Find out more about our latest publications

The Usefulness of Material Disclosure on ESG Activities to Improve the Value Relevance

Research Papers 22-04 Dec. 16, 2022

- Research Topic Capital Markets

- Page 71

- No other publications.

- No other publications.

As a member of the social community, if a company puts effort into sustainable activities and creates environmentally and socially meaningful outcomes, it in itself solidifies the going concern assumption. Therefore, it is reasonable to assume that ESG performance and corporate value would have a meaningful association. However, a number of empirical literature over a long period of time have presented mixed conclusions about the relationship between ESG performance and a firm's financial performance or corporate value(Waddock & Graves, 1997; Zhao & Murrell, 2016). In particular, in the case of Korea, it is not even clear or robust whether investors utilize a company's ESG performance in making investment decisions as well as purchase decisions in the product and service market(Kim et al., 2022).

This report intends to reconcile the inconsistent discussions on the relationship between existing ESG activities and corporate value, and to re-visit the relationship between the two in terms of financial materiality.

We examined the relationship between ESG activities and corporate value of Korean listed companies and suggest that the main reason why existing studies did not find consistent empirical evidence is that overall ESG performance improvement activities, on average, possibly deviated from the main channels in creating corporate value. Companies that improved their ESG performance by focusing on financially material activities not only achieved long-term abnormal returns in the stock market but also persistently maintained high ESG performance.

The results imply that financially material ESG activities are deeply related to the long-term value creation of a company, and ultimately, it would be reflected through security prices. However, in the short term, it appears that market participants underestimate such value relevance rather than fully understand it in a timely manner.

Results of this report have great implications not only for managers who want to increase their corporate value by improving ESG performance but also for policymakers who want to alleviate the chronic discount phenomenon in the Korean capital market. First, companies should focus on financially material ESG activities. ESG activities that do not drive long-term financial performance are not only systematically suppressed under the current legal system that intends to protect the interests of shareholders, but it is also difficult to attract sustained support from key stakeholders.

Second, since the participants in the capital market may not be able to understand the value relevance of ESG activities in a timely manner, disclosure should be able to clearly express the financial significance of ESG activities. Although the performance of ESG activities with high financial materiality will be relatively more comparable than non-financial performance, investors still underreact in the short term, which raises the need to improve the market's valuation mechanism. The ESG information disclosure, which is scheduled to become mandatory in 2025, needs to incorporate an identification and reporting system focusing on important risk and opportunity factors that affect corporate value which is necessary to promote a virtuous cycle effect that is a source of financing.

This report intends to reconcile the inconsistent discussions on the relationship between existing ESG activities and corporate value, and to re-visit the relationship between the two in terms of financial materiality.

We examined the relationship between ESG activities and corporate value of Korean listed companies and suggest that the main reason why existing studies did not find consistent empirical evidence is that overall ESG performance improvement activities, on average, possibly deviated from the main channels in creating corporate value. Companies that improved their ESG performance by focusing on financially material activities not only achieved long-term abnormal returns in the stock market but also persistently maintained high ESG performance.

The results imply that financially material ESG activities are deeply related to the long-term value creation of a company, and ultimately, it would be reflected through security prices. However, in the short term, it appears that market participants underestimate such value relevance rather than fully understand it in a timely manner.

Results of this report have great implications not only for managers who want to increase their corporate value by improving ESG performance but also for policymakers who want to alleviate the chronic discount phenomenon in the Korean capital market. First, companies should focus on financially material ESG activities. ESG activities that do not drive long-term financial performance are not only systematically suppressed under the current legal system that intends to protect the interests of shareholders, but it is also difficult to attract sustained support from key stakeholders.

Second, since the participants in the capital market may not be able to understand the value relevance of ESG activities in a timely manner, disclosure should be able to clearly express the financial significance of ESG activities. Although the performance of ESG activities with high financial materiality will be relatively more comparable than non-financial performance, investors still underreact in the short term, which raises the need to improve the market's valuation mechanism. The ESG information disclosure, which is scheduled to become mandatory in 2025, needs to incorporate an identification and reporting system focusing on important risk and opportunity factors that affect corporate value which is necessary to promote a virtuous cycle effect that is a source of financing.

Ⅰ. 서론

지난 십수년간 많은 기업들이 Environmental, Social and Governance(이하 ESG) 활동에 상당한 노력을 기울이고 있다. 이와 동시에 기업의 ESG 성과를 표준화하여 측정하고, 평가하려는 시도가 계속되었으며, 자본시장의 투자자들 또한 이를 투자의사결정에 체계적으로 반영하려는 노력을 경주해왔다. 학술문헌들도 기업의 ESG 성과가 기업의 가치를 제고하는지의 관점에서 ESG 활동에 대한 경제적 시사점을 도출해왔다. 그러나 ESG 성과와 기업의 재무성과 혹은 기업가치 간의 관계를 살펴본 실증문헌들의 결론은 엇갈리고 있다(Waddock & Graves, 1997; Zhao & Murrell, 2016). 우리나라 기업을 분석한 연구들도 일관된 결과를 찾지 못하고 있다(김세희 외, 2022). 즉, 상품서비스시장이나 자본시장의 참여자들이 ESG 성과를 구매의사결정이나 투자의사결정에 체계적으로 반영한다는 증거가 부재한 것이다.

그럼에도 불구하고 ESG 성과와 기업가치의 관련성은 사뭇 당위적인 것이다. 재무성과와의 관련성이 떨어지는 ESG 활동은 그 자체로 지속가능하지 않고, 지속가능하지 않은 활동은 기업가치 창출역량이 제한적이기 때문이다. 이는 다음과 같이 설명할 수 있다.

첫째, 재무성과를 견인하지 못하는 ESG 활동은 주주의 지지를 받기 어렵다. 기업지배구조를 포함하여 주주의 이익을 보호하고 도모하는 것을 지향해온 현행의 법규범 하에서는, 주주에게 분배가능한 부(예: 손익계산서 상 당기순이익)를 제고하지 못하는 활동은 제도적으로 억제된다.

둘째, 효율적으로 작동하는 자본시장에서는 현금흐름 창출능력과 체계적 위험을 적극적으로 가격에 반영한다. 따라서 재무성과와의 관련성이 약한 ESG 활동은 투자의사결정의 고려사항이 아니며, 따라서 자본제공의 대상이 아니다. 이처럼 외부 투자자의 투자의사결정을 이끌어내기 어려운 활동은 지속가능하지 않다.

셋째, 재무성과 지표들이 비재무성과 지표들에 비하여 비교가능성이 높기 때문에, ESG 성과를 평가하는 지표로써 더 타당하다. 기업의 ESG 활동은 즉각적으로 추가적인 비용을 수반하는 반면 그 효익은 불확실하기 때문에, 본래적으로 비용-효익의 관점에서 평가하기 어렵다. 따라서 객관성이 높은 재무성과들이 경영자 평가의 성과지표로써 더 비중 있게 사용된다(Ittner, Larcker, & Meyer, 2003). 따라서 시장의 평가 메커니즘에 노출되어 있는 경영자들은 재무성과 지표와의 관련성이 떨어지는 ESG 활동을 지속할 유인이 없다.1)

ESG 공시기준들은 이러한 특성에 근거하여 ESG 활동의 재무적 중요성을 중심으로 공시대상 정보를 파악하고 있다. 특히, ESG 정보공시의 글로벌 기준선(global baseline)을 마련 중인 국제지속가능성기준위원회(International Sustainability Standards Board: ISSB)는 기업의 장기 현금 창출 능력 및 전사적 가치(enterprise value)에 중요한 영향을 미치는 정보를 중심으로 ESG 정보 공시의 원칙을 마련하고 있다.2) 이때 이해관계자에게 더 파급력(혹은 영향력)이 큰 ESG 활동보다는 투자자 입장에서 재무적으로 중요한 ESG 정보를 공시한다는 관점을 명확히 유지한다. 즉, 재무적으로 중요하지 않은 ESG 활동은 장기적으로 지속되기 어려울 것이므로, 정보로서의 가치가 작을 것이라고 전제하는 것이다.

이와 같은 배경을 바탕으로, 본 연구는 국내기업을 대상으로 1) 평균적으로 ESG 활동이 기업가치를 결정하는 요인들에 긍정적인 영향을 주는지, 2) 재무성과와의 관련성이 명확한 ESG 활동이 그렇지 않은 ESG 활동에 비하여 주식수익률에 반영되는 정도가 더 높은지, 그리고 3) 이 차이가 ESG 활동의 지속성 차이에서 기인하는지를 실증적으로 분석하였다. 이 분석에서 가장 핵심적인 변수는 ESG 활동의 재무적 중요성(즉, 재무성과와의 관련성)인데, 이는 SASB가 식별한 산업별 중요 지속가능성 지표에 근거한다. 구체적으로, 블룸버그가 보유한 기업별 지속가능성 공시지표를 바탕으로, SASB 산업분류에 기반한 중요한 공시지표가 얼마나 많이 공시되었는지로 측정하였다.

주요 실증분석 결과는 다음과 같다. 첫째, 평균적으로 ESG 활동은 미래 현금흐름창출 및 기업위험과 인과관계가 있는 것으로 나타나지 않았다. 둘째, 재무적 중요성(Material Disclosure: MD)이 높은 ESG 활동이 개선될 때, 주가수익률이 상승하였다. 반면 MD가 뚜렷하지 않은 ESG 활동의 개선은 주가수익률과의 관련성이 유의적이지 못하였다. 셋째, MD가 높은 ESG 활동의 개선에 대해 시장이 이러한 가치관련성을 적시에 이해하는 것은 아니었다. MD가 높은 ESG 활동을 개선했다는 정보가 시장에 공시된 이후에도, 주가수익률은 한동안 상승세가 지속되었다 (즉, 과소반응). 이 두 가지 결과는, 재무적 중요도가 높은 ESG 활동일수록 기업가치와의 관련성이 높지만, 이 정보가 적시에 주가에 반영되지 않음을 의미한다. 즉, 시장은 ESG 활동이 기업가치와 어떠한 관련성을 갖는지 이해하는 데 시간이 걸린다는 것이다.

마지막으로, MD가 높은 ESG 활동이 MD가 낮은 ESG 활동에 비해, 차기의 ESG 활동과 더 유의한 양(+)의 시계열 상관관계를 보였다. 이는 재무적으로 중요한 ESG 활동이 더 지속적이라는 위의 논의를 지지하는 결과이다. 또한 지속적인 ESG 활동만이 자본시장에서 가치관련성을 체계적으로 인정받을 수 있다는 간접적인 증거이다. 이와 같은 결과는 지속적이지 않은 일회성 성과가 증권가격에 체계적으로 반영되기 어렵다는 기존 문헌(예: Kormendi & Lipe, 1987)과도 일관된다.

ESG 활동과 기업가치 간의 관련성을 명확하게 찾지 못했던 선행연구의 한계를 고려하면, 본 연구의 결과는 주목할 만한 것이다. 기존 연구에서 일관된 실증증거가 부재했던 것은 1) ESG 활동이 애초에 기업가치 창출경로(예: 미래현금흐름이나 자본조달비용)와 무관할 가능성, 혹은 2) ESG 활동과 기업가치 요소들의 관련성에 대한 시장의 평가가 체계적이지 않을 가능성을 모두 내포한다. 기업이 내세우는 ESG 활동의 기조가 기업의 전략이나 운영지침에 구체적으로 반영되어 있지 않거나, ESG 활동에 대한 공시가 시장에 기업가치와 관련된 정보를 제공하지 못하는 것이다.3) 본 연구는 ESG 활동의 재무적 중요성을 상호교차 변수로 사용하여 정황적 증거를 제공함으로써, ESG 활동과 기업가치 간의 관련성에 대한 기존 문헌의 논의들을 통합하고 있다.

또한 본 연구의 결과는 ESG 활동을 통하여 기업가치를 제고하고자 하는 기업 및 정책입안자들에게 상기에서 지적한 1)과 2)의 맥락에서 두 가지 시사점을 제공한다. 첫째, 기업들은 재무적 중요성이 높은 ESG 활동에 집중해야 한다. 이는 큰 비용을 수반하는 ESG 활동을 지속적으로 수행할 수 있게 하는 기업 내부적인 원동력이 될 뿐만 아니라, 투자자의 긍정적인 평가를 바탕으로 안정적인 외부자금을 확보할 수 있게끔 한다. 즉, 기업 안팎으로 ESG 활동에 대한 당위성을 공고히 할 수 있는 것이다. 둘째, 자본시장의 참여자들이 ESG 활동의 가치관련성을 즉각적으로 이해할 수 있는 것은 아니기 때문에, ESG 활동의 재무적 중요성을 공시를 통해 명확히 표현해야 한다. 이는 ESG 공시규정을 준비하고 있는 국내 정책입안자들이 기업의 특성별로 재무적 성과와 밀접한 관련이 있는 ESG 활동이 무엇인지를 먼저 식별하고, 이를 정보이용자들에게 효율적으로 전달할 수 있는 방법을 숙고해야 할 것임을 의미한다. 이 과정에서 기업 및 자본시장참여자들과의 긴밀한 의사소통은 필수적일 것이다.

Ⅱ. 선행연구의 검토 및 연구주제

1. ESG 활동과 기업가치

ESG 활동에 대한 폭발적인 관심은 2010년대 말 UN PRI, BlackRock, Vanguard, State Street 등의 국제 대규모 펀드운용사들이 포트폴리오 구성에 지속가능성 요소를 비중 있게 고려하면서 본격 확대되었다(Welch & Yoon, 2022). 이는 과거의 주주가치 옹호자들이 ESG 활동은 전통적인 기업가치 창출활동과 배치되므로 주주가치를 제고하는데 도움이 되지 않는다는 입장(Friedman, 1970; Jensen, 2002)으로는 설명될 수 없는 경향이다. 최근 투자자들이 주목하는 ESG 활동의 효과는, ESG 활동이 기업가치를 창출하는 다양한 경로에 긍정적인 영향을 줌으로써 궁극적으로 주주가치도 제고하는 효과를 가져올 수 있다는 주장으로 뒷받침될 수 있다. 즉, 과거에는 기업의 ESG 활동이 이해관계자 가치 옹호자들에 의해 규범적인 측면에서 요구되었던 반면(Freeman, 2010), 최근 투자자들이 강조하고 있는 ESG 활동의 당위성은 경제적 효과를 염두에 두고 있다는 점에서 차별화된다.

ESG 활동은 다양한 경로로 기업가치를 창출할 가능성을 가지고 있다(Cornell & Damodaran, 2020). 기업가치는 기업이 미래에 창출할 것으로 예상되는 현금흐름을 위험조정할인율로 할인한 값이다. 따라서 ESG 활동은 이 두 가지 요소인 미래현금흐름과 할인율에 영향을 줌으로써 기업가치를 창출할 수 있다. 예를 들면, ESG 활동은 소비자의 선호도를 높여 매출액 신장에 도움이 되고(Lev et al., 2010), 안정된 인적자원 운영을 할 수 있고 유능한 인재를 영입할 가능성이 높으므로(Turban & Greening, 1997; Dess & Shaw, 2001; Lazear & Shaw, 2007) 장기적으로 생산성 및 원가구조를 개선할 수 있으며, 운영효율성을 높여 매출원가나 영업비용을 절감할 수 있게 해준다(Aral et al., 2021). 또한 활발한 ESG 활동은 기업 평판에 긍정적인 영향을 미치고(Fombrun & Shanley, 1990; Fombrun, 2005; Freeman, Harrison, & Wicks, 2007), 투자자들의 투자선호도를 높여 자본비용을 낮출 수 있다(Fama & French, 2007; Pedersen et al., 2021).

그러나 기업의 ESG 활동이 긍정적인 효과를 가지고 오지 않을 가능성도 존재한다. 전통적인 주주가치 옹호자의 주장에 따르면 ESG 활동은 대리인 문제를 야기할 수 있다. 즉, ESG 활동은 주주의 비용으로 경영자 본인의 명성을 축적하는 도구로 활용될 수 있으며(Cheng et al., 2013; Krueger, 2015) 이는 비효율적인 투자로 이어져 기업의 경쟁력을 하락시킨다(Friedman, 1970; Jensen, 2002). 또한 ESG 활동은 그 유형과 정도가 매우 방대하다(Christensen et al., 2022). 따라서 경영자들은 투자자들의 요구에 부합하는 ESG 활동을 구분해 내는 데 어려움을 겪을 수 있다(Welch & Yoon, 2022). 극단적으로는, 표면적인 선언에만 그치고 본연의 목적에 충실하지 않은 (green-washing) ESG 활동을 펼치는 경향도 보고되고 있다(Basu et al., 2022; Raghunandan & Rajgopal, 2022).

이와 같은 엇갈린 주장과 실증연구 결과를 종합하면, 투자자들은 기업의 ESG 활동이 경제적 효과를 창출하는지에 대해서 ESG 활동이 갖는 특성에 따라 차별적으로 평가할 가능성이 있다. 실제로 Khan et al.(2016)은 기업의 핵심산업과 연계된 ESG 활동은 주식시장에서 긍정적으로 평가되지만, 핵심산업과의 연관성이 떨어지는 ESG 활동은 투자자들이 차별적으로 평가하지 않는다는 것을 밝혔다. Grewal et al.(2021) 역시 개별기업의 주가에는 핵심산업과 깊게 관계된 ESG 활동에 관한 정보가 반영됨을 보였다. Serafeim & Yoon(2022)은 ESG 관련 정보가 주가에 반영되는 정도는 ESG rating에 대한 합의 정도에 따라 달라짐을 제시하였다. 이러한 연구들은 투자자들이 기업의 ESG 활동 중 경제적 효과를 가져올 가능성이 큰 활동만을 기업가치평가에 반영한다는 것을 시사한다.

국내에서는 대부분의 연구가 Tobin’s Q로 측정된 기업가치와 ESG 활동과의 관계를 살펴보고 있다. Choi et al.(2010), 나영‧임욱빈(2011), 임욱빈(2019), 강원‧정무권(2020)은 ESG 활동과 기업가치 간에 양의 관련성이 있음을 밝혔다. 한편 ESG 활동과 기업가치와의 관계가 제한적인 상황에서 강화된다는 것을 제시한 연구들도 있다. 예를 들어, 임종옥(2016)과 김양희 외(2021)는 기업의 환경 및 사회분야의 활동에 대해서만 기업가치와의 양의 관계가 있음을 밝혔고, 이창섭 외(2021)는 영업이익 변동성이 높은 기업의 ESG 활동과 기업가치와의 관계가 강하다고 보였다. 또한 김양희 외(2021)는 기업의 ESG 활동에 대한 소비자 인지가 높을수록 환경, 사회분야의 활동과 기업가치와의 양의 관계가 더 강하다고 보고하였다. 이들 국내 연구결과는 다양한 횡단면적 상황에서 투자자들의 ESG 활동에 대한 평가가 달라질 수 있다는 점을 보여준다.

2. 연구주제

최근 넓은 스펙트럼을 보이고 있는 ESG 활동에 대한 구체적인 지침이 요구되고 있다. 첫째, ISSB를 비롯한 주요 글로벌 기준제정기구는 장기 기업가치와 관련성이 높은 ESG 활동을 강조한다. 둘째, 이를 충실히 식별‧보고하기 위해 산업별 핵심 특성을 고려하여 세부 보고 지침을 구체화한다.

ISSB는 지속가능성 공시기준의 공개초안을 발표하면서 산업전반(cross-industry)에 적용할 보편적 지표 외에 산업별 특수성을 반영한 산업기반(industry-specific) 지표를 제시하여 전사적 가치에 영향을 미치는 중요한 위험 및 기회 요인을 보다 상세하게 공개토록 할 계획이다.4) ISSB와 비교하여 이해관계자에 대한 파급력을 더욱 중시하는(즉, 이중중요성) Global Reporting Initiative(이하 GRI)도 산업별로 차별화한 기준을 제정하여 기존 보고체계를 보완‧개편하는 과정에 있으며5), 유럽연합(EU) 내 ESG 정보공개 표준으로 활용될 European Sustainable Reporting Standards(이하 ESRS)도 산업별 핵심 공시사항을 마련 중이다.6) 한국거래소는 국제정합성을 제고하는 측면에서 ESG 정보공개 가이던스를 고도화할 계획으로 우리나라 기업들 역시 점차 글로벌 기준에 부합하는 수준에서 ESG 활동과 기업가치창출 동인(driver)을 유기적으로 연계할 필요성이 제기된다.7)

이처럼 주요 국제 기준제정기구들이 ESG 활동의 기업가치에 대한 영향력과 산업별 특수성을 고려하여 공시기준의 제‧개정 작업에 착수한 근간에는 핵심사업과 깊게 연계된 ESG 활동일수록 기업의 지속가능성과 관련도가 높고(Khan et al., 2016), 그러한 정보가 이해관계자들에게도 유용하다는 인식이 전제한다(Grewal et al., 2021).

이에, 본 연구보고서에서는 우리 기업의 ESG 활동이 기업가치 창출경로에 영향을 주는지를 시작으로, 투자자들이 실제로 기업의 ESG 활동을 기업가치평가에 긍정적으로 반영하는지, 어떠한 맥락에서 이러한 평가가 두드러지는지를 살펴본다. 특히나 핵심사업과 ESG 활동 간의 밀접성은 투자자들이 기업가치와의 연계성을 판단할 때 중요하게 고려되는 요소인 만큼(Khan et al., 2016; Grewal et al., 2021), 본 연구는 산업별 핵심 주제와의 연관성 정도가 ESG 활동에 대한 투자자의 평가에 어떠한 영향을 미치는지를 조사한다.

이때, 핵심 주제와의 연관성 정도는 SASB의 중요성(materiality) 기준에 따라 파악한다. SASB 기준은 최초의 산업기반 공시기준으로 그 타당도에 대한 학계의 검증이 이루어져(예: Khan et al., 2016; Grewal et al., 2021; Serafeim & Yoon, 2022 등), 최근 제정 과정에 있는 타 기준(예: GRI, ESRS 등) 대비 신뢰도가 높은 이점이 있다. 또한, 국제적으로 통용될 가능성이 큰 ISSB의 공시기준이 지속가능성 관련 위험 및 기회의 식별을 위해 SASB의 산업기반 공시주제를 검토하도록 명시적으로 요구하므로(IFRS S1[초안] 문단 51), 향후 ISSB 기준을 적용할 수도 있는 국내기업의 영향을 예비적으로 살펴보는 시사점을 기대할 수 있다.

Ⅲ. ESG 활동과 가치창출요소 간의 관계

1. 분석표본

본 장의 분석은 2012년부터 2020년까지 유가증권 및 코스닥시장에 상장된 기업 중 아래와 같은 기준을 충족하는 7,243 기업-연도를 대상으로 한다.

(1) 결산일이 12월 말인 기업

(2) 비금융업을 영위하는 기업

(3) 한국기업지배구조원이 ESG 종합점수를 산출한 기업

상기 표본을 기초로 각 분석에 필요한 특성 변수의 구성이 가능한 표본을 최종 분석 대상으로 하였다. 기업의 재무제표 자료 및 주가 자료는 DataGuide에서 추출하였으며, 무위험이자율의 대용치는 한국은행 경제통계시스템(ECOS)에서 제공하는 통화안정증권 364일물 수익률 자료를 이용하였다. 극단치로 인한 편의 가능성을 완화하고자 연속형 변수는 상‧하위 1% 수준에서 윈저화(winsorization)하였다.

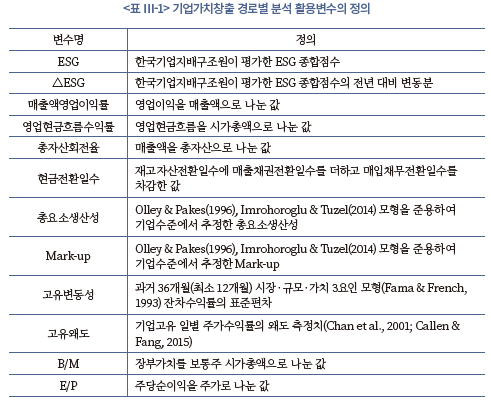

2. 기업가치창출 경로별 활용변수

가. 현금흐름경로

배당 지급 기업이 적은 국내 자본시장의 특수성을 감안하여 배당 수익성 지표보다는 영업 마진‧현금흐름측면의 수익성 지표를 고려하고, 영업 경쟁력을 확인하기 위해 효율성 지표와 무형자산‧기술측면의 생산성 지표를 활용하였다. 구체적으로 수익성 지표로는 매출액영업이익률 및 영업현금흐름수익률을, 효율성 지표로는 총자산회전율 및 현금전환일수를, 생산성 지표로는 총요소생산성 및 Mark-up8)을 살펴보았다.

나. 기업고유위험경로

시장‧규모‧가치 3요인으로 설명되지 않는 주가수익률의 변동성을 기업 고유의 비체계적인 위험으로 측정하고, 꼬리 위험을 집중적으로 살펴보기 위해 비대칭적인 주가폭락 위험을 포착하는 고유수익률의 왜도(skewness)를 검증에 활용하였다. 구체적으로 비체계적 위험 지표는 고유변동성으로, 주가폭락 위험 지표는 고유왜도로 측정하였다.

다. 상대가치평가경로

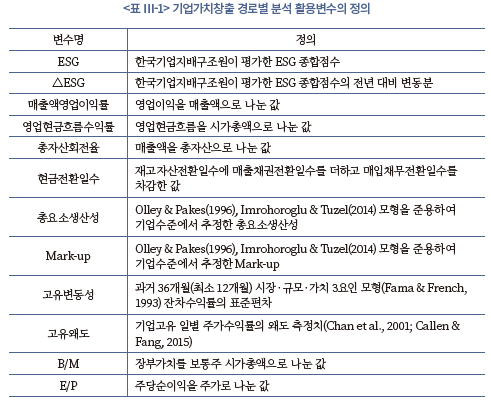

투자자들이 부여하는 가치평가 배수를 시장가치 대비 장부가치 비율(B/M) 및 주가 대비 주당이익 비율(E/P)로 측정하였다. 변수의 구체적인 정의는 <표 Ⅲ-1>과 같다.

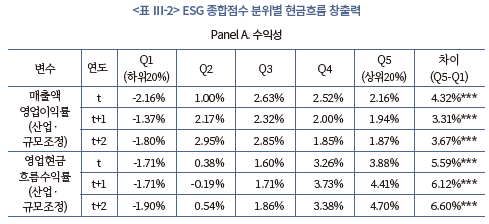

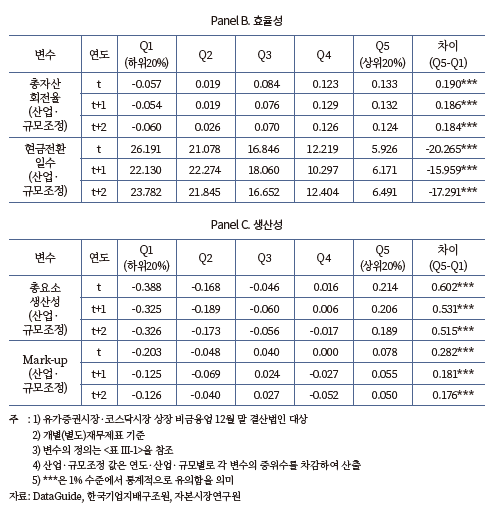

3. ESG 활동과 기업가치창출 경로별 상관관계

가. 현금흐름경로

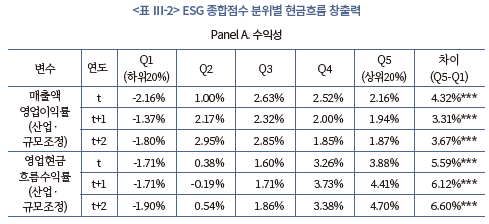

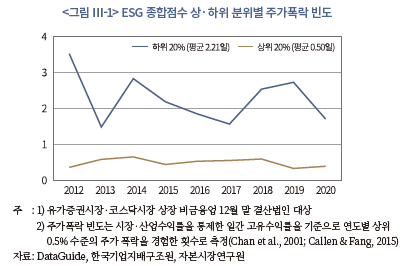

기업의 ESG 활동과 장기 현금흐름 창출 능력 간의 관련성을 살펴본 결과, ESG 점수가 높은 기업일수록 수익성‧효율성‧생산성 측면에서 우수한 성과를 보이는 것으로 나타났다. <표 Ⅲ-2>는 t 시점의 ESG 점수를 기준으로 구분한 5분위 집단별 수익성‧효율성‧생산성 지표의 평균값을 제시한다. ESG 점수가 가장 높은 수준의 집단(Q5)은 ESG 점수가 가장 낮은 집단(Q1)에 비해 영업 마진이 높고(매출액영업이익률), 현금흐름 측면에서 이익의 질이 좋을 뿐 아니라(영업현금흐름수익률), 자산 및 운전자본을 효율적으로 활용하며(총자산회전율, 현금전환일수), 무형자산‧기술 생산성 역시 탁월하여(총요소생산성, Mark-up), 전반적인 현금흐름 창출 능력 수준이 월등한 것으로 확인된다. 해당 격차는 산업 및 규모 특성을 조정한 이후에 나타난 결과로 1% 수준에서 통계적으로도 유의하며(양방향 검정), 장기간 안정적으로 유지되는 특성을 보인다.

나. 기업고유위험경로

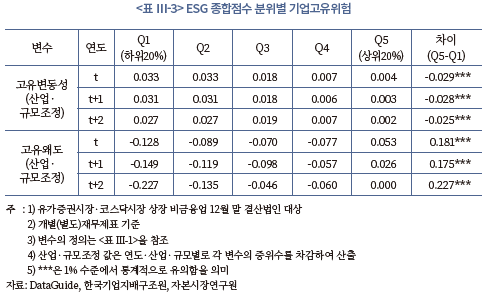

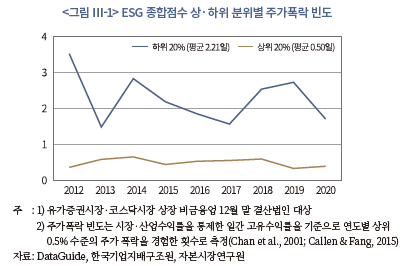

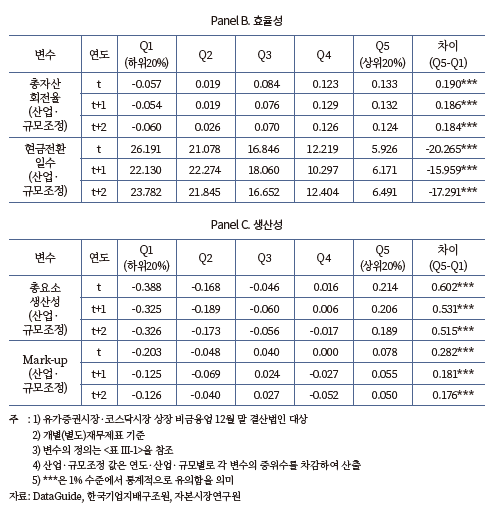

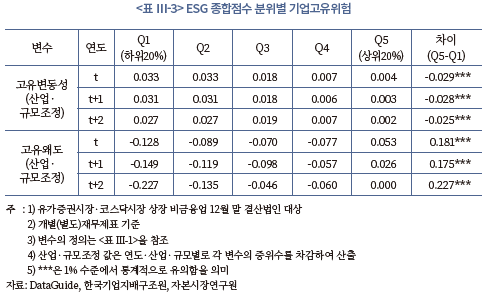

기업의 ESG 활동과 기업고유위험 간의 관련성을 살펴본 결과, ESG 점수가 높은 기업일수록 위험관리 체계가 고도화되어 있을 가능성이 높은 것으로 나타났다. <표 Ⅲ-3>은 t 시점의 ESG 점수를 기준으로 구분한 5분위 집단별 기업고유위험 지표의 평균값을 제시한다. ESG 점수가 가장 높은 수준의 집단(Q5)은 ESG 점수가 가장 낮은 집단(Q1)에 비해 시장‧규모‧가치 요인으로 설명되지 않는 기업 고유의 비체계적 위험이 작고(고유변동성), 비대칭적인 주가하락 위험도 낮은 것으로 확인된다(고유왜도). 관련 특성 변수는 산업 및 규모 영향을 조정한 것으로 해당 격차는 1% 수준에서 통계적으로 유의하며(양방향 검정), 장기간 안정적으로 유지된다. 아울러, <그림 Ⅲ-1>에서도 나타나듯 ESG 점수 수준이 높은 집단에서는 실제 극단적인 주가폭락을 경험하는 빈도도 적게 나타나 전반적으로 우수한 수준의 위험관리 역량을 보인다.

다. 상대가치평가경로

경쟁우위에 기반한 현금흐름 창출력은 안정적인 배당현금흐름을 실현하는 원천이 되고, 위험관리 체계의 고도화는 악재로 인해 발생할 수 있는 불필요한 비용 요인을 통제하기에 기업가치를 직접적으로 높이는 요인이 된다. 만약, 3.3.1절 및 3.3.2절에서 확인한 현금흐름 및 기업고유위험 경로상 ESG 활동과 가치관련 변수 간 양(+)의 상관관계가 기업의 ESG 활동이 동인이 되어 나타난 결과라면, 투자자들이 부여하는 상대가치평가 배수 역시 높게 나타날 것을 예상할 수 있다(Penman, 2013).

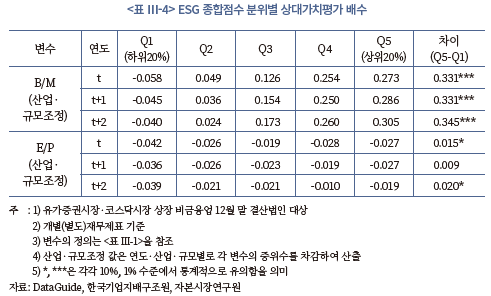

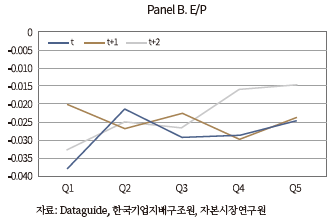

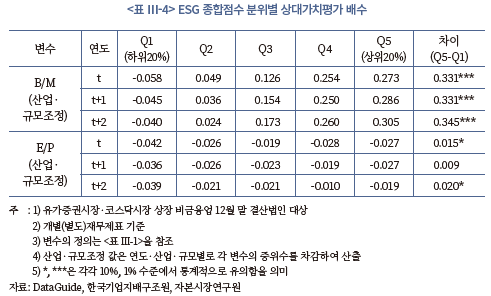

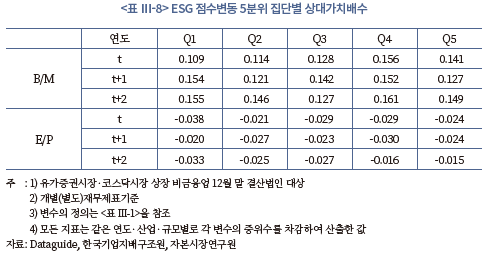

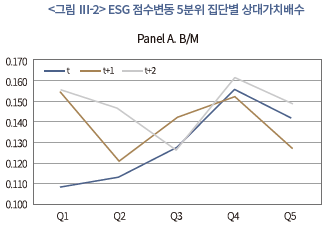

그러나 기업의 ESG 활동과 상대가치평가 배수 간의 관련성을 살펴본 결과, ESG 점수가 높은 기업일수록 오히려 낮은 평가 배수를 적용받는 것으로 확인된다. <표 Ⅲ-4>는 t 시점의 ESG 점수를 기준으로 구분한 5분위 집단별 상대가치평가 배수의 평균값을 제시하는데, ESG 점수가 가장 높은 수준의 집단(Q5)은 ESG 점수가 가장 낮은 집단(Q1)에 비해 장부가치 대비 시장가 비율(B/M)이 전반적으로 높게 나타나 상대가치평가배수는 낮게 형성되어 있다. 이는 동종 산업 내 유사 규모 기업과 비교하여 산출한 격차로 1% 수준에서 통계적으로 유의하며(양방향 검정), 해당 격차는 장기간 좁혀지지 않는 특성을 보인다. 다만, 순이익에 대한 평가 배수 비율(E/P) 격차는 기간에 따라 통계적 유의성이 일관되지 않아 상대가치평가 경로의 유효성에 대해서는 명확한 결론을 내릴 수 없었다.

4. ESG 활동과 기업가치창출 경로별 인과관계

ESG 활동과 기업가치창출 경로별 상관관계 분석에서 나타난 결과는 ESG 활동이 갖는 내생성에 기인할 가능성이 크다. 이와 같은 내생성은 1) 높은 기업가치를 가진 기업이 충분한 자원을 활용하여 ESG 활동을 활발히 하게 되는 역인과관계, 2) 연구자들이 인지하지 못한 인자가 기업의 ESG활동과 재무성과 및 자본비용에 동시에 영향을 줌으로써 두 요소 간의 상관관계를 관찰하게 되는 경우(즉, 생략된 변수의 문제)에 의해 발생한다(김세희 외, 2022).9) 따라서 ESG 점수의 변동분이 미래 가치창출경로의 변화를 유도하는지 살펴 인과관계를 보다 명확히 할 필요성이 있다.

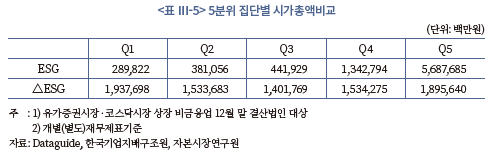

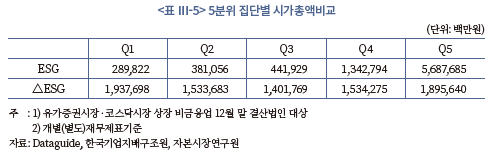

이에 본 절에서는 전년도 대비 당년도 ESG 점수의 변동분(△ESG)을 계산하여 매년 5분위로 구분하여 앞선 분석을 재수행해본다. 변동분에 대한 분석은 2013년부터 2020년까지 유가증권시장과 코스닥시장에 상장된 12월 말 결산법인 중 비금융업종에 해당되는 6,023 기업-연도를 대상으로 한다. <표 Ⅲ-5>에 나타나듯, ESG 점수 수준(ESG)을 기준으로 5분위로 구분하였을 때는 상위집단으로 갈수록 기업규모(시가총액)가 커지는 양상이 뚜렷하였으나, 변동분을 바탕으로 5분위 집단을 구성하였을 때는 이러한 양상이 완화되어, 기업규모와 관련된 ESG 활동의 내생성을 어느 정도 통제할 수 있는 것으로 나타난다.

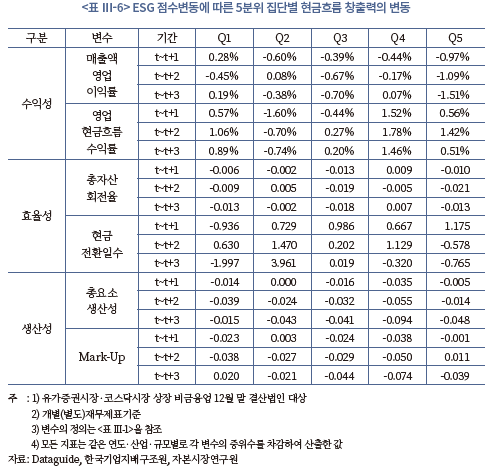

가. 현금흐름경로

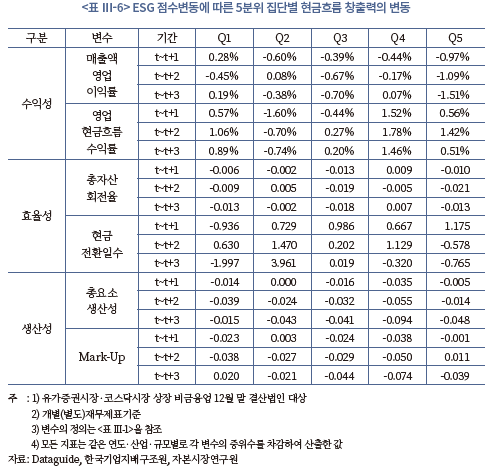

<표 Ⅲ-6>은 ESG 점수변동을 기준으로 구분한 5분위 집단별 수익성, 효율성, 생산성 지표 변동분의 평균값을 제시한다. 각 지표의 변동분은 t기를 기준으로 향후 1년, 2년, 3년 동안의 변동분의 비율을 나타낸다. 앞서 제시한 수준 분석의 결과와는 다르게, ESG 점수변동이 클수록 향후 수익성, 효율성, 생산성 지표가 개선되는 경향이 관찰되지 않는다. 예를 들어, 매출액 영업이익률은 ESG 점수변동이 가장 적은 수준의 집단(Q1)에서 향후 1년간 0.28%의 성장률을 보였으나, ESG 점수변동이 가장 높은 수준의 집단(Q5)에서는 –0.97%의 성장률을 보인다. 다른 지표들을 살펴보아도 ESG 점수가 개선될수록 미래현금흐름을 창출할 수 있는 경로에 긍정적인 영향을 미친다는 증거는 발견되지 않는다.

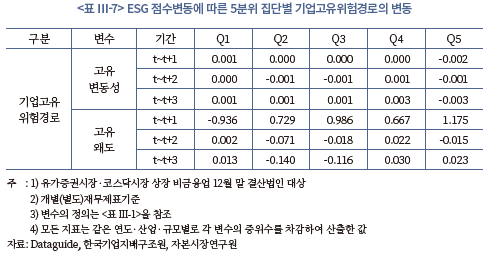

나. 기업고유위험경로

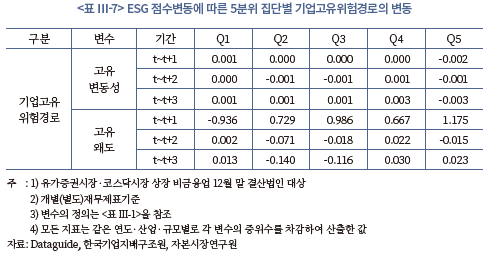

<표 Ⅲ-7>은 ESG 점수변동을 기준으로 구분한 5분위 집단별 기업고유위험경로의 변동분을 보여준다. 기업 주가수익률의 고유변동성은 단조적인 양상을 보이지는 않으나, ESG 점수변동이 가장 높은 집단(Q5)의 고유변동성이 다른 집단에 비해 더 많이 감소하는 현상은 나타나고 있다. 주가폭락 가능성을 나타내는 고유왜도 또한 ESG 점수변동에 따라 단조적인 양상을 보이고 있지 않다.

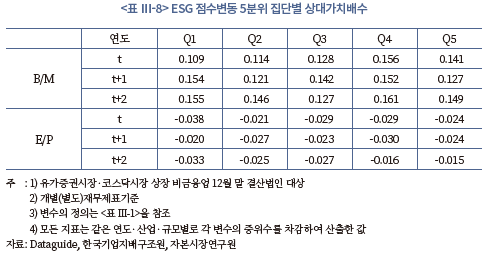

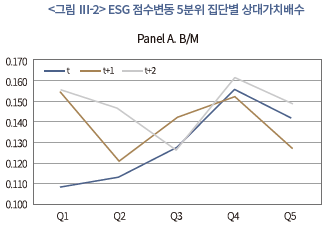

다. 상대가치평가경로

앞선 결과들은 ESG 점수의 증가가 기업가치 창출경로인 수익성, 효율성, 생산성의 향상으로 이어질 것이라는 예상을 뒷받침하지 못하고 있다. 기업고유위험 및 주가폭락위험 또한 ESG 점수의 향상으로 인해 개선된다는 주장을 제한적으로만 지지하고 있다. 이는 ESG 점수의 변동이 기업가치와 무관하게 나타날 가능성을 시사한다. 이를 명시적으로 확인하고자, 앞선 분석과 마찬가지로 표본을 ESG 점수의 변동분(△ESG)을 바탕으로 연도별 5분위로 구분한 뒤, t기, t+1기, t+2기의 B/M, E/P 배율을 살펴보았다. <표 Ⅲ-8> 및 <그림 Ⅲ-2>에 나타나듯 ESG 점수변동 분위별 B/M의 일정한 변화 추이는 확인되지 않으나, t기의 경우 t+1, t+2에 비해 상위집단의 B/M이 더 높은 것으로 나타난다. 이는 ESG 점수가 개선될수록 오히려 기업가치가 상대적으로 낮게 평가될 수 있음을 의미한다. E/P 분석 결과를 살펴보더라도 ESG 성과 개선 상위집단의 가치평가배수 향상 효과를 확인하기 어렵다.

5. ESG 점수 기반 포트폴리오 수익률

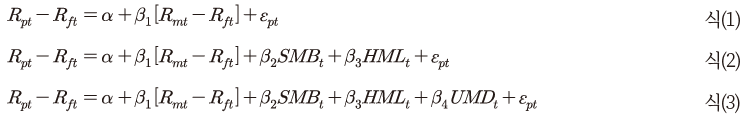

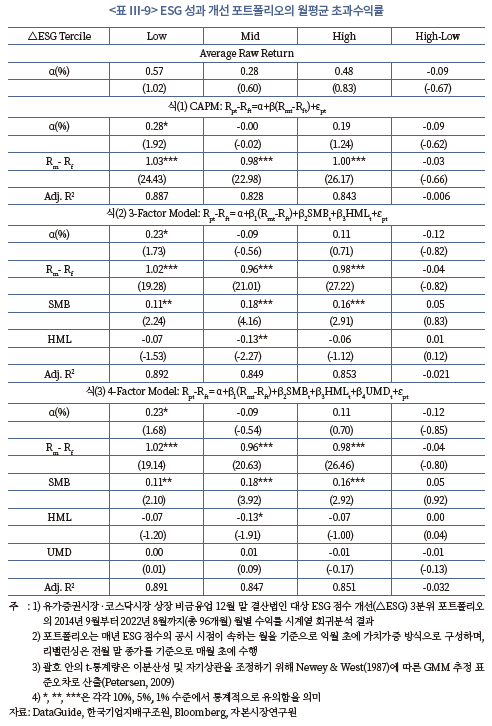

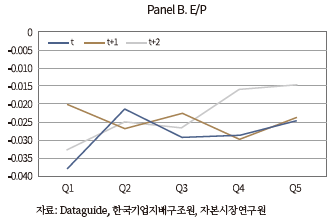

본 절에서는 기업의 ESG 활동이 기업가치에 반영되는지를 추가로 살펴보고자 ESG 점수의 변동(△ESG)을 기반으로 구성한 포트폴리오의 초과수익률 분석을 수행하였다. 이는 ESG 성과의 개선이 실제 기업가치에 반영되기까지 일정한 기간이 필요하다는 가정을 기반으로 한다. 따라서 매년 ESG 점수가 공개되는 시점이 속한 월의 익월 초를 기준으로 ESG 점수의 증분에 따라 3분위 포트폴리오를 구성하여 차기 ESG 점수 공표일이 속한 월의 말일까지 미래 초과수익률과 일정한 관련성이 있는지를 살펴보았다.10) 미래 초과수익률은 식(1)~(3)의 월별 시계열 회귀분석을 통해 추정하였다.

임의의 t 시점에 대하여, Rp는 포트폴리오 수익률, Rm과 Rf는 각각 시장수익률과 무위험수익률을 의미한다. 식(1)은 시장요인(Rm-Rf)을 고려한 CAPM(Sharpe, 1964; Lintner, 1965), 식(2)는 CAPM에서 규모요인(SMB)과 가치요인(HML)을 추가 고려한 3-요인 모형(Fama & French, 1993), 식(3)은 3-요인 모형에서 단기추세요인(UMD)을 추가 고려한 4-요인 모형이며(Carhart, 1997), 추정된 절편값 α는 각 모형에서 고려한 위험요인들을 조정한 이후의 월평균 초과수익률을 나타낸다.

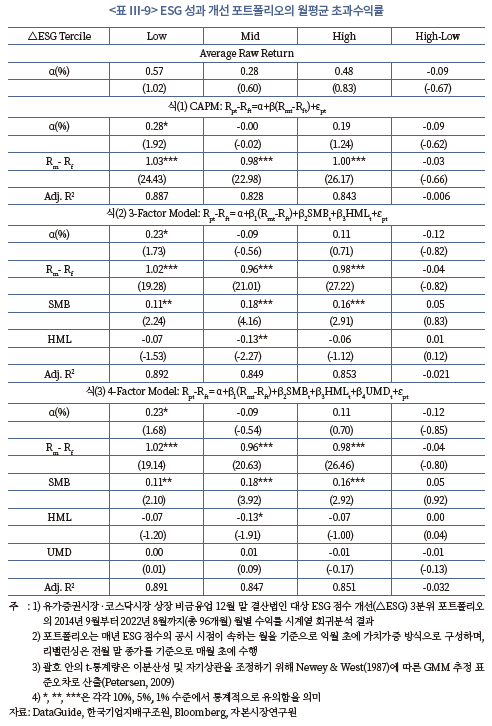

2014년 9월부터 2022년 8월까지 총 96개월간 ESG 성과 개선 포트폴리오의 월별 수익률 자료를 시계열 회귀분석한 결과를 <표 Ⅲ-9>에서 제시한다. 먼저 ESG 점수의 개선도(△ESG)가 가장 낮은 Low 집단의 미래 초과수익률은 월평균 0.57%이고, 가장 높은 High 집단의 초과수익률은 월평균 0.48%로 ESG 활동의 개선과 미래 초과수익률 간 유의미한 관련성은 확인되지 않는다. Mid 집단을 포함한 전반적인 횡단면적 변동을 살펴보더라도 ESG 성과의 개선에 따라 수익률이 단조적으로 증가하는 경향성은 확인되지 않으며, ESG 성과의 개선도가 높은 기업을 매수하고 낮은 기업을 매도하는 차익거래(High-Low) 전략 또한 유의미한 초과수익률을 창출하지 않는 것으로 나타났다. 이러한 결과는 시장‧규모‧가치‧단기추세 요인 등을 순차적으로 고려한 모형 모두에서 일관되며, 지면상 생략하였으나 동일가중 방식으로 포트폴리오를 구성한 경우에도 질적으로 유사한 결과가 확인된다.

6. 소결

이상의 분석 결과는 기업의 다양한 특성 변수들을 통제한 엄밀한 분석으로 보기는 어려우나, ESG 성과와 기업가치 간의 관련성을 가치창출 경로별로 세분화하여 살펴보았다는 점에서 국내의 선행연구와 차별화된다. 그럼에도 본 절의 결과가 시사하는 바는 ESG 성과와 기업의 가치창출경로 간 상관관계는 존재하지만, 인과관계가 뚜렷하지 않음을 밝힌 선행연구(Waddock & Graves, 1997; Zhao & Murrell, 2016; 김세희 외, 2022)와 일관된다. 단, 이와 같은 결과는 우리나라 기업을 평균적으로 분석한 결과이며, 기업 또는 소속 산업의 특정한 성격 및 환경에 따라 ESG 성과가 기업가치를 제고하는 경로가 더 뚜렷하게 나타날 가능성이 존재함을 감안하여 해석할 필요가 있다. 특히 태생적으로 광범위한 ESG 활동에 대한 투자자들의 이해를 돕는 추가적인 정보의 제공은 ESG 활동이 기업가치평가에 반영되는 과정을 원활하게 할 수 있다. 이에, 본 연구는 중요성공시에 초점을 맞추어 ESG 활동이 기업가치평가에 반영되는지를 더 살펴본다.

Ⅳ. 중요성공시와 ESG 활동의 효과

1. 중요성공시(MD) 자료

기업이 공시하는 지속가능성 관련 정보 중 전사적 가치와 밀접한 관련이 있는 정보는 중요한(material) 것으로 판단할 수 있다. 현재 IFRS 재단이 공표한 지속가능성 공시기준의 일반 공시원칙과 기후 관련 공시 공개초안은 투자자 관점에서 기업가치에 영향을 미치는 중요한 정보를 지속가능성보고서에 담는 것을 기본 원칙으로 한다. 그리고 중요한 정보의 선별은 IFRS의 기준이 별도로 마련되지 않는 한 SASB의 기준을 원용할 것을 천명하고 있다(IFRS S1[초안] 문단 51).

SASB는 고유의 산업분류 체계인 Sustainability Industry Classification System(이하 SICS)에 기초하여 11개 섹터의 77개 산업별로 지속가능성 관련 핵심 주제를 식별하고 있으며, 각 산업마다 기준서를 마련하여 산업 특성에 맞는 공시주제와 이를 측정하는 지표 및 단위를 제시한다. 국내 상장기업 중 SASB 산업분류에 기반하여 지속가능성 정보를 공개하기 시작한 기업은 많지 않다. 그러나 명시적인 SASB 기준 채택 여부와 상관없이 과거에 공개한 지속가능성 정보 중 어느 정도가 SASB의 산업 분류 체계에 따른 중요한 정보인지는 파악할 수 있다.

블룸버그는 전 세계 12,990개 이상의 상장사에 대하여 ESG 정보공개 점수(ESG Disclosure Score)를 연간 단위로 산정하며, 한국 상장사의 경우 2022년 5월 8일 기준 411개 기업에 대해 점수를 제공하고 있다. ESG 정보공개 점수는 블룸버그가 고유의 지표와 측정 단위를 설정하여 환경, 사회, 지배구조 부문 각각에 평가대상으로 선정한 지표 중 기업이 공개하는 지표의 비중을 동일 가중 평균하여 백분율로 산정한다.

이때, 블룸버그는 SASB 기준에 따라 정보의 중요성(materiality)을 판단하는 다수 이해관계자의 요구를 반영하여 자체 평가 지표 중 SASB 지표와 동일하거나 유사한 지표를 식별‧대응(mapping)할 수 있는 도구를 제공한다.11) 블룸버그의 고유 평가 기준과 연계하여 재무적으로 중요한 ESG 활동의 공시성과를 추가로 평가할 수 있는 체계를 마련한 것이다.

이를 이용하면 국내 상장사에 대해서도 중요성공시(MD) 점수를 산출할 수 있다. 첫 번째 단계는 개별 종목의 SICS 분류에 따른 귀속 산업을 확인한 후 해당 산업의 SASB 기준서에 명시된 지표를 확인하는 것이다.12) 다음으로 블룸버그의 식별 코드와 함수를 사용하여 전체 ESG 정보공개 항목 중 중요성 기준에 입각한 공시 비중을 확인한다. 즉, 특정 기업에 대하여 SICS 체계에 해당하는 산업을 확인하고, SASB 기준에 의거한 산업 내 중요 공시주제와 측정 단위를 식별한 후, 블룸버그의 대응(mapping) 도구를 활용하여 전체 정보공개 항목 중 중요성 항목의 공시비중을 백분율로 계산하면 최종적인 MD 점수를 확보할 수 있다.

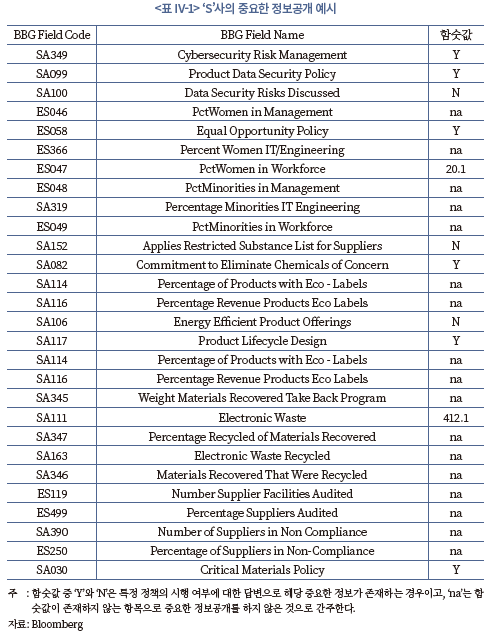

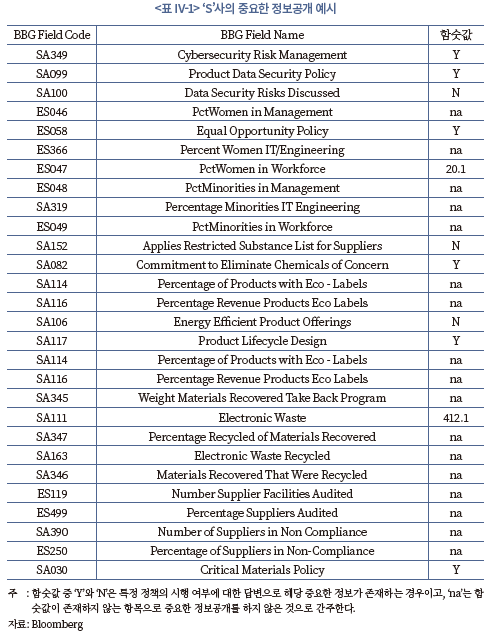

예를 들어 국내 유가증권 상장사 ‘S’사의 MD 점수 산출 과정을 단계별로 살펴보면 다음과 같다.

① SICS 분류에 따른 ‘S’사의 산업은 TC-HW(Technology & Communication 섹터 내 Hardware 산업)임을 확인한다.

② SASB가 식별하는 TC-HW 산업의 일반 이슈는 제품 안전(product safety), 직원 다양성과 포용성(employee diversity & inclusion), 제품 생애주기 관리(product lifecycle management), 공급망 관리(supply chain management), 소재 구매(material sourcing)이고, 이와 연관된 공시주제와 해당 지표를 식별한다.

③ SASB to Bloomberg Field Mapping 파일에서 식별된 SASB의 지표와 동일하거나 유사한 Bloomberg의 지표(BBG Field Name)와 해당 인식 코드(BBG Field Code)를 식별한다. <표 IV-1>은 ‘S’사의 SASB 지표에 대응하는 블룸버그 지표 예시이다.

④ 식별된 BBG Field Code를 Bloomberg 함수의 변수로 입력하여 해당 지표의 공개 여부를 확인한다.

표에서 개별 지표에 해당하는 함숫값이 존재하지 않으면 ‘na’로 표시되고 이는 정보공개를 하지 않은 것으로 간주한다. 전체 중요한 공시주제는 28개이고 ‘na’를 제외한 값이 11개이므로 MD는 39%로 산출된다.

단, 위와 같이 측정한 MD 점수는 조작적으로 중요성 기준에 입각한 ESG 활동 정보의 공시량을 나타내는 것이지, 관련 성과를 직접적으로 의미하는 것은 아니다(Grewal et al., 2021). 다만 정보이용자들은 MD 점수가 높을수록 기업이 공시한 ESG 활동이 재무적으로 중요한 분야에 집중되어 있다고 판단할 수 있다. 즉, 지속가능성 정보의 자발적 공시 체제 하에서 MD 점수의 증가(감소)는 중요 주제에 대한 공시 범위의 확대(축소)를 의미하므로 ESG 활동의 성과 개선(악화)과 기업가치 간의 연관성에 대한 더욱 명확한 정보를 전달할 것이다. 따라서, 후술하는 분석에서는 MD 점수의 증분을 관심변수로 활용한다.

2. 표본의 구성 및 기초통계량

본 장의 분석은 2013년부터 2020년까지 유가증권 및 코스닥시장에 상장된 기업 중 아래와 같은 기준을 충족하는 25,544 기업-월을 대상으로 한다.

(1) 결산일이 12월 말인 기업

(2) 비금융업을 영위하는 기업

(3) 한국기업지배구조원이 ESG 종합점수를 산출한 기업

(4) Bloomberg가 MD 점수를 산출한 기업

(5) 주식가격(월별 종가)이 1,000원 이상인 기업

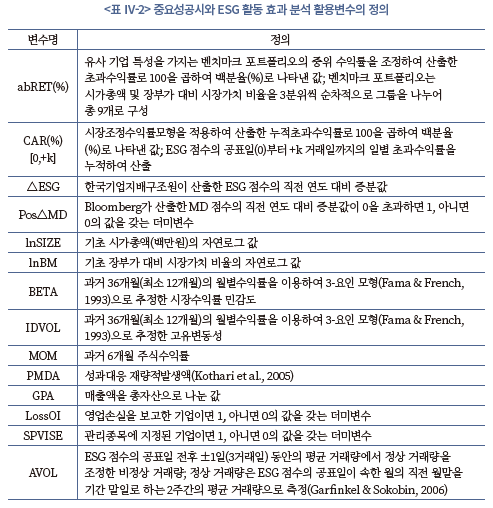

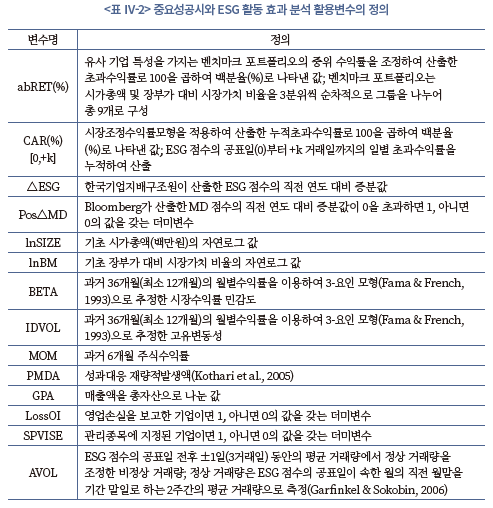

상기 표본을 기초로 각 분석에 필요한 특성 변수의 구성이 가능한 표본을 최종 분석 대상으로 한다. 기업의 재무제표 자료 및 주가 자료는 DataGuide에서 추출하였으며, 무위험이자율의 대용치는 한국은행 경제통계시스템(ECOS)에서 제공하는 통화안정증권 364일물 수익률 자료를 이용하였다. 극단치로 인한 편의 가능성을 완화하고자 주가수익률을 제외한 모든 연속형 변수는 상‧하위 1% 수준에서 윈저화(winsorization)하였다. 본 장의 분석에 활용한 변수의 구체적 정의는 <표 Ⅳ-2>에서 제시한다.

가. 중요성공시에 따른 ESG 성과 개선 포트폴리오의 구성 및 기초통계량

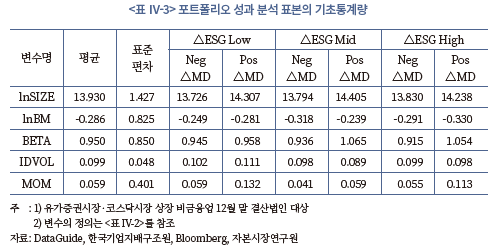

우선 MD가 높은 ESG 활동의 개선이 미래 주가수익률을 견인하는지를 검증하고자 ESG 점수의 증분(△ESG)과 MD 점수의 증분(△MD)에 따른 이중 정렬 포트폴리오를 구성한다. 연도별 ESG 점수의 공시 시점에 전년도 대비 점수가 얼마나 개선되었는지를 기준으로 상(High), 중(Mid), 하(Low) 3개의 그룹으로 구분하고, 다시 MD 점수의 개선 여부를 기준으로 개선(Pos△MD), 미개선(Neg△MD) 2개의 그룹으로 구분하여 총 6개의 그룹을 구성하였으며, 관련 그룹 정보를 당기 ESG 점수의 공시 시점이 속하는 월의 익월 초부터 차기 ESG 점수 공시 시점이 속하는 월의 말일까지 적용하여 매년 △ESG‧△MD 포트폴리오를 재구성하였다. 이에 따라 주가자료를 이용하는 실증분석 기간은 2014년 9월 초부터 2022년 8월 말까지 총 96개월로 설정하였다.

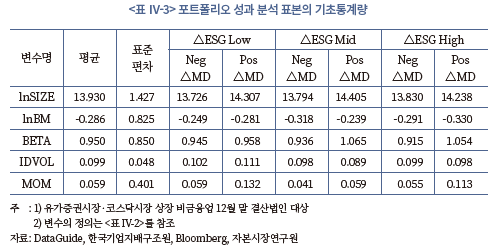

<표 Ⅳ-3>은 25,544 기업-월 관측치로 구성한 △ESG‧△MD 포트폴리오별 주요 특성 변수의 평균값을 제시한다. 평균값은 매년 해당 포트폴리오를 구성하는 개별기업의 변숫값을 동일 가중하여 산출하였다. 기업규모(lnSIZE)는 대체로 Pos△MD 집단이 Neg△MD 집단에 비해 크게 나타났으나, 6개 그룹 모두 베타(BETA)의 평균값이 1에 가깝게 나타나 시장베타 수준에서 크게 벗어나지 않았고, 장부가 대비 시장가(lnBM) 특성, 고유변동성(IDVOL)으로 대리한 비체계적 위험 특성도 뚜렷한 차이를 보이진 않았다. 단, 과거 수익률 성과(MOM) 측면에서 일정한 차이가 확인되어 후술하는 △ESG‧△MD 포트폴리오 성과 분석에서는 시장‧규모‧가치요인에 단기추세 요인을 추가로 고려한 Carhart 4-요인 모형의 시계열 회귀분석을 통해 월평균 초과수익률을 추정하고자 한다.

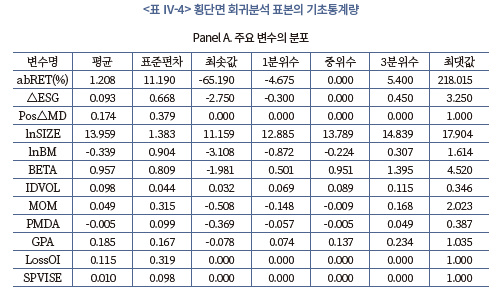

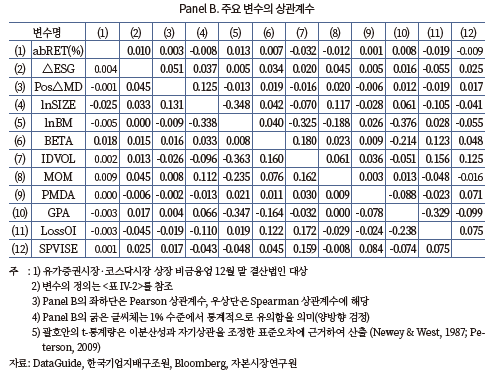

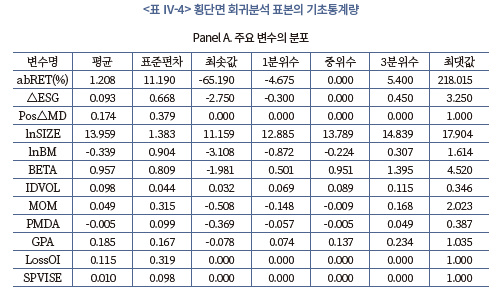

나. 횡단면 회귀분석 표본 구성 및 기초통계량

전술한 포트폴리오 성과 분석, 즉, MD가 높은 ESG 활동의 개선이 미래 주가수익률을 견인하는지를 개별기업 수준에서 재검증하고자 횡단면 회귀분석 표본을 구성하였다. 포트폴리오 수준의 시계열 회귀분석에서는 통제할 수 없는 성과대응 재량적 발생액(PMDA), 총수익성(GPA) 등 개별기업 특성 변수를 추가적으로 고려하면서 최종 표본은 24,681 기업-월 관측치로 구성된다. <표 Ⅳ-4>는 관련 주요 특성 변수에 대한 기초통계량을 제시한다. Panel A에서 주요 변수의 분포를 살펴보면, 종속변수로 활용할 월평균 초과수익률(abRET(%))의 경우 평균이 1.208%, 중위수는 0%, 최솟값 및 최댓값이 각각 –65.190%, 218.015%로 양(+)으로 치우친 분포를 보인다. 또한, Panel B에서 주요 독립변수와 abRET(%) 간 상관관계를 보면 Spearman의 서열 상관계수는 대부분 1% 수준에서 유의하지만, Pearson의 모수적 상관계수는 유의성이 낮게 나타나 통상적인 OLS 회귀분석 수행이 부적합할 것으로 판단된다.13) 이에 후술하는 횡단면 회귀분석에서는 주식수익률의 극단값으로 인한 영향을 완화하기 위해 선행연구의 방법론에 따라(예: Livnat & Mendenhall, 2006; 고봉찬‧김진우, 2009 등) 각 연속형 통제변수들을 10분위 순위에 기초하여 –0.5에서 +0.5의 값을 갖도록 표준화하고 관심변수인 △ESG는 포트폴리오 수익률 분석과의 일관성을 위해 3분위를 기준으로 –0.5에서 +0.5의 값을 갖도록 표준화하여 이분산성을 완화하는 비보수적 검정을 수행하고자 한다.

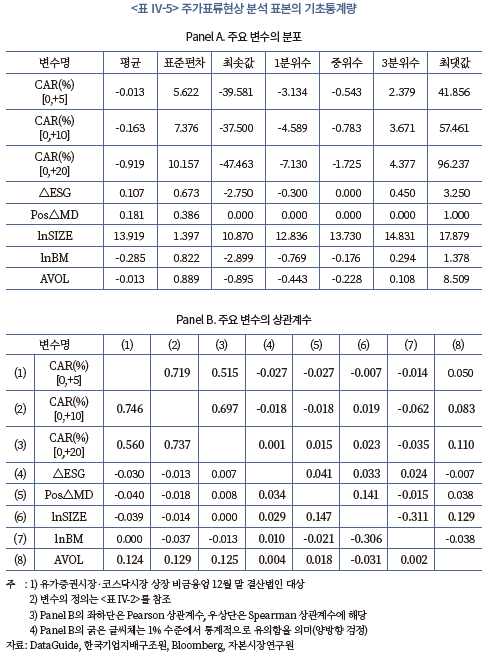

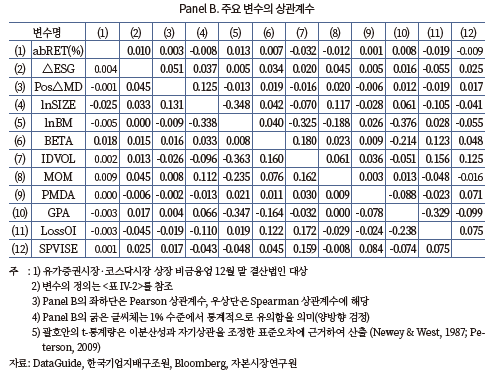

다. 주가표류현상 분석 표본 구성 및 기초통계량

다음으로 MD가 높은 ESG 활동의 개선에 대해 시장이 가치관련성을 적시에 이해하는 지를 검증하고자 단기 시장반응, 즉, ESG 점수의 공표 후 주가표류현상(post-announcement drift)이 나타나는지를 검증하는 표본을 구성한다. 표본기간에 해당하는 2013년부터 2020년까지 한국기업지배구조원은 매년 8월에서 11월 사이에 ESG 점수를 최초 공표한 바, 본 분석의 표본은 기업-연 단위이며 <표 Ⅳ-5>에서 2,138 기업-연 관측치에 대한 기초통계량을 제시한다. <표 Ⅳ-4>의 횡단면 회귀분석 표본과 유사하게 주식수익률의 극단값으로 인한 편의가 예상되어 후술하는 회귀분석에서는 각 연속형 독립변수들을 10분위 순위에 기초해 –0.5에서 +0.5의 값을 갖도록 표준화하고 관심변수인 △ESG는 포트폴리오 수익률 분석과의 일관성을 위해 3분위를 기준으로 –0.5에서 +0.5의 값을 갖도록 표준화하여 주식수익률의 극단값으로 인한 영향을 완화하는 비보수적 검정을 수행한다(Livnat & Mendenhall, 2006; 고봉찬‧김진우, 2009).

3. 중요성공시에 따른 기업 ESG 활동에 대한 주식시장 반응

ESG 활동은 다양한 경로로 기업가치를 창출할 가능성이 있다(Cornell & Damodaran, 2020). 그럼에도 불구하고 Ⅲ장에서의 분석 결과는 ESG 성과의 종합적 개선이 기업의 가치창출 동인이 되는지에 대해 일관성 있는 결론을 보여주지 못하며, 이는 ESG 성과와 기업가치 간 명확한 관련성을 찾지 못한 선행연구의 한계와도 일치한다(Waddock & Graves, 1997; Zhao & Murrell, 2016; 김세희 외, 2022). 이에 본 절에서는 재무성과와 관련성이 보다 명확한 ESG 활동을 개선하는 경우와 그렇지 않은 경우를 구분하여 ESG 활동과 기업가치 간의 관련성을 재조명하였다.

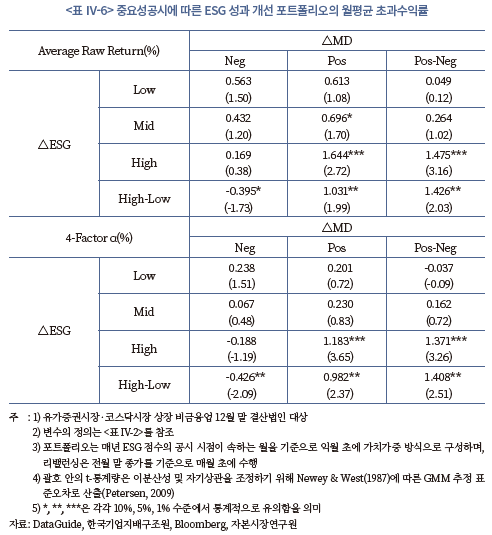

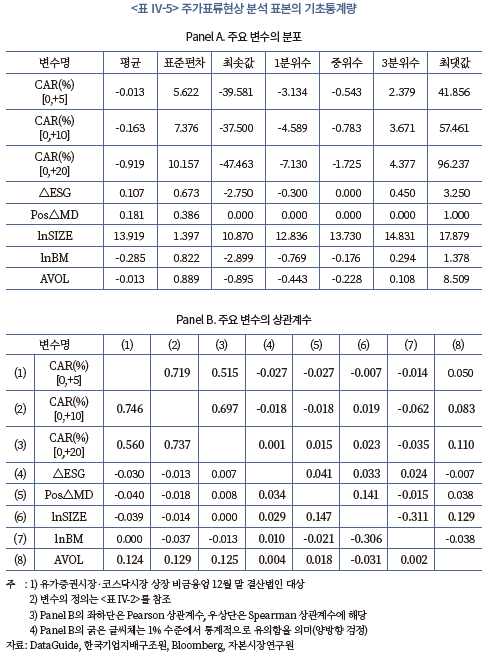

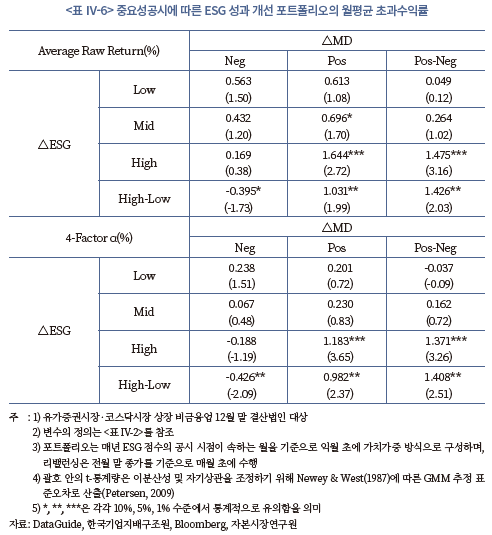

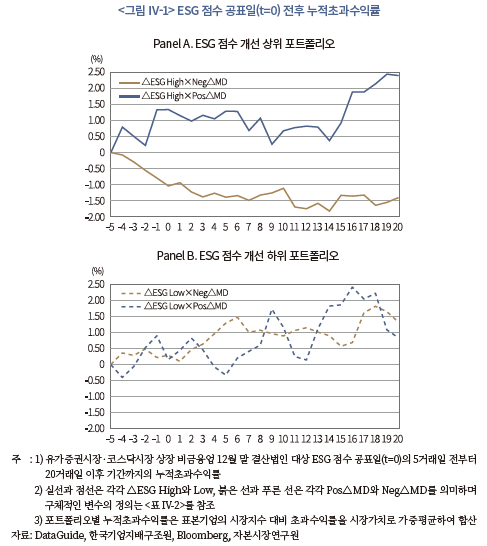

첫째, ESG 활동의 개선이 미래 주가수익률을 견인하는 효과가 재무적 중요성에 기반한 공시성과에 따라 차별적으로 나타나는지를 분석하기 위해 <표 Ⅳ-6>에서 ESG 점수의 증분(△ESG)과 MD 점수의 증분(△MD)에 따라 구성한 3×2의 이중 정렬 포트폴리오의 월평균 초과수익률 성과를 살펴보았다. 초과수익률은 Carhart의 4-요인 모형을 이용하여 월별 수익률의 시계열 회귀분석을 통해 추정하였다(Ⅲ장 5절 식(3) 참조). 분석 결과, ESG 성과의 개선이 미래 주가수익률을 견인하는 효과는 MD의 개선이 병행된 집단에서만 유의미하게 나타났다. 구체적으로 ESG 성과의 개선 정도가 높은 집단(△ESG High)을 매수하고 낮은 집단(△ESG Low)을 매도하는 차익거래 전략(High-Low)은 MD의 개선이 동반된 경우(△MD Pos)에만 월평균 0.982%의 양(+)의 초과수익률을 달성하는 것으로 나타났다(5% 유의수준). 특히, ESG 성과의 개선 정도가 높은 집단(△ESG High)만 별도로 살펴보면 MD의 개선을 동반한 집단(△MD Pos)은 월평균 1.183%의 유의한 초과수익률을 기록한 반면(1% 유의수준), MD의 개선이 동반되지 않은 집단(△MD Neg)은 유의하지 않은 성과를 보인다. 이상의 결과는 MD의 개선이 명확한 ESG 활동의 개선이 기업의 가치창출과 유기적으로 연계될 수 있음을 시사한다.14)

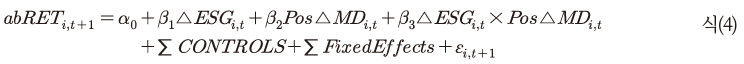

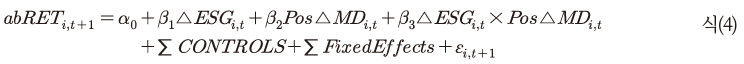

한편, 개별기업의 특성 변수를 충분히 통제한 상태에서도 상술한 포트폴리오 수준의 시계열 회귀분석 결과가 재현되는지를 추가 검증하기 위해 아래 식(4)의 모형을 이용하여 Fama & MacBeth(1973)의 횡단면 회귀분석을 수행하였다.

종속변수 abRET는 벤치마크 포트폴리오 대비 초과수익률을 의미하며, 통제변수로는 기업규모(lnSIZE), 성장성(lnBM), 시장민감도(BETA), 고유변동성(IDVOL), 단기추세효과(MOM) 등을 고려하여 기본적인 개별기업‧시장 관련 위험 특성을 통제하였다. 개별기업의 펀더멘털 특성을 통제하고자 성과대응 재량적 발생액(PMDA), 총수익성(GPA)을 비롯하여 영업손실 여부(LossOI) 및 관리종목 지정 여부(SPVISE)와 관련한 더미변수를 추가로 고려하였다. 더미변수를 제외한 연속형 통제변수는 10분위 순위에 기초해 –0.5에서 +0.5의 값을 갖도록 표준화하고, 관심변수인 △ESG는 포트폴리오 수익률 분석과 해석의 일관성을 위해 3분위 순위를 기준으로 –0.5에서 +0.5의 값을 갖도록 표준화하여 이분산성을 완화하는 비보수적 검정을 수행하였다(Livnat & Mendenhall, 2006; 고봉찬‧김진우, 2009).

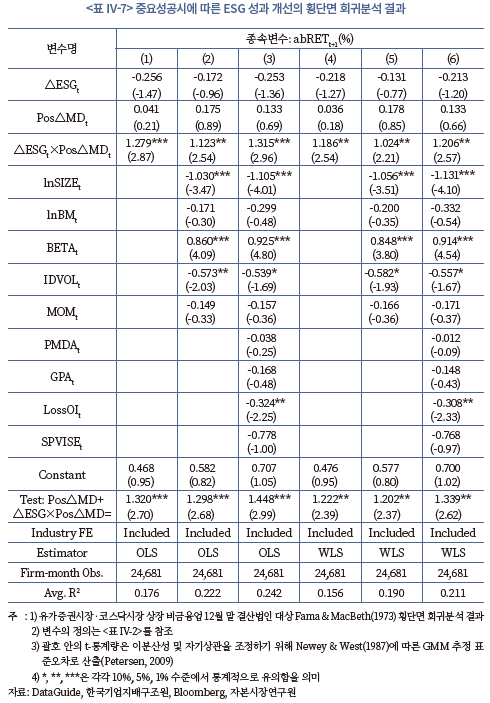

<표 Ⅳ-7>의 열(1)은 통제변수를 제외한 결과를, 열(2)는 기본적인 위험 특성 요인만 통제한 결과를, 열(3)은 기업 펀더멘털 특성을 추가 통제한 결과를 제시한다. 횡단면 회귀분석에서 일반적인 최소자승법(OLS)보다 가중최소자승법(WLS) 추정의 편의가 더 적다는 선행연구(Shanken & Zhou, 2007; Petersen, 2009)를 참조하여 기업규모의 역수를 가중치로 하는 WLS 추정결과를 열(4)에서 열(6)까지 함께 제시한다. 모든 열에서 ESG 활동의 개선에 대한 순위정보와 MD의 개선 여부를 교차한 항(△ESG×Pos△MD)의 계수값이 유의한 양(+)으로 나타나(5% 혹은 1% 유의수준) MD의 개선이 명확한 경우 개별기업 수준에서도 ESG 성과는 기업가치 창출과 유기적으로 연계됨이 확인된다. 특히, 여러 기업 특성 요인들을 통제한 열(6)을 기준으로 ESG 성과의 개선도가 높은 기업(△ESG=0.5)은 MD의 개선을 동반한 때(Pos△MD=1) 월평균 0.630%(=-0.213×0.5+0.133×1+1.206×0.5×1)의 양(+)의 초과수익률을 보이지만, MD의 개선이 병행되지 않았을 때(Pos△MD=0)는 월평균 –0.107%(=-0.213×0.5+0.133×0+1.206×0.5×0)의 음(-)의 초과수익률이 나타나 포트폴리오 수준의 시계열 회귀분석 결과와 일관성을 보인다.

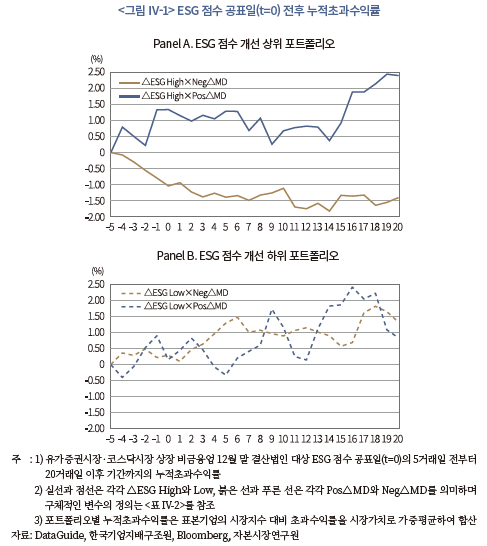

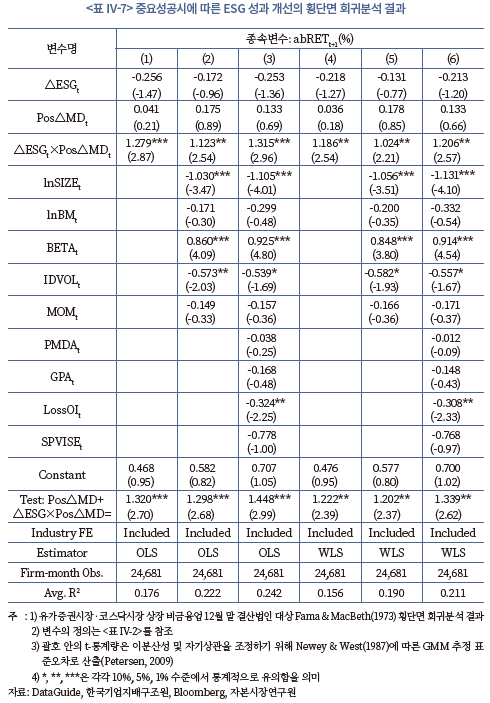

즉, 재무적 중요성에 기반한 ESG 성과의 개선은 전반적인 ESG 활동을 확대하는 것과는 달리 미래 주가수익률을 유의미하게 견인하는 효과가 있음이 명확하게 관찰된다. 이에 시장이 그러한 가치관련성을 적시에 이해하고 있는지를 추가로 검증하고자 하였다. 구체적으로 <그림 Ⅳ-1>에서 ESG 점수의 공표일(t=0) 전 –5거래일, +20거래일 기간에 대해 누적초과수익률을 산출하여 투자자들의 지연반응 행태가 존재하는지를 판별하였다. Panel A에서 ESG 점수 개선 상위 집단(△ESG High)의 누적초과수익률 경로를 살펴보면, MD의 개선을 동반하였을 때(Pos△MD)는 최종 수익률이 2.41%(+20거래일)로 나타나며 수익률 또한 관측 기간에 걸쳐 단계적으로 상승하는 패턴을 보였으나, MD의 개선을 동반하지 않았을 때(Neg△MD)는 최종 수익률이 –1.41%(+20거래일)로 나타났을 뿐만 아니라 수익률 또한 일정하게 하락하는 패턴이 뚜렷하게 관찰된다. 반면, Panel B에서 ESG 점수 개선 하위 집단(△ESG Low)의 누적초과수익률 경로를 살펴보면 일정한 패턴을 식별하기 어렵다.

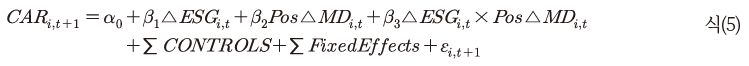

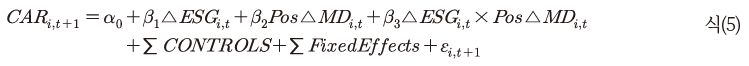

이와 같은 ESG 점수 공표 후 주가표류현상이 개별기업의 특성 변수를 충분히 통제한 상태에서도 통계적으로 유의한지를 검증하기 위해 아래 식(5)의 모형을 이용하여 Fama & MacBeth(1973)의 횡단면 회귀분석을 수행하였다.

종속변수 CAR는 시장조정수익률모형을 적용하여 산출한 누적초과수익률을 의미한다. 통제변수로는 기업규모(lnSIZE), 성장성(lnBM)을 고려하여 단기 시장반응을 검증하는 모형에 적합한 개별기업 위험 특성을 통제하였다. ESG 점수의 공표 시기에 투자자의 의견 불일치(opinion divergence)로 인한 잠재적 편의 가능성을 완화하고자 ESG 점수 공표일 전후 3거래일간의 비정상 거래량(AVOL)을 추가로 통제하였다(Garfinkel & Sokobin, 2006; Garfinkel, 2009). 더미변수를 제외한 연속형 통제변수는 10분위 순위에 기초해 –0.5에서 +0.5의 값을 갖도록 표준화하고, 관심변수인 △ESG는 포트폴리오 수익률 분석과 해석의 일관성을 위해 3분위 순위를 기준으로 –0.5에서 +0.5의 값을 갖도록 표준화하여 이분산성을 완화하는 비보수적 검정을 수행하였다(Livnat & Mendenhall, 2006; 고봉찬‧김진우, 2009).

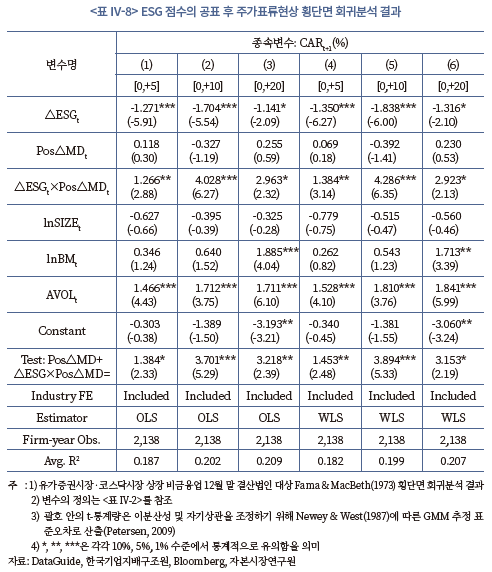

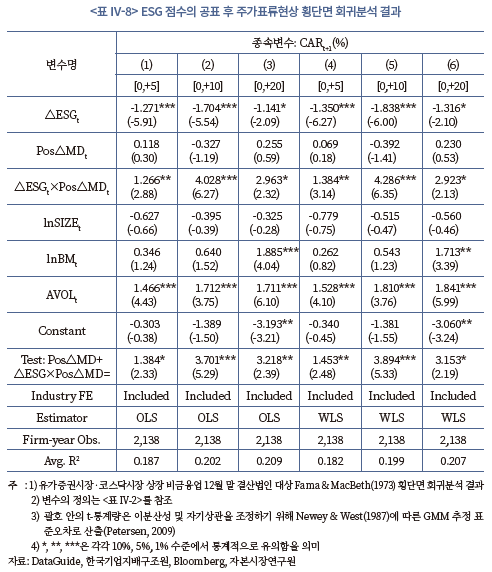

<표 Ⅳ-8>의 열(1)과 열(4)는 ESG 점수의 공표일부터 +5거래일까지의 누적초과수익률을 종속변수로 하며, 열(2)와 열(5)는 +10거래일까지의, 열(3)과 열(6)은 +20거래일까지의 누적초과수익률을 종속변수로 한 결과를 제시한다. 횡단면 회귀분석에서 일반적인 최소자승법(OLS)보다 가중최소자승법(WLS) 추정의 편의가 더 적다는 선행연구(Shanken & Zhou, 2007; Petersen, 2009)를 참조하여 기업규모의 역수를 가중치로 하는 WLS 추정결과를 열(4)에서 열(6)까지 함께 제시한다. 모든 열에서 ESG 활동의 개선에 대한 순위정보와 MD의 개선 여부를 교차한 항(△ESG×Pos△MD)의 계수값이 유의한 양(+)으로 나타나(10%, 5% 혹은 1% 유의수준), 시장의 과소반응이 통계적으로 유의하게 관측된다. 이상의 결과를 종합하면 시장은 ESG 성과의 개선 정보를 적시에 이해하는 것은 아니며, 특히 MD의 개선 여부에 따라 과소반응이 심화하는 양상을 보인다.

4. 중요성공시에 따른 기업 ESG 활동의 지속성

전술한 결과에 따르면, 주식시장은 ESG 활동이 과거보다 더 활발해지고 이러한 활동이 재무적으로 중요한 경우에 이를 긍정적으로 평가한다. 이러한 투자자들의 긍정적인 평가의 원천은 이들 기업의 ESG 활동이 지속적으로 수행되어 왔다는 점에 근거할 가능성이 있다. 이와 같은 예측은 재무정보의 지속성이 가치관련성에 있어 핵심적인 속성으로 논의되고 있는 것과 일치한다(Easton & Harris, 1991; Ali & Zarowin, 1992). 특히, 최근 논란이 불거지고 있는 green washing을 체계적으로 가치평가에 반영하기 위해, 투자자들은 기업의 ESG 활동이 꾸준히 이루어지는지에 관심을 가질 수 있다. ESG 활동에 소비되는 상당한 비용을 감안할 때, 명목상의 ESG 활동은 상대적으로 지속성이 떨어질 것이기 때문이다. 따라서 본 연구에서는 재무적으로 중요한 ESG 활동이 더 지속적인지를 아래 모형을 추정함으로써 명시적으로 살펴본다.

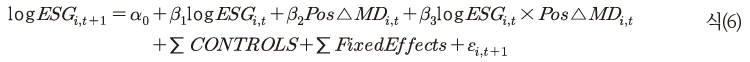

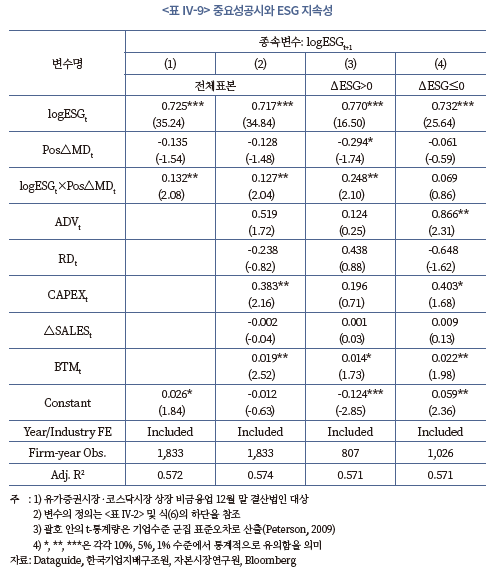

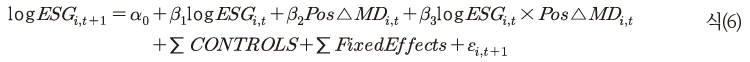

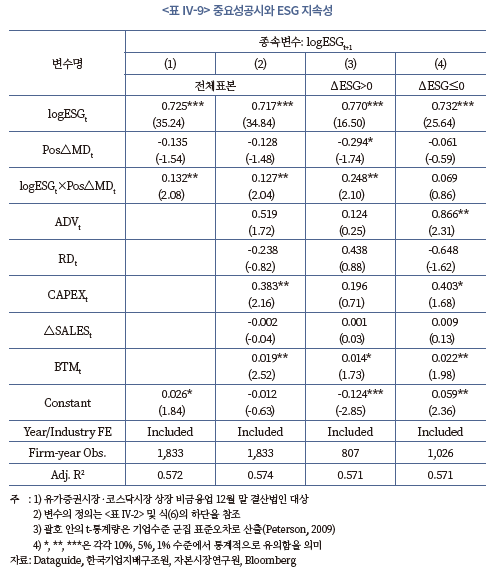

logESG는 ESG 점수에 자연로그를 취한 값이며, 통제변수로는 기업의 총자산으로 나눈 연구개발비(RD), 광고선전비(ADV), 유형자산순취득액(CAPEX), 그리고 전기대비 당기의 매출 증감(△SALES)과 총자본의 장부가액 대비 시장가치 비율(BTM)을 포함하여 기업의 성장성을 통제하였다(김세희 외, 2022). 만일 재무적으로 중요한 ESG 활동의 지속성이 그렇지 않은 활동과 다르다면, logESG×Pos△MD의 계수는 통계적으로 유의하게 추정될 것이다. <표 Ⅳ-9>의 열(1)은 식(6)에서 통제변수를 제외한 결과를, 열(2)는 식(6)의 추정 결과를 보여준다. 먼저 logESG의 계수는 통계적으로 유의한 양(+)의 값으로 추정되어, 기업의 ESG 활동이 기본적으로 지속적임을 나타낸다. 관심변수인 logESG×Pos△MD는 통계적으로 유의한 양(+)의 계수를 갖는데, 이는 과거에 비해 중요성공시가 증가한 기업의 ESG 활동 지속성이 더 높다는 것을 의미한다. 열(3)과 열(4)는 ESG 활동이 전기 대비 증가한 기업과 감소한 기업으로 표본을 나누어 식(6)을 각각 추정해본 결과, 열(2)에 나타난 결과는 ESG 활동이 증가한 열(3)의 표본에서 두드러지게 나타남을 확인할 수 있다. 이는 앞선 주가반응분석과 일관된 결과이다. 이러한 결과는 재무적으로 중요한 ESG 활동을 활발하게 하는 기업의 ESG 활동의 상대적으로 높은 지속성을 보이며, 이러한 높은 지속성이 투자자의 긍정적 평가의 원천일 수 있음을 시사한다.

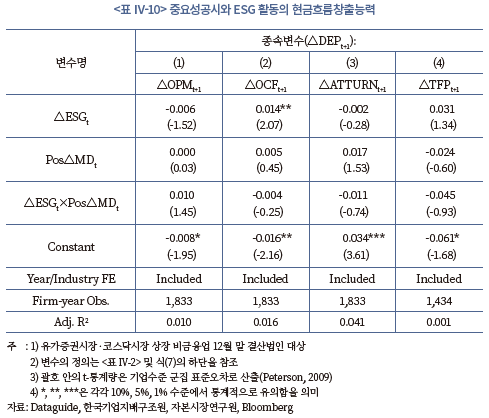

5. 중요성공시에 따른 기업 ESG 활동과 현금흐름창출역량 간의 인과관계

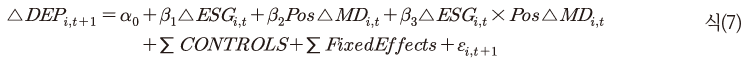

한편, 투자자들이 재무적으로 중요한 ESG 활동의 증가에 더 민감하게 반응한다는 앞선 결과는 이러한 ESG 활동이 현금흐름창출역량의 제고에 더 중요한 역할을 할 수 있다는 가능성도 제시한다. 이러한 가능성을 검증하기 위해 아래의 식(7)의 모형을 추정해보았다.

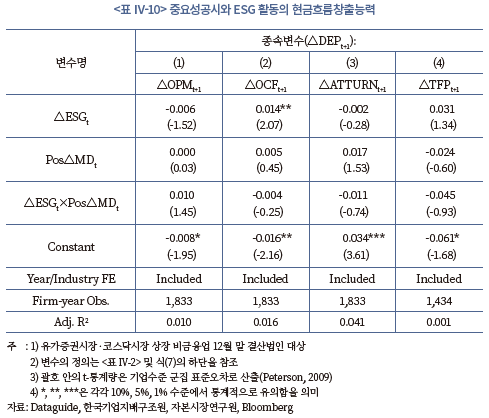

종속변수(△DEP)는 현금흐름창출역량을 나타내는 매출액영업이익률(△OPM), 영업현금흐름수익률(△OCF), 총자산회전률(△ATTURN), 총요소생산성(△TFP)의 미래 변동분(t기부터 t+1기까지)으로 추정하였다. 만일 재무적으로 중요한 ESG 활동의 변동이 미래 현금흐름창출에 기여하는 소비자, 공급자 및 종업원과 같은 이해관계자의 의사결정에 주요한 영향을 미친다면 △ESG×Pos△MD의 계수는 통계적으로 유의한 양의 값을 가질 것으로 예측된다. 그러나 <표 Ⅳ-10>에 제시된 추정결과에 따르면 모든 현금흐름창출능력의 대용치에서 △ESG×Pos△MD의 계수가 통계적으로 유의하지 않은 것으로 나타난다. 이와 같은 결과는 식(6)에 포함된 통제변수를 추가하여 추정한 경우에도 달라지지 않았다(지면 상 생략).

이같은 결과는, ESG 활동의 재무적 중요도가 소비자, 공급자 및 종업원과 같은 이해관계자의 의사결정에 유의하게 고려될 수 있다는 주장을 뒷받침하지 못한다. 이는 1) 이러한 이해관계자들이 중요성공시를 의사결정에 활용하지 못하고 있거나, 2) 애초에 재무적 중요도가 이들 이해관계자의 의사결정에 유용한 정보가 아닐 가능성 모두를 내포한다.

6. 소결

이제까지의 결과를 종합하면, 기업의 ESG 활동은 투자자들이 재무적으로 중요하다는 판단을 내린 경우에만 기업가치에 유의한 영향을 미친다. 또한 ESG 활동의 재무적 중요도는 소비자, 공급자, 종업원 등 현금흐름창출역량에 직접적인 기여를 하는 이해관계자들의 의사결정에는 유의한 영향을 미치지 못하는 것으로 나타났다. 따라서 현재 우리 기업의 ESG 활동은 재무성과와 관련성이 있다고 판단된 범위 내에서, 기업가치를 결정하는 요인 중 분모효과인 자본비용의 조정을 통해서만 가치평가에 반영되고 있으며 분자인 현금흐름창출역량에 대한 영향은 명확하지 않은 것으로 보인다.

Ⅴ. 결론 및 정책적 시사점

본 연구는 국내 기업들의 재무적 중요도가 높은 ESG 활동이 개선될 때, 주식투자자들이 긍정적으로 반응하고 있으며, 더 지속적인 ESG 활동을 수행하는 것을 발견했다. 이는 재무적으로 중요한 ESG 활동이 더 지속적이며 자본시장에서 가치관련성을 체계적으로 인정받을 수 있다는 것을 시사한다.

본 연구는 ESG 활동의 재무적 중요성을 상호교차 변수로 사용하여 정황적 증거를 제공함으로써, ESG 활동과 기업가치 간의 관련성에 대한 기존 문헌의 논의들을 통합하고 있다는 점에서 그 공헌점을 갖는다. 기존 연구에서 일관된 실증증거가 부재했던 것은 1) ESG 활동이 애초에 기업가치 창출경로(예: 미래현금흐름이나 자본조달비용)와 무관할 가능성, 혹은 2) ESG 활동과 기업가치 요소들의 관련성에 대한 시장의 평가가 체계적이지 않을 가능성을 모두 내포한다. 본 연구에서 제시하는 결과는 재무적 중요도가 높은 ESG 활동이 이 두 가지 가능성을 해결할 수 있는 실마리가 될 수 있음을 암시한다.

구체적으로, 본 연구의 결과는 ESG 활동을 통하여 기업가치를 제고하고자 하는 기업 및 정책입안자들에게 크게 두 가지 시사점을 제공한다. 첫째, 기업들은 재무적 중요성이 높은 ESG 활동에 집중해야한다. 이는 큰 비용을 수반하는 ESG 활동을 지속적으로 수행할 수 있게 하는 기업 내부적인 원동력이 될 뿐만 아니라, 투자자의 긍정적인 평가를 바탕으로 안정적인 외부자금을 확보할 수 있게끔 한다. 즉, 기업 안팎으로 ESG 활동에 대한 당위성을 공고히 할 수 있는 것이다. 둘째, 자본시장의 참여자들이 ESG 활동의 가치관련성을 즉각적으로 이해할 수 있는 것은 아니기 때문에, ESG 활동의 재무적 중요성을 공시를 통해 명확히 표현해야 한다. 이는 ESG 공시규정을 준비하고 있는 국내 정책입안자들이 기업의 특성별로 재무적 성과와 밀접한 관련이 있는 ESG 활동이 무엇인지를 먼저 식별하고, 이를 정보이용자들에게 효율적으로 전달할 수 있는 방법을 숙고해야 할 것임을 의미한다. 이 과정에서 기업 및 자본시장참여자들과의 긴밀한 의사소통은 필수적일 것이다.

1) 재무성과와의 관련성이 뚜렷하지 않은 ESG 활동의 지속가능성은 연구개발 투자에 대한 회계기준을 통해 더 직관적으로 가늠할 수 있다. 연구개발 투자는 미래 경제적 효익, 즉 미래수익성에 대한 불확실성이 큰 경우, 즉각적으로 당기비용으로 처리해야 한다. 따라서 미래 수익을 견인할 수 있는 경로가 불명확한 연구개발 투자는 당기의 재무성과를 훼손하는 결과를 초래하고, 외부자금조달이 어렵고 지속가능하지 않으며, 따라서 가치관련성도 낮다. 때문에 기업들은 연구개발 투자의 효율성을 제고하고자 노력할 유인이 생긴다. 유사한 맥락에서 기업들은 재무성과를 어떻게 창출할 수 있는지의 경로가 뚜렷하지 않은 ESG 활동을 궁극적으로 수행하지 않게 될 것이다.

2) ISSB는 ESG 정보의 통합보고 체계를 마련한 국제통합보고위원회(IIRC), 산업별 기준을 확립한 지속가능성회계기준위원회(SASB), 세부 주제로써 기후 관련 기준을 수립한 기후정보기준위원회(CDSB)와 합병을 결정하였으며, 기타 주요 국제기준제정기구(예: TCFD, WEF 등)와도 기술적 실무단(TRWG)을 구성하여 ESG 정보공시의 글로벌 기준선 마련을 주도하고 있다.

3) 학계와 실무에서 전자는 ‘Walk-the-Talk’이라는 용어로, 후자는 ‘Green Washing’이라는 용어로 표현하고 있다.

4) International Sustainability Standards Board, 2022. 3. 31, IFRS S1 General Requirements for Disclosure of Sustainability-related Financial [Draft].

5) Global Sustainability Standards Board, 2020. 11. 19, GRI Sector Program - Revised list of prioritized sectors.

6) European Financial Reporting Advisory Group, 2022. 1. 18, PTF-ESRS Batch 1 working papers – Cover note and next steps.

7) 한국거래소, 2022. 6. 27,「KRX ESG 포럼 2022」‘ESG 시대, 한국 자본시장의 현안과 대응과제’.

8) 생산적인(productive) 기업일수록 한계비용 체감에 따라 제품‧서비스 원가에 가산하여 책정하는 판매가격이 높게 형성되므로 Mark-up은 기업 생산성의 대용치가 된다(Melitz & Ottaviano, 2008).

9) 예를 들어, 기업의 생산성은 규모의 경제 효과와 밀접한 관련이 있다(Cohen & Klepper, 1996). 만약 규모의 경제를 달성한 고생산성 기업이 여유 자원을 활용하여 ESG 활동을 활발히 수행한다면, ESG 활동과 기업가치 간 양(+)의 상관관계는 가성(spurious) 상관관계 혹은 역인과관계로 인해 관찰되었을 가능성을 배제하기 어렵다.

10) 표본기간에 해당하는 2013년부터 2020년까지 ESG 점수는 매년 8~11월 중 공표되었으며 연도별 공식적인 공시일은 한국기업지배구조원으로부터 제공받아 분석에 활용하였다.

11) 구체적으로, ‘Sustainability Accounting Standards Board to Bloomberg Field Mapping (Version 2.0)’ 이름의 엑셀 파일을 제공한다.

12) SASB는 2021년 말 기준으로 3,398개의 한국 상장 및 비상장 기업을 SICS 기준으로 산업분류를 하고 있으며, 이 중 블룸버그가 ESG 정보공개 점수를 산정하는 상장사에 한하여 MD 점수를 산출할 수 있다.

13) 지면상 생략하였으나 Breush-Pagan 검정, Sharpiro-Wilk 검정 결과 등분산성, 정규성을 가정하는 각각의 귀무가설을 1% 유의수준에서 모두 기각하는 것으로 나타났다.

14) 지면상 생략하였으나 동일가중 방식으로 포트폴리오를 구성하는 경우, ESG 성과의 개선 정도를 다양하게 설정하는 경우(예: 2분위, 5분위 등), Kraft et al.(2006)에 따라 포트폴리오 구성 기간 내 연간수익률이 200%를 초과하는 극단적 성과 표본(983 기업-월)을 제외한 분석 등에서도 결과가 유지됨을 확인하였다.

참고문헌

강원‧정무권, 2020, ESG 활동의 효과와 기업의 재무적 특성, 『한국증권학회지』 49(5), 681-707.

고봉찬‧김진우, 2009, 발생액 이상현상과 차익거래기회에 관한 연구, 『한국증권학회지』 38(1), 77-105.

김세희‧선우희연‧이우종‧정아름, 2022, ESG 활동과 기업가치의 상관관계와 인과관계, 『회계저널』 31(3), 31-60.

김양희‧석준희‧김병도, 2021, 기업의 ESG역량과 기업가치의 관계에 대한 연구, 소비자 인지의 조절효과를 중심으로, 『경영학연구』 50(6), 1571-1593.

나영‧임욱빈, 2011, ESG 정보의 가치관련성에 관한 실증연구, 『경영교육연구』 26(4), 439-467.

이창섭‧정아름‧전홍민, 2021, ESG 결정요인 및 기업가치에 관한 연구: 경제정책 불확실성과 영업이익 변동성을 중심으로, 『회계학연구』 46(6), 115-139.

임욱빈, 2019, 비재무적 정보가 기업성과에 미치는 영향: ESG 점수를 중심으로, 『국제회계연구』 86, 119-144.

임종옥, 2016, ESG 평가정보 및 이익관리가 기업가치에 미치는 영향, 『경영교육연구』 31(1), 111-139.

Ali, A., Zarowin, P., 1992, The role of earnings levels in annual earnings-returns studies, Journal of Accounting Research 30(2), 286-296.

Aral, K., Giambona, E., Vam Wassenhov, L.N., 2021, Stakeholder orientation and operations outcomes: Evidence from constituency statutes, SSRN working paper No.3680127.

Basu, S., Vitanza, J., Wang, W., Zhu, X., 2022, Walking the walk? Bank ESG disclosures and home mortgage lending, SSRN working paper No.3807685.

Carhart, M.M., 1997, On persistence in mutual fund performance, Journal of Finance 52(1), 57–82.

Cheng, I.H., Hong, H., Shue, K., 2013, Do managers do good with other people's money? NBER working paper No.19432.

Choi, J.S., Kwak, Y.M., Choe, C., 2010, Corporate social responsibility and corporate financial performance: Evidence from Korea, Australian Journal of Management 35(3), 291-311.

Christensen, D.M., Serafeim, G., Sikochi, S., 2022, Why is corporate virtue in the eye of the beholder? The case of ESG ratings, The Accounting Review 97(1), 147–175.

Cohen, W.M., Klepper, S., 1996, Firm Size and the Nature of Innovation within Industries: The Case of Process and Product R&D, The Review of Economics and Statistics 78(2), 232–243.

Cornell, B., Damodaran, A., 2020, Valuing ESG: Doing good or sounding good? SSRN working paper No.3557432.

Dess, G.D., Shaw, J.D., 2001, Voluntary turnover, social capital, and organizational performance, Academy of Management Review 26(3), 446–456.

Easton, P.E., Harris, T.S., 1991, Earnings as an explanatory variable for returns, Journal of Accounting Research 29(1), 19-36.

Fama, E.F., French, K.R., 2007, Disagreement, tastes and asset prices, Journal of Financial Economics 83(3), 667-689.

Fama, E.F., MacBeth, J.D, 1973, Risk, Return, and Equilibrium: Empirical Tests, Journal of Political Economy 81(3), 607–636.

Fama, E.F., French, K.R., 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics 33(1), 3–56.

Fombrun, C., Shanley, M., 1990, What's in a name? Reputation building and corporate strategy, Academy of Management Journal 33(2), 233-258.

Fombrun, C.J., 2005, A world of reputation research, analysis and thinking—Building corporate reputation through CSR initiatives: evolving standards, Corporate Reputation Review 8(1), 7–12.

Freeman, R.E., 2010, Strategic management: A stakeholder approach, Cambridge University Press.

Freeman, R.E., Harrison, J.S., Wicks, A.C., 2007, Managing for stakeholders: Survival, reputation, and success, Yale University Press.

Friedman, M., 1970. 9. 13, The social responsibility of business is to increase profits, New York Times Magazine.

Garfinkel, J.A., 2009, Measuring investors’ opinion divergence, Journal of Accounting Research 47(5), 1317–1348.

Garfinkel, J.A., Sokobin, J., 2006, Volume, opinion divergence, and returns: A study of post-earnings announcement drift, Journal of Accounting Research 44(1), 85–112.

Grewal, J., Hauptmann, C., Serafeim, G., 2021, Material Sustainability Information and Stock Price Informativeness, Journal of Business Ethics 171(3), 513–544.

İmrohoroğlu, A., Tüzel, Ş., 2014, Firm-level productivity, risk, and return. Management Science 60(8), 2073-2090.

Ittner, C., Larcker, D., Meyer, M., 2003, Subjectivity and the Weighting of Performance Measures: Evidence from a Balanced Scorecard, The Accounting Review 78(3), 725-758.

Jensen, M.C., 2002, Value maximization, stakeholder theory, and the corporate objective function, Business Ethics Quarterly 12(2), 235-256.

Khan, M., Serafeim, G., Yoon, A., 2016, Corporate sustainability: First evidence on materiality, The Accounting Review 91(6), 1697-1724.

Kormendi, R., Lipe, R., 1987, Earnings Innovations, Earnings Persistence, and Stock Returns, Journal of Business 60(3), 323-345.

Kraft, A.G., Leone, A.J., Wasley, C.E., 2006, An analysis of the theories and explanations offered for the mispricing of accruals and accrual components, Journal of Accounting Research 44(2), 297-339.

Krueger, P., 2015, Corporate goodness and shareholder wealth, Journal of Financial Economics 115(2), 304-329.

Lazear, E., Shaw, K., 2007, Personnel economics: The economist’s view of human resources, The Journal of Economic Perspectives 21(4), 91–114.

Lev, B., Petrovits, C., Radhakrishnan, S., 2010, Is doing good good for you? How corporate charitable contributions enhance revenue growth, Strategic Management Journal 31(2), 181-200.

Lintner, J., 1965, Security Prices, Risk, and Maximal Gains From Diversification, The Journal of Finance 20(4), 587–615.

Livnat, J., Mendenhall, R.R., 2006, Comparing the post-earnings announcement drift for surprises calculated from analyst and time series forecasts, Journal of Accounting Research 44(1), 177–205.

Melitz, M.J., Ottaviano, G.I.P., 2008, Market size, trade, and productivity, The Review of Economic Studies 75(1), 295–316.

Newey, W.K., West, K.D., 1987, Hypothesis Testing with Efficient Method of Moments Estimation, International Economic Review 28(3), 777.

Olley, G.S., Pakes, A., 1996, The dynamics of productivity in the telecommunications equipment industry, Econometrica 64(6), 1263-1297.

Pedersen, L.H., Fitzgibbons, S., Pomorski. K., 2021, Responsible investing, The ESG-efficient frontier, Journal of Financial Economics 142(2), 572-597.

Penman, S.H., 2013, Financial statement analysis and security valuation(5th), McGraw-Hill Irwin.

Petersen, M.A, 2009, Estimating standard errors in finance panel data sets: Comparing approaches, Review of Financial Studies 22(1), 435–480.

Raghunandan, A., Rajgopal, S., 2022, Do ESG funds make stakeholder-friendly investments? Review of Accounting Studies, 27, 822–863.

Shanken, J., Zhou, G., 2007, Estimating and testing beta pricing models: Alternative methods and their performance in simulations, Journal of Financial Economics 84(1), 40–86.

Sharpe, W.F., 1964, Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk, The Journal of Finance 19(3), 425–442.

Turban, D.B., Greening, D.W., 1997, Corporate social performance and organizational attractiveness to prospective employees, Academy of Management Journal 40(3), 658-672.

Waddock S.A., Graves, S.B., 1997, The corporate social performance-financial performance link, Strategic Management Journal 18(4), 303–319.

Welch, K., Yoon, A., 2022, Do high-ability managers choose ESG projects that create shareholder value? Evidence from employee opinions, Review of Accounting Studies, 1-28.

Zhao, X., Murrell, A.J., 2016, Revisiting the Corporate Social Performance – Financial Performance Link: A Replication of Waddock and Graves, Strategic Management Journal 37(11), 2378-2388.

지난 십수년간 많은 기업들이 Environmental, Social and Governance(이하 ESG) 활동에 상당한 노력을 기울이고 있다. 이와 동시에 기업의 ESG 성과를 표준화하여 측정하고, 평가하려는 시도가 계속되었으며, 자본시장의 투자자들 또한 이를 투자의사결정에 체계적으로 반영하려는 노력을 경주해왔다. 학술문헌들도 기업의 ESG 성과가 기업의 가치를 제고하는지의 관점에서 ESG 활동에 대한 경제적 시사점을 도출해왔다. 그러나 ESG 성과와 기업의 재무성과 혹은 기업가치 간의 관계를 살펴본 실증문헌들의 결론은 엇갈리고 있다(Waddock & Graves, 1997; Zhao & Murrell, 2016). 우리나라 기업을 분석한 연구들도 일관된 결과를 찾지 못하고 있다(김세희 외, 2022). 즉, 상품서비스시장이나 자본시장의 참여자들이 ESG 성과를 구매의사결정이나 투자의사결정에 체계적으로 반영한다는 증거가 부재한 것이다.

그럼에도 불구하고 ESG 성과와 기업가치의 관련성은 사뭇 당위적인 것이다. 재무성과와의 관련성이 떨어지는 ESG 활동은 그 자체로 지속가능하지 않고, 지속가능하지 않은 활동은 기업가치 창출역량이 제한적이기 때문이다. 이는 다음과 같이 설명할 수 있다.

첫째, 재무성과를 견인하지 못하는 ESG 활동은 주주의 지지를 받기 어렵다. 기업지배구조를 포함하여 주주의 이익을 보호하고 도모하는 것을 지향해온 현행의 법규범 하에서는, 주주에게 분배가능한 부(예: 손익계산서 상 당기순이익)를 제고하지 못하는 활동은 제도적으로 억제된다.

둘째, 효율적으로 작동하는 자본시장에서는 현금흐름 창출능력과 체계적 위험을 적극적으로 가격에 반영한다. 따라서 재무성과와의 관련성이 약한 ESG 활동은 투자의사결정의 고려사항이 아니며, 따라서 자본제공의 대상이 아니다. 이처럼 외부 투자자의 투자의사결정을 이끌어내기 어려운 활동은 지속가능하지 않다.

셋째, 재무성과 지표들이 비재무성과 지표들에 비하여 비교가능성이 높기 때문에, ESG 성과를 평가하는 지표로써 더 타당하다. 기업의 ESG 활동은 즉각적으로 추가적인 비용을 수반하는 반면 그 효익은 불확실하기 때문에, 본래적으로 비용-효익의 관점에서 평가하기 어렵다. 따라서 객관성이 높은 재무성과들이 경영자 평가의 성과지표로써 더 비중 있게 사용된다(Ittner, Larcker, & Meyer, 2003). 따라서 시장의 평가 메커니즘에 노출되어 있는 경영자들은 재무성과 지표와의 관련성이 떨어지는 ESG 활동을 지속할 유인이 없다.1)

ESG 공시기준들은 이러한 특성에 근거하여 ESG 활동의 재무적 중요성을 중심으로 공시대상 정보를 파악하고 있다. 특히, ESG 정보공시의 글로벌 기준선(global baseline)을 마련 중인 국제지속가능성기준위원회(International Sustainability Standards Board: ISSB)는 기업의 장기 현금 창출 능력 및 전사적 가치(enterprise value)에 중요한 영향을 미치는 정보를 중심으로 ESG 정보 공시의 원칙을 마련하고 있다.2) 이때 이해관계자에게 더 파급력(혹은 영향력)이 큰 ESG 활동보다는 투자자 입장에서 재무적으로 중요한 ESG 정보를 공시한다는 관점을 명확히 유지한다. 즉, 재무적으로 중요하지 않은 ESG 활동은 장기적으로 지속되기 어려울 것이므로, 정보로서의 가치가 작을 것이라고 전제하는 것이다.

이와 같은 배경을 바탕으로, 본 연구는 국내기업을 대상으로 1) 평균적으로 ESG 활동이 기업가치를 결정하는 요인들에 긍정적인 영향을 주는지, 2) 재무성과와의 관련성이 명확한 ESG 활동이 그렇지 않은 ESG 활동에 비하여 주식수익률에 반영되는 정도가 더 높은지, 그리고 3) 이 차이가 ESG 활동의 지속성 차이에서 기인하는지를 실증적으로 분석하였다. 이 분석에서 가장 핵심적인 변수는 ESG 활동의 재무적 중요성(즉, 재무성과와의 관련성)인데, 이는 SASB가 식별한 산업별 중요 지속가능성 지표에 근거한다. 구체적으로, 블룸버그가 보유한 기업별 지속가능성 공시지표를 바탕으로, SASB 산업분류에 기반한 중요한 공시지표가 얼마나 많이 공시되었는지로 측정하였다.

주요 실증분석 결과는 다음과 같다. 첫째, 평균적으로 ESG 활동은 미래 현금흐름창출 및 기업위험과 인과관계가 있는 것으로 나타나지 않았다. 둘째, 재무적 중요성(Material Disclosure: MD)이 높은 ESG 활동이 개선될 때, 주가수익률이 상승하였다. 반면 MD가 뚜렷하지 않은 ESG 활동의 개선은 주가수익률과의 관련성이 유의적이지 못하였다. 셋째, MD가 높은 ESG 활동의 개선에 대해 시장이 이러한 가치관련성을 적시에 이해하는 것은 아니었다. MD가 높은 ESG 활동을 개선했다는 정보가 시장에 공시된 이후에도, 주가수익률은 한동안 상승세가 지속되었다 (즉, 과소반응). 이 두 가지 결과는, 재무적 중요도가 높은 ESG 활동일수록 기업가치와의 관련성이 높지만, 이 정보가 적시에 주가에 반영되지 않음을 의미한다. 즉, 시장은 ESG 활동이 기업가치와 어떠한 관련성을 갖는지 이해하는 데 시간이 걸린다는 것이다.

마지막으로, MD가 높은 ESG 활동이 MD가 낮은 ESG 활동에 비해, 차기의 ESG 활동과 더 유의한 양(+)의 시계열 상관관계를 보였다. 이는 재무적으로 중요한 ESG 활동이 더 지속적이라는 위의 논의를 지지하는 결과이다. 또한 지속적인 ESG 활동만이 자본시장에서 가치관련성을 체계적으로 인정받을 수 있다는 간접적인 증거이다. 이와 같은 결과는 지속적이지 않은 일회성 성과가 증권가격에 체계적으로 반영되기 어렵다는 기존 문헌(예: Kormendi & Lipe, 1987)과도 일관된다.

ESG 활동과 기업가치 간의 관련성을 명확하게 찾지 못했던 선행연구의 한계를 고려하면, 본 연구의 결과는 주목할 만한 것이다. 기존 연구에서 일관된 실증증거가 부재했던 것은 1) ESG 활동이 애초에 기업가치 창출경로(예: 미래현금흐름이나 자본조달비용)와 무관할 가능성, 혹은 2) ESG 활동과 기업가치 요소들의 관련성에 대한 시장의 평가가 체계적이지 않을 가능성을 모두 내포한다. 기업이 내세우는 ESG 활동의 기조가 기업의 전략이나 운영지침에 구체적으로 반영되어 있지 않거나, ESG 활동에 대한 공시가 시장에 기업가치와 관련된 정보를 제공하지 못하는 것이다.3) 본 연구는 ESG 활동의 재무적 중요성을 상호교차 변수로 사용하여 정황적 증거를 제공함으로써, ESG 활동과 기업가치 간의 관련성에 대한 기존 문헌의 논의들을 통합하고 있다.

또한 본 연구의 결과는 ESG 활동을 통하여 기업가치를 제고하고자 하는 기업 및 정책입안자들에게 상기에서 지적한 1)과 2)의 맥락에서 두 가지 시사점을 제공한다. 첫째, 기업들은 재무적 중요성이 높은 ESG 활동에 집중해야 한다. 이는 큰 비용을 수반하는 ESG 활동을 지속적으로 수행할 수 있게 하는 기업 내부적인 원동력이 될 뿐만 아니라, 투자자의 긍정적인 평가를 바탕으로 안정적인 외부자금을 확보할 수 있게끔 한다. 즉, 기업 안팎으로 ESG 활동에 대한 당위성을 공고히 할 수 있는 것이다. 둘째, 자본시장의 참여자들이 ESG 활동의 가치관련성을 즉각적으로 이해할 수 있는 것은 아니기 때문에, ESG 활동의 재무적 중요성을 공시를 통해 명확히 표현해야 한다. 이는 ESG 공시규정을 준비하고 있는 국내 정책입안자들이 기업의 특성별로 재무적 성과와 밀접한 관련이 있는 ESG 활동이 무엇인지를 먼저 식별하고, 이를 정보이용자들에게 효율적으로 전달할 수 있는 방법을 숙고해야 할 것임을 의미한다. 이 과정에서 기업 및 자본시장참여자들과의 긴밀한 의사소통은 필수적일 것이다.

Ⅱ. 선행연구의 검토 및 연구주제

1. ESG 활동과 기업가치

ESG 활동에 대한 폭발적인 관심은 2010년대 말 UN PRI, BlackRock, Vanguard, State Street 등의 국제 대규모 펀드운용사들이 포트폴리오 구성에 지속가능성 요소를 비중 있게 고려하면서 본격 확대되었다(Welch & Yoon, 2022). 이는 과거의 주주가치 옹호자들이 ESG 활동은 전통적인 기업가치 창출활동과 배치되므로 주주가치를 제고하는데 도움이 되지 않는다는 입장(Friedman, 1970; Jensen, 2002)으로는 설명될 수 없는 경향이다. 최근 투자자들이 주목하는 ESG 활동의 효과는, ESG 활동이 기업가치를 창출하는 다양한 경로에 긍정적인 영향을 줌으로써 궁극적으로 주주가치도 제고하는 효과를 가져올 수 있다는 주장으로 뒷받침될 수 있다. 즉, 과거에는 기업의 ESG 활동이 이해관계자 가치 옹호자들에 의해 규범적인 측면에서 요구되었던 반면(Freeman, 2010), 최근 투자자들이 강조하고 있는 ESG 활동의 당위성은 경제적 효과를 염두에 두고 있다는 점에서 차별화된다.

ESG 활동은 다양한 경로로 기업가치를 창출할 가능성을 가지고 있다(Cornell & Damodaran, 2020). 기업가치는 기업이 미래에 창출할 것으로 예상되는 현금흐름을 위험조정할인율로 할인한 값이다. 따라서 ESG 활동은 이 두 가지 요소인 미래현금흐름과 할인율에 영향을 줌으로써 기업가치를 창출할 수 있다. 예를 들면, ESG 활동은 소비자의 선호도를 높여 매출액 신장에 도움이 되고(Lev et al., 2010), 안정된 인적자원 운영을 할 수 있고 유능한 인재를 영입할 가능성이 높으므로(Turban & Greening, 1997; Dess & Shaw, 2001; Lazear & Shaw, 2007) 장기적으로 생산성 및 원가구조를 개선할 수 있으며, 운영효율성을 높여 매출원가나 영업비용을 절감할 수 있게 해준다(Aral et al., 2021). 또한 활발한 ESG 활동은 기업 평판에 긍정적인 영향을 미치고(Fombrun & Shanley, 1990; Fombrun, 2005; Freeman, Harrison, & Wicks, 2007), 투자자들의 투자선호도를 높여 자본비용을 낮출 수 있다(Fama & French, 2007; Pedersen et al., 2021).

그러나 기업의 ESG 활동이 긍정적인 효과를 가지고 오지 않을 가능성도 존재한다. 전통적인 주주가치 옹호자의 주장에 따르면 ESG 활동은 대리인 문제를 야기할 수 있다. 즉, ESG 활동은 주주의 비용으로 경영자 본인의 명성을 축적하는 도구로 활용될 수 있으며(Cheng et al., 2013; Krueger, 2015) 이는 비효율적인 투자로 이어져 기업의 경쟁력을 하락시킨다(Friedman, 1970; Jensen, 2002). 또한 ESG 활동은 그 유형과 정도가 매우 방대하다(Christensen et al., 2022). 따라서 경영자들은 투자자들의 요구에 부합하는 ESG 활동을 구분해 내는 데 어려움을 겪을 수 있다(Welch & Yoon, 2022). 극단적으로는, 표면적인 선언에만 그치고 본연의 목적에 충실하지 않은 (green-washing) ESG 활동을 펼치는 경향도 보고되고 있다(Basu et al., 2022; Raghunandan & Rajgopal, 2022).

이와 같은 엇갈린 주장과 실증연구 결과를 종합하면, 투자자들은 기업의 ESG 활동이 경제적 효과를 창출하는지에 대해서 ESG 활동이 갖는 특성에 따라 차별적으로 평가할 가능성이 있다. 실제로 Khan et al.(2016)은 기업의 핵심산업과 연계된 ESG 활동은 주식시장에서 긍정적으로 평가되지만, 핵심산업과의 연관성이 떨어지는 ESG 활동은 투자자들이 차별적으로 평가하지 않는다는 것을 밝혔다. Grewal et al.(2021) 역시 개별기업의 주가에는 핵심산업과 깊게 관계된 ESG 활동에 관한 정보가 반영됨을 보였다. Serafeim & Yoon(2022)은 ESG 관련 정보가 주가에 반영되는 정도는 ESG rating에 대한 합의 정도에 따라 달라짐을 제시하였다. 이러한 연구들은 투자자들이 기업의 ESG 활동 중 경제적 효과를 가져올 가능성이 큰 활동만을 기업가치평가에 반영한다는 것을 시사한다.

국내에서는 대부분의 연구가 Tobin’s Q로 측정된 기업가치와 ESG 활동과의 관계를 살펴보고 있다. Choi et al.(2010), 나영‧임욱빈(2011), 임욱빈(2019), 강원‧정무권(2020)은 ESG 활동과 기업가치 간에 양의 관련성이 있음을 밝혔다. 한편 ESG 활동과 기업가치와의 관계가 제한적인 상황에서 강화된다는 것을 제시한 연구들도 있다. 예를 들어, 임종옥(2016)과 김양희 외(2021)는 기업의 환경 및 사회분야의 활동에 대해서만 기업가치와의 양의 관계가 있음을 밝혔고, 이창섭 외(2021)는 영업이익 변동성이 높은 기업의 ESG 활동과 기업가치와의 관계가 강하다고 보였다. 또한 김양희 외(2021)는 기업의 ESG 활동에 대한 소비자 인지가 높을수록 환경, 사회분야의 활동과 기업가치와의 양의 관계가 더 강하다고 보고하였다. 이들 국내 연구결과는 다양한 횡단면적 상황에서 투자자들의 ESG 활동에 대한 평가가 달라질 수 있다는 점을 보여준다.

2. 연구주제

최근 넓은 스펙트럼을 보이고 있는 ESG 활동에 대한 구체적인 지침이 요구되고 있다. 첫째, ISSB를 비롯한 주요 글로벌 기준제정기구는 장기 기업가치와 관련성이 높은 ESG 활동을 강조한다. 둘째, 이를 충실히 식별‧보고하기 위해 산업별 핵심 특성을 고려하여 세부 보고 지침을 구체화한다.

ISSB는 지속가능성 공시기준의 공개초안을 발표하면서 산업전반(cross-industry)에 적용할 보편적 지표 외에 산업별 특수성을 반영한 산업기반(industry-specific) 지표를 제시하여 전사적 가치에 영향을 미치는 중요한 위험 및 기회 요인을 보다 상세하게 공개토록 할 계획이다.4) ISSB와 비교하여 이해관계자에 대한 파급력을 더욱 중시하는(즉, 이중중요성) Global Reporting Initiative(이하 GRI)도 산업별로 차별화한 기준을 제정하여 기존 보고체계를 보완‧개편하는 과정에 있으며5), 유럽연합(EU) 내 ESG 정보공개 표준으로 활용될 European Sustainable Reporting Standards(이하 ESRS)도 산업별 핵심 공시사항을 마련 중이다.6) 한국거래소는 국제정합성을 제고하는 측면에서 ESG 정보공개 가이던스를 고도화할 계획으로 우리나라 기업들 역시 점차 글로벌 기준에 부합하는 수준에서 ESG 활동과 기업가치창출 동인(driver)을 유기적으로 연계할 필요성이 제기된다.7)

이처럼 주요 국제 기준제정기구들이 ESG 활동의 기업가치에 대한 영향력과 산업별 특수성을 고려하여 공시기준의 제‧개정 작업에 착수한 근간에는 핵심사업과 깊게 연계된 ESG 활동일수록 기업의 지속가능성과 관련도가 높고(Khan et al., 2016), 그러한 정보가 이해관계자들에게도 유용하다는 인식이 전제한다(Grewal et al., 2021).

이에, 본 연구보고서에서는 우리 기업의 ESG 활동이 기업가치 창출경로에 영향을 주는지를 시작으로, 투자자들이 실제로 기업의 ESG 활동을 기업가치평가에 긍정적으로 반영하는지, 어떠한 맥락에서 이러한 평가가 두드러지는지를 살펴본다. 특히나 핵심사업과 ESG 활동 간의 밀접성은 투자자들이 기업가치와의 연계성을 판단할 때 중요하게 고려되는 요소인 만큼(Khan et al., 2016; Grewal et al., 2021), 본 연구는 산업별 핵심 주제와의 연관성 정도가 ESG 활동에 대한 투자자의 평가에 어떠한 영향을 미치는지를 조사한다.

이때, 핵심 주제와의 연관성 정도는 SASB의 중요성(materiality) 기준에 따라 파악한다. SASB 기준은 최초의 산업기반 공시기준으로 그 타당도에 대한 학계의 검증이 이루어져(예: Khan et al., 2016; Grewal et al., 2021; Serafeim & Yoon, 2022 등), 최근 제정 과정에 있는 타 기준(예: GRI, ESRS 등) 대비 신뢰도가 높은 이점이 있다. 또한, 국제적으로 통용될 가능성이 큰 ISSB의 공시기준이 지속가능성 관련 위험 및 기회의 식별을 위해 SASB의 산업기반 공시주제를 검토하도록 명시적으로 요구하므로(IFRS S1[초안] 문단 51), 향후 ISSB 기준을 적용할 수도 있는 국내기업의 영향을 예비적으로 살펴보는 시사점을 기대할 수 있다.

Ⅲ. ESG 활동과 가치창출요소 간의 관계

1. 분석표본

본 장의 분석은 2012년부터 2020년까지 유가증권 및 코스닥시장에 상장된 기업 중 아래와 같은 기준을 충족하는 7,243 기업-연도를 대상으로 한다.

(1) 결산일이 12월 말인 기업

(2) 비금융업을 영위하는 기업

(3) 한국기업지배구조원이 ESG 종합점수를 산출한 기업

상기 표본을 기초로 각 분석에 필요한 특성 변수의 구성이 가능한 표본을 최종 분석 대상으로 하였다. 기업의 재무제표 자료 및 주가 자료는 DataGuide에서 추출하였으며, 무위험이자율의 대용치는 한국은행 경제통계시스템(ECOS)에서 제공하는 통화안정증권 364일물 수익률 자료를 이용하였다. 극단치로 인한 편의 가능성을 완화하고자 연속형 변수는 상‧하위 1% 수준에서 윈저화(winsorization)하였다.

2. 기업가치창출 경로별 활용변수

가. 현금흐름경로

배당 지급 기업이 적은 국내 자본시장의 특수성을 감안하여 배당 수익성 지표보다는 영업 마진‧현금흐름측면의 수익성 지표를 고려하고, 영업 경쟁력을 확인하기 위해 효율성 지표와 무형자산‧기술측면의 생산성 지표를 활용하였다. 구체적으로 수익성 지표로는 매출액영업이익률 및 영업현금흐름수익률을, 효율성 지표로는 총자산회전율 및 현금전환일수를, 생산성 지표로는 총요소생산성 및 Mark-up8)을 살펴보았다.

나. 기업고유위험경로

시장‧규모‧가치 3요인으로 설명되지 않는 주가수익률의 변동성을 기업 고유의 비체계적인 위험으로 측정하고, 꼬리 위험을 집중적으로 살펴보기 위해 비대칭적인 주가폭락 위험을 포착하는 고유수익률의 왜도(skewness)를 검증에 활용하였다. 구체적으로 비체계적 위험 지표는 고유변동성으로, 주가폭락 위험 지표는 고유왜도로 측정하였다.

다. 상대가치평가경로

투자자들이 부여하는 가치평가 배수를 시장가치 대비 장부가치 비율(B/M) 및 주가 대비 주당이익 비율(E/P)로 측정하였다. 변수의 구체적인 정의는 <표 Ⅲ-1>과 같다.

가. 현금흐름경로

기업의 ESG 활동과 장기 현금흐름 창출 능력 간의 관련성을 살펴본 결과, ESG 점수가 높은 기업일수록 수익성‧효율성‧생산성 측면에서 우수한 성과를 보이는 것으로 나타났다. <표 Ⅲ-2>는 t 시점의 ESG 점수를 기준으로 구분한 5분위 집단별 수익성‧효율성‧생산성 지표의 평균값을 제시한다. ESG 점수가 가장 높은 수준의 집단(Q5)은 ESG 점수가 가장 낮은 집단(Q1)에 비해 영업 마진이 높고(매출액영업이익률), 현금흐름 측면에서 이익의 질이 좋을 뿐 아니라(영업현금흐름수익률), 자산 및 운전자본을 효율적으로 활용하며(총자산회전율, 현금전환일수), 무형자산‧기술 생산성 역시 탁월하여(총요소생산성, Mark-up), 전반적인 현금흐름 창출 능력 수준이 월등한 것으로 확인된다. 해당 격차는 산업 및 규모 특성을 조정한 이후에 나타난 결과로 1% 수준에서 통계적으로도 유의하며(양방향 검정), 장기간 안정적으로 유지되는 특성을 보인다.

기업의 ESG 활동과 기업고유위험 간의 관련성을 살펴본 결과, ESG 점수가 높은 기업일수록 위험관리 체계가 고도화되어 있을 가능성이 높은 것으로 나타났다. <표 Ⅲ-3>은 t 시점의 ESG 점수를 기준으로 구분한 5분위 집단별 기업고유위험 지표의 평균값을 제시한다. ESG 점수가 가장 높은 수준의 집단(Q5)은 ESG 점수가 가장 낮은 집단(Q1)에 비해 시장‧규모‧가치 요인으로 설명되지 않는 기업 고유의 비체계적 위험이 작고(고유변동성), 비대칭적인 주가하락 위험도 낮은 것으로 확인된다(고유왜도). 관련 특성 변수는 산업 및 규모 영향을 조정한 것으로 해당 격차는 1% 수준에서 통계적으로 유의하며(양방향 검정), 장기간 안정적으로 유지된다. 아울러, <그림 Ⅲ-1>에서도 나타나듯 ESG 점수 수준이 높은 집단에서는 실제 극단적인 주가폭락을 경험하는 빈도도 적게 나타나 전반적으로 우수한 수준의 위험관리 역량을 보인다.

경쟁우위에 기반한 현금흐름 창출력은 안정적인 배당현금흐름을 실현하는 원천이 되고, 위험관리 체계의 고도화는 악재로 인해 발생할 수 있는 불필요한 비용 요인을 통제하기에 기업가치를 직접적으로 높이는 요인이 된다. 만약, 3.3.1절 및 3.3.2절에서 확인한 현금흐름 및 기업고유위험 경로상 ESG 활동과 가치관련 변수 간 양(+)의 상관관계가 기업의 ESG 활동이 동인이 되어 나타난 결과라면, 투자자들이 부여하는 상대가치평가 배수 역시 높게 나타날 것을 예상할 수 있다(Penman, 2013).

그러나 기업의 ESG 활동과 상대가치평가 배수 간의 관련성을 살펴본 결과, ESG 점수가 높은 기업일수록 오히려 낮은 평가 배수를 적용받는 것으로 확인된다. <표 Ⅲ-4>는 t 시점의 ESG 점수를 기준으로 구분한 5분위 집단별 상대가치평가 배수의 평균값을 제시하는데, ESG 점수가 가장 높은 수준의 집단(Q5)은 ESG 점수가 가장 낮은 집단(Q1)에 비해 장부가치 대비 시장가 비율(B/M)이 전반적으로 높게 나타나 상대가치평가배수는 낮게 형성되어 있다. 이는 동종 산업 내 유사 규모 기업과 비교하여 산출한 격차로 1% 수준에서 통계적으로 유의하며(양방향 검정), 해당 격차는 장기간 좁혀지지 않는 특성을 보인다. 다만, 순이익에 대한 평가 배수 비율(E/P) 격차는 기간에 따라 통계적 유의성이 일관되지 않아 상대가치평가 경로의 유효성에 대해서는 명확한 결론을 내릴 수 없었다.

ESG 활동과 기업가치창출 경로별 상관관계 분석에서 나타난 결과는 ESG 활동이 갖는 내생성에 기인할 가능성이 크다. 이와 같은 내생성은 1) 높은 기업가치를 가진 기업이 충분한 자원을 활용하여 ESG 활동을 활발히 하게 되는 역인과관계, 2) 연구자들이 인지하지 못한 인자가 기업의 ESG활동과 재무성과 및 자본비용에 동시에 영향을 줌으로써 두 요소 간의 상관관계를 관찰하게 되는 경우(즉, 생략된 변수의 문제)에 의해 발생한다(김세희 외, 2022).9) 따라서 ESG 점수의 변동분이 미래 가치창출경로의 변화를 유도하는지 살펴 인과관계를 보다 명확히 할 필요성이 있다.

이에 본 절에서는 전년도 대비 당년도 ESG 점수의 변동분(△ESG)을 계산하여 매년 5분위로 구분하여 앞선 분석을 재수행해본다. 변동분에 대한 분석은 2013년부터 2020년까지 유가증권시장과 코스닥시장에 상장된 12월 말 결산법인 중 비금융업종에 해당되는 6,023 기업-연도를 대상으로 한다. <표 Ⅲ-5>에 나타나듯, ESG 점수 수준(ESG)을 기준으로 5분위로 구분하였을 때는 상위집단으로 갈수록 기업규모(시가총액)가 커지는 양상이 뚜렷하였으나, 변동분을 바탕으로 5분위 집단을 구성하였을 때는 이러한 양상이 완화되어, 기업규모와 관련된 ESG 활동의 내생성을 어느 정도 통제할 수 있는 것으로 나타난다.

<표 Ⅲ-6>은 ESG 점수변동을 기준으로 구분한 5분위 집단별 수익성, 효율성, 생산성 지표 변동분의 평균값을 제시한다. 각 지표의 변동분은 t기를 기준으로 향후 1년, 2년, 3년 동안의 변동분의 비율을 나타낸다. 앞서 제시한 수준 분석의 결과와는 다르게, ESG 점수변동이 클수록 향후 수익성, 효율성, 생산성 지표가 개선되는 경향이 관찰되지 않는다. 예를 들어, 매출액 영업이익률은 ESG 점수변동이 가장 적은 수준의 집단(Q1)에서 향후 1년간 0.28%의 성장률을 보였으나, ESG 점수변동이 가장 높은 수준의 집단(Q5)에서는 –0.97%의 성장률을 보인다. 다른 지표들을 살펴보아도 ESG 점수가 개선될수록 미래현금흐름을 창출할 수 있는 경로에 긍정적인 영향을 미친다는 증거는 발견되지 않는다.

<표 Ⅲ-7>은 ESG 점수변동을 기준으로 구분한 5분위 집단별 기업고유위험경로의 변동분을 보여준다. 기업 주가수익률의 고유변동성은 단조적인 양상을 보이지는 않으나, ESG 점수변동이 가장 높은 집단(Q5)의 고유변동성이 다른 집단에 비해 더 많이 감소하는 현상은 나타나고 있다. 주가폭락 가능성을 나타내는 고유왜도 또한 ESG 점수변동에 따라 단조적인 양상을 보이고 있지 않다.

앞선 결과들은 ESG 점수의 증가가 기업가치 창출경로인 수익성, 효율성, 생산성의 향상으로 이어질 것이라는 예상을 뒷받침하지 못하고 있다. 기업고유위험 및 주가폭락위험 또한 ESG 점수의 향상으로 인해 개선된다는 주장을 제한적으로만 지지하고 있다. 이는 ESG 점수의 변동이 기업가치와 무관하게 나타날 가능성을 시사한다. 이를 명시적으로 확인하고자, 앞선 분석과 마찬가지로 표본을 ESG 점수의 변동분(△ESG)을 바탕으로 연도별 5분위로 구분한 뒤, t기, t+1기, t+2기의 B/M, E/P 배율을 살펴보았다. <표 Ⅲ-8> 및 <그림 Ⅲ-2>에 나타나듯 ESG 점수변동 분위별 B/M의 일정한 변화 추이는 확인되지 않으나, t기의 경우 t+1, t+2에 비해 상위집단의 B/M이 더 높은 것으로 나타난다. 이는 ESG 점수가 개선될수록 오히려 기업가치가 상대적으로 낮게 평가될 수 있음을 의미한다. E/P 분석 결과를 살펴보더라도 ESG 성과 개선 상위집단의 가치평가배수 향상 효과를 확인하기 어렵다.

본 절에서는 기업의 ESG 활동이 기업가치에 반영되는지를 추가로 살펴보고자 ESG 점수의 변동(△ESG)을 기반으로 구성한 포트폴리오의 초과수익률 분석을 수행하였다. 이는 ESG 성과의 개선이 실제 기업가치에 반영되기까지 일정한 기간이 필요하다는 가정을 기반으로 한다. 따라서 매년 ESG 점수가 공개되는 시점이 속한 월의 익월 초를 기준으로 ESG 점수의 증분에 따라 3분위 포트폴리오를 구성하여 차기 ESG 점수 공표일이 속한 월의 말일까지 미래 초과수익률과 일정한 관련성이 있는지를 살펴보았다.10) 미래 초과수익률은 식(1)~(3)의 월별 시계열 회귀분석을 통해 추정하였다.

2014년 9월부터 2022년 8월까지 총 96개월간 ESG 성과 개선 포트폴리오의 월별 수익률 자료를 시계열 회귀분석한 결과를 <표 Ⅲ-9>에서 제시한다. 먼저 ESG 점수의 개선도(△ESG)가 가장 낮은 Low 집단의 미래 초과수익률은 월평균 0.57%이고, 가장 높은 High 집단의 초과수익률은 월평균 0.48%로 ESG 활동의 개선과 미래 초과수익률 간 유의미한 관련성은 확인되지 않는다. Mid 집단을 포함한 전반적인 횡단면적 변동을 살펴보더라도 ESG 성과의 개선에 따라 수익률이 단조적으로 증가하는 경향성은 확인되지 않으며, ESG 성과의 개선도가 높은 기업을 매수하고 낮은 기업을 매도하는 차익거래(High-Low) 전략 또한 유의미한 초과수익률을 창출하지 않는 것으로 나타났다. 이러한 결과는 시장‧규모‧가치‧단기추세 요인 등을 순차적으로 고려한 모형 모두에서 일관되며, 지면상 생략하였으나 동일가중 방식으로 포트폴리오를 구성한 경우에도 질적으로 유사한 결과가 확인된다.

이상의 분석 결과는 기업의 다양한 특성 변수들을 통제한 엄밀한 분석으로 보기는 어려우나, ESG 성과와 기업가치 간의 관련성을 가치창출 경로별로 세분화하여 살펴보았다는 점에서 국내의 선행연구와 차별화된다. 그럼에도 본 절의 결과가 시사하는 바는 ESG 성과와 기업의 가치창출경로 간 상관관계는 존재하지만, 인과관계가 뚜렷하지 않음을 밝힌 선행연구(Waddock & Graves, 1997; Zhao & Murrell, 2016; 김세희 외, 2022)와 일관된다. 단, 이와 같은 결과는 우리나라 기업을 평균적으로 분석한 결과이며, 기업 또는 소속 산업의 특정한 성격 및 환경에 따라 ESG 성과가 기업가치를 제고하는 경로가 더 뚜렷하게 나타날 가능성이 존재함을 감안하여 해석할 필요가 있다. 특히 태생적으로 광범위한 ESG 활동에 대한 투자자들의 이해를 돕는 추가적인 정보의 제공은 ESG 활동이 기업가치평가에 반영되는 과정을 원활하게 할 수 있다. 이에, 본 연구는 중요성공시에 초점을 맞추어 ESG 활동이 기업가치평가에 반영되는지를 더 살펴본다.

Ⅳ. 중요성공시와 ESG 활동의 효과

1. 중요성공시(MD) 자료

기업이 공시하는 지속가능성 관련 정보 중 전사적 가치와 밀접한 관련이 있는 정보는 중요한(material) 것으로 판단할 수 있다. 현재 IFRS 재단이 공표한 지속가능성 공시기준의 일반 공시원칙과 기후 관련 공시 공개초안은 투자자 관점에서 기업가치에 영향을 미치는 중요한 정보를 지속가능성보고서에 담는 것을 기본 원칙으로 한다. 그리고 중요한 정보의 선별은 IFRS의 기준이 별도로 마련되지 않는 한 SASB의 기준을 원용할 것을 천명하고 있다(IFRS S1[초안] 문단 51).

SASB는 고유의 산업분류 체계인 Sustainability Industry Classification System(이하 SICS)에 기초하여 11개 섹터의 77개 산업별로 지속가능성 관련 핵심 주제를 식별하고 있으며, 각 산업마다 기준서를 마련하여 산업 특성에 맞는 공시주제와 이를 측정하는 지표 및 단위를 제시한다. 국내 상장기업 중 SASB 산업분류에 기반하여 지속가능성 정보를 공개하기 시작한 기업은 많지 않다. 그러나 명시적인 SASB 기준 채택 여부와 상관없이 과거에 공개한 지속가능성 정보 중 어느 정도가 SASB의 산업 분류 체계에 따른 중요한 정보인지는 파악할 수 있다.

블룸버그는 전 세계 12,990개 이상의 상장사에 대하여 ESG 정보공개 점수(ESG Disclosure Score)를 연간 단위로 산정하며, 한국 상장사의 경우 2022년 5월 8일 기준 411개 기업에 대해 점수를 제공하고 있다. ESG 정보공개 점수는 블룸버그가 고유의 지표와 측정 단위를 설정하여 환경, 사회, 지배구조 부문 각각에 평가대상으로 선정한 지표 중 기업이 공개하는 지표의 비중을 동일 가중 평균하여 백분율로 산정한다.

이때, 블룸버그는 SASB 기준에 따라 정보의 중요성(materiality)을 판단하는 다수 이해관계자의 요구를 반영하여 자체 평가 지표 중 SASB 지표와 동일하거나 유사한 지표를 식별‧대응(mapping)할 수 있는 도구를 제공한다.11) 블룸버그의 고유 평가 기준과 연계하여 재무적으로 중요한 ESG 활동의 공시성과를 추가로 평가할 수 있는 체계를 마련한 것이다.

이를 이용하면 국내 상장사에 대해서도 중요성공시(MD) 점수를 산출할 수 있다. 첫 번째 단계는 개별 종목의 SICS 분류에 따른 귀속 산업을 확인한 후 해당 산업의 SASB 기준서에 명시된 지표를 확인하는 것이다.12) 다음으로 블룸버그의 식별 코드와 함수를 사용하여 전체 ESG 정보공개 항목 중 중요성 기준에 입각한 공시 비중을 확인한다. 즉, 특정 기업에 대하여 SICS 체계에 해당하는 산업을 확인하고, SASB 기준에 의거한 산업 내 중요 공시주제와 측정 단위를 식별한 후, 블룸버그의 대응(mapping) 도구를 활용하여 전체 정보공개 항목 중 중요성 항목의 공시비중을 백분율로 계산하면 최종적인 MD 점수를 확보할 수 있다.

예를 들어 국내 유가증권 상장사 ‘S’사의 MD 점수 산출 과정을 단계별로 살펴보면 다음과 같다.

① SICS 분류에 따른 ‘S’사의 산업은 TC-HW(Technology & Communication 섹터 내 Hardware 산업)임을 확인한다.

② SASB가 식별하는 TC-HW 산업의 일반 이슈는 제품 안전(product safety), 직원 다양성과 포용성(employee diversity & inclusion), 제품 생애주기 관리(product lifecycle management), 공급망 관리(supply chain management), 소재 구매(material sourcing)이고, 이와 연관된 공시주제와 해당 지표를 식별한다.

③ SASB to Bloomberg Field Mapping 파일에서 식별된 SASB의 지표와 동일하거나 유사한 Bloomberg의 지표(BBG Field Name)와 해당 인식 코드(BBG Field Code)를 식별한다. <표 IV-1>은 ‘S’사의 SASB 지표에 대응하는 블룸버그 지표 예시이다.

④ 식별된 BBG Field Code를 Bloomberg 함수의 변수로 입력하여 해당 지표의 공개 여부를 확인한다.

표에서 개별 지표에 해당하는 함숫값이 존재하지 않으면 ‘na’로 표시되고 이는 정보공개를 하지 않은 것으로 간주한다. 전체 중요한 공시주제는 28개이고 ‘na’를 제외한 값이 11개이므로 MD는 39%로 산출된다.

단, 위와 같이 측정한 MD 점수는 조작적으로 중요성 기준에 입각한 ESG 활동 정보의 공시량을 나타내는 것이지, 관련 성과를 직접적으로 의미하는 것은 아니다(Grewal et al., 2021). 다만 정보이용자들은 MD 점수가 높을수록 기업이 공시한 ESG 활동이 재무적으로 중요한 분야에 집중되어 있다고 판단할 수 있다. 즉, 지속가능성 정보의 자발적 공시 체제 하에서 MD 점수의 증가(감소)는 중요 주제에 대한 공시 범위의 확대(축소)를 의미하므로 ESG 활동의 성과 개선(악화)과 기업가치 간의 연관성에 대한 더욱 명확한 정보를 전달할 것이다. 따라서, 후술하는 분석에서는 MD 점수의 증분을 관심변수로 활용한다.

본 장의 분석은 2013년부터 2020년까지 유가증권 및 코스닥시장에 상장된 기업 중 아래와 같은 기준을 충족하는 25,544 기업-월을 대상으로 한다.

(1) 결산일이 12월 말인 기업

(2) 비금융업을 영위하는 기업

(3) 한국기업지배구조원이 ESG 종합점수를 산출한 기업

(4) Bloomberg가 MD 점수를 산출한 기업

(5) 주식가격(월별 종가)이 1,000원 이상인 기업

상기 표본을 기초로 각 분석에 필요한 특성 변수의 구성이 가능한 표본을 최종 분석 대상으로 한다. 기업의 재무제표 자료 및 주가 자료는 DataGuide에서 추출하였으며, 무위험이자율의 대용치는 한국은행 경제통계시스템(ECOS)에서 제공하는 통화안정증권 364일물 수익률 자료를 이용하였다. 극단치로 인한 편의 가능성을 완화하고자 주가수익률을 제외한 모든 연속형 변수는 상‧하위 1% 수준에서 윈저화(winsorization)하였다. 본 장의 분석에 활용한 변수의 구체적 정의는 <표 Ⅳ-2>에서 제시한다.

우선 MD가 높은 ESG 활동의 개선이 미래 주가수익률을 견인하는지를 검증하고자 ESG 점수의 증분(△ESG)과 MD 점수의 증분(△MD)에 따른 이중 정렬 포트폴리오를 구성한다. 연도별 ESG 점수의 공시 시점에 전년도 대비 점수가 얼마나 개선되었는지를 기준으로 상(High), 중(Mid), 하(Low) 3개의 그룹으로 구분하고, 다시 MD 점수의 개선 여부를 기준으로 개선(Pos△MD), 미개선(Neg△MD) 2개의 그룹으로 구분하여 총 6개의 그룹을 구성하였으며, 관련 그룹 정보를 당기 ESG 점수의 공시 시점이 속하는 월의 익월 초부터 차기 ESG 점수 공시 시점이 속하는 월의 말일까지 적용하여 매년 △ESG‧△MD 포트폴리오를 재구성하였다. 이에 따라 주가자료를 이용하는 실증분석 기간은 2014년 9월 초부터 2022년 8월 말까지 총 96개월로 설정하였다.

<표 Ⅳ-3>은 25,544 기업-월 관측치로 구성한 △ESG‧△MD 포트폴리오별 주요 특성 변수의 평균값을 제시한다. 평균값은 매년 해당 포트폴리오를 구성하는 개별기업의 변숫값을 동일 가중하여 산출하였다. 기업규모(lnSIZE)는 대체로 Pos△MD 집단이 Neg△MD 집단에 비해 크게 나타났으나, 6개 그룹 모두 베타(BETA)의 평균값이 1에 가깝게 나타나 시장베타 수준에서 크게 벗어나지 않았고, 장부가 대비 시장가(lnBM) 특성, 고유변동성(IDVOL)으로 대리한 비체계적 위험 특성도 뚜렷한 차이를 보이진 않았다. 단, 과거 수익률 성과(MOM) 측면에서 일정한 차이가 확인되어 후술하는 △ESG‧△MD 포트폴리오 성과 분석에서는 시장‧규모‧가치요인에 단기추세 요인을 추가로 고려한 Carhart 4-요인 모형의 시계열 회귀분석을 통해 월평균 초과수익률을 추정하고자 한다.

전술한 포트폴리오 성과 분석, 즉, MD가 높은 ESG 활동의 개선이 미래 주가수익률을 견인하는지를 개별기업 수준에서 재검증하고자 횡단면 회귀분석 표본을 구성하였다. 포트폴리오 수준의 시계열 회귀분석에서는 통제할 수 없는 성과대응 재량적 발생액(PMDA), 총수익성(GPA) 등 개별기업 특성 변수를 추가적으로 고려하면서 최종 표본은 24,681 기업-월 관측치로 구성된다. <표 Ⅳ-4>는 관련 주요 특성 변수에 대한 기초통계량을 제시한다. Panel A에서 주요 변수의 분포를 살펴보면, 종속변수로 활용할 월평균 초과수익률(abRET(%))의 경우 평균이 1.208%, 중위수는 0%, 최솟값 및 최댓값이 각각 –65.190%, 218.015%로 양(+)으로 치우친 분포를 보인다. 또한, Panel B에서 주요 독립변수와 abRET(%) 간 상관관계를 보면 Spearman의 서열 상관계수는 대부분 1% 수준에서 유의하지만, Pearson의 모수적 상관계수는 유의성이 낮게 나타나 통상적인 OLS 회귀분석 수행이 부적합할 것으로 판단된다.13) 이에 후술하는 횡단면 회귀분석에서는 주식수익률의 극단값으로 인한 영향을 완화하기 위해 선행연구의 방법론에 따라(예: Livnat & Mendenhall, 2006; 고봉찬‧김진우, 2009 등) 각 연속형 통제변수들을 10분위 순위에 기초하여 –0.5에서 +0.5의 값을 갖도록 표준화하고 관심변수인 △ESG는 포트폴리오 수익률 분석과의 일관성을 위해 3분위를 기준으로 –0.5에서 +0.5의 값을 갖도록 표준화하여 이분산성을 완화하는 비보수적 검정을 수행하고자 한다.

다음으로 MD가 높은 ESG 활동의 개선에 대해 시장이 가치관련성을 적시에 이해하는 지를 검증하고자 단기 시장반응, 즉, ESG 점수의 공표 후 주가표류현상(post-announcement drift)이 나타나는지를 검증하는 표본을 구성한다. 표본기간에 해당하는 2013년부터 2020년까지 한국기업지배구조원은 매년 8월에서 11월 사이에 ESG 점수를 최초 공표한 바, 본 분석의 표본은 기업-연 단위이며 <표 Ⅳ-5>에서 2,138 기업-연 관측치에 대한 기초통계량을 제시한다. <표 Ⅳ-4>의 횡단면 회귀분석 표본과 유사하게 주식수익률의 극단값으로 인한 편의가 예상되어 후술하는 회귀분석에서는 각 연속형 독립변수들을 10분위 순위에 기초해 –0.5에서 +0.5의 값을 갖도록 표준화하고 관심변수인 △ESG는 포트폴리오 수익률 분석과의 일관성을 위해 3분위를 기준으로 –0.5에서 +0.5의 값을 갖도록 표준화하여 주식수익률의 극단값으로 인한 영향을 완화하는 비보수적 검정을 수행한다(Livnat & Mendenhall, 2006; 고봉찬‧김진우, 2009).

ESG 활동은 다양한 경로로 기업가치를 창출할 가능성이 있다(Cornell & Damodaran, 2020). 그럼에도 불구하고 Ⅲ장에서의 분석 결과는 ESG 성과의 종합적 개선이 기업의 가치창출 동인이 되는지에 대해 일관성 있는 결론을 보여주지 못하며, 이는 ESG 성과와 기업가치 간 명확한 관련성을 찾지 못한 선행연구의 한계와도 일치한다(Waddock & Graves, 1997; Zhao & Murrell, 2016; 김세희 외, 2022). 이에 본 절에서는 재무성과와 관련성이 보다 명확한 ESG 활동을 개선하는 경우와 그렇지 않은 경우를 구분하여 ESG 활동과 기업가치 간의 관련성을 재조명하였다.

첫째, ESG 활동의 개선이 미래 주가수익률을 견인하는 효과가 재무적 중요성에 기반한 공시성과에 따라 차별적으로 나타나는지를 분석하기 위해 <표 Ⅳ-6>에서 ESG 점수의 증분(△ESG)과 MD 점수의 증분(△MD)에 따라 구성한 3×2의 이중 정렬 포트폴리오의 월평균 초과수익률 성과를 살펴보았다. 초과수익률은 Carhart의 4-요인 모형을 이용하여 월별 수익률의 시계열 회귀분석을 통해 추정하였다(Ⅲ장 5절 식(3) 참조). 분석 결과, ESG 성과의 개선이 미래 주가수익률을 견인하는 효과는 MD의 개선이 병행된 집단에서만 유의미하게 나타났다. 구체적으로 ESG 성과의 개선 정도가 높은 집단(△ESG High)을 매수하고 낮은 집단(△ESG Low)을 매도하는 차익거래 전략(High-Low)은 MD의 개선이 동반된 경우(△MD Pos)에만 월평균 0.982%의 양(+)의 초과수익률을 달성하는 것으로 나타났다(5% 유의수준). 특히, ESG 성과의 개선 정도가 높은 집단(△ESG High)만 별도로 살펴보면 MD의 개선을 동반한 집단(△MD Pos)은 월평균 1.183%의 유의한 초과수익률을 기록한 반면(1% 유의수준), MD의 개선이 동반되지 않은 집단(△MD Neg)은 유의하지 않은 성과를 보인다. 이상의 결과는 MD의 개선이 명확한 ESG 활동의 개선이 기업의 가치창출과 유기적으로 연계될 수 있음을 시사한다.14)

<표 Ⅳ-7>의 열(1)은 통제변수를 제외한 결과를, 열(2)는 기본적인 위험 특성 요인만 통제한 결과를, 열(3)은 기업 펀더멘털 특성을 추가 통제한 결과를 제시한다. 횡단면 회귀분석에서 일반적인 최소자승법(OLS)보다 가중최소자승법(WLS) 추정의 편의가 더 적다는 선행연구(Shanken & Zhou, 2007; Petersen, 2009)를 참조하여 기업규모의 역수를 가중치로 하는 WLS 추정결과를 열(4)에서 열(6)까지 함께 제시한다. 모든 열에서 ESG 활동의 개선에 대한 순위정보와 MD의 개선 여부를 교차한 항(△ESG×Pos△MD)의 계수값이 유의한 양(+)으로 나타나(5% 혹은 1% 유의수준) MD의 개선이 명확한 경우 개별기업 수준에서도 ESG 성과는 기업가치 창출과 유기적으로 연계됨이 확인된다. 특히, 여러 기업 특성 요인들을 통제한 열(6)을 기준으로 ESG 성과의 개선도가 높은 기업(△ESG=0.5)은 MD의 개선을 동반한 때(Pos△MD=1) 월평균 0.630%(=-0.213×0.5+0.133×1+1.206×0.5×1)의 양(+)의 초과수익률을 보이지만, MD의 개선이 병행되지 않았을 때(Pos△MD=0)는 월평균 –0.107%(=-0.213×0.5+0.133×0+1.206×0.5×0)의 음(-)의 초과수익률이 나타나 포트폴리오 수준의 시계열 회귀분석 결과와 일관성을 보인다.

이와 같은 ESG 점수 공표 후 주가표류현상이 개별기업의 특성 변수를 충분히 통제한 상태에서도 통계적으로 유의한지를 검증하기 위해 아래 식(5)의 모형을 이용하여 Fama & MacBeth(1973)의 횡단면 회귀분석을 수행하였다.

전술한 결과에 따르면, 주식시장은 ESG 활동이 과거보다 더 활발해지고 이러한 활동이 재무적으로 중요한 경우에 이를 긍정적으로 평가한다. 이러한 투자자들의 긍정적인 평가의 원천은 이들 기업의 ESG 활동이 지속적으로 수행되어 왔다는 점에 근거할 가능성이 있다. 이와 같은 예측은 재무정보의 지속성이 가치관련성에 있어 핵심적인 속성으로 논의되고 있는 것과 일치한다(Easton & Harris, 1991; Ali & Zarowin, 1992). 특히, 최근 논란이 불거지고 있는 green washing을 체계적으로 가치평가에 반영하기 위해, 투자자들은 기업의 ESG 활동이 꾸준히 이루어지는지에 관심을 가질 수 있다. ESG 활동에 소비되는 상당한 비용을 감안할 때, 명목상의 ESG 활동은 상대적으로 지속성이 떨어질 것이기 때문이다. 따라서 본 연구에서는 재무적으로 중요한 ESG 활동이 더 지속적인지를 아래 모형을 추정함으로써 명시적으로 살펴본다.

한편, 투자자들이 재무적으로 중요한 ESG 활동의 증가에 더 민감하게 반응한다는 앞선 결과는 이러한 ESG 활동이 현금흐름창출역량의 제고에 더 중요한 역할을 할 수 있다는 가능성도 제시한다. 이러한 가능성을 검증하기 위해 아래의 식(7)의 모형을 추정해보았다.

이같은 결과는, ESG 활동의 재무적 중요도가 소비자, 공급자 및 종업원과 같은 이해관계자의 의사결정에 유의하게 고려될 수 있다는 주장을 뒷받침하지 못한다. 이는 1) 이러한 이해관계자들이 중요성공시를 의사결정에 활용하지 못하고 있거나, 2) 애초에 재무적 중요도가 이들 이해관계자의 의사결정에 유용한 정보가 아닐 가능성 모두를 내포한다.

이제까지의 결과를 종합하면, 기업의 ESG 활동은 투자자들이 재무적으로 중요하다는 판단을 내린 경우에만 기업가치에 유의한 영향을 미친다. 또한 ESG 활동의 재무적 중요도는 소비자, 공급자, 종업원 등 현금흐름창출역량에 직접적인 기여를 하는 이해관계자들의 의사결정에는 유의한 영향을 미치지 못하는 것으로 나타났다. 따라서 현재 우리 기업의 ESG 활동은 재무성과와 관련성이 있다고 판단된 범위 내에서, 기업가치를 결정하는 요인 중 분모효과인 자본비용의 조정을 통해서만 가치평가에 반영되고 있으며 분자인 현금흐름창출역량에 대한 영향은 명확하지 않은 것으로 보인다.

Ⅴ. 결론 및 정책적 시사점

본 연구는 국내 기업들의 재무적 중요도가 높은 ESG 활동이 개선될 때, 주식투자자들이 긍정적으로 반응하고 있으며, 더 지속적인 ESG 활동을 수행하는 것을 발견했다. 이는 재무적으로 중요한 ESG 활동이 더 지속적이며 자본시장에서 가치관련성을 체계적으로 인정받을 수 있다는 것을 시사한다.

본 연구는 ESG 활동의 재무적 중요성을 상호교차 변수로 사용하여 정황적 증거를 제공함으로써, ESG 활동과 기업가치 간의 관련성에 대한 기존 문헌의 논의들을 통합하고 있다는 점에서 그 공헌점을 갖는다. 기존 연구에서 일관된 실증증거가 부재했던 것은 1) ESG 활동이 애초에 기업가치 창출경로(예: 미래현금흐름이나 자본조달비용)와 무관할 가능성, 혹은 2) ESG 활동과 기업가치 요소들의 관련성에 대한 시장의 평가가 체계적이지 않을 가능성을 모두 내포한다. 본 연구에서 제시하는 결과는 재무적 중요도가 높은 ESG 활동이 이 두 가지 가능성을 해결할 수 있는 실마리가 될 수 있음을 암시한다.

구체적으로, 본 연구의 결과는 ESG 활동을 통하여 기업가치를 제고하고자 하는 기업 및 정책입안자들에게 크게 두 가지 시사점을 제공한다. 첫째, 기업들은 재무적 중요성이 높은 ESG 활동에 집중해야한다. 이는 큰 비용을 수반하는 ESG 활동을 지속적으로 수행할 수 있게 하는 기업 내부적인 원동력이 될 뿐만 아니라, 투자자의 긍정적인 평가를 바탕으로 안정적인 외부자금을 확보할 수 있게끔 한다. 즉, 기업 안팎으로 ESG 활동에 대한 당위성을 공고히 할 수 있는 것이다. 둘째, 자본시장의 참여자들이 ESG 활동의 가치관련성을 즉각적으로 이해할 수 있는 것은 아니기 때문에, ESG 활동의 재무적 중요성을 공시를 통해 명확히 표현해야 한다. 이는 ESG 공시규정을 준비하고 있는 국내 정책입안자들이 기업의 특성별로 재무적 성과와 밀접한 관련이 있는 ESG 활동이 무엇인지를 먼저 식별하고, 이를 정보이용자들에게 효율적으로 전달할 수 있는 방법을 숙고해야 할 것임을 의미한다. 이 과정에서 기업 및 자본시장참여자들과의 긴밀한 의사소통은 필수적일 것이다.

1) 재무성과와의 관련성이 뚜렷하지 않은 ESG 활동의 지속가능성은 연구개발 투자에 대한 회계기준을 통해 더 직관적으로 가늠할 수 있다. 연구개발 투자는 미래 경제적 효익, 즉 미래수익성에 대한 불확실성이 큰 경우, 즉각적으로 당기비용으로 처리해야 한다. 따라서 미래 수익을 견인할 수 있는 경로가 불명확한 연구개발 투자는 당기의 재무성과를 훼손하는 결과를 초래하고, 외부자금조달이 어렵고 지속가능하지 않으며, 따라서 가치관련성도 낮다. 때문에 기업들은 연구개발 투자의 효율성을 제고하고자 노력할 유인이 생긴다. 유사한 맥락에서 기업들은 재무성과를 어떻게 창출할 수 있는지의 경로가 뚜렷하지 않은 ESG 활동을 궁극적으로 수행하지 않게 될 것이다.

2) ISSB는 ESG 정보의 통합보고 체계를 마련한 국제통합보고위원회(IIRC), 산업별 기준을 확립한 지속가능성회계기준위원회(SASB), 세부 주제로써 기후 관련 기준을 수립한 기후정보기준위원회(CDSB)와 합병을 결정하였으며, 기타 주요 국제기준제정기구(예: TCFD, WEF 등)와도 기술적 실무단(TRWG)을 구성하여 ESG 정보공시의 글로벌 기준선 마련을 주도하고 있다.

3) 학계와 실무에서 전자는 ‘Walk-the-Talk’이라는 용어로, 후자는 ‘Green Washing’이라는 용어로 표현하고 있다.

4) International Sustainability Standards Board, 2022. 3. 31, IFRS S1 General Requirements for Disclosure of Sustainability-related Financial [Draft].

5) Global Sustainability Standards Board, 2020. 11. 19, GRI Sector Program - Revised list of prioritized sectors.

6) European Financial Reporting Advisory Group, 2022. 1. 18, PTF-ESRS Batch 1 working papers – Cover note and next steps.

7) 한국거래소, 2022. 6. 27,「KRX ESG 포럼 2022」‘ESG 시대, 한국 자본시장의 현안과 대응과제’.

8) 생산적인(productive) 기업일수록 한계비용 체감에 따라 제품‧서비스 원가에 가산하여 책정하는 판매가격이 높게 형성되므로 Mark-up은 기업 생산성의 대용치가 된다(Melitz & Ottaviano, 2008).

9) 예를 들어, 기업의 생산성은 규모의 경제 효과와 밀접한 관련이 있다(Cohen & Klepper, 1996). 만약 규모의 경제를 달성한 고생산성 기업이 여유 자원을 활용하여 ESG 활동을 활발히 수행한다면, ESG 활동과 기업가치 간 양(+)의 상관관계는 가성(spurious) 상관관계 혹은 역인과관계로 인해 관찰되었을 가능성을 배제하기 어렵다.

10) 표본기간에 해당하는 2013년부터 2020년까지 ESG 점수는 매년 8~11월 중 공표되었으며 연도별 공식적인 공시일은 한국기업지배구조원으로부터 제공받아 분석에 활용하였다.

11) 구체적으로, ‘Sustainability Accounting Standards Board to Bloomberg Field Mapping (Version 2.0)’ 이름의 엑셀 파일을 제공한다.

12) SASB는 2021년 말 기준으로 3,398개의 한국 상장 및 비상장 기업을 SICS 기준으로 산업분류를 하고 있으며, 이 중 블룸버그가 ESG 정보공개 점수를 산정하는 상장사에 한하여 MD 점수를 산출할 수 있다.

13) 지면상 생략하였으나 Breush-Pagan 검정, Sharpiro-Wilk 검정 결과 등분산성, 정규성을 가정하는 각각의 귀무가설을 1% 유의수준에서 모두 기각하는 것으로 나타났다.

14) 지면상 생략하였으나 동일가중 방식으로 포트폴리오를 구성하는 경우, ESG 성과의 개선 정도를 다양하게 설정하는 경우(예: 2분위, 5분위 등), Kraft et al.(2006)에 따라 포트폴리오 구성 기간 내 연간수익률이 200%를 초과하는 극단적 성과 표본(983 기업-월)을 제외한 분석 등에서도 결과가 유지됨을 확인하였다.

참고문헌

강원‧정무권, 2020, ESG 활동의 효과와 기업의 재무적 특성, 『한국증권학회지』 49(5), 681-707.

고봉찬‧김진우, 2009, 발생액 이상현상과 차익거래기회에 관한 연구, 『한국증권학회지』 38(1), 77-105.

김세희‧선우희연‧이우종‧정아름, 2022, ESG 활동과 기업가치의 상관관계와 인과관계, 『회계저널』 31(3), 31-60.

김양희‧석준희‧김병도, 2021, 기업의 ESG역량과 기업가치의 관계에 대한 연구, 소비자 인지의 조절효과를 중심으로, 『경영학연구』 50(6), 1571-1593.

나영‧임욱빈, 2011, ESG 정보의 가치관련성에 관한 실증연구, 『경영교육연구』 26(4), 439-467.

이창섭‧정아름‧전홍민, 2021, ESG 결정요인 및 기업가치에 관한 연구: 경제정책 불확실성과 영업이익 변동성을 중심으로, 『회계학연구』 46(6), 115-139.

임욱빈, 2019, 비재무적 정보가 기업성과에 미치는 영향: ESG 점수를 중심으로, 『국제회계연구』 86, 119-144.

임종옥, 2016, ESG 평가정보 및 이익관리가 기업가치에 미치는 영향, 『경영교육연구』 31(1), 111-139.

Ali, A., Zarowin, P., 1992, The role of earnings levels in annual earnings-returns studies, Journal of Accounting Research 30(2), 286-296.

Aral, K., Giambona, E., Vam Wassenhov, L.N., 2021, Stakeholder orientation and operations outcomes: Evidence from constituency statutes, SSRN working paper No.3680127.

Basu, S., Vitanza, J., Wang, W., Zhu, X., 2022, Walking the walk? Bank ESG disclosures and home mortgage lending, SSRN working paper No.3807685.

Carhart, M.M., 1997, On persistence in mutual fund performance, Journal of Finance 52(1), 57–82.

Cheng, I.H., Hong, H., Shue, K., 2013, Do managers do good with other people's money? NBER working paper No.19432.

Choi, J.S., Kwak, Y.M., Choe, C., 2010, Corporate social responsibility and corporate financial performance: Evidence from Korea, Australian Journal of Management 35(3), 291-311.

Christensen, D.M., Serafeim, G., Sikochi, S., 2022, Why is corporate virtue in the eye of the beholder? The case of ESG ratings, The Accounting Review 97(1), 147–175.

Cohen, W.M., Klepper, S., 1996, Firm Size and the Nature of Innovation within Industries: The Case of Process and Product R&D, The Review of Economics and Statistics 78(2), 232–243.

Cornell, B., Damodaran, A., 2020, Valuing ESG: Doing good or sounding good? SSRN working paper No.3557432.

Dess, G.D., Shaw, J.D., 2001, Voluntary turnover, social capital, and organizational performance, Academy of Management Review 26(3), 446–456.

Easton, P.E., Harris, T.S., 1991, Earnings as an explanatory variable for returns, Journal of Accounting Research 29(1), 19-36.

Fama, E.F., French, K.R., 2007, Disagreement, tastes and asset prices, Journal of Financial Economics 83(3), 667-689.

Fama, E.F., MacBeth, J.D, 1973, Risk, Return, and Equilibrium: Empirical Tests, Journal of Political Economy 81(3), 607–636.

Fama, E.F., French, K.R., 1993, Common risk factors in the returns on stocks and bonds, Journal of Financial Economics 33(1), 3–56.

Fombrun, C., Shanley, M., 1990, What's in a name? Reputation building and corporate strategy, Academy of Management Journal 33(2), 233-258.

Fombrun, C.J., 2005, A world of reputation research, analysis and thinking—Building corporate reputation through CSR initiatives: evolving standards, Corporate Reputation Review 8(1), 7–12.

Freeman, R.E., 2010, Strategic management: A stakeholder approach, Cambridge University Press.

Freeman, R.E., Harrison, J.S., Wicks, A.C., 2007, Managing for stakeholders: Survival, reputation, and success, Yale University Press.

Friedman, M., 1970. 9. 13, The social responsibility of business is to increase profits, New York Times Magazine.

Garfinkel, J.A., 2009, Measuring investors’ opinion divergence, Journal of Accounting Research 47(5), 1317–1348.

Garfinkel, J.A., Sokobin, J., 2006, Volume, opinion divergence, and returns: A study of post-earnings announcement drift, Journal of Accounting Research 44(1), 85–112.

Grewal, J., Hauptmann, C., Serafeim, G., 2021, Material Sustainability Information and Stock Price Informativeness, Journal of Business Ethics 171(3), 513–544.

İmrohoroğlu, A., Tüzel, Ş., 2014, Firm-level productivity, risk, and return. Management Science 60(8), 2073-2090.

Ittner, C., Larcker, D., Meyer, M., 2003, Subjectivity and the Weighting of Performance Measures: Evidence from a Balanced Scorecard, The Accounting Review 78(3), 725-758.

Jensen, M.C., 2002, Value maximization, stakeholder theory, and the corporate objective function, Business Ethics Quarterly 12(2), 235-256.

Khan, M., Serafeim, G., Yoon, A., 2016, Corporate sustainability: First evidence on materiality, The Accounting Review 91(6), 1697-1724.

Kormendi, R., Lipe, R., 1987, Earnings Innovations, Earnings Persistence, and Stock Returns, Journal of Business 60(3), 323-345.

Kraft, A.G., Leone, A.J., Wasley, C.E., 2006, An analysis of the theories and explanations offered for the mispricing of accruals and accrual components, Journal of Accounting Research 44(2), 297-339.

Krueger, P., 2015, Corporate goodness and shareholder wealth, Journal of Financial Economics 115(2), 304-329.

Lazear, E., Shaw, K., 2007, Personnel economics: The economist’s view of human resources, The Journal of Economic Perspectives 21(4), 91–114.

Lev, B., Petrovits, C., Radhakrishnan, S., 2010, Is doing good good for you? How corporate charitable contributions enhance revenue growth, Strategic Management Journal 31(2), 181-200.

Lintner, J., 1965, Security Prices, Risk, and Maximal Gains From Diversification, The Journal of Finance 20(4), 587–615.

Livnat, J., Mendenhall, R.R., 2006, Comparing the post-earnings announcement drift for surprises calculated from analyst and time series forecasts, Journal of Accounting Research 44(1), 177–205.

Melitz, M.J., Ottaviano, G.I.P., 2008, Market size, trade, and productivity, The Review of Economic Studies 75(1), 295–316.

Newey, W.K., West, K.D., 1987, Hypothesis Testing with Efficient Method of Moments Estimation, International Economic Review 28(3), 777.

Olley, G.S., Pakes, A., 1996, The dynamics of productivity in the telecommunications equipment industry, Econometrica 64(6), 1263-1297.

Pedersen, L.H., Fitzgibbons, S., Pomorski. K., 2021, Responsible investing, The ESG-efficient frontier, Journal of Financial Economics 142(2), 572-597.

Penman, S.H., 2013, Financial statement analysis and security valuation(5th), McGraw-Hill Irwin.

Petersen, M.A, 2009, Estimating standard errors in finance panel data sets: Comparing approaches, Review of Financial Studies 22(1), 435–480.

Raghunandan, A., Rajgopal, S., 2022, Do ESG funds make stakeholder-friendly investments? Review of Accounting Studies, 27, 822–863.

Shanken, J., Zhou, G., 2007, Estimating and testing beta pricing models: Alternative methods and their performance in simulations, Journal of Financial Economics 84(1), 40–86.

Sharpe, W.F., 1964, Capital Asset Prices: A Theory of Market Equilibrium Under Conditions of Risk, The Journal of Finance 19(3), 425–442.

Turban, D.B., Greening, D.W., 1997, Corporate social performance and organizational attractiveness to prospective employees, Academy of Management Journal 40(3), 658-672.

Waddock S.A., Graves, S.B., 1997, The corporate social performance-financial performance link, Strategic Management Journal 18(4), 303–319.

Welch, K., Yoon, A., 2022, Do high-ability managers choose ESG projects that create shareholder value? Evidence from employee opinions, Review of Accounting Studies, 1-28.

Zhao, X., Murrell, A.J., 2016, Revisiting the Corporate Social Performance – Financial Performance Link: A Replication of Waddock and Graves, Strategic Management Journal 37(11), 2378-2388.

Related

Publications

Introduction of Sustainability-Linked Bonds into Korea: Expectations and Challenges

Senior Research Fellow Choi, Soon Young

Recently, sustainable linked bonds (SLBs) have been newly adopted in Korea’s ESG bond market. The market has achieved highly quantitative growth but is faced with problems such as a leaning toward social bonds and a lack of private company engagement, which requires qualitative improvements. Under the circumstances, it is unfortunate that domestic companies rarely make full use of ESG bonds to meet environmental and social goals such as the net-zero transition that require enormous funds. Among various factors that contribute to underused ESG bonds, the most notable is that the use of funds from ESG bonds is limited to specific projects. On the other hand, SLBs are not constrained by the scope of fund use and thus, a growing number of companies are expected to tap into SLBs to improve environmental and social issues.

SLB issuers can use the funds raised from SLBs for achieving specific environmental or social goals to finance any corporate activities. For this reason, SLBs can provide an opportunity for companies, which are unable to find a huge green or social project or fall into the brown industry category, to have access to the ESG bond market. In addition, an SLB is an incentive-based borrowing instrument under which financial conditions such as interest rates are tied to whether the issuer achieves a commitment. This is beneficial for investors as the risk of greenwashing that comes with conventional ESG bonds can be mitigated. However, SLBs may give rise to other types of greenwashing, depending on goal setting or incentive structure, which requires both SLB issuers and investors to exercise caution.

The introduction of SLBs is expected to expand Korea’s ESG bond market base and boost the engagement of private companies. As any SLB has yet to be issued in Korea, however, Korea needs to make thorough preparation to ensure that SLBs take hold and thrive. First of all, a database across industries and sectors should be created based on corporate ESG disclosure to set a goal and evaluate whether an SLB accomplishes the goal. What is also needed is a sophisticated methodology to assess an SLB design structure, based on which Korean companies should establish ESG strategies. Most importantly, trust in the early SLB market should be built to ensure that they live up to the expectations of market participants. Sustainability Reporting Based on Materiality and Price Informativeness Senior Research Fellow Lee, Inhyung and others That corporate sustainability information disclosure enhances enterprise value discovery is a basic premise underlying sustainability disclosure discussions. If this is not the case, sustainability reporting efforts can be of little value to both the corporate and the investors. This aspect of sustainability reporting should be taken into consideration when regulatory efforts are undertaken to mandate disclosure. This paper aims to ascertain empirically whether disclosure of material sustainability information increases the price informativeness of the firm’s stock price to provide evidence that can be considered in the regulatory design.