Find out more about our latest publications

Research Papers 18-03 Apr. 24, 2018

- Research Topic Financial Services Industry

- Page 93

Ⅰ. 서론

기업의 최고경영자(Chief Executive Officer: CEO)는 기업의 경영전략을 수립하고 수립된 전략의 추진에 따른 자원 배분을 결정하는 최고ㆍ최종의 의사결정자이다. CEO의 판단은 기업의 현재 성과 뿐 아니라 장기적인 기업가치 및 지속가능성(sustainability)에 매우 큰 영향을 미친다. 또한 기업지배구조 이론의 관점에서 볼 때, CEO는 기업의 주인(principal), 또는 소유자(owner)인 주주를 대리하여 이와 같은 의사결정자로서의 역할을 수행하는 대리인(agent)이다. CEO는 대리인으로서 주주의 이익에 입각하여 이와 같은 의사결정자로서의 역할을 수행하여야 한다. 그리고 일반적으로 주주의 이익은 자신이 보유하고 있는 주식(지분)가치의 극대화로 이해되고 있으며, 주식가치의 극대화는 해당 기업의 기업가치 극대화를 통하여 달성된다. 따라서 CEO는 자신에게 주어진 최고ㆍ최종 의사결정자로서의 권한, 즉 경영권을 기업가치가 극대화되도록 행사하여 기업을 경영해야 할 책임이 있다. 그리고 주인인 주주 및 주주의 위임을 받은 이사회는 CEO가 이러한 자신의 책임을 제대로 이행하고 있는지를 감시하고 통제함으로써 CEO를 규율(discipline)한다. CEO에 대한 규율, 즉 기업지배구조에는 다양한 메커니즘이 존재하며, 그 중에서도 CEO의 선임과 교체, 그리고 CEO에 대한 보상을 통한 규율은 가장 핵심적이며 중요한 것이라고 할 수 있다. 즉, 기업이 필요로 하는 올바른 전략을 수립하고 구현할 수 있는 유능한 CEO를 찾아 선임하고 합당한 보상을 제공하며, 반대로 그렇지 못한 CEO를 적시에 교체하는 것은 기업지배구조의 핵심이며, 기업에서 가장 중요한 의사결정의 하나이다.

CEO의 중요성은 증권업에서도 예외가 아니다. 특히 국내 증권업계에서는 증권회사들의 경쟁력 제고를 어렵게 만드는 요인 중의 하나로 CEO 문제가 꼽히고 있으며, CEO와 관련된 여러 측면 중에서도 특히 재임기간과 관련된 우려가 많다. 우리나라 증권업이 국제적인 경쟁력을 갖추고 한 단계 높은 수준으로 도약하기 위해서는 본격적 투자은행(Investment Bank: IB)으로의 발전 혹은 특화ㆍ전문화를 이루어 나가야 한다는 데에는 이미 공감대가 형성되어 있다. 그런데 이러한 전략 방향을 추구하고 목표를 달성하는 데 필요한 역량 축적은 단기간에 이루어질 수 없고, 회사의 비전을 구현할 수 있는 경영전략을 수립하고 수립된 경영전략을 장기간에 걸쳐 꾸준하고 일관성 있게 추진하는 것이 필수적이다.

미국 기업에서는 지나치게 강력한 CEO들이 효과적인 규율을 받지 않는 가운데 과도하게 오랫동안 재임하는 경향이 있다는 것이 주로 제기되는 문제인 반면1), 국내 증권업계에서의 CEO 문제는 반대로 재임기간이 경직적이며 지나치게 짧다는 데 있다. 이를테면 다수 증권회사에서 2~3년 기간 재임한 CEO를 관행에 따라 교체하는 모습이 발견되고 있다. 이와 같이 CEO의 재임기간이 짧고 경직적일 경우, CEO들은 자신이 경영하는 증권회사의 장기적 경쟁력 강화와 성장, 그리고 지속가능성을 위한 전략을 수립하여 일관성있게 추진하기가 어렵게 되고, 따라서 전략 수행을 위한 투자에는 소홀하게 될 가능성이 높다. 그리고 그 결과 증권회사별로 차별화된 역량의 축적이 이루어지기 어렵다는 것이 우려의 핵심이다.

그런데 국내 증권회사 CEO의 선임과 교체, 재임기간, 경영성과 등에 관한 데이터의 축적 및 통계적 분석은 현재까지 거의 이루어져 있지 않다. 따라서 국내 증권업계에서의 CEO의 짧고 동시에 경직적인 재임기간에 관한 우려 혹은 논의의 대부분은 업계에서의 오랜 경험 등에 기반한 추론 수준에서 제기되어 왔다. 이와 같은 문제의식에서 출발하여 본 보고서는 다음과 같은 목적을 갖고 작성되었다. 첫째로 국내 증권업에서의 CEO 선임, 재임, 교체 관련 통계를 분석하여 이로부터 정확한 현황을 파악ㆍ정리한다. CEO의 재임기간은 선임과 교체 의사결정에 의하여 결정되기 때문에 함께 살펴보는 것이 불가피하다. 둘째로 국내 증권업에서의 CEO 재임기간과 경영성과 간의 관계를 분석한다. 장기로 재임한 CEO의 경영성과가 여타의 CEO와 어떠한 차이를 보이고 있는지 평가하고, 그 요인에 대해 논의한다. 셋째로 국내 증권업에서 CEO 교체의 효율성, 즉 CEO의 교체가 경영성과를 반영하여 이루어지는지의 여부를 분석한다. 이를 통해 CEO 교체가 CEO의 경영역량과 노력을 이끌어내는 규율로서 작용하는지 논의한다. 다만, 또 하나의 중요한 규율 메커니즘인 CEO에 대한 보상체계는 본 보고서에서 다루지 않는다.

기업에서 가장 중요한 의사결정의 하나인 CEO 교체(turnover)와 관련해서는 많은 연구들이 이루어졌다. 우선 CEO에 대한 규율이라는 측면에서 CEO의 교체가 효율적으로, 즉 경영성과를 반영하여 이루어지고 있는지의 여부를 분석한 연구들이 있다. 이 중에서 Huson et al.(2001)은 미국 기업들에서의 경영성과와 CEO 교체 사이의 관련성이 높지 않음을 발견한 반면, Jenter & Lewellen(2014), Jenter & Kanaan(2015)은 비교적 높은 관련성이 있다는 결과를 보고하였다. 다음으로 기업 및 이사회의 CEO 교체 의사결정에 영향을 미치는 요인을 분석한 연구들로 Huson et al.(2004), Guo & Masulis(2015), Fich & Shivdasani(2006), Ellis et al.(2017), 김수정 외(2012), 신현한ㆍ장진호(2003a, 2005), 최웅용ㆍ배현정(2009) 등이 있다. 이 연구들은 주로 강력하고 전문적인 이사회의 존재 여부, 소유구조, 기업집단 소속 여부 등과 같은 기업지배구조 관련 요인들이 CEO 교체에 어떠한 영향을 미치는지를 분석하고 있다.

CEO의 교체 관련 이슈를 분석한 연구가 다수 존재하는 데 비하여 CEO 재임기간의 장ㆍ단기 경영성과 혹은 경영활동과 어떤 관계를 가지며 어떤 영향을 미치는지를 분석한 연구는 상대적으로 드물다. 이 중에서 Allgood & Farrell(2000)은 미국 기업에서 CEO의 재임 연차에 따라 지배주주 CEO는 초기에는 강력한 참호구축을 통하여 교체 가능성이 낮지만 이후 연차가 경과함에 따라 점차로 이러한 참호구축이 약화되며, 외부에서 영입된 전문 CEO는 초기에는 성과를 지켜보는 시기, 중기에는 참호구축 시기, 이후에는 참호구축이 약화되는 양상을 나타낸다는 결과를 보고하였다.

미국 기업의 CEO 문제를 분석한 연구들과는 달리, 국내 증권업에서의 CEO 문제를 분석함에 있어서 고려해야 할 중요한 요인은 국내 증권회사들의 소유구조이다. 미국 기업들이 뚜렷한 대주주가 없이 비교적 분산된 소유구조를 가지고 있는 반면, 국내 증권회사들은 모두 회사에 결정적인 지배권을 행사할 수 있는 최대 지분을 보유한 주주, 즉 지배주주가 존재하며, 따라서 CEO의 선임과 교체에 있어서도 지배주주의 영향력이 매우 크다. 그리고 이 지배주주가 자신의 포트폴리오 중 하나로서 증권회사의 중요성, CEO의 역할과 중요성, 그리고 선임과 교체에 대하여 어떠한 관점과 태도를 갖고 있는지가 본 보고서에서 분석하고자 하는 CEO의 선임, 재임, 교체 의사결정에서의 차이로 나타날 가능성이 높다. 이에 따라 본 보고서에서는 국내 증권회사를 지배주주의 성격에 따라 독립 증권회사와 그룹소속 증권회사로 구분하여 그 차이를 살펴본다.

본 보고서는 다음과 같이 구성되어 있다. 제Ⅱ장에서는 국내 증권업 CEO들의 실태를 선임과 재임기간에 대한 통계분석을 통하여 제시한다. 제Ⅲ장에서는 CEO의 재임기간과 경영성과 간에 어떠한 관계가 존재하는지를 분석하며, 또한 CEO 교체의 효율성을 계량경제학적 분석을 이용하여 평가한다. 그리고 제Ⅳ장에서는 이러한 분석 결과를 토대로 시사점을 도출, 제시한다.

Ⅱ. 국내 증권업 CEO 재임기간 현황 분석

본 장에서는 국내 증권회사 CEO들의 출신배경, 발탁경로, 재임기간 등의 현황을 통계자료를 통하여 살펴보고 분석한다. 서론에서도 언급한 바와 같이 이와 같은 사항들에 대해서는 그 동안 정확한 통계자료가 수집ㆍ분석된 적이 없었던 바, 본 보고서의 분석은 최초의 시도라는 점에서 큰 의미를 갖는다.2)

1. 분석 대상 증권회사 및 CEO

본 보고서는 2001년부터 2016년까지 16년의 기간 동안 국내에 존재했거나 존재하고 있는 증권회사들을 분석의 대상으로 한다. 그 중에서 위탁매매, 인수, 상품판매, 자기매매 등 증권업의 기본적인 비즈니스를 두루 영위하고 있는 증권회사3)를 분석 대상으로 하였으며, 특정 비즈니스로 영업 범위가 제한된 증권회사4)는 대상에서 제외하였다. 또한 외국 증권회사의 국내 현지법인 또는 지점은 모두 제외하였으나, 국내 증권회사로 설립되었으면서 지배주주가 국내와 외국인 사이에서 변화한 경우5)는 분석 대상에 포함하였다. 최종적으로 71개 증권회사가 분석 대상이 되며, 16년의 기간 중 총 179명6)이 이 71개 증권회사에서 CEO로 재임하였거나 재임 중에 있는 것으로 나타났다. 71개 증권회사 중에서 2017년 3월말 현재 존재하는 증권회사는 30개사이다.

증권회사별 CEO의 성명, 선임 및 퇴임일, 주요 경력사항 및 회사의 최대주주 등 소유ㆍ지배구조 관련 사항에 관한 데이터는 금융감독원의 전자공시시스템(DART)에 공시된 각사의 사업보고서ㆍ반기보고서ㆍ분기보고서를 통하여 수집하였고, 증권회사별 재무제표 데이터는 각사의 영업보고서를 이용하여 수집하였다.

증권회사의 최대주주 혹은 지배주주는 자신의 전체 자산에서 증권회사가 차지하는 중요성에 따라 그 증권회사의 경영과 관련하여 관점의 차이가 있을 수 있고, 이러한 차이는 CEO의 역할과 중요성에 대한 인식의 차이로, 그리고 이는 다시 CEO 선임과 해임에서의 차이로 나타날 수 있다. 예를 들어 증권회사가 자신의 전체 자산의 70%를 차지하는 지배주주는 그 증권회사의 가치가 전체 자산의 가치에 결정적인 영향을 미치기 때문에 증권회사 가치 극대화가 최우선의 목표일 가능성이 높은 반면, 증권회사가 자신의 전체 자산의 10%에 불과한 지배주주는 다른 중요한 계열기업의 가치 증가를 함께 고려할 수 있기 때문에 증권회사 가치 극대화가 최우선의 목표가 아닐 수 있다. 즉 후자의 경우 전자보다는 증권회사 CEO의 선임과 해임에 대한 의사결정에 있어서 그룹 차원의 여러 다른 요인을 추가로 고려할 가능성이 크다.

이러한 가능성을 고려하여 본 보고서에서는 분석 대상 증권회사를 소유구조에 따라 독립 증권회사와 그룹소속 증권회사로 구분하였다. 어떤 증권회사의 자산이 그 증권회사 최대주주가 지배하는 전체 그룹 자산의 30% 이상을 차지하는 경우 그 증권회사는 독립 증권회사로, 그렇지 않은 나머지 모든 증권회사는 그룹소속 증권회사로 구분된다.7) 그룹소속 증권회사에는 은행, 보험 등 비증권 금융계 및 일반 산업계 증권회사들이 포함된다.

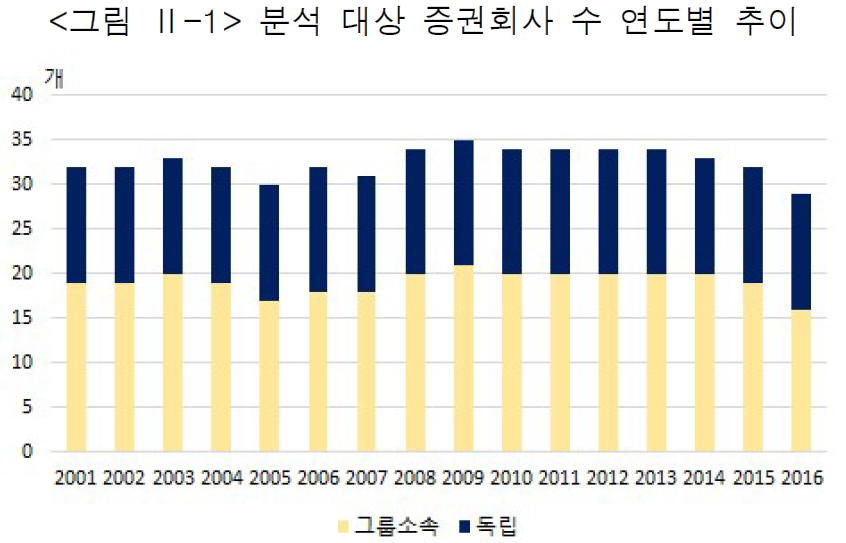

<그림 Ⅱ-1>은 분석 대상 증권회사 수의 연도별 추이를 보여준다. 전체적으로 매년 29~35개 증권회사가 분석에 포함되었으며, 독립 증권회사의 비중은 39.4%(2003년, 2014년)에서 44.8%(2016년) 정도를 차지하고 있다.

본 보고서에서는 CEO를 출신배경 및 발탁경로에 따라 몇 개의 그룹으로 구분하였다. 지배주주 자신(가족 포함)이 CEO인 경우(이하 ‘지배주주 CEO’라 한다.)와 전문경영인 CEO(이하 ‘전문 CEO’라 한다.)는 CEO에 대한 규율, CEO가 갖는 유인 및 시계(time horizon) 등에서 상당한 차이가 존재할 가능성이 크다. 따라서 우선 지배주주 CEO와 전문 CEO를 구분하였고, 이 중에서 다시 전문 CEO를 출신배경에 따라 ‘증권출신’과 ‘비증권출신’ 으로, 발탁경로에 따라 ‘내부승진’과 ‘외부영입’으로 구분하였다. 증권출신은 CEO에 선임되기 전까지의 핵심적인 경력을 자본시장 관련 비스니스(증권 및 자산운용)에서 쌓아온 경우를, 비증권출신은 그렇지 않은 경우(은행과 보험 등 비증권 금융 출신, 일반 산업 출신, 공직자 출신)를 가리키며, 이는 증권회사의 CEO로서 자신의 회사가 영위하는 비즈니스에 대한 경험과 전문성에서의 차이를 반영하고자 하는 것이다. 그리고 내부승진은 해당 CEO가 경력을 쌓았던 회사 혹은 그 회사가 소속된 그룹 내부에서 발탁된 경우이고, 외부영입은 회사 혹은 그룹 외부에서 발탁되어 곧바로 CEO에 선임된 경우를 가리키며, 이는 CEO를 맡고 있는 회사에 대한 친숙도 및 CEO 후보로서의 능력에 대한 검증에서의 차이를 반영하고자 하는 것이다.

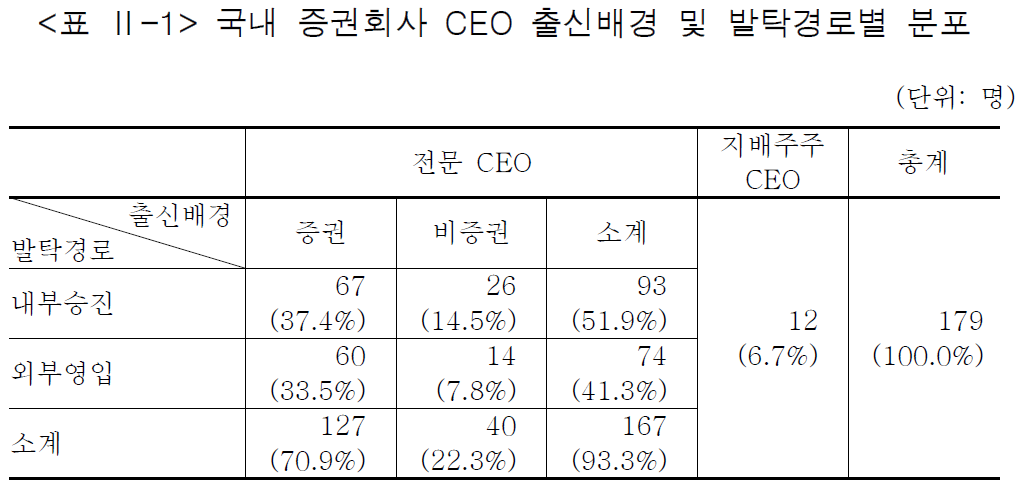

<표 Ⅱ-1>은 CEO 출신배경 및 발탁경로별 분포를 보여주고 있다. 전문 CEO가 179명 중 167명으로 전체의 93.3%를 차지하여 지배주주 CEO보다 압도적으로 많았다. 전문 CEO를 다시 발탁경로별로 살펴보면, 내부승진(51.9%)이 외부영입(41.3%)보다 높은 비중을 차지하였다. 한편 전문 CEO의 출신배경별로는 증권출신 CEO의 비중이 70.9%로 나타나 CEO 선임에 있어서 자본시장에서의 경험과 전문성이 중요한 요건으로 받아들여지고 있음을 보여준다.

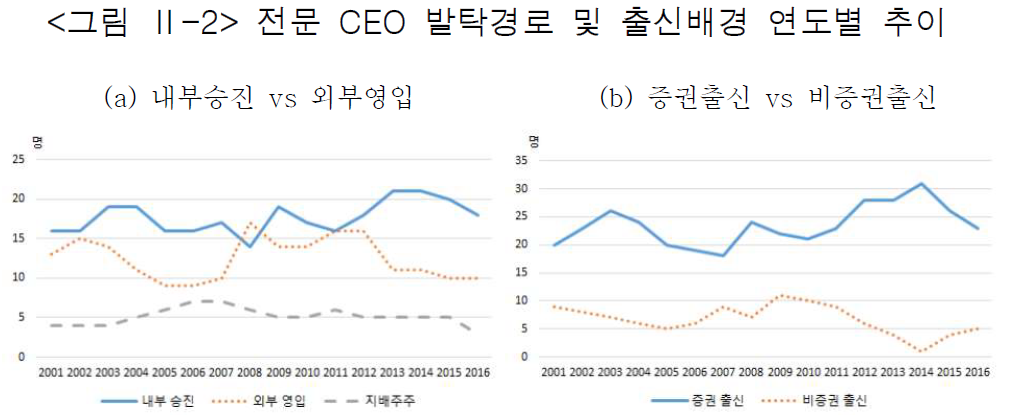

<그림 Ⅱ-2>는 CEO의 발탁경로 및 출신배경 분포의 연도별 추이를 보여준다. 전체적으로 시간의 경과에 따라 내부승진, 그리고 증권출신 CEO의 비중이 높아지다가 2013년 이후 약간 반대 흐름의 모습을 보이고 있다. 내부승진 CEO 수는 2008년 한해를 제외하고는 외부영입보다 많았고, 2011~2013년 사이에 크게 증가하면서 외부영입 CEO와의 차이를 벌린 모습이다. 또한 증권출신 CEO는 2006년 19명으로부터 꾸준하게 증가하면서 2014년에는 30명에 달하여 전문 CEO의 거의 전부를 차지하기도 하였다. 분석기간 전체로 보면 내부승진과 외부영입, 증권출신과 비증권출신의 상대적 비중은 주기적으로 변하고 있음을 알 수 있다. 이러한 관찰로부터 미루어 볼 때, 증권회사들이 시기에 따라 외부영입[내부승진]에서 내부승진[외부영입]으로, 증권[비증권]출신에서 비증권[증권]출신으로 CEO의 발탁경로와 출신배경을 달리하여 CEO를 선임하고 있음을 알 수 있다. 마지막으로, <그림 Ⅱ-2>에서 볼 수 있듯이 지배주주 CEO 수는 2006년과 2007년에 7명으로 분석기간 중 가장 많았으나, 이후 꾸준히 감소하는 추세를 보이며 2016년 현재 3명인 것으로 나타나고 있다.

2. CEO 선임 및 재임기간

가. CEO 선임

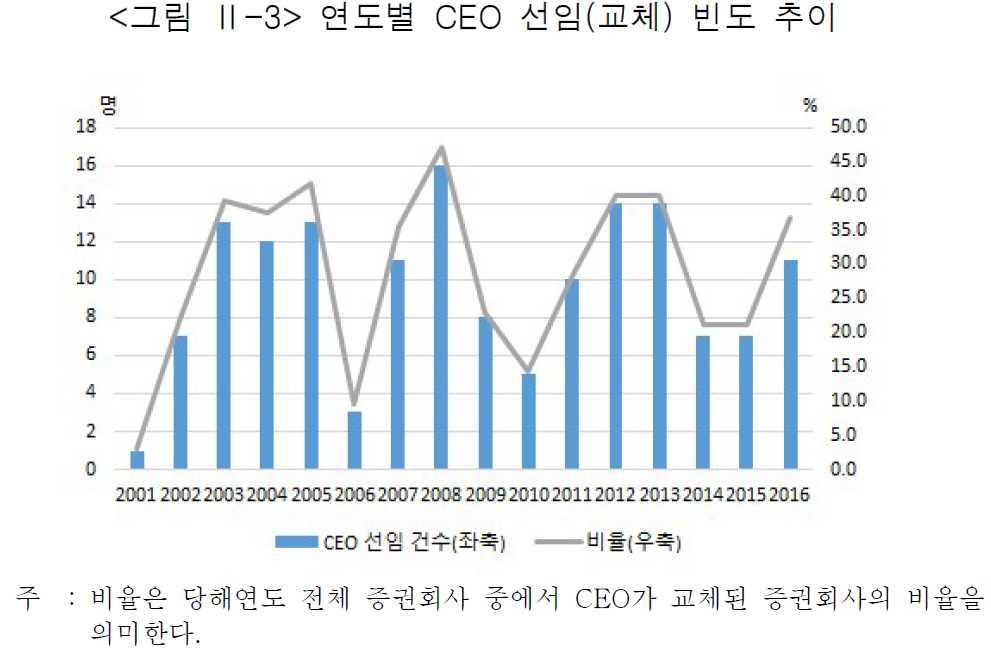

<그림 Ⅱ-3>은 국내 증권업에서 매년 몇 명의 CEO가 새롭게 선임되는지(즉 CEO 교체가 몇 건 발생하는지)를 보여준다. 그림으로부터 CEO 선임에 있어서 4~5년 주기의 상당히 뚜렷한 순환(cycle)을 볼 수 있다. 2001년, 2006년, 2010년, 2014년, 2015년에는 새로운 CEO의 선임이 현저하게 적게 이루어졌고, 반대로 2003년, 2005년, 2008년, 2012년, 2013년에는 CEO의 교체가 활발하였다. 후술하는 CEO 재임기간에 대한 분석에서 보다 자세하게 살펴보겠지만, ‘2~3년 임기’라는 재임기간 패턴을 갖고 있는 국내 증권업에서 많은 수의 CEO가 교체된 다음 2~3년 동안에는 자연스럽게 교체 건수가 줄어드는 것으로 보인다. 흥미로운 것은 CEO의 교체가 연도별로 상당히 군집된 모습(clustering)을 보인다는 점이다. 이러한 군집현상의 원인은 분명하게 알 수는 없으나, 1997~1998년의 외환위기, 2003년의 카드채 사태, 2008년의 글로벌 금융위기와 같은 증권업 전체에 영향을 주는 위기상황에서 구조조정 등으로 일시에 다수의 CEO가 교체된 데 기인할 수 있다는 추론이 가능하다.

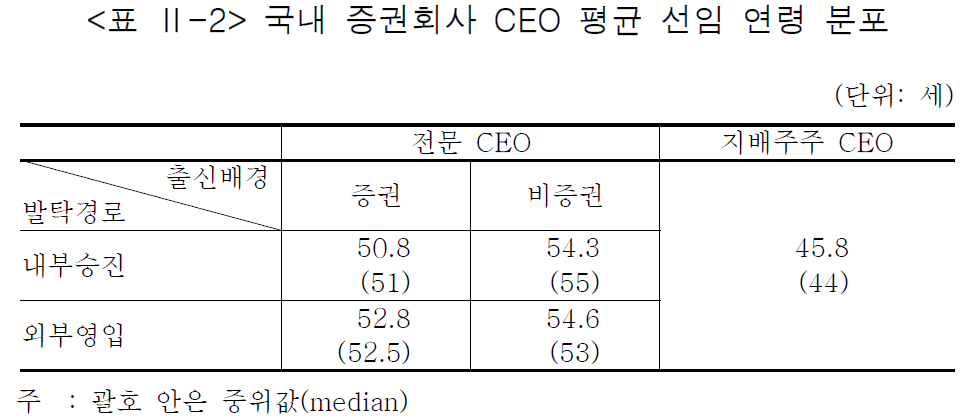

<표 Ⅱ-2>는 국내 증권회사의 CEO들이 평균적으로 몇 세에 CEO에 선임되는지를 정리하여 보여준다. 전문 CEO들은 52세에 CEO에 선임되는 반면, 지배주주 CEO는 45세 정도에 CEO에 선임되어 상당한 차이를 나타내고 있다. 또한 전문 CEO 중에서는 증권출신이면서 내부승진인 경우 가장 이른 나이에 CEO의 자리에 오르는 것으로 나타났다.

나. CEO 재임기간

본 절에서는 본 보고서의 핵심적 분석 대상인 국내 증권회사 CEO의 재임기간 현황을 다양한 관련 통계를 통하여 살펴본다. 재임기간의 길이에 대한 통계와 재임기간별 분포를 전체 표본에 대해서 뿐 아니라 출신배경 및 발탁경로별, 증권회사 소유구조별로 구분하여 제시한다.

1) 재임기간의 길이

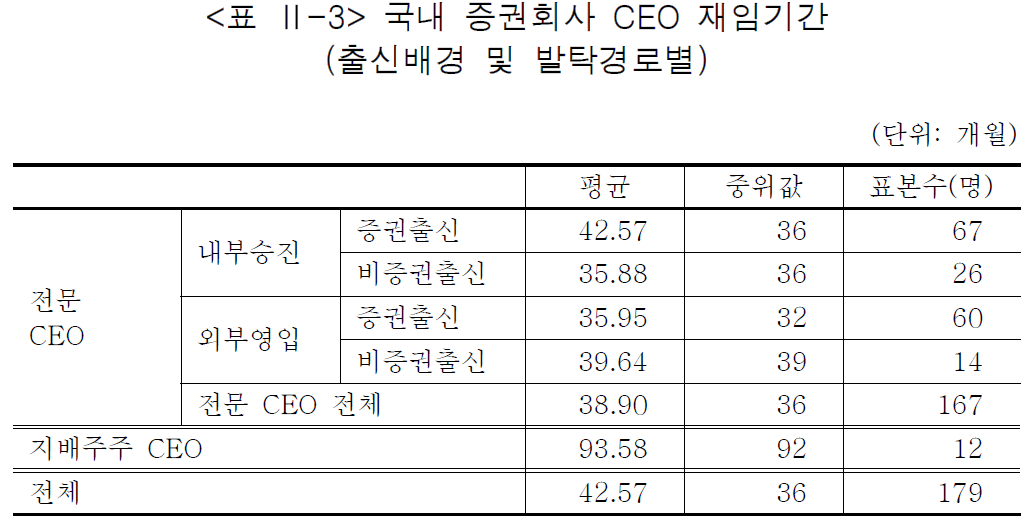

<표 Ⅱ-3>에 제시된 바와 같이, 2001~2016년 분석기간 전체 표본인 179명 CEO 재임기간의 평균(mean)은 약 42.6개월(3.5년)이고 중위값(median)은 36개월(3년)이다. 이 중에서 전문 CEO는 38.9개월 정도 재임하고 있으며, 지배주주 CEO는 이보다 훨씬 긴 93.6개월 동안 재임하는 것으로 나타났다.

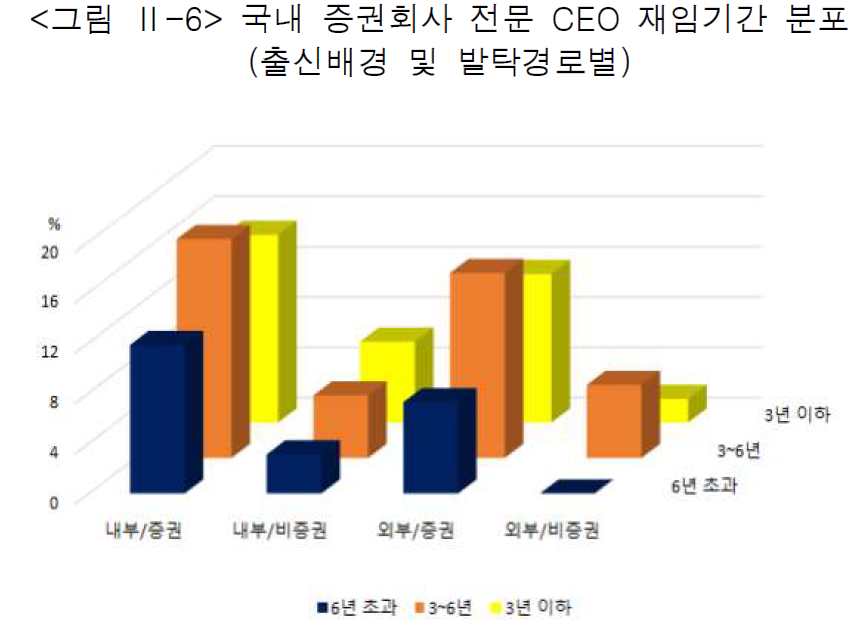

전문 CEO 중에서는 내부승진/증권출신의 평균 재임기간이 42.6개월로 가장 길었으며, 내부승진/비증권출신이 35.9개월로 가장 짧았다. 그러나 재임기간을 중위값 기준으로 보면 외부영입/비증권출신이 39개월로 가장 길었고, 외부영입/증권출신이 32개월로 가장 짧았다. 평균과 중위값 간에 순위의 차이가 나타나는 이유는 출신배경별로 재임기간의 분포가 다르기 때문이다. 이를테면 내부승진/증권출신의 경우 재임기간의 평균은 가장 긴 반면 중위값은 그렇지 않은데, 이는 <그림 Ⅱ-6>에서 볼 수 있듯이 내부승진/증권출신의 경우 6년을 초과한 장기재임 CEO들이 가장 많았으면서 동시에 단기재임한 CEO들의 빈도수도 높았기 때문이다.

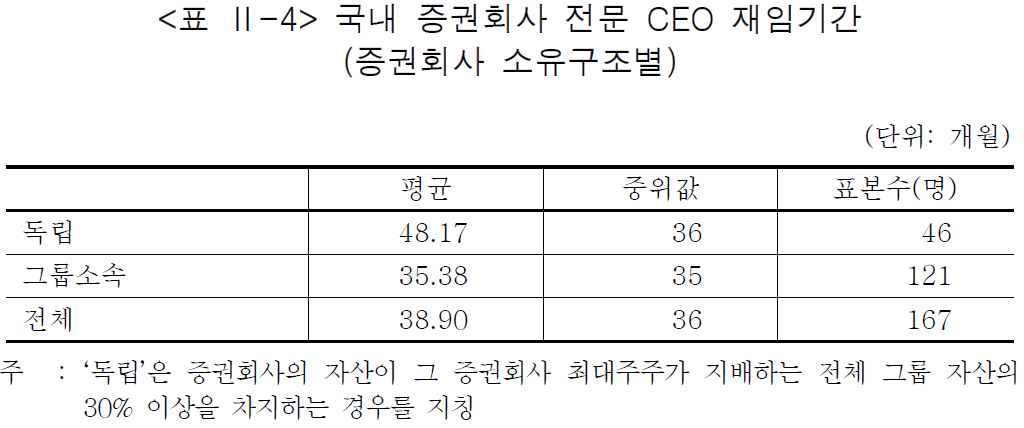

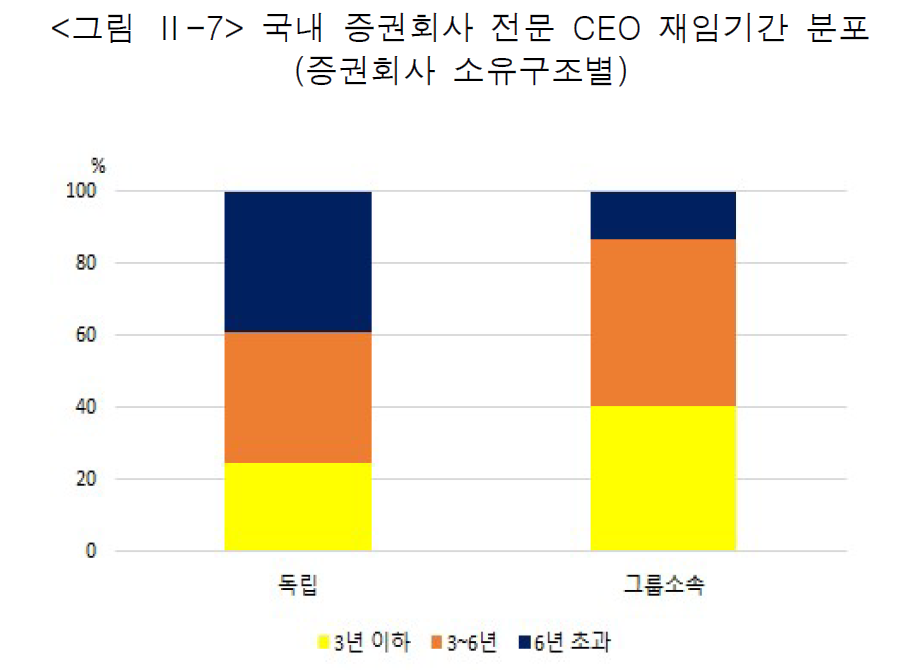

<표 Ⅱ-4>는 증권회사의 소유구조, 즉 독립인지 그룹소속인지에 따른 전문 CEO의 재임기간을 보여준다. 독립 증권회사 CEO의 평균 재임기간은 48.2개월로 그룹소속 증권회사 CEO의 평균 재임기간 35.4개월에 비하여 약 1년 정도 긴 것으로 나타났다.

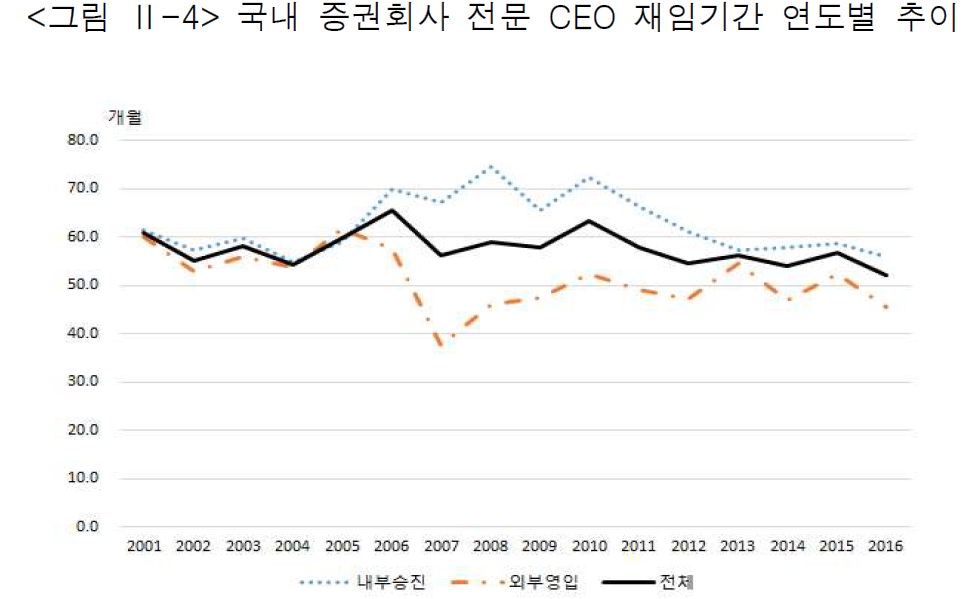

<그림 Ⅱ-4>는 전문 CEO 재임기간이 연도별로 어떤 변화를 보이는지를 나타내고 있다. 전문 CEO의 재임기간은 2001년부터 2010년까지 60개월8) 전후를 보이고 있었으나, 그 이후 추세적으로 짧아지고 있다. 분석기간 전체에 대해 내부승진 CEO들이 외부영입인 경우보다 재임기간이 길었다. 시계열적으로 보면 2007년에는 내부승진과 외부영입 CEO 간 재임기간의 차이가 30개월에 달하기도 하였지만 최근에는 내부승진과 외부영입 CEO 간 재임기간의 차이가 좁혀지는 모습을 보이고 있다.

2) 재임기간의 분포

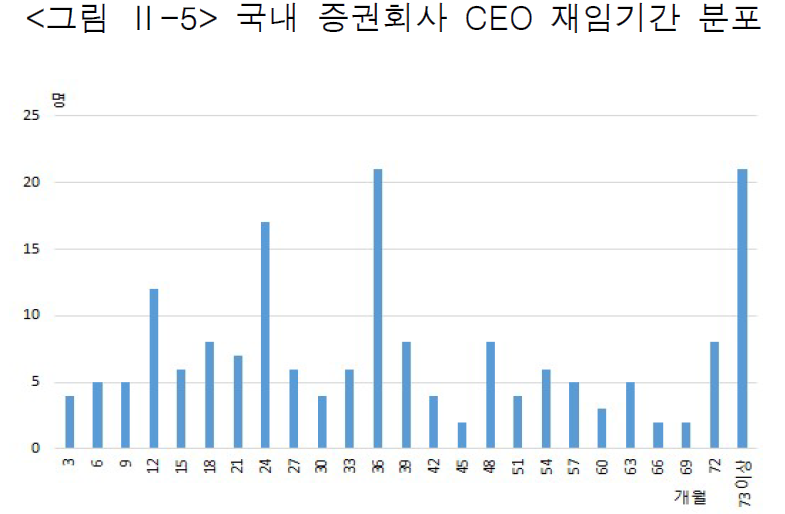

<그림 Ⅱ-5>는 분석 대상 179명 CEO들의 재임기간의 분포를 보여주는 히스토그램이다. CEO의 재임기간 분포는 3개월 단위로 합산하였고, 72개월을 초과한 CEO는 모두 그림의 ‘73이상’에 포함하였다.

그림에서 볼 수 있는 흥미로운 패턴은 1년(12개월), 2년, 3년 등 연 단위의 재임기간을 갖는 CEO가 많다는 점이다. 이는 정기 주주총회가 있는 시점에서 임기 만료에 따른 CEO 교체가 빈번했음을 시사한다. 특히 연 단위의 재임기간 중 24개월과 36개월의 빈도가 매우 높았으며, 국내 증권회사의 전문 CEO 재임기간에 있어서 ‘2년 또는 3년 임기’라는 틀이 상당히 형성되어 있음을 보여준다. 실제로 재임기간 36개월은 전체의 중위값인 동시에 최빈값(mode)임을 알 수 있다. 국내 증권회사 CEO의 재임기간이 ‘2년 또는 3년 임기’의 틀로 형성된 이유는 명확하지 않다. 다만, CEO의 임기와 관련된 규정으로 이사의 임기가 3년을 초과하지 못하도록 정한 상법 제383조가 있으며, 이 규정이 영향을 미쳤을 가능성을 생각해 볼 수 있다.9)

<그림 Ⅱ-6>은 지배주주 CEO를 제외한 전문 CEO들의 출신배경별 재임기간의 분포를 제시하고 있다. 그림의 분포는 전문 CEO를 3년 이하(단기), 3년 초과~6년 이하(중기), 6년 초과(장기)의 재임기간별로 구분하고, 재임기간별 CEO 비중을 각 연도별로 구한 다음 이를 평균하여 얻은 것이다. 예를 들어 6년간 재임한 CEO의 경우 표본으로 보면 각각의 연도에 대하여 매번 포함되기 때문에 6번 반복하여 계산된다.10)

그림에서 볼 수 있듯이, 내부승진/증권출신에서 장기재임 CEO의 비중이 가장 높았던 반면, 외부영입/비증권출신은 장기재임한 사례가 전무하였다. 외부영입 CEO는 내부승진 CEO에 비해 중기재임의 비중이 높았다. 또한 그룹 내 계열사로부터 발탁된 경우로 대체로 재무 및 금융 관련 경력을 가진 내부승진/비증권출신 CEO는 단기재임의 비중이 높았다.

<그림 Ⅱ-7>은 증권회사 소유구조별 CEO 재임기간의 분포를 보여준다. 6년을 초과하여 재임한 장기재임 CEO의 비중은 그룹소속 증권회사보다 독립 증권회사에서 훨씬 높은 반면, 3년 이하로 재임한 단기재임 CEO의 비중은 그룹소속 증권회사에서 더 높게 나타났다. 전체적으로 독립 증권회사가 그룹소속 증권회사에 비하여 CEO의 재임기간을 더 길게 가져가는 경향이 있음을 알 수 있다.

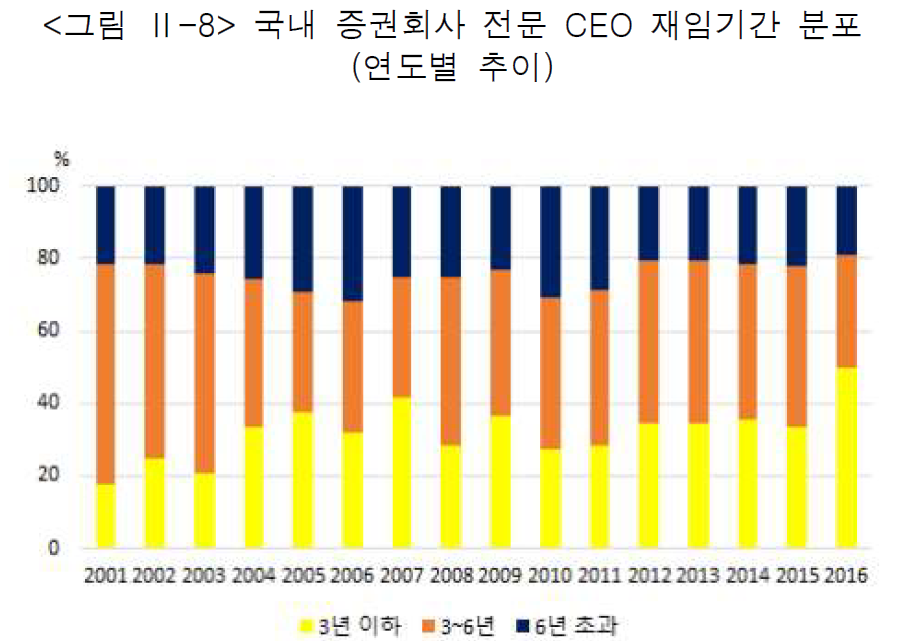

<그림 Ⅱ-8>은 장기, 중기, 단기재임 CEO 분포의 연도별 추이를 보여준다. 그림에서 볼 수 있듯이 2010년 이후 단기재임 CEO의 비중이 추세적으로 증가하고 있는 반면, 장기재임 CEO의 비중은 꾸준하게 감소하고 있다. 이는 앞에서 제시한 <그림 Ⅱ-4>의 전체적인 전문 CEO의 재임기간 평균의 추이를 재임기간별 분포를 통하여 살펴본 것으로, 전문 CEO의 재임기간 단축 추세가 장기재임 CEO의 감소 및 단기재임 CEO의 증가에 기인함을 알 수 있다.

3. 외국 주요 증권회사와의 CEO 재임기간 비교

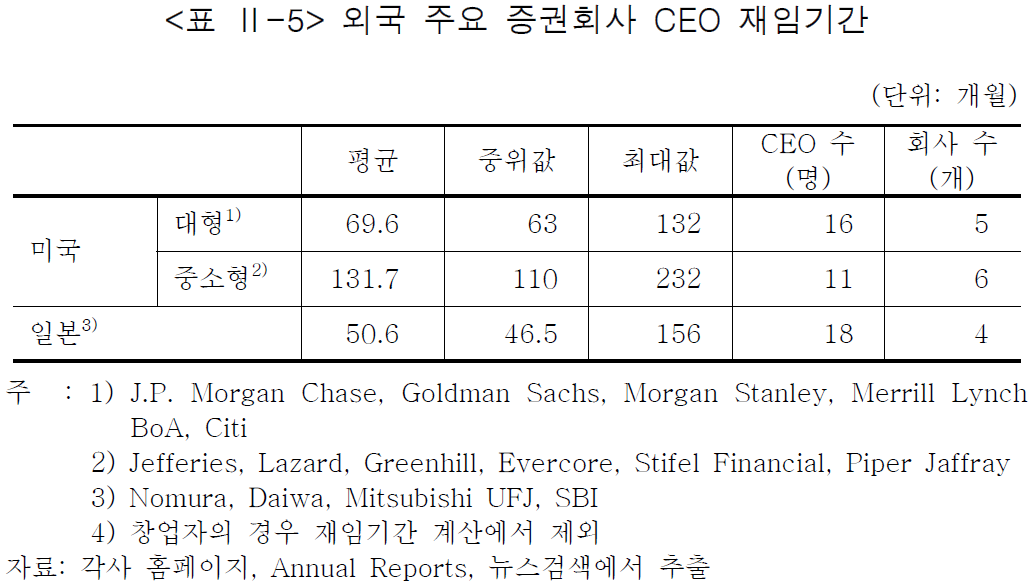

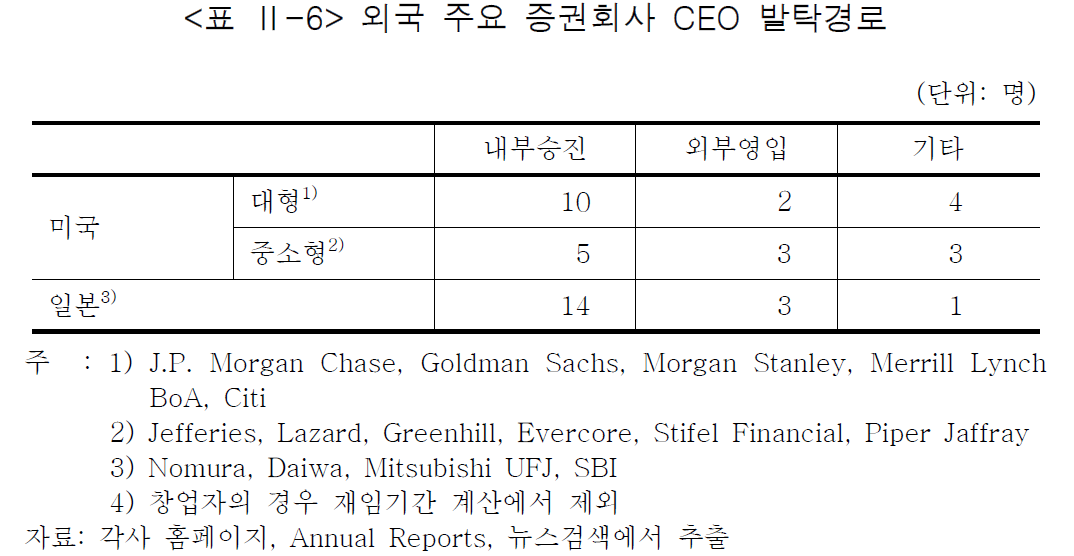

본 절에서는 국내 증권회사 CEO 재임기간의 상대적인 장ㆍ단 여부를 판단하고, 발탁경로상의 차이를 비교하기 위하여 외국의 주요 증권회사(투자은행)의 사례를 조사하여 소개한다. 구체적으로 J.P. Morgan Chase, Goldman Sachs, Morgan Stanley, Merrill Lynch BoA, Citi 등 미국의 5개 글로벌 투자은행(대형사), Jefferies, Lazard, Greenhill, Evercore, Stifel Financial, Piper Jaffray 등 미국의 6개 중소형 투자은행11), Nomura, Daiwa, Mitsubishi UFJ, SBI 등 일본의 4개 대형 증권회사를 선정하여, 국내 증권회사와 동일하게 2001~2016년 기간 중 재임한 CEO들의 재임기간 및 발탁경로를 조사하였다.

<표 Ⅱ-5>는 조사 대상 증권회사 CEO들의 재임기간의 평균과 중간값을 보여주고 있다. 표에서 볼 수 있듯이, 미국의 경우 CEO의 재임기간 평균은 대형사 69.6개월, 중소형사 131.7개월로 국내 증권회사 CEO 재임기간의 2~3배 정도인 것으로 나타났다. 일본 증권회사들의 경우 평균 재임기간이 50.6개월로, 한국 증권회사보다는 길지만 미국의 투자은행들보다는 짧은 중간적 모습을 보이고 있다.12)

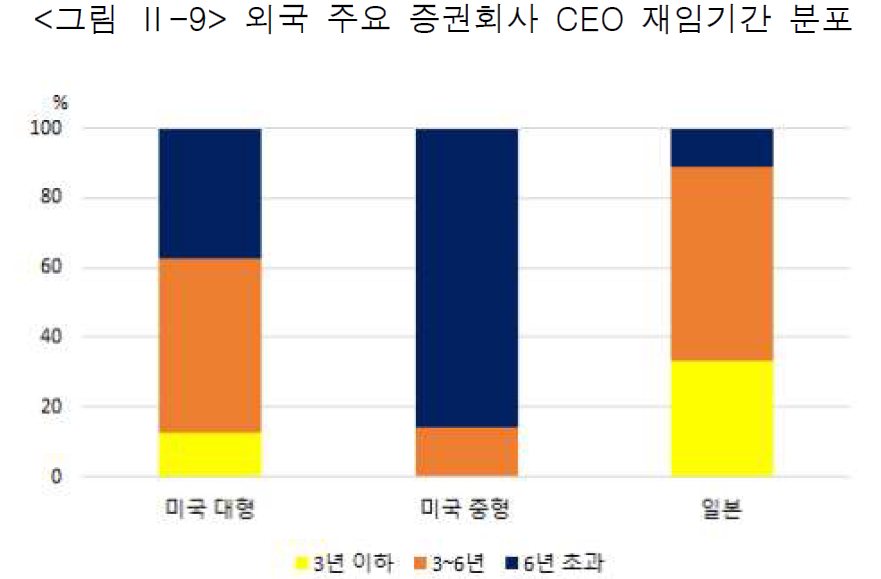

<그림 Ⅱ-9>는 국내 증권회사와 동일하게 CEO 재임기간을 단기, 중기, 장기로 나누어 그 비중을 나타낸 것이다. 미국 대형사의 경우 6년을 초과하여 장기재임하는 CEO도 상당수 존재하지만, 3~6년 재임하는 CEO의 수가 그보다 더 많은 것으로 나타났다. 또한 3년 이하 단기재임하는 CEO의 비중이 10% 대로 매우 적다는 점은 주목할 만하다.

미국의 대형사 J.P. Morgan Chase는 2005년 12월에 William Harrison이 CEO에서 물러나면서(은퇴) 현 Jamie Dimon으로의 승계가 이루어졌으며, Goldman Sachs는 2006년 6월 당시 CEO였던 Henry Paulson이 미국 재무부장관에 임명되면서 현 Lloyd Blankfein으로의 승계가 이루어지는 등 조사 대상 기간 중 단 한차례 CEO 교체를 경험하였다. 이와는 대조적으로 조사 대상 기간 중 Merrill Lynch BoA는 5명, Citi는 4명의 CEO가 재임하는 등 CEO의 교체가 상대적으로 잦았는데, 이는 글로벌 금융위기 와중에 회사가 인수되거나 구조조정을 겪는 과정에서 발생한 CEO의 교체이다.13) 즉 글로벌 금융위기 시기에 큰 어려움을 겪지 않고 위기를 무난하게 극복한 회사와 그렇지 못한 회사 간에 CEO의 교체와 재임기간에 상당한 차이가 나타나고 있다.

미국의 중소형사들은 특정 비즈니스에 특화ㆍ전문화되어 있는 소위 ‘부티크 IB’들로서, 대형사보다 CEO 재임기간이 훨씬 길다. 미국 중소형사에서는 단기재임 CEO가 전혀 없고, 6년을 초과하여 장기재임하는 CEO가 압도적 다수를 차지하고 있다. 특히 6개사 중에서도 Jefferies, Stifel Financial, Piper Jaffray는 조사 대상 기간 중 CEO의 교체 없이 단 한명의 CEO가 현재까지 재임하고 있다. 중소형사들은 자신의 고객기반을 갖고 회사를 설립하여 사업을 하는 창업자가 CEO를 겸하는 경우가 많고, 창업자가 후임 CEO를 선임할 때에도 비슷하게 글로벌 대형사에서 자신의 고객기반을 갖고 있는 인물을 영입하는 경우가 많다. 따라서 이렇게 선임된 CEO가 단기간에 회사를 떠나게 되면 그에 따라 고객기반을 잃어버리는 결과를 초래할 수 있다는 것이 장기재임을 가능하게 하는 원인의 하나이다.

일본의 대형 증권회사의 경우에는 미국과는 달리 6년을 초과하여 장기재임한 CEO의 비중이 매우 낮으며, 오히려 한국의 증권회사보다도 더 낮다. 반면 한국 증권회사에 비하여 중기재임 CEO의 비중이 훨씬 높아, 이것이 평균 재임기간이 한국 증권회사의 평균 재임기간보다 길게 나타나게 하는 요인이 되고 있다.

<표 Ⅱ-6>은 조사 대상 외국 주요 투자은행 CEO들의 발탁경로별 분포를 보여준다. 미국의 대형사와 일본 증권회사들에서는 외부영입보다는 내부승진이 훨씬 많다. 이는 회사의 규모가 큰 만큼 미래의 CEO 후보를 발굴하고 양성할 수 있는 내부적 기반이 상대적으로 넓고 탄탄하다는 것을 시사하는 것으로 보인다. J.P. Morgan Chase의 Jamie Dimon은 COO(Chief Operating Officer)에서 CEO가 되었으며, Goldman Sachs의 Lloyd Blankfein은 FICC(Fixed Income, Currency and Commondities) 부문과 주식 부문 책임자를 거쳐 CEO에 선임되었다.

<표 Ⅱ-6>에서 ‘기타’는 CEO가 창업자 자신인 경우 혹은 합병회사 중 하나의 CEO가 합병 후 CEO가 된 경우이다. 미국 대형사는 모두 후자의 경우로서, Travelers Group의 CEO였다가 Citicorp와의 합병을 통해 Citigroup이 탄생하면서 Citigroup의 CEO가 된 Sanford Weill을 예로 들 수 있다. 반면 미국 중소형사에서 ‘기타’는 모두 창업자인 경우로서 대형사와 대조된다.

한편 미국 중소형사의 경우에는 외부영입의 비중이 대형사에 비하여 약간 높게 나타나는데, 이는 대형사와는 달리 작은 회사 규모로 인하여 잠재적인 CEO 후보들을 가려내고 키워낼 수 있는 인적 기반이 상대적으로 충분하지 않기 때문이라는 추론이 가능하다. 중소형사에서 외부영입의 비중이 상대적으로 높으면서 동시에 재임기간이 매우 길다는 것은 창업자를 포함한 지배주주가 회사의 비전과 전략에 부합하는 인물을 외부로부터 효과적으로 찾아내어 발탁하고, 일단 선임된 CEO에 대해서는 인내심을 갖고 충분한 시간과 기회를 준다는 것을 시사하는 것으로 볼 수 있다. 또한 전술한 바와 같이 부티크 IB들은 자신의 고객기반을 갖고 있는 인물을 CEO로 선임하려고 하기 때문에, 글로벌 대형 IB에서 CEO 후보를 물색하고 영입하는 것이 필요하다는 점도 외부영입의 비중이 높은 원인의 하나이다.

일본의 대형 증권회사들에서는 내부에서 인재를 육성하여 CEO로 발탁하는 것이 일반적인 것으로 보인다. Nomura와 Daiwa의 경우 2001~2016년 기간에 CEO로 재임한 인물들은 모두 그 증권회사에 입사하여 10~30년 근무한 후 CEO에 선임되었으며, 또한 1명을 제외하고는 모두 해당 그룹(Nomura Holdings, Daiwa증권그룹) 회장으로 옮겨갔다는 공통점이 있다.

4. 소결

장에서는 국내 증권회사 CEO들의 출신배경, 발탁경로, 재임기간 등의 현황을 통계자료를 통하여 분석하고, 미국와 일본의 주요 투자은행 CEO들의 경우와 비교하여 살펴보았다. 2001~2016년 기간 중 국내 증권회사의 전문 CEO들 중에서는 내부승진이면서 증권출신 배경을 가진 CEO가 가장 많은 비중을 차지하고 있는 것으로 나타나 국내 증권업계가 CEO의 자본시장에서의 경험과 전문성, 그리고 회사에 대한 친숙도를 비교적 중요하게 여기고 있음을 보여주었다.

한편 평균, 중위값과 같은 통계량, 선임(교체)빈도 및 재임기간의 분포 등과 같은 분석결과를 종합해서 볼 때, 국내 증권업계에서는 전문 CEO의 ‘2년 또는 3년 재임’이라는 틀이 상당한 정도로 형성되어 있음을 알 수 있다. 재임기간의 중위값은 36개월이며, 재임기간의 분포 역시 24개월 또는 36개월에서 높은 빈도를 보이고 있다. CEO의 발탁경로 및 출신배경별로는 전체적으로 내부승진/증권출신 CEO들의 재임기간이 가장 길며, 6년을 초과하여 장기재임한 CEO의 수 역시 내부승진/증권출신에서 가장 많은 것으로 나타났다. 그리고 독립 증권회사가 그룹소속 증권회사에 비하여 전반적으로 CEO의 임기를 더 길게 가져가는 경향이 있음을 볼 수 있다. 또한 시간의 경과에 따라 CEO의 재임기간이 추세적으로 짧아지고 있으며, 이는 장기재임 CEO가 차지하는 비중의 감소에 기인하는 것으로 나타났다.

미국과 일본의 주요 투자은행의 경우, 평균적으로 국내 증권회사에 비하여 CEO의 재임기간이 더 길다. 미국 투자은행의 CEO 재임기간은 국내 증권회사 CEO 재임기간에 비하여 대형사의 경우 2배, 중소형사의 경우 3배 정도이다. 일본 증권회사의 경우에는 CEO의 재임기간이 미국의 투자은행들보다는 짧지만 국내 증권회사보다는 긴 모습을 보이고 있다.

Ⅲ. 국내 증권업 CEO 재임기간ㆍ교체의 효율성 분석

CEO는 기업의 주인(principal)인 주주들의 핵심적인 대리인으로서 기업의 최종적인 의사결정을 담당한다. 따라서 CEO는 한 기업의 경영성과, 나아가 흥망을 결정할 수 있는 위치에 있다. 그리고 한 기업에서 CEO의 중요성은 그 기업이 영위하는 사업의 특성 또는 부여된 역할 및 권한의 범위에 따라 달라진다. 예를 들어 고도로 성숙된 산업에서 정형화된 비즈니스를 영위하는 기업에 비하여 불확실성이 많은 산업에서 모험적인 비즈니스를 영위하는 기업에서는 CEO의 전략적 판단이나 의사결정이 기업의 성과에 미치는 영향이 훨씬 크다. 즉 이런 기업일수록 CEO의 경영역량과 노력이 중요하며, 따라서 합당한 CEO를 선임하는 것이 더욱 중요한 의사결정 과정이 된다. 다른 한편, 지배주주가 CEO에게 부여한 역할 및 권한이 매우 제한적이라면 그 CEO는 자신의 경영역량을 펼쳐 보이기 어려울 것이다. 예를 들어, CEO의 재임기간은 CEO의 역할을 제한하는 한 형태가 될 수 있다. 자신의 경영성과에 따라 장기재임할 수 있다는 기대를 갖는 CEO에 비하여 2~3년 재임하고 물러나야 한다는 것을 알고 있는 CEO는 자신의 경영역량을 충분하게 발휘할 기회도 유인도 갖기 어려울 것이며, 이러한 차이는 경영성과의 차이로 나타날 것이다. 이러한 배경에서, 본 장의 1절은 CEO의 재임기간과 경영성과 간의 관계를 분석하고 국내 증권업에서 경영성과의 개선에 있어 CEO 선임의 중요성을 논의한다.

또한 기업의 경영철학을 구현하고 주주의 부를 극대화하는데 있어서 경영역량이 부족하거나 최선의 노력을 경주하지 않는 CEO를 교체하는 것 역시 매우 중요하다. 이러한 맥락에서 국내 증권회사들이 경영역량이 부족하거나 최선의 노력을 경주하지 않는 CEO를 교체하고 있는지를 살펴볼 필요가 있다. 즉 국내 증권업의 CEO 교체가 빈번하였는데, 그 원인이 뛰어난 경영역량을 가진 CEO가 적었던 것이었을 수 있지만, 또한 ‘2년 또는 3년 임기’의 틀 또는 증권회사의 소유구조 등의 여타 요인에서 비롯되었을 수도 있다. 분석 결과의 검토를 통하여 CEO의 교체과정이 증권회사 경영성과에 개선을 주는 방향으로 작용하는지를 평가해볼 수 있다. 2절에서는 CEO 교체와 경영성과 간의 관계를 분석하고 CEO에 대한 교체과정이 경영역량과 노력을 이끌어내는 CEO 규율로서 작용하고 있는지를 평가한다.

이를 위해 본 장은 먼저 1절에서 CEO 재임기간과 경영성과 간의 관계를 분석하고, 2절에서 CEO 선임 및 교체 결정의 효율성이 증권회사 유형별로 차이가 있는지의 여부를 살펴본다.

1. CEO 재임기간과 경영성과에 관한 분석

Ⅱ장에서 살펴본 바와 같이 국내 증권업에서는 CEO의 ‘2년 또는 3년 재임’이라는 틀이 상당한 정도로 형성되어 있다. 그리고 이러한 단기재임 관행으로 인하여 국내 증권회사 CEO들이 자신이 경영하는 회사의 장기적 성장과 지속가능성 제고에 관심을 갖고 장기적 경영전략을 수립하여 일관성 있게 추진하기가 어렵다는 우려가 지속적으로 제기되어 왔다.14) 더욱이 단기재임이 부진한 경영성과로 인한 것이 아니라, 경영성과와는 관계없이 경직적인 관행이나 그룹 내 인사상의 필요에 따른 경우에는 해당 CEO는 자신의 경영성과에 따른 연임가능성에 대한 기대를 갖지 않게 되고, CEO로서 최선의 노력을 경주하지 않을 가능성도 있다.

특히 우리나라 증권업의 현실, 그리고 향후 나아가야 할 방향을 생각할 때, CEO가 장기적 안목과 비전을 갖게 하고 이를 경영활동에 옮길 수 있는 충분한 재임기간의 보장이 필요하다는 시각이 많다. 예를 들면, 본격적 투자은행으로의 발전 혹은 특화ㆍ전문화를 위한 역량 축적은 단기간에 이루어질 수 없고, 회사의 비전을 구현할 수 있는 경영전략을 수립하고 수립된 경영전략을 장기간에 걸쳐 꾸준하고 일관성 있게 추진하는 것이 필수적이다. 그리고 이것은 CEO가 2~3년마다 교체되는 환경에서는 불가능할 것이다.

본 절에서는 이와 같은 문제의식에서 출발하여 국내 증권업에서 CEO의 재임기간이 경영성과에 영향을 미치는지의 여부, 즉 CEO 재임기간의 장ㆍ단에 따라 경영성과에 차이가 나타나는지의 여부를 살펴본다. 아울러 경영성과의 차이가 CEO 재임 중 어느 시점부터 본격적으로 드러나는지를 분석하고자 한다. 만일 장기재임 CEO의 경영성과가 재임연차가 경과함에 따라 향상되고 단기재임 CEO의 경영성과보다 우월한 것으로 나타난다면 이는 증권업계의 CEO 단기재임 관행에 따른 업계의 우려에 대한 실증적 근거를 제공한다는 의미를 갖는다고 볼 수 있다.

가. 경영성과의 지표

기업의 경영성과는 크게 ‘회계적 실적에 기초한 성과(accounting- based performance)’와 ‘(주식)시장에 기초한 성과(market-based performance)’로 대별할 수 있다. CEO의 경영활동이 회사 재무제표상의 실적에 즉각적으로 나타나는 경우, CEO의 이러한 경영성과를 평가하기 위해서는 회계적 실적에 기초한 성과지표를 사용하는 것이 적절하다. 또한 회계적 실적에 기초한 성과지표는 이미 실현된 경영성과를 측정한다는 의미에서 ‘과거지향적(backward-looking)’ 성격을 갖는다. 그러나 회사 조직의 효율성 제고나 중장기적 성장을 위한 투자 등과 관련된 경영활동에 따른 성과는 회계적 실적에 즉각적으로 반영되기 어렵고, 오히려 회계적 실적의 저하로 나타날 수도 있다. 이 경우 CEO의 경영성과는 미래의 기업가치 증가에 대한 기대를 반영할 수 있는 ‘미래지향적(forward-looking)’ 성과지표를 사용하여 평가하는 것이 적절하다(Engel et al., 2003). 그리고 주식시장에서 형성되는 주가는 바로 이러한 미래의 기업가치에 대한 기대를 반영하고 있다는 점에서 가장 대표적인 미래지향적 성과지표라고 할 수 있다.

본 절에서는 회계적 실적에 기초한 성과지표로 총자산수익률(Return on Assets: ROA)과 자기자본수익률(Return on Equity: ROE)을, 시장에 기초한 성과지표로는 각 증권회사 주가, 곧 주식의 수익률을 사용한다. 본 절의 분석은 Ⅱ장에서와 동일하게 2001~2016년 기간 중 존재했던 71개 증권회사의 179명 CEO 중 지배주주 CEO 12명, 공동 CEO 20명, 투신 증권회사15) CEO 5명을 제외한 142명의 전문 CEO를 대상으로 하며, 각 증권회사의 재무제표 데이터는 각 사의 사업보고서 및 영업보고서를 통하여 수집하였다.

나. CEO 재임기간과 ROA / ROE

본 절에서는 ROA를 회사의 영업이익을 총자산으로 나눈 값으로 정의하고 있다. 당기순이익이 아닌 영업이익을 사용하는 이유는 증권회사의 본질적 비즈니스와 무관한 영업외이익이나 특별이익을 제외하고, 투자은행, 위탁매매 등과 같은 본질적 비즈니스의 성과만을 측정하기 위함이다. 또 ROA는 부채 증가에 따른 위험증가 혹은 레버리지의 수익효과를 조정하여 CEO의 순수한 경영역량 또는 경영성과를 대리하는 지표로서 의미가 있다. ROE는 영업이익을 자기자본으로 나눈 값으로 정의하였으며, 전체 경영성과 중에서 주주에게 귀속되는 부분, 혹은 주주의 투자에 대한 기업 영업활동을 통한 보상을 나타내는 지표로서의 의미를 갖는다.16) CEO의 선임과 교체가 핵심적인 기업지배구조상의 이슈이고, 기업지배구조의 중심에 주주가 있다는 점에서 ROE는 또 하나의 의미 있는 성과지표가 된다.

ROA 및 ROE로 측정된 경영성과와 CEO를 매칭할 때, 즉 한 회계연도의 ROA와 ROE가 어느 CEO의 경영성과인지를 결정할 때, 회계연도 중에 CEO가 교체된 경우 그 회계연도의 실적을 누구에게 귀속시킬 것인지를 결정해야 한다. 본 절에서는 한 회계연도 중 CEO로서 재임한 기간이 9개월, 즉 3/4 미만인 경우에는 그 회계연도의 경영성과를 해당 CEO의 경영성과로 인정하기 곤란하다고 판단하여 최소 9개월 이상 재임한 경우에만 그 회계연도의 경영성과를 해당 CEO에게 귀속시켰다. 그리고 CEO로 선임된 회계연도의 재임기간이 9개월 미만인 경우에는 그 해의 경영성과는 계산에 포함하지 않고, 그 다음해의 경영성과를 재임 1년차의 경영성과로 간주하여 통계를 작성하였다.

또한 각 회계연도별로 분석 대상 증권회사 전체의 해당 연도 ROA와 ROE의 중위값(median)을 차감한 ‘조정 ROA’ 및 ‘조정 ROE’를 사용함으로써 특정연도 증권업 ROA와 ROE에 영향을 미치는 공통의 요인을 통제하고 전체적인 증권업 수준에 비하여 얼마나 ‘더’ 우수한 혹은 열등한 경영성과를 올렸는지를 보고자 하였다.17) 또한 조정 지표의 사용은 개별 CEO의 연도별 경영성과로부터 해당연도 증권업 경영성과의 수준을 조정함으로써 회계연도가 다른 CEO의 경영성과를 상호 비교할 수 있는 장점을 가지고 있다.

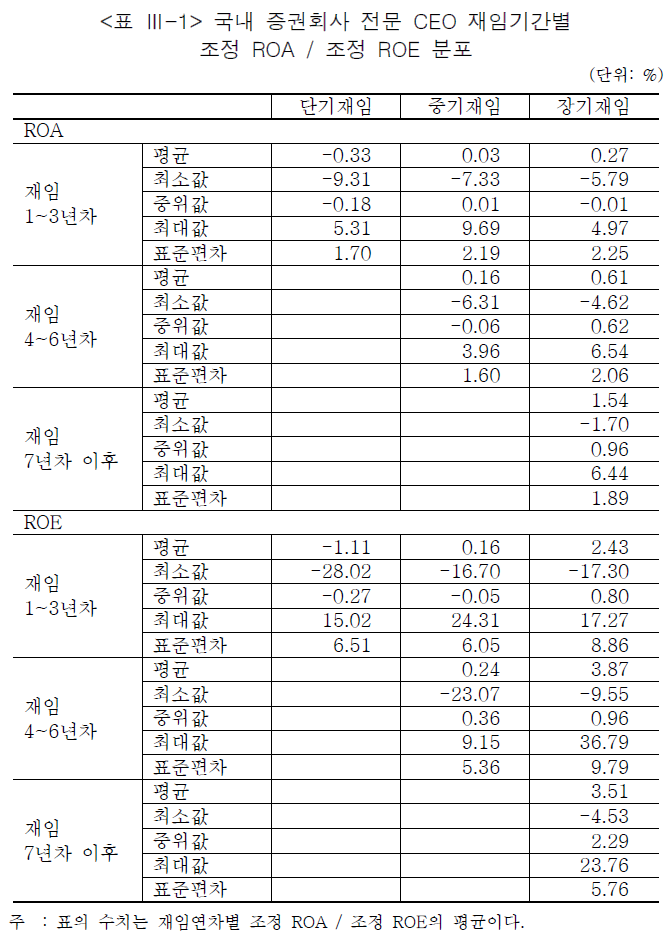

<표 Ⅲ-1>은 분석 대상 CEO를 선임에서부터 퇴임까지의 재임기간이 3년 이하인 그룹(단기재임)과 3년 초과~6년 이하인 그룹(중기재임), 6년을 초과하여 재임하고 있는 그룹(장기재임)으로 나누고, 각각의 그룹에 대하여 재임연차의 기간별(1~3년차, 4~6년차, 7년차 이후) 해당 증권회사의 조정 ROA와 조정 ROE의 분포를 보여주고 있다. 즉, 재임연차가 1~3년차라고 하면 CEO의 첫 번째 임기 기간에 해당하고, 4~6년차라고 하면 3년을 초과하여 재임한 CEO의 두 번째 임기 기간에 해당하는 것이라고 볼 수 있다.

<표 Ⅲ-1>은 ROA와 ROE 모두에서 단기재임 CEO보다는 중기재임 CEO, 그리고 그보다는 장기재임 CEO의 경영성과가 우월함을 보여주고 있다. 재임 1~3년차 기간의 조정 ROA의 평균은 단기재임 CEO가 –0.33%, 중기재임 CEO가 0.03%, 장기재임 CEO가 0.27%이다. 조정 ROE의 평균은 각각의 그룹에 대하여 –1.11%, 0.16%, 2.43%로 나타났다. 중위값을 기준으로 살펴보아도 장기재임 CEO의 조정 ROA를 제외하고는 동일한 결과를 보여주고 있다.

재임 4~6년차를 살펴보면 중기재임 CEO와 비교하여 장기재임 CEO의 우수한 경영성과가 좀 더 뚜렷하게 나타난다. 조정 ROA의 평균은 중기재임 CEO의 경우 0.16%이고, 장기재임 CEO의 경우 0.61%이다. 조정 ROE 역시 각각 0.24%와 3.87%로 장기재임 CEO에게서 더 높게 나타났다. 그리고 중위값을 기준으로 살펴보아도 동일한 결과를 볼 수 있다.

그렇지만 최소값과 최대값의 차이가 매우 크고 표준편차 역시 매우 크다는 점을 알 수 있다. 즉 장기재임 CEO 중에서도 증권업 평균 수준에 비하여 매우 우월한 경영성과를 올린 경우도 있지만 매우 저조한 경영성과를 올린 경우도 있다. 이는 경영성과가 CEO의 경영역량과 그들의 노력을 반영하기는 하지만, 동시에 여러 다른 요인들에 의해서도 영향을 받는다는 점을 보여주는 것이다. 따라서 단순한 평균 혹은 중위값의 차이 비교는 경영성과를 비교ㆍ평가하는 데 제한적일 수밖에 없다. 재임기간별 경영성과의 차이는 회귀분석과 같이 여러 다른 요인들을 통제하고 통계적 유의성을 다루는 분석을 통해 검토할 필요가 있으며, 그 결과는 다음 소절에서 제시된다.

또한 <표 Ⅲ-1>은 장기재임 CEO의 경우 재임연차가 경과할수록 경영성과가 점점 더 향상되었음을 보여준다. 조정 ROA의 평균을 보면, 장기재임 CEO의 재임 1~3년차에는 0.27%, 재임 4~6년차에는 0.61%, 재임 7년차 이후에는 1.54%로 나타났다. 그리고 중위값을 기준으로 살펴보아도 동일한 방향성을 볼 수 있다. 조정 ROE 역시 한 경우(재임 7년차 이후의 평균 3.51%)를 제외하고 동일하게 재임연차가 경과할수록 점점 더 높은 값을 보여준다.

중기재임 CEO 역시 재임 1~3년차보다는 4~6년차의 경영성과가 더 개선된 모습을 보여주고 있다. 재임연차 경과에 따른 중기재임 CEO의 경영성과 개선은 장기재임 CEO에 비하면 매우 미미한 정도를 나타내고 있다. 이를 달리 보면, 중기재임 CEO는 장기재임 CEO에 비하여 저조한 경영성과를 보인 경우가 많았음을 의미한다. 이 시기 중기재임 CEO들이 교체되었다는 점을 고려하면, 장기재임 CEO에 비해 저조한 경영성과를 보인 것이 이들의 교체 요인 중 하나로 작용했을 가능성을 시사한다.

단기재임 CEO 보다 장기재임 CEO의 경영성과가 우수하고, 또한 재임연차가 경과할수록 경영성과가 향상된다는 <표 Ⅲ-1>의 결과로부터 평균적으로 장기재임 CEO들은 단기재임 CEO들에 비하여 선임이 잘 이루어진 경우(즉 우수한 인물이 선임된 경우)이며, 잘 선택한 인물을 CEO에 선임하여 오랫동안 재임하게 할 경우 점차로 우수한 실력을 발휘하게 된다는 추론을 이끌어 낼 수 있다. 사실 CEO는 장기간 재임함으로써 자신이 경영하는 증권회사의 직원과 문화, 구체적인 사업 내용에 대해 충분히 파악할 수 있고 자신의 경영전략을 일관성 있고 효과적으로 추진할 수 있다. 이러한 이유로 장기재임 CEO는 그들의 경영역량 외에도 장기재임의 기회로 인하여 여타의 CEO보다 우수한 경영성과를 낼 수 있는 조건을 가지고 있는 것이다.

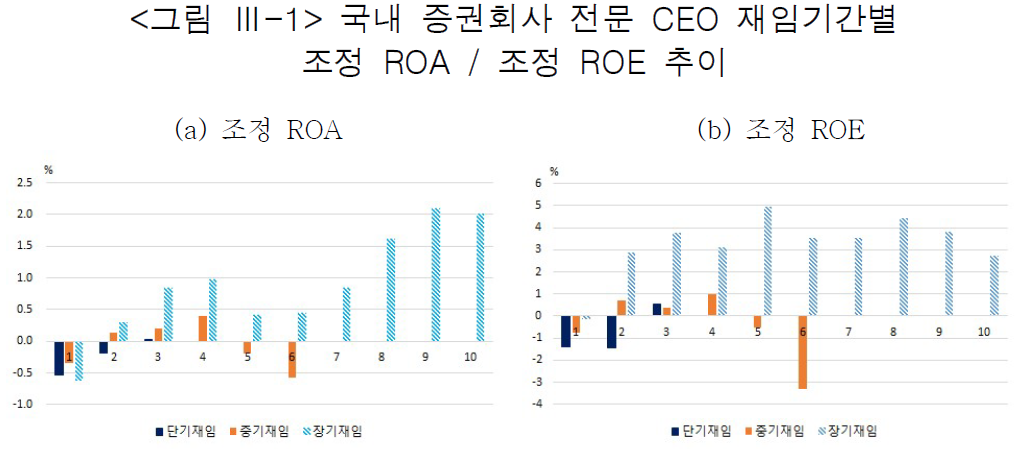

<그림 Ⅲ-1>은 단기재임, 중기재임, 장기재임 CEO 그룹 및 재임연차별 조정 ROA와 조정 ROE를 나타낸 것이다. CEO의 재임 시기별(1~3년차, 4~6년차, 7년차 이후)로 구분한 <표 Ⅲ-1>에서와 달리, <그림 Ⅲ-1>은 조정 ROA와 조정 ROE의 변화를 매 연차별로 나타냄으로써 추세적인 특징을 보여주고 있다. <표 Ⅲ-1>에서와 마찬가지로 <그림 Ⅲ-1> 역시 장기재임 CEO들이 상대적으로 우수한 경영실적을 올리고 있음을 보여준다. 재임 1년차에는 모든 그룹의 조정 ROA와 조정 ROE가 음(-)의 값을 가지나, 2년차부터 장기재임 CEO 그룹이 상대적으로 우수한 경영실적을 나타내기 시작하여 이후 10년차까지 지속된다.

이에 비하여 단기재임 CEO 그룹은 재임 1년차, 2년차에 모두 증권업 평균 수준에 비하여 저조한 음(-)의 조정 ROA 및 조정 ROE를 나타내고 있다. 즉, 증기 및 장기재임 CEO들이 2년차에는 경영성과를 양(+)으로 반전시킨 반면, 단기재임 CEO들은 그렇지 못했다는 것이다. 이는 최초 CEO 후보를 검증하여 선임하기까지의 과정에서의 차이를 나타내는 것일 수 있다는 추론을 가능하게 한다.

<그림 Ⅲ-1>에서 볼 수 있는 또 하나의 흥미로운 점은 장기재임 CEO가 2년차 이후 꾸준하게 양(+)의 조정 ROA와 ROE를 시현하고 있는 데 반하여, 중기재임 CEO는 재임 5년차와 6년차에 경영성과가 음(-)으로 떨어진다는 것이다. 이와 같은 재임 5~6년차의 경영성과 차이가 재임기간 6년을 초과하여 장기재임으로 가느냐, 중기재임으로 끝나느냐를 결정하는 요인의 하나일 가능성을 생각해볼 수 있다.

다. CEO 재임기간과 주식수익률

주식수익률 분석은 주가가 존재하는 상장 증권회사만을 대상으로 하며, 앞의 ROA와 ROE 분석에서와 마찬가지로 특정 연도 증권업 주식수익률에 영향을 미치는 공통의 요인을 통제하기 위하여 분석 대상 증권회사들의 해당연도 주식수익률의 중위값을 차감한 ‘조정초과수익률(조정 RET)’을 사용한다.

구체적으로 분석 대상 개별 증권회사의 회계연도별 주식수익률(Rate of Return: RET)을 보유기간수익률(buy-and-hold return)에 의하여 계산하고, 상장 증권회사 주식수익률의 중위값(증권업 RET)을 차감하여 ‘조정 RET’를 구하였다. 그리고 한 회계연도의 조정 RET와 CEO의 매칭은 앞의 조정 ROA / 조정 ROE 분석에서와 마찬가지로 그 회계연도 중 CEO 재임기간이 9개월 이상인지의 여부를 기준으로 이루어졌다.

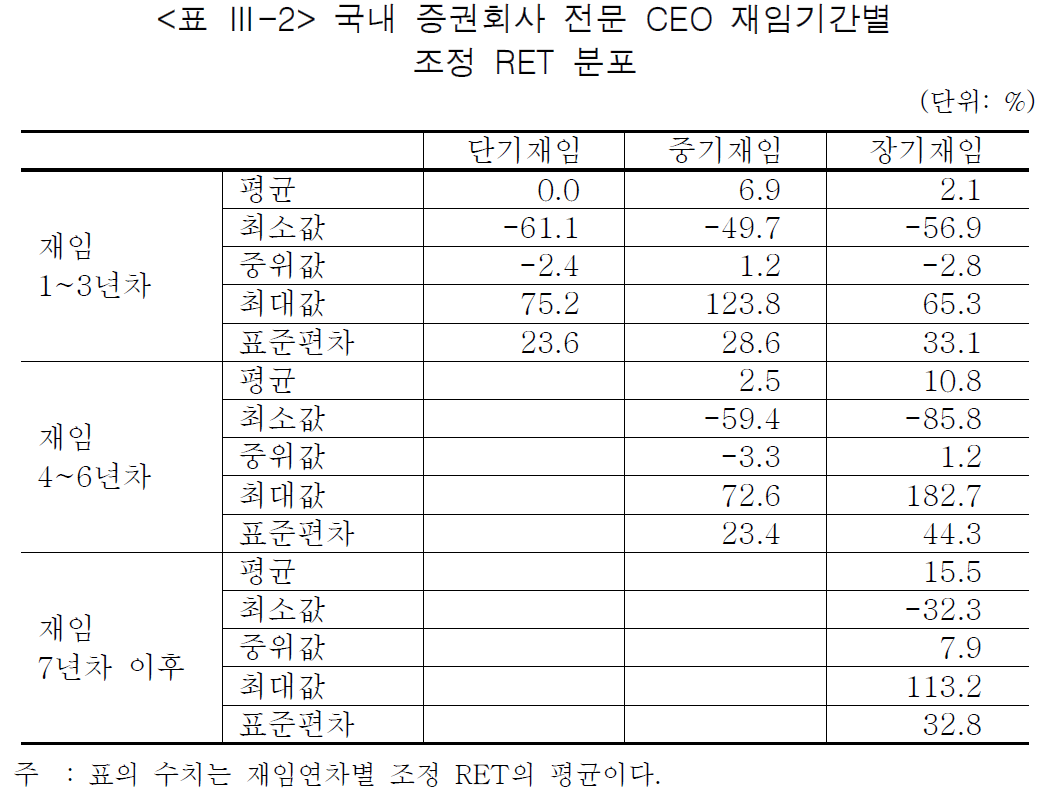

<표 Ⅲ-2>는 <표 Ⅲ-1>과 마찬가지로 분석 대상 CEO를 선임에서부터 퇴임까지의 재임기간이 3년 이하인 그룹(단기재임)과 3년 초과~6년 이하인 그룹(중기재임), 6년을 초과하여 재임하고 있는 그룹(장기재임)으로 나누고, 각각의 그룹에 대하여 재임연차의 기간별(1~3년차, 4~6년차, 7년차 이후) 해당 증권회사의 조정 RET의 분포를 보여주고 있다.

조정 ROA / 조정 ROE 분석은 재임기간과 단기 경영성과 간의 관계를 보여주는 반면, 조정 RET 분석은 CEO가 장기적 투자 혹은 조직ㆍ인력 관리 등을 효과적으로 수행하였는지에 대한 시장의 평가를 통해서 재임기간이 경영성과에 미치는 영향을 보여준다. CEO가 단기 회계실적에 집중하고 장기적 투자나 조직ㆍ인력 관리를 소홀히 하는 경우 조정 ROA나 조정 ROE는 높게 나타날 수 있으나 시장의 평가인 조정 RET는 낮아지는 결과를 초래한다. CEO의 경영역량이나 노력에 의한 결과는 단기 회계실적과 장기 경영성과를 통해서 여러 형태로 나타날 수 있고 이를 통해 CEO에 대한 평가를 다각도로 할 수 있다. 따라서 조정 RET 분석은 조정 ROA / 조정 ROE 분석결과를 보완하고 추가적인 시사점을 얻을 수 있다. 여기서는 조정 ROA 분석과 유사한 방식으로 조정 RET에 대해 분석한 결과를 통해 재임기간과 장기 경영성과 간의 관계를 논의한다.

전체적으로 <표 Ⅲ-2>에서 제시된 CEO 재임기간별 조정 RET의 분포는 <표 Ⅲ-1>에서 제시된 조정 ROA 및 조정 ROE의 분포와 거의 유사한 형태를 보여준다. 전반적으로 조정 RET는 단기재임보다는 중기재임, 그리고 그보다는 장기재임 CEO에게서 높게 나타난다. 다만 재임 1~3년차에는 장기재임 CEO보다 중기재임 CEO에게서 조정 RET가 높게 나타나는데, 이는 재임 초기 1~3년은 이들 CEO의 역량 및 경영전략에 대한 시장에서의 새로운 기대가 명확하게 형성되고 차별화되기에는 짧은 기간이기 때문일 것으로 생각된다.

또한 재임기간이 경과할수록 장기재임 CEO의 조정 RET가 점차로 높아지는 것 역시 조정 ROA / 조정 ROE에서와 동일한 결과이다. 즉 장기재임 CEO들 중 상당수의 경우, 재임 4년차 이후 해당연도의 실적을 보여주는 조정 ROA / 조정 ROE 뿐 아니라 미래 현금흐름에 대한 시장의 기대를 반영하는 조정 RET 역시 업계를 대표하는 중위값보다 크게 높았던 것이다. 즉 재임 초기에는 시장에서 CEO별로 차별화된 기대가 형성되기 어렵지만, 시간이 경과함에 따라 CEO의 역량이 점차로 드러나고 경영전략에서의 차별성이 시장에서 명확하게 인식됨에 따라 새롭게 형성된 기대가 주가에 반영되기 때문인 것으로 보인다. 그리고 이는 장기재임 CEO들이 단기적 성과 뿐 아니라 효율적 투자 혹은 효과적인 조직ㆍ인력 관리를 중시했음을 시사한다고도 볼 수 있다.

그러나 <표 Ⅲ-1>에서와 마찬가지로 <표 Ⅲ-2>에서도 동일 그룹 내에서 최소값과 최대값의 차이가 매우 크고, 따라서 표준편차가 매우 크다는 것을 볼 수 있다. 예를 들어 장기재임 CEO의 재임 7년차 이후의 경우 최대 113.2%의 조정 RET를 올린 CEO가 있는 반면, -32.3%의 조정 RET를 올린 CEO도 존재한다. 이러한 결과는 증권회사의 지배주주 또는 이사회가 조정 ROA나 조정 ROE, 또는 조정 RET 외에 경영성과에 영향을 미친 다른 요인들도 함께 고려하여 CEO의 경영역량 및 노력을 평가할 가능성이 충분히 있음을 의미한다.

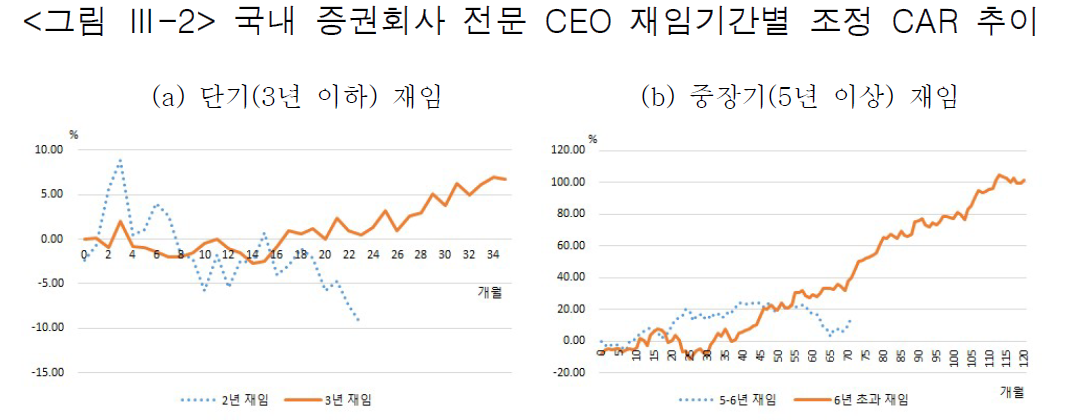

<그림 Ⅲ-2>는 재임기간이 2년이었던 CEO, 3년이었던 CEO, 5~6년이었던 CEO, 6년을 초과한 CEO에 대하여 재임연차별 조정 ‘누적초과수익률(조정 Cumulative Abnormal Return: CAR)’의 추이를 그림으로 나타낸 것이다.18) <그림 Ⅲ-2>는 단기(2년, 3년)재임과 중장기(5~6년, 6년 초과)재임한 CEO 간의 재임연차별 조정 CAR 값의 차이가 매우 커서 시각적 비교를 쉽게 하기 위하여 두 개의 그래프로 분리하였다.19)

조정 ROA에서와 마찬가지로 조정 CAR에서도 <그림 Ⅲ-2>는 <표 Ⅲ-2>와 질적으로 동일한 결과를 보여준다. 6년을 초과한 장기재임 CEO들의 조정 CAR는 선임 초기 2~3년 동안 저조한 수준이었으나 재임 3년차 이후 꾸준하게 상승하는 모습을 보였다. 단기재임의 경우(왼쪽 그래프), 3년 재임한 CEO는 재임 2년차에 접어들면서 상대적으로 주가 실적을 견조하게 유지하는 반면, 2년 재임에 그친 CEO는 2년차 후반에 주가 실적이 하락함을 볼 수 있다. 2년 재임에 그친 CEO는 조정 ROA 뿐 아니라 조정 CAR 역시 하락한 상황에서 교체가 이루어진 것으로 보인다.

6년을 초과한 장기재임 CEO들은 선임 초기 2~3년 동안 단기 경영성과인 조정 ROA에 비해 저조한 조정 CAR를 보였다. 장기재임하면서 우수한 실적을 내었던 CEO의 경우라도 재임 1~3년차 기간 동안에는 우수한 조정 CAR를 보이지 못한 데 대해서는 CEO 재임 초 1~3년의 기간은 새로운 경영전략과 활동을 통해 미래의 현금흐름 개선에 대한 기대와 확신을 시장에 제공하고, 시장에서 CEO의 능력과 자질에 대한 평가와 판단이 이루어져 주가에 반영되기에는 짧은 시간임을 보여주는 것으로 해석할 수 있다.

중장기재임의 경우(b), 5~6년 재임에 그친 CEO와 6년을 초과한 장기재임 CEO 사이에서 주가 실적의 추이가 크게 다르다. 5~6년 재임한 CEO의 경우, 재임 초 2~3년 사이까지 20%대의 조정 CAR를 보였으나 이후 5년차까지 추가적인 주가 실적을 보이지 못하는 모습을 보였다. 반면 장기재임 CEO의 조정 CAR는 3년차까지 0%대를 보였으나 이후 꾸준하게 상승하여 재임 6년차에는 평균 40%를, 8년차에는 80%대로 상승하였다. 즉 장기재임 CEO들이 재임 초 보다는 재임 중기 이후부터 장기적 의미의 경영성과를 시장에서 평가받고 있는 것이다. 또한 장기재임 CEO들이 주도한 경영활동이 증권회사 경쟁력으로 발현되고 시장에서 평가받기까지 어느 정도의 시간이 필요하다는 점을 보여주는 것이기도 하다.

라. 회귀분석

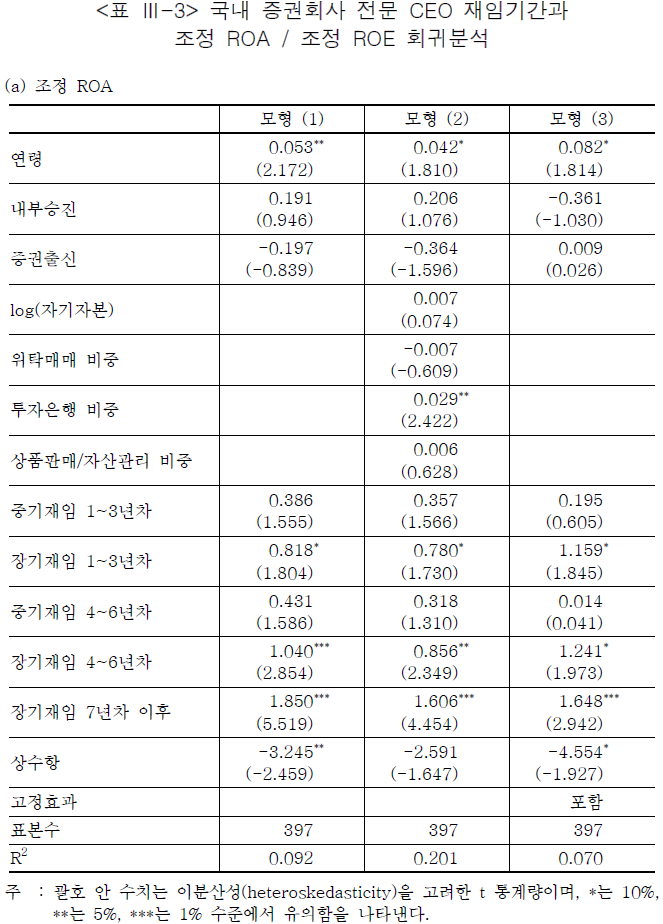

CEO의 재임기간과 경영성과 간의 관계에 대한 단변량분석에 이어 이를 보다 체계적으로 살펴보기 위하여 본 소절에서는 회귀분석을 실시하였고, 그 결과는 <표 Ⅲ-3>과 <표 Ⅲ-4>에 정리되어 있다. 구체적으로 본 회귀분석에서는 개별 CEO의 재임연차별 조정 ROA 및 조정 ROE, 그리고 조정 RET로 측정된 경영성과가 종속변수가 된다. 설명변수로는 CEO의 연령, 발탁경로, 출신배경, 그리고 중기재임과 장기재임 CEO들의 재임연차(1~3년, 4~6년, 7년차 이후)별로 경영성과에 어떠한 차이가 있는지 보기 위한 더미변수를 포함하였다. 증권회사의 수익구조 또는 증권회사별로 다른 경영성과의 차이가 CEO의 재임기간과 관련이 있을 경우, 증권회사 자체의 효과로 인한 경영성과를 CEO의 재임기간에 따른 경영성과로 평가하는 추정 상의 편의를 생성해낼 수 있다. 따라서 이러한 편의를 제어하고자 모형 (2)에서는 증권회사별 수익구조에 따른 차이를 통제하기 위하여 위탁매매 비중, 투자은행 비중, 상품판매/자산관리 비중 변수를 포함하였고, 모형 (3)에서는 이들 변수를 포함하지 않고 증권회사의 고정효과를 포함하여 추정하였다.

‘중기[장기]재임 1~3년차’는 종속변수인 경영성과가 중기[장기]재임한 CEO가 재임 1~3년차에 나타난 것이라면 1이 되고 그렇지 않은 경우이면 0이 되는 더미변수이다. 마찬가지로 ‘중기[장기]재임 4~6년차’ 또는 ‘장기재임 7년차 이후’는 종속변수인 경영성과가 중기[장기]재임한 CEO 또는 장기재임한 CEO가 각각 해당되는 재임연차에서 나타난 것이라면 1이 되고 그렇지 않은 경우이면 0이 되는 더미변수이다.

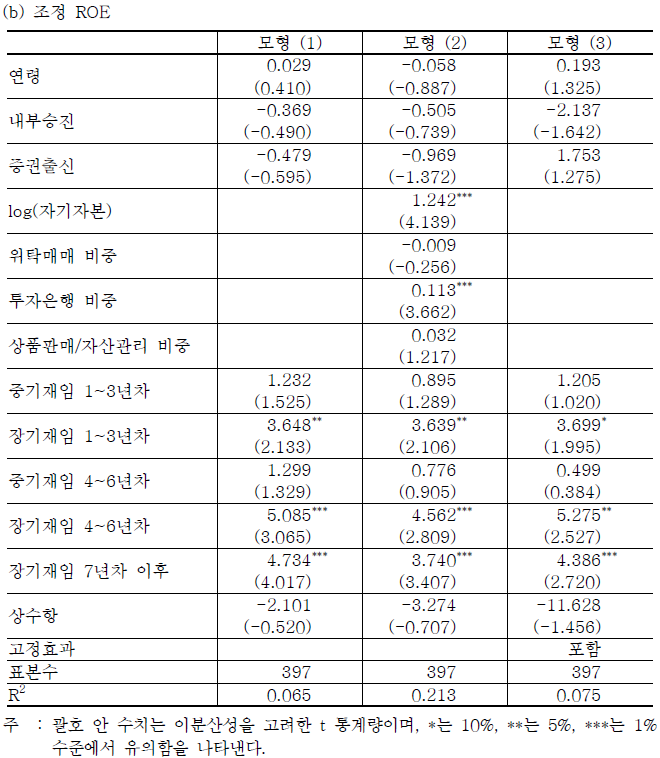

<표 Ⅲ-3>은 조정 ROA(패널 (a))와 조정 ROE(패널 (b))로 측정된 경영성과에 대한 회귀분석 결과를 보여준다. 조정 ROA에 대한 추정과 조정 ROE에 대한 추정은 본 보고서에서 주목하는 단기ㆍ중기ㆍ장기재임 CEO의 재임시기별 경영성과의 특성에 대해 거의 동일한 결과를 얻었다.

가장 핵심적인 변수 중의 하나인 장기재임 CEO의 재임연차별 더미변수들(장기재임 1~3년차, 4~6년차, 7년차 이후)의 추정계수는 모든 모형에서 통계적으로 유의한 양(+)의 값을 갖는 것으로 나타났다. 조정 ROA의 경우, 모형 (1)에서 장기재임 CEO의 재임 1~3년차의 추정계수는 0.818%, 재임 4~6년차 및 7년차 이후의 추정계수는 1.040%와 1.850%로 나타났다. 이는 단기재임 CEO의 재임 1~3년차 조정 ROA에 대비한 차이를 보여주는 것이다. 즉 장기재임 CEO의 7년차 이후의 조정 ROA는 단기재임 CEO의 재임 1~3년차의 조정 ROA보다 평균적으로 1.850% 높은 것을 의미한다. 그리고 조정 ROE에 대한 분석에서도 거의 모든 계수가 1~5% 수준에서 통계적으로 유의한 양(+)의 값을 갖는다. 이에 비하여 중기재임 CEO에 대한 모든 재임연차별 더미변수의 추정계수는 양(+)의 값을 보였으나 통계적으로 유의하지 않다. 모형에 상관없이 CEO 재임기간별 경영성과의 분석결과는 질적으로 다르지 않아 분석결과의 강건성을 확인할 수 있었다.

회귀분석의 결과는 앞에서 서술한 단변량분석의 결과를 뒷받침하는 것으로 장기재임 CEO 그룹은 재임 초기부터 우수한 성과를 보이며, 이러한 성과는 재임기간의 경과에 따라 지속되거나 더욱 강화된다는 것을 의미한다. 장기재임 CEO가 여타의 CEO보다 우수한 경영역량을 가진 CEO였을 가능성이 충분하고 그들의 경영역량 외에도 장기재임의 기회로 인하여 여타의 CEO보다 우수한 경영성과를 낼 수 있었던 것으로 사료된다.

조정 ROA의 경우, 재임기간 외 CEO의 특성 변수 중에서 연령 변수에 대한 추정계수가 통계적으로 유의한 양(+)의 값을 갖는 것으로 나타났고, 이외에 발탁경로를 나타내는 변수(내부승진) 및 출신배경을 나타내는 변수(증권출신)에 대한 추정계수는 유의적이지 않았다. 그리고 조정 ROE의 경우 CEO의 연령, 내부승진, 증권출신 변수에 대한 추정계수는 모든 모형에서 통계적 유의성을 갖지 않았다. 요약하면 CEO의 연령이 많을수록 단기 경영성과가 다소 높아졌으나 CEO가 증권출신인지의 여부나 내부승진인지의 여부는 경영성과와 밀접한 관계를 보이지 않았다.

증권회사의 특성 변수 중 자기자본의 추정계수는 종속변수가 조정 ROE인 경우에 통계적으로 유의한 값을 갖는 것으로 나타났다. 수익구조와 관련하여, 투자은행 비중의 추정계수는 통계적으로 유의한 양(+)의 값은 갖는 반면, 위탁매매 비중의 추정계수는 음(-)의 값을 나타냈으나 통계적 유의성은 없었다. 이는 위탁매매 부문의 비중이 컸던 증권회사들의 수익성이 낮았고 투자은행 부문의 비중이 컸던 증권회사들의 수익성이 높았다는 것을 의미한다.

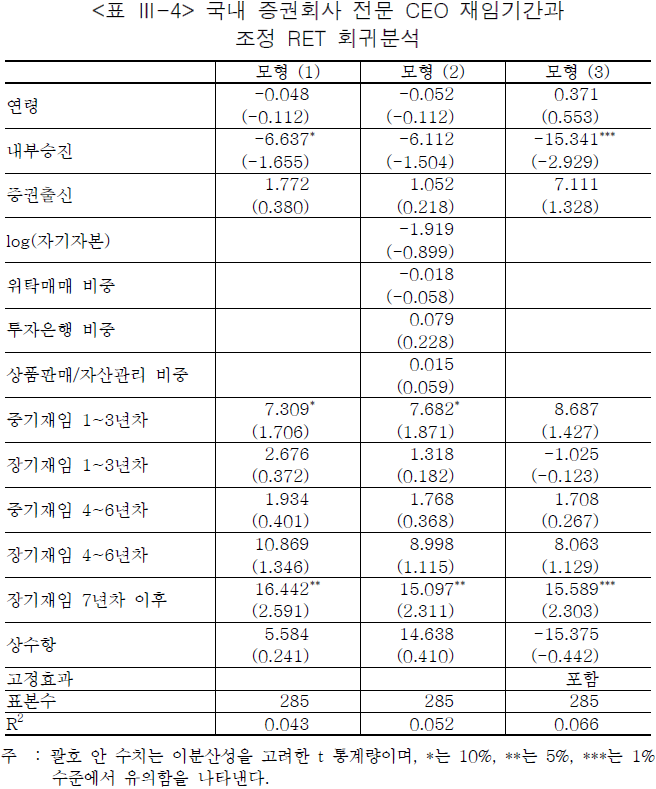

<표 Ⅲ-4>는 경영성과의 지표로서 조정 RET를 사용한 회귀분석 결과를 정리한 것이다. 조정 ROA 및 조정 ROE에 대한 분석결과와 달리 장기재임 CEO의 재임 1~3년차와 재임 4~6년차 변수에 대한 추정계수는 모형 (3)에서 재임 1~3년차의 계수를 제외하고 모두 양(+)의 값을 가졌지만 모두 통계적 유의성은 없었다. 반면 장기재임 CEO의 재임 7년차 이후 변수에 대한 추정계수는 모든 모형에 대해 약 15%로 매우 큰 수치로 나타났고 5% 수준에서 통계적으로 유의하였다. 또한 장기재임 CEO의 재임연차가 경과할수록 조정 RET가 상승하는 것을 확인할 수 있다. 장기재임 CEO의 조정 RET 분석은 비록 단기 경영성과인 조정 ROA나 조정 ROE에 비해 추정계수의 유의성이 나타나지 않는 경우도 있었지만 질적으로는 유사한 결과를 보였다.

중기재임 CEO의 경우, 재임 1~3년차 변수에 대한 추정계수가 7~8%로 크고 10% 수준에서 통계적으로 유의하였으나, 재임 4~6년차 변수에 대한 추정계수는 1~2%로 크지 않았고 통계적 유의성도 없었다. 그리고 장기재임 CEO와 달리 중기재임 CEO는 재임연차가 경과하면서 조정 RET가 하락하는 모습을 보였다.

정리하면, 조정 ROA나 조정 ROE와 달리 재임 1~3년차에서는 장기재임 CEO 여부에 따라 조정 RET에서 차이가 나타나지 않았으며 오히려 중기재임 CEO의 성과가 약간 더 우수한 것으로 보인다. 그러나 조정 RET는 장기재임 CEO에 대해서만 재임연차가 경과하면서 상승하였으며, 특히 7년차 이후 높은 값을 보였다. 이는 장기재임 CEO에 대한 시장에서의 평가와 기대가 주가에 반영되는 데는 ROA나 ROE와 같은 단기실적에 반영되는 것 보다는 시간이 더 걸리며, 이후 재임연차가 경과함에 따라 단기 및 중기재임 CEO와의 차별화가 점차로 명확해지는 것으로 볼 수 있다.

2. CEO 교체와 경영성과에 관한 분석

본 절에서는 국내 증권업의 CEO의 경영역량과 노력이 상당부분 반영되어 나타나는 경영성과와 CEO 교체 간의 관계를 분석한다. 이를 통해 CEO 교체가 CEO의 경영역량과 노력을 이끌어내는 효과적인 규율로서 작동하고 있는지를 논의한다. 경영성과에 따른 CEO 연임과 교체는 CEO의 경영성과 유인을 높여 이들에 대한 효과적인 규율로 작동하는 기제가 됨을 의미한다. 이 외에도 CEO 교체와 경영성과에 관한 분석은 앞서 제시한 장기재임 CEO의 우월한 경영성과에 대한 원인을 논의하고 증권회사 소유지배구조가 CEO 교체에 미치는 영향을 이해하는데 단서를 제공할 것으로 본다.

장기재임 CEO들은 재임초기에 비해 재임중기 이후 우수한 경영성과를 보였다. 이는 장기재임 자체가 CEO의 경영성과에 긍정적으로 작용한 것에서 비롯될 수 있으나, 경영역량이 뛰어난 CEO를 연임시키고 그렇지 않은 CEO를 교체시킨 결과일 수 있다. 즉 장기재임 CEO의 우수한 경영성과는 경영역량이 탁월한 CEO만을 연임시키는 교체과정에 따른 생존편의(survivorship bias)의 결과일 수 있다. 만약 CEO의 교체가 경영성과와 관련이 크다면 장기재임 CEO의 재임중반 이후 우수한 경영성과는 장기재임 자체의 긍정적인 영향 뿐 아니라 교체과정의 효율성에서 비롯되었을 수 있는 것이다.

CEO의 교체는 이사회 또는 지배주주에 의해 결정되기 때문에 기업의 소유지배구조와 밀접한 관련성이 있다. Ⅱ장에서 그룹소속 증권회사의 지배주주는 규모가 매우 큰 은행, 보험회사 또는 여타 비금융 기업을 동시에 소유하는 특징을 가지고 있고, 이러한 이유로 그룹소속 증권회사는 경영역량 외의 그룹 차원의 여러 요인을 함께 고려하여 CEO의 교체를 결정할 가능성이 크다. 즉 그룹소속 증권회사는 독립 증권회사에 비해 경영성과가 CEO 교체에 미치는 영향이 더 작을 수 있다. 본 절에서는 독립 증권회사와 그룹소속 증권회사로 증권회사의 유형을 구분한 분석을 추가함으로써 증권회사 소유지배구조가 CEO 교체에 미치는 영향을 논의한다.

가. CEO 교체와 경영성과: 단변량분석

본 소절에서는 교체된 CEO와 연임된 CEO의 장ㆍ단기 경영성과를 단변량분석을 통해 비교한다. 또한 CEO의 재임연차와 증권회사의 유형에 따라 CEO 교체와 경영성과 간의 관계가 어떻게 달라지는지를 논의한다.

경영성과 지표는 앞 절의 분석에서와 같이 동일연도 CEO들에 대한 경영성과(ROA, ROE, RET) 중위값을 차감한 조정 ROA, 조정 ROE, 조정 RET를 이용한다. 이와 같은 경영성과 지표는 특정연도의 시장수요나 경쟁 여건의 변화에 의해 증권업 전체가 공통적으로 영향을 받게 되는 경영성과를 배제함으로써 회계연도가 다른 CEO 간에도 상호 비교할 수 있는 장점을 가진다.

증권회사는 통상 1년에서 3년 사이의 임기로 CEO와 계약을 하고 계약기간 상의 임기를 마친 CEO를 연임시킬지 또는 교체할지 결정하는 것으로 알려져 있다. 그러나 사업보고서 등의 자료를 검토한 결과, 명시적인 계약기간이 있지 않거나 임기 중으로 판단되는 기간에도 CEO가 교체되는 사례가 적지 않았다. 즉 매년 경영성과나 여타의 사항들을 고려하여 CEO의 교체 여부를 결정하는 경우가 적지 않았던 것으로 보인다. 따라서 본 연구는 임기 내 기간이더라도 교체되지 않고 재임 중인 모든 CEO에 대해 ‘연임 CEO’라는 표현을 사용한다. 연임 CEO는 계약기간 상의 임기를 마치고 재계약된 경우와 함께 계약기간 상의 임기가 남은 시점에서 차기년도에 재임하는 CEO 모두를 의미한다. 분석 자료에서는 특정 CEO가 전년도와 당해년도 모두 경영성과를 가지는 경우 연임 CEO로 보는 반면, 교체 CEO는 전년도의 경영성과만을 가지는 경우로 보았다.

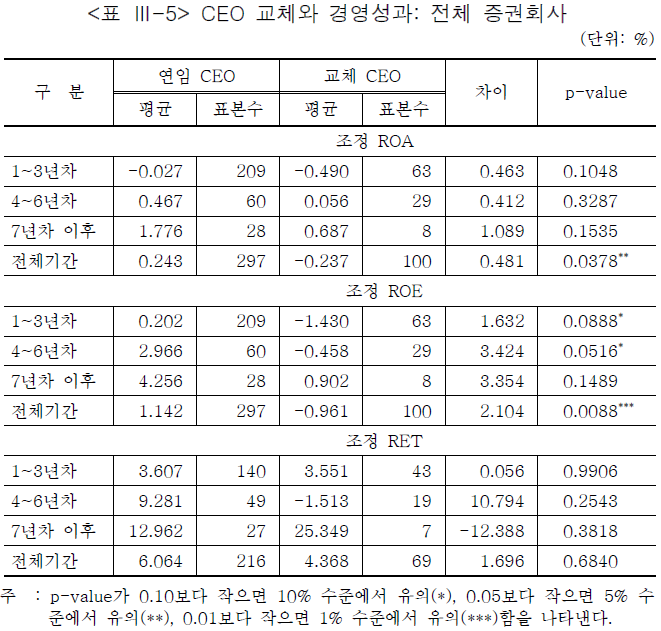

<표 Ⅲ-5>는 CEO가 재임한 전체 기간 뿐 아니라 재임 시기별로 교체 CEO와 연임 CEO의 직전년도 경영성과를 비교하고 있다. 재임 시기는 1~3년차, 4~6년차, 7년차 이후의 재임연차로 구분하였다. 예컨대, 재임 1~3년차 연임 CEO의 경영성과는 1년차, 2년차 또는 3년차에 연임된 CEO들의 해당년도 경영성과를 평균한 값을 나타내고 있다. CEO가 2004년 5월에 선임되어 2007년 6월에 교체된 경우, 2005년과 2006년 3월말 경영성과는 재임 1년차와 2년차에 연임된 CEO의 경영성과로, 2007년 3월말 경영성과는 재임 3년차에 교체된 CEO의 경영성과로 구분하였다.

전체 기간에 대해 분석한 결과, 전반적으로 조정 ROA 또는 조정 ROE가 낮았던 CEO들이 교체되었다. 연임 CEO의 조정 ROA와 조정 ROE는 교체 CEO보다 평균적으로 높았다. 구체적인 수치로 보면, 연임 CEO의 조정 ROA와 조정 ROE는 교체 CEO보다 평균 0.481%p와 2.104%p 높았으며, 이 차이는 통계적으로도 유의적이었다.

재임 시기별 분석 결과에서도 연임 CEO의 조정 ROA와 조정 ROE가교체 CEO보다 높았다. 다만, 그 차이에 대한 통계적 유의성은 존재하지 않거나 크지 않았다. 재임연차가 1~3년차에서 4~6년차, 그리고 7년차 이후의 시기로 올라갈수록 연임 CEO 뿐 아니라 교체 CEO의 단기 경영성과의 지표값도 높아지는 특징을 보이고 있어, CEO를 교체하는 단기 경영성과의 기준이 재임 초기에 비해 재임 중반 이후 더 높았던 것으로 사료된다.

장기 경영성과의 지표인 조정 RET의 경우, 연임 CEO가 평균적으로 교체 CEO보다 높았지만 그 차이는 크지 않았고 통계적 유의성도 보이지 않았다. 재임 시기별 분석결과를 보면, 조정 RET가 재임 1~3년차와 재임 7년차 이후의 시기에서는 CEO 교체 결정에 영향을 주지 못하였던 것으로 보이나 재임 4~6년차에서는 CEO 교체 결정에 다소 영향을 미쳤던 것으로 보인다.

이상의 단변량분석 결과를 정리해보면, 증권회사가 CEO 교체를 결정할 당시 장기보다는 단기 경영성과를 중요하게 고려하였고 재임 시기에 따라 경영성과가 CEO 교체에 미치는 영향이 다소 달랐던 것으로 판단된다.

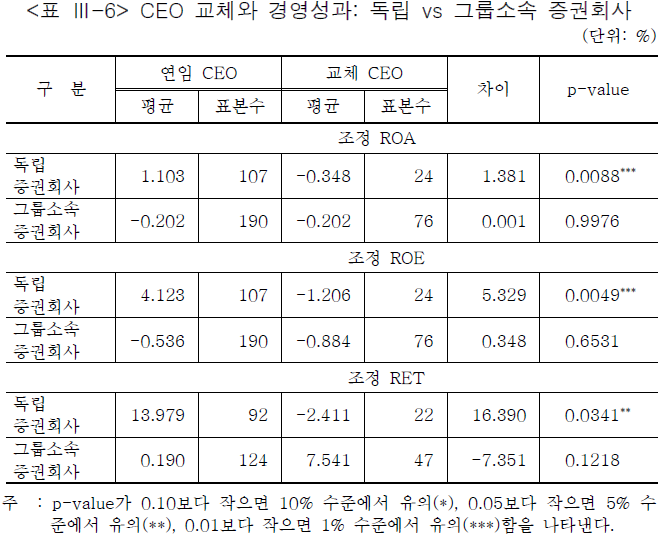

그룹소속 증권회사는 경영성과뿐 아니라 그룹차원의 여러 요인을 고려하여 CEO를 교체할 가능성이 존재하는 바, 이러한 이유로 CEO 교체와 경영성과 간의 관계가 독립 증권회사와 다르게 나타날 수 있다. 이를 고려하여, 독립 증권회사와 그룹소속 증권회사로 구분하고 연임 CEO와 교체 CEO의 직전년도 경영성과의 지표를 비교하였다.

<표 Ⅲ-6>에서 알 수 있듯이, 연임 CEO와 교체 CEO 간 단기 경영성과의 차이가 그룹소속 증권회사보다 독립 증권회사에서 컸다. 연임 CEO와 교체 CEO 간 조정 ROA(조정 ROE)의 차이는 독립 증권회사의 경우 1.381%p(5.329%p)였고 그룹소속 증권회사의 경우 0.001%p(0.348%p)로 나타났다. 이와 같이 독립 증권회사의 경우 조정 ROA와 조정 ROE 모두에 대해 연임 CEO와 교체 CEO 간의 차이가 클 뿐 아니라, 통계적으로도 매우 유의적이었다. 독립 증권회사와는 대조적으로, 그룹소속 증권회사의 경우 교체 CEO의 단기 경영성과가 연임 CEO보다 크게 낮지 않거나 유사한 것으로 나타났다.

독립 증권회사의 경우, 연임 CEO의 조정 RET가 평균적으로 교체 CEO의 조정 RET보다 크게 높았다. 연임 CEO의 조정 RET는 평균 13.979%였고 교체 CEO의 조정 RET는 –2.411%로 둘 간의 차이는 16.39%p였으며, 통계적으로 유의적이었다. 반면 그룹소속 증권회사의 경우, 교체 CEO의 조정 RET가 연임 CEO보다 평균적으로 더 높은 결과를 보였다. 연임 CEO와 교체 CEO의 조정 RET가 각각 0.19%와 7.541%로, 교체 CEO의 조정 RET가 연임 CEO보다 7.351%p 더 높았다.

정리하면, 그룹소속 증권회사는 CEO 교체를 결정할 당시 독립 증권회사보다 조정 ROA, 조정 ROE 또는 조정 RET 외의 다른 요인을 좀 더 고려하였던 것으로 판단된다. 반면 독립 증권회사는 CEO 교체 결정과정에서 단기와 장기 경영성과를 중요한 요인으로 고려하고 우수한 경영성과를 보여준 CEO를 연임시켰던 것으로 판단된다.

나. CEO 교체와 경영성과: 로짓(Logit) 분석

본 소절에서는 로짓모형20)을 이용하여 경영성과 지표가 CEO 교체에 어떠한 영향을 주고 있는지를 평가한다. 또한 증권회사의 유형(독립 vs 그룹소속 증권회사)과 재임 시기별로 경영성과 지표가 CEO 교체에 미치는 영향이 어떻게 다른지도 검토한다.

설명변수로는 경영성과 지표, 증권회사의 유형과 경영성과 지표의 교차항, 연령(age), 발탁경로(‘내부승진’), 출신배경(‘증권출신’) 등 CEO의 특성변수들을 포함하고 있다. CEO의 경영성과 지표로는 앞서와 같이 직전년도 조정 ROA(또는 조정 ROE)와 조정 RET를 사용한다. 또한 직전년도 증권회사 CEO들에 대한 ROA(또는 ROE)와 RET에 대한 중위값으로 구한 증권업 ROA(또는 증권업 ROE)와 증권업 RET를 설명변수로 포함하여 증권업 전체적인 경영성과 지표가 CEO 교체에 미치는 영향도 함께 검토한다. 종속변수는 CEO 교체 시에 1, CEO 연임 시에는 0인 더미변수를 사용한다.

본 소절의 로짓 분석은 경영성과 지표로 조정 ROA(또는 조정 ROE)와 조정 RET를 모두 가지는 상장 증권회사를 대상으로 한다. 전체 분석대상 증권회사 CEO의 회계연도별 경영성과에 대한 표본 수 471개 중 상장 증권회사 CEO에 대한 표본 수가 346개였고, 중대형 증권회사 상당수가 상장 증권회사로 증권업을 대표하는데 무리가 없을 것으로 보았다. 더욱이 비상장 증권회사 또는 전체 분석대상 증권회사를 대상으로 조정 ROA와 조정 ROE만을 포함하여 실시한 로짓모형의 분석 결과는 상장 증권회사만을 대상으로 한 것과 질적으로 다르지 않았고 양적으로도 매우 유사하였다. 이에 보고서에서는 이에 대한 분석 결과를 따로 보고하거나 논의하지 않는다.

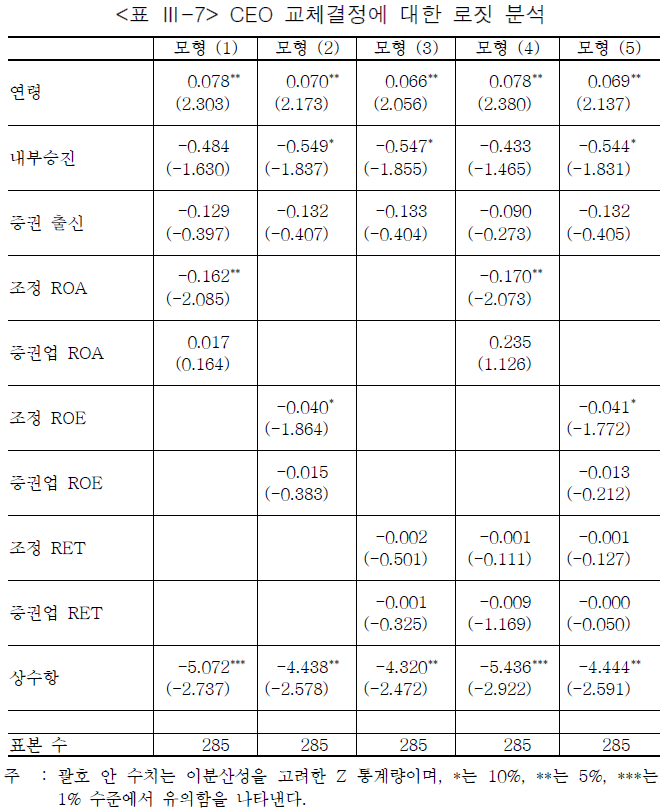

<표 Ⅲ-7>은 로짓모형의 분석 결과로서 경영성과 또는 특성변수가 CEO 교체에 미치는 영향을 보여주고 있다. 경영성과 지표로 조정 ROA와 증권업 ROA만을 포함한 모형 (1)에서의 분석 결과를 보면, 조정 ROA는 CEO 교체에 미치는 효과가 유의적으로 나타났으나 증권업 ROA의 경우 CEO 교체에 미치는 효과가 없었다. 경영성과 지표를 조정 ROA와 증권업 ROA 대신 조정 ROE와 증권업 ROE로 대체한 모형 (2)에서도 모형 (1)과 같이 조정 ROE에 대해서만 유의적인 계수 추정치를 보였다. 이와 같은 조정 ROA와 조정 ROE에 대한 분석 결과는 조정 RET와 증권업 RET를 설명변수로 추가한 모형 (4)와 모형 (5)에서도 유사하게 나왔다. 앞서 언급하였듯이 비상장 증권회사와 전체 분석대상 증권회사에 대한 분석에서도 이러한 결과는 질적으로 다르지 않게 나왔다.

경영성과 지표로 조정 RET와 증권업 RET만을 포함한 모형 (3)의 분석 결과, 조정 RET와 증권업 RET 모두 CEO 교체에 영향을 주지 않는 것으로 나타났다. 경영성과 지표로 조정 ROA와 증권업 ROA, 또는 조정 ROE와 증권업 ROE를 추가한 모형 (4)와 모형 (5)에서도 조정 RET와 증권업 RET 모두 CEO 교체에 영향을 주지 않는 것으로 나타났다.

증권업 전반적으로 보면, 단기 경영성과의 지표인 ROA나 ROE가 CEO 교체에 영향을 주었던 반면 장기 경영성과의 지표인 RET는 CEO 교체에 영향을 주지 않았던 것으로 사료된다.

그 외 CEO의 특성변수가 CEO 교체에 미친 영향을 분석한 결과, 모형 (1)~(5)에서 공통적으로 CEO의 연령이 높을수록 CEO가 교체될 가능성이 높아지고, 내부승진인 경우 CEO가 교체될 가능성이 낮아지는 것으로 나왔다. 그러나 CEO가 증권출신인지 여부에 따라 CEO 교체 가능성은 달라지지 않은 것으로 나왔다.

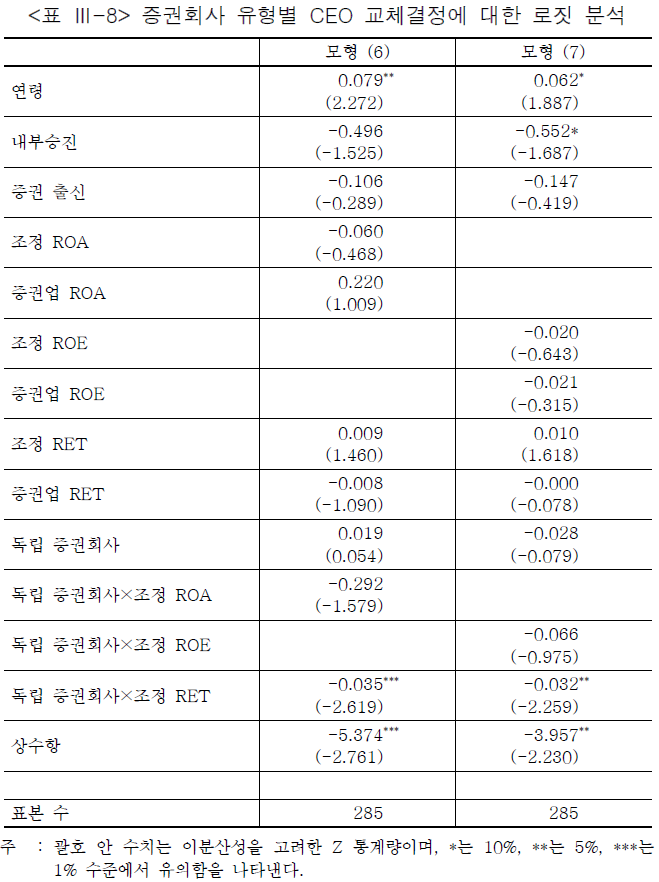

<표 Ⅲ-8>은 독립 증권회사와 그룹소속 증권회사로 구분하여 증권회사의 소유구조에 따라 경영성과 지표가 CEO 교체에 미치는 영향을 분석한 결과를 보여주고 있다. 이와 같은 회귀분석을 위해 독립 증권회사이면 1이 되고 그렇지 않으면 0인 ‘독립 증권회사’ 더미변수를 정의하고, ‘독립 증권회사’ 더미변수와 경영성과 지표의 교차항을 설명변수로 추가하였다. 이러한 교차항의 추정치를 이용하여 증권회사의 소유구조에 따라 경영성과가 CEO 교체에 미치는 영향이 다른지를 검정한다. 모형 (6)은 조정 ROA와 증권업 ROA, 조정 RET와 증권업 RET를 경영성과의 지표로 포함한 분석이며, 모형 (7)은 모형 (6)에서의 조정 ROA와 증권업 ROA 대신 조정 ROE와 증권업 ROE를 단기 경영성과 지표로 이용한 분석이다.

모형 (6)의 분석 결과, ‘독립 증권회사×조정 RET’에 대해 추정된 계수는 1% 수준에서 유의한 음(-)의 값을 보였다. ‘조정 RET’에 대해 추정된 계수는 그룹소속 증권회사에 대한 분석 결과로 양(+)의 값을 보였지만 유의적이지는 않았다. 독립 증권회사는 그룹소속 증권회사보다 조정 RET를 유의적으로 고려하여 CEO 교체를 결정했던 것으로 사료된다.

앞서 <표 Ⅲ-7>의 상장 증권회사 전체를 대상으로 한 모형 (3)~(5)의 분석에서는 조정 RET가 CEO 교체에 영향을 주지 않았는데, 이는 ‘조정 RET’에 대한 양(+)의 추정된 계수와 '독립 증권회사×조정 RET'에 대한 음(-)의 추정된 계수가 결합된 결과에 따른 것으로 보인다. 비록 증권업 전반적으로 볼 때 장기 경영성과가 CEO 교체에 미치는 영향이 없었던 것으로 나왔으나, 증권회사의 유형을 구분해서 보면 독립 증권회사의 경우 장기 경영성과가 CEO 교체에 영향을 주었던 것이다.

모형 (6)에서 볼 수 있듯이, 비록 통계적 유의성이 높지 않았지만 ‘독립 증권회사×조정 ROA’의 경우 음(-)의 추정된 계수를 보였다. 그룹소속 증권회사에 대한 분석 결과인 ‘조정 ROA’에 대한 추정된 계수도 통계적 유의성은 없었으나 음(-)의 값을 보였다. 다만 ‘독립 증권회사×조정 ROA’에 대한 추정 계수치(-0.292)가 절대값에서 ‘조정 ROA’에 대한 추정 계수치(-0.06)보다 컸다. 독립 증권회사는 그룹소속 증권회사보다 CEO 교체 시에 조정 ROA를 더 고려했던 것으로 보인다. 이러한 분석 결과는 조정 ROA 대신 조정 ROE를 사용한 모형 (7)에서도 유사하였다.

이상의 결과로부터, 독립 증권회사는 그룹소속 증권회사보다 CEO 교체 결정에서 장기와 단기 경영성과 지표 모두를 더 고려하였던 것으로 사료된다. 그 이유로는 그룹소속 증권회사는 CEO 교체 결정에서 경영성과 지표 외 그룹차원의 추가적인 요인들을 함께 고려하였기 때문으로 보인다.

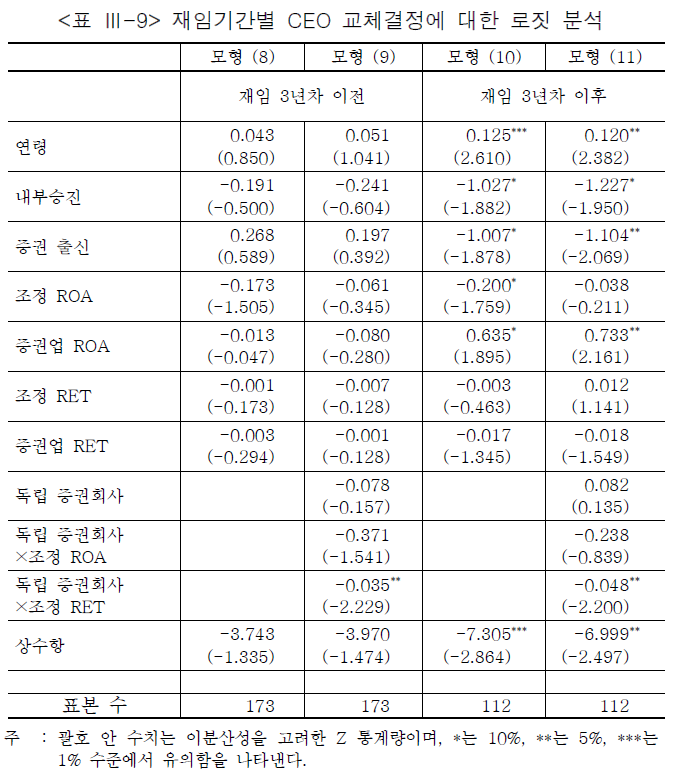

<표 Ⅲ-9>는 재임 시기별로 구분하여 경영성과가 CEO 교체에 미치는 영향을 분석한 결과를 보여주고 있다. 모형 (8)과 (9)는 재임연차가 3년 이하인 CEO의 표본을 대상으로 경영성과가 CEO 교체에 미치는 영향을 분석한 결과를, 모형 (10)과 (11)은 재임연차가 3년을 초과한 CEO의 표본을 대상으로 분석한 결과를 보여주고 있다. 재임기간이 6년이었던 CEO를 예로 들면, 재임 36개월차까지(이후 ‘재임 3년차 이전’이라 한다) 자료에 대해서는 모형 (8)과 (9)의 분석 대상으로 하고 재임 37개월차 이후(이후 ‘재임 3년차 이후’라고 한다) 자료에 대해서는 모형 (10)과 (11)의 분석 대상으로 한 것이다.

재임 3년차 이전 CEO에 대한 모형 (8)의 분석 결과, 조정 ROA와 조정 RET에 대한 추정 계수치 모두 통계적 유의성을 보이지 않는 것으로 나타났다. 이러한 추정 계수치들을 재임 3년차 이후 CEO에 대한 모형 (10)에서의 조정 ROA와 조정 RET에 대한 추정 계수치들과 비교해보면 절대값에서나 통계적 유의성에서 차이가 크지 않았다. 즉 증권업 전반적으로 조정 ROA와 조정 RET가 CEO 교체에 미치는 영향은 재임 시기에 따라 크게 다르지 않은 것으로 사료된다.

모형 (9)와 (11)에서 ‘독립 증권회사×조정 ROA’와 ‘독립 증권회사× 조정 RET’에 대한 추정 계수치는 두 재임 시기(재임 3년차 이전과 이후) 모두 음(-)의 값을 보였고 그 중 ‘독립 증권회사×조정 RET’의 추정 계수치는 통계적으로 유의적이었다. 또한 그룹소속 증권회사에 대한 분석인 모형 (9)와 (11)에서 조정 ROA와 조정 RET에 대한 추정 계수치는 재임 시기에 관계없이 모두 통계적 유의성을 보이지 않았다. 즉 독립 증권회사와 그룹소속 증권회사 모두 재임 3년차 이전의 CEO 교체 결정 시 장ㆍ단기 경영성과를 고려한 정도나 3년차 이후의 CEO에 대해 장ㆍ단기 경영성과를 고려한 정도가 크게 다르지 않았던 것으로 보인다.

3. 소결

본 장에서는 국내 증권회사 CEO의 경영성과가 재임기간에 따라 어떠한 차이를 보이는지 분석하였다. 분석 결과, 재임 1~3년차의 시기에 장기재임 CEO들의 조정 ROA와 조정 ROE가 중기 및 단기재임 CEO들보다 큰 차이는 아니지만 평균적으로 높은 것으로 나타났다. 재임 4~6년차의 시기에서도 장기재임 CEO들의 조정 ROA와 조정 ROE, 조정 RET 모두 중기재임 CEO들보다 평균적으로 높았다. 이는 장기재임 CEO가 우수한 경영역량을 가진 CEO이었을 가능성을 시사하며, CEO에 대한 효과적인 선임결정에 따라 증권회사의 경영성과가 개선되거나 악화될 수 있음을 보여주는 것이다.

또한 재임기간과 경영성과 간의 분석 결과로, 장기재임 CEO는 재임 1~3년차보다는 4~6년차에, 4~6년차보다는 7년차 이후에 더 우수한 경영성과를 보이는 것으로 나타났다. 이러한 장기재임 CEO의 경영성과 특징은 경영성과가 CEO 교체 결정에 영향을 주었다는 분석 결과를 고려해 볼 때 경영역량이 뛰어난 CEO들이 살아남은 생존편의의 결과로 보인다. 동시에 장기재임 CEO가 재임연차가 경과하면서 더 우수한 경영성과를 보였다는 사실 자체는 경영역량이 뛰어난 CEO의 생존편의의 결과이기도 하지만 장기재임 기회의 긍정적인 효과를 보여주는 것이기도 하다. 사실 CEO는 장기로 재임함으로써 자신이 경영하는 증권회사의 직원과 문화, 구체적인 사업 내용에 대해 충분히 파악할 수 있고 일관적이면서 효과적인 경영전략을 구사할 수 있다.

분석대상 증권회사 전체에 대해 CEO 교체와 경영성과 간의 관계를 분석한 결과, 단기 경영성과가 CEO 교체 결정에 영향을 주었던 반면 장기 경영성과는 그렇지 않았던 것으로 나왔다. 다만, 증권회사의 소유구조에 따라 구분해서 분석한 결과는 독립 증권회사는 CEO 교체 결정에서 단기 경영성과를 그룹소속 증권회사보다 더 고려했을 뿐만 아니라 장기 경영성과도 유의적으로 고려하였음을 보여준다. 즉 독립 증권회사는 장·단기 경영성과를 유의적으로 고려하여 CEO의 교체를 결정한 반면 그룹소속 증권회사는 경영성과 외에도 그룹 차원의 여러 상황들을 고려한 것으로 보인다. 따라서 독립 증권회사의 경우, CEO 교체과정이 CEO의 경영역량과 노력을 이끌어내는 규율로서 작용하는데 기여했을 것으로 사료된다. 마지막으로 CEO에 대한 교체 결정 시 경영성과를 고려하는 정도는 재임 3년차 이전과 3년 이후로 구분했을 때 크게 다르지 않았던 것으로 보인다.

Ⅳ. 결론 및 시사점

국내 증권업은 최근 심화된 경쟁 환경에서 수익 개선을 위해 많은 변화를 꾀하고 있다. 증권회사들은 주요 수익원인 위탁매매 부문에서 수익성을 확보하기 어려워진 가운데, 투자은행과 자산관리, 파생결합증권 등으로 수익원을 다양화하고 있다. 또한 대형 증권회사들은 초대형 투자은행으로 탈바꿈하려 하고 있고 중소형 증권회사들도 특화된 영역에서 나름의 생존전략을 찾으려는 움직임이 일어나고 있다. 한편 현재의 이러한 변화 속에서 각자 나름의 차별화된 성장 전략을 발굴하고 추진할 CEO의 중요성이 커지고 있음은 명확하다. CEO의 짧은 재임기간이 증권회사들의 경쟁력 제고를 어렵게 만든다는 업계의 오래된 우려와 함께 최근 증권업에서 요구되고 있는 CEO의 중추적 역할을 고려하여, 본 연구는 CEO의 선임과 교체, 재임기간과 경영성과 간의 관계에 초점을 두고 분석하였다.

본 보고서의 분석 결과를 요약하면 다음과 같다. 첫째, 국내 증권업계에는 전문 CEO의 ‘2년 또는 3년 재임’이라는 틀이 상당한 정도로 형성되어 있으며, 이와 같은 재임기간은 미국이나 일본의 주요 증권회사 CEO들의 재임기간에 비하여 현저하게 짧았다. 다만, ‘2년 또는 3년 임기’의 단기재임 CEO가 차지하는 비중이 상당히 높았지만 6년을 초과한 장기재임 CEO도 적지 않았다. 둘째, 장기재임 CEO는 자본시장에서 오랜 경험을 쌓은 증권 출신이거나 충분한 검증이 가능한 내부승진 CEO들이었다. 셋째, 장기재임 CEO의 경영성과는 여타의 재임기간을 가졌던 CEO보다 전반적으로 우수하였을 뿐 아니라 재임연차가 경과함에 따라 꾸준히 향상되는 모습을 보였다. 그 원인은 장기재임 CEO의 경우 교체과정에서 생존편의의 결과로 살아남은 탁월한 CEO들일 뿐 아니라 그들이 장기재임의 기회를 통해 자신의 우수한 경영역량을 일관성 있고 효과적으로 펼칠 수 있었기 때문으로 판단된다. 넷째, 증권회사 전반적으로 단기 경영성과가 CEO 교체 결정에 영향을 주었던 반면 장기 경영성과는 그렇지 않았다. 다섯째, 독립 증권회사는 장?단기 경영성과를 유의적으로 고려하여 CEO의 교체를 결정한 반면 그룹소속 증권회사는 경영성과 외에도 그룹 차원의 여러 상황들을 고려한 것으로 보인다. 이에 독립 증권회사의 경우, CEO 교체과정이 CEO의 경영역량과 노력을 이끌어내는 규율로서 작용하는데 기여했을 것으로 사료된다. 마지막으로 CEO에 대한 교체 결정 시 경영성과를 고려하는 정도는 재임 3년차 이전과 3년 이후로 구분했을 때 크게 다르지 않았던 것으로 보인다.

본 연구는 무엇보다도 CEO의 선임과 교체, 재임기간에 대한 증권회사의 정책에 따라 경영성과가 개선되거나 악화될 수 있음을 제시하고 있다. 이에 증권회사들이 CEO가 기업의 경영철학을 구현하고 주주의 부를 극대화할 수 있도록 하는 CEO의 선임과 교체와 관련된 체계를 마련하는 것이 바람직하다. 관련하여, CEO의 선임과 교체, 재임기간에 대한 구체적인 시사점을 다음과 같이 제시하고자 한다.

우선 ‘2년 또는 3년 임기’라는 경직적인 틀이 갖는 문제점이다. 현재 상당수의 증권회사 CEO들은 단기 임기로 인해 자신의 비전과 철학을 경영전략에 반영하거나 성과가 가시적으로 나타나기 전에 CEO 자리를 떠나야 하고 후임자는 다시 처음부터 시작해야 하는 패턴이 반복되고 있다. 증권회사들의 차별화된 서비스나 네트워크 등 장기적 역량 축적을 위한 투자의 부재는 CEO의 짧은 재임기간 때문일 가능성이 높다. 다른 증권회사와 차별화된 자신만의 고유한 역량구축은 장기간에 걸쳐 일관성 있는 경영전략이 추진될 때 가능하기에, 증권회사들은 2년 또는 3년마다 CEO를 교체하는 관행을 개선할 필요가 있다.

장기재임 CEO는 여타의 재임기간을 가졌던 CEO보다 우수한 경영성과를 보였으며 재임연차가 경과함에 따라 경영성과도 향상되었다. 이러한 장기재임 CEO의 우수한 경영성과는 경영 역량이 뛰어난 CEO를 선임한 것과 이들에 대한 지배주주의 신뢰에 기인한 측면이 있다. 만약 자사의 경영비전과 방침에 적합한 역량을 가진 CEO 후보를 발굴ㆍ양성하고 철저한 검증을 거쳐 CEO를 선임한다면, 이사회 및 지배주주는 깊은 신뢰를 가지고 CEO가 자신의 역량을 발휘할 때까지 인내심을 갖고 기다려줄 수 있을 것이다. 이러한 과정에서 CEO가 장기적으로 재임할 수 있다면, 자신이 경영하는 증권회사의 직원과 문화, 구체적인 사업 내용에 대해 충분히 파악할 수 있고 일관적이면서 효과적인 경영전략을 구사할 수 있다. 즉 효율적인 CEO의 선임과정은 장기재임할 수 있는 CEO를 발굴하고 이들이 우수한 경영성과를 내도록 하는데 있어서 중요한 전제조건이다.

CEO가 선임된 직후 2~3년 기간의 경영성과는 전임 CEO의 경영활동이나 조직체계 등 CEO가 물려받은 경영여건에 의해 영향을 받을 수 있다. 뿐만 아니라 새로운 경영전략이 시장에서 평가받기까지는 시간이 걸린다. 이러한 이유로 CEO가 선임된 후 2년 또는 3년 동안의 경영성과로 CEO를 평가하는 것은 매우 어렵고 바람직하지 않을 수 있다. 그러나 동시에 CEO의 경영역량과 그들의 노력을 이끌어내는 규율 메커니즘으로서 CEO 교체 정책은 매우 중요하다. 즉 증권회사들은 CEO 재임 초기에는 인내심을 갖고 기다려주되, 그 이후에는 경영성과에 따른 CEO 교체 정책을 확고하게 수립하여 CEO들로 하여금 자신의 역량을 최대한 발휘하도록 유도해야 할 것이다.

1) 기업지배구조 관점에서 CEO 문제를 다룬 다수의 연구들이 이 측면에 초점을 맞추고 있다. (Jensen, 1993; Hermalin & Weisbach, 1998)

2) 본장과 Ⅲ장 1절은 이석훈ㆍ조성훈(2017)의 내용을 확장ㆍ발전시킨 것임을 밝힌다.

3) 과거 ‘종합증권회사’로 구분되던 증권회사들과 거의 일치한다.

4) 예를 들어 한국ECN증권, KIDB채권중개, 코리아에셋투자증권 등이 이에 해당한다.

5) 예를 들어 이베스트투자증권(이트레이드증권), 유안타증권(동양증권) 등이 이에 해당한다.

6) 총 179명의 CEO 수는 대표이사가 2인 이상인 공동 CEO 모두를 포함한 것이며, Ⅲ장 분석에서는 공동 CEO 중 대표 CEO 1인만을 포함한다.

7) 따라서 증권회사가 전체 그룹 자산의 30% 이상을 차지하는 경우에는 실제로는 그룹에 소속되어 있음에도 불구하고 본 보고서에서는 독립 증권회사로 분류된다.

8) 이 60개월이라는 수치는 <표 Ⅱ-3>에서 제시된 전문 CEO의 평균 재임기간 38.9개월보다 긴데, 그 이유는 <그림 Ⅱ-4>의 연도별 추이 분석에서는 장기재임한CEO들의 표본이 단기재임한 CEO보다 매년 반복적으로 합산되는 빈도가 높기 때문이다.

9) CEO는 ‘대표이사’로서 이사의 1인이다.

10) 이 경우 장기재임 CEO의 비중이 다소 과대평가될 소지가 있으나 분석기간 중 임의년도 기준으로 CEO 또는 증권회사 유형에 따라 재임기간의 분포가 어떠한지를 보고자하는 목적에는 이와 같은 계산방식이 적절한 것으로 판단하였다.

11) 조사 대상 미국 중소형 투자은행 6개사는 최순영(2015)을 근거로 선정하였다.

12) 2016년 12월 현재 현직 CEO의 재임기간은 2016년 12월까지 재임하는 것으로 가정하여 국내 증권회사에 대한 분석과 동일하게 산출하였다. 따라서 국내외 모두제시된 수치와 분포는 현직 CEO의 실제 재임기간보다 짧게 계산된 것이다.

13) 미국 대형사에서 3년 이하로 재임한 CEO는 단 2명으로, Merrill Lynch BoA의 John Thain과 Kenneth Lewis이다. 이들은 모두 서브프라임 사태 이후 금융위기의 와중에서 위기에 빠진 Merrill Lynch를 수습하고 BoA에 인수되는 과정에서CEO로 재임한 인물들이다.

14) CEO의 단기재임과 관련된 중요한 이슈로서 단기업적주의(short-termism)의 문제가 있으며, 투자은행을 비롯한 미국 기업에서 지속적으로 지적되어 왔다. 일각에서는2008년 금융위기를 초래한 원인의 하나로 단기업적주의를 지적하기도 하였다.그러나 미국 기업의 경우는 단기업적주의가 CEO의 경직적인 단기재임에 따른문제가 아니라 상장기업으로서 단기실적을 추구하는 시장(주주)의 압력에 따른문제(Asker et al., 2015; Bernstein, 2015; Ferreira et al., 2014)로 파악되고있다는 점에서 국내 증권업과는 약간의 차이가 있다.

15) 외환위기 이후 구조조정에 따라 투자신탁으로부터 분리된 증권회사를 가리킨다.

16) 통상 ROE는 당기순이익을 자기자본으로 나누어 계산되나, 본 보고서에서는 증권회사의 본질적 비즈니스를 통한 CEO의 경영성과에 초점을 맞추기 위하여 영업이익을 사용하였다.

17) 표본수가 작아 평균이 이상치(outlier)의 영향을 많이 받을 수 있다는 가능성을 고려하여 중위값을 이용하여 조정 ROA와 조정 ROE를 구하였다. 평균을 이용하여조정하여도 분석 결과는 본질적으로 동일하다.

18) <그림 Ⅲ-2>는 월별 조정 CAR를 보여주고 있으며, 증권회사(즉 CEO)별로 일별조정초과수익률을 계산하고, 이를 월 단위로 누적하여 조정 CAR를 구한 다음,재임기간으로 구분한 CEO의 유형별 해당 월의 평균 조정 CAR를 계산하여 그래프로나타낸 것이다. 따라서 조정 CAR와 CEO의 매칭 방법이 <표 Ⅲ-1>과 다르다.

19) 단기재임(a) 그래프와 중장기재임(b) 그래프의 종축(수익률)의 눈금을 비교하면 절대적크기의 차이를 알 수 있다.

20) 로짓 모형은 CEO의 경영성과, 특성 등의 변수(![]() )가 주어졌을 때 CEO 교체(

)가 주어졌을 때 CEO 교체(![]() )의 조건부 확률이

)의 조건부 확률이 ![]() 으로 정의된 모형이다. 여기서,

으로 정의된 모형이다. 여기서, ![]() 는 로지스틱분포의 누적확률이다.

는 로지스틱분포의 누적확률이다.

참고문헌

금융위원회, 2011. 7. 26, 자본시장과 「 금융투자업에 관한 법률」개정안 입법예고, 보도자료.

금융위원회, 2013. 4. 9,「자본시장과 금융투자업에 관한 법률」개정안 정무위 법안소위 통과, 보도자료.

금융위원회, 2016. 8. 2, 초대형 투자은행 육성을 위한 종합금융투자사업자제도 개선방안, 보도자료.

금융위원회, 2017. 5. 2,「초대형 투자은행 육성방안」및「공모펀드 시장 활성화」를 위한 자본시장법 시행령 및 금융투자업규정 개정, 보도자료.

김수정ㆍ박종훈ㆍ김창수, 2012, 기업집단의 최고경영자 활용 및 퇴출에 관한 연구: 재벌집단과 비재벌집단 간 비교,『경영학연구』제41권, 483-510.

신현한ㆍ장진호, 2003a, 소유구조가 최고경영자 교체에 미차는 영향,『금융학회지』제8권, 15-39.

신현한ㆍ장진호, 2003b, 최고경영자의 교체에 따른 경영성과 변화,『재무연구』제16권, 231-256.

신현한ㆍ장진호, 2005, 최고경영자 교체에 영향을 미치는 요인분석: 경영성과, 전문경영자, 대규모기업집단,『경영학연구』제34권, 289-311.

심동석ㆍ안창호, 2012, 최고경영자 교체와 기업가치,『회계정보연구』제30권, 315-335.

심동석ㆍ조승제ㆍ안창호, 2016, 최고경영자 교체유형별 이익조정측정치와 주가간의 관계,『회계정보연구』제34권, 485-507.

이석훈ㆍ조성훈, 2017,『국내 증권업 CEO 재임기간과 경영성과 분석』, 자본시장연구원 이슈보고서 17-08.

조성훈, 2017, 우리나라 증권업 CEO 재임기간과 경영활동,『자본시장포커스』오피니언 2017-23호, 자본시장연구원.

최순영, 2015,『미국 증권회사의 특화ㆍ전문화 전략: 부티크IB 사례 중심으로』, 자본시장연구원 조사보고서 15-05.

최웅용ㆍ배현정, 2009, 기업지배구조가 최고경영자 교체에 미치는 영향, 『회계정보연구』제27권, 95-124.

Allgood, S., Farrell, A., 2000, The effect of CEO tenure on the relation between firm performance and turnover, Journal of Financial Research 23, 373-390.

Asker, J., Farre-Mensa, J., Ljungqvist, A.L., 2015, Corporate investment and stock market listing: A Puzzle? Review of Financial Studies 28, 342-390.

Bennedsen, M., Nielsen, K.M., Perez-Gonzales, F., Wolfenzon, D., 2007, Inside the family firm: The role of families in succession decision and performance, Quarterly Journal of Economics 122, 647-691.

Bernstein, S., 2015, Does going public affect innovation? Journal of Finance 70, 1365-1403.

Dechow, P.M., Sloan, R.G., 1991, Executive incentives and the horizon problem: An empirical investigation, Journal of Accounting and Economics 14, 51-89.

Denis, D.J., Denis, D.K., 1995, Performance changes following top management dismissals, Journal of Finance 50, 1029-1057.

Denis, D.J., Denis, D.K., Sarin, A., 1997, Ownership structure and top executive turnover, Journal of Financial Economics 45, 193-221.

Ellis, J., Guo, L., Mobbs, S., 2017, Learning from forced CEO turnover experience, https://ssrn.com/abstract=2543716.

Engel, E., Hayes, R.M., Wang, X., 2003, CEO turnover and properties of accounting information, Journal of Accounting and Economics 36, 197-226.

Fee, C.E., Hadlock, C.J., Huang, J., Pierce, J.R., 2017, Robust models of CEO turnover: New evidence on relative performance evaluation, https://ssrn.com/abstract=2616738.

Ferreira, D., Manso, G., Silva, A.C., 2014, Incentives to innovate and the decision to go public or private, Review of Financial Studies 27, 256-300.

Fich, E.M., Shivdasani, A., 2006, Are busy boards effective monitors? Journal of Finance 61, 689-724.

Gonzalez-Uribe, J., Groen-Xu, M., 2017, CEO contract horizon and innovation, https://ssrn.com/abstract=2633763.

Guo, L., Masulis, R.W., 2015, Board structure and monitoring: New evidence from CEO turnovers, Review of Financial Studies 28, 2770-2811.

Hermalin, B.E., Weisbach, M.S., 1998, Endogenously chosen boards of directors and their monitoring of the CEO, American Economic Review 88, 96-118.

Huson, M.R., Parrino, R., Starks, L.T., 2001, Internal monitoring mechanisms and CEO turnover: A long-term perspective, Journal of Finance 56, 2265-2297.

Huson, M.R., Malatesta, P.H., Parrino, R., 2004, Managerial succession and firm performance, Journal of Financial Economics 74, 237-275.

Jensen, M.C., 1993, The modern industrial revolution, exit, and the failure of internal control systems, Journal of Finance 48, 831-880.

Jenter, D., Lewellen, K., 2014, Performance-induced CEO turnover, CEPR Discussion Paper No. DP12274.

Jenter, D., Kanaan, F., 2015, CEO turnover and relative performance evaluation, Journal of Finance 70, 2155-2183.

Manso, G., 2011, Motivating innovation, Journal of Finance 66, 1823-1860.

Marinovic, I., Varas, F., 2017, CEO horizon, optimal duration and the escalation of short-termism, Working Paper.

McNeil, C., Niehaus, G., Powers, E., 2004, Management turnover in subsidiaries of conglomerates versus stand-alone firms, Journal of Financial Economics 72, 63-96.

Murphy, K.J., Zimmerman, J.L., 1993, Financial performance surrounding CEO turnover, Journal of Accounting and Economics 16, 273-315.

Weisbach, M.S., 1995, CEO turnover and the firm’s investment decisions, Journal of Financial Economics 37, 159-188.

금융감독원 전자공시스템 dart.fss.or.kr