OPINION

2023 Dec/05

Forecast and Implications of Neutral Real Interest Rates in Response to Economic Structural Transformation

Dec. 05, 2023

PDF

- Summary

- Amid concerns about the persistent high-interest rate environment in the US and other major economies, discussions in Korea, particularly led by the Bank of Korea, are underway regarding the potential decline in the neutral real interest rate caused by population aging. The aging population that entails a decrease in the working-age population contributes to reducing the demand for funds, while simultaneously increasing the supply of funds through the elderly’s excess savings, leading to a drop in the neutral real interest rate. Considering that the neutral real interest rate serves as a reference rate for monetary policy, its decline implies an inevitable policy shift towards lower interest rates. This article employs a model encompassing economic structural changes such as population aging to project the neutral real interest rate for Korea and the US. Analysis findings indicate a potential rebound in the US neutral real interest rate, driven by improvements in productivity and an expansion of government debt, whereas the neutral real interest rate in Korea is anticipated to remain at low levels without remarkable changes. This result could suggest that the sharp decline in economic growth driven by population aging may narrow the difference between growth rates and the neutral real interest rate, which casts doubt on the long-term sustainability of government debt. Furthermore, the potential structural inversion of domestic and foreign interest rate differentials implies that Korea’s monetary independence may be limited by central banks of major economies. This can also pose a challenge for Korean monetary authorities in implementing policy responses to secular stagflation.

Following the outbreak of the Covid-19 pandemic, major economies witnessed a significant increase in liquidity and disruptions in global supply chains, causing inflation to rapidly escalate. In response, their central banks substantially raised benchmark interest rates. It was initially expected that interest rates would stabilize downward promptly on the back of the contraction in the real economy fueled by high interest rates. However, the US economy shows resilience and inflation in major economies stays at high levels and thus, the high interest rate environment has persisted longer than anticipated. Amid these developments, international financial markets are deliberating whether after inflation subsides, long-term stagnation similar to the one resulting from the global financial crisis will make a comeback, or high interest rates will be entrenched due to the expansion of government debt and rising inflation. Korea is also experiencing a similar situation. Recently (on November 6), Governor Rhee, Chang-yong of the Bank of Korea and Profession Lawrence Summers of Harvard University expressed divergent views on the future direction of Korea’s neutral real interest rate at the Bank of Korea-World Bank Seoul Forum.1) Professor Summers predicted Korea’s neutral interest rate to increase in sync with global trends, while Governor Rhee suggested that the neutral interest rate would be on a gradual decline because population aging and low fertility will lead to low growth.

Significance and trends of neutral real interest rates

First of all, it is necessary to briefly examine the concept of the neutral real interest rate, which is at the center of the discussion. Alan Blinder, former Vice Chairman of the Federal Reserve, defined the neutral real interest rate as the real interest rate that aligns with potential GDP and stable inflation rates in the medium to long term, without stimulating or tightening the economy. According to this definition, if the real interest rate is lower than the neutral real interest rate, inflation will not maintain stable levels and go up in the medium to long term. Conversely, inflation will fall if the real interest rate is higher. The neutral real interest rate is of great importance in monetary policy or financial markets in that it serves as a reference rate to assess whether a policy interest rate adjusted by central banks is tight or relaxed. If the real policy rate is lower than the neutral real interest rate, monetary policy is considered relaxed. For this reason, the neutral real interest plays a pivotal role in determining policy rates under various monetary policy rules. Notably, numerous research findings suggest that the neutral real interest rate, which has been regarded to be stable for an extended period, has declined since the global financial crisis. Based on this analysis result, the neutral real interest rate has been widely accepted as a theoretical basis for low interest rate policies and thus, has been integrated into the monetary policy framework of major economies.

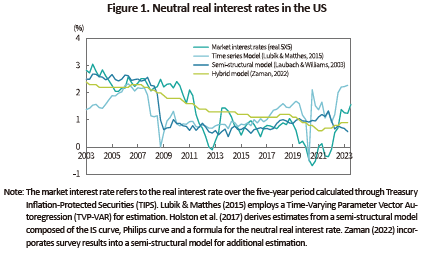

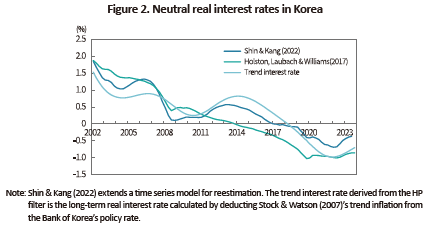

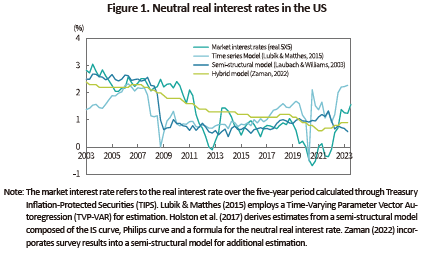

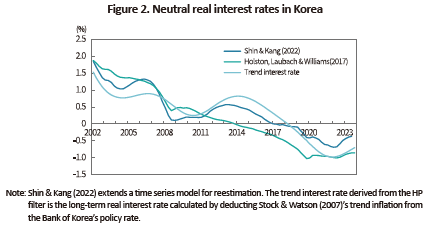

Concerning the possibility of prolonged high-interest rates, central banks and financial markets are primarily concerned with whether inflation will persist at higher levels due to deglobalization and other factors and whether the neutral real interest rate will increase. In this context, leading investment banks such as Goldman Sachs and Deutsche Bank have presented findings that the sustained decline in the neutral real interest rate in the US, fueled by the global financial crisis, has come to an end, albeit with the possibility of a rebound. As the neutral real interest rate cannot be observed and its definition is abstract, economists take different approaches to its estimation, resulting in a wide range of estimates. Although this makes it challenging to reach the same conclusion, the estimates shown in Figure 1 generally suggest that the declining trend in the US has disappeared while some are even on the rise. In the case of Korea, the neutral real interest rate has persistently dropped since the 2000s, in line with the fall in potential growth rate. Recently, however, its decline trend shows a sign of halting (Figure 2).

Population aging and the neutral real interest rate

In light of the concerns voiced by Bank of Korea Governor Rhee, is there a discernible relationship between population aging and the neutral real interest rate? Like any interest rate, the neutral real interest rate can be distinguished between the demand and supply of funds. Firstly, if the working-age population is reduced due to population aging, the economic scale is curtailed, contracting the demand for capital required for production. As a result, the investment demand for capital expansion decreases, leading to a reduction in the demand for funds. On the other hand, as population aging and low fertility exacerbate, financial assets become disproportionately concentrated in the elderly population and thus, excessive savings held by the elderly boost the supply of funds. Consequently, the demand for funds dwindles while the supply increases, resulting in a decline in the equilibrium level of interest rates, i.e., the neutral real interest rate.

Long-term outlook on the neutral real interest rate in Korea and the US

What impact will economic structural changes, including population aging, have on the long-term neutral real interest rate? Kang, Baek & Jang (2023) employs a methodology that models on the process of production, borrowing, saving and retirement for individuals aged 20 to 99, based on long-term population forecasts of the United Nations. Drawing on the model, the study aims to estimate the real interest rate required to achieve a balance between saving and borrowing in the asset market. The model not only focuses on the population structure but also reflects long-term changes in productivity, the expansion of government debt, and external factors such as global interest rates as highlighted by Professor Summers.

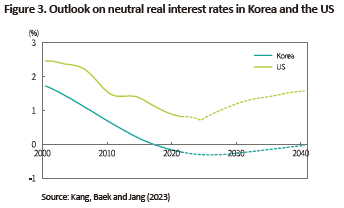

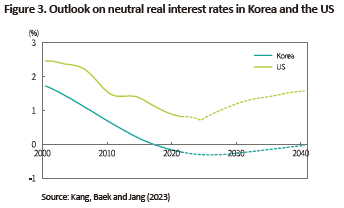

The analysis reveals significant divergences in the long-term trajectories of the neutral real interest rates between Korea and the US. As the US is anticipated to experience the slowest population aging among advanced countries, population aging is expected to have a relatively limited impact on interest rate cuts. With expected improvements in sluggish productivity coupled with a surge in government debt, its neutral real interest rate is projected to climb by 0.75 percentage points by 2040. Considering the long-term relationship between the neutral real interest rate and the 10-year Treasury yield, it suggests an additional 1.15% to 1.35% increase in the 10-year Treasury yield. As for Korea, however, the impact of population aging is expected to offset positive factors such as improvements in global productivity, the expansion of Korean government debt and global rate hikes. As a result, its neutral real interest rate is projected to hover around 0% practically, with a modest increase of 0.25 percentage points during the same period.

Implications for macroeconomic stabilization policy

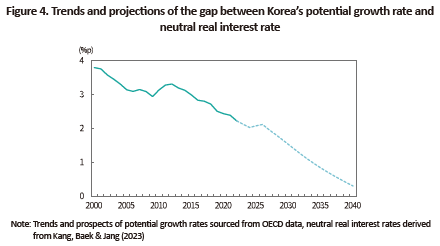

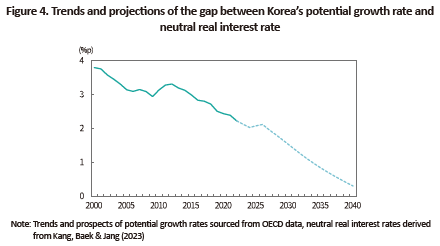

These findings not only imply that economic structural transformation can bring about a prolonged era of high interest rates globally but also highlight significant challenges for Korea to implement policy responses. As the National Assembly Budget Office projects that the government debt-GDP ratio may reach 100% by 2040, it could raise concerns about the sustainability of debt amid the potential plunge in economic growth rates. If the economic growth rate is higher than interest rates, the government debt could stabilize in the long term as the increase in the growth rate denominator of the government debt-to-GDP ratio exceeds that of the numerator. However, it should be noted that amid the expectation for the structural expansion of fiscal demand, the gap between the growth rate and the neutral real interest rate2) is likely to narrow gradually as illustrated in Figure 4. This leads to a growing need for stable fiscal management.

On the monetary policy front, there is a substantial risk that Governor Rhee’s concerns are likely to become a reality. As the neutral real interest rates in Korea and the US are anticipated to follow divergent paths, the interest rate gap between the two countries is projected to widen further. Accordingly, the ongoing inversion of the interest rate differential between Korea and the US may be structurally prolonged or exacerbated, potentially sparking controversy over whether monetary policy decisions can be made independently from central banks of major economies.

Meanwhile, a low neutral real interest rate represents a sign of sluggish economic growth. Given that inflation may stem from supply-side factors such as deglobalization or a shortage of the working-age population, it implies that the Korean economy could enter a secular stagflation phase. In this situation, if monetary authorities insist on achieving a low inflation target without allowing for structural inflationary factors, unintended tightening effects may arise. This essentially requires relevant authorities to present policy responses underpinned by meticulous analysis of economic structural changes and external conditions.

1) Yonhap Infomax, November 6, 2023, Contrasting views on the neutral interest rate in Korea: Bank of Korea Governor Rhee, Chang-yong predicts a decline due to population aging while Professor Summers projects the rate to follow global trends.

2) In a standard economic model, the neutral real interest rate is composed of the potential growth rate and other factors, the latter corresponding to the negative (-) discount factor. In the Korean economy, factors such as employment insecurity and increased macroeconomic uncertainty have led to an expansion of the discount factor (a decline in other factors), in the aftermath of the 1997 Asian financial crisis and the 2008 global financial crisis. As a result, economic agents have deferred consumption and increased savings, causing the neutral real interest rate to significantly hover below the potential growth rate.

References

Holston, K., Laubach, T., Williams, J., 2017, Measuring the natural rate of Interest: international tends and determinants, Journal of International Economics 108, S59-S75.

Lubik, T., Matthes, C., 2015, Time-varying parameter vector autoregressions: Specification, Estimation and an Application, Economic Quarterly 101(4), 323-352, Federal Reserve Bank of Richmond.

Stock, J.H., Watson, M.H., 2007, Why has U.S. inflation become harder to forecast, Journal of Money, Credit and Banking 39(1), 3-33.

Zaman, S., 2022, A unified framework to estimate macroeconomic stars, Federal Reserve Bank of Cleveland, Working Paper No. 21-23R

[Korean]

Kang, H.J., Baek, I.S. and Jang, G.H., 2023, Assessment of potential structural changes in the interest rate regime, Presentation materials for LCMI inaugural seminar.

Shin, I.S. and Kang, H.J., 2022, Evaluation and issues in Korea’s recent monetary policy stance, Journal of Korean Economy Studies, 14(4), 25-55.

Significance and trends of neutral real interest rates

First of all, it is necessary to briefly examine the concept of the neutral real interest rate, which is at the center of the discussion. Alan Blinder, former Vice Chairman of the Federal Reserve, defined the neutral real interest rate as the real interest rate that aligns with potential GDP and stable inflation rates in the medium to long term, without stimulating or tightening the economy. According to this definition, if the real interest rate is lower than the neutral real interest rate, inflation will not maintain stable levels and go up in the medium to long term. Conversely, inflation will fall if the real interest rate is higher. The neutral real interest rate is of great importance in monetary policy or financial markets in that it serves as a reference rate to assess whether a policy interest rate adjusted by central banks is tight or relaxed. If the real policy rate is lower than the neutral real interest rate, monetary policy is considered relaxed. For this reason, the neutral real interest plays a pivotal role in determining policy rates under various monetary policy rules. Notably, numerous research findings suggest that the neutral real interest rate, which has been regarded to be stable for an extended period, has declined since the global financial crisis. Based on this analysis result, the neutral real interest rate has been widely accepted as a theoretical basis for low interest rate policies and thus, has been integrated into the monetary policy framework of major economies.

Concerning the possibility of prolonged high-interest rates, central banks and financial markets are primarily concerned with whether inflation will persist at higher levels due to deglobalization and other factors and whether the neutral real interest rate will increase. In this context, leading investment banks such as Goldman Sachs and Deutsche Bank have presented findings that the sustained decline in the neutral real interest rate in the US, fueled by the global financial crisis, has come to an end, albeit with the possibility of a rebound. As the neutral real interest rate cannot be observed and its definition is abstract, economists take different approaches to its estimation, resulting in a wide range of estimates. Although this makes it challenging to reach the same conclusion, the estimates shown in Figure 1 generally suggest that the declining trend in the US has disappeared while some are even on the rise. In the case of Korea, the neutral real interest rate has persistently dropped since the 2000s, in line with the fall in potential growth rate. Recently, however, its decline trend shows a sign of halting (Figure 2).

In light of the concerns voiced by Bank of Korea Governor Rhee, is there a discernible relationship between population aging and the neutral real interest rate? Like any interest rate, the neutral real interest rate can be distinguished between the demand and supply of funds. Firstly, if the working-age population is reduced due to population aging, the economic scale is curtailed, contracting the demand for capital required for production. As a result, the investment demand for capital expansion decreases, leading to a reduction in the demand for funds. On the other hand, as population aging and low fertility exacerbate, financial assets become disproportionately concentrated in the elderly population and thus, excessive savings held by the elderly boost the supply of funds. Consequently, the demand for funds dwindles while the supply increases, resulting in a decline in the equilibrium level of interest rates, i.e., the neutral real interest rate.

Long-term outlook on the neutral real interest rate in Korea and the US

What impact will economic structural changes, including population aging, have on the long-term neutral real interest rate? Kang, Baek & Jang (2023) employs a methodology that models on the process of production, borrowing, saving and retirement for individuals aged 20 to 99, based on long-term population forecasts of the United Nations. Drawing on the model, the study aims to estimate the real interest rate required to achieve a balance between saving and borrowing in the asset market. The model not only focuses on the population structure but also reflects long-term changes in productivity, the expansion of government debt, and external factors such as global interest rates as highlighted by Professor Summers.

The analysis reveals significant divergences in the long-term trajectories of the neutral real interest rates between Korea and the US. As the US is anticipated to experience the slowest population aging among advanced countries, population aging is expected to have a relatively limited impact on interest rate cuts. With expected improvements in sluggish productivity coupled with a surge in government debt, its neutral real interest rate is projected to climb by 0.75 percentage points by 2040. Considering the long-term relationship between the neutral real interest rate and the 10-year Treasury yield, it suggests an additional 1.15% to 1.35% increase in the 10-year Treasury yield. As for Korea, however, the impact of population aging is expected to offset positive factors such as improvements in global productivity, the expansion of Korean government debt and global rate hikes. As a result, its neutral real interest rate is projected to hover around 0% practically, with a modest increase of 0.25 percentage points during the same period.

These findings not only imply that economic structural transformation can bring about a prolonged era of high interest rates globally but also highlight significant challenges for Korea to implement policy responses. As the National Assembly Budget Office projects that the government debt-GDP ratio may reach 100% by 2040, it could raise concerns about the sustainability of debt amid the potential plunge in economic growth rates. If the economic growth rate is higher than interest rates, the government debt could stabilize in the long term as the increase in the growth rate denominator of the government debt-to-GDP ratio exceeds that of the numerator. However, it should be noted that amid the expectation for the structural expansion of fiscal demand, the gap between the growth rate and the neutral real interest rate2) is likely to narrow gradually as illustrated in Figure 4. This leads to a growing need for stable fiscal management.

Meanwhile, a low neutral real interest rate represents a sign of sluggish economic growth. Given that inflation may stem from supply-side factors such as deglobalization or a shortage of the working-age population, it implies that the Korean economy could enter a secular stagflation phase. In this situation, if monetary authorities insist on achieving a low inflation target without allowing for structural inflationary factors, unintended tightening effects may arise. This essentially requires relevant authorities to present policy responses underpinned by meticulous analysis of economic structural changes and external conditions.

1) Yonhap Infomax, November 6, 2023, Contrasting views on the neutral interest rate in Korea: Bank of Korea Governor Rhee, Chang-yong predicts a decline due to population aging while Professor Summers projects the rate to follow global trends.

2) In a standard economic model, the neutral real interest rate is composed of the potential growth rate and other factors, the latter corresponding to the negative (-) discount factor. In the Korean economy, factors such as employment insecurity and increased macroeconomic uncertainty have led to an expansion of the discount factor (a decline in other factors), in the aftermath of the 1997 Asian financial crisis and the 2008 global financial crisis. As a result, economic agents have deferred consumption and increased savings, causing the neutral real interest rate to significantly hover below the potential growth rate.

References

Holston, K., Laubach, T., Williams, J., 2017, Measuring the natural rate of Interest: international tends and determinants, Journal of International Economics 108, S59-S75.

Lubik, T., Matthes, C., 2015, Time-varying parameter vector autoregressions: Specification, Estimation and an Application, Economic Quarterly 101(4), 323-352, Federal Reserve Bank of Richmond.

Stock, J.H., Watson, M.H., 2007, Why has U.S. inflation become harder to forecast, Journal of Money, Credit and Banking 39(1), 3-33.

Zaman, S., 2022, A unified framework to estimate macroeconomic stars, Federal Reserve Bank of Cleveland, Working Paper No. 21-23R

[Korean]

Kang, H.J., Baek, I.S. and Jang, G.H., 2023, Assessment of potential structural changes in the interest rate regime, Presentation materials for LCMI inaugural seminar.

Shin, I.S. and Kang, H.J., 2022, Evaluation and issues in Korea’s recent monetary policy stance, Journal of Korean Economy Studies, 14(4), 25-55.