Find out more about our latest publications

Government Sponsored Venture Capital Funds in Korea: Recent Trends and Policy Issues

Issue Papers 22-03 Mar. 08, 2022

- Research Topic Other

- Page 21

A government venture capital (GVC) fund refers to a fund of funds financed by the government. It aims to increase the supply of funding to sectors that are of public policy importance but are unlikely to receive sufficient funding from the market. Although each government department manages a number of GVC funds, there are growing concerns about inefficient public spending, primarily due to unreasonable target market setting and lack of a comprehensive administration system. As an essential precondition, the GVC scheme should minimize crowding out private venture capital funds while providing a pump primer to effectively nurture the relevant market. The government should adhere to this policy objective and place relevant constraints consistently during the entire GVC funds’ cycle including fund establishment-management-liquidation phases.

When a GVC fund is newly set up, factors including the possibility of crowding out private VC funds, the attainability of policy goals and inefficiency stemming from overlapped investments should be fully taken into account. It is desirable to take a conservative approach to the establishment of a new GVC fund after examining the appropriateness of government-sponsored equity investment and the availability of other supporting policies. What is important in GVC fund management is to find a proper balance between non-financial policy objectives and the marketability of private venture funds. This requires the public fund of funds, which acts as a general partner (GP) exclusively responsible for GVC funds, to have investment capability and expertise. Although target markets and investment purposes of GVC funds vary depending on policies that each government department seeks to implement, it would be cost-effective to hinder the establishment of a separate GP for each fund if possible. A GVC fund’s dissolution needs to be distinguished from the liquidation of its GP. Also necessary is the privatization of the public fund of funds.

The government-financed startups development policy has both benefits and drawbacks. However, it is also true that the GVC fund is one of the main drivers behind growth of Korea’s enterprises. It is high time that we should discuss how to improve Korea’s GVC scheme regarding the startups development policy that evolves from quantitative expansion to qualitative growth.

When a GVC fund is newly set up, factors including the possibility of crowding out private VC funds, the attainability of policy goals and inefficiency stemming from overlapped investments should be fully taken into account. It is desirable to take a conservative approach to the establishment of a new GVC fund after examining the appropriateness of government-sponsored equity investment and the availability of other supporting policies. What is important in GVC fund management is to find a proper balance between non-financial policy objectives and the marketability of private venture funds. This requires the public fund of funds, which acts as a general partner (GP) exclusively responsible for GVC funds, to have investment capability and expertise. Although target markets and investment purposes of GVC funds vary depending on policies that each government department seeks to implement, it would be cost-effective to hinder the establishment of a separate GP for each fund if possible. A GVC fund’s dissolution needs to be distinguished from the liquidation of its GP. Also necessary is the privatization of the public fund of funds.

The government-financed startups development policy has both benefits and drawbacks. However, it is also true that the GVC fund is one of the main drivers behind growth of Korea’s enterprises. It is high time that we should discuss how to improve Korea’s GVC scheme regarding the startups development policy that evolves from quantitative expansion to qualitative growth.

Ⅰ. 서론

각국 정부는 재정으로 정책펀드를 조성하여 자국의 벤처기업에 대한 원활한 자금 공급을 도모하고 있다. 우리나라도 예외는 아니어서, 정부 부처별로 다수의 정책펀드를 운용하고 있다. 2005년부터 운용 중인 중소벤처기업부의 중소기업투자모태조합1)이 대표적이며, 이를 운용하기 위하여 한국벤처투자(Korea Venture Investmnet Corp.: KVIC) 같은 모태펀드 전문운용기관이 설립되기도 하였다. 이러한 정책펀드는 두 번의 벤처붐을 포함하여 우리나라 벤처산업 발전의 원동력이 되었으나, 오늘날까지도 국내 벤처투자 조합 결성의 1/3 이상이 여전히 정부의 재정 지원에 의존하는 상황이 지속되고 있으며, 그 중심에는 개별 부처별로 경쟁적으로 설정되고 관리되는 정책펀드가 있다. 민간 벤처캐피탈(Venture Capital: VC) 시장에 대한 정부의 개입에 대하여 벤처시장 발전을 지속적으로 견인하는 긍정적인 효과가 보다 큰 것으로 평가되나, 민간이 주도하는 VC 생태계의 자생력 강화라는 측면에서는 과도한 정부 지원으로 인한 부정적 효과도 함께 지적되는 부분이다.

정책펀드는 정부 재정을 민간 기업에 지분투자하기 위한 정책 수단의 일환이다. 이는 투자시장이라는 민간 영역에 대한 국가의 직접적 개입을 의미한다. 따라서 그 대상과 실행 방식이 매우 제한적일 수밖에 없다. 그럼에도 불구하고 개별 정부 부처의 정책적 필요성에 의해 다수의 정책펀드가 새롭게 설정되고 있다. 2020년 한 해 동안 추가로 재정이 투입된 정책펀드만 23개로, 이를 위한 예산 규모는 1조 6천억원에 이른다. 23개 정책펀드 중에서 60% 이상이 최근 5년 내에 신규 설정되었다.2) 정책펀드의 목표 시장은 금융시장의 불완전성으로 인한 시장실패(market failure) 영역임이 확인되어야 한다. 정책펀드가 민간 시장을 구축하지 않기 위한 필수적인 전제 조건이다. 모험적이고 혁신적인 창업기업에 투자하는 VC 시장이 대표적이다. 하지만 최근 들어 이른바 비벤처형 산업의 육성을 목표로 하는 정책펀드가 확대됨에 따라 이러한 시장실패 영역의 확인도 벤처산업에서와 같이 선명하지는 않은 상황이다.

벤처형 산업에 있어서도 정책펀드 초기 설정 단계에서 확인되었던 시장실패가 정책펀드의 집행에 따라 얼마나 해소되고 있는가에 대한 판단이 불명확하다. 예를 들어, 대표적 정책펀드인 중소기업모태펀드 중진계정의 정책펀드 출자 비중은 20% 수준으로, 2016년에는 10% 미만으로 축소되기도 하였다. 자펀드3) 결성에 있어 모태펀드의 출자 비중 축소 양상은 민간 자금의 유입이라는 정책펀드 목적에 부합하는 긍정적 측면이 크다. 하지만 모태펀드가 참여하는 출자사업의 유효 경쟁률이 3배를 상회하고 있으며, 이에 따라 모태펀드의 출자비중이 1% 미만으로 실제 출자금액이 거의 미미한 자펀드도 다수 결성되고 있다.4) 이러한 상황은 시장에서 요구하는 모태펀드의 역할이 실질적인 모험자본의 공급이 아니라 인증효과와 같은 민간 경쟁의 지원 수단으로 인식되고 있음을 의미한다. 시장실패가 해소되고 정책펀드와 민간의 경쟁이 과열되는 상황이라면 정책펀드의 청산 관련 논의가 요구될 수 있는 부분이다.

민간 시장 구축의 최소화와 운용 효율성의 극대화라는 관점에서 정책펀드의 실행 방식은 민간 투자시장을 최대한 활용하는 재간접펀드(fund of funds)5) 구조가 일반적이다. 이는 초기 벤처육성정책의 시행착오에 따른 학습의 결과일 뿐만 아니라, Brander et al.(2015) 같은 많은 선행연구에서 ‘정부의 직접적인 VC 설립을 통한 자금 배분이 민간 VC를 활용하는 재간접 구조에 비해 모든 측면에서 성과가 저조하다‘는 실증분석에 기인한다. 대부분의 정책펀드는 영구존속(evergreen)을 가정하지 않으며, 한정된 사업기간 내에 정책목표를 달성하면 청산되어 재정으로 환수되어야 한다. 흔히 말하는 마중물의 역할이다. 펀드의 설정과 운용, 청산이라는 전 주기에 걸쳐 이러한 정책펀드의 목적과 제약조건이 일관되게 견지되어야 한다. 정책펀드를 신규 조성하기 위해서는 시장실패 영역이 명확함으로 정부 개입이 필요하다는 정당성이 확보될 수 있어야 한다. 또한 정부 지원의 여러 방식6) 중에서 지분투자가 효율적이며, 제도 시행 이후 일정 기간이 경과되면 민간이 주도하는 투자시장으로 자립할 가능성이 확인되어야 한다. 이를 위해서는 자펀드 결성 과정에서 민간자금의 유입 또는 민간 VC의 참여가 원활하여야 하며, 결성된 자펀드는 재무적 투자 수익률 외에 정책펀드의 조성 목적에 부합하게 투자 활동을 전개하여야 한다. 이를 관리 감독하는 것이 모태펀드 운용기관의 역할이고 역량이며, 이에 수반되는 다양한 이해관계가 정렬되도록 조직과 운용 구조를 설계하는 것이 제도 개편의 방향이라 할 수 있다.

이러한 배경 하에, 본 연구에서는 국내 정책펀드 제도의 현황과 문제점을 펀드의 설정-운용-청산이라는 전체 운영 단계별로 파악하고 이로부터 의미 있는 정책적 시사점을 도출하고자 한다. Ⅱ장에서는 펀드의 설정 단계에서 고려되어야 할 요인으로 민간시장에 대한 정부 개입의 적정성과 중복투자의 문제 등을 살펴보고, 신규로 정책펀드를 조성하고자 할 때 고려해야 할 사항을 정리하였다. Ⅲ장에서는 펀드의 운용 관점에서, 민간 자금의 유입을 통한 시장 활성화와 같은 정책펀드의 조성 목적을 효과적으로 달성하는데 있어 가장 중요한 역할인 모태펀드 전담 운용기관을 살펴본다. Ⅳ장에서는 정책펀드의 청산 단계에서 고려해야 할 요인과 바람직한 환수 방안을 모색하고, 마지막 Ⅴ장에서는 이상의 논의를 종합하여, 민간의 영역에 대한 정부의 개입이라는 정책펀드의 부정적 영향을 최소화하면서 추구하는 정책적 목적을 온전히 달성하기 위한 제도적 시사점을 정리하였다.

Ⅱ. 정책펀드의 설정

1. 정책펀드의 신규 설정

국내에는 12개 정부 부처와 특허청 및 공공기관이 출자한 자금으로 조성된 다수의 정책펀드가 운영 중이다. 아래 표와 같이, 2020년 정부 예산 기준으로 1조 6,195억원 규모의 재정이 23개 정책펀드에 추가로 투입되었다. 정책펀드 공공부문의 재원은 대부분 소관 부처가 편성한 정부 예산으로 조달되나, 금융위원회의 성장사다리펀드나 혁신모험펀드 같이 공기업의 정책자금이 활용되는 사례도 있다. 이러한 재원 조성의 차이가 별도의 모태펀드 운용기관 설치의 이유가 되기도 하나7), 대부분의 정책펀드는 중소벤처기업부 산하 공공기관인 한국벤처투자(KVIC)에서 각각의 별도 계정으로 분리 운용되고 있다.

중소기업모태펀드의 중진계정, 문화계정, 특허계정 등을 제외하면 대부분의 정책펀드가 2015년 이후에 조성되어 아직은 청산된 펀드의 성과를 바탕으로 정책펀드의 목적 달성도를 정량적으로 평가하기는 어렵다. 그럼에도 불구하고 정책펀드의 초기 단계인 민간 자금의 매칭을 통한 자펀드 결성부터 어려움을 호소하는 모태펀드가 증가하는 양상은 정책목적 달성의 어려움을 간접적으로 시사한다.

중소기업모태펀드의 부처별 계정을 비교해보면, 가장 규모가 크고 오래된 중진계정의 민간출자비중8)이 평균 79%에 이르는데 비해, 2014년 이후 조성된 신설 계정의 평균 민간출자비중은 50%에 미치지 못하고 있다. 이에 따라 자펀드가 규약에 명시된 민간매칭비율을 만족시키지 못하여 펀드 결성에 실패하는 사례도 증가하고 있으며9), 모태펀드의 출자비중 대비 자펀드의 투자집행비율을 의미하는 투자승수효과도 신규 조성 펀드일수록 낮은 경향을 보인다. 저조한 민간유인과 낮은 투자승수효과가 지속되는 경우 초기 정책펀드 설정의 타당성 또는 적절성에 대한 의문이 제기될 수 있다. 이는 정책펀드의 설정 단계에서 목표 시장의 자금 수요 규모 또는 성장가능성 같은 시장 특성보다는 특정 분야의 시장을 조성해야 한다는 정책적 당위성이 우선된 결과로 사료된다.

정책펀드의 신규 설정에 있어 먼저 민간 시장에 대한 정부 개입의 타당성이 확보되어야 한다. 정부 지원이 정당화될 수 있는 시장실패 영역임이 확인되어야 하며, 신규 설정 및 운용 과정에서 민간에 대한 구축(crowding out) 가능성이 지속적으로 검토되어야 한다. 정부지원의 여러 수단 중에서 지분자금 공급 방식이 가장 효율적인지 검토되어야 하며, 아울러 일정 기간 정부 지원이 실행된 후에는 민간 주도 시장으로 발전할 가능성이 확인되어야 한다. 마지막으로, 정부 예산 집행의 효율성 측면에서 정책펀드의 중복성 문제가 검토되고, 신규 설정에 앞서 기존 정책펀드의 확대 또는 활용 가능성이 우선 고려되어야 한다.

2. 정부 개입의 타당성

정책펀드는 본질적으로 민간의 영역에 대한 국가의 개입이다. 따라서 정책펀드 설정의 타당성은 일차적으로 VC 시장이라는 민간 영역에 대한 정부 개입의 적절성을 의미하며, 이에 대한 가장 중요한 근거는 해당 영역의 시장실패가 확인되고 이를 보정하기 위한 정부 지원의 필요성이라 할 수 있다. VC 시장에서 시장실패가 일어나는 주요 원인은 상장 이전 기업에 투자하는 VC 시장의 심각한 정보비대칭(information asymmetry)이다. 공개된 정보가 절대적으로 부족한 상황에서 투자자는 개별 기업의 정확한 위험수익특성(risk return profile)을 파악하기 어려우며, 결국 시장 평균 수준에서 투자 조건을 제시하게 된다. 이러한 투자 조건을 받아들이는 기업은 시장 평균 이상의 고위험 기업일 가능성이 크며 결과적으로 해당 투자의 수익성을 악화시키는, 이른바 역선택의 문제가 제기된다. 투자 이후에도 심각한 정보비대칭성은 기업의 부적절한 도덕적 해이를 통제하기 위한 감시비용(monitoring cost)을 상승시켜 투자 실패의 가능성을 높이게 된다. 그 외에 벤처산업이 갖는 높은 외부성(externality) 또한 시장실패의 주요 원인으로 제기된다.10) 이러한 여러 제약 요인들로 인해 민간에 의한 자본 공급이 지속적으로 적정 수준에 미달하는 시장실패를 확인하는 작업이 정책펀드의 신규 설정에서 검토해야 할 첫 번째 단계이다.

정책펀드 설정의 논리적 근거는 결국 시장실패로 인한 사회후생(social welfare)의 손실이다. 하지만 시장실패에는 다양한 원인이 작용하며, 서로 다른 이유로 인해 시장실패가 발생하는 경우 이를 보정하기 위한 정책 개입도 다른 방식으로 이루어져야 한다. 정부 지원의 필요성 및 지원 방식의 적절성을 판단하기 위해서는 해당 영역에서 시장실패가 발생하고 있는지에 대한 사실 규명과 함께, 구체적으로 어떤 요인을 원인으로 시장실패가 발생하는지도 함께 점검되어야 함을 의미한다. 이러한 관점에서 개별 정책펀드 사업군에 포함되는 펀드를 벤처형 펀드와 비벤처형 펀드로 구분할 수 있다(박창균 외, 2021). 벤처형 펀드는 창업초기 및 그 이전 단계에 속하는 혁신형 기업에 대한 자금 공급을 목적으로 운영되며, 이에 대한 정책펀드의 역할과 필요성은 이론적으로나 현실적으로 충분하다. 중소기업모태펀드의 중진계정과 특허계정 등이 대표적 사례이다. 비벤처형 펀드는 특정 정책 또는 사업 수행에 소요되는 자금 공급을 목적으로 혁신이라는 벤처기업 특징과는 무관한 산업 또는 기업에 자금을 제공하는 펀드이다. 비벤처형 펀드의 경우 정책펀드 설정의 논리가 보다 정교하고 구체적으로 제시될 필요가 있다. 만성적인 자금 공급 부족이 정보비대칭성 또는 외부성에 의한 시장실패의 결과인지 명확하지 않은 경우가 많기 때문이다.

시장실패를 보정하기 위한 정부 지원의 타당성이 확보되더라도, 그 지원 방식이 반드시 지분투자이어야 함을 의미하는 것은 아니다. Sahlman & Scherlis(2003)에 의하면 고위험ㆍ고수익 구조의 미래 현금흐름을 특징으로 하는 혁신 기업에 대한 장기투자에 있어 내재된 정보비대칭을 극복하는 데는 부채자금보다 지분자금 공급이 상대적으로 우월하다. 따라서 일정 수준 이상의 고정자본이 요구되며 자본의 회임기간이 긴 혁신 기업에 대한 정책펀드의 지분자금 공급의 정당성은 충분하다고 할 것이다. 하지만 정책펀드를 통한 지분자금 공급을 추진하기보다 기존의 부채자금 공급이나 보증 또는 보조금 지급 수단을 활용하는 것이 보다 효율적인 영역도 다수 존재한다. 지분자금 공급은 보증 또는 대출과 같은 기존의 정부지원 수단이 적절하지 않거나 효과가 없는 경우로 한정하여 추진되는 것이 바람직하다.

정부 지원의 적절성은 제시된 정책개입 수단을 통하여 시장실패로 인한 자원배분의 비효율성이 효과적으로 보정될 수 있는지를 판단하여야 한다. 정책펀드를 통한 VC 시장에의 자금 공급은 일정 기간이 경과하면 시장실패 요인이 해소되어 정부의 개입 없이 민간이 주도하는 투자 시장의 형성이 가능할 것이라는 기대를 전제로 한다. 따라서 정부 개입에도 불구하고 시장실패 요인의 해소가 불가능하거나 매우 어려운 영역은 원천적으로 정책펀드의 지원 대상에서 배제됨이 합리적이다. 예를 들어, 2015년에 설정된 중소기업모태펀드의 영화계정은 국내 영화 산업을 기업화하고 전문성을 확대하여 해외 시장으로 진출하는데 긍정적 기여를 한 것으로 평가된다. 하지만 관련 시장이 확대되고 민간의 경쟁이 심화됨에 따라 정책펀드의 기존 역할이 재설정되어야 할 필요성이 제기되고 있다. 이에 따라 영화계정의 목표 시장을 기존의 상업 영화에서 예술 영화 또는 독립 영화 시장으로 옮기는 방안이 논의되고 있으나, 이는 앞서 언급한 정부지원에 따른 민간 시장의 활성화 가능성을 감안하면 적절치 않은 추진 방향으로 평가될 수 있다. 장기간의 정부 지원에도 불구하고 민간의 자체 역량으로 생존 및 발전이 불가능하거나 어려운 영역은 재정에 의한 직접 지원이나 보조의 대상이지 정책펀드를 통한 투자의 대상은 아니기 때문이다. 일정 기간 정책펀드에 의한 정부 지원에도 불구하고 시장실패의 근본적 요인이 해소가 불가능하거나 매우 어려울 것으로 예상되는 경우 다른 형태의 정부 지원 방안을 모색하는 것이 바람직하다. 시장 조성에 대한 정책적 필요성이 아무리 크다고 하더라도, 이에 대한 정부 지원의 수단이 반드시 ‘한시적으로 설정되는 정책펀드’일 필요는 없기 때문이다.

3. 민간 시장 구축의 문제

정책펀드의 목표 시장이 시장실패 영역임을 확인하는 작업은 정책펀드 확대로 인한 민간 시장의 구축 가능성에 대한 논란과 궤를 같이한다. 이른바 정부 벤처캐피탈(Government Venture Capital: GVC)의 민간 VC 구축의 문제이다. GVC의 확대가 민간 시장을 얼마나 구축하는지에 대한 기존의 실증연구 결과를 살펴보면, 분석 대상 지역과 프로그램의 특성에 따라 일치되지 않은 결과를 보고하고 있다. 대표적 사례연구인 Brander et al.(2015)의 연구에서는 25개 국가의 20,466개 기업에 대하여 GVC와 민간 VC 모두에게서 투자를 받은 기업이 민간 VC로부터만 투자를 받은 경우보다 자금 유입의 규모면에서 우월하다는 분석 결과를 바탕으로 GVC가 민간의 투자 활동을 구축하지 않는 것으로 해석하고 있다. 하지만 Rin et al.(2006)은 절대 투자 규모가 아니라 상대 투자 비중에서는 GVC의 투자에 참여하는 민간 VC의 매칭 규모가 지속적으로 1:1에 미치지 못하는 점을 들어 일정 부분 GVC가 민간 투자를 구축하는 효과가 있는 것으로 주장하고 있다. 따라서 해외사례 또는 기존의 실증분석 결과를 토대로 민간 시장에 대한 구축 가능성을 결론내리는 것에는 상당한 주의가 요구된다. 상기 실증분석에서 정의하고 있는 GVC의 유형에는 직접 투자 펀드 또는 재간접 벤처펀드 등이 혼재되어 있어 재간접 투자 기구인 모태펀드를 통해 정책자금을 집행하는 우리 GVC의 경우와 직접 비교는 적절치 않은 측면으로 고려되어야 한다.

이렇듯 정책펀드가 민간시장을 얼마나 구축하는지에 대한 엄밀한 판단 기준이나 정량적인 척도는 존재하지 않는다. 하지만 앞서 살펴본 미시적 분석이 아닌 거시 지표를 활용하여 경제상황이 유사한 다른 나라와의 비교를 통하여 우리나라 VC 시장의 성숙도를 개략적으로 판단할 수 있다. 우리나라 VC 시장의 규모는 절대적으로나 GDP 대비 상대적으로나 OECD 회원국 중 최상위권에 속한다. OECD(2018) 통계에 의하면 VC 시장의 총 투자 규모로 볼 때 우리나라는 OECD 회원국 중 미국, 영국, 캐나다, 일본에 이어 5위이며, GDP 대비 상대적 투자 규모는 미국과 캐나다에 이어 3위를 기록하고 있기 때문이다.11) 적어도 양적인 측면에서 우리나라의 VC 시장은 상당한 성숙도에 도달한 것으로 판단되나, 그럼에도 불구하고 VC 시장의 1/3 이상을 정책펀드가 차지하고 있는 것도 현실이다. 개별 정책펀드 설정의 적정성 관점에서 민간 시장의 구축효과를 가늠하기 위해서는 개별 정책펀드가 목표로 하는 VC 시장의 개별적인 특성을 미시적으로 고려해야 할 것이다.

다만, 정책펀드의 신규 설정 또는 시장 확대 단계에서 이미 GVC와 민간 VC의 경쟁 구도가 우려되는 상황이라면 이는 정책펀드가 목표로 하는 시장이 더 이상 시장실패의 영역이 아닐 수 있음을 방증한다. 민간 자금이 자발적으로 유입되기 어려운 시장 구조의 문제가 아니라 시장의 마찰적 요인으로 인해 충분한 규모의 공급이 이루어지지 않는 효율성의 문제라면 정책펀드와 같은 직접적인 정부 개입보다는 민간 투자의 효율성을 제고하고 민간의 경쟁 구도를 강화할 수 있는 제도적 개선 같은 간접적 정부 지원이 선행되어야 한다. 정책펀드 설정에 있어 민간시장에 대한 구축 가능성은 펀드의 초기 설정 단계에서뿐만 아니라 청산 내지는 회수 시점에서도 상시적으로 검토되어야 하는 요인이다.

4. 정책펀드 중복성의 문제

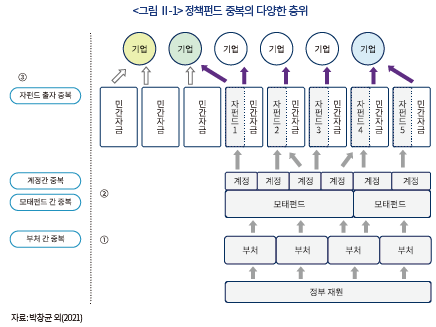

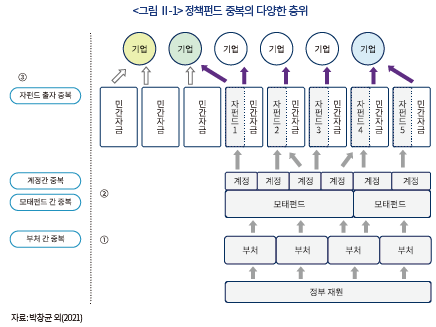

정책펀드의 신규 설정과 관련하여 고려해야 할 중요한 요인으로 중복성의 문제가 제기된다. 공공의 납세재원으로 운영되는 정책펀드는 집행 면에서 중복에 의한 재정지출의 비효율성을 방지하려는 노력이 원칙적으로 요구된다. 국회 및 언론 등에서 정책펀드 중복의 문제를 반복적으로 제기하는 이유다. 하지만 이러한 중복의 문제는 정책펀드 운용 구조상에서 다양한 양태를 가질 수 있으며, 제기되는 모든 문제가 이른바 ‘과잉지원으로 인한 비효율성 확대’를 의미하는 것은 아니다. 정책펀드에서 제기되는 다양한 층위의 중복은 <그림 Ⅱ-1>과 같이 정리될 수 있다(박창균 외, 2021).

정책펀드의 궁극적인 목적은 VC 시장의 활성화를 통한 벤처기업의 육성이다. 따라서 다양한 층위의 중복 문제는 궁극적으로 정부 지원의 최종 수혜자인 피투자 기업 단위에서 과잉지원으로 인한 비효율성으로 측정되어야 한다. 예를 들면, 동일 기업에 대한 여러 자펀드의 중복투자, 또는 동일 자펀드의 반복 투자(③번 중복)의 경우, 중복투자 자체는 시장의 일반적인 투자 관행으로 과잉지원의 문제에 해당하지 않는다. 다만 피투자 기업 단위에서 과도한 중복 출자를 받는 기업이 그에 상응하는 성과 제고를 보이지 못하거나12), 과잉투자로 인하여 성과가 오히려 악화된다면 자펀드 단위의 중복투자가 문제가 될 수 있다. 하지만 이는 자펀드를 운용하는 민간 VC(업무집행조합원(GP))의 투자 역량 문제이지, 정책펀드 자체의 비효율성을 의미하는 것은 아니다. 이러한 측면에서 모태펀드의 계정 간 중복(②번) 역시 자펀드를 선정 및 관리하는 모태펀드의 운용 역량에 관련된 사안으로 중복투자의 비효율성 문제로 해석하기는 어렵다.

정책펀드 설정의 중복을 의미하는 부처 간 중복(①번)에서는 비효율성의 문제가 제기될 수 있다. 정책펀드의 목표 시장이 기존 정책펀드와 유사하거나 동일한 경우 기존 정책펀드를 활용할 수 있음에도 불구하고 신규로 정책펀드를 설정하는 것은 재정 집행의 효율성 관점에서 부정적이다. 자금 공급의 충분성 측면에서 중복투자 자체가 문제가 되는 것은 아니나, 추가 투자 또는 후속 투자를 위해서 반드시 신규로 정책펀드를 조성해야 하는 것은 아니기 때문이다. 신규로 조성되는 정책펀드의 상당수는 기존 정책펀드와 비교하여 완전히 다른 시장 또는 다른 기업의 육성을 목적으로 하지는 않는다. 정책펀드의 목표 시장 자체는 기존과 동일하거나 유사함에도 불구하고, 해당 부처에서 요구하는 수준만큼의 충분한 자금 공급이 기존 정책펀드를 통해서는 이루어지기 힘들다는 판단에 따라 신규로 정책펀드를 설정하려는 경우가 많다. 자본 공급의 충분성 측면에서 추가적인 지원 수단이 요구되는 상황이라면, 재정지출의 효율성과 직간접적인 비용 요인 등을 감안하여 기존 정책펀드에 정부 지원 규모를 증액하는 방안이 신규 조성에 앞서 우선적으로 고려될 필요가 있다. 목표 시장이 유사할수록 중복투자의 문제를 새로운 모태펀드 운용기관 설치로 차별화하려는 동인도 강화될 수 있다. 정책펀드가 목표하는 시장의 유사성은 개별 정책펀드 간의 피투자 기업에 대한 사후적인 투자 중복도를 측정하여 정량적으로 확인할 수 있다. 하지만 현재로선 정책펀드 간의 투자 정보를 취합하여 통합적으로 분석할 수 있는 관리 체계가 부재하여 이러한 분석이 원천적으로 불가능한 상황이다.

이상의 논의를 종합하면, 정책펀드의 신규 설정은 가능한 보수적으로 접근할 필요가 있음이 강조된다. 정책펀드에 대한 개별 부처의 정책적 필요성은 언제나 충분하다. 정책적 필요성 외에 정부 지원의 타당성과 지분투자 방식의 적절성, 기존의 다른 정책 수단의 활용 가능성 등이 면밀히 검토되어야 한다. 고려할 수 있는 모든 대안이 적절치 않은 경우에 최종적으로 정책펀드의 신규 설정이 허용되는 보수적 판단 기준이 요구된다.

Ⅲ. 정책펀드의 운용

개별 부처의 정책적 목적에 의해 조성된 정책펀드는 대부분 정부의 직접적인 투자가 아닌 민간 운용사를 활용하는 재간접벤처펀드의 형태로 운용되며, 이를 공공모태펀드(public fund of venture fund)로 정의한다. 벤처기업에 대한 모험자본의 공급에 있어 기업에 대한 정부의 직접 투자보다는 VC에 대한 투자라는 재간접 투자수단이 보다 효율적이기 때문이다. Wilson & Silva(2013)는 벤처산업 육성을 위한 정부의 재정지원 프로그램을 직접지원과 간접지원으로 구분하고 있다. 정부가 정책펀드를 조성하여 벤처기업에 직접 지분 투자하는 방식이 직접공공펀드(direct public fund)이다. 우리 벤처정책사에도 초기에 이러한 직접공공펀드가 실행되었으나 운용의 비효율성으로 인해 폐지된 사례가 있다. Standaert & Manigart(2017)는 직접공공펀드 방식의 문제점으로 민간 VC 구축 가능성, 이해관계자 그룹의 시장 왜곡 가능성, 공공부문의 비효율적 지배구조, 공공펀드 운용역의 낮은 보상체계 등을 지적하고 있다. 따라서 대부분의 정부는 간접지원 방식으로 정책펀드를 집행하고 있다.

간접지원 방식은 크게 민관합동펀드(hybrid private public fund)와 재간접펀드(fund of fund)로 나뉜다. Owen et al.(2019)에 의하면 벤처시장에 대한 민관합동펀드는 주로 민간이 주도하는 벤처펀드에 정부가 매칭 투자 방식으로 참여하는 구조이다. 조합 결성에서부터 실질적인 투자의사결정을 민간 VC가 주도하고 정부는 단순한 재무적 투자자(LP)로 참여함으로, 보다 민간 중심의 정책자금 집행 방식이라 할 수 있다. 이 경우 민간 투자자와 정부의 투자 조건을 동일하게 설정하지 않고 민간 투자자에게 일정 수준의 하방위험보호(downside risk protection) 기제를 부여하기도 한다. 한국성장금융의 성장사다리펀드에서 민간출자 인센티브로 우선손실충당을 제공하는 것과 유사한 방식이다.

이에 비하여 재간접펀드는 정부가 기업이 아닌 펀드에 투자하는 모태펀드를 설정하여 정책자금을 집행하는 방식으로 민관합동펀드에 비해 보다 정부 주도적이라 할 수 있다(Wilson & Silva, 2013). 재간접펀드를 구성하는 경우도 정부의 재정출자만이 아닌 민간의 자금을 공동 출자하는 것도 가능하다. 우리나라의 공공모태펀드는 정부 출자만으로 구성되나, 터키의 ‘Istanbul Venture Capital Initiative’ 같은 경우 터키 정부 외에 유럽투자펀드(European Investment Fund)를 포함한 국책 및 민간 은행들이 공동 출자하고 있다13) (곽기현, 2019). 이러한 공공모태펀드는 시장성이 떨어지는 특수한 정책목표를 견지하기 위하여 대부분 공공기관의 형태로 정부가 설립한 모태펀드 전담운용기관에 의해 운용되고 있으며 이는 우리도 예외가 아니다.

이러한 공공모태펀드 체계에서 비재무적인 정책목표의 달성과 재무적 수익성 간에 적절한 균형을 유지하는 것은 매우 도전적인 과제라 할 수 있다. 바람직한 정책펀드 운용 체계를 모색함에 있어 이러한 정책 목표의 달성과 민간 운용사의 시장성을 종합적으로 고려하는 것이 무엇보다 중요한 이유이다. 정책펀드 운용 체계를 고려함에 있어 공공모태펀드는 시장실패 영영에서 효과적인 지분투자 시장을 조성하려는 정책 목적을 구현하는 역할이며, 이를 가장 효율적으로 달성할 수 있는 방향으로 모태펀드 운용 구조가 결정되어야 한다. 이러한 관점에서 대부분의 정책펀드는 정책 목적 달성을 위한 주목적투자(인정투자)와 일정 수준 시장의 운용 효율성을 유지하기 위한 일반투자(비인정투자)의 비중을 사전적으로 설정하고 상황에 따라 탄력적으로 조정한다. 정책 목적 달성을 위한 주목적투자의 의무비중이 지나치게 높을 경우 민간투자의 매칭을 전제로 하는 자펀드 결성 단계에서부터 어려움이 있으며, 조성된 자펀드에서 약정 기간 내에 투자를 집행하는데도 한계가 있을 수 있다. 반대로 비인정투자를 지나치게 관대하게 허용할 경우 민간 자금의 유입과 운용 효율성은 양호할 수 있겠으나, 결과적으로 정책펀드를 조성한 본연의 목적이 희석될 수 있다. 정책펀드의 지나친 고효율성 추구는 시장실패 영역이라는 정책펀드의 기본 전제에 부합하지 않기 때문이다.

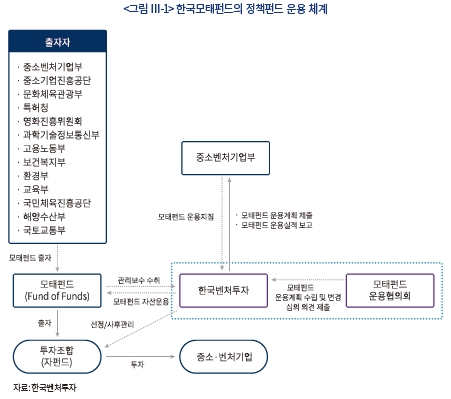

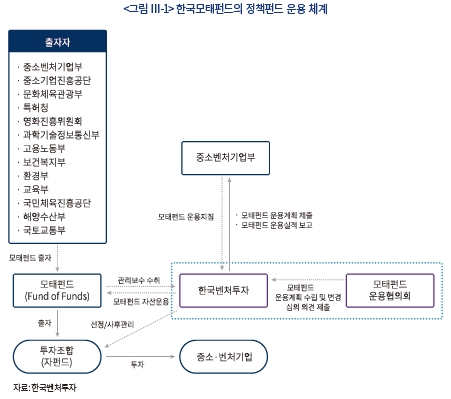

정책펀드가 요구하는 이러한 운용 조건을 만족시키기 위하여 대표적 공공모태펀드인 한국모태펀드는 <그림 Ⅲ-1>과 같은 운용체계를 구축하고 있다. 모태펀드 전담운용기관인 한국벤처투자를 중심으로 다수의 출자자에 대하여 독립된 별도 계정을 설치하고 있으며, 한국벤처투자는 계정별로 자펀드를 구성하고 관리하는 모태펀드 업무를 수행한다. 출자자인 정부 부처 또는 공공기관과 모태펀드 간에 정기적 협의체가 구성되기는 하나 그 연결고리는 약한 편이며, 자펀드 결성을 포함한 모태펀드의 운용 전반은 중소벤처기업부의 직접적인 관리·감독 하에 있다. 상이한 정책 목적과 주목적투자를 정의하는 개별 부처의 의지와 요구가 일부 희석될 수 있는 구조라는 문제점이 제기될 수 있는 부분이다.

이로 인하여 일부 부처는 신규 정책펀드를 조성함에 있어 별도의 모태펀드 관리기관을 설치하고 있다. 대표적으로 농식품모태펀드를 운용하는 농림축산식품부의 농업정책금융원과 성장사다리펀드 등을 운용하는 금융위원회의 한국성장금융 등이 있다. 이들 모두 정부 혹은 정책기관의 출자로 이루어진 정책펀드를 운용하는 공공모태펀드라 할 수 있다. 농식품모태펀드와 중소기업모태펀드는 정부 부처로부터 직접 재정지원을 받는 반면, 성장사다리펀드는 정책금융기관으로부터 출자를 받는다는 점에서 차이가 있다. 하지만 자금 공급의 원활화를 통해 건강한 기업 생태계 조성을 목표로 한다는 점에서는 공적자금 투입의 목적이 동일하다고 볼 수 있다. 한국벤처투자가 운용하는 중소기업모태펀드의 경우에도 정부 부처 외에 국민체육진흥공단과 같은 공공기관 등으로 출자자 범위를 확대하고 있다. 정책펀드의 투자 목적 및 투자 대상에 있어 형식적인 포괄성의 차이는 있겠으나 완전히 배타적으로 구분되지는 않으며, 모두 시장 활성화를 위하여 정책 지원이 수반되는 재간접 또는 재재간접 펀드라는 점에서 동일하다.

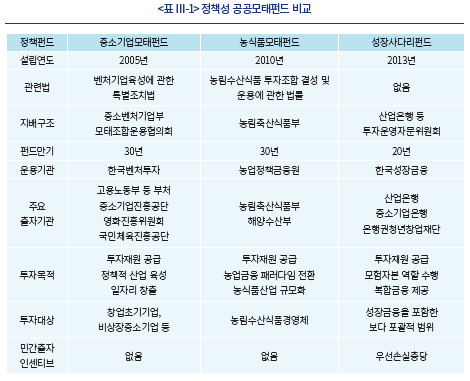

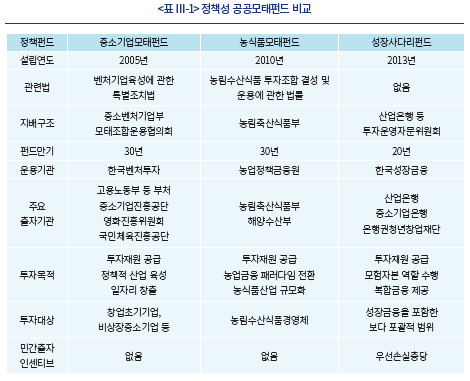

모든 공공모태펀드는 20년 또는 30년의 만기를 갖는 유한펀드로 설정되어 있으나, 기한 내에 정책 목표를 조기 달성하였을 경우의 청산 기준이나 만기 이후의 환수 절차 같은 구체적인 정책방안은 부재한 상황이다. 대표적 공공모태펀드에 대한 자세한 내용은 <표 Ⅲ-1>에 정리하였다.

유사한 정책 목적 하에 다수의 공공모태펀드가 설립됨에 따라 모태펀드 전담 운용기관 간에 운용 역량 및 성과의 차이가 나타날 수 있다. 따라서 공공모태펀드의 자펀드 관리 체계에 대한 표준규약의 필요성이 제기되기도 한다. 하지만 정책펀드의 운용 방식이 민간운용사를 활용하는 재간접펀드 구조임을 감안할 때, 개략적인 규율 체계가 아닌 표준규약의 제시 같은 직접적인 감독 체계는 적절치 않은 측면이 있다. 국내에는 아직 민간모태펀드라 할 수 있는 민간이 주도하는 재간접벤처펀드 시장이 부재하나, VC 선진국의 경우 벤처투자에서 민간모태펀드 시장이 매우 활성화되어 있다. 이는 정책펀드의 성공적 운용은 결국 민간 시장에서의 활발한 경쟁구도를 전제로 하기 때문이다. 모태펀드의 자펀드 선정 및 관리는 모태펀드의 핵심 업무이자 가장 중요한 경쟁요인이다. 향후 민간모태펀드로의 전환을 감안한다면 공공모태펀드의 재무적 성과 제고 및 운용 효율성 강화가 보다 강조될 필요가 있다.

개별 부처 입장에서는 정책펀드의 조성과 함께 이를 운용하기 위한 전담운용기관을 별도로 설치 및 운영하려는 동인이 크다. 이는 정책펀드의 운용이라는 전담운용기관의 핵심 업무 외에, 정부 부처가 수요하는 관련 산업 또는 시장에 대한 연구와 조사업무 같은 부가적인 기능을 모태펀드 운용기관으로부터 기대할 수 있기 때문이다. 그럼에도 불구하고, 정책펀드의 운용기구는 가능한 일원화하는 것이 바람직하다. 모태펀드의 운용은 특유의 공공성에도 불구하고 본질적으로 자산운용의 일환이다. 규모의 경제와 업력의 축적이 무엇보다 중요한 영역이다. 운용의 효율성 및 이에 수반되는 제반 비용 등을 감안할 때, 개별 정책펀드에 대한 별도의 운용기구 설치보다는 전문 공공모태펀드 운용기관에 대한 운용 일원화가 보다 바람직한 정책 방향으로 사료된다.

Ⅳ. 정책펀드의 청산 및 회수

정책펀드 사업 개시 후 일정 기간이 경과되었음에도 불구하고 자펀드 결성 시도 자체가 부진하거나 자펀드 결성에 실패함으로써 자금집행 실적이 부진한 정책펀드 사례가 보고된다. 시장수요에 대한 정확한 사전 예측이 부재하거나 지분투자를 통한 자금 공급이 활성화되기 어려운 시장 상황 등이 원인이라 할 수 있는데, 특히 정책적 목적이 강하고 이로 인해 주목적투자 비중이 높게 설정된 정책펀드 사업에서 투자 집행 부진의 가능성이 높다. 모태 환경계정의 미래환경산업펀드, 미세먼지특화펀드, 모태 과기정통계정의 디지털콘텐츠코리아펀드, 모태 스포츠 계정의 스포츠산업펀드 등이 자금집행 부진으로 국회의 지적을 받은 사례가 있다. 성공적인 자펀드 결성의 요인인 목적투자 정의 및 민간 매칭 비율 등은 대부분 담당 부처가 정책적으로 결정하는 사안으로, 이를 전체 정책펀드 차원에서 총괄적으로 규정화하기는 어렵다. 정책펀드 신규 설정 단계에서의 충분한 적절성 검토‧강조되는 부분이다.

정책펀드는 펀드 설정 단계에서부터 존속기간이 확정되어 설치되는 폐쇄형펀드(closed end fund)이며, 따라서 펀드 만기 이후에는 청산되어 재정으로 환수되는 것이 원칙이다. <표 Ⅱ-1>에서 확인할 수 있듯이, 정책펀드는 2년에서부터 30년까지 다양한 사업기간이 설정되어 있다. 여기에 표시되어 있는 정책펀드의 사업기간은 정부 재정 지출(예산 투입) 관점에서의 사업기간을 의미하며, 실질적인 펀드의 존속 여부는 해당 시점에서 정책 목적의 달성 여부 등을 종합적으로 고려하여 판단될 것이다. 앞서 논의한 정책펀드의 한계와 제약요인 등을 감안할 때 펀드의 존속기간 이내라도 사전에 설정한 정책 목표가 조기 달성된다면 해당 정책펀드는 즉시 청산되는 것이 바람직하다. 시장실패를 보정하기 위해 투입된 자금의 목표가 달성되었다면 그때부터 정부의 개입은 바로 민간의 구축을 의미하기 때문이다. 결국 정책펀드의 청산에 있어 법에 의해 설정된 사업기간보다는 정책 목표의 달성 정도라는 성과평가가 보다 중요하다는 의미이다. 예산 측면의 사업기간과는 별도로 정책펀드의 조성 목적과 목표 산업의 육성, VC 시장의 활성화 등을 종합적으로 고려하여 모태펀드의 존속과 청산에 대한 구체적인 정책 방안이 마련될 필요가 있다.

정책펀드의 속성을 감안할 때 정부의 추가적인 재정이 투입되지 않으면서 펀드의 자체 수입으로 영구 존속토록 하는 방안은 정책펀드의 기본 개념에 부합하지 않는다. 자체 수입으로 영구존속 할 수 있다면 그 자체가 더 이상 시장실패의 영역이 아님을 증명하는 것이기 때문이다. 이 경우 필요하다면 모태펀드 운용기구를 민영화하는 방안을 모색할 수 있다. 정책펀드의 해산과 이에 따른 모태펀드 운용기구의 청산은 다른 각도에서 접근할 필요가 있기 때문이다. 완전한 시장실패 영역에서 새로운 지분투자 시장을 개척한 공공모태펀드의 운용 역량은 민간모태펀드로의 전환을 통해 시장에 계속해서 유지될 필요가 있다. 이는 민간이 주도하는 재간접 형태의 벤처투자 기구가 부재한 국내 벤처투자 시장의 문제점을 개선하는데 효과적인 기제가 될 수 있다.

V. 결론 및 시사점

금융시장 실패를 보정하여 정책적으로 중요한 영역으로 원활한 자금공급을 촉진하기 위한 수단으로 개별 정부 부처는 복수의 정책펀드를 조성 및 운영하고 있다. 정책펀드 사업군은 12개 부처와 특허청이 출자한 자금으로 조성되어 2020년 한 해 동안 18개 펀드에 1조 6,195억원의 정부 예산이 투입되었다. 정책펀드 제도는 국내 벤처산업정책에 있어 가장 중요한 정책 수단이다. 벤처투자라는 민간의 영역에 국가가 직접적으로 개입하는 정책펀드의 본질적 속성을 감안하여, 펀드의 설정 및 운용, 청산이라는 전 주기에 걸쳐 일관된 정책 목표와 제약요인이 고려되어야 한다.

정책펀드의 신규 설정에 있어 가장 우선적으로 고려되어야 할 사안은 민간시장에 대한 구축 가능성이며, 따라서 정책펀드의 설정은 목표로 하는 시장의 시장실패를 전제로 한다. 다음으로 정책 목표의 달성 가능성, 중복투자의 비효율성, 기존 정책펀드의 활용 가능성 등이 종합적으로 고려되어야 한다. 신규 정책펀드 설정은 재정에 의한 지분투자 방식의 적절성과 다른 정책 수단의 활용 가능성 등을 면밀히 검토하여 가능한 보수적으로 허용되는 것이 바람직하다. 정책펀드 운용의 주안점은 비재무적인 정책 목표의 달성과 재간접벤처투자 기구의 시장성 간에 적절한 균형을 유지하는 것이다. 이를 위해서는 전담 운용기관인 공공모태펀드의 운용역량과 전문성이 담보되어야 한다. 개별 부처의 정책적 필요성에 의해 조성되는 정책펀드의 목표시장과 투자 대상은 상이하나, 민간 시장을 활용하는 공공모태펀드의 운용은 보다 전문화 될 필요가 있다. 정책펀드의 해산은 전담운용기관의 청산과 분리하여 접근할 필요가 있으며, 이와 병행하여 공공모태펀드의 민영화도 정책적으로 고려될 수가 있다. 공공모태펀드의 분사 또는 전환을 통한 민영화는 국내 민간모태펀드 시장 활성화의 직접적인 계기가 될 수 있기 때문이다.

정책펀드 제도를 합리적으로 운영하기 위해서는 정부 재정에서부터 시작되어 모태펀드-자펀드-피투자기업으로 이어지는 일련의 자금 흐름에 대한 정량적 분석이 전체 정책펀드에 대해 통합적으로 이루어져야 한다. 특히 정책펀드 간 목표 시장의 유사성과 이로 인한 중복투자의 문제 등을 합리적으로 논의하기 위해서는 이러한 통합 분석이 필수적이다. 하지만 현재로선 정책펀드의 효과성과 효율성 등이 개별 정책펀드의 모태펀드 단위에서만 평가되고 관리된다. 자펀드의 피투자 기업에 대한 보유 및 투자 데이터가 외부로 공개되지 않기 때문이다. 이는 개별 모태펀드에 관한 특별법과 사모펀드를 관할하는 자본시장법 등에서 자료의 외부 공개를 허용하지 않기 때문이다. 이러한 제약조건을 완화하기 위하여 관련법의 개정 또는 정보 제공 기관의 설치 등을 고려할 수 있다. 예를 들면, 자본시장법에 의거한 크라우드펀딩 제도에서는 관련 규정에서 연구목적과 같은 예외적인 사유에 대해서는 투자 정보를 외부에 제공할 수 있도록 허용하고 있다.14) 재정 집행의 효율성 측면에서 볼 때 보증이나 보조금, 융자 등 정부의 재정지출 사업에 대해서는 통합적인 자금 관리가 시스템적으로 이루어지고 있음을 참조할 필요가 있다.

정부 주도의 벤처기업 육성 정책에는 명과 암이 공존한다. 그럼에도 불구하고 정책펀드 제도가 지금까지 우리 벤처산업 및 벤처캐피탈 시장을 견인해 온 주요 원동력임에는 분명하다. 민간 영역에 대한 정부개입이라는 정책펀드의 근본적인 속성을 감안할 때 필수불가결한 영역으로 적용 대상을 엄격히 한정하고 규모와 영향력은 가능한 보수적 기준으로 접근하는 정책 방향이 요구된다. 국내 벤처산업정책도 양적 성장에서 질적 발전으로 진화하고 있다. 이에 부응하는 정책펀드 제도의 합리적 개선 방안이 논의되어야 할 시점이다.

1) 2005년 「벤처기업육성에 관한 특별조치법」에 의해 조성되었으며 한국모태펀드(Korea Fund of Fund)로 명명되어 관련 업계에서는 ‘모태펀드’라는 용어를 중소기업투자모태조합을 지칭하는 말로 흔히 사용하고 있다. 하지만 본고에서는 ‘모태펀드’를 정책펀드를 실행하는 과정에서 설정되는 재간접벤처펀드(Fund of Venture Fund)에 대한 보통명사로 정의하며, 용어의 혼선을 피하기 위하여 중소기업투자모태조합은 ‘중소기업모태펀드’로 지칭한다.

2) 2017년 이후 조성된 정책펀드가 14개이며, 2020년 한 해 동안에만 5개의 정책펀드가 새롭게 조성되었다(<표 Ⅱ-1> 참조).

3) 정부의 정책자금을 집행하는 모태펀드에 대비하여 실제 기업에 대한 투자를 실행하는 벤처조합을 자펀드라 한다. 이의 업무집행조합원(General Partner: GP)은 민간 VC가 되며 모태펀드는 유한책임조합원(Limited Partner: LP) 중 하나로 참여하게 된다.

4) 출자사업의 경쟁률은 자펀드 결성에 있어 선정조합수 대비 신청조합수의 비율로 측정한다.자세한 내용은 한국벤처투자(연도별) ‘모태펀드 운영성과평가 보고서’를 참조한다.

5) 재간접펀드와 모태펀드는 사전적으로 동일어이다. 하지만 본고에서는 용어의 혼란을 피하기 위하여 정책펀드의 실행 수단으로 설정되는 재간접벤처펀드를 공공모태펀드로, 민간에 의한 재간접벤처펀드를 민간모태펀드로 지칭한다.

6) 특정 산업 또는 기업을 육성하기 위한 정부 지원에는 보조금 지급 또는 보증 및 융자와 같은 다양한 정책 수단이 있다.

7) 산업은행, 기업은행 등 금융 공기업의 정책자금이 정책펀드 공공 부문의 전부 또는 일부를 차지하고 있으며, 한국성장금융(K-Growth)이라는 별도의 모태펀드 운용기관을 두고 있다. 그 외에 농림축산식품부의 농식품모태펀드와 국토교통부의 글로벌인프라펀드 등이 자체 모태펀드 운용기관을 설치하여 재간접 또는 재재간접의 형식으로 모태펀드를 운용하고 있다.

8) 자펀드 결성을 위한 총 납입액에서 모태펀드 납입액을 제외한 민간 납입액 비중

9) 일례로 스포츠 계정은 2015년 이후 총 11개의 자조합을 선정하였는데, 이 중 2개 조합이 민간자금 매칭의 어려움으로 자펀드 결성에 실패한 것으로 보고된다.

10) 자세한 내용은 Jaki et al.(2017)을 참조한다.

11) 국내 VC 시장은 관련법에 따라 벤처캐피탈과 사모펀드(PEF)로 업권이 분리되어 있을 뿐만 아니라, 벤처캐피탈 또한 「벤처기업육성에 관한 특별조치법」에 의한 창업투자회사(창투사) 외에 여신전문업의 신기술금융사업자(신기사)도 경제적 실질이 동일하다. 국내 신기술금융사업자도 창업투자회사와 비슷한 규모를 추산되고 있어, 이를 합산할 경우 국내 VC시장의 양적 성장은 OECD 통계보다 훨씬 클 수 있다.

12) ROA, 매출액, 연구개발비 등의 성과지표 개선을 의미한다.

13) 성장사다리펀드도 산업은행 등 정책금융기관의 출자로 조성됨으로 이와 유사한 형태의 재간접펀드로 볼 수 있겠으나, 정부 재정이 추가되지 않는다는 점에서 공식적으로 정책자금 집행의 정책펀드로 분류되지는 않는다.

14) 금융투자업규정 제4-115조 제4항은 “정보주체 또는 제3자의 이익을 부당하게 침해할 우려가 없는 통계작성 및 학술연구 등의 목적을 위하여 필요한 경우로서 특정 개인을 알아볼 수 없는 형태로 개인정보를 제3자에게 제공”할 수 있도록 규정(개정 2017.2.23)

참고문헌

강원, 2019, 국내 모태펀드의 성과에 대한 연구, 『벤처창업연구』 14(6).

곽기현, 2019, 모태펀드가 국내 벤처캐피탈 산업에 미치는 영향, 한국벤처투자 『벤처 오피니언』.

기획재정부, 2011. 9. 28, 펀드 운용효율화 방안, 보도자료.

남재우ㆍ장정모ㆍ권민경, 2016, 『모태펀드 관리기관 운용역량 평가』 자본시장연구원 학술 용역보고서.

박창균ㆍ남재우ㆍ정화영ㆍ권재현ㆍ최동욱, 2021, 『정책펀드 사업군 효율화 방안』 자본시장 연구원 학술용역보고서.

송원근, 2014, 『중소기업 모태펀드 운용실태 분석』 국회예산정책처 학술용역보고서.

조세재정연구원, 2012, 『재정사업 성과지표개발 매뉴얼』.

한국벤처투자(연도별), 『모태펀드 운영성과평가 보고서』.

Brander, J., Du, Q., Hellmann, T., 2015, The effects of Government-sponsored venture capital: International evidence, Review of Finance 19(2), 571-618.

Jaki, E., Molnar, E. M., Walter, G., 2017, Market failures of start-up financing, Management International Conference.

OECD, 2018, OECD Statistics: Venture capital investments, OECD Publishing.

Owen, R., North, D., Bhaird, C. M., 2019, The role of government venture capital funds: Recent lessons form the UK experience, Strategic Change 28(1), 69-82.

Rin, D., Nicodano, G., Sembenelli, A., 2006, Public policy and the creation of active venture capital markets, Journal of Public Economics 90, 1699-1723.

Sahlman, W. A., Scherlis, D. R., 2003, A method for valuing high-risk longterm Investments, Harvard Business School Press, Boston.

Standaert, T., Manigart, S., 2017, Government as fund-of-fund and VC fund sponsors: Effect on employment in portfolio companies, Small Business Economics 50, 357-373.

Wilson, K., Silva, F., 2013, Policies for seed and early stage finance: Findings from the 2012 OECD financing questionnaire, OECD Science, Technology and Industry Policy Papers 9, OECD Publishing.

농업정책보험금융원 www.apfs.kr

세계로선박금융 www.globalmarifin.com

정보공개포털 www.open.go.kr

한국벤처투자 www.kvic.or.kr

한국성장금융 www.kgrowth.or.kr

각국 정부는 재정으로 정책펀드를 조성하여 자국의 벤처기업에 대한 원활한 자금 공급을 도모하고 있다. 우리나라도 예외는 아니어서, 정부 부처별로 다수의 정책펀드를 운용하고 있다. 2005년부터 운용 중인 중소벤처기업부의 중소기업투자모태조합1)이 대표적이며, 이를 운용하기 위하여 한국벤처투자(Korea Venture Investmnet Corp.: KVIC) 같은 모태펀드 전문운용기관이 설립되기도 하였다. 이러한 정책펀드는 두 번의 벤처붐을 포함하여 우리나라 벤처산업 발전의 원동력이 되었으나, 오늘날까지도 국내 벤처투자 조합 결성의 1/3 이상이 여전히 정부의 재정 지원에 의존하는 상황이 지속되고 있으며, 그 중심에는 개별 부처별로 경쟁적으로 설정되고 관리되는 정책펀드가 있다. 민간 벤처캐피탈(Venture Capital: VC) 시장에 대한 정부의 개입에 대하여 벤처시장 발전을 지속적으로 견인하는 긍정적인 효과가 보다 큰 것으로 평가되나, 민간이 주도하는 VC 생태계의 자생력 강화라는 측면에서는 과도한 정부 지원으로 인한 부정적 효과도 함께 지적되는 부분이다.

정책펀드는 정부 재정을 민간 기업에 지분투자하기 위한 정책 수단의 일환이다. 이는 투자시장이라는 민간 영역에 대한 국가의 직접적 개입을 의미한다. 따라서 그 대상과 실행 방식이 매우 제한적일 수밖에 없다. 그럼에도 불구하고 개별 정부 부처의 정책적 필요성에 의해 다수의 정책펀드가 새롭게 설정되고 있다. 2020년 한 해 동안 추가로 재정이 투입된 정책펀드만 23개로, 이를 위한 예산 규모는 1조 6천억원에 이른다. 23개 정책펀드 중에서 60% 이상이 최근 5년 내에 신규 설정되었다.2) 정책펀드의 목표 시장은 금융시장의 불완전성으로 인한 시장실패(market failure) 영역임이 확인되어야 한다. 정책펀드가 민간 시장을 구축하지 않기 위한 필수적인 전제 조건이다. 모험적이고 혁신적인 창업기업에 투자하는 VC 시장이 대표적이다. 하지만 최근 들어 이른바 비벤처형 산업의 육성을 목표로 하는 정책펀드가 확대됨에 따라 이러한 시장실패 영역의 확인도 벤처산업에서와 같이 선명하지는 않은 상황이다.

벤처형 산업에 있어서도 정책펀드 초기 설정 단계에서 확인되었던 시장실패가 정책펀드의 집행에 따라 얼마나 해소되고 있는가에 대한 판단이 불명확하다. 예를 들어, 대표적 정책펀드인 중소기업모태펀드 중진계정의 정책펀드 출자 비중은 20% 수준으로, 2016년에는 10% 미만으로 축소되기도 하였다. 자펀드3) 결성에 있어 모태펀드의 출자 비중 축소 양상은 민간 자금의 유입이라는 정책펀드 목적에 부합하는 긍정적 측면이 크다. 하지만 모태펀드가 참여하는 출자사업의 유효 경쟁률이 3배를 상회하고 있으며, 이에 따라 모태펀드의 출자비중이 1% 미만으로 실제 출자금액이 거의 미미한 자펀드도 다수 결성되고 있다.4) 이러한 상황은 시장에서 요구하는 모태펀드의 역할이 실질적인 모험자본의 공급이 아니라 인증효과와 같은 민간 경쟁의 지원 수단으로 인식되고 있음을 의미한다. 시장실패가 해소되고 정책펀드와 민간의 경쟁이 과열되는 상황이라면 정책펀드의 청산 관련 논의가 요구될 수 있는 부분이다.

민간 시장 구축의 최소화와 운용 효율성의 극대화라는 관점에서 정책펀드의 실행 방식은 민간 투자시장을 최대한 활용하는 재간접펀드(fund of funds)5) 구조가 일반적이다. 이는 초기 벤처육성정책의 시행착오에 따른 학습의 결과일 뿐만 아니라, Brander et al.(2015) 같은 많은 선행연구에서 ‘정부의 직접적인 VC 설립을 통한 자금 배분이 민간 VC를 활용하는 재간접 구조에 비해 모든 측면에서 성과가 저조하다‘는 실증분석에 기인한다. 대부분의 정책펀드는 영구존속(evergreen)을 가정하지 않으며, 한정된 사업기간 내에 정책목표를 달성하면 청산되어 재정으로 환수되어야 한다. 흔히 말하는 마중물의 역할이다. 펀드의 설정과 운용, 청산이라는 전 주기에 걸쳐 이러한 정책펀드의 목적과 제약조건이 일관되게 견지되어야 한다. 정책펀드를 신규 조성하기 위해서는 시장실패 영역이 명확함으로 정부 개입이 필요하다는 정당성이 확보될 수 있어야 한다. 또한 정부 지원의 여러 방식6) 중에서 지분투자가 효율적이며, 제도 시행 이후 일정 기간이 경과되면 민간이 주도하는 투자시장으로 자립할 가능성이 확인되어야 한다. 이를 위해서는 자펀드 결성 과정에서 민간자금의 유입 또는 민간 VC의 참여가 원활하여야 하며, 결성된 자펀드는 재무적 투자 수익률 외에 정책펀드의 조성 목적에 부합하게 투자 활동을 전개하여야 한다. 이를 관리 감독하는 것이 모태펀드 운용기관의 역할이고 역량이며, 이에 수반되는 다양한 이해관계가 정렬되도록 조직과 운용 구조를 설계하는 것이 제도 개편의 방향이라 할 수 있다.

이러한 배경 하에, 본 연구에서는 국내 정책펀드 제도의 현황과 문제점을 펀드의 설정-운용-청산이라는 전체 운영 단계별로 파악하고 이로부터 의미 있는 정책적 시사점을 도출하고자 한다. Ⅱ장에서는 펀드의 설정 단계에서 고려되어야 할 요인으로 민간시장에 대한 정부 개입의 적정성과 중복투자의 문제 등을 살펴보고, 신규로 정책펀드를 조성하고자 할 때 고려해야 할 사항을 정리하였다. Ⅲ장에서는 펀드의 운용 관점에서, 민간 자금의 유입을 통한 시장 활성화와 같은 정책펀드의 조성 목적을 효과적으로 달성하는데 있어 가장 중요한 역할인 모태펀드 전담 운용기관을 살펴본다. Ⅳ장에서는 정책펀드의 청산 단계에서 고려해야 할 요인과 바람직한 환수 방안을 모색하고, 마지막 Ⅴ장에서는 이상의 논의를 종합하여, 민간의 영역에 대한 정부의 개입이라는 정책펀드의 부정적 영향을 최소화하면서 추구하는 정책적 목적을 온전히 달성하기 위한 제도적 시사점을 정리하였다.

Ⅱ. 정책펀드의 설정

1. 정책펀드의 신규 설정

국내에는 12개 정부 부처와 특허청 및 공공기관이 출자한 자금으로 조성된 다수의 정책펀드가 운영 중이다. 아래 표와 같이, 2020년 정부 예산 기준으로 1조 6,195억원 규모의 재정이 23개 정책펀드에 추가로 투입되었다. 정책펀드 공공부문의 재원은 대부분 소관 부처가 편성한 정부 예산으로 조달되나, 금융위원회의 성장사다리펀드나 혁신모험펀드 같이 공기업의 정책자금이 활용되는 사례도 있다. 이러한 재원 조성의 차이가 별도의 모태펀드 운용기관 설치의 이유가 되기도 하나7), 대부분의 정책펀드는 중소벤처기업부 산하 공공기관인 한국벤처투자(KVIC)에서 각각의 별도 계정으로 분리 운용되고 있다.

중소기업모태펀드의 부처별 계정을 비교해보면, 가장 규모가 크고 오래된 중진계정의 민간출자비중8)이 평균 79%에 이르는데 비해, 2014년 이후 조성된 신설 계정의 평균 민간출자비중은 50%에 미치지 못하고 있다. 이에 따라 자펀드가 규약에 명시된 민간매칭비율을 만족시키지 못하여 펀드 결성에 실패하는 사례도 증가하고 있으며9), 모태펀드의 출자비중 대비 자펀드의 투자집행비율을 의미하는 투자승수효과도 신규 조성 펀드일수록 낮은 경향을 보인다. 저조한 민간유인과 낮은 투자승수효과가 지속되는 경우 초기 정책펀드 설정의 타당성 또는 적절성에 대한 의문이 제기될 수 있다. 이는 정책펀드의 설정 단계에서 목표 시장의 자금 수요 규모 또는 성장가능성 같은 시장 특성보다는 특정 분야의 시장을 조성해야 한다는 정책적 당위성이 우선된 결과로 사료된다.

정책펀드의 신규 설정에 있어 먼저 민간 시장에 대한 정부 개입의 타당성이 확보되어야 한다. 정부 지원이 정당화될 수 있는 시장실패 영역임이 확인되어야 하며, 신규 설정 및 운용 과정에서 민간에 대한 구축(crowding out) 가능성이 지속적으로 검토되어야 한다. 정부지원의 여러 수단 중에서 지분자금 공급 방식이 가장 효율적인지 검토되어야 하며, 아울러 일정 기간 정부 지원이 실행된 후에는 민간 주도 시장으로 발전할 가능성이 확인되어야 한다. 마지막으로, 정부 예산 집행의 효율성 측면에서 정책펀드의 중복성 문제가 검토되고, 신규 설정에 앞서 기존 정책펀드의 확대 또는 활용 가능성이 우선 고려되어야 한다.

2. 정부 개입의 타당성

정책펀드는 본질적으로 민간의 영역에 대한 국가의 개입이다. 따라서 정책펀드 설정의 타당성은 일차적으로 VC 시장이라는 민간 영역에 대한 정부 개입의 적절성을 의미하며, 이에 대한 가장 중요한 근거는 해당 영역의 시장실패가 확인되고 이를 보정하기 위한 정부 지원의 필요성이라 할 수 있다. VC 시장에서 시장실패가 일어나는 주요 원인은 상장 이전 기업에 투자하는 VC 시장의 심각한 정보비대칭(information asymmetry)이다. 공개된 정보가 절대적으로 부족한 상황에서 투자자는 개별 기업의 정확한 위험수익특성(risk return profile)을 파악하기 어려우며, 결국 시장 평균 수준에서 투자 조건을 제시하게 된다. 이러한 투자 조건을 받아들이는 기업은 시장 평균 이상의 고위험 기업일 가능성이 크며 결과적으로 해당 투자의 수익성을 악화시키는, 이른바 역선택의 문제가 제기된다. 투자 이후에도 심각한 정보비대칭성은 기업의 부적절한 도덕적 해이를 통제하기 위한 감시비용(monitoring cost)을 상승시켜 투자 실패의 가능성을 높이게 된다. 그 외에 벤처산업이 갖는 높은 외부성(externality) 또한 시장실패의 주요 원인으로 제기된다.10) 이러한 여러 제약 요인들로 인해 민간에 의한 자본 공급이 지속적으로 적정 수준에 미달하는 시장실패를 확인하는 작업이 정책펀드의 신규 설정에서 검토해야 할 첫 번째 단계이다.

정책펀드 설정의 논리적 근거는 결국 시장실패로 인한 사회후생(social welfare)의 손실이다. 하지만 시장실패에는 다양한 원인이 작용하며, 서로 다른 이유로 인해 시장실패가 발생하는 경우 이를 보정하기 위한 정책 개입도 다른 방식으로 이루어져야 한다. 정부 지원의 필요성 및 지원 방식의 적절성을 판단하기 위해서는 해당 영역에서 시장실패가 발생하고 있는지에 대한 사실 규명과 함께, 구체적으로 어떤 요인을 원인으로 시장실패가 발생하는지도 함께 점검되어야 함을 의미한다. 이러한 관점에서 개별 정책펀드 사업군에 포함되는 펀드를 벤처형 펀드와 비벤처형 펀드로 구분할 수 있다(박창균 외, 2021). 벤처형 펀드는 창업초기 및 그 이전 단계에 속하는 혁신형 기업에 대한 자금 공급을 목적으로 운영되며, 이에 대한 정책펀드의 역할과 필요성은 이론적으로나 현실적으로 충분하다. 중소기업모태펀드의 중진계정과 특허계정 등이 대표적 사례이다. 비벤처형 펀드는 특정 정책 또는 사업 수행에 소요되는 자금 공급을 목적으로 혁신이라는 벤처기업 특징과는 무관한 산업 또는 기업에 자금을 제공하는 펀드이다. 비벤처형 펀드의 경우 정책펀드 설정의 논리가 보다 정교하고 구체적으로 제시될 필요가 있다. 만성적인 자금 공급 부족이 정보비대칭성 또는 외부성에 의한 시장실패의 결과인지 명확하지 않은 경우가 많기 때문이다.

시장실패를 보정하기 위한 정부 지원의 타당성이 확보되더라도, 그 지원 방식이 반드시 지분투자이어야 함을 의미하는 것은 아니다. Sahlman & Scherlis(2003)에 의하면 고위험ㆍ고수익 구조의 미래 현금흐름을 특징으로 하는 혁신 기업에 대한 장기투자에 있어 내재된 정보비대칭을 극복하는 데는 부채자금보다 지분자금 공급이 상대적으로 우월하다. 따라서 일정 수준 이상의 고정자본이 요구되며 자본의 회임기간이 긴 혁신 기업에 대한 정책펀드의 지분자금 공급의 정당성은 충분하다고 할 것이다. 하지만 정책펀드를 통한 지분자금 공급을 추진하기보다 기존의 부채자금 공급이나 보증 또는 보조금 지급 수단을 활용하는 것이 보다 효율적인 영역도 다수 존재한다. 지분자금 공급은 보증 또는 대출과 같은 기존의 정부지원 수단이 적절하지 않거나 효과가 없는 경우로 한정하여 추진되는 것이 바람직하다.

정부 지원의 적절성은 제시된 정책개입 수단을 통하여 시장실패로 인한 자원배분의 비효율성이 효과적으로 보정될 수 있는지를 판단하여야 한다. 정책펀드를 통한 VC 시장에의 자금 공급은 일정 기간이 경과하면 시장실패 요인이 해소되어 정부의 개입 없이 민간이 주도하는 투자 시장의 형성이 가능할 것이라는 기대를 전제로 한다. 따라서 정부 개입에도 불구하고 시장실패 요인의 해소가 불가능하거나 매우 어려운 영역은 원천적으로 정책펀드의 지원 대상에서 배제됨이 합리적이다. 예를 들어, 2015년에 설정된 중소기업모태펀드의 영화계정은 국내 영화 산업을 기업화하고 전문성을 확대하여 해외 시장으로 진출하는데 긍정적 기여를 한 것으로 평가된다. 하지만 관련 시장이 확대되고 민간의 경쟁이 심화됨에 따라 정책펀드의 기존 역할이 재설정되어야 할 필요성이 제기되고 있다. 이에 따라 영화계정의 목표 시장을 기존의 상업 영화에서 예술 영화 또는 독립 영화 시장으로 옮기는 방안이 논의되고 있으나, 이는 앞서 언급한 정부지원에 따른 민간 시장의 활성화 가능성을 감안하면 적절치 않은 추진 방향으로 평가될 수 있다. 장기간의 정부 지원에도 불구하고 민간의 자체 역량으로 생존 및 발전이 불가능하거나 어려운 영역은 재정에 의한 직접 지원이나 보조의 대상이지 정책펀드를 통한 투자의 대상은 아니기 때문이다. 일정 기간 정책펀드에 의한 정부 지원에도 불구하고 시장실패의 근본적 요인이 해소가 불가능하거나 매우 어려울 것으로 예상되는 경우 다른 형태의 정부 지원 방안을 모색하는 것이 바람직하다. 시장 조성에 대한 정책적 필요성이 아무리 크다고 하더라도, 이에 대한 정부 지원의 수단이 반드시 ‘한시적으로 설정되는 정책펀드’일 필요는 없기 때문이다.

3. 민간 시장 구축의 문제

정책펀드의 목표 시장이 시장실패 영역임을 확인하는 작업은 정책펀드 확대로 인한 민간 시장의 구축 가능성에 대한 논란과 궤를 같이한다. 이른바 정부 벤처캐피탈(Government Venture Capital: GVC)의 민간 VC 구축의 문제이다. GVC의 확대가 민간 시장을 얼마나 구축하는지에 대한 기존의 실증연구 결과를 살펴보면, 분석 대상 지역과 프로그램의 특성에 따라 일치되지 않은 결과를 보고하고 있다. 대표적 사례연구인 Brander et al.(2015)의 연구에서는 25개 국가의 20,466개 기업에 대하여 GVC와 민간 VC 모두에게서 투자를 받은 기업이 민간 VC로부터만 투자를 받은 경우보다 자금 유입의 규모면에서 우월하다는 분석 결과를 바탕으로 GVC가 민간의 투자 활동을 구축하지 않는 것으로 해석하고 있다. 하지만 Rin et al.(2006)은 절대 투자 규모가 아니라 상대 투자 비중에서는 GVC의 투자에 참여하는 민간 VC의 매칭 규모가 지속적으로 1:1에 미치지 못하는 점을 들어 일정 부분 GVC가 민간 투자를 구축하는 효과가 있는 것으로 주장하고 있다. 따라서 해외사례 또는 기존의 실증분석 결과를 토대로 민간 시장에 대한 구축 가능성을 결론내리는 것에는 상당한 주의가 요구된다. 상기 실증분석에서 정의하고 있는 GVC의 유형에는 직접 투자 펀드 또는 재간접 벤처펀드 등이 혼재되어 있어 재간접 투자 기구인 모태펀드를 통해 정책자금을 집행하는 우리 GVC의 경우와 직접 비교는 적절치 않은 측면으로 고려되어야 한다.

이렇듯 정책펀드가 민간시장을 얼마나 구축하는지에 대한 엄밀한 판단 기준이나 정량적인 척도는 존재하지 않는다. 하지만 앞서 살펴본 미시적 분석이 아닌 거시 지표를 활용하여 경제상황이 유사한 다른 나라와의 비교를 통하여 우리나라 VC 시장의 성숙도를 개략적으로 판단할 수 있다. 우리나라 VC 시장의 규모는 절대적으로나 GDP 대비 상대적으로나 OECD 회원국 중 최상위권에 속한다. OECD(2018) 통계에 의하면 VC 시장의 총 투자 규모로 볼 때 우리나라는 OECD 회원국 중 미국, 영국, 캐나다, 일본에 이어 5위이며, GDP 대비 상대적 투자 규모는 미국과 캐나다에 이어 3위를 기록하고 있기 때문이다.11) 적어도 양적인 측면에서 우리나라의 VC 시장은 상당한 성숙도에 도달한 것으로 판단되나, 그럼에도 불구하고 VC 시장의 1/3 이상을 정책펀드가 차지하고 있는 것도 현실이다. 개별 정책펀드 설정의 적정성 관점에서 민간 시장의 구축효과를 가늠하기 위해서는 개별 정책펀드가 목표로 하는 VC 시장의 개별적인 특성을 미시적으로 고려해야 할 것이다.

다만, 정책펀드의 신규 설정 또는 시장 확대 단계에서 이미 GVC와 민간 VC의 경쟁 구도가 우려되는 상황이라면 이는 정책펀드가 목표로 하는 시장이 더 이상 시장실패의 영역이 아닐 수 있음을 방증한다. 민간 자금이 자발적으로 유입되기 어려운 시장 구조의 문제가 아니라 시장의 마찰적 요인으로 인해 충분한 규모의 공급이 이루어지지 않는 효율성의 문제라면 정책펀드와 같은 직접적인 정부 개입보다는 민간 투자의 효율성을 제고하고 민간의 경쟁 구도를 강화할 수 있는 제도적 개선 같은 간접적 정부 지원이 선행되어야 한다. 정책펀드 설정에 있어 민간시장에 대한 구축 가능성은 펀드의 초기 설정 단계에서뿐만 아니라 청산 내지는 회수 시점에서도 상시적으로 검토되어야 하는 요인이다.

4. 정책펀드 중복성의 문제

정책펀드의 신규 설정과 관련하여 고려해야 할 중요한 요인으로 중복성의 문제가 제기된다. 공공의 납세재원으로 운영되는 정책펀드는 집행 면에서 중복에 의한 재정지출의 비효율성을 방지하려는 노력이 원칙적으로 요구된다. 국회 및 언론 등에서 정책펀드 중복의 문제를 반복적으로 제기하는 이유다. 하지만 이러한 중복의 문제는 정책펀드 운용 구조상에서 다양한 양태를 가질 수 있으며, 제기되는 모든 문제가 이른바 ‘과잉지원으로 인한 비효율성 확대’를 의미하는 것은 아니다. 정책펀드에서 제기되는 다양한 층위의 중복은 <그림 Ⅱ-1>과 같이 정리될 수 있다(박창균 외, 2021).

정책펀드 설정의 중복을 의미하는 부처 간 중복(①번)에서는 비효율성의 문제가 제기될 수 있다. 정책펀드의 목표 시장이 기존 정책펀드와 유사하거나 동일한 경우 기존 정책펀드를 활용할 수 있음에도 불구하고 신규로 정책펀드를 설정하는 것은 재정 집행의 효율성 관점에서 부정적이다. 자금 공급의 충분성 측면에서 중복투자 자체가 문제가 되는 것은 아니나, 추가 투자 또는 후속 투자를 위해서 반드시 신규로 정책펀드를 조성해야 하는 것은 아니기 때문이다. 신규로 조성되는 정책펀드의 상당수는 기존 정책펀드와 비교하여 완전히 다른 시장 또는 다른 기업의 육성을 목적으로 하지는 않는다. 정책펀드의 목표 시장 자체는 기존과 동일하거나 유사함에도 불구하고, 해당 부처에서 요구하는 수준만큼의 충분한 자금 공급이 기존 정책펀드를 통해서는 이루어지기 힘들다는 판단에 따라 신규로 정책펀드를 설정하려는 경우가 많다. 자본 공급의 충분성 측면에서 추가적인 지원 수단이 요구되는 상황이라면, 재정지출의 효율성과 직간접적인 비용 요인 등을 감안하여 기존 정책펀드에 정부 지원 규모를 증액하는 방안이 신규 조성에 앞서 우선적으로 고려될 필요가 있다. 목표 시장이 유사할수록 중복투자의 문제를 새로운 모태펀드 운용기관 설치로 차별화하려는 동인도 강화될 수 있다. 정책펀드가 목표하는 시장의 유사성은 개별 정책펀드 간의 피투자 기업에 대한 사후적인 투자 중복도를 측정하여 정량적으로 확인할 수 있다. 하지만 현재로선 정책펀드 간의 투자 정보를 취합하여 통합적으로 분석할 수 있는 관리 체계가 부재하여 이러한 분석이 원천적으로 불가능한 상황이다.

이상의 논의를 종합하면, 정책펀드의 신규 설정은 가능한 보수적으로 접근할 필요가 있음이 강조된다. 정책펀드에 대한 개별 부처의 정책적 필요성은 언제나 충분하다. 정책적 필요성 외에 정부 지원의 타당성과 지분투자 방식의 적절성, 기존의 다른 정책 수단의 활용 가능성 등이 면밀히 검토되어야 한다. 고려할 수 있는 모든 대안이 적절치 않은 경우에 최종적으로 정책펀드의 신규 설정이 허용되는 보수적 판단 기준이 요구된다.

Ⅲ. 정책펀드의 운용

개별 부처의 정책적 목적에 의해 조성된 정책펀드는 대부분 정부의 직접적인 투자가 아닌 민간 운용사를 활용하는 재간접벤처펀드의 형태로 운용되며, 이를 공공모태펀드(public fund of venture fund)로 정의한다. 벤처기업에 대한 모험자본의 공급에 있어 기업에 대한 정부의 직접 투자보다는 VC에 대한 투자라는 재간접 투자수단이 보다 효율적이기 때문이다. Wilson & Silva(2013)는 벤처산업 육성을 위한 정부의 재정지원 프로그램을 직접지원과 간접지원으로 구분하고 있다. 정부가 정책펀드를 조성하여 벤처기업에 직접 지분 투자하는 방식이 직접공공펀드(direct public fund)이다. 우리 벤처정책사에도 초기에 이러한 직접공공펀드가 실행되었으나 운용의 비효율성으로 인해 폐지된 사례가 있다. Standaert & Manigart(2017)는 직접공공펀드 방식의 문제점으로 민간 VC 구축 가능성, 이해관계자 그룹의 시장 왜곡 가능성, 공공부문의 비효율적 지배구조, 공공펀드 운용역의 낮은 보상체계 등을 지적하고 있다. 따라서 대부분의 정부는 간접지원 방식으로 정책펀드를 집행하고 있다.

간접지원 방식은 크게 민관합동펀드(hybrid private public fund)와 재간접펀드(fund of fund)로 나뉜다. Owen et al.(2019)에 의하면 벤처시장에 대한 민관합동펀드는 주로 민간이 주도하는 벤처펀드에 정부가 매칭 투자 방식으로 참여하는 구조이다. 조합 결성에서부터 실질적인 투자의사결정을 민간 VC가 주도하고 정부는 단순한 재무적 투자자(LP)로 참여함으로, 보다 민간 중심의 정책자금 집행 방식이라 할 수 있다. 이 경우 민간 투자자와 정부의 투자 조건을 동일하게 설정하지 않고 민간 투자자에게 일정 수준의 하방위험보호(downside risk protection) 기제를 부여하기도 한다. 한국성장금융의 성장사다리펀드에서 민간출자 인센티브로 우선손실충당을 제공하는 것과 유사한 방식이다.

이에 비하여 재간접펀드는 정부가 기업이 아닌 펀드에 투자하는 모태펀드를 설정하여 정책자금을 집행하는 방식으로 민관합동펀드에 비해 보다 정부 주도적이라 할 수 있다(Wilson & Silva, 2013). 재간접펀드를 구성하는 경우도 정부의 재정출자만이 아닌 민간의 자금을 공동 출자하는 것도 가능하다. 우리나라의 공공모태펀드는 정부 출자만으로 구성되나, 터키의 ‘Istanbul Venture Capital Initiative’ 같은 경우 터키 정부 외에 유럽투자펀드(European Investment Fund)를 포함한 국책 및 민간 은행들이 공동 출자하고 있다13) (곽기현, 2019). 이러한 공공모태펀드는 시장성이 떨어지는 특수한 정책목표를 견지하기 위하여 대부분 공공기관의 형태로 정부가 설립한 모태펀드 전담운용기관에 의해 운용되고 있으며 이는 우리도 예외가 아니다.

이러한 공공모태펀드 체계에서 비재무적인 정책목표의 달성과 재무적 수익성 간에 적절한 균형을 유지하는 것은 매우 도전적인 과제라 할 수 있다. 바람직한 정책펀드 운용 체계를 모색함에 있어 이러한 정책 목표의 달성과 민간 운용사의 시장성을 종합적으로 고려하는 것이 무엇보다 중요한 이유이다. 정책펀드 운용 체계를 고려함에 있어 공공모태펀드는 시장실패 영영에서 효과적인 지분투자 시장을 조성하려는 정책 목적을 구현하는 역할이며, 이를 가장 효율적으로 달성할 수 있는 방향으로 모태펀드 운용 구조가 결정되어야 한다. 이러한 관점에서 대부분의 정책펀드는 정책 목적 달성을 위한 주목적투자(인정투자)와 일정 수준 시장의 운용 효율성을 유지하기 위한 일반투자(비인정투자)의 비중을 사전적으로 설정하고 상황에 따라 탄력적으로 조정한다. 정책 목적 달성을 위한 주목적투자의 의무비중이 지나치게 높을 경우 민간투자의 매칭을 전제로 하는 자펀드 결성 단계에서부터 어려움이 있으며, 조성된 자펀드에서 약정 기간 내에 투자를 집행하는데도 한계가 있을 수 있다. 반대로 비인정투자를 지나치게 관대하게 허용할 경우 민간 자금의 유입과 운용 효율성은 양호할 수 있겠으나, 결과적으로 정책펀드를 조성한 본연의 목적이 희석될 수 있다. 정책펀드의 지나친 고효율성 추구는 시장실패 영역이라는 정책펀드의 기본 전제에 부합하지 않기 때문이다.

정책펀드가 요구하는 이러한 운용 조건을 만족시키기 위하여 대표적 공공모태펀드인 한국모태펀드는 <그림 Ⅲ-1>과 같은 운용체계를 구축하고 있다. 모태펀드 전담운용기관인 한국벤처투자를 중심으로 다수의 출자자에 대하여 독립된 별도 계정을 설치하고 있으며, 한국벤처투자는 계정별로 자펀드를 구성하고 관리하는 모태펀드 업무를 수행한다. 출자자인 정부 부처 또는 공공기관과 모태펀드 간에 정기적 협의체가 구성되기는 하나 그 연결고리는 약한 편이며, 자펀드 결성을 포함한 모태펀드의 운용 전반은 중소벤처기업부의 직접적인 관리·감독 하에 있다. 상이한 정책 목적과 주목적투자를 정의하는 개별 부처의 의지와 요구가 일부 희석될 수 있는 구조라는 문제점이 제기될 수 있는 부분이다.

모든 공공모태펀드는 20년 또는 30년의 만기를 갖는 유한펀드로 설정되어 있으나, 기한 내에 정책 목표를 조기 달성하였을 경우의 청산 기준이나 만기 이후의 환수 절차 같은 구체적인 정책방안은 부재한 상황이다. 대표적 공공모태펀드에 대한 자세한 내용은 <표 Ⅲ-1>에 정리하였다.

개별 부처 입장에서는 정책펀드의 조성과 함께 이를 운용하기 위한 전담운용기관을 별도로 설치 및 운영하려는 동인이 크다. 이는 정책펀드의 운용이라는 전담운용기관의 핵심 업무 외에, 정부 부처가 수요하는 관련 산업 또는 시장에 대한 연구와 조사업무 같은 부가적인 기능을 모태펀드 운용기관으로부터 기대할 수 있기 때문이다. 그럼에도 불구하고, 정책펀드의 운용기구는 가능한 일원화하는 것이 바람직하다. 모태펀드의 운용은 특유의 공공성에도 불구하고 본질적으로 자산운용의 일환이다. 규모의 경제와 업력의 축적이 무엇보다 중요한 영역이다. 운용의 효율성 및 이에 수반되는 제반 비용 등을 감안할 때, 개별 정책펀드에 대한 별도의 운용기구 설치보다는 전문 공공모태펀드 운용기관에 대한 운용 일원화가 보다 바람직한 정책 방향으로 사료된다.

Ⅳ. 정책펀드의 청산 및 회수

정책펀드 사업 개시 후 일정 기간이 경과되었음에도 불구하고 자펀드 결성 시도 자체가 부진하거나 자펀드 결성에 실패함으로써 자금집행 실적이 부진한 정책펀드 사례가 보고된다. 시장수요에 대한 정확한 사전 예측이 부재하거나 지분투자를 통한 자금 공급이 활성화되기 어려운 시장 상황 등이 원인이라 할 수 있는데, 특히 정책적 목적이 강하고 이로 인해 주목적투자 비중이 높게 설정된 정책펀드 사업에서 투자 집행 부진의 가능성이 높다. 모태 환경계정의 미래환경산업펀드, 미세먼지특화펀드, 모태 과기정통계정의 디지털콘텐츠코리아펀드, 모태 스포츠 계정의 스포츠산업펀드 등이 자금집행 부진으로 국회의 지적을 받은 사례가 있다. 성공적인 자펀드 결성의 요인인 목적투자 정의 및 민간 매칭 비율 등은 대부분 담당 부처가 정책적으로 결정하는 사안으로, 이를 전체 정책펀드 차원에서 총괄적으로 규정화하기는 어렵다. 정책펀드 신규 설정 단계에서의 충분한 적절성 검토‧강조되는 부분이다.

정책펀드는 펀드 설정 단계에서부터 존속기간이 확정되어 설치되는 폐쇄형펀드(closed end fund)이며, 따라서 펀드 만기 이후에는 청산되어 재정으로 환수되는 것이 원칙이다. <표 Ⅱ-1>에서 확인할 수 있듯이, 정책펀드는 2년에서부터 30년까지 다양한 사업기간이 설정되어 있다. 여기에 표시되어 있는 정책펀드의 사업기간은 정부 재정 지출(예산 투입) 관점에서의 사업기간을 의미하며, 실질적인 펀드의 존속 여부는 해당 시점에서 정책 목적의 달성 여부 등을 종합적으로 고려하여 판단될 것이다. 앞서 논의한 정책펀드의 한계와 제약요인 등을 감안할 때 펀드의 존속기간 이내라도 사전에 설정한 정책 목표가 조기 달성된다면 해당 정책펀드는 즉시 청산되는 것이 바람직하다. 시장실패를 보정하기 위해 투입된 자금의 목표가 달성되었다면 그때부터 정부의 개입은 바로 민간의 구축을 의미하기 때문이다. 결국 정책펀드의 청산에 있어 법에 의해 설정된 사업기간보다는 정책 목표의 달성 정도라는 성과평가가 보다 중요하다는 의미이다. 예산 측면의 사업기간과는 별도로 정책펀드의 조성 목적과 목표 산업의 육성, VC 시장의 활성화 등을 종합적으로 고려하여 모태펀드의 존속과 청산에 대한 구체적인 정책 방안이 마련될 필요가 있다.

정책펀드의 속성을 감안할 때 정부의 추가적인 재정이 투입되지 않으면서 펀드의 자체 수입으로 영구 존속토록 하는 방안은 정책펀드의 기본 개념에 부합하지 않는다. 자체 수입으로 영구존속 할 수 있다면 그 자체가 더 이상 시장실패의 영역이 아님을 증명하는 것이기 때문이다. 이 경우 필요하다면 모태펀드 운용기구를 민영화하는 방안을 모색할 수 있다. 정책펀드의 해산과 이에 따른 모태펀드 운용기구의 청산은 다른 각도에서 접근할 필요가 있기 때문이다. 완전한 시장실패 영역에서 새로운 지분투자 시장을 개척한 공공모태펀드의 운용 역량은 민간모태펀드로의 전환을 통해 시장에 계속해서 유지될 필요가 있다. 이는 민간이 주도하는 재간접 형태의 벤처투자 기구가 부재한 국내 벤처투자 시장의 문제점을 개선하는데 효과적인 기제가 될 수 있다.

V. 결론 및 시사점

금융시장 실패를 보정하여 정책적으로 중요한 영역으로 원활한 자금공급을 촉진하기 위한 수단으로 개별 정부 부처는 복수의 정책펀드를 조성 및 운영하고 있다. 정책펀드 사업군은 12개 부처와 특허청이 출자한 자금으로 조성되어 2020년 한 해 동안 18개 펀드에 1조 6,195억원의 정부 예산이 투입되었다. 정책펀드 제도는 국내 벤처산업정책에 있어 가장 중요한 정책 수단이다. 벤처투자라는 민간의 영역에 국가가 직접적으로 개입하는 정책펀드의 본질적 속성을 감안하여, 펀드의 설정 및 운용, 청산이라는 전 주기에 걸쳐 일관된 정책 목표와 제약요인이 고려되어야 한다.

정책펀드의 신규 설정에 있어 가장 우선적으로 고려되어야 할 사안은 민간시장에 대한 구축 가능성이며, 따라서 정책펀드의 설정은 목표로 하는 시장의 시장실패를 전제로 한다. 다음으로 정책 목표의 달성 가능성, 중복투자의 비효율성, 기존 정책펀드의 활용 가능성 등이 종합적으로 고려되어야 한다. 신규 정책펀드 설정은 재정에 의한 지분투자 방식의 적절성과 다른 정책 수단의 활용 가능성 등을 면밀히 검토하여 가능한 보수적으로 허용되는 것이 바람직하다. 정책펀드 운용의 주안점은 비재무적인 정책 목표의 달성과 재간접벤처투자 기구의 시장성 간에 적절한 균형을 유지하는 것이다. 이를 위해서는 전담 운용기관인 공공모태펀드의 운용역량과 전문성이 담보되어야 한다. 개별 부처의 정책적 필요성에 의해 조성되는 정책펀드의 목표시장과 투자 대상은 상이하나, 민간 시장을 활용하는 공공모태펀드의 운용은 보다 전문화 될 필요가 있다. 정책펀드의 해산은 전담운용기관의 청산과 분리하여 접근할 필요가 있으며, 이와 병행하여 공공모태펀드의 민영화도 정책적으로 고려될 수가 있다. 공공모태펀드의 분사 또는 전환을 통한 민영화는 국내 민간모태펀드 시장 활성화의 직접적인 계기가 될 수 있기 때문이다.

정책펀드 제도를 합리적으로 운영하기 위해서는 정부 재정에서부터 시작되어 모태펀드-자펀드-피투자기업으로 이어지는 일련의 자금 흐름에 대한 정량적 분석이 전체 정책펀드에 대해 통합적으로 이루어져야 한다. 특히 정책펀드 간 목표 시장의 유사성과 이로 인한 중복투자의 문제 등을 합리적으로 논의하기 위해서는 이러한 통합 분석이 필수적이다. 하지만 현재로선 정책펀드의 효과성과 효율성 등이 개별 정책펀드의 모태펀드 단위에서만 평가되고 관리된다. 자펀드의 피투자 기업에 대한 보유 및 투자 데이터가 외부로 공개되지 않기 때문이다. 이는 개별 모태펀드에 관한 특별법과 사모펀드를 관할하는 자본시장법 등에서 자료의 외부 공개를 허용하지 않기 때문이다. 이러한 제약조건을 완화하기 위하여 관련법의 개정 또는 정보 제공 기관의 설치 등을 고려할 수 있다. 예를 들면, 자본시장법에 의거한 크라우드펀딩 제도에서는 관련 규정에서 연구목적과 같은 예외적인 사유에 대해서는 투자 정보를 외부에 제공할 수 있도록 허용하고 있다.14) 재정 집행의 효율성 측면에서 볼 때 보증이나 보조금, 융자 등 정부의 재정지출 사업에 대해서는 통합적인 자금 관리가 시스템적으로 이루어지고 있음을 참조할 필요가 있다.

정부 주도의 벤처기업 육성 정책에는 명과 암이 공존한다. 그럼에도 불구하고 정책펀드 제도가 지금까지 우리 벤처산업 및 벤처캐피탈 시장을 견인해 온 주요 원동력임에는 분명하다. 민간 영역에 대한 정부개입이라는 정책펀드의 근본적인 속성을 감안할 때 필수불가결한 영역으로 적용 대상을 엄격히 한정하고 규모와 영향력은 가능한 보수적 기준으로 접근하는 정책 방향이 요구된다. 국내 벤처산업정책도 양적 성장에서 질적 발전으로 진화하고 있다. 이에 부응하는 정책펀드 제도의 합리적 개선 방안이 논의되어야 할 시점이다.

1) 2005년 「벤처기업육성에 관한 특별조치법」에 의해 조성되었으며 한국모태펀드(Korea Fund of Fund)로 명명되어 관련 업계에서는 ‘모태펀드’라는 용어를 중소기업투자모태조합을 지칭하는 말로 흔히 사용하고 있다. 하지만 본고에서는 ‘모태펀드’를 정책펀드를 실행하는 과정에서 설정되는 재간접벤처펀드(Fund of Venture Fund)에 대한 보통명사로 정의하며, 용어의 혼선을 피하기 위하여 중소기업투자모태조합은 ‘중소기업모태펀드’로 지칭한다.

2) 2017년 이후 조성된 정책펀드가 14개이며, 2020년 한 해 동안에만 5개의 정책펀드가 새롭게 조성되었다(<표 Ⅱ-1> 참조).

3) 정부의 정책자금을 집행하는 모태펀드에 대비하여 실제 기업에 대한 투자를 실행하는 벤처조합을 자펀드라 한다. 이의 업무집행조합원(General Partner: GP)은 민간 VC가 되며 모태펀드는 유한책임조합원(Limited Partner: LP) 중 하나로 참여하게 된다.

4) 출자사업의 경쟁률은 자펀드 결성에 있어 선정조합수 대비 신청조합수의 비율로 측정한다.자세한 내용은 한국벤처투자(연도별) ‘모태펀드 운영성과평가 보고서’를 참조한다.

5) 재간접펀드와 모태펀드는 사전적으로 동일어이다. 하지만 본고에서는 용어의 혼란을 피하기 위하여 정책펀드의 실행 수단으로 설정되는 재간접벤처펀드를 공공모태펀드로, 민간에 의한 재간접벤처펀드를 민간모태펀드로 지칭한다.

6) 특정 산업 또는 기업을 육성하기 위한 정부 지원에는 보조금 지급 또는 보증 및 융자와 같은 다양한 정책 수단이 있다.

7) 산업은행, 기업은행 등 금융 공기업의 정책자금이 정책펀드 공공 부문의 전부 또는 일부를 차지하고 있으며, 한국성장금융(K-Growth)이라는 별도의 모태펀드 운용기관을 두고 있다. 그 외에 농림축산식품부의 농식품모태펀드와 국토교통부의 글로벌인프라펀드 등이 자체 모태펀드 운용기관을 설치하여 재간접 또는 재재간접의 형식으로 모태펀드를 운용하고 있다.

8) 자펀드 결성을 위한 총 납입액에서 모태펀드 납입액을 제외한 민간 납입액 비중

9) 일례로 스포츠 계정은 2015년 이후 총 11개의 자조합을 선정하였는데, 이 중 2개 조합이 민간자금 매칭의 어려움으로 자펀드 결성에 실패한 것으로 보고된다.

10) 자세한 내용은 Jaki et al.(2017)을 참조한다.

11) 국내 VC 시장은 관련법에 따라 벤처캐피탈과 사모펀드(PEF)로 업권이 분리되어 있을 뿐만 아니라, 벤처캐피탈 또한 「벤처기업육성에 관한 특별조치법」에 의한 창업투자회사(창투사) 외에 여신전문업의 신기술금융사업자(신기사)도 경제적 실질이 동일하다. 국내 신기술금융사업자도 창업투자회사와 비슷한 규모를 추산되고 있어, 이를 합산할 경우 국내 VC시장의 양적 성장은 OECD 통계보다 훨씬 클 수 있다.

12) ROA, 매출액, 연구개발비 등의 성과지표 개선을 의미한다.

13) 성장사다리펀드도 산업은행 등 정책금융기관의 출자로 조성됨으로 이와 유사한 형태의 재간접펀드로 볼 수 있겠으나, 정부 재정이 추가되지 않는다는 점에서 공식적으로 정책자금 집행의 정책펀드로 분류되지는 않는다.

14) 금융투자업규정 제4-115조 제4항은 “정보주체 또는 제3자의 이익을 부당하게 침해할 우려가 없는 통계작성 및 학술연구 등의 목적을 위하여 필요한 경우로서 특정 개인을 알아볼 수 없는 형태로 개인정보를 제3자에게 제공”할 수 있도록 규정(개정 2017.2.23)

참고문헌

강원, 2019, 국내 모태펀드의 성과에 대한 연구, 『벤처창업연구』 14(6).

곽기현, 2019, 모태펀드가 국내 벤처캐피탈 산업에 미치는 영향, 한국벤처투자 『벤처 오피니언』.

기획재정부, 2011. 9. 28, 펀드 운용효율화 방안, 보도자료.

남재우ㆍ장정모ㆍ권민경, 2016, 『모태펀드 관리기관 운용역량 평가』 자본시장연구원 학술 용역보고서.

박창균ㆍ남재우ㆍ정화영ㆍ권재현ㆍ최동욱, 2021, 『정책펀드 사업군 효율화 방안』 자본시장 연구원 학술용역보고서.

송원근, 2014, 『중소기업 모태펀드 운용실태 분석』 국회예산정책처 학술용역보고서.

조세재정연구원, 2012, 『재정사업 성과지표개발 매뉴얼』.

한국벤처투자(연도별), 『모태펀드 운영성과평가 보고서』.

Brander, J., Du, Q., Hellmann, T., 2015, The effects of Government-sponsored venture capital: International evidence, Review of Finance 19(2), 571-618.

Jaki, E., Molnar, E. M., Walter, G., 2017, Market failures of start-up financing, Management International Conference.

OECD, 2018, OECD Statistics: Venture capital investments, OECD Publishing.

Owen, R., North, D., Bhaird, C. M., 2019, The role of government venture capital funds: Recent lessons form the UK experience, Strategic Change 28(1), 69-82.

Rin, D., Nicodano, G., Sembenelli, A., 2006, Public policy and the creation of active venture capital markets, Journal of Public Economics 90, 1699-1723.

Sahlman, W. A., Scherlis, D. R., 2003, A method for valuing high-risk longterm Investments, Harvard Business School Press, Boston.

Standaert, T., Manigart, S., 2017, Government as fund-of-fund and VC fund sponsors: Effect on employment in portfolio companies, Small Business Economics 50, 357-373.

Wilson, K., Silva, F., 2013, Policies for seed and early stage finance: Findings from the 2012 OECD financing questionnaire, OECD Science, Technology and Industry Policy Papers 9, OECD Publishing.

농업정책보험금융원 www.apfs.kr

세계로선박금융 www.globalmarifin.com

정보공개포털 www.open.go.kr

한국벤처투자 www.kvic.or.kr

한국성장금융 www.kgrowth.or.kr