Find out more about our latest publications

Korea’s Specially Listed Technology Companies: Long-Run Performance and Implications

Issue Papers 22-16 Aug. 29, 2022

- Research Topic Capital Markets

- Page 22

Recently, a growing number of companies seek to go public through technology special listing in Korea. Emerging as a crucial listing track, it is expected to promote IPOs on the KOSDAQ. On the other hand, some raise concerns about companies listed through the special track which are exempted from financial requirements. Against this backdrop, this article assesses Korea’s technology special listing track by analyzing how those listed companies perform in the stock market and explores challenges for further improving the technology special listing track.

Although companies listed via the special track are subject to different listing requirements and have rarely achieved stable financial performance, the cost of funding through IPOs is pretty much the same between them and other normally listed companies. In terms of long-term stock performance, those companies outperform market indexes or their counterparts under the normal listing track. If the analysis scope is limited to biotech companies, the stock performance of the specially listed ones is hardly different from that of others. They usually begin to perform well in the stock market in the fourth or fifth year after listing, a few of which report outstanding performance that has never been observed in typical IPOs. In addition, there is not much difference in the percentage of stocks falling on the watch list between companies listed via two different tracks. These findings have shown that the special listing track offers opportunities for raising capital through IPOs to technology growth enterprises. It also opens up possibilities of finding companies that deserve to be listed through differentiated requirements. In an analysis of listing requirements’ adequacy, the long-term stock performance of specially listed companies is found not to be adversely affected by relaxed financial qualifications. The result also underscores the need for improving technology assessment capabilities. It is notable that many specially listed companies have failed to enhance financial performance significantly over a long post-IPO period. This implies that their performance in the stock market is highly dependent on technological prowess. Some of the companies may end up with failed technological development, which could aggravate the violation of disclosure requirements or unfair trading practices. In this respect, the financial authorities need to enhance the disclosure system for technological results and monitor closely any violation of disclosure rules or unfair trade practices. If the authorities bolster technical assessment capabilities and take stricter measures for investor protection, technology special listing would be established as the important listing track on the KOSDAQ.

Although companies listed via the special track are subject to different listing requirements and have rarely achieved stable financial performance, the cost of funding through IPOs is pretty much the same between them and other normally listed companies. In terms of long-term stock performance, those companies outperform market indexes or their counterparts under the normal listing track. If the analysis scope is limited to biotech companies, the stock performance of the specially listed ones is hardly different from that of others. They usually begin to perform well in the stock market in the fourth or fifth year after listing, a few of which report outstanding performance that has never been observed in typical IPOs. In addition, there is not much difference in the percentage of stocks falling on the watch list between companies listed via two different tracks. These findings have shown that the special listing track offers opportunities for raising capital through IPOs to technology growth enterprises. It also opens up possibilities of finding companies that deserve to be listed through differentiated requirements. In an analysis of listing requirements’ adequacy, the long-term stock performance of specially listed companies is found not to be adversely affected by relaxed financial qualifications. The result also underscores the need for improving technology assessment capabilities. It is notable that many specially listed companies have failed to enhance financial performance significantly over a long post-IPO period. This implies that their performance in the stock market is highly dependent on technological prowess. Some of the companies may end up with failed technological development, which could aggravate the violation of disclosure requirements or unfair trading practices. In this respect, the financial authorities need to enhance the disclosure system for technological results and monitor closely any violation of disclosure rules or unfair trade practices. If the authorities bolster technical assessment capabilities and take stricter measures for investor protection, technology special listing would be established as the important listing track on the KOSDAQ.

Ⅰ. 서론

특례상장 제도는 전문평가기관으로부터 일정 수준 이상의 기술평가등급을 받거나 상장주관사의 추천을 받은 기술성장기업에 대해 일반상장보다 완화된 재무 관련 요건으로 상장을 허용하는 제도이다. 기술성장기업들은 기술 개발을 완수하기까지 장기간 R&D에 투자해야 하고, 이것이 매출과 수익으로 나타나는 데에도 오랜 시간이 소요된다. 따라서 이러한 기업들이 기술력이 우수하여 성장 가능성이 있더라도 안정적인 재무성과를 요구하는 일반상장의 상장요건을 맞추기가 어렵다. 이러한 점을 고려한 금융당국은 2005년에 성장형 바이오벤처기업들을 대상으로 특례상장 제도를 도입하였다.

특례상장 제도가 도입된 후 10년을 보면 이 제도를 이용하여 상장한 기업들의 등장은 미미하다. 그래서 최근 특례상장 제도를 통해 상장하는 기업들이 크게 증가하고 있는 것이 오히려 이례적으로 보일 수 있다. 그러나 그 요인을 살펴보면 2010년대 중반 금융당국이 특례상장 제도를 활성화하기 위해 다양한 정책들을 제시한 점과 바이오 부문의 열풍, 4차 산업혁명으로 바이오와 IT 부문에서 신성장 기업들이 크게 증가한 점, 그리고 기술기업들에 대한 투자자들의 기대와 투자인식이 향상된 점 등 장기적인 변화에 기인하고 있다. 즉 특례상장 제도는 코스닥 시장의 중요한 상장방식으로 떠오르고 정체된 코스닥 IPO 시장에 큰 활력을 줄 수 있을 것으로 기대되고 있다. 그러나 다른 한편으로는 상장 후 이들의 주가가 큰 폭으로 등락하고 재무성과가 지지부진한 기업들이 많아지고 있으며 상장폐지 결정까지도 발표되면서 특례상장 제도에 대한 우려도 제기되고 있다. 따라서 특례상장 기업들에 대한 성과분석을 통해 특례상장 제도를 평가해 보고 그 발전 방안을 논의해 볼 필요가 있다. 본 연구는 2005년 제도가 도입된 이후 상장한 특례상장 기업들의 장기 주가성과와 재무성과를 분석하고 이들이 일반상장 기업들과 어떠한 차이가 있는지를 살펴본다. 이 외에 특례상장 기업들의 성과에 대한 요인 분석을 토대로 현재의 상장요건을 평가하고 더불어 이러한 기업들에 대한 투자자보호 이슈를 논의한다.

Ⅱ. 특례상장 제도 및 상장 전 특례상장 기업의 특성

1. 특례상장 제도의 연혁과 주요 내용

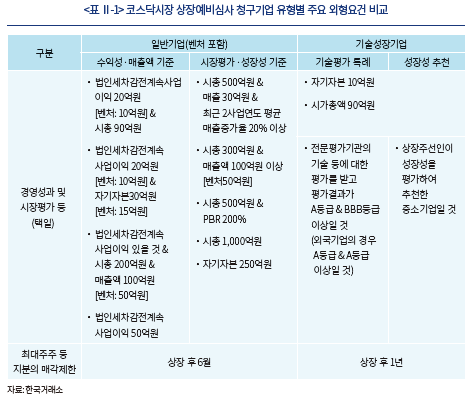

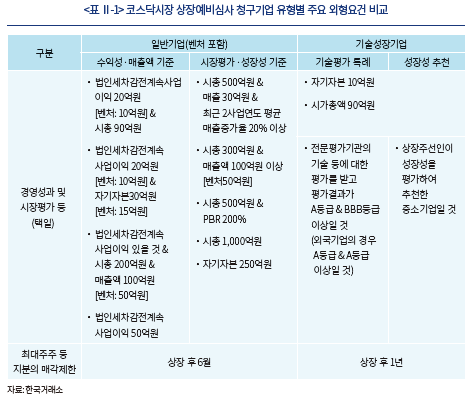

금융당국은 2005년 성장형 바이오벤처기업을 대상으로 기술평가 특례상장 제도를 도입하고 2014년에 대상 기업을 전 부문으로 확대하였다. 이러한 제도는 거래소가 지정한 전문평가기관 중 2개의 복수기관으로부터 A와 BBB 등급 이상의 기술평가등급을 받은 기술성장기업에 대해 경영성과 및 시장평가 등의 재무요건을 면제하고 있다(<표 Ⅱ-1> 참조). 하지만 전문평가기관의 기술평가등급에 전적으로 근거해야 하므로 기술력을 보유하고 있지만 이를 객관적으로 평가받기 어려운 성장성 기업들까지 적용되기 어려운 점이 있다. 금융당국은 2017년에 이를 보완하고 동시에 상장주관사의 기업발굴 기능을 강화하고자 상장주관사의 추천으로 운영되는 성장성평가 특례상장 제도를 신설하였다.1)

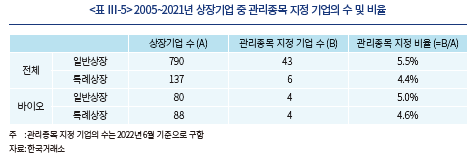

<표 Ⅱ-1>에서 볼 수 있듯이, 기술평가와 성장성평가를 근거로 특례상장한 기업들은 일반상장의 재무요건보다 완화된 기준으로 상장한다. 즉 일반상장 기업들은 안정적인 수익성, 매출액 등을 갖추어야 하고 기업규모도 일정 수준 이상이어야 상장할 수 있지만, 특례상장 기업들은 상장 당시 소규모 자본력에 적자를 내거나 매출액이 없어도 상장할 수 있다. 때문에 특례상장 기업들은 상장 직후 일반상장 기업을 대상으로 일정 수준 이상의 재무성과를 요구하는 관리종목 지정제도를 충족시키기가 어렵다. 이러한 점을 고려하여, 코스닥시장은 특례상장 기업에 한해 관리종목 지정기준 중 일부를 상장 후 3년에서 5년에 걸쳐 유예하는 상장규정을 두고 있다.2)

2. 특례상장 기업의 현황과 특성 분석

가. 특례상장 기업의 현황과 추이

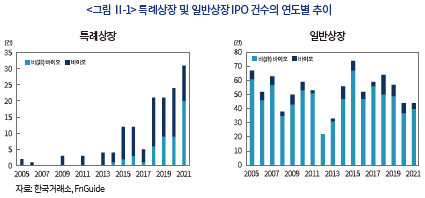

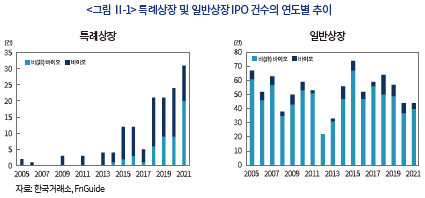

특례상장 제도를 이용한 IPO 기업은 2005년부터 2021년까지 총 143개사로 동기간 코스닥 일반상장 제도를 이용한 IPO 기업(887개사)의 1/6 수준에 해당한다.3) 특례상장 IPO는 2005년부터 2014년까지 10년간 총 15건에 불과하였으나, 2015년 12건으로 크게 증가하고 2018년 20건으로 반등한 후 현재까지 꾸준한 상승세를 보이고 있다.4) 이와 같은 특례상장 IPO의 성장세는 연간 40~50건에서 정체되어 있는 최근 일반상장 IPO와 대조적이다(<그림 Ⅱ-1> 참조). 그 요인으로는 2010년대 중반 특례상장 활성화를 위한 정책적 노력이 있었던 점5), 바이오 부문의 열풍, 4차 산업혁명으로 바이오와 IT 부문에서 신성장 기업들이 크게 증가한 점, 그리고 기술기업들에 대한 투자자들의 기대와 투자 인식이 향상된 점을 들 수 있다.

특례상장 기업들은 2017년 이전까지 대부분 바이오 기업들이었으나, 최근 IT와 산업재, 소비재, 소재 등의 부문에서 크게 증가하고 있다.6) 2021년에는 특례상장 중 IT 기업이 48%를 차지하며 바이오 기업(33%)을 추월하였다. 이는 최근 4차 산업혁명의 급격한 진행으로 기술력을 기반으로 성장하는 IT 기업들이 크게 증가하였기 때문으로 보인다.

나. 상장 전 특례상장 기업의 특성

본 연구는 제도가 도입된 2005년부터 2021년까지 특례상장과 일반상장 IPO 기업들의 전체 자료를 이용하여 주가성과 및 재무성과를 분석한다. 다만, 분석에서 스팩 합병을 통해 상장한 기업들을 제외함으로써, 일반적인 공모절차를 통해 코스닥 시장에 상장한 기업들로 분석 대상을 한정하였다. 바이오 부문은 특례상장에서 차지하는 비중이 높을 뿐 아니라, 일반상장 기업들도 임상시험 등 장기간의 기술 개발의 과정을 거쳐 성장한다는 점이나 최근 시장에서의 투자 열기가 높았다는 점에서 다른 부문과 차이가 있다. 이러한 점을 고려하여, 본 연구는 전체 기업뿐 아니라 바이오 기업만을 대상으로 한 분석을 동시에 제시한다. 본 연구는 FnGuide로부터 기업들의 주가 및 재무적 특성 변수들을 추출하였고 해당 공모주의 증권신고서에서 공모금액, 인수수수료, 기관투자자 주식보유 비중 등을 직접 수집하였다.

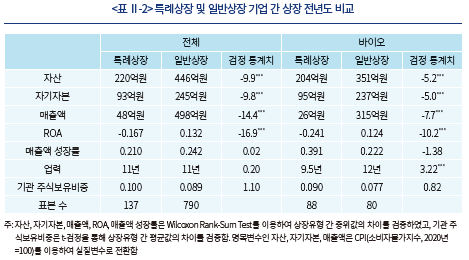

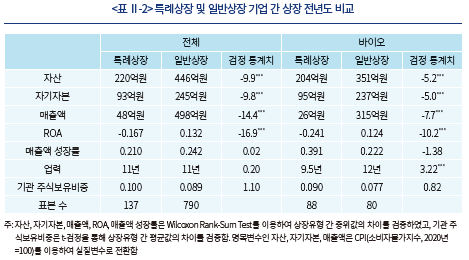

<표 Ⅱ-2>는 상장직전 회계연도 기준 특례상장과 일반상장 기업들의 재무 특성을 비교하고 있다. 중위값을 기준으로, 특례상장 기업의 자산과 자기자본은 일반상장 기업의 약 1/2 수준이고 매출액은 일반상장 기업의 1/10에도 미치지 못하고 있다. ROA의 경우, 일반상장 기업은 10%를 초과하는 반면 특례상장 기업은 –20% 전후로 매우 낮았다. 다만 매출액 성장률과 업력은 일반상장 기업과 크게 다르지 않았다. 요컨대, 특례상장 기업은 일반상장 기준의 재무요건을 충족하지 못하고 있을 뿐 아니라 매출액, ROA 등의 재무적 지표에서 상당히 취약한 것으로 나타났다.

특례상장 기업의 기관투자자 소유주식비중은 일반상장 기업보다 약 1%p 높은 평균을 보이고 있으나 통계적으로 유의하지 않았다. 특례상장 기업들은 상장 전 일반상장 기업들보다 크게 떨어지는 재무성과를 보이고 있지만 이들과 유사한 수준으로 벤처캐피탈 등의 전문 기관투자자로부터 투자자금을 조달해 온 것이다.

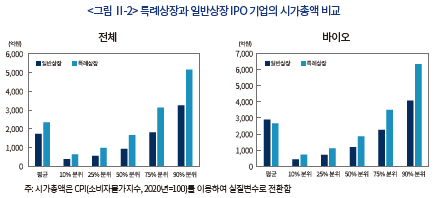

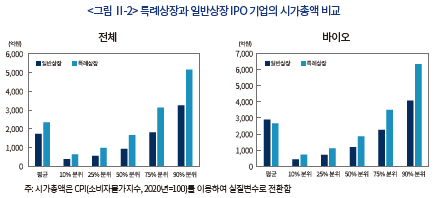

<그림 Ⅱ-2>는 특례상장과 일반상장 기업들의 상장 당시 시가총액을 나타내고 있다. 여기서, 시가총액은 상장 후 5영업일 종가에 상장주식수를 곱하여 구하였다. 분석 결과, 특례상장 기업들의 시가총액은 대부분의 분위에서 일반상장보다 1.5배 정도 컸다. 이러한 결과로 볼 때, 특례상장 기업들의 상장 직전 자산, 자기자본, 매출액은 일반상장보다 적었지만 기술력에 대한 시장의 평가로 인해 이들의 상장 당시 시가총액은 일반상장보다 오히려 컸던 것으로 판단된다.

Ⅲ. 특례상장 기업의 주가성과 분석

1. 특례상장 기업의 IPO 공모 비용

특례상장 기업은 재무성과가 없지만 기술성 평가를 충족하여 상장한 기업들이다. 따라서 투자자들은 이들에 대해 재무성과보다는 잠재적인 기술력에 기반을 두고 투자를 결정할 것이다. 예를 들면 재무성과가 없는 점에 대한 우려가 크거나 기술력에 대한 투자자들의 기대가 낮다면 이러한 기업들은 공모주 투자자들을 유치하는데 많은 비용을 지불해야 할 수도 있다. 이러한 관점에서, 본 소절은 인수수수료와 초기수익률을 일반상장과 비교하여 특례상장 기업들이 IPO 과정에서 지불한 직ㆍ간접비용을 알아보고자 한다.

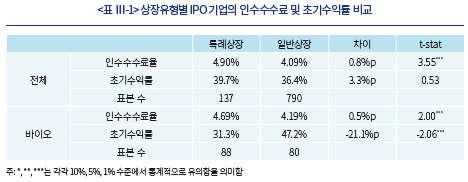

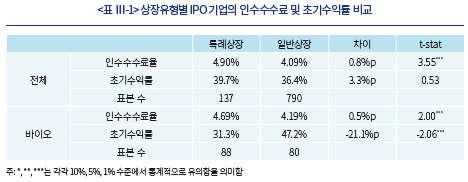

<표 Ⅲ-1>은 특례상장과 일반상장 기업의 인수수수료와 초기수익률을 보여주고 있다. 투자자를 유치하기 어려운 IPO 기업의 경우, 주관회사는 투자자를 유치하기 위해 더 많은 노력을 해야 하며 공모주 투자자를 충분히 유치하지 못하여 공모주를 인수해야 하는 위험도 크다. 따라서 주관회사는 투자자를 유치하기 어려운 IPO 기업에 대해서는 더 높은 인수수수료를 요구한다. 분석 결과, 특례상장 기업들의 인수수수료는 일반상장 기업들의 인수수수료보다 평균적으로 0.8%p(전체)와 0.5%p(바이오) 더 높은 것으로 나타났다.7)

IPO 기업은 인수수수료로 주관회사에게 직접 비용을 지불하기도 하지만 투자자를 유치하기 위해 공모가를 낮추기도 한다. 이러한 맥락에서 주관회사는 투자자를 유치할 목적으로 공모가를 시장가보다 낮게 책정하려는 경향을 보인다. 일반적으로 이와 같은 공모가 저가 책정(underpricing) 또는 초기수익률을 IPO 과정에서 기업이 지불하는 간접비용으로 본다. 본 연구에서는 초기수익률을 공모가 대비 상장 5영업일 종가(=(상장 5영업일 종가/공모가 –1)×100%)로 구하였다. 분석 결과, 초기수익률이 전체 분석에서는 상장유형 간 차이가 나지 않았지만, 바이오 부문에서는 특례상장 기업이 더 낮았다. 이러한 결과는 특례상장 기업들의 간접비용이 일반상장보다 더 높지 않았음을 보여주는 것이다.8)

2. 특례상장 기업의 장기 주가성과

특례상장 제도는 기술성장기업의 특성에 맞추어 상장요건을 조정한 것이지만, 기술성 평가를 근거로 상장한 기업들이 장기적으로 우수한 주가성과를 보일 수 있다는 기대가 반영된 것이기도 하다. 거래소는 우수한 주가성과를 기대할 수 있는 기업에게 상장을 허용함으로써 투자자를 보호하고 시장을 활성화하려는 목적을 가지고 있기 때문에, 특례상장 기업들이 우수한 주가성과를 보인다면 이러한 제도를 좋게 평가할 수 있을 것이다. 따라서 본 연구는 Ritter(1991) 등 기존의 연구문헌에서 제시한 여러 방법론을 이용하여 특례상장과 일반상장 기업의 장기 주가성과를 비교‧분석한다.

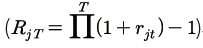

두 상장유형 기업들의 장기 주가성과를 비교하는 첫 번째 지표로 Ritter(1991)가 제시한 wealth relative 를 이용한다.

를 이용한다.  은 Ritter(1991)가 제시한 것과 동일하게 상장 6영업일부터 3년(T=761일)과 5년(T=1265일) 기간 동안의 IPO 기업 보유기간수익률

은 Ritter(1991)가 제시한 것과 동일하게 상장 6영업일부터 3년(T=761일)과 5년(T=1265일) 기간 동안의 IPO 기업 보유기간수익률 과 동기간 시장지수 보유기간수익률

과 동기간 시장지수 보유기간수익률 의 상대비율

의 상대비율 로 구하였다.9) Ritter(1991)는

로 구하였다.9) Ritter(1991)는  이 1보다 크면 IPO 기업의 장기 주가성과가 시장지수보다 좋고 1보다 작으면 시장지수보다 좋지 못한 것으로 해석하고 있다.

이 1보다 크면 IPO 기업의 장기 주가성과가 시장지수보다 좋고 1보다 작으면 시장지수보다 좋지 못한 것으로 해석하고 있다.

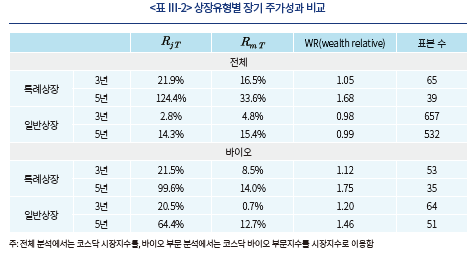

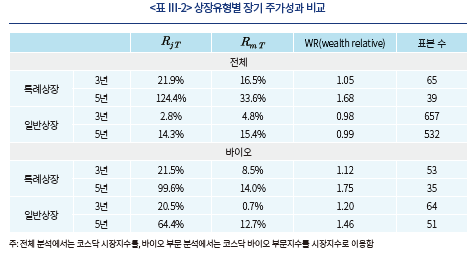

분석 결과, 상장 5년 기준 특례상장 기업들의 은 전체 및 바이오 부문 각각 1.68과 1.75로 나와 1보다 컸다. 즉 특례상장 전체와 바이오 기업들의 장기 주가성과는 각각 동기간 코스닥 시장지수와 바이오 부문지수보다 좋았다. 특례상장 기업의 비교 대상인 상장 5년 기준 일반상장 기업들의

은 전체 및 바이오 부문 각각 1.68과 1.75로 나와 1보다 컸다. 즉 특례상장 전체와 바이오 기업들의 장기 주가성과는 각각 동기간 코스닥 시장지수와 바이오 부문지수보다 좋았다. 특례상장 기업의 비교 대상인 상장 5년 기준 일반상장 기업들의  은 0.99(전체)와 1.46(바이오 부문)으로 나왔다. 즉 특례상장 기업들의 주가성과는 일반상장보다 좋았으며 바이오 기업들로 비교를 한정하더라도 일반상장과 유사하였다.

은 0.99(전체)와 1.46(바이오 부문)으로 나왔다. 즉 특례상장 기업들의 주가성과는 일반상장보다 좋았으며 바이오 기업들로 비교를 한정하더라도 일반상장과 유사하였다.

특례상장 기업들의 은 3년차(전체: 1.05, 바이오: 1.12)에서보다 5년차(전체: 1.68, 바이오: 1.75)에서 더 높게 나타났다. 이러한 결과로 볼 때, 특례상장 기업들의 주가성과는 상장 직후보다 상장 4~5년차에서 크게 좋아지고 있는 것이다. <표 Ⅲ-2>에 제시하지는 않았지만 비(非) 바이오 특례상장 기업들도 3년차보다는 5년차의 주가성과가 더 높게 나타났다. 다만, 표본이 많지 않아 이러한 분석 결과를 일반화하여 해석하는데 한계가 있어 보인다.10)

은 3년차(전체: 1.05, 바이오: 1.12)에서보다 5년차(전체: 1.68, 바이오: 1.75)에서 더 높게 나타났다. 이러한 결과로 볼 때, 특례상장 기업들의 주가성과는 상장 직후보다 상장 4~5년차에서 크게 좋아지고 있는 것이다. <표 Ⅲ-2>에 제시하지는 않았지만 비(非) 바이오 특례상장 기업들도 3년차보다는 5년차의 주가성과가 더 높게 나타났다. 다만, 표본이 많지 않아 이러한 분석 결과를 일반화하여 해석하는데 한계가 있어 보인다.10)

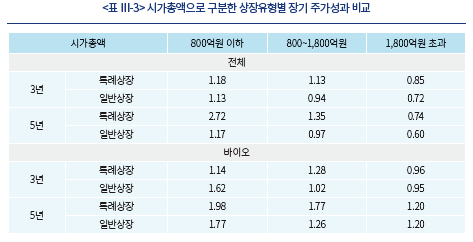

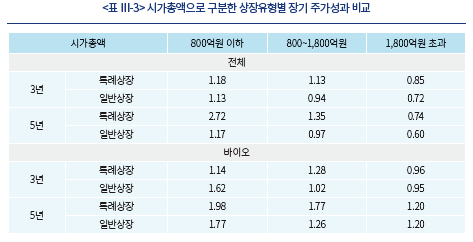

다음으로는 시가총액을 기준으로 유사한 위험수준의 기업 그룹을 구분하고 두 상장유형의  을 비교한다.11) 특례상장과 일반상장 표본이 각각 1/3씩 나누어지도록 시가총액 800억원 이하, 800~1,800억원, 1,800억원 초과한 기업들로 구분하였다. 분석 결과, 모든 분석에서 기업 규모가 작을수록 WR의 지표가 높은 것으로 나타났다. 즉 투자위험이 높은 소규모 시가총액의 기업 그룹들이 장기 주가성과도 더 높았다. 이러한 결과로 볼 때, 유사한 위험수준을 나타내는 기업규모별로 장기 주가성과를 비교하여 앞서 분석한 결과의 강건성을 살펴보는 것이 적절해 보인다. 시가총액이 유사한 기업 그룹별로 보더라도 특례상장 기업들의 5년 주가성과가 일반상장보다 좋았고 3년 주가성과나 바이오 기업들로 비교한 경우에서도 일반상장과 유사한 분석 결과를 얻어, 전체 분석 결과와 다르지 않음을 확인하였다.

을 비교한다.11) 특례상장과 일반상장 표본이 각각 1/3씩 나누어지도록 시가총액 800억원 이하, 800~1,800억원, 1,800억원 초과한 기업들로 구분하였다. 분석 결과, 모든 분석에서 기업 규모가 작을수록 WR의 지표가 높은 것으로 나타났다. 즉 투자위험이 높은 소규모 시가총액의 기업 그룹들이 장기 주가성과도 더 높았다. 이러한 결과로 볼 때, 유사한 위험수준을 나타내는 기업규모별로 장기 주가성과를 비교하여 앞서 분석한 결과의 강건성을 살펴보는 것이 적절해 보인다. 시가총액이 유사한 기업 그룹별로 보더라도 특례상장 기업들의 5년 주가성과가 일반상장보다 좋았고 3년 주가성과나 바이오 기업들로 비교한 경우에서도 일반상장과 유사한 분석 결과를 얻어, 전체 분석 결과와 다르지 않음을 확인하였다.

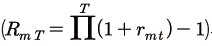

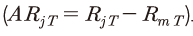

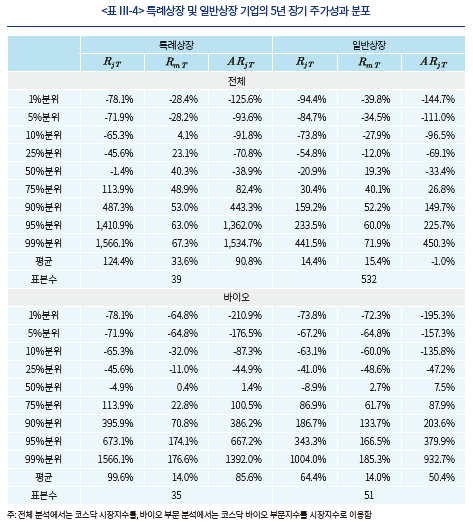

두 번째는, 일반상장과 특례상장 기업들의 장기 주가성과 분포를 비교한다. 상장유형별 장기 주가성과의 분포는 상장 6영업일부터 5년(T=1265) 기간 동안의 IPO 기업의 보유기간수익률 과 동기간 시장지수의 보유기간수익률

과 동기간 시장지수의 보유기간수익률 그리고 IPO 기업의 보유기간초과수익률

그리고 IPO 기업의 보유기간초과수익률 로 구분하여 각각 비교한다.

로 구분하여 각각 비교한다.

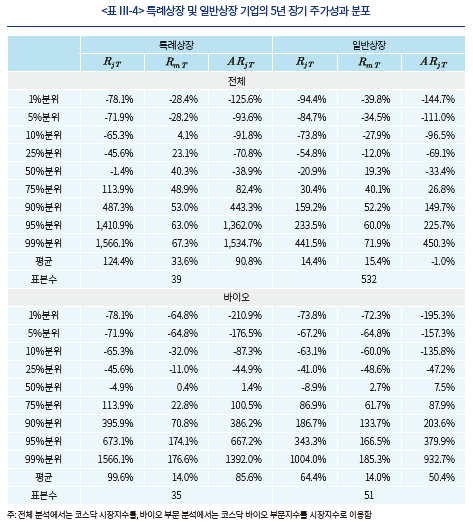

분석 결과, 특례상장 기업들의 보유기간수익률 은 전체와 바이오 부문 모두 50% 분위 이하에서는 일반상장과 차이가 거의 없었던 반면 50% 분위를 초과하면 일반상장보다 높았다. 다만, 상장기업들의 보유기간수익률은 동기간 시장수익률에 영향을 받을 수 있다. 이를 테면, 시장수익률이 상승할 때 많은 기업들의 수익률이 자신의 실적과 무관하게 덩달아 상승한다. 특례상장과 일반상장 기업들이 상장한 시점이 서로 다르므로 시장수익률이 차감된 보유기간초과수익률로 분석할 필요가 있다.12) 보유기간초과수익률로 분석한 결과에서도 50% 분위 이하에서는 특례상장과 일반상장 기업들 간 차이가 거의 없었던 반면 50% 분위를 초과하면 특례상장 기업들이 일반상장보다 높게 나타났다. 90% 분위를 초과하는 소수의 특례상장 기업들이 일반상장 기업들에서 보기 어려운 1,000% 이상의 높은 주가성과를 보이고 있는데, 이러한 기업들의 높은 주가성과가 두 상장유형 간 평균의 차이를 만들고 있는 것으로 생각된다.

은 전체와 바이오 부문 모두 50% 분위 이하에서는 일반상장과 차이가 거의 없었던 반면 50% 분위를 초과하면 일반상장보다 높았다. 다만, 상장기업들의 보유기간수익률은 동기간 시장수익률에 영향을 받을 수 있다. 이를 테면, 시장수익률이 상승할 때 많은 기업들의 수익률이 자신의 실적과 무관하게 덩달아 상승한다. 특례상장과 일반상장 기업들이 상장한 시점이 서로 다르므로 시장수익률이 차감된 보유기간초과수익률로 분석할 필요가 있다.12) 보유기간초과수익률로 분석한 결과에서도 50% 분위 이하에서는 특례상장과 일반상장 기업들 간 차이가 거의 없었던 반면 50% 분위를 초과하면 특례상장 기업들이 일반상장보다 높게 나타났다. 90% 분위를 초과하는 소수의 특례상장 기업들이 일반상장 기업들에서 보기 어려운 1,000% 이상의 높은 주가성과를 보이고 있는데, 이러한 기업들의 높은 주가성과가 두 상장유형 간 평균의 차이를 만들고 있는 것으로 생각된다.

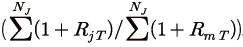

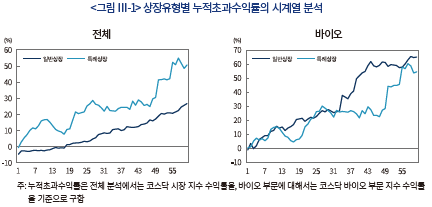

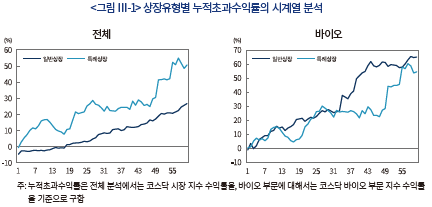

세 번째는, 특례상장과 일반상장 기업들의 상장 후 5년 기간 동안의 시장지수 대비 누적초과수익률(Cummulative Abnormal Return: CAR)의 추이를 살펴본다. 여기서 제시하는 누적초과수익률은 Ritter(1991)가 제시한 측정 방식을 따르고 있다. 먼저, 상장 6영업일부터 26영업일까지를 첫 1개월로 하고, 이후 매 21영업일을 1개월 단위로 구분하여 2~60개월까지 월별 기간을 정한다. 기업 j의 t월 초과수익률 은 t월 21영업일 동안의 기업 j의 보유기간수익률을 동기간 시장지수 보유기간수익률로 차감하여 구한다. 상장유형별 누적초과수익률

은 t월 21영업일 동안의 기업 j의 보유기간수익률을 동기간 시장지수 보유기간수익률로 차감하여 구한다. 상장유형별 누적초과수익률 은 상장유형별 기업들의 월별 평균 초과수익률

은 상장유형별 기업들의 월별 평균 초과수익률 을 시계열로 합산하여 구한다. 이러한 지표는 상장 후 5년 기간 특례상장과 일반상장 기업들의 평균적인 월별 초과수익률의 추이를 보여준다. 따라서 이러한 지표를 통해 상장 후 시기에 따라 상장유형별 초과수익률이 어떠한지를 살펴볼 수 있다.

을 시계열로 합산하여 구한다. 이러한 지표는 상장 후 5년 기간 특례상장과 일반상장 기업들의 평균적인 월별 초과수익률의 추이를 보여준다. 따라서 이러한 지표를 통해 상장 후 시기에 따라 상장유형별 초과수익률이 어떠한지를 살펴볼 수 있다.

일반상장 전체 기업들의 누적초과수익률은 5년 전반에 걸쳐 완만하게 상승하고 있으며, 바이오 기업들은 상장 후 46개월까지 다소 가파른 상승세를 보이고 이후 정체되는 모습을 보이고 있다. 반면 특례상장 기업들의 누적초과수익률은 전체와 바이오 부문 모두 상장 첫 10개월, 18~28개월, 48~56개월에서는 상승세를, 11~17개월에서는 반대로 하락세를, 28~48개월에서는 정체하는 모습을 보이고 있다. 특히 특례상장 기업들의 누적초과수익률은 48~56개월에서 두드러지게 상승하고 있는데, 이는 앞서 3년차 주가성과와 대비하여 5년차 주가성과가 크게 좋았던 분석 결과와 부합한다. 특례상장 기업들의 주가성과가 상승과 하락을 보이며 일반상장보다 변동성이 컸는데, 그 이유는 분석 표본이 상대적으로 적은 것도 있지만 기술 개발이나 실패 소식에 기업들의 주가가 큰 폭으로 변동하기 때문으로 보인다. 재무성과에 의해 결정되는 일반상장 기업들과 달리, 특례상장 기업들의 주가성과는 기술력의 변화(바이오 부문을 예로 들면 임상시험의 성공 또는 실패)에 크게 영향을 받는다. 이를테면 특례상장 기업들이 임상시험의 성공이나 기술 개발을 발표할 경우 단기에 주가가 1~2배 급상승하기도 하는데, 이 때 특례상장 기업들의 월별 평균 초과수익률도 크게 상승한 것이다.

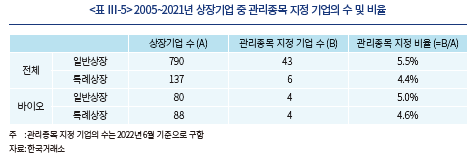

마지막으로, 2005년부터 2021년까지 상장한 기업들에 대해 상장유형별 관리종목 지정 기업의 수와 그 비율을 살펴본다. 영업손실, 시가총액, 자본잠식, 정기보고서 관련, 거래량, 주식분산, 공시의무위반, 기업지배구조 등의 관리종목 지정 사유에 대해서는 일반상장과 특례상장 기업 모두 동일하게 적용받는다. 다만 앞의 II장에서 설명하였듯이, 매출액과 경상손실 등 일부 관리종목 지정 사유에 대해서는 상장일로부터 3개/5개 사업연도까지 특례상장 기업에의 적용을 유예하고 있다. 동일한 기준으로 관리종목 지정 비율의 비교를 위해서 특례상장 기업에 적용되지 않는 사유로 관리종목으로 지정된 일반상장 기업 2개사를 포함하지 않았다. <표 Ⅲ-5>에서 알 수 있듯이, 전체와 바이오 부문 모두 특례상장 기업들이 관리종목으로 지정되는 비율이 일반상장과 크게 다르지 않았다. 특례상장 기업의 관리종목 지정사유는 2개사가 감사의견 부적정, 3개사가 상장적격성 실질심사 대상, 1개사(신라젠)가 상장폐지 결정13)인 것으로 나타났다.

Ⅳ. 특례상장 제도의 상장요건에 대한 분석

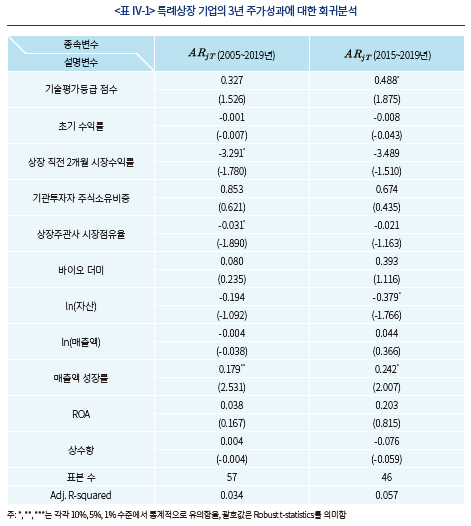

앞에서 보여 주었듯이, 특례상장 기업들의 주가성과는 다른 상장요건에도 불구하고 일반상장과 크게 다르지 않았다. 여기서는, 특례상장 제도의 기술성 평가와 완화된 재무요건의 적용이 이들 기업들의 장기 주가성과에 어떠한 영향을 주고 있는지 살펴봄으로써 특례상장 제도의 상장요건을 평가하고자 한다. 본 연구는 특례상장의 주요 상장요건을 중심으로 주가성과에 대한 회귀분석을 수행한다.

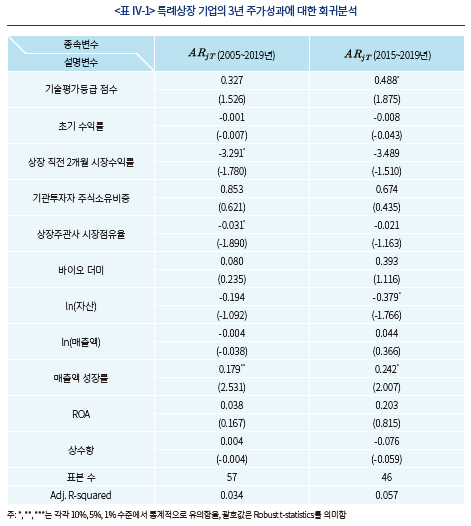

설명변수는 특례상장의 상장요건과 관련한 기술평가등급 점수, 상장 직전 재무성과(자산, 매출액, ROA, 매출액 성장률) 변수, 바이오 부문 더미 변수와 기존 연구문헌14)에서 제시한 초기수익률, 상장일 직전 2개월 시장수익률, 상장 직전 기관투자자의 주식보유비중과 상장주관사의 시장점유율 변수를 이용하였다. 종속변수는 특례상장 기업의 상장 3년 동안의 보유기간누적초과수익률 로 정하였다.15) 특례상장 IPO 기업들이 2015년부터 크게 증가한 점을 고려하여 2005년부터 2019년 사이 특례상장한 기업들로 구성된 전체 표본과 2015년부터 2019년 사이 특례상장한 기업들로 구성된 부분 표본으로 회귀분석을 수행하였다.

로 정하였다.15) 특례상장 IPO 기업들이 2015년부터 크게 증가한 점을 고려하여 2005년부터 2019년 사이 특례상장한 기업들로 구성된 전체 표본과 2015년부터 2019년 사이 특례상장한 기업들로 구성된 부분 표본으로 회귀분석을 수행하였다.

기술평가등급 점수 변수는 각 전문평가기관의 기술평가등급에 대해 1점(BBB), 2점(A), 3점(AA)을 부여하여 최소 3점에서 최대 6점으로 구성된다.16) 분석 결과, 전체 및 부분 표본을 이용한 두 회귀분석 모두 기술평가등급 점수의 계수치가 양(+)의 값을 보이고 있으나 통계적 유의성이 높지 않았다. 이러한 결과는 기술평가등급이 높을수록 특례상장 기업의 주가성과가 좋을 가능성이 있다는 것을 의미한다. 다만, 통계적 유의성이 높지 않아 기술성 평가 등급이 높더라도 우수한 장기 주가성과를 보장하기 어렵다는 의미도 지니고 있어, 기술성 평가 역량이 현재보다 더 향상될 필요가 있다는 점을 제시하고 있다.

재무 상장요건과 관련한 매출액, ROA, 자산 등의 변수들은 상장 후 장기 주가성과와 상관관계가 없거나 음(-)인 것으로 나타났다. 즉 일반상장 요건에 해당된 재무지표가 상장 전 취약하였다고 해서 특례상장 기업의 장기 주가성과가 더 나쁘지는 않았던 것이다. 또한 장기 주가성과는 해당 특례상장 기업이 바이오 기업인지의 여부와 무관한 것으로 나타났다. 이상의 결과로 볼 때, 완화된 상장요건의 적용이나 전 부문으로 확장한 2014년 정책이 특례상장 기업들의 장기 주가성과에 부정적으로 영향을 주지 않은 것으로 판단된다.

초기수익률과 상장 직전 2개월 시장수익률의 계수는 음(-)의 값을 보이고 있으나 통계적 유의성이 높지 않았다. 이러한 결과로 볼 때, 상장 당시 특례상장 기업에 대해 투자자 심리가 과도하게 표출되지 않았고 따라서 장기 주가성과에 영향을 주지 않았던 것으로 판단된다. 기관투자자 주식보유비중의 계수치는 양(+)이었으나 통계적 유의성이 없었다. 즉 상장 전 기관투자자로부터 투자를 많이 받은 특례상장 기업이라고 해서 장기적으로 더 우수한 주가성과를 보이지는 않았다. 대형 상장주관사는 뛰어난 전문인력을 보유하고 있고 좋은 평판을 관리하기 위해서도 우수한 특례상장 기업을 발굴할 가능성이 높다. 상장주관사의 시장점유율을 분석한 결과, 기대와 달리 이러한 변수의 계수치는 음(-)의 값을 보이고 있어 대형 상장주관사들이 장기 주가성과가 좋은 특례상장 기업을 특별히 발굴하고 있지는 않은 것으로 판단된다.

Ⅴ. 상장 후 특례상장 기업의 특성

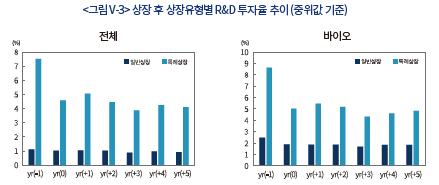

특례상장 기업은 재무성과 없이 기술력만을 가지고 상장하여 태생적으로 주가성과의 불확실성이 큰데, 앞서 분석한 결과 상장 후 특례상장 기업들의 장기 주가성과는 일반상장 기업들과 비교해서 크게 다르지 않았다. 이러한 결과를 이해하기 위해, 상장 후 특례상장과 일반상장 기업의 ROA, 자산회전율, R&D 투자율을 비교해 보고 이를 바탕으로 특례상장 기업의 특성을 논의해 본다.

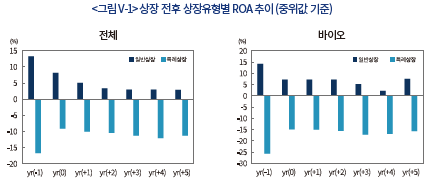

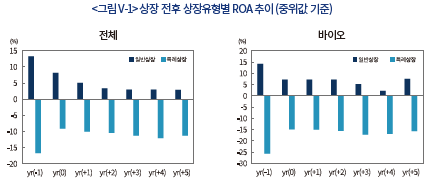

<그림 Ⅳ-1>은 상장 직전 회계연도부터 상장 후 5년차 회계연도까지 특례상장 및 일반상장 기업의 ROA를 보여주고 있다. 상장 당해 연도 특례상장(일반상장) 기업의 ROA 중위값은 상장 직전 대비 크게 상승(하락)하였는데, 이는 IPO 공모자금이 더해져 ROA의 분모인 자산이 상장 당해 연도에 크게 증가한 영향이 크다.17) 즉 자산에 추가된 공모자금을 고려하면 두 회계연도 간 수익성의 변화는 크지 않다. 따라서 비교의 수월성을 위해 상장 당해 연도에 대비하여 상장 후 ROA 중위값의 변화를 분석하였다. 먼저, 상장 당해 연도 대비 상장 5년차 일반상장 기업들의 ROA 하락 폭이 특례상장보다 컸는데, 이는 앞서 특례상장보다 좋지 못한 일반상장 기업들의 주가성과 분석 결과와 유사하다. 또한 유사한 주가성과를 보였던 두 상장유형의 바이오 기업들은 ROA에서도 둘 모두 큰 변화를 보이지 않았다. 한편 상장 후 5년의 기간 내내 특례상장 기업들의 ROA 중위값이 –10% 전후에 머물고 있는 점을 볼 때, 상당수의 기업들이 상장 전 취약했던 재무성과를 상장 후에도 크게 개선하지 못하고 있음을 알 수 있다.

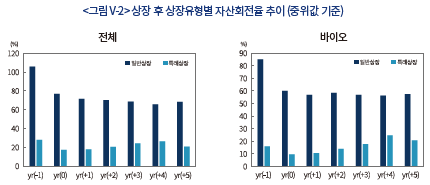

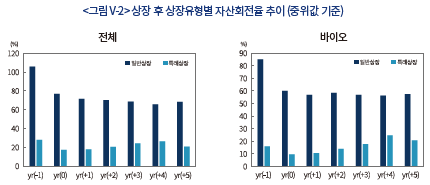

두 번째는 기업이 자산을 사용하여 매출액을 창출하는 효율성 지표인 자산회전율(=매출액/평균자산)의 중위값을 살펴본다. 상장 당해 연도 대비 상장 후 자산회전율 중위값의 경우, 특례상장 기업들은 상승하고 있고 일반상장 기업들은 완만하게 하락하고 있다. 예를 들면, 특례상장 기업들의 상장 5년차 자산회전율(전체, 바이오: 20.8%)은 상장 당해 연도(전체: 17.4%, 바이오: 9.6%) 대비 상승하였고 일반상장 기업들의 자산회전율은 동기간 76.7%(전체)와 60.1%(바이오)에서 68.4%와 57.5%로 하락하였다. ROA와 마찬가지로, 상장 후 특례상장 기업들의 자산회전율은 20% 수준으로 상장 전 취약했던 모습에서 벗어나지 못하고 있다. 이러한 결과로 볼 때, 많은 특례상장 기업들이 상장 후 오랜 시간이 지난 후에도 자신이 보유한 기술력을 시장의 매출로 만들어내지 못하고 있는 것으로 판단된다.

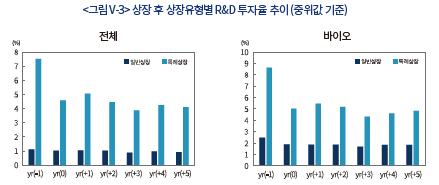

마지막으로, 특례상장과 일반상장 기업들의 R&D 투자율(=R&D 지출액/총자산)의 중위값을 비교한다. 분석 결과, 특례상장 기업들은 ROA와 자산회전율이 일반상장과 비교해서 크게 낮은 상황에서도 R&D 투자율을 높게 유지하고 있었다. 구체적으로 보면 상장 후 R&D 투자율의 중위값은 특례상장 기업들은 5%(전체, 바이오)를, 일반상장 기업들은 1%(전체)와 2%(바이오)를 유지하고 있었다. 이는 특례상장 기업들이 기술 개발로 성장할 수 있는 기술성장기업이라는 특성도 있지만 기술개발을 통해 기업 가치를 높게 평가받을 수 있기 때문으로 보인다. 생각건대, 주식시장의 모니터링 기능이 상장 후 특례상장 기업들의 R&D 투자를 독려하고 있는 것으로 보인다.

정리해 보면, ROA와 자산회전율로 살펴본 바와 같이 상장 후 특례상장 기업이 재무성과가 취약한 모습을 여전히 보임에도 불구하고 주가성과가 일반상장과 다르지 않았던 요인으로는 이들 기업들이 재무성과보다는 높은 R&D 투자에 의한 기술향상으로 시장 평가를 받고 있기 때문으로 보인다.

Ⅵ. 결론

최근 특례상장을 통해 상장하는 기업들의 증가에 시장의 기대가 커지고 있다. 하지만 특례상장 제도가 안정적인 재무성과 없이 상장을 허용하고 있어 전폭적인 신뢰를 받고 있지는 못하다. 이에 본 연구는 특례상장 기업들의 IPO 자금조달 비용과 상장 후 장기 주가성과의 측면에서 특례상장 제도를 검토해 보았다. 분석 결과, 특례상장 기업들은 IPO 자금조달에 있어서 일반상장 기업들보다 큰 비용을 지불하지 않고서도 투자자들을 유치하였다. 특례상장 기업들의 평균적인 장기 주가성과는 시장지수나 일반상장보다 좋았으며 바이오 기업들로 비교를 한정하더라도 일반상장과 유사하였다. 특히 소수의 특례상장 기업들은 일반상장 기업들에서 보기 어려운 높은 주가성과를 보였으며, 특례상장 기업들의 관리종목 지정 비율도 일반상장과 다르지 않았다. 이러한 분석 결과로 미루어 볼 때, 특례상장 제도는 기술성장기업에게 IPO 자금조달의 기회를 제공하였을 뿐 아니라 차별화된 상장요건을 통해서도 상장할만한 기업을 새롭게 발굴할 수 있다는 가능성을 보여 주었다.

다음으로, 특례상장 제도의 상장요건인 기술성 평가와 완화된 재무요건의 적절성을 장기 주가성과에 대한 회귀분석을 통해 살펴보았다. 분석 결과, 일반상장보다 완화된 재무 상장요건을 적용한 것이 특례상장 기업들의 장기 주가성과에 부정적인 영향을 주지 않는 것으로 나왔다. 기술성 평가 등급과 장기 주가성과 간 회귀분석의 결과로 볼 때, 기술성 평가 역량이 현재보다 더 향상될 필요가 있다고 판단된다. 기술평가 결과에 따라 기술성장기업으로 선정되거나 탈락될 수 있으므로 전문평가기관의 평가 역량이나 평가기준은 무엇보다 중요하다. 더욱이 다양한 부문에서 신기술이 쏟아지는 산업구조의 환경에서 기존의 평가기준이 적절하게 따라가지 못할 수 있다. 따라서 거래소는 신기술을 적절하게 평가할 수 있는 기준의 마련과 효과적인 운영 전략을 위한 지속적인 노력이 필요해 보인다.

특례상장 기업 중 상당수는 상장 후 장기간 지난 후에도 큰 폭의 적자를 보이고 있었으며 자신이 보유한 기술력을 매출로 전환하지 못하고 있었다. 사실 많은 특례상장 기업들이 상장 후 가시적인 재무성과를 내지 못하고 있는데, 이는 기술개발이 완성되기까지 여러 단계를 거쳐야 하고 상업화되는 과정도 오래 걸리기 때문으로 보인다. 따라서 상장 후 많은 특례상장 기업들의 주가성과는 재무성과보다는 잠재적인 기술력이나 기술의 시장성에 관한 정보에 기반을 두고 형성되고 있는 것이다. 즉 특례상장 기업의 주가는 기술개발의 성공 여부에 따라 크게 등락할 수 있다. 이러한 이유로 기술개발과 관련한 특례상장 기업의 공시 정보가 사전에 유출될 경우 투자자 피해가 매우 클 수 있다. 꾸준한 R&D 투자에도 불구하고 일부 특례상장 기업들은 기술개발의 실패로 귀결될 수 있는데, 그 과정에서 공시 위반이나 불공정거래가 증가할 위험도 커 보인다. 강소현(2020)은 이 외에도 특례상장기업에 대한 개인투자자 거래가 매우 높다는 점을 지적하며 투자자보호를 위한 방안의 필요성을 강조하였다. 금융당국과 거래소는 기술성과에 관한 공시제도를 발전시키고 특례상장 기업들의 공시 위반이나 불공정거래의 모니터링을 강화할 필요가 있다고 생각된다.

정리하면, 특례상장 기업의 상장요건인 기술성 평가의 역량과 특례상장 기업과 관련한 투자자보호가 보강된다면 특례상장 제도는 코스닥 시장에서 더욱 중요한 상장방식이 될 것으로 기대된다.

1) 이 경우, 상장주관사의 책임성을 강화하기 위해 상장 후 6개월간 상장주관사 일반청약자에 대해 환매청구권(풋백옵션)을 부여하고 부실기업을 상장시킨 전례가 있는 주관사는 추천자격이 제한될 수 있도록 하고 있다.

2) 최근 사업연도 30억원 미만의 매출액 요건에 대해서는 상장 후 5년간 유예를 받게 된다. 관리종목 지정기준 중 자기자본 50% 이상(&10억원 이상)의 법인세비용차감전 계속사업손실이 최근 3년간 2회 이상(&최근연도 계속사업손실)에 대해서도 기술성장기업은 상장 후 3년, 성장성 특례상장 기업은 5년간 적용되지 않는다.

3) 이 중 스팩 합병을 이용한 특례상장 IPO 기업은 6개사, 스팩 합병을 통한 일반상장 IPO 기업은 97개사이다. 한편, 2022년 1월부터 7월말까지 특례상장 IPO 기업은 19개사로 나타났다.

4) 2017년에 도입된 성장성 특례상장 IPO는 2018년 1건이었으나 이후 연간 5~7건의 수준으로 나타나고 있다.

5) 금융위원회(2016. 10. 5)

6) 특례상장 기업 중 바이오 기업이 92개사, IT 기업이 27개사, 산업재 부문의 기업이 6개사, 경기소비재, 필수소비재, 소재 부문의 기업이 각각 5개사, 에너지 부문의 기업이 1개사인 것으로 나타났다.

7) 공모금액이 100~200억원인 IPO 그룹과 200~300억원인 IPO 그룹으로 구분하여 인수수수료를 비교한 결과, 특례상장 기업의 평균 인수수수료가 일반상장 기업보다 1.24%p와 0.94%p 높게 나타났다. 그 외에 다른 규모의 공모금액과 바이오 부문 여부에 따라 IPO 그룹을 구분한 분석에서도 특례상장 기업의 인수수수료가 일반상장 기업보다 다소 높았다.

8) 박성화‧기은선(2021)도 본 연구의 분석 결과와 동일하게 특례상장이 일반상장에 비하여 신규공모주 할인이 덜하다는 분석 결과를 제시하고 있다.

9) Brav & Gompers(1997)는 을 이용하여 벤처기업과 비(非) 벤처기업 IPO의 장기 주가성과를 비교하였는데, 본 연구와 동일하게 시장지수의 보유기간수익률을 이용하고 있다.

을 이용하여 벤처기업과 비(非) 벤처기업 IPO의 장기 주가성과를 비교하였는데, 본 연구와 동일하게 시장지수의 보유기간수익률을 이용하고 있다.

10) 이러한 현상은 특례상장 기업의 특성으로 볼 수도 있지만 바이오 부문의 특성에서 비롯된 것일 수 있다. 사실, 특례상장 기업들의 상당수가 바이오 기업이다. 더욱이 일반상장 바이오 기업들의 도 상장 3년차보다 5년차에서 더 높다. 향후 비(非) 바이오 기업들의 표본이 증가하면 이러한 결과의 원인을 보다 잘 식별해 볼 필요가 있어 보인다.

도 상장 3년차보다 5년차에서 더 높다. 향후 비(非) 바이오 기업들의 표본이 증가하면 이러한 결과의 원인을 보다 잘 식별해 볼 필요가 있어 보인다.

11) Ritter(1991)는 IPO 기업과 동일 산업의 유사한 시가총액을 가진 상장기업으로 매칭기업을 설정하여 장기 주가성과를 분석하였다.

12) 코스닥 바이오 부문 지수는 2000년대 중반 높게 형성되었다가 2010년대 전후로 크게 하락하였고 다시 2010년대 중반 상승하는 등 수익률의 변화가 컸다. 이는 바이오 부문지수 보유기간수익률의 편차가 코스닥 시장지수보다 큰 이유이기도 하다(<표 Ⅲ-4> 참조).

13) 신라젠은 2022년 1월 거래소 기업심사위원회에서 상장폐지로 결정되었고 현재는 코스닥시장위원회가 부여한 개선 기간에 있으며 오는 10월 거래 재개 여부가 결정될 예정이다.

14) Ritter(1991)는 초기수익률과 hot market 지표, Carter et. al.(1998)은 주관회사 평판 지수, Chen & Niu(2021)는 상장 전 기관투자자의 주식보유비중을 장기 주가성과와 관련이 있는 분석 변수로 이용하고 있다.

15) 바이오 기업에게는 코스닥 바이오 부문 지수를, 비(非) 바이오 기업에게는 코스닥 시장 지수를 적용하여 보유기간초과수익률을 구하였다.

16) 기술성 특례상장 기업은 2개의 전문평가기관으로부터 최소 (A, BBB)의 기술평가등급을 받아야 하며 최대 (AA, AA)의 기술평가등급을 받을 수 있다. 그리고 성장성 특례상장 기업은 상장주관사 추천으로 상장한 기업이고 상장 후 3년이 지난 기업이 1개사에 불과하여 분석에서 제외하였다.

17) 예를 들면, 상장 전 자산과 공모자금이 각각 100억원이고 상장을 전후하여 당기순이익이 동일하게 –10억원이면 ROA는 -10%에서 –5%로 상승하고, 반대로 상장을 전후하여 당기순이익이 동일하게 10억원이면 ROA는 10%에서 5%로 하락한다.

참고문헌

강소현, 2020, 거래소 특례상장 증가와 투자자 보호 방안, 자본시장연구원 『자본시장포커스』 2020-05호.

금융위원회, 2016. 10. 5, 역동적인 자본시장 구축을 위한 상장ㆍ공모제도 개편 방안, 보도자료.

박성화ㆍ기은선, 2021, 기술특례상장기업의 신규공모주 할인, 『회계와 정책연구』 26(1), 229-253.

Brav, A., Gompers, P., 1997, Myth or reality? The long-run underperformance of initial public offerings: Evidence from venture and nonventure capital-backed companies, Journal of Finance 52, 1791-1821.

Carter, R., Dark, F., Singh, A., 1998, Underwriter reputation, initial returns, and the long-run performance of IPO stocks, Journal of Finance 53, 285-311.

Chen M., Niu, X., 2021, Aftermarket performance of emerging growth companies and role of institutional investors, SSRN working paper.

Jain, B., Kini, O., 1994, The post-issue operating performance of IPO firms, Journal of Finance 49, 1699-1726.

Ritter, Jay R., 1991, The long-run performance of initial public offerings, Journal of Finance 46, 3–27

특례상장 제도는 전문평가기관으로부터 일정 수준 이상의 기술평가등급을 받거나 상장주관사의 추천을 받은 기술성장기업에 대해 일반상장보다 완화된 재무 관련 요건으로 상장을 허용하는 제도이다. 기술성장기업들은 기술 개발을 완수하기까지 장기간 R&D에 투자해야 하고, 이것이 매출과 수익으로 나타나는 데에도 오랜 시간이 소요된다. 따라서 이러한 기업들이 기술력이 우수하여 성장 가능성이 있더라도 안정적인 재무성과를 요구하는 일반상장의 상장요건을 맞추기가 어렵다. 이러한 점을 고려한 금융당국은 2005년에 성장형 바이오벤처기업들을 대상으로 특례상장 제도를 도입하였다.

특례상장 제도가 도입된 후 10년을 보면 이 제도를 이용하여 상장한 기업들의 등장은 미미하다. 그래서 최근 특례상장 제도를 통해 상장하는 기업들이 크게 증가하고 있는 것이 오히려 이례적으로 보일 수 있다. 그러나 그 요인을 살펴보면 2010년대 중반 금융당국이 특례상장 제도를 활성화하기 위해 다양한 정책들을 제시한 점과 바이오 부문의 열풍, 4차 산업혁명으로 바이오와 IT 부문에서 신성장 기업들이 크게 증가한 점, 그리고 기술기업들에 대한 투자자들의 기대와 투자인식이 향상된 점 등 장기적인 변화에 기인하고 있다. 즉 특례상장 제도는 코스닥 시장의 중요한 상장방식으로 떠오르고 정체된 코스닥 IPO 시장에 큰 활력을 줄 수 있을 것으로 기대되고 있다. 그러나 다른 한편으로는 상장 후 이들의 주가가 큰 폭으로 등락하고 재무성과가 지지부진한 기업들이 많아지고 있으며 상장폐지 결정까지도 발표되면서 특례상장 제도에 대한 우려도 제기되고 있다. 따라서 특례상장 기업들에 대한 성과분석을 통해 특례상장 제도를 평가해 보고 그 발전 방안을 논의해 볼 필요가 있다. 본 연구는 2005년 제도가 도입된 이후 상장한 특례상장 기업들의 장기 주가성과와 재무성과를 분석하고 이들이 일반상장 기업들과 어떠한 차이가 있는지를 살펴본다. 이 외에 특례상장 기업들의 성과에 대한 요인 분석을 토대로 현재의 상장요건을 평가하고 더불어 이러한 기업들에 대한 투자자보호 이슈를 논의한다.

Ⅱ. 특례상장 제도 및 상장 전 특례상장 기업의 특성

1. 특례상장 제도의 연혁과 주요 내용

금융당국은 2005년 성장형 바이오벤처기업을 대상으로 기술평가 특례상장 제도를 도입하고 2014년에 대상 기업을 전 부문으로 확대하였다. 이러한 제도는 거래소가 지정한 전문평가기관 중 2개의 복수기관으로부터 A와 BBB 등급 이상의 기술평가등급을 받은 기술성장기업에 대해 경영성과 및 시장평가 등의 재무요건을 면제하고 있다(<표 Ⅱ-1> 참조). 하지만 전문평가기관의 기술평가등급에 전적으로 근거해야 하므로 기술력을 보유하고 있지만 이를 객관적으로 평가받기 어려운 성장성 기업들까지 적용되기 어려운 점이 있다. 금융당국은 2017년에 이를 보완하고 동시에 상장주관사의 기업발굴 기능을 강화하고자 상장주관사의 추천으로 운영되는 성장성평가 특례상장 제도를 신설하였다.1)

<표 Ⅱ-1>에서 볼 수 있듯이, 기술평가와 성장성평가를 근거로 특례상장한 기업들은 일반상장의 재무요건보다 완화된 기준으로 상장한다. 즉 일반상장 기업들은 안정적인 수익성, 매출액 등을 갖추어야 하고 기업규모도 일정 수준 이상이어야 상장할 수 있지만, 특례상장 기업들은 상장 당시 소규모 자본력에 적자를 내거나 매출액이 없어도 상장할 수 있다. 때문에 특례상장 기업들은 상장 직후 일반상장 기업을 대상으로 일정 수준 이상의 재무성과를 요구하는 관리종목 지정제도를 충족시키기가 어렵다. 이러한 점을 고려하여, 코스닥시장은 특례상장 기업에 한해 관리종목 지정기준 중 일부를 상장 후 3년에서 5년에 걸쳐 유예하는 상장규정을 두고 있다.2)

가. 특례상장 기업의 현황과 추이

특례상장 제도를 이용한 IPO 기업은 2005년부터 2021년까지 총 143개사로 동기간 코스닥 일반상장 제도를 이용한 IPO 기업(887개사)의 1/6 수준에 해당한다.3) 특례상장 IPO는 2005년부터 2014년까지 10년간 총 15건에 불과하였으나, 2015년 12건으로 크게 증가하고 2018년 20건으로 반등한 후 현재까지 꾸준한 상승세를 보이고 있다.4) 이와 같은 특례상장 IPO의 성장세는 연간 40~50건에서 정체되어 있는 최근 일반상장 IPO와 대조적이다(<그림 Ⅱ-1> 참조). 그 요인으로는 2010년대 중반 특례상장 활성화를 위한 정책적 노력이 있었던 점5), 바이오 부문의 열풍, 4차 산업혁명으로 바이오와 IT 부문에서 신성장 기업들이 크게 증가한 점, 그리고 기술기업들에 대한 투자자들의 기대와 투자 인식이 향상된 점을 들 수 있다.

특례상장 기업들은 2017년 이전까지 대부분 바이오 기업들이었으나, 최근 IT와 산업재, 소비재, 소재 등의 부문에서 크게 증가하고 있다.6) 2021년에는 특례상장 중 IT 기업이 48%를 차지하며 바이오 기업(33%)을 추월하였다. 이는 최근 4차 산업혁명의 급격한 진행으로 기술력을 기반으로 성장하는 IT 기업들이 크게 증가하였기 때문으로 보인다.

본 연구는 제도가 도입된 2005년부터 2021년까지 특례상장과 일반상장 IPO 기업들의 전체 자료를 이용하여 주가성과 및 재무성과를 분석한다. 다만, 분석에서 스팩 합병을 통해 상장한 기업들을 제외함으로써, 일반적인 공모절차를 통해 코스닥 시장에 상장한 기업들로 분석 대상을 한정하였다. 바이오 부문은 특례상장에서 차지하는 비중이 높을 뿐 아니라, 일반상장 기업들도 임상시험 등 장기간의 기술 개발의 과정을 거쳐 성장한다는 점이나 최근 시장에서의 투자 열기가 높았다는 점에서 다른 부문과 차이가 있다. 이러한 점을 고려하여, 본 연구는 전체 기업뿐 아니라 바이오 기업만을 대상으로 한 분석을 동시에 제시한다. 본 연구는 FnGuide로부터 기업들의 주가 및 재무적 특성 변수들을 추출하였고 해당 공모주의 증권신고서에서 공모금액, 인수수수료, 기관투자자 주식보유 비중 등을 직접 수집하였다.

<표 Ⅱ-2>는 상장직전 회계연도 기준 특례상장과 일반상장 기업들의 재무 특성을 비교하고 있다. 중위값을 기준으로, 특례상장 기업의 자산과 자기자본은 일반상장 기업의 약 1/2 수준이고 매출액은 일반상장 기업의 1/10에도 미치지 못하고 있다. ROA의 경우, 일반상장 기업은 10%를 초과하는 반면 특례상장 기업은 –20% 전후로 매우 낮았다. 다만 매출액 성장률과 업력은 일반상장 기업과 크게 다르지 않았다. 요컨대, 특례상장 기업은 일반상장 기준의 재무요건을 충족하지 못하고 있을 뿐 아니라 매출액, ROA 등의 재무적 지표에서 상당히 취약한 것으로 나타났다.

특례상장 기업의 기관투자자 소유주식비중은 일반상장 기업보다 약 1%p 높은 평균을 보이고 있으나 통계적으로 유의하지 않았다. 특례상장 기업들은 상장 전 일반상장 기업들보다 크게 떨어지는 재무성과를 보이고 있지만 이들과 유사한 수준으로 벤처캐피탈 등의 전문 기관투자자로부터 투자자금을 조달해 온 것이다.

1. 특례상장 기업의 IPO 공모 비용

특례상장 기업은 재무성과가 없지만 기술성 평가를 충족하여 상장한 기업들이다. 따라서 투자자들은 이들에 대해 재무성과보다는 잠재적인 기술력에 기반을 두고 투자를 결정할 것이다. 예를 들면 재무성과가 없는 점에 대한 우려가 크거나 기술력에 대한 투자자들의 기대가 낮다면 이러한 기업들은 공모주 투자자들을 유치하는데 많은 비용을 지불해야 할 수도 있다. 이러한 관점에서, 본 소절은 인수수수료와 초기수익률을 일반상장과 비교하여 특례상장 기업들이 IPO 과정에서 지불한 직ㆍ간접비용을 알아보고자 한다.

<표 Ⅲ-1>은 특례상장과 일반상장 기업의 인수수수료와 초기수익률을 보여주고 있다. 투자자를 유치하기 어려운 IPO 기업의 경우, 주관회사는 투자자를 유치하기 위해 더 많은 노력을 해야 하며 공모주 투자자를 충분히 유치하지 못하여 공모주를 인수해야 하는 위험도 크다. 따라서 주관회사는 투자자를 유치하기 어려운 IPO 기업에 대해서는 더 높은 인수수수료를 요구한다. 분석 결과, 특례상장 기업들의 인수수수료는 일반상장 기업들의 인수수수료보다 평균적으로 0.8%p(전체)와 0.5%p(바이오) 더 높은 것으로 나타났다.7)

2. 특례상장 기업의 장기 주가성과

특례상장 제도는 기술성장기업의 특성에 맞추어 상장요건을 조정한 것이지만, 기술성 평가를 근거로 상장한 기업들이 장기적으로 우수한 주가성과를 보일 수 있다는 기대가 반영된 것이기도 하다. 거래소는 우수한 주가성과를 기대할 수 있는 기업에게 상장을 허용함으로써 투자자를 보호하고 시장을 활성화하려는 목적을 가지고 있기 때문에, 특례상장 기업들이 우수한 주가성과를 보인다면 이러한 제도를 좋게 평가할 수 있을 것이다. 따라서 본 연구는 Ritter(1991) 등 기존의 연구문헌에서 제시한 여러 방법론을 이용하여 특례상장과 일반상장 기업의 장기 주가성과를 비교‧분석한다.

두 상장유형 기업들의 장기 주가성과를 비교하는 첫 번째 지표로 Ritter(1991)가 제시한 wealth relative

분석 결과, 상장 5년 기준 특례상장 기업들의

특례상장 기업들의

분석 결과, 특례상장 기업들의 보유기간수익률

일반상장 전체 기업들의 누적초과수익률은 5년 전반에 걸쳐 완만하게 상승하고 있으며, 바이오 기업들은 상장 후 46개월까지 다소 가파른 상승세를 보이고 이후 정체되는 모습을 보이고 있다. 반면 특례상장 기업들의 누적초과수익률은 전체와 바이오 부문 모두 상장 첫 10개월, 18~28개월, 48~56개월에서는 상승세를, 11~17개월에서는 반대로 하락세를, 28~48개월에서는 정체하는 모습을 보이고 있다. 특히 특례상장 기업들의 누적초과수익률은 48~56개월에서 두드러지게 상승하고 있는데, 이는 앞서 3년차 주가성과와 대비하여 5년차 주가성과가 크게 좋았던 분석 결과와 부합한다. 특례상장 기업들의 주가성과가 상승과 하락을 보이며 일반상장보다 변동성이 컸는데, 그 이유는 분석 표본이 상대적으로 적은 것도 있지만 기술 개발이나 실패 소식에 기업들의 주가가 큰 폭으로 변동하기 때문으로 보인다. 재무성과에 의해 결정되는 일반상장 기업들과 달리, 특례상장 기업들의 주가성과는 기술력의 변화(바이오 부문을 예로 들면 임상시험의 성공 또는 실패)에 크게 영향을 받는다. 이를테면 특례상장 기업들이 임상시험의 성공이나 기술 개발을 발표할 경우 단기에 주가가 1~2배 급상승하기도 하는데, 이 때 특례상장 기업들의 월별 평균 초과수익률도 크게 상승한 것이다.

앞에서 보여 주었듯이, 특례상장 기업들의 주가성과는 다른 상장요건에도 불구하고 일반상장과 크게 다르지 않았다. 여기서는, 특례상장 제도의 기술성 평가와 완화된 재무요건의 적용이 이들 기업들의 장기 주가성과에 어떠한 영향을 주고 있는지 살펴봄으로써 특례상장 제도의 상장요건을 평가하고자 한다. 본 연구는 특례상장의 주요 상장요건을 중심으로 주가성과에 대한 회귀분석을 수행한다.

설명변수는 특례상장의 상장요건과 관련한 기술평가등급 점수, 상장 직전 재무성과(자산, 매출액, ROA, 매출액 성장률) 변수, 바이오 부문 더미 변수와 기존 연구문헌14)에서 제시한 초기수익률, 상장일 직전 2개월 시장수익률, 상장 직전 기관투자자의 주식보유비중과 상장주관사의 시장점유율 변수를 이용하였다. 종속변수는 특례상장 기업의 상장 3년 동안의 보유기간누적초과수익률

기술평가등급 점수 변수는 각 전문평가기관의 기술평가등급에 대해 1점(BBB), 2점(A), 3점(AA)을 부여하여 최소 3점에서 최대 6점으로 구성된다.16) 분석 결과, 전체 및 부분 표본을 이용한 두 회귀분석 모두 기술평가등급 점수의 계수치가 양(+)의 값을 보이고 있으나 통계적 유의성이 높지 않았다. 이러한 결과는 기술평가등급이 높을수록 특례상장 기업의 주가성과가 좋을 가능성이 있다는 것을 의미한다. 다만, 통계적 유의성이 높지 않아 기술성 평가 등급이 높더라도 우수한 장기 주가성과를 보장하기 어렵다는 의미도 지니고 있어, 기술성 평가 역량이 현재보다 더 향상될 필요가 있다는 점을 제시하고 있다.

재무 상장요건과 관련한 매출액, ROA, 자산 등의 변수들은 상장 후 장기 주가성과와 상관관계가 없거나 음(-)인 것으로 나타났다. 즉 일반상장 요건에 해당된 재무지표가 상장 전 취약하였다고 해서 특례상장 기업의 장기 주가성과가 더 나쁘지는 않았던 것이다. 또한 장기 주가성과는 해당 특례상장 기업이 바이오 기업인지의 여부와 무관한 것으로 나타났다. 이상의 결과로 볼 때, 완화된 상장요건의 적용이나 전 부문으로 확장한 2014년 정책이 특례상장 기업들의 장기 주가성과에 부정적으로 영향을 주지 않은 것으로 판단된다.

초기수익률과 상장 직전 2개월 시장수익률의 계수는 음(-)의 값을 보이고 있으나 통계적 유의성이 높지 않았다. 이러한 결과로 볼 때, 상장 당시 특례상장 기업에 대해 투자자 심리가 과도하게 표출되지 않았고 따라서 장기 주가성과에 영향을 주지 않았던 것으로 판단된다. 기관투자자 주식보유비중의 계수치는 양(+)이었으나 통계적 유의성이 없었다. 즉 상장 전 기관투자자로부터 투자를 많이 받은 특례상장 기업이라고 해서 장기적으로 더 우수한 주가성과를 보이지는 않았다. 대형 상장주관사는 뛰어난 전문인력을 보유하고 있고 좋은 평판을 관리하기 위해서도 우수한 특례상장 기업을 발굴할 가능성이 높다. 상장주관사의 시장점유율을 분석한 결과, 기대와 달리 이러한 변수의 계수치는 음(-)의 값을 보이고 있어 대형 상장주관사들이 장기 주가성과가 좋은 특례상장 기업을 특별히 발굴하고 있지는 않은 것으로 판단된다.

특례상장 기업은 재무성과 없이 기술력만을 가지고 상장하여 태생적으로 주가성과의 불확실성이 큰데, 앞서 분석한 결과 상장 후 특례상장 기업들의 장기 주가성과는 일반상장 기업들과 비교해서 크게 다르지 않았다. 이러한 결과를 이해하기 위해, 상장 후 특례상장과 일반상장 기업의 ROA, 자산회전율, R&D 투자율을 비교해 보고 이를 바탕으로 특례상장 기업의 특성을 논의해 본다.

<그림 Ⅳ-1>은 상장 직전 회계연도부터 상장 후 5년차 회계연도까지 특례상장 및 일반상장 기업의 ROA를 보여주고 있다. 상장 당해 연도 특례상장(일반상장) 기업의 ROA 중위값은 상장 직전 대비 크게 상승(하락)하였는데, 이는 IPO 공모자금이 더해져 ROA의 분모인 자산이 상장 당해 연도에 크게 증가한 영향이 크다.17) 즉 자산에 추가된 공모자금을 고려하면 두 회계연도 간 수익성의 변화는 크지 않다. 따라서 비교의 수월성을 위해 상장 당해 연도에 대비하여 상장 후 ROA 중위값의 변화를 분석하였다. 먼저, 상장 당해 연도 대비 상장 5년차 일반상장 기업들의 ROA 하락 폭이 특례상장보다 컸는데, 이는 앞서 특례상장보다 좋지 못한 일반상장 기업들의 주가성과 분석 결과와 유사하다. 또한 유사한 주가성과를 보였던 두 상장유형의 바이오 기업들은 ROA에서도 둘 모두 큰 변화를 보이지 않았다. 한편 상장 후 5년의 기간 내내 특례상장 기업들의 ROA 중위값이 –10% 전후에 머물고 있는 점을 볼 때, 상당수의 기업들이 상장 전 취약했던 재무성과를 상장 후에도 크게 개선하지 못하고 있음을 알 수 있다.

Ⅵ. 결론

최근 특례상장을 통해 상장하는 기업들의 증가에 시장의 기대가 커지고 있다. 하지만 특례상장 제도가 안정적인 재무성과 없이 상장을 허용하고 있어 전폭적인 신뢰를 받고 있지는 못하다. 이에 본 연구는 특례상장 기업들의 IPO 자금조달 비용과 상장 후 장기 주가성과의 측면에서 특례상장 제도를 검토해 보았다. 분석 결과, 특례상장 기업들은 IPO 자금조달에 있어서 일반상장 기업들보다 큰 비용을 지불하지 않고서도 투자자들을 유치하였다. 특례상장 기업들의 평균적인 장기 주가성과는 시장지수나 일반상장보다 좋았으며 바이오 기업들로 비교를 한정하더라도 일반상장과 유사하였다. 특히 소수의 특례상장 기업들은 일반상장 기업들에서 보기 어려운 높은 주가성과를 보였으며, 특례상장 기업들의 관리종목 지정 비율도 일반상장과 다르지 않았다. 이러한 분석 결과로 미루어 볼 때, 특례상장 제도는 기술성장기업에게 IPO 자금조달의 기회를 제공하였을 뿐 아니라 차별화된 상장요건을 통해서도 상장할만한 기업을 새롭게 발굴할 수 있다는 가능성을 보여 주었다.

다음으로, 특례상장 제도의 상장요건인 기술성 평가와 완화된 재무요건의 적절성을 장기 주가성과에 대한 회귀분석을 통해 살펴보았다. 분석 결과, 일반상장보다 완화된 재무 상장요건을 적용한 것이 특례상장 기업들의 장기 주가성과에 부정적인 영향을 주지 않는 것으로 나왔다. 기술성 평가 등급과 장기 주가성과 간 회귀분석의 결과로 볼 때, 기술성 평가 역량이 현재보다 더 향상될 필요가 있다고 판단된다. 기술평가 결과에 따라 기술성장기업으로 선정되거나 탈락될 수 있으므로 전문평가기관의 평가 역량이나 평가기준은 무엇보다 중요하다. 더욱이 다양한 부문에서 신기술이 쏟아지는 산업구조의 환경에서 기존의 평가기준이 적절하게 따라가지 못할 수 있다. 따라서 거래소는 신기술을 적절하게 평가할 수 있는 기준의 마련과 효과적인 운영 전략을 위한 지속적인 노력이 필요해 보인다.

특례상장 기업 중 상당수는 상장 후 장기간 지난 후에도 큰 폭의 적자를 보이고 있었으며 자신이 보유한 기술력을 매출로 전환하지 못하고 있었다. 사실 많은 특례상장 기업들이 상장 후 가시적인 재무성과를 내지 못하고 있는데, 이는 기술개발이 완성되기까지 여러 단계를 거쳐야 하고 상업화되는 과정도 오래 걸리기 때문으로 보인다. 따라서 상장 후 많은 특례상장 기업들의 주가성과는 재무성과보다는 잠재적인 기술력이나 기술의 시장성에 관한 정보에 기반을 두고 형성되고 있는 것이다. 즉 특례상장 기업의 주가는 기술개발의 성공 여부에 따라 크게 등락할 수 있다. 이러한 이유로 기술개발과 관련한 특례상장 기업의 공시 정보가 사전에 유출될 경우 투자자 피해가 매우 클 수 있다. 꾸준한 R&D 투자에도 불구하고 일부 특례상장 기업들은 기술개발의 실패로 귀결될 수 있는데, 그 과정에서 공시 위반이나 불공정거래가 증가할 위험도 커 보인다. 강소현(2020)은 이 외에도 특례상장기업에 대한 개인투자자 거래가 매우 높다는 점을 지적하며 투자자보호를 위한 방안의 필요성을 강조하였다. 금융당국과 거래소는 기술성과에 관한 공시제도를 발전시키고 특례상장 기업들의 공시 위반이나 불공정거래의 모니터링을 강화할 필요가 있다고 생각된다.

정리하면, 특례상장 기업의 상장요건인 기술성 평가의 역량과 특례상장 기업과 관련한 투자자보호가 보강된다면 특례상장 제도는 코스닥 시장에서 더욱 중요한 상장방식이 될 것으로 기대된다.

1) 이 경우, 상장주관사의 책임성을 강화하기 위해 상장 후 6개월간 상장주관사 일반청약자에 대해 환매청구권(풋백옵션)을 부여하고 부실기업을 상장시킨 전례가 있는 주관사는 추천자격이 제한될 수 있도록 하고 있다.

2) 최근 사업연도 30억원 미만의 매출액 요건에 대해서는 상장 후 5년간 유예를 받게 된다. 관리종목 지정기준 중 자기자본 50% 이상(&10억원 이상)의 법인세비용차감전 계속사업손실이 최근 3년간 2회 이상(&최근연도 계속사업손실)에 대해서도 기술성장기업은 상장 후 3년, 성장성 특례상장 기업은 5년간 적용되지 않는다.

3) 이 중 스팩 합병을 이용한 특례상장 IPO 기업은 6개사, 스팩 합병을 통한 일반상장 IPO 기업은 97개사이다. 한편, 2022년 1월부터 7월말까지 특례상장 IPO 기업은 19개사로 나타났다.

4) 2017년에 도입된 성장성 특례상장 IPO는 2018년 1건이었으나 이후 연간 5~7건의 수준으로 나타나고 있다.

5) 금융위원회(2016. 10. 5)

6) 특례상장 기업 중 바이오 기업이 92개사, IT 기업이 27개사, 산업재 부문의 기업이 6개사, 경기소비재, 필수소비재, 소재 부문의 기업이 각각 5개사, 에너지 부문의 기업이 1개사인 것으로 나타났다.

7) 공모금액이 100~200억원인 IPO 그룹과 200~300억원인 IPO 그룹으로 구분하여 인수수수료를 비교한 결과, 특례상장 기업의 평균 인수수수료가 일반상장 기업보다 1.24%p와 0.94%p 높게 나타났다. 그 외에 다른 규모의 공모금액과 바이오 부문 여부에 따라 IPO 그룹을 구분한 분석에서도 특례상장 기업의 인수수수료가 일반상장 기업보다 다소 높았다.

8) 박성화‧기은선(2021)도 본 연구의 분석 결과와 동일하게 특례상장이 일반상장에 비하여 신규공모주 할인이 덜하다는 분석 결과를 제시하고 있다.

9) Brav & Gompers(1997)는

10) 이러한 현상은 특례상장 기업의 특성으로 볼 수도 있지만 바이오 부문의 특성에서 비롯된 것일 수 있다. 사실, 특례상장 기업들의 상당수가 바이오 기업이다. 더욱이 일반상장 바이오 기업들의

11) Ritter(1991)는 IPO 기업과 동일 산업의 유사한 시가총액을 가진 상장기업으로 매칭기업을 설정하여 장기 주가성과를 분석하였다.

12) 코스닥 바이오 부문 지수는 2000년대 중반 높게 형성되었다가 2010년대 전후로 크게 하락하였고 다시 2010년대 중반 상승하는 등 수익률의 변화가 컸다. 이는 바이오 부문지수 보유기간수익률의 편차가 코스닥 시장지수보다 큰 이유이기도 하다(<표 Ⅲ-4> 참조).

13) 신라젠은 2022년 1월 거래소 기업심사위원회에서 상장폐지로 결정되었고 현재는 코스닥시장위원회가 부여한 개선 기간에 있으며 오는 10월 거래 재개 여부가 결정될 예정이다.

14) Ritter(1991)는 초기수익률과 hot market 지표, Carter et. al.(1998)은 주관회사 평판 지수, Chen & Niu(2021)는 상장 전 기관투자자의 주식보유비중을 장기 주가성과와 관련이 있는 분석 변수로 이용하고 있다.

15) 바이오 기업에게는 코스닥 바이오 부문 지수를, 비(非) 바이오 기업에게는 코스닥 시장 지수를 적용하여 보유기간초과수익률을 구하였다.

16) 기술성 특례상장 기업은 2개의 전문평가기관으로부터 최소 (A, BBB)의 기술평가등급을 받아야 하며 최대 (AA, AA)의 기술평가등급을 받을 수 있다. 그리고 성장성 특례상장 기업은 상장주관사 추천으로 상장한 기업이고 상장 후 3년이 지난 기업이 1개사에 불과하여 분석에서 제외하였다.

17) 예를 들면, 상장 전 자산과 공모자금이 각각 100억원이고 상장을 전후하여 당기순이익이 동일하게 –10억원이면 ROA는 -10%에서 –5%로 상승하고, 반대로 상장을 전후하여 당기순이익이 동일하게 10억원이면 ROA는 10%에서 5%로 하락한다.

참고문헌

강소현, 2020, 거래소 특례상장 증가와 투자자 보호 방안, 자본시장연구원 『자본시장포커스』 2020-05호.

금융위원회, 2016. 10. 5, 역동적인 자본시장 구축을 위한 상장ㆍ공모제도 개편 방안, 보도자료.

박성화ㆍ기은선, 2021, 기술특례상장기업의 신규공모주 할인, 『회계와 정책연구』 26(1), 229-253.

Brav, A., Gompers, P., 1997, Myth or reality? The long-run underperformance of initial public offerings: Evidence from venture and nonventure capital-backed companies, Journal of Finance 52, 1791-1821.

Carter, R., Dark, F., Singh, A., 1998, Underwriter reputation, initial returns, and the long-run performance of IPO stocks, Journal of Finance 53, 285-311.

Chen M., Niu, X., 2021, Aftermarket performance of emerging growth companies and role of institutional investors, SSRN working paper.

Jain, B., Kini, O., 1994, The post-issue operating performance of IPO firms, Journal of Finance 49, 1699-1726.

Ritter, Jay R., 1991, The long-run performance of initial public offerings, Journal of Finance 46, 3–27