Find out more about our latest publications

ICO and STO Markets in Korea: Challenges and Opportunities

Issue Papers 22-13 Jul. 28, 2022

- Research Topic Capital Markets

- Page 25

In response to rapid digitalization across global asset markets, Korea should enhance the international competitiveness of its digital asset industry while striving to gain investors’ confidence in the digital asset market. In this regard, it is desirable to adopt a two-track approach. Under this approach, Korea’s virtual asset market would gain investors’ confidence with the enactment of the digital asset law, while the issuance and trading of security tokens should be dealt with through the reform of the existing Financial Investment Services and Capital Markets Act (the “FSCMA”). For effective implementation of the two-track policy, it is necessary to closely analyze the convergence of the virtual asset market and the capital markets and devise measures to secure consistency in the regulatory scheme.

Most Importantly, the digital asset law designed to regulate the new virtual asset market should be promptly enacted to ensure the sustainable development of Korea’s Initial Coin Offering (ICO) market. The matters to be specified in the law include the definition of an issuer responsible for disclosure of material information, the Korean version of white paper, mandatory disclosure of material changes in the white paper, classification of ICO-related unfair trading practices and strict restrictions on such practices. For sustainable development of Korea’s Security Token Offering (STO) market, features of the virtual asset market should be reflected in the reform of the FSCMA. Relevant regulatory improvements include how to catch up with the innovation of blockchain technology using regulatory sandboxes, the fiduciary duty of security token depository agencies regarding protection of customers’ digital assets, the regulation of low-price speculative tokenized securities, and improvement plans for the STO infrastructure. Also necessary is to increase the predictability of Korea’s virtual asset market by distinguishing the jurisdiction of the FSCMA from that of the proposed digital asset law. This requires mandatory procedures for determining whether a virtual asset is a security under the FSCMA.

Most Importantly, the digital asset law designed to regulate the new virtual asset market should be promptly enacted to ensure the sustainable development of Korea’s Initial Coin Offering (ICO) market. The matters to be specified in the law include the definition of an issuer responsible for disclosure of material information, the Korean version of white paper, mandatory disclosure of material changes in the white paper, classification of ICO-related unfair trading practices and strict restrictions on such practices. For sustainable development of Korea’s Security Token Offering (STO) market, features of the virtual asset market should be reflected in the reform of the FSCMA. Relevant regulatory improvements include how to catch up with the innovation of blockchain technology using regulatory sandboxes, the fiduciary duty of security token depository agencies regarding protection of customers’ digital assets, the regulation of low-price speculative tokenized securities, and improvement plans for the STO infrastructure. Also necessary is to increase the predictability of Korea’s virtual asset market by distinguishing the jurisdiction of the FSCMA from that of the proposed digital asset law. This requires mandatory procedures for determining whether a virtual asset is a security under the FSCMA.

Ⅰ. 서언

전 세계적으로 급속히 진행되는 자산시장의 디지털화에 대응하여, 우리나라는 디지털자산산업의 국제적 경쟁력을 높임과 동시에 디지털자산시장의 투자자 신뢰성을 확보해야 하는 이중 과제를 안고 있다. 이러한 상황 속에서 지난 5월 10일 출범한 신정부는 “투자자 보호장치가 확보”1)되는 방식으로 ICO(Initial Coin Offering)를 허용하기로 하였다. 또한 토큰화(tokenization)된 증권 즉, 증권토큰의 발행에 대해서는 자본시장법을 적용하고, STO(Security Token Offering)를 위한 시장여건을 조성하고 규율체계를 확립할 것임을 밝혔다.2)

결국 가상자산의 발행과 유통에 관해서는 디지털자산법3)의 제정을 통해 투자자보호 및 시장신뢰성을 확보하고, 증권토큰의 발행과 유통에 관해서는 기존 자본시장법령의 개정을 통해 법제 정비를 하는 가상자산시장과 증권토큰시장에 대한 투트랙 정책이 추진될 전망이다. 루나-테라 사태를 통해, 가상자산시장에서 시장참여자의 정보격차와 불공정거래 취약성이 크게 드러났으며 가상자산사업자의 이용자 보호수준이 낮은 점이 확인되었다. 이러한 상황에서 최소한의 공시규제, 불공정거래규제, 사업자규제의 내용을 담은 디지털자산법의 조속한 제정이 요구된다. 최근 조각투자 등의 영역에서 증권을 토큰화하는 경향이 커지고 관련 STO 시장4)이 태동함에 따라, 자본시장법령 정비를 통해 STO 시장의 제도적 인프라를 구축해야 할 필요성도 커졌다. 이러한 STO 시장에 대한 제도정비는 너무 급하게 진행되기보다는, 금융규제 샌드박스를 통해 실증적으로 해당 제도도입의 혁신성 및 필요성을 확인해 가면서 신중하게 추진될 전망이다.

이러한 ICO 시장과 STO 시장의 제도 정비에 관한 투트랙 정책이 효율적으로 작동하기 위해서는 토큰화된 자산이 증권인지의 여부를 결정하는 증권성 심사기준이 중요하다. 최근 위믹스(WEMIX)와 같이 투자성이 높은 가상자산의 증권성이 논란이 되고 있는 점도 증권성 심사의 실무적 중요성을 잘 나타낸다. 이러한 증권성 심사는 기존의 자본시장법과 향후 입법화될 디지털자산법의 관할범위를 명확히 한다는 점에서 큰 의의가 있다.

본고는 위에서 언급한 가상자산 ICO 시장과 증권토큰 STO 시장의 당면 과제와 발전 방향을 발행시장 중심으로 분석하고 제언한다. 본고에서는 먼저 국내 가상자산 ICO 시장의 당면 과제를 살피고 대응 방안을 모색한다. 또한 가상자산거래업자 주도의 ICO인 IEO(Initial Exchange Offering)의 개념과 관련한 이해상충 문제에 대해서도 고찰한다. 이후 국내 증권토큰 STO 시장의 당면 과제를 살피고 대응 방안을 모색한 후, 국내 ICO 시장과 STO 시장의 규제 정합성을 논하고 나서, 종합적으로 양 시장의 발전 방향을 제시한다.

Ⅱ. 국내 ICO 시장의 당면 과제와 대응 방안

1. ICO의 개념

ICO란 “일정한 권리가 포함된 디지털 코인 또는 토큰을 발행하는 대가로 자금을 조달하는 수단”을 의미한다.5) 본고에서 ICO란 증권6)에 해당하지 않는 가상자산의 발행행위를 의미한다. ICO 규제하는데 있어서의 핵심은 가상자산의 생성행위(minting)에 있는 것이 아니라, 가상자산의 청약(offering)을 본질로 하는 발행행위(issuance)에 있다. 거래자 보호의 필요성은 발행인이 가상자산을 생성하는 시점이 아닌 가상자산을 다수의 일반투자자에게 청약 또는 청약의 권유를 하는 시점에서 발생하기 때문에, 가상자산의 생성행위보다 투자자에 대한 발행행위에 규제의 초점이 맞추어지는 것이다. 얼마 전 이슈가 된 위믹스 깜깜이 매도의 경우에도 위메이드라는 상장법인이 위믹스라는 가상자산을 해외에서 생성하였다는 점이 아닌 국내 가상자산거래업자의 거래시설을 통해 일반투자자에게 투자정보의 제공 없이 대규모 청약의 권유(발행행위)를 하였다는 점에서 크게 쟁점화되었던 것이다.

최근까지 우리 정부는 행정지도를 통해 “모든 형태의 ICO를 금지”7)하고 있었다. 따라서 가상자산의 국내 유통은 싱가포르 등 해외에서 가상자산을 생성하여 이해관계자 등을 대상으로 일부 사모 발행을 한 후 국내 가상자산거래업자의 거래시설(소위 ‘가상자산거래소’)8)에서 유통시키는 방식으로 이루어졌다. 이 경우 발행인이 가상자산거래업자의 거래시설에서 해당 가상자산의 매매주문을 하여 호가를 제시하는 행위는 청약 또는 청약의 권유에 해당한다. 따라서 해외에서 ICO를 하였다고 하는 가상자산의 경우, 해당 가상자산의 공모(public offering)는 국내에서 이루어진 경우가 대다수이다. 그러나 이러한 공모 발행에 있어, 중요투자정보(material information)를 담은 백서(발행공시서류)를 거래자에게 사전에 배포한 후 관련 가상자산을 판매하는 행위는 이루어지지 않고 있다.

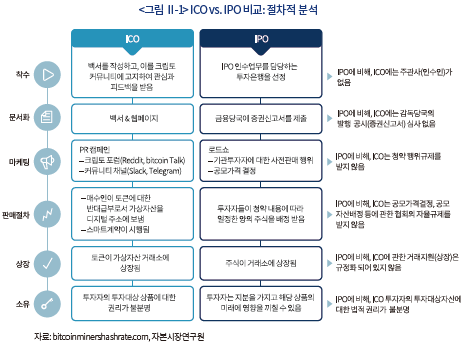

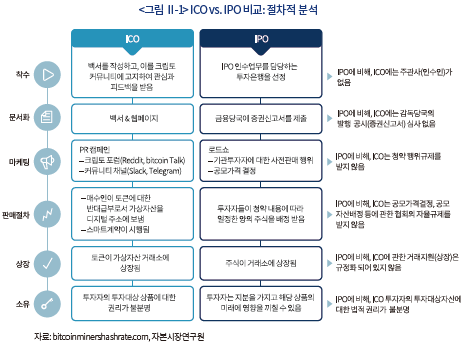

ICO를 증권의 최초 발행행위인 IPO(Initial Public Offering)와 비교하면 <그림 Ⅱ-1>과 같다. <그림 Ⅱ-1>에서 잘 나타나듯, 증권 IPO에 비해 가상자산 ICO에 있어 발행공시 심사기능 및 가상자산사업자의 문지기(gatekeeper) 기능은 미약하다.

2. IEO 개관

가. IEO의 개념

IEO(Initial Exchange Offering)란 자금조달을 목적으로 가상자산거래업자의 관리하에 이루어지는 분산원장 네트워크상의 코인 또는 토큰의 발행행위를 의미한다. 즉, 가상자산거래업자가 가상자산의 신규 거래지원(소위 ‘상장’9))을 위한 절차를 주도함으로써 판매하는 가상자산의 인증 효과를 높인 ICO라고 할 수 있다. 2019년 무분별한 ICO로 인해 가상자산 발행시장의 신뢰성이 추락하자, 가상자산거래업자인 바이낸스(Binance)가 가상자산을 직접 심사하여 Binance Launchpad를 통해 최소기능상품(Minimum Viable Product: MVP) 수준 이상의 가상자산을 발행하여 시장의 호응을 얻으며 IEO가 알려지기 시작하였다. Binance Launchpad 이후로 Gate.io, Bittrex, Huobi, Kucoin 등 다수의 가상자산거래업자가 IEO 사업에 진출하였으나, 초기 시장의 기대만큼 성장하지 못하였다.

IEO는 국내에서 거래자 보호에 근간을 둔 ICO 제도도입의 일환으로 고려되었다. 그러나 정부의 감독권이 배제된 민간 가상자산사업자 주도의 IEO가 현재 성공적으로 정착한 제도라고 평가하기 어렵다. 오히려 미국 SEC(Securities and Exchange Commission)는 2020년 IEO에 대한 투자경보(Investor Alert)를 발동하여, IEO의 주체인 가상자산거래업자는 증권거래법상의 거래소 또는 등록된 사업자가 아니기 때문에 거래자들이 투자에 유의하여야 한다는 점을 강조하였다.10)

IEO는 ICO보다 거래지원 심사수준이 높다는 점에서 거래자 보호에 있어 보다 유익하다. 그러나 거래비용 측면에서 IEO는 ICO보다 거래자 부담이 크다. 또한 IPO를 통한 증권 상장과 비교할 때, IEO는 거래자 보호수준이 낮고 문지기 기능이 약하다. 무엇보다 IEO는 아래 기술하는 바와 같이 구조적 이해상충의 문제로 인해 신뢰성 있는 가상자산 자금조달 수단이라고 평가하기 어렵다.

나. IEO에 있어서의 이해상충 문제와 해결 방안

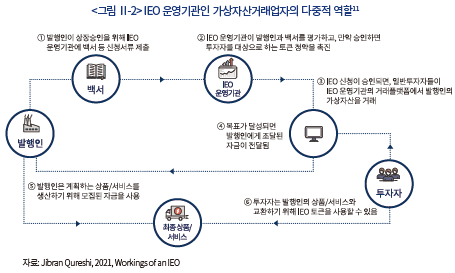

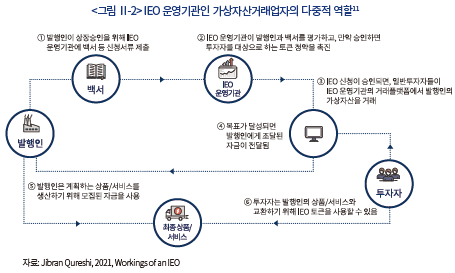

IEO는 동일 가상자산거래업자가 발행시장의 인수인, 공시감독기구, 상장심사기구의 역할을 모두 담당한다는 점에서 이해상충의 우려가 크다. <그림 Ⅱ-2>는 IEO 운영기관인 가상자산거래업자가 다중적 역할을 수행하며 이해상충 가능성을 높이는 점을 잘 나타낸다.

<그림 Ⅱ-2>에서 나타나는 바와 같이, IEO는 운영기관인 가상자산거래업자가 백서 및 청약 대상 가상자산의 신뢰성을 보장하는 장점이 있다. 그러나 IEO를 운영하는 거래업자의 인증 내용을 독립된 제3의 기관이 심사하지 않고 해당 거래업자가 자기의 검증내용을 셀프심사한다는 점은 IEO의 절차적 취약성을 드러낸다. 운영기관인 가상자산거래업자는 <그림 Ⅱ-2> ②번 절차에서 백서를 심사하는 공시감독 기능을 하고, <그림 Ⅱ-2> ③번 절차에서 상장(거래지원)심사 기능을 수행한다. 그러나 <그림 Ⅱ-2> ④번 절차 등에 있어서는 발행인을 위한 중개업자(인수업자)의 역할을 하고 있다. 증권발행에 있어 인수인이 기업실사를 하고 실사 내용을 증권신고서에 반영하면 해당 증권신고서를 외부 감독기관이 심사하는 것에 비교하여, IEO 운영기관이 영리행위로서 수행하는 운영업무 및 검증 내용에 대해서는 외부 감독기구의 심사를 받지 않는다. 자율규제의 공공성이 부여되지 않은 영리법인인 가상자산거래업자가 공적 감독을 받지 않고 투자정보를 인증하고 거래지원심사를 하는 경우, 수수료 수입 등 사적 이해관계를 공익(시장신뢰성)에 우선하여 거래지원관리를 할 위험이 있다.

지난 대선 공약에서 제시된 IEO 제도도입은 해외 특정 가상자산거래업자의 비즈니스 모델로서의 IEO를 제도화하겠다는 의미가 아니라, 국내 가상자산거래업자의 신규 거래지원에 있어 투자자에 대한 인증 기능과 문지기 기능을 높여 가상자산거래자 보호의 수준을 제고한다는 의미로 이해하여야 할 것이다. 이러한 가상자산거래업자의 문지기 기능 강화 노력은 최근 가상자산 관련 당정간담회에서 구체화되고 있다. 지난 6월 13일 당정간담회에서 논의된 “가상자산 사업자 공동 자율 개선방안”에서 국내 5개 가상자산거래업자는 “가상자산 거래지원~종료까지 강화된 평가·규율 체계 마련”을 약속하였다.12) 또한 6월 22일 공동협의체를 설립하여 거래지원 기능을 강화하기로 업무협약을 맺은 것도 이러한 문지기 기능 강화의 일환으로 이해할 수 있다.

국내 가상자산거래업자가 IEO 수준의 시장진입 관리권한을 가지기 위해서는 우선 구조적 이해상충의 문제를 해결하여야 할 것이다. 이해상충 문제가 해결되어야만 가상자산거래업자가 신뢰성 있는 문지기 기능을 잘 수행할 수 있으며 정부로부터 높은 수준의 자율규제권한을 부여받을 수 있다. 가상자산거래업자의 구조적 이해상충을 해결하기 위해, 예탁결제와 매매의 분리, 시장조성(market making) 불허용 등의 조치가 필요하다. 미국 SEC 게리 겐슬러 의장이 가상자산거래업자가 거래시설을 운영하는 업무를 가상자산 수탁업무(custody) 및 마켓메이킹업무와 분리해야 한다고 주장13)하는 이유도 가상자산거래업자의 이해상충으로 인한 시장신뢰성 하락을 막기 위함이다.

3. ICO 관련 당면 개선과제

가. 공시의 주체, 내용, 방식

ICO에서는 통상 개발자, 네트워크운영자, 재단 등 다양한 이해관계자가 연루되어 있기 때문에, 공시의 주체가 되는 발행인(issuer)의 범위가 명확하지 못한 측면이 있다. 발행인 범위가 불명확하다는 ICO의 특성은 그간 ICO에 대한 공시규제가 적합하지 않다는 주요 논거가 되어 가상자산시장참여자간의 정보격차를 심화시키는 문제점을 야기하여 왔다. 그러나 ICO의 경제적 실질을 살펴보면 가상자산 발행, 개발, 자금조달 등에 적극적으로 참여하는 자(active participant)가 존재하며, 이러한 적극적 참여자를 발행인 개념에 포섭하여 발행공시의무를 부과할 수 있다. 최근 루나-테라 사태가 잘 나타내듯이, 외견상 탈중앙화(decentralization)가 되었다고 보여지는 가상자산의 경우에도 공시의무의 주체가 되기에 충분한 권한과 정보를 가진 법적 주체가 존재하는 경우가 대다수이다. EU(유럽연합)의 MiCA(Market in Crypto-Assets)규제안은 발행인의 자격을 법인으로 제한하고, 발행인을 일차적 가상자산 공시의 주체로 규정하고 있다.14) 현재 EU 의회의 MiCA규제안 논의 과정에서, NFT, 스테이블코인 규제, 감독기관, 시행기간 등이 쟁점화되고 있는데 반하여 가상자산 발행인 규제와 공시 규제는 큰 이견 없이 통과될 전망이다.15) 반면 국회에 발의되어 있는 가상자산 관련 법안은 발행인이 아닌 가상자산거래업자에 공시의무를 부과하는 접근방법을 취하고 있다.

국내 ICO 금지 정책은 국내 시장에서 무분별한 ICO를 방지하는 효과를 거두기는 하였지만, 가상자산 발행·유통에 관한 체계적인 공시체계를 발전시킬 기회를 박탈하였다는 아쉬운 측면이 있다. 국내 ICO 금지로 인해 가상자산 발행시 국문 백서의 제출이 의무화되어 있지 않아서 많은 국내 가상자산거래자들이 언어장벽의 문제를 겪고 있다. 또한 백서에 포함되는 중요투자정보가 규정화 되어 있지 않기 때문에 많은 중요투자정보가 백서에서 누락 되어 발행공시가 부실화되었다. 따라서 현재 가상자산 프로젝트에 관련된 중요 투자위험, 마일스톤, 가상자산 배분계획(distribution plan) 등 중요투자정보를 담은 발행공시가 제대로 이루어지지 못하는 실정이다. 가상자산 발행·유통에 있어, 강행법규에 따른 의무공시의 대상이 되는 중요투자정보와 자율규제규정에 따른 공시의 대상이 되는 중요투자정보의 기준과 범위도 정립되어 있지 못하다. 결과적으로 가상자산 발행에 있어 중요공시사항에 대한 법적 심사 및 감독 없이 가상자산 판매행위가 이루어지고 있다. 루나-테라와 같이 외부 공격 또는 외부 경제상황 변화에 취약한 알고리즘 스테이블코인이 투자위험에 대한 고지 없이 일반투자자들을 대상으로 대규모 유통될 수 있었던 원인도 공시규제의 부재에서 찾아야 할 것이다.

현재 가상자산의 발행과 유통에 있어, 거래자를 위한 투자정보의 제공은 발행인 또는 가상자산거래업자의 홈페이지 등을 통해 분산적으로 이루어지고 있다. 이로 인해 투자자들의 투자정보 검색에 있어서의 불편과 비용이 높아지게 되었다. 가상자산 통합공시시스템의 구축 없이 의무공시제도가 도입되는 경우, 거래자의 불편과 함께 감독당국의 공시규제 비효율도 예상된다.

나. ICO 관련 불공정거래규제 공백

국내 ICO 시장에 대한 법제 정비가 이루어지지 못하고 있어, ICO 배정 및 시장조성 관련 불공정거래, 내부자거래, 기타 부정거래행위에 대한 규제 공백이 큰 실정이다. 가상자산을 상품(commodity)으로 취급하는 미국에 있어, ICO 관련 불공정거래행위는 CFTC(Commodity Futures Trading Commission)의 불공정거래규제의 대상이 된다.16) 반면 우리나라는 가상자산에 대한 불공정거래금지 근거규정이 없다. 따라서 해당 행위에 대해 형법상 사기죄를 적용하여야 하며, 사기죄 구성요건의 입증이 매우 어렵다. 이로 인한 불공정거래 규제의 공백은 가상자산 공모가격의 올바른 형성을 저해한다. 또한 ICO 기간 중에 부정한 방법으로 다른 시장참여자를 기망하여 해당 가상자산을 거래하는 행위에 대한 금지조항이 미비되어 있기 때문에, ICO전(前) 장외시장 불공정거래가 만연할 위험이 크다. 가상자산 신규 거래지원시 공모가격 결정의 신뢰성을 담보할 수 있는 제도적 절차(IPO의 경우 수요예측제도)와 관련 위반행위에 대한 제재규정도 없기 때문에, 공모시장의 시세조종도 손쉽게 이루어진다.

ICO 절차에 있어서의 규제 공백 문제는 청약행위, 물량배정, 시장조성 등에서 나타난다. 먼저 투자설명서 중심의 청약행위규제가 없기 때문에, 백서상의 중요투자정보에 근거하여 ICO 투자자를 모집하는 경우가 드물고 사기적 청약행위 가능성도 높다. ICO 물량배정에 있어 IPO 수요예측규정과 같은 절차적 통제장치가 없기 때문에, 대가성(quid pro quo) 배정행위가 만연할 수 있으며 ICO 시장의 신뢰성이 실추되기 쉽다. 또한 시장조성에 관한 명확한 규정이 없기 때문에, 마켓메이커의 시장조성을 빙자한 시세조종의 위험이 크다. 실제로 국내 가상자산시장에서 가상자산거래업자의 마켓메이킹 또는 유동성공급이 시세조종이 아니냐는 여러 의혹이 있어 왔다. 그러나 가상자산사업자의 시장조성 규제가 미비되어 있기 때문에 처벌이 어렵고 시장 불신만 커지는 상황이 발생하고 있다. 미국에서도 이러한 가상자산거래업자의 시장조성을 빙자한 시세조종성 마켓메이킹은 여러 문제점을 야기하고 있기 때문에, SEC 게리 겐슬러 의장은 거래시설을 운영하는 가상자산거래업자가 직접 마켓메이킹을 하는 행위를 금지해야 한다고 주장하고 있다.17)

다. Pre-ICO 장외 판매행위에 대한 규제 공백

향후 ICO가 이루어지면 해당 가상자산의 가격이 급등한다는 것을 미끼로 일반투자자, 특히 노인 등 금융취약계층을 상대로 장외에서 사기적인 가상자산 판매행위가 빈번하게 이루어지고 있다.18) ICO를 미끼로 한 허위·과장된 청약행위는 다단계 판매조직을 통해 이루어지는 경우가 많아 투자자 피해가 확산될 위험이 크다. 가상자산거래시설이 스스로를 거래소라고 명명하며 자체 발행한 가상자산을 장외에서 다단계로 판매하여 투자자 피해사례를 유발하는 경우도 많다.19) 작년 특금법시행령 개정을 통해 가상자산사업자(특수관계인 포함)의 자체 발행 가상자산을 자기 거래시설에서 중개·알선·대행하는 행위는 제한되었지만20), 여전히 가상자산거래시설이 발행한 가상자산의 장외 판매행위가 불공정거래로 이어질 위험이 크다.

가상자산 판매에 있어 금융투자상품 판매에 있어서와 같은 투자권유준칙이 정립되어 있지 않은 점은 가상자산 장외거래의 투자자 피해를 확대시키는 요인으로 작용한다. 투자권유준칙의 부재는 고객확인(Know-Your-Customer: KYC) 절차, 적합성·적정성의 원칙, 설명의무 등 장외 판매행위의 다양한 측면에서 문제점을 드러낸다. 먼저 ICO전 가상자산 판매행위를 함에 있어 KYC 절차가 제대로 이행되지 못하고 있다. 장외에서 이루어지는 가상자산거래에 있어, 판매자는 거래자의 투자목적, 투자경험, 재산상황 등을 제대로 파악하지 않는다. 또한 고객확인사항을 바탕으로 고객에게 적합·적정한 가상자산을 투자권유하는 경우도 찾기 어렵다. 이러한 과정 속에서 일반투자자에게 가상자산의 내용, 투자위험 등을 제대로 설명하지 않고 판매행위가 이루어지는 경우가 빈번하게 발생한다.

ICO전 가상자산 판매과정에서 발행인 및 특수관계인의 미공개중요정보이용행위에 대한 규제 역시 공백 상태에 있다. 만약 ICO를 계획하는 가상자산 발행인이 미공개중요정보이용행위에 대한 혐의가 있는 경우, 이를 일반 사기죄로 처벌할 수는 있으나 형사상 입증이 매우 어렵다. 반면 주식시장에서 6개월 이내에 주식을 상장하려는 발행인의 내부자는 엄격한 미공개중요정보이용행위의 규제를 받는다.21)

라. 규정화되지 못한 거래지원 기준 및 절차

가상자산거래업자의 신규 거래지원심사가 거래지원규정 등 자율규제규정이 없이 거래업자의 경영판단에 따라 이루어지기 때문에, 거래지원기준과 절차의 일관성 및 신뢰성이 낮고 거래업자의 이해관계에 따라 거래지원행위가 이루어질 가능성이 있다. 현재 국내 5개 가상자산거래업자들은 거래시설 진입·퇴출에 관한 적정한 계량화된 기준 및 실질심사요건을 마련하지 못하고 있으며, 공동협의체를 설립하여 최소한의 거래지원요건에 대한 합의점을 찾고 있는 실정이다.

국내 주식 장내거래시장인 유가증권시장 또는 코스닥시장과 유사한 수준의 대규모 경쟁매매를 하는 국내 가상자산거래업자의 거래지원요건은 유가증권시장 또는 코스닥시장의 상장요건과 비교할 때 진입요건이 매우 낮은 수준이다. 이렇게 낮은 가상자산 심사 수준은 시장의 문지기 기능을 약화시켜 거래자 보호수준을 낮춘다. 가상자산 신규 거래지원의 문턱이 낮다는 문제점에 더하여, 가상자산거래업자가 예측가능한 원칙 없이 임의로 거래지원 또는 거래지원 중단을 결정하여 시장참여자의 불신을 받는다는 점도 문제점으로 지적될 수 있다. 국내 가상자산거래업자의 일관성 없는 거래지원, 발행인과 협의 없는 거래지원, 기습 거래지원 중단, 자의적 유의종목 지정 등이 지속적으로 이슈가 되어 오고 있다.22)

국내 가상자산거래업자는 거래지원 후 거래지원 유지요건에 대해서도 명확히 규정화하지 못하고 있고, 부실 가상자산에 대한 신속하고 일관성 있는 거래지원 중단제도를 운영하지 못하고 있다. 거래지원 유지요건에 미달하는 가상자산에 대해 적극적으로 개선계획안 제출을 명하고 이행기간 내에 거래지원요건을 재충족하지 못하는 경우 과감히 거래지원을 중단하는 절차를 규정화할 필요가 있다. 절차적으로 가상자산의 거래시설 진입·퇴출에 관한 주요 의사결정이 가상거래업자 내부 임직원에 의해서만 이루어지고 이해관계가 없는 전문가들로 구성된 독립된 거래지원위원회에서 이루어지지 못하고 있다는 점도 개선사항으로 지적할 수 있다.

4. ICO 시장 발전 방향

국내 ICO 시장이 합법적으로 태동하여 지속가능한 발전을 이루기 위해서는 무엇보다 가상자산의 발행인과 거래자간의 정보격차와 대리인 비용을 줄이기 위한 공시제도와 시장신뢰성 확보를 위한 불공정거래행위 금지제도의 확립이 필요하다. 또한 건전한 가상자산 유통시장 조성을 위해, 가상자산의 시장진입 단계에서 문지기 기능을 강화하여야 한다. 이러한 ICO 시장 발전 방향을 주요 사안별로 살피면 다음과 같다.

첫째, ICO 발행공시 체계를 구축하여야 한다. 이에 관련한 필수적 입법 사항으로 발행인의 법적 정의, 백서의 국문화, 중요투자정보의 공시의무화, 백서의 중요사항 변동에 대한 계속공시 의무화 등을 들 수 있다. 공시 주체로서의 발행인 범위를 명확히 함에 있어, 가상자산 발행인은 탈중앙화된 시장 특성을 반영하여 자본시장의 발행인보다 광의의 개념으로 정의되어야 한다. 즉, 토큰의 발행자 이외에 개발자인 재단, 프로모터, 상장 신청자 등의 적극적 참여자를 특수관계인으로 포섭하여야 할 것이다. 아울러 ICO 관련 내부자거래 규제를 위해, 미공개중요정보 이용행위의 주체인 내부자의 개념 및 범위도 명확히 하여야 할 것이다.

발행인이 가상자산거래업자에게 거래지원을 신청함에 있어, 국문 백서 발간을 의무화하고 백서에 기재해야 하는 중요투자정보를 의무공시대상으로 법제화하여야 할 것이다. 백서의 필수기재 사항을 규정화함에 있어, MiCA규제안 등 해외 입법례, 국내외 가상자산거래업자의 백서 심사기준, 가상자산 평가기관의 평가기준 등을 고려하여 국제적 정합성과 국내 시장현실을 잘 반영한 중요투자정보를 의무공시의 대상으로 하여야 한다. 최근 테라 백서의 투자위험 공시 부재, 위믹스 깜깜이 매도 사태 등이 가상자산시장의 신뢰성을 크게 실추시킨 점에서, 발행인의 지분변동, 마일스톤 달성여부, 투자위험 요소 등에 관한 사항은 반드시 백서의 필수기재사항에 포함되어야 할 것이다. 또한 마일스톤 공시와 락업(lock-up, 일종의 보호예수)된 물량의 배분계획에 관한 이행여부에 대해서도 철저한 사후감독이 필요하다. 해외에서 ICO된 가상자산을 국내 가상자산거래업자가 거래지원을 하여 국내 투자자에게 유통시키는 경우, 중요투자정보에 대한 국문화된 공시의무는 해당 거래업자가 부담하여야 할 것이다. ICO 후 유통공시(계속공시) 관련하여, 발행인에게 정기공시의무를 부과하는 것은 현 단계에서 어려울 수 있으나, 최소한 백서에서 공시한 중요 내용에 대한 변경사항은 의무공시화 하여야 한다. 공시의 방식에 있어, 증권시장에서 금융감독원이 운영하는 DART(Data Analysis, Retrieval and Transfer System)와 같이 규제당국이 직접 운영하거나 감독하는 통합적 공시시스템의 구축이 필요하다.

둘째, ICO 관련하여 발생하는 불공정거래 및 불완전판매행위에 대한 규제체계가 정립되어야 한다. ICO 관련 대가성 배정, 시세조종성 마켓메이킹 등을 근절하기 위해, 관련 불공정거래행위를 유형화하고 위반행위의 구성요건 해당성 입증을 용이하게 하여야 한다. 이와 함께 불공정거래 금지조항 위반에 대해 강력한 제재를 위한 근거조항도 마련하여야 한다. ICO를 미끼로 하는 사기성 장외거래행위, 다단계 판매행위 등을 방지하기 위해, Pre-ICO 판매행위에 대한 KYC의무, 적합성∙적정성의 원칙, 설명의무 등의 투자권유준칙을 제도화하여야 할 것이다.

셋째, 문지기 기능을 강화하기 위해 가상자산거래업자의 거래지원관리업무를 규정화하고, 해당 가상자산거래업자의 주무관청이 관련 규정을 승인하도록 하여야 한다. 주무관청의 승인을 받아야 할 가상자산거래업자의 거래시설규정의 주요 내용으로 i) 가상자산 거래지원을 위한 요건, 심사 및 승인절차, ii) 거래가 허용되지 않는 가상자산의 유형, iii) 거래지원을 위한 정책, 절차, 수수료 수준, iv) 공정하고 질서 있는 거래를 보장하기 위한 요건, v) 유동성, 정기공시 등에 관한 거래가능 요건, vi) 거래정지 사유 등을 들 수 있다. 가상자산 상장관리업무 중 영리성이 높은 업무는 가상자산거래업자의 사업부에서 수행하되, 공익성이 높은 신규 거래지원 및 거래지원 중단 등에 관한 결정은 외부 전문가를 포함한 독립적인 거래지원위원회에서 담당하여야 할 것이다. 문지기 기능을 수행하는 가상자산거래업자의 거래지원관리업무는 영리법인의 경영업무가 아닌 자율규제업무로 포섭하여야 한다. 가상자산거래업자간 공통된 최소한의 거래지원심사기준을 마련하고 체계적인 시장감시기능을 수행하기 위해 자율규제기구의 설립이 필요하다. 자율규제기능의 신뢰성, 관련 제재의 실효성을 확보하기 위해서는 자율규제를 담당하는 가상자산사업자협회를 허가기관으로 하는 것보다는 법정기관화하는 것이 효과적일 것으로 사료된다.

Ⅲ. 국내 STO 시장의 당면 과제와 대응 방안

1. STO의 개념

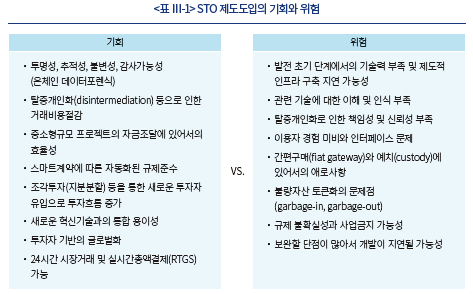

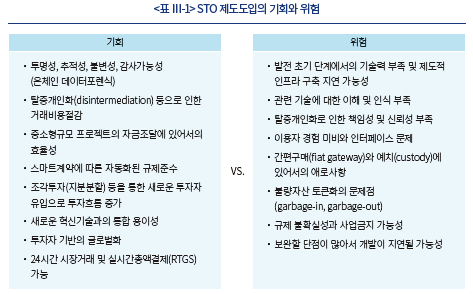

STO란 불특정 다수의 투자자에게 토큰화된 증권의 취득 청약을 권유하는 행위를 의미한다. STO는 다수 투자자에 대한 증권 취득 청약의 권유라는 점과 증권법(자본시장법)상 공모규제를 받는다는 점에서 IPO와 공통점을 가진다. 그러나 STO는 블록체인기술에 기반한 탈중앙화, 탈중개인화, 거래자동화 등의 특성을 보인다는 점에서 IPO와 차별화된다. STO는 탈중앙화된 네트워크에서 중개인의 신뢰성 대신 기술적 신뢰성을 바탕으로 스마트계약에 기반한 자동화된 거래가 이루어진다는 점에서 다양한 투자기회를 제공할 수 있는 반면, 불량자산이 토큰화되어 투자자에게 큰 피해를 주고 시장신뢰성을 훼손하는 등의 위험성도 내포하고 있다. STO 제도를 도입하는 경우 국내 디지털자산시장이 누릴 수 있는 기회와 당면하게 될 위험을 설명하면 <표 Ⅲ-1>과 같다.

STO의 대상인 증권토큰은 발행인이 의도적으로 증권을 토큰화하여 증권법(자본시장법)에 따라 발행·유통시키는 의도적 증권토큰과 발행인이 가상자산으로 발행·유통하였다가 이후 투자계약증권 등으로 선언되어 증권법(자본시장법)의 규율을 받게 되는 비의도적 증권토큰으로 나눌 수 있다. 의도적 증권토큰과 비의도적 증권토큰의 구분에 있어, ‘의도’는 해당 디지털자산을 증권으로 취급하여 증권법에 따라 발행·유통하려는 발행인의 의도를 의미한다. 의도적 증권토큰에 관해서는, STO 관련 제도적 정비가 주요 이슈가 된다. 우리나라의 경우, STO에 관한 제도적 정비가 즉각적인 법령개정을 통해 이루어지지 않고, 금융규제 샌드박스(혁신금융서비스)를 통해 STO의 혁신성과 필요성을 확인하는 절차를 거치며 이루어지고 있다. 비의도적 증권토큰 개념은 기존의 자본시장법과 입법화가 예정된 디지털자산법간의 관할권을 명확히 하기 위한 증권성 심사의 대상을 지칭하는 도구개념으로서 의의를 가진다. 비의도적 증권토큰은 발행공시규제 위반(증권신고서 미제출 등), 불공정거래규제 위반(시세조종 등), 사업자규제 위반(미인가 중개업 등) 등의 불법성을 내포하고 있다. 관련하여 위메이드의 위믹스, 테라폼랩스의 미러프로토콜 등의 증권성 논쟁이 최근 이슈가 되고 있다. 미국 SEC는 2013년 3분기부터 2020년 4분기까지 가상자산 거래행위에 관해 공시위반, 불공정거래 등을 이유로 총 75건의 제재조치를 하였는데, 관련 조치는 대부분 비의도적 증권토큰에 대한 것으로 볼 수 있다.23)

2. STO 관련 당면 개선과제

현행 자본시장법은 토큰화된 증권의 발행과 유통을 예상하여 입법화되지는 못하였다. 다만 자본시장법상 포괄주의 원칙, 기능별 규제 원칙 등에 따라, 경제적 실질이 증권의 정의에 해당하게 되면 형식, 응용기술 등에 관계없이 자본시장법의 적용을 받게 된다. 그러나 블록체인기술의 특성을 반영한 증권토큰의 발행과 유통에 관한 절차규정 및 세부규제가 마련되어 있지 못하기 때문에, STO 자금조달의 효율성을 높이고 투자자보호를 강화하기 위한 제도적 정비가 필요한 실정이다. 디지털자산시장의 특수성을 반영한 증권토큰 발행·유통에 관한 법규정의 미비는 증권의 토큰화에 관련된 투자위험의 공시, 증권토큰 장외거래의 매출규제, 증권토큰 예탁기관의 선관주의의무의 내용과 수준, 개인키 탈취 후 유통되는 증권토큰의 선의취득 문제 등에서 나타난다. 또한 현행 전자증권법상 분산원장의 법적 원본성이 인정되지 않기 때문에, 증권토큰 거래에 관한 분산원장 기록내용을 중앙집중화된 전자등록기관에도 중복적으로 반영해야 하는 이중장부(미러링24))의 비효율 문제가 발생한다.

현재 국내 STO는 금융규제 샌드박스를 통해 허용되는데, 관련 샌드박스 사업의 지정기간(최대 2년+2년) 만료 전까지 규제면제 사항에 대한 입법화가 이루어지지 않으면 해당 STO 사업은 불법화되고 사업이 중단될 수 있다. 따라서 현행 STO 관련 샌드박스 사업의 중요 규제면제 사항에 관한 법령 개정 논의도 진행될 필요가 있다. 관련한 법령 개정 논의 사항으로 부동산 수익증권 허용 여부, 증권토큰 매출규제 완화, 장외 증권토큰 거래시설에서의 다자간 상대매매 허용 여부, 증권토큰에 특화된 금융투자업자의 허용 여부 및 인가·등록 수준 등을 들 수 있다.

STO가 활성화됨에 따라 나타날 수 있는 STO의 구조적 취약성에 대해서도 제도적 보완이 필요하다. 증권이 토큰화되어 저가증권화되면 유통성이 증가하고 투기적 요소가 높아질 수 있는데 이에 대한 투자자보호 장치도 논의될 필요가 있다. 또한 STO의 탈중개인화로 인해 관련 금융투자업자의 책임성이 약화되는 문제에 대해서도 보완방안이 필요하다.

발행인이 증권이 아닌 가상자산으로 취급하여 ICO의 형태로 발행하였으나 자본시장법상 증권의 개념에 해당하는 비의도적 증권토큰에 대한 법적 처리도 당면한 과제이다. 특히 최근 논란이 되는 위메이드의 위믹스 사례와 같이 해당 상품이 투자계약증권인지의 여부가 이슈인 경우, 자본시장법상 발행공시(증권신고서 제출) 및 부정거래행위 규정의 적용이 문제된다. 그러나 테라폼랩스의 미러프로토콜의 경우와 같이 해당 상품이 투자계약증권 이외의 증권(특히 파생결합증권)인지의 여부가 이슈인 경우, 사업자 규제 및 유통공시 규제 등도 추가로 받게 되어 사실상 관련 사업을 접어야 할 위험이 투자계약증권 사례에 비해 커진다. 관련하여 해당 증권토큰을 일반 가상자산으로 인식하여 거래한 투자자에 대한 보호방안도 논의될 필요가 있다.

3. STO 시장 발전 방향

국내 STO 시장의 지속가능한 발전을 이루기 위해서는 증권성 심사를 강화하여 자본시장법의 적용을 받는 증권토큰의 범위를 명확히 하고, 토큰화된 증권이 효율적으로 발행되고 유통될 수 있도록 관련 제도를 개선하여야 한다. 또한 과거 자산유동화의 부작용이 증권의 토큰화(특히 조각투자)에 있어 발생하지 않도록 증권토큰 판매에 있어서의 투자권유준칙 강화 등이 필요하다.

증권토큰과 가상자산을 구분하는 법적 장치인 증권성 심사는 기존의 자본시장법과 앞으로 입법화될 디지털자산법의 규제 관할을 정하기 위한 핵심적 절차로서 제도화될 필요가 있다. 특히 현재 가상자산거래업자의 거래지원(상장) 절차에 있어 증권성 심사는 의무화하여야 한다. 비의도적 증권토큰이 가상자산으로 취급되어 가상자산거래업자의 거래시설에서 발행·유통되는 경우, 가상자산거래자가 위법하게 발행·유통되는 증권거래의 당사자가 됨으로써 입을 수 있는 피해규모가 워낙 대규모이기 때문이다. 따라서 가상자산거래업자의 거래지원(상장) 심사 절차에 증권성 관련 법률의견서 검토 절차를 의무화하고, 증권토큰을 가상자산거래업자의 거래시설에서 유통시키는 경우 가상자산거래업자의 법적 책임을 명확히 규정함으로써 증권토큰 발행·유통시장의 건전한 발전을 유도해야 한다.

블록체인 네트워크상에서 토큰화된 증권이 효율적으로 발행·유통되기 위해서는 무엇보다 분산원장의 원본성을 법적으로 인정할 필요가 있다. 현행 전자증권법은 주식, 사채 등이 전자등록계좌부에 기재되는 방식으로 전자등록기관을 통한 중앙전자등록방식만을 인정하고 있다. 따라서 분산원장기술(Distributed Ledger Technology: DLT)을 이용한 탈중앙화된 전자증권 등록방식에 관한 전자증권법상의 근거규정 마련이 필요하다. 분산원장 전자등록방식의 무분별한 확산이 우려되는 경우, 분산원장 전자등록방식을 금지할 것이 아니라 부분적으로 허용하여 충분한 시간을 가지고 검증한 후 적용범위를 확대해 나가는 접근방법을 취하는 것이 더욱 합리적이다. 2021년 전자증권법에 분산원장 전자등록방식을 수용한 독일의 경우, 큰 문제 없이 분산원장 전자등록 제도가 운용되고 있는 점도 참고할 필요가 있다.

기존의 중앙집중적 증권예탁 방식과 달리 증권토큰의 예탁에 있어, 탈중앙화된 블록체인네트워크상의 개인키(암호키) 관리가 핵심이다. 따라서 개인키 관리에 관한 예탁기관의 고객자산보호의무를 명확히 규정하고 관련 면책사유를 구체적으로 열거할 필요가 있다. 금융감독당국은 증권토큰 예탁기관의 수탁업무에 관한 정책과 절차를 수립하고 이에 대해 감독하여야 한다. 증권토큰 수탁기관의 고객자산보호의무에 관한 면책규정을 제정함에 있어, 미국 특수목적 브로커-딜러(Special Purpose Broker-Dealer: SPBD)의 가상자산 보관업무에 관한 SEC의 규정 개정안(Release 34-90788)은 중요한 입법 참조자료가 될 것으로 사료된다. 특히 고객의 가상자산을 수탁한 SPBD가 해당 디지털자산증권에 대한 접근권을 가지고 해킹위험 등으로부터 적극적으로 고객자산을 보호하는 내용은 국내 입법에 꼭 반영하여야 할 것이다.

STO의 제도화에 있어, 우선 금융규제 샌드박스를 통해 허용한 후 시범운영 기간을 거쳐 운영 경험을 바탕으로 국내 실정에 맞게 제도적 개선을 하는 접근방법이 효과적이다. STO 관련 금융규제 샌드박스는 혁신을 촉진하고 점진적 제도개선의 효과를 볼 수 있다는 장점이 있다. 금융규제 샌드박스를 통해 증권토큰 거래시설을 만들어 비의도적 증권토큰을 위한 유통플랫폼으로 활용하는 방안도 고려해 볼 만하다. 무엇보다 현재 사업 지정기간이 2년도 남지 않은 STO 관련 샌드박스의 규제면제 사항에 대한 입법화 논의가 시급히 이루어져야 한다. 관련한 법령 개정 논의 사항으로 증권토큰 발행플랫폼에 대한 인허가, 부동산 수익증권 허용 여부, 증권토큰 매출규제 완화, 장외 증권토큰 거래시설에서의 다자간 상대매매 허용 여부 등을 들 수 있다.

마지막으로 STO를 통한 조각투자화로 인해 투기성 저가증권시장이 형성되는 것을 막기 위해서 관련 금융투자업자의 투자권유준칙을 강화할 필요가 있다. 특히 장외에서 거래되는 투기성 저가증권토큰에 대한 중개업자의 정보제공의무 강화, 적합성·적정성 원칙의 엄격한 적용이 필요하다.25) 또한 STO 대상자산에 대한 가치평가 규제체계(이해상충, 평가방법, 평가기관자격 등)를 확립하고, 증권토큰 발행플랫폼의 진입요건 및 행위규제에 대한 법령정비도 이루어져야 한다.

Ⅳ. 국내 ICO 시장과 STO 시장의 규제 정합성

1. 개요

국내 가상자산 ICO 시장은 향후 입법화될 디지털자산법에 의해 규율되고, 증권토큰 STO 시장은 기존의 자본시장법에 의해 규율된다는 점에서 양 시장은 규제체계를 달리한다고도 볼 수 있다. 그러나 ICO 시장과 STO 시장은 발행대상 투자상품이 블록체인 기술을 활용하여 토큰화되었다는 공통점을 가진다. 또한 투자자산의 디지털화라는 큰 흐름 속에서 가상자산시장과 증권토큰시장은 상호 수렴하는 현상을 보인다. 이러한 점에서 ICO 시장과 STO 시장은 규제 및 감독체계에 있어 정합성을 유지해야 할 필요성이 크다. 특히 국내 ICO 시장과 STO 시장이 블록체인 네트워크상에서 상호 수렴하고 공존하는 현상에 대응한 효율적 규제체계 정립을 위해 양 시장 규제체계의 정합성이 요구된다. 본 장에서는 가상자산시장과 자본시장의 상호 수렴 현상을 설명하고, 양 시장 감독기능의 연계성 바탕으로 독립된 디지털자산감독기구의 문제점을 분석해 보고자 한다.

2. 디지털자산시장의 상호 수렴 현상

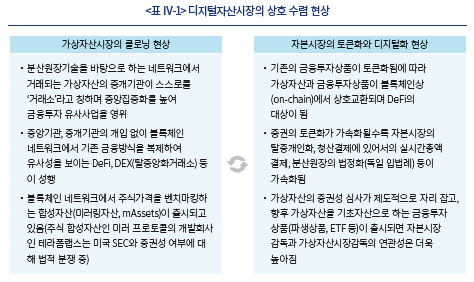

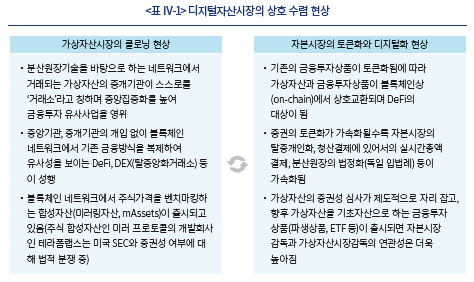

가상자산시장이 급성장하면서 가상자산거래업자는 불특정다수인을 상대로 대량 경쟁매매를 하는 중앙집중화된 거래소 사업을 확장하고 있으며, 탈중앙화 금융인 DeFi(Decentralized Finance) 사업 주체는 블록체인상에서 이자농사 등의 금융유사행위를 확대해 나가고 있다. 국제 증권감독기구인 IOSCO(International Organization of Securities Commissions)는 블록체인 네트워크상의 탈중앙화 금융이 전통 금융시장을 모방하는 현상을 클로닝(cloning, 복제)이라 칭하며 자본시장 유사규제를 적용해야 한다고 주장하고 있다.26) 반면 기존의 자본시장에서 증권을 토큰화(tokenization)하여 블록체인 네트워크에서 유통시키면서 가상자산과 증권토큰이 하나의 네트워크에서 교환(swap)되고 공존하게 되었다. 미국 등 해외 증권토큰 거래시장에서, 투자자가 메타마스크(MetaMask) 등의 가상자산 지갑을 통해 가상자산을 증권토큰 매수의 대가로 지급하는 경우가 빈번하다. 또한 가상자산을 기초자산으로 하는 ETP(Exchange-Traded Product)의 출연은 가상자산시장과 자본시장의 상호수렴 현상을 더욱 가속화시키고 있다. 클로닝과 토큰화에 따른 가상자산시장과 자본시장의 상호 수렴 현상을 보다 구체적으로 설명하면 <표 Ⅳ-1>과 같다.

이러한 가상자산시장의 클로닝과 자본시장의 토큰화로 나타나는 양 시장의 상호수렴 현상인 분산원장 네트워크 온체인(on-chain)화는 향후 IT업계, 은행업계, 금융투자업계의 무한 경쟁을 예고한다. 특히 빅테크 기업은 규제 공백이 존재하고 상대적으로 건전성규제(prudential regulation)가 약한 가상자산시장의 인프라와 투자자 기반을 활용하여 금융산업 영역 확대를 모색할 것으로 보인다. 이러한 점에서 나타날 수 있는 투자자보호의 취약점과 기관별 규제차익의 문제를 해결하기 위해, 자본시장규제체계와 가상자산시장규제체계간의 정합성이 더욱 중요해진다.

EU의 MiCA규제안 등 주요국의 가상자산 관련 입법안이 공시 및 불공정거래 규제체계를 근간으로 증권법과 체계적 유사성을 띠는 점은 향후 디지털자산시장의 수렴 현상이 진행될수록 가상자산시장과 자본시장의 규제체계 정합성이 더욱 커질 수 있는 가능성을 내포한다. 현재 미국 상원에서 발의된 가상자산법안인 ‘책임 있는 금융혁신법’안(Lummis-Gillibrand Responsible Financial Innovation Act: RFIA)은 증권은 아니지만 투자대상이 되는 가상자산을 보조자산(ancillary asset)으로 분류하여 상품(commodity)으로 취급하며 원칙적으로 CFTC의 관할하에 둔다. 그러나 시장참여자를 위한 투자정보의 제공을 위해, 해당 발행인에게 1934년 증권거래법상의 유통공시의무를 부과한다.27) 이러한 RFIA의 규제 방식은 가상자산규제체계와 자본시장규제체계의 경계가 모호해지면서 수렴하는 현상을 잘 나타낸다.

3. 독립된 디지털자산감독기구의 문제점

앞서 언급한 자본시장과 가상자산시장의 상호 수렴 현상은 양 시장에 대한 효율적이고 체계적인 규제와 감독체계를 구축하는데 있어 반드시 고려되어야 할 사항이다. 미국, 영국 등 글로벌 주요국에서 가상자산시장 감독은 대부분 금융감독기구의 관할하에 있다는 점에서28), 자본시장과 가상자산시장의 상호 수렴 현상에 대응하여 양 시장의 상호 정합성과 연계성을 고려한 디지털자산시장 규제체계를 구축할 수 있는 조직적 기반은 어느 정도 마련되어 있다고 볼 수 있다. 현재 국회에 발의된 가상자산 관련 입법안29)도 금융감독기구인 금융위원회에 가상자산 규제관할권을 부여하고 있다.

국내에서 기존의 금융감독기구와 다른 별도의 디지털자산감독기구를 설치하여 해당 기구가 가상자산시장감독을 전담하게 하자는 주장이 있다. 이러한 독립된 가상자산전담 감독체계는 해외 주요국에서 유례를 찾기 어려운 감독기관모델이다. 해당 모델은 자본시장감독과 가상자산시장감독의 연계성 측면에서 다음과 같은 문제점을 유발한다.

첫째, 디지털자산감독기구와 금융감독기구간의 관할권 분쟁의 위험이 있다. 디지털자산 신상품은 복잡다변한 형태로 출시되어 법적 성격이 명확하지 않은 경우가 빈번할 것으로 예상된다. 따라서 해당 상품이 증권으로서 자본시장법의 적용을 받을지 또는 가상자산으로서 디지털자산법의 적용을 받을지에 관한 증권성 심사의 중요성은 더욱 커질 것이다. 자본시장법상 증권의 정의규정에 대한 유권해석 권한을 가지는 금융감독기구와 가상자산의 규제범위에 관한 유권해석 권한을 가지는 디지털자산감독기구간에 의견 충돌이 있는 경우 디지털자산시장의 예측가능성은 크게 훼손된다. 또한 디지털자산감독기구가 가상자산의 육성에 관한 권한도 가지는 경우, 금융감독기구와의 관할권 분쟁 가능성은 더욱 커질 수 있다.

둘째, 가상자산을 기초자산으로 하는 금융투자상품 규제에 있어 비효율성이 발생할 수 있다. 가상자산을 기초자산으로 하는 금융투자상품에 대한 효율적인 불공정거래 규제를 위해서는 해당 기초자산 현물시장에 대한 불공정거래 규제체계의 구축이 필요하다. 이 경우 가상자산시장과 자본시장에 대한 감독관할은 효율적이고 유기적으로 행사되어야 한다. 국내 자본시장법 해석상 가상자산이 파생결합증권 또는 파생상품의 기초자산이 되는 경우, 해당 상품의 “매매등에서 부당한 이익을 얻거나 제삼자에게 부당한 이익을 얻게 할 목적”으로 그 상품의 기초자산 시세를 조작하는 행위는 불공정거래행위로서 금지되며 처벌된다.30) 만약 가상자산시장감독권을 디지털자산감독기구에만 전속적으로 귀속시키는 경우, 금융감독당국은 가상자산을 기초자산으로 하는 금융투자상품에 대한 감독권을 효율적으로 행사하기 어렵다. 가상자산 ETF 등에 관한 불공정거래행위는 기초자산인 가상자산의 현물시장을 교란하는 방식으로 이루어지기 때문이다. 미국에서 비트코인 현물 ETF에 대한 승인이 늦어지는 이유도, 금융감독당국인 SEC가 비트코인 현물시장에 대한 관할권을 확보하지 못하였기 때문이다.31)

셋째, 증권토큰시장이 확대되어 증권토큰과 가상자산간의 교환(swap)이 이루어지는 통합적 디지털자산시장이 대규모로 형성되는 경우, 디지털자산감독기구와 금융감독기구간의 관할권 중복이 크게 발생한다. 증권이 토큰화되면 해당 증권토큰은 블록체인 네트워크에서 다른 가상자산과 교환되고 DeFi의 대상이 될 수 있는데, 이 경우 가상자산의 교환에 대해서는 디지털자산감독기구가 관할권을 가지고 증권토큰의 교환에 대해서는 금융감독기구가 관할권을 가진다. 결국 하나의 교환계약에 대한 목적물의 감독기구가 서로 다르기 때문에, 규제의 불확실성이 커지고 규제공백의 위험이 증대될 수 있다. 따라서 가상자산과 증권토큰이 공존하는 디지털자산시장에 대한 포괄적 감독관할권은 단일 감독기구에 귀속되는 것이 규제의 효율성을 높인다.

Ⅴ. 결어: 국내 ICO 시장과 STO 시장의 발전 방향

본문에서 논한 국내 ICO 시장과 STO 시장의 당면 과제 및 대응 방안을 종합하여 양 시장의 발전 방향을 제시하면 다음과 같다.

먼저 국내 ICO 시장에 대해서는, 현재의 규제 공백을 해소하기 위해 디지털자산법 제정이 시급히 요구된다. 디지털자산법상 ICO 규제는 발행시장규제로서 공시규제, 불공정거래규제, 사업자규제로 나눌 수 있다. ICO 공시규제는 가상자산 발행과 거래자간의 정보격차를 줄이기 위한 것으로, 이에 관련하여 발행인의 정의, 국문 백서상의 중요투자정보, 통합적 공시시스템 등에 관한 법규정이 필요하다. ICO 불공정거래규제는 ICO 시장의 건전성 유지를 위한 것으로, 이에 관련하여 불공정거래행위의 유형화(시세조종, 미공개중요정보이용행위, 부정거래행위 등), 시장감시시스템, 불공정거래조사 국제공조 등에 관한 법규정이 필요하다. ICO 시장 사업자규제는 고객에 대한 신인의무의 강화를 위한 것으로서, 이에 관련하여 사업자의 선관주의의무(최선집행의무, 고객자산보호의무 등), 거래지원 기준 등에 관한 법규정이 필요하다. 이러한 내용을 주요 골자로 하는 디지털자산법이 제정되기 전까지 규제 공백을 메우기 위해 가상자산사업자의 자발적인 이용자 보호 노력이 중요하다. 현재 이러한 노력의 일환으로 가상자산거래업자의 공동협의체가 구성되었다. 정부, 국회, 그리고 가상자산업계는 상호 소통을 강화하여 디지털자산법 규제체계가 국내 가상자산시장에서 연착륙할 수 있도록 민관 협력체계를 강화하여야 할 것이다.

국내 STO 시장에 대해서는, 탈중앙화된 분산원장 거래를 자본시장법에 수용하기 위한 관련 법령의 정비가 필요하다. 먼저 전자증권법 개정을 통해 분산원장의 원본성을 법적으로 인정할 필요가 있다. 암호키를 관리하는 금융투자업자의 고객자산보호의무를 명확히 하는 등 디지털 시대에 적합한 금융투자업자의 신관주의의무를 구체화할 필요가 있다. 토큰화로 인해 투기적 조각투자가 활성화되는 것을 막기 위해, 증권토큰 발행플랫폼 등에 대한 규제체계를 정비하고 금융투자업자의 정보제공의무 및 투자권유준칙을 강화하여야 한다. 또한 현재 사업 지정기간이 2년도 남지 않은 STO 관련 금융규제 샌드박스의 규제면제 사항에 대한 입법화 논의(증권토큰 매출규제 완화, 부동산 수익증권 허용 등)를 서둘러야 할 것이다.

자본시장과 가상자산시장이 상호 수렴하는 현상에 대응하여, 국내 ICO 시장과 STO 시장의 규제체계는 상호 연계성을 가지고 구축되어야 한다. 디지털자산이 복잡다변한 형태의 상품으로 출시되는 경향이 앞으로 더욱 가속화될 전망이기 때문에, 기존 규제체계에서 유형화되지 않은 디지털자산 상품의 관할권을 명확히 하기 위한 증권성 심사 절차가 더 강화되어야 할 것이다. 가상자산을 기초자산으로 하는 금융투자상품 규제체계를 효율적으로 구축하여 가상자산시장규제와 자본시장규제간의 혼선을 최소화하여야 할 필요성이 크다. 마지막으로 가상자산과 증권토큰이 동일 블록체인 네트워크에서 공존하고 상호 교환되는 디지털자산시장 환경에 대비하여, 가상자산시장 규제체계와 자본시장 규제체계의 정합성과 연계성을 유지하는 정책적 노력을 지속하여야 한다.

1) 제20대 대통령직인수위원회(2022, p.72)

2) 위의 글

3) 현재 국회에 발의된 가상자산시장 거래자 보호를 위한 법률안은 ‘가상자산업법’안(의안번호 2109935), ‘디지털자산산업 육성과 이용자 보호에 관한 법률’안(의안번호 2111771) 등 다양한 명칭으로 불린다. 신정부는 110대 국정과제에서 관련 법률을 ‘디지털자산 기본법’으로 지칭하였다. 본고에서는 가상자산시장 거래자 보호와 가상자산사업자 규제에 관한 법률을 ‘디지털자산법’으로 칭한다.

4) 국내에서 STO는 금융규제 샌드박스를 통해 제한적으로 허용(카사코리아, 루센트블록, 펀블, 비브릭 등)되고 있지만, 미국에서 STO는 네거티브 규제체계하에서 원칙적으로 허용되며 추세적으로 성장하고 있다.

5) CRS(2018)

6) 증권에 해당하는 토큰화된 디지털자산의 발행행위는 STO로서 증권법(자본시장법)에 의해 규율된다.

7) 금융위원회(2017. 9. 27)

8) 국내 가상자산거래업자의 거래시설(trading facility)에 대해, 가상자산시장참여자들은 통상 ‘가상자산거래소’라고 칭한다. 그러나 특금법상 신고된 가상자산거래업자의 거래시설을 가상자산거래소라고 칭하는 경우, 해당 거래시설의 법적 지위가 자본시장법상 허가를 받은 거래소와 동등하다는 오해를 불러일으킬 수 있다. 따라서 본고에서는 ‘가상자산거래소’라는 용어를 쓰지 않고 가상자산거래업자의 ‘거래시설’이라는 용어를 사용한다.

9) 가상자산거래업자가 일정 요건을 충족한 가상자산을 자신의 거래시설에서 신규취급하여 유통을 허용하는 행위에 대해, 가상자산시장참여자들이 ‘상장’이라는 용어를 사용한다. 그러나 가상자산의 상장은 자본시장법상 주식의 거래소 상장과 같은 높은 수준의 거래소 진입요건 충족을 의미하는 것이 아니다. 따라서 ‘상장’보다는 ‘거래지원’이라는 용어가 보다 정확한 표현이라 할 수 있다.

10) SEC(2020)

11) 해당 그림에서 사용된 ‘상장’이라는 용어는 정확히 가상자산거래업자의 ‘거래지원’을 의미한다.

12) 제2차 당정간담회(2022. 6. 13, pp.3-5)

13) SEC(2022)

14) MiCA §4

15) Tassev(2022. 6. 19)

16) 17 CFR Part 180. CFTC 관할의 불공정거래규제조항인 17 CFR Part 180은 미국 SEC 관할의 반사기조항을 벤치마크하여 입법화되었다(CFTC, 2011).

또한 미국 뉴욕주의 경우 비트라이선스 제도에 따라 가상자산사업자가 반사기정책을 수립하여 합리적 수준의 불공정거래 예방조치를 하도록 의무화하고 있다(23 CRR-NY 200.19(g)).

17) SEC(2022)

18) “자체 개발한 가상자산이 상장 예정이라며 투자시 원금·고수익이 보장된다고 홍보하여 자금 모집 후 편취”, 금융감독원(2022, p.3)

19) 한국경제(2021. 8. 18)

20) 특정금융거래정보의보고및이용등에관한법률시행령 제10조의20제5호

21) 자본시장법 제174조

22) 발행인과 협의 없는 거래지원(소위 ‘도둑상장’)에 관해서는 한국경제(2022. 4. 19), 기습 거래지원 중단(소위 ‘기습 상장폐지’)에 관해서는 소비자가 만드는 신문(2022. 6. 8), 자의적 유의종목 지정에 관해서는 한겨례(2022. 5. 19) 참조

23) Cornerstone Research(2021)

24) 미러링 개념에 대해서는, 이경자(2022, p.11) 참조

25) 투기성 저가증권에 대한 해외 투자자보호제도에 관해, 미국의 Penny Stock Rule 참조(17 CFR § 240.15g-9)

26) IOSCO(2022)

27) RFIA §301

28) 글로벌 주요국의 가상자산감독기구에 관하여, ComplyAdvantage(2022) 참조

29) 현재 국회에 발의된 7개의 가상자산 관련 제정안은 모두 2021년 발의되었으며 다음과 같다. 이용우안(의안번호 9935), 김병욱안(의안번호 10190), 양경숙안(의안번호 10312), 권은희안(의안번호 11459), 민형배안(의안번호 11771), 윤창현안(의안번호 13016), 김은혜안(의안번호 13168) 등이다.

30) 자본시장법 제176조제4항

31) SEC(2021)

참고문헌

금융감독원, 2022. 1. 28, 당신의 소중한 재산을 노리는 유사수신 사기를 조심하세요!, 보도자료.

금융위원회, 2017. 9. 29, 기관별 추진현황 점검을 위한 가상통화 관계기관 합동TF 개최, 보도자료.

소비자가 만드는 신문, 2022. 6. 8, 멋대로 코인 상장폐지에 투자자만 피멍... ‘테라-루나 사태’도 거래소가 키워.

이경자, 2022, 『프롭테크: 자산 토큰화, 부동산 디지털증권부터 시작』, 삼성증권 조사분석자료.

임재연, 2022, 『자본시장법 강의』.

제20대 대통령직인수위원회, 2022, 윤석열정부 110대 국정과제.

제2차 당정간담회, 2022. 6. 13, 가상자산 사업자 공동 자율 개선방안.

코인데스크코리아, 2022. 6. 24, 테라 붕괴 주범 지목된 ‘지갑 A’는 테라폼랩스의 지갑이다.

한겨례, 2022. 5. 19, 가상자산 유의종목·상장폐지 기준 물어보니... 거래소도 모른다?

한국경제, 2021. 8. 18, 코인 시세조작에 가짜 명품몰까지 운영.

한국경제, 2022. 4. 19, ‘컴투스 코인’ 도둑 상장?...“코빗에 돌 던질 수 없어”.

Anderson, A., 2019, Initial Exchange Offerings for Beginners.

CFTC, 2011, Anti-Manipulation and Anti-Fraud Final Rules, Fact Sheet.

ComplyAdvantage, 2022, Cryptocurrency Regulations Around The World, https://complyadvantage.com/insights/cryptocurrency-regulations-around-world/

Cornerstone Research, 2021, SEC Cryptocurrency Enforcement.

CRS, 2018, Securities Regulation and ICOs.

Hale, V., 2018, Launch an ICO & Token Crowdsale.

Hazen, T., 2020, Principles of Securities Regulation, West Academic.

Hinman, W., 2018, Digital Asset Transactions: When Howey Met Gary (Plastic), Remarks at the Yahoo Finance All Markets Summit: Crypto.

IOSCO, 2022, IOSCO Explains How Decentralised Finance is Cloning Financial Markets, Media Release.

SEC, 2020, Initial Exchange Offerings (IEOs), Investor Alert.

SEC, 2021, Order Disapproving a Proposed Rule Change to List and Trade Shares of the VanEck Bitcoin Trust under BZX Rule 14.11(e)(4), Release No. 34-93559(Nov. 12, 2021).

SEC, 2022, Prepared Remarks of Gary Gensler On Crypto Markets.

Tassev, L., 2022. 6. 19, EU nears agreement on crypto regulations, report reveals, Bitcoin.com.

<해외 법률안>

Lummis-Gillibrand Responsible Financial Innovation Act (RFIA), 2022, S.4356.

Proposal for a Regulation of the European Parliament and of the Council on MiCA (Markets in Crypto-assets), and Amending Directive (EU), 2020, COM/2020/593 Final.

전 세계적으로 급속히 진행되는 자산시장의 디지털화에 대응하여, 우리나라는 디지털자산산업의 국제적 경쟁력을 높임과 동시에 디지털자산시장의 투자자 신뢰성을 확보해야 하는 이중 과제를 안고 있다. 이러한 상황 속에서 지난 5월 10일 출범한 신정부는 “투자자 보호장치가 확보”1)되는 방식으로 ICO(Initial Coin Offering)를 허용하기로 하였다. 또한 토큰화(tokenization)된 증권 즉, 증권토큰의 발행에 대해서는 자본시장법을 적용하고, STO(Security Token Offering)를 위한 시장여건을 조성하고 규율체계를 확립할 것임을 밝혔다.2)

결국 가상자산의 발행과 유통에 관해서는 디지털자산법3)의 제정을 통해 투자자보호 및 시장신뢰성을 확보하고, 증권토큰의 발행과 유통에 관해서는 기존 자본시장법령의 개정을 통해 법제 정비를 하는 가상자산시장과 증권토큰시장에 대한 투트랙 정책이 추진될 전망이다. 루나-테라 사태를 통해, 가상자산시장에서 시장참여자의 정보격차와 불공정거래 취약성이 크게 드러났으며 가상자산사업자의 이용자 보호수준이 낮은 점이 확인되었다. 이러한 상황에서 최소한의 공시규제, 불공정거래규제, 사업자규제의 내용을 담은 디지털자산법의 조속한 제정이 요구된다. 최근 조각투자 등의 영역에서 증권을 토큰화하는 경향이 커지고 관련 STO 시장4)이 태동함에 따라, 자본시장법령 정비를 통해 STO 시장의 제도적 인프라를 구축해야 할 필요성도 커졌다. 이러한 STO 시장에 대한 제도정비는 너무 급하게 진행되기보다는, 금융규제 샌드박스를 통해 실증적으로 해당 제도도입의 혁신성 및 필요성을 확인해 가면서 신중하게 추진될 전망이다.

이러한 ICO 시장과 STO 시장의 제도 정비에 관한 투트랙 정책이 효율적으로 작동하기 위해서는 토큰화된 자산이 증권인지의 여부를 결정하는 증권성 심사기준이 중요하다. 최근 위믹스(WEMIX)와 같이 투자성이 높은 가상자산의 증권성이 논란이 되고 있는 점도 증권성 심사의 실무적 중요성을 잘 나타낸다. 이러한 증권성 심사는 기존의 자본시장법과 향후 입법화될 디지털자산법의 관할범위를 명확히 한다는 점에서 큰 의의가 있다.

본고는 위에서 언급한 가상자산 ICO 시장과 증권토큰 STO 시장의 당면 과제와 발전 방향을 발행시장 중심으로 분석하고 제언한다. 본고에서는 먼저 국내 가상자산 ICO 시장의 당면 과제를 살피고 대응 방안을 모색한다. 또한 가상자산거래업자 주도의 ICO인 IEO(Initial Exchange Offering)의 개념과 관련한 이해상충 문제에 대해서도 고찰한다. 이후 국내 증권토큰 STO 시장의 당면 과제를 살피고 대응 방안을 모색한 후, 국내 ICO 시장과 STO 시장의 규제 정합성을 논하고 나서, 종합적으로 양 시장의 발전 방향을 제시한다.

Ⅱ. 국내 ICO 시장의 당면 과제와 대응 방안

1. ICO의 개념

ICO란 “일정한 권리가 포함된 디지털 코인 또는 토큰을 발행하는 대가로 자금을 조달하는 수단”을 의미한다.5) 본고에서 ICO란 증권6)에 해당하지 않는 가상자산의 발행행위를 의미한다. ICO 규제하는데 있어서의 핵심은 가상자산의 생성행위(minting)에 있는 것이 아니라, 가상자산의 청약(offering)을 본질로 하는 발행행위(issuance)에 있다. 거래자 보호의 필요성은 발행인이 가상자산을 생성하는 시점이 아닌 가상자산을 다수의 일반투자자에게 청약 또는 청약의 권유를 하는 시점에서 발생하기 때문에, 가상자산의 생성행위보다 투자자에 대한 발행행위에 규제의 초점이 맞추어지는 것이다. 얼마 전 이슈가 된 위믹스 깜깜이 매도의 경우에도 위메이드라는 상장법인이 위믹스라는 가상자산을 해외에서 생성하였다는 점이 아닌 국내 가상자산거래업자의 거래시설을 통해 일반투자자에게 투자정보의 제공 없이 대규모 청약의 권유(발행행위)를 하였다는 점에서 크게 쟁점화되었던 것이다.

최근까지 우리 정부는 행정지도를 통해 “모든 형태의 ICO를 금지”7)하고 있었다. 따라서 가상자산의 국내 유통은 싱가포르 등 해외에서 가상자산을 생성하여 이해관계자 등을 대상으로 일부 사모 발행을 한 후 국내 가상자산거래업자의 거래시설(소위 ‘가상자산거래소’)8)에서 유통시키는 방식으로 이루어졌다. 이 경우 발행인이 가상자산거래업자의 거래시설에서 해당 가상자산의 매매주문을 하여 호가를 제시하는 행위는 청약 또는 청약의 권유에 해당한다. 따라서 해외에서 ICO를 하였다고 하는 가상자산의 경우, 해당 가상자산의 공모(public offering)는 국내에서 이루어진 경우가 대다수이다. 그러나 이러한 공모 발행에 있어, 중요투자정보(material information)를 담은 백서(발행공시서류)를 거래자에게 사전에 배포한 후 관련 가상자산을 판매하는 행위는 이루어지지 않고 있다.

ICO를 증권의 최초 발행행위인 IPO(Initial Public Offering)와 비교하면 <그림 Ⅱ-1>과 같다. <그림 Ⅱ-1>에서 잘 나타나듯, 증권 IPO에 비해 가상자산 ICO에 있어 발행공시 심사기능 및 가상자산사업자의 문지기(gatekeeper) 기능은 미약하다.

가. IEO의 개념

IEO(Initial Exchange Offering)란 자금조달을 목적으로 가상자산거래업자의 관리하에 이루어지는 분산원장 네트워크상의 코인 또는 토큰의 발행행위를 의미한다. 즉, 가상자산거래업자가 가상자산의 신규 거래지원(소위 ‘상장’9))을 위한 절차를 주도함으로써 판매하는 가상자산의 인증 효과를 높인 ICO라고 할 수 있다. 2019년 무분별한 ICO로 인해 가상자산 발행시장의 신뢰성이 추락하자, 가상자산거래업자인 바이낸스(Binance)가 가상자산을 직접 심사하여 Binance Launchpad를 통해 최소기능상품(Minimum Viable Product: MVP) 수준 이상의 가상자산을 발행하여 시장의 호응을 얻으며 IEO가 알려지기 시작하였다. Binance Launchpad 이후로 Gate.io, Bittrex, Huobi, Kucoin 등 다수의 가상자산거래업자가 IEO 사업에 진출하였으나, 초기 시장의 기대만큼 성장하지 못하였다.

IEO는 국내에서 거래자 보호에 근간을 둔 ICO 제도도입의 일환으로 고려되었다. 그러나 정부의 감독권이 배제된 민간 가상자산사업자 주도의 IEO가 현재 성공적으로 정착한 제도라고 평가하기 어렵다. 오히려 미국 SEC(Securities and Exchange Commission)는 2020년 IEO에 대한 투자경보(Investor Alert)를 발동하여, IEO의 주체인 가상자산거래업자는 증권거래법상의 거래소 또는 등록된 사업자가 아니기 때문에 거래자들이 투자에 유의하여야 한다는 점을 강조하였다.10)

IEO는 ICO보다 거래지원 심사수준이 높다는 점에서 거래자 보호에 있어 보다 유익하다. 그러나 거래비용 측면에서 IEO는 ICO보다 거래자 부담이 크다. 또한 IPO를 통한 증권 상장과 비교할 때, IEO는 거래자 보호수준이 낮고 문지기 기능이 약하다. 무엇보다 IEO는 아래 기술하는 바와 같이 구조적 이해상충의 문제로 인해 신뢰성 있는 가상자산 자금조달 수단이라고 평가하기 어렵다.

나. IEO에 있어서의 이해상충 문제와 해결 방안

IEO는 동일 가상자산거래업자가 발행시장의 인수인, 공시감독기구, 상장심사기구의 역할을 모두 담당한다는 점에서 이해상충의 우려가 크다. <그림 Ⅱ-2>는 IEO 운영기관인 가상자산거래업자가 다중적 역할을 수행하며 이해상충 가능성을 높이는 점을 잘 나타낸다.

지난 대선 공약에서 제시된 IEO 제도도입은 해외 특정 가상자산거래업자의 비즈니스 모델로서의 IEO를 제도화하겠다는 의미가 아니라, 국내 가상자산거래업자의 신규 거래지원에 있어 투자자에 대한 인증 기능과 문지기 기능을 높여 가상자산거래자 보호의 수준을 제고한다는 의미로 이해하여야 할 것이다. 이러한 가상자산거래업자의 문지기 기능 강화 노력은 최근 가상자산 관련 당정간담회에서 구체화되고 있다. 지난 6월 13일 당정간담회에서 논의된 “가상자산 사업자 공동 자율 개선방안”에서 국내 5개 가상자산거래업자는 “가상자산 거래지원~종료까지 강화된 평가·규율 체계 마련”을 약속하였다.12) 또한 6월 22일 공동협의체를 설립하여 거래지원 기능을 강화하기로 업무협약을 맺은 것도 이러한 문지기 기능 강화의 일환으로 이해할 수 있다.

국내 가상자산거래업자가 IEO 수준의 시장진입 관리권한을 가지기 위해서는 우선 구조적 이해상충의 문제를 해결하여야 할 것이다. 이해상충 문제가 해결되어야만 가상자산거래업자가 신뢰성 있는 문지기 기능을 잘 수행할 수 있으며 정부로부터 높은 수준의 자율규제권한을 부여받을 수 있다. 가상자산거래업자의 구조적 이해상충을 해결하기 위해, 예탁결제와 매매의 분리, 시장조성(market making) 불허용 등의 조치가 필요하다. 미국 SEC 게리 겐슬러 의장이 가상자산거래업자가 거래시설을 운영하는 업무를 가상자산 수탁업무(custody) 및 마켓메이킹업무와 분리해야 한다고 주장13)하는 이유도 가상자산거래업자의 이해상충으로 인한 시장신뢰성 하락을 막기 위함이다.

3. ICO 관련 당면 개선과제

가. 공시의 주체, 내용, 방식

ICO에서는 통상 개발자, 네트워크운영자, 재단 등 다양한 이해관계자가 연루되어 있기 때문에, 공시의 주체가 되는 발행인(issuer)의 범위가 명확하지 못한 측면이 있다. 발행인 범위가 불명확하다는 ICO의 특성은 그간 ICO에 대한 공시규제가 적합하지 않다는 주요 논거가 되어 가상자산시장참여자간의 정보격차를 심화시키는 문제점을 야기하여 왔다. 그러나 ICO의 경제적 실질을 살펴보면 가상자산 발행, 개발, 자금조달 등에 적극적으로 참여하는 자(active participant)가 존재하며, 이러한 적극적 참여자를 발행인 개념에 포섭하여 발행공시의무를 부과할 수 있다. 최근 루나-테라 사태가 잘 나타내듯이, 외견상 탈중앙화(decentralization)가 되었다고 보여지는 가상자산의 경우에도 공시의무의 주체가 되기에 충분한 권한과 정보를 가진 법적 주체가 존재하는 경우가 대다수이다. EU(유럽연합)의 MiCA(Market in Crypto-Assets)규제안은 발행인의 자격을 법인으로 제한하고, 발행인을 일차적 가상자산 공시의 주체로 규정하고 있다.14) 현재 EU 의회의 MiCA규제안 논의 과정에서, NFT, 스테이블코인 규제, 감독기관, 시행기간 등이 쟁점화되고 있는데 반하여 가상자산 발행인 규제와 공시 규제는 큰 이견 없이 통과될 전망이다.15) 반면 국회에 발의되어 있는 가상자산 관련 법안은 발행인이 아닌 가상자산거래업자에 공시의무를 부과하는 접근방법을 취하고 있다.

국내 ICO 금지 정책은 국내 시장에서 무분별한 ICO를 방지하는 효과를 거두기는 하였지만, 가상자산 발행·유통에 관한 체계적인 공시체계를 발전시킬 기회를 박탈하였다는 아쉬운 측면이 있다. 국내 ICO 금지로 인해 가상자산 발행시 국문 백서의 제출이 의무화되어 있지 않아서 많은 국내 가상자산거래자들이 언어장벽의 문제를 겪고 있다. 또한 백서에 포함되는 중요투자정보가 규정화 되어 있지 않기 때문에 많은 중요투자정보가 백서에서 누락 되어 발행공시가 부실화되었다. 따라서 현재 가상자산 프로젝트에 관련된 중요 투자위험, 마일스톤, 가상자산 배분계획(distribution plan) 등 중요투자정보를 담은 발행공시가 제대로 이루어지지 못하는 실정이다. 가상자산 발행·유통에 있어, 강행법규에 따른 의무공시의 대상이 되는 중요투자정보와 자율규제규정에 따른 공시의 대상이 되는 중요투자정보의 기준과 범위도 정립되어 있지 못하다. 결과적으로 가상자산 발행에 있어 중요공시사항에 대한 법적 심사 및 감독 없이 가상자산 판매행위가 이루어지고 있다. 루나-테라와 같이 외부 공격 또는 외부 경제상황 변화에 취약한 알고리즘 스테이블코인이 투자위험에 대한 고지 없이 일반투자자들을 대상으로 대규모 유통될 수 있었던 원인도 공시규제의 부재에서 찾아야 할 것이다.

현재 가상자산의 발행과 유통에 있어, 거래자를 위한 투자정보의 제공은 발행인 또는 가상자산거래업자의 홈페이지 등을 통해 분산적으로 이루어지고 있다. 이로 인해 투자자들의 투자정보 검색에 있어서의 불편과 비용이 높아지게 되었다. 가상자산 통합공시시스템의 구축 없이 의무공시제도가 도입되는 경우, 거래자의 불편과 함께 감독당국의 공시규제 비효율도 예상된다.

나. ICO 관련 불공정거래규제 공백

국내 ICO 시장에 대한 법제 정비가 이루어지지 못하고 있어, ICO 배정 및 시장조성 관련 불공정거래, 내부자거래, 기타 부정거래행위에 대한 규제 공백이 큰 실정이다. 가상자산을 상품(commodity)으로 취급하는 미국에 있어, ICO 관련 불공정거래행위는 CFTC(Commodity Futures Trading Commission)의 불공정거래규제의 대상이 된다.16) 반면 우리나라는 가상자산에 대한 불공정거래금지 근거규정이 없다. 따라서 해당 행위에 대해 형법상 사기죄를 적용하여야 하며, 사기죄 구성요건의 입증이 매우 어렵다. 이로 인한 불공정거래 규제의 공백은 가상자산 공모가격의 올바른 형성을 저해한다. 또한 ICO 기간 중에 부정한 방법으로 다른 시장참여자를 기망하여 해당 가상자산을 거래하는 행위에 대한 금지조항이 미비되어 있기 때문에, ICO전(前) 장외시장 불공정거래가 만연할 위험이 크다. 가상자산 신규 거래지원시 공모가격 결정의 신뢰성을 담보할 수 있는 제도적 절차(IPO의 경우 수요예측제도)와 관련 위반행위에 대한 제재규정도 없기 때문에, 공모시장의 시세조종도 손쉽게 이루어진다.

ICO 절차에 있어서의 규제 공백 문제는 청약행위, 물량배정, 시장조성 등에서 나타난다. 먼저 투자설명서 중심의 청약행위규제가 없기 때문에, 백서상의 중요투자정보에 근거하여 ICO 투자자를 모집하는 경우가 드물고 사기적 청약행위 가능성도 높다. ICO 물량배정에 있어 IPO 수요예측규정과 같은 절차적 통제장치가 없기 때문에, 대가성(quid pro quo) 배정행위가 만연할 수 있으며 ICO 시장의 신뢰성이 실추되기 쉽다. 또한 시장조성에 관한 명확한 규정이 없기 때문에, 마켓메이커의 시장조성을 빙자한 시세조종의 위험이 크다. 실제로 국내 가상자산시장에서 가상자산거래업자의 마켓메이킹 또는 유동성공급이 시세조종이 아니냐는 여러 의혹이 있어 왔다. 그러나 가상자산사업자의 시장조성 규제가 미비되어 있기 때문에 처벌이 어렵고 시장 불신만 커지는 상황이 발생하고 있다. 미국에서도 이러한 가상자산거래업자의 시장조성을 빙자한 시세조종성 마켓메이킹은 여러 문제점을 야기하고 있기 때문에, SEC 게리 겐슬러 의장은 거래시설을 운영하는 가상자산거래업자가 직접 마켓메이킹을 하는 행위를 금지해야 한다고 주장하고 있다.17)

다. Pre-ICO 장외 판매행위에 대한 규제 공백

향후 ICO가 이루어지면 해당 가상자산의 가격이 급등한다는 것을 미끼로 일반투자자, 특히 노인 등 금융취약계층을 상대로 장외에서 사기적인 가상자산 판매행위가 빈번하게 이루어지고 있다.18) ICO를 미끼로 한 허위·과장된 청약행위는 다단계 판매조직을 통해 이루어지는 경우가 많아 투자자 피해가 확산될 위험이 크다. 가상자산거래시설이 스스로를 거래소라고 명명하며 자체 발행한 가상자산을 장외에서 다단계로 판매하여 투자자 피해사례를 유발하는 경우도 많다.19) 작년 특금법시행령 개정을 통해 가상자산사업자(특수관계인 포함)의 자체 발행 가상자산을 자기 거래시설에서 중개·알선·대행하는 행위는 제한되었지만20), 여전히 가상자산거래시설이 발행한 가상자산의 장외 판매행위가 불공정거래로 이어질 위험이 크다.

가상자산 판매에 있어 금융투자상품 판매에 있어서와 같은 투자권유준칙이 정립되어 있지 않은 점은 가상자산 장외거래의 투자자 피해를 확대시키는 요인으로 작용한다. 투자권유준칙의 부재는 고객확인(Know-Your-Customer: KYC) 절차, 적합성·적정성의 원칙, 설명의무 등 장외 판매행위의 다양한 측면에서 문제점을 드러낸다. 먼저 ICO전 가상자산 판매행위를 함에 있어 KYC 절차가 제대로 이행되지 못하고 있다. 장외에서 이루어지는 가상자산거래에 있어, 판매자는 거래자의 투자목적, 투자경험, 재산상황 등을 제대로 파악하지 않는다. 또한 고객확인사항을 바탕으로 고객에게 적합·적정한 가상자산을 투자권유하는 경우도 찾기 어렵다. 이러한 과정 속에서 일반투자자에게 가상자산의 내용, 투자위험 등을 제대로 설명하지 않고 판매행위가 이루어지는 경우가 빈번하게 발생한다.

ICO전 가상자산 판매과정에서 발행인 및 특수관계인의 미공개중요정보이용행위에 대한 규제 역시 공백 상태에 있다. 만약 ICO를 계획하는 가상자산 발행인이 미공개중요정보이용행위에 대한 혐의가 있는 경우, 이를 일반 사기죄로 처벌할 수는 있으나 형사상 입증이 매우 어렵다. 반면 주식시장에서 6개월 이내에 주식을 상장하려는 발행인의 내부자는 엄격한 미공개중요정보이용행위의 규제를 받는다.21)

라. 규정화되지 못한 거래지원 기준 및 절차

가상자산거래업자의 신규 거래지원심사가 거래지원규정 등 자율규제규정이 없이 거래업자의 경영판단에 따라 이루어지기 때문에, 거래지원기준과 절차의 일관성 및 신뢰성이 낮고 거래업자의 이해관계에 따라 거래지원행위가 이루어질 가능성이 있다. 현재 국내 5개 가상자산거래업자들은 거래시설 진입·퇴출에 관한 적정한 계량화된 기준 및 실질심사요건을 마련하지 못하고 있으며, 공동협의체를 설립하여 최소한의 거래지원요건에 대한 합의점을 찾고 있는 실정이다.

국내 주식 장내거래시장인 유가증권시장 또는 코스닥시장과 유사한 수준의 대규모 경쟁매매를 하는 국내 가상자산거래업자의 거래지원요건은 유가증권시장 또는 코스닥시장의 상장요건과 비교할 때 진입요건이 매우 낮은 수준이다. 이렇게 낮은 가상자산 심사 수준은 시장의 문지기 기능을 약화시켜 거래자 보호수준을 낮춘다. 가상자산 신규 거래지원의 문턱이 낮다는 문제점에 더하여, 가상자산거래업자가 예측가능한 원칙 없이 임의로 거래지원 또는 거래지원 중단을 결정하여 시장참여자의 불신을 받는다는 점도 문제점으로 지적될 수 있다. 국내 가상자산거래업자의 일관성 없는 거래지원, 발행인과 협의 없는 거래지원, 기습 거래지원 중단, 자의적 유의종목 지정 등이 지속적으로 이슈가 되어 오고 있다.22)

국내 가상자산거래업자는 거래지원 후 거래지원 유지요건에 대해서도 명확히 규정화하지 못하고 있고, 부실 가상자산에 대한 신속하고 일관성 있는 거래지원 중단제도를 운영하지 못하고 있다. 거래지원 유지요건에 미달하는 가상자산에 대해 적극적으로 개선계획안 제출을 명하고 이행기간 내에 거래지원요건을 재충족하지 못하는 경우 과감히 거래지원을 중단하는 절차를 규정화할 필요가 있다. 절차적으로 가상자산의 거래시설 진입·퇴출에 관한 주요 의사결정이 가상거래업자 내부 임직원에 의해서만 이루어지고 이해관계가 없는 전문가들로 구성된 독립된 거래지원위원회에서 이루어지지 못하고 있다는 점도 개선사항으로 지적할 수 있다.

4. ICO 시장 발전 방향

국내 ICO 시장이 합법적으로 태동하여 지속가능한 발전을 이루기 위해서는 무엇보다 가상자산의 발행인과 거래자간의 정보격차와 대리인 비용을 줄이기 위한 공시제도와 시장신뢰성 확보를 위한 불공정거래행위 금지제도의 확립이 필요하다. 또한 건전한 가상자산 유통시장 조성을 위해, 가상자산의 시장진입 단계에서 문지기 기능을 강화하여야 한다. 이러한 ICO 시장 발전 방향을 주요 사안별로 살피면 다음과 같다.

첫째, ICO 발행공시 체계를 구축하여야 한다. 이에 관련한 필수적 입법 사항으로 발행인의 법적 정의, 백서의 국문화, 중요투자정보의 공시의무화, 백서의 중요사항 변동에 대한 계속공시 의무화 등을 들 수 있다. 공시 주체로서의 발행인 범위를 명확히 함에 있어, 가상자산 발행인은 탈중앙화된 시장 특성을 반영하여 자본시장의 발행인보다 광의의 개념으로 정의되어야 한다. 즉, 토큰의 발행자 이외에 개발자인 재단, 프로모터, 상장 신청자 등의 적극적 참여자를 특수관계인으로 포섭하여야 할 것이다. 아울러 ICO 관련 내부자거래 규제를 위해, 미공개중요정보 이용행위의 주체인 내부자의 개념 및 범위도 명확히 하여야 할 것이다.

발행인이 가상자산거래업자에게 거래지원을 신청함에 있어, 국문 백서 발간을 의무화하고 백서에 기재해야 하는 중요투자정보를 의무공시대상으로 법제화하여야 할 것이다. 백서의 필수기재 사항을 규정화함에 있어, MiCA규제안 등 해외 입법례, 국내외 가상자산거래업자의 백서 심사기준, 가상자산 평가기관의 평가기준 등을 고려하여 국제적 정합성과 국내 시장현실을 잘 반영한 중요투자정보를 의무공시의 대상으로 하여야 한다. 최근 테라 백서의 투자위험 공시 부재, 위믹스 깜깜이 매도 사태 등이 가상자산시장의 신뢰성을 크게 실추시킨 점에서, 발행인의 지분변동, 마일스톤 달성여부, 투자위험 요소 등에 관한 사항은 반드시 백서의 필수기재사항에 포함되어야 할 것이다. 또한 마일스톤 공시와 락업(lock-up, 일종의 보호예수)된 물량의 배분계획에 관한 이행여부에 대해서도 철저한 사후감독이 필요하다. 해외에서 ICO된 가상자산을 국내 가상자산거래업자가 거래지원을 하여 국내 투자자에게 유통시키는 경우, 중요투자정보에 대한 국문화된 공시의무는 해당 거래업자가 부담하여야 할 것이다. ICO 후 유통공시(계속공시) 관련하여, 발행인에게 정기공시의무를 부과하는 것은 현 단계에서 어려울 수 있으나, 최소한 백서에서 공시한 중요 내용에 대한 변경사항은 의무공시화 하여야 한다. 공시의 방식에 있어, 증권시장에서 금융감독원이 운영하는 DART(Data Analysis, Retrieval and Transfer System)와 같이 규제당국이 직접 운영하거나 감독하는 통합적 공시시스템의 구축이 필요하다.

둘째, ICO 관련하여 발생하는 불공정거래 및 불완전판매행위에 대한 규제체계가 정립되어야 한다. ICO 관련 대가성 배정, 시세조종성 마켓메이킹 등을 근절하기 위해, 관련 불공정거래행위를 유형화하고 위반행위의 구성요건 해당성 입증을 용이하게 하여야 한다. 이와 함께 불공정거래 금지조항 위반에 대해 강력한 제재를 위한 근거조항도 마련하여야 한다. ICO를 미끼로 하는 사기성 장외거래행위, 다단계 판매행위 등을 방지하기 위해, Pre-ICO 판매행위에 대한 KYC의무, 적합성∙적정성의 원칙, 설명의무 등의 투자권유준칙을 제도화하여야 할 것이다.

셋째, 문지기 기능을 강화하기 위해 가상자산거래업자의 거래지원관리업무를 규정화하고, 해당 가상자산거래업자의 주무관청이 관련 규정을 승인하도록 하여야 한다. 주무관청의 승인을 받아야 할 가상자산거래업자의 거래시설규정의 주요 내용으로 i) 가상자산 거래지원을 위한 요건, 심사 및 승인절차, ii) 거래가 허용되지 않는 가상자산의 유형, iii) 거래지원을 위한 정책, 절차, 수수료 수준, iv) 공정하고 질서 있는 거래를 보장하기 위한 요건, v) 유동성, 정기공시 등에 관한 거래가능 요건, vi) 거래정지 사유 등을 들 수 있다. 가상자산 상장관리업무 중 영리성이 높은 업무는 가상자산거래업자의 사업부에서 수행하되, 공익성이 높은 신규 거래지원 및 거래지원 중단 등에 관한 결정은 외부 전문가를 포함한 독립적인 거래지원위원회에서 담당하여야 할 것이다. 문지기 기능을 수행하는 가상자산거래업자의 거래지원관리업무는 영리법인의 경영업무가 아닌 자율규제업무로 포섭하여야 한다. 가상자산거래업자간 공통된 최소한의 거래지원심사기준을 마련하고 체계적인 시장감시기능을 수행하기 위해 자율규제기구의 설립이 필요하다. 자율규제기능의 신뢰성, 관련 제재의 실효성을 확보하기 위해서는 자율규제를 담당하는 가상자산사업자협회를 허가기관으로 하는 것보다는 법정기관화하는 것이 효과적일 것으로 사료된다.

Ⅲ. 국내 STO 시장의 당면 과제와 대응 방안

1. STO의 개념

STO란 불특정 다수의 투자자에게 토큰화된 증권의 취득 청약을 권유하는 행위를 의미한다. STO는 다수 투자자에 대한 증권 취득 청약의 권유라는 점과 증권법(자본시장법)상 공모규제를 받는다는 점에서 IPO와 공통점을 가진다. 그러나 STO는 블록체인기술에 기반한 탈중앙화, 탈중개인화, 거래자동화 등의 특성을 보인다는 점에서 IPO와 차별화된다. STO는 탈중앙화된 네트워크에서 중개인의 신뢰성 대신 기술적 신뢰성을 바탕으로 스마트계약에 기반한 자동화된 거래가 이루어진다는 점에서 다양한 투자기회를 제공할 수 있는 반면, 불량자산이 토큰화되어 투자자에게 큰 피해를 주고 시장신뢰성을 훼손하는 등의 위험성도 내포하고 있다. STO 제도를 도입하는 경우 국내 디지털자산시장이 누릴 수 있는 기회와 당면하게 될 위험을 설명하면 <표 Ⅲ-1>과 같다.

2. STO 관련 당면 개선과제

현행 자본시장법은 토큰화된 증권의 발행과 유통을 예상하여 입법화되지는 못하였다. 다만 자본시장법상 포괄주의 원칙, 기능별 규제 원칙 등에 따라, 경제적 실질이 증권의 정의에 해당하게 되면 형식, 응용기술 등에 관계없이 자본시장법의 적용을 받게 된다. 그러나 블록체인기술의 특성을 반영한 증권토큰의 발행과 유통에 관한 절차규정 및 세부규제가 마련되어 있지 못하기 때문에, STO 자금조달의 효율성을 높이고 투자자보호를 강화하기 위한 제도적 정비가 필요한 실정이다. 디지털자산시장의 특수성을 반영한 증권토큰 발행·유통에 관한 법규정의 미비는 증권의 토큰화에 관련된 투자위험의 공시, 증권토큰 장외거래의 매출규제, 증권토큰 예탁기관의 선관주의의무의 내용과 수준, 개인키 탈취 후 유통되는 증권토큰의 선의취득 문제 등에서 나타난다. 또한 현행 전자증권법상 분산원장의 법적 원본성이 인정되지 않기 때문에, 증권토큰 거래에 관한 분산원장 기록내용을 중앙집중화된 전자등록기관에도 중복적으로 반영해야 하는 이중장부(미러링24))의 비효율 문제가 발생한다.

현재 국내 STO는 금융규제 샌드박스를 통해 허용되는데, 관련 샌드박스 사업의 지정기간(최대 2년+2년) 만료 전까지 규제면제 사항에 대한 입법화가 이루어지지 않으면 해당 STO 사업은 불법화되고 사업이 중단될 수 있다. 따라서 현행 STO 관련 샌드박스 사업의 중요 규제면제 사항에 관한 법령 개정 논의도 진행될 필요가 있다. 관련한 법령 개정 논의 사항으로 부동산 수익증권 허용 여부, 증권토큰 매출규제 완화, 장외 증권토큰 거래시설에서의 다자간 상대매매 허용 여부, 증권토큰에 특화된 금융투자업자의 허용 여부 및 인가·등록 수준 등을 들 수 있다.

STO가 활성화됨에 따라 나타날 수 있는 STO의 구조적 취약성에 대해서도 제도적 보완이 필요하다. 증권이 토큰화되어 저가증권화되면 유통성이 증가하고 투기적 요소가 높아질 수 있는데 이에 대한 투자자보호 장치도 논의될 필요가 있다. 또한 STO의 탈중개인화로 인해 관련 금융투자업자의 책임성이 약화되는 문제에 대해서도 보완방안이 필요하다.

발행인이 증권이 아닌 가상자산으로 취급하여 ICO의 형태로 발행하였으나 자본시장법상 증권의 개념에 해당하는 비의도적 증권토큰에 대한 법적 처리도 당면한 과제이다. 특히 최근 논란이 되는 위메이드의 위믹스 사례와 같이 해당 상품이 투자계약증권인지의 여부가 이슈인 경우, 자본시장법상 발행공시(증권신고서 제출) 및 부정거래행위 규정의 적용이 문제된다. 그러나 테라폼랩스의 미러프로토콜의 경우와 같이 해당 상품이 투자계약증권 이외의 증권(특히 파생결합증권)인지의 여부가 이슈인 경우, 사업자 규제 및 유통공시 규제 등도 추가로 받게 되어 사실상 관련 사업을 접어야 할 위험이 투자계약증권 사례에 비해 커진다. 관련하여 해당 증권토큰을 일반 가상자산으로 인식하여 거래한 투자자에 대한 보호방안도 논의될 필요가 있다.

3. STO 시장 발전 방향

국내 STO 시장의 지속가능한 발전을 이루기 위해서는 증권성 심사를 강화하여 자본시장법의 적용을 받는 증권토큰의 범위를 명확히 하고, 토큰화된 증권이 효율적으로 발행되고 유통될 수 있도록 관련 제도를 개선하여야 한다. 또한 과거 자산유동화의 부작용이 증권의 토큰화(특히 조각투자)에 있어 발생하지 않도록 증권토큰 판매에 있어서의 투자권유준칙 강화 등이 필요하다.

증권토큰과 가상자산을 구분하는 법적 장치인 증권성 심사는 기존의 자본시장법과 앞으로 입법화될 디지털자산법의 규제 관할을 정하기 위한 핵심적 절차로서 제도화될 필요가 있다. 특히 현재 가상자산거래업자의 거래지원(상장) 절차에 있어 증권성 심사는 의무화하여야 한다. 비의도적 증권토큰이 가상자산으로 취급되어 가상자산거래업자의 거래시설에서 발행·유통되는 경우, 가상자산거래자가 위법하게 발행·유통되는 증권거래의 당사자가 됨으로써 입을 수 있는 피해규모가 워낙 대규모이기 때문이다. 따라서 가상자산거래업자의 거래지원(상장) 심사 절차에 증권성 관련 법률의견서 검토 절차를 의무화하고, 증권토큰을 가상자산거래업자의 거래시설에서 유통시키는 경우 가상자산거래업자의 법적 책임을 명확히 규정함으로써 증권토큰 발행·유통시장의 건전한 발전을 유도해야 한다.

블록체인 네트워크상에서 토큰화된 증권이 효율적으로 발행·유통되기 위해서는 무엇보다 분산원장의 원본성을 법적으로 인정할 필요가 있다. 현행 전자증권법은 주식, 사채 등이 전자등록계좌부에 기재되는 방식으로 전자등록기관을 통한 중앙전자등록방식만을 인정하고 있다. 따라서 분산원장기술(Distributed Ledger Technology: DLT)을 이용한 탈중앙화된 전자증권 등록방식에 관한 전자증권법상의 근거규정 마련이 필요하다. 분산원장 전자등록방식의 무분별한 확산이 우려되는 경우, 분산원장 전자등록방식을 금지할 것이 아니라 부분적으로 허용하여 충분한 시간을 가지고 검증한 후 적용범위를 확대해 나가는 접근방법을 취하는 것이 더욱 합리적이다. 2021년 전자증권법에 분산원장 전자등록방식을 수용한 독일의 경우, 큰 문제 없이 분산원장 전자등록 제도가 운용되고 있는 점도 참고할 필요가 있다.

기존의 중앙집중적 증권예탁 방식과 달리 증권토큰의 예탁에 있어, 탈중앙화된 블록체인네트워크상의 개인키(암호키) 관리가 핵심이다. 따라서 개인키 관리에 관한 예탁기관의 고객자산보호의무를 명확히 규정하고 관련 면책사유를 구체적으로 열거할 필요가 있다. 금융감독당국은 증권토큰 예탁기관의 수탁업무에 관한 정책과 절차를 수립하고 이에 대해 감독하여야 한다. 증권토큰 수탁기관의 고객자산보호의무에 관한 면책규정을 제정함에 있어, 미국 특수목적 브로커-딜러(Special Purpose Broker-Dealer: SPBD)의 가상자산 보관업무에 관한 SEC의 규정 개정안(Release 34-90788)은 중요한 입법 참조자료가 될 것으로 사료된다. 특히 고객의 가상자산을 수탁한 SPBD가 해당 디지털자산증권에 대한 접근권을 가지고 해킹위험 등으로부터 적극적으로 고객자산을 보호하는 내용은 국내 입법에 꼭 반영하여야 할 것이다.

STO의 제도화에 있어, 우선 금융규제 샌드박스를 통해 허용한 후 시범운영 기간을 거쳐 운영 경험을 바탕으로 국내 실정에 맞게 제도적 개선을 하는 접근방법이 효과적이다. STO 관련 금융규제 샌드박스는 혁신을 촉진하고 점진적 제도개선의 효과를 볼 수 있다는 장점이 있다. 금융규제 샌드박스를 통해 증권토큰 거래시설을 만들어 비의도적 증권토큰을 위한 유통플랫폼으로 활용하는 방안도 고려해 볼 만하다. 무엇보다 현재 사업 지정기간이 2년도 남지 않은 STO 관련 샌드박스의 규제면제 사항에 대한 입법화 논의가 시급히 이루어져야 한다. 관련한 법령 개정 논의 사항으로 증권토큰 발행플랫폼에 대한 인허가, 부동산 수익증권 허용 여부, 증권토큰 매출규제 완화, 장외 증권토큰 거래시설에서의 다자간 상대매매 허용 여부 등을 들 수 있다.

마지막으로 STO를 통한 조각투자화로 인해 투기성 저가증권시장이 형성되는 것을 막기 위해서 관련 금융투자업자의 투자권유준칙을 강화할 필요가 있다. 특히 장외에서 거래되는 투기성 저가증권토큰에 대한 중개업자의 정보제공의무 강화, 적합성·적정성 원칙의 엄격한 적용이 필요하다.25) 또한 STO 대상자산에 대한 가치평가 규제체계(이해상충, 평가방법, 평가기관자격 등)를 확립하고, 증권토큰 발행플랫폼의 진입요건 및 행위규제에 대한 법령정비도 이루어져야 한다.

Ⅳ. 국내 ICO 시장과 STO 시장의 규제 정합성

1. 개요

국내 가상자산 ICO 시장은 향후 입법화될 디지털자산법에 의해 규율되고, 증권토큰 STO 시장은 기존의 자본시장법에 의해 규율된다는 점에서 양 시장은 규제체계를 달리한다고도 볼 수 있다. 그러나 ICO 시장과 STO 시장은 발행대상 투자상품이 블록체인 기술을 활용하여 토큰화되었다는 공통점을 가진다. 또한 투자자산의 디지털화라는 큰 흐름 속에서 가상자산시장과 증권토큰시장은 상호 수렴하는 현상을 보인다. 이러한 점에서 ICO 시장과 STO 시장은 규제 및 감독체계에 있어 정합성을 유지해야 할 필요성이 크다. 특히 국내 ICO 시장과 STO 시장이 블록체인 네트워크상에서 상호 수렴하고 공존하는 현상에 대응한 효율적 규제체계 정립을 위해 양 시장 규제체계의 정합성이 요구된다. 본 장에서는 가상자산시장과 자본시장의 상호 수렴 현상을 설명하고, 양 시장 감독기능의 연계성 바탕으로 독립된 디지털자산감독기구의 문제점을 분석해 보고자 한다.

2. 디지털자산시장의 상호 수렴 현상

가상자산시장이 급성장하면서 가상자산거래업자는 불특정다수인을 상대로 대량 경쟁매매를 하는 중앙집중화된 거래소 사업을 확장하고 있으며, 탈중앙화 금융인 DeFi(Decentralized Finance) 사업 주체는 블록체인상에서 이자농사 등의 금융유사행위를 확대해 나가고 있다. 국제 증권감독기구인 IOSCO(International Organization of Securities Commissions)는 블록체인 네트워크상의 탈중앙화 금융이 전통 금융시장을 모방하는 현상을 클로닝(cloning, 복제)이라 칭하며 자본시장 유사규제를 적용해야 한다고 주장하고 있다.26) 반면 기존의 자본시장에서 증권을 토큰화(tokenization)하여 블록체인 네트워크에서 유통시키면서 가상자산과 증권토큰이 하나의 네트워크에서 교환(swap)되고 공존하게 되었다. 미국 등 해외 증권토큰 거래시장에서, 투자자가 메타마스크(MetaMask) 등의 가상자산 지갑을 통해 가상자산을 증권토큰 매수의 대가로 지급하는 경우가 빈번하다. 또한 가상자산을 기초자산으로 하는 ETP(Exchange-Traded Product)의 출연은 가상자산시장과 자본시장의 상호수렴 현상을 더욱 가속화시키고 있다. 클로닝과 토큰화에 따른 가상자산시장과 자본시장의 상호 수렴 현상을 보다 구체적으로 설명하면 <표 Ⅳ-1>과 같다.

EU의 MiCA규제안 등 주요국의 가상자산 관련 입법안이 공시 및 불공정거래 규제체계를 근간으로 증권법과 체계적 유사성을 띠는 점은 향후 디지털자산시장의 수렴 현상이 진행될수록 가상자산시장과 자본시장의 규제체계 정합성이 더욱 커질 수 있는 가능성을 내포한다. 현재 미국 상원에서 발의된 가상자산법안인 ‘책임 있는 금융혁신법’안(Lummis-Gillibrand Responsible Financial Innovation Act: RFIA)은 증권은 아니지만 투자대상이 되는 가상자산을 보조자산(ancillary asset)으로 분류하여 상품(commodity)으로 취급하며 원칙적으로 CFTC의 관할하에 둔다. 그러나 시장참여자를 위한 투자정보의 제공을 위해, 해당 발행인에게 1934년 증권거래법상의 유통공시의무를 부과한다.27) 이러한 RFIA의 규제 방식은 가상자산규제체계와 자본시장규제체계의 경계가 모호해지면서 수렴하는 현상을 잘 나타낸다.

3. 독립된 디지털자산감독기구의 문제점

앞서 언급한 자본시장과 가상자산시장의 상호 수렴 현상은 양 시장에 대한 효율적이고 체계적인 규제와 감독체계를 구축하는데 있어 반드시 고려되어야 할 사항이다. 미국, 영국 등 글로벌 주요국에서 가상자산시장 감독은 대부분 금융감독기구의 관할하에 있다는 점에서28), 자본시장과 가상자산시장의 상호 수렴 현상에 대응하여 양 시장의 상호 정합성과 연계성을 고려한 디지털자산시장 규제체계를 구축할 수 있는 조직적 기반은 어느 정도 마련되어 있다고 볼 수 있다. 현재 국회에 발의된 가상자산 관련 입법안29)도 금융감독기구인 금융위원회에 가상자산 규제관할권을 부여하고 있다.

국내에서 기존의 금융감독기구와 다른 별도의 디지털자산감독기구를 설치하여 해당 기구가 가상자산시장감독을 전담하게 하자는 주장이 있다. 이러한 독립된 가상자산전담 감독체계는 해외 주요국에서 유례를 찾기 어려운 감독기관모델이다. 해당 모델은 자본시장감독과 가상자산시장감독의 연계성 측면에서 다음과 같은 문제점을 유발한다.

첫째, 디지털자산감독기구와 금융감독기구간의 관할권 분쟁의 위험이 있다. 디지털자산 신상품은 복잡다변한 형태로 출시되어 법적 성격이 명확하지 않은 경우가 빈번할 것으로 예상된다. 따라서 해당 상품이 증권으로서 자본시장법의 적용을 받을지 또는 가상자산으로서 디지털자산법의 적용을 받을지에 관한 증권성 심사의 중요성은 더욱 커질 것이다. 자본시장법상 증권의 정의규정에 대한 유권해석 권한을 가지는 금융감독기구와 가상자산의 규제범위에 관한 유권해석 권한을 가지는 디지털자산감독기구간에 의견 충돌이 있는 경우 디지털자산시장의 예측가능성은 크게 훼손된다. 또한 디지털자산감독기구가 가상자산의 육성에 관한 권한도 가지는 경우, 금융감독기구와의 관할권 분쟁 가능성은 더욱 커질 수 있다.

둘째, 가상자산을 기초자산으로 하는 금융투자상품 규제에 있어 비효율성이 발생할 수 있다. 가상자산을 기초자산으로 하는 금융투자상품에 대한 효율적인 불공정거래 규제를 위해서는 해당 기초자산 현물시장에 대한 불공정거래 규제체계의 구축이 필요하다. 이 경우 가상자산시장과 자본시장에 대한 감독관할은 효율적이고 유기적으로 행사되어야 한다. 국내 자본시장법 해석상 가상자산이 파생결합증권 또는 파생상품의 기초자산이 되는 경우, 해당 상품의 “매매등에서 부당한 이익을 얻거나 제삼자에게 부당한 이익을 얻게 할 목적”으로 그 상품의 기초자산 시세를 조작하는 행위는 불공정거래행위로서 금지되며 처벌된다.30) 만약 가상자산시장감독권을 디지털자산감독기구에만 전속적으로 귀속시키는 경우, 금융감독당국은 가상자산을 기초자산으로 하는 금융투자상품에 대한 감독권을 효율적으로 행사하기 어렵다. 가상자산 ETF 등에 관한 불공정거래행위는 기초자산인 가상자산의 현물시장을 교란하는 방식으로 이루어지기 때문이다. 미국에서 비트코인 현물 ETF에 대한 승인이 늦어지는 이유도, 금융감독당국인 SEC가 비트코인 현물시장에 대한 관할권을 확보하지 못하였기 때문이다.31)

셋째, 증권토큰시장이 확대되어 증권토큰과 가상자산간의 교환(swap)이 이루어지는 통합적 디지털자산시장이 대규모로 형성되는 경우, 디지털자산감독기구와 금융감독기구간의 관할권 중복이 크게 발생한다. 증권이 토큰화되면 해당 증권토큰은 블록체인 네트워크에서 다른 가상자산과 교환되고 DeFi의 대상이 될 수 있는데, 이 경우 가상자산의 교환에 대해서는 디지털자산감독기구가 관할권을 가지고 증권토큰의 교환에 대해서는 금융감독기구가 관할권을 가진다. 결국 하나의 교환계약에 대한 목적물의 감독기구가 서로 다르기 때문에, 규제의 불확실성이 커지고 규제공백의 위험이 증대될 수 있다. 따라서 가상자산과 증권토큰이 공존하는 디지털자산시장에 대한 포괄적 감독관할권은 단일 감독기구에 귀속되는 것이 규제의 효율성을 높인다.

Ⅴ. 결어: 국내 ICO 시장과 STO 시장의 발전 방향

본문에서 논한 국내 ICO 시장과 STO 시장의 당면 과제 및 대응 방안을 종합하여 양 시장의 발전 방향을 제시하면 다음과 같다.

먼저 국내 ICO 시장에 대해서는, 현재의 규제 공백을 해소하기 위해 디지털자산법 제정이 시급히 요구된다. 디지털자산법상 ICO 규제는 발행시장규제로서 공시규제, 불공정거래규제, 사업자규제로 나눌 수 있다. ICO 공시규제는 가상자산 발행과 거래자간의 정보격차를 줄이기 위한 것으로, 이에 관련하여 발행인의 정의, 국문 백서상의 중요투자정보, 통합적 공시시스템 등에 관한 법규정이 필요하다. ICO 불공정거래규제는 ICO 시장의 건전성 유지를 위한 것으로, 이에 관련하여 불공정거래행위의 유형화(시세조종, 미공개중요정보이용행위, 부정거래행위 등), 시장감시시스템, 불공정거래조사 국제공조 등에 관한 법규정이 필요하다. ICO 시장 사업자규제는 고객에 대한 신인의무의 강화를 위한 것으로서, 이에 관련하여 사업자의 선관주의의무(최선집행의무, 고객자산보호의무 등), 거래지원 기준 등에 관한 법규정이 필요하다. 이러한 내용을 주요 골자로 하는 디지털자산법이 제정되기 전까지 규제 공백을 메우기 위해 가상자산사업자의 자발적인 이용자 보호 노력이 중요하다. 현재 이러한 노력의 일환으로 가상자산거래업자의 공동협의체가 구성되었다. 정부, 국회, 그리고 가상자산업계는 상호 소통을 강화하여 디지털자산법 규제체계가 국내 가상자산시장에서 연착륙할 수 있도록 민관 협력체계를 강화하여야 할 것이다.

국내 STO 시장에 대해서는, 탈중앙화된 분산원장 거래를 자본시장법에 수용하기 위한 관련 법령의 정비가 필요하다. 먼저 전자증권법 개정을 통해 분산원장의 원본성을 법적으로 인정할 필요가 있다. 암호키를 관리하는 금융투자업자의 고객자산보호의무를 명확히 하는 등 디지털 시대에 적합한 금융투자업자의 신관주의의무를 구체화할 필요가 있다. 토큰화로 인해 투기적 조각투자가 활성화되는 것을 막기 위해, 증권토큰 발행플랫폼 등에 대한 규제체계를 정비하고 금융투자업자의 정보제공의무 및 투자권유준칙을 강화하여야 한다. 또한 현재 사업 지정기간이 2년도 남지 않은 STO 관련 금융규제 샌드박스의 규제면제 사항에 대한 입법화 논의(증권토큰 매출규제 완화, 부동산 수익증권 허용 등)를 서둘러야 할 것이다.

자본시장과 가상자산시장이 상호 수렴하는 현상에 대응하여, 국내 ICO 시장과 STO 시장의 규제체계는 상호 연계성을 가지고 구축되어야 한다. 디지털자산이 복잡다변한 형태의 상품으로 출시되는 경향이 앞으로 더욱 가속화될 전망이기 때문에, 기존 규제체계에서 유형화되지 않은 디지털자산 상품의 관할권을 명확히 하기 위한 증권성 심사 절차가 더 강화되어야 할 것이다. 가상자산을 기초자산으로 하는 금융투자상품 규제체계를 효율적으로 구축하여 가상자산시장규제와 자본시장규제간의 혼선을 최소화하여야 할 필요성이 크다. 마지막으로 가상자산과 증권토큰이 동일 블록체인 네트워크에서 공존하고 상호 교환되는 디지털자산시장 환경에 대비하여, 가상자산시장 규제체계와 자본시장 규제체계의 정합성과 연계성을 유지하는 정책적 노력을 지속하여야 한다.

1) 제20대 대통령직인수위원회(2022, p.72)

2) 위의 글

3) 현재 국회에 발의된 가상자산시장 거래자 보호를 위한 법률안은 ‘가상자산업법’안(의안번호 2109935), ‘디지털자산산업 육성과 이용자 보호에 관한 법률’안(의안번호 2111771) 등 다양한 명칭으로 불린다. 신정부는 110대 국정과제에서 관련 법률을 ‘디지털자산 기본법’으로 지칭하였다. 본고에서는 가상자산시장 거래자 보호와 가상자산사업자 규제에 관한 법률을 ‘디지털자산법’으로 칭한다.

4) 국내에서 STO는 금융규제 샌드박스를 통해 제한적으로 허용(카사코리아, 루센트블록, 펀블, 비브릭 등)되고 있지만, 미국에서 STO는 네거티브 규제체계하에서 원칙적으로 허용되며 추세적으로 성장하고 있다.

5) CRS(2018)

6) 증권에 해당하는 토큰화된 디지털자산의 발행행위는 STO로서 증권법(자본시장법)에 의해 규율된다.

7) 금융위원회(2017. 9. 27)

8) 국내 가상자산거래업자의 거래시설(trading facility)에 대해, 가상자산시장참여자들은 통상 ‘가상자산거래소’라고 칭한다. 그러나 특금법상 신고된 가상자산거래업자의 거래시설을 가상자산거래소라고 칭하는 경우, 해당 거래시설의 법적 지위가 자본시장법상 허가를 받은 거래소와 동등하다는 오해를 불러일으킬 수 있다. 따라서 본고에서는 ‘가상자산거래소’라는 용어를 쓰지 않고 가상자산거래업자의 ‘거래시설’이라는 용어를 사용한다.

9) 가상자산거래업자가 일정 요건을 충족한 가상자산을 자신의 거래시설에서 신규취급하여 유통을 허용하는 행위에 대해, 가상자산시장참여자들이 ‘상장’이라는 용어를 사용한다. 그러나 가상자산의 상장은 자본시장법상 주식의 거래소 상장과 같은 높은 수준의 거래소 진입요건 충족을 의미하는 것이 아니다. 따라서 ‘상장’보다는 ‘거래지원’이라는 용어가 보다 정확한 표현이라 할 수 있다.

10) SEC(2020)

11) 해당 그림에서 사용된 ‘상장’이라는 용어는 정확히 가상자산거래업자의 ‘거래지원’을 의미한다.

12) 제2차 당정간담회(2022. 6. 13, pp.3-5)

13) SEC(2022)

14) MiCA §4

15) Tassev(2022. 6. 19)

16) 17 CFR Part 180. CFTC 관할의 불공정거래규제조항인 17 CFR Part 180은 미국 SEC 관할의 반사기조항을 벤치마크하여 입법화되었다(CFTC, 2011).

또한 미국 뉴욕주의 경우 비트라이선스 제도에 따라 가상자산사업자가 반사기정책을 수립하여 합리적 수준의 불공정거래 예방조치를 하도록 의무화하고 있다(23 CRR-NY 200.19(g)).

17) SEC(2022)

18) “자체 개발한 가상자산이 상장 예정이라며 투자시 원금·고수익이 보장된다고 홍보하여 자금 모집 후 편취”, 금융감독원(2022, p.3)

19) 한국경제(2021. 8. 18)

20) 특정금융거래정보의보고및이용등에관한법률시행령 제10조의20제5호

21) 자본시장법 제174조

22) 발행인과 협의 없는 거래지원(소위 ‘도둑상장’)에 관해서는 한국경제(2022. 4. 19), 기습 거래지원 중단(소위 ‘기습 상장폐지’)에 관해서는 소비자가 만드는 신문(2022. 6. 8), 자의적 유의종목 지정에 관해서는 한겨례(2022. 5. 19) 참조

23) Cornerstone Research(2021)

24) 미러링 개념에 대해서는, 이경자(2022, p.11) 참조

25) 투기성 저가증권에 대한 해외 투자자보호제도에 관해, 미국의 Penny Stock Rule 참조(17 CFR § 240.15g-9)

26) IOSCO(2022)

27) RFIA §301

28) 글로벌 주요국의 가상자산감독기구에 관하여, ComplyAdvantage(2022) 참조

29) 현재 국회에 발의된 7개의 가상자산 관련 제정안은 모두 2021년 발의되었으며 다음과 같다. 이용우안(의안번호 9935), 김병욱안(의안번호 10190), 양경숙안(의안번호 10312), 권은희안(의안번호 11459), 민형배안(의안번호 11771), 윤창현안(의안번호 13016), 김은혜안(의안번호 13168) 등이다.

30) 자본시장법 제176조제4항

31) SEC(2021)

참고문헌

금융감독원, 2022. 1. 28, 당신의 소중한 재산을 노리는 유사수신 사기를 조심하세요!, 보도자료.

금융위원회, 2017. 9. 29, 기관별 추진현황 점검을 위한 가상통화 관계기관 합동TF 개최, 보도자료.

소비자가 만드는 신문, 2022. 6. 8, 멋대로 코인 상장폐지에 투자자만 피멍... ‘테라-루나 사태’도 거래소가 키워.

이경자, 2022, 『프롭테크: 자산 토큰화, 부동산 디지털증권부터 시작』, 삼성증권 조사분석자료.

임재연, 2022, 『자본시장법 강의』.

제20대 대통령직인수위원회, 2022, 윤석열정부 110대 국정과제.

제2차 당정간담회, 2022. 6. 13, 가상자산 사업자 공동 자율 개선방안.

코인데스크코리아, 2022. 6. 24, 테라 붕괴 주범 지목된 ‘지갑 A’는 테라폼랩스의 지갑이다.

한겨례, 2022. 5. 19, 가상자산 유의종목·상장폐지 기준 물어보니... 거래소도 모른다?

한국경제, 2021. 8. 18, 코인 시세조작에 가짜 명품몰까지 운영.

한국경제, 2022. 4. 19, ‘컴투스 코인’ 도둑 상장?...“코빗에 돌 던질 수 없어”.

Anderson, A., 2019, Initial Exchange Offerings for Beginners.

CFTC, 2011, Anti-Manipulation and Anti-Fraud Final Rules, Fact Sheet.

ComplyAdvantage, 2022, Cryptocurrency Regulations Around The World, https://complyadvantage.com/insights/cryptocurrency-regulations-around-world/

Cornerstone Research, 2021, SEC Cryptocurrency Enforcement.

CRS, 2018, Securities Regulation and ICOs.

Hale, V., 2018, Launch an ICO & Token Crowdsale.

Hazen, T., 2020, Principles of Securities Regulation, West Academic.

Hinman, W., 2018, Digital Asset Transactions: When Howey Met Gary (Plastic), Remarks at the Yahoo Finance All Markets Summit: Crypto.

IOSCO, 2022, IOSCO Explains How Decentralised Finance is Cloning Financial Markets, Media Release.

SEC, 2020, Initial Exchange Offerings (IEOs), Investor Alert.

SEC, 2021, Order Disapproving a Proposed Rule Change to List and Trade Shares of the VanEck Bitcoin Trust under BZX Rule 14.11(e)(4), Release No. 34-93559(Nov. 12, 2021).

SEC, 2022, Prepared Remarks of Gary Gensler On Crypto Markets.

Tassev, L., 2022. 6. 19, EU nears agreement on crypto regulations, report reveals, Bitcoin.com.

<해외 법률안>

Lummis-Gillibrand Responsible Financial Innovation Act (RFIA), 2022, S.4356.

Proposal for a Regulation of the European Parliament and of the Council on MiCA (Markets in Crypto-assets), and Amending Directive (EU), 2020, COM/2020/593 Final.