Find out more about our latest publications

Sustainability Reporting Based on Materiality and Price Informativeness

Research Papers 23-01 Jan. 05, 2023

- Research Topic Capital Markets

- Page 70

- No other publications.

That corporate sustainability information disclosure enhances enterprise value discovery is a basic premise underlying sustainability disclosure discussions. If this is not the case, sustainability reporting efforts can be of little value to both the corporate and the investors. This aspect of sustainability reporting should be taken into consideration when regulatory efforts are undertaken to mandate disclosure. This paper aims to ascertain empirically whether disclosure of material sustainability information increases the price informativeness of the firm’s stock price to provide evidence that can be considered in the regulatory design.

The IFRS S1 General Requirements for Disclosure of Sustainability emphasizes the disclosure of material information that has relevance to the enterprise value. When there are no disclosure standards specified by the IFRS S1, companies are to be guided by the SASB industry-specific disclosure standards. Since sustainability issues related to the environment and social agenda have a different level of relevance for each industry and firm, disclosure standards are uniquely provided for 77 different industries that have been identified by the SASB.

For each disclosure standard, firms are to decide which disclosure topics and related metrics are material and report them accordingly. So any sustainability information disclosed in this manner is firm-specific and the information content should be reflected in the idiosyncratic firm price movement. This hypothesis is put to test by utilizing Bloomberg’s ESG Disclosure Score database. Bloomberg provides SASB to Bloomberg Field Mapping service, which is a tool that provides a Bloomberg mapping of the material ESG metrics and data points aligned to the SASB Standards ESG disclosure topics based on SASB industry materiality.

Price informativeness is defined as the part of a price movement that is purely attributable to the firm-specific information content. This variable is explained by the material disclosure level of a firm after taking into consideration other independent variables that are deemed to affect the price informativeness through separate channels. Control variables such as firm size, business characteristics, institutional investors’ ownership, accounting information, etc., are employed and the year and firm fixed effects are also applied.

Results indicate that material information enhances price informativeness, and other control variables also show relational signs that are theoretically correct and empirically supported in the literature. Different lags and leads are employed to check the robustness of the results.

Furthermore, firms in a group that show a higher level of profit uncertainty with a lower growth prospect show significant price information content of material information than the group with a lower level of uncertainty and higher growth prospect. In a similar manner, the group of firms that engage in less conservative accounting practices also show higher price informativeness than the groups that do otherwise.

The IFRS S1 General Requirements for Disclosure of Sustainability emphasizes the disclosure of material information that has relevance to the enterprise value. When there are no disclosure standards specified by the IFRS S1, companies are to be guided by the SASB industry-specific disclosure standards. Since sustainability issues related to the environment and social agenda have a different level of relevance for each industry and firm, disclosure standards are uniquely provided for 77 different industries that have been identified by the SASB.

For each disclosure standard, firms are to decide which disclosure topics and related metrics are material and report them accordingly. So any sustainability information disclosed in this manner is firm-specific and the information content should be reflected in the idiosyncratic firm price movement. This hypothesis is put to test by utilizing Bloomberg’s ESG Disclosure Score database. Bloomberg provides SASB to Bloomberg Field Mapping service, which is a tool that provides a Bloomberg mapping of the material ESG metrics and data points aligned to the SASB Standards ESG disclosure topics based on SASB industry materiality.

Price informativeness is defined as the part of a price movement that is purely attributable to the firm-specific information content. This variable is explained by the material disclosure level of a firm after taking into consideration other independent variables that are deemed to affect the price informativeness through separate channels. Control variables such as firm size, business characteristics, institutional investors’ ownership, accounting information, etc., are employed and the year and firm fixed effects are also applied.

Results indicate that material information enhances price informativeness, and other control variables also show relational signs that are theoretically correct and empirically supported in the literature. Different lags and leads are employed to check the robustness of the results.

Furthermore, firms in a group that show a higher level of profit uncertainty with a lower growth prospect show significant price information content of material information than the group with a lower level of uncertainty and higher growth prospect. In a similar manner, the group of firms that engage in less conservative accounting practices also show higher price informativeness than the groups that do otherwise.

Ⅰ. 연구배경

국내 상장사 중 일정 규모 이상의 기업은 2025년부터 단계적으로 지속가능성 관련 정보를 공시하여야 한다. 현재는 유가증권시장 상장사 중 120여 개 이상 기업이 자발적으로 ‘지속가능경영보고서’(이하 지속가능성보고서)를 자사 홈페이지를 통해 발간하고 있고 그중 일부는 거래소 자율공시 형태로 등록하고 있다.

환경과 사회 관련 지속가능성 요소는 다양하고 개별 기업이 속한 산업의 특성에 따라 해당 요소의 중요성이 다를 수 있다. 따라서 일정한 중요성 기준과 표준화된 지표를 갖고 작성 기준을 정하지 않으면 지속가능성보고서 내용의 활용 가치와 비교가능성이 떨어진다.

이러한 문제를 해결하기 위한 논의가 국제적으로 진행 중이다.1) 현재 가장 광범위한 관심과 지지를 받는 지속가능성보고서 작성 기준 논의는 IFRS(International Financial Reporting Standards, 이하 IFRS) 재단이 주도하고 있다. IFRS는 2021년 11월 3일 산하에 ISSB(International Sustainability Standards Board, 이하 ISSB)를 설립하여 IFRS 지속가능성 공시기준 제정을 위한 제도적 기반을 마련하였다.2) ISSB는 2022년 3월 31일 IFRS S1 일반 공시 요구사항(IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information)과 IFRS S2 기후 관련 공시(IFRS S2 Climate-related Disclosure)의 공개초안(exposure draft)을 발표하였고, 광범위한 의견 수렴을 거친 후 2022년 말에 시안을 공식적으로 확정할 예정이다.3) IFRS 회계기준을 채택하고 있는 국가는 제정된 지속가능성 공시기준을 국제 기준선(global baseline)으로 인정하고 이를 기본 골격으로 하여 일부 수정 혹은 추가를 통하여 각국 사정에 맞는 공시기준을 마련할 것으로 예상된다.

이번에 마련된 IFRS 일반 공시원칙과 기후 관련 공시 공개초안은 투자자 관점에서 기업가치에 영향을 미치는 중요한 정보(material information)를 지속가능성보고서에 담는 것을 기본 원칙으로 한다. 그리고 중요한 정보의 선별은 IFRS의 기준이 별도로 마련되지 않는 한 SASB(Sustainability Accounting Standards Board, 이하 SASB)의 기준을 원용할 것을 천명하고 있다.4)

최근 국내에서 발간되는 몇몇 지속가능성보고서에서는 SASB 기준에 의한 중요성(materiality) 지표를 채택하여 관련 정보를 공개하고 있으나 아직 해당 정보의 주식 가격 유용성에 관한 연구는 이루어지고 있지 않다. 다양한 지속가능성 정보 중 중요한 정보가 기업가치와 현재적(contemporaneous) 연관성을 갖는지는 투자자뿐만 아니라, 지속가능성보고서를 작성하는 기업으로서도 중요하다. 만약 기업이 공개하는 지속가능성 정보가 기업가치와 무관하다면, 정보공개의 유인체계가 효과적으로 작동하지 않기 때문이다.

본 보고서는 국내 상장회사를 대상으로 SASB 기준에 의한 중요한 정보가 현재 어느 정도 공개되고 있으며 해당 정보의 가격 유용성이 존재하는지를 검증한다. 그에 앞서 2장에서는 중요한 정보 관점에서 주가와의 관련성을 다룬 선행 연구 검토를 통해 주요 논점을 살펴본 후 논점을 실증한 주요 연구 결과를 소개한다.

SASB는 산업별 특성에 맞는 중요성 주제와 지표를 식별하기 위해 SASB 고유의 산업분류 체계를 마련하고 있다. 3장에서는 SASB 분류에 따른 국내 상장기업의 산업별 중요성 정보공개 현황을 진단하고 4장에서는 이들 정보가 주가 정보성(price informativeness)을 내포하고 있는지 검증한다.

결론에서는 검증 결과의 의미를 정리하여 국내 지속가능성 정보 공시기준 도입 논의에 유용한 시사점을 제시하고자 한다.

II. 중요한 정보

1. 중요한 정보의 의미

기업은 사업내용, 재무에 관한 사항, 주주에 관한 사항 및 그 밖에 투자자 보호를 위하여 필요한 사항 등에 관하여 사업보고서에 그 내용을 기재하여야 한다.5) 만약 사업보고서에 중요사항에 관하여 거짓의 기재 또는 표시가 있거나 중요사항이 기재 또는 표시되지 않아서 투자자가 손해를 입으면 책임을 져야 한다.6)7) 회계기준에서 중요한(material) 정보는 해당 정보가 누락, 허위 혹은 왜곡 작성되었을 경우, 그 정보를 사용하는 자의 의사결정에 영향을 미치리라고 합리적으로 예상되는 경우로 간주한다.

따라서 지속가능성 관점에서 중요한 정보란 기업이 환경과 사회에 끼치는 영향이 미래 기업의 현금흐름에 영향을 미칠 수 있다고 합리적 관점에서 예상할 수 있는 경우와 발생 가능성은 작으나, 미래 현금흐름에 매우 큰 영향을 끼칠 수 있는 사건 모두를 포함한다.8) IFRS S1 일반 공시 요구사항에서 중요성 정의는 이러한 견해와 일치한다.

여기서 유추할 수 있는 것은 기업가치 지향 지속가능성 중요한 정보가 공개될 경우, 시장은 이를 소화하게 되고 결과적으로 주가 정보성에 영향을 미칠 수 있다는 점이다. 따라서 중요한 정보량이 증가할수록 고유 가격 정보성과 정의 관계가 성립될 수 있다.

2. 선행 연구

기업의 정보 공시와 기업가치 간 관계에 관한 연구는 자기자본비용(cost of equity capital) 측면에서 수년간 이루어져 왔다.9) 공시 자체는 투자자와 대리인 간 정보 비대칭 문제를 해소하여 활발한 거래를 유발하고(유동성 효과)10) 투자자의 자산 가격 산정 정확도를 증가시키는 것으로 알려진다.11) 또한 법적 공시로 인한 정보 투명성은 주주의 감시비용을 감소시키는 것으로 나타난다.12)

이러한 연유로 정보 공시의 양과 질에 비례하여 자기자본비용은 감소하는 것으로 밝혀진다. 자기자본비용은 지분 투자자가 요구하는 기대수익률로서 위험과 불확실성이 적은 투자일수록 요구 수익률은 낮아진다. 이는 결국 낮은 할인율을 의미하므로, 정보 공시와 기업가치와의 관계는 정의 관계가 성립된다.

이러한 이론적, 실증적 관계는 투명하고 비교할 수 있는 정보 공시의 중요성을 뒷받침하는 논거로 사용되고 있다. 동시에 자본시장의 위험-가격 형성 메커니즘이 기업으로 하여금 최적 수준의 정보공개를 하도록 유도하는 강한 유인책으로 작동하고 있음을 증빙한다.

지속가능성 정보의 자발적 공개가 자기자본비용과 연관이 있음을 처음으로 실증한 연구는 Dhaliwal et al.(2011)이다. 2000년 이후 미국 상장사의 CSR(Corporate Social Responsibility) 관련 정보공개가 급증하는 배경을 놓고 이를 자기자본비용 절감 노력으로 설명한 연구이다. 주요 결과로는 전기에 자기자본비용이 높았던 기업은 그다음 기에 CSR 정보를 자발적으로 공개하는 경우가 유의미하게 많고, CSR 성과가 좋은 기업의 자기자본비용은 감소하는 것으로 나타난다.

Guidry & Patten(2010)은 지속가능성보고서를 처음 발간하는 시점을 전후로 해당 기업의 시장 가격이 초과 수익의 형태로 반응하는지 검증하였으나, 유의미한 결과가 보고되지 않는다. 반면 동일한 기업군을 대상으로 횡단면 분석을 한 결과, 지속가능성 보고서의 질이 우수할수록13) 그러하지 않은 기업에 비하여 긍정적인 시장 가격 반응을 보이는 것으로 보고된다. 이는 지속가능보고서에 담긴 정보의 절대량보다 해당 내용이 중요함을 보여준 최초의 연구 결과이다.

Khan et al.(2016)은 처음으로 SASB의 중요한 정보에 바탕을 둔 지속가능성 성과 측정을 시도하였고, 측정된 성과로 상위 포트폴리오 구성 시 하위 포트폴리오의 수익을 두 배가량 능가하는 초과 수익이 관측됨을 보고하고 있다. 학계에서 기업의 사회적책임 성과를 측정하는 데 주된 데이터베이스 역할을 해온 KLD(Kinder, Lydenberg, & Domini)의 지표 중 SASB의 중요성 지표를 대응시켜서(mapping) 확인된 지표를 바탕으로 성과를 측정하였다. Khan et al.(2016)의 결과는 중요성 기준 지속가능성 정보와 시장 수익 간 상관성을 입증하는 최초의 실증 결과였고, SASB의 중요성 기준 도입의 정당성을 부여하는 논거로 다수 인용되었다.14)

SASB의 중요성 기준 지속가능성 정보는 산업 특성별로 분류되어 있다. 기업은 자신이 속한 산업의 중요한 정보 중 개별 기업으로서 중요하다고 판단되는 것을 공개할 경우, 이는 개별 기업 고유 정보이므로 주가의 정보성(price informativeness)15)을 증가시킬 것이다. 주가 정보성은 기존 문헌에서 오랫동안 연구된 분야이다. 투자자 유형, 분석가 집중도, 내부자 정보 유무에 따른 정보성 증진 여부 검증16), 이사회 구성과 정보성 관계 검증17), 대주주 지분, 외국인 보유 비중, 감사품질 요인이 정보성에 미치는 영향18) 등이 대표적인 사례이다.

Grewal et al.(2021)은 기업이 중요성 기준 관점에서 지속가능성 관련 정보를 공개할 경우, 주가 정보성이 증가한다는 가설을 검증하였다. SASB의 산업별 기준서에 제시된 중요성 지표를 블룸버그의 ESG 정보공개 데이터베이스에 대응(mapping)하여 중요한 정보량을 산출한 후 주가 정보성과 정의 관계가 있음을 실증하였다.

기업의 지속가능성 정보 공시 의무화가 임박한 가운데, 국제적 정합성을 갖춘 IFRS의 지속가능성 기준은 기업이 투자자에게 중요한(material) 정보를 선별하여 보고하도록 하고 있다.19) 앞에 소개한 선행 연구는 중요한 정보공개 자체 내지는 중요한 정보를 바탕으로 한 지속가능성 평가가 기업의 가치 혹은 가격 정보성과 유의미한 관계가 있음을 보여주고 있다는 데 의미가 있다.

다음 장에서는 Grewal et al.(2021)의 분석 방법론을 준용하여 국내 상장기업을 대상으로 중요한 정보의 주가 정보성을 검증한다. 이를 통해 IFRS 지속가능성 공시기준의 국내 적용 의미와 가치를 가늠해 본다.

III. 지속가능성 관점에서의 중요성 기준

1. SASB의 지속가능성 보고기준

SASB가 지칭하는 ‘지속가능성’ 활동은 장기에 걸쳐 기업이 가치를 창출할 수 있는 능력을 유지 내지는 증진하는 경제활동을 의미한다. 따라서 ESG 관점에서의 지속가능성 보고는 기업이 환경과 사회적 관계에서 발생할 수 있는 위험과 기회요인을 기업가치 측면에서 파악하고 관리하는 방식과 이를 이행 하는 지배구조 차원에서의 조직과 전략의 활용에 대한 보고이다.

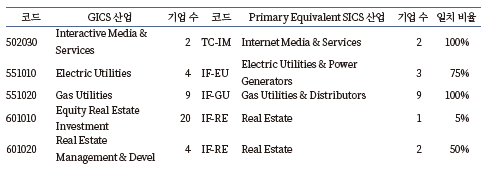

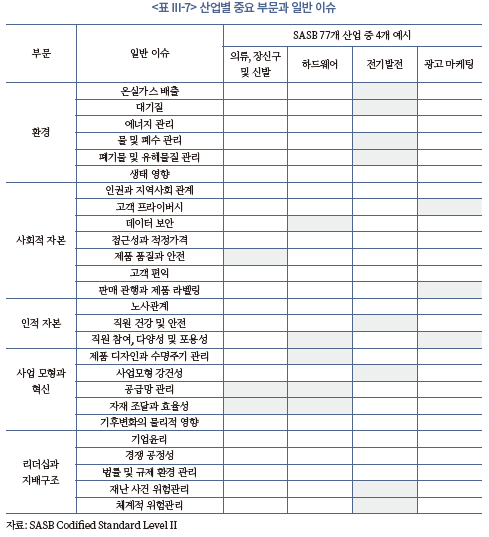

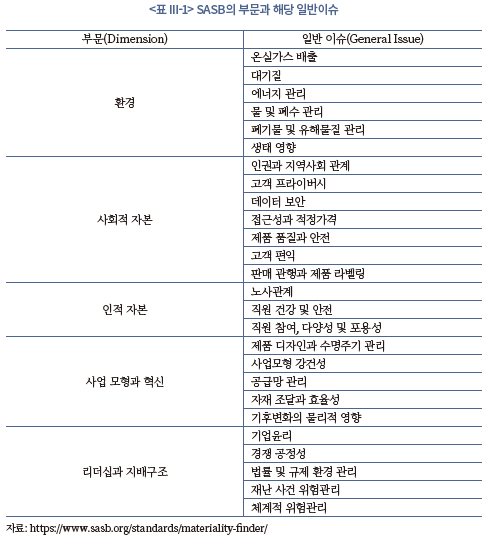

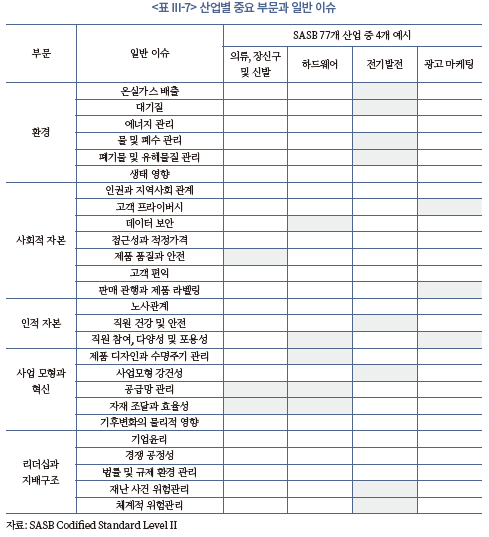

SASB는 지속가능성을 환경(Environment), 사회적 자본(Social Capital), 인적 자본(Human Capital), 사업모형과 혁신(Business Model & Innovation), 리더십과 지배구조(Leadership & Governance)의 다섯 부문으로 구분하여 인식하고 있다. 각 부문에는 <표 III-1>과 같이 일반 이슈(General Issue)가 선별되어 있다. 예를 들어 환경 부문에는 온실가스 배출, 대기질, 에너지 관리, 물과 폐수의 관리, 폐기물 및 유해물질의 관리 그리고 생태에 대한 영향을 관련 이슈로 선정하고 있다. 이슈 선정의 기준은 가치창출에 대한 영향력 존재 여부, 투자자 관심 여부, 해당 산업 전반에 걸친 적용 가능성, 기업의 능동적 대처 가능성, 이해관계자의 합의 반영 여부이다.20)

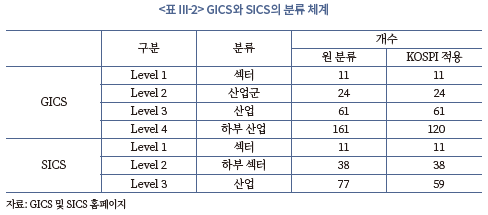

개별 기업으로서는 SASB의 일반 이슈 모두가 똑같이 중요하지 않다. 기업이 속한 산업의 특성과 개별 기업 고유의 특성으로 인해 이슈의 중요도는 다르다. 이 때문에 SASB는 산업별로 지속가능성 일반 이슈와 하위 주제를 식별한다. 이를 위해 고유의 산업분류 체계인 Sustainability Industry Classification System, SICS®(이하 SICS)를 마련하여 11개 섹터와 77개 산업을 구분하고 있다.

SICS의 경우는 지속가능성 관련 위험과 기회요인을 공유하는 기업을 하나의 유사 단위로 파악한다. 이를 기존 시장에서 사용하는 산업분류 체계21)에 적용한 후 기업들을 재편하여 지속가능성 특성을 공유하는 섹터와 산업의 신설 내지는 기존 산업의 섹터 재편을 통하여 SICS 체계를 완성하고 있다.

다음 절에서는 SICS를 현재 전 세계 자산운용 업계에서 표준으로 사용하고 있는 Global Industry Classification Standard(이하 GICS)와 비교를 통하여 산업분류로서 갖는 특성을 살펴본다. 이는 후술하는 주가 정보성을 산출하는 데 필요한 SICS 섹터 지수의 적용 가능성을 규명하기 위한 사전 조사 성격이다.

2. SICS 분류의 상대적 특성

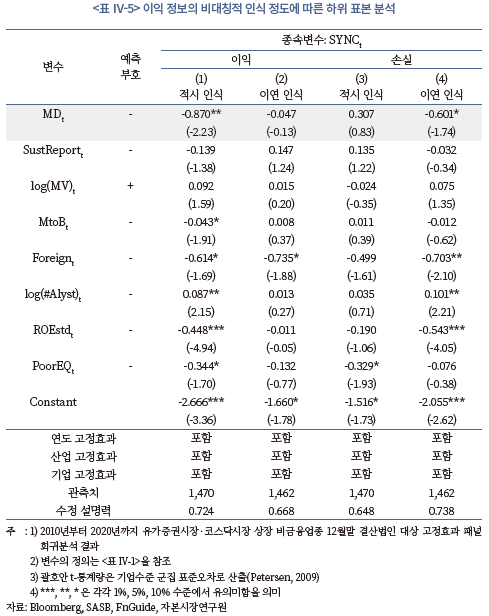

가. SICS와 GICS 체계 비교

비교 대상이 되는 GICS는 전 세계 투자자가 표준화된 산업분류 체계를 이용할 수 있도록 MSCI와 S&P Dow Jones가 1999년에 개발하였다.22) 현재는 한국거래소를 포함한 주요국 거래소와 주요 지수산출 기관이 GICS 분류를 기반으로 섹터 및 산업 지수를 산출하고, 이를 기초로 한 ETF가 운용되고 있다.

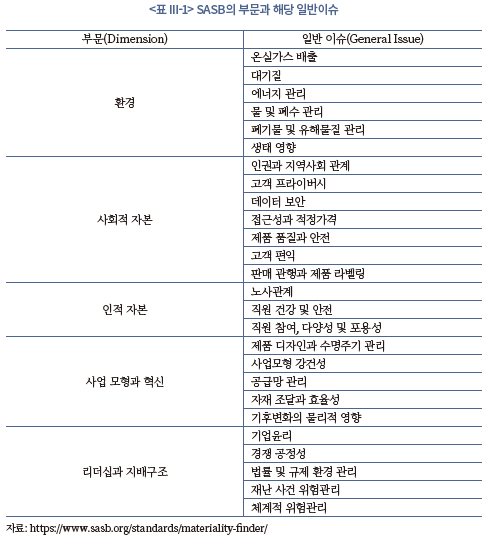

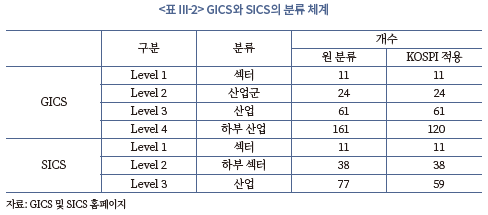

SICS와 GICS의 전체적인 분류 체계를 살펴보기 위하여 <표 III-2>에서 상위 대분류에서 하위 소분류까지 구분과 개별 섹터와 산업의 개수를 구분하였다. GICS와 SICS는 모두 11개의 섹터를 기반으로 산업군을 분류하고 있다. 실제 KOSPI 시장에 상장된 국내 기업을 대상으로 적용하면 적용되지 않는 산업분류가 있음을 알 수 있다.

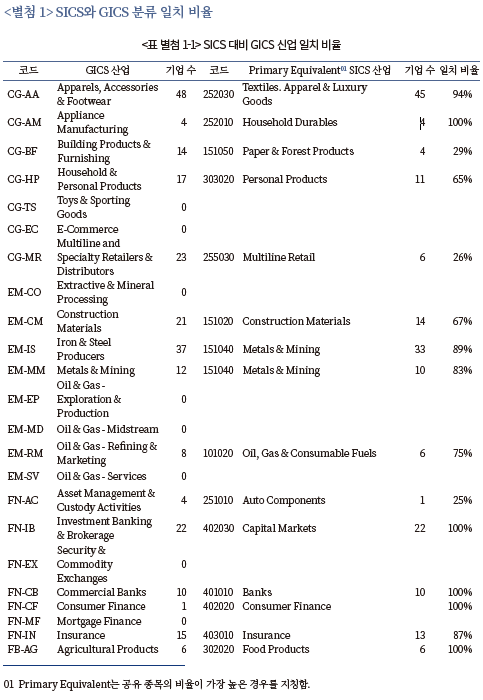

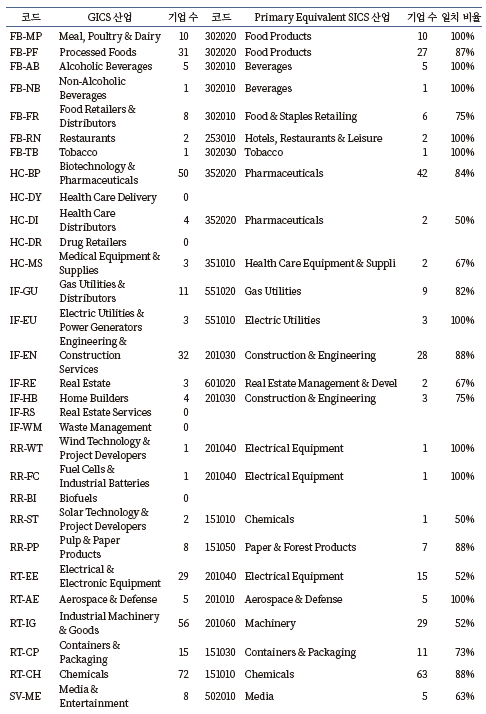

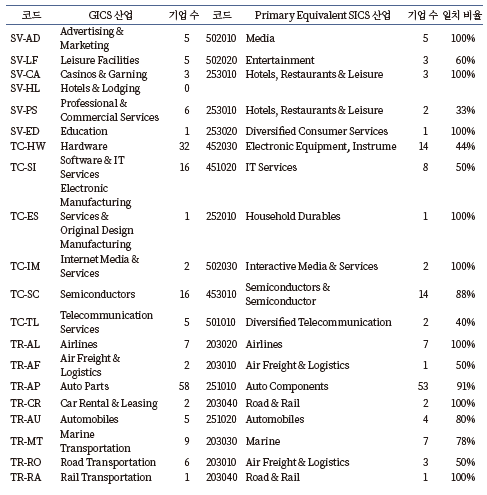

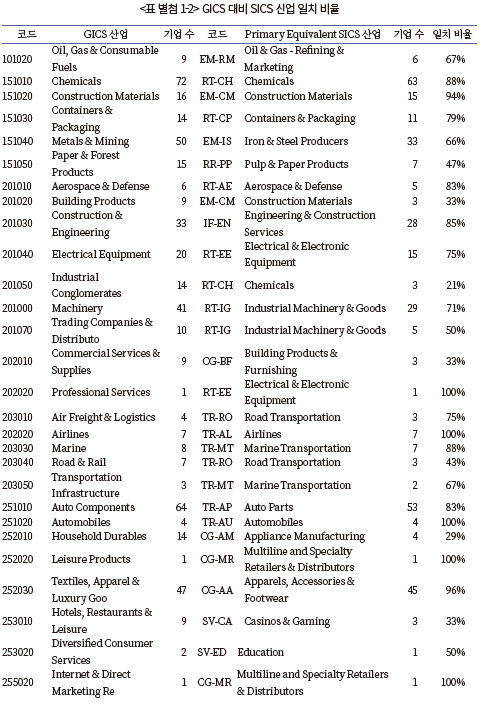

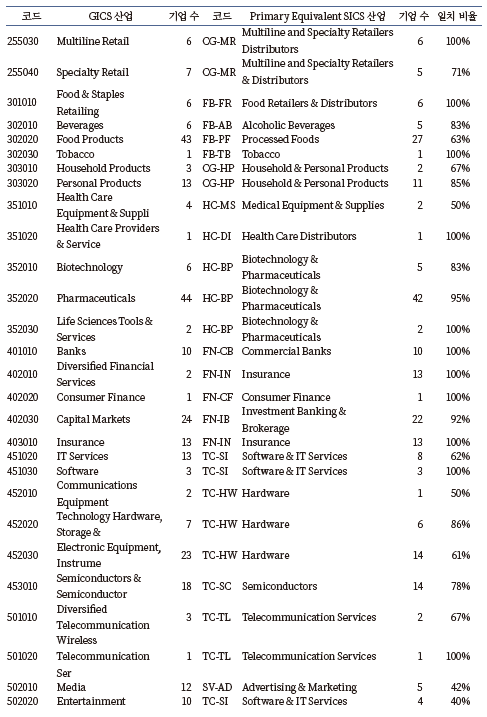

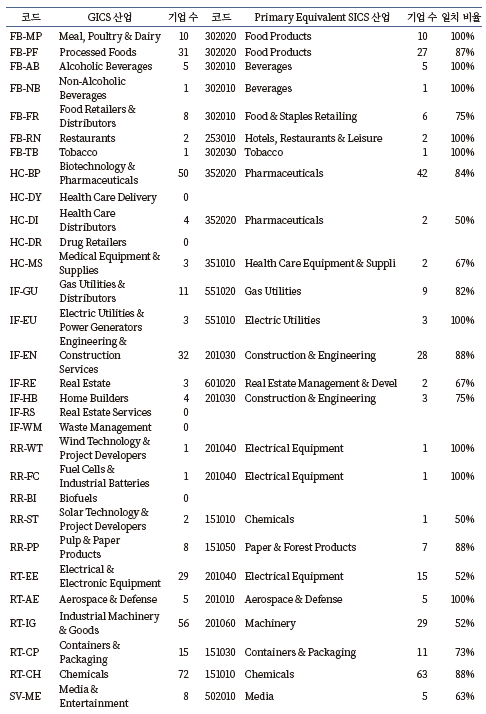

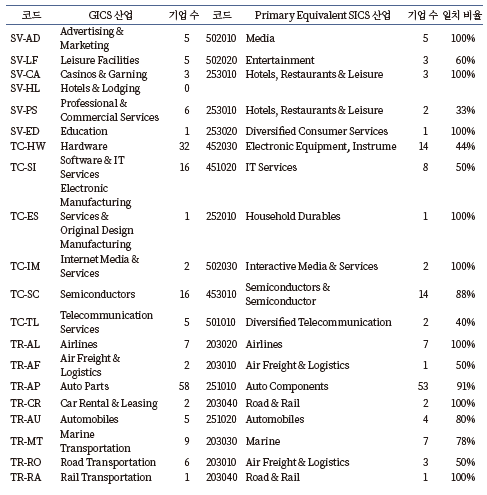

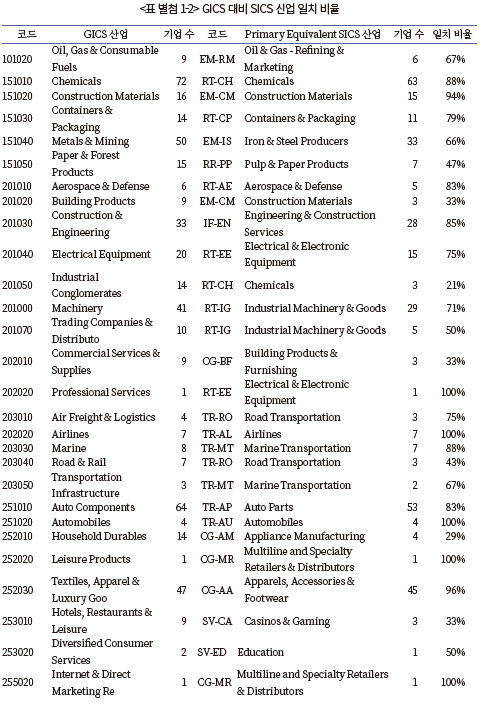

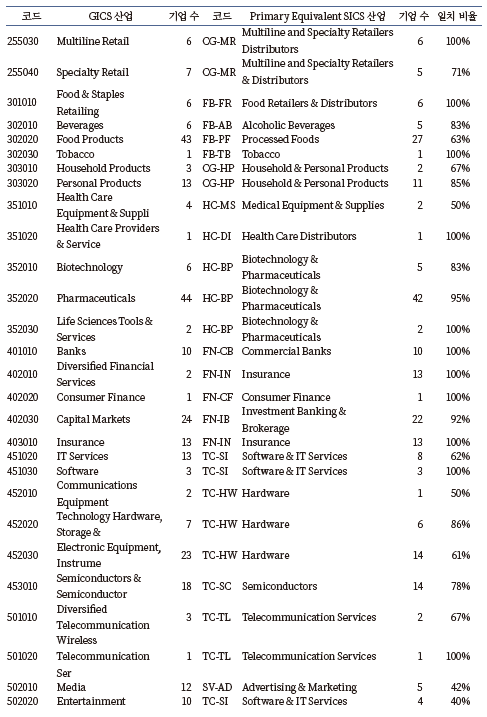

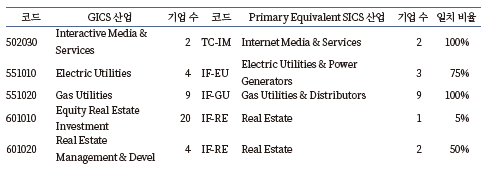

KOSPI 구성 종목 중 GICS 정보가 존재하는 813개 종목에 대해 SICS와 일치하는 정도를 산업 기준에서 살펴보면, SICS 정보가 존재하는 789개 종목에 대해 598개 종목이 일치하여 일치 비율은 74%로, GICS 종목 4종목 중 3종목은 SICS 분류와 같다고 할 수 있다. 반대의 경우에도 살펴보면, SICS 정보가 존재하는 789개 종목에 대해 76%인 600개 종목이 GICS 분류와 일치한다.23)

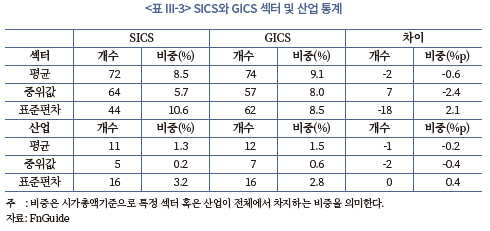

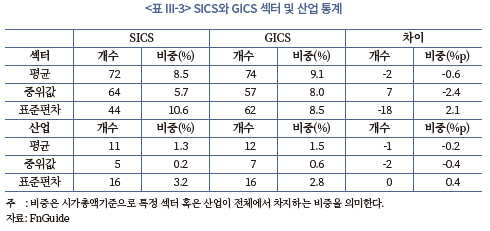

<표 III-3>은 KOSPI 데이터를 활용하여, SICS와 GICS 기준의 섹터와 산업 내 종목 수와 비중에 대한 통계량을 보여주고 있다. 각각 11개의 섹터에 대해 SICS가 GICS 대비 섹터와 산업 기준으로 종목의 평균 개수는 거의 동일함을 알 수 있다. 다만 섹터 기준으로는 SICS가 개수에 대한 낮은 변동성을 보여주고 있으며, 비중의 변동성은 약간 높게 나타나고 있다.

전반적으로 SICS 체계가 GICS 체계와 크게 벗어나지 않는 구조임을 알 수 있어서, GICS와의 연결고리를 통해 SICS 체계를 살펴보는 것이 유의미함을 알 수 있다.

나. SICS 체계의 유용성 분석

Bhojraj et al.(2003)은 미국 시장을 대상으로 당시로선 새로운 업종 분류 체계인 GICS를 기존 업종 분류 체계인 NAICS(North American Industry Classification System) 등과 비교 분석을 수행하였다. 비교의 주안점은 개별 분류에 따른 집합이 얼마나 내부적으로 동질적 성격을 공유하는가에 있다. 이를 개별 종목의 속성과 종목이 속한 섹터의 평균 속성이 얼마나 통계적 유사점을 공유하는가를 기준으로 살펴보았다.

해당 연구에 따르면 주가 움직임, PBR과 같은 상대 가치평가 지표, 수익성, 성장성 등의 속성을 기준으로 GICS 분류가 다른 분류 체계보다 동질적임을 증명하였다.

본 보고서에서 SICS와 GICS 간 비교를 동일한 속성과 방법론을 적용하여 분석하였다. KOSPI 상장 종목을 대상으로 2011년부터 2021년까지의 분기말 데이터를 사용하였다.

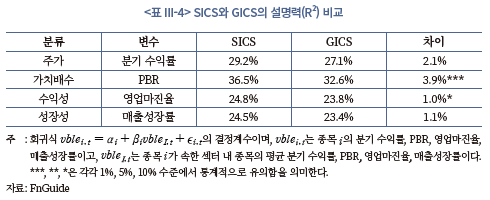

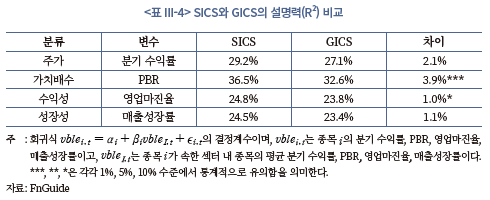

<표 III-4>에서는 SICS와 GICS 각각의 기준별로 분기 수익률, PBR, 영업마진율, 매출성장률 속성에 대해 개별 종목과 섹터 간 회귀식의 결정계수를 추정하였다. 이를 통해 SICS와 GICS 기준의 절대적인 설명력(R2) 수준을 비교한 결과, 모든 지표에서 SICS 모형의 R2가 더 높게 나타났다. 이는 SICS 분류에 따른 섹터 수준 평균값이 GICS 분류에 따른 평균값보다 개별 종목의 특성 변수들을 더 잘 설명함을 의미한다.24) Vuong(1989) 검정을 수행하여 R2 차이의 통계적 유의성을 살펴본 결과, 가치배수(PBR) 및 수익성(영업마진율) 측면에서 SICS 분류의 설명력이 유의하게 높은 것으로 나타났다(1% 및 5% 유의수준). 단, 주가(분기 수익률) 및 성장성(매출성장률) 측면에서는 차별적인 설명력을 보이진 않았다.

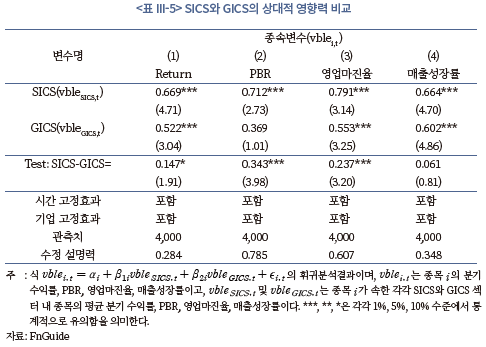

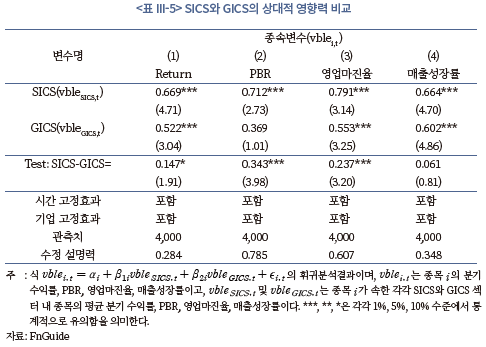

<표 III-5>에서는 SICS와 GICS 기준의 상대적인 영향력을 비교하기 위해 SICS 및 GISC 분류에 따른 섹터 수준 평균값을 모두 포함한 다중 회귀분석을 수행하였다. 시간(분기) 및 기업 고정 효과를 고려하여 개별 종목의 분기 수익률, PBR, 영업마진율, 매출성장률 속성에 영향을 미칠 수 있는 잠재 생략 변수 특성을 충분히 통제하였다. 그 결과, 모든 지표에서 SICS 변수의 계수 값이 GICS 변수의 계수값보다 크게 나타나, SICS 분류에 따른 섹터 수준 평균값이 GICS 분류에 따른 평균값보다 개별 종목 특성 변수의 변동과 더 큰 연관성을 보이는 것으로 나타났다. Chow 검정을 수행하여 계수값 차이의 통계적 유의성을 살펴본 결과, 성장성(매출성장률)을 제외한 모든 변수에서 SICS 분류의 영향력이 유의미하게 큰 것으로 확인된다(10% 또는 1% 유의수준).

지금까지 SICS가 분류 체계로서 갖는 타당성과 유용성을 국내 유가증권 시장 상장 종목을 대상으로 살펴보았다. 기존 분류 체계인 GICS와 산업별로 3/4 정도 종목 일치를 보이고 있고, 보유 종목 평균값도 거의 일치하고 있다. 제한적이나마 분류 체계로서의 유용성을 확인하였고, 섹터 내 속성의 동질성도 기존 체계 대비 낮지 않을 것으로 판단된다. 다만, 섹터별 특성으로 참값이 아닌 관측값을 이용하여 관련 회귀분석을 수행한 만큼 본 장의 분석 결과에 관측오차로 인한 영향이 포함됨을 충분히 감안한 해석이 필요하다.

3. SICS 구분에 의한 산업별 중요한 정보

SASB는 SICS 분류에 따른 77개의 산업별로 각각 지속가능성 회계 기준서(Sustainability Accounting Standards, 이하 SASB 기준서)를 마련하고 있다. SASB 기준서는 공시 주제(disclosure topics)와 이를 측정하는 지표와 단위(accounting metrics) 그리고 지표를 기술적 측면(적용 범위, 측정 단위, 계산 방법 등)에서 설명하는 기술 프로토콜(technical protocol) 그리고 활동 지표(activity metrics)로 이루어져 있다. 마지막의 활동 지표는 매출액이나 종업원 규모와 같이 기업의 크기를 나타내는 항목으로, 기업 상호 간 비교를 위해 표준화하는 데 활용할 수 있다.

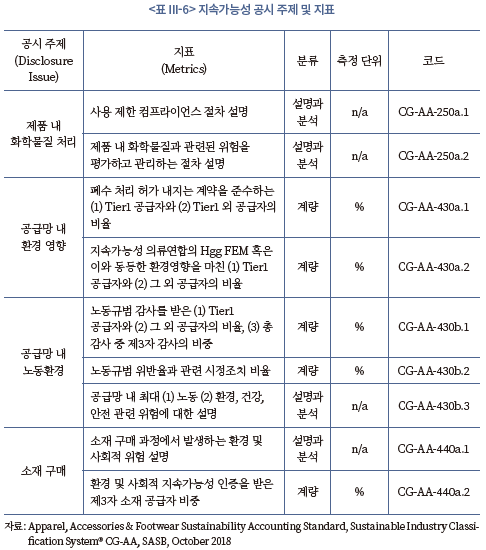

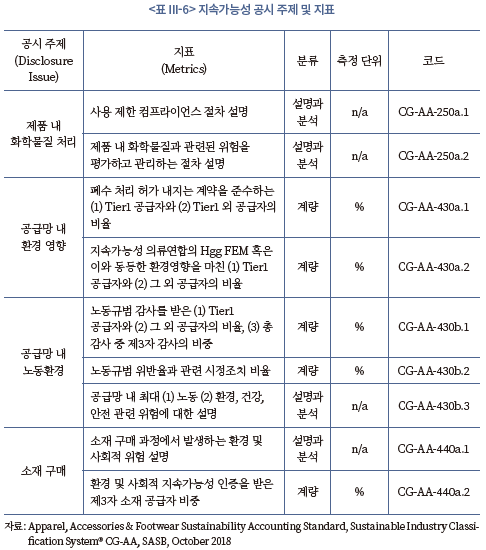

<표 III-6>은 소비재(Consumer Goods) 섹터 내 의류, 장신구 및 신발(Apparels, Accessories & Footwear) 산업의 공시 주제와 지표 설정 예시이다. 지표를 측정하는 단위에서 정량값이 아닌 절차나 제도, 규정의 존재 여부와 같은 정보는 단위가 없으므로 n/a로 표시되어 있다. 또한 모든 지표는 고유의 해당 코드로 식별되어 있다.

모든 공시 주제(Disclosure Issue)는 <표 III-1> 상의 해당 부문(Dimension)과 일반 이슈(General Issue)에 귀속되어 있다. <표 III-7>에서 예시로 의류, 장신구 및 신발, 하드웨어, 전기발전, 광고 마케팅 산업의 중요성 기준에 의한 연관 부문과 일반 이슈를 음영으로 표시하였다. 예를 들어 <표 III-6>의 「제품 내 화학물질 처리」 공시 주제는 「사회적 자본」부문의 일반 이슈인 「제품 품질과 안전」에 속해 있다.25)

SASB는 2013년 7월에서 2016년 3월에 걸쳐 SASB 기준서를 작성하였다. 해당 섹터에 속하는 기업, 회계법인, 법무법인, 시장 분석가, 금융기관, 시민단체, 공공부문 등의 전문가가 참여하여 섹터별로 순차적으로 예비 기준서(Provisional Standards)를 작성하였다. 예비 기준서는 공시 주제의 재무 중요성에 대한 실증 자료가 포함된 산업 연구서(Industry Research Briefs)가 첨부된다. 예비 기준서는 공개 초안 형태로 발표되어 전문가의 의견 수렴 후 확정되는 과정을 거쳤다.26)

종합적으로 살펴보면 SASB 기준은 5개 지속가능성 부문과 26개의 일반 이슈 그리고 SICS를 바탕으로 한 11개 섹터와 77개 산업별 하부 공시 주제와 해당 지표로 이루어진 체계를 갖고 있다.27)

SASB 기준은 방대한 공시 주제와 지표로 이루어져 있지만, 중요한 점은 동일 산업군에서 활동하는 기업은 평균적으로 6개의 공시 주제와 13개의 관련 지표를 공시하는 것으로 조사된다는 점이다.28) SASB 기준서에서 제시하는 모든 주제와 지표를 공시할 필요는 없고, 기업이 중요성 기준에서 자율적으로 판단하여 해당 정보를 공개하므로 이는 SASB 기준이 추구하는 정보의 비용 효율성을 일면 충족한다고 할 수 있다.

4. 국내 상장회사의 중요한 정보공개 현황

본 연구의 핵심 변수는 중요한 정보량(Material Disclosure, 이하 MD)이다.29) 산업별 및 개별 특성을 반영한 지속가능성 관련 중요한 정보량과 주가 정보성이 비례관계에 있는가를 규명하기 위해 MD를 측정하여야 한다. 국내 상장기업 중 SASB 산업분류에 기반하여 지속가능성 정보를 공개하기 시작한 기업은 많지 않다. 그러나 명시적인 SASB 기준 채택 여부와 상관없이 과거에 공개한 지속가능성 정보 중 얼마나 SASB의 산업 분류 체계에 따른 중요한 정보인지는 파악할 수 있다. 이를 위해 블룸버그의 ESG 정보공개 데이터를 활용하고, 세부적인 설명은 다음 절에서 소개한다.

가. 블룸버그 식별 중요한 정보

블룸버그는 전 세계 12,990개 이상의 상장사에 대하여 ESG 정보공개 점수(ESG Disclosure Score)를 연간 제공하고 있다. 2022년 5월 8일 기준으로 411개의 한국 상장사에 대하여 ESG 정보공개 데이터를 산정하고 있다.

ESG 정보공개 점수는 블룸버그가 고유의 환경, 사회, 지배구조 관련 주제, 지표와 측정 단위를 설정하여 기업이 해당 정보를 얼마나 공개하는지를 바탕으로 산정한다. 정보공개 점수는 해당 기업의 정보공개 양을 측정하는 것일 뿐, ESG 성과를 나타내는 것은 아니다.30)

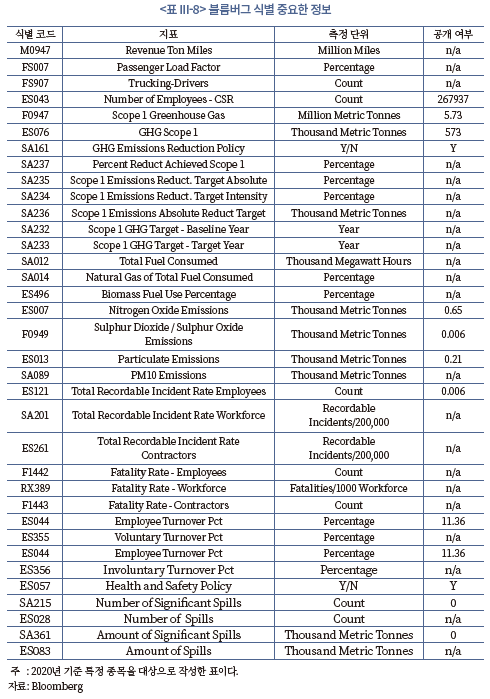

블룸버그는 SASB 기준에 따른 중요한 정보의 사용자가 늘어남에 따라, 블룸버그가 보유하고 있는 지속가능성 지표 중에 SASB 지표와 같거나 유사한 지표를 식별하여 제공하고 있다. <표 III-6>의 개별 지표 식별 코드와 블룸버그 지속가능성 지표 고유 식별 코드(BBG Field ID)를 대응(mapping)한 파일을 마련하고 있다.31)

나. 중요한 정보량

국내 상장사의 MD를 측정하기 위한 첫 번째 단계는 개별 종목의 SICS 분류에 따른 귀속 산업을 확인한 후 해당 산업의 SASB 기준서에 명시된 지표를 확인하는 것이다. SASB는 2021년 말 기준으로 3,398개의 한국 상장 및 비상장 기업을 SICS 기준으로 산업분류를 하고 있다. 이 중 일차적으로 블룸버그가 ESG 정보공개 데이터를 산정하는 상장사를 모집단으로 하여 중요한 정보량을 산출하여 보았다.32)

MD는 전체 중요한 정보 항목 중 정보공개가 된 항목의 비율로 산출한다. 이를 블룸버그의 식별 코드로 인지하므로, 블룸버그 함수를 사용하여 정보 유무를 확인하는 과정을 거친다.

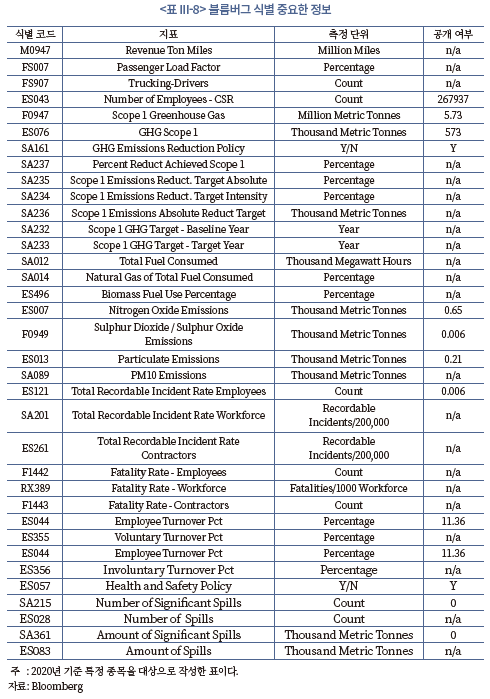

<표 III-8>은 특정 종목에 대하여 블룸버그가 중요한 정보로 인식하는 지표와 해당 측정 단위를 보여주고 있다. 그중 공개 여부 열은 식별 코드를 입력 변수로 한 블룸버그 함수값이고 대응하는 값이 없는 경우 n/a로 처리된다. 총 35개의 중요성 항목이 있고, 그중 정보 공개된 항목은 13개이므로 MD는 37%로 계산된다.

앞서 밝혔듯이 블룸버그는 개별 상장사의 ESG 정보공개 점수를 산정한다. 이는 기업이 자발적 혹은 의무적으로 공개하는 모든 지속가능성 관련 정보량에 해당한다. 반면에 MD는 기업가치와 연관성이 있다고 판단되는 중요한 정보량이다. 특정 기업이 공개하는 정보량은 많으나 중요한 정보량이 적으면, 내용 대부분은 정보가치가 없는 선언적 상용구(bolierplate)일 가능성이 크다.

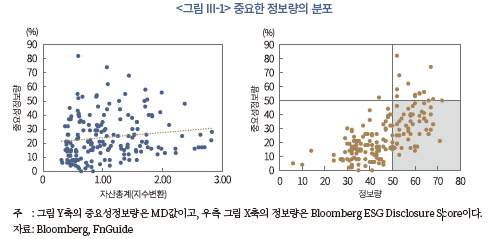

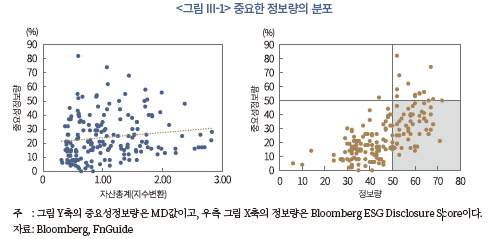

<그림 III-1>에서는 국내 자산총계 2조원 이상 상장회사를 대상으로 조사한 정보량과 MD와의 관계를 보여준다.33) 통상적으로 ESG 정보량은 기업의 규모와 비례한다고 알려졌지만, 좌측 그림에서 알 수 있듯이 중요한 정보량은 기업규모와 의미 있게 비례하지 않음을 알 수 있다. 우측 그림에서 정보량이 50%를 넘는 기업 중 중요한 정보량도 50%를 넘는 수는 그리하지 않은 경우보다 적다. 또한 정보량의 평균값은 46%인데 반해서 중요한 정보량은 절반 정도인 24%이다. 따라서 정보량과 중요한 정보량은 어느 정도 비례하나, 정보량이 많다고 해서 반드시 중요한 정보량도 많은 것은 아님을 알 수 있다.

IV. 중요한 정보공개와 주가 정보성 관계 실증분석

1. 분석 배경

ESG 활동과 기업의 지속가능성에 대한 투자자의 관심도는 꾸준히 증가하고 있다. 2010년대 말 BlackRock, Vanguard를 비롯한 국제 대규모 자산운용사들이 투자의사결정에 ESG 요소를 적극적으로 반영하는 등, 계속기업(going concern)으로서의 지속가능성을 평가하는 데 ESG 성과를 고려하는 이해관계자가 늘어난 것이다(Welch & Yoon, 2022).

이에 기업의 지속가능성 요소에 대한 충실한 정보공개를 강조하는 한편, 지속가능성 관련 정보 자체의 유용성에 대한 의문도 함께 제기되고 있다. 자발적 공시 체제하에서 ESG 성과의 공시는 이해관계자들에게 긍정적인 신호 효과(signaling effect)를 전달하는 경로로 기능하여 정보적 유용성이 있다는 견해와 함께(Christensen et al., 2022; 이인형‧이상호, 2021), 구체적 의무와 검증이 부재한 상황에서 ESG 성과의 공시는 표면적인 선언 수단(boilerplate)에 그칠 소지가 다분하여 정보적 유용성이 제한적이라는 견해(Basu et al., 2022; Raghunandan & Rajgopal, 2022)가 공존한다.

이처럼 지속가능성 관련 정보의 유용성에 대해 학계의 문헌들이 일치되지 않은 견해를 보이는 가운데 유럽연합의 집행위원회는 비재무정보보고지침(Non-Financial Reporting Directive), 기업지속가능성보고지침(Corporate Sustainability Reporting Directive) 등 의무공시의 범위와 수준을 강화하는 방향으로 정책적 대응 방안을 모색해 왔다. 반면, 미국의 증권거래위원회(SEC)는 기업가치에 유의적인 영향을 미치는 지속가능성 요소를 명확히 파악하기 어렵다고 판단하여 공시 의무화에 다소 신중한 입장을 견지해 왔다(이인형‧이상호, 2021).

이러한 상황에서 SASB는 개별 기업의 전사적 가치에 중요한 영향을 미치는 지속가능성 주제를 더욱 구체적으로 식별하고자 노력해 왔다. 특히, 기업가치에 중요한 영향을 미치는 정도(즉, 중요성)는 핵심사업의 특성에 큰 영향을 받는다고 보고 개별 기업이 속한 산업적 맥락에서 중요한 지속가능성 주제를 선별하고자 했다. 이에 산업기반(industry-specific) 지표를 구현하여 동일 산업 내 유사(peer) 기업 수준에서 비교가능한 정보를 제공하는 기준체계를 마련하였다. 이를테면, 철강 업종 내 POSCO와 현대제철 간, 반도체 업종 내 삼성전자와 SK하이닉스 간 온실가스 배출 저감 성과 혹은 유해 물질 관리 성과 등을 객관적으로 비교할 수 있는 정보를 제공하고자 하였다.

최근 미국 자본시장을 대상으로는 위와 같은 SASB 기준이 기업 고유의 지속가능성 주제를 표현하는 데 효과적임을 입증하는 시도들이 있었으나(Grewal et al., 2021; Serafeim & Yoon, 2022), 국내 자본시장을 대상으로 한 연구는 찾아보기 어렵다. 장기적인 기업가치와 관련성이 낮은 공시내용은 정보적 유용성이 떨어지는 상용구에 해당할 가능성이 크나(Amel-Zadeh & Serafeim, 2018), 재무적으로 중요한 지속가능성 주제의 공시내용은 핵심 이해관계자의 의사결정에 유용한 정보일 개연성이 높다(Grewal et al., 2021).

이에 본 장에서는 국내 기업을 대상으로 중요성 기준의 정보적 유용성을 검증하고자 한다. 또한, 해당 검증 결과가 지속가능성 관련 정보의 수요 특성에 따라 차별적으로 나타나는지를 살펴본다. 본 장의 이러한 분석은 주가 정보성 측면에서 중요성 기준의 유용성을 검증하는 국내의 첫 실증결과로 주목할만하다. 특히, 국제적으로 통용될 가능성이 높은 ISSB의 공시기준이 지속가능성 관련 위험 및 기회 요인의 식별에 SASB 기준을 원용하는 점을 고려하면(IFRS S1[초안] 문단 51), 향후 ISSB 기준을 적용했을 때 국내 기업에의 영향을 사전적으로 검토해보는 시사점을 기대할 수 있다. 또한, 국내 지속가능경영보고서의 단계적 의무화 일정을 고려하면, 정보환경이 차별적인 상황에서의 기업 영향을 예비적으로 검토하는 점에서 정책적 함의를 제공한다.

본 절의 분석 배경에 이어 제2절에서는 주가 정보성의 측정 방법론을 설명하고, 제3절에서 실증분석 결과를 제시한다. 마지막으로 분석 결과의 시사점을 요약한다.

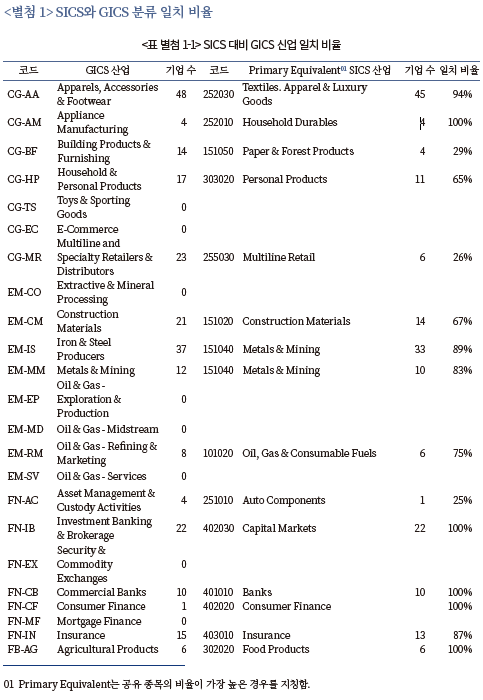

2. 주가 정보성

기업의 사적 정보가 주가에 더 많이 반영될수록 전체 주식시장에 대한 개별 기업의 주가 동조화(synchronicity) 현상이 줄어들어 시장모형의 설명력(R2)이 낮게 나타나는 결과는 기업의 정보환경 및 지배구조 특성 측면에서 익히 잘 알려진 사실이다(Piotroski & Roulstone, 2004; Ferreira et al., 2011; Crawford et al., 2012; 고봉찬‧김류미, 2012). 관련 연구에서는 시장 및 산업의 공통 요인으로 설명되지 않는 기업 고유의 주가 정보성(price informativeness)을 대리(proxy)하기 위해 시장모형의 R2를 활용했다. R2는 개별 기업의 주가수익률이 시장 및 산업 지수 전반의 변동으로 얼마나 잘 설명되는지를 측정하는 지표로 R2가 클수록 체계적 위험 정보가 주가에 더 많이 내재함을 나타낸다. 반대로 R2가 작을수록 비체계적 위험 정보, 즉, 기업의 사적 정보가 주가의 정보성을 더 잘 나타낸다고 볼 수 있다.

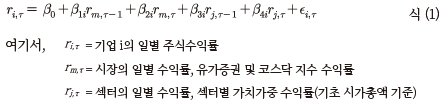

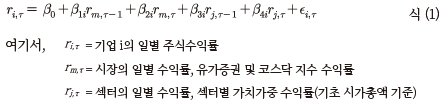

본 연구에서는 선행연구(Hutton et al., 2009; Crawford et al., 2012; Li et al., 2014; Grewal et al., 2021 등)의 방법론을 준용하여 기업 고유의 가격 정보성을 측정하였다. 우선, 식 (1)과 같이 개별 기업의 일별 주가수익률에서 시장 및 섹터34) 전반의 수익률을 통제한 모형을 토대로 기업-연도별 회귀분석을 수행하여 개별 주가수익률에 대한 시장‧섹터 수익률의 R2를 측정하였다.35)

임의의 t 연도에 대한 기업-연도별 회귀분석 시 지속가능경영보고서가 이듬해 8월부터 10월 사이에 공시되는 점을 고려하여 회귀분석 구간은 t 연도 11월 초부터 t+1 연도 10월 말로 설정하였다.36) 극단값에 의한 편의 가능성을 고려하여 일별 주식수익률은 연도별 상‧하위 1% 수준에서 윈저화(winsorizaion)하였으며, 연도별 관측치가 50거래일 미만이거나 월별 관측치가 12거래일 미만일 경우 측정 대상에서 제외하였다(Crawford et al., 2012; Li et al., 2014).

최종적으로 기업-연도별 주가 동조화 측정치(SYNC)는 식 (1)에서 산출한 R2를 토대로 기업 고유의 사적 정보로 인한 변동(1-R2) 대비 공통 정보로 인한 변동(R2) 비율을 로그 변환하여 식 (2)와 같이 산출하였다. SYNC가 큰 값을 가질수록 개별 기업의 주식수익률이 시장 및 산업 수익률에 동조화되어 공통 정보에 많은 영향을 받고 있음을 의미하며, 반대로, 기업의 사적 정보가 공통 정보 대비 추가적인 정보력을 가질수록 주가의 동조화 현상은 줄어들어 SYNC는 작은 값을 가진다.

위와 같이 산출한 주가 동조화 측정치는 시장 및 산업의 공통 요인과 무관한 기업 고유의 정보성과 음(-)의 관련성을 갖는다는 점에서 본 장의 분석 목적에 잘 부합한다. 정보적 유용성의 검증 대상에 해당하는 SASB의 중요성 기준은 동일 섹터 내 유사 기업 수준에서 기업 고유의 비교가능한 정보를 산출하고자 의도한 기준이므로, 중요한 정보량이 증가하면 시장 및 섹터 수익률과의 동조화 현상이 줄어들 것임을 예상할 수 있다.

3. 중요한 정보공개의 정보적 유용성 검증

가. 표본의 구성 및 기초통계량

본 연구의 표본은 2010년부터 2020년까지 유가증권 및 코스닥시장에 상장된 기업 중 아래 기준을 충족하는 2,932 기업-연 관측치를 대상으로 구성한다.37)

(1) 비금융업을 영위하는 기업

(2) 재무제표의 결산일이 12월 말인 기업

(3) 중요한 정보량(MD)의 산출이 가능한 기업

(4) 주가 정보성(SYNC)의 측정이 가능한 기업

(5) 기타 통제변수의 구성이 가능한 기업

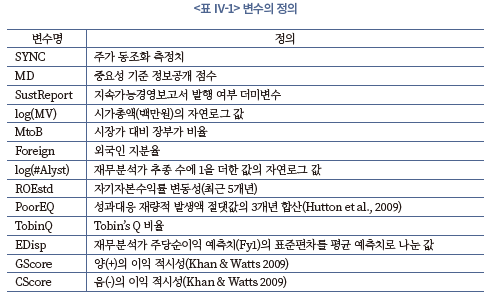

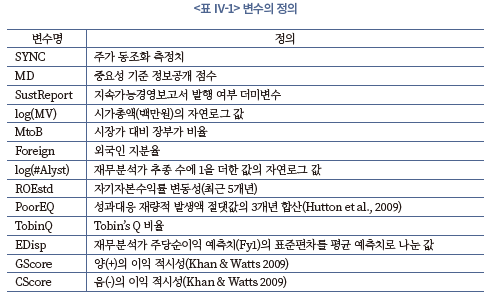

분석 대상 기간은 주요 관심 변수인 중요한 정보량(MD) 자료를 블룸버그로부터 입수한 2010년부터 2020년까지로 설정하였다. 해당 기간에 유가증권 및 코스닥시장 상장 비금융업종 중 12월말 결산법인에 해당하는 19,509 기업-연도 중 MD 자료의 입수가 가능한 관측치는 3,129 기업-연도이며, 이 중 종속변수로 활용할 주가 동조화 변수(SYNC) 및 주요 통제변수의 측정이 불가능한 기업-연도를 제외한 최종 분석 대상 표본은 2,932 기업-연도이다. 기업의 재무제표 자료 및 주가 자료는 FnGuide에서 추출하였으며, 극단치로 인한 편의 가능성을 완화하고자 모든 연속형 변수는 상‧하위 1% 수준에서 윈저화(winsorization)하였다. 변수의 구체적 정의는 아래 표 <Ⅳ-1>와 같다.

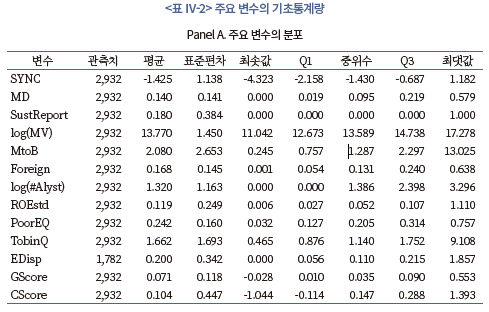

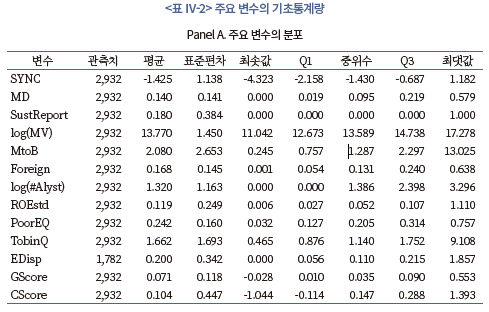

중요한 정보공개와 가격 유용성 간의 관계를 검증하기 위한 2,932 기업-연도의 기초통계량은 <표 Ⅳ-2>에서 제시한다. Panel A를 살펴보면, 주가 동조화 측정치(SYNC)의 평균(중위수)은 –1.425(-1.430)로 나타난다.38) 시가총액의 자연로그값(log(MV)) 평균은 13.77로 평균 시가총액 규모는 9,555억원에 해당한다. 중위수의 평균 시가총액 규모는 7,975억원이며, 하위 25%(상위 25%)의 경우 3,191억원(2조 5,151억원)으로 나타나, MD 자료의 입수가 가능한 표본이 대체로 대규모 기업에 편중되고 소규모 기업 비중은 낮은 것으로 확인된다.39) 외국인 지분율(Foreign)의 중위수 역시 13.1%로 비교적 높게 나타났다.40) 또한, 시장가 대비 장부가 비율(MtoB) 평균도 2.08로 매우 높은 수준을 보여, 전반적으로 분석 대상 표본의 특성이 전체 비금융업종의 특성과는 상당히 이질적일 것으로 예상된다.

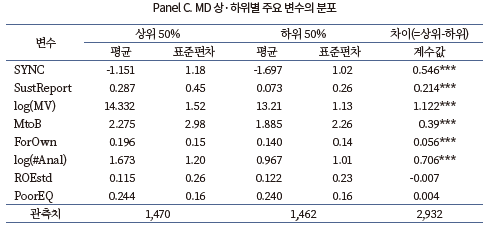

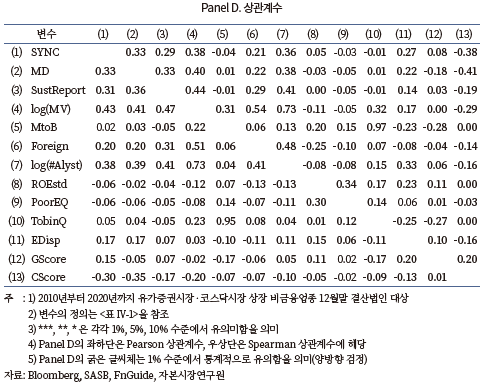

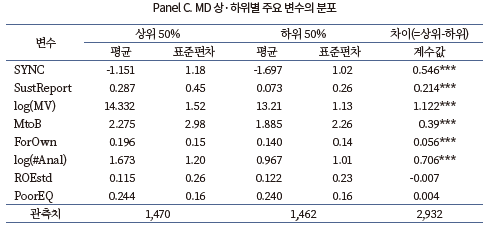

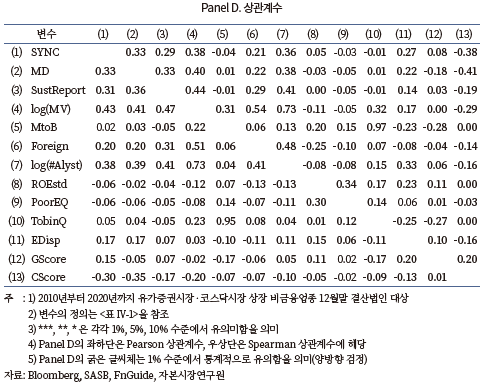

Panel B와 Panel C에서 각각 주가 동조화(SYNC), 중요한 정보량(MD) 변수의 구간별로 기초통계량을 확인한 결과, SYNC가 상위 50%에 해당할 경우 MD의 평균은 0.168로 SYNC가 하위 50%에 해당하는 경우의 MD 평균 대비 0.056만큼 유의하게 큰 값을 가지는 것으로 나타났다(1% 유의수준). MD가 상위 50%에 해당하는 경우에 SYNC의 평균은 –1.151로 MD가 하위 50%에 해당하는 경우의 SYNC 평균 대비 0.546만큼 유의하게 큰 값을 가지는 것으로 확인된다(1% 유의수준). 또한, Panel D에서 주요 변수의 상관관계를 보면, 중요한 정보량(MD)과 주가 동조화(SYNC) 변수 간 Pearson 상관계수는 0.33으로 1% 유의수준에서 유의한 양(+)의 관련성을 보인다. 이러한 기초통계량은 일견 중요성 기준에 입각한 지속가능성 정보의 공시가 시장 및 산업 전반의 공통 정보 대비 고유 정보성이 없을 가능성을 의미할 수도 있으나, MD 자료의 입수가 가능한 표본의 특수성을 감안하면 일변량 관계에서 통제할 수 없는 기업 특성 요인에 의해 가성적으로 나타난 상관관계(spurious correlation)일 가능성을 시사한다. 특히, 기업규모(log(MV))와 주가 동조화(SYNC) 변수 간 Pearson 상관계수가 0.43으로 1% 유의수준에서 유의적인 양(+)의 관련성을 보여, 시장 지수 및 섹터 수익률에 영향이 큰 대규모 기업 수익률이 내생적으로 주가 동조화(SYNC) 수준을 결정하고 있음이 확인된다. 전반적으로 기업 특성과 관련한 생략 변수 문제를 충분히 통제한 분석이 필요해 보인다.

나. 중요한 정보량과 주가 정보성 간 회귀분석 결과

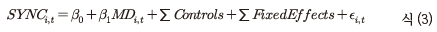

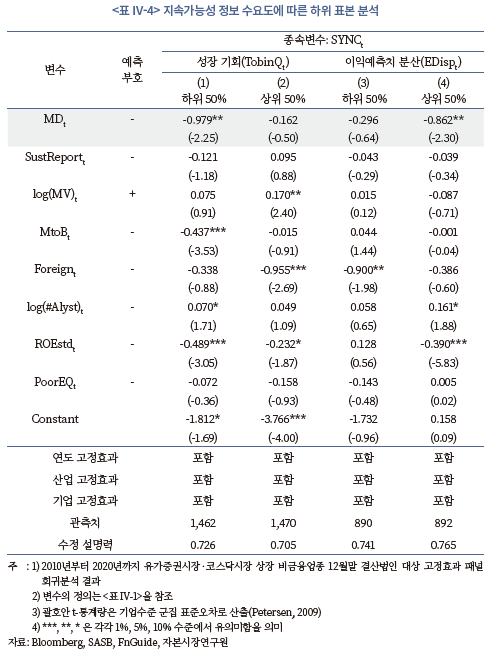

SASB의 중요성 기준에 따른 지속가능성 정보가 주가 정보성 측면에서 기업 고유의 정보력이 있는지를 검증하기 위해 아래 식(3)의 모형을 이용하여 회귀분석을 수행하였다.

종속변수는 주가 동조화(SYNC) 변수이고, 관심변수는 중요한 정보량(MD)에 해당한다. 통제변수로는 지속가능성 정보의 전달 경로에 따른 차별적 효과를 통제하기 위해 지속가능경영보고서의 공시 여부(SustReport)를 고려하였으며, 주가 동조화 현상의 주요 결정 요인에 해당하는 기업규모(log(MV)) 및 성장성(MtoB) 요인을 통제하였다(Piotroski & Roulstone, 2004; Grewal et al., 2021). 전문 투자자(sophisticated investor)의 정보 특성에 대한 대용치로 외국인 지분율(Foreign) 및 재무분석가 추종 수(log(#Alyst))를 고려하였으며, 사업구조 상 정보 예측의 복잡성을 통제하고자 자기자본이익률의 변동성(ROEstd) 변수를, 경영진 특유의 기회주의적 공시 특성을 통제하고자 회계불투명성(PoorEQ) 변수를 추가로 통제하였다(Jin & Myers, 2006; Hutton et al., 2009). 고정효과로는 연도‧섹터 더미 변수를 통제하였으며, 앞선 주요 변수의 분포에서 확인하였듯(<표 Ⅳ-2> 참조), 시장‧섹터 수익률에 영향력이 큰 대규모 기업이 내생적으로 주가 동조화 수준을 결정하는 문제를 비롯해 관측이 어려운 기업 이질성이 설명변수와 연관될 가능성을 고려하여 기업 고정효과 모형을 적용한 패널 회귀분석을 수행하였다.41)

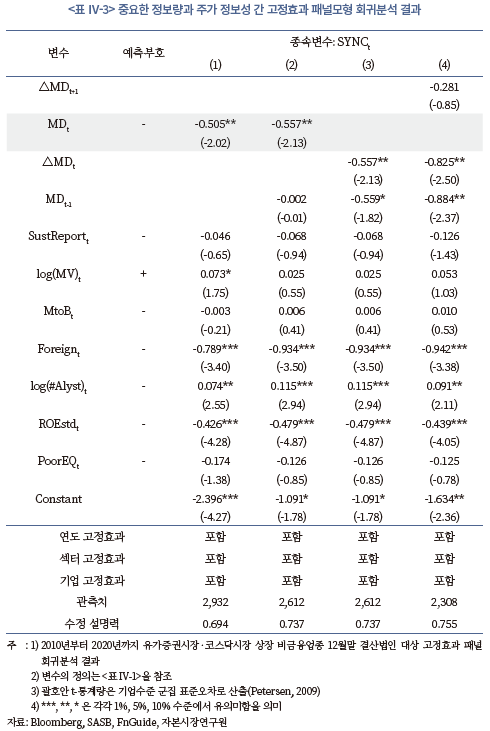

<표 Ⅳ-3>에서 중요한 정보량과 주가 정보성 간 고정효과 패널 회귀분석 결과를 제시한다. 열 (1)은 식 (3)의 회귀분석을 수행한 기본 결과에 해당하며, MD의 계수값이 유의한 음(-)으로 나타나(5% 유의수준) 중요성 기준에 입각한 개별 기업의 지속가능성 정보가 기업 고유의 가격 변동을 설명하는데 유의미한 정보력이 있음이 확인된다. 이익 변동성(ROEstd), 회계불투명성(PoorEQ) 등 대부분의 통제변수 역시 이론적 부호와 일관되게 나타나 정보 예측의 복잡성 및 경영진의 공시 특성 등 기업의 정보환경과 관련한 다양한 영향요인이 잘 통제된 것으로 판단된다(1% 또는 10% 유의수준). 외국인 지분율(Foreign) 역시 예상대로 유의미한 음(-)의 관련성이 나타났다(1% 유의수준). 단, 재무분석가 추종 수(log(#Alyst))는 예측부호와 반대로 유의미한 양(+)의 관련성을 보인다(5% 유의수준). 외국인의 투자는 고유 정보력에 기반하나, 재무분석가의 추종은 시장 혹은 산업 전반의 정보와 깊게 연관된 것으로 해석할 수 있다. 이러한 결과는 시장의 관심도가 증가하는 기업을 집중적으로 추종하는 재무분석가의 군집행동 특성(herding behavior)으로 인해 나타났을 가능성을 시사한다(안윤영 외, 2006).

열 (2), (3), (4)는 공시정보의 수준(level)과 변화량(change)을 시차에 따라 구분하여 고정효과 패널 회귀분석을 수행한 강건성 검증 결과를 제시한다. 이익 정보의 가치관련성을 검증한 선행연구는 정보의 영구적 속성과 일시적 속성을 구분하여 평균 수준이 내포하는 정보적 유용성과 비기대 상황에서의 변화분이 내포하는 정보적 유용성이 차별적임을 실증한 바 있다(Easton & Harris, 1991). 과거 및 당기 수준 변수(MDt-1 및 MDt)를 동시에 포함한 열 (2)의 분석 결과를 살펴보면, 당기 수준 변수만 유의미한 음(-)의 계수값을 보이나(5% 유의수준), 당기 증분 변수(△MDt)를 포함한 열 (3)에서는 과거 수준 변수(MDt-1)도 동시에 유의미한 음(-)의 계수값을 보인다(10% 유의수준). 이는 재무적으로 중요한 정보의 과거 평균적인 공시량과 당기에 새롭게 공시를 확대한 정보 모두 기업 고유의 가격 변동을 설명하는데 유용성이 있을 가능성을 내포한다. 한편, 열 (4)에서 차기 증분 변수(△MDt+1)는 주가의 정보성을 유의적으로 설명하지 못하는 것으로 나타났다. 즉, 사업장의 사고나, 환경 제재, 지배구조 상의 문제점 등 과거 사건이 공론화 되어 주가가 반응한 이후 관련 공시를 확대함에 따라 사후적으로 가격 유용성이 관측되고 있을 가능성은 크지 않을 것으로 판단된다.

이상의 결과는 국내 자본시장에서 지속가능성 관련 정보의 공개가 투자의사결정에 어떻게 반영되는지 통찰할 수 있는 계기가 된다는 점에서 의미가 깊다. 특히, MD의 계수값과 달리 SustReport의 계수값이 모두 유의하지 않은 음(-)으로 나타난 점은 총체적인 ESG 활동 성과를 보고하는 지속가능경영보고서의 경우 그 정보적 유용성이 제한적일 수 있음을 시사함과 동시에 재무적으로 중요한 정보공개의 유용성을 강조한다.

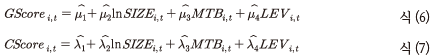

다. 정보 수요 특성을 고려한 추가분석 결과

전술한 결과에 따르면 기업의 핵심 이해관계자에 해당하는 투자자들은 재무적으로 중요한 지속가능성 정보를 기업 고유의 가격 정보로서 기업가치에 반영한다. 만약, 자본시장 참여자들이 지속가능성 정보를 투자의사결정에 반영하는 과정이 체계적이라면 중요성 정보의 가격 유용성은 지속가능성 정보의 수요도가 높은 기업 집단에서 유의미하게 나타날 개연성이 높다. 특히, 합리적인 투자자일수록 이익 정보의 불확실성 정도에 반응하여 투자 비중을 체계적으로 조정한다는 이론 및 실증 문헌에 비추어 보면(Brav & Heaton, 2002; Francis et al., 2007), 사업 구조적으로 이익 정보가 불확실하거나, 경영진이 공격적으로 이익을 인식하여 그 지속성에 대한 불확실성이 큰 경우 MD 정보에 대한 수요도가 높게 나타날 것으로 예상할 수 있다.

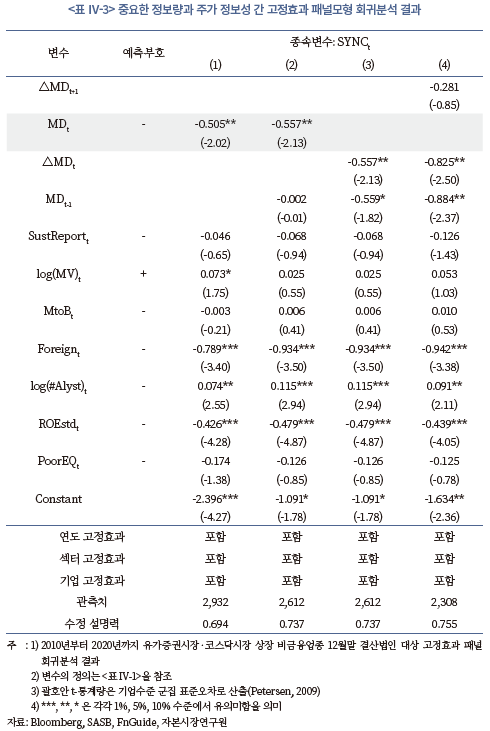

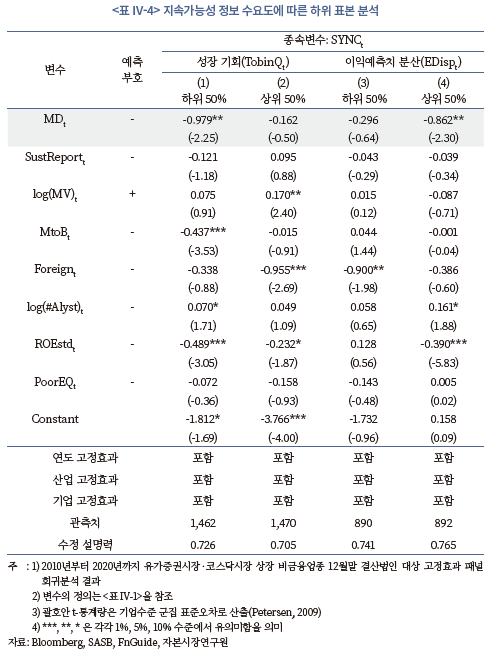

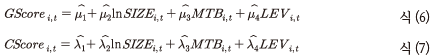

우선, 사업 구조적으로 이익 정보가 불확실한 상황이 MD의 정보성에 미치는 영향을 <표 Ⅳ-4>에서 분석하였다. 투자자들이 성장 기회(TobinQ)를 낮게 평가하는 기업일수록 사업의 지속가능성에 대한 불확실성을 해소할 필요성이 크고 따라서 지속가능성 관련 정보의 수요도가 높을 것으로 예상할 수 있다. 아울러, 이익 예측치 분산(EDisp)이 커 미래 이익 전망에 대한 의견불일치가 큰 기업 역시 정보의 불확실성 해소를 위한 지속가능성 관련 정보의 수요도가 높을 것으로 예상된다. 고정효과 패널 회귀분석 결과, 성장 기회(TobinQ)가 하위 50%에 해당하는 열 (1), 이익 예측치에 대한 분산(EDisp)이 상위 50%에 해당하는 열 (4)에서만 MD의 정보성이 유의미한 것으로 나타나(5% 유의수준), 사업 구조적으로 지속가능성 정보에 대한 수요도가 높은 기업 집단에서 MD 정보의 유용성이 극대화되고 있음이 확인된다.

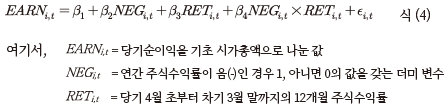

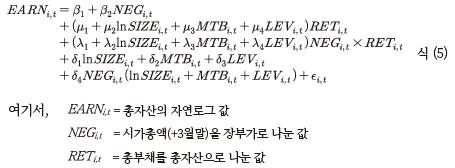

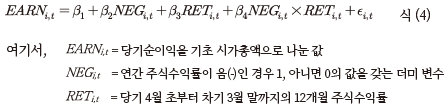

마지막으로, 경영진의 비대칭적 이익‧손실의 인식 양상이 MD의 정보성에 미치는 영향을 분석하였다. 분석에 앞서 Khan & Watts(2009)의 기업-연도별 이익 적시성 추정 모형을 활용하여 양(+)의 이익 적시성(GScore)과 음(-)의 이익(즉, 손실) 적시성(CScore)을 측정하였다. 조건부 보수주의의 측정 모형을 고안한 Basu(1997)는 주식수익률을 경제적 이익의 대용치로 간주하고 식 (4)와 같이 손익계산서상 경제적 이익에 대한 적시 인식 정도를 β3, 경제적 손실에 대한 증분적인 적시 인식 정도를 β4로 추정한 바 있다.

Khan & Watts(2009)는 경영진의 비대칭적 이익‧손실 인식 행태를 유발하는 기업 고유의 투자 기회 집합 특성으로 정보환경, 성장성, 대리인 문제 등을 제시하였으며, 이에 대한 대용치로 기업규모의 자연로그값(lnSIZE), 시장가 대비 장부가치 비율(MTB), 총부채비율(LEV) 등을 식 (4) Basu(1997) 모형의 경제적 이익 계수(β3)와 손실 계수(β4)에 선형조합으로 결합하여 아래 식 (5)를 도출하였다.

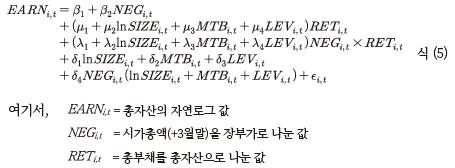

최종적으로 식 (5)의 연도별 회귀분석을 수행하여 기업 고유의 투자 기회 집합 특성에 대한 각 계수값을 추정한 후 기업-연도별로 경제적 이익 및 손실에 대한 적시성을 포착하는 GScore 및 CScore를 식 (6) 및 식 (7)과 같이 산출하였다.

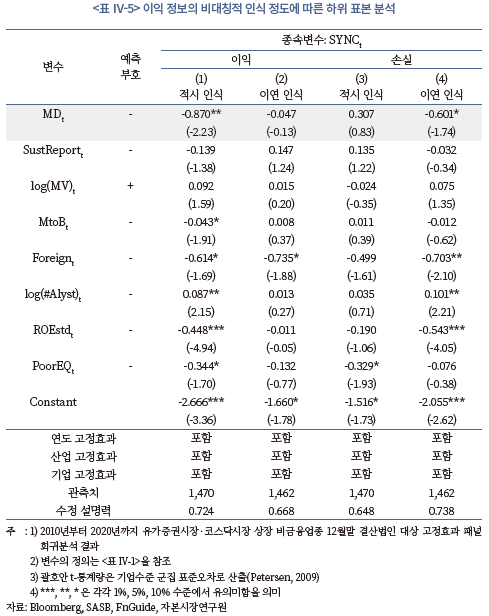

<표 Ⅳ-5>에서 기업 고정효과 모형을 적용한 패널 회귀분석을 수행한 결과, 호재에 해당하는 이익을 적시에 인식하는 열 (1)과 악재에 해당하는 손실을 이연하여 인식하는 열 (4)에서만 MD의 계수값이 유의하게 음(-)으로 나타났다(5% 유의수준). 이는 이익은 적시에, 손실은 이연하여 인식하는 공격적 회계처리 성향이 강한 경우에 MD의 정보성이 유의미하며, 보수적 회계처리 경향이 강한 경우에는 MD의 정보성이 제한적임을 시사한다. 공격적 회계처리에 기반한 발생주의 이익은 차기 혹은 차차기에 반전(reversal)될 가능성이 큼을 고려하면(Chan et al., 2004), 공격적 회계처리 성향이 강한 집단에서 지속가능성 정보의 유용성이 유의미하게 나타난 결과는 자본시장 참여자들이 이익의 장기 지속성 판단을 위한 정보 수요도가 높은 상황에서 재무적으로 중요한 지속가능성 정보를 더 유용하게 활용할 가능성을 시사한다.

V. 결론

이인형‧이상호(2021)에서 투자자는 기업의 지속가능성 관련 활동이 궁극적으로 기업가치에 미치는 영향에 관심이 있으므로 재무적 중요성 관점에서 정보공개의 필요성을 주장했다. 지속가능성 대응력이 높은 기업이 정보공개를 통하여 자본시장에서 정당한 평가를 받을 수 있다면, 정보공개에 대한 유인체계가 형성되어 효율적인 자원배분이 가능해진다.

본 보고서는 이러한 관점을 배경으로 지속가능성 정보 중 기업가치와 연관성이 있다고 판단되는 중요한 정보의 공개가 주가 정보성과 관련이 있는지 국내 상장사를 대상으로 살펴보았다. 현재 논의되고 있는 IFRS 지속가능성 공시기준이 중요성 측면을 강조하기 때문에, 공시기준의 근간이 되는 SASB의 공시 체계를 바탕으로 중요한 정보의 공개량을 측정하였다.

IFRS 지속가능성 공시기준은 기업이 속한 산업의 지속가능성 지표 중 관련성이 있다고 판단되는 지표를 공시하도록 하고 있다. 이를 기준으로 공개된 정보는 기업 고유 속성을 반영하는 중요한 정보이기 때문에 시장에서 형성되는 주가의 정보성을 높일 수 있다. 이를 검증하기 위해 블룸버그가 제공하고 있는 ESG 정보공개 데이터 중 SASB 기준의 중요성이 있는 정보공개 비중 MD를 관심변수로 설정하였다.

시장과 섹터의 영향력을 제외한 기업 고유의 정보가 반영된 주가 변동분인 주가 정보성을 종속변수로 하여 MD의 설명력을 검증하였다. 주가 정보성을 설명하는 기존 문헌을 참조하여, 중요한 정보의 전달 경로에 따른 차별적 효과를 통제하기 위해 기업규모, 성장성, 전문 투자자, 사업구조, 회계정보와 관련된 변수를 통제변수로 설정하였다. 동시에 시간 불변의 기업 특성 요인과 관련된 생략 변수 문제를 통제하기 위해 연도 고정효과와 함께 기업 고정효과를 고려하였다.

본문의 분석 결과는 재무적으로 중요한 지속가능성 정보가 우리 자본시장의 가격발견기능을 도모함을 일관되게 보여준 연구로서 의미가 있다. 특히, ESG 활동과 관련한 모든 정보가 가격 정보에 반영되는 것은 아니며, 재무적으로 중요한 정보만이 주가에 체계적으로 반영됨을 밝힌 점에서 의의가 있다. 또한, 중요한 정보량이 주가의 정보성을 결정하는 요인임을 밝혀 관련 문헌의 확장에도 공헌한다. 아울러, 중요한 정보의 가격 유용성 결과가 지속가능성 정보에 대한 핵심 이해관계자의 수요도에 따라 차별적으로 나타남을 밝혀 정보환경 측면에서도 입체적인 논의를 제공한다. 이와 같은 결과는 ESG 성과를 보고하는 경영진에게는 공시의 범위와 방법에 대한 우선순위를, ESG 공시 규정을 마련하는 정책입안자에게는 규제의 방향성을 제시한다.

본 연구는 국내에서는 처음으로 상장사를 대상으로 IFRS 지속가능성 공시기준의 적용 의의를 실증하였다는 데 의미가 있다. 기업가치와 관련 있다고 판단되는 중요한 지속가능성 정보의 증가는 주가 정보성을 같이 증진시킨다. 이는 자본시장에서 기업가치의 지속가능성을 평가하여 자본이동을 매개하는 시장원리의 작동 가능성을 환기하는 중요한 시사점을 내포한다. 기업이 스스로 미래지향적이고 전략적인 관점에서 지속가능성을 담보하는 위험과 기회 요인을 파악하여, 시장과 적극적으로 소통하면 이를 바탕으로 공정한 가치평가가 가능하다. 능동적인 관점에서는 자기자본비용 절감을 도모할 수 있으며, 이는 동시에 자발적 공시 유인 증가를 통하여 선순환 체계를 완성하는 계기가 될 수 있다.

기업으로서는 지속가능성 정보를 공개할 때, 투자자 관점에서 의미 있는 중요한 정보를 공개함으로써, 기업 시장가치와 자본조달비용의 적정 평가가 가능하다는 점을 전략적 관점에서 인식할 필요가 있다. 지속가능보고서를 작성하는 실무적 관점에서도 IFRS 지속가능성 공시기준을 채택하면 기업이 공시하여야 하는 주제 항목과 지표는 표준화되고 재무적 중요성 관점에서 선택할 수 있으므로 오히려 작성이 간편해진다.42)43) 이 점은 IFRS의 회계기준이 2005년 유럽연합 내 각 거래소에 상장된 기업을 대상으로 처음 도입되기 시작하면서 그 정당성을 뒷받침하는 주요 논거였다. 당시에 표준화된 국제회계기준의 도입은 회계정보의 투명성을 제고하고 기업 및 국가 간 비교를 쉽게 하여 자본 흐름을 원활하게 하며 이에 따른 자본 조달 비용의 감소를 가져올 것으로 예상하였다.44)

현재 기업이 공개하는 지속가능성 체계와 주요 주제 및 지표가 각양각색이고 이에 기반한 평가 결과도 일관성이 떨어지기 때문에 정부가 표준화된 기준으로 중요한 정보공개를 의무화한다면 공익적 효과가 클 것으로 기대된다. 2025년 예정된 상장사의 지속가능성 공시 의무화를 준비하는 과정에서 이 점은 충분히 고려하여야 한다. 그러지 않을 경우, 기업이 작성하는 지속가능보고서는 정보 유용성 측면에서 투자자에게 실질적으로 도움이 되지 못하면서 상호 적지 않은 시간과 비용의 낭비 요소가 될 수 있다.

본 연구가 가지는 시사점에도 불구하고, 실증분석 결과의 해석에는 주의를 요한다. 별도의 표로 제시하지는 않았으나 Hutton et al. (2009)이 활용한 주가의 고유설명력 변수, 시장‧섹터와 무관한 요인을 추출한 Amihud (2002)의 비유동성 지표 등을 주가 정보성을 대리하는 대안적 변수로 활용한 분석에서도 질적으로 동일한 실증결과를 확인하였으나, 관련 변수 모두 측정오차 문제가 상존하고 개별 주가의 잡음(noise)이 커질 때 유사한 결과가 나타날 가능성 역시 배제하기 어렵다(Li et al., 2014). 아울러, 분석에 사용된 기업의 수는 데이터상의 제약으로 인하여 국내 전체 상장사의 14% 정도로 한정된다. 데이터 군집의 대표성 문제로 발생할 수 있는 잠재적 추정의 편의를 보완하는 방법은 블룸버그와 같이 국내 상장사에 대한 ESG 평가에 사용되는 지표를 SASB 지표와 대응하여 더 많은 기업과 지표를 살펴보는 것이다. 이는 추후 연구과제로 남겨 놓는다.

1) 지속가능성보고서 작성 기준에 대한 논의는 이인형‧이상호(2021)를 참조한다.

2) 2022년 8월 31일 기준 ISSB를 구성하는 14명의 위원 인선 작업이 마무리되었다.

3) 2022년 7월 29일 의견 접수가 마감되었다. 세계 주요 이해관계자로부터 1,300개 이상 의견이 접수되었고, 이에 대한 검토 절차를 거친다.

4) IFRS(2022. 3. 31) 보도자료 참고

https://www.ifrs.org/news-and-events/news/2022/03/issb-communicates-plans-to-build-on-sasbs-industry-based-standards/

5)「자본시장과 금융투자업에 관한 법률(이하 자본시장법)」제159조 및 연관 시행령 및 위임행정규칙

6) 자본시장법 제162조(거짓의 기재 등에 의한 배상책임)

7) 타법 개정 이전에 자본시장법 제47조에서는 중요사항을 투자자의 합리적 투자 판단 또는 해당 금융상품의 가치에 중대한 영향을 미칠 수 있는 사항으로 정의하고 있고 해당 조항은 2020년 12월 19일 제정된 「금융소비자 보호에 관한 법률」 제19조로 이관되었다.

8) 이인형‧이상호(2021) 46면을 참조한다.

9) Diamond & Verrecchia(1991)와 Botosan & Plumlee(2002)

10) Verrecchia(2001)

11) Lambert et al.(2007)

12) Lombardo & Pagano(2002)

13) 보고서의 질은 당시 지속가능성보고서 작성 기준의 국제 표준이라 할 수 있는 GRI(Global Reporting Initiative)기준에 의한 지표를 얼마나 많이 보고하는가로 측정하고 있다.

14) SASB Conceptual Framework(2017) 8면에서 학술 사례로 인용하고 있고, 다음과 같이 미국 의회에서 증언되었다: Streur, John. 2019. “The Application of Environmental, Social, and Governance Principles in Investing and the Role of Asset Managers, Proxy Advisors, and Other Intermediaries.” Testimony before US Senate Committee on Banking, Housing and Urban Affairs on April 2. 2019.

15) 주가에는 시장, 산업, 기업 고유 특성이 반영되어 있고, 주가 정보성은 이 중 기업 고유 정보를 지칭한다.

16) Piotroski & Roulstone(2004), Crawford et al.(2012)

17) Ferreira et al.(2011)

18) Gul et al.(2010)

19) 지속가능성 보고기준 제정을 위해 설립한 ISSB는 SASB의 산업별 중요성 기준을 그대로 채택하여 향후 관리와 개정 작업을 책임지고 있다.

20) SASB Conceptual Framework(2017)

21) Bloomberg Industrial Classification System을 기본 분류 체계로 사용하였다. Khan et al.(2016) 9면 참조

22) 일반적으로 산업분류 체계는 과거 상관계수에 기반한 통계적 접근방식, 생산 지향적 접근방식, 시장수요 지향적 접근방식 등이 있다. GICS는 기업에 대한 분석과 구분에 있어서 시장수요 지향적인 접근방식을 채택하고 있다. https://www.msci.com/documents/1296102/11185224/GICS+Methodology+2022.pdf/f9910041-6127-17d2-1246-4052926adaf7?t=1645738126436를 참조한다.

23) 산업 기준에서 GICS와 SICS 간 종목 일치 현황은 <별첨 1>에서 참조할 수 있다.

24) 영업마진율과 매출성장률의 경우 200%를 상회하는 특이치(outlier)를 제거해도 결과는 같았다.

25) 2021년 12월 6일 기준 라이선스 파일인 SASB Codified Standards Level II를 참조하였다.

26) 개별 산업 기준서의 예비 기준서와 산업 연구서 그리고 공개 초안에 대한 의견과 답변서는 문서 형태로 https://www.sasb.org/standards/archive/#document-descriptions에서 찾아볼 수 있다.

27) 77개 산업별 공시 주제의 총개수는 445개이고 관련 지표는 993개이다.

28) Briefing on ISSB & Regulatory Development, VRF(2022.4.6.) 발표 자료이고 미국의 경우를 예로 들고 있다.

29) 지속가능성 관점에서의 중요한 정보에 관한 정의는 II장 1절을 참조한다.

30) 환경, 사회, 지배구조 부문 각각에 대하여 요구하는 지표 중 정보공개를 하는 지표의 백분율을 동일 가중 평균하여 산정하고 있다.

31) Sustainability Accounting Standards Board to Bloomberg Field Mapping (Version 2.0) 이름의 엑셀 파일을 제공한다.

32) 블룸버그는 411개의 국내 상장사에 대하여 ESG Disclosure Score를 산출한다고 하고 있으나, 실제 분석에서는 표본 구간인 2010년부터 2020년 전체에 걸쳐 데이터가 존재하는 경우로 국한하였다.

33) 여기서 정보량은 블룸버그가 중요성에 상관없이 ESG 평가를 위하여 요구하고 있는 지표 중 정보 공개된 비중을 의미하고, MD는 요구되는 중요한 정보 중 공개된 중요한 정보 비중을 의미한다.

34) 개별 산업 내 종목의 수가 제한되는 경우가 있어서 자기 설명력이 높아지는 것을 방지하기 위하여 섹터 분류를 사용하였다.

35) 거래량이 적은 기업의 비동시거래(nonsynchronous trading)에 따른 측정오차를 완화하고자 직전일 수익률을 추가로 통제하였다(Dimson, 1979).

36) 사업보고서는 각 사업연도 경과후 90일 이내로 제출기한이 정해져 있는 반면, 지속가능경영보고서는 정해진 제출기한은 없으나 통상적으로 다음 해 8월부터 10월 사이에 공시가 이루어지고 있어 지속가능성 정보가 시장에 반영되는 시차를 고려하여 회귀분석 구간을 설정할 필요가 있다.

37) 개별 기업으로는 305개 기업이 분석 대상이다.

38) 동일 기간 비금융업을 영위하는 유가증권 및 코스닥시장 상장 12월말 결산법인 18,994 기업-연도의 SYNC 중위수는 –1.770로 확인된다.

39) 동일 기간 비금융업을 영위하는 유가증권 및 코스닥시장 상장 12월말 결산법인 19,372 기업-연도의 시가총액 중위수는 1,066억원으로 확인된다.

40) 동일 기간 비금융업을 영위하는 유가증권 및 코스닥시장 상장 12월말 결산법인 19,509 기업-연도의 외국인 지분율 중위수는 2.0%로 확인된다.

41) 식 (3)의 Hausman 검정을 수행한 결과, 오차항과 설명변수 간 1% 유의수준에서 상관관계가 존재하여(Hausman χ2: 77.66), 임의효과 모형 대비 고정효과 모형을 이용한 추정이 적합한 것으로 나타났다.

42) 미국의 경우 SASB 기준을 적용하여 지속가능성보고서를 작성하는 기업은 평균적으로 6개의 주요 주제와 13개의 관련 지표를 공시하는 것으로 조사된다(VRF, 2022. 4. 6).

43) 더 나아가, IFRS 재단은 ‘비례성’의 원칙에 따라 본격적인 지속가능성 보고서를 작성하기에 관련 인력과 지식이 부족한 중소기업 혹은 저개발 국가의 기업을 위하여 요건이 완화된 지속가능성 보고기준을 마련하여 작성의 부담을 경감하려 노력하고 있다.

44) 이와 관련한 문헌 조사는 이인형‧이상호(2021) 및 De George et al.(2016)을 참조한다.

참고문헌

고봉찬‧김류미, 2012, R2와 기업가치의 관계에 관한 실증연구, 「재무관리연구」 29(3), 177-202.

안윤영‧장진호‧신현한‧유영태, 2006, 재무분석가의 이익예측 허딩 및 허딩 결정요인,

「경영학연구」 35(4), 1241-1260.

이인형‧이상호, 2021, 「지속가능보고 의무공시 이행을 위한 논의 방향」, 자본시장연구원 조사보고서 21-01.

Amel-Zadeh, A., Serafeim, G., 2018, Why and how investors use ESG information: Evidence from a global survey, Financial Analysts Journal 74(3), 87-103.

Amihud, Y., 2002, Illiquidity and stock returns: Cross-section and time-series effects, Journal of Financial Markets Volume 5(1), 31-56.

Basu, S., 1997, The conservatism principle and the asymmetric timeliness of earnings, Journal of Accounting and Economics 24(1).

Basu, S., Vitanza, J., Wang, W., Zhu, X., 2022, Walking the walk? Bank ESG disclosures and home mortgage lending, SSRN Working Paper No.3807685.

Bhojraj, S., Lee, C.M.C., Oler, D.K., 2003, What’s my line? A comparison of industry classification schemes for capital market research, Journal of Accounting Research 41(5).

Botosan, C.A., Plumlee, M.A., 2002, A re-examination of disclosure level and the expected cost of equity capital, Journal of Accounting Research 40.

Brav, A., Heaton, J.B., 2002, Competing theories of financial anomalies, The Review of Financial Studies 15(2), 575-606.

Chan, K., Jegadeesh, N., Sougiannis, T., 2004, The accrual effect on future earnings, Review of Quantitative Finance and Accounting 22(2), 97-121.

Christensen, D.M., Serafeim, G., Sikochi, S., 2022, Why is corporate virtue in the eye of the beholder? The case of ESG ratings, The Accounting Review 97(1), 147–175.

Crawford, S.S., Roulstone, D.T., So, E.C., 2012, Analyst initiations of coverage and stock return synchronicity, The Accounting Review 97(4).

De George, E.T., Li, X., Shivakumar, L., 2016, A review of the IFRS adoption literature, Review of Accounting Studies 21(3), 898-1004.

Dhaliwal, D.S., Li, O.Z., Tsang, A., Yang, Y.G., 2011, Voluntary nonfinancial disclosure and the cost of equity capital: The Initiation of Corporate Social Responsibility Reporting, The Accounting Review 86(1).

Diamond, D., Verrecchia, R., 1991, Disclosure, liquidity and the cost of equity capital, The Journal of Finance 46.

Dimson, E., 1979, Risk measurement when shares are subject to infrequent trading, Journal of Financial Economics 7(2), 197-226.

Easton, P.D., Harris, T.S., 1991, Earnings As an Explanatory Variable for Returns, Journal of Accounting Research 29(1), 19-36.

Ferreira, D., Ferreira, M., Raposo, C., 2011, Board structure and price informativeness, Journal of Financial Economics 99(3).

Francis, J., Lafond, R., Olsson, P., Schipper, K., 2007, Information uncertainty and post‐earnings‐announcement‐drift, Journal of Business Finance & Accounting 34(3‐4), 403-433.

Grewal, J., Hauptmann, C., Serafeim, G., 2021, Material Sustainability Information and Stock Price Informativeness, Journal of Business Ethics 171(3).

Guidry, R., Patten, D., 2010, Market reactions to the first-time issuance of corporate sustainability reports, Sustainability Accounting, Management and Policy Journal 1(1).

Gul, F.A., Kim, J.B., Qiu, A.A., 2010, Ownership concentration, foreign shareholding, audit quality, and stock price synchronicity: Evidence from China, Journal of Financial Economics 95(3).

Hutton, A.P., Marcus, A.J., Tehranian, H., 2009, Opaque financial reports, R2, and crash risk, Journal of Financial Economics 94(1), 67–86.

IFRS, 2022, Exposure Draft IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information.

Jin, L., Myers, S.C., 2006, R2 around the world: New theory and new tests, Journal of financial Economics 79(2), 257-292.

Khan, M., Watts, R. L., 2009, Estimation and empirical properties of a firm-year measure of accounting conservatism, Journal of Accounting and Economics 48(2–3), 132–150.

Khan, M.N., Serafeim, G., Yoon, A., 2016, Corporate Sustainability: First Evidence on Materiality, The Accounting Review 91(6).

Lambert, R., Leuz, C., Verrecchia, R.E., 2007, Accounting information, disclosure, and the cost of capital, Journal of Accounting Research 45.

Li, B., Rajgopal, S., Venkatachalam, M., 2014, R2 and idiosyncratic risk are not interchangeable, The Accounting Review 89(6), 2261-2295.

Lombardo, D., Pagano, M., 2002, Law and equity markets: A simple model, In McCahery, J., Moerland, P., Renneboog, L., Raaijmakers, T.(Eds.), Corporate Governance Regimes: Convergence and diversity, Oxford University Press.

Petersen, M.A., 2009, Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches, The Review of Financial Studies Volume 22(1), 435–480.

Piotroski, J.D., Roulstone, D.T., 2004, The influence of analysts, institutional investors, and insiders on the incorporation of market, industry, and firm-specific information into stock prices, The Accounting Review 79(4).

Raghunandan, A., Rajgopal, S., 2022, Do ESG funds make stakeholder-friendly investments? Review of Accounting Studies 27, 822–863.

Sustainability Accounting Standards Boards, 2017, SASB Conceptual Framework.

Serafeim, G., Yoon, A., 2022, Stock price reactions to ESG news: The role of ESG ratings and disagreement, Review of accounting studies 1-31.

VRF(Value Reporting Foundation), 2022. 4. 6, Briefing on ISSB & Regulatory Development.

Verrecchia, R.E., 2001, Essays on disclosure, Journal of Accounting and Economics 32(1-3).

Vuong, Q.,H., 1989, Likelihood ratio tests for model selection and non-nested hypotheses, Econometrica: Journal of the Econometric Society 307-333.

Welch, K., Yoon, A., 2022, Do high-ability managers choose ESG projects that create shareholder value? Evidence from employee opinions, Review of Accounting Studies 1-28.

국내 상장사 중 일정 규모 이상의 기업은 2025년부터 단계적으로 지속가능성 관련 정보를 공시하여야 한다. 현재는 유가증권시장 상장사 중 120여 개 이상 기업이 자발적으로 ‘지속가능경영보고서’(이하 지속가능성보고서)를 자사 홈페이지를 통해 발간하고 있고 그중 일부는 거래소 자율공시 형태로 등록하고 있다.

환경과 사회 관련 지속가능성 요소는 다양하고 개별 기업이 속한 산업의 특성에 따라 해당 요소의 중요성이 다를 수 있다. 따라서 일정한 중요성 기준과 표준화된 지표를 갖고 작성 기준을 정하지 않으면 지속가능성보고서 내용의 활용 가치와 비교가능성이 떨어진다.

이러한 문제를 해결하기 위한 논의가 국제적으로 진행 중이다.1) 현재 가장 광범위한 관심과 지지를 받는 지속가능성보고서 작성 기준 논의는 IFRS(International Financial Reporting Standards, 이하 IFRS) 재단이 주도하고 있다. IFRS는 2021년 11월 3일 산하에 ISSB(International Sustainability Standards Board, 이하 ISSB)를 설립하여 IFRS 지속가능성 공시기준 제정을 위한 제도적 기반을 마련하였다.2) ISSB는 2022년 3월 31일 IFRS S1 일반 공시 요구사항(IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information)과 IFRS S2 기후 관련 공시(IFRS S2 Climate-related Disclosure)의 공개초안(exposure draft)을 발표하였고, 광범위한 의견 수렴을 거친 후 2022년 말에 시안을 공식적으로 확정할 예정이다.3) IFRS 회계기준을 채택하고 있는 국가는 제정된 지속가능성 공시기준을 국제 기준선(global baseline)으로 인정하고 이를 기본 골격으로 하여 일부 수정 혹은 추가를 통하여 각국 사정에 맞는 공시기준을 마련할 것으로 예상된다.

이번에 마련된 IFRS 일반 공시원칙과 기후 관련 공시 공개초안은 투자자 관점에서 기업가치에 영향을 미치는 중요한 정보(material information)를 지속가능성보고서에 담는 것을 기본 원칙으로 한다. 그리고 중요한 정보의 선별은 IFRS의 기준이 별도로 마련되지 않는 한 SASB(Sustainability Accounting Standards Board, 이하 SASB)의 기준을 원용할 것을 천명하고 있다.4)

최근 국내에서 발간되는 몇몇 지속가능성보고서에서는 SASB 기준에 의한 중요성(materiality) 지표를 채택하여 관련 정보를 공개하고 있으나 아직 해당 정보의 주식 가격 유용성에 관한 연구는 이루어지고 있지 않다. 다양한 지속가능성 정보 중 중요한 정보가 기업가치와 현재적(contemporaneous) 연관성을 갖는지는 투자자뿐만 아니라, 지속가능성보고서를 작성하는 기업으로서도 중요하다. 만약 기업이 공개하는 지속가능성 정보가 기업가치와 무관하다면, 정보공개의 유인체계가 효과적으로 작동하지 않기 때문이다.

본 보고서는 국내 상장회사를 대상으로 SASB 기준에 의한 중요한 정보가 현재 어느 정도 공개되고 있으며 해당 정보의 가격 유용성이 존재하는지를 검증한다. 그에 앞서 2장에서는 중요한 정보 관점에서 주가와의 관련성을 다룬 선행 연구 검토를 통해 주요 논점을 살펴본 후 논점을 실증한 주요 연구 결과를 소개한다.

SASB는 산업별 특성에 맞는 중요성 주제와 지표를 식별하기 위해 SASB 고유의 산업분류 체계를 마련하고 있다. 3장에서는 SASB 분류에 따른 국내 상장기업의 산업별 중요성 정보공개 현황을 진단하고 4장에서는 이들 정보가 주가 정보성(price informativeness)을 내포하고 있는지 검증한다.

결론에서는 검증 결과의 의미를 정리하여 국내 지속가능성 정보 공시기준 도입 논의에 유용한 시사점을 제시하고자 한다.

II. 중요한 정보

1. 중요한 정보의 의미

기업은 사업내용, 재무에 관한 사항, 주주에 관한 사항 및 그 밖에 투자자 보호를 위하여 필요한 사항 등에 관하여 사업보고서에 그 내용을 기재하여야 한다.5) 만약 사업보고서에 중요사항에 관하여 거짓의 기재 또는 표시가 있거나 중요사항이 기재 또는 표시되지 않아서 투자자가 손해를 입으면 책임을 져야 한다.6)7) 회계기준에서 중요한(material) 정보는 해당 정보가 누락, 허위 혹은 왜곡 작성되었을 경우, 그 정보를 사용하는 자의 의사결정에 영향을 미치리라고 합리적으로 예상되는 경우로 간주한다.

따라서 지속가능성 관점에서 중요한 정보란 기업이 환경과 사회에 끼치는 영향이 미래 기업의 현금흐름에 영향을 미칠 수 있다고 합리적 관점에서 예상할 수 있는 경우와 발생 가능성은 작으나, 미래 현금흐름에 매우 큰 영향을 끼칠 수 있는 사건 모두를 포함한다.8) IFRS S1 일반 공시 요구사항에서 중요성 정의는 이러한 견해와 일치한다.

여기서 유추할 수 있는 것은 기업가치 지향 지속가능성 중요한 정보가 공개될 경우, 시장은 이를 소화하게 되고 결과적으로 주가 정보성에 영향을 미칠 수 있다는 점이다. 따라서 중요한 정보량이 증가할수록 고유 가격 정보성과 정의 관계가 성립될 수 있다.

2. 선행 연구

기업의 정보 공시와 기업가치 간 관계에 관한 연구는 자기자본비용(cost of equity capital) 측면에서 수년간 이루어져 왔다.9) 공시 자체는 투자자와 대리인 간 정보 비대칭 문제를 해소하여 활발한 거래를 유발하고(유동성 효과)10) 투자자의 자산 가격 산정 정확도를 증가시키는 것으로 알려진다.11) 또한 법적 공시로 인한 정보 투명성은 주주의 감시비용을 감소시키는 것으로 나타난다.12)

이러한 연유로 정보 공시의 양과 질에 비례하여 자기자본비용은 감소하는 것으로 밝혀진다. 자기자본비용은 지분 투자자가 요구하는 기대수익률로서 위험과 불확실성이 적은 투자일수록 요구 수익률은 낮아진다. 이는 결국 낮은 할인율을 의미하므로, 정보 공시와 기업가치와의 관계는 정의 관계가 성립된다.

이러한 이론적, 실증적 관계는 투명하고 비교할 수 있는 정보 공시의 중요성을 뒷받침하는 논거로 사용되고 있다. 동시에 자본시장의 위험-가격 형성 메커니즘이 기업으로 하여금 최적 수준의 정보공개를 하도록 유도하는 강한 유인책으로 작동하고 있음을 증빙한다.

지속가능성 정보의 자발적 공개가 자기자본비용과 연관이 있음을 처음으로 실증한 연구는 Dhaliwal et al.(2011)이다. 2000년 이후 미국 상장사의 CSR(Corporate Social Responsibility) 관련 정보공개가 급증하는 배경을 놓고 이를 자기자본비용 절감 노력으로 설명한 연구이다. 주요 결과로는 전기에 자기자본비용이 높았던 기업은 그다음 기에 CSR 정보를 자발적으로 공개하는 경우가 유의미하게 많고, CSR 성과가 좋은 기업의 자기자본비용은 감소하는 것으로 나타난다.

Guidry & Patten(2010)은 지속가능성보고서를 처음 발간하는 시점을 전후로 해당 기업의 시장 가격이 초과 수익의 형태로 반응하는지 검증하였으나, 유의미한 결과가 보고되지 않는다. 반면 동일한 기업군을 대상으로 횡단면 분석을 한 결과, 지속가능성 보고서의 질이 우수할수록13) 그러하지 않은 기업에 비하여 긍정적인 시장 가격 반응을 보이는 것으로 보고된다. 이는 지속가능보고서에 담긴 정보의 절대량보다 해당 내용이 중요함을 보여준 최초의 연구 결과이다.

Khan et al.(2016)은 처음으로 SASB의 중요한 정보에 바탕을 둔 지속가능성 성과 측정을 시도하였고, 측정된 성과로 상위 포트폴리오 구성 시 하위 포트폴리오의 수익을 두 배가량 능가하는 초과 수익이 관측됨을 보고하고 있다. 학계에서 기업의 사회적책임 성과를 측정하는 데 주된 데이터베이스 역할을 해온 KLD(Kinder, Lydenberg, & Domini)의 지표 중 SASB의 중요성 지표를 대응시켜서(mapping) 확인된 지표를 바탕으로 성과를 측정하였다. Khan et al.(2016)의 결과는 중요성 기준 지속가능성 정보와 시장 수익 간 상관성을 입증하는 최초의 실증 결과였고, SASB의 중요성 기준 도입의 정당성을 부여하는 논거로 다수 인용되었다.14)

SASB의 중요성 기준 지속가능성 정보는 산업 특성별로 분류되어 있다. 기업은 자신이 속한 산업의 중요한 정보 중 개별 기업으로서 중요하다고 판단되는 것을 공개할 경우, 이는 개별 기업 고유 정보이므로 주가의 정보성(price informativeness)15)을 증가시킬 것이다. 주가 정보성은 기존 문헌에서 오랫동안 연구된 분야이다. 투자자 유형, 분석가 집중도, 내부자 정보 유무에 따른 정보성 증진 여부 검증16), 이사회 구성과 정보성 관계 검증17), 대주주 지분, 외국인 보유 비중, 감사품질 요인이 정보성에 미치는 영향18) 등이 대표적인 사례이다.

Grewal et al.(2021)은 기업이 중요성 기준 관점에서 지속가능성 관련 정보를 공개할 경우, 주가 정보성이 증가한다는 가설을 검증하였다. SASB의 산업별 기준서에 제시된 중요성 지표를 블룸버그의 ESG 정보공개 데이터베이스에 대응(mapping)하여 중요한 정보량을 산출한 후 주가 정보성과 정의 관계가 있음을 실증하였다.

기업의 지속가능성 정보 공시 의무화가 임박한 가운데, 국제적 정합성을 갖춘 IFRS의 지속가능성 기준은 기업이 투자자에게 중요한(material) 정보를 선별하여 보고하도록 하고 있다.19) 앞에 소개한 선행 연구는 중요한 정보공개 자체 내지는 중요한 정보를 바탕으로 한 지속가능성 평가가 기업의 가치 혹은 가격 정보성과 유의미한 관계가 있음을 보여주고 있다는 데 의미가 있다.

다음 장에서는 Grewal et al.(2021)의 분석 방법론을 준용하여 국내 상장기업을 대상으로 중요한 정보의 주가 정보성을 검증한다. 이를 통해 IFRS 지속가능성 공시기준의 국내 적용 의미와 가치를 가늠해 본다.

III. 지속가능성 관점에서의 중요성 기준

1. SASB의 지속가능성 보고기준

SASB가 지칭하는 ‘지속가능성’ 활동은 장기에 걸쳐 기업이 가치를 창출할 수 있는 능력을 유지 내지는 증진하는 경제활동을 의미한다. 따라서 ESG 관점에서의 지속가능성 보고는 기업이 환경과 사회적 관계에서 발생할 수 있는 위험과 기회요인을 기업가치 측면에서 파악하고 관리하는 방식과 이를 이행 하는 지배구조 차원에서의 조직과 전략의 활용에 대한 보고이다.

SASB는 지속가능성을 환경(Environment), 사회적 자본(Social Capital), 인적 자본(Human Capital), 사업모형과 혁신(Business Model & Innovation), 리더십과 지배구조(Leadership & Governance)의 다섯 부문으로 구분하여 인식하고 있다. 각 부문에는 <표 III-1>과 같이 일반 이슈(General Issue)가 선별되어 있다. 예를 들어 환경 부문에는 온실가스 배출, 대기질, 에너지 관리, 물과 폐수의 관리, 폐기물 및 유해물질의 관리 그리고 생태에 대한 영향을 관련 이슈로 선정하고 있다. 이슈 선정의 기준은 가치창출에 대한 영향력 존재 여부, 투자자 관심 여부, 해당 산업 전반에 걸친 적용 가능성, 기업의 능동적 대처 가능성, 이해관계자의 합의 반영 여부이다.20)

SICS의 경우는 지속가능성 관련 위험과 기회요인을 공유하는 기업을 하나의 유사 단위로 파악한다. 이를 기존 시장에서 사용하는 산업분류 체계21)에 적용한 후 기업들을 재편하여 지속가능성 특성을 공유하는 섹터와 산업의 신설 내지는 기존 산업의 섹터 재편을 통하여 SICS 체계를 완성하고 있다.

다음 절에서는 SICS를 현재 전 세계 자산운용 업계에서 표준으로 사용하고 있는 Global Industry Classification Standard(이하 GICS)와 비교를 통하여 산업분류로서 갖는 특성을 살펴본다. 이는 후술하는 주가 정보성을 산출하는 데 필요한 SICS 섹터 지수의 적용 가능성을 규명하기 위한 사전 조사 성격이다.

2. SICS 분류의 상대적 특성

가. SICS와 GICS 체계 비교

비교 대상이 되는 GICS는 전 세계 투자자가 표준화된 산업분류 체계를 이용할 수 있도록 MSCI와 S&P Dow Jones가 1999년에 개발하였다.22) 현재는 한국거래소를 포함한 주요국 거래소와 주요 지수산출 기관이 GICS 분류를 기반으로 섹터 및 산업 지수를 산출하고, 이를 기초로 한 ETF가 운용되고 있다.

SICS와 GICS의 전체적인 분류 체계를 살펴보기 위하여 <표 III-2>에서 상위 대분류에서 하위 소분류까지 구분과 개별 섹터와 산업의 개수를 구분하였다. GICS와 SICS는 모두 11개의 섹터를 기반으로 산업군을 분류하고 있다. 실제 KOSPI 시장에 상장된 국내 기업을 대상으로 적용하면 적용되지 않는 산업분류가 있음을 알 수 있다.

<표 III-3>은 KOSPI 데이터를 활용하여, SICS와 GICS 기준의 섹터와 산업 내 종목 수와 비중에 대한 통계량을 보여주고 있다. 각각 11개의 섹터에 대해 SICS가 GICS 대비 섹터와 산업 기준으로 종목의 평균 개수는 거의 동일함을 알 수 있다. 다만 섹터 기준으로는 SICS가 개수에 대한 낮은 변동성을 보여주고 있으며, 비중의 변동성은 약간 높게 나타나고 있다.

나. SICS 체계의 유용성 분석

Bhojraj et al.(2003)은 미국 시장을 대상으로 당시로선 새로운 업종 분류 체계인 GICS를 기존 업종 분류 체계인 NAICS(North American Industry Classification System) 등과 비교 분석을 수행하였다. 비교의 주안점은 개별 분류에 따른 집합이 얼마나 내부적으로 동질적 성격을 공유하는가에 있다. 이를 개별 종목의 속성과 종목이 속한 섹터의 평균 속성이 얼마나 통계적 유사점을 공유하는가를 기준으로 살펴보았다.

해당 연구에 따르면 주가 움직임, PBR과 같은 상대 가치평가 지표, 수익성, 성장성 등의 속성을 기준으로 GICS 분류가 다른 분류 체계보다 동질적임을 증명하였다.

본 보고서에서 SICS와 GICS 간 비교를 동일한 속성과 방법론을 적용하여 분석하였다. KOSPI 상장 종목을 대상으로 2011년부터 2021년까지의 분기말 데이터를 사용하였다.

<표 III-4>에서는 SICS와 GICS 각각의 기준별로 분기 수익률, PBR, 영업마진율, 매출성장률 속성에 대해 개별 종목과 섹터 간 회귀식의 결정계수를 추정하였다. 이를 통해 SICS와 GICS 기준의 절대적인 설명력(R2) 수준을 비교한 결과, 모든 지표에서 SICS 모형의 R2가 더 높게 나타났다. 이는 SICS 분류에 따른 섹터 수준 평균값이 GICS 분류에 따른 평균값보다 개별 종목의 특성 변수들을 더 잘 설명함을 의미한다.24) Vuong(1989) 검정을 수행하여 R2 차이의 통계적 유의성을 살펴본 결과, 가치배수(PBR) 및 수익성(영업마진율) 측면에서 SICS 분류의 설명력이 유의하게 높은 것으로 나타났다(1% 및 5% 유의수준). 단, 주가(분기 수익률) 및 성장성(매출성장률) 측면에서는 차별적인 설명력을 보이진 않았다.

3. SICS 구분에 의한 산업별 중요한 정보

SASB는 SICS 분류에 따른 77개의 산업별로 각각 지속가능성 회계 기준서(Sustainability Accounting Standards, 이하 SASB 기준서)를 마련하고 있다. SASB 기준서는 공시 주제(disclosure topics)와 이를 측정하는 지표와 단위(accounting metrics) 그리고 지표를 기술적 측면(적용 범위, 측정 단위, 계산 방법 등)에서 설명하는 기술 프로토콜(technical protocol) 그리고 활동 지표(activity metrics)로 이루어져 있다. 마지막의 활동 지표는 매출액이나 종업원 규모와 같이 기업의 크기를 나타내는 항목으로, 기업 상호 간 비교를 위해 표준화하는 데 활용할 수 있다.

<표 III-6>은 소비재(Consumer Goods) 섹터 내 의류, 장신구 및 신발(Apparels, Accessories & Footwear) 산업의 공시 주제와 지표 설정 예시이다. 지표를 측정하는 단위에서 정량값이 아닌 절차나 제도, 규정의 존재 여부와 같은 정보는 단위가 없으므로 n/a로 표시되어 있다. 또한 모든 지표는 고유의 해당 코드로 식별되어 있다.

SASB는 2013년 7월에서 2016년 3월에 걸쳐 SASB 기준서를 작성하였다. 해당 섹터에 속하는 기업, 회계법인, 법무법인, 시장 분석가, 금융기관, 시민단체, 공공부문 등의 전문가가 참여하여 섹터별로 순차적으로 예비 기준서(Provisional Standards)를 작성하였다. 예비 기준서는 공시 주제의 재무 중요성에 대한 실증 자료가 포함된 산업 연구서(Industry Research Briefs)가 첨부된다. 예비 기준서는 공개 초안 형태로 발표되어 전문가의 의견 수렴 후 확정되는 과정을 거쳤다.26)

종합적으로 살펴보면 SASB 기준은 5개 지속가능성 부문과 26개의 일반 이슈 그리고 SICS를 바탕으로 한 11개 섹터와 77개 산업별 하부 공시 주제와 해당 지표로 이루어진 체계를 갖고 있다.27)

SASB 기준은 방대한 공시 주제와 지표로 이루어져 있지만, 중요한 점은 동일 산업군에서 활동하는 기업은 평균적으로 6개의 공시 주제와 13개의 관련 지표를 공시하는 것으로 조사된다는 점이다.28) SASB 기준서에서 제시하는 모든 주제와 지표를 공시할 필요는 없고, 기업이 중요성 기준에서 자율적으로 판단하여 해당 정보를 공개하므로 이는 SASB 기준이 추구하는 정보의 비용 효율성을 일면 충족한다고 할 수 있다.

본 연구의 핵심 변수는 중요한 정보량(Material Disclosure, 이하 MD)이다.29) 산업별 및 개별 특성을 반영한 지속가능성 관련 중요한 정보량과 주가 정보성이 비례관계에 있는가를 규명하기 위해 MD를 측정하여야 한다. 국내 상장기업 중 SASB 산업분류에 기반하여 지속가능성 정보를 공개하기 시작한 기업은 많지 않다. 그러나 명시적인 SASB 기준 채택 여부와 상관없이 과거에 공개한 지속가능성 정보 중 얼마나 SASB의 산업 분류 체계에 따른 중요한 정보인지는 파악할 수 있다. 이를 위해 블룸버그의 ESG 정보공개 데이터를 활용하고, 세부적인 설명은 다음 절에서 소개한다.

가. 블룸버그 식별 중요한 정보

블룸버그는 전 세계 12,990개 이상의 상장사에 대하여 ESG 정보공개 점수(ESG Disclosure Score)를 연간 제공하고 있다. 2022년 5월 8일 기준으로 411개의 한국 상장사에 대하여 ESG 정보공개 데이터를 산정하고 있다.

ESG 정보공개 점수는 블룸버그가 고유의 환경, 사회, 지배구조 관련 주제, 지표와 측정 단위를 설정하여 기업이 해당 정보를 얼마나 공개하는지를 바탕으로 산정한다. 정보공개 점수는 해당 기업의 정보공개 양을 측정하는 것일 뿐, ESG 성과를 나타내는 것은 아니다.30)

블룸버그는 SASB 기준에 따른 중요한 정보의 사용자가 늘어남에 따라, 블룸버그가 보유하고 있는 지속가능성 지표 중에 SASB 지표와 같거나 유사한 지표를 식별하여 제공하고 있다. <표 III-6>의 개별 지표 식별 코드와 블룸버그 지속가능성 지표 고유 식별 코드(BBG Field ID)를 대응(mapping)한 파일을 마련하고 있다.31)

나. 중요한 정보량

국내 상장사의 MD를 측정하기 위한 첫 번째 단계는 개별 종목의 SICS 분류에 따른 귀속 산업을 확인한 후 해당 산업의 SASB 기준서에 명시된 지표를 확인하는 것이다. SASB는 2021년 말 기준으로 3,398개의 한국 상장 및 비상장 기업을 SICS 기준으로 산업분류를 하고 있다. 이 중 일차적으로 블룸버그가 ESG 정보공개 데이터를 산정하는 상장사를 모집단으로 하여 중요한 정보량을 산출하여 보았다.32)

MD는 전체 중요한 정보 항목 중 정보공개가 된 항목의 비율로 산출한다. 이를 블룸버그의 식별 코드로 인지하므로, 블룸버그 함수를 사용하여 정보 유무를 확인하는 과정을 거친다.

<표 III-8>은 특정 종목에 대하여 블룸버그가 중요한 정보로 인식하는 지표와 해당 측정 단위를 보여주고 있다. 그중 공개 여부 열은 식별 코드를 입력 변수로 한 블룸버그 함수값이고 대응하는 값이 없는 경우 n/a로 처리된다. 총 35개의 중요성 항목이 있고, 그중 정보 공개된 항목은 13개이므로 MD는 37%로 계산된다.

<그림 III-1>에서는 국내 자산총계 2조원 이상 상장회사를 대상으로 조사한 정보량과 MD와의 관계를 보여준다.33) 통상적으로 ESG 정보량은 기업의 규모와 비례한다고 알려졌지만, 좌측 그림에서 알 수 있듯이 중요한 정보량은 기업규모와 의미 있게 비례하지 않음을 알 수 있다. 우측 그림에서 정보량이 50%를 넘는 기업 중 중요한 정보량도 50%를 넘는 수는 그리하지 않은 경우보다 적다. 또한 정보량의 평균값은 46%인데 반해서 중요한 정보량은 절반 정도인 24%이다. 따라서 정보량과 중요한 정보량은 어느 정도 비례하나, 정보량이 많다고 해서 반드시 중요한 정보량도 많은 것은 아님을 알 수 있다.

1. 분석 배경

ESG 활동과 기업의 지속가능성에 대한 투자자의 관심도는 꾸준히 증가하고 있다. 2010년대 말 BlackRock, Vanguard를 비롯한 국제 대규모 자산운용사들이 투자의사결정에 ESG 요소를 적극적으로 반영하는 등, 계속기업(going concern)으로서의 지속가능성을 평가하는 데 ESG 성과를 고려하는 이해관계자가 늘어난 것이다(Welch & Yoon, 2022).

이에 기업의 지속가능성 요소에 대한 충실한 정보공개를 강조하는 한편, 지속가능성 관련 정보 자체의 유용성에 대한 의문도 함께 제기되고 있다. 자발적 공시 체제하에서 ESG 성과의 공시는 이해관계자들에게 긍정적인 신호 효과(signaling effect)를 전달하는 경로로 기능하여 정보적 유용성이 있다는 견해와 함께(Christensen et al., 2022; 이인형‧이상호, 2021), 구체적 의무와 검증이 부재한 상황에서 ESG 성과의 공시는 표면적인 선언 수단(boilerplate)에 그칠 소지가 다분하여 정보적 유용성이 제한적이라는 견해(Basu et al., 2022; Raghunandan & Rajgopal, 2022)가 공존한다.

이처럼 지속가능성 관련 정보의 유용성에 대해 학계의 문헌들이 일치되지 않은 견해를 보이는 가운데 유럽연합의 집행위원회는 비재무정보보고지침(Non-Financial Reporting Directive), 기업지속가능성보고지침(Corporate Sustainability Reporting Directive) 등 의무공시의 범위와 수준을 강화하는 방향으로 정책적 대응 방안을 모색해 왔다. 반면, 미국의 증권거래위원회(SEC)는 기업가치에 유의적인 영향을 미치는 지속가능성 요소를 명확히 파악하기 어렵다고 판단하여 공시 의무화에 다소 신중한 입장을 견지해 왔다(이인형‧이상호, 2021).

이러한 상황에서 SASB는 개별 기업의 전사적 가치에 중요한 영향을 미치는 지속가능성 주제를 더욱 구체적으로 식별하고자 노력해 왔다. 특히, 기업가치에 중요한 영향을 미치는 정도(즉, 중요성)는 핵심사업의 특성에 큰 영향을 받는다고 보고 개별 기업이 속한 산업적 맥락에서 중요한 지속가능성 주제를 선별하고자 했다. 이에 산업기반(industry-specific) 지표를 구현하여 동일 산업 내 유사(peer) 기업 수준에서 비교가능한 정보를 제공하는 기준체계를 마련하였다. 이를테면, 철강 업종 내 POSCO와 현대제철 간, 반도체 업종 내 삼성전자와 SK하이닉스 간 온실가스 배출 저감 성과 혹은 유해 물질 관리 성과 등을 객관적으로 비교할 수 있는 정보를 제공하고자 하였다.

최근 미국 자본시장을 대상으로는 위와 같은 SASB 기준이 기업 고유의 지속가능성 주제를 표현하는 데 효과적임을 입증하는 시도들이 있었으나(Grewal et al., 2021; Serafeim & Yoon, 2022), 국내 자본시장을 대상으로 한 연구는 찾아보기 어렵다. 장기적인 기업가치와 관련성이 낮은 공시내용은 정보적 유용성이 떨어지는 상용구에 해당할 가능성이 크나(Amel-Zadeh & Serafeim, 2018), 재무적으로 중요한 지속가능성 주제의 공시내용은 핵심 이해관계자의 의사결정에 유용한 정보일 개연성이 높다(Grewal et al., 2021).

이에 본 장에서는 국내 기업을 대상으로 중요성 기준의 정보적 유용성을 검증하고자 한다. 또한, 해당 검증 결과가 지속가능성 관련 정보의 수요 특성에 따라 차별적으로 나타나는지를 살펴본다. 본 장의 이러한 분석은 주가 정보성 측면에서 중요성 기준의 유용성을 검증하는 국내의 첫 실증결과로 주목할만하다. 특히, 국제적으로 통용될 가능성이 높은 ISSB의 공시기준이 지속가능성 관련 위험 및 기회 요인의 식별에 SASB 기준을 원용하는 점을 고려하면(IFRS S1[초안] 문단 51), 향후 ISSB 기준을 적용했을 때 국내 기업에의 영향을 사전적으로 검토해보는 시사점을 기대할 수 있다. 또한, 국내 지속가능경영보고서의 단계적 의무화 일정을 고려하면, 정보환경이 차별적인 상황에서의 기업 영향을 예비적으로 검토하는 점에서 정책적 함의를 제공한다.

본 절의 분석 배경에 이어 제2절에서는 주가 정보성의 측정 방법론을 설명하고, 제3절에서 실증분석 결과를 제시한다. 마지막으로 분석 결과의 시사점을 요약한다.

2. 주가 정보성

기업의 사적 정보가 주가에 더 많이 반영될수록 전체 주식시장에 대한 개별 기업의 주가 동조화(synchronicity) 현상이 줄어들어 시장모형의 설명력(R2)이 낮게 나타나는 결과는 기업의 정보환경 및 지배구조 특성 측면에서 익히 잘 알려진 사실이다(Piotroski & Roulstone, 2004; Ferreira et al., 2011; Crawford et al., 2012; 고봉찬‧김류미, 2012). 관련 연구에서는 시장 및 산업의 공통 요인으로 설명되지 않는 기업 고유의 주가 정보성(price informativeness)을 대리(proxy)하기 위해 시장모형의 R2를 활용했다. R2는 개별 기업의 주가수익률이 시장 및 산업 지수 전반의 변동으로 얼마나 잘 설명되는지를 측정하는 지표로 R2가 클수록 체계적 위험 정보가 주가에 더 많이 내재함을 나타낸다. 반대로 R2가 작을수록 비체계적 위험 정보, 즉, 기업의 사적 정보가 주가의 정보성을 더 잘 나타낸다고 볼 수 있다.

본 연구에서는 선행연구(Hutton et al., 2009; Crawford et al., 2012; Li et al., 2014; Grewal et al., 2021 등)의 방법론을 준용하여 기업 고유의 가격 정보성을 측정하였다. 우선, 식 (1)과 같이 개별 기업의 일별 주가수익률에서 시장 및 섹터34) 전반의 수익률을 통제한 모형을 토대로 기업-연도별 회귀분석을 수행하여 개별 주가수익률에 대한 시장‧섹터 수익률의 R2를 측정하였다.35)

최종적으로 기업-연도별 주가 동조화 측정치(SYNC)는 식 (1)에서 산출한 R2를 토대로 기업 고유의 사적 정보로 인한 변동(1-R2) 대비 공통 정보로 인한 변동(R2) 비율을 로그 변환하여 식 (2)와 같이 산출하였다. SYNC가 큰 값을 가질수록 개별 기업의 주식수익률이 시장 및 산업 수익률에 동조화되어 공통 정보에 많은 영향을 받고 있음을 의미하며, 반대로, 기업의 사적 정보가 공통 정보 대비 추가적인 정보력을 가질수록 주가의 동조화 현상은 줄어들어 SYNC는 작은 값을 가진다.

3. 중요한 정보공개의 정보적 유용성 검증

가. 표본의 구성 및 기초통계량

본 연구의 표본은 2010년부터 2020년까지 유가증권 및 코스닥시장에 상장된 기업 중 아래 기준을 충족하는 2,932 기업-연 관측치를 대상으로 구성한다.37)

(1) 비금융업을 영위하는 기업

(2) 재무제표의 결산일이 12월 말인 기업

(3) 중요한 정보량(MD)의 산출이 가능한 기업

(4) 주가 정보성(SYNC)의 측정이 가능한 기업

(5) 기타 통제변수의 구성이 가능한 기업

분석 대상 기간은 주요 관심 변수인 중요한 정보량(MD) 자료를 블룸버그로부터 입수한 2010년부터 2020년까지로 설정하였다. 해당 기간에 유가증권 및 코스닥시장 상장 비금융업종 중 12월말 결산법인에 해당하는 19,509 기업-연도 중 MD 자료의 입수가 가능한 관측치는 3,129 기업-연도이며, 이 중 종속변수로 활용할 주가 동조화 변수(SYNC) 및 주요 통제변수의 측정이 불가능한 기업-연도를 제외한 최종 분석 대상 표본은 2,932 기업-연도이다. 기업의 재무제표 자료 및 주가 자료는 FnGuide에서 추출하였으며, 극단치로 인한 편의 가능성을 완화하고자 모든 연속형 변수는 상‧하위 1% 수준에서 윈저화(winsorization)하였다. 변수의 구체적 정의는 아래 표 <Ⅳ-1>와 같다.

Panel B와 Panel C에서 각각 주가 동조화(SYNC), 중요한 정보량(MD) 변수의 구간별로 기초통계량을 확인한 결과, SYNC가 상위 50%에 해당할 경우 MD의 평균은 0.168로 SYNC가 하위 50%에 해당하는 경우의 MD 평균 대비 0.056만큼 유의하게 큰 값을 가지는 것으로 나타났다(1% 유의수준). MD가 상위 50%에 해당하는 경우에 SYNC의 평균은 –1.151로 MD가 하위 50%에 해당하는 경우의 SYNC 평균 대비 0.546만큼 유의하게 큰 값을 가지는 것으로 확인된다(1% 유의수준). 또한, Panel D에서 주요 변수의 상관관계를 보면, 중요한 정보량(MD)과 주가 동조화(SYNC) 변수 간 Pearson 상관계수는 0.33으로 1% 유의수준에서 유의한 양(+)의 관련성을 보인다. 이러한 기초통계량은 일견 중요성 기준에 입각한 지속가능성 정보의 공시가 시장 및 산업 전반의 공통 정보 대비 고유 정보성이 없을 가능성을 의미할 수도 있으나, MD 자료의 입수가 가능한 표본의 특수성을 감안하면 일변량 관계에서 통제할 수 없는 기업 특성 요인에 의해 가성적으로 나타난 상관관계(spurious correlation)일 가능성을 시사한다. 특히, 기업규모(log(MV))와 주가 동조화(SYNC) 변수 간 Pearson 상관계수가 0.43으로 1% 유의수준에서 유의적인 양(+)의 관련성을 보여, 시장 지수 및 섹터 수익률에 영향이 큰 대규모 기업 수익률이 내생적으로 주가 동조화(SYNC) 수준을 결정하고 있음이 확인된다. 전반적으로 기업 특성과 관련한 생략 변수 문제를 충분히 통제한 분석이 필요해 보인다.

SASB의 중요성 기준에 따른 지속가능성 정보가 주가 정보성 측면에서 기업 고유의 정보력이 있는지를 검증하기 위해 아래 식(3)의 모형을 이용하여 회귀분석을 수행하였다.

종속변수는 주가 동조화(SYNC) 변수이고, 관심변수는 중요한 정보량(MD)에 해당한다. 통제변수로는 지속가능성 정보의 전달 경로에 따른 차별적 효과를 통제하기 위해 지속가능경영보고서의 공시 여부(SustReport)를 고려하였으며, 주가 동조화 현상의 주요 결정 요인에 해당하는 기업규모(log(MV)) 및 성장성(MtoB) 요인을 통제하였다(Piotroski & Roulstone, 2004; Grewal et al., 2021). 전문 투자자(sophisticated investor)의 정보 특성에 대한 대용치로 외국인 지분율(Foreign) 및 재무분석가 추종 수(log(#Alyst))를 고려하였으며, 사업구조 상 정보 예측의 복잡성을 통제하고자 자기자본이익률의 변동성(ROEstd) 변수를, 경영진 특유의 기회주의적 공시 특성을 통제하고자 회계불투명성(PoorEQ) 변수를 추가로 통제하였다(Jin & Myers, 2006; Hutton et al., 2009). 고정효과로는 연도‧섹터 더미 변수를 통제하였으며, 앞선 주요 변수의 분포에서 확인하였듯(<표 Ⅳ-2> 참조), 시장‧섹터 수익률에 영향력이 큰 대규모 기업이 내생적으로 주가 동조화 수준을 결정하는 문제를 비롯해 관측이 어려운 기업 이질성이 설명변수와 연관될 가능성을 고려하여 기업 고정효과 모형을 적용한 패널 회귀분석을 수행하였다.41)

<표 Ⅳ-3>에서 중요한 정보량과 주가 정보성 간 고정효과 패널 회귀분석 결과를 제시한다. 열 (1)은 식 (3)의 회귀분석을 수행한 기본 결과에 해당하며, MD의 계수값이 유의한 음(-)으로 나타나(5% 유의수준) 중요성 기준에 입각한 개별 기업의 지속가능성 정보가 기업 고유의 가격 변동을 설명하는데 유의미한 정보력이 있음이 확인된다. 이익 변동성(ROEstd), 회계불투명성(PoorEQ) 등 대부분의 통제변수 역시 이론적 부호와 일관되게 나타나 정보 예측의 복잡성 및 경영진의 공시 특성 등 기업의 정보환경과 관련한 다양한 영향요인이 잘 통제된 것으로 판단된다(1% 또는 10% 유의수준). 외국인 지분율(Foreign) 역시 예상대로 유의미한 음(-)의 관련성이 나타났다(1% 유의수준). 단, 재무분석가 추종 수(log(#Alyst))는 예측부호와 반대로 유의미한 양(+)의 관련성을 보인다(5% 유의수준). 외국인의 투자는 고유 정보력에 기반하나, 재무분석가의 추종은 시장 혹은 산업 전반의 정보와 깊게 연관된 것으로 해석할 수 있다. 이러한 결과는 시장의 관심도가 증가하는 기업을 집중적으로 추종하는 재무분석가의 군집행동 특성(herding behavior)으로 인해 나타났을 가능성을 시사한다(안윤영 외, 2006).

열 (2), (3), (4)는 공시정보의 수준(level)과 변화량(change)을 시차에 따라 구분하여 고정효과 패널 회귀분석을 수행한 강건성 검증 결과를 제시한다. 이익 정보의 가치관련성을 검증한 선행연구는 정보의 영구적 속성과 일시적 속성을 구분하여 평균 수준이 내포하는 정보적 유용성과 비기대 상황에서의 변화분이 내포하는 정보적 유용성이 차별적임을 실증한 바 있다(Easton & Harris, 1991). 과거 및 당기 수준 변수(MDt-1 및 MDt)를 동시에 포함한 열 (2)의 분석 결과를 살펴보면, 당기 수준 변수만 유의미한 음(-)의 계수값을 보이나(5% 유의수준), 당기 증분 변수(△MDt)를 포함한 열 (3)에서는 과거 수준 변수(MDt-1)도 동시에 유의미한 음(-)의 계수값을 보인다(10% 유의수준). 이는 재무적으로 중요한 정보의 과거 평균적인 공시량과 당기에 새롭게 공시를 확대한 정보 모두 기업 고유의 가격 변동을 설명하는데 유용성이 있을 가능성을 내포한다. 한편, 열 (4)에서 차기 증분 변수(△MDt+1)는 주가의 정보성을 유의적으로 설명하지 못하는 것으로 나타났다. 즉, 사업장의 사고나, 환경 제재, 지배구조 상의 문제점 등 과거 사건이 공론화 되어 주가가 반응한 이후 관련 공시를 확대함에 따라 사후적으로 가격 유용성이 관측되고 있을 가능성은 크지 않을 것으로 판단된다.

이상의 결과는 국내 자본시장에서 지속가능성 관련 정보의 공개가 투자의사결정에 어떻게 반영되는지 통찰할 수 있는 계기가 된다는 점에서 의미가 깊다. 특히, MD의 계수값과 달리 SustReport의 계수값이 모두 유의하지 않은 음(-)으로 나타난 점은 총체적인 ESG 활동 성과를 보고하는 지속가능경영보고서의 경우 그 정보적 유용성이 제한적일 수 있음을 시사함과 동시에 재무적으로 중요한 정보공개의 유용성을 강조한다.

전술한 결과에 따르면 기업의 핵심 이해관계자에 해당하는 투자자들은 재무적으로 중요한 지속가능성 정보를 기업 고유의 가격 정보로서 기업가치에 반영한다. 만약, 자본시장 참여자들이 지속가능성 정보를 투자의사결정에 반영하는 과정이 체계적이라면 중요성 정보의 가격 유용성은 지속가능성 정보의 수요도가 높은 기업 집단에서 유의미하게 나타날 개연성이 높다. 특히, 합리적인 투자자일수록 이익 정보의 불확실성 정도에 반응하여 투자 비중을 체계적으로 조정한다는 이론 및 실증 문헌에 비추어 보면(Brav & Heaton, 2002; Francis et al., 2007), 사업 구조적으로 이익 정보가 불확실하거나, 경영진이 공격적으로 이익을 인식하여 그 지속성에 대한 불확실성이 큰 경우 MD 정보에 대한 수요도가 높게 나타날 것으로 예상할 수 있다.

우선, 사업 구조적으로 이익 정보가 불확실한 상황이 MD의 정보성에 미치는 영향을 <표 Ⅳ-4>에서 분석하였다. 투자자들이 성장 기회(TobinQ)를 낮게 평가하는 기업일수록 사업의 지속가능성에 대한 불확실성을 해소할 필요성이 크고 따라서 지속가능성 관련 정보의 수요도가 높을 것으로 예상할 수 있다. 아울러, 이익 예측치 분산(EDisp)이 커 미래 이익 전망에 대한 의견불일치가 큰 기업 역시 정보의 불확실성 해소를 위한 지속가능성 관련 정보의 수요도가 높을 것으로 예상된다. 고정효과 패널 회귀분석 결과, 성장 기회(TobinQ)가 하위 50%에 해당하는 열 (1), 이익 예측치에 대한 분산(EDisp)이 상위 50%에 해당하는 열 (4)에서만 MD의 정보성이 유의미한 것으로 나타나(5% 유의수준), 사업 구조적으로 지속가능성 정보에 대한 수요도가 높은 기업 집단에서 MD 정보의 유용성이 극대화되고 있음이 확인된다.

이인형‧이상호(2021)에서 투자자는 기업의 지속가능성 관련 활동이 궁극적으로 기업가치에 미치는 영향에 관심이 있으므로 재무적 중요성 관점에서 정보공개의 필요성을 주장했다. 지속가능성 대응력이 높은 기업이 정보공개를 통하여 자본시장에서 정당한 평가를 받을 수 있다면, 정보공개에 대한 유인체계가 형성되어 효율적인 자원배분이 가능해진다.

본 보고서는 이러한 관점을 배경으로 지속가능성 정보 중 기업가치와 연관성이 있다고 판단되는 중요한 정보의 공개가 주가 정보성과 관련이 있는지 국내 상장사를 대상으로 살펴보았다. 현재 논의되고 있는 IFRS 지속가능성 공시기준이 중요성 측면을 강조하기 때문에, 공시기준의 근간이 되는 SASB의 공시 체계를 바탕으로 중요한 정보의 공개량을 측정하였다.

IFRS 지속가능성 공시기준은 기업이 속한 산업의 지속가능성 지표 중 관련성이 있다고 판단되는 지표를 공시하도록 하고 있다. 이를 기준으로 공개된 정보는 기업 고유 속성을 반영하는 중요한 정보이기 때문에 시장에서 형성되는 주가의 정보성을 높일 수 있다. 이를 검증하기 위해 블룸버그가 제공하고 있는 ESG 정보공개 데이터 중 SASB 기준의 중요성이 있는 정보공개 비중 MD를 관심변수로 설정하였다.

시장과 섹터의 영향력을 제외한 기업 고유의 정보가 반영된 주가 변동분인 주가 정보성을 종속변수로 하여 MD의 설명력을 검증하였다. 주가 정보성을 설명하는 기존 문헌을 참조하여, 중요한 정보의 전달 경로에 따른 차별적 효과를 통제하기 위해 기업규모, 성장성, 전문 투자자, 사업구조, 회계정보와 관련된 변수를 통제변수로 설정하였다. 동시에 시간 불변의 기업 특성 요인과 관련된 생략 변수 문제를 통제하기 위해 연도 고정효과와 함께 기업 고정효과를 고려하였다.

본문의 분석 결과는 재무적으로 중요한 지속가능성 정보가 우리 자본시장의 가격발견기능을 도모함을 일관되게 보여준 연구로서 의미가 있다. 특히, ESG 활동과 관련한 모든 정보가 가격 정보에 반영되는 것은 아니며, 재무적으로 중요한 정보만이 주가에 체계적으로 반영됨을 밝힌 점에서 의의가 있다. 또한, 중요한 정보량이 주가의 정보성을 결정하는 요인임을 밝혀 관련 문헌의 확장에도 공헌한다. 아울러, 중요한 정보의 가격 유용성 결과가 지속가능성 정보에 대한 핵심 이해관계자의 수요도에 따라 차별적으로 나타남을 밝혀 정보환경 측면에서도 입체적인 논의를 제공한다. 이와 같은 결과는 ESG 성과를 보고하는 경영진에게는 공시의 범위와 방법에 대한 우선순위를, ESG 공시 규정을 마련하는 정책입안자에게는 규제의 방향성을 제시한다.

본 연구는 국내에서는 처음으로 상장사를 대상으로 IFRS 지속가능성 공시기준의 적용 의의를 실증하였다는 데 의미가 있다. 기업가치와 관련 있다고 판단되는 중요한 지속가능성 정보의 증가는 주가 정보성을 같이 증진시킨다. 이는 자본시장에서 기업가치의 지속가능성을 평가하여 자본이동을 매개하는 시장원리의 작동 가능성을 환기하는 중요한 시사점을 내포한다. 기업이 스스로 미래지향적이고 전략적인 관점에서 지속가능성을 담보하는 위험과 기회 요인을 파악하여, 시장과 적극적으로 소통하면 이를 바탕으로 공정한 가치평가가 가능하다. 능동적인 관점에서는 자기자본비용 절감을 도모할 수 있으며, 이는 동시에 자발적 공시 유인 증가를 통하여 선순환 체계를 완성하는 계기가 될 수 있다.

기업으로서는 지속가능성 정보를 공개할 때, 투자자 관점에서 의미 있는 중요한 정보를 공개함으로써, 기업 시장가치와 자본조달비용의 적정 평가가 가능하다는 점을 전략적 관점에서 인식할 필요가 있다. 지속가능보고서를 작성하는 실무적 관점에서도 IFRS 지속가능성 공시기준을 채택하면 기업이 공시하여야 하는 주제 항목과 지표는 표준화되고 재무적 중요성 관점에서 선택할 수 있으므로 오히려 작성이 간편해진다.42)43) 이 점은 IFRS의 회계기준이 2005년 유럽연합 내 각 거래소에 상장된 기업을 대상으로 처음 도입되기 시작하면서 그 정당성을 뒷받침하는 주요 논거였다. 당시에 표준화된 국제회계기준의 도입은 회계정보의 투명성을 제고하고 기업 및 국가 간 비교를 쉽게 하여 자본 흐름을 원활하게 하며 이에 따른 자본 조달 비용의 감소를 가져올 것으로 예상하였다.44)

현재 기업이 공개하는 지속가능성 체계와 주요 주제 및 지표가 각양각색이고 이에 기반한 평가 결과도 일관성이 떨어지기 때문에 정부가 표준화된 기준으로 중요한 정보공개를 의무화한다면 공익적 효과가 클 것으로 기대된다. 2025년 예정된 상장사의 지속가능성 공시 의무화를 준비하는 과정에서 이 점은 충분히 고려하여야 한다. 그러지 않을 경우, 기업이 작성하는 지속가능보고서는 정보 유용성 측면에서 투자자에게 실질적으로 도움이 되지 못하면서 상호 적지 않은 시간과 비용의 낭비 요소가 될 수 있다.

본 연구가 가지는 시사점에도 불구하고, 실증분석 결과의 해석에는 주의를 요한다. 별도의 표로 제시하지는 않았으나 Hutton et al. (2009)이 활용한 주가의 고유설명력 변수, 시장‧섹터와 무관한 요인을 추출한 Amihud (2002)의 비유동성 지표 등을 주가 정보성을 대리하는 대안적 변수로 활용한 분석에서도 질적으로 동일한 실증결과를 확인하였으나, 관련 변수 모두 측정오차 문제가 상존하고 개별 주가의 잡음(noise)이 커질 때 유사한 결과가 나타날 가능성 역시 배제하기 어렵다(Li et al., 2014). 아울러, 분석에 사용된 기업의 수는 데이터상의 제약으로 인하여 국내 전체 상장사의 14% 정도로 한정된다. 데이터 군집의 대표성 문제로 발생할 수 있는 잠재적 추정의 편의를 보완하는 방법은 블룸버그와 같이 국내 상장사에 대한 ESG 평가에 사용되는 지표를 SASB 지표와 대응하여 더 많은 기업과 지표를 살펴보는 것이다. 이는 추후 연구과제로 남겨 놓는다.

1) 지속가능성보고서 작성 기준에 대한 논의는 이인형‧이상호(2021)를 참조한다.

2) 2022년 8월 31일 기준 ISSB를 구성하는 14명의 위원 인선 작업이 마무리되었다.

3) 2022년 7월 29일 의견 접수가 마감되었다. 세계 주요 이해관계자로부터 1,300개 이상 의견이 접수되었고, 이에 대한 검토 절차를 거친다.

4) IFRS(2022. 3. 31) 보도자료 참고

https://www.ifrs.org/news-and-events/news/2022/03/issb-communicates-plans-to-build-on-sasbs-industry-based-standards/

5)「자본시장과 금융투자업에 관한 법률(이하 자본시장법)」제159조 및 연관 시행령 및 위임행정규칙

6) 자본시장법 제162조(거짓의 기재 등에 의한 배상책임)

7) 타법 개정 이전에 자본시장법 제47조에서는 중요사항을 투자자의 합리적 투자 판단 또는 해당 금융상품의 가치에 중대한 영향을 미칠 수 있는 사항으로 정의하고 있고 해당 조항은 2020년 12월 19일 제정된 「금융소비자 보호에 관한 법률」 제19조로 이관되었다.

8) 이인형‧이상호(2021) 46면을 참조한다.

9) Diamond & Verrecchia(1991)와 Botosan & Plumlee(2002)

10) Verrecchia(2001)

11) Lambert et al.(2007)

12) Lombardo & Pagano(2002)

13) 보고서의 질은 당시 지속가능성보고서 작성 기준의 국제 표준이라 할 수 있는 GRI(Global Reporting Initiative)기준에 의한 지표를 얼마나 많이 보고하는가로 측정하고 있다.

14) SASB Conceptual Framework(2017) 8면에서 학술 사례로 인용하고 있고, 다음과 같이 미국 의회에서 증언되었다: Streur, John. 2019. “The Application of Environmental, Social, and Governance Principles in Investing and the Role of Asset Managers, Proxy Advisors, and Other Intermediaries.” Testimony before US Senate Committee on Banking, Housing and Urban Affairs on April 2. 2019.

15) 주가에는 시장, 산업, 기업 고유 특성이 반영되어 있고, 주가 정보성은 이 중 기업 고유 정보를 지칭한다.

16) Piotroski & Roulstone(2004), Crawford et al.(2012)

17) Ferreira et al.(2011)

18) Gul et al.(2010)

19) 지속가능성 보고기준 제정을 위해 설립한 ISSB는 SASB의 산업별 중요성 기준을 그대로 채택하여 향후 관리와 개정 작업을 책임지고 있다.

20) SASB Conceptual Framework(2017)

21) Bloomberg Industrial Classification System을 기본 분류 체계로 사용하였다. Khan et al.(2016) 9면 참조

22) 일반적으로 산업분류 체계는 과거 상관계수에 기반한 통계적 접근방식, 생산 지향적 접근방식, 시장수요 지향적 접근방식 등이 있다. GICS는 기업에 대한 분석과 구분에 있어서 시장수요 지향적인 접근방식을 채택하고 있다. https://www.msci.com/documents/1296102/11185224/GICS+Methodology+2022.pdf/f9910041-6127-17d2-1246-4052926adaf7?t=1645738126436를 참조한다.

23) 산업 기준에서 GICS와 SICS 간 종목 일치 현황은 <별첨 1>에서 참조할 수 있다.

24) 영업마진율과 매출성장률의 경우 200%를 상회하는 특이치(outlier)를 제거해도 결과는 같았다.

25) 2021년 12월 6일 기준 라이선스 파일인 SASB Codified Standards Level II를 참조하였다.

26) 개별 산업 기준서의 예비 기준서와 산업 연구서 그리고 공개 초안에 대한 의견과 답변서는 문서 형태로 https://www.sasb.org/standards/archive/#document-descriptions에서 찾아볼 수 있다.

27) 77개 산업별 공시 주제의 총개수는 445개이고 관련 지표는 993개이다.

28) Briefing on ISSB & Regulatory Development, VRF(2022.4.6.) 발표 자료이고 미국의 경우를 예로 들고 있다.

29) 지속가능성 관점에서의 중요한 정보에 관한 정의는 II장 1절을 참조한다.

30) 환경, 사회, 지배구조 부문 각각에 대하여 요구하는 지표 중 정보공개를 하는 지표의 백분율을 동일 가중 평균하여 산정하고 있다.

31) Sustainability Accounting Standards Board to Bloomberg Field Mapping (Version 2.0) 이름의 엑셀 파일을 제공한다.

32) 블룸버그는 411개의 국내 상장사에 대하여 ESG Disclosure Score를 산출한다고 하고 있으나, 실제 분석에서는 표본 구간인 2010년부터 2020년 전체에 걸쳐 데이터가 존재하는 경우로 국한하였다.

33) 여기서 정보량은 블룸버그가 중요성에 상관없이 ESG 평가를 위하여 요구하고 있는 지표 중 정보 공개된 비중을 의미하고, MD는 요구되는 중요한 정보 중 공개된 중요한 정보 비중을 의미한다.

34) 개별 산업 내 종목의 수가 제한되는 경우가 있어서 자기 설명력이 높아지는 것을 방지하기 위하여 섹터 분류를 사용하였다.

35) 거래량이 적은 기업의 비동시거래(nonsynchronous trading)에 따른 측정오차를 완화하고자 직전일 수익률을 추가로 통제하였다(Dimson, 1979).

36) 사업보고서는 각 사업연도 경과후 90일 이내로 제출기한이 정해져 있는 반면, 지속가능경영보고서는 정해진 제출기한은 없으나 통상적으로 다음 해 8월부터 10월 사이에 공시가 이루어지고 있어 지속가능성 정보가 시장에 반영되는 시차를 고려하여 회귀분석 구간을 설정할 필요가 있다.

37) 개별 기업으로는 305개 기업이 분석 대상이다.

38) 동일 기간 비금융업을 영위하는 유가증권 및 코스닥시장 상장 12월말 결산법인 18,994 기업-연도의 SYNC 중위수는 –1.770로 확인된다.

39) 동일 기간 비금융업을 영위하는 유가증권 및 코스닥시장 상장 12월말 결산법인 19,372 기업-연도의 시가총액 중위수는 1,066억원으로 확인된다.

40) 동일 기간 비금융업을 영위하는 유가증권 및 코스닥시장 상장 12월말 결산법인 19,509 기업-연도의 외국인 지분율 중위수는 2.0%로 확인된다.

41) 식 (3)의 Hausman 검정을 수행한 결과, 오차항과 설명변수 간 1% 유의수준에서 상관관계가 존재하여(Hausman χ2: 77.66), 임의효과 모형 대비 고정효과 모형을 이용한 추정이 적합한 것으로 나타났다.

42) 미국의 경우 SASB 기준을 적용하여 지속가능성보고서를 작성하는 기업은 평균적으로 6개의 주요 주제와 13개의 관련 지표를 공시하는 것으로 조사된다(VRF, 2022. 4. 6).

43) 더 나아가, IFRS 재단은 ‘비례성’의 원칙에 따라 본격적인 지속가능성 보고서를 작성하기에 관련 인력과 지식이 부족한 중소기업 혹은 저개발 국가의 기업을 위하여 요건이 완화된 지속가능성 보고기준을 마련하여 작성의 부담을 경감하려 노력하고 있다.

44) 이와 관련한 문헌 조사는 이인형‧이상호(2021) 및 De George et al.(2016)을 참조한다.

참고문헌

고봉찬‧김류미, 2012, R2와 기업가치의 관계에 관한 실증연구, 「재무관리연구」 29(3), 177-202.

안윤영‧장진호‧신현한‧유영태, 2006, 재무분석가의 이익예측 허딩 및 허딩 결정요인,

「경영학연구」 35(4), 1241-1260.

이인형‧이상호, 2021, 「지속가능보고 의무공시 이행을 위한 논의 방향」, 자본시장연구원 조사보고서 21-01.

Amel-Zadeh, A., Serafeim, G., 2018, Why and how investors use ESG information: Evidence from a global survey, Financial Analysts Journal 74(3), 87-103.

Amihud, Y., 2002, Illiquidity and stock returns: Cross-section and time-series effects, Journal of Financial Markets Volume 5(1), 31-56.

Basu, S., 1997, The conservatism principle and the asymmetric timeliness of earnings, Journal of Accounting and Economics 24(1).

Basu, S., Vitanza, J., Wang, W., Zhu, X., 2022, Walking the walk? Bank ESG disclosures and home mortgage lending, SSRN Working Paper No.3807685.

Bhojraj, S., Lee, C.M.C., Oler, D.K., 2003, What’s my line? A comparison of industry classification schemes for capital market research, Journal of Accounting Research 41(5).

Botosan, C.A., Plumlee, M.A., 2002, A re-examination of disclosure level and the expected cost of equity capital, Journal of Accounting Research 40.

Brav, A., Heaton, J.B., 2002, Competing theories of financial anomalies, The Review of Financial Studies 15(2), 575-606.

Chan, K., Jegadeesh, N., Sougiannis, T., 2004, The accrual effect on future earnings, Review of Quantitative Finance and Accounting 22(2), 97-121.

Christensen, D.M., Serafeim, G., Sikochi, S., 2022, Why is corporate virtue in the eye of the beholder? The case of ESG ratings, The Accounting Review 97(1), 147–175.

Crawford, S.S., Roulstone, D.T., So, E.C., 2012, Analyst initiations of coverage and stock return synchronicity, The Accounting Review 97(4).

De George, E.T., Li, X., Shivakumar, L., 2016, A review of the IFRS adoption literature, Review of Accounting Studies 21(3), 898-1004.

Dhaliwal, D.S., Li, O.Z., Tsang, A., Yang, Y.G., 2011, Voluntary nonfinancial disclosure and the cost of equity capital: The Initiation of Corporate Social Responsibility Reporting, The Accounting Review 86(1).

Diamond, D., Verrecchia, R., 1991, Disclosure, liquidity and the cost of equity capital, The Journal of Finance 46.

Dimson, E., 1979, Risk measurement when shares are subject to infrequent trading, Journal of Financial Economics 7(2), 197-226.

Easton, P.D., Harris, T.S., 1991, Earnings As an Explanatory Variable for Returns, Journal of Accounting Research 29(1), 19-36.

Ferreira, D., Ferreira, M., Raposo, C., 2011, Board structure and price informativeness, Journal of Financial Economics 99(3).

Francis, J., Lafond, R., Olsson, P., Schipper, K., 2007, Information uncertainty and post‐earnings‐announcement‐drift, Journal of Business Finance & Accounting 34(3‐4), 403-433.

Grewal, J., Hauptmann, C., Serafeim, G., 2021, Material Sustainability Information and Stock Price Informativeness, Journal of Business Ethics 171(3).

Guidry, R., Patten, D., 2010, Market reactions to the first-time issuance of corporate sustainability reports, Sustainability Accounting, Management and Policy Journal 1(1).

Gul, F.A., Kim, J.B., Qiu, A.A., 2010, Ownership concentration, foreign shareholding, audit quality, and stock price synchronicity: Evidence from China, Journal of Financial Economics 95(3).

Hutton, A.P., Marcus, A.J., Tehranian, H., 2009, Opaque financial reports, R2, and crash risk, Journal of Financial Economics 94(1), 67–86.

IFRS, 2022, Exposure Draft IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information.

Jin, L., Myers, S.C., 2006, R2 around the world: New theory and new tests, Journal of financial Economics 79(2), 257-292.

Khan, M., Watts, R. L., 2009, Estimation and empirical properties of a firm-year measure of accounting conservatism, Journal of Accounting and Economics 48(2–3), 132–150.

Khan, M.N., Serafeim, G., Yoon, A., 2016, Corporate Sustainability: First Evidence on Materiality, The Accounting Review 91(6).

Lambert, R., Leuz, C., Verrecchia, R.E., 2007, Accounting information, disclosure, and the cost of capital, Journal of Accounting Research 45.

Li, B., Rajgopal, S., Venkatachalam, M., 2014, R2 and idiosyncratic risk are not interchangeable, The Accounting Review 89(6), 2261-2295.

Lombardo, D., Pagano, M., 2002, Law and equity markets: A simple model, In McCahery, J., Moerland, P., Renneboog, L., Raaijmakers, T.(Eds.), Corporate Governance Regimes: Convergence and diversity, Oxford University Press.

Petersen, M.A., 2009, Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches, The Review of Financial Studies Volume 22(1), 435–480.

Piotroski, J.D., Roulstone, D.T., 2004, The influence of analysts, institutional investors, and insiders on the incorporation of market, industry, and firm-specific information into stock prices, The Accounting Review 79(4).

Raghunandan, A., Rajgopal, S., 2022, Do ESG funds make stakeholder-friendly investments? Review of Accounting Studies 27, 822–863.

Sustainability Accounting Standards Boards, 2017, SASB Conceptual Framework.

Serafeim, G., Yoon, A., 2022, Stock price reactions to ESG news: The role of ESG ratings and disagreement, Review of accounting studies 1-31.

VRF(Value Reporting Foundation), 2022. 4. 6, Briefing on ISSB & Regulatory Development.

Verrecchia, R.E., 2001, Essays on disclosure, Journal of Accounting and Economics 32(1-3).

Vuong, Q.,H., 1989, Likelihood ratio tests for model selection and non-nested hypotheses, Econometrica: Journal of the Econometric Society 307-333.

Welch, K., Yoon, A., 2022, Do high-ability managers choose ESG projects that create shareholder value? Evidence from employee opinions, Review of Accounting Studies 1-28.