Find out more about our latest publications

Discussion on Implementation of Mandatory Corporate Sustainability Reporting

Survey Papers 21-01 Dec. 22, 2021

- Research Topic Financial Services Industry

- Page 92

Listed companies that meet specific size criteria are obliged to disclose sustainability-related information, starting from 2025. This paper aims to provide a conceptual framework for discussing how the sustainability reporting is to be disclosed while at the same time introduce the current international discussions that are led by both the EU and the IFRS Foundation.

Sustainability reporting differs from traditional financial reporting in several key ways: For example, it has to deal explicitly with externalities firms cause and how they are incorporated back into the firm value over the short, medium and long-term period. In doing so, faced with a multitude of stakeholders, a firm also has to decide in a strategic manner which of those externalities are of material importance, setting priorities and action plans that can mitigate potential risks or enhance adaptability. This introduces a forward-looking and dynamic dimension to the decision-making process, which must be conveyed to the stakeholders through the sustainability disclosure.

The experience of the EU – three years of mandatory Non-Financial Reporting Directive (NFRD) - is introduced through the analysis of the progress assessment report and the proposed Corporate Sustainability Reporting Directive (CSRD). The proposed framework by the European Financial Reporting Advisory Group (EFRAG), with adherence to their principles, suggests three layers of reporting to promote comparability and relevance while covering three topics in the area of strategy, governance, and targets.

The newly created International Sustainability Standards Board (ISSB) under the IFRS Foundation is expected to review the prototype on the sustainability-related financial information disclosure standard suggested by the Technical Readiness Working Group (TRWG). The prototype aims to provide financial information related to sustainability issues faced by a firm, thereby making a distinction with the EFRAG framework, which upholds the double-materiality principle.

The international baseline framework for sustainability disclosure standard that the ISSB promotes is expected to be the basic anchoring framework that integrates financial information related to sustainability issues with the traditional financial statement. EU, which is the most significant economic block that adheres to the IFRS standard for its financial reporting, is expected to adopt the ISSB baseline framework. They share the Task Force on Climate-related Financial Disclosure (TCFD) and the Sustainability Accounting Standard Board (SASB) framework, and the principles applied are more or less the same as each other. However, the EU is likely to add additional standards that reflect their political agenda and ideology, which is already implemented through legislative acts such as EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR).

Implications of adopting the international baseline for domestic purposes are provided in the last chapter for domestic policy discussion and implementation.

Sustainability reporting differs from traditional financial reporting in several key ways: For example, it has to deal explicitly with externalities firms cause and how they are incorporated back into the firm value over the short, medium and long-term period. In doing so, faced with a multitude of stakeholders, a firm also has to decide in a strategic manner which of those externalities are of material importance, setting priorities and action plans that can mitigate potential risks or enhance adaptability. This introduces a forward-looking and dynamic dimension to the decision-making process, which must be conveyed to the stakeholders through the sustainability disclosure.

The experience of the EU – three years of mandatory Non-Financial Reporting Directive (NFRD) - is introduced through the analysis of the progress assessment report and the proposed Corporate Sustainability Reporting Directive (CSRD). The proposed framework by the European Financial Reporting Advisory Group (EFRAG), with adherence to their principles, suggests three layers of reporting to promote comparability and relevance while covering three topics in the area of strategy, governance, and targets.

The newly created International Sustainability Standards Board (ISSB) under the IFRS Foundation is expected to review the prototype on the sustainability-related financial information disclosure standard suggested by the Technical Readiness Working Group (TRWG). The prototype aims to provide financial information related to sustainability issues faced by a firm, thereby making a distinction with the EFRAG framework, which upholds the double-materiality principle.

The international baseline framework for sustainability disclosure standard that the ISSB promotes is expected to be the basic anchoring framework that integrates financial information related to sustainability issues with the traditional financial statement. EU, which is the most significant economic block that adheres to the IFRS standard for its financial reporting, is expected to adopt the ISSB baseline framework. They share the Task Force on Climate-related Financial Disclosure (TCFD) and the Sustainability Accounting Standard Board (SASB) framework, and the principles applied are more or less the same as each other. However, the EU is likely to add additional standards that reflect their political agenda and ideology, which is already implemented through legislative acts such as EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR).

Implications of adopting the international baseline for domestic purposes are provided in the last chapter for domestic policy discussion and implementation.

Ⅰ. 조사 배경

국내 유가증권 상장사 중 일정규모 이상인 기업은「지속가능경영보고서」를 2025년부터 의무적으로 공시할 예정이다.1) 현재는 한국거래소 자율공시2) 규정이 마련되어 있고 개별 기업은 공시 부담과 능력을 감안하여 자발적으로 지속가능경영보고서를 발행하고 있다. 이와 함께 2019년부터 자산 2조원 이상 유가증권시장 상장사는 의무적으로 「기업지배구조보고서」를 공시하고 있다.

지속가능경영보고서는 성격상 사업보고서와는 두 가지 측면에서 차이가 있다. 하나는 정보 공개 범위와 대상이 사업보고서보다 다양하다. 환경, 사회 및 지배구조 관련 의제에 대한 정보를 해당 부문의 이해관계자에게 중요도 관점에서 전달해야 한다. 기존 사업보고서는 재무 투자자가 주된 이해관계자인 반면에 지속가능경영보고서는 공익을 표방하는 민간단체, 일반 소비자, 공공부문 등으로 이해관계자의 범위가 확대된다. 다른 하나는 지속가능경영보고서가 사업보고서에 비해 기업 장기 성장에 대한 보다 포괄적인 내용을 담게 된다. 사업보고서는 단일 사업연도에 대하여 과거 정보를 바탕으로 서술되기 때문에 향후 지속적인 가치 창출 여부에 대한 정보가 부족하다. 지속가능경영보고서는 미래지향적(forward-looking) 관점에서 관련 이해관계자와 공유 가능한 지속가능 가치 창출 내용에 초점이 맞춰진다.3)

사업보고서상의 재무제표는 일반적으로 인정된 회계원칙에 따라서 표준화된 방법으로 작성된다. 각국마다 기업 경영 환경과 관련 법규가 상이하나 일반적으로 인정된 회계원칙을 공통으로 채택하고 있다. 국가 간 자본이동의 중요성이 부각되면서 회계정보의 국가 간 비교 가능성을 가능하게 하기 위해서 국제회계기준위원회(International Accounting Standards Board: IASB)가 제정한 국제회계기준(International Financial Reporting Standard: IFRS)을 사용하고 있다.4) 그러나 지속가능경영보고서는 회계기준에 준하는 공통된 작성 기준이 존재하고 있지 않아 국내 기업을 포함한 해외 기업들은 기존의 국제 이니셔티브5)를 개별 기업의 사정에 맞게 절충하여 사용하고 있다.6)

국제회계기준 재단은 지속가능성을 표방하는 투자 규모가 전 세계적으로 점증하고 있는 상황에서 정보의 투명성과 비교가능성 확보를 위해 국제 기준 제정의 필요성을 인식하고 국제지속가능기준위원회(International Sustainability Standards Board: ISSB)를 설립하였다.7) 유럽연합(European Union: EU)은 2014년에 연합 내 일정 조건을 충족하는 상장기업과 금융기관에 대해 비재무정보공시지침(Non-Financial Reporting Directive: NFRD)을 발효하여 2018년부터 적용하고 있다. 2017년에 정보 공개를 위한 가이드라인8)에서 보고기준 채택은 개별 기업의 특성과 경영 환경에 따라 자율적으로 채택하도록 했다. 미국의 경우 지금까지는 Form 10-K 연차보고서에서 비재무정보를 중요성 관점에서 자율적으로 기술하도록 하고 있다. 현재는 증권거래위원회(Securities and Exchange Commission: SEC)가 기후변화에 한정하여 공시를 의무화하는 법 개정을 준비하면서 단일 보고기준 채택의 타당성 여부를 검토하고 있다. 국내에서는 한국거래소가 제공한 정보공개 가이던스9)에서 국제 이니셔티브 채택에 관한 권고안을 제공하고 있다.

본 보고서는 2025년부터 단계적으로 적용되는 지속가능경영보고서 의무화 일정에 앞서 제도 정비 논의에 도움이 되는 개념 소개와 국제 기준 제정의 실무 작업 동향을 조사하는 것을 목적으로 한다.

기업 정보 공시와 기준 마련에 관한 사안은 회계, 재무, 경제, 경영학에서 다년간에 걸쳐 연구가 진행되어 왔다. 정보의 실질적 중요성(materiality) 파악, 정보 공개의 유인체계, 기업가치와의 관계, 경영진의 행동 변화 등에 관한 사안이 주된 연구 주제이다.

따라서 일차적으로는 사안 조사를 위한 개념체계를 과거 연구에 의거하여 마련해본다. 여기서 기존의 재무공시와 지속가능공시의 차이점에 방점을 두어 향후 지속가능공시 체계를 마련하기 위해 고려해야 할 사안이 무엇인지를 파악해 본다. 아울러 보다 깊이 있는 논의를 위해 실증 분석 국내 환경 관련 정보 공시의 유인 체계를 실증 분석을 통해 파악하여 본다.

이차적으로는 유럽연합의 경험을 바탕으로 지속가능 공시 실행에 있어서 고려되어야 할 점이 무엇인지를 파악해 본다. 유럽 NFRD 시행 3년 전후의 경험을 참조하여 지속가능 의무공시 시행을 앞둔 기업과 정책당국이 참고할 수 있는 자료를 조사한다.

마지막으로는 최근 마련된 IFRS 지속가능성 공시기준의 시안(prototype)과 EFRAG (European Financial Reporting Advisory Group)의 자문 보고서를 통해 구체화되어 가는 국제 표준 기준안의 내용을 조사하여 소개한다.

Ⅱ. 지속가능보고의 개념적 특성

1. 개요

Christensen et al.(2021a)에서는 지속가능보고10)를 “지속가능 활동, 위험, 정책을 포함한 관련 주제들에 대해서 정보의 측정, 공시 및 소통”으로 정의하고 있다.11) 반면에 실무적 관점에서 국제 이니셔티브를 이끌고 있는 SASB(Sustainability Accounting Standard Board)는 개념 체계에서 지속가능성(sustainability)을 “기업이 장기적으로 기업 가치를 창출할 수 있는 능력을 유지하거나 제고시키는 행위”로 정의하여 규범적 관점보다는 가치 창출에 무게를 두고 있기 때문에 지속가능보고 행위를 그 연속선상으로 간주하고 있다.

본 보고서에서는 기업의 지속가능 활동은 기존의 사회적 책임이라는 규범적 성격의 의미보다는 기업이 직간접으로 영향을 주고받는 모든 이해관계자와의 역동적 상호작용 결과로 발생하는 위험과 기회요인을 인식하고 이를 선행적으로 관리하거나 활용하여 기업가치를 보존하거나 지속적으로 창출하는 행위로 인식한다. 따라서 지속가능보고라 함은 기업의 지속가능 활동과 관련된 정보를 측정하고 공개하는 것을 의미한다.

지속가능보고 기준은 이러한 정보를 어떤 방식으로 분류12)하고 측정할 것인가를 판단하는 근거를 제공하는 잣대이다. 따라서 보고의 기준이 마련되어 있지 않거나 기업마다 채택하는 기준이 다를 경우 이해관계자 입장에서는 정보의 유용성과 비교가능성은 현저하게 낮아질 수 있다.13)

회계기준에 의한 의무공시의 편익은 표준화된 정보 제공에 따른 정보 투명성 향상과 비교가능성에 있다. 긍정적인 외부효과가 있는 셈이다. Foster(1980)는 시계 차원(time dimension)에서 외부효과가 발생할 수 있음을 밝히고 있다. 예를 들어 동일한 위험 요소를 갖고 있는 기업들이 각자의 편의에 따라 불규칙한 시점에 자료를 공개할 경우 투자자는 정보의 적시성 측면에서 투자 의사 결정에 어려움을 겪을 것이다. 정보 공개 시점을 통일시켜 준다면 비교가능성을 높일 수 있다.14)

자발적 공시 환경에서는 개별 기업이 공시 표준화의 외부효과로 증가하는 사회 후생적 측면을 고려하지 않기 때문에 사회 전체적으로 기준 마련을 위한 노력이 부족할 것이다. 강제 규정에 의한 기준 채택과 표준화된 보고를 정당화하는 정책 논의에서 상술한 논거가 가장 대표적으로 인용되고 있고, 실제로 이를 실증하려는 연구가 진행되어 왔다.15)

지속가능보고 기준의 범주에는 공개 매체도 포함된다. 기존 사업보고서에 포함할지, 별도의 보고서로 작성하는지 아니면 재무 정보와 지속가능 정보를 일관성 있는 체계하에 통합 보고(integrated reporting)를 해야 하는지의 논의가 포함된다.16)

그러나 지속가능 활동의 대상인 이해관계자는 기업이 속한 산업분류 상의 업종에 따라 다르고 더 나아가 사안에 따라 지속가능 주제의 중요성은 개별 기업마다 다를 수 있다. 이런 점을 감안할 때 지속가능보고 기준에 대한 가이드라인을 마련할 때 기업 간 일관된 비교를 위해 전 업종에 걸쳐 적용할 수 있는 표준적인 부분과 개별 기업의 특성을 반영할 수 있는 부분이 절충적으로 적용되는 현실을 반영하는 것을 고려해 볼 수 있다.17)

따라서 향후 의무공시를 앞두고 가이던스 혹은 규정 보완에 있어서 지속가능보고가 기존의 재무보고와 어떻게 다른지를 이해하는 것이 중요하다.

2. 재무보고와 구분되는 특징

지속가능보고와 관련된 제도적 논의를 할 때, 기존 재무정보 보고와 구분되는 특징을 인지하는 것이 중요하다. 이들 특징은 지속가능보고의 기준 제정과 적용의 긍정적인 효과를 구현하기 어렵게 하는 요인이기 때문에 향후 추가적인 논의와 연구가 필요한 부분이다.

가. 외부효과와 중요성(materiality)의 판단

기업 정보의 중요성은 일반적으로 재무적 관점에서 논의되어 왔고 주 이해관계자는 투자자이다. 기업이 발행하는 사업보고서상의 재무정보는 일차적으로 감사인의 회계감사를 거쳐 투자자에게 전달된다. 주로 회계정보의 중요성(materiality)관점에서 정보의 누락 혹은 왜곡표시 정도를 감사하는데, 중요성은 회계정보가 투자자 의사결정에 영향을 미치는가의 여부에 따라 결정된다.

자본시장법상의 ‘중요사항’은 제47조 제3항에서 투자자의 합리적인 투자판단 또는 해당 금융투자상품의 가치에 중대한 영향을 미칠 수 있는 사항으로 규정하였다.18) 국내 대법원의 판결에서도 자본시장법상의 ‘중요사항’의 의미를 합리적인 투자자가 금융투자상품과 관련된 투자판단이나 의사결정을 할 때에 중요하게 고려할 상당한 개연성이 있는 사항으로 보고 있다.19)

이해관계자를 재무적 투자자로 국한할 경우, 중요성의 요체는 합리적 투자 의사결정을 할 때 영향을 미치는 사안이다. 이를 지속가능 관점에서 고려하면 두 가지 요소를 고려해야 한다. 하나는 외부효과(externality)의 존재다. 기업 활동 결과로 이해관계자에게 돌아가는 영향이다. 대표적인 것이 지구온난화로 인한 피해 발생 문제다. 다른 하나는 외부효과로 발생하는 사회적 비용을 결국 기업이 부담할 수 있다는 점이다.20) 탄소중립 정책으로 인하여 저감 장치의 설치 혹은 탄소배출권 매입으로 운용비용이 발생하여 기업 수익이 영향을 받는다는 점이다. 지속가능보고를 중요성 관점에서 어떤 주제를 선별하여 보고하는가는 외부효과의 내부화 비용 크기에 달려있다.

비재무보고서 공시를 먼저 의무화한 유럽의 경우는 이중 중요성(double materiality) 원칙21)하에 외부효과와 내부화되는 부분을 동시에 고려할 것을 요구하고 있으나, 미국의 경우는 비재무정보는 기존 공시 규제인 Regulation S-K 범주 내에서 재무적 중요성 관점에 따라 기술하도록 하고 있다. 유럽의 이중 중요성 원칙은 European Commission(2017) NFRD 시행 가이드라인에서 처음 언급되었다.

따라서 지속가능보고의 작성 과정에서 중요성 수준의 설정 기준을 기존 회계감사기준에 준하는 수준으로 마련할 수 있을지가 중요하다. 중요성 수준은 정보이용자의 경제적 의사결정에 영향을 미치지 않을 것으로 예상되는 오류의 허용 한도를 의미하는데 기존 재무정보의 경우 계속영업이익 혹은 총매출 대비 상대적 크기 등으로 설정할 수 있지만 지속가능경영보고서상의 중요성 판단은 많은 부분 기준금액의 설정이 불가능할 수 있다. 이에 따라 외부효과 존재 시 중요성 판단은 기업의 재량에 좌우될 가능성이 높다.

나. 이해관계자 다양성

2012년 미국 의회는 아프리카 분쟁 지역에서 채굴되는 광물(conflict mineral)로부터 발생하는 수입이 불법 무장단체의 이익과 직결되는 것을 막기 위하여 미국 기업 중 분쟁광물 채굴과 판매 전 과정에 관련이 있는 기업은 법정공시에 내용을 포함하도록 하는 법안을 발의하였다. 이를 위해 미국 증권거래위원회는 법 개정에 대한 의견을 수렴하였고 700건이 넘는 서한을 접수하였다. 이 가운데 62%는 일반인과 민간단체 그리고 나머지 38%는 기업, 관련 협회, 금융기관, 회계법인으로부터 접수한 의견이었다. 전자의 경우는 분쟁국을 실질적으로 지원하는 상행위는 바람직하지 않다는 사회적 의제를 지지하는 내용을 담고 있고, 후자의 경우는 공시를 위한 내역 확인과 공증과 관련한 비용의 증가를 우려하였다.

이와 같이 기업이 직간접적으로 영향을 받는 이해관계자는 정치인과 일반인 그리고 민간단체까지 다양함을 보여주고 있다. 이들이 법정공시 내용을 파악하여 분쟁 광물과 연관된 기업들에 대한 불매 운동을 벌이거나, 정치권에서 입법화를 통해 규제를 발의할 경우에는 기업 입장에서는 중요성이 커진다.

그러나 지속가능 의제 또한 기업의 특색에 따라 상이하며 이해관계자의 선호에 따라 바뀔 수 있다. 예를 들어 대기업 집단의 경영 승계나, 플랫폼을 장악한 기업의 독과점식 행위에 대한 여론의 향방에 따라 정치권의 입법 활동이 영향을 받고, 궁극적으로 관련 기업이 사회적 비용을 내부화하게 된다. 이 경우 지속가능요소는 다양성과 시의적 가변성을 갖게 된다. 정적인 개념보다는 동적(dynamic) 중요성을 갖는다.

기업은 이 부분에 대하여 전략적 관점에서 지속가능보고를 통해 해당 이해관계자를 파악하고 관련 지속가능요소에 대하여 소통하려는 유인을 갖게 된다. 즉 지속가능경영보고서를 매체로 하여 신호 효과(signaling effect)를 발휘하려 할 것이다.

다. 미래 지향성

기업과 연관된 이해관계자와 소통하는 과정에서 기업은 단기 이익을 유보하고 지속가능한 장기 이익을 추구하는 전략적 판단을 할 수 있다. 직원의 복지와 교육에 투자를 늘려 양질의 인적자원(human capital)을 확보하려는 노력, 인권에 대한 높아진 사회적 인식을 제품 생산 전 과정에 반영하기 위해 협력사 선정 기준에 비용 외적 기준을 적용하는 사례를 들 수 있다. 일종의 투자를 통한 사회적 무형자산을 구축하려는 장기 전략으로 파악할 수 있다. 그러나 이러한 무형자산은 회계 처리상 무형자산의 요건22)을 충족하기 어렵기 때문에 사업보고서상으로는 비용으로 인식된다. 따라서 이를 장기적 효익으로 인식하기 위해서는 구축하는 사회적 무형자산의 전략적 중요성에 대한 인식이 기업 내부와 외부에 공유되어야 하고, 지속가능보고가 그 기능을 수행할 수 있다.

또한 지속가능보고는 미래 예견되는 위험요인에 대한 기업의 인식과 대응 능력을 보여준다. 식별되는 미래 요인 위험에 대하여 지배구조상의 역할과 책임 부여, 역할 수행 절차 전 과정에 대한 설명, 수행 결과에 대한 지표 측정을 통해 기업가치 보전 내지는 증진을 도모할 수 있다.

이와 같이 전략적 관점에서는 과거 지향적이고 정적인 사업보고서에 비해 지속가능경영보고서의 가치는 상당히 높을 수 있으며, 단기 이익을 추구하는 주주와 기타 이해관계자와의 간극을 좁히는 역할을 할 수도 있다.

그러나 미래 지향 정보가 많고 낙관적일수록 소송으로 인한 피해 가능성이 높을 수 있기 때문에 정보 공개를 적극적으로 유도할 법적 장치 마련이 필요하다.23) Johnson et al.(2001)은 미국의 증권집단소송제도의 남발로 인한 불필요한 사회적 비용을 제한하고자 1995년에 도입한 증권민사소송개혁법 시행 이후에 523개의 정보통신 및 제약 관련 기업들의 미래 지향 정보 공개24)가 증가하였음을 밝히고 있다.

비슷한 맥락에서 최근 미국의 증권거래위원회가 기후 관련 공시 의무화를 추진하면서 접수한 공개 의견 청취 내용을 살펴보는 것도 의미가 있다. 내용 중에 Alphabet을 비롯한 7개사25)는 기후변화 관련 정보는 불확실성을 내포한 가정과 추정에 의존하기 때문에 관련 정보를 연차보고서 Form 10-K보다는 별도 보고서로 제출하여 과도한 책임을 피하는 것이 바람직하다는 의견을 제출하였다. 미국 상공회의소(Chamber of Commerce)와 전국제조업협회(National Association of Manufacturers)도 마찬가지로 잘못된 정보 제공에 따른 소송의 위험 부담을 완화하여 정보 공개를 적극적으로 유도하기 위해서는 지속가능 정보 공개에 대한 면책 조항의 도입이 필요하다는 의견을 밝히고 있다.

미래정보의 전략적 중요성을 감안할 경우 이와 관련된 지속가능 정보를 적극적으로 공개할 수 있도록 하는 법적 보완 장치 마련도 중요하다.26)

라. 이니셔티브의 다양성과 기업의 재량권

지속가능경영보고서를 작성하는 기준을 제시하는 이니셔티브를 살펴보면 대부분 지속가능 행위 유형을 대분류로 구분하고 각 분류별 세부 주제와 해당 주제의 이행 여부를 측정하는 성과지표로 이루어져 있다.27) 그러나 이니셔티브마다 이해관계자에 대한 세부 유형과 주제가 다르다.28)

지속가능 의무공시의 규율 틀은 원칙 중심하에 설명 내지는 준수 의무로 시행될 가능성이 높다. 이 경우, 중요성 판단에 있어 기업의 재량권이 중요할 수 있다. 재량권은 기업으로 하여금 고유의 정보를 선별하여 제공한다는 긍정적인 효과가 있지만, 반대로 부정적 요인을 최소화하기 위한 선택적 보고나 상용구(boilerplate language)의 활용으로 위장된 친환경(greenwashing) 내용을 전달하는 부정적 측면도 있다.29)

이런 관점에서 통일된 이니셔티브를 확정하여 적용할 경우 기업 입장에서는 선택적 보고의 재량이 줄어들어 보고의 임의성을 제어한다는 의미가 있을 수 있다. 공시의 사회적 후생 중 하나는 정보 투명성과 비교가능성이기 때문에 정확한 비교를 위해 일관된 잣대가 필요하고, 어떠한 이니셔티브를 채택하는가는 중요한 논의 사항이다.

3. 자본시장 규율 체계 관점

정보 공시 행위는 제공 기업의 유인체계에 따라 내생적으로 결정될 수 있다. 경쟁 관계에 있는 기업들이 공시 행위의 비용과 편익에 따라 전략적으로 정보 공개의 범위와 깊이를 결정하기 때문이다.30)

자본시장 참가자 관점에서는 정보 공시의 일차적 효과는 정보 제공자와 이용자 간의 정보 비대칭 문제를 해결하여 역선택과 도덕적 해이를 방지하는 데 있다. 이를 통한 가격 발견은 유통시장의 유동성을 증가시켜 거래비용과 불확실성을 감소시키고 자본시장 참가자 간 위험 분담을 활성화한다. 궁극적으로 투자 기대 수익은 위험 프리미엄의 감소로 낮아질 수 있으며 기업은 자본 조달 비용 감소로 효익을 향유할 수 있다.

실제로 기업이 비용과 편익 관점에서 공시를 결정하는지를 실증하는 것은 쉽지 않다. 실험을 위한 통제 그룹을 설정하기 어렵기 때문이다. 그러나 간접적으로 유추해 볼 수 있는 사례는 미국 장외시장인 OTCBB(Over-The-Counter Bulletin Board)의 예를 살펴볼 수 있다. 감독당국은 OTCBB 상장기업의 정보 투명성을 강화하기 위해 의무공시 제도를 도입하였다. 기업은 공시 부담을 피해 공시 요건이 없는 Pink Sheets 장외시장으로 옮길 수 있는 선택권이 있기 때문에 OTCBB에 잔류한 기업가치 변화 여부를 통해 공시의 결정 요인을 유추해 볼 수 있다. Bushee & Leuz(2005)는 OTCBB 상장 유지를 결정한 기업의 경우 유동성이 증가하고 주가가 상승하였음을 실증했다.31)

미국은 기존 연차보고서인 Form 10-K에 중요성(material) 관점에서 기후변화와 관련된 위험요인을 기술하도록 하고 있다. 그러나 기후변화 위험의 중요성을 판별하는 기준과 이행 준수를 위한 구체적 제재 내용이 마련되어 있지 않은 상황에서 공시에 대한 결정과 수위는 기업의 재량에 맡겨져 있다. 그럼에도 불구하고 위험요인을 기술하는 기업과 그렇지 않은 기업 간에 자본시장 내의 평가가 어떻게 다른가를 확인하는 것은 유인체계를 실증하는 중요한 작업이다. Matsumura et al.(2020)의 연구 결과에 의하면 정보 공개를 하는 기업은 그렇지 않은 기업에 비해 자기자본비용(cost of equity)이 평균 27bps 낮았고, 기후변화 위험에 대한 취약도가 높은 업종에서는 50bps 더 낮은 것을 확인하였다. 즉, 실제로 기후변화 정보가 중요한 기업이 정보 공개를 할 경우 자본시장에서는 해당 기업의 자기자본비용, 즉 위험을 낮게 평가하는 것으로 나타났다. 중요성 관점에서 정보 공개를 시장이 평가해준다는 반증으로 볼 수 있다.

정보 공시가 가져오는 경제적 효익 이면에는 이를 상쇄할 수 있는 공시 비용이 있다. 공시 비용32)은 기업들의 자발적 공시 여부와 공시의 질을 좌우하는 중요한 요소이다. 명시적 비용은 공시를 담당하는 인력과 이와 수반되는 행정 비용과 시스템 구축 비용, 정보의 신뢰성을 인증 받는 비용 등이 포함된다. 규모가 큰 대형사에게 명시적 비용은 공시 여부나 공시의 질을 좌우할 만큼의 요소가 되지는 않지만 소형사 입장에서는 고려의 대상이 될 수 있다. 반면에 사업 부문별 상세 정보의 공개로 인하여 해당 기업이 전유하고 있는 고유한 사업 경쟁력이 노출되어 발생할 수 있는 공시 비용은 전략적 판단의 근거가 될 수 있다.

전유정보 공시비용(proprietary cost)은 특정 정보의 공시로 경쟁기업이 이를 알게 됨으로써 공시기업에게 손해를 끼칠 수도 있는 경우 이로 인한 피해 추정액을 의미한다. Berger & Hann(2007)은 경영진의 정보 공개는 사업의 부문 단위로 분할된 정보보다는 종합 정보를 공개하는 경향이 있으며 이는 경쟁 회사로부터 수익을 지키기 위한 유인체계라고 밝히고 있다. EFRAG(2021a)에서는 EU 지속가능 보고 기준 제정을 위한 제안서에서 이러한 유인의 중요성을 인지하여 기준 적용 개념 가이드라인에서 지속가능정보 중 특정 정보의 노출로 인한 상업적 타격 가능성을 고려해야 함을 밝히고 있다.

지속가능 의무공시는 이해관계자의 다양성으로 인하여 표준화에 따른 효익이 작성자와 수용자 모두에게 클 것으로 판단된다. 동시에 표준화를 어렵게 하는 지속가능 보고의 특성도 파악하여 보았다. 이러한 점을 고려하여 의무공시와 수반되는 논의에서는 특성을 반영한 공시 체계를 어떻게 효율적으로 마련할 수 있을지에 대한 논의가 필요하다. 작성자의 유인체계를 이해하고 자본시장의 규율 원리를 파악하여 적용할 수 있을 경우 효율성이 증대될 것이다.

다음 장에서는 국내 상장기업의 지속가능경영보고서 작성 현황과 특성을 살펴보고, 제한적이나마 어떤 유인체계에 따라 작성하고 있는지 살펴보기로 한다.

Ⅲ. 국내 지속가능보고 현황

전장에서 밝혔듯이 국내 기업의 사업보고서 공시에는 지속가능요소와 관련 있는 내용이 상당 부분 담겨 있다. 예를 들어 사업의 내용을 설명하는 장에서 그 밖에 투자의사결정에 필요한 사항으로 환경 관련 규제사항과 준수 현황을 설명하기도 한다. 또한 그 밖에 투자자 보호를 위하여 필요한 사항을 설명하는 장에서는 정상적인 영업과정에서 발생하는 소송, 분쟁 및 규제기관의 조사 내용을 소개하면서 소송 등의 결과가 재무 상태에 중요한 영향을 미칠 것인지에 대한 의견을 제시한다. 이와 부수적으로 「산업안전보건법」, 「노동조합 및 노동관계 조정법」, 「독점규제 및 공정거래에 관한 법률」등 환경, 사회, 지배구조와 유관된 법률 위반으로 인한 제재 현황 등을 기술한다. 물론 개별 기업이 속한 업종과 특성에 따라 지속가능정보에 대한 내용은 차이가 있다.33)

사업보고서상의 지속가능정보는 작성 의도에서 나타나듯이 기업은 투자자를 정보이용자로 인식하고 있다. 이는 「자본시장과 금융투자업에 관한 법률」(이하 자본시장법)에서 ‘중요정보’의 누락이나 왜곡으로 인하여 투자자가 손해를 본 경우 배상의 책임을 명시하고 있기 때문에 기업가치에 영향을 미칠 수 있는 정보라고 판단이 될 경우 해당 정보는 공시의 대상이 되기 때문이다. 따라서 보다 다양한 이해관계자를 대상으로 하고 미래지향적인 정보를 사업보고서에 함께 담아내기에는 무리가 있을 수 있다.

1. 기업지배구조보고서 의무화의 경험

지속가능요소 중 지배구조에 관해서는 2018년 12월에 한국거래소의 「유가증권시장 공시규정」을 개정하여 자산총액 2조원 이상 대형 유가증권시장 상장사는 2019년부터 기업지배구조보고서를 의무적으로 공시하도록 하였다.34) 지배구조 활동의 유형분류(taxonomy)와 각 유형에 적용되는 원칙(principle)과 주요성과지표(KPI)는 한국기업지배구조원이 2016년에 마련한 「기업지배구조 모범규준」과 「OECD‧G20 기업지배구조 원칙」 등을 참조하였음을 밝히고 있다. 기업들은 제시된 10개 원칙하에서 세부 원칙에 따른 현황과 지표를 공시하고 있다.35)

이행을 담보하는 규율은 준수 내지는 설명 원칙을 적용하고 있고, 작성 대상 기업이 작성하지 않거나 허위 사실 공시를 할 경우에는 거래소의 불성실공시법인 지정과 벌점이 부과된다.

현재 기업지배구조보고서에 적용되는 핵심 원칙의 범주는 주주에게만 한정되어 있어 보다 폭넓은 이해관계자와의 관계에서 지속가능성을 담보하기 위한 원칙은 적용되지 않고 있다.36) 이를 보완하기 위해 2021년 8월에 발간된 「ESG 모범규준」의 지배구조 모범규준에서는37) 이사회를 중심으로 지속가능성을 추구할 것을 제안하고 경영전략, 위험관리, 보상체계 등에서 지속가능성을 검토하고 이해관계자와 적극적인 소통을 할 것을 권고한다.38) 특히 이사회의 역할과 책임에서 이해관계자와의 상호협력이 장기적으로 기업에 이익이 된다는 사실을 인식하여야 한다고 기술하고 있어, 상호 의존성을 전제로 하고 있음을 알 수 있다. 이해관계자에 대한 정보 공개에 대해서는 법령에 의해 요구되는 공시사항 이외에도 주주 및 이해관계자의 의사결정에 중대한 영향을 미치거나 미칠 수 있는 사항은 공시하여야 함을 밝히고 있다.

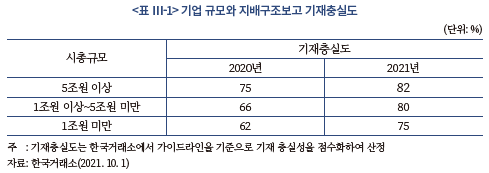

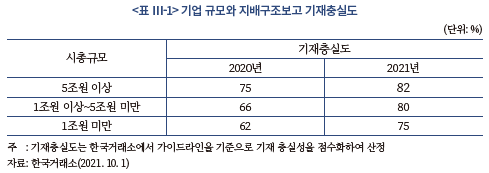

한국거래소는 2021년 175개사의 지배구조보고서를 검토한 결과 시행 첫해인 2019년에 비해 정성 및 정량 항목 모두에서 지속적인 개선이 있음 밝히고 있다.39) 기재충실도는 <표 Ⅲ-1>과 같이 기업의 시총 규모가 클수록 높은 것으로 나타난다. 이에 대한 해석으로는 경영진과 대주주에 대한 견제 장치의 유무와 같은 지배구조 이슈가 대기업에 집중되기 때문에 이를 설명하려는 동기가 더 많이 작동한다고 해석해 볼 수 있다. Marquis et al.(2016)에서도 전 세계 4,750개 기업의 환경보고서를 분석한 결과, 평소에 환경문제를 더 많이 일으키는 기업은 그렇지 않은 기업에 비해 선택적 보고 경향이 덜하다는 연구 결과를 보여준다. 그 이유로 환경문제를 주변 이해관계자가 인지하고 있는 상황에서는 오히려 설명 의무가 높아진다고 해석하고 있다. 국내 지배구조보고서의 기재충실도를 설명할 수 있는 요인들에 대한 추가적인 연구를 통해 지속가능보고 공시의 유인체계에 대한 이해를 도모할 필요가 있다.

환경과 사회를 다루는 지속가능보고는 현재 상장사가 자율적으로 보고하는 ‘지속가능경영보고서’가 있다. 한국거래소 유가증권시장 공시규정에 근거가 마련되어 있다. 보고에 대한 기준은 별도로 마련되어 있지 않고 한국거래소 ESG 정보공개 가이던스에서 국제 이니셔티브를 기업 개별 상황에 맞게 채택하라고 권고하고 있다. 국제 이니셔티브에 대한 이해를 돕기 위해 다음 절에서 현황을 소개한다.

2. 국제 이니셔티브 현황

EFRAG는 2021년 SFDR(Sustainable Finance Disclosure Regulation) 이행을 위한 권고안 보고서에서 현존하는 전 세계 이니셔티브에 대한 현황 조사를 실시하였다.40)41) 이니셔티브를 업종과 주제 구분 없이 포괄적으로 적용하는 기준과 주제별, 업종별로 특화된 기준, 중소기업 전용 기준으로 구분하여 분류하였다. 포괄 기준은 14개, 업종 기준은 28개, 주제별 기준은 29개로 조사된다. 이밖에 중소기업에 특화한 기준이 24개 별도로 존재한다. 이 중 포괄과 주제별 기준에서 별도로 마련한 업종 기준이 있기 때문에 중복을 제외하고 총 88개의 기준에 대해 조사하였다.

업종별로 기준을 제시한 대표적 이니셔티브는 SASB 기준이다. 이와 더불어 GRI는 대표적인 포괄 기준이긴 하지만 업종 특화된 지표를 제시하고 있다. 따라서 개별 기업은 본인이 속한 업종에 해당하는 SASB 기준을 채택해도 되고, GRI 체계하에서 업종에 관계없이 포괄적으로 적용되는 지표와 함께 특화된 업종 지표를 사용해도 된다. 그러나 SASB와 GRI의 업종 분류가 다르기 때문에 채택한 이니셔티브에 따라서 서로 다른 비교군(peer group)이 형성되어 일관된 비교가 쉽지 않은 문제가 있다. 따라서 이니셔티브마다 사용하는 업종 분류 체계가 다를 경우에 기업 간 상대 비교 관점에서는 일관성이 떨어질 수 있다.

주제별 기준은 양성평등, 기후변화, 인권, 반부패, 환경 등 일반적으로 지속가능 주제에 특화한다. 환경 범주에 속하는 기준은 13개로 가장 많고 그다음이 사회 범주에 11개의 기준이 존재한다. 이들은 많은 경우에 UN SDGs 17개 목표를 벤치마크하고 있어서, UN SDGs가 지속가능 의제 설정과 구체적 달성 목표 그리고 해당 지표에 대한 일종의 가이던스 역할을 하는 것으로 파악된다.

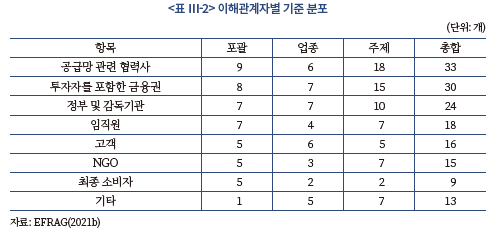

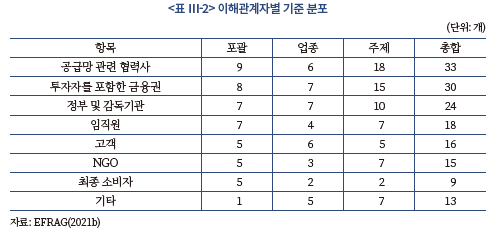

<표 Ⅲ-2>에서 기준별로 인식하는 이해관계자를 살펴보면 기업의 주된 정보 공개 대상은 통상적으로 상대하는 협력사, 투자를 받는 금융권 그리고 규제 기관임을 유추해 볼 수 있다.

국제 이니셔티브의 신뢰도를 평가하는 원칙으로 ISEAL Credibility Principle이 있다.42) 10개의 원칙 중 타 이니셔티브와의 협력을 통한 효율성 증진 원칙이 있다. 기존 이니셔티브가 다른 이니셔티브를 참조한다는 의미는 벤치마크의 의미가 있기 때문에 참조되는 횟수가 많을수록 중요하다고 판단할 수 있다. 이를 이니셔티브의 효율성 검증이라 하고, 가장 참조가 많이 되어 효율성을 증진시킨 이니셔티브는 GRI(24회), CDP(Carbon Disclosure Project)(10회), TCFD(9회), SASB(8회), CDSB(Climate Disclosure Standards Board)(6회) 등이다. 유엔이 주도한 이니셔티브인 ILO43), UNGP, SDGs의 경우는 총 27회 참조된다. 따라서 현재의 이니셔티브는 이들이 주도가 되어 지속가능 보고 기준으로 역할을 하고 있고, 국제회계기준(IFRS) 재단과 함께 기후변화와 관련한 글로벌 베이스라인 보고기준을 마련 중에 있다.

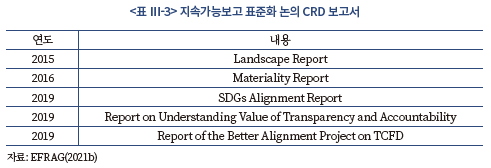

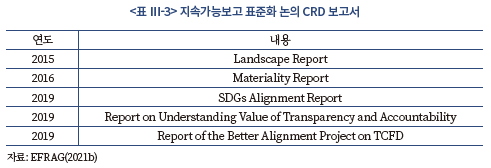

다수의 이니셔티브가 존재하는 것은 지속가능성 맥락에서 이해관계자 및 주제의 다양성을 반영하는 것이기는 하지만, 정보 공개의 표준을 마련하여 최대한의 효율화를 달성하고자 하는 노력이 있어왔다. 표준화 논의의 최초 시도는 2014년의 CRD(Corporate Reporting Dialogue) 표제하에 6개의 이니셔티브가 논의를 시작하였다.44) 이들이 작성한 보고서는 지속가능보고 기준을 마련하기 위한 주요 관계자의 논의를 담고 있다는 의미에서 참고 가치가 있다고 판단된다. 연대기별로 정리하면 <표 Ⅲ-3>과 같다.

그들은 중요성(materiality) 파악, 유엔 SDGs 목표와의 조율45) 그리고 TCFD와의 조율46)을 논의 의제로 다루었음을 알 수 있다.

2020년 9월에는 다섯 개의 이니셔티브가 협력 의향서47)를 발표하였다. 궁극적으로 재무정보와 비재무정보 통합을 지향하며 유기적인 기업 정보 보고 체계를 구축할 것을 천명하였다. 이들은 현재 국제증권감독기구(International Organization of Securities Commissions: IOSCO)의 권고하에 IFRS 재단과 공동으로 국제 표준 지속가능보고 기준 작성에 참여하고 있다. 따라서 협력 의향서에서 밝히고 있는 중요성의 개념과 보고 체계는 중요한 의미가 있다고 판단되어 상술하기로 한다.48)

가. 중요성 개념

2장에서 지속가능보고와 재무보고의 차이점 중 하나는 외부효과의 존재임을 밝혔다. 기업은 다양한 이해관계자에게 다양한 형태로 영향을 끼친다. 동시에 외부효과는 정부 규제나 사회적 압력을 통한 시장의 규율로 기업가치에 영향을 끼칠 수 있다. 경우에 따라서는 외부효과의 의제가 시대적 상황이나 공유 가치에 따라 변할 수 있다.49) 이에 따라 외부효과가 언제 어느 정도로 기업가치에 영향을 미치는지 그리고 외부효과 주제가 어떻게 결정되는지에 대한 불확실성이 존재한다.50)

중요성에 대한 정의는 각 이니셔티브마다 입장이 서로 상이하므로 우선 IFRS의 중요성에 대한 정의를 비교기준으로 설정한다.51) 가장 오랜 역사를 갖고 있는 GRI는 경제, 환경, 사회에 중요한 영향을 미치거나 이해관계자의 평가나 의사결정에 사실상(substantively) 영향을 주는 주제(topics)를 지속가능보고에 담고자 한다. 기업 입장에서 중요하다고 판단되는 외부효과 자체를 기술하는 것이다. SASB는 IFRS와 동일하다. 누락 혹은 왜곡 시 투자와 금융 대출 의사결정에 영향을 주는 정보이다. 다만 의사결정이 단기, 중기 및 장기 성과와 기업가치(enterprise value) 관점에서 이루어진다고 보고 있다. IIRC는 기업의 단기, 중기 및 장기 가치 창출 능력에 사실상 영향을 주는 주제로 간주한다. CDSB는 환경 영향력이 그 크기와 성격에 따라 기업의 재무 상태와 사업 영위 결과 및 전략 수행에 막대한 긍정 혹은 부정 영향을 끼칠 경우 중요한 정보라고 정의하고 있다.

IFRS와 SASB의 중요성 지향점이 같은 것은 SASB의 지배구조를 살펴보면 이해할 수 있다. 기준 제정을 검토하고 승인하는 위원회인 SASB는 투자자, 회사, 법률, 회계 및 학계 구성원으로 이루어져 있다. 반면에 GRI의 기준 제정 위원회인 GSSB(Global Sustainability Standards Board)는 이사 구성이 기업, 민간 사회단체, 투자 기관, 노동 중재 기관으로 구성된다.

반면에 SASB와 IIRC는 둘 다 장기적으로 기업가치에 영향을 미치는 요소를 중요시하기 때문에 과거 정보로 기술되는 IFRS와는 차별화된다.

나. 보고 체계

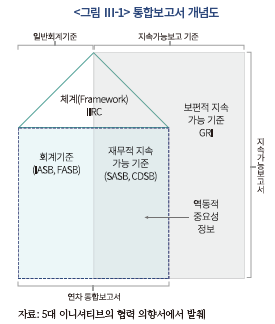

지속가능요소 중 기업가치에 실질적으로 영향을 주는 정보를 기존의 회계정보와 연차보고서에 일괄 통합하여 재무적 의사결정을 하는 이해관계자에게 공표하는 것이 기존 다섯 이니셔티브의 목표이다. 여기서 SASB와 CDSB는 업종의 특성을 반영하는 기준과 환경 특화된 기준을 각각의 중요성 원칙에 따라 제공하고, GRI는 업종 특성과 관계없이 제공되는 기준52)과 기타 이해관계자들이 필요로 하는 기준을 제공하는 역할을 담당한다. IIRC는 통합보고서의 체계를 마련하는 역할을 할 수 있다.

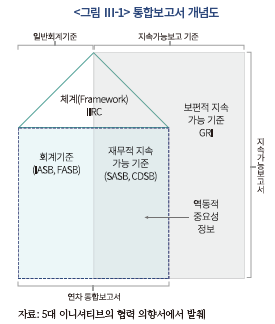

<그림 Ⅲ-1>은 통합보고서 작성에서 전술한 주요 이니셔티브의 역할을 보여주고 있다.

지속가능요소의 역동성을 나타내기 위해 연차 통합보고서는 경계가 점선으로 표시되어 있다. 지속가능요소 중 미래 기업가치에 실질적으로 영향을 줄 수 있는 정보가 반영될 가능성을 의미한다.

5대 국제 이니셔티브가 표방하는 통합보고서 개념은 후술하는 EU의 지속가능경영보고서 개정안에 상당 부분 반영되어 있고, 현재 IFRS 재단이 지속가능기준위원회를 신설하여 국제적으로 통용될 수 있는 단일 지속가능 기준 제정의 기본 방향을 이해하는 데도 중요하다.

3. 한국거래소의 ESG 정보공개 가이던스

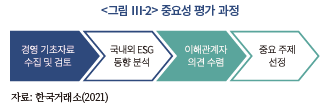

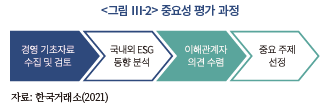

한국거래소(2021)에서는 지속가능경영보고서에서 중요성이란 회사에 미치는 재무적 영향에 한정되진 않는다고 밝히면서 회사마다 주제별 중요도가 다르기 때문에 상대적 우선순위를 스스로 정할 것을 권하고 있다. 중요 주제 선정은 <그림 Ⅲ-2>와 같이 중요성 평가 단계별 과정을 거쳐 이루어진다.

경영 기초자료 수집 및 검토 단계에서 지속가능 정보 공개는 기업의 경영전략, 이사회, 조직, 내부감사의 자료를 검토할 것을 권고하고 있으며 실제로 지속가능요소가 의사결정에 반영되고 있는지 확인하라고 되어 있어 지배구조 요소를 강조하고 있음을 알 수 있다. 이해관계자 의견 수렴 과정에서 이해관계자를 회사의 영업 활동, 제품 또는 서비스에 의해 상당한 영향을 받거나(principal impact), 기업의 전략 수행 및 목표 달성에 상당한 영향력을 행사할 수 있는 자로 밝히고 있다. 이해관계자와 기업 간 상호작용 관계를 인식하고 있어 이중 중요성 관점이 내포되어 있다.

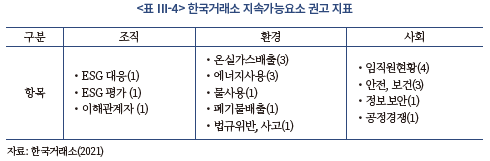

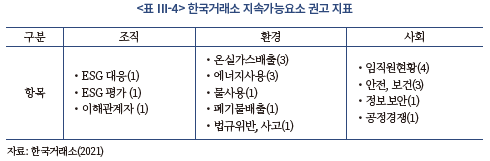

중요 이슈를 선정하기 위하여 글로벌 공개 표준(이니셔티브)을 활용할 수 있다고 밝히고 GRI, IIRC, TCFD, SASB를 주요 정보공개표준으로 소개하고 있다. 권고 지표로는 조직, 환경, 사회 각 부문에 <표 Ⅲ-4>와 같이 총 21개 지표를 제시하고 있고 지표의 객관성53)은 환경 부문이 제일 높다. 사회 부문의 경우도 계량화가 가능한 지표로 이루어져 있으나 구체적 측정 방법과 단위에서 작성자마다 다를 수 있는 여지가 있다. 조직 부문은 대부분 경영진의 역할이나 지속가능 위험에 대한 파악과 같은 서술형 기재로 되어있어, 비교가능성이 낮을 수 있다.

한국거래소의 ESG 정보공개 가이던스는 기존의 국제 이니셔티브의 기본 방향을 반영하고 있다. 업종별 기준의 구체성은 없기 때문에 전반적으로 GRI의 기준 체계를 반영하고 있다고 평가된다. 다만 권고 지표에 대한 선정 배경이 생략되어 있어 그에 대한 설명이 필요하다.54)

한국거래소의 가이던스의 기본 방향에는 국내 경영 환경이나 특수성 그리고 현재 정부 부처에서 마련하고 있는 ‘한국형’ 가이던스나 분류체계와의 관계는 천명하지 않고 있다. 앞으로 조율이 필요한 부분이므로 현재 진행되고 있는 정부의 이니셔티브를 간단하게 살펴보기로 한다.

4. 한국 정부의 이니셔티브

국제사회의 기후변화에 대응하기 위한 금융의 역할 논의가 빠르게 진행되자 정부는 녹색금융 추진계획을 발표하였다.55) 추진 계획의 일환인 민간 금융 활성화를 위해 금년 3월 24일 「환경기술 및 환경산업 지원법」(이하 ‘환경기술산업법’)이 개정되었다.

주요 골자는 환경책임투자 지원 및 활성화 조항의 신설이다.56) 동 조항에서 금융기관은 환경적 요소를 투자의사결정에 반영하는 투자(환경책임투자)를 하기 위하여 노력하여야 한다고 규정하고 있다. 이를 지원하기 위해 환경부는 녹색분류체계를 수립하고 기업이 환경성과를 평가하는 표준 평가체계 구축 사업을 할 수 있도록 하였다.

아울러 현재 녹색기업과 배출권거래제 대상기업에게만 적용되던 환경 정보 작성 및 공개 의무가 주권상장법인 중 자산총액이 대통령령으로 정하는 규모 이상인 기업으로 확대되었다. 공개 대상 정보57)는 환경관리를 위한 목표 및 주요 활동 계획, 제품 및 서비스의 개발과 활용에 관한 사항, 환경관리 성과에 관한 사항, 「기후위기 대응을 위한 탄소중립·녹색성장 기본법」(이하 ‘탄소중립기본법’)에서 밝히고 있는 기업의 녹색경영 관련 내용58) 등이다. 동 조항은 2022년 3월 25일 시행 예정이다.

산업통상자원부는 평가지표와 기관이 난립하고 있어 기업과 이용자에게 혼란이 가중되고 있고 한국의 경영 환경과 특수성을 고려하지 않고 있다는 이유로 지침 성격인 K-ESG 지표 초안을 공개하였다.59) 근거법은 「산업발전법」으로 산업의 지속가능성을 측정 및 평가하기 위한 평가 기준과 지표를 설정할 수 있다고 밝히고 있다.60) 국내외 주요 13지표를 참조하여 공통 문항 중심으로 마련하였다고 밝히고 있으며 정보 공시, 환경, 사회, 지배구조 부문에 총 61개의 지표 문항을 설정하였다.

현재로서는 상기 이니셔티브가 어느 정도의 구속력을 갖고 의도한 정책 목표를 달성할 수 있을지는 실행에 따른 이행 과정 점검을 통해서 가능하기 때문에 현재는 예단할 수 없다.61) 녹색분류체계는 EU Taxonomy를 참조하였기 때문에 국제 정합성을 갖고 있다고 판단할 수 있다. 또한 정보의 수집과 관리를 중앙 집중 방식으로 추진하고 있는 점은 EU가 효율성 극대화를 위해 추구하고 있는 디지털 표식에 의한 정보 데이터베이스화 정책과도 일맥상통하고 있어, 정보 표준화에 의한 정보 제공자 및 이용자의 후생은 증가할 것으로 기대된다.

반면 K-ESG 지표는 지침 성격이기 때문에 기존에 지속가능경영보고서를 작성하고 있는 기업이 새로이 채택할 유인은 많지 않아 보인다. 또한 현재 진행 중인 IFRS의 지속가능성 공시기준과의 유기적 관계와 연관성이 불투명하여 발표될 예정인 글로벌 베이스라인 기준과 어떻게 양립될지에 대한 불확실성이 존재한다. 또한 지속가능요소의 역동성을 감안하여 기준에 대한 지속적인 검토와 이행 과정 및 결과에 대한 검토를 상시적으로 평가할 수 있는 정치적으로 독립된 위원회 설립이 필요해 보이며, 기업과 시장의 반응을 파악하여 반영할 수 있는 기제 마련이 필요하다.

현재 국내 기업이 작성하고 있는 지속가능경영보고서의 현황 파악을 통해 이 부분에 대한 시사점을 살펴볼 필요가 있다.

5. 국내 지속가능경영보고서 발간 현황

2025년부터 유가증권시장 상장사 중 일정규모 이상인 기업은 지속가능보고 의무공시 대상이 될 것으로 예상된다. 2020년말 기준 자산규모 2조원 이상인 기업은 217개로 파악된다. 이중 112개사가 지속가능경영보고서를 작성하고 있다.62) 향후 발간 대상이 될 것으로 예상되는 기업63) 중 52%가 이미 자발적으로 지속가능보고를 하고 있다. 자산규모 5조원 이상인 기업 124개 중에는 67%가 기 작성하고 있어 기업 규모에 비례하여 작성 비중이 높다. 지주회사를 제외할 경우에는 자산규모 2조원 이상 기업 중 59%, 자산규모 5조원 이상 기업 중 74%가 작성하고 있다.

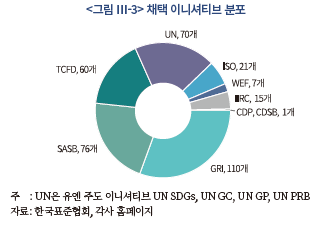

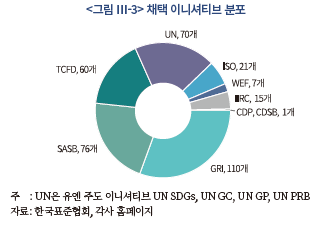

보고서 작성에 채택하고 있는 이니셔티브는 <그림 Ⅲ-3>과 같이 분포하고 있다. 대부분의 기업들은 단일 기준을 채택하지 않고 복수의 기준을 사용하고 있다. 이니셔티브 중 GRI의 경우 전체 보고 기업 중 2개사만 제외하고 모두 채택하고 있어 사실상의 표준 작성 기준인 것으로 파악된다. SASB를 채택한 기업은 76개사로 그 다음으로 많아 투자자를 정보 이용자로 염두에 두고 있는 경우가 늘어나고 있음을 알 수 있다.64) 이는 지속가능경영보고서를 기업 입장에서 기업가치(enterprise value) 관점의 의미를 부여하기 시작한다고 해석할 수 있다.65) 유엔이 주도하고 있는 국제 규범 또한 주요 지향점으로 역할을 하고 있는 것으로 나타난다.

이중에는 원칙 채택 여부만 선언적으로 기술한 곳도 있고, UN SDGs의 17개 목표 중에서 해당 여부를 판단하여 지표와 함께 기술하는 경우도 있다. TCFD의 경우를 채택 내지는 언급하는 경우는 60개사로 과거에 비해 증가하고 있어66) 최근 기후변화와 탄소중립에 대한 중요성 인식 변화가 반영되는 것으로 판단된다.

보고서의 유효성을 판단하는 검증 여부의 경우는 100개사가 검증 기준을 밝히고 있어 비교적 높은 89%의 검증률을 보인다. 대부분의 경우 검증 기준으로 AA 1000AS(절차) 또는 AA 1000AP(원칙)를 활용하고 있다.

이들 보고서의 중요성 판단 근거와 업종 특성 반영 여부, 형식 이외 내용상의 충실성 판단 여부에 대해서는 추가적인 조사가 필요하고, 궁극적으로 지속가능성 발간과 기준 채택 여부와 기업가치 간의 실증 관계가 입증될 수 있는지에 대한 연구가 향후 필요하다.

6. 국내 상장기업 지속가능보고 공시 유인

ESG 정보에 대한 공시의무는 전 세계적으로 확대되는 추세이다. 물론 동일한 지침을 공유하는 유럽연합 내 회원국 간에도 지침의 국내법적 수용 과정에서 의무화 도입 수준에 엄연한 차이가 존재한다. 자율규제 중심의 제도화 입장을 견지하는 미국의 사례를 보더라도 권역별‧국가별 제도의 특성 차이는 뚜렷하다. 그러나 지속가능보고를 확대하려는 기조만큼은 범국가적인 현상으로 볼 수 있다.

국내 정책당국의 경우 자율공시를 우선적으로 활성화하고, 단계적 의무화를 거쳐 유가증권시장 상장기업을 대상으로 2030년까지 공시의무화를 추진할 계획이다. 일각에서는 유럽 국가들에 비해 공시의무화의 추진 일정이 신속하지 않고, 공시의무의 적용 대상도 유가증권시장 상장기업으로만 한정하여 국제적인 추세에 어긋난다는 견해를 피력한 바 있다. 의무공시 시점을 대폭 앞당기고, 코스닥시장 상장기업을 포함한 전체 상장기업을 의무공시 대상으로 하되 유럽연합의 CSDR과 같이 대형 비상장기업에 대해서도 공시의무를 부과할 필요가 있다는 주장이다.67)

다만, 국내 자본시장에서 기업의 ESG 정보에 대한 공시 유인이 어떻게 작동하고 있는지 관련 실증분석을 수행한 선행연구가 매우 제한적인 상황에서 유럽과 같은 전면적인 공시의무화 정책을 도입하자는 주장은 섣부른 판단일 수 있다. 공시의무화에는 필연적으로 상당한 이행부담이 발생하기에 사회적 편익과 비용을 균형 있게 검토한 정책 수립이 필요하다.

이에 본 절에서는 국내 상장기업의 ESG 공시 유인에 대한 이론적 배경을 검토하고 실증분석을 수행하여 국내 자본시장 특성에 적합한 ESG 정보 공시제도를 설계하는 데 기초자료를 제공하고자 한다.

가. 이론적 배경

근원적으로 ESG 활동가들은 사법적‧행정적 규제체계의 부재로 기업의 책임소재는 불분명하지만 사회적으로 교정이 필요하다고 판단되는 영역에서 기업의 시민의식을 강조한다(Hendersen, 2020). 따라서 각 기업별 ESG 활동 수준은 경영진의 전략적인 의사결정에 의해 선택되는 양상을 보인다(Manchiraju & Rajgopal, 2017).

국제적으로 ESG 정보의 공시 확대 필요성이 꾸준히 제기됨에도 불구하고, 국내에서 전체 기업 수 대비 지속가능경영보고서를 발간하는 기업 수가 많지 않은 근본 원인에는 ESG 정보 공시에 대해서도 경영진의 전략적 선택 유인이 크게 작용할 가능성이 높기 때문으로 풀이된다(Bouten et al., 2012).

이에 정보의 선택적 공시유인과 관련한 선행연구를 검토해보면, ESG 활동수준과 공시수준 간에는 사전적으로 일관된 방향성을 예상하기 어렵다. 공시유인의 특성에 따라 양(+) 또는 음(-)의 상반된 관계가 나타날 수 있기 때문이다.

구체적으로 회계학 분야의 자발적 공시(voluntary disclosure) 이론에 따르면, ESG 대응수준이 높은 기업일수록 공시수준 또한 높을 가능성이 크다(Verrecchia, 1983; Bewley & Li, 2000). ESG 대응수준이 높은 기업은 대응수준이 낮은 기업과 동등한 평가를 받는 역선택 상황에 놓이지 않기 위해 최적의 비용 수준에서 ESG 성과를 자발적으로 알릴 유인이 생기기 때문이다(Akerlof, 1970).

반면, 사회정치학에서 발달한 정당성(legitimacy) 이론에 따르면, ESG 대응수준이 낮은 기업일수록 이를 정당화하기 위해 공시를 적극적으로 할 유인이 크다(Deegan, 2002; Cho & Patten, 2007). 오염물질 배출을 획기적으로 저감하기 어려운 기업일수록 타 분야의 성과를 적극적으로 공시하거나 이해관계자들로 하여금 낮은 성과를 낮지 않은 성과로 오인하도록 위장 공시를 하는 등 대중의 부정적인 인식을 환기하고 사회적 정당성을 획득할 유인이 크기 때문이다. 실제 죄악(sin) 업종으로 분류되는 술, 담배, 총기류 제조업종에 속한 기업일수록 사회공헌 활동에 대한 공시를 적극적으로 하는 경향이 보고된 바 있다(Byrd et al., 2016; Grougiou et al., 2016).

이상의 논의들은 ESG 정보의 선택적 공시 유인을 설명하는 이론 중 우리나라 자본시장에서 어떠한 관점이 기업의 공시 유인을 잘 설명하는지 실증분석이 선행될 필요가 있음을 시사한다. 정당성 이론은 ESG 대응이 부족한 기업일수록 이를 정당화하기 위해 기업이 공시제도를 적극적‧재량적으로 활용할 것을 예상하는데 이러한 이론이 우세할 경우 공시정책은 위장 ESG 공시를 방지하기 위한 공시 표준화와 제3자 인증 의무화 등 공시의 신뢰성 강화에 초점이 맞추어져야 할 것이다. 반면, ESG 활동수준이 높은 기업일수록 ESG 공시도 적시에 충실히 할 것으로 예상하는 자발적 공시 이론이 우세할 경우 자발적 공시에 대한 유인체계를 보강하고 이러한 메커니즘이 작동하지 않는 영역을 중심으로 정보비대칭성 문제를 완화하는 단계적 의무화 정책이 실효적일 것이다.

나. 표본선정 기준 및 분석모형

정보의 선택적 공시 유인을 검증하기 위해서는 공시의 전략적 선택 상황을 고려한 표본 설계가 필요하다(Bouten et al., 2012). 이에 이상호 (2021)에 따라 탄소보상배율 1미만인 기업을 환경한계기업, 탄소보상배율이 50이상인 기업을 환경우량기업으로 정의하여 두 집단을 분석대상 표본으로 구성한다. 환경한계기업은 환경 요소의 부정적 외부효과를 기업 스스로 내부화할 역량이 극히 제한적인 반면, 환경우량기업은 이에 대한 내부화 역량이 충분하므로 선택적 공시 유인을 비교‧검증하기에 적합한 표본선정 기준으로 판단된다.68)

신뢰성 있게 이용 가능한 가장 최근의 탄소배출량 자료인 2019 사업연도를 기준으로 환경한계기업과 우량기업을 특정하였으며69), 금융업종은 재무적 특수성을 고려하여 분석대상에서 제외하였다. 사업보고서상 연차지표의 일관된 비교를 위해 12월말 결산법인을 대상으로 표본을 구성하였으며, 최종적으로 유가증권‧코스닥시장 상장 12월말 결산 비금융업종 중 3년 평균 탄소보상배율을 측정할 수 있는 292개 기업에서 통제변수의 구성이 가능한 환경한계기업 49개, 환경우량기업 57개, 총 106개 기업을 분석대상 표본으로 설정하였다. 해당 기업의 홈페이지 및 사업보고서를 직접 조회하여 ESG 관련 별도의 보고서와 사업보고서 내 공시정보를 현황 파악의 기초자료로 활용하였다.

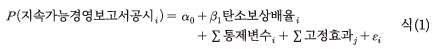

지속가능경영보고서의 작성 및 공시 유인을 분석하기 위한 모형은 관련 선행연구의 방법론을 참조하여(한종수 외, 2021) 아래 식(1)과 같이 설정하였으며, 하첨자 i, j는 각각 기업, 산업을 의미한다.

여기서, 지속가능경영보고서공시는 기업이 ESG 관련 보고서를 공시하였으면 1, 그렇지 않으면 0의 값을 갖는 더미(dummy) 변수이다. 탄소보상배율은 영업이익을 탄소보상비용으로 나눈 값으로, Matsumura et al.(2014)에 따라 탄소배출량 1톤의 사회정화 비용을 약 $17로 환산하여 탄소보상비용을 추정하였으며(원/달러 환율₩1,100 적용), 경기변동에 따른 영향을 최소화하기 위해 3년 평균값을 활용하였다(이상호, 2021).

통제변수 벡터로는 기업규모, 재무구조, 성장성, R&D 투자성향, 소비자 특성, 관리종목 여부 등을 포함한다. 지속가능경영보고서의 경우 시가총액이 크고 재무상태가 우량한 소수 기업을 위주로 발간이 되는 경향이 있어(한종수 외, 2021), 이로 인한 표본의 선택 편의 가능성을 통제하기 위하여 시가총액규모, 시장가대비장부가치비율을 통제하였다. 재무적 제약 상황에 직면한 기업일수록 ESG 성과에 대한 이해관계자의 평가절하 현상이 뚜렷하고(Bae et al., 2021), 이는 경영진의 공시 유인 하락과도 관련성이 있을 것으로 예상되는 바 부채자본비율, 이자보상배율을 통제하였다. 여유 자원 이론(slack resource theory)에 따르면 투자 재원이 풍부하고 성장여력이 높은 기업일수록 ESG 활동을 활발히 할 가능성이 높으므로(Waddock & Grave, 1997), 기업의 여유 자원의 특성으로 인한 역인과관계의 편의 가능성을 통제하기 위해 매출액성장률, R&D집중도, 관리종목 여부 등을 통제하였다. ESG 활동수준이 브랜드 평판에 미치는 영향은 B2B 업종보다 B2C 업종이 유의적일 것으로 예상되는 바(Hendersen, 2020), B2C 업종 여부(B2C)를 통제하였으며, 산업에 대한 고정효과 또한 모형에 포함하였다.

최종적으로 식(1)의 Probit 회귀분석을 통해, 탄소보상배율과 지속가능경영보고서의 공시 확률 간 어떠한 관련성이 있는지를 검증한다. 전술한 바와 같이 자발적 공시 이론에 따라 ESG 대응수준이 높은 기업일수록 공시수준 또한 높은 양상이 국내 자본시장에서 관측된다면, β1은 유의미한 양(+)의 값을 가질 것이다. 반면, 정당성 이론에 따라, ESG 대응수준이 낮은 기업일수록 이를 정당화하기 위해 공시수준을 높이는 양상이 지배적이라면 β1은 유의미한 음(-)의 값을 가질 것이다.

다. 분석결과

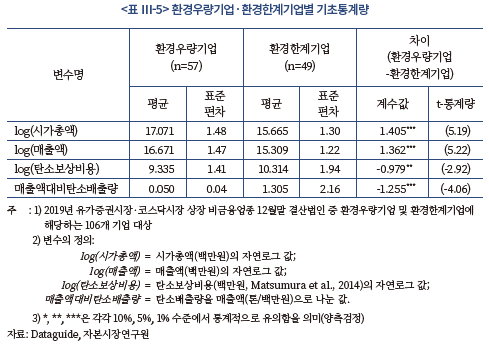

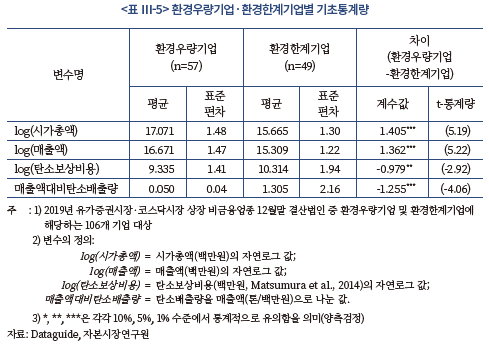

공시 유인 분석에 앞서 환경우량기업‧환경한계기업 집단별 기초통계량 특성을 <표 Ⅲ-5>에서 제시한다. 시가총액, 매출액 모두 환경우량기업이 환경한계기업 대비 1% 수준에서 유의하게 큰 것으로 확인되며, 대체로 환경우량기업은 대규모, 환경한계기업은 중소‧중견규모 기업에 해당하는 특성을 보인다.

기업규모는 환경우량기업이 유의미하게 큰 특성을 보였으나 탄소보상비용의 규모, 매출액 대비 탄소배출량은 환경우량기업이 환경한계기업 대비 각각 5%, 1% 수준에서 유의미하게 작은 것으로 나타나 사회적 비용의 유발 규모는 환경한계기업이 더 큰 특성을 보인다. 그럼에도 불구하고 환경한계기업은 3년 평균 탄소보상배율이 1미만인 기업들로 기업 스스로 유발한 사회적 비용을 내부화할 역량이 현저히 낮은 수준에 머물러 있다.

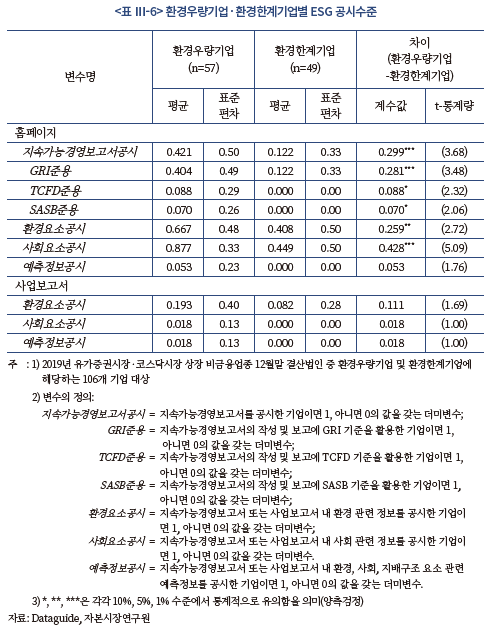

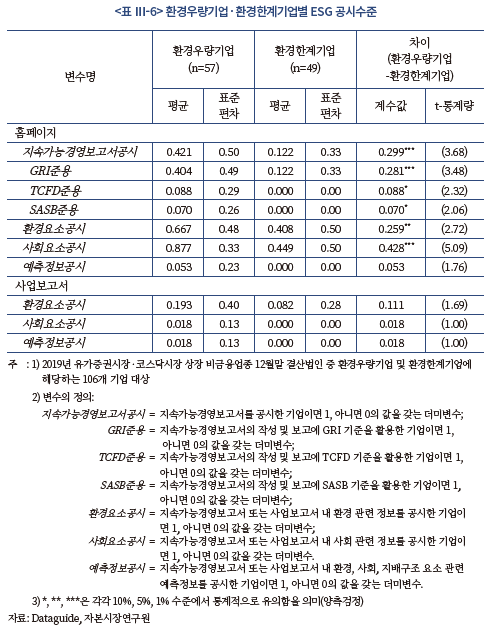

환경우량기업‧환경한계기업 집단별 공시수준을 <표 Ⅲ-6>에서 살펴보면, 대체로 환경우량기업의 공시수준이 높은 것을 확인할 수 있다.

우선 ESG 요소에 대하여 국제기구의 인증을 받은 별도보고서 혹은 이에 준하는 형태의 정보를 각 기업별 홈페이지에 얼마나 공시하였는지를 살펴보면, 환경한계기업은 환경우량기업 대비 오염물질 배출량이 높고 영업마진이 낮아 기후변화 및 에너지 전환 관련 중대한 위험에 노출되어 있음에도 이러한 위험요인을 공시하는 빈도는 오히려 환경우량기업이 25.9%p 높게 나타났으며 통계적으로도 5% 수준에서 유의미한 차이를 보인다(t-통계량: 2.72). GRI‧TCFD‧SASB 등의 국제기준을 준용한 공시 비율 역시 10% 또는 1% 유의수준에서 환경우량기업이 높은 것으로 확인된다. 지속가능경영보고서 역시 오염물질 배출저감 정책과 함께 내부화 역량을 보유한 환경우량기업에서 보고빈도가 29.9%p 유의미하게 높게 나타났다(t-통계량: 3.68).

사업보고서 내 ‘사업의 내용’ 혹은 ‘투자자 보호를 위하여 필요한 사항’ 등을 중심으로 ESG 관련 외부 규제 강화가 사업위험에 미치는 영향에 대한 공시 여부에 있어서도 환경우량기업의 공시빈도가 대체로 높게 나타났으나 통계적 유의성은 확인되지 않았다. 환경우량기업의 경우 환경요소와 관련한 규제 위험 자체가 낮아 실제 공시할 내용이 적을 개연성이 일부 있지만, 2021년은 배출권거래제의 유상할당 범위가 기존 3%에서 10%이상으로 확대되는 시기일뿐만 아니라70) 온실가스 배출과 관련해서는 2050년까지 배출량을 0으로 만드는 ‘넷제로’ 이행체계가 확립되어71) 기업들이 직면하는 규제 위험은 큰 폭으로 상승하였을 가능성이 높다. 그럼에도 환경한계기업과 환경우량기업 모두 유사하게 낮은 공시수준을 보이는 것은 규제 위험과 관련한 공시가 사업보고서상 충실히 이루어지지 않고 있을 가능성을 시사한다.

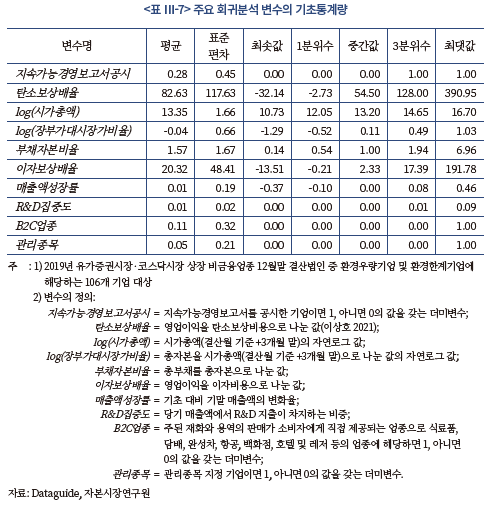

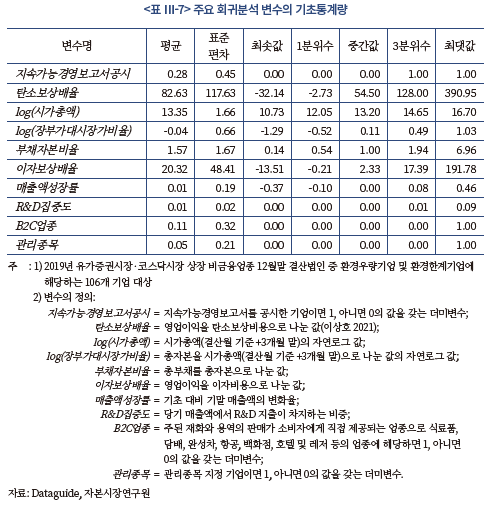

주요 변수에 대한 기술통계량은 <표 Ⅲ-7>에서 제시한다. 전체 표본에서 지속가능경영보고서를 공시한 기업은 28%에 해당하며, 로그변환한 시가총액은 13.35로 평균 시가총액 규모는 6,284억원 수준이다. 자기자본 대비 부채 레버리지 비율은 평균 157%에 해당하며, 평균적인 매출액 성장률은 1%로 확인된다. 매출액에서 R&D 비용 혹은 R&D 자산화 금액이 차지하는 비중은 평균 1%이며, 주된 재화와 용역의 판매가 소비자에게 직접 제공되는 B2C 업종 기업 비중은 11%로 확인된다.

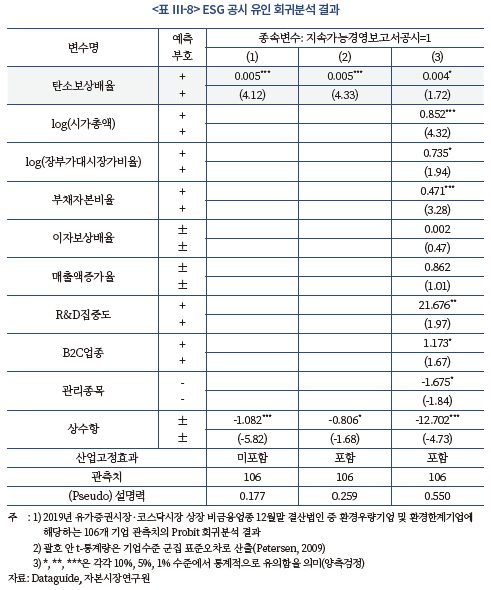

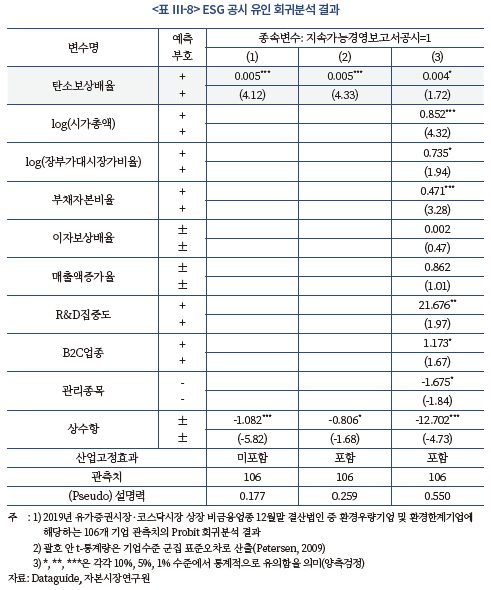

최종적인 회귀분석 결과는 <표 Ⅲ-8>에서 제시한다. Probit 회귀분석을 통해 탄소보상배율과 지속가능경영보고서의 공시 확률 간 기초적인 관련성을 분석한 열(1)의 결과를 살펴보면, 탄소보상배율이 높을수록 지속가능경영보고서의 공시 확률은 1% 유의수준에서 상승하는 방향으로 작용함이 확인된다(계수값: 0.005, t-통계량: 4.12). 산업고정효과를 추가적으로 포함한 열(2)의 분석과 기타 설명변수를 포함한 열(3)의 분석에서도 각각 1%, 10% 유의수준에서 일관된 결과를 확인하였다.

산업고정효과와 지속가능경영보고서의 공시 확률에 대한 설명변수를 모두 포함한 열(3)의 분석결과를 기준으로 탄소보상배율 계수값의 경제적 유의성을 살펴보면, 탄소보상배율이 1분위에서 3분위 수준으로 증가할 경우 지속가능경영보고서의 공시 확률은 52.3%p 증가할 것으로 추정되며 이는 2020년 평균 대비 185% 증가하는 수준이다. 탄소보상배율이 환경한계기업의 중위수 수준인 –5.1에서 환경우량기업의 최솟값 수준인 51.1로 상승하더라도 지속가능경영보고서의 공시 확률은 22.5%p 증가할 것으로 추정되며 이는 2020년 평균 대비 79% 증가하는 수준으로 경제적으로 상당히 유의적임이 확인된다.

이는 환경 요소에 대한 대응수준이 높고 스스로 유발한 사회적 비용을 내부화할 역량이 충분한 환경우량기업일수록 지속가능경영보고서의 공시 수준이 높다는 것을 의미한다. 탄소배출 측면에서 기업이 유발하는 사회적 비용이 영업이익의 100%를 초과하는 환경한계기업은 기후변화 및 에너지 전환과 관련하여 기업이 부담해야 할 현재 의무와 자원 유출 가능성이 훨씬 큼에도 불구하고 공시수준이 낮게 나타났다.

즉, 국내 자본시장에서 기업의 ESG 정보에 대한 공시유인은 ESG 대응수준이 낮은 기업일수록 이를 정당화하기 위해 공시수준을 높일 것으로 예상하는 정당성 이론보다 ESG 대응수준이 높은 기업일수록 공시수준 또한 높일 것으로 예상하는 자발적 공시 이론에 의해 잘 설명되는 것으로 판단할 수 있다. 이는 우리나라 기업 부문에서 ESG 정보 공시의 신호효과(signaling effect)가 유의하게 발현되고 있을 가능성을 의미한다.

IV. 지속가능보고 국제 논의

1. IFRS의 국제 기준 논의

2020년 4월 14일 국제증권감독기구(IOSCO)는 지속가능 미래를 위한 금융의 중요성과 함께 글로벌 금융시장의 제도개선을 위한 감독당국의 역할을 강조하였다. 특히, ESG 정보 공시의 투명성을 제고하여 위장친환경 및 투자자 보호 문제를 개선하기 위해서는 각국별 감독당국의 일관된 관리감독 체제의 확립이 필요하고 국가 간 협력을 통해 국제적 정합성을 고려한 ESG 공시 체계를 마련할 필요가 있음을 강조하였다.72)

또한, IOSCO는 지속가능금융 TF(Sustainable Finance Taskforce)를 구성하여 현행 기업 공시제도의 문제점으로 지속가능금융 관련 공시 내용 미흡, 보고기준 간 일관성 결여, 위장 환경 공시의 위험 등을 지적한 바 있다. 지속가능 정보의 완결성, 일관성, 비교가능성, 신뢰성 및 검증가능성을 높이기 위한 제도 개선이 시급하며, 산업 특성에 맞는 계량 지표의 개발과 서술 정보의 국제 표준화가 필요함을 진단하였다.73)

최종적으로 국제회계기준(IFRS) 재단은 2021년 11월 3일에 출범한 국제지속가능성기준위원회(ISSB)를 통해 ESG 정보 공시에 관한 글로벌 기준선을 마련할 예정이며, 기존 재무보고 기준 및 감사‧인증 체계와의 유기적인 통합 목표를 달성하고자 한다.74)

ISSB는 이해관계자의 수요도가 가장 높은 환경 주제에 대해 최우선적으로 글로벌 기준선(global baseline)을 마련한다. 국가별 정책 및 규제 등과 상호 운영성을 담보하기 위해 글로벌 기준선을 기초로 빌딩-블록(building-block) 접근 방식을 채택한다. 투자자 관점에서 기업가치에 중요한 영향을 미치는 지속가능성 관련 정보의 공시를 강조하여 광범위한 이해관계자를 대상으로 하는 기존 지속가능성 보고기준과는 차별화를 이룬다. 기존 지속가능보고 중 지속가능 관련 재무 사항이면 기존 재무보고에 담아 법정 공시하는 것이 목표이다. 이러한 일정은 2022년 하반기를 목표로 기후 관련 지속가능 기준을 공표할 예정이다.75)

IFRS 재단은 글로벌 기준선 마련을 위한 기술준비실무단(Technical Readiness Working Group, 이하 TRWG)을 구성하여 기준서의 시안(prototype)을 작성중이다. TRWG는 GRI를 제외한 기존 국제 기준 제정기관들로 구성되어 있는데76), 기관들의 지속가능 관련 정보 제공의 지향점은 궁극적으로 기업가치(enterprise value) 평가에 있다.

가. 지속가능 관련 재무정보 공시 시안

ISSB가 출범하면서 TRWG는 지속가능 관련 재무정보 공시를 위한 일반 요구사항을 발표하였다.77) 발표된 시안을 바탕으로 하여 기후관련 공시 시안을 동시에 발표하였고, 나머지 사회 및 지배구조 관련 정보 기준에 적용할 예정이다. 아직 명칭이 공식화되지는 않았지만 「IFRS 지속가능성 공시기준(IFRS Sustainability Disclosure Standard)」 적용을 위하여 지속가능 관련 재무정보 공시 요구사항을 발표한 것이다. 주요 내용을 살펴보면 다음과 같다.

1) 목적과 범위

지속가능 관련 재무공시의 목적은 일반목적 재무정보(general purpose financial information)78)를 사용하는 투자자, 대출자, 주주에게 지속가능 관련 위험과 기회 요인에 관한 정보를 제공하는데 있다. 기준은 이러한 목적을 달성하기 위해 지속가능 관련 재무정보 공시에 필요한 요구사항들을 담고 있다. 또한 공시되는 정보는 동일기업 내에 기간 간 혹은 동일기간 내에 기업 상호 간 일관성 있게 비교 가능해야 한다.

일반목적 재무정보는 사용자가 궁극적으로 기업가치(enterprise value)79)를 평가하기 위해 필요한 단기, 중기 및 장기에 걸친 현금흐름 발생의 크기, 시점 및 확실성을 예측할 수 있는 정보를 담아야 한다. 따라서 지속가능 관련 재무정보는 지속가능 관련 위험과 기회 요인에 대한 중요성(material) 정보를 담아야 한다.

이러한 정보는 이미 재무제표에 명목금액으로 반영되어 있을 수 있다. 그러나 지속가능 관련 재무정보는 이 범주를 넘어 미래 현금흐름에 영향을 미치는 기업의 의사결정 사항까지 포함한다.

기준 적용을 위한 선행 조건으로는 재무제표가 IFRS 혹은 일반적으로 인정되는 회계원칙에 따라 작성되어야 하고, 기업가치와 무관한 지속가능요소는 통상적인 재무보고의 범위를 벗어나기 때문에 기재할 필요가 없음을 밝히고 있다.

2) 개념 요소

가) 중요성(Materiality)과 범주

중요성의 정의는 일반적인 회계 기준에 적용되는 개념에 준한다. 즉, 어떠한 지속가능 정보가 누락, 허위 혹은 왜곡 되었을 경우, 그 정보를 사용하는 자의 의사결정에 영향을 미치리라고 합리적으로 예상되는 경우에는 해당 정보는 중요하다. 여기서 중요한 정보는 i) 기업이 사회와 환경에 끼치는 영향이 미래 기업의 현금흐름에 영향을 미칠 수 있다고 합리적 관점에서 예상할 수 있는 경우와 ii) 발생 가능성은 낮으나 미래 현금흐름에 매우 큰 영향을 끼칠 수 있는 사건 모두를 포함한다.

중요성에 대한 판단은 기업 스스로 판단하도록 하고 있고, 중요하지 않다고 판단되는 경우 정보 공개를 하지 않아도 된다. 경우에 따라 IFRS 지속가능성 공시기준에서 구체적인 요구사항 내지는 최소 충족 요구사항을 제시하더라도 중요하지 않다고 판단되는 경우 제공하지 않아도 되고, 그 반대로 중요하다고 판단되는 경우 요구사항을 벗어나는 범위의 정보를 제공할 수 있다.

정보 공개 범주는 재무제표 연결 기준에 준하나, 지속가능 요인은 전 공급망에 걸쳐 중요도 관점에서 발생할 수 있기 때문에 연결기준에 국한되지 않는다.

나) 연계성(Connectivity)

지속가능 관련 재무정보는 일반적인 재무에 관한 사항에 해당하는 재무제표와 연결되어야 함을 밝히고 있다. 예를 들어 기업이 지속가능 관련 재무정보 내용에서 탄소전환에 따른 전략적 판단 사항을 기술한다면, 이에 수반되는 비용을 재무제표 상의 비용에 명확하게 반영하여야 한다. 이와 더불어 상쇄 효과(trade-offs)를 연계시켜 보고하도록 하고 있다. 즉, 탄소 배출 감축을 위해 사업부서의 구조조정이 수반될 경우 이에 따른 고용인의 고용 안정성에 대한 영향을 평가하여 대책 마련을 기술하여야 한다.

3) 기준 체계

IFRS 지속가능 공시 기준은 TCFD의 체계를 원형 그대로 채택하고 있다. 원래는 기후관련 재무공시를 위한 체계이나 기업가치의 지속가능성 평가를 위한 전사적 측면에서의 기준선을 제시하다 보니, 이를 일반적인 지속가능 공시 기준 체계로 받아들인 것이다. 이에 따라 TCFD 체계 범주인 지속가능 관련 위험과 기회에 대한 지배구조, 전략, 위험관리, 목표 및 지표 관련 요구 정보는 다음과 같다.

가) 지배구조

지속가능 관련 재무정보에서 요구하는 지배구조 정보는 회사가 지속가능 위험과 기회 요소를 감지하고 관리하기 위해 필요한 지배구조상의 절차와 과정 및 제어 기능이다. 이를 위해 지속가능 관련 위험과 기회 요인을 관리 및 감사하는 회사 내의 기구와 임원진의 역할을 서술해야 한다.

서술의 내용은 상당히 구체적으로 제시되어 있으며, 역할을 맡는 관리자 혹은 조직의 지정 여부, 역할의 회사 내규 혹은 정책에 반영 여부, 관리자의 자격 요건, 상위 감사위원회 혹은 조직에 관련 정보가 제공되는 절차와 빈도, 회사의 전략, 주요 거래, 위험관리 정책에서 관련 지속가능 위험 및 기회 요소가 반영되고 있는지 여부, 관리 조직의 지속가능 관련 목표와 달성 성과지표 설정 여부, 성과의 보수 연계 여부 등이 포함된다.

나) 전략

지속가능 관련 재무 위험과 기회 요인을 회사의 전사적 전략 수립과 실행에 어떻게 감안하는지에 대한 정보를 상세히 요구를 하고 있다. 단기, 중기, 장기에 걸쳐 기업의 사업모형, 전략, 현금흐름에 영향을 줄 수 있는 지속가능 관련 위험과 기회 요인 그리고 위험에 대한 내성 평가를 기술하여야 한다.

이러한 평가를 위한 인식 절차를 기술해야 하고, 단기, 중기 및 장기에 대한 구체적 기간 정의와 정의된 기간이 전사적 전략 기획 및 자본 지출 계획과 어떻게 연계되는지 설명해야 한다. 또한 위험과 기회가 언제 재무적 영향으로 반영될지에 대한 합리적 수준의 기대를 서술해야 한다.

더 나아가 현시점뿐만 아니라 미래 기대되는 위험과 기회 요소의 기업 활동 전 가치사슬에 걸친 영향 평가를 정보 이용자가 이해할 수 있도록 관련 정보를 제공해야 한다.

경영진의 전략과 의사결정에 지속가능 관련 위험과 기회 요인이 어떤 영향을 미치는지를 평가해야 하고 이에 필요한 위기와 기회 대응 방안, 전년도 공시 정보 대비 진행 상황에 대한 정성 및 정량 정보, 상쇄 효과에 대한 고려 사항, 재무 계획에의 반영 여부 등의 정보를 제공해야 한다.

연계성 측면에서는 지속가능 관련 위험과 기회 요인의 재무성과와 현금흐름 영향, 지속가능 관련 전략의 결과로 인한 투자 계획과 이에 수반되는 재무 상태에의 영향을 밝혀야 한다. 이를 현재 시점뿐만 아니라 단기, 중기, 장기에 걸쳐 기대되는 영향을 평가해야 한다. 이와 아울러 이러한 평가가 재무제표 작성에 있어서 추정상의 불확실성을 야기하거나 판단이 필요할 경우 어떤 영향을 미치는지도 밝혀야 한다.

다) 위험관리

기업이 현재 직면하거나 향후 직면하게 될 지속가능 관련 위험을 어떻게 인지 및 평가하고, 관리하여 줄일 수 있는지를 관련 정책을 포함하여 설명해야 한다.

이를 위해 위험이 인지되는 과정과 평가 요소를 설명하여야 하며, 평가 시 위험의 영향과 가능성, 기타 유형의 위험 대비 우선순위 설정 방법, 모형 적용 시 사용하는 계수와 가정 및 과거 평가 대비 변경 사항을 포함하여야 한다.

라) 척도와 목표

지속가능 관련 위험과 기회 요인에 대한 달성 목표를 설정하고, 목표 달성 여부를 측정할 수 있는 주요 지표를 설정해야 한다. 이러한 지표를 어떤 척도(metrics)로 측정하고 검토하는지에 대한 정보를 제공해야 한다. 이를 위한 정보로는 기업이 속한 산업과 관계없이 산업 간 비교 가능한 척도와 특정 산업 고유의 척도 그리고 개별 기업 수준에서의 척도를 제시해야 한다. 관련 척도는 적용 가능한 IFRS 지속가능성 공시기준과 가이던스에 의해 정의되어야 한다.

기업은 지속가능 관련 위험 요인 감축을 위한 목표와 기회 요인 포착을 위한 전략적 지향 목표를 제시해야한다. 목표 지표가 절대 수준 혹은 상대 수준인지, 정규화(normalized) 되었는지 밝혀야 하고, 목표가 적용되는 기간과 성과 측정의 시작 시점, 중간 목표 혹은 중요 이정표 설정 여부도 제시해야 한다. 목표가 외부 지표로 구성되는 경우 지속가능 이니셔티브의 일환으로 검증되어야 한다. 또한 목표 달성 여부에 대한 평가가 가능하기 위해 지표는 일관성 있게 추적 가능해야 한다.

마) 비교 정보

전기와 비교 가능한 정보를 제공해야 한다. 이를 위해 최근 수정된 추정치를 반영해야 한다. 비교 정보가 전기와 차이가 발생할 경우 차이에 대한 설명과 함께 크기를 제시해야 한다. 데이터 부재로 인하여 과거와 비교 가능하지 않을 경우에는 그 사실을 적시해야 한다.

바) 보고 주기

지속가능 관련 재무정보 공시는 기존 재무제표와 동일하게 12개월 주기로 이루어져야 한다. 주기가 다를 경우에는 적용 주기를 밝히고 그 사유를 설명해야 한다. 분기 공시와 같이 중간 보고(interim report)에 대한 입장은 없고, 정보의 적시성에 따라 필요할 경우 공시할 수 있다.

사) 공시 채널

일반목적 재무정보 공시의 일환으로 지속가능 관련 재무정보가 제공된다. 따라서 지속가능 관련 재무정보의 공시는 기존 재무정보 공시가 이루어지는 채널을 공유한다. 통상적으로 재무정보와 같이 제공되는 경영자 논평(management commentary)에 해당되는 부분으로 제시하고 있다. 국내의 경우 사업보고서상 재무정보를 제외한 회사현황과 지배구조에 관련된 서술 부분으로 이해된다.

나. 시사점

이상 IFRS 지속가능공시 기준을 위한 지속가능 관련 재무정보 공시 요구사항을 살펴본 결과 다음과 같은 시사점을 얻을 수 있다.

첫째는 기존 기업이 발간하고 있는 지속가능경영보고서가 지속가능 위험과 기회 요인에 대한 기업의 지배구조, 전략, 위험관리, 척도와 목표를 주요 내용으로 하여 재편될 수 있다. 업종 특성과 개별 기업의 특성을 반영하는 척도가 최대한 표준화되어 공시되기 때문에 투자자 측면에서는 정보 가용성과 효율성이 제고될 것으로 예상된다.

둘째는 기업가치 측면에서 기업 스스로 판단하여 중요성이 떨어지는 사회 및 환경에 대한 영향(impact) 정보는 제외될 수 있다. 투자자에게 중요성 판단을 흐릴 수 있는 중요하지 않은(immaterial) 정보는 최대한 제외하려는 ISSB의 의도 때문이다.

셋째는 정보 사용자에게 제공되는 일반목적 재무정보의 전달 채널은 통합보고서(integrated report) 형태를 취할 가능성이 높다. 현재의 지속가능경영보고서는 기존 사업보고서 내로 편입되어 지속가능 관련 재무정보와 기존의 재무정보로 연계성을 반영하여 통합될 수 있다.

넷째는 기업은 미래지향적(forward-looking) 정보를 지속가능 위험관리와 기회 포착 차원에서 전략과 이를 수행할 수 있는 지배구조하에서 재무정보로 담아내야 한다. 이는 기업가치 평가라는 재무투자 관점이 반영된 것으로 미래 현금흐름에 영향을 줄 수 있는 모든 지속가능 정보를 담아내도록 요구하는 셈이다.

이와 같은 국제적인 제도 논의의 흐름을 비추어보면, 지속가능 정보의 공시와 관련한 국제 표준안의 도출 가능성은 매우 높을 것으로 예상된다. 이는 우리나라 지속가능 정보 공시제도의 설계 과정에서 공시 표준화를 위한 자체 기준 마련보다 향후 제정될 국제 표준안과 우리나라 공시제도의 유기적인 연계를 우선순위로 할 필요가 있음을 시사한다.

2. EU의 지속가능보고 의무공시 논의

가. NFRD

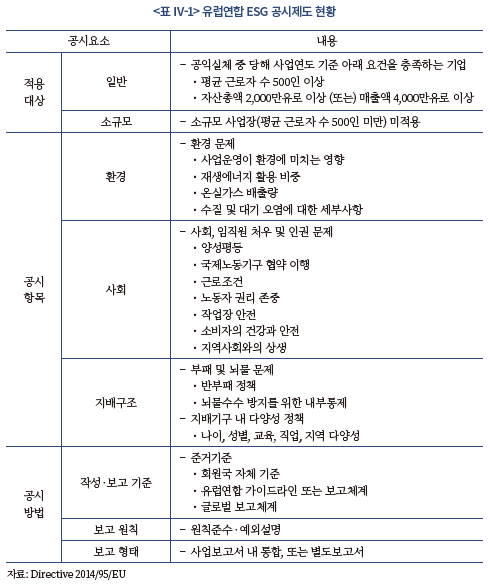

유럽연합은 2014년 11월 15일 제정된 비재무정보보고지침(NFRD)80)에 기반하여 2018년부터 모든 회원국 내 공익실체(public interest entity)81)의 ESG 정보 공시를 강제하고 있다. 기업의 사회적 책임과 지속가능한 성과와 관련한 비재무정보의 공시를 의무화함으로써 기업이 사회적 책임을 자발적으로 이행하도록 유인하고, 기업 부문을 비롯한 경제 전반의 지속가능한 성과를 관리하는데 유용한 정보 체계를 확립하는 것을 주된 목적으로 하였다.

각 회원국들은 2016년 12월 6일까지 NFRD를 국내법으로 수용하기 위한 법제화 과정을 거쳐, 2017년 1월 1일 이후 시작하는 사업연도부터 의무화 규정을 적용하였으며, 관련 내용은 사업보고서 내에 통합 공시하거나 별도의 비재무정보 보고서로 공시하되 제출일은 재무상태표일의 6개월을 초과하지 않도록 하여, 실질적으로 2018년부터 ESG 정보를 의무적으로 공시하도록 제도화하였다.

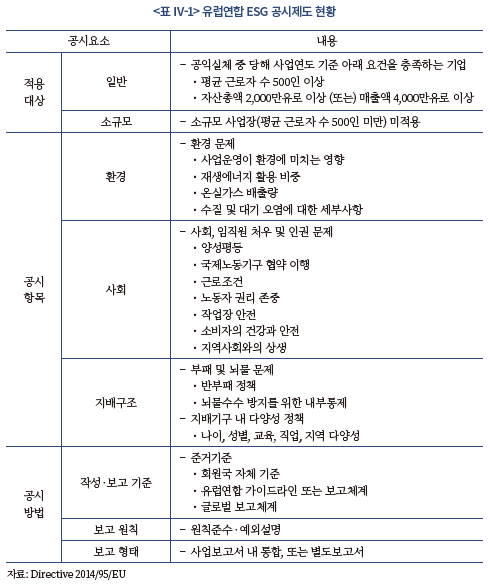

공시의무의 적용대상 기업은 당해 사업연도를 기준으로 평균 근로자 수 500인 이상, 자산 또는 매출액 규모가 각각 2,000만유로 또는 4,000만유로 이상인 공익실체이다. 최소한 환경, 사회, 임직원 처우 및 인권, 부패 및 뇌물 문제와 관련한 정보는 의무적으로 공시할 것을 규정하며, 보유 사업모형에 대한 설명과 함께 각각의 문제와 관련한 실사 절차 및 개선 정책을 비롯하여 해당 정책의 수행 결과와 위험관리 수단, 성과평가를 위한 핵심성과지표 등을 공시내용에 포함하여야 한다.

비재무정보 보고서의 작성 및 공시와 관련하여 특정 준거기준을 활용도록 강제하는 별도의 지침은 없으며 각 회원국별 혹은 국제적으로 통용되는 이니셔티브를 자율적으로 활용하되, 어떠한 기준을 준용하였는지에 대해서는 관련 공시내용에 명시해야한다.

단, 의무공시 사항에 대하여 원칙준수‧예외설명(comply or explain) 방식을 채택하고 있으며, 미공시 이유에 대한 명확하고 합리적인 설명을 전제로 공시에 대한 자율성을 폭넓게 보장하고 있다. 이상의 내용을 정리하면 <표 Ⅳ-1>과 같다.

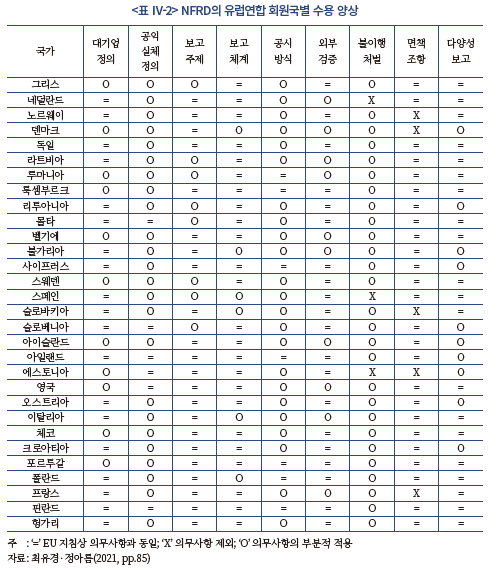

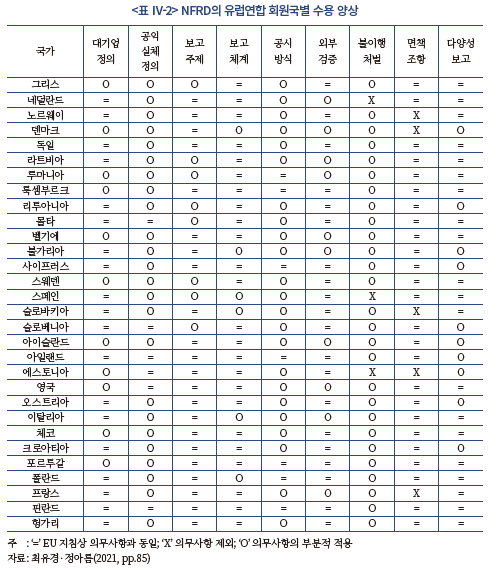

그 밖에도 NFRD의 국내법 수용 과정에서 회원국별 제반 사정을 고려하여 일정 범위의 재량성을 허용하고 있으며, 이에 적용대상 기업의 요건, 공시항목, 공시방법 등 다양한 영역에서 회원국별 지침의 전환 정도는 <표 Ⅳ-2>와 같이 차별적으로 나타난다.82) 특히, 예측정보에 대한 면책조항(safe harbour) 도입 여부나 위반책임에 대한 제제 등에 있어서도 회원국별 수용 양상이 다양하다.

나. NFRD 이행 점검

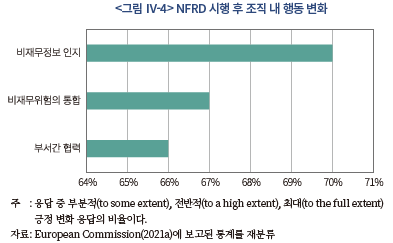

유럽 집행위원회는 NFRD 집행 이후 이행 점검 지침에 따라 실제로 비재무정보 보고서를 작성한 기업들을 대상으로 현황 조사를 의뢰하였다. 의뢰를 맡은 CEPS(Center for European Policy Studies)는 EU 회원국 소재 기업 중에서 NFRD 이행 대상인 2,340개의 기업 중 비교가능성이 높은 기업을 위주로 212개 기업을 선별하여 이행 경험을 조사하였다.83)

조사는 세 가지 측면에서 이루어졌다. 첫 번째는 중요성에 대한 인식과 정보 공개를 위하여 채택한 이니셔티브 현황이고 두 번째는 보고서 작성과 검증을 위한 비용 조사이다. 세 번째 조사는 NFRD 도입에 따른 기업 조직 내의 행동 양식이나 행정상의 변화가 있는지에 대한 여부이다.

1) 중요성 인식과 채택 기준

유럽의 회계기준 지침 EU Directive 2013/34/EU에서는 환경과 고용 관련 정보를 포함한 비재무 주요성과지표를 필요한 경우 제공할 것을 요구한다. NFRD에서는 비재무정보의 범위를 환경, 사회 및 고용관계, 인권, 반부패 및 뇌물방지로 확대 적용하였다. 또한 2017년에 마련한 이행 가이드라인에서는 정보 공개를 이중 중요성(double-materiality) 관점에서 판단할 것을 권고한다. 그러나 중요성을 판단하는 구체적 기준은 제시하지 않았고, 개별 기업이 타당한 기준을 채택하도록 하였다.

European Commission(2021a)에 의하면 조사 대상 기업들은 가이드라인에도 불구하고 대부분 이중 중요성을 충분히 이해하지 못하는 것으로 나타났고, 보고서 작성을 위해 자문에 참여했던 전문가 그룹의 평가는 대부분 이중 중요성 관점에서 작성되고 있지 않고 있음을 지적한다. 실제로 기업의 1/3 정도는 중요성에 입각하여 정보를 선별하는 것을 매우 어렵다고 보고하고 있다. 그러나 NFRD 시행 이전부터 비재무정보를 보고하던 기업은 선별에 어려움을 덜 느끼는 것으로 나타난다.

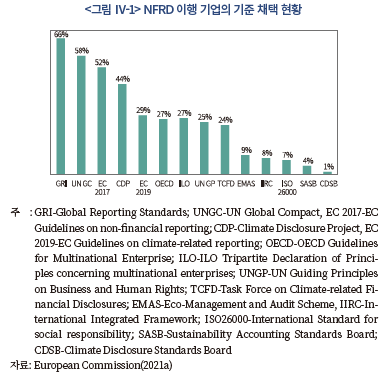

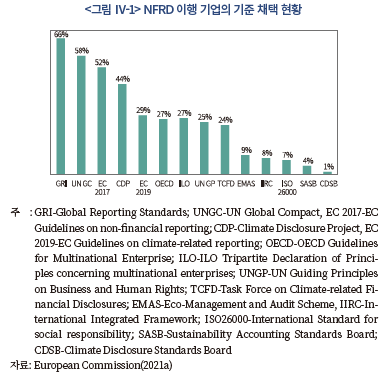

중요성 판단을 위해 채택하는 기준은 <그림 Ⅳ-1>에서 보는 것과 같이 다양하다. 대부분 복수의 기준을 채택하는 것으로 나타났고 GRI를 가장 많이 사용하고 있다. 복수의 기준을 이용하는 이유는 환경과 사회 부문별 그리고 세부 항목별로 각각의 기준을 적용하기 때문이다.

이와 같이 다양한 기준의 절충 사용 현황은 과연 단일 기준의 채택을 통한 정보 표준화가 가능한지에 대한 질문을 던지고 있다. 지속가능 정보의 표준화는 기준뿐만 아니라 지표의 시계열 및 횡단면 표준화가 가능해야 비교의 일관성이 있다. 그러나 표준화 지향점과 중요성의 원칙은 양립하지 않을 수 있다. 업종 간은 물론 동일 업종 내에서도 개별 기업 간에 중요한 이해관계자와 주제가 다르기 때문이다.

2) 공시 발행 비용

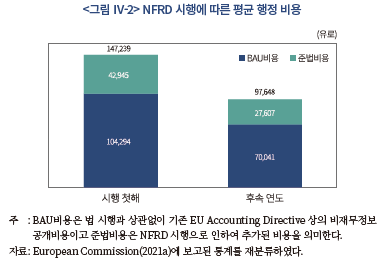

European Commission(2021a)은 EU의 NFRD 시행 이후 기업이 비재무정보 공시를 위해 부담해야 하는 행정 비용을 보고하고 있다. 비용 추정은 SCM 방법론84)을 따르고 있으며 행정 비용과 감사 및 인증 비용을 다루고 있다.85) 국내에서 2025년부터 지속가능경영보고서 의무 시행을 앞두고 기업들이 부담해야 하는 공시 비용을 가늠해 볼 수 있는 참고 자료로서 유용성이 있기 때문에 좀 더 상세하게 살펴볼 필요가 있다.

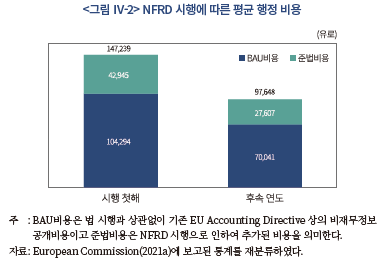

<그림 Ⅳ-2>에서 보는 바와 같이 NFRD 시행 첫해(사업연도 2017년)의 평균 행정 비용은 147,239유로로 추산된다. 이후 사업연도 2018~2019년에 대한 평균 행정 비용은 97,648유로로 감소한다.86) 물가 수준을 감안하기 위해 당시 2017년 말 기준 환율87)로 계산하면 각각 1.88억원과 1.25억원인 셈이다. NFRD는 기존 유럽연합 회계 지침(EU Accounting Directive)을 개정한 것이기 때문에 조사된 비용에는 그 이전 지침에 따라 비재무정보를 작성하던 비용이 포함되어 있다. 이를 감안하면 NFRD 규정을 준수하기 위해 추가로 지불하는 준법 비용은 기존의 40% 정도이다.

인증 비용은 인증의 확신 정도에 따라 다르게 조사되는데, 연간 평균 금액은 제한된 확신(검토 수준)의 경우는 70,000유로(0.89억원), 합리적 확신(감사 수준)의 경우는 115,000유로(1.47억원)이다.

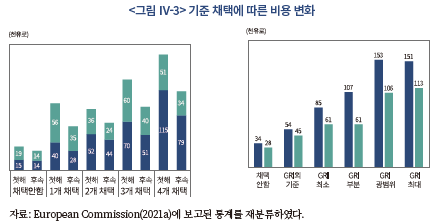

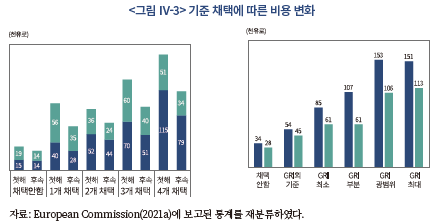

총 행정 비용은 기준 채택 여부에 따라 차이가 나는 것으로 조사된다. <그림 Ⅳ-3>에서와 같이 채택하는 기준이 다수일수록 그리고 채택하는 기준을 광범위하게 사용할수록 비용은 증가한다.

비용에 관한 내용을 정리하면 행정 비용을 결정하는 요인으로는 기업의 크기, 국제 이니셔티브 채택 여부, 공시하는 항목의 수, 인증 채택 여부 등이다. 의무공시 도입에 따라 수반되는 비용은 보다 체계적인 보고를 위하여 기준을 채택할수록, 정보 항목을 늘리고 인증의 확신을 심화할수록 증가하는 것으로 나타난다. 이러한 점을 감안하면 기업 입장에서, 특히 규모가 작은 기업일수록 적극적인 공시의 부담은 커지기 때문에 소극적인 정보 공개 행태를 보이게 될 가능성이 높다.

3) 기업 행태 변화

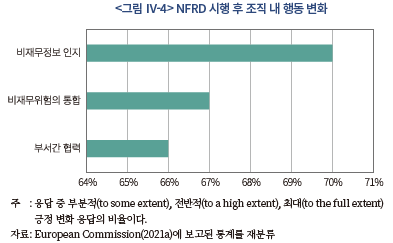

NFRD 도입 이후에 유발된 기업의 행태 변화에 대한 조사는 조직 내부의 인식과 행동 변화 여부에 초점이 맞춰져 있다. 비재무적 요소의 위험에 대한 인식과 이를 재무적 위험과 통합 관리하는지, 비재무적 요인의 중요성 파악을 위해 부서 간 인식이 공유되고 업무가 조율되는지 그리고 비재무정보 보고서에 대한 인지도가 조직 내에서 제고되었는지 여부를 조사하였다.

심층 조사에서는 지속가능요소에 대한 위험과 기회 요인 정보가 이사회에 더 많이 제공되었고, 이해관계자와 임직원과의 문제 참여(engagement)가 증가한 것을 긍정 요인으로 보고 있다. 이 과정에서 부서와 팀 간 소통과 조율이 심화되었고, 회사 내 관련 위원회와 실무 조직이 가교 역할을 한 것으로 보고 있다. 재무적 및 비재무적 위험을 통합하여 관리하면서 조직 내 위험관리 시스템의 재평가가 이루어졌고 업무 과정 체계화를 위해 자원이 투입된 것으로 조사되었다.

NFRD 이행 과정에서 기업들은 외부 자문 기관의 도움을 받고 있다. 이들 외부 전문가들은 보고서 작성 과정에서 내부 이사회 승인 절차와 같이 전사적 차원에서 내용 확인과 중요 파악 및 해당 정보 공유가 이루어짐에 따라 조직 구성원이 행동 동기 변화가 유발된다고 평가하면서 동시에 비재무정보 보고서 작성이 단지 회사 브랜드 명성 유지를 위한 소통 수단으로 인식하고 있는 부분도 적지 않다고 보고 있다. 또한 다른 부분보다도 기후변화 위험과 관련해서는 투자자와 외부 사업 관계자 사이에서 NFRD 시행 후에 기업의 인식 변화가 감지된다는 보고를 하고 있다.

서베이 기업 중 기존에 지속가능경영보고서를 작성하던 기업에서는 NFRD 자체가 기존 실사 과정이나 정책에 새로운 변화를 가져오지 않은 것으로 보고 있다. 이들은 경험상 보고서 의무화 자체보다도 이해관계자의 요구 수용 여부, 내부적인 위험관리 평가 결과에 의해 실질적 변화가 유발된다고 생각하고 있다.

부정적 요인으로는 기존의 연차보고서와 작업이 중첩되는 부분이 있고(지속가능요소 법률 위반 내용), 공급망 기업에 대한 후방 통합 보고 의무로 인하여 데이터 확보와 분류 및 보고에 수반되는 비용 상승, 감사 의무 충족으로 인한 행정 업무 증가 및 기타 준수비용(compliance cost) 증가를 예로 들고 있다.

다. EFRAG의 기준 권고안

유럽 집행위원회(European Commission)는 NFRD 개정을 앞두고 공개 의견 수렴을 실시하였고, 개정 사안 중 보고기준 적용을 의무화할지 여부에 대해 의견을 구했다. 이에 대해 응답자의 80%가 도입에 찬성을 표시하였다. 지속가능경영보고서를 작성해야 하는 기업들도 81% 찬성을 표시해, 작성 기준 채택을 의무화할 경우 작성자와 수용자 모두 효용이 증가할 개연성이 있음을 알 수 있다. 또한 EU 차원에서 지속가능 기준을 제정한다면 현재의 국제 이니셔티브와 일관성이 있어야 한다고 밝히고 있다.88) 이는 이미 대부분의 지속가능경영보고서가 국제 이니셔티브를 사용하고 있기 때문에 새로운 체계의 기준을 적용할 경우에 얻는 효과보다 초기 비용 부담을 고려한 반응일 것으로 추측된다.

집행위원회는 기준 제정에 대한 수요와 중요성을 인식하여 이에 대한 기술자문을 2020년 6월에 유럽회계기준위원회(European Financial Reporting Advisory Group: EFRAG)에 의뢰하였고 EFRAG는 2021년 2월에 자문보고서를 발간하였다89).

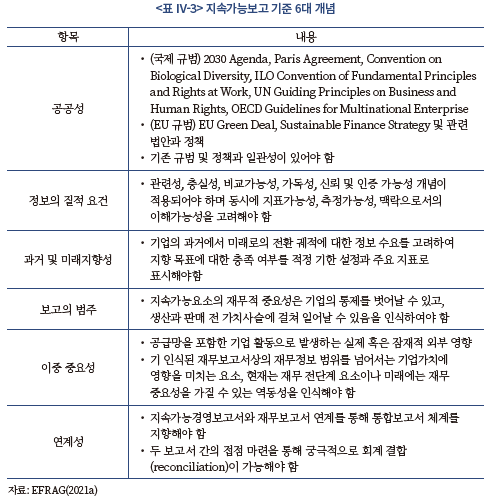

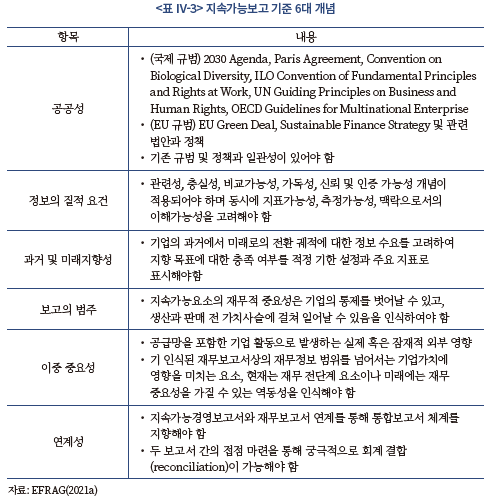

자문보고서는 구체적인 공시 요구 사항이나 지표 또는 측도를 제시하지 않고 있다. 대신 지속가능보고의 기본 방향, 작성 기준 마련을 위해 필요한 6개의 개념 가이드라인, 기준 체계의 일관성 있고 포괄적인 설계안 그리고 이를 반영한 NFRD 개정의 단계적 일정을 제시하고 있다. 이를 반영한 총 54개의 제안이 담겨 있다.

지속가능정보 작성 기준을 제정하는데 있어서 필요한 6개의 개념과 내용을 살펴보면 <표 Ⅳ-3>과 같다.

공공성은 향후 지속가능보고의 기준을 마련하는데 있어서 EU가 지향하는 상위 정책 목표들과 일관성이 있어야 함을 강조한 부분이다. 탄소중립 이행을 위한 지속가능 금융 정책의 실효성이 근본 목표임을 인식하여 EU Taxonomy나 SDFR과 같은 연관 규제와 중복되거나 상충되어서는 안 된다는 것을 의미한다. 정보의 질적 요건은 정보 사용자가 지속가능 정보를 바탕으로 의사결정을 하게 되므로 충족하여야 할 질적 요건이다.

미래지향성은 연계성과 관련 있다. 통합보고서의 목적은 지속가능한 기업가치(enterprise value) 창출을 위한 전략과 행동 요령을 담게 되므로 과거 정보인 재무정보와는 차별화되는 미래 역동적 정보를 담아야 한다. 이런 맥락에서는 이중 중요성 원칙과도 개념상 맞닿아 있다.

일반적인 재무정보는 기업 활동의 외부효과는 고려하진 않는다. 그러나 앞장에서 밝혔듯이 재무보고서와 지속가능 보고서의 차이는 외부효과의 인식과 반영 여부이다. 외부효과는 기업의 통제 범위를 벗어나는 부분이기 때문에 보고의 범주가 가치사슬 전 과정에 걸쳐 통제 범위 밖의 요소를 염두에 두어야 한다는 개념이다.

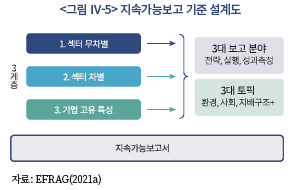

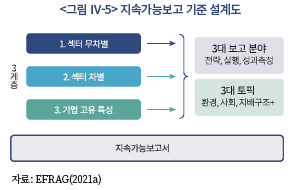

자문보고서는 기준의 일관성 있고 포괄적인 설계를 통해 보다 명확한 체계를 제시하고 있다. <그림 Ⅳ-5>는 제시된 설계 구도이다.

지속가능 정보의 특징인 외부 이해관계자의 다양성은 기업이 속하는 업종과 개별 기업의 특성에 따라 다를 수 있기 때문에 이를 무시하고 일률적인 기준을 적용하기 어렵기 때문에 기준 적용에 3단계 계층을 적용하였다. 이는 지속가능보고 기준 6대 개념에서 정보의 질적 요건 중 관련성과 비교가능성을 고려한 결과이다. 첫 단계에서는 산업과 업종에 관계없이 적용될 수 있는 공통 기준의 마련이다. 비교가능성이 높은 지배구조 이슈와 관련될 수 있다.90) 두 번째 단계는 업종 고유의 특성을 반영하는 기준 마련이다. 기존의 연구들은 업종의 특징을 반영한 중요성(material) 정보에는 주가가 반응하고 업종의 특징을 반영하지 않은 중요성 정보에는 반응하지 않는다는 연구 결과를 보여주고 있다.91) 업종 관련성을 고려하는 SASB 기준이 대표적인 경우이다. 기업 고유의 특성을 반영하기 위해서는 특화된 기준 채택이 필요하다. 현재 IFRS 재단 산하 TRWG가 작성 중인 지속가능공시 시안에서도 동일한 체계가 적용되고 있고, SASB 기준을 업종 기준으로 제시하고 있다.

3대 보고 분야는 지속가능성 이행을 가능하게 하는 전략, 실행 및 결과 측정 전 과정에 대한 기술이다. 3대 토픽(주제)에서 지배구조+는 기존 지배구조 이슈 범위를 확장한 개념으로 지속가능성 측면에서 이해관계자와의 관계 설정을 위한 경영 능력에 더하여 지속가능요소의 위험과 기회 요인을 파악하여 전략에 반영할 수 있는 지배구조상의 제반 이슈를 담고 있다. 이 역시 마찬가지로 TRWG가 작성 중인 지속가능공시 시안과 같이 TCFD의 체계를 그대로 적용하였다.

마지막으로는 기준 제정 이행을 위한 일정을 제시하고 있다. 일정은 기준의 적용 범위, 깊이(하위주제별로 공개해야 하는 정보의 수와 성격) 그리고 시행 일정의 시급성 사이의 균형을 도모하는 것을 원칙으로 한다. 또한 단계별 적용에서 주제별 핵심(core) 기준과 고도화(advanced) 기준을 구분하여 핵심을 먼저 적용하는 것을 원칙으로 한다.

1단계는 이중 중요성과 정보의 질적 요건 개념만을 우선 적용하며, 전체 3층 구조에 적용되는 기준과 주제별 핵심 기준을 적용하여 실행하는 것으로 2024년 발간을 목표로 하고 있다. 나머지 4개의 개념 하의 주제별 고도화 기준은 2025년을 목표로 제시하고 있다.

다소 추상적으로 정리된 EFRAG 자문보고서 건의 사항은 다음 절에 소개하는 지속가능성보고 지침(Corporate Sustainability Reporting Directive: CSRD) 안에 상당부분 실려 있다. CSRD의 구체적 개정 내용을 토대로 EFRAG 자문의 구체성을 확인해 볼 수 있다.

라. CSRD

유럽 집행위원회는 NFRD에 기초한 공시제도의 실효성에 한계가 있음을 인정하고, 새로운 지속가능성보고 지침(CSRD)92)을 제안하였다. 다음은 주제별로 주요 내용을 정리하였다.

1) 적용 범위 확대

CSRD는 기존 NFRD 대비 공시범위를 확대하고, 공시정보의 유용성 및 신뢰성을 제고하여 보다 실효적인 공시체계를 구축하고자 한다.

구체적으로, CSRD는 모든 상장기업 및 대규모 비상장기업으로 공시의무의 적용대상을 확대한다. 기존 NFRD는 공시의무의 적용대상을 공익실체로 한정함에 따라 금융회사를 제외한 대부분의 비상장기업이 공시대상에서 제외되었으나 CSRD는 (i)평균 근로자 수 250인 이상, (ii)자산총액 2,000만유로 이상, (iii)매출액 4,000만유로 이상 요건 중 2가지 이상 요건을 충족하는 경우 이를 대규모 기업으로 정의하여 공시의무를 부과한다. 유럽연합 내 NFRD에 따른 의무공시 기업 수는 약 11,600개인 반면, CSRD 적용 시 예상되는 의무공시 기업 수는 약 49,000개로 향후 유럽연합 내 약 75%의 기업이 비재무정보 공시의무를 부담할 전망이다. 단, 상장기업 중 소규모기업에 대해서는 3년의 유예기간을 부여하고, 간소화된 보고기준도 마련할 예정이다.

CSRD는 의무공시항목 또한 세부적인 하위주제 영역까지 확장하여 이해관계자의 의사결정에 구체적이고 유용한 정보를 제공하는 것을 목표로 한다. 기존에는 사업모형과 관련된 공시를 의무사항으로 두었다면 CSRD는 사업모형과 경영전략, 경영목표 등 공시항목을 보다 구체적으로 세분화하고 있다. 지배구조 측면에서도 기존에는 부패방지 및 뇌물 관련 주제만 최소한의 공시 항목으로 규정하였으나 CSRD는 이사회 및 경영진의 역할, 경영 윤리, 기업 문화, 정치 관여, 내부통제 등 다양한 주제를 다룰 것을 요구한다. 각종 전환 위험에 관한 대응 계획, 무형자산 등 기존에는 열거하지 않은 영역에 대한 공시의무도 부과할 예정이다. Article 19a에서는 지속가능보고 분야 세부 내용과 작성 방향을 제시하고 있고 Article 19b는 보다 구체적인 주제별 하위주제(sub-topic)와 적용 기준에 대해 설명하고 있다.

2) 분야별 세부 내용

Article 19a에서는 보고서에 담아야할 분야별 내용과 작성 방향을 제시하고 있다. 지속가능과 관련하여 발생할 수 있는 주요 위험과 기회 요인을 전체 가치사슬 과정을 포괄하여 기업 입장에서 사업모형과 전략을 연차보고서인 사업보고서(management report)에 담아내도록 하는 것이 요체이다. 구체적으로 살펴보면 다음과 같다.

기업의 사업모형과 전략을 설명하여야 한다. 여기에는 지속가능요소93)와 관련된 위험에 대한 내성(resilience), 지속가능요소로부터 발생할 수 있는 기회, 지속가능 경제로의 전환과 파리협약에 의한 지구온난화 1.5도 제약과의 정합성, 이해관계자의 관심을 어떻게 반영하는지와 지속가능요소에 대한 영향, 전략 실행의 내용이 포함된다.

세부적으로는 지속가능요소와 관련하여 설정된 목표에 대한 설명과 진행 과정 그리고 행정부서, 경영진, 내부 감시의 역할 및 정책을 설명해야 한다. 또한 지속가능요소에 대한 실사 과정(due diligence process), 기업 자신과 공급망을 포함하는 전체 가치사슬에 걸쳐 발생할 수 있는 주요 실재 및 잠재적 부정적 영향, 이러한 부정적 영향을 방지, 감소, 교정하기 위해 취한 행동을 설명해야 한다.

기업은 단기 및 중장기적 관점, 과거와 미래지향적, 정성적 및 정량적 정보를 담아야 하고, 지적재산, 인적 및 사회적 자산을 포함하는 무형자산에 대한 정보도 공개해야 한다. 단 EU 회원국은 지침의 자국 법제화 과정에서 지속가능정보 공개로 인하여 심각한 상업적 타격이 예상될 경우에는 예외적으로 정보를 제외(omit)하는 것을 허용할 수 있다.

이상의 내용을 살펴보면 지속가능요소를 무형자산의 일환으로 개념화하고 경영자 보고서(management report)에 보고하게 함으로서 궁극적으로 통합보고(integrated reporting) 체계를 지향하고자 함을 알 수 있다. 또한 이는 IFRS 지속가능성 공시기준 시안의 TCFD 분류 채택과 기존 재무공시와의 시기와 채널 측면에서 통합을 추구하려는 방향과 궤를 같이하고 있다.

3) 보고 기준

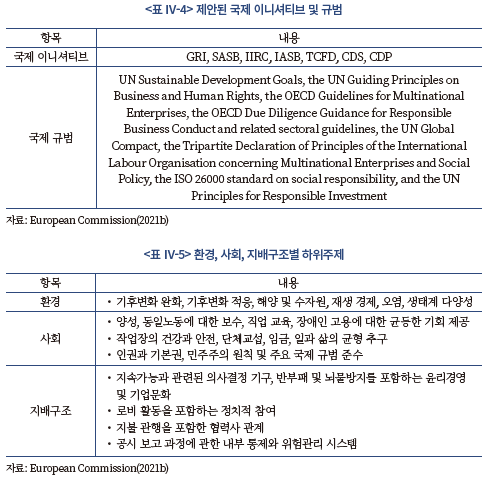

Article 19b에서는 집행위원회가 지속가능보고에 적용할 기준 채택을 입법화하는 내용을 담고 있다. 그동안에는 기준 채택이 권고 사항이었을 뿐만 아니라 구체적 이니셔티브에 대한 입장 표명은 없었다.94) 그러나 NFRD 시행 이후에도 기준 부재로 인하여 정보의 비교가능성이 개선되지 않고 있다는 의견에 따라 기준 채택을 의무화하였다.

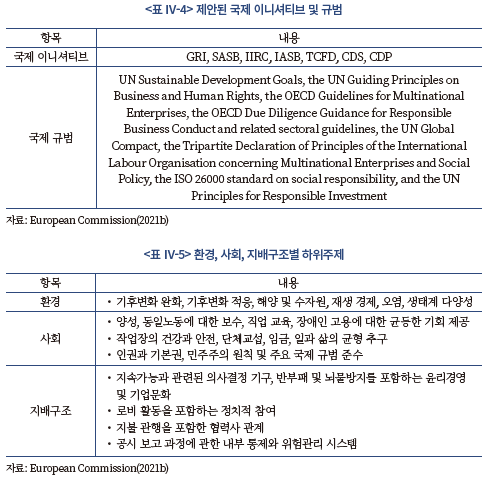

기존 관행을 유지하고 공시 부담을 완화하기 위해 기존 주요 이니셔티브를 열거하고 있으며 <표 Ⅳ-4>는 CSDR에서 열거하고 있는 주요 이니셔티브와 국제 규범이다. 또한 지속가능 이슈에 대하여 제공해야 할 하위주제를 <표 Ⅳ-5>와 같이 명시하였다. 작성자는 하위주제별로 적용할 기준을 채택하여 기준에서 마련하고 있는 해당 지표를 기술하면 된다.

이행은 단계별로 진행될 예정이다. Article 19a의 내용을 하위주제별로 기준을 채택하여 적용하는 방안을 담은 초안을 2022년 10월 31일까지 마련할 계획이다. 이와 더불어 SFDR을 충족하기 위한 금융기관들의 정보 수요를 같이 반영하도록 하여 제도 정렬을 꾀하고 있다. 업종 특성을 반영하는 정보와 필요 시 기타 보완적인 정보를 구체화하는 방안을 담은 초안은 2023월 10월 31일까지 마련할 계획이다. 실제 지속가능보고서 작성은 EFRAG(2021a)의 권고안에 따라 일차 단계는 2023년 사업연도에 대해 2024년부터 적용, 이차 단계는 2024년 사업연도에 대해 2025년부터 적용될 것으로 예상된다.

채택 기준은 EFRAG의 기술 자문 내용을 바탕으로 3년마다 평가하며 필요시 국제 이니셔티브를 포함한 관련 변화를 반영하여 개정할 수 있다.

아울러, 텍스트 기반 분석이 용이하도록 디지털 태그(digital tag) 방식을 도입한 전자공시 형태를 고려하는 등 전반적으로 공시정보의 유용성과 접근성을 제고하는 안을 마련할 계획이다.

뿐만 아니라 공시정보의 신뢰성을 강화하기 위해 제3자 인증절차를 의무화하는 방안을 제안하였으며, 제한된 확신(limited assurance) 수준에서 인증절차를 우선 도입하고 단계적으로 인증 수준을 상향하여 궁극적으로 합리적 확신(reasonable assurance) 수준의 인증절차를 도입하는 것을 목표로 한다.95)

공시 범위를 대폭 확대하면서 이중 중요성과 같이 실질을 중시하는 개념을 강조하면서 실제로 공시양식이 얼마나 표준화되는지는 추이를 살펴 보아야 한다. 원칙 중심의 규정에서 얼마만큼 상세한 공시 기준으로 확장이 가능할지 불확실하기 때문이다. 환경 지표의 경우 SFDR 준수에 필요한 정보 제공을 위해 EU Taxonomy에 연계하여 보다 상세하고 표준화된 보고 요건을 강제할 예정이나, 사회 지표와 관련해서는 아직 분류체계 초안만 제시된 상태이다.96) 따라서 CSRD 실시 이후 발간되는 지속가능경영보고서에 담긴 정보가 실제로 비교가능성을 확보하여 평가의 일관성이 제고되는 것이 확인될 때까지는 일정 기간이 지나야 할 것으로 예상된다.

3. 미국의 동향

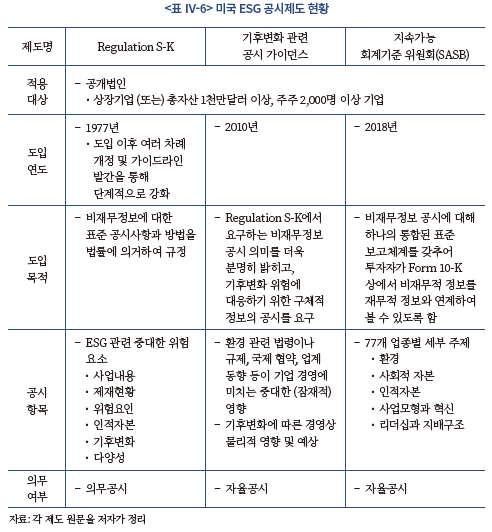

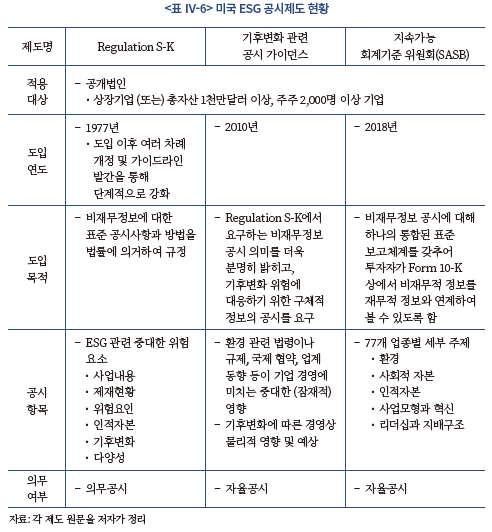

미국의 ESG 관련 비재무정보의 공시체계는 비재무정보에 대한 공시사항을 다루는 Regulation S-K 규정, 기후변화 관련 공시 가이던스(Commission Guidance Regarding Disclosure Related to Climate Change)97) 및 지속가능 회계기준 위원회(SASB)의 보고기준 총 3가지로 구성된다(<표 Ⅳ-6>).98)

Regulation S-K의 경우 사업에 관한 중대한(material) 규제 사항에 대해 공개법인(public companies)99)이 의무적으로 공시해야 할 항목을 규정한다. 1977년 동 규정을 도입한 이후 지속적으로 보완‧수정하여 사업위험과 관련한 비재무정보의 공시의무를 단계적으로 강화해왔다. 기존 Regulation S-K 규정은 환경 요소의 규제와 직접적인 관련성이 있는 중요 사업위험 및 제재 조치를 중심으로 공시의무를 부과해왔으나, 2020년 11월 9일 동 규정의 개정안을 시행함에 따라 중요 사업위험 및 제재 조치에 대한 공시의무를 환경 요소뿐만 아니라 사회 및 지배구조 요소로도 확대 적용하였다.100)

ESG와 관련한 세부 주제에 대해서는 자율공시 기준을 마련하여 시장중심의 규율체계를 강화해왔다. 2010년 2월, 미국 증권거래위원회는 기후변화와 관련된 정보를 10-K에 보고하도록 하는 기후변화 관련 공시 가이던스를 공표하여 기후변화 위험에 대응하기 위한 구체적 정보의 공시 기준을 제시한 바 있다. 이후 SASB는 2018년 11월 지속가능성 회계기준을 공표하여 세부업종별 중요성(materiality) 분석 절차를 통해 재무성과 및 운영성과와 가장 관련성이 높을 것으로 판단되는 중요 ESG 주제를 식별하여 재무정보와 통합하여 보고하는 상세 기준을 마련하였다.

미국의 경우 의무공시 항목에 있어서도 기업의 중요성(materiality) 판단에 기초하여 공시 수준의 재량성을 인정한다는 점에서 광범위한 공시의무 확대와 공시 표준화를 추진해온 유럽연합과는 상반된 제도적 특성을 보인다. 특히, 세부 주제에 대한 공시는 자율공시 체제를 우선하고 있으며 의무공시 사항에 대해서도 구체적이고 명확하게 공시가 가능한 요소(예: 제재사항)는 규정 중심(prescriptive-based)의 공시 체계를, 산업별‧기업별 특성 요인이 다르게 적용되거나 여러 이해관계자들 간 선호체계가 동질적이지 않은 요소(예: ESG 규제 위험)에 대해서는 중요성 판단에 기초한 원칙 중심(principle-based)의 공시 체계를 견지하고 있다.

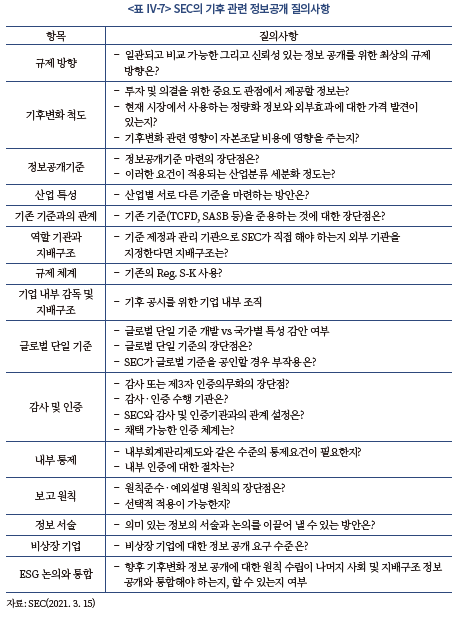

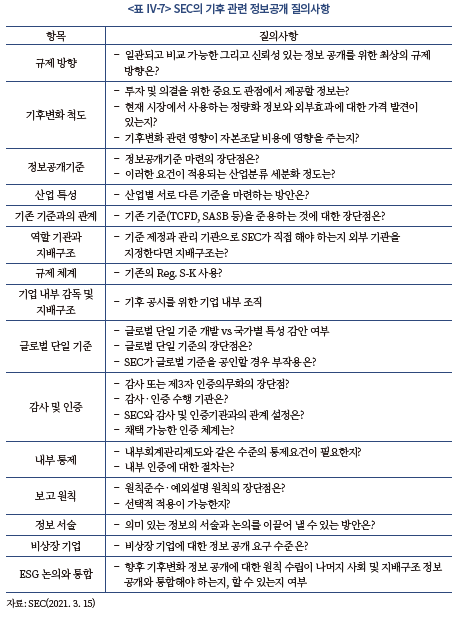

다만, 미국에서도 ESG 관련 공시의무를 확대하려는 움직임은 명확하다. 2021년 6월 17일 미 하원에서 ESG 공시 표준화 관련 법안(ESG Disclosure Simplification Act of 2021)이 통과된 바 있다.101) 특히, SEC는 기후 관련 정보 공개에 대해 15개의 질의사항을 선정하여(<표 Ⅳ-7>) 공개 의견 수집을 완료하였고, 기후 관련 정보의 공시의무화를 위한 규정개정안(Notice of Proposed Rulemaking)을 2021년 10월 고지할 예정이다.102)

V. 시사점 및 결어

본 보고서는 지속가능성 정보 공시의 의무화 논의에 앞서 선행되어야 할 주요 논의 사항을 선행연구와 유럽연합의 이행 경험을 토대로 정리하였다. 이와 동시에 IFRS 재단과 EU의 지속가능기준 제정 노력을 최근 자료를 통해 비교 검토하였다. 관련 시사점을 정리하면 다음과 같다.

IFRS 지속가능공시 시안은 II장에서 논의한 지속가능보고의 개념적 차별점에 대해 다음과 같이 대응하였다고 평가할 수 있다.

첫째, 외부효과와 그 영향의 중요성을 판단하는 기준으로 기업가치를 제시한 점이다. 예를 들어 탄소중립을 위해 지출해야 하는 자본 투하로 미래 현금흐름과 기업가치가 의미 있게 영향을 받는다면, 해당 정보는 중요하다. 투자자 관점에서는 정보의 중요도 식별 기준이 명확해진 셈이다.

둘째, 지속가능요소는 다양성과 시의적 가변성을 갖게 되기 때문에 동적 중요성을 갖는다. 따라서 기업은 다양한 지속가능요소를 전략적 관점에서 중요성 우선순위를 파악해야 한다. 전략 수립과 이행을 위한 지배구조를 설명하게 함으로써 이 문제에 접근하고 있다.

셋째, 미래지향적 정보의 반영을 요구하였고, 이를 가능하게 하는 지배구조와 전략을 설명하도록 요구하고 있다. 추정에 필요한 가정이나 변수에 대한 구체적 설명을 요구함으로써 지나치게 낙관적으로 설명하려는 편의를 제어하고자 한다.

넷째, 다양한 이니셔티브 중 TCFD와 SASB를 골격으로 삼아, 임의 기준 채택에 따른 선택적 보고를 제어하고 있다. 공시의 사회적 후생 중 하나는 정보 투명성과 비교가능성 제고이기 때문에 단일의 일관된 기준이 필요하고, 국제 표준 마련으로 이 문제에 대응하고 있다.

ISSB의 지속가능성 공시기준이 국제기준선으로 널리 활용되면, 국제회계기준을 준용하고 있는 회원국은 자국의 공시 제도와 규정 체계를 감안하여 ISSB의 기준을 준거기준으로 채택할 가능성이 높다. 단, EU의 경우는 EFRAG가 기술하고 있는 EU 지속가능기준안을 지속 추진 중에 있다.

그러나 앞서 살펴보았듯이 IFRS와 EU의 기준 제정 지향점은 기본 골격을 공유하고 있다. 즉, TCFD의 체계를 공유하고 있고, 산업과 개별 기업의 특성을 반영하는 지표를 SASB의 분류를 기준으로 적용하려 한다. IFRS 재무보고 기준을 채택하고 있는 최대의 단일 경제권인 EU 입장에서는 ISSB의 글로벌 기준선을 채택하고 이를 바탕으로 EU의 정치적, 이념적 정책 목표를 지향하는 추가적인 기준 요소를 부여할 가능성이 높다.

새로이 마련되는 IFRS 지속가능성 공시기준 시안은 우선적으로 환경 분야에 적용되어 2022년 하반기에 확정될 예정이다. 이와 별도로 국내에서는 환경기술산업법에 의거하여 녹색기업과 일정 규모 이상의 상장법인은 환경 정보를 의무적으로 작성하고 공개해야 한다. 환경기술산업법에 근거한 환경 정보 공개는 성격상 기업의 환경에 대한 외부 영향에 대한 기술이다. 이와 더불어 탄소중립기본법에서 명시하고 있는 온실가스 감축과 기후위기 대응을 위한 기업의 노력도 수반되어야 한다.

이에 따라 국내 기업은 이러한 환경 관련 국가 정책과 규제 환경하에서 향후 예상되는 위험과 기회요인에 전략적으로 대응해야 하고, 이에 수반되는 자원의 유출‧유입 영향을 재무적 중요성 관점에서 미래지향적 정보로 제공해야 한다. 투자자의 입장에서는 기업이 외부에 미치는 환경 영향 그 자체보다는 그로 인하여 예상되는 기업가치에의 영향에 궁극적으로 관심이 있기 때문에 재무적 중요성 관점에서 정보 공개가 이루어지는 것이 중요하다.

이는 지속가능투자 생태계 내의 의미 있는 환류체계를 형성하기 위한 중요한 단서가 된다. 지속가능 관련 재무정보 공개로 자본시장에서 기업가치 평가가 투명하게 이루어져야만 자본의 효율적 투자가 가능하기 때문이다. 지속가능 대응성이 높은 기업이 자본시장에서 좋은 평가를 받는다면 이는 기업으로 하여금 중요성이 있는 정보를 적극적으로 공개하게끔 유도하는 강력한 유인이 될 수 있다.

궁극적으로, 지속가능 관련 정보의 다양성과 인식의 어려움이라는 내재된 특징이 있기는 하지만, 공시 기준의 표준화로부터 얻을 수 있는 사회 후생적 효과는 클 것으로 예상된다.

1) 금융위원회(2021. 1. 14)를 참조한다.

2) 한국거래소 유가증권시장 공시 규정 제28조 및 동 규정 시행세칙 제87조 제7호 마목을 참조한다.

3) 기존 사업보고서에도 비재무정보가 비교적 다양하게 제공되고 있으나 주로 해당 사업연도 법규 적용과 제재 사항이 주를 이룬다.

4) 한국은 일부 규정을 추가하여 한국채택국제회계기준(K-IFRS)을 2011년부터 상장기업에 의무적으로 적용하고 있다. 미국은 자국의 재무회계기준위원회에서 제정한 FASB(Financial Accounting Standards Board) 기준을 사용한다.

5) 본문에서 국제 이니셔티브라 함은 GRI(Global Reporting Initiative)나 SASB(Sustainability Accounting Standard Board)와 같이 지속가능 활동 유형 분류와 해당 항목, 세부 지표를 제시하는 작성 기준 및 IIRC(International Integrated Reporting Council), TCFD(Task Force on Climate-related Financial Disclosure)와 같이 지배구조, 위험관리, 실행과정 등의 원칙을 제시하는 작성 체계 모두를 일컫는다. 본 보고서에서는 이니셔티브와 기준을 구분하지 않고 혼용하고 있다.

6) 이와 관련하여 파생되는 문제점 중 하나는 ESG 평가의 일관성이 떨어진다는 점이다. 이와 관련한 내용은 이인형(2021a), 이인형(2021b), Dimson et al.(2021)을 참조한다.

7) 이와 관련한 내용은 IFRS(2020)를 참조한다.

8) European Commission(2017)을 참조한다.

9) 한국거래소(2021)를 참조한다.

10) 학계에서는 그동안 기업의 사회적 책임(Corporate Social Responsibility: CSR) 보고로 통용했었으나 본문에서는 지속가능보고로 통일하여 서술한다.

11) Christensen et al.(2021a)은 기업의 지속가능보고의 동인과 효과를 분석한 380개의 학술 논문에 대한 문헌 조사를 통하여 지속가능보고와 보고기준의 채택이 가져오는 경제적 효과를 분석한 논문이다.

12) 지속가능 활동의 분류는 지속가능성이 있다고 판단되는 기업의 활동 중 구분 가능한 속성별로 정리한 것을 의미하며 대표적인 분류로는 EU Taxonomy를 예로 들 수 있다.

13) 이인형(2021a)에서는 ESG 평가사 간 평가 결과의 일관성이 떨어지는 이유 중 하나를 보고기준의 부재 혹은 다양성에 있을 수 있음을 밝히고 있다.

14) 지속가능 연관 정보는 재무정보에 비해 출처가 다양하고 관련 정보 공개 시점도 상이하기 때문에 ESG 평가사는 정보의 파편성과 정보 접근 시점이 상이한 점을 어려움으로 호소하고 있다. IOSCO(2021a)는 ESG 평가사에 대한 규율체계를 검토하는 보고서에서 평가자와 피평가 기업 간 정보가 요구되고 제공되는 시점을 일치시키기 위한 의견 교환을 권고하고 있다.

15) 국제회계기준은 유럽연합 내 상장되어 있는 기업을 대상으로 2005년에 첫 적용되었다. De George et al.(2016)에서는 IFRS 기준 채택 이후의 영향을 분석한 논문들에 대한 문헌 조사에서 정보 투명성, 자본 조달 비용의 감소, 국가 간 자본이동의 증가, 재무보고서 비교가능성 제고 등의 긍정적인 효과가 초기 논문들에서 발견됨을 확인하였으나, 일부의 후속 연구에서는 실증된 부분이 IFRS 기준 채택 자체의 온전한 효과가 아닐 수 있음을 밝히고 있다. 논문 간 채택된 상이한 계량 방법론과 데이터 등의 이유로 전후 연구들의 직접적인 비교가 어렵기 때문에 일방적 판단은 유보하고 있다.

16) 남아프리카 공화국은 최초로 통합보고서를 의무화한 국가이다. 준수 혹은 설명의무 원칙하에 작성하고 있기 때문에 기업들의 정보 공개 범위와 심도가 어떤 유인체계로 작동하는지에 대한 연구가 있어왔다. Barth et al.(2017)을 참조한다.

17) EFRAG(2021b) 보고서에 의하면 유럽 기업이 채택하는 지속가능보고 기준은 88개로 조사되고 있으며 이중 14개 정도가 전 산업에 걸쳐 포괄적으로 적용될 수 있는 기준이고 나머지는 기후변화나 양성평등과 같은 주제에 특화되거나, 업종별 특성에 맞춰진 기준들이다. EFRAG는 비영리 단체로 국제회계기준 마련과 이행 평가, 개선 사항 등을 유럽 집행위원회에 자문을 하고 있다. 유럽 집행위원회의 요청에 따라 보고를 위한 기준 체계 마련을 내용으로 하는 EFRAG(2021a)를 발간하였다.

18) 동 조항은 2020년 3월 24일 타법개정에 의하여 ‘금융소비자 보호에 관한 법률’ 제19조 제3항으로 대체되었다. 금융소비자보호에 관한 법률 제19조 제3항은 일반금융소비자의 합리적인 판단 또는 금융상품의 가치에 중대한 영향을 미칠 수 있는 사항 중 투자성 상품에 대한 내용으로 구분하고 있다.

19) 대법원 2015.12.10. 선고 2012다16063 판결을 참조한다. 미국의 경우는 1976년 연방대법원의 TSC Industries와 Northway 간 소송 판결에서 합리적인 투자자가 투자나 표결 시 중요하다고 판단할 가능성이 매우 높은 경우 해당 정보는 실질적이라고 판단하고 있다.

20) Hart & Zingales(2017)는 기업 활동과 외부효과가 불가분(inseparable) 관계에 있기 때문에 기업은 외부효과를 내부화하여 기업의 시장가치가 아닌 이해관계자의 후생(welfare)을 극대화할 필요가 있음을 주장하고 있다.

21) 이중 중요성은 기업이 환경과 사회에 미치는 중요한 영향(impact)과 그 결과로서 기업이 재무적 중요성 관점에서 영향을 받는 것을 동시에 고려하는 것을 말한다. 이중 중요성의 관점에서 정보 제공의 예를 들어보면, 기업은 연간 탄소 배출량과 함께 탄소 배출량 관리를 위해 지출된 비용을 동시 공개할 수 있다.

22) 무형자산은 물리적 실체가 없기 때문에 자산으로 인정받기 위해서는 식별가능성, 자원에 대한 통제와 미래 경제적 효익의 존재 등 일정한 정의를 충족함과 동시에 관련 경제적 효익의 미래 유입 가능성이 높고 자산의 원가 또한 신뢰성 있게 측정할 수 있어야 한다. 이러한 요건을 충족하지 못할 경우 이를 창출하기 위해 지출한 금액은 비용으로 처리한다(한국채택국제회계기준 제1038호).

23) S&P는 2017년과 2020년 사이에 기후변화 관련 법적 분쟁의 수가 두 배가량 증가하였고, 2021년 5월 기준 40개국에 걸쳐 1,800건의 기후변화 관련 송사가 진행 중이라고 밝히고 있다(www.environmental-finance.com/content/news/global-climate-litigation-cases-sky-rocket-says-s-and-p.html 참조).

24) 이익 및 매출 증가 추정치 등과 같은 정보를 포괄한다.

25) SEC(2021)를 참조한다(Alphabet Inc, Amazon.com Inc, Autodesk Inc, eBay Inc, Facebook Inc, Intel Corporation, Salesforce.com Inc).

26) 자본시장법 제125조(거짓의 기재 등으로 인한 배상책임)에서 예측정보는 조건을 충족할 경우 손해에 관하여 배상의 책임을 지지 않는다고 명시하고 있다. 그러나 예측이 합리적 근거나 가정에 기초하였음을 증명해야 하는 부담이 있다.

27) 국제 이니셔티브에 대한 보다 상세한 설명은 Nissay Asset Management Corporation(2019)을 참조한다.

28) 상황을 더 어렵게 만드는 것은 기업의 지속가능성을 평가하는 ESG 평가사들도 사실상 나름의 이니셔티브를 작성하고 있다는 것이다. 평가사들은 지속가능요소를 나름 기준으로 분류하여 주제와 항목을 설정하고 측정 지표를 설정한다. 따라서 기업 입장에서는 지속가능보고에 적용하는 국제 이니셔티브와 평가사가 평가체계가 다를 경우 혼란을 겪을 수 있다.

29) 5장에서 이러한 행위를 정당성(legitimacy) 추구 행위로 간주하고 국내 상장기업의 환경 정보 공시 자료를 이용하여 실증한다.

30) Verrecchia(2001)를 참조한다.

31) 기업의 정보 공개 결정은 투자자에게 신호효과를 보내기 때문에 정보를 공개하는 기업에게 유동성이 몰린다. OTCBB에 잔류한 기업들은 대부분 상대적으로 대형주이면서 외부자금 수요가 높은 것으로 파악되었기 때문에 공시의 유인을 어느 정도 설명해 준다.

32) 비용의 범주에는 명시적 비용, 기회비용을 포함하는 잠재적 비용 모두 포괄한다.

33) 심원태(2021)를 참조한다.

34) 금융위원회(2018. 12. 19)를 참조한다.

35) 세부 원칙에 따른 구체적 현황과 지표 공시는 한국거래소의 기업지배구조 보고서 공시 가이드라인을 통해 마련되어 있다.

36) 경우에 따라서는 기업이 발행하는 기업지배구조보고서의 기타 지배구조 주요 사항에서 사회적책임 수행 관련 내용을 담고 있으나 선언적 수준에 머물고 있다.

37) 이는 지배구조 모범규준의 3차 개정 작업에 해당된다.

38) 한국기업지배구조원(2021)을 참조한다.

39) 정성 항목을 평가하는 기재충실도는 2019년의 54.5%에서 2021년 78.8%로, 정량 항목의 준수율은 47.9%에서 57.8%로 모두 상승하였다(한국거래소(2021. 10. 1) 참조).

40) 이니셔티브에는 GRI, SASB와 같은 민간단체 제정 기준, UN SDGs(Sustainable Development Goals), UNGP(United Nations Guiding Principles on Business and Human Rights)와 같은 국제 규범에서 파생되는 기준, 거래소 가이던스, 상업 컨설팅 기관 기준, 환경단체 제정 기준 등이 포함된다(EFRAG(2021b) 참조).

41) 이니셔티브 중에는 보고에 대한 체계(framework)를 제시하는 경우와 기준(standard)을 제공하는 경우로 나눌 수 있다. 체계는 보고서 작성에 적용되는 원칙과 보고서 구조, 작성 방법과 대주제 정도를 제시한다. 기준은 주어진 체계를 바탕으로 구체적으로 제공해야 하는 세부 주제, 주제별 항목, 항목별 지표, 지표의 단위 등을 제시한다. TCFD와 IIRC가 전자의 경우고, GRI, SASB 등이 후자의 경우다.

42) ISEAL Credibility Principles Version 2(2021, 6)를 참조한다.

43) ILO Tripartite Declaration of Principles concerning multinational enterprises

44) 6개의 이니셔티브는 GRI, CDP, ISO, SASB, CDSB, IIRC이고 국제회계기준위원회(IASB)도 동일한 자격으로, 미국회계기준위원회(FASB)는 참관인 자격으로 참여하였다.

45) UN SDGs는 국가 단위의 지속가능 추구 목표와 지표를 제시하고 있기 때문에 이를 기업 단위 지속가능보고에 담아내는 논의이다.

46) TCFD는 기후변화와 관련한 기업들의 정보 공개를 위한 체계(framework)만을 주로 제시하고 있기 때문에 이를 구체적으로 반영하기 위한 논의이다.

47) Impact Management Project(2020)

48) SASB와 IIRC는 2020년 11월에 Value Reporting Foundation으로 기관 통합을 하였다.

49) 예를 들어 Covid-19로 인하여 생존권을 제약 당한 사회 계층이 증가하고 이에 따라 사회 갈등이 고조되면서 기업 이익의 공유나 연봉 제한과 같은 이슈가 부각되는 경우에 기업가치는 영향을 받을 수 있다.

50) 이를 역동적 중요성(dynamic materiality)으로 일컫는다.

51) 재무 정보 중 누락 혹은 왜곡될 경우 투자자의 의사결정에 영향을 줄 수 있을 것으로 합당하게 예상할 수 있는 정보는 중요하다(material).

52) 반부패 및 뇌물방지와 같이 지속가능요소를 반영하는 지배구조 상의 주제를 예로 들 수 있다.

53) 정량 정보이면서 측정 단위까지 제시된 경우 객관성이 제일 높다고 할 수 있고, 조치 내용이나 경영진의 역할과 같은 정성 정보는 객관성이 낮다고 할 수 있다.

54) 참고 부분에서 세계거래소연맹의 ESG Metrics와 GRI의 Standard Index를 소개하고 있으나 한국거래소의 권고 지표보다는 광범위하다.

55) 금융위원회‧환경부(2021. 1. 25)를 참조한다.

56) 환경기술산업법 제10조의4를 참조한다.

57) 환경기술산업법 제16조의8을 참조한다.

58) 탄소중립기본법 제55조를 참조한다.

59) 산업통상자원부(2021. 4. 21)를 참조한다.

60) 산업발전법 제18조를 참조한다.

61) 환경기술산업법은 2021년 10월 14일에 시행되고, 산업부의 K-ESG 지표는 최종안이 확정되지 않았다.

62) 2020~2021년 사이 한 번이라도 발간한 기업의 수이다.

63) 기업지배구조보고서의 경우 자산규모 2조원 이상 상장사를 대상으로 공시를 의무화하였기 때문에 발간 대상 기업이 자산규모 2조원 이상인 기업이 될 것으로 예상된다.

64) 2018년과 2019년 기간에 대한 지속가능경영보고서 106개 중에서 SASB를 언급한 경우는 17개사였다.

65) 지속가능한 기업가치 관점에서 작성 체계를 제시하는 IIRC를 채택한 기업 중 2개사를 제외하고는 SASB를 동시에 사용하고 있다.

66) 2018년과 2019년 기간에 대한 지속가능경영보고서 106개 중에서 16개만 TCFD를 언급했다.

67) 임팩트온(2021. 1. 15)을 참조한다.

68) 단, 이러한 표본 구성은 환경 관련 경영진의 전략적 의사결정 유인이 환경을 비롯한 사회, 지배구조 전반의 선택적 공시유인 문제로 확대될 수 있는지 여부에 대하여 확대해석의 가능성을 배제하지 못하는 한계점을 지닌다. 그러나 비재무정보와 관련한 주요 기준제정기구는 환경, 사회, 지배구조 요소 중 환경 요소를 재무적 위험성이 가장 높은 요소로 판단하고 있고(IFRS, 2020; EC, 2021a), 오염물질 배출 규모가 큰 기업일수록 근로자의 안전‧인권 등 사회 요소를 비롯한 전반적인 지배구조 요소 측면에서도 문제의 발생가능성이 높다는 점에서 환경 요소와 타 요소는 밀접한 관련성이 예상된다.

69) 2020 사업연도의 경우, Covid-19의 여파로 기업의 조업도가 급격히 변동하는 외생적 충격 사건이 발생하여 분석 기간에서 제외한다. 조업도의 급격한 변동은 영업이익뿐만 아니라 탄소배출량에도 직접적인 영향을 미치므로 분석 결과의 편의를 가져올 가능성이 있다.

70) 금융감독원(2021. 4. 9)

71) 기획재정부(2020. 12. 7)

72) IOSCO(2020)

73) IOSCO(2021b)

74) IOSCO(2021. 6. 28)

75) 한국회계기준원 개원 22주년 기념 웹 세미나 지속가능성 보고의 현황: 국제 표준화를 앞두고..., 2021년 8월 31일 자료를 참조한다.

76) CDSB, TCFD, IASB, Value Reporting Foundation(기존 SASB와 IIRC의 합병 기관), World Economic Forum으로 구성되어 있고, IOSCO가 참관한다. 또한 EU의 지속가능기준 작성의 협력 기관인 GRI와 기술협의를 병행한다.

77) General Requirements for Disclosure of Sustainability-related Financial Information Prototype과 Climate-related Disclosures Prototype

78) 일반목적 재무정보는 사업보고서 상의 재무제표보다 확장된 개념으로 지속가능 관련 재무정보까지 포함한다.

79) 기업가치는 기업의 시가총액과 순부채의 금액의 합이다.

80) Directive 2014/95/EU of the European Parliament and of the Council of 22 October 2014 amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups

81) 공익실체는 EU 회원국 내 상장회사, 금융회사 및 회원국별 공익실체로 지정한 조직에 해당

82) 이상호‧이인형(2021)

83) European Commission(2021a)을 참조한다.

84) SCM(Standard Cost Model)은 행정 규제의 비용 부담을 측정하는 방법론으로 유럽 국가를 중심으로 도입되었으며, 방법론 제정은 규제로부터 발생하는 비용을 최소화하는데 목적을 두고 있다.

85) NFRD 시행 이전 영향 평가 보고서에서 행정 비용을 추산하였으나, European Commission(2021a)은 시행 이후의 기업을 대상으로 조사하였기 때문에 이를 사용한다.

86) 2017년 12월 29일 기준 환율 1,279.25원으로 환산하면 각각 1.88억원, 1.25억원이고, 시행 첫해는 인력 충원과 시스템 구축 등의 일회성 비용이 반영된다.

87) 1유로=1,279.25원

88) European Commission(2021b)을 참조한다.

89) EFRAG(2021a)를 참조한다.

90) 이사진의 다양성 주제하에 여성 임원 비율을 예로 들 수 있다.

91) Khan et al.(2016)을 참조한다.

92) Proposal for a Directive of the European Parliament and of the Council amending Directive 2013/34/EU, Directive 2004/109/EC, Directive 2006/43/EC and Regulation (EU) No 537/2014, as regards corporate sustainability reporting

93) CSRD에서 ‘지속가능요소’는 환경, 사회, 고용 관련 의제, 인권 존중, 반부패 및 뇌물방지로 규정하고 있다.

94) 유일하게 2019년 NFRD 이행 가이드라인에서 TCFD 체계 채택을 권고하였다.

95) 합리적 확신(reasonable assurance)은 인증업무위험을 수용 가능한 수준 이하로 통제하기 위해 충분하고 적격한 증거 수집 절차를 거치며 인증보고서상 최종 결론을 적극적인 형태로 표명하는 반면, 제한된 확신(limited assurance)은 결론을 소극적 형태로 표명하므로 수용 가능한 위험수준이 높고 증거수집 절차 또한 제한적이다.

96) Platform on Sustainable Finance(2021)를 참조한다.

97) SEC(2010. 2. 2)

98) www.sasb.org/standards/download/

99) 공개법인은 상장기업이거나, 총자산이 1천만달러 이상, 주주가 2,000명 이상인 기업에 해당한다.

100) SEC(2020. 11. 6)

101) 상장기업은 사업 전략과 ESG 지표와의 관계를 투명하게 설명하고, SEC는 ESG 공개 기준을 마련하여 공시를 의무화할 것을 내용으로 하고 있다. 표결 결과를 보면 215대 214(공화당 찬성 0표, 민주당 반대 4표)로 통과되었기 때문에 상원 통과 여부는 불투명하다.

102) SEC(2021. 3. 15)

참고문헌

금융감독원, 2021. 4. 9, 온실가스 배출권과 배출부채 관련 주석공시 모범사례, 보도자료.

금융위원회, 2018. 12. 19, 내년부터 대형 상장사는 기업지배구조 핵심정보를 투자자에게 의무적으로 공개합니다, 보도자료.

금융위원회, 2021. 1. 14, 기업공시제도 종합개선방안, 보도자료.

금융위원회‧환경부, 2021. 1. 25, 「녹색금융 추진TF」 전체회의를 개최하여, 2050 탄소중립을 적극 뒷받침하기 위한 「2021년 녹색금융 추진계획(안)」을 마련했습니다, 보도자료.

기획재정부, 2020. 12. 7, 2050 탄소중립 추진전략, 보도자료.

김성기, 2001, 중요성 결정기준에 대한 고찰, 서울대학교 경영연구소 『경영논집』 35(4), 1-36.

산업통상자원부, 2021. 4. 21, 산업부, 한국식 환경·사회·지배구조(ESG) 지표 정립 본격 착수, 보도자료.

심원태, 2021, 국내 ESG 공시제도 현황, 서울대학교 금융법센터 『BFL』 제109호.

율촌, 2021, 환경기술산업법 개정 녹색분류체계 도입 및 환경정보공개 대상 확대 등, Legal Update.

이상호, 2021, 『ESG 정보 유용성 제고를 위한 기업공시 개선방안』, 자본시장연구원 이슈보고서 21-12.

이상호‧이인형, 2021. 5. 26, ESG 기업공시 개선방안, 자본시장연구원 정책세미나 발표자료.

이인형, 2021a, 『ESG 평가 체계 현황과 특성 분석』, 자본시장연구원 이슈보고서 21-09.

이인형, 2021b, ESG 평가 현황과 평가 제도의 발전 방향, 서울대학교 금융법센터 『BFL』 제109호.

임팩트온, 2021. 1. 15, 2025년 너무 늦다 vs. 기업들 소화불량 걸린다... ESG 정보공시 의무화, 어떻게 봐야 하나.

최유경‧정아름, 2021, 『국내외 E.S.G. 공시 동향과 법제화 전망』, 한국법제연구원.

한국거래소, 2021, 『ESG 정보공개 가이던스』.

한국거래소, 2021. 10. 1, 21년 지배구조보고서 점검 결과, 뚜렷한 개선효과 확인, 보도자료.

한국기업지배구조원, 2021, 『ESG 모범규준』.

한종수‧강정윤‧강소현, 2021, 기업의 지속가능성과 관련한 회계실무 및 정책시사점 중심 문헌연구, 『회계저널』 30(5), 263-336.

Akerlof, G., 1970, The market for “Lemons”: Quality uncertainty and the market mechanism, The Quarterly Journal of Economics 84(3), 488-500.

Bae, J., Yang, X., Kim, M.I., 2021, ESG and stock price crash risk: role of financial constraints, Asia‐Pacific Journal of Financial Studies, forthcoming.

Barth, M.E., Cahan, S.F., Chen, L., Venter, E.R. 2017, The economic consequences associated with integrated report quality: capital market and real effect, Accounting, Organizations and Society 62, 43-64.

Berger P.G., Hann, R.N., 2007, Segment profitability and the proprietary and agency costs of disclosure, The Accounting Review, 82, 4, 869-906.

Bewley, K., Li, Y., 2000, Disclosure of environmental information by Canadian manufacturing companies: a voluntary disclosure perspective, Advances in Environmental Accounting & Management 1, 201-226.

Botosan, C.A, 1997, Disclosure level and the cost of equity capital, The Accounting Review 72(3), 323-349.

Bouten, L., Everaert, P., Roberts, R.W., 2012, How a two‐step approach discloses different determinants of voluntary social and environmental reporting, Journal of Business Finance & Accounting 39(5‐6), 567-605.

Bushee, B.J., Leuz, C. 2005, Economic consequences of SED disclosure regulation: Evidence from the OTC bulletin board, Journal of Accounting and Economics 39(2), 233-264.

Byrd, J.W., Hickman, K., Baker, C.R., Cohanier, B., 2016, Corporate social responsibility reporting in controversial industries, International Review of Accounting, Banking & Finance 8(2-4), 1-14.

Cho, C.H., Patten, D.M., 2007, The role of environmental disclosures as tools of legitimacy: A research note, Accounting, Organizations and Society 32(7-8), 639-647.

Christensen, D.M., Serafeim, G., Sikochi, S., 2021b, Why is corporate virtue in the eye of the beholder? The case of ESG ratings, The Accounting Review, forthcoming.

Christensen, H.B., Hail, L., Leuz, C., 2021a, Mandatory CSR and sustainability reporting: economic analysis and literature review, Review of Account Studies 26(3), 1176–1248.

Cohen, J., Simnett, R., 2015, CSR and assurance services: A research agenda, Auditing: A Journal of Practice & Theory 34(1), 59-74.

De George, E.T., Li, X., Shivakumar, L., 2016, A review of the IFRS adoption literature, Review of Accounting Studies 21(3), 898-1004.

Deegan, C., 2002, Introduction: The legitimising effect of social and environmental disclosures–a theoretical foundation, Accounting, Auditing & Accountability Journal 15(3), 282-311.

Dimson, E., Marsh, P., Staunto, M., 2020, Divergent ESG ratings, The Jorunal of Portfolio Management 47(1), 75-87.

EFRAG, 2021a, Proposals for a Relevant and Dynamic EU Sustainability Reporting Standard Setting.

EFRAG, 2021b, Possible Input from Existing Initiatives, Appendix 4.2: Stream A2 Assessment Report.

European Commission, 2017, Guidelines on non-financial reporting (methodology for reporting non-financial information), 2017/C 215/01.

European Commission, 2021a, Study on the Non-Financial Reporting Directive.

European Commission, 2021b, Proposal for a Directive of the European Parliament and of the Council amending Directive 2013/34/Eu, Directive 2004/109/EC, Directive 2006/43/EC and Regulation(EU) No 537/2014, as regards corporate sustainability reporting, Burssels, 21.4.2021 COM(2021) 189 final.

Foster, G., 1980, Externalities and financial reporting, Journal of Finance 35(2), 521-533.

Francis, J., Nanda, D., Olson, P., 2008, Voluntary disclosure, earnings quality, and cost of capital, Journal of Accounting Research 46, 53-99.

Grossman, S.J., Hart, O.D., 1980, Disclosure laws and takeover bids, Journal of Finance 35(2), 323-334.

Grougiou, V., Dedoulis, E., Leventis, S., 2016, Corporate social responsibility reporting and organizational stigma: The case of “sin” industries, Journal of Business Research 69(2), 905-914.

Hart, O., Zingales, L., 2017, Companies should maximize shareholder welfare not market value, Journal of Law, Finance, and Accounting 2 (2), 247-274.

Henderson, R., 2020, Reimagining Capitalism in a World on Fire, Hachette UK.

IFRS Foundation, 2020, Consultation Paper on Sustainability Reporting September 2020.

Impact Management Project, 2020, Statement of Intent to Work Together towards Comprehensive Corporate Reporting.

IOSCO, 2020, Sustainable Finance and the Role of Securities Regulators and IOSCO.

IOSCO, 2021a, ESG ratings and data products providers, Consultation Paper.

IOSCO, 2021b, Report on Sustainability-related Issuer Disclosures.

IOSCO, 2021. 6. 28, IOSCO elaborates on its vision and expectations for the IFRS Foundation’s work towards a global baseline of investor-focussed sustainability standards to improve the global consistency, comparability and reliability of sustainability reporting, media release.

Johnson, M.F., Kasznik, R., Nelson, K. K., 2001, The impact of securities litigation reform on the disclosure of forward-looking information by high technology firms, Journal of Accounting Research, 39, 2, 297-327.

Khan, M., Serafeim, G., Yoon, G.A., 2016, Corporate sustainability: First evidence on materiality, The Accounting Review 91(6), 1697-1724.

Manchiraju, H., Rajgopal, S., 2017, Does corporate social responsibility (CSR) create shareholder value? Evidence from the Indian Companies Act 2013, Journal of Accounting Research 55(5), 1257-1300.

Marquis, C., Toffel, M.W., Zhou, Y., 2016, Scrutiny, norms, and selective disclosure: A global study of greenwashing, Organization Science 27(2), 483-504.

Matsumura, E.M., Prakash, R., Vera-Muñoz, S.C., 2014, Firm-value effects of carbon emissions and carbon disclosures, The Accounting Review 89(2), 695–724.

Matsumura, E.M., Prakash, R., Vera-Muñoz, S.C., 2020, Climate risk materiality and firm risk, Available at SSRN.

Nissay Asset Management Corporation, 2019, Study of ESG Information Disclosure.

Petersen, M.A., 2009, Estimating standard errors in finance panel data sets: Comparing approaches, Review of Financial Studies 22(1), 435–480.

Platform on Sustainable Finance, 2021, Draft Report by Subgroup 4: Social Taxonomy.

Ross, S.A., 1979, Disclosure regulation in financial markets: Implications of modern finance theory and signaling theory, Issues in Financial Regulation 5, 177-202.

SEC, 2010. 2. 2, Commission Guidance Regarding Disclosure Related to Climate Change.

SEC, 2020. 11. 6, Modernization of Regulation S-K Items 101, 103, and 105 A Small Entity Compliance Guide.

SEC, 2021, Re: Request for public input on climate change disclosures.

SEC, 2021. 3. 15, Public input welcomed on climate change disclosures.

TRWG, 2021b, General Requirements for Disclosure of Sustainability-related Financial Information Prototype.

Verrecchia, R.E., 1983, Discretionary disclosure, Journal of Accounting and Economics 5, 179-194.

Verrecchia, R.E., 2001, Essays on disclosure, Journal of Accounting and Economics 32(3), 97-180.

Waddock, S.A., Graves, S.B., 1997, The corporate social performance-financial performance link, Strategic Management Journal 18(4), 303–319.

국내 유가증권 상장사 중 일정규모 이상인 기업은「지속가능경영보고서」를 2025년부터 의무적으로 공시할 예정이다.1) 현재는 한국거래소 자율공시2) 규정이 마련되어 있고 개별 기업은 공시 부담과 능력을 감안하여 자발적으로 지속가능경영보고서를 발행하고 있다. 이와 함께 2019년부터 자산 2조원 이상 유가증권시장 상장사는 의무적으로 「기업지배구조보고서」를 공시하고 있다.

지속가능경영보고서는 성격상 사업보고서와는 두 가지 측면에서 차이가 있다. 하나는 정보 공개 범위와 대상이 사업보고서보다 다양하다. 환경, 사회 및 지배구조 관련 의제에 대한 정보를 해당 부문의 이해관계자에게 중요도 관점에서 전달해야 한다. 기존 사업보고서는 재무 투자자가 주된 이해관계자인 반면에 지속가능경영보고서는 공익을 표방하는 민간단체, 일반 소비자, 공공부문 등으로 이해관계자의 범위가 확대된다. 다른 하나는 지속가능경영보고서가 사업보고서에 비해 기업 장기 성장에 대한 보다 포괄적인 내용을 담게 된다. 사업보고서는 단일 사업연도에 대하여 과거 정보를 바탕으로 서술되기 때문에 향후 지속적인 가치 창출 여부에 대한 정보가 부족하다. 지속가능경영보고서는 미래지향적(forward-looking) 관점에서 관련 이해관계자와 공유 가능한 지속가능 가치 창출 내용에 초점이 맞춰진다.3)

사업보고서상의 재무제표는 일반적으로 인정된 회계원칙에 따라서 표준화된 방법으로 작성된다. 각국마다 기업 경영 환경과 관련 법규가 상이하나 일반적으로 인정된 회계원칙을 공통으로 채택하고 있다. 국가 간 자본이동의 중요성이 부각되면서 회계정보의 국가 간 비교 가능성을 가능하게 하기 위해서 국제회계기준위원회(International Accounting Standards Board: IASB)가 제정한 국제회계기준(International Financial Reporting Standard: IFRS)을 사용하고 있다.4) 그러나 지속가능경영보고서는 회계기준에 준하는 공통된 작성 기준이 존재하고 있지 않아 국내 기업을 포함한 해외 기업들은 기존의 국제 이니셔티브5)를 개별 기업의 사정에 맞게 절충하여 사용하고 있다.6)

국제회계기준 재단은 지속가능성을 표방하는 투자 규모가 전 세계적으로 점증하고 있는 상황에서 정보의 투명성과 비교가능성 확보를 위해 국제 기준 제정의 필요성을 인식하고 국제지속가능기준위원회(International Sustainability Standards Board: ISSB)를 설립하였다.7) 유럽연합(European Union: EU)은 2014년에 연합 내 일정 조건을 충족하는 상장기업과 금융기관에 대해 비재무정보공시지침(Non-Financial Reporting Directive: NFRD)을 발효하여 2018년부터 적용하고 있다. 2017년에 정보 공개를 위한 가이드라인8)에서 보고기준 채택은 개별 기업의 특성과 경영 환경에 따라 자율적으로 채택하도록 했다. 미국의 경우 지금까지는 Form 10-K 연차보고서에서 비재무정보를 중요성 관점에서 자율적으로 기술하도록 하고 있다. 현재는 증권거래위원회(Securities and Exchange Commission: SEC)가 기후변화에 한정하여 공시를 의무화하는 법 개정을 준비하면서 단일 보고기준 채택의 타당성 여부를 검토하고 있다. 국내에서는 한국거래소가 제공한 정보공개 가이던스9)에서 국제 이니셔티브 채택에 관한 권고안을 제공하고 있다.

본 보고서는 2025년부터 단계적으로 적용되는 지속가능경영보고서 의무화 일정에 앞서 제도 정비 논의에 도움이 되는 개념 소개와 국제 기준 제정의 실무 작업 동향을 조사하는 것을 목적으로 한다.

기업 정보 공시와 기준 마련에 관한 사안은 회계, 재무, 경제, 경영학에서 다년간에 걸쳐 연구가 진행되어 왔다. 정보의 실질적 중요성(materiality) 파악, 정보 공개의 유인체계, 기업가치와의 관계, 경영진의 행동 변화 등에 관한 사안이 주된 연구 주제이다.

따라서 일차적으로는 사안 조사를 위한 개념체계를 과거 연구에 의거하여 마련해본다. 여기서 기존의 재무공시와 지속가능공시의 차이점에 방점을 두어 향후 지속가능공시 체계를 마련하기 위해 고려해야 할 사안이 무엇인지를 파악해 본다. 아울러 보다 깊이 있는 논의를 위해 실증 분석 국내 환경 관련 정보 공시의 유인 체계를 실증 분석을 통해 파악하여 본다.

이차적으로는 유럽연합의 경험을 바탕으로 지속가능 공시 실행에 있어서 고려되어야 할 점이 무엇인지를 파악해 본다. 유럽 NFRD 시행 3년 전후의 경험을 참조하여 지속가능 의무공시 시행을 앞둔 기업과 정책당국이 참고할 수 있는 자료를 조사한다.

마지막으로는 최근 마련된 IFRS 지속가능성 공시기준의 시안(prototype)과 EFRAG (European Financial Reporting Advisory Group)의 자문 보고서를 통해 구체화되어 가는 국제 표준 기준안의 내용을 조사하여 소개한다.

Ⅱ. 지속가능보고의 개념적 특성

1. 개요

Christensen et al.(2021a)에서는 지속가능보고10)를 “지속가능 활동, 위험, 정책을 포함한 관련 주제들에 대해서 정보의 측정, 공시 및 소통”으로 정의하고 있다.11) 반면에 실무적 관점에서 국제 이니셔티브를 이끌고 있는 SASB(Sustainability Accounting Standard Board)는 개념 체계에서 지속가능성(sustainability)을 “기업이 장기적으로 기업 가치를 창출할 수 있는 능력을 유지하거나 제고시키는 행위”로 정의하여 규범적 관점보다는 가치 창출에 무게를 두고 있기 때문에 지속가능보고 행위를 그 연속선상으로 간주하고 있다.

본 보고서에서는 기업의 지속가능 활동은 기존의 사회적 책임이라는 규범적 성격의 의미보다는 기업이 직간접으로 영향을 주고받는 모든 이해관계자와의 역동적 상호작용 결과로 발생하는 위험과 기회요인을 인식하고 이를 선행적으로 관리하거나 활용하여 기업가치를 보존하거나 지속적으로 창출하는 행위로 인식한다. 따라서 지속가능보고라 함은 기업의 지속가능 활동과 관련된 정보를 측정하고 공개하는 것을 의미한다.

지속가능보고 기준은 이러한 정보를 어떤 방식으로 분류12)하고 측정할 것인가를 판단하는 근거를 제공하는 잣대이다. 따라서 보고의 기준이 마련되어 있지 않거나 기업마다 채택하는 기준이 다를 경우 이해관계자 입장에서는 정보의 유용성과 비교가능성은 현저하게 낮아질 수 있다.13)

회계기준에 의한 의무공시의 편익은 표준화된 정보 제공에 따른 정보 투명성 향상과 비교가능성에 있다. 긍정적인 외부효과가 있는 셈이다. Foster(1980)는 시계 차원(time dimension)에서 외부효과가 발생할 수 있음을 밝히고 있다. 예를 들어 동일한 위험 요소를 갖고 있는 기업들이 각자의 편의에 따라 불규칙한 시점에 자료를 공개할 경우 투자자는 정보의 적시성 측면에서 투자 의사 결정에 어려움을 겪을 것이다. 정보 공개 시점을 통일시켜 준다면 비교가능성을 높일 수 있다.14)

자발적 공시 환경에서는 개별 기업이 공시 표준화의 외부효과로 증가하는 사회 후생적 측면을 고려하지 않기 때문에 사회 전체적으로 기준 마련을 위한 노력이 부족할 것이다. 강제 규정에 의한 기준 채택과 표준화된 보고를 정당화하는 정책 논의에서 상술한 논거가 가장 대표적으로 인용되고 있고, 실제로 이를 실증하려는 연구가 진행되어 왔다.15)

지속가능보고 기준의 범주에는 공개 매체도 포함된다. 기존 사업보고서에 포함할지, 별도의 보고서로 작성하는지 아니면 재무 정보와 지속가능 정보를 일관성 있는 체계하에 통합 보고(integrated reporting)를 해야 하는지의 논의가 포함된다.16)

그러나 지속가능 활동의 대상인 이해관계자는 기업이 속한 산업분류 상의 업종에 따라 다르고 더 나아가 사안에 따라 지속가능 주제의 중요성은 개별 기업마다 다를 수 있다. 이런 점을 감안할 때 지속가능보고 기준에 대한 가이드라인을 마련할 때 기업 간 일관된 비교를 위해 전 업종에 걸쳐 적용할 수 있는 표준적인 부분과 개별 기업의 특성을 반영할 수 있는 부분이 절충적으로 적용되는 현실을 반영하는 것을 고려해 볼 수 있다.17)

따라서 향후 의무공시를 앞두고 가이던스 혹은 규정 보완에 있어서 지속가능보고가 기존의 재무보고와 어떻게 다른지를 이해하는 것이 중요하다.

2. 재무보고와 구분되는 특징

지속가능보고와 관련된 제도적 논의를 할 때, 기존 재무정보 보고와 구분되는 특징을 인지하는 것이 중요하다. 이들 특징은 지속가능보고의 기준 제정과 적용의 긍정적인 효과를 구현하기 어렵게 하는 요인이기 때문에 향후 추가적인 논의와 연구가 필요한 부분이다.

가. 외부효과와 중요성(materiality)의 판단

기업 정보의 중요성은 일반적으로 재무적 관점에서 논의되어 왔고 주 이해관계자는 투자자이다. 기업이 발행하는 사업보고서상의 재무정보는 일차적으로 감사인의 회계감사를 거쳐 투자자에게 전달된다. 주로 회계정보의 중요성(materiality)관점에서 정보의 누락 혹은 왜곡표시 정도를 감사하는데, 중요성은 회계정보가 투자자 의사결정에 영향을 미치는가의 여부에 따라 결정된다.