Find out more about our latest publications

Discussions on Sustainability Disclosure by Collective Investment Vehicles

Issue Papers 22-18 Oct. 04, 2022

- Research Topic Asset Management/Pension

- Page 25

After recognizing greenwashing and investor protection as critical issues, financial authorities of major economies have recently worked on administrative restrictions and legislative bills to meet the related challenges. As part of these efforts, the European Commission adopted the Regulatory Technical Standards (RTS) for implementing the Sustainable Finance Disclosure Regulation (SFDR), while the US Securities and Exchange Commission (SEC) released the regulation mandating ESG disclosure by investment advisers and investment companies.

A wide range of funds are subject to ESG disclosure. All funds managed within the EU should in principle describe sustainability risks and major adverse impacts in the format and template set forth by the RTS at the level of both GPs and funds. If they fail to do so, the reason for non-compliance should be explained in detail. In the US, a broader definition of ESG funds by the SEC could make most funds subject to the ESG disclosure regulation. Notably, the EU and US have adopted the principle of proportionality in their ESG disclosure rules, meaning that how much impact sustainability factors have on investment decisions determines the level of information to be disclose.

It might be difficult for Korea to bring its ESG disclosure practices up to the level of the EU’s scheme in a short period of time. Hence, a more practical alternative would be the establishment of guidelines for effectively encouraging ESG-related information disclosure, based on the existing regulatory framework for better investor protection and greater responsibility for asset managers as specified in the Financial Investment Services and Capital Markets Act. But separate guidelines should be devised only if ESG is represented or mentioned in the name and prospectus of funds.

ESG funds should provide a detailed description of the investment type and method and periodically report the process and results of investments. The internal control system is necessary to guarantee the participation of professionals for sustainability analysis and integrity of data being used. Additionally, a due diligence process should be arranged if a fund depends on third-party service providers for data and analysis. ESF funds also need to adopt a benchmark that aligns with sustainability features pursued by them and if they engage in shareholder activities for ESG agendas, they should inform investors of such agenda items and the implementation process and report whether the goal of shareholder activities is achieved on a periodic basis.

A wide range of funds are subject to ESG disclosure. All funds managed within the EU should in principle describe sustainability risks and major adverse impacts in the format and template set forth by the RTS at the level of both GPs and funds. If they fail to do so, the reason for non-compliance should be explained in detail. In the US, a broader definition of ESG funds by the SEC could make most funds subject to the ESG disclosure regulation. Notably, the EU and US have adopted the principle of proportionality in their ESG disclosure rules, meaning that how much impact sustainability factors have on investment decisions determines the level of information to be disclose.

It might be difficult for Korea to bring its ESG disclosure practices up to the level of the EU’s scheme in a short period of time. Hence, a more practical alternative would be the establishment of guidelines for effectively encouraging ESG-related information disclosure, based on the existing regulatory framework for better investor protection and greater responsibility for asset managers as specified in the Financial Investment Services and Capital Markets Act. But separate guidelines should be devised only if ESG is represented or mentioned in the name and prospectus of funds.

ESG funds should provide a detailed description of the investment type and method and periodically report the process and results of investments. The internal control system is necessary to guarantee the participation of professionals for sustainability analysis and integrity of data being used. Additionally, a due diligence process should be arranged if a fund depends on third-party service providers for data and analysis. ESF funds also need to adopt a benchmark that aligns with sustainability features pursued by them and if they engage in shareholder activities for ESG agendas, they should inform investors of such agenda items and the implementation process and report whether the goal of shareholder activities is achieved on a periodic basis.

Ⅰ. 보고서 작성 배경

국내 공모 주식형 펀드 중 ESG(Environment, Social and Governance) 및 이와 유사한 이름1)으로 출시된 펀드(이하 ESG 펀드)는 모두 52개로 파악된다.2) 이 펀드들의 설정액은 1조 7,458억원, 순자산은 2조 4,090억원으로 전체 공모 주식형 펀드 설정 및 순자산 금액 기준으로 각각 동일하게 2.13%에 해당한다.3) 미국 ESG 펀드의 전체 뮤추얼 펀드와 ETF(Exchange Traded Fund) 순자산 기준 1.6%보다 큰 비중이다.4)

펀드 명칭은 해당 펀드의 주요 운용 특성(주요 투자전략, 지역 등)을 나타낸다. 투자자를 오인케 할 우려가 있는 명칭은 사용하지 않도록 연성규범이 마련되어 있다.5) 논란이 되는 투자상품의 그린워싱 문제는 명칭과 투자전략에 지속가능성을 표방하나, 실제 투자 의사결정 과정에서는 투자자의 기대와는 달리 실질적으로 그렇게 하지 않기 때문에 발생한다.6)

박혜진(2020)은 국내 ESG 펀드들의 ESG 수준은 평균적으로 일반 펀드와 유사하고, ESG 요소를 활용하여 엑티브 운용전략을 추구하는 펀드 간에도 포트폴리오 ESG 점수가 두 배 이상 차이 나는 것으로 보고하고 있다. 문제는 투자자가 사전에 이러한 정보를 현재의 투자설명서를 통해 식별하기 쉽지 않다는 데 있다.

각국의 금융당국은 투자상품의 그린워싱과 투자자 보호를 중요한 의제로 인식하기 시작하여 최근 일련의 행정 제재와 입법 제안을 통해 문제점 해결에 나서고 있다. II장에서 규정 일부가 이미 시행되고 있는 유럽연합(European Union: EU, 이하 EU)과 최근 규정안을 발표한 미국의 증권거래위원회(U.S. Securities and Exchange Commission: SEC, 이하 SEC)의 사례를 살펴본다.7) III장에서는 국내 ESG 펀드의 투자설명서에 게재된 지속가능성 정보의 개선점을 살펴본 후 집합투자기구의 그린워싱 방지를 위한 지속가능성 정보공개 논의 방향을 제시한다.

이를 위해 EU와 SEC의 공식문서와 관련 보도자료를 중점으로 조사하고, 관련 이해당사자 기관의 의견도 참고한다.8) 정보를 최대한 객관적으로 전달하기 위해 각주를 통해 원문을 링크하여 이해를 돕고자 한다.

II. 주요국의 지속가능성 정보공시 규정

1. EU

가. 지속가능성 정보 체계

EU는 EU 조약(Treaties of the European Union) 제3.3조에 완전 고용 및 사회 발전을 전제로 하는 사회적 시장경제(social market economy)와 환경보호를 통한 지속가능한 발전(sustainable development)을 도모한다고 명시하고 있다. 이러한 유럽 역내 사회적 합의는 기업의 사회적 역할을 중시하는 이념적 배경이 되고 있다.

지속가능한 발전의 일환으로 EU는 2050년까지 온실가스 넷제로(net-zero)와 재생가능 에너지 기반 및 포용적 성장을 위하여 일련의 정책 제안인 유럽 그린딜(European Green Deal)을 발표하였다. 정책 제안을 뒷받침하는 재원 마련을 위해 민간‧공공부문 투자 체계 구축이 필요하였고 이를 뒷받침하는 일련의 규제와 지침을 마련하였다.9)

금융상품의 지속가능성 정보공개를 위해 마련한 지속가능금융 공시 규정(Sustainable Finance Disclosure Regulation: SFDR, 이하 SFDR)10)과 규정 이행을 위한 세부 기술 기준서(Regulatory Technical Standards: RTS, 이하 RTS)인 위임 규정(Delegated Regulation)11)은 이러한 목적으로 제정되었다. 그린워싱 방지를 통한 시장 질서 확립과 투자자의 지속가능성 선호에 부합하는 금융상품 식별을 통한 민간투자 활성화가 목적이다.

지속가능성 요소 중 환경 관련 사항은 텍사노미 규정(Taxonomy Regulation: TR, 이하 TR)12)에 의해 보완되었으며, SFDR의 개정을 통해 운용사와 펀드의 환경 관련 공시를 규율하고 있다. SFDR에서 정의하는 지속가능한 투자(sustainable investment)13) 개념에 환경적으로 지속가능한 경제활동(environmentally sustainable economic activities)14)에 대한 투자 요건을 마련한 것이다.

동시에 투자자의 지속가능성 선호 조사를 의무화하는 MiFID II 조항이 신설되어 2022년 8월 2일부터 시행이 의무화된다. 금융상품 판매사와 자문사는 고객에 대해 지속가능성 선호 적격성 평가를 해야 한다. 동시에, 금융상품의 지속가능성 관련 목표(sustainability-related objectives)를 구체적으로 밝혀 투자자의 선호에 부합하는 상품을 판매하여야 한다.

나. SFDR의 유형별 공시

SFDR은 EU 내에서 활동 및 판매되는 자산운용사와 펀드15)를 대상으로 고객 자산의 투자 행위로 인한 환경과 사회에 대한 지속가능성 관점에서의 영향과 그와 관련되어 펀드 수익에 영향을 끼칠 수 있는 위험 요소를 공개하는 것을 목적으로 한다.

정보공개는 기관과 펀드 단위로 각각 이루어지고, 요구되는 정보의 범위와 깊이는 해당 펀드가 지향하는 지속가능성 목표의 정도에 비례한다. SFDR은 지속가능성 펀드의 운용 목표나 전략은 구체적으로 정의하지 않기 때문에 운용사 스스로가 다음에 설명하는 유형에 해당하는지 판단하여 관련 정보를 공시하여야 한다.

1) 펀드 공통사항

ESG나 지속가능성의 표방 여부에 상관없이 모든 자산운용사와 펀드는 원칙준수, 예외설명 입장에서 다음 사항을 공시하여야 한다.

가) 운용사 단위 공시

• 지속가능성 위험(sustainability risk)16)을 투자 의사결정 과정에 통합(integration)하는 정책을 홈페이지에 공개한다.17)

• 투자로 인하여 발생하는 주요 부정적 영향(Principal Adverse Impact: PAI, 이하 PAI)에 대해 고려할 경우, 이를 홈페이지에 공개한다.18)19)

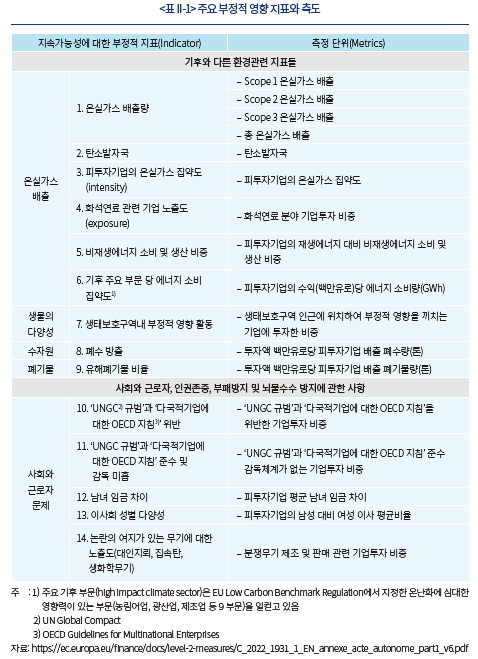

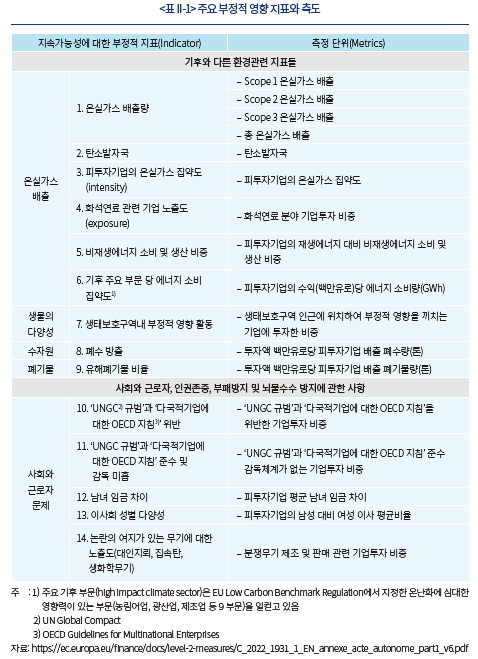

PAI는 투자로 인하여 지속가능성 요소(sustainability factor)20)에 미치는 부정적 영향을 의미하며 총 60개의 지표와 연관 측정 단위로 구성된다. <표 II-1>은 의무적으로 기재해야 하는 14개의 지표를 보여주고 있다.

지표와 측정 단위 외에도 PAI에 관한 식별과 중요도 우선순위 결정에 관한 정책, 주주활동(engagement) 정책, 준수하는 국제규범, 과거 5년간 기록과의 비교를 상술해야 한다.21)

나) 펀드 단위 공시

• 지속가능성 위험을 투자 의사결정 과정에 통합하는 방법과 해당 위험의 펀드 수익에 대한 영향력 평가 결과를 투자설명서22)에 기재한다.23)

• 자산운용사가 PAI를 고려할 경우, 개별 펀드가 PAI를 어떻게 고려하는지에 대한 설명을 투자설명서에 포함하고, 관련 정보가 주기적 보고서(periodic reports)에 기재될 것임을 밝힌다.24)

• 펀드가 SFDR Article 8 혹은 Article 9에 해당하지 않을 경우, 투자설명서와 주기적 보고서에 “해당 펀드는 EU의 환경적으로 지속가능한 경제행위 기준을 고려하지 않고 투자함” 문구를 기술한다.25)

2) Article 8 펀드26)

펀드가 환경과 사회적 특성을 증진(promote) 시키는 것을 목적으로 하고, 관련 투자기업의 지배구조 관행이 양호한 경우에는 모든 펀드에 공통으로 적용되는 공시내용 외에 다음 사항을 추가한다.27)

가) 운용사 단위 공시

• 증진 대상 환경, 사회적 특성에 관한 설명과 특성을 평가, 측정 및 관측하는 방법론, 그리고 여기에 사용하는 데이터 소스, 스크리닝 기준, 측정을 위한 관련 지속가능성 지표를 홈페이지에서 설명한다.28)

나) 펀드 단위 공시

• 증진 대상 환경, 사회적 특성이 어떻게 달성되며, 채택한 준거지수가 있다면 특성과 지수의 일관성에 관해 설명하고, 지수 산출 방법론에 대한 설명을 어디서 찾을 수 있는지를 투자설명서에 기재한다.29)

• 해당 펀드가 환경 특성을 증진하고자 한다면, TR에서 정의하는 6개의 환경 목표(environmental objectives)30) 중 어떤 목표에 이바지하는지 설명하고, 전체 투자액 중 텍사노미 일치된(Taxonomy-aligned)31) 비중을 투자설명서에 기재한다.32)

• 펀드의 운용 결과, 증진 대상 환경 및 사회적 특성이 어느 정도 진척되었는지를 주기적 보고서를 통해 설명한다.33)

• 환경 특성을 증진하는 경우 이바지하는 환경 목표와 텍사노미 일치 비중에 관한 정보를 주기적 보고서를 통해 설명한다.34)

3) Article 9 펀드

펀드가 지속가능한 투자(sustainable investment)35)를 목표로 하면서 준거지수를 채택하면, 모든 펀드에 공통으로 적용되는 공시 내용 외에 다음 사항을 추가한다.

가) 운용사 단위 공시

• 지속가능한 투자 목표에 관한 설명과 지속가능한 투자 영향력을 평가, 측정 및 관측하는 방법론, 그리고 여기에 사용하는 데이터 소스, 스크리닝 기준, 측정을 위한 관련 지속가능성 지표를 홈페이지에서 설명한다.36)

나) 펀드 단위 공시

• 준거지수가 투자 목표와 일관성을 갖는지 투자설명서에 밝히고, 다른 범 시장지수와 왜 그리고 어떻게 다른지 투자설명서에 기재한다. 만약 준거지수를 채택하지 않았다면 투자 목표를 어떻게 달성할지 설명한다. 마지막으로 지수 산출 방법론에 대한 설명을 어디서 찾을 수 있는지를 투자설명서에 기재한다.37)

• 해당 펀드가 환경 목표에 이바지하는 경제활동에 투자하는 경우, TR에서 정의하는 6개의 환경 목표 중 어떤 목표에 이바지하는지 투자설명서에 설명하고38), 전체 투자액 중 텍사노미 일치된 비중을 투자설명서 및 주기적 보고서에 기재한다.

• 펀드의 운용 결과, 지속가능성에 대한 전반적인 영향력을 연관 지속가능성 지표를 통해 주기적 보고서에 기재한다. 펀드의 전반적인 영향력을 준거지수와 범 시장지수의 영향력과 연관 지속가능성 지표를 갖고 비교하여 기재한다.39)

2. 미국

미국의 SEC는 ESG 관련 규정 위반행위를 적극적으로 적발하기 위하여 2021년 3월에 집행국(Division of Enforcement) 내 기후 및 ESG 대책팀(Climate and ESG Task Force)을 구성하였다. 점증하고 있는 ESG 관련 투자 규모와 투자자 저변을 고려하여 정보 비대칭에 따른 투자자 보호 문제가 확산하는 것을 방지하는 조치로 풀이된다.40) 아울러 SEC는 2022년 3월에 기업의 기후변화 관련 위험을 파악할 수 있는 중요성 정보공시 규정을 제안하였고41), 동년 5월에 투자자문사 및 투자회사(investment advisers and investment companies)42)의 ESG 관련 정보공시를 의무화하는 규정(이하 ESG 정보공시 규정안)을 제안하였다.43)

다음 절에서는 ESG 정보공시 규정안 제정 배경과 내용을 살펴보기로 한다.

가. ESG 정보공시 규정안 제정 배경

일반적으로 SEC는 펀드의 특정 전략에 관하여 구체적 공시 요건을 적용하지는 않지만, ESG 투자의 경우에는 다음을 이유로 공시 필요성을 설명하고 있다.

ESG 투자는 다수의 유형이 존재하고 해당 유형에서도 투자 대상 기업에 대한 ESG 정보 습득과 내용이 정보 제공자에 따라 다양하게 나타날 수 있다. 따라서 지속가능성을 표방하는 펀드는 자신의 투자전략 유형과 전략 이행에 관한 구체적 정보를 제공하여 투자자 선호에 합당한 펀드를 선택할 수 있도록 해야 한다. 여기서 투자자 선호는 투자 결과의 재무적 위험-수익 관계 개선(risk-return ESG) 내지는 환경과 사회에 관한 공동의 이익 증진(collateral benefits ESG)이 될 수 있기 때문에 선호에 합당한 전략과 이행 절차 및 결과에 관한 정보 제공이 필요하다.44)

현행 규정상 ‘ESG’ 내지는 유사 표현으로 지속가능성을 표방하는 펀드의 실제 운용 결과가 투자설명서의 내용과 다를 경우, 잠재적 소송 위험을 내포할 수 있다. 미국의 투자회사법(Investment Company Act of 1940)과 투자자문업자법(Investment Advisers Act of 1940)에서는 중요성 정보(material information)의 공시와 해당 정보의 의도적 누락이나 왜곡을 처벌하는 규정이 존재하고 실제로 이에 기반한 행정 제재의 사례가 있다.45) SEC는 지속가능성을 표방하는 펀드에 관한 구체적 공시 요건을 명확히 할 경우, 이러한 사례의 재발을 방지할 수 있다는 입장이다.

SEC는 ESG 요소의 투자전략 상의 중요도와 지향점에 따라 펀드 유형을 구분하고, 유형에 상응하는 정보공개 범위를 다음과 같이 제시하고 있다.

나. ESG 투자 펀드 유형별 공시

ESG 투자는 보통 환경, 사회 및 지배구조 요소를 동시에 복합적으로 고려한다. 기후변화라는 환경 요소만을 단독으로 반영하는 금융투자 상품도 있을 수 있으나, 일반적으로 ‘ESG’ 혹은 이와 유사한 테마를 전면에 내세워 상품을 출시하는 경우가 대부분이다. 이 경우에도 ESG 요소를 어느 정도 투자전략에 반영하는가에 따라 펀드 유형을 구분해 볼 수 있다. SEC는 다음과 같은 유형에 대해 각각의 특징에 맞는 정보를 범위와 깊이를 달리하여 공시할 것을 제안하고 있다.46)

1) ESG 통합 펀드(ESG Integration Fund)

SEC는 ESG 통합 펀드를 투자 의사결정 과정에서 ESG 요소를 그 외의 전통적인 투자 판단 요소와 동시에 고려하되, ESG 요소를 우선하지 않는 펀드로 정의하고 있다. 따라서 통합 펀드는 특정 종목의 편출입과 관련하여 ESG 요소가 주된 고려사항이 아니다.47)

ESG 통합 펀드는 투자설명서(statutory prospectus)의 투자전략 부분에 고려 대상인 ESG 요소를 투자 의사결정 과정에 어떻게 반영하는지 구체적으로 서술한다. 반면에 간이투자설명서(summary prospectus)에는 필요 이상으로 자세한 기술은 하지 않아야 한다. 이는 ESG 특성의 고려가 통합 펀드에서는 주된 의사결정 사항이 아니기 때문에 필요 이상으로 강조되는 것을 방지하기 위함으로 설명하고 있다.

만약 ESG 요소 중 온실가스 배출을 고려할 경우, 측정 방법과 관련 구체 사항을 투자설명서에 상세히 기재할 것을 요구한다.

2) ESG 중점 펀드(ESG-Focused Fund)

ESG 중점 펀드는 ESG 요소를 투자 결정과 주주활동(shareholder engagement) 의제 설정의 중요하거나 주된 기준(significant or main consideration)으로 삼는 펀드이다. 탄소배출 내지는 직원 다양성과 같은 요소를 고려하여 특정 종목을 배제하거나 주주활동의 근거로 삼는 펀드를 예로 들 수 있다. 특정 ESG 지수를 추종하는 펀드, ESG 등급으로 스크리닝 기준을 적용하여 종목 편출입을 결정하는 경우도 이에 해당한다. 펀드 명칭이나 선전 광고 자료에 ESG 요소를 투자 의사결정의 주요 기준으로 표시하는 경우, 해당 펀드는 ESG 중점 펀드로 분류한다.48)

ESG 임팩트 펀드(ESG Impact Fund)는 특정 ESG 요소의 개선 내지는 증진을 투자 목표로 명시한 펀드이다. ESG 요소를 주된 의사결정 요인으로 삼는다는 측면에서 ESG 중점 펀드 유형 중 하나로 분류한다. 저렴한 주택 건설을 위한 재원에 투자함과 동시에 일정한 수준의 수익을 보장받는 펀드의 경우를 예로 들 수 있다. ESG 중점 펀드에 요구되는 모든 공시내용 외에, 임팩트 펀드의 경우는 목표 달성 시한, 이행 경과 그리고 임팩트 목표와 펀드의 재무적 성과와의 상호 관계를 공시한다.

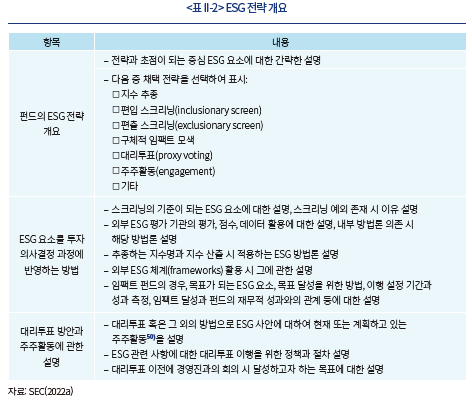

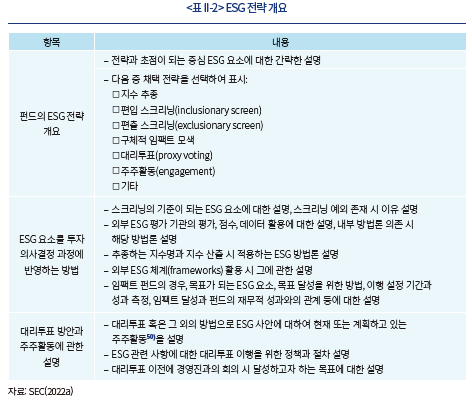

ESG 중점 펀드는 ESG 투자전략을 표로 정형화한 형식(tabular)으로 투자설명서에 공시하여야 한다. <표 II-2>는 SEC가 제시하고 있는 ESG 전략 개요표(ESG Strategy Overview Table)이다. 정형화된 공시양식을 제시하는 이유는 구체적인 ESG 요소에 관심이 있는 투자자가 복수의 ESG 펀드를 비교 분석하는데 일관성과 효율성을 제공하기 위함이다. 간결한 내용과 표준 양식을 바탕으로 비교 가능성을 높여 펀드 선택을 쉽게 하는 것이 목적이다.

전략 개요표(이하 개요표)에는 핵심 내용을 간결하게 기술하고, 더 자세한 내용은 투자설명서의 다른 부분에 기술한다.49) 예를 들어 종목 편출 스크리닝을 위해 개요표에서는 환경 부문의 온실가스 배출량을 기준으로 특정 산업이나 종목을 배제한다고 설명하고 이때 적용하는 온실가스 배출량 측정 방법, 기준 한계선 등 세부 기술적 내용은 투자설명서 다른 부분에 기술한다.

제3자가 제공하는 ESG 점수, 등급, 데이터를 투자 의사결정 과정에 사용하는 경우, 개요표에서 어떻게 사용하는지 간략하게 설명하고 점수 및 등급 산정 방법론에 대한 자세한 설명은 투자설명서에 후술한다. 이는 외부 ESG 평가 기관 간 평가 관점이나 방법론의 차이가 있으므로 투자자의 비교 선택을 돕기 위함이다.

펀드가 특정 ESG 지수를 추종하면 해당 지수를 밝히고, 지수 구성 방법과 편입 종목에 대한 간단한 개요를 설명한다. 지수가 종목 선정과 편입 의사결정에서 어떻게 ESG 요소를 고려하는지 등 자세한 내용은 투자설명서에 후술한다.

펀드가 지속가능한 투자를 추구하기 위해, 특정 규범을 채택하여 그와 부합하는 투자 정책을 수립하면 해당 규범을 명시하고 개요표에 규범 체계에 관한 소개를 한다. 예를 들어 펀드의 지속가능성 투자를 위해 유엔 지속가능 개발 목표(UN Sustainable Development Goals)를 지지하는 기업에 우선하여 투자한다면 그에 대한 투자 정책을 설명한다.

임팩트 투자의 경우 달성하고자 하는 구체적 목표와 시한 그리고 측정 지표를 투자설명서에 기술하고, 목표 달성 여부는 주기적으로 연간보고서(annual report)를 통해 보고한다. 연간보고서에서는 목표 달성 여부 확인을 위한 정량 정보와 함께, 운용 과정에서 직면한 실질적 문제를 상술한다. 예를 들어 그린빌딩을 건설하는 프로젝트에 투자한 경우, 연간 완성된 건물 수, 그린빌딩을 판별하는 기준과 그에 따른 환경 영향 등을 투자자에게 알린다. 이와 아울러 임팩트 투자의 지속가능성 목표가 펀드의 수익률 목표보다 우선하는지(collateral benefit ESG) 아니면 그와 반대로 수익률이 우선하는지(risk-return ESG)를 명확하게 밝혀 투자 판단을 도와야 한다.

개요표의 마지막 항목인 대리투표와 주주활동은 이들 행위가 펀드의 ESG 전략 실행을 위한 주된 수단일 경우에만 해당 활동을 투자설명서에 간략하게 설명한다.51) 이는 펀드의 대리투표 혹은 주주활동이 행하여지더라도 일시적 안건이거나 형식적인 주권 행사에 국한될 수 있으므로 펀드가 추구하는 ESG 전략을 체계적으로 이행하기 위한 행위일 때에만 설명하도록 한다. 따라서 구체적인 ESG 요소와 관련한 공식 대리투표 정책과 절차, 그리고 주주활동으로 달성하고자 하는 구체적인 ESG 목표와 측정할 수 있는 정량 정보가 동반되어야 한다. 대리투표와 주주활동에 관한 구체적 사안은 해당 정량 정보와 함께 주기적 운용보고서에 기록한다. 구체적으로는 펀드가 목표로 하는 ESG 개선 내지 증진 사안에 대해 전체 대리투표에서의 찬성 비율, 펀드 내 주주활동 대상이 된 기업의 수와 비율, 총 주주활동 횟수를 보고해야 한다.

3) 온실가스 배출 공시

ESG 요소 중 온실가스 배출을 고려하면 이와 관련한 구체적 정보를 공시하며, 정보의 내용에는 온실가스 배출을 측정하고 의사결정에 반영하는 방법을 포함한다. 이는 최근 핵심 논제로 부상하고 있는 기후 온난화 관련 위험과 기회요인에 관한 투자자들의 관심이 높은 상황에서 단지 펀드 명칭에 ESG 혹은 유사 표기만으로 기후 온난화 문제가 충분히 고려되고 있다는 오해를 방지하기 위함이다.

구체적 공시사항은 탄소발자국(carbon footprint)52)과 가중평균 탄소집중도(weighted average carbon intensity: WACI, 이하 WACI)이다. WACI는 매출액 대비 온실가스 배출 총량 비중(탄소집중도)을 모든 개별 기업에 대해 구한 다음 이들 기업의 펀드 내 비중으로 가중평균한 값이고 실제 계산을 위해서는 많은 기술적 사항들이 고려되어야 한다.53)54)

이들 지표에 사용되는 탄소배출량은 Scope 1과 Scope 2로 국한하고 있다. 아직 Scope 3 범위까지 보고하는 기업이 많지 않고, 데이터의 확보와 정확성을 담보하기 어렵기 때문이다. 다만 투자 대상 기업이 Scope 3 배출량을 보고하는 경우 Scope 1과 2와는 별도로 탄소발자국에 국한해서 계산하여 보고하도록 한다. Scope 3은 기업 생산‧판매 전 단계에 걸쳐 관련 업체의 탄소배출량을 포함하기 때문에, 펀드 내 기업이 탄소배출량 공시 기업임과 동시에 다른 기업과 Scope 3 관계에 있다면 이중 계산의 문제가 발생하기 때문이다.

다. 펀드 명칭 규정

미국에서는 투자회사법 Rule 35d-1, 일명 명칭 규정(Names Rule)에 따라 펀드 명칭이 내포하는 투자 정책을 최소 80% 이상 운용에 반영해야 한다. SEC는 ESG 정보공시 규정안과 별도로 명칭 규정 개정안을 발표하였다.55)

투자전략 이행과 의사결정 과정에 ESG 요소를 고려하지만 기존 재무나 경제적 요소에 우선하지 않으면 펀드 명칭에 ‘ESG’, ‘지속가능성’과 같은 표현을 금하는 내용을 담고 있다. 이에 따라 ESG 중점 펀드, 즉 환경, 사회 및 지배구조 요소 중 하나 이상을 투자 의사 판단의 주된 기준으로 삼는 경우에만 ESG 및 연관 명칭을 사용할 수 있고, 투자설명서에서 해당 명칭에 대한 정의와 그에 부합하는 투자 정책 및 전략을 설명하여야 한다. 규정과 부합하지 않는 ESG 명칭을 사용하면 투자자를 중요성 관점에서 기망 및 호도(materially deceptive and misleading)하는 행위로 간주하여 제재 대상이 될 수 있다.

3. 평가

EU는 지속가능성 정보공시 필요성에 관한 역내 합의가 전제되어 있고 미국에 비해 연계 규정 제정을 통해 체계적으로 접근하고 있다.56) 아울러 텍사노미 규정에 따라 환경 관련 정보공개 요건이 SEC에 비해 광범위하고 기타 환경 목표와 최소한의 사회적 안전망 달성 목적을 동시에 고려해야 한다. 투자자 보호에 초점이 한정된 SEC의 규정안 보다는 포괄적인 공시를 요구한다.

공시 대상이 되는 펀드의 범위는 광범위하다. SFDR의 Article 6에 의해 EU 역내 모든 펀드는 원칙적으로 운용사와 펀드 단위에서 지속가능성 위험과 PAI에 대해 주어진 양식과 내용으로 기술해야 하고, 이를 기재하지 않으면 그 이유와 경위에 대해 별도로 설명하여야 한다. 미국도 SEC의 ESG 통합 펀드 정의가 광범위하여서 대부분의 펀드가 적용 대상이 될 수 있다.57)

반면에 미국과 EU 모두 비례 원칙이 적용된다. 지속가능성 요소를 결정적(determinative)인 방법으로 투자 의사결정에 반영할수록 요구되는 정보는 구체적이고 정보량과 범위도 확대된다.

제안된 지속가능성 정보공개 요구에 대한 실효성을 사전에 점검할 필요가 있다. 투자자 보호를 위해 법적 요건을 갖춘 투자설명서에 특정 투자전략에 관한 공시 규정을 별도로 제정할 경우, 해당 투자전략의 중요성을 실제 이상으로 강조하는 결과를 초래하여 오히려 투자자 보호 측면에서 의도하지 않게 부정적 영향을 미칠 수 있다.58)

SFDR과 ESG 정보공시 규정안은 공히 세분된 데이터와 방법론을 기술하여야 한다. 이는 운용사 자체 연구인력을 동원하거나 아니면 외부 서비스업자와 상업적 계약을 통해 가능하다. 이와 관련한 비용은 펀드 총 보수의 인상 요인이 될 수 있다. 또한 외부 ESG 평가나 지수 산출 서비스는 계약상 해당 방법론의 공개가 제약받을 수 있으며, 더 나아가서 제3자 정보의 정확성에 관한 법적 책임 소재가 불분명할 수 있다. 더욱이 지속가능성 관련 기업의 정보공개 기준이 마련되어 실행되고 있지 않은 상황에서 관련 정보량이 증가할수록 정보의 비교 가능성이 떨어질 수 있기 때문에59) 문제는 가중된다.

포트폴리오 단위 온실가스 배출량 산출 기준 산식은 SFDR과 ESG 정보공시 규정안 모두 같다. SFDR은 PAI 관점에서 원칙적으로 모든 펀드 대상이나, ESG 정보공시 규정안은 ESG 중점 펀드 중 환경 요소를 고려하는 경우로 한정된다. EU는 더 많은 공시 비용을 감수하면서 온실가스 감축이라는 대의를 달성하겠다는 의지로 해석된다.

다만 정량적인 정보가 갖는 한계를 인식할 필요가 있다. 탄소집중도가 높은 산업군 혹은 기업에 투자하는 이유가 재생에너지로의 전환 전략에 능동적으로 투자하기 위한 것이라면, 이 펀드의 온실가스 배출량은 높겠지만 내용상으로는 친환경 전략이다. 마찬가지로 ESG 정보공시 규정안은 주주행동에 관한 회의 개최 횟수와 같은 정량적 정보를 요구하고 있다. 그러나 회의 횟수보다는 내용이 더 중요하므로 주주행동에 관한 공시는 ESG 맥락 속에서 회의의 결과가 어떠했는지에 관한 서술이 더 중요할 수 있다.

III. 국내 주식형 펀드에 대한 시사점

1. 공시 현황

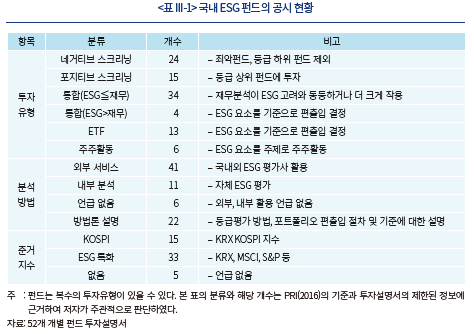

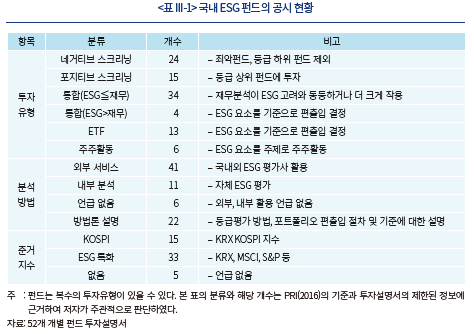

국내 ESG 펀드는 집합투자증권의 기재 사항 요건60)에 따른 투자설명서의 투자전략 부문에서 ESG 요소를 투자에 반영하는 전략을 설명하고 있다. <표 III-1>은 투자설명서에 나타난 ESG 펀드들의 투자 유형과 관련 내용을 바탕으로 작성한 통계이다.

통합(integration)은 가장 일반적으로 언급되는 투자전략이다.61) 재무분석과 ESG 성과 분석을 동시에 고려하나, 재무분석이 우선이라고 밝히는 경우(ESG≦재무)와 ESG 성과 분석이 재무분석을 우선하는 경우(ESG>재무)로 구분할 수 있다. ESG 펀드의 대부분이 ETF를 제외하고는 통합 유형에 속하나, ESG 요소가 투자 의사결정의 주된 요인으로 작용하는 펀드는 4개에 국한된다. ETF의 경우, ESG 평가를 바탕으로 알파를 추구하는 액티브 전략을 구사하는 경우는 ESG 성과 분석이 재무분석을 우선하는 경우로 분류할 수 있다.62)

주주활동 분류는 ESG를 주제로 투자 대상 기업과 소통하거나 주주총회에서 주주권 행사를 통해 기업가치 제고를 목표로 한다고 설명하는 경우이다. 기업과 지속가능한 주제를 가지고 계속 대화하며 기업가치를 제고시킬 수 있다는 측면에서 바람직한 수탁자 책임 이행 활동이라 할 수 있으나, 이를 투자설명서에 적시한 ESG 펀드는 6개에 불과하다.

펀드 이름에 ESG를 사용하나, 투자전략 설명에서 “ESG 투자전략에 근거” 혹은 “ESG 평가를 통한 지속가능한 기업에 투자” 문구 외에 추가적인 설명이 없는 ESG 펀드도 7개 존재한다. 또한 조사 대상 펀드의 반 이상이 분석방법론에 대한 기본적인 설명이 없다. 구체적으로 어떤 ESG 요소를 어떻게 반영하는지, 분석에 사용된 방법론, 데이터 소스에 관한 설명이 없는 것이다.

조사 대상 모든 펀드는 ESG 요소를 전략에 반영한 후 운용 경과와 수익률에 어떤 영향이 있었는지에 대한 설명을 자산운용보고서에 기술하지 않고 있다. ESG 요소를 주제로 주주활동을 한다고 밝힌 펀드도 의결권행사 여부 및 그 내용을 서술하는 영업보고서에는63) 이사 선임, 재무제표승인 등 통상적인 이사회 의안 외에 ESG와 관련한 의안과 의견은 없다.64)

투자 대상 기업에 대한 ESG 평가는 대부분 외부 사업자에 의존하는 것으로 파악된다. 외부 평가 방법에 관한 설명은 ESG 고려가 선언적 성격인 경우보다, 구체적인 투자전략으로 소개될 때 방법론 설명이 동반되고 있다. 다만 방법론에 관한 내부 실사(due diligence) 시행 여부는 언급이 없다.

2. 제언

EU는 상위법 체계와 유기적으로 연계하여 지속가능금융 행동계획을 통해 수년간 TR과 SFDR 규제체계를 완성했고 현재도 이를 계속 보완하며 이해관계자 의견 수렴을 통해 일관성 있고 비교 가능한 공시체계로의 이행에 노력하고 있다. SEC는 중요성 정보의 의미가 다중적인 ESG 펀드의 속성상 의도 여부와 상관없이 투자자 보호 문제 발생 소지가 상당히 있다고 판단하여 이를 미리 방지하고자 한다.

국내 발행 ESG 펀드는 EU 기준으로는 Article 8, SEC 기준으로는 ESG 중점 펀드에 해당한다. 투자자에게 지속가능성에 대한 투명하고 비교 가능한 정보를 제공하는 기준을 검토할 필요가 있다. 다만 국내에서 EU 수준의 공시체계를 단시간 내에 마련하기는 어렵기에 기존 자본시장법상의 투자자 보호 확충 및 자산운용사의 책임 강화를 위한 제반 제도하에서 ESG 관련 정보공개를 보다 실효성 있게 유도하는 가이드라인 마련이 현실적인 대안이 될 수 있다.

우선 펀드 명칭과 투자설명서에서 ESG 관련 내용을 표시하거나 언급하는 경우에 한해서 가이드라인을 마련할 필요가 있다. EU의 경우처럼 모든 펀드에 대해 지속가능성 위험과 PAI를 기재하는 것은 기업의 지속가능성보고서 작성 기준이 확정되어 일반화되지 않은 상황에서는 선언적 상용구(boilerplate)로 채워질 가능성이 크다. 중요성 정보를 담아야 하는 투자설명서에 펀드의 본질적 위험-수익 구조와 관련이 없는 지속가능성 정보를 기재하면 투자자는 펀드의 지속가능성을 과대평가할 수 있다.65)

ESG 펀드 가이드라인은 다음과 같은 최소한의 내용을 요구할 수 있고, 해당 내용은 비례 원칙에 따라 지속가능성 요소를 결정적인 방법으로 투자 의사결정에 반영할수록 자세한 설명이 뒤따라야 한다.

비례 원칙에 따른 정보공개의 범위와 요건을 제시하기 위해서는 해당 펀드가 지속가능성 요소를 구체적으로 얼마나 그리고 어떤 방법으로 투자전략에 고려하는지를 상세히 밝혀야 한다. 자의성을 배제하기 위해 <표 III-1>과 같이 구체적 투자유형을 제시하고 펀드가 어느 유형에 해당하는지를 선택하게 하는 것을 고려할 수 있다.

운용사 자체의 지속가능성 분석 역량을 전문 인력 보유 여부와 데이터 보유 여부 측면에서 설명할 필요가 있다. ESG 등급, 데이터 및 분석 도구를 제3자 서비스에 의존하는 경우 해당 서비스 업체에 대한 자체 실사 과정을 수탁자 책임 이행 차원에서 마련해야 한다. <표 III-1>에서 조사된 투자설명서에는 상당수가 등급 및 데이터를 외부 기관에 의존하나 해당 기관의 평가 방법론이나 데이터 유의성, 시의성에 관한 검증 여부는 명시되지 않고 있다.

펀드가 추구하는 환경, 사회, 지배구조 특성에 적합한 준거지수를 채택하고 지수 산출의 원리와 방법론에 관한 설명을 지적재산권 보호 범위 내에서 최대한 자세히 설명하여야 한다. 예를 들어 탄소중립 달성을 목표로 하는 경우, 국제 정합성을 갖춘 벤치마크 도입 여부를 밝힐 필요가 있다. 우리나라도 이미 탄소중립기본법 제정을 통해 같은 취지의 시책 마련을 요구하고 있다.66) 이에 따라 펀드 투자와 연계된 온실가스 배출량 규모가 어느 정도인지 파악해야 하고, 감축목표를 위한 준거지수를 채택하여 이행과정을 점검해야 한다.67) 자산운용보고서에서는 투자전략에서 주장하는 ESG 투자의 내용과 과정 및 결과를 최소한의 객관적 자료를 통해 설명해야 한다.

마지막으로, ESG 의제를 갖고 주주활동을 하는 경우 해당 의제에 관한 설명과 주주활동의 목표가 규범적 성격인지 아니면 수익 추구인지를 명확히 밝히고, 활동 과정 및 목표 달성 여부를 밝혀야 한다.

그린워싱에 관한 행정 제재가 강화될수록 금융투자업계의 ESG 펀드 발행은 정제될 것이다.68) 다만 전장에서 밝힌 바와 같이 환경과 사회 관련 광범위한 정보를 법적 요건을 갖춘 투자설명서에 요구할 때, 투자자 의사결정에 실질적으로 도움을 주어야 한다. 그러지 못한 경우에는 운용사에 불필요한 비용69)을 증가시킬 수 있다는 점도 동시에 고려하여야 한다.

1) ‘지속가능성’, ‘ESG’, ‘SRI(사회적 책임)’, ‘그린’ 등이 사용된다. 본 보고서는 이들 명칭이 환경, 사회 및 지배구조 이슈를 포괄하는 것으로 간주하여 구분하지 않고 혼용한다.

2) 본 보고서는 에프앤가이드 FnSpectrum의 테마형 ESG(주식) 분류 기준을 사용하였다. 총 21개의 자산운용사가 ESG 펀드를 출시하였다.

3) 2022년 8월 18일 기준

4) 2022년 6월 30일 기준 Investment Company Institute 통계

5) 금융투자협회 금융투자회사의 영업 및 업무에 관한 규정 제4편 제4-2조(집합투자기구 명칭의 사용)

6) Raghunanda & Rajgopal(2022)은 2010년부터 2018년까지 미국에서 운용된 ESG 펀드의 다중 이해관계자 친화 정도를 분석하였다. ESG 펀드는 ESG 평가 점수가 높은 기업들을 편입하고는 있으나 이들 점수는 기업이 자발적으로 공개하고 있는 지속가능성 정보량과 상관관계를 보일 뿐, 위법 기록이나 탄소 배출량과 같은 중요성 정보와는 상관성이 없음을 밝히고 있다.

7) 영국 금융감독원(Financial Conduct Authority: FCA, 이하 FCA)도 지속가능성 펀드 설계 시 공시 문서화 방안, 투자 실행과 편입 종목에 대한 모니터링, 투자자에게 의사결정에 도움이 되는 정보를 주제로 한 가이드라인을 2021년 7월 19일 발표하였다. 본 보고서에서는 세부 설명을 생략한다.

https://www.fca.org.uk/publication/correspondence/dear-chair-letter-authorised-esg-sustainable-investment-funds.pdf

8) Principles for Responsible Investment, Investment Company Institute, CFA Institute 등을 참고하였다.

9) 이를 총칭하여 지속가능금융 행동계획(Sustainable Finance Action Plan)이라 하고, 유럽 그린딜을 공식화하기 이전인 2018년 3월에 계획을 마련하였다. 자본의 지속가능경제로의 흐름 유도, 지속가능성 관점의 위험관리, 투명성과 장기성과주의 증진을 목표로 하고 있으며 이를 위해 10개의 행동계획을 마련하고 있다.

10) Regulation(EU) 2019/2088을 참조한다.

11) SFDR의 시행령에 해당하고, 유럽 집행위원회(European Commission)는 RTS의 작성을 유럽 금융감독 연합체인 ESAs(European Supervisory Authorities)에 위임하였으며, 2022년 4월 6일 최종 채택했다. 입법 절차상 유럽 의회와 이사회의 최종 검토와 승인을 거쳐야 하고, 현재 일정으로는 2023년 1월 1일 시행을 목표로 하고 있다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_1_EN_ACT_part1_v6%20(1).pdf

12) Regulation(EU) 2020/852을 참조한다.

13) SFDR Article 2(17)

14) TR Article 3의 정의를 참조한다.

15) SFDR의 대상은 전체 금융시장참가자(보험사, 자산운용사, 연금 사업자, 대체투자운용사, 벤처캐피탈사, UCIT 운용사 등)와 해당 금융상품을 포괄하고 있으나, 본 보고서에서는 자산운용사와 펀드를 중심으로 설명한다.

16) 지속가능성 위험을 SFDR Article 2(22)에서 환경, 사회 혹은 지배구조 관련 이벤트로 발생 시 중요성 관점에서 투자 가치에 실질 혹은 잠재 부정적 영향을 주는 위험으로 정의하고 있다.

17) SFDR Article 3(1)

18) SFDR Article 4(1)(a). 단 해당 회계연도 기간 평균 근로자 수가 500인 이상이면 2021년 6월 30일부터 의무화한다.

19) PAI의 세부 내용과 기재 양식(template)은 RTS의 Annex 1을 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_1_EN_annexe_acte_autonome_part1_v6.pdf

20) SFDR Article 2(24)에서 환경, 사회 및 고용, 인권 존중, 부패 및 뇌물 관련 사항으로 정의하고 있다.

21) SFDR Article 4(2), RTS Article 7, 8, 9, 10

22) SFDR 본문에는 계약 이전 공시(pre-contractual disclosures)로 표현되어 있고 이는 성격상 집합투자기구가 발행하는 집합투자증권의 증권신고서에 해당하나, 본 보고서에서는 투자설명서로 표현하기로 한다.

23) SFDR Article 6(1)

24) SFDR Article 7(1)

25) TR Article 7

26) Article 8 펀드와 Article 9 펀드는 SFDR 규정 8과 9에 요건에 부합하는 펀드를 의미한다.

27) SFDR에는 ‘증진(promote)’ 용어가 정의되어 있지 않다. ESAs의 SFDR 질의 답변서에서 증진의 의미와 Article 8 유형 판단에 관한 지침을 제공하고 있다. 참고로, 지속가능한 위험에 대한 고려는 모든 펀드에 공통 적용되기에 그 자체를 언급하는 것만으로는 Article 8 펀드로 구분되지 않는다.

https://www.esma.europa.eu/sites/default/files/library/c_2022_3051_f1_annex_en_v3_p1_1930070.pdf

28) SFDR Article 10(1). 시행을 위한 세부 사항은 RTS Article 24~36을 참조한다.

29) SFDR Article 8(1)(2)

30) TR Article 9를 참조한다.

31) 텍사노미 일치된 투자는 TR Article 3의 환경적으로 지속가능한 경제활동 기준을 충족하는 투자를 말한다. 충족 기준에는 UN, OECD, ILO(International Labour Organization) 제 규범의 최소한 준수와 같은 환경 외적 요인도 포함된다.

32) SFDR Article 8(2a). 연계 규정인 TR Article 3, 5 ,6을 참조한다. 시행을 위한 세부 사항은 RTS Article 14~17을 참조한다. 세부 내용과 기재 양식은 RTS의 Annex 2를 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_2_EN_annexe_acte_autonome_cp_part1_v5.pdf

33) SFDR Article 11(1)(a)

34) SFDR Article 11(1)(d). 연계 규정인 TR Article 3, 5, 6을 참조한다. 시행을 위한 세부 사항은 RTS Article 50~57을 참조한다. 세부 내용과 기재 약식은 RTS의 Annex 4를 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_4_EN_annexe_acte_autonome_cp_part1_v5.pdf

35) SFDR Article 2(17)에서 지속가능한 투자를 정의하고 있다. 환경과 사회적 목적에 기여하는 경제행위에 투자하는 것을 의미하며 동시에 행위로 인하여 다른 환경 및 사회적 목적을 심각하게 저해하지 않는 행위(do not significant harm)로 규명하고 있다.

36) SFDR Article 10(1). 시행을 위한 세부 사항은 RTS Article 37~49를 참조한다.

37) SFDR Article 9(1)(2)(4)

38) SFDR Article 9(4a), 11(1)(c). 연계 규정인 TR Article 3, 5를 참조한다. 시행을 위한 세부 사항은 RTS Article 18~19, Article 59를 참조한다. 세부 내용과 기재 양식은 RTS의 Annex 3을 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_3_EN_annexe_acte_autonome_cp_part1_v5.pdf

39) SFDR Article 11(1)(b). 시행을 위한 세부 사항은 RTS Article 58~63을 참조한다. 세부 내용과 기재 약식은 RTS의 Annex 5를 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_5_EN_annexe_acte_autonome_cp_part1_v5.pdf

40) 대책팀 설립 이후 대체 연료 수송차 제조사인 Nikola사의 대표를 사기죄로 기소한 것을 비롯하여 최근에는 투자자문사인 BNY Mellon을 자사가 추천한 펀드의 ESG 실사 여부가 설명과 달리 상당 부분 생략된 혐의로 기소하여 150만달러 벌금을 부과하였다.

https://www.sec.gov/spotlight/enforcement-task-force-focused-climate-esg-issues

41) 미국 재계를 대표하는 Business Roundtable과 미국상공회의소(US Chamber of Commerce)는 기업의 과도한 공시 부담을 이유로 반대하고 있고, 미국 공화당 의원 중 일부는 위헌 소송을 제기할 것을 공언하고 있어서 실제 이행 여부는 불투명하다. 최근 보수 성향의 미국 대법원이 발전소의 온실가스 배출량을 제한하는 미국 환경보호국(Environmental Protection Agency)의 행정 명령이 월권이라는 결론을 내린 점에 비추어 보아, SEC의 기후 공시 규정은 대법원에서 제지될 가능성이 없지 않다.

42) 일반적으로 미국에서 investment adviser는 investment manager와 동일한 의미로 사용하기도 하고 이는 국내에서 집합투자업자(자산운용사)에 해당하며, investment companies는 집합투자기구(펀드)를 의미한다.

43) 전문은 SEC(2022a)를 참조한다.

https://www.sec.gov/rules/proposed/2022/ia-6034.pdf

44) 투자자 선호와 수탁자 책임에 관한 법률 및 경제적 해석에 관한 논거는 Schanzenbach & Sitkoff(2020)를 참조한다.

45) 2008년 7월 30일 SEC는 Pax World Management Corp.에 대하여 중지 명령(cease and desist order) 행정 조치와 함께 과징금 50만달러를 부과하였다. 증권신고서에 기재한 SRI 투자목적과 실제 운용상의 불일치를 근거로 하였다. 최근 BNY Mellon에 대한 과징금 부과도 같은 조치의 일환이다.

https://www.sec.gov/litigation/admin/2008/ia-2761.pdf

46) ESG 정보공시 개정안의 문구와 양식은 SEC(2022a)의 303면 Text of Proposed Rule and Form Amendment에서 찾아볼 수 있다. SEC의 증권신고서 양식인 Form N-1A를 개정한 부분은 314면에서 시작된다. 구체적인 작성 내용에 관한 지시는 Instruction에 상술되어 있다.

47) 기존 재무분석에 사용되는 거시경제 변수, 재무 변수 등과 더불어 ESG 요소는 전체적인 기업의 가치 평가에 사용되는 하나의 변수로 취급된다.

48) SEC는 펀드 명칭에 ESG 내지는 유사 용어가 사용되지 않더라도 판촉물 글귀에 예를 들어 “지속가능성 도전에 해결책을 제공하는 기업에 초점을 맞추고 있다”라는 것과 같은 표시가 있으면, ESG가 종목 선택의 주된 결정 요인임을 암시하므로 ESG 중점 펀드로 분류한다고 설명하고 있다. 판촉물에 ESG 요소를 고려하는 설명이 있을 수 있으나, 주된 결정 요인이 아님을 밝히면 ESG 통합 펀드로 분류된다. SEC(2022a) 34면을 참조한다.

49) 전자공시 형태(운용사의 웹사이트 혹은 EDGAR)에서는 전략 개요표의 내용 중 부연 설명이 연계되는 링크를 제공하는 것을 고려 중이다.

50) SEC는 ‘ESG 주주활동(engagement)’을 해당 기업의 ESG 사안을 개선하고 증진하기 위하여 경영진과 갖는 실질적 대화 행위로 정의하고 있다. 또한 대화의 결과로 ESG 목표가 어느 정도 달성되었는지 측정할 수 있어야 한다. SEC(2022a) 81면을 참조한다.

51) 대리투표와 주주활동이 현재 주된 수단이 아니고 앞으로도 그러한 계획이 없더라도 그와 같은 사실을 동일하게 설명해야 한다. 이는 투자자가 ESG 중점 펀드 대부분이 적극적인 주주활동을 하는 것으로 인식할 수 있어서 그에 관한 정확한 정보를 밝히는 것이 중요하다고 판단하기 때문이다.

52) 탄소발자국은 펀드가 보유하고 있는 개별 기업의 온실가스 배출 총량을 해당 기업의 기업가치(enterprise value) 펀드 보유 비중을 곱하여 계산하고, 이를 펀드 내 모든 기업에 적용한 후 총합을 구하여 계산한다. 펀드 규모가 클수록 탄소발자국이 자동으로 커지게 되므로 단위 당 비교를 위해 운용자산 규모로 나누어 다른 펀드와 비교를 가능하게 한다.

53) 탄소배출량 측정 단위와 기간, 기업가치 및 펀드 순자산가치 산정 방식 및 시점, 기업의 탄소상쇄(carbon offset)량 차감 여부, 재간접펀드와 파생상품의 처리, 온실가스 데이터 원천 및 추정 방식 등에 관한 고려사항들이다. 이에 관한 SEC의 설명은 SEC(2022a) 94~109면을 참조한다.

54) 펀드의 탄소발자국과 가중평균 탄소집중도는 현재 국제 표준으로 자리 잡은 PCAF(Partnership for Carbon Accounting Financials)와 TCFD(Task Force on Climate-Related Financial Disclosures)의 기준을 따르고 있다.

55) 본문은 SEC(2022b)를 참조한다.

56) 기업의 지속가능성 공시 지침(Corporate Sustainability Reporting Directive), 텍사노미 규정, 기후변화 관련 벤치마크 규정 개정을 예로 들 수 있다.

57) 일반 펀드도 환경, 사회, 지배구조와 관련하여 적어도 하나 이상의 의제를 투자 의사결정에서 고려할 수 있기 때문에 SEC의 ESG 통합 펀드 범주에 해당할 수 있다. 실제로 SEC는 공모 펀드의 80%가량이 통합 펀드에 해당하는 것으로 추산하고 있다.

58) 펀드가 온실가스 배출 감축을 목표로 하지 않지만, 하나의 고려 요소로 간주하여 투자설명서 조항을 통해 설명한다면 펀드의 본질적 위험-수익 내용상 과도한 정보가 될 수 있다. 이는 그린워싱을 오히려 더 부추기는 기재가 될 수 있다. 관련 내용은 다음 문서를 참고한다.

https://www.sec.gov/comments/s7-17-22/s71722-20136279-307345.pdf

59) 국내외 ESG 평가 회사의 평가 등급 다양성과 이로 인한 투자자 보호 문제에 관한 내용은 이인형(2021)을 참조한다.

60) 「자본시장과 금융투자업에 관한 시행령」제127조(집합투자증권의 증권신고서의 기재사항 등) 제1호 3항 나목

61) 재무 요소와 ESG 요소를 다루는 설명을 ‘통합’,‘함께’,‘동시에’라는 수식어를 사용하는 경우 모두 통합 전략으로 간주한다.

62) FnGuide 한화 ESG Value, Growth, 우수기업 지수를 기초지수로 하는 액티브증권상장지수투자신탁을 예로 들 수 있다.

63) 금융투자협회 펀드공시 분기영업보고서 의결권행사여부 및 그 내용 참조

64) 별건이기는 하나 금융감독원으로부터 불완전판매로 문책 경고받은 금융회사의 임원을 그동안의 공로를 인정하여 이사 재선임에 찬성한 예도 있다. 금융회사의 불완전판매 행위는 ESG 평가에서 부정적 요인으로 간주한다.

65) ESG 펀드의 그린워싱 우려를 계기로 펀드 명칭에 관한 현재의 자율규제 체계를 경성규범화 하는 것에 대한 검토가 필요하다.

66) 탄소중립‧녹색성장 기본법(약칭: 탄소중립기본법) 제55조(기업의 녹색경영 촉진 등) 2호에서 기업의 온실가스 배출량, 온실가스 감축 실적 및 온실가스 감축 계획의 공개, 제58조(금융의 지원 활성화) 1항에서 재원 조성, 자금 지원, 금융상품의 개발, 민간투자 활성화, 탄소중립 관련 정보 공시제도 강화 등을 포함하는 시책을 수립‧시행하여야 한다고 명시하고 있다.

67) 탄소배출 관련 정보는 정확성, 시의성, 비교 가능성 측면에서 아직 완전하지 않다. 현재로는 운용사의 기후변화 관련 위험관리와 영향 파악은 주주활동을 통해 능동적으로 하는 것이 바람직하다.

68) SEC와 BaFin으로부터 그린워싱 혐의로 조사받아온 DWS 자산운용사는 2021년에 자체 운용 ‘ESG 통합 펀드’ 규모를 4,590억유로로 밝혔다가, 대표이사 사임과 자체 기준 강화 후 2022년 3월에 1,115억유로로 75% 축소 발표하였다.

https://www.ifre.com/story/3400033/dws-greenwashing-raid-marks-the-start-of-esg-20-51xvhxfxhg

69) 공시 관련 직접 비용 외에 예기치 않은 투자자 손실 소송 비용도 포함된다.

참고문헌

박혜진, 2020, 『국내 ESG 펀드의 현황 및 특징 분석』, 자본시장연구원 이슈보고서 20-28.

이인형, 2021, 『ESG 평가 체계 현황과 특성 분석』, 자본시장연구원 이슈보고서 21-09.

이인형‧이상호, 2021, 『지속가능보고 의무공시 이행을 위한 논의 방향』, 자본시장연구원 조사보고서 21-01.

CDP, 2020, The Time to Green Finance, CDP Financial Services Disclosure Report 2020.

EC, 2022, ANNEX 1 to the Commission Delegated Regulation (EU) Supplementing Regulation (EU) 2019/2088 of the European Parliament and of the Council, C(2022) 1931 Final.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_1_EN_annexe_acte_autonome_part1_v6.pdf

EU, 2019, Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector, Official Journal of the European Union.

EU, 2020, Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (Eu) 2019/2088, Official Journal of the European Union.

Freshfields Bruckhaus Deringer, 2021, A Legal Framework for Impact – Sustainability Impact in Investor Decision Making, Report Commissioned by UNEP FI, The Generation Foundation and PRI.

Investment Company Institute, 2020, Fund’s Use of ESG Integration and Sustainable Investing Strategies: An Introduction.

PRI, 2016, A Practical Guide to ESG Integration for Equity Investing.

Raghunandan, A., Rajgopal, S., 2022, Do ESG fund make stakeholder-friendly investments? Review of Accounting Studies 27, 822-863.

Schanzenbach, M.M., Sitkoff, R.H., 2020, Reconciling fiduciary duty and social conscience: The law and economics of ESG investing by a trustee, Stanford Law Review 72.

SEC, 2022a, Enhanced Disclosure by Certain Investment Advisers and Investment Companies About Environmental, Social, and Governance Investment Practices, Proposed Rule Release No.IA-6034.

SEC, 2022b, Investment Company Names, Proposed Rule Release No.IC-34593.

국내 공모 주식형 펀드 중 ESG(Environment, Social and Governance) 및 이와 유사한 이름1)으로 출시된 펀드(이하 ESG 펀드)는 모두 52개로 파악된다.2) 이 펀드들의 설정액은 1조 7,458억원, 순자산은 2조 4,090억원으로 전체 공모 주식형 펀드 설정 및 순자산 금액 기준으로 각각 동일하게 2.13%에 해당한다.3) 미국 ESG 펀드의 전체 뮤추얼 펀드와 ETF(Exchange Traded Fund) 순자산 기준 1.6%보다 큰 비중이다.4)

펀드 명칭은 해당 펀드의 주요 운용 특성(주요 투자전략, 지역 등)을 나타낸다. 투자자를 오인케 할 우려가 있는 명칭은 사용하지 않도록 연성규범이 마련되어 있다.5) 논란이 되는 투자상품의 그린워싱 문제는 명칭과 투자전략에 지속가능성을 표방하나, 실제 투자 의사결정 과정에서는 투자자의 기대와는 달리 실질적으로 그렇게 하지 않기 때문에 발생한다.6)

박혜진(2020)은 국내 ESG 펀드들의 ESG 수준은 평균적으로 일반 펀드와 유사하고, ESG 요소를 활용하여 엑티브 운용전략을 추구하는 펀드 간에도 포트폴리오 ESG 점수가 두 배 이상 차이 나는 것으로 보고하고 있다. 문제는 투자자가 사전에 이러한 정보를 현재의 투자설명서를 통해 식별하기 쉽지 않다는 데 있다.

각국의 금융당국은 투자상품의 그린워싱과 투자자 보호를 중요한 의제로 인식하기 시작하여 최근 일련의 행정 제재와 입법 제안을 통해 문제점 해결에 나서고 있다. II장에서 규정 일부가 이미 시행되고 있는 유럽연합(European Union: EU, 이하 EU)과 최근 규정안을 발표한 미국의 증권거래위원회(U.S. Securities and Exchange Commission: SEC, 이하 SEC)의 사례를 살펴본다.7) III장에서는 국내 ESG 펀드의 투자설명서에 게재된 지속가능성 정보의 개선점을 살펴본 후 집합투자기구의 그린워싱 방지를 위한 지속가능성 정보공개 논의 방향을 제시한다.

이를 위해 EU와 SEC의 공식문서와 관련 보도자료를 중점으로 조사하고, 관련 이해당사자 기관의 의견도 참고한다.8) 정보를 최대한 객관적으로 전달하기 위해 각주를 통해 원문을 링크하여 이해를 돕고자 한다.

II. 주요국의 지속가능성 정보공시 규정

1. EU

가. 지속가능성 정보 체계

EU는 EU 조약(Treaties of the European Union) 제3.3조에 완전 고용 및 사회 발전을 전제로 하는 사회적 시장경제(social market economy)와 환경보호를 통한 지속가능한 발전(sustainable development)을 도모한다고 명시하고 있다. 이러한 유럽 역내 사회적 합의는 기업의 사회적 역할을 중시하는 이념적 배경이 되고 있다.

지속가능한 발전의 일환으로 EU는 2050년까지 온실가스 넷제로(net-zero)와 재생가능 에너지 기반 및 포용적 성장을 위하여 일련의 정책 제안인 유럽 그린딜(European Green Deal)을 발표하였다. 정책 제안을 뒷받침하는 재원 마련을 위해 민간‧공공부문 투자 체계 구축이 필요하였고 이를 뒷받침하는 일련의 규제와 지침을 마련하였다.9)

금융상품의 지속가능성 정보공개를 위해 마련한 지속가능금융 공시 규정(Sustainable Finance Disclosure Regulation: SFDR, 이하 SFDR)10)과 규정 이행을 위한 세부 기술 기준서(Regulatory Technical Standards: RTS, 이하 RTS)인 위임 규정(Delegated Regulation)11)은 이러한 목적으로 제정되었다. 그린워싱 방지를 통한 시장 질서 확립과 투자자의 지속가능성 선호에 부합하는 금융상품 식별을 통한 민간투자 활성화가 목적이다.

지속가능성 요소 중 환경 관련 사항은 텍사노미 규정(Taxonomy Regulation: TR, 이하 TR)12)에 의해 보완되었으며, SFDR의 개정을 통해 운용사와 펀드의 환경 관련 공시를 규율하고 있다. SFDR에서 정의하는 지속가능한 투자(sustainable investment)13) 개념에 환경적으로 지속가능한 경제활동(environmentally sustainable economic activities)14)에 대한 투자 요건을 마련한 것이다.

동시에 투자자의 지속가능성 선호 조사를 의무화하는 MiFID II 조항이 신설되어 2022년 8월 2일부터 시행이 의무화된다. 금융상품 판매사와 자문사는 고객에 대해 지속가능성 선호 적격성 평가를 해야 한다. 동시에, 금융상품의 지속가능성 관련 목표(sustainability-related objectives)를 구체적으로 밝혀 투자자의 선호에 부합하는 상품을 판매하여야 한다.

나. SFDR의 유형별 공시

SFDR은 EU 내에서 활동 및 판매되는 자산운용사와 펀드15)를 대상으로 고객 자산의 투자 행위로 인한 환경과 사회에 대한 지속가능성 관점에서의 영향과 그와 관련되어 펀드 수익에 영향을 끼칠 수 있는 위험 요소를 공개하는 것을 목적으로 한다.

정보공개는 기관과 펀드 단위로 각각 이루어지고, 요구되는 정보의 범위와 깊이는 해당 펀드가 지향하는 지속가능성 목표의 정도에 비례한다. SFDR은 지속가능성 펀드의 운용 목표나 전략은 구체적으로 정의하지 않기 때문에 운용사 스스로가 다음에 설명하는 유형에 해당하는지 판단하여 관련 정보를 공시하여야 한다.

1) 펀드 공통사항

ESG나 지속가능성의 표방 여부에 상관없이 모든 자산운용사와 펀드는 원칙준수, 예외설명 입장에서 다음 사항을 공시하여야 한다.

가) 운용사 단위 공시

• 지속가능성 위험(sustainability risk)16)을 투자 의사결정 과정에 통합(integration)하는 정책을 홈페이지에 공개한다.17)

• 투자로 인하여 발생하는 주요 부정적 영향(Principal Adverse Impact: PAI, 이하 PAI)에 대해 고려할 경우, 이를 홈페이지에 공개한다.18)19)

지표와 측정 단위 외에도 PAI에 관한 식별과 중요도 우선순위 결정에 관한 정책, 주주활동(engagement) 정책, 준수하는 국제규범, 과거 5년간 기록과의 비교를 상술해야 한다.21)

나) 펀드 단위 공시

• 지속가능성 위험을 투자 의사결정 과정에 통합하는 방법과 해당 위험의 펀드 수익에 대한 영향력 평가 결과를 투자설명서22)에 기재한다.23)

• 자산운용사가 PAI를 고려할 경우, 개별 펀드가 PAI를 어떻게 고려하는지에 대한 설명을 투자설명서에 포함하고, 관련 정보가 주기적 보고서(periodic reports)에 기재될 것임을 밝힌다.24)

• 펀드가 SFDR Article 8 혹은 Article 9에 해당하지 않을 경우, 투자설명서와 주기적 보고서에 “해당 펀드는 EU의 환경적으로 지속가능한 경제행위 기준을 고려하지 않고 투자함” 문구를 기술한다.25)

2) Article 8 펀드26)

펀드가 환경과 사회적 특성을 증진(promote) 시키는 것을 목적으로 하고, 관련 투자기업의 지배구조 관행이 양호한 경우에는 모든 펀드에 공통으로 적용되는 공시내용 외에 다음 사항을 추가한다.27)

가) 운용사 단위 공시

• 증진 대상 환경, 사회적 특성에 관한 설명과 특성을 평가, 측정 및 관측하는 방법론, 그리고 여기에 사용하는 데이터 소스, 스크리닝 기준, 측정을 위한 관련 지속가능성 지표를 홈페이지에서 설명한다.28)

나) 펀드 단위 공시

• 증진 대상 환경, 사회적 특성이 어떻게 달성되며, 채택한 준거지수가 있다면 특성과 지수의 일관성에 관해 설명하고, 지수 산출 방법론에 대한 설명을 어디서 찾을 수 있는지를 투자설명서에 기재한다.29)

• 해당 펀드가 환경 특성을 증진하고자 한다면, TR에서 정의하는 6개의 환경 목표(environmental objectives)30) 중 어떤 목표에 이바지하는지 설명하고, 전체 투자액 중 텍사노미 일치된(Taxonomy-aligned)31) 비중을 투자설명서에 기재한다.32)

• 펀드의 운용 결과, 증진 대상 환경 및 사회적 특성이 어느 정도 진척되었는지를 주기적 보고서를 통해 설명한다.33)

• 환경 특성을 증진하는 경우 이바지하는 환경 목표와 텍사노미 일치 비중에 관한 정보를 주기적 보고서를 통해 설명한다.34)

3) Article 9 펀드

펀드가 지속가능한 투자(sustainable investment)35)를 목표로 하면서 준거지수를 채택하면, 모든 펀드에 공통으로 적용되는 공시 내용 외에 다음 사항을 추가한다.

가) 운용사 단위 공시

• 지속가능한 투자 목표에 관한 설명과 지속가능한 투자 영향력을 평가, 측정 및 관측하는 방법론, 그리고 여기에 사용하는 데이터 소스, 스크리닝 기준, 측정을 위한 관련 지속가능성 지표를 홈페이지에서 설명한다.36)

나) 펀드 단위 공시

• 준거지수가 투자 목표와 일관성을 갖는지 투자설명서에 밝히고, 다른 범 시장지수와 왜 그리고 어떻게 다른지 투자설명서에 기재한다. 만약 준거지수를 채택하지 않았다면 투자 목표를 어떻게 달성할지 설명한다. 마지막으로 지수 산출 방법론에 대한 설명을 어디서 찾을 수 있는지를 투자설명서에 기재한다.37)

• 해당 펀드가 환경 목표에 이바지하는 경제활동에 투자하는 경우, TR에서 정의하는 6개의 환경 목표 중 어떤 목표에 이바지하는지 투자설명서에 설명하고38), 전체 투자액 중 텍사노미 일치된 비중을 투자설명서 및 주기적 보고서에 기재한다.

• 펀드의 운용 결과, 지속가능성에 대한 전반적인 영향력을 연관 지속가능성 지표를 통해 주기적 보고서에 기재한다. 펀드의 전반적인 영향력을 준거지수와 범 시장지수의 영향력과 연관 지속가능성 지표를 갖고 비교하여 기재한다.39)

2. 미국

미국의 SEC는 ESG 관련 규정 위반행위를 적극적으로 적발하기 위하여 2021년 3월에 집행국(Division of Enforcement) 내 기후 및 ESG 대책팀(Climate and ESG Task Force)을 구성하였다. 점증하고 있는 ESG 관련 투자 규모와 투자자 저변을 고려하여 정보 비대칭에 따른 투자자 보호 문제가 확산하는 것을 방지하는 조치로 풀이된다.40) 아울러 SEC는 2022년 3월에 기업의 기후변화 관련 위험을 파악할 수 있는 중요성 정보공시 규정을 제안하였고41), 동년 5월에 투자자문사 및 투자회사(investment advisers and investment companies)42)의 ESG 관련 정보공시를 의무화하는 규정(이하 ESG 정보공시 규정안)을 제안하였다.43)

다음 절에서는 ESG 정보공시 규정안 제정 배경과 내용을 살펴보기로 한다.

가. ESG 정보공시 규정안 제정 배경

일반적으로 SEC는 펀드의 특정 전략에 관하여 구체적 공시 요건을 적용하지는 않지만, ESG 투자의 경우에는 다음을 이유로 공시 필요성을 설명하고 있다.

ESG 투자는 다수의 유형이 존재하고 해당 유형에서도 투자 대상 기업에 대한 ESG 정보 습득과 내용이 정보 제공자에 따라 다양하게 나타날 수 있다. 따라서 지속가능성을 표방하는 펀드는 자신의 투자전략 유형과 전략 이행에 관한 구체적 정보를 제공하여 투자자 선호에 합당한 펀드를 선택할 수 있도록 해야 한다. 여기서 투자자 선호는 투자 결과의 재무적 위험-수익 관계 개선(risk-return ESG) 내지는 환경과 사회에 관한 공동의 이익 증진(collateral benefits ESG)이 될 수 있기 때문에 선호에 합당한 전략과 이행 절차 및 결과에 관한 정보 제공이 필요하다.44)

현행 규정상 ‘ESG’ 내지는 유사 표현으로 지속가능성을 표방하는 펀드의 실제 운용 결과가 투자설명서의 내용과 다를 경우, 잠재적 소송 위험을 내포할 수 있다. 미국의 투자회사법(Investment Company Act of 1940)과 투자자문업자법(Investment Advisers Act of 1940)에서는 중요성 정보(material information)의 공시와 해당 정보의 의도적 누락이나 왜곡을 처벌하는 규정이 존재하고 실제로 이에 기반한 행정 제재의 사례가 있다.45) SEC는 지속가능성을 표방하는 펀드에 관한 구체적 공시 요건을 명확히 할 경우, 이러한 사례의 재발을 방지할 수 있다는 입장이다.

SEC는 ESG 요소의 투자전략 상의 중요도와 지향점에 따라 펀드 유형을 구분하고, 유형에 상응하는 정보공개 범위를 다음과 같이 제시하고 있다.

나. ESG 투자 펀드 유형별 공시

ESG 투자는 보통 환경, 사회 및 지배구조 요소를 동시에 복합적으로 고려한다. 기후변화라는 환경 요소만을 단독으로 반영하는 금융투자 상품도 있을 수 있으나, 일반적으로 ‘ESG’ 혹은 이와 유사한 테마를 전면에 내세워 상품을 출시하는 경우가 대부분이다. 이 경우에도 ESG 요소를 어느 정도 투자전략에 반영하는가에 따라 펀드 유형을 구분해 볼 수 있다. SEC는 다음과 같은 유형에 대해 각각의 특징에 맞는 정보를 범위와 깊이를 달리하여 공시할 것을 제안하고 있다.46)

1) ESG 통합 펀드(ESG Integration Fund)

SEC는 ESG 통합 펀드를 투자 의사결정 과정에서 ESG 요소를 그 외의 전통적인 투자 판단 요소와 동시에 고려하되, ESG 요소를 우선하지 않는 펀드로 정의하고 있다. 따라서 통합 펀드는 특정 종목의 편출입과 관련하여 ESG 요소가 주된 고려사항이 아니다.47)

ESG 통합 펀드는 투자설명서(statutory prospectus)의 투자전략 부분에 고려 대상인 ESG 요소를 투자 의사결정 과정에 어떻게 반영하는지 구체적으로 서술한다. 반면에 간이투자설명서(summary prospectus)에는 필요 이상으로 자세한 기술은 하지 않아야 한다. 이는 ESG 특성의 고려가 통합 펀드에서는 주된 의사결정 사항이 아니기 때문에 필요 이상으로 강조되는 것을 방지하기 위함으로 설명하고 있다.

만약 ESG 요소 중 온실가스 배출을 고려할 경우, 측정 방법과 관련 구체 사항을 투자설명서에 상세히 기재할 것을 요구한다.

2) ESG 중점 펀드(ESG-Focused Fund)

ESG 중점 펀드는 ESG 요소를 투자 결정과 주주활동(shareholder engagement) 의제 설정의 중요하거나 주된 기준(significant or main consideration)으로 삼는 펀드이다. 탄소배출 내지는 직원 다양성과 같은 요소를 고려하여 특정 종목을 배제하거나 주주활동의 근거로 삼는 펀드를 예로 들 수 있다. 특정 ESG 지수를 추종하는 펀드, ESG 등급으로 스크리닝 기준을 적용하여 종목 편출입을 결정하는 경우도 이에 해당한다. 펀드 명칭이나 선전 광고 자료에 ESG 요소를 투자 의사결정의 주요 기준으로 표시하는 경우, 해당 펀드는 ESG 중점 펀드로 분류한다.48)

ESG 임팩트 펀드(ESG Impact Fund)는 특정 ESG 요소의 개선 내지는 증진을 투자 목표로 명시한 펀드이다. ESG 요소를 주된 의사결정 요인으로 삼는다는 측면에서 ESG 중점 펀드 유형 중 하나로 분류한다. 저렴한 주택 건설을 위한 재원에 투자함과 동시에 일정한 수준의 수익을 보장받는 펀드의 경우를 예로 들 수 있다. ESG 중점 펀드에 요구되는 모든 공시내용 외에, 임팩트 펀드의 경우는 목표 달성 시한, 이행 경과 그리고 임팩트 목표와 펀드의 재무적 성과와의 상호 관계를 공시한다.

ESG 중점 펀드는 ESG 투자전략을 표로 정형화한 형식(tabular)으로 투자설명서에 공시하여야 한다. <표 II-2>는 SEC가 제시하고 있는 ESG 전략 개요표(ESG Strategy Overview Table)이다. 정형화된 공시양식을 제시하는 이유는 구체적인 ESG 요소에 관심이 있는 투자자가 복수의 ESG 펀드를 비교 분석하는데 일관성과 효율성을 제공하기 위함이다. 간결한 내용과 표준 양식을 바탕으로 비교 가능성을 높여 펀드 선택을 쉽게 하는 것이 목적이다.

전략 개요표(이하 개요표)에는 핵심 내용을 간결하게 기술하고, 더 자세한 내용은 투자설명서의 다른 부분에 기술한다.49) 예를 들어 종목 편출 스크리닝을 위해 개요표에서는 환경 부문의 온실가스 배출량을 기준으로 특정 산업이나 종목을 배제한다고 설명하고 이때 적용하는 온실가스 배출량 측정 방법, 기준 한계선 등 세부 기술적 내용은 투자설명서 다른 부분에 기술한다.

펀드가 특정 ESG 지수를 추종하면 해당 지수를 밝히고, 지수 구성 방법과 편입 종목에 대한 간단한 개요를 설명한다. 지수가 종목 선정과 편입 의사결정에서 어떻게 ESG 요소를 고려하는지 등 자세한 내용은 투자설명서에 후술한다.

펀드가 지속가능한 투자를 추구하기 위해, 특정 규범을 채택하여 그와 부합하는 투자 정책을 수립하면 해당 규범을 명시하고 개요표에 규범 체계에 관한 소개를 한다. 예를 들어 펀드의 지속가능성 투자를 위해 유엔 지속가능 개발 목표(UN Sustainable Development Goals)를 지지하는 기업에 우선하여 투자한다면 그에 대한 투자 정책을 설명한다.

임팩트 투자의 경우 달성하고자 하는 구체적 목표와 시한 그리고 측정 지표를 투자설명서에 기술하고, 목표 달성 여부는 주기적으로 연간보고서(annual report)를 통해 보고한다. 연간보고서에서는 목표 달성 여부 확인을 위한 정량 정보와 함께, 운용 과정에서 직면한 실질적 문제를 상술한다. 예를 들어 그린빌딩을 건설하는 프로젝트에 투자한 경우, 연간 완성된 건물 수, 그린빌딩을 판별하는 기준과 그에 따른 환경 영향 등을 투자자에게 알린다. 이와 아울러 임팩트 투자의 지속가능성 목표가 펀드의 수익률 목표보다 우선하는지(collateral benefit ESG) 아니면 그와 반대로 수익률이 우선하는지(risk-return ESG)를 명확하게 밝혀 투자 판단을 도와야 한다.

개요표의 마지막 항목인 대리투표와 주주활동은 이들 행위가 펀드의 ESG 전략 실행을 위한 주된 수단일 경우에만 해당 활동을 투자설명서에 간략하게 설명한다.51) 이는 펀드의 대리투표 혹은 주주활동이 행하여지더라도 일시적 안건이거나 형식적인 주권 행사에 국한될 수 있으므로 펀드가 추구하는 ESG 전략을 체계적으로 이행하기 위한 행위일 때에만 설명하도록 한다. 따라서 구체적인 ESG 요소와 관련한 공식 대리투표 정책과 절차, 그리고 주주활동으로 달성하고자 하는 구체적인 ESG 목표와 측정할 수 있는 정량 정보가 동반되어야 한다. 대리투표와 주주활동에 관한 구체적 사안은 해당 정량 정보와 함께 주기적 운용보고서에 기록한다. 구체적으로는 펀드가 목표로 하는 ESG 개선 내지 증진 사안에 대해 전체 대리투표에서의 찬성 비율, 펀드 내 주주활동 대상이 된 기업의 수와 비율, 총 주주활동 횟수를 보고해야 한다.

3) 온실가스 배출 공시

ESG 요소 중 온실가스 배출을 고려하면 이와 관련한 구체적 정보를 공시하며, 정보의 내용에는 온실가스 배출을 측정하고 의사결정에 반영하는 방법을 포함한다. 이는 최근 핵심 논제로 부상하고 있는 기후 온난화 관련 위험과 기회요인에 관한 투자자들의 관심이 높은 상황에서 단지 펀드 명칭에 ESG 혹은 유사 표기만으로 기후 온난화 문제가 충분히 고려되고 있다는 오해를 방지하기 위함이다.

구체적 공시사항은 탄소발자국(carbon footprint)52)과 가중평균 탄소집중도(weighted average carbon intensity: WACI, 이하 WACI)이다. WACI는 매출액 대비 온실가스 배출 총량 비중(탄소집중도)을 모든 개별 기업에 대해 구한 다음 이들 기업의 펀드 내 비중으로 가중평균한 값이고 실제 계산을 위해서는 많은 기술적 사항들이 고려되어야 한다.53)54)

이들 지표에 사용되는 탄소배출량은 Scope 1과 Scope 2로 국한하고 있다. 아직 Scope 3 범위까지 보고하는 기업이 많지 않고, 데이터의 확보와 정확성을 담보하기 어렵기 때문이다. 다만 투자 대상 기업이 Scope 3 배출량을 보고하는 경우 Scope 1과 2와는 별도로 탄소발자국에 국한해서 계산하여 보고하도록 한다. Scope 3은 기업 생산‧판매 전 단계에 걸쳐 관련 업체의 탄소배출량을 포함하기 때문에, 펀드 내 기업이 탄소배출량 공시 기업임과 동시에 다른 기업과 Scope 3 관계에 있다면 이중 계산의 문제가 발생하기 때문이다.

다. 펀드 명칭 규정

미국에서는 투자회사법 Rule 35d-1, 일명 명칭 규정(Names Rule)에 따라 펀드 명칭이 내포하는 투자 정책을 최소 80% 이상 운용에 반영해야 한다. SEC는 ESG 정보공시 규정안과 별도로 명칭 규정 개정안을 발표하였다.55)

투자전략 이행과 의사결정 과정에 ESG 요소를 고려하지만 기존 재무나 경제적 요소에 우선하지 않으면 펀드 명칭에 ‘ESG’, ‘지속가능성’과 같은 표현을 금하는 내용을 담고 있다. 이에 따라 ESG 중점 펀드, 즉 환경, 사회 및 지배구조 요소 중 하나 이상을 투자 의사 판단의 주된 기준으로 삼는 경우에만 ESG 및 연관 명칭을 사용할 수 있고, 투자설명서에서 해당 명칭에 대한 정의와 그에 부합하는 투자 정책 및 전략을 설명하여야 한다. 규정과 부합하지 않는 ESG 명칭을 사용하면 투자자를 중요성 관점에서 기망 및 호도(materially deceptive and misleading)하는 행위로 간주하여 제재 대상이 될 수 있다.

3. 평가

EU는 지속가능성 정보공시 필요성에 관한 역내 합의가 전제되어 있고 미국에 비해 연계 규정 제정을 통해 체계적으로 접근하고 있다.56) 아울러 텍사노미 규정에 따라 환경 관련 정보공개 요건이 SEC에 비해 광범위하고 기타 환경 목표와 최소한의 사회적 안전망 달성 목적을 동시에 고려해야 한다. 투자자 보호에 초점이 한정된 SEC의 규정안 보다는 포괄적인 공시를 요구한다.

공시 대상이 되는 펀드의 범위는 광범위하다. SFDR의 Article 6에 의해 EU 역내 모든 펀드는 원칙적으로 운용사와 펀드 단위에서 지속가능성 위험과 PAI에 대해 주어진 양식과 내용으로 기술해야 하고, 이를 기재하지 않으면 그 이유와 경위에 대해 별도로 설명하여야 한다. 미국도 SEC의 ESG 통합 펀드 정의가 광범위하여서 대부분의 펀드가 적용 대상이 될 수 있다.57)

반면에 미국과 EU 모두 비례 원칙이 적용된다. 지속가능성 요소를 결정적(determinative)인 방법으로 투자 의사결정에 반영할수록 요구되는 정보는 구체적이고 정보량과 범위도 확대된다.

제안된 지속가능성 정보공개 요구에 대한 실효성을 사전에 점검할 필요가 있다. 투자자 보호를 위해 법적 요건을 갖춘 투자설명서에 특정 투자전략에 관한 공시 규정을 별도로 제정할 경우, 해당 투자전략의 중요성을 실제 이상으로 강조하는 결과를 초래하여 오히려 투자자 보호 측면에서 의도하지 않게 부정적 영향을 미칠 수 있다.58)

SFDR과 ESG 정보공시 규정안은 공히 세분된 데이터와 방법론을 기술하여야 한다. 이는 운용사 자체 연구인력을 동원하거나 아니면 외부 서비스업자와 상업적 계약을 통해 가능하다. 이와 관련한 비용은 펀드 총 보수의 인상 요인이 될 수 있다. 또한 외부 ESG 평가나 지수 산출 서비스는 계약상 해당 방법론의 공개가 제약받을 수 있으며, 더 나아가서 제3자 정보의 정확성에 관한 법적 책임 소재가 불분명할 수 있다. 더욱이 지속가능성 관련 기업의 정보공개 기준이 마련되어 실행되고 있지 않은 상황에서 관련 정보량이 증가할수록 정보의 비교 가능성이 떨어질 수 있기 때문에59) 문제는 가중된다.

포트폴리오 단위 온실가스 배출량 산출 기준 산식은 SFDR과 ESG 정보공시 규정안 모두 같다. SFDR은 PAI 관점에서 원칙적으로 모든 펀드 대상이나, ESG 정보공시 규정안은 ESG 중점 펀드 중 환경 요소를 고려하는 경우로 한정된다. EU는 더 많은 공시 비용을 감수하면서 온실가스 감축이라는 대의를 달성하겠다는 의지로 해석된다.

다만 정량적인 정보가 갖는 한계를 인식할 필요가 있다. 탄소집중도가 높은 산업군 혹은 기업에 투자하는 이유가 재생에너지로의 전환 전략에 능동적으로 투자하기 위한 것이라면, 이 펀드의 온실가스 배출량은 높겠지만 내용상으로는 친환경 전략이다. 마찬가지로 ESG 정보공시 규정안은 주주행동에 관한 회의 개최 횟수와 같은 정량적 정보를 요구하고 있다. 그러나 회의 횟수보다는 내용이 더 중요하므로 주주행동에 관한 공시는 ESG 맥락 속에서 회의의 결과가 어떠했는지에 관한 서술이 더 중요할 수 있다.

III. 국내 주식형 펀드에 대한 시사점

1. 공시 현황

국내 ESG 펀드는 집합투자증권의 기재 사항 요건60)에 따른 투자설명서의 투자전략 부문에서 ESG 요소를 투자에 반영하는 전략을 설명하고 있다. <표 III-1>은 투자설명서에 나타난 ESG 펀드들의 투자 유형과 관련 내용을 바탕으로 작성한 통계이다.

통합(integration)은 가장 일반적으로 언급되는 투자전략이다.61) 재무분석과 ESG 성과 분석을 동시에 고려하나, 재무분석이 우선이라고 밝히는 경우(ESG≦재무)와 ESG 성과 분석이 재무분석을 우선하는 경우(ESG>재무)로 구분할 수 있다. ESG 펀드의 대부분이 ETF를 제외하고는 통합 유형에 속하나, ESG 요소가 투자 의사결정의 주된 요인으로 작용하는 펀드는 4개에 국한된다. ETF의 경우, ESG 평가를 바탕으로 알파를 추구하는 액티브 전략을 구사하는 경우는 ESG 성과 분석이 재무분석을 우선하는 경우로 분류할 수 있다.62)

주주활동 분류는 ESG를 주제로 투자 대상 기업과 소통하거나 주주총회에서 주주권 행사를 통해 기업가치 제고를 목표로 한다고 설명하는 경우이다. 기업과 지속가능한 주제를 가지고 계속 대화하며 기업가치를 제고시킬 수 있다는 측면에서 바람직한 수탁자 책임 이행 활동이라 할 수 있으나, 이를 투자설명서에 적시한 ESG 펀드는 6개에 불과하다.

조사 대상 모든 펀드는 ESG 요소를 전략에 반영한 후 운용 경과와 수익률에 어떤 영향이 있었는지에 대한 설명을 자산운용보고서에 기술하지 않고 있다. ESG 요소를 주제로 주주활동을 한다고 밝힌 펀드도 의결권행사 여부 및 그 내용을 서술하는 영업보고서에는63) 이사 선임, 재무제표승인 등 통상적인 이사회 의안 외에 ESG와 관련한 의안과 의견은 없다.64)

투자 대상 기업에 대한 ESG 평가는 대부분 외부 사업자에 의존하는 것으로 파악된다. 외부 평가 방법에 관한 설명은 ESG 고려가 선언적 성격인 경우보다, 구체적인 투자전략으로 소개될 때 방법론 설명이 동반되고 있다. 다만 방법론에 관한 내부 실사(due diligence) 시행 여부는 언급이 없다.

2. 제언

EU는 상위법 체계와 유기적으로 연계하여 지속가능금융 행동계획을 통해 수년간 TR과 SFDR 규제체계를 완성했고 현재도 이를 계속 보완하며 이해관계자 의견 수렴을 통해 일관성 있고 비교 가능한 공시체계로의 이행에 노력하고 있다. SEC는 중요성 정보의 의미가 다중적인 ESG 펀드의 속성상 의도 여부와 상관없이 투자자 보호 문제 발생 소지가 상당히 있다고 판단하여 이를 미리 방지하고자 한다.

국내 발행 ESG 펀드는 EU 기준으로는 Article 8, SEC 기준으로는 ESG 중점 펀드에 해당한다. 투자자에게 지속가능성에 대한 투명하고 비교 가능한 정보를 제공하는 기준을 검토할 필요가 있다. 다만 국내에서 EU 수준의 공시체계를 단시간 내에 마련하기는 어렵기에 기존 자본시장법상의 투자자 보호 확충 및 자산운용사의 책임 강화를 위한 제반 제도하에서 ESG 관련 정보공개를 보다 실효성 있게 유도하는 가이드라인 마련이 현실적인 대안이 될 수 있다.

우선 펀드 명칭과 투자설명서에서 ESG 관련 내용을 표시하거나 언급하는 경우에 한해서 가이드라인을 마련할 필요가 있다. EU의 경우처럼 모든 펀드에 대해 지속가능성 위험과 PAI를 기재하는 것은 기업의 지속가능성보고서 작성 기준이 확정되어 일반화되지 않은 상황에서는 선언적 상용구(boilerplate)로 채워질 가능성이 크다. 중요성 정보를 담아야 하는 투자설명서에 펀드의 본질적 위험-수익 구조와 관련이 없는 지속가능성 정보를 기재하면 투자자는 펀드의 지속가능성을 과대평가할 수 있다.65)

ESG 펀드 가이드라인은 다음과 같은 최소한의 내용을 요구할 수 있고, 해당 내용은 비례 원칙에 따라 지속가능성 요소를 결정적인 방법으로 투자 의사결정에 반영할수록 자세한 설명이 뒤따라야 한다.

비례 원칙에 따른 정보공개의 범위와 요건을 제시하기 위해서는 해당 펀드가 지속가능성 요소를 구체적으로 얼마나 그리고 어떤 방법으로 투자전략에 고려하는지를 상세히 밝혀야 한다. 자의성을 배제하기 위해 <표 III-1>과 같이 구체적 투자유형을 제시하고 펀드가 어느 유형에 해당하는지를 선택하게 하는 것을 고려할 수 있다.

운용사 자체의 지속가능성 분석 역량을 전문 인력 보유 여부와 데이터 보유 여부 측면에서 설명할 필요가 있다. ESG 등급, 데이터 및 분석 도구를 제3자 서비스에 의존하는 경우 해당 서비스 업체에 대한 자체 실사 과정을 수탁자 책임 이행 차원에서 마련해야 한다. <표 III-1>에서 조사된 투자설명서에는 상당수가 등급 및 데이터를 외부 기관에 의존하나 해당 기관의 평가 방법론이나 데이터 유의성, 시의성에 관한 검증 여부는 명시되지 않고 있다.

펀드가 추구하는 환경, 사회, 지배구조 특성에 적합한 준거지수를 채택하고 지수 산출의 원리와 방법론에 관한 설명을 지적재산권 보호 범위 내에서 최대한 자세히 설명하여야 한다. 예를 들어 탄소중립 달성을 목표로 하는 경우, 국제 정합성을 갖춘 벤치마크 도입 여부를 밝힐 필요가 있다. 우리나라도 이미 탄소중립기본법 제정을 통해 같은 취지의 시책 마련을 요구하고 있다.66) 이에 따라 펀드 투자와 연계된 온실가스 배출량 규모가 어느 정도인지 파악해야 하고, 감축목표를 위한 준거지수를 채택하여 이행과정을 점검해야 한다.67) 자산운용보고서에서는 투자전략에서 주장하는 ESG 투자의 내용과 과정 및 결과를 최소한의 객관적 자료를 통해 설명해야 한다.

마지막으로, ESG 의제를 갖고 주주활동을 하는 경우 해당 의제에 관한 설명과 주주활동의 목표가 규범적 성격인지 아니면 수익 추구인지를 명확히 밝히고, 활동 과정 및 목표 달성 여부를 밝혀야 한다.

그린워싱에 관한 행정 제재가 강화될수록 금융투자업계의 ESG 펀드 발행은 정제될 것이다.68) 다만 전장에서 밝힌 바와 같이 환경과 사회 관련 광범위한 정보를 법적 요건을 갖춘 투자설명서에 요구할 때, 투자자 의사결정에 실질적으로 도움을 주어야 한다. 그러지 못한 경우에는 운용사에 불필요한 비용69)을 증가시킬 수 있다는 점도 동시에 고려하여야 한다.

1) ‘지속가능성’, ‘ESG’, ‘SRI(사회적 책임)’, ‘그린’ 등이 사용된다. 본 보고서는 이들 명칭이 환경, 사회 및 지배구조 이슈를 포괄하는 것으로 간주하여 구분하지 않고 혼용한다.

2) 본 보고서는 에프앤가이드 FnSpectrum의 테마형 ESG(주식) 분류 기준을 사용하였다. 총 21개의 자산운용사가 ESG 펀드를 출시하였다.

3) 2022년 8월 18일 기준

4) 2022년 6월 30일 기준 Investment Company Institute 통계

5) 금융투자협회 금융투자회사의 영업 및 업무에 관한 규정 제4편 제4-2조(집합투자기구 명칭의 사용)

6) Raghunanda & Rajgopal(2022)은 2010년부터 2018년까지 미국에서 운용된 ESG 펀드의 다중 이해관계자 친화 정도를 분석하였다. ESG 펀드는 ESG 평가 점수가 높은 기업들을 편입하고는 있으나 이들 점수는 기업이 자발적으로 공개하고 있는 지속가능성 정보량과 상관관계를 보일 뿐, 위법 기록이나 탄소 배출량과 같은 중요성 정보와는 상관성이 없음을 밝히고 있다.

7) 영국 금융감독원(Financial Conduct Authority: FCA, 이하 FCA)도 지속가능성 펀드 설계 시 공시 문서화 방안, 투자 실행과 편입 종목에 대한 모니터링, 투자자에게 의사결정에 도움이 되는 정보를 주제로 한 가이드라인을 2021년 7월 19일 발표하였다. 본 보고서에서는 세부 설명을 생략한다.

https://www.fca.org.uk/publication/correspondence/dear-chair-letter-authorised-esg-sustainable-investment-funds.pdf

8) Principles for Responsible Investment, Investment Company Institute, CFA Institute 등을 참고하였다.

9) 이를 총칭하여 지속가능금융 행동계획(Sustainable Finance Action Plan)이라 하고, 유럽 그린딜을 공식화하기 이전인 2018년 3월에 계획을 마련하였다. 자본의 지속가능경제로의 흐름 유도, 지속가능성 관점의 위험관리, 투명성과 장기성과주의 증진을 목표로 하고 있으며 이를 위해 10개의 행동계획을 마련하고 있다.

10) Regulation(EU) 2019/2088을 참조한다.

11) SFDR의 시행령에 해당하고, 유럽 집행위원회(European Commission)는 RTS의 작성을 유럽 금융감독 연합체인 ESAs(European Supervisory Authorities)에 위임하였으며, 2022년 4월 6일 최종 채택했다. 입법 절차상 유럽 의회와 이사회의 최종 검토와 승인을 거쳐야 하고, 현재 일정으로는 2023년 1월 1일 시행을 목표로 하고 있다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_1_EN_ACT_part1_v6%20(1).pdf

12) Regulation(EU) 2020/852을 참조한다.

13) SFDR Article 2(17)

14) TR Article 3의 정의를 참조한다.

15) SFDR의 대상은 전체 금융시장참가자(보험사, 자산운용사, 연금 사업자, 대체투자운용사, 벤처캐피탈사, UCIT 운용사 등)와 해당 금융상품을 포괄하고 있으나, 본 보고서에서는 자산운용사와 펀드를 중심으로 설명한다.

16) 지속가능성 위험을 SFDR Article 2(22)에서 환경, 사회 혹은 지배구조 관련 이벤트로 발생 시 중요성 관점에서 투자 가치에 실질 혹은 잠재 부정적 영향을 주는 위험으로 정의하고 있다.

17) SFDR Article 3(1)

18) SFDR Article 4(1)(a). 단 해당 회계연도 기간 평균 근로자 수가 500인 이상이면 2021년 6월 30일부터 의무화한다.

19) PAI의 세부 내용과 기재 양식(template)은 RTS의 Annex 1을 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_1_EN_annexe_acte_autonome_part1_v6.pdf

20) SFDR Article 2(24)에서 환경, 사회 및 고용, 인권 존중, 부패 및 뇌물 관련 사항으로 정의하고 있다.

21) SFDR Article 4(2), RTS Article 7, 8, 9, 10

22) SFDR 본문에는 계약 이전 공시(pre-contractual disclosures)로 표현되어 있고 이는 성격상 집합투자기구가 발행하는 집합투자증권의 증권신고서에 해당하나, 본 보고서에서는 투자설명서로 표현하기로 한다.

23) SFDR Article 6(1)

24) SFDR Article 7(1)

25) TR Article 7

26) Article 8 펀드와 Article 9 펀드는 SFDR 규정 8과 9에 요건에 부합하는 펀드를 의미한다.

27) SFDR에는 ‘증진(promote)’ 용어가 정의되어 있지 않다. ESAs의 SFDR 질의 답변서에서 증진의 의미와 Article 8 유형 판단에 관한 지침을 제공하고 있다. 참고로, 지속가능한 위험에 대한 고려는 모든 펀드에 공통 적용되기에 그 자체를 언급하는 것만으로는 Article 8 펀드로 구분되지 않는다.

https://www.esma.europa.eu/sites/default/files/library/c_2022_3051_f1_annex_en_v3_p1_1930070.pdf

28) SFDR Article 10(1). 시행을 위한 세부 사항은 RTS Article 24~36을 참조한다.

29) SFDR Article 8(1)(2)

30) TR Article 9를 참조한다.

31) 텍사노미 일치된 투자는 TR Article 3의 환경적으로 지속가능한 경제활동 기준을 충족하는 투자를 말한다. 충족 기준에는 UN, OECD, ILO(International Labour Organization) 제 규범의 최소한 준수와 같은 환경 외적 요인도 포함된다.

32) SFDR Article 8(2a). 연계 규정인 TR Article 3, 5 ,6을 참조한다. 시행을 위한 세부 사항은 RTS Article 14~17을 참조한다. 세부 내용과 기재 양식은 RTS의 Annex 2를 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_2_EN_annexe_acte_autonome_cp_part1_v5.pdf

33) SFDR Article 11(1)(a)

34) SFDR Article 11(1)(d). 연계 규정인 TR Article 3, 5, 6을 참조한다. 시행을 위한 세부 사항은 RTS Article 50~57을 참조한다. 세부 내용과 기재 약식은 RTS의 Annex 4를 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_4_EN_annexe_acte_autonome_cp_part1_v5.pdf

35) SFDR Article 2(17)에서 지속가능한 투자를 정의하고 있다. 환경과 사회적 목적에 기여하는 경제행위에 투자하는 것을 의미하며 동시에 행위로 인하여 다른 환경 및 사회적 목적을 심각하게 저해하지 않는 행위(do not significant harm)로 규명하고 있다.

36) SFDR Article 10(1). 시행을 위한 세부 사항은 RTS Article 37~49를 참조한다.

37) SFDR Article 9(1)(2)(4)

38) SFDR Article 9(4a), 11(1)(c). 연계 규정인 TR Article 3, 5를 참조한다. 시행을 위한 세부 사항은 RTS Article 18~19, Article 59를 참조한다. 세부 내용과 기재 양식은 RTS의 Annex 3을 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_3_EN_annexe_acte_autonome_cp_part1_v5.pdf

39) SFDR Article 11(1)(b). 시행을 위한 세부 사항은 RTS Article 58~63을 참조한다. 세부 내용과 기재 약식은 RTS의 Annex 5를 따른다.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_5_EN_annexe_acte_autonome_cp_part1_v5.pdf

40) 대책팀 설립 이후 대체 연료 수송차 제조사인 Nikola사의 대표를 사기죄로 기소한 것을 비롯하여 최근에는 투자자문사인 BNY Mellon을 자사가 추천한 펀드의 ESG 실사 여부가 설명과 달리 상당 부분 생략된 혐의로 기소하여 150만달러 벌금을 부과하였다.

https://www.sec.gov/spotlight/enforcement-task-force-focused-climate-esg-issues

41) 미국 재계를 대표하는 Business Roundtable과 미국상공회의소(US Chamber of Commerce)는 기업의 과도한 공시 부담을 이유로 반대하고 있고, 미국 공화당 의원 중 일부는 위헌 소송을 제기할 것을 공언하고 있어서 실제 이행 여부는 불투명하다. 최근 보수 성향의 미국 대법원이 발전소의 온실가스 배출량을 제한하는 미국 환경보호국(Environmental Protection Agency)의 행정 명령이 월권이라는 결론을 내린 점에 비추어 보아, SEC의 기후 공시 규정은 대법원에서 제지될 가능성이 없지 않다.

42) 일반적으로 미국에서 investment adviser는 investment manager와 동일한 의미로 사용하기도 하고 이는 국내에서 집합투자업자(자산운용사)에 해당하며, investment companies는 집합투자기구(펀드)를 의미한다.

43) 전문은 SEC(2022a)를 참조한다.

https://www.sec.gov/rules/proposed/2022/ia-6034.pdf

44) 투자자 선호와 수탁자 책임에 관한 법률 및 경제적 해석에 관한 논거는 Schanzenbach & Sitkoff(2020)를 참조한다.

45) 2008년 7월 30일 SEC는 Pax World Management Corp.에 대하여 중지 명령(cease and desist order) 행정 조치와 함께 과징금 50만달러를 부과하였다. 증권신고서에 기재한 SRI 투자목적과 실제 운용상의 불일치를 근거로 하였다. 최근 BNY Mellon에 대한 과징금 부과도 같은 조치의 일환이다.

https://www.sec.gov/litigation/admin/2008/ia-2761.pdf

46) ESG 정보공시 개정안의 문구와 양식은 SEC(2022a)의 303면 Text of Proposed Rule and Form Amendment에서 찾아볼 수 있다. SEC의 증권신고서 양식인 Form N-1A를 개정한 부분은 314면에서 시작된다. 구체적인 작성 내용에 관한 지시는 Instruction에 상술되어 있다.

47) 기존 재무분석에 사용되는 거시경제 변수, 재무 변수 등과 더불어 ESG 요소는 전체적인 기업의 가치 평가에 사용되는 하나의 변수로 취급된다.

48) SEC는 펀드 명칭에 ESG 내지는 유사 용어가 사용되지 않더라도 판촉물 글귀에 예를 들어 “지속가능성 도전에 해결책을 제공하는 기업에 초점을 맞추고 있다”라는 것과 같은 표시가 있으면, ESG가 종목 선택의 주된 결정 요인임을 암시하므로 ESG 중점 펀드로 분류한다고 설명하고 있다. 판촉물에 ESG 요소를 고려하는 설명이 있을 수 있으나, 주된 결정 요인이 아님을 밝히면 ESG 통합 펀드로 분류된다. SEC(2022a) 34면을 참조한다.

49) 전자공시 형태(운용사의 웹사이트 혹은 EDGAR)에서는 전략 개요표의 내용 중 부연 설명이 연계되는 링크를 제공하는 것을 고려 중이다.

50) SEC는 ‘ESG 주주활동(engagement)’을 해당 기업의 ESG 사안을 개선하고 증진하기 위하여 경영진과 갖는 실질적 대화 행위로 정의하고 있다. 또한 대화의 결과로 ESG 목표가 어느 정도 달성되었는지 측정할 수 있어야 한다. SEC(2022a) 81면을 참조한다.

51) 대리투표와 주주활동이 현재 주된 수단이 아니고 앞으로도 그러한 계획이 없더라도 그와 같은 사실을 동일하게 설명해야 한다. 이는 투자자가 ESG 중점 펀드 대부분이 적극적인 주주활동을 하는 것으로 인식할 수 있어서 그에 관한 정확한 정보를 밝히는 것이 중요하다고 판단하기 때문이다.

52) 탄소발자국은 펀드가 보유하고 있는 개별 기업의 온실가스 배출 총량을 해당 기업의 기업가치(enterprise value) 펀드 보유 비중을 곱하여 계산하고, 이를 펀드 내 모든 기업에 적용한 후 총합을 구하여 계산한다. 펀드 규모가 클수록 탄소발자국이 자동으로 커지게 되므로 단위 당 비교를 위해 운용자산 규모로 나누어 다른 펀드와 비교를 가능하게 한다.

53) 탄소배출량 측정 단위와 기간, 기업가치 및 펀드 순자산가치 산정 방식 및 시점, 기업의 탄소상쇄(carbon offset)량 차감 여부, 재간접펀드와 파생상품의 처리, 온실가스 데이터 원천 및 추정 방식 등에 관한 고려사항들이다. 이에 관한 SEC의 설명은 SEC(2022a) 94~109면을 참조한다.

54) 펀드의 탄소발자국과 가중평균 탄소집중도는 현재 국제 표준으로 자리 잡은 PCAF(Partnership for Carbon Accounting Financials)와 TCFD(Task Force on Climate-Related Financial Disclosures)의 기준을 따르고 있다.

55) 본문은 SEC(2022b)를 참조한다.

56) 기업의 지속가능성 공시 지침(Corporate Sustainability Reporting Directive), 텍사노미 규정, 기후변화 관련 벤치마크 규정 개정을 예로 들 수 있다.

57) 일반 펀드도 환경, 사회, 지배구조와 관련하여 적어도 하나 이상의 의제를 투자 의사결정에서 고려할 수 있기 때문에 SEC의 ESG 통합 펀드 범주에 해당할 수 있다. 실제로 SEC는 공모 펀드의 80%가량이 통합 펀드에 해당하는 것으로 추산하고 있다.

58) 펀드가 온실가스 배출 감축을 목표로 하지 않지만, 하나의 고려 요소로 간주하여 투자설명서 조항을 통해 설명한다면 펀드의 본질적 위험-수익 내용상 과도한 정보가 될 수 있다. 이는 그린워싱을 오히려 더 부추기는 기재가 될 수 있다. 관련 내용은 다음 문서를 참고한다.

https://www.sec.gov/comments/s7-17-22/s71722-20136279-307345.pdf

59) 국내외 ESG 평가 회사의 평가 등급 다양성과 이로 인한 투자자 보호 문제에 관한 내용은 이인형(2021)을 참조한다.

60) 「자본시장과 금융투자업에 관한 시행령」제127조(집합투자증권의 증권신고서의 기재사항 등) 제1호 3항 나목

61) 재무 요소와 ESG 요소를 다루는 설명을 ‘통합’,‘함께’,‘동시에’라는 수식어를 사용하는 경우 모두 통합 전략으로 간주한다.

62) FnGuide 한화 ESG Value, Growth, 우수기업 지수를 기초지수로 하는 액티브증권상장지수투자신탁을 예로 들 수 있다.

63) 금융투자협회 펀드공시 분기영업보고서 의결권행사여부 및 그 내용 참조

64) 별건이기는 하나 금융감독원으로부터 불완전판매로 문책 경고받은 금융회사의 임원을 그동안의 공로를 인정하여 이사 재선임에 찬성한 예도 있다. 금융회사의 불완전판매 행위는 ESG 평가에서 부정적 요인으로 간주한다.

65) ESG 펀드의 그린워싱 우려를 계기로 펀드 명칭에 관한 현재의 자율규제 체계를 경성규범화 하는 것에 대한 검토가 필요하다.

66) 탄소중립‧녹색성장 기본법(약칭: 탄소중립기본법) 제55조(기업의 녹색경영 촉진 등) 2호에서 기업의 온실가스 배출량, 온실가스 감축 실적 및 온실가스 감축 계획의 공개, 제58조(금융의 지원 활성화) 1항에서 재원 조성, 자금 지원, 금융상품의 개발, 민간투자 활성화, 탄소중립 관련 정보 공시제도 강화 등을 포함하는 시책을 수립‧시행하여야 한다고 명시하고 있다.

67) 탄소배출 관련 정보는 정확성, 시의성, 비교 가능성 측면에서 아직 완전하지 않다. 현재로는 운용사의 기후변화 관련 위험관리와 영향 파악은 주주활동을 통해 능동적으로 하는 것이 바람직하다.

68) SEC와 BaFin으로부터 그린워싱 혐의로 조사받아온 DWS 자산운용사는 2021년에 자체 운용 ‘ESG 통합 펀드’ 규모를 4,590억유로로 밝혔다가, 대표이사 사임과 자체 기준 강화 후 2022년 3월에 1,115억유로로 75% 축소 발표하였다.

https://www.ifre.com/story/3400033/dws-greenwashing-raid-marks-the-start-of-esg-20-51xvhxfxhg

69) 공시 관련 직접 비용 외에 예기치 않은 투자자 손실 소송 비용도 포함된다.

참고문헌

박혜진, 2020, 『국내 ESG 펀드의 현황 및 특징 분석』, 자본시장연구원 이슈보고서 20-28.

이인형, 2021, 『ESG 평가 체계 현황과 특성 분석』, 자본시장연구원 이슈보고서 21-09.

이인형‧이상호, 2021, 『지속가능보고 의무공시 이행을 위한 논의 방향』, 자본시장연구원 조사보고서 21-01.

CDP, 2020, The Time to Green Finance, CDP Financial Services Disclosure Report 2020.

EC, 2022, ANNEX 1 to the Commission Delegated Regulation (EU) Supplementing Regulation (EU) 2019/2088 of the European Parliament and of the Council, C(2022) 1931 Final.

https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_1_EN_annexe_acte_autonome_part1_v6.pdf

EU, 2019, Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector, Official Journal of the European Union.

EU, 2020, Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (Eu) 2019/2088, Official Journal of the European Union.

Freshfields Bruckhaus Deringer, 2021, A Legal Framework for Impact – Sustainability Impact in Investor Decision Making, Report Commissioned by UNEP FI, The Generation Foundation and PRI.

Investment Company Institute, 2020, Fund’s Use of ESG Integration and Sustainable Investing Strategies: An Introduction.

PRI, 2016, A Practical Guide to ESG Integration for Equity Investing.

Raghunandan, A., Rajgopal, S., 2022, Do ESG fund make stakeholder-friendly investments? Review of Accounting Studies 27, 822-863.

Schanzenbach, M.M., Sitkoff, R.H., 2020, Reconciling fiduciary duty and social conscience: The law and economics of ESG investing by a trustee, Stanford Law Review 72.

SEC, 2022a, Enhanced Disclosure by Certain Investment Advisers and Investment Companies About Environmental, Social, and Governance Investment Practices, Proposed Rule Release No.IA-6034.

SEC, 2022b, Investment Company Names, Proposed Rule Release No.IC-34593.