자단기사채의 두 가지 유형의 상품으로 운영되었다. 2019년에는 「주식ㆍ사채 등의 전자등록에 관한 법률(이하 전자등록법)」이 제정되어 「전자단기사채의 발행과 유통에 관한 법률」은 폐지되는 대신 전자단기사채 관련 내용은 전자등록법에 통합되었다.

단기조달증권은 유동화 구조로 활용되기도 하였다. 유동화기업어음(ABCP)과 유동화전자단기사채(ABSTB)는 유동화법상 특례조항의 필요성이 크지 않은 채무자가 단일 채무자이거나 소수일 경우에 주로 활용되었다. 또한 발행비용 절감, 규제회피 및 발행절차 간소화 등의 이점을 활용할 목적으로 다양한 구조의 ABCP와 ABSTB가 발행되어 시장규모가 대폭 증가하였다.

2. 제도 변화에 따른 단기조달증권 시장구조의 변화

가. 단기조달증권 잔액 추이

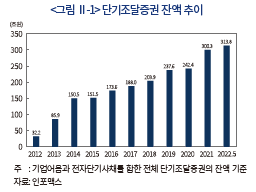

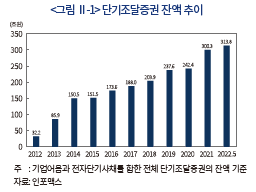

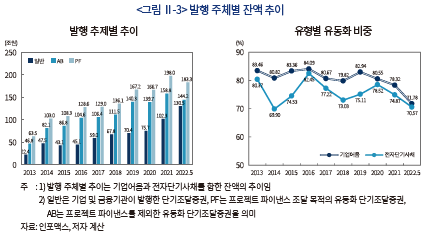

기업어음과 전자단기사채를 합한 단기조달증권 잔액은 2012년 32.2조원에서 매년 지속적으로 증가하여 2021년말에는 300.3조원을 기록하였다. 이와 같이 단기조달증권 잔액이 크게 증가한 것은 신용도 높은 기업 및 금융기관이 발행 편의성이 높은 단기조달증권을 통한 조달을 확대하였고, 최근에는 일부 여신전문금융기관이 기업어음을 장기 조달의 대체수단으로 활용하고 있기 때문이다. 특히 최근 회사채시장 경색에 대응하여 기업과 금융기관의 단기조달증권을 통한 조달을 확대함에 따라 2022년 5월말 현재 단기조달증권 잔액은 전년말 대비 4.5% 증가한 313.8조원을 기록하였다.

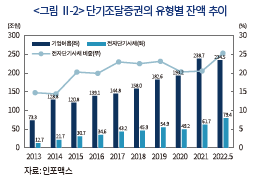

나. 단기조달증권 유형별 비중

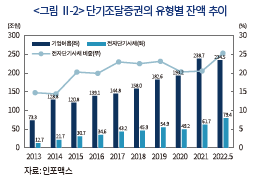

국내 단기조달증권시장은 기업어음과 전자단기사채의 두 가지 유형으로 구성되어 있다. 기업어음 잔액은 2013년 73.3조원에서 연도별로 변동을 보이는 가운데 증가하는 추세를 보여 2021년말에는 238.7조원으로 늘어났다. 그러나 2022년 들어서는 유동화기업어음 발행이 감소하여 전체 기업어음 잔액은 전년말 대비 소폭 감소하였다.

전자단기사채의 경우 도입 초기인 2013년에 잔액이 12.7조원을 기록한 이후 일부 기간을 제외하고 지속적인 증가세를 보여 2021년말에는 61.7조원, 2022년 5월말에는 79.4조원을 기록하였다. 이에 따라 단기조달증권시장에서 전자단기사채가 차지하는 비중도 다소 증가하고 있다.

기업어음이 지닌 법적, 경제적인 문제를 해결하기 위해 전자단기사채 제도를 도입하였음에도 현재까지도 기업어음은 여전히 높은 비중을 차지하고 있다. 이는 기업어음과 전자단기사채 간에 규제 차이가 존재하기 때문이다. 전자단기사채는 1년을 초과하여 발행하지 못한다.5) 증권신고서 제출에 있어서도 기업어음의 경우 만기 1년 미만의 기업어음에 대해 증권신고서 제출이 면제되는 반면 전자단기사채는 3개월 이하의 경우에만 증권신고서 제출을 면제6)받고 있다. 또한 일부 투자기관들은 투자 대상에 전자단기사채를 포함시키지 않아서 기업어음에 비해 투자자 저변이 제한되어 있다. 이와 같은 규제 차이는 전자단기사채가 기업어음을 대체하는 데에 제약 요인으로 작용하고 있다.

다. 단기조달증권의 발행 주체별 비중

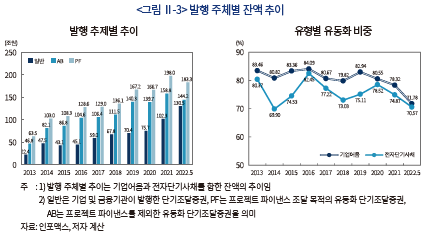

단기조달증권은 기업 및 금융기관의 단기 자금조달 수단 뿐만 아니라 유동화의 수단으로도 활용되고 있다. ABCP와 ABSTB는 프로젝트 파이낸스 유동화, 예금을 기초로 한 유동화 등에 주로 활용되고 있고 이외에도 신용파생상품 구조나 지적재산권에 기초한 유동화 등 다양한 구조를 도입한 유동화 수단으로 활용되었다. 프로젝트 파이낸스 유동화를 제외한 유동화 단기증권 잔액은 2013년 46.8조원에서 매년 증가세를 보여 2021년말에는 158.8조원으로 늘어났다. 그러나 2022년 5월말 잔액은 전년말 대비 감소하였다. 이는 최근 단기 유동화증권의 대부분을 차지하는 예금을 기초로 한 단기유동화와 프로젝트 파이낸스 단기유동화가 감소하고 있기 때문이다.

Ⅲ. 일반법인 단기조달증권의 특성 분석

1. 일반법인 유형별 비중 추이

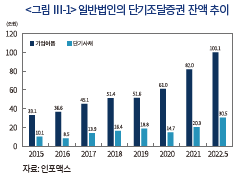

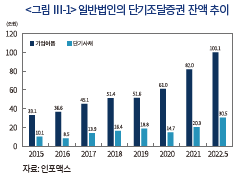

일반법인이 발행한 단기조달증권 잔액은 지속적으로 증가하는 추세를 보이고 있다. 일반법인의 단기조달증권 잔액은 2015년 43.2조원에서 매년 증가세를 보여 2021년말에는 102.3조원, 2022년 5월말에는 130.6조원을 기록하였다. 최근 일반법인의 단기조달증권 잔액이 증가한 것은 여신전문금융회사와 공사 등이 단기조달증권 발행을 확대한 데에 기인한다.

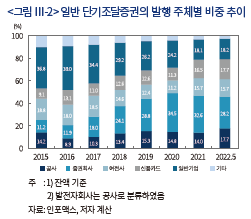

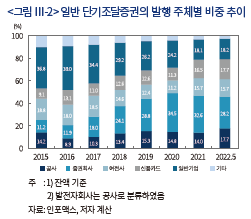

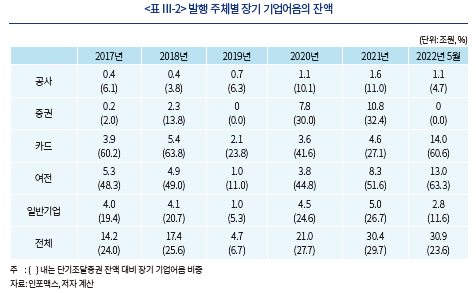

발행 주체별 잔액 추이를 보면 신용카드사와 공사의 비중이 증가하는 반면 일반기업의 비중은 감소하고 있다. 한편 여신전문금융회사와 증권회사는 기간에 따라 비중이 변화하는 추세를 보이고 있다.

증권회사는 단기조달증권시장에서 가장 높은 비중을 차지하고 있다. 이는 2015년부터 증권회사의 콜시장 참여를 제한하는 규제가 도입됨에 따라 증권회사의 단기 차입구조가 크게 변화하였기 때문이다. 증권회사는 단기자금 조달을 콜차입에서 환매조건부채권 매도나 단기조달증권으로 전환하였고, 다양한 만기의 단기조달증권 발행을 통해 탄력적인 자금조달을 하고 있다. 증권회사가 단기조달증권시장에서 차지하는 비중 추이를 보면 2020년까지 증가하다가 이후 감소하고 있다. 2020년 증권회사 비중이 대폭 증가한 것은 글로벌 주가 하락에 따라 자체 ELS 헤지거래를 한 대형 증권회사의 단기차입 수요가 크게 증가하였기 때문이다. 그러나 이후 주식시장이 안정화됨에 따라 증권회사의 단기 자금수요가 감소하여 단기조달증권시장에서 증권회사가 차지하는 비중은 점차 줄어들고 있다.

공사의 비중은 2016년 8.9%에서 2021년말에는 14.0%, 2022년 5월에는 17.7%로 늘어났다. 이는 한국전력이 대규모로 단기조달증권을 발행하였기 때문이다. 한국전력은 에너지 가격 상승에 따른 적자로 대규모 자금조달 수요가 발생하여 한전채와 단기조달증권의 발행을 크게 늘렸고 이러한 발행 증가가 공사의 비중을 증가시킨 주요 요인으로 작용하였다.

신용카드사는 2021~2022년에 걸쳐 비중이 증가하는 추세를 보이고 있다. 신용카드사를 제외한 여신전문금융회사의 비중은 2020년까지는 줄어드는 추세를 보였으나 2021년에는 증가하였다. 최근 들어 신용카드사를 포함한 여신전문금융회사의 단기조달증권 잔액이 증가하는 것은 단기 자금조달의 확대와 더불어 장기 기업어음 발행을 크게 늘렸기 때문이다. 코로나19 사태 이후 금리 상승에 따라 채권 발행 여건이 악화되고 있고, 이에 따라 기존의 채권 발행 대신 장기 기업어음 발행을 통한 조달을 크게 늘리고 있다.

한편 일반기업의 경우에는 연간 18~23조원 내외의 단기조달증권 잔액을 유지하고 있다. 단기조달증권은 단기신용등급 A3 이상의 신용도를 지닌 기업만이 참여할 수 있으며, 이에 따라 동 시장에 참여가 가능한 일반기업이 대기업으로 제한되어 있어 일정 수준의 잔액을 유지하고 있다. 그러나 전체 일반법인의 단기조달증권시장 잔액이 증가함에 따라 기업의 비중은 지속적으로 줄어들고 있다.

2. 단기조달증권 신용등급별 비중 추이

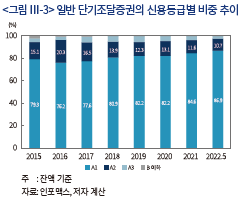

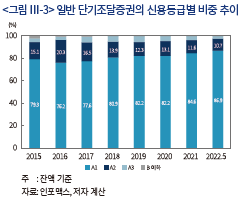

단기조달증권의 신용등급은 회사채 신용등급과 다른 A1, A2, A3, B, C, D의 기호를 사용하며, 등급의 정교성 제고를 위해 A2부터 B까지는 +또는 –의 기호를 부여한다. 단기등급은 기업의 펀더멘털과 더불어 유동성과 단기 채무 상환능력 등을 감안하여 결정되며, 단기등급과 장기등급 간에는 일정한 상관성을 지니고 있다. 일반적으로 AAA~A+의 장기 신용등급을 받은 기업 중 유동성이 높은 기업들이 A1등급으로 평가되고 있다. 한편 단기조달증권은 대부분 무보증으로 발행되기 때문에 투자자들은 적격 투자기준7)을 설정하여 주로 우량 기업이 발행한 단기조달증권에 투자한다.

일반법인 단기조달증권의 신용등급 분포를 보면 A1등급의 비중이 높게 나타나고 있다. A1등급의 비중은 2016년 76.2%에서 매년 지속적으로 증가하여 2022년 5월말에는 86.9%를 차지하고 있다. 이와 같이 A1등급의 비중이 높은 것은 투자자들이 높은 신용도의 단기조달증권에 한정하여 투자하는 기준을 도입하고 있기 때문이다. 단기조달증권의 주요 투자자인 MMF의 경우 상위 2개 등급에 투자를 할 수 있지만 고객들이 A1 이외 등급의 자산이 편입되는 것을 꺼리기 때문에 주로 A1등급을 위주로 투자가 이루어진다. 이와 같이 신용도가 높은 증권에 대한 투자자들의 선호로 인하여 상대적으로 낮은 신용도를 지닌 기업이나 금융기관들은 단기조달증권을 통한 원활한 단기자금 조달에 제약이 존재한다.

3. 일반법인 기업어음의 만기구조

가. 일반법인 기업어음 만기구조 현황

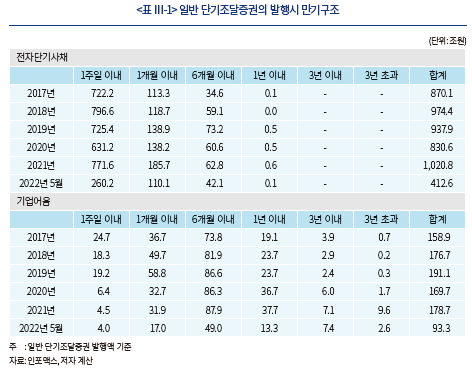

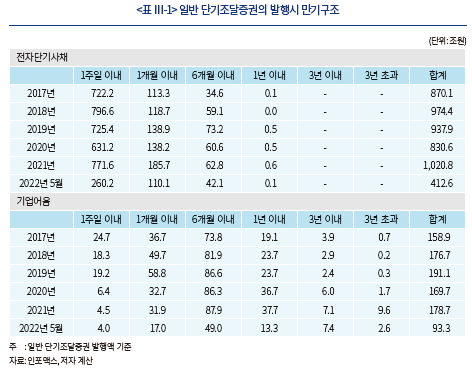

전자단기사채와 기업어음으로 구분하여 일반법인들의 단기조달증권의 만기별 발행 추이를 살펴본 결과는 <표 Ⅲ-1>과 같다. 전자단기사채와 기업어음의 만기별 발행 규모는 커다란 차이를 보이고 있다. 전자단기사채의 경우에는 1주일 이내의 비중이 가장 높고, 다음으로 1개월 이내의 비중이 높아 단기물 위주로 발행이 이루어지는 것으로 나타났다. 반면 기업어음의 경우에는 상대적으로 만기가 긴 증권의 비중이 높게 나타나고 있다. 연도별 기업어음 발행 중 1년을 초과하는 장기 기업어음의 비중은 2019년까지는 2% 미만으로 낮은 비중을 보였으나 2020년부터 증가하기 시작하여 2022년 중에는 전체 발행 기업어음 중 장기 기업어음이 차지하는 비중이 10.8%를 기록하고 있다.

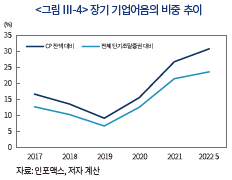

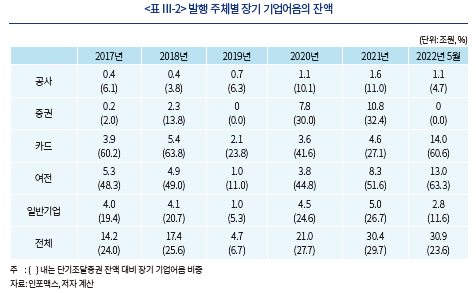

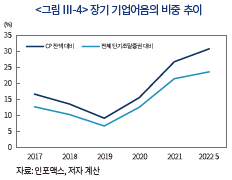

장기 기업어음 발행 확대에 따라 잔액도 늘어나고 있다. 장기 기업어음 잔액은 2017년 7.5조원에서 2019년 4.7조원으로 줄어들었으나 2021년말에는 22조원, 2022년 5월말에는 30.9조원으로 늘어났다. 전체 단기조달증권 잔액에서 장기 기업어음이 차지하는 비중은 2017년 12.7%에서 2019년에는 6.7%로 낮아졌으나 이후 그 비중이 지속적으로 증가하여 2022년 5월말에는 23.6%를 차지하고 있다. 이와 같이 장기 기업어음의 비중이 늘어나는 것은 일부 기업어음 발행하는 기업과 금융기관이 채권조달을 대신하여 장기 기업어음 발행을 크게 늘린 데에 기인한다.

발행 주체별 전체 단기조달증권 잔액에서 장기 기업어음이 차지하는 비중 추이를 보면 공사, 증권, 일반기업 부문은 감소하는 추세를 보인 반면 여신전문금융회사와 카드사는 증가하는 추세를 보이고 있다. 여신전문금융회사와 카드사들은 조달의 유연성을 제고하기 위해 2020년부터 장기 기업어음 발행을 확대하기 시작하였고, 2021년 들어 금리가 상승하고 채권시장의 수요가 감소함에 따라 장기 기업어음의 조달 비중이 더욱 늘어나고 있다. 특히 최근에는 일부 신용카드회사가 10년 만기 기업어음을 발행하기도 하였다. 이와 같이 여신전문금융회사와 카드사는 채권시장의 수요 여건 및 금리 상황 등에 따라 장기 기업어음을 여전채의 대체적인 수단으로 활용하고 있다.

증권회사의 경우 2020년과 2021년에는 1년 이상의 만기를 지닌 기업어음을 발행하였으나 최근 들어서는 장기 기업어음을 통한 조달을 하지 않는 것으로 나타났다. 일반기업의 경우에도 여신전문금융기관에 비해 비중은 높지 않지만 장기 기업어음을 통한 조달이 일부 이루어진 것으로 나타났다.

나. 기업어음 만기구조의 평가

최근 장기 기업어음 발행이 확대된 것은 금리 상승 기조로 채권시장의 수요 감소에 대응하여 장기 조달수단으로 기업어음을 활용한 데에 따른 것이다. 이와 더불어 채권을 통한 조달의 경우 수요예측 등과 같은 절차상의 번거로움이 존재하여 상대적으로 조달의 편의성이 높은 장기 기업어음 발행을 선택했을 가능성도 있다. 제도적인 측면에서 2009년 자본시장법 도입시 기업어음에 대한 만기 제한을 폐지한 것도 장기 기업어음 발행 확대의 한 요인으로 작용하였다. 한편 2012년에는 장기 기업어음의 확대를 방지하고 시장의 투명성을 제고하기 위해 만기 1년을 초과하는 기업어음에 대해 증권신고서 제출의무를 부과하였다. 동 제도의 도입으로 기업어음시장의 투명성을 제고하는 효과를 거두었지만 장기 기업어음 발행을 억제하는 효과는 미미한 것으로 나타났다.

장기 기업어음 발행 확대는 최근 금리 상승에 따른 신용채권시장의 경색에 대응한 탄력적인 조달전략이라고 보여진다. 기업어음의 경우 특정 금융기관과의 지속적인 거래관계를 기반으로 자금을 조달할 수 있고, 금리의 탄력성도 낮기 때문에 투자자 기반이 탄탄한 신용카드회사 등은 상대적으로 낮은 비용의 장기 자금조달 수단으로 장기 기업어음 발행을 확대한 것으로 판단된다. 또한 장기 기업어음을 통한 자금조달은 조달기관의 입장에서 단기조달증권의 차환 위험을 줄임으로써 단기자금시장의 변동성에 대응하는 전략으로 활용될 수도 있다.

그러나 장기 기업어음은 단기조달증권 기능 부조화를 포함한 다양한 문제를 야기할 가능성도 있다. 대부분의 국가에서는 자체적인 단기조달증권시장을 운영하고 있으며, 1년 이하의 만기의 전자등록 방식으로 기업어음8)을 정의하고 있다. 이와 같이 만기를 규제하는 것은 기업어음시장이 채권과 다른 특성을 지니고 있으며, 시장안정 및 규제 측면에서도 채권과 차별화할 필요가 있기 때문이다.

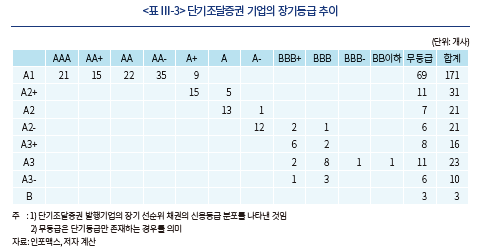

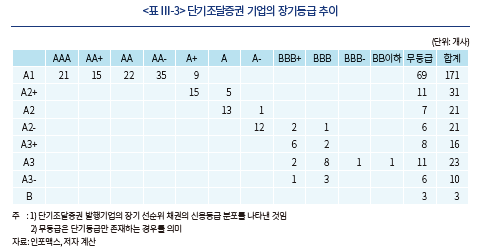

신용평가의 관점에서 기업어음은 1년 미만의 상환 가능성을 전제로 신용도가 결정되기 때문에 장기 기업어음은 신용등급의 정교성을 저하시키는 요인으로 작용할 가능성이 있다. <표 Ⅲ-3>은 2022년 5월말 현재 단기조달증권 잔액이 있는 기업의 장기등급 분포를 나타내고 있다. 이처럼 단기등급은 단기 지급능력을 나타내기 때문에 장기의 상환가능성과 개념적으로 차이가 있다. 한편 채권을 발행하지 않는 기업이나 금융기관은 장기등급을 보유하지 않아 장기 상환 가능성을 파악하기 어렵다. 이와 같이 단기등급에 근거하여 발행되는 장기 기업어음은 장기적인 상환 가능성 정보 제공에 있어 제약이 존재할 가능성이 있다.

기업어음의 주요 투자자는 은행, 증권사 랩어카운트 및 펀드 등이며, 단기조달증권으로 분류되어 투자가 이루어진다. 그런데 장기 기업어음의 경우 만기가 길고 유동성이 낮기 때문에 고객의 환매 요구에 적시적인 대응이 어렵고, 가격의 정교성도 낮을 가능성이 있다. 특히 금리가 크게 상승하거나 대규모 환매가 발생하는 경우 장기 기업어음은 대처가 어려워질 가능성이 있다.

또한 장기 기업어음의 과도한 확대는 신용채권시장에 영향을 미칠 가능성도 있다. 기업어음은 당사자 위주의 거래가 이루어지고 있고, 회사채의 수요예측과 같은 주요한 발행절차를 도입하지 않는다. 이러한 편의성으로 인해 기업이나 금융기관은 채권시장의 경색을 보이는 경우 장기 기업어음을 선택할 가능성이 높으며 이로 인하여 신용채권시장은 더욱 위축될 가능성이 있다.

Ⅳ. 단기조달증권 가격 특성 분석

1. 단기조달증권의 수익률 추이

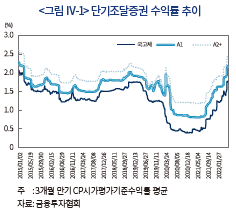

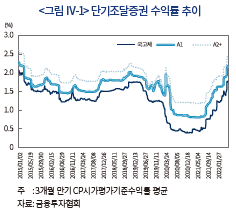

채권시가평가회사는 1년 이하의 A1, A2+ 등급의 단기조달증권만을 대상으로 유통수익률 정보를 제공하고 있다. 동 자료를 이용하여 단기조달증권의 수익률 추이를 살펴보면 일부 기간을 제외하고 단기조달증권 금리는 무위험 단기채권과 유사한 패턴을 나타내고 있다. 3개월 만기 A1등급의 단기조달증권 수익률은 2015년 초 2.2%를 기록한 이후 등락을 보이는 가운데 2019년 하반기에는 1.5% 수준으로 하락하였다. 그러나 코로나19 사태 발생 초기인 2020년 초 일시적으로 2%대까지 상승하였다. 이는 글로벌 주가 하락으로 인해 해외 ETF 헤지를 한 증권회사의 단기자금 조달 수요 확대에 따른 일시적인 단기조달증권시장 경색의 영향에 의한 것이다. 이후 시장은 안정세를 보여 2021년 8월 하순까지 단기조달증권의 금리는 1% 미만의 낮은 수준을 지속하였다. 그러나 2021년 10월 이후에는 단기조달증권의 금리가 지속적으로 상승하고 있다. 이는 최근 인플레이션 압력 증가, 기준금리 인상, 경기둔화 우려에 따른 신용위험 증가 가능성 등이 복합적으로 작용하였기 때문이다. 향후에도 대외적인 요인으로 금리 상승은 지속될 것으로 예상되며 이에 따라 단기조달증권 수익률은 더욱 상승할 가능성이 높다고 볼 수 있다.

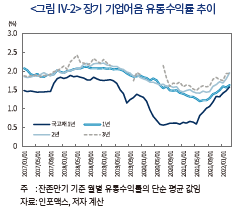

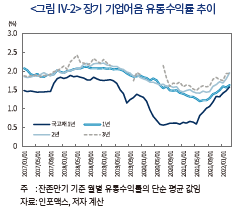

채권시가평가회사의 유통수익률 자료는 단기 상품에 대한 정보만을 제공하기 때문에 장기 기업어음의 유통금리를 파악할 수 없다. 이에 따라 본 분석에서는 개별 장기 기업어음의 거래정보를 이용하여 장기 기업어음의 수익률을 살펴본다. 인포맥스의 개별 기업어음 거래 자료를 이용하여 잔존기간을 기준으로 장기 기업어음의 유통수익률 평균 값을 구한 결과는 <그림 Ⅳ-2>와 같다.

장기 기업어음 유통수익률의 특성을 보면 국고채 금리의 변화 추이와는 다소 다른 패턴을 보이고 있다. 국고채 금리가 하락하는 시기에 장기 기업어음 유통수익률은 상대적으로 더딘 하락 폭을 나타내고 있고, 금리 상승기에도 일정한 시차를 두고 상승하고 있다. 이와 같은 결과는 장기 기업어음의 거래가 활발하지 않은 것이 주요 요인으로 작용하였기 때문이다. 특히 잔존기간 3년 기업어음의 경우에는 일부 기간에 거래가 이루어지지 않아 금리가 단절된 기간이 관찰되고 있다. 2020년 초에 1년 미만 만기의 단기조달증권 금리가 일시적으로 상승한 기간의 경우에도 거래가 크게 줄어들어 드는 대신 금리는 크게 상승하지 않는 모습을 보이고 있다. 이와 같이 장기 기업어음의 유통금리는 시장의 금리 변동과 다소 다른 모습을 보이고 있으며 이는 동 상품의 유동성이 크게 낮기 때문에 나타내는 특성으로 해석해 볼 수 있다.

2. 단기조달증권의 스프레드 분석

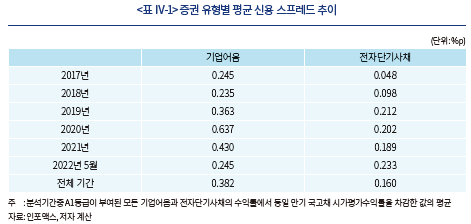

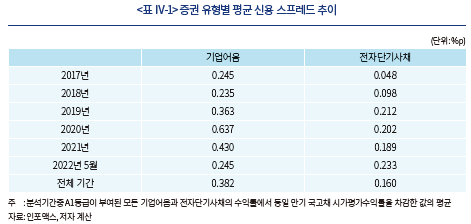

단기조달증권의 유형별 신용 스프레드의 차이가 존재하는가를 살펴보기 위해 A1등급의 기업어음과 전자단기사채의 모든 거래 수익률을 동일한 만기의 국고채 시가평균 수익률로 차감한 신용 스프레드를 산정하고 연도별로 이를 평균하였다. 유형별 신용 스프레드의 추이를 보면 전기간에 걸쳐 기업어음이 전자단기사채에 비해 큰 것으로 나타났다. 이는 전자단기사채가 기업어음에 비해 조달비용 측면에서 유리한 수단임을 보여주는 것이다.

이러한 차이가 발생한 주요 요인은 두 가지 측면으로 해석해 볼 수 있다. 첫 번째는 양 시장의 구조적인 차이가 가격에 반영되었다는 측면이다. 기업어음의 경우 1년을 초과한 증권 발행이 가능하고 다양한 목적의 자금조달 수단으로 활용되는데 반해 전자단기사채의 경우에는 주로 발행기관의 단기 자금조달 수단으로 활용되는 시장의 특성이 가격에 반영된 것으로 볼 수 있다.

다른 해석으로는 상대적으로 신용도가 높은 기관이 전자단기사채를 통해 자금을 조달했을 가능성이 높다는 측면이다. 일반적으로 A1등급은 회사채 신용등급 기준으로 4개 노치에 해당하는 기업으로 구성되어 있다. 상대적으로 신용도가 높은 발행기관의 경우 시장 상황의 변화에도 불구하고 기간별 자금 수요에 따라 장기자금은 회사채를 활용하고, 단기자금은 기업어음이나 전자단기사채를 고루 활용할 수 있다. 단기자금 조달 방식 중에 전자단기사채가 조달 효율성이 높다면 신용도 높은 발행기관은 기업어음보다는 전자단기사채를 통해 단기자금을 조달할 가능성이 높다.

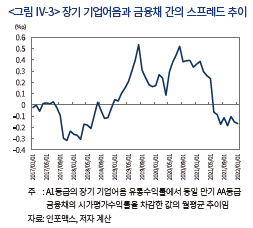

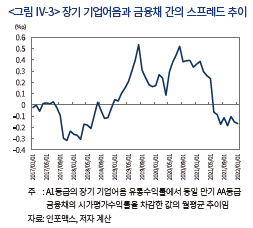

장기 기업어음이 비용 측면에서 채권 발행과 차이가 존재하는지를 살펴보기 위해 동일 조건(만기 및 신용도)의 금융채와의 스프레드 추이를 살펴보았다. <그림 Ⅳ-3>은 A1등급의 장기 기업어음 유통수익률을 잔존만기 기준으로 구분하여 거래일자의 동일 만기 AA등급 금융채 시가평가 수익률을 차감한 값의 월별 평균 추이를 나타낸 것이다.

장기 기업어음과 금융채의 스프레드 추이를 보면 2019년 4월부터 2021년 5월까지는 기업어음의 금리가 높은 것으로 나타난 반면 다른 기간에는 금융채의 금리가 높은 것으로 나타났다. 이와 같은 결과는 채권금리와 장기 기업어음 금리가 각기 다른 요인에 따라 변화하고 있음을 나타내는 것이다. 특히 2019년 하반기부터 2021년에 걸쳐 장기 기업어음의 발행이 확대됨에 따라 상대적으로 동 상품의 조달 금리가 상승하였고 이에 따라 장기 기업어음의 금리가 상승하는 모습을 나타내고 있다. 그럼에도 불구하고 무위험금리의 상승 및 채권시장의 조달 여건 악화 등으로 일부 기업 및 금융기관은 상대적으로 조달 편의성이 높은 장기 기업어음 발행을 통한 조달을 확대한 것으로 나타났다. 한편 최근 들어 스프레드가 크게 하락한 것은 기업어음의 거래가 둔화되어 시장 금리 변동을 반영하지 못한 결과로 해석해 볼 수 있다.

Ⅴ. 결론 및 시사점

국내 단기조달증권은 발행기관의 단기자금 과부족을 해결하는 수단으로 도입되었다. 그러나 규제와 시장환경 변화에 따라 유동화 수단이나 장기조달의 대체 수단으로 활용되는 등 상품 특성이 크게 변화하고 있다.

특히 장기 기업어음은 채권시장 경색기에 대체적인 자금조달의 기능을 일부 수행하고 있다. 그러나 장기 기업어음은 신용등급의 왜곡, 거래가격의 정교성 저하, 시장의 변동성이 증가하는 경우 낮은 유동성으로 인하여 이에 투자한 금융투자상품의 환매 제한 등의 문제가 발생할 가능성도 있다.

이에 따라 단기조달증권의 기능과 상품의 효율성을 제고시키는 방향에서의 시장구조를 개선할 필요가 있다. 우선 기업어음과 전자단기사채의 규제 차이를 줄이는 방안이 추진되어야 한다. 이를 위해서는 전자단기사채의 증권신고서 제출 의무 대상을 기업어음과 동일하게 바꾸고 단기사채의 발행 유연성도 제고시킬 필요가 있다.

국내 기업어음의 경우에는 법적 제약이 존재하는 상황에서 단기조달과 장기조달이 혼재하여 신용등급의 적정성이 저하되고 투자자의 혼동을 불러오는 문제를 발생시킬 가능성이 있다. 이에 따라 기업어음 신용평가의 경우 전자단기사채와 같이 발행 총한도와 기간을 설정하고 등급을 부여하는 방식의 도입을 검토해야 한다.

단기조달증권의 투명성 제고를 위한 방안도 마련되어야 한다. 현재 단기조달증권은 발행 수익률 정보를 제공하지 않고 있다. 이에 따라 투자자들은 다양한 유형의 단기조달증권의 가격을 검토하지 못하고 투자가 이루어지고 있으며, 이는 시장의 가격효율성을 낮추는 요인으로 작용할 가능성이 있다. 이에 따라 향후 발행가격 정보를 포함한 다양한 수익률 정보의 제공을 확대해야 한다.

장기적으로는 단기조달에 충실하고 법적인 제약도 없는 전자단기사채로의 통합을 추진할 필요가 있다. 기업어음이 지속되는 경우 사채와 어음의 중간적인 법적 지위와 전자 등록이 이루어지지 않음으로써 낮은 발행 효율의 문제를 근본적으로 해결할 수 없다. 이에 따라 일본의 사례와 같이 기업어음의 발행 비용을 높이는 방안도 검토해 볼 수 있다. 단기조달증권시장이 본연에 기능에 충실하도록 시장구조에 대한 근본적인 개선을 고민할 때이다.

1) 미국의 경우 투자적격등급 이상의 기업 및 금융기관만이 기업어음 발행이 가능하고 발행되는 기업어음의 만기는 270일 미만이다.

2) 카드사태, 건설사 PF ABCP 부실화 사태, 한진해운 사태 등이 대표적인 기업어음으로 인한 기업금융시장 변동성 확대 사례로 볼 수 있다.

3)「전자단기사채등의 발행 및 유통에 관한 법률」을 제정하여 전자단기사채 제도를 도입하였다.

4) 당일자 증권 발행을 통해 콜론을 대체할 수 있는 조달구조의 도입을 도모하였다.

5) 전자등록법 제59조에 의거하여 전자단기사채는 만기가 1년 이내로 제한되어 있다.

6) 자본시장법 시행령 제119조.

7) 일반적으로 투자자들은 상대적으로 신용도가 우수한 A1~A3를 적격 투자대상으로 정하고 있다.

8) 미국은 SEC의 No action letter에 근거하여 적격 CP를 만기 270일 이내로 제한하는 제도를 도입하고 있고, 일본은 단기사채제도 도입시 만기 1년 이내를 적격 단기사채로 정의하고 있으며, 프랑스의 경우에도 1년 이내 단기증권으로 CP를 정의하고 있다. 유럽의 자본시장 관련 표준 규범으로 활용되는 ICMA의 Primary Market Handbook은 유럽 CP의 만기를 1일 이상, 1년 미만으로 규정하고 있다.

9) 일본은 전자단기사채 제도 도입 이후 기업어음을 전자단기사채로 전환하기 위해 인지대 비용을 대폭 인상하였다.

참고문헌

기준하, 2019, 『전자단기사채 제도의 입법영향분석』, 국회입법조사처 입법영향분석보고서 제40호.

김필규, 2018, 전자단기사채시장의 특성분석과 활성화 과제, 자본시장연구원 『자본시장포커스』 2018-10.

김필규, 2020, 코로나19 사태가 자금조달시장에 미친 영향, 자본시장연구원 『자본시장포커스』 2020-08.

박동민ㆍ이항용, 2011, 전자단기사채 제도 도입을 통한 기업어음시장 개선에 관한 연구, 『한국증권학회지』 40(1).

백인석ㆍ황세운, 2016, 『전자단기사채 도입 효과 평가 및 향후 발전과제』, 자본시장연구원 조사보고서 16-04.

안영복, 2022, 장기 CP 어떻게 볼 것인가, NICE 신용평가 Special Report.

정광호, 2011, 미국 기업어음(CP)시장의 간략한 역사와 우리에게 주는 교훈, NICE 신용평가 Special Report.

허항진, 2009, 기업어음(CP)시장의 개편방안에 대한 법적 소고, 『증권법연구』 10(2).

Alworth, J.S., C.E.V. Borio, 1993, Commercial Paper Markets: A Survey, BIS Economic Papers, No.37.

ICMA, 2021, The European Commercial Paper and Certificates of Debt Market, A white paper by the ICMA Commercial Paper Committee.

한국은행은 경제주체 간에 단기자금 과부족을 조절하기 위하여 보통 만기 1년 이내의 단기금융상품이 거래되는 시장을 단기금융시장으로 정의하고 있다. 단기금융시장의 가장 대표적인 상품은 단기조달증권(기업어음, 전자단기채권)이다. 단기조달증권은 기업과 금융기관의 단기적인 자금 수요에 따라 발행하는 증권으로 발행과 관련한 규제가 적어 신속한 자금조달이 가능하고, 장기 채권에 비해 비용 측면의 이점이 있기 때문에 신용도 높은 기업이나 금융기관의 단기 자금조달 수단으로 널리 활용되고 있다. 그러나 단기조달증권은 금융시장 불안정성에 대한 민감도가 높고, 시장의 경색이 금융시장 전반에 영향을 미칠 수 있는 위험을 지닌 투자상품이기도 하다.

국내의 경우 1970년대 단기금융업법 제정을 통해 기업어음이 도입된 이래 다양한 제도 개선이 이루어졌다. 자본시장법 제정시 기업어음에 대한 규제를 대폭 완화하여 다양한 구조의 기업어음 발행이 가능한 제도를 마련하였다. 2012년에는 기업어음의 정보 투명성 제고를 위해 공시제도를 강화하였다. 이러한 제도 개선에도 불구하고 기업어음이 지닌 근본적인 문제가 해결되지 않음에 따라 2013년에는 기업어음을 대체할 전자단기사채 제도가 도입되었다.

제도와 시장환경 변화로 단기조달증권시장의 구조도 변화하였다. 기업어음은 단기 자금조달 수단 이외에 유동화나 회사채를 대체하는 조달 수단으로 활용 범위가 확대되었다. 전자단기사채 제도 도입 이후 전자단기사채가 차지하는 비중이 점진적으로 늘어났지만 기업어음과 전자단기사채의 규제와 활용도의 차이로 전자단기사채 비중은 여전히 낮은 상황이다. 최근에는 금리 상승과 금융시장 불확실성 증대에 따른 장기 채권에 대한 투자자 수요 위축으로 채권 발행 대신 장기 기업어음을 발행하는 기관이 늘어나고 있다. 이와 같은 기업어음의 장기화는 단기조달증권의 신용 스프레드 및 장단기 스프레드에 영향을 미치고 있다.

이에 본고에서는 단기조달증권시장의 제도 및 환경의 변화가 시장구조에 어떤 영향을 미쳤는지를 살펴본다. 또한 장기 기업어음의 발행 확대의 원인과 특성을 살피고 시장에 미친 영향을 검토한다. 이러한 분석에 근거하여 단기조달증권시장의 본원적인 기능 제고를 위한 시사점을 제시한다.

Ⅱ. 시장제도에 따른 단기조달증권의 특성 변화

1. 단기조달증권제도의 변화 추이

기업어음(Commercial Paper: CP)은 기업 및 금융기관의 탄력적인 자금조달을 지원하는 금융혁신 상품으로 도입되었다. 도입 초기 미국의 기업어음은 발행자의 자체 신용도로 자본시장에서 단기자금1)을 조달하고, 유동성 보강기관이 차환의 위험을 보완하여 탄력적인 자금조달 수단으로 각광을 받았다. 투자자들은 신용리스크가 낮고, 만기가 짧아 가격변동 리스크도 적은 기업어음을 주요한 단기 여유자금의 운용 대상으로 활용하였다. 그러나 글로벌 금융위기의 과정에서 유동화 기업어음의 부실화로 다양한 투자자가 손실을 입었고, 기업어음이 신용위험을 이전시킨 주범으로 지목되었다. 이에 따라 기업어음에 대한 규제가 강화되고 위험관리도 강화되었다. 최근에는 코로나19 사태로 기업의 신용위험이 높아지고 기업어음에 투자한 펀드 수탁고가 감소함에 따라, 기업어음 경색현상이 발생하였다. 이에 따라 미국 정부는 각종 지원 방안을 마련하여 단기 조달시장의 정상화를 도모하기도 하였다.

국내 기업어음은 1970년대 단기금융업법 제정을 통해 도입되었다. 제도 도입 이후 기업어음은 상장법인만이 발행 가능하고, 1년 이내 만기를 지니며, 최저액면 1억원 이상, 단기신용등급 B 이상의 기업만이 발행 가능한 제도로 운영되었다. 그러나 2009년 자본시장법 제정으로 기업어음에 대한 규제가 대폭 완화되었다. 기존의 발행주체, 만기, 최저액면, 신용등급의 요건을 모두 삭제하고 기업의 위탁으로 지급을 대행하는 은행이 교부한 어음용지(조폐공사용지)를 활용한 기업어음은 모두 금융투자상품(채무증권)에 포함시켜 다양한 구조의 기업어음 발행이 가능해지는 제도를 도입하였다. 이러한 제도 개선에 힘입어 다양한 구조의 기업어음이 도입되었으나, 다양한 유형의 상품 도입이 단기금융시장의 불안정성을 확대시키기도 하였다. 기업어음은 어음과 채권의 이중적인 성격을 지니고, 실물 발행으로 인해 분실과 위변조의 가능성이 있으며, 발행과 유통에 관한 정보가 부족하다는 문제가 존재하여 금융불안기에 다양한 문제2)를 발생시키기도 하였다.

기업어음의 낮은 정보투명성을 해결하기 위해 2012년에는 기업어음의 공시를 강화하는 정책이 추진되었다. 기업어음은 사모 방식으로 발행되어 신용도나 발행 조건 등에 대한 공시가 적절히 이루어지지 않았고 특히 발행자의 요청에 따라 신용평가기관이 신용등급을 공시하지 않는 소위 미공시 기업어음도 상당한 비중을 차지하였다. 이에 따라 2012년부터 신용등급을 받은 모든 기업어음은 공시를 의무화하였고, 만기 1년 이상의 기업어음에 대하여 증권신고서 제출 의무를 부과하는 규제가 도입되었다.

이러한 제도 개선에도 불구하고 기업어음이 지닌 근본적인 문제는 해결되지 않음에 따라 2013년에는 기업어음을 대체할 새로운 증권제도인 전자단기사채 제도가 도입3)되었다. 전자단기사채는 만기 1년 이내에 할인채 방식의 전자등록채권으로 정의되고 있다. 전자단기사채는 기업어음과 경제적 실질은 동일하지만 전자등록을 통해 발행ㆍ유통과 관련한 정보 투명성을 제고하고, 1년 이내 다양한 만기의 증권4) 발행이 가능하여 기업 및 금융기관의 효율적 자금조달을 지원할 목적으로 도입되었다. 그러나 전자단기사채 도입에도 불구하고 기존의 기업어음 제도는 그대로 유지되어 단기조달증권시장은 기업어음과 전자단기사채의 두 가지 유형의 상품으로 운영되었다. 2019년에는 「주식ㆍ사채 등의 전자등록에 관한 법률(이하 전자등록법)」이 제정되어 「전자단기사채의 발행과 유통에 관한 법률」은 폐지되는 대신 전자단기사채 관련 내용은 전자등록법에 통합되었다.

단기조달증권은 유동화 구조로 활용되기도 하였다. 유동화기업어음(ABCP)과 유동화전자단기사채(ABSTB)는 유동화법상 특례조항의 필요성이 크지 않은 채무자가 단일 채무자이거나 소수일 경우에 주로 활용되었다. 또한 발행비용 절감, 규제회피 및 발행절차 간소화 등의 이점을 활용할 목적으로 다양한 구조의 ABCP와 ABSTB가 발행되어 시장규모가 대폭 증가하였다.

2. 제도 변화에 따른 단기조달증권 시장구조의 변화

가. 단기조달증권 잔액 추이

기업어음과 전자단기사채를 합한 단기조달증권 잔액은 2012년 32.2조원에서 매년 지속적으로 증가하여 2021년말에는 300.3조원을 기록하였다. 이와 같이 단기조달증권 잔액이 크게 증가한 것은 신용도 높은 기업 및 금융기관이 발행 편의성이 높은 단기조달증권을 통한 조달을 확대하였고, 최근에는 일부 여신전문금융기관이 기업어음을 장기 조달의 대체수단으로 활용하고 있기 때문이다. 특히 최근 회사채시장 경색에 대응하여 기업과 금융기관의 단기조달증권을 통한 조달을 확대함에 따라 2022년 5월말 현재 단기조달증권 잔액은 전년말 대비 4.5% 증가한 313.8조원을 기록하였다.

국내 단기조달증권시장은 기업어음과 전자단기사채의 두 가지 유형으로 구성되어 있다. 기업어음 잔액은 2013년 73.3조원에서 연도별로 변동을 보이는 가운데 증가하는 추세를 보여 2021년말에는 238.7조원으로 늘어났다. 그러나 2022년 들어서는 유동화기업어음 발행이 감소하여 전체 기업어음 잔액은 전년말 대비 소폭 감소하였다.

전자단기사채의 경우 도입 초기인 2013년에 잔액이 12.7조원을 기록한 이후 일부 기간을 제외하고 지속적인 증가세를 보여 2021년말에는 61.7조원, 2022년 5월말에는 79.4조원을 기록하였다. 이에 따라 단기조달증권시장에서 전자단기사채가 차지하는 비중도 다소 증가하고 있다.

다. 단기조달증권의 발행 주체별 비중

단기조달증권은 기업 및 금융기관의 단기 자금조달 수단 뿐만 아니라 유동화의 수단으로도 활용되고 있다. ABCP와 ABSTB는 프로젝트 파이낸스 유동화, 예금을 기초로 한 유동화 등에 주로 활용되고 있고 이외에도 신용파생상품 구조나 지적재산권에 기초한 유동화 등 다양한 구조를 도입한 유동화 수단으로 활용되었다. 프로젝트 파이낸스 유동화를 제외한 유동화 단기증권 잔액은 2013년 46.8조원에서 매년 증가세를 보여 2021년말에는 158.8조원으로 늘어났다. 그러나 2022년 5월말 잔액은 전년말 대비 감소하였다. 이는 최근 단기 유동화증권의 대부분을 차지하는 예금을 기초로 한 단기유동화와 프로젝트 파이낸스 단기유동화가 감소하고 있기 때문이다.

1. 일반법인 유형별 비중 추이

일반법인이 발행한 단기조달증권 잔액은 지속적으로 증가하는 추세를 보이고 있다. 일반법인의 단기조달증권 잔액은 2015년 43.2조원에서 매년 증가세를 보여 2021년말에는 102.3조원, 2022년 5월말에는 130.6조원을 기록하였다. 최근 일반법인의 단기조달증권 잔액이 증가한 것은 여신전문금융회사와 공사 등이 단기조달증권 발행을 확대한 데에 기인한다.

증권회사는 단기조달증권시장에서 가장 높은 비중을 차지하고 있다. 이는 2015년부터 증권회사의 콜시장 참여를 제한하는 규제가 도입됨에 따라 증권회사의 단기 차입구조가 크게 변화하였기 때문이다. 증권회사는 단기자금 조달을 콜차입에서 환매조건부채권 매도나 단기조달증권으로 전환하였고, 다양한 만기의 단기조달증권 발행을 통해 탄력적인 자금조달을 하고 있다. 증권회사가 단기조달증권시장에서 차지하는 비중 추이를 보면 2020년까지 증가하다가 이후 감소하고 있다. 2020년 증권회사 비중이 대폭 증가한 것은 글로벌 주가 하락에 따라 자체 ELS 헤지거래를 한 대형 증권회사의 단기차입 수요가 크게 증가하였기 때문이다. 그러나 이후 주식시장이 안정화됨에 따라 증권회사의 단기 자금수요가 감소하여 단기조달증권시장에서 증권회사가 차지하는 비중은 점차 줄어들고 있다.

공사의 비중은 2016년 8.9%에서 2021년말에는 14.0%, 2022년 5월에는 17.7%로 늘어났다. 이는 한국전력이 대규모로 단기조달증권을 발행하였기 때문이다. 한국전력은 에너지 가격 상승에 따른 적자로 대규모 자금조달 수요가 발생하여 한전채와 단기조달증권의 발행을 크게 늘렸고 이러한 발행 증가가 공사의 비중을 증가시킨 주요 요인으로 작용하였다.

신용카드사는 2021~2022년에 걸쳐 비중이 증가하는 추세를 보이고 있다. 신용카드사를 제외한 여신전문금융회사의 비중은 2020년까지는 줄어드는 추세를 보였으나 2021년에는 증가하였다. 최근 들어 신용카드사를 포함한 여신전문금융회사의 단기조달증권 잔액이 증가하는 것은 단기 자금조달의 확대와 더불어 장기 기업어음 발행을 크게 늘렸기 때문이다. 코로나19 사태 이후 금리 상승에 따라 채권 발행 여건이 악화되고 있고, 이에 따라 기존의 채권 발행 대신 장기 기업어음 발행을 통한 조달을 크게 늘리고 있다.

2. 단기조달증권 신용등급별 비중 추이

단기조달증권의 신용등급은 회사채 신용등급과 다른 A1, A2, A3, B, C, D의 기호를 사용하며, 등급의 정교성 제고를 위해 A2부터 B까지는 +또는 –의 기호를 부여한다. 단기등급은 기업의 펀더멘털과 더불어 유동성과 단기 채무 상환능력 등을 감안하여 결정되며, 단기등급과 장기등급 간에는 일정한 상관성을 지니고 있다. 일반적으로 AAA~A+의 장기 신용등급을 받은 기업 중 유동성이 높은 기업들이 A1등급으로 평가되고 있다. 한편 단기조달증권은 대부분 무보증으로 발행되기 때문에 투자자들은 적격 투자기준7)을 설정하여 주로 우량 기업이 발행한 단기조달증권에 투자한다.

일반법인 단기조달증권의 신용등급 분포를 보면 A1등급의 비중이 높게 나타나고 있다. A1등급의 비중은 2016년 76.2%에서 매년 지속적으로 증가하여 2022년 5월말에는 86.9%를 차지하고 있다. 이와 같이 A1등급의 비중이 높은 것은 투자자들이 높은 신용도의 단기조달증권에 한정하여 투자하는 기준을 도입하고 있기 때문이다. 단기조달증권의 주요 투자자인 MMF의 경우 상위 2개 등급에 투자를 할 수 있지만 고객들이 A1 이외 등급의 자산이 편입되는 것을 꺼리기 때문에 주로 A1등급을 위주로 투자가 이루어진다. 이와 같이 신용도가 높은 증권에 대한 투자자들의 선호로 인하여 상대적으로 낮은 신용도를 지닌 기업이나 금융기관들은 단기조달증권을 통한 원활한 단기자금 조달에 제약이 존재한다.

가. 일반법인 기업어음 만기구조 현황

전자단기사채와 기업어음으로 구분하여 일반법인들의 단기조달증권의 만기별 발행 추이를 살펴본 결과는 <표 Ⅲ-1>과 같다. 전자단기사채와 기업어음의 만기별 발행 규모는 커다란 차이를 보이고 있다. 전자단기사채의 경우에는 1주일 이내의 비중이 가장 높고, 다음으로 1개월 이내의 비중이 높아 단기물 위주로 발행이 이루어지는 것으로 나타났다. 반면 기업어음의 경우에는 상대적으로 만기가 긴 증권의 비중이 높게 나타나고 있다. 연도별 기업어음 발행 중 1년을 초과하는 장기 기업어음의 비중은 2019년까지는 2% 미만으로 낮은 비중을 보였으나 2020년부터 증가하기 시작하여 2022년 중에는 전체 발행 기업어음 중 장기 기업어음이 차지하는 비중이 10.8%를 기록하고 있다.

증권회사의 경우 2020년과 2021년에는 1년 이상의 만기를 지닌 기업어음을 발행하였으나 최근 들어서는 장기 기업어음을 통한 조달을 하지 않는 것으로 나타났다. 일반기업의 경우에도 여신전문금융기관에 비해 비중은 높지 않지만 장기 기업어음을 통한 조달이 일부 이루어진 것으로 나타났다.

최근 장기 기업어음 발행이 확대된 것은 금리 상승 기조로 채권시장의 수요 감소에 대응하여 장기 조달수단으로 기업어음을 활용한 데에 따른 것이다. 이와 더불어 채권을 통한 조달의 경우 수요예측 등과 같은 절차상의 번거로움이 존재하여 상대적으로 조달의 편의성이 높은 장기 기업어음 발행을 선택했을 가능성도 있다. 제도적인 측면에서 2009년 자본시장법 도입시 기업어음에 대한 만기 제한을 폐지한 것도 장기 기업어음 발행 확대의 한 요인으로 작용하였다. 한편 2012년에는 장기 기업어음의 확대를 방지하고 시장의 투명성을 제고하기 위해 만기 1년을 초과하는 기업어음에 대해 증권신고서 제출의무를 부과하였다. 동 제도의 도입으로 기업어음시장의 투명성을 제고하는 효과를 거두었지만 장기 기업어음 발행을 억제하는 효과는 미미한 것으로 나타났다.

장기 기업어음 발행 확대는 최근 금리 상승에 따른 신용채권시장의 경색에 대응한 탄력적인 조달전략이라고 보여진다. 기업어음의 경우 특정 금융기관과의 지속적인 거래관계를 기반으로 자금을 조달할 수 있고, 금리의 탄력성도 낮기 때문에 투자자 기반이 탄탄한 신용카드회사 등은 상대적으로 낮은 비용의 장기 자금조달 수단으로 장기 기업어음 발행을 확대한 것으로 판단된다. 또한 장기 기업어음을 통한 자금조달은 조달기관의 입장에서 단기조달증권의 차환 위험을 줄임으로써 단기자금시장의 변동성에 대응하는 전략으로 활용될 수도 있다.

그러나 장기 기업어음은 단기조달증권 기능 부조화를 포함한 다양한 문제를 야기할 가능성도 있다. 대부분의 국가에서는 자체적인 단기조달증권시장을 운영하고 있으며, 1년 이하의 만기의 전자등록 방식으로 기업어음8)을 정의하고 있다. 이와 같이 만기를 규제하는 것은 기업어음시장이 채권과 다른 특성을 지니고 있으며, 시장안정 및 규제 측면에서도 채권과 차별화할 필요가 있기 때문이다.

신용평가의 관점에서 기업어음은 1년 미만의 상환 가능성을 전제로 신용도가 결정되기 때문에 장기 기업어음은 신용등급의 정교성을 저하시키는 요인으로 작용할 가능성이 있다. <표 Ⅲ-3>은 2022년 5월말 현재 단기조달증권 잔액이 있는 기업의 장기등급 분포를 나타내고 있다. 이처럼 단기등급은 단기 지급능력을 나타내기 때문에 장기의 상환가능성과 개념적으로 차이가 있다. 한편 채권을 발행하지 않는 기업이나 금융기관은 장기등급을 보유하지 않아 장기 상환 가능성을 파악하기 어렵다. 이와 같이 단기등급에 근거하여 발행되는 장기 기업어음은 장기적인 상환 가능성 정보 제공에 있어 제약이 존재할 가능성이 있다.

또한 장기 기업어음의 과도한 확대는 신용채권시장에 영향을 미칠 가능성도 있다. 기업어음은 당사자 위주의 거래가 이루어지고 있고, 회사채의 수요예측과 같은 주요한 발행절차를 도입하지 않는다. 이러한 편의성으로 인해 기업이나 금융기관은 채권시장의 경색을 보이는 경우 장기 기업어음을 선택할 가능성이 높으며 이로 인하여 신용채권시장은 더욱 위축될 가능성이 있다.

Ⅳ. 단기조달증권 가격 특성 분석

1. 단기조달증권의 수익률 추이

채권시가평가회사는 1년 이하의 A1, A2+ 등급의 단기조달증권만을 대상으로 유통수익률 정보를 제공하고 있다. 동 자료를 이용하여 단기조달증권의 수익률 추이를 살펴보면 일부 기간을 제외하고 단기조달증권 금리는 무위험 단기채권과 유사한 패턴을 나타내고 있다. 3개월 만기 A1등급의 단기조달증권 수익률은 2015년 초 2.2%를 기록한 이후 등락을 보이는 가운데 2019년 하반기에는 1.5% 수준으로 하락하였다. 그러나 코로나19 사태 발생 초기인 2020년 초 일시적으로 2%대까지 상승하였다. 이는 글로벌 주가 하락으로 인해 해외 ETF 헤지를 한 증권회사의 단기자금 조달 수요 확대에 따른 일시적인 단기조달증권시장 경색의 영향에 의한 것이다. 이후 시장은 안정세를 보여 2021년 8월 하순까지 단기조달증권의 금리는 1% 미만의 낮은 수준을 지속하였다. 그러나 2021년 10월 이후에는 단기조달증권의 금리가 지속적으로 상승하고 있다. 이는 최근 인플레이션 압력 증가, 기준금리 인상, 경기둔화 우려에 따른 신용위험 증가 가능성 등이 복합적으로 작용하였기 때문이다. 향후에도 대외적인 요인으로 금리 상승은 지속될 것으로 예상되며 이에 따라 단기조달증권 수익률은 더욱 상승할 가능성이 높다고 볼 수 있다.

장기 기업어음 유통수익률의 특성을 보면 국고채 금리의 변화 추이와는 다소 다른 패턴을 보이고 있다. 국고채 금리가 하락하는 시기에 장기 기업어음 유통수익률은 상대적으로 더딘 하락 폭을 나타내고 있고, 금리 상승기에도 일정한 시차를 두고 상승하고 있다. 이와 같은 결과는 장기 기업어음의 거래가 활발하지 않은 것이 주요 요인으로 작용하였기 때문이다. 특히 잔존기간 3년 기업어음의 경우에는 일부 기간에 거래가 이루어지지 않아 금리가 단절된 기간이 관찰되고 있다. 2020년 초에 1년 미만 만기의 단기조달증권 금리가 일시적으로 상승한 기간의 경우에도 거래가 크게 줄어들어 드는 대신 금리는 크게 상승하지 않는 모습을 보이고 있다. 이와 같이 장기 기업어음의 유통금리는 시장의 금리 변동과 다소 다른 모습을 보이고 있으며 이는 동 상품의 유동성이 크게 낮기 때문에 나타내는 특성으로 해석해 볼 수 있다.

단기조달증권의 유형별 신용 스프레드의 차이가 존재하는가를 살펴보기 위해 A1등급의 기업어음과 전자단기사채의 모든 거래 수익률을 동일한 만기의 국고채 시가평균 수익률로 차감한 신용 스프레드를 산정하고 연도별로 이를 평균하였다. 유형별 신용 스프레드의 추이를 보면 전기간에 걸쳐 기업어음이 전자단기사채에 비해 큰 것으로 나타났다. 이는 전자단기사채가 기업어음에 비해 조달비용 측면에서 유리한 수단임을 보여주는 것이다.

이러한 차이가 발생한 주요 요인은 두 가지 측면으로 해석해 볼 수 있다. 첫 번째는 양 시장의 구조적인 차이가 가격에 반영되었다는 측면이다. 기업어음의 경우 1년을 초과한 증권 발행이 가능하고 다양한 목적의 자금조달 수단으로 활용되는데 반해 전자단기사채의 경우에는 주로 발행기관의 단기 자금조달 수단으로 활용되는 시장의 특성이 가격에 반영된 것으로 볼 수 있다.

다른 해석으로는 상대적으로 신용도가 높은 기관이 전자단기사채를 통해 자금을 조달했을 가능성이 높다는 측면이다. 일반적으로 A1등급은 회사채 신용등급 기준으로 4개 노치에 해당하는 기업으로 구성되어 있다. 상대적으로 신용도가 높은 발행기관의 경우 시장 상황의 변화에도 불구하고 기간별 자금 수요에 따라 장기자금은 회사채를 활용하고, 단기자금은 기업어음이나 전자단기사채를 고루 활용할 수 있다. 단기자금 조달 방식 중에 전자단기사채가 조달 효율성이 높다면 신용도 높은 발행기관은 기업어음보다는 전자단기사채를 통해 단기자금을 조달할 가능성이 높다.

장기 기업어음과 금융채의 스프레드 추이를 보면 2019년 4월부터 2021년 5월까지는 기업어음의 금리가 높은 것으로 나타난 반면 다른 기간에는 금융채의 금리가 높은 것으로 나타났다. 이와 같은 결과는 채권금리와 장기 기업어음 금리가 각기 다른 요인에 따라 변화하고 있음을 나타내는 것이다. 특히 2019년 하반기부터 2021년에 걸쳐 장기 기업어음의 발행이 확대됨에 따라 상대적으로 동 상품의 조달 금리가 상승하였고 이에 따라 장기 기업어음의 금리가 상승하는 모습을 나타내고 있다. 그럼에도 불구하고 무위험금리의 상승 및 채권시장의 조달 여건 악화 등으로 일부 기업 및 금융기관은 상대적으로 조달 편의성이 높은 장기 기업어음 발행을 통한 조달을 확대한 것으로 나타났다. 한편 최근 들어 스프레드가 크게 하락한 것은 기업어음의 거래가 둔화되어 시장 금리 변동을 반영하지 못한 결과로 해석해 볼 수 있다.

국내 단기조달증권은 발행기관의 단기자금 과부족을 해결하는 수단으로 도입되었다. 그러나 규제와 시장환경 변화에 따라 유동화 수단이나 장기조달의 대체 수단으로 활용되는 등 상품 특성이 크게 변화하고 있다.

특히 장기 기업어음은 채권시장 경색기에 대체적인 자금조달의 기능을 일부 수행하고 있다. 그러나 장기 기업어음은 신용등급의 왜곡, 거래가격의 정교성 저하, 시장의 변동성이 증가하는 경우 낮은 유동성으로 인하여 이에 투자한 금융투자상품의 환매 제한 등의 문제가 발생할 가능성도 있다.

이에 따라 단기조달증권의 기능과 상품의 효율성을 제고시키는 방향에서의 시장구조를 개선할 필요가 있다. 우선 기업어음과 전자단기사채의 규제 차이를 줄이는 방안이 추진되어야 한다. 이를 위해서는 전자단기사채의 증권신고서 제출 의무 대상을 기업어음과 동일하게 바꾸고 단기사채의 발행 유연성도 제고시킬 필요가 있다.

국내 기업어음의 경우에는 법적 제약이 존재하는 상황에서 단기조달과 장기조달이 혼재하여 신용등급의 적정성이 저하되고 투자자의 혼동을 불러오는 문제를 발생시킬 가능성이 있다. 이에 따라 기업어음 신용평가의 경우 전자단기사채와 같이 발행 총한도와 기간을 설정하고 등급을 부여하는 방식의 도입을 검토해야 한다.

단기조달증권의 투명성 제고를 위한 방안도 마련되어야 한다. 현재 단기조달증권은 발행 수익률 정보를 제공하지 않고 있다. 이에 따라 투자자들은 다양한 유형의 단기조달증권의 가격을 검토하지 못하고 투자가 이루어지고 있으며, 이는 시장의 가격효율성을 낮추는 요인으로 작용할 가능성이 있다. 이에 따라 향후 발행가격 정보를 포함한 다양한 수익률 정보의 제공을 확대해야 한다.

장기적으로는 단기조달에 충실하고 법적인 제약도 없는 전자단기사채로의 통합을 추진할 필요가 있다. 기업어음이 지속되는 경우 사채와 어음의 중간적인 법적 지위와 전자 등록이 이루어지지 않음으로써 낮은 발행 효율의 문제를 근본적으로 해결할 수 없다. 이에 따라 일본의 사례와 같이 기업어음의 발행 비용을 높이는 방안도 검토해 볼 수 있다. 단기조달증권시장이 본연에 기능에 충실하도록 시장구조에 대한 근본적인 개선을 고민할 때이다.

1) 미국의 경우 투자적격등급 이상의 기업 및 금융기관만이 기업어음 발행이 가능하고 발행되는 기업어음의 만기는 270일 미만이다.

2) 카드사태, 건설사 PF ABCP 부실화 사태, 한진해운 사태 등이 대표적인 기업어음으로 인한 기업금융시장 변동성 확대 사례로 볼 수 있다.

3)「전자단기사채등의 발행 및 유통에 관한 법률」을 제정하여 전자단기사채 제도를 도입하였다.

4) 당일자 증권 발행을 통해 콜론을 대체할 수 있는 조달구조의 도입을 도모하였다.

5) 전자등록법 제59조에 의거하여 전자단기사채는 만기가 1년 이내로 제한되어 있다.

6) 자본시장법 시행령 제119조.

7) 일반적으로 투자자들은 상대적으로 신용도가 우수한 A1~A3를 적격 투자대상으로 정하고 있다.

8) 미국은 SEC의 No action letter에 근거하여 적격 CP를 만기 270일 이내로 제한하는 제도를 도입하고 있고, 일본은 단기사채제도 도입시 만기 1년 이내를 적격 단기사채로 정의하고 있으며, 프랑스의 경우에도 1년 이내 단기증권으로 CP를 정의하고 있다. 유럽의 자본시장 관련 표준 규범으로 활용되는 ICMA의 Primary Market Handbook은 유럽 CP의 만기를 1일 이상, 1년 미만으로 규정하고 있다.

9) 일본은 전자단기사채 제도 도입 이후 기업어음을 전자단기사채로 전환하기 위해 인지대 비용을 대폭 인상하였다.

참고문헌

기준하, 2019, 『전자단기사채 제도의 입법영향분석』, 국회입법조사처 입법영향분석보고서 제40호.

김필규, 2018, 전자단기사채시장의 특성분석과 활성화 과제, 자본시장연구원 『자본시장포커스』 2018-10.

김필규, 2020, 코로나19 사태가 자금조달시장에 미친 영향, 자본시장연구원 『자본시장포커스』 2020-08.

박동민ㆍ이항용, 2011, 전자단기사채 제도 도입을 통한 기업어음시장 개선에 관한 연구, 『한국증권학회지』 40(1).

백인석ㆍ황세운, 2016, 『전자단기사채 도입 효과 평가 및 향후 발전과제』, 자본시장연구원 조사보고서 16-04.

안영복, 2022, 장기 CP 어떻게 볼 것인가, NICE 신용평가 Special Report.

정광호, 2011, 미국 기업어음(CP)시장의 간략한 역사와 우리에게 주는 교훈, NICE 신용평가 Special Report.

허항진, 2009, 기업어음(CP)시장의 개편방안에 대한 법적 소고, 『증권법연구』 10(2).

Alworth, J.S., C.E.V. Borio, 1993, Commercial Paper Markets: A Survey, BIS Economic Papers, No.37.

ICMA, 2021, The European Commercial Paper and Certificates of Debt Market, A white paper by the ICMA Commercial Paper Committee.